Two decades after Millennium Park opened,

Two decades after Millennium Park opened,

By John Pletz

Mario Guallpa, a New York middle schooler, was so fascinated by “The Bean” that he made a replica of the sculpture for a class project. Then he begged his father to take him to see it in person. Last month, they flew from Long Island to Chicago and counted themselves among the 20 million people who likely will visit Millennium Park this year. Since it opened 20 years ago today, Millennium Park has been a tourism magnet, ranked among the 10 most visited sites

See MILLENNIUM on Page 34

The Bears, Sox and Red Stars want new stadiums. Could taxpayers get stuck footing the bills? I PAGE 11

The vice president’s elevation to the top of the ticket could re-energize local fundraisers and potentially tap new donors

By Justin Laurence

As Vice President Kamala Harris tightens her grip on the Democratic nomination for president, her campaign has announced record fundraising hauls that have calmed fears that uncertainty at the top of the ticket would give donors pause.

those who have already ponied up for the Democratic National Convention host committee, charged with welcoming the party to the city Aug. 19. Fundraisers in the works

Millennium Park became a shining example of Chicago’s tradition of public-private partnership.

Springfield ponders whether to fix or just throw money at

Harris inherited the campaign apparatus of President Joe Biden, including his hefty political account. The former California senator has added over $100 million to that pool in the days since Biden exited the race, according to CBS News. A Democratic super PAC, Future Forward, brought in another $150 million, according to Politico.

It’s too early to track how much of that poured in from Illinois. But Chicago’s donor class is signaling they’re likely to pump money into her campaign and affiliated Democratic super PACs, despite what one bundler described as potential “donor fatigue” among

Harris’ ability to deliver a clear message supporting abortion access and her potential to be the first Black and South Asian woman occupying the Oval Office could also draw out the checkbooks of new donors, according to fundraisers with experience asking wealthy Chicagoans to empty their pockets.

A donor who helped bundle contributions for Harris’ campaign for the 2020 nomination told Crain’s there is a “significant appetite to hold fundraisers,” but the logistics of hosting them are on pause as Harris fills out her campaign team and organizes a new strategy.

The donor, who asked not to

Massive South Works quantum project now must get nearby residents on board.

Few things are more important to Chicago’s economy than having a safe, reliable, comprehensive and affordable public transit system.

What we have today isn't any of that.

Greg Hinz

“What we’re doing now isn’t working,” says state Rep. Kam Buckner, a Chicago Democrat who has focused on transit issues in his career. That’s why all of us — train riders and automobile users, workers and employers — would be well advised to pay close attention to Springfield and what lawmakers are preparing to do. And not do.

On the table in a series of legislative hearings that recently began are various proposals intended to provide a needed financial bailout to the Chicago Transit Authority, Metra and Pace as they struggle to adapt to the post-COVID world and, in turn, require much better coordination and oversight of agencies that far too often act in isolation.

Both sides of that equation, the carrot and the stick, are needed if

the Chicago area is to get the transit system it used to have, much less the quality of service Paris, London, Tokyo and other peer cities enjoy. But with the transit agencies in full turf-protection mode, I fear lawmakers will end up coughing up the money without imposing real conditions.

That would be a huge mistake. Gov. J.B. Pritzker needs to get involved here. He’s the one official with the statewide perspective and clout to force real change. More on him later.

The true state of this debate was apparent recently when, led by Chicago Transit Authority

President Dorval Carter, the transit chiefs said lawmakers need to pony up new taxes to close a $730 million projected deficit in 2026 and forget that nasty talk about merging the three together or other significant reform.

At least Carter didn’t repeat what he told the City Council earlier this year: that firing him and taking away mayoral control of the CTA (and suburban control of Metra and Pace) would be “racist,” a statement Carter made even though 29 of the 50 alders have signed a resolution urging Carter be dumped for the ghost trains, missing buses, soaring crime and filthy stations that

flourished amid COVID and still occur in far too many instances. The at-least-partial exception to the preceding stonewall comes from Kirk Dillard, chairman of the Regional Transportation Authority, which does its best with limited authority to get the CTA, Metra and Pace on the same page despite supermajority vote requirements on its board that

fare policy, focus on security and make key decisions on where limited capital dollars ought to go, Dillard proposes.

“I believe we can achieve meaningful reform by strengthening the RTA,” he says.

The idea has some potential.

Micheal Podgers, policy lead at the activist group Better Streets Chicago, notes the three agencies,

Illinois does not need yet another tax hike on services, congestion, highway tolls or whatever that could end up going down a swirling hole. It needs a better transit system.

allow each of the operating units to protect its turf from change.

Dillard says he backs an alternative to consolidation pitched by the Chicago Metropolitan Agency for Planning. That’s to give the RTA or a successor regional agency new powers to cut fat, move money where it needs to go and improve service. For instance, Dillard calls for consolidation of much of the back offices of the three agencies so that each doesn’t have its own purchasing, public relations, personnel and other such administrative units. The RTA also ought to set overall

after decades of public pressure, only now are testing a pilot program to allow riders to use one fare card on all three systems. Wow! An empowered RTA could require CTA and Metra to coordinate service, decide how fares need to be adjusted, speed the transition to electric vehicles and contextualize the ongoing extension of the Red Line South with other transit needs, he says. Chicagoland Chamber of Commerce CEO Jack Lavin agrees. Getting “the best customer experience” requires not only more tax money but smarter

decisions on how that money is spent, he says.

Illinois Senate Transportation Committee Chairman Sen. Ram Villivalam, who has begun hearings aimed at producing a bill that can pass by next spring, says he intends to hold firm: No reform, no money. “It’s incredibly difficult to have true oversight of four different agencies,” as he puts it.

Still, knowing how Springfield works, I fear a scenario is setting up in which the CTA will threaten to cripple the city’s economy with mass service cuts unless it gets its way and scared lawmakers will pony up while settling for just cosmetic, unenforceable “reform.” That would be a major blunder, and Pritzker, who recently called for “an evaluation of (transit) leadership,” is in position to give reformers the political backing to stand their ground. Merely signing off on what lawmakers come up with is to ratify the status quo. Illinois does not need yet another tax hike on services, congestion, highway tolls or whatever that could end up going down a swirling hole. It needs a better transit system. “This is a once-in-a-generation chance to build the transit system we want,” says Villivalam.

He’s right. Don’t blow it, folks.

By Jon Asplund

AbbVie said last month it has received U.S. Food & Drug Administration approval of Skyrizi for adults with moderately to severely active ulcerative colitis, further bolstering its pipeline of drugs that treat inflammatory bowel diseases.

The approval makes Skyrizi — one of two drugs on which AbbVie is pinning its sales growth hopes — the first treatment of its kind for use on moderate to severe ulcerative colitis and moderate to severe Crohn’s disease. Skyrizi, or risankizumab, is the first interleukin-23, or IL-23, specific inhibitor to be approved for both UC and Crohn’s.

With the nod from the FDA, Skyrizi joins Rinvoq as immunology drugs in the AbbVie pipeline approved for both IBD conditions, UC and Crohn’s.

With the arrival of biosimilar competition for its blockbuster drug Humira, AbbVie has said much of its sales growth potential lies with these two anti-inflammatories. In April, the North Chicago company raised its earnings forecast on the strength of sales of Skyrizi, in the plaque psoriasis market, and Rinvoq, in rheumatoid arthritis.

The success of anti-inflammatory drugs — including IL-23 drugs like Skyrizi, Johnson & Johnson’s Tremfya and Stelara, and Eli Lilly’s Omvoh — is ushering in an era of “disease modification” for patients who suffer from IBD, says UChicago Medicine gastroenterologist Dr. David Rubin.

Rubin said the disease marked by chronic inflammation of the intestines can cause continuous or remitting pain and digestive difficulties because the immune system has lost the ability to control itself. Immune-based therapies are now available and effective at shutting down immune responses by targeting intestinal proteins, the interleukins numbered from IL-1 to IL-50.

“In the last 10 years, we’ve had some 10 new therapies; it’s essentially a gold rush,” Rubin said.

For patients, this means they no longer need to live with their disease as it gets progressively worse, but instead can treat it early and expect remission.

Rubin, chief of UChicago Medicine’s section of gastroenterology, hepatology and nutrition, recently led a global study of another IL-23 antagonist used to treat psoriasis and psoriatic arthritis that is proving effective for UC.

