Perspectivas Macro Globales

BAC Costa Rica

8 noviembre 2022

Kathryn

Rooney Vera, Head of Research and Strategykrooneyvera@bulltick.com

EEUU—Nunca ha habido una recesión sin que los indicadores líderes estuvieron negativos a/a

US--Leading Indicator Index, % chg y/y (recessions shaded) Source: Bloomberg, Bulltick

EEUU—Tasa desempleo como indicador de recesión

Unemployment Rate Vs 12mma As Recession Indicator US Recessions Indicator Unemployment rate, % Unemployment Rate, 12mma

EEUU

Confianza

como indicador de recesión

EEUU—

Proyecciones económicas Fed. Ojo en desemplo, inflación y PIB

EEUU—Bienes raíces en desaceleración

US--Case-Shiller Home Price Index

Case-Shiller National Home Price Index (LHS)

Case-Shiller National Home Price Index, % chg y/y (RHS)

Jan-90 Jan-92 Jan-94 Jan-96 Jan-98 Jan-00 Jan-02 Jan-04 Jan-06 Jan-08 Jan-10 Jan-12 Jan-14 Jan-16 Jan-18 Jan-20 Jan-22

Source: Bloomberg, Bulltick

EEUU—Regla de Taylor dice 7.75% fed funds

15.00

US--Taylor Rule For Fed Funds Rate (including altered assumptions)

10.00

5.00

0.00

-5.00

-10.00

-15.00

Fed Funds Upper Bound, % Taylor Rule (baseline assumptions)

Taylor Rule (r*=2, NAIRU=3)

Taylor Rule (r*=1, NAIRU=4)

Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 Dec-20 Dec-21

Source: Bloomberg, Bulltick

EEUU

—Euro más débil y DXY más fuerte desde 2002

EEUU

En desaceleración: ¿Dónde estamos ahora en el ciclo económico?

Growth/Inflation DeviationsFrom 10YTrend Since1970

2

Nos encontramos en el cuadrante IV

Growth (Inflation adjusted LEI Index)

-1

0

1

Goldilocks Environment (-/+ inflation/growth)

-2

-3

-4

Lorem Ipsum Lorem Ipsum Lorem Ipsum

Reflation Environment (+/+ inflation/growth)

1982

2010 2011 2012

2013

1992 1993

1991

1983 1984 1985 1986 19871988 1989 1990

Disinflation Environment (-/- inflation/growth)

1994 1995 1996

1997 1998 1999 2000 2001

2014 2015 2016

2002

2017 2018 2019 2020

1971

2009

2003 2004 2005 2006 2007 2008

1976 1977 1978 1979

1975

1980 1981

Lorem Ipsum Lorem Ipsum Lorem Ipsum

1970

1972 1973 1974

Stagflation Environment (+/- inflation/growth)

Lorem Ipsum Lorem Ipsum Lorem Ipsum

2021f -5

3 -4 -2 0 2 4 6 8

Inflation (Headline CPI)

EEUU—Hoy en Día Hay Dos Trabajos Disponibles para cada desempleado.

Cuando eso baja, la tasa de desempleo sube.

US--Job Vacancies Vs Unemployment Rate

Job Openings Rate, %

Unemployment Rate, %

Source: Bloomberg

La Política en EEUU: ¿Los republicanos tomarán el Congreso en noviembre?

Truman (1946)

Incumbent Party Typically Fights An Uphill Battle

Obama (2014)

Truman (1950)

Carter (1978) Reagan (1982)

(2018) Biden (2022)

Kennedy (1962) Johnson (1966)

Nixon (1970) Ford (1974)

Eisenhower (1954) Eisenhower (1958)

Reagan (1986) Bush (1990) Clinton (1994)

Clinton (1998) W. Bush (2002) W. Bush (2006) Obama (2010)

President's Gallup Approval Rating Just Before Midterm

China—Volviendo a Vivir

China--Industrial Production Growth & Commodity Prices

CHINA--Imports From Latin America, % chg y/y (including 12mma)

-60.0 -40.0 -20.0 0.0 20.0 40.0 60.0 80.0 100.0 120.0 140.0 Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 Dec-20 Dec-21

Source: Bloomberg, Bulltick

China--GDP Growth Contributors, pp

Primary Industry (Farming, Forestry, Animal Husbandry) Secondary Industry (Manufacturing, Construction)

Tertiary Industry (Retail, Services, Finance, Real Estate) Real Growth in Gross Domestic Product, %

Source: Bloomberg, Bulltick. Note: e/f = estimate/forecast

60.0

25.0

20.0

China IP Growth (LHS) Copper (Jan 2002=100) Oil (Jan 2002=100) Soy (Jan 2002=100)

15.0

10.0

5.0

0.0

0

700

600

500

400

300

200

100

800 -5.0

Feb-06 Feb-07 Feb-08 Feb-09 Feb-10 Feb-11 Feb-12 Feb-13 Feb-14 Feb-15 Feb-16 Feb-17 Feb-18 Feb-19 Feb-20 Feb-21 Feb-22

