Summer 2024 Commodity Report

All content correct at the time of publication, May 2024.

There is no doubt that the levels of food inflation are falling, in comparison to the same point last year - a welcome sight for foodservice operators. A large part of this is due to lower energy costs, a normalisation of supply chains and the grain corridor allowing key grains to make it out of the Black Sea region.

According to industry professionals, we have seen the worst of high food inflation, and this is being reflected in the reduced inflation levels seen across Europe. With that said, UK food inflation remains higher than other Western economies, with Brexit Red Tape contributing to this.

“We

have seen the worst of high

food inflation”

Carlos Mera, Head of Agricultural Commodities at Rabobank

The future, however, remains a little more uncertain. Poor weather conditions across Europe have the potential to disrupt crops in a significant way and additional customs checks on goods imported from Europe are only likely to add further complexity to the supply of the UK market. Crude oil is high (historically), labour costs are increasing and ongoing conflict, both Russia/Ukraine and across the Middle East, can quickly sway Government policy and in turn, affect commodity markets.

Outlook Contents

All content correct at the time of publication, May 2024.

Outlook 2 Inflation 3 Exchange Rates 4 Energy 4 Shipping 5 Fuel 6 Key Commodity Pricing 7 Dairy 8 Meat & Poultry 10 Fish 12 Fruit & Vegetables 14 Grocery 15 Drinks 19 Non Food 20 2 UK inflation falls as some food prices drop UK facing food shortages and price rises after extreme weather

Inflation

The Consumer Prices Index rose by 2.3% in the 12 months to April 2024, down from 3.2% in the 12 months to March.

The largest downward contributions to the monthly change in both CPIH and CPI annual rates came from falling gas and electricity prices.

FOOD FOCUS

Inflation prices of food and non-alcoholic beverages rose by 4% in the year to March 2024 according to the ONS. However, it is at the lowest rate since November 2021.

The bad news is, that after 7 months of decline the food price index ticks up in March, mostly driven by higher prices on vegetable oil and dairy products.

With an annual view, we are positive that the overall food market is trending back up as bad crops, uncontrollable weather, labour costs and motor fuels are pushing prices.

FOOD & NON-ALCOHOLIC BEVERAGES

Source: Consumer price inflation from the Office for National Statistics

All content correct at the time of publication, May 2024. 3

Exchange Rates Energy

The Pound to Dollar exchange rate dropped dramatically following the release of yet another above-consensus jobs report. This pushed the favoured start date of the first rate cut at the Federal Exchange, from July to September. The extent of the move suggested a breakdown was underway in not only PoundDollar, but other Dollar-based exchange rates.

The GBP-USD level is currently at 1.26, but forecasts are tilted upward for later in the year—reaching 1.30 by year-end.

The Pound Sterling registered a 0.30% recovery against the Euro in early April, helped by guidance from the Bank of England though they won’t be tempted to cut interest rates as soon as May.

The Pound-Euro fell to a fresh nine-week low at 1.1626 in response to these developments.

Good news for households, as the Energy Price Cap fell by 12% to £1,690 a year based on a typical household that uses dual fuel. This is versus the £1,928 Price Cap in January 2024.

There is expected to be a further 8% price drop, down to £1,560 a year from July 2024, but then a 5% increase at the back end of the year, at a time when most households use more fuel.

However, whilst the pe kWh pricing has reduced, the standing charges per day have risen, as seen in the table below. This means that without using any energy at all, it will still cost each household a minimum of £82 between 1 April – 30 June 2024.

Source: Money Saving Expert

All content correct at the time of publication, May 2024.

4 Energy price cap rates from 1 April to 30 June 2024 Energy price cap rates from 1 January to 31 March 2024 Gas Unit rate: 6.04p per kilowatt hour (kWh). Standing charge: 31.43p per day Unit rate: 7.42p per kilowatt hour (kWh). Standing charge: 29.60p per day Electricity Unite rate: 24.50p per kWh. Standing charge: 60.10p per day Unit rate: 28.62p per kWh. Standing charge: 53.35p per day

£1.00 TO $1.26 EURO EXCHANGE RATE £1.00 TO €1.16

US DOLLAR EXCHANGE RATE

Shipping

WORLD CONTAINER INDEX

The average composite index for the year-to-date is $3,260 per 40ft container, which is $500 higher than the 10-year average rate of $2,710 (which was inflated by the exceptional 2020-22 Covid period).

Whilst the noise seems silent, just over a month ago another vessel was struck, and Houthis are promising more attacks on shipping lanes. Suppliers are finding ways to combat these issues by increasing stock holding and avoiding the areas under attack, but this comes at a cost.