At a May presentation during the American Gastroenterological Association’s Digestive Disease Week, he detailed a Phase 3 study of Johnson & Johnson’s Tremfya, or guselkumab. Tremfya is currently approved to treat plaque psoriasis and active psoriatic arthritis.

Tremfya, not yet approved for UC, can achieve symptomatic remission and also has unique bowel-healing capabilities to keep UC in remission, Rubin said his study has found.

FDA approval of Tremfya for ulcerative colitis is expected in the coming months, with approval for

Crohn’s disease expected to come later, he said.

Rubin, who is a paid consultant of Johnson & Johnson Innovative Medicine, said the competition among drug companies in the IBD market is good for patients.

“There is sort of a race going on,

a competition,” he said, with one pharmaceutical company targeting UC first and another targeting Crohn’s but many companies making progress.

“So at the end of the day, patients should just make sure they’re looking at these treatments and being on something that helps it go into remission,” Rubin said.

In the Skyrizi announcement, AbbVie noted more than 1 million people are living with ulcerative colitis in the U.S., which has one of the largest populations affected by this disease.

With nearly $200 million raised already, it plans to complete the project — which includes improvements, redesigns and new facilities across the 235-acre property — over the next 15 years I By

Brookfield Zoo Chicago is embarking upon an ambitious $500 million redevelopment plan over 15 years that will upgrade and expand current facilities and include new habitats on the 235-acre property.

In the first detailed public unveiling of the project, dubbed the “Next Century Plan,” zoo officials showcased plans to build out more than 100 acres of zoo property, including a $66 million Tropical Forests habitat, a new Africa landscape that will find rhinos alongside giraffes and elephants, and an Australian provinces habitat.

In addition to new habitat structures, the plan also calls for a redesign of the North Gate entry, investments in current structures,

See BROOKFIELD ZOO on Page 35

Brandon Dupré

“We were blessed with a lot of undeveloped property that we’re now envisioning growing into.”

Dr. Michael Adkesson, president and CEO of Brookfield Zoo Chicago

Health Care Services Corp. CEO Maurice Smith saw his compensation more than double in just two years despite a slight drop in profits

By Katherine Davis

Keeping with tradition, top executives at the parent company of Blue Cross & Blue Shield of Illinois were given large raises last year, despite a slight drop in profits.

The largest sum went to Health Care Service Corp. CEO Maurice Smith, who saw his total compensation rise 26% to nearly $28 million in 2023, according to the Chicago-based company’s financial records obtained by Crain’s through a Freedom of Information Act request. Smith’s salary was about $1.6 million in 2023, up 9% from the year before, but a $26.3 million bonus skyrocketed his total pay.

Milton Carroll, executive board chair and a former energy industry executive, was the next highest-paid leader at HCSC, taking home $17.7 million in 2023, nearly double the $9.3 million he was given the year before. Following Carroll was HCSC Markets President Dr. Opella Ernest, who saw her pay rise 21% to $9.4 million.

Altogether, the 10 highest-paid employees at HCSC received a combined $88.7 million last year, up about 26% from 2022.

The raises came the same year HCSC saw revenue soar to a record $54 billion as the health insurance giant hiked premium rates and added new customers to its plans across Illinois, Montana, New Mexico, Oklahoma and Texas. However, a larger federal tax burden pulled down

year-over-year net income 2% to $1.4 billion.

Unlike its publicly traded health insurance peers, which are required to disclose full financial and compensation records on a quarterly and annual basis, HCSC classifies itself as a "mutual legal reserve company," meaning it is customer-owned and is not required to publicly share financial or compensation data.

“In a public company, it is very, very imperative that you hold your executives to a performance standard that would meet a certain peer group.”

Josh Crist, a co-managing partner at Chicago-based executive search firm Crist-Kolder Associates

HCSC executive and board member compensation is determined by the company’s board of directors with guidance from independent compensation advisers, said HCSC spokeswoman Colleen Miller, who added that the company’s leadership compensation is “in line” with that of similar companies.

Officials backing the development must now convince residents it’s not the latest in a string of failed promises to redevelop the long-vacant site

By Justin Laurence

The new quantum computing campus planned for the long-vacant U.S. Steel South Works site has the support of officials from every level of government, who must now convince nearby residents it’s not the latest in a string of failed promises to redevelop the site.

The project will convert 128 acres along Lake Michigan into the tech hub of the future anchored by Silicon Valley startup PsiQuantum. It will be subsidized to the tune of hundreds of millions from the state, $5 million in initial payments from

both the city and county, and millions more through a yet-tobe-approved property tax incentive that slashes the tax rate at the site from 5% to 10% for 30 years.

While the state subsidies have been agreed upon, the Cook County Board of Commissioners and City Council must still sign off on the property tax relief, and developer Related Midwest is pushing for a construction timeline “as fast as possible.”

With Gov. J.B. Pritzker, Mayor Brandon Johnson, county Board President Toni Preckwinkle and the two City Council members whose wards overlap the site all on board, the legislative approvals

are likely. But local community groups argue a community benefits agreement that secures their ability to share in the prosperity should be approved as well.

Oscar Sanchez, co-executive director of the Southeast Alliance Task Force, who ran unsuccessfully to represent the 10th Ward as a Johnson ally, said the development can “elevate the Southeast Side,” but argued “there should be a community benefits agreement at the end of the day.”

His group will partner with the Alliance of the Southeast, whichhas been calling for a community

Share of available space across the suburbs wrapped up the first half of 2024 at a new all-time high

It's been four years since the COVID-19 pandemic and the rise of remote work began drubbing suburban office landlords with weak demand and surging vacancy. They're still waiting for the beatdown to end.

The share of available office space across the suburbs wrapped up the first half of 2024 at a new all-time high of 31.3%, according to data from real estate services firm Jones Lang LaSalle. The vacancy rate is up from 28.9% one year ago and 22.1% at the beginning of the public health crisis, and has hit new record highs for 14 consecutive quarters.

The numbers tell the same story that office building owners have been longing to put behind them: Companies are cutting back on workspace with fewer people regularly in the office.

The attrition has cost the suburbs nearly 4 million square feet of office tenants since the beginning of 2020, JLL data shows. That's roughly 8% more than the suburban office space reduction from the beginning of 2008 to the end of 2010 when the Great Recession hammered the market, according to the brokerage.

Combined with two years of rising interest rates, the soft demand has pummeled property values and fueled a historic wave of foreclosures and other distress as many landlords grapple with maturing debt.

"What's happening in the suburbs is a big process of resetting the market," said JLL International Director Andrea Van Gelder, who negotiates leases on behalf of tenants. "This process is going to take a while."

The slow burning off of longterm office leases has prolonged the pandemic-fueled pain for office owners, a contrast to commercial property sectors like retail and hotels that suffered more intense initial blows from the crisis but have seen steadily recovering demand.

Even though many companies have stronger conviction about how much office space they need for their post-COVID workplace usage, it's still far from clear how much more space-shedding is ahead and what that means for the economics of owning an office property. That lack of clarity muddies what many office buildings are worth — particularly with a number of them now formally or effectively controlled by lenders — making it difficult for owners and tenants to agree on leasing terms, Van Gelder said.

"It's kind of paralyzing lenders and receivers and owners because we really don't have good examples of where (capitalization) rates are," she said, referring to the income that a property owner expects to generate relative to the building's market value.

By Danny Ecker

cupied space compared with the prior period, fell by about 180,000 square feet during the second quarter, according to JLL.

Two cases pushing that number down came from corporate changes rather than companies adapting to new remote work patterns. Medical equipment maker Vyaire vacated 63,000 square feet at its office building in Mettawa after filing for Chapter 11 bankruptcy protection last month, JLL data shows. And Advocate Aurora Health formally left behind 185,000 square feet in Downers Grove, a move tied to its merger with Charlotte, N.C.based Atrium Health, according to the brokerage.

Recent leasing activity also underscored the downshift in suburban office demand. In a severe case, insurance giant Aon told employees it is moving its north suburban office from Lincolnshire to Bannockburn, a move that sources said would take the company from more than 600,000 square feet down to about 40,000 square feet.

In the biggest suburban office lease in more than two years, fleet management company Wheels subleased more than 200,000 square feet from Zurich North America at the insurance company's headquarters in Schaumburg. But that move will consolidate the suburban offices of Wheels, Donlen and LeasePlan USA — which are now all part of the same company — leaving more available office space in its wake.

Van Gelder said leases that are getting signed are overwhelmingly at newer and more recently updated properties, she said, a continuation of the so-called "flight to quality" that has dominated the post-COVID market as companies look to encourage employees to come to the office.