Source: Bloomberg

China--Components of Nominal GDP, % of Total

50.0

40.0

30.0

20.0

Primary Industry (Farming, Forestry, Animal Husbandry)

Secondary Industry (Manufacturing, Construction)

Tertiary Industry (Retail, Services, Finance, Real Estate)

10.0

0.0

Source: Bloomberg, Bulltick. Note: e/f = estimate/forecast

China

Volviendo a Vivir

CHINA--Retail Sales, % y/y (including 12mma)

CHINA--Foreign Exchange Reserves, USDbn

Source:

CHINA--Real GDP Growth, % y/y (including 4qma)

Source: Bloomberg

Estrategias de Inversión: Renta Variable ¿Cíclicos o Defensivos?

Estrategias de Inversión: Renta Fija

Perspectivas

Macroeconómicas para Centroamérica: retos y oportunidades

Gabriel Zaourak, Economista Senior de la unidad de Macroeconomía, inversión y comercio, Banco Mundial

Gabriel Zaourak, Economista Senior de la unidad de Macroeconomía, inversión y comercio, Banco Mundial

1. Una mirada rápida al contexto económico y social de la plazo

La región está sujeta a 4 desafíos de corto plazo

(i) Crecimiento débil pre and post pandemia (ii) Inflación alta (iii) Deuda de los gobiernos elevada (iv) Deficit fiscales elevados

Contexto Económico y Social: retos regionales

Crecimiento

América Latina ha crecido por debajo de otras regiones en desarrollo durante la ultima década, afectada por la pandemia del COVID proyección de crecimiento lento a futuro.

Economias Emergentes y en Desarrollo de Asia

Economias Emergentes y en Desarrollo de Europa

America Latina y el Caribe

Medio Oriente y Asia Central Africa Sub-Sahariana

Perspectivas Macroeconómicas para Centroamérica: retos y oportunidades

2021-2023e

Contexto Económico y Social: retos regionales

Inflación

La mayoría de los países de la región han sufrido el impacto del aumento de los precios internacionales y la inflación se encuentra por encima de sus metas.

Inflación e Inflación núcleo, Julio 2022 (% anual)

Fuente: Staff del Banco Mundial en base a Autoridades Nacionales y Haver Analytics

Nota: headline inflation refiere a la inflacion total anual al mes de Septiembre 2022, ‘Core’ inflation refiere a la inflacion sin consdierar elementos volatiles como alimentos y transporte

Perspectivas Macroeconómicas para Centroamérica: retos y oportunidades

Contexto Económico y Social: retos regionales

Inflación y pobreza

El shock inflacionario causaría 0,73 millones de nuevos pobres en América Central en 2022 con la República Dominicana y Nicaragua contribuyendo con casi la mitad del número de personas. pobres aumentaría para todos los países debido a la inflación en 2022 un aumento fuerte en Costa Rica

Variación en la pobreza debido al shock inflacionario, por línea de pobreza

Source: Estimaciones del personal del Banco Mundial basado on 2021 SEDLAC (CEDLAS WB) microdata y proyecciones macroeconomicas de la MTI Global Practice.(datos al 19 de Septimebre, 2022)

Perspectivas Macroeconómicas para Centroamérica: retos y oportunidades

Deuda Pública

COVID-19 aumentó los ya elevados niveles de endeudamiento público, recuperación se han mantenido altos en 2022 lo que limita el espacio fiscal para afrontar los retos de inclusión y resiliencia.

Deuda Pública (% of GDP) 2020 2021 2022

Fuente: MPO AM22

Latinoamérica: El reto de retomar la convergencia con inclusión y resiliencia

70 por ciento

Déficit Fiscales

Los déficits primarios se reducen, pero el espacio fiscal y la composición sigue siendo un obstáculo para el crecimiento y las medidas de fomento de la equidad dado que los pagos de los intereses han aumentado los déficit globales y la deuda. Las subas de tasas globales aumentar

Source: Estimaciones del personal del Banco Mundial basado on 2021 SEDLAC (CEDLAS WB) microdata y proyecciones macroeconomicas de la MTI Global Practice.(datos al 19 de Septimebre, 2022) Perspectivas Macroeconómicas para Centroamérica: retos y oportunidades

Contexto Económico y Social: retos regionales

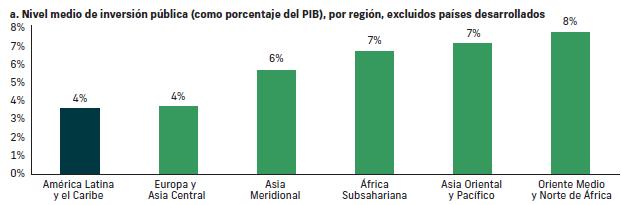

Cerrando la brecha fiscal

Pese a los altos retornos y al bajo nivel de la inversión pública, los gobiernos tienden a reducir el gasto en este rubro.