The situation feels more stable, however, it is difficult to predict what will happen going forwards. The leader of Houthis said this last month: “Our main battle is to prevent ships linked to the Israeli enemy from passing through not only the Arabian Sea, the Red Sea and the Gulf of Aden, but also the Indian Ocean towards the Cape of Good Hope. This is a major step and we have begun to implement our operations related to it.”

The Houthis have been attacking ships in the Red Sea and Gulf of Aden since November 2023 in what they say is a campaign of solidarity with Palestinians and against Israel’s continuing war on Gaza.

Vessel struck in Red Sea as Houtis promise attacks on more shipping lanes

All content correct at the time of publication, May 2024. 5

RED SEA

Fuel

There was a 5% increase in the cost of a barrel of oil ($83.55 to $87.48) in March, which contributed to the increase. However, the increased demand for petrol in the US meant that there was just over a 1p difference between Diesel and Petrol on the wholesale market.

The average margin on petrol has reduced to 8p, from 10.5p, however the margin on diesel is up by 1p, to 11p for the same period.

The CMA have expressed their concerns about “high margins which indicate weakened competition” and is continuing to monitor the situation. According to the CMA, supermarkets in the UK recorded margins of 4% in 2017. This then increased to 7.6% in 2022. This then increased again to 7.8% in 2023.

Source: RAC Fuel Watch

All content correct at the time of publication, May 2024.

UK wide Motorway Forecast Unleaded 150.12p 170.40p → No change forecast Diesel 158.22p 179.40p → No change forecast Super unleaded 163.32p LPG 174.22p 6 Average UK petrol and Diesel prices by year 2019 131.17p 125.78p 2021 136.05p 133.36p 2023 157.55p 140.64p 2020 119.46p 115.53p 2022 178.13p 165.06p 2024 YTD 152.51p 143.84p Diesel Unleaded Current

year’s averages are for the year to-date

Key Commodity Pricing

prices down stable prices up mixed dependent on product area All content correct at the time of publication, May 2024. 7

Dairy

Prospects for milk production are not looking favourable, as the wet weather across the UK and Ireland is starting to take hold on the market. Northern Europe is also seeing a similar pattern, which means a pretty bleak outlook for milk volumes. For example, Ireland’s milk volumes for March are believed to be between 10-15% down versus the previous year.

Key processors such as Freshways, First Milk and Yew Tree Dairy have all announced milk price rises in recent weeks, meaning that they will pay more to their farmers going forward with sluggish supply and the impact of poor weather conditions being cited as the main reasons for this.

Despite the sentiment around milk volumes and pricing, this hasn’t yet fed through to butter and cream pricing which have both been quiet after increasing in previous weeks. The bulk butter price stands around £4,900 per tonne with slight easing in recent weeks, followed by a small spike on the bulk market cream. Prices are around £2.10 per litre at present, with similar like-for-like prices in Europe but not particularly moving anywhere fast.

Usually, these do take some time to filter through into the market so buyers and sellers alike will be keeping a close eye on raw material prices as we progress into the Summer.

It is worth noting that naturally given the time of year and despite the poor weather conditions, we are still going through the higher production months for milk production and therefore this may still be skewing the market slightly.

It remains to be seen exactly what overall impact the lower yields and possible lack of silage causes later in the year. Dairy giants Interfood has already changed their ongoing dairy prospects from ‘weak’ in March to ‘firm’ in April.

All content correct at the time of publication, May 2024.

MILK

8

BUTTER & CREAM

CHEDDAR & MOZARELLA

Export demand remains strong and along with the possible future milk supply situation, it is causing nervousness in cheddar markets for the future. Currently, there seems to be enough supply to satisfy demand but with the feeling that buyers are not well covered into the future.

In addition, it is muted that some Irish producers have a lot less product to sell than previously, which again could be an indicator of what is to come. The market is quite flat pricewise.

GRANA PADANO

As expected, pricing has increased in Q2 and Grana Padano has been hit harder than the rest of the Italian Cheese range. The gap is closing between Grana and Parmigiano Reggiano so some operators could look to switch up menus and provide a premium offering.

EGGS

HALLOUMI & FETA

Both Halloumi and Feta have steadied out in 2024 and hopefully coming at a perfect time for the Summer season. The only predicted potential danger could happen at the back end of the year, where stocks will dry up due to demand and in turn, bring the price back up to Q1 2023 levels. There is also the danger of Protected Designation of Origin (PDO) requirements for Halloumi changing in milk % but that is just a ‘watch this space’ situation for now.

BRIE & GOATS LOG