Wheels' deal at the Zurich property and Aon's impending lease at Bannockburn Corporate Center highlight that trend, she said. "The nicest projects are the fullest and claiming the highest rents."

Redevelopment of less competitive office properties into other uses like warehouses, data centers or residential buildings could also help curb the vacancy rate increases, though financing and winning public approval for such projects remain hurdles.

With few non-distressed buildings changing hands over the past couple years, entities controlling office properties may be unsure of what their buildings

are worth and hesitant to make long-term capital commitments to tenants, Van Gelder said. "That's the biggest stumbling block right now for the suburbs."

Move-outs outpacing moveins also continues to be a thorny issue for landlords. Net absorption, which measures the change in the amount of leased and oc-

The office complex that Aon is leaving behind at 4 Overlook Point in Lincolnshire is one of the latest redevelopment candidates to hit the market. Officials from the village of Lincolnshire said recently they are not interested in an industrial redevelopment for the 31-acre property in the heart of the Lincolnshire Corporate Center campus, but envision a mix of uses that could include housing, restaurants and entertainment.

chicagosfoodbank.org/crains

By Jon Asplund

Chicago’s major academic medical centers top the local rankings in U.S. News & World Report’s 2023-2024 Best Hospitals report, with Northwestern Memorial Hospital and Rush University Medical Center topping the metro area and statewide list and the University of Chicago Medical Center just behind.

Both Northwestern and Rush belong to this year’s honor roll of hospitals in the nation recognized for their exceptional performance across specialties, procedures and conditions. For Northwestern, it’s the 13th consecutive honor roll year. For Rush, it’s the fifth straight year.

Of 20 procedures and conditions, Northwestern ranked “high performing” in all categories, while Rush earned high performing ratings in 18 and UChicago Medical Center was considered high performing in 16.

“Our continuous recognition would not be achieved if not for the dedication and commitment made each and every day by our physicians, nurses and staff to providing world-class compassionate care to our patients,” Dr. Howard Chrisman, president and chief executive officer of Northwestern Memorial HealthCare, said in a statement. “Driven by our patients first mission, we strive to be better by any measure that has a positive impact on our delivery of care and patient outcomes.”

“Being on the honor roll for the first couple years was exciting, but with five straight years, we know we’ve really earned our spot,” said Dr. Paul Casey, senior vice president and chief medical officer for Rush.

Casey said he was particularly proud that, in most specialties, Rush shows continued improvement in the largely data-driven ratings from U.S. News. For example, its rank in cardiology a few years back was 34th, and now it is 12th in the nation. And for cancer,

especially

in which the health system recently began partnering with MD Anderson, the rankings have moved up over five years from 48th in the nation to 29th.

“The focus, though, is not on the ratings or recognition, it is on improving care and safety, and the ratings will follow,” Casey said.

‘Transformation

He said Rush has been on a “lean transformation journey,” which includes every aspect of the care team, instituting staff safety huddles throughout the three-hospital system and its outpatient centers, and making quality improvement and patient experience part of the culture.

Overall, Rush’s three hospitals — including Rush Copley Medical Center and Rush Oak Park Hospital — earned high performing designations for a total of 26 adult specialties, conditions and procedures.

At Northwestern Medicine, many of the system’s other hospitals fared well in state and

For example, Northwestern Medicine Central DuPage Hospital is ranked No. 7, Lake Forest Hospital is tied at No. 8, and the system’s hospitals in Huntley and Woodstock, combined, are ranked No. 13.

At UChicago Medicine, having the top cancer program in the state and the 12th in the country is one huge distinction, particularly as the health system builds its mammoth free-standing cancer center on its Hyde Park campus.

“Given the cancer center’s strategic priority, it is good to show that that care is being met with success in our programs as well,” said Dr. Tom Spiegel, vice president and health system chief quality officer at the University of Chicago Medicine.

“When you look at the U.S. News rankings, they concentrate on both outcomes — through riskadjusted survival rates — and at appropriate discharging patients to home,” Spiegel said. “We take a very wholistic approach to the

discharging patients into their home setting and providing the resources to keep them well outside the hospital.”

“When we talk about readmissions, we know it has all to do with the resources that we provide to patients when they leave,” he said. Ensuring access to outpatient care and social services makes all the difference, he added.

Outpatient care is also important for another aspect of running a health system these days, the ongoing issue of a tight labor market.

“It’s not just a temporary labor crunch,” Spiegel said. “It is the new reality. So we have to provide the smartest, most efficient ways to provide exceptional care.”

He said that really concentrating on a multidisciplinary approach to care and ensuring that the outpatient network serves patients well is key to dealing with fewer care providers.

“And the rankings, like U.S. News, are starting to recognize the importance of outpatient care and

steadily increasing the amount of outpatient metrics they study,” he said. “It used to be much more focused on inpatient stays and people over the age of 65, with Medicare data, but that can’t give the whole picture.”

Among the other Chicago-area hospitals to receive recognition was Shirley Ryan AbilityLab, which tops the list of rehabilitation hospitals in the nation for an astonishing 34th year in a row.

AbilityLab said it is the only hospital of any kind to hold this distinction.

“When we continue to do great work the world continues to notice, and we are honored by this and many other external accolades,” Dr. Pablo Celnik, Shirley Ryan AbilityLab CEO, said in a press release. “In evaluating our achievements, we look to the more than 50,000 patients we serve every year. Their success is our success, and their outcomes are made possible by our team, which is 2,700 people strong. We remain committed to advancing rehabilitation science and care — and to advancing human ability.”

Beyond the top three acute care hospitals, the other Chicago-area hospitals to make the list, are from highest to lowest rank: Advocate Christ Medical Center; Endeavor Health NorthShore hospitals; Advocate Lutheran General Hospital; Northwestern Medicine Central DuPage Hospital; Advocate Good Shepherd Hospital; Loyola University Medical Center; Northwestern Medicine Lake Forest Hospital; Endeavor Health Edward Hospital; Northwestern Medicine McHenry, Huntley and Woodstock hospitals; Northwestern Medicine Palos Hospital; Advocate Good Samaritan Hospital; Endeavor Health Elmhurst Hospital; Advocate Trinity Hospital; Silver Cross Hospital; Mount Sinai Hospital; Advocate Condell Medical Center and Community Hospital in Munster, Ind.

By Jack Grieve

The city of Chicago on July 12 denied a permit request for a highly anticipated open-water swim in the Chicago River, but the September event could still happen under an alternative plan.

Five hundred people were expected to participate in the organized swim, slated for the early morning of Sept. 22, on a course looping the main stem of the downtown river corridor between State Street and Wolf Point. However, city officials threw a wrench in those plans earlier this month when they denied organizers’ request for a permit, citing “significant safety concerns.”

A statement from the Chicago Department of Transportation ac-

knowledged the “positive nature” of the swim but said a review from multiple city departments, including the Chicago Fire Department and Chicago Police Department, identified safety issues for participants, first responders and the general public.

Still, plans for the swim have not completely dried up. CDOT said “the applicant was offered an alternative route that allows the event to proceed while ensuring high standards of safety for all participants and the effective allocation of city resources.”

CDOT did not respond to a request from Crain’s for more details about the counterproposal, nor did event organizers offer more information. It is unclear what changes the city sought from the

original plans.

Doug McConnell, co-founder of A Long Swim, the Barringtonbased nonprofit organizing the event, said in a written statement “our goal remains to hold the swim on September 22, 2024, as scheduled.”

“While we are disappointed, we are hopeful that we will have the opportunity to address CDOT’s concerns and demonstrate the strength of our comprehensive safety plan,” McConnell added. Green light from Coast Guard

Swim organizers have pitched the plunge, which received a green light from the U.S. Coast Guard in April, as a celebration of the waterway’s environmental turnaround. It would highlight the

decades-long river cleanup efforts of the Metropolitan Water Reclamation District of Greater Chicago and groups like Friends of the Chicago River. The swim would mark the revival of the long-dormant open-water swims that were commonplace on the Chicago River in the early 1900s.

A Long Swim says it has raised about $2 million for amyotrophic lateral sclerosis, or ALS, research at Northwestern University’s Feinberg School of Medicine. The planned Chicago event also has a philanthropic element to it: Participants who swim one mile on the course are expected to raise a minimum of $1,000 each for the nonprofit, with those swimming two miles expected to raise $1,500 each. Proceeds would go to ALS

research funding and learn-toswim programs for underserved communities in the city.