Gasto en inversión pública como porcentaje del PIB

Perspectivas Macroeconómicas para Centroamérica: retos y oportunidades

Mayor movilización de recursos fiscales es también clave para inversión publica en infraestructura y capital humano

Si bien la recaudación fiscal ha mejorado en la ultima década, aún se encuentra lejos de los países desarrollados.

Aunque algunos países como Nicaragua y Honduras han podido incrementar el recaudo, Centroamérica esta aún por debajo del promedio latinoamericano, con Guatemala teniendo la segunda recaudación más baja de la región.

Asimismo, mejorar la eficiencia de la recaudación fiscal generaría ahorros en la administración pública

La gran diferencia entre los países de alta y baja recaudación esta marcada por baja recaudación en impuestos a los ingresos personales y la propiedad.

Estudios acerca del efecto de los impuestos sobre la actividad estiman que Centroamérica tiene espacio para aumentar el recaudo sin afectar significativamente la actividad económica.

Fuente: Gunter et al. (2021)

Oportunidades regionales: fuentes de financiamiento inclusivas y resilientes

Asimismo, mejorar la eficiencia del gasto generaría grandes ahorros

Pérdidas en transferencias, contrataciones y salario elevadas.

Ahorro como porcentaje del Gasto

• 2/3 de los países podrían equilibrar sus presupuestos con el ahorro.

• Puerta de entrada a la modernización del Estado y al aumento de la confianza de los ciudadanos.

Fuente: OECDstats

Perspectivas Macroeconómicas para Centroamérica: retos y oportunidades

Fuente: Gunter et al. (2021)

2. Desafios

La región tiene varios desafíos estructurales, las cuales son a la vez oportunidades

(i) Gasto social bajo e ineficiente

(ii) Gaps en cantidad y calidad de la educación

(iii)Mercados de trabajo rígidos y poco inclusivos

(iv)Mercados financieros poco profundos

(v) Diversificación de exportaciones y participación en cadenas globales de valor

Contexto Económico y Social: retos regionales

Gasto Social

12

Gasto social del gobierno central como % del PIB en Centroamérica, 2019

10

8

6

4

La evolución del gasto social en Latinoamérica y países centroamericanos ha ido en aumento durante la última década. 5.96 6.38 7.09 0

14 Guatemala Panama Dominican Republic

2

Source:Ownelaborationbasedon CEPALSTAT.

Macroeconómicas para Centroamérica: retos y oportunidades

is computed simple average expenditure the Caribbean region (when 2019 data were not available, data corresponding to the previous available year were used instead). Social public expenditure computed as the sum of health, education and social protection expenditure of central government.

Contexto

Capital Humano

0.60

0.55

0.50

0.45

Perspectivas

0.65 0 500 1000

SLV JAMPRY

NIC GTM

HCI, gasto social per cápita y eficiencia en LAC, 2020 2010

Human Capital Index Per capita social expenditure (2017 PPP) 13

HND

ECU GUY 0.40

Educación

El gasto público en educación en la región encima de lo que se relaciona con su nivel de desarrollo. Sin embargo, resultados.

Mercados laborales poco flexibles…..

Y en donde existen recursos no explotados

Utilizando recursos no explotados: capital

Existe un potencial de crecimiento que no está siendo explotado dada la baja profundidad del sistema financiero, en promedio.

Para incrementar crecimiento, se requiere incrementar la participación en el Comercio Internacional en cantidad y calidad…

El Comercio global de bienes tuvo una rápida recuperación, en Enero 2021 ya había recuperado los niveles pre-pandemia.

Exportaciones en USD (Enero 2020 = 100)

Global Asia del Este y Pacifico (exlc. China) Europa y Asia Central Latinoamerica y el Caribe South Asia

Oportunidades regionales: fuentes de financiamiento inclusivas y resilientes Perspectivas Macroeconómicas para Centroamérica: retos y oportunidades

Sin embargo, las cantidades exportas solo encontraban 2% por encima del nivel pre pandemia, con Centroamérica liderando la recuperación y Sudamérica todavía por debajo.

Cantidades exportadas (2019Q4 = 100, ajustado por estacionalidad) Caribe Centroamerica Sudamerica America Latina y el Caribe

Oportunidades regionales: fuentes de financiamiento inclusivas y resilientes

…y un esfuerzo por atraer más y mejor Inversión Extranjera Directa

Los flujos de IED se han estancado desde el 2014, y la mayoría de ellos son explicados por Panamá, DR y Costa Rica Los países ADD han tenido éxito significativo en atraer IED en comparación con sus pares regionales.

Fuente: WDI y CEPALstats (Foreign Direct Investment in Latin America and the Caribbean, 2020) Para la descomposición sectorial

Contexto Económico y Social: retos regionales

Integración regional

Siendo mayor que el promedio de ALC, la región participa poco en cadenas de valor, derivado de (i) altas barreras comerciales, (ii) procesos de cruce de fronteras complicados e (iii) infraestructura y logística deficientes.