Under the original plans, organizers said they would closely monitor water quality levels ahead of the swim. After decades of unsafe contamination levels, the Chicago River is now safe for swimming “most of the time,” McConnell said, but even he acknowledged that heavy storms and other extenuating factors can render the conditions less safe.

Assuming the water quality is up to standard come Sept. 22, the swim would start at 6:45 a.m. and end with a hard cutoff at 9 a.m. — intentionally early to reduce the event’s effect on regularly scheduled river activity.

‘This episode is a wake-up call for the auto industry, and a

By John Huetter, Automotive News

Anderson Economic Group estimated dealerships lost 56,200 new-vehicle sales and more than $1 billion between June 19 and July 15 because of the CDK Global cyberattacks and subsequent software outages.

The consulting firm, which also conducted loss analyses after the 2023 and 2019 UAW strikes, had projected July 1 dealerships would lose $944 million between June 19 and July 6.

“The small increase is due to a somewhat larger sales loss revealed by now-available June sales data, the actual duration of the outage, and a slight downward adjustment in the estimated lost service and used car business,” AEG wrote in a news release July 15.

‘Cyber ransom event’

Hoffman Estaes-based CDK suffered at least two cyberattacks June 19 in what it called a “cyber ransom event.” It took its software offline as a precaution, forcing dealerships to find alternative ways to do business. On June 26, CDK said it had restored service to a test group of retailers and began bringing others online; by July 2, CDK announced “substantially all dealer connec-

tions” to the DMS had been restored as of that morning.

Other CDK software followed, and the company ultimately wrapped up its restoration earlier than July 15 though some thirdparty software companies with programs integrated with the DMS provider might not have brought those tools back online yet.

“All major applications are now available,” CDK said in a statement July 11. “We are thankful to our customers, partners and employees for their partnership.”

Allan Liska, a threat analyst at Recorded Future, attributed the CDK cyberattack to the hacking group BlackSuit, according to a Bloomberg June 24 report.

On June 21, about 387 bitcoin worth more than $25 million was sent to an “address assessed by TRM Labs to be controlled by the ransomware group BlackSuit,” according to a statement from blockchain intelligence firm TRM Labs.

Three unidentified sources said CDK likely made that payment, CNN reported July 11.

CDK did not responded to a July 15 email request for comment on the AEG analysis and CNN report.

AEG’s latest $1.02 billion loss calculation factored in income dealers theoretically lost from new-vehicle sales and diminished service and parts revenue during the time the CDK outage hindered operations. The consulting firm assumed most customers who encountered a delay in servicing their car because of the CDK out-

age still used the dealership and completed the deal. It didn’t count those temporary losses toward the final number. However, transactions where the dealership lost the business entirely or saw the customer postponing the sale, service or parts work indefinitely were treated as losses for the purposes of the AEG report.

“This has been a painful experience for dealerships and customers,” Max Melstrom, a member of the AEG loss estimation team, said in a statement. “The sales data for June confirm what we were anticipating two weeks ago.”

The actual financial hit to dealerships might have been higher than $1.02 billion. AEG said its analysis didn’t include a variety of other lossers retailers might have suffered, including litigation, reputational hits and incentive payments.

“This episode is a wake-up call for the auto industry, and a warning to all others,” AEG CEO Patrick Anderson said in a statement. He said any companies using automation and centralized software, “which means nearly all businesses,” run the risk of a vendor being hacked — “and the losses caused by an outage can escalate quickly.”

John Huetter writes for Crain’s sister site Automotive News.

Apparently, it’s the season for dramatic moves and big-picture thinking.

And no, we’re not talking about the seismic shifts taking place on the presidential stage, as one campaign rebounds from a frightening assassination attempt and another throws the incumbent overboard in favor of a more youthful replacement.

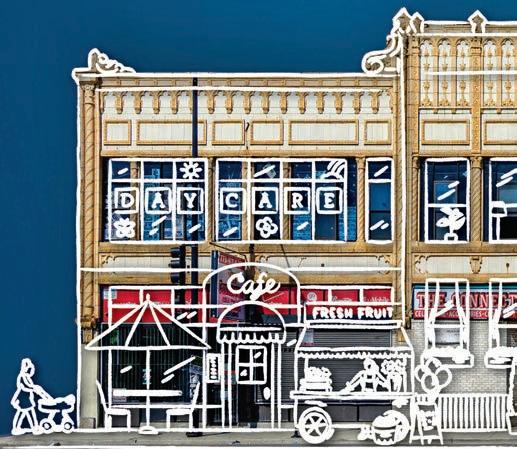

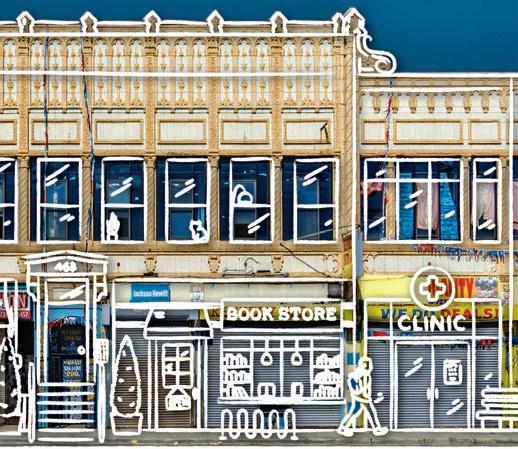

Consequential pivots and swing-forthe-fences energy have been taking place much closer to home in the past week or so, as two prominent plans to remake vast swaths of the South and West sides make their debut.

First up: The next-generation owners of the United Center lifted the veil on their plan to undertake a $7 billion transformation of the property around the Near West Side arena, a blueprint that would redraw 55 acres surrounding the venue with a megadevelopment that includes a new 6,000-seat music hall, hotel and retail buildings, public open space and thousands of apartments.

Chicago Bulls President and CEO Michael Reinsdorf and Chicago Blackhawks Chairman Danny Wirtz touted their plan, dubbed the 1901 Project, as the largest-ever private investment on the city’s West Side. Their vision includes a wide-ranging, 10year redevelopment of the parking lots encircling the stadium at 1901 W. Madison St. as well as nearby sites they control.

The 14 million-square-foot proposal would fulfill the team owners’ long-term aspiration of making the arena the centerpiece of a broader mixed-use campus, in line with modern professional sports ven-

ues that anchor entertainment districts.

Days later, the Pritzker administration as well as corporate and academic partners trumpeted a plan to turn the long-dormant U.S. Steel South Works site along Chicago’s far southern lakefront into a technological center that promises to make Chicago one of the global capitals of next-generation quantum computing. The goal: attracting more than $20 billion in private and public investment and, ultimately, creating thousands of jobs.

South Works will be home to a 128-acre campus anchored by PsiQuantum, a Silicon Valley startup with ambitious plans to build the world’s largest quantum computer. PsiQuantum’s facility will be about 300,000 square feet and employ up to 150 people within five years. The centerpiece of the project is a unique super-cold computing facility where blast furnaces once stood.

As Crain’s Danny Ecker pointed out in a July 26 analysis, both projects have a significant advantage over other planned megadevelopments elsewhere in the city — namely, that each has its own anchor user lined up, creating their own momentum, and that sets the stage for more real estate investors to follow into neighborhoods where they haven’t been active before.

And as Ecker further explains, the two development announcements come after years in which City Hall has labored to kickstart real estate investment in areas that face similar challenges to neighborhoods such as, say, Calumet Heights and South Chicago, which stand to benefit from the quantum plan, or East Garfield Park and Lawndale, which could see a spillover effect

from the 1901 Project. But the level of investment being discussed for the United Center and South Works is an order of magnitude greater than the city has seen in years — and along with that opportunity comes some reason for caution.

With Gov. J.B. Pritzker, Mayor Brandon Johnson, Cook County Board President Toni Preckwinkle and the two City Council members whose wards overlap the site all on board with the various subsidies contemplated in the South Works plan, the necessary legislative OKs and zoning approvals are likely. But, as Crain’s Justin Laurence reports, local community groups argue a community benefits agreement that secures their ability to share in the prosperity should be approved as well — though attaching such strings to plans to revive a parcel that’s sat frozen in time for decades seems ill-advised, to put it mildly.

The City Council will also surely want to know more about the economic incentive package they’ll be asked to approve and when the city can expect to receive a return on that investment beyond the immediate construction jobs created to build the site in coming years, so it will be incumbent on Team Johnson to manage those expectations accordingly.