Indice de participación en cadenas globales de valor Perspectivas Macroeconómicas para Centroamérica: retos y oportunidades

3. Riesgos

Contexto internacional

Los factores externos que eran favorables en 2021 se han deteriorado este último año Perspectivas Macroeconómicas para Centroamérica: retos y oportunidades

Riesgos

Existen variaciones respecto al cambio en el índice de riesgo en las regiones durante los últimos 10 años.

Latinoamérica ha presentado un incremento general en comparación con Asia.

Fuente: INFORM Report 2022

Contexto Económico y Social: retos regionales Perspectivas Macroeconómicas para Centroamérica: retos y oportunidades

Financiamiento de riesgos de desastre– Bonos verdes/azules, sociales, sostenibles

Se estima que se necesitan entre $1.6 y $3.8 billones de dólares para alcanzar la transición a una economía baja en carbono entre el 2016 y 2050. En consecuencia se requiere una inversión de $300 mil millones anuales para cubrir los costos de la adaptación

Los bonos verdes/azules son cualquier tipo de instrumento de bonos en el que los ingresos se aplicarán exclusivamente para financiar o refinanciar, en parte o en su totalidad, proyectos verdes/azules nuevos y/o existentes elegibles

Los bonos con etiqueta sostenible abarcan elementos tanto de los bonos verdes como de los sociales

Los bonos sociales son bonos de uso de los ingresos que recaudan fondos para proyectos nuevos y existentes con resultados sociales positivos

Oportunidades regionales: fuentes de financiamiento inclusivas y resilientes

Bonos Climáticos

La emisión anual de bonos verdes superó la marca del medio billón por primera vez en 2021, terminando con 522.700 millones de dólares, un aumento del 75% respecto a 2020.

Dentro del tema de la sostenibilidad, América Latina registró el incremento más impresionante, con un aumento del 338% interanual hasta los 11 500 millones de USD. La mayor parte de esta cifra procede de emisores soberanos (principalmente Chile).

Asignación de Iniciativa Regional de Bonos Climáticos

4. Riesgos climáticos y medioambientales para el sector bancario en

regionales: fuentes de financiamiento inclusivas y resilientes

Los préstamos bancarios se concentran en las capitales y sus alrededores, lo que conlleva mayores riesgos físicos ante las catástrofes naturales propias de cada provincia Mapa geográfico de los porcentajes de la cartera de créditos de los bancos en provincias, diciembre 2019

Oportunidades regionales: fuentes de financiamiento inclusivas y resilientes

Las

grandes catástrofes naturales podrían provocar un aumento del NPL total* de hasta 1,4 puntos porcentuales en las provincias

afectadas

El efecto es mayor para la cartera de créditos de las sociedades no financieras, donde el aumento puede ser de hasta 2,5 puntos porcentuales en la morosidad cuatro trimestres después del evento.

Bolivia, Paraguay y Uruguay son los mayores emisores de GHC si se ajusta al tamaño de su economía

Oportunidades regionales: fuentes de financiamiento inclusivas y resilientes

Carteras de crédito de los bancos en sectores generadores de CO2e

5. Cierre

1. A menos que la región realice cambios, COVID-19 dejará heridas de largo plazo y será difícil cerrar la brecha de ingresos con los países desarrollados.

2. Oportunidad para embarcarse en reformas estructurales que mejoren la productividad y crear resiliencia en las economías, dado los crecientes riesgos del cambio climático.

3. Los desafíos de implementar tales políticas serán intensos políticamente, y probablemente implique “ganadores y perdedores”.

Abordarlos de manera efectiva requiere:

(i) Una profunda visión estratégica; (ii) Una mejor coordinación intrarregional de políticas; y (iii) El desarrollo de las capacidades del Estado en Centroamérica.

Costa Rica Macroeconomic Outlook

Contrasts with Latin America

Costa Rica : Overview

• Overall, turning more positive on the economic outlook for Costa Rica.

(+) 5 Positive aspects:

• Structural strengths of the economy: export-driven, political stability (oldest democracy in LatAm), environmental policies (ESG), security (migration), educated workforce compared to LatAm peers

• Fiscal rule is working: Big improvement in fiscal balance versus 2019. Primary surplus. Fiscal stability arguably most important challenge of Chaves administration.

• IMF program provides low-cost financing and oversight.

• Public employment reform was approved in last administration. Positive spillovers on fiscal outlook.

• Green energy supply makes Costa Rica less exposed to global energy shock.

(- ) 5 negative aspects:

• Risk of stalemate in Congress. President’s party has small minority. Some populist proposals have emerged (pension fund withdrawals).

• Fiscal rule could be amended because it is too strict . Markets would react negatively. High budget rigidity. Earmarking of revenues.

• Domestic debt (most of the debt stock) is expensive and keeps Costa Rica’s interest burden elevated. Crowdingout effect.

• Political opposition to raising taxes. despite the fact that tax revenues are very low as % of GDP.

• High financing needs (mostly domestic). Around 10% of GDP.

What to Watch:

• Authorization by Congress to issue external debt (at least $1.5bn expected to be approved by year end). Multi year authorization would be more positive than one-off authorization.

• Alleged campaign financing irregularities affecting President Chaves.

• Proposal to sell government banks and insurance company.

• IMF program reviews.

Monetary policy:

will probably continue

Monetary policy rates in the US and the inflation-targeting countries of LatAm (%)

US Fed hikes and high inflation put pressure on central banks to continue hiking

Monetary policy rate avg 2005-2019

4Q201Q212Q213Q214Q211Q222Q22Nov-22 4Q201Q212Q213Q214Q211Q222Q22Nov-22 4Q201Q212Q213Q214Q211Q222Q22Nov-22 4Q201Q212Q213Q214Q211Q222Q22Nov-22 4Q201Q212Q213Q214Q211Q222Q22Nov-22 4Q201Q212Q213Q214Q211Q222Q22Nov-22 4Q201Q212Q213Q214Q211Q222Q22Nov-22 4Q201Q212Q213Q214Q211Q222Q22Nov-22 4Q201Q212Q213Q214Q211Q222Q22Nov-22 4Q201Q212Q213Q214Q211Q222Q22Nov-22 4Q201Q212Q213Q214Q211Q222Q22Nov-22

US Bra Chi Col CRi DRe Gua Hon Mex Par Per

Fiscal policy : Unequivocal improvement in Costa Rica’s results

Fiscal Balance across Central America and mid-size LatAm economies (%)

Costa Rica’s fiscal rule is showing effectiveness at capping expenditures. Fiscal stability is key to reduce borrowing costs, anchor exchange rate, and attract foreign investment

Risk premium: Markets reacting positively to Costa Rica’s policies

10 - year USD bond spread vs. US Treasuries (%) Costa Rica’s risk premium is one of the few in the region with an improving trend. IMF program and fiscal discipline are the drivers, in our view

Current

and

BofA forecasts for Costa Rica

Forecasts for Costa Rican economy

We expect GDP growth to be robust in the coming years, and public debt ratio to trend down

2014 2015 2016 2017 2018 2019 2020 2021 2022F 2023F 2024F

GDP growth (%) 3.5 3.7 4.2 4.2 2.6 2.4 -4.1 7.8 4.3 2.9 3.5

Nominal GDP (US$ bn) 52 56.4 58.8 60.5 62.4 64.5 62.2 64.4 68.3 75.8 79.6

CPI inflation (eop, %) 5.1 -0.8 0.8 2.6 2 1.5 0.9 3.3 11.5 4.4 3

Nominal exchange rate (CRC/US$, eop, + depreciation) 539 537 553 569 607 571 613 642 650 660 660

Monetary policy rate (eop, %) 5.25 2.25 1.75 4.75 5.25 2.75 0.75 1.25 10.00 6.00 4.75

Central Government primary balance (% of GDP) -3.2 -2.9 -2.4 -2.9 -2.3 -2.6 -3.4 -0.3 0.8 1.5 1.5

Central Government overall balance (% of GDP) -5.5 -5.5 -5.1 -5.9 -5.7 -6.6 -8.0 -5.0 -4.0 -3.4 -3.1

Central Government gross public debt (% of GDP) 37.5 39.8 44.1 47.1 51.9 56.4 67.2 68.2 64.8 62.9 61.5

Current account balance (% of GDP) -4.7 -3.4 -2.1 -3.6 -3.0 -1.3 -1.0 -3.3 -4.9 -4.0 -3.0

International reserves (US$ bn) 7.2 7.8 7.6 7.2 7.5 8.9 7.2 6.9 8.4 8.4 8.8

Source: BofA Global Research, Ministry of Finance

Thank you

Important Disclosures

BofA Global Research personnel (including the analyst(s) responsible for this report) receive compensation based upon, among other factors, the overall profitability of Bank of America Corporation, including profits derived from investment banking. The analyst(s) responsible for this report ma y also receive compensation based upon, among other factors, the overall profitability of the Bank’s sales and trading businesses relating to the class of secu rities or financial instruments for which such analyst is responsible.

Other Important Disclosures

Prices are indicative and for information purposes only. Except as otherwise stated in the report, for any recommendation in rel ation to an equity security, the price referenced is the publicly traded price of the security as of close of business on the day prior to the date of the report or, i f the report is published during intraday trading, the price referenced is indicative of the traded price as of the date and time of the report and in relation to a debt security (including equity preferred and CDS), prices are indicative as of the date and time of the report and are from various sources including BofA Securities trading desks.

Officers of BofAS or one or more of its affiliates (other than research analysts) may have a financial interest in securities of the issuer(s) or in related investments. Individuals identified as economists do not function as research analysts under U.S. law and reports prepared by them are not re search reports under applicable U.S. rules and regulations. Macroeconomic analysis is considered investment research for purposes of distribution in the U.K. under the rules of the Financial Conduct Authority.

Refer to BofA Global Research policies relating to conflicts of interest.

"BofA Securities" includes BofA Securities, Inc. ("BofAS") and its affiliates. Investors should contact their BofA Securities representative or Merrill Global Wealth Management financial advisor if they have questions concerning this report or concerning the appropriateness of any investment idea described herein for such investor. "BofA Securities" is a global brand for BofA Global Research.