At South Works in particular, which has seen more than one failed attempt at revivification, the stakes are especially high. Elected officials should do everything in their power to quell factional infighting that could delay swift movement on a project that has statewide significance, not just as a real estate play but as an economic development juggernaut that could put Illinois

on the quantum computing map globally.

The challenge, particularly at South Works, will be making sure the coming changes improve the quality of life and build wealth for existing residents in the area, said Dave Doig, whose Chicago Neighborhood Initiatives organization has led development of projects that have revitalized the Pullman neighborhood over the past decade.

“It’s going to take some intentionality. It’s not just going to happen,” he said in an interview with Crain’s. “The fear is that this just becomes an island — people go there to work and then leave, and nobody benefits — so I think there’s going to have to be some real planning and intentionality around making sure that those linkages (are made) with residential, retail, jobs. . . .I’m sure there are hundreds of city-owned vacant lots that dot this area.”

And both the South Works and United Center projects give City Hall an opportunity to focus resources and attention on nearby neighborhoods rather than trying to create new anchor projects from scratch. One example: using Neighborhood Opportunity Fund grants — money from developers that paid to build more dense downtown projects — to help revive vacant cityowned lots or boost entrepreneurs in the vicinity of both sites rather than spreading money more thinly across the city.

“They shouldn’t just be seen as little dots on the map, and that’s the only planning that happens,” as city Planning Department veteran Eleanor Gorski, now CEO of the Chicago Architecture Center, tells Crain’s. “These are dots with ripples, and the city needs to step up and produce the ripples.”

There is no crisis with Chicago’s pension funds.

At least not now. But indications are that a crisis is looming large when it comes to the ability of Chicago’s pension funds to pay benefits to current and future annuitants. Unfortunately, it’s the nature of government not to act until the very last moment, but in this case, it will be too late. We will likely see a situation whereby one of the four direct city pension funds — Fire, Laborers, Municipal Employees or Police — runs out of money and a monthly check written by one of these funds to its retirees is significantly less. Not the kind of surprise that anyone enjoys. And that’s when the crisis occurs.

Recently, it was reported that the funded levels of the pension funds again moved in the wrong direction. As was widely reported, the standard measure of a pension fund’s health, the “funded ratio” — the extent to

which the pensions are funded — of the four was 26% at the end of 2023. This is down from 28% in 2022. Conventional wisdom states that the funded ratio of a public pension fund should be at least 80%, and there are many across the country that are closer to 90% and higher. Funding for a private company’s pension is required by law to be at 100%.

Yet, in 2023, the stock market, in which each of the funds is heavily invested, returned a whopping 26.3% as per the S&P 500. And the average annual S&P return for the previous 10 years has been 13.8%. What’s worse is that there seems to be no

outrage at this dichotomy — that market investment returns are significantly positive and the health of Chicago’s pensions continues to deteriorate — from any sector of government, nor from the pension funds, nor even from the annuitants themselves.

Keep in mind that the intent of 2010 Illinois legislation calling for an increasing contribution to the pension funds from the city starting in 2016, when the pensions were funded at 30%, was for the pensions to be funded at 90% by 2045. The way that the contribution was and continues to be funded is based on significant increases in property taxes. That’s why all Chicagoans saw their property taxes increase by at least 20% back in 2016. Yet, despite the increases that amount to millions more dollars going to the pension funds each year since 2016, the funded ratio continues to drop. In 2005, it was 64%. In 2010, it was 49%, and 26% in

2023. So 90% in 2045? It isn’t going to happen. By the way, the recent funded ratios translate into city debt of $37.2 billion in 2023, up from $35.4 billion in 2022.

Why is there no sense of outrage among all parties? Moreover, also missing is a demonstrated desire to fix this situation.

So why is this happening in the first place? Certainly, it’s not due to market returns. However, it could be partially ascribable to the investment returns of the four city pension funds themselves — in other words, specifically how are they invested? In 2023, the firefighters' pension fund, which had the best returns among the four funds, earned 13.9%, about half of the S&P return of 26.3% in 2023. That’s part of the problem.

Could it be that the amount of the contributions being made annually by the city to the pension funds is inadequate? Many years ago, that was true, but as mentioned earlier,

In an article published July 11, Crain’s Chicago Business detailed the status of three significant local development projects, including Lincoln Yards. We want to thank Crain’s for keeping tabs on one of Chicago’s most dynamic industries that is critical to the city’s economic development. They rightly pointed out that today’s real estate market may have changed some of the timing and elements of Lincoln Yards, but it does not change our resolve to bring it to life.

Chicago is one of the greatest cities in the world, and the projects we are invested in will only enhance that standing. Sterling Bay was born in Chicago, and we live and work here every day. Everything we do supports a longterm vision for the market and the growth of Chicago’s neighborhoods.

Our vision for Lincoln Yards is clear and exciting. It will not happen overnight, but we have more than enough patience and resolve to make it happen.

Anyone who doubts this should look no further than the West Loop and Fulton Market. These neighborhoods are vibrant districts bustling with shops, corporate headquarters, acclaimed restaurants and stunning residences that have boosted development for miles around. Just imagine what is in store for Lincoln Yards.

Our investors, financial partners and lenders have held a strong belief in this vision, and we continue to work with leaders in the industry to overcome global economic challenges that have nothing to do with Chicago. As we continue forward with Lincoln Yards, the next step is to recapitalize the project and consolidate ownership of the

contributions — yes, as funded by property taxes — are now at or close to the ARC, or the “actuarially required contribution.”

Could it be the level of benefits that annuitants are paid? Regardless, nothing can be done to diminish public pension benefits in the state of Illinois, as has been affirmed by the Illinois Supreme Court.

Nevertheless, should this situation not be fixed, there is, based upon these data, more likelihood now that one or more of the pension funds approaches insolvency. Even now, we know that at least one fund is going down the slippery slope of selling assets to pay for benefits. And this, dear readers, is the hardest part of writing this article. We just don’t know what happens next. If the city is forced to reach into its pocket even more to pay the annuitants’ benefits in full, it will have to significantly raise property taxes even further, and Chicago’s property taxes are already among the highest of any major city in the nation. What are those implications? I shudder to think. But for certain, we will then have a crisis when it comes to Chicago’s pension funds.

development. We expect to accomplish that this year, and our goal remains to begin critical infrastructure work as quickly as possible.

We will also rely on our partnership with the Johnson administration, which has correctly identified that the only sustainable path out of Chicago’s fiscal challenges is through economic development and growth. The multiple billions of dollars of annual economic output from a development like Lincoln Yards

will be critical to facing these challenges, stimulating growth and creating economic opportunities for all Chicagoans. This is a cyclical business, and today’s challenges will subside. Chicago was not built overnight, and we will continue to be bold in pursuing our transformational vision for Lincoln Yards. We intend to see it through to completion.

ANDY GLOOR CEO

To place your listing, visit www.chicagobusiness.com/peoplemoves or, for more information, contact Debora Stein at 917.226.5470 / dstein@crain.com

Lamar Johnson Collaborative, Chicago

Lamar Johnson Collaborative (LJC) welcomes Lisa Dziekan as Principal, Economic Development. Most recently, Lisa served as Senior Vice President for World Business Chicago (WBC). Dziekan brings extensive experience in strategically growing Public-Private Partnerships (PPPs) to drive economic development. In her new role, Dziekan will lead initiatives and build relationships to propel the firm’s growth and impact across Chicagoland and other markets for LJC, Clayco, and its subsidiaries.

Centric Consulting, Chicago

Jeff Ehman has been promoted to Partner/ Director within Centric Consulting’s Chicago practice. With over 2 decades of experience, Jeff blends agility and precision to deliver comprehensive strategic transformations that achieve results for Fortune 500 clients. His work covers many industries, with notable CPG sector and M&A achievements. As Partner, he’ll continue to lead and grow Centric’s Chicago team of highcaliber consultants, while forging strong collaborations with local business leaders.

Wintrust Financial Corporation, Rosemont

Wintrust Financial Corp., a financial services holding company based in Rosemont, Illinois, with more than 170 locations across Illinois, Indiana, Wisconsin, and Florida is pleased to announce two promotions.

Lamar Johnson Collaborative, Chicago

Elaine Fitzgerald joins Lamar Johnson Collaborative (LJC) as Principal and Senior Specification Writer in its Chicago office. Focused on strengthening LJC’s virtual design/construction and project delivery processes, Fitzgerald brings more than 30 years of industry expertise in contract documents, group leadership and motivating teams. Fitzgerald earned her Master of Architecture degree from the University of Illinois Chicago.