Information relating to Non US affiliates of BofA Securities and Distribution of Affiliate Research Reports: BofAS and/or Merrill Lynch, Pierce, Fenner & Smith Incorporated ("MLPF&S") may in the future distribute, information of the following non US affiliates in the US (short name: legal name, regulator): Merrill Lynch (South Africa): Merrill Lynch South Africa (Pty) Ltd., regulated by The Fi nancial Service Board; MLI (UK): Merrill Lynch International, regulated by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA); BofASE (France): BofA Securities Europe SA is authorized by the Autorité de Contrôle Prudentiel et de Résolution (ACPR) and regulated by the ACPR and the Autorité des Marchés Financiers (AMF). Note that BofA Securities Europe SA has registered address at 51 rue la Boétie, 75008 Paris, is registered under no. 842 602 690 RCS Paris, and its share capital can be found on BofASE’s disclaimer webpage; BofA Europe (Milan): Bank of America Europe Designated Activity Company, Milan Branch, regulated by the Ban k of Italy, the European Central Bank (ECB) and the Central Bank of Ireland (CBI); BofA Europe (Frankfurt): Bank of America Europe Designated Activity Co mpany, Frankfurt Branch regulated by BaFin, the ECB and the CBI; BofA Europe (Madrid): Bank of America Europe Designated Activity Company, Sucursal en España, regulated by the Bank of Spain, the ECB and the CBI; Merrill Lynch (Australia): Merrill Lynch Equities (Australia) Limited, regulated by the Australian Securities a nd Investments Commission; Merrill Lynch (Hong Kong): Merrill Lynch (Asia Pacific) Limited, regulated by the Hong Kong Securities and Futures Commission (HKSFC); Merrill Lynch (Singapore): Merrill Lynch (Singapore) Pte Ltd, regulated by the Monetary Authority of Singapore (MAS); Merrill Lynch (Canada): Merrill Lynch Canada Inc, regulated by the Investment Industry Regulatory Organization of Canada; Merrill Lynch (Mexico): Merrill Lynch Mexico, SA de CV, Casa de Bolsa , regulated by the Comisión Nacional Bancaria y de Valores ; Merrill Lynch (Argentina): Merrill Lynch Argentina SA, regulated by Comisión Nacional de Valores ; BofAS Japan: BofA Securities Japan Co., Ltd., regulated by the Financial Services Agency; Merrill Lynch (Seoul): Merrill Lynch International, LLC Seoul Branch, regulated by the Financial S upervisory Service; Merrill Lynch (Taiwan): Merrill Lynch Securities (Taiwan) Ltd., regulated by the Securities and Futures Bureau; BofAS India: BofA Securities India Li mited, regulated by the Securities and Exchange Board of India (SEBI); Merrill Lynch (Indonesia): PT Merrill Lynch Sekuritas Indonesia, regulated by Otoritas Jasa Keuangan (OJK); Merrill Lynch (Israel): Merrill Lynch Israel Limited, regulated by Israel Securities Authority; Merrill Lynch (Russia): OOO Merrill Lynch Securities, Mo scow, regulated by the Central Bank of the Russian Federation; Merrill Lynch (DIFC): Merrill Lynch International (DIFC Branch), regulated by the Dubai Financial Services Authority (DFSA); Merrill Lynch (Brazil): Merrill Lynch S.A. Corretora de Títulos e Valores Mobiliários , regulated by Comissão de Valores Mobiliários ; Merrill Lynch KSA Company: Merrill Lynch Kingdom of Saudi Arabia Company, regulated by the Capital Market Authority.