Live Oak Bank, Chicago

Carole Robertson Center for Learning, Chicago

Yolanda Luna-Mroz has joined the Carole Robertson Center for Learning as Vice President of Youth Development. Yolanda brings more than 20 years of leadership experience in elementary and middle school education, serving most recently as Chief Programs Officer at High Jump and as Principal at Decatur Classical School in Chicago. In her new role, she leads strategic efforts to deepen the Center’s youth development program impact, elevate program quality, and ensure long-term fiscal sustainability.

Dan Stiles was promoted to SVP, Senior Commercial Banker, Commercial Banking at Libertyville Bank & Trust Company, N.A. Dan joined Wintrust in 2013. Umar Riaz was promoted to SVP, Lending, Commercial Real Estate at Old Plank Trail Community Bank, N.A. Umar joined Wintrust in 2014.

Croke Fairchild Duarte & Beres LLC, Chicago

Garcia Dussard is a Senior Loan Officer based in Chicago on the Small Business Banking Team at Live Oak Bank. In this role, Garcia is responsible for helping small and mediumsized business owners in Chicago and the surrounding suburbs access capital via the SBA for business acquisitions, partner buyouts, real estate mortgages and equipment loans. Garcia has been in the banking industry for over 25 years and worked at several major US banks prior to his role at Live Oak.

The Morton Arboretum, Lisle

Skender, Chicago

Skender, one of the nation’s top building contractors, welcomes Matt Nemshick as Director of Data Center Accounts. In this new role, Nemshick will assist in expanding Skender’s footprint in mission-critical construction, which comprises essential, always-on facilities such as data centers and other high-tech infrastructure. He joins Skender with 17 years of experience in the construction industry and also serves as Board Ambassador and Past President of the veteran support charity SALUTE, Inc.

Derek Stovall-Leonard, MBA, joined The Morton Arboretum as Chief Financial Officer on July 24. He provides strategic direction for the Arboretum’s financial activities, facilities, information technology, and sustainability initiatives. He was most recently CFO and Executive Director of Converge Consulting at Forefront. He will play a lead role in forwarding the Arboretum’s vision of a greener, healthier, more beautiful world where people and trees thrive together.

Croke Fairchild Duarte & Beres welcomes partners Thomas Kilbride and Adam Vaught to the firm’s litigation group. Former Chief Justice of the Illinois Supreme Court Tom Kilbride oversaw numerous landmark cases and led efforts to modernize the state judiciary and expand Illinoisans’ access to justice. Noted appellate lawyer Adam Vaught began his career as a law clerk and Counselor to Justice Kilbride before moving into private practice, where he spent 10 years handling complex and highstakes litigation for a host of leading business and public sector clients. Kilbride and Vaught will develop a dedicated appellate court practice, focusing their work on expanding the firm’s leadership in addressing clients’ most complex and novel legal issues.

Chicago

Michael Zalay has been promoted from income principal to equity principal at Much. Zalay, chair of the Corporate & Finance group, will bring a knowledgeable, fresh perspective as part of the firm’s next generation of leadership. In his legal practice, Zalay is an accomplished corporate attorney. Clients ranging from established businesses to emerging startups rely on him to lead M&A deals and complex transactions as well as to serve as de facto general counsel.

Burke, Warren, MacKay & Serritella, P.C., Chicago

Jayne Bart-Plange joined Burke, Warren, MacKay & Serritella as a Partner. As a civil litigation and trial attorney, Jayne has tried high-value, complex cases and successfully argued dispositive motions at the State and Federal court level. Jayne brings her unique insights, work ethic, and passion to every matter and is excited to grow her commercial practice at Burke Warren. Jayne attended the University of Missouri Kansas City School of Law and received her B.A. from Loyola University Chicago.

Poplar Homes, Chicago

Sean Story has joined Poplar Homes as Executive Vice President to oversee leadership of its multifamily management and leasing portfolio. Story will build on the firm’s solid foundation of strong relationships and efficient operations established by legacy company 33 Realty to scale Poplar’s multifamily division nationwide. He will also have oversight across leasing, property management, maintenance, marketing, and business development.

Croke Fairchild Duarte & Beres LLC, Chicago

Croke Fairchild Duarte & Beres welcomes Jenna DePorre as an associate in the firm’s venture capital practice group. Jenna primarily represents emerging companies, founders and investors in a variety of venture capital transactions and general corporate matters, including equity and debt financings, securities filings, company formations, corporate governance and exit opportunities.

Leadership Greater Chicago, Chicago

Leadership Greater Chicago (LGC), the region’s premier civic leadership development organization, announces the election of Melissa Y. Washington, Senior Vice President of Customer Operations and Strategic Initiatives at ComEd as its new Board Chair and welcomes John C. Robak former Chairman and CEO of Greeley and Hansen to its Board of Directors. Washington will guide the board in strategy, governance and fund development, collaborating with CEO Myetie Hamilton to continue the legacy of driving transformative civic impact across the Greater Chicago region. Robak’s extensive experience in philanthropy and civic engagement will bolster LGC’s efforts to develop a strong pipeline of civic leaders to shape an equitable future for our Region.

Parts Town Unlimited, Addison

Jamie Head joins Parts Town Unlimited, the parent company of Parts Town, as the group’s Chief Information Officer. Jamie brings over 20 years of global experience, specializing in leading and partnering across various digital transformations and capability building for growth and efficiency. Jamie will be a key partner in realizing Parts Town Unlimited’s goal to become the global leader in high-tech distribution of mission critical replacement parts across several categories.

Mesirow mesirow.com/home

Mesirow, an independent, employee-owned financial services firm, announced the launch of its outsourced Fiduciary Partnership Services at Capital Group, home of American Funds®. This integrated, outsourced fiduciary program is overseen by Mesirow Fiduciary Solutions, which delivers a full suite of fiduciary services to recordkeepers, sponsors, advisors and participants through easy-to-understand investment programs.

Capital Group will be Mesirow’s 25th recordkeeper integration since the group’s inception in 2006. With this newest launch, Mesirow will provide ERISA 3(21) and 3(38) Fiduciary Partnership Services to plan sponsors and their advisors that use Capital Group’s turnkey products, RecordkeeperDirect® and PlanPremier®.

The Baldwin Group baldwin.com

Rosenthal Brothers, a Baldwin Risk Partner and an industry leader within the real estate insurance sector, announced it will rebrand to The Baldwin Group.

Since becoming a Baldwin Risk Partner in 2020, Rosenthal Brothers has been able to enhance its existing client relationships, attract new clients and extend its impact across Chicago and the Midwest. Now as The Baldwin Group, Rosenthal Brothers will continue to provide innovative solutions, deep expertise and excellent service to clients while leveraging the full suite of risk management, insurance, employee benefits and wealth management services from the network of nearly 40 regional brands across the country which will also be transitioning to The Baldwin Group in the coming year.

$1.0 billion

The amount of public money the team requested for a new

$1.5 billion

The amount of public money the team requested for a new stadium

Chicago fans of professional sports are just as likely to talk about their favorite teams’ stadiums as they are about those teams’ performances these days.

e Chicago Bears have pitched a $3.2 billion proposal for a new domed stadium on the lakefront. Funding for the plan would include more than $2 billion from the Bears and a $300 million loan from the NFL. e remainder would come from public nancing that includes using the city’s existing 2% hotel tax to back bonds issued by the Illinois Sports Facilities Author-

ity, and other sources. Taxpayers would pay $900 million in upfront costs toward the stadium, through the ISFA-issued bonds.

An additional $1.5 billion in the proposal would be spent on infrastructure improvement around the stadium.

At the same time, the Chicago White Sox are looking for $1 billion in public funding for a new $2 billion baseball stadium in e 78, a planned megadevelopment site that will create a new neighborhood south of downtown.

Given both the city of Chicago and the state of Illinois budgets — Chicago has the

second-largest debt load of any U.S. city, and Illinois is in the top ve among states nationwide — the path to publicly funded stadiums is going to be fraught. Discussions in Chicago have some Windy City speci cs, such as concerns about building a new stadium on the lakefront. But at their core, the questions raised in this debate are the same across the country. Is publiclynancing stadiums and arenas good for a city? Is this the best way to be the steward of a municipality’s nances? What are the

See STADIUMS on Page 12

|

By Margaret Littman

Chicago has the secondlargest debt load of any U.S. city, and Illinois is in the top ve among states nationwide.