Other Important Disclosures

This information: has been approved for publication and is distributed in the United Kingdom (UK) to professional clients and el igible counterparties (as each is defined in the rules of the FCA and the PRA) by MLI (UK), which is authorized by the PRA and regulated by the FCA and the PRA details about the extent of our regulation by the FCA and PRA are available from us on request; has been approved for publication and is distributed in the Euro pean Economic Area (EEA) by BofASE (France), which is authorized by the ACPR and regulated by the ACPR and the AMF; has been considered and distributed in Japan by BofAS Japan, a registered securities dealer under the Financial Instruments and Exchange Act in Japan, or its permitted affiliates; is issued and distributed in Hong Kong by Merrill Lynch (Hong Kong) which is regulated by HKSFC; is issued and distributed in Taiwan by Merrill Lynch (Taiwan); is issued and distributed i n India by BofAS India; and is issued and distributed in Singapore to institutional investors and/or accredited investors (each as defined under the Financial Advisers Regulations) by Merrill Lynch (Singapore) (Company Registration No 198602883D). Merrill Lynch (Singapore) is regulated by MAS. Merrill Lynch Equities (Australia) Limited (ABN 65 006 276 795), AFS License 235132 (MLEA) distributes this information in Australia only to 'Wholesale' clients as defined by s.761G of the Corporations Act 2001. With the exception of Bank of America N.A., Australia Branch, neither MLEA nor any of its affiliates involved in preparing this information is an Authorised Deposit Taking Institution under the Banking Act 1959 nor regulated by the Australian Prudential Regulation Authority. No approval is required for publication or dis tribution of this information in Brazil and its local distribution is by Merrill Lynch (Brazil) in accordance with applicable regulations. Merrill Lynch (DIFC) is authorized and regulated by the DFSA. Information prepared and issued by Merrill Lynch (DIFC) is done so in accordance with the requirements of the DFSA conduct of business rules. BofA Europe (Frankfurt) distributes this information in Germany and is regulated by BaFin, the ECB and the CBI. BofA Securities entities, including BofA Europe and BofASE (France), may outsource/delegate the marketing and/or provision of certain research services or aspects of research services to other branches or members of the BofA Securities group. You may be contacted by a different BofA Securities entity acting for and on behalf of your service provi der where permitted by applicable law. This does not change your service provider. Please refer to the Electronic Communications Disclaimers for further information . This information has been prepared and issued by BofAS and/or one or more of its non US affiliates. The author(s) of this information may not be licensed to carry on regulated activities in your jurisdiction and, if not licensed, do not hold themselves out as being able to do so. BofAS and/ or MLPF&S is the distributor of this information in the US and accepts full responsibility for information distributed to BofAS and/or MLPF&S clients in the US by its non US affiliates. Any US person receiving this information and wishing to effect any transaction in any security discussed herein should do so through BofAS and/or MLPF&S and not such foreign affiliates. Hong Kong recipients of this information should contact Merrill Lynch (Asia Pacific) Limited in respect of any ma tters relating to dealing in securities or provision of specific advice on securities or any other matters arising from, or in connection with, this information. Singapore recipients of this information should contact Merrill Lynch (Singapore) Pte Ltd in respect of any matters arising from, or in connection with, this information. For clients that are not accredited inve stors, expert investors or institutional investors Merrill Lynch (Singapore) Pte Ltd accepts full responsibility for the contents of this information distributed to such clients in Singapore.

Other Important Disclosures

General Investment Related Disclosures:

Taiwan Readers: Neither the information nor any opinion expressed herein constitutes an offer or a solicitation of an offer to transact in any securities or other financial instrument. No part of this report may be used or reproduced or quoted in any manner whatsoever in Taiwan by the press or any other person without the express written consent of BofA Securities.

This document provides general information only, and has been prepared for, and is intended for general distribution to, BofA Securities clients. Neither the information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities o r o ther financial instrument or any derivative related to such securities or instruments (e.g., options, futures, warrants, and contracts for differences). This document is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation and the particula r n eeds of, and is not directed to, any specific person(s). This document and its content do not constitute, and should not be considered to constitute, investment a dvi ce for purposes of ERISA, the US tax code, the Investment Advisers Act or otherwise. Investors should seek financial advice regarding the appropriateness of inves ting in financial instruments and implementing investment strategies discussed or recommended in this document and should understand that statements regarding future prospects may not be realized. Any decision to purchase or subscribe for securities in any offering must be based solely on existing public inform ati on on such security or the information in the prospectus or other offering document issued in connection with such offering, and not on this document. Securities and other financial instruments referred to herein, or recommended, offered or sold by BofA Securities, are not insured by the Federal Deposit Insurance Corporation and are not deposits or other obligations of any insured depository institution (including, Bank of America, N.A.). Investments in general and, derivatives, in particular, involve numerous risks, including, among others, market risk, counterparty default risk and liquidity risk. No security, financial instrument or derivative is suitable for all investors. Digital assets are extremely speculative, volatile and are largely unregulated. In some cases , s ecurities and other financial instruments may be difficult to value or sell and reliable information about the value or risks related to the security or financial instrum ent may be difficult to obtain. Investors should note that income from such securities and other financial instruments, if any, may fluctuate and that price or value o f s uch securities and instruments may rise or fall and, in some cases, investors may lose their entire principal investment. Past performance is not necessarily a guide to future performance. Levels and basis for taxation may change.

BofA Securities is aware that the implementation of the ideas expressed in this report may depend upon an investor's ability to "short" securities or other financial instruments and that such action may be limited by regulations prohibiting or restricting "shortselling" in many jurisdictions. Investors are urged to seek advice regarding the applicability of such regulations prior to executing any short idea contained in this report.

Other Important Disclosures

Foreign currency rates of exchange may adversely affect the value, price or income of any security or financial instrument mentioned in this report. Investors in such securities and instruments effectively assume currency risk.

BofAS or one of its affiliates is a regular issuer of traded financial instruments linked to securities that may have been re com mended in this report. BofAS or one of its affiliates may, at any time, hold a trading position (long or short) in the securities and financial instruments discussed in th is report.