The path to publicly funded stadiums is going to be fraught.

costs of not doing a deal and risking losing a team? How can a deal be made in the best interests of taxpayers?

e answers, as always, are, “It depends.”

It isn’t unheard of for separate teams to vie for public funding for separate stadiums at the same time. Both the NFL’s Kansas City Chiefs and MLB’s Kansas City Royals recently asked for tax incentives to leave their current Missouri locations to build new stadiums in Kansas after Missouri voters in April rejected a sales tax increase to nance

move a home game to accommodate the Riot Fest music festival in September.

Laura Ricketts purchased the Red Stars last year and brought Karen Leetzow, former chief legal ocer of the U.S. Soccer Federation, on as president. Ricketts and Leetzow have been vocal about wanting gender equity for public stadium nancing. “I’ve been extremely frustrated with how I’m having to advocate for things that the men have already gotten,” Leetzow says.

State Rep. Eva-Dina Delgado introduced HB 5841 to evaluate whether the ISFA is meeting equity goals.

In 2022, the Kansas City Current opened the rst soccer-speci c stadium for a women’s team. e $120

“It is kind of worrisome to never have had a committee meeting or a City Council meeting on it and no public hearings. There’s no place for people to say what they think.”

Chicago Ald. Scott Waguespack, 32nd

the developments.

But given the high pro le of Chicago’s teams and the added interest of the Chicago Red Stars soccer club to be part of any allocation of public funds for sports stadiums, local conversations are louder than a Stanley Cup playo crowd. e Red Stars of the National Women’s Soccer League have voiced their frustrations at SeatGeek Stadium in Bridgeview after being forced to

million facility was largely privately nanced.

“As a public policy position, we’ve taken the position that we will invest and give public taxpayer dollars to men’s teams, but we’ve never done the same for women’s teams,” Leetzow says. “Men’s teams have gotten a head start by about 50 years. e question for us as a culture is, are we going to do the same for women’s teams?” Leetzow be-

lieves that women’s teams can see the same valuation growth with the same “seed money” that men’s teams have received.

Neither stadium where the Bears or White Sox currently play is paid o . About $620 million in debt is still outstanding for the last Soldier Field renovation in 2003, with $50 million in debt still outstanding for Guaranteed Rate Field, which opened in 1991 and has been renovated twice since. Sports stadium nancing experts say this is not uncommon.

Because stadium-building booms happen about every 2530 years, it stands to reason that those with terms of more than two decades will still have debt on the books when they start to strategize for the next upgrade. According to a paper in the Journal of Policy Analysis & Management, more than 60 North American professional sports teams’ stadiums will be 30 years old or more by 2030, suggesting that this round of stadium upgrade wishes is right on time.

Where that puts Chicago stadium dreams, it’s hard to say, but evaluating what has happened in other cities can help. e overwhelming majority of the 36 stadiums that have been built or had major renovations since 2003 with price tags of more than $575 million (the original budgeted cost of the 2003 Soldier Field renovation) have done so

Do stadium projects bring a measurable economic bene t to a city?

Teams

with at least some public funding, based on Crain’s research. Nationwide, football stadiums tend to be the most expensive and baseball stadiums tend to be the most heavily nanced through tax bonds, according to the National Tax Journal. e selling points on the part of those teams were similar to those of the Bears and White Sox: When a municipality invests in a sports stadium, it boosts the local economy in terms of spending and job creation. Newer roofed or domed stadiums attract bigger events to town — possibly marquee events such as the Super Bowl — bringing in tourist dollars.

“Sports in our culture are very popular and hold some sway,” says Andrew Zimbalist, the Robert A. Woods Professor Emeritus of Economics at Smith College and an expert in stadium nancing, about how we got to this moment in time where such projects are often publicly funded. “Team owners are wealthy and have good connections. ey are large employers. All of these forces lean on politicians who care about re-election.”

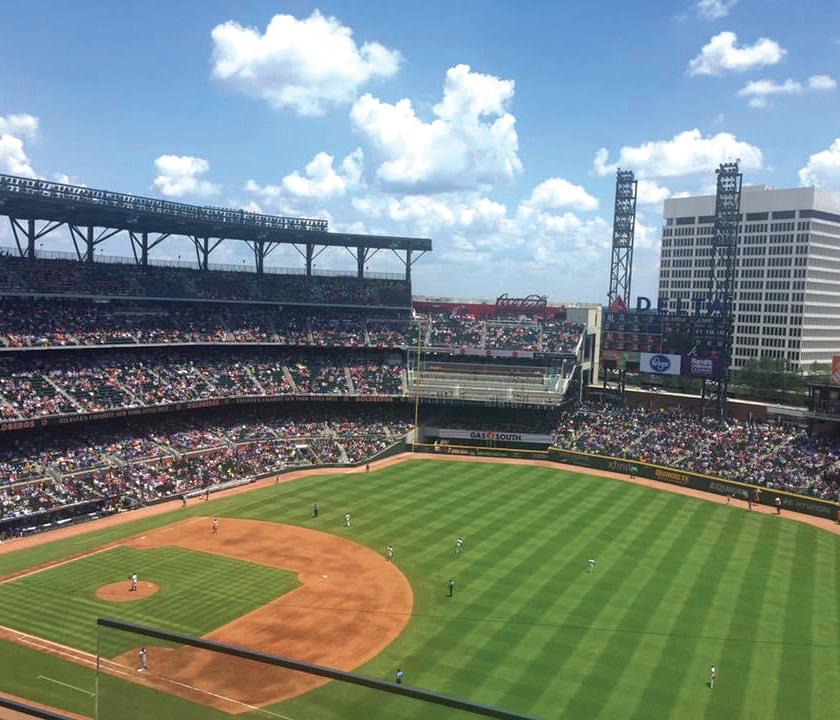

Yet most economic research shows that stadiums, at least on paper, are not necessarily good investments. Time and again, stadiums fail to generate estimated economic boosts. In Cobb County outside Atlanta, Truist Park, home of the Atlanta Braves, is generally considered a success. e Battery Atlanta entertainment district is a model for other new stadiums,

with pedestrian-friendly restaurants, shops and a hotel.

But according to a report by John Charles Bradbury of Kennesaw State University, the project has resulted in an annual de cit of $12 million to $15 million, which he predicts will continue for the next two decades.

In general, stadiums shift economic activity; they don’t increase it. For example, if a family has $300 to spend on a White Sox game at the team’s proposed new stadium and dinner afterward in e 78, they likely won’t spend $300 on something else. And, if they have limited spending dollars, the city of Chicago would rather have them spend it in town rather than in suburban Arlington Heights, where the Bears had proposed building a new stadium before releasing plans for a lakeside stadium in Chicago. e structure of stadium deals varies so signi cantly that experts say it’s impossible to categorically state whether public funding is “good” or “bad.”

Former Nashville Mayor John Cooper supported the Tennessee Titans’ e orts to build a new $2.2 billion domed football stadium, in part, because the lease for the existing Nissan Stadium, signed in 1996, legally obligated the city to provide a “ rst-class” stadium until 2039. e Cooper administration calculated that upgrade obligation at between $1.75 billion and $1.95 bil-

See STADIUMS on Page 13

Good data is hard to come by and recent history suggests that sometimes it does spur growth, but other times it does not. Let’s look at two examples.

The

The amount of public money the team used to build the Chase Center

From Page 12

lion and felt the more fiscally prudent decision was to negotiate a deal for a new stadium, which is now under construction. Opponents thought the costs of the upgrades were inflated. But the Titans’ deal illustrates the importance of negotiating a good deal for the city in the future. The team’s new stadium is being funded, in part, with bonds backed by a hotel occupancy tax, as the Bears have proposed. In contrast, Geodis Park, the Nashville Soccer Club’s new home and the largest stadium for the sport in North America, was built entirely through private funding, at a total of $335 million.

Yet even privately funded stadiums can have public investment, largely for infrastructure like roads and improvements in the surrounding area. Zimbalist, the economist, notes that many cities use stadium deals to get investments they might not otherwise be able to obtain.

At SoFi Stadium, the new $5.5 billion privately funded home of the Los Angeles Rams and Los Angeles Chargers, the city of Inglewood says it will eventually repay about $250 million for infrastructure supporting the stadium but will not have to start reimbursement until tax revenues reach more than $25 million annually.

Timing too fast?