BofA Securities, through business units other than BofA Global Research, may have issued and may in the future issue trading ideas or recommendations that are inconsistent with, and reach different conclusions from, the information presented herein. Such ideas or recommendations may ref lect different time frames, assumptions, views and analytical methods of the persons who prepared them, and BofA Securities is under no obligation to ens ure that such other trading ideas or recommendations are brought to the attention of any recipient of this information.

In the event that the recipient received this information pursuant to a contract between the recipient and BofAS for the provisi on of research services for a separate fee, and in connection therewith BofAS may be deemed to be acting as an investment adviser, such status relates, if at all, s olely to the person with whom BofAS has contracted directly and does not extend beyond the delivery of this report (unless otherwise agreed specifically in writing b y B ofAS). If such recipient uses the services of BofAS in connection with the sale or purchase of a security referred to herein, BofAS may act as principal for its o wn account or as agent for another person. BofAS is and continues to act solely as a broker dealer in connection with the execution of any transactions, including transactions in any securities referred to herein.

Copyright and General Information:

Copyright 2022 Bank of America Corporation. All rights reserved. iQdatabase® is a registered service mark of Bank of America Co rporation. This information is prepared for the use of BofA Securities clients and may not be redistributed, retransmitted or disclosed, in whole or in part, o r in any form or manner, without the express written consent of BofA Securities. BofA Global Research information is distributed simultaneously to internal and cl ien t websites and other portals by BofA Securities and is not publicly available material. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute, retransmit, or disclose to others the contents, opinions, conclusion, or information contained herein (i ncl uding any investment recommendations, estimates or price targets) without first obtaining express permission from an authorized officer of BofA Securities. Materials prepared by BofA Global Research personnel are based on public information. Facts and views presented in this material have not been reviewed by, and may not reflect information known to, professionals in other business areas of BofA Securities, including investment banking personnel. BofA Securities has established information barriers between BofA Global Research and certain business groups. As a result, BofA Securities does not disclose certain client relationships with, or compensation received from, such issuers. To the extent this material discusses any legal proceeding or issues, it has not been prepared as nor is it intended to express any legal conclusion, opinion or advice. Investors should consult their own legal advisers as to issues of law rel ating to the subject matter of this material. BofA Global Research personnel’s knowledge of legal proceedings in which any BofA Securities entity and/or its directors, off icers and employees may be plaintiffs, defendants, co defendants or co plaintiffs with or involving issuers mentioned in this material is based on public information. Facts and views presented in this material that relate to any such proceedings have not been reviewed by, discussed with, and may not reflect information known to , professionals in other business areas of BofA Securities in connection with the legal proceedings or matters relevant to such proceedings.

Other Important Disclosures

This information has been prepared independently of any issuer of securities mentioned herein and not in connection with any pro posed offering of securities or as agent of any issuer of any securities. None of BofAS any of its affiliates or their research analysts has any authority whats oever to make any representation or warranty on behalf of the issuer(s). BofA Global Research policy prohibits research personnel from disclosing a recommendation, investment rating, or investment thesis for review by an issuer prior to the publication of a research report containing such rating, recommendation or investmen t thesis.

Any information relating to the tax status of financial instruments discussed herein is not intended to provide tax advice or to be used by anyone to provide tax advice. Investors are urged to seek tax advice based on their particular circumstances from an independent tax professional.

The information herein (other than disclosure information relating to BofA Securities and its affiliates) was obtained from vari ous sources and we do not guarantee its accuracy. This information may contain links to third party websites. BofA Securities is not responsible for the content of any third party website or any linked content contained in a third party website. Content contained on such third party websites is not part of this information and i s not incorporated by reference. The inclusion of a link does not imply any endorsement by or any affiliation with BofA Securities. Access to any third party website is at your own risk, and you should always review the terms and privacy policies at third party websites before submitting any personal information to them. BofA Securities is not responsible for such terms and privacy policies and expressly disclaims any liability for them.

All opinions, projections and estimates constitute the judgment of the author as of the date of publication and are subject to change without notice. Prices also are subject to change without notice. BofA Securities is under no obligation to update this information and BofA Securities abili ty to publish information on the subject issuer(s) in the future is subject to applicable quiet periods. You should therefore assume that BofA Securities will not update any fact, circumstance or opinion contained herein.

Certain outstanding reports or investment opinions relating to securities, financial instruments and/or issuers may no longer be current. Always refer to the most recent research report relating to an issuer prior to making an investment decision.

In some cases, an issuer may be classified as Restricted or may be Under Review or Extended Review. In each case, investors s hould consider any investment opinion relating to such issuer (or its security and/or financial instruments) to be suspended or withdrawn and should not rely on th e a nalyses and investment opinion(s) pertaining to such issuer (or its securities and/or financial instruments) nor should the analyses or opinion(s) be considered a solicitation of any kind. Sales persons and financial advisors affiliated with BofAS or any of its affiliates may not solicit purchases of securities or financial instruments that are Restricted or Under Review and may only solicit securities under Extended Review in accordance with firm policies.

Neither BofA Securities nor any officer or employee of BofA Securities accepts any liability whatsoever for any direct, indirect or consequential damages or losses arising from any use of this information.