For many in Chicago, the pace of discussion around the Bears’ latest lakefront proposal, in particular, is moving too fast for the plan to be thoroughly evaluated.

“When we think about how long a neighborhood park can take, the years grocery stores take, the thought that a project of this scale could just pop up when all these other projects have to go through rigorous analyses just feels like jumping to the front of the line,” says Gin Kilgore, interim executive director of the nonprofit Friends of the Parks, which has concerns about building on the lakefront, wanting to keep it “open, clear and free.” These same concerns led to the filing of a lawsuit against filmmaker George Lucas that prompted him to move the development of the Lucas Museum of Narrative Art from Chicago to Los Angeles, as well as an ongoing debate on the construction of the Obama Presidential Center in Jackson Park.

“Everything’s been roughshod,” says Chicago Ald. Scott Waguespack, 32nd, who was surprised when Mayor Brandon Johnson voiced his support of the Bears’ proposal in April, and that the conversation has not yet been brought to the City Council.

Waguespack believes that there are possible deals that could be beneficial for taxpayers, with such infrastructure as train stations, sidewalks and green spaces for public use in The 78, or bridges and sidewalks on the lakefront near the Museum Campus. In June, he sent Johnson a four-page list of ques-

tions about the Bears’ proposal, coming from the perspective that the mayor’s job is to act in the best interests of the city. Waguespack says he has not heard back.

“The mayor is not looking at the whole picture of what is needed,” he says. “I think it is brilliant marketing. People get hooked on these teams whether you can afford to go to (games) or not. The job is to be the fiduciary for the city, and the mayor is not replying to questions.”

Waguespack and others in particular, have concerns about whether the job-creation numbers Johnson touts for the Bears’ proposed development (approximately 2,300 permanent city jobs and 4,600 permanent regional jobs) are not truly “new” jobs, but rather a reallocation of jobs.

Marc Ganis, founder and president of Sportscorp and a Chicago-based stadium consultant, calls those numbers “political blather.”

“It is kind of worrisome to never have had a committee meeting or a City Council meeting on it and no public hearings. There’s no place for people to say what they think,” Waguespack adds.

For decades, owners of sports teams have used the threat of relocation in order to receive funding. And sometimes, they follow through. MLB’s Atlanta Braves moved from the city to the suburbs, the NFL’s Oakland Raiders relocated to Las Vegas and the NHL’s Arizona Coyotes are heading to Salt Lake City. Ganis thinks it is highly unlikely that the Bears will leave the greater Chicago area, but sees the White Sox leaving as a larger possibility. The Sox’s lower-profile broadcast deal gives the team less incentive to stay in the major TV market.

In addition, Ganis envisions “any number” of possible incarnations for Guaranteed Rate Field should the Sox relocate, including new housing and parking lots and a possible stadium for both Major League Soccer’s Chicago Fire and the NWSL’s Red Stars.

He notes that Chicago has long been inconsistent in its funding of professional stadiums, with the Sox receiving public funding for their stadium and the Chicago Cubs’ ballpark privately funded by the Ricketts family.

Leaders in Springfield have indicated it will be difficult for teams to get state funding for these projects. Gov. J.B. Pritzker says they are “a non-starter,” and emphasized in a meeting with Bears President Kevin Warren earlier this month that any deal must be “good for taxpayers.” Illinois Senate President Don Harmon emphasized that the public has “next to no appetite” for public funding.

“We need to be willing to have courageous, informed conversations,” says Friends of the Parks’ Kilgore. “The big question is: Who does this really benefit? And, of course, if it was an easy question to answer, we would have answered it already.”

Team owners sometimes leverage the possibility of leaving town — either to other cities or suburbs or out of state entirely — in public stadium financing negotiations. It does happen, but not often. Here’s a look at some professional teams that have pulled up stakes.

The Athletics (MLB)

The organization will move from Oakland to a new stadium in las Vegas in 2028. The team will play in Sacramento from 2025 to 2027.

The team will move from Tempe, Ariz., to Salt lake City in

The team moved from San Diego to l .A.’s

By Margaret Littman

While most of the headlines around stadium nancing in Chicago have centered on American football and baseball, owners of the city’s professional soccer teams are listening intently.

On one hand, there’s Joe Mansueto, billionaire entrepreneur and owner of Major League Soccer’s Chicago Fire club. Until 2019, the Fire played at SeatGeek Stadium, formerly known as Toyota Park, in Bridgeview. e team now plays at Soldier Field.

On the other hand, there’s Karen Leetzow, president of the Chicago Red Stars, the National Women’s Soccer League team currently playing at SeatGeek. Neither team has complete control over its current stadium situation. While the Fire have some bene ts to playing at Soldier Field, Mansueto says, the team is “not completely happy” there. Scheduling games around the Bears’ schedule and other events such as concerts, particularly during warm summer months that are best for soccer games, is tricky. e Bears also have exclusive sponsorship agreements at Soldier Field that limit the Fire’s sponsorship opportunities. ( at said, under Mansueto’s

leadership, the Fire have more than doubled their sponsor companies from 30 to 78 and quadrupled future contracted sponsorship revenue.)

At SeatGeek Stadium, the Red Stars defer to the Fire’s youth league schedules, the Chicago Hounds rugby team’s calendar, and various events. e club has been bumped from its home stadium for a scheduled game against San Diego Wave FC to accommodate the three-day Riot Fest in September.

Both executives note that SeatGeek is a quality facility but its Bridgeview location is hard to get to for North Siders and those in the north suburbs. And the venue doesn’t attract the young fans of women’s soccer, Leetzow says. Mansueto says the venue didn’t bring the amount of economic development to the area that was hoped for when it was built in 2006.

Both teams would like to play where the needs of their athletes, their fans and their management come rst. “It is not just frustrating, but, actually, we are athletically impaired by the fact that we’re behind everyone else in terms of when we can schedule our training times,”

Leetzow says of the current unavailability of optimal early-morning practice times for the Red Stars.

e Fire would prefer to play on grass, so if a new Bears stadium includes arti cial turf, that would prompt the team to look for a new home. If that were to happen, though, Mansueto doesn’t see heading to Spring eld for nancial help.

“If we’re going to build a stadium, we will privately nance. I’m not comfortable taking public money. Stadiums, in general, are not great investments,” he says. “ ey are big, expensive, costly to maintain and sit empty most of the time.” Given that Illinois already has high taxes and strained budgets, he says he wouldn’t consider adding to that public burden. Other MLS teams have successfully privately nanced new stadiums, including the Nashville SC. e team’s Geodis Park is the largest soccer-speci c stadium in North America.

Leetzow and Red Stars owner Laura Ricketts think all professional women’s sports teams should be part of any conversation on public funding of stadiums for pro teams.

“If you see little girls around the country, they value seeing women competing at the same level as men. And we know from the studies that have been done that if little girls see women compete at the same level

as men, they will be less likely to experience teen pregnancy, they’ll be more likely to end up in the C-suite, they’ll be less likely to experience depression,” Leetzow says. “ ere are just so many positive consequences that come from investing in women’s sports. . . .I’ve been extremely frustrated with how I’m having to advocate for things that the men have already gotten.”

Both teams have experienced signi cant growth with their new ownership. Under Mansueto’s leadership, the Fire have increased attendance and sponsorship support. Season-ticket memberships have also increased 47% year over year. Last month, the Red Stars broke a league attendance record when more than 35,000 fans watched them play against the Bay FC at Wrigley Field.

Conversations around town have included seeing the Fire and Red Stars play at Guaranteed Rate Field if the White Sox were to nd a new home in e 78 or elsewhere. “ at kind of surprised us,” Mansueto says. “We are not opposed to considering it, but we have not been consulted on how it could be recongured. We have not been party to that discussion.”

While Leetzow is not opposed to the Fire and Red Stars building an “amazing facility” together, she’s not enthusiastic about the site of the Sox’s current home. “It feels a little bit degrading to be taking over the leftovers of men’s sports and trying to turn that into something that is positive. It feels like if an MLB franchise couldn’t make it work where they are right now, why would you think we could?”

Working to advance racial equity and economic mobility for the ne xt generation in the Great Lakes region.

With the Chicago Bears and White Sox both seeking public support to build shiny new homes while so many Chicagoans are struggling with homelessness and rising housing costs, Friends of the Parks sees this as a critical moment to reflect on not just our civic values, but the value we place on our civic assets. Can these megadevelopments deliver enough public benefits in enough time to justify what they are seeking from public coffers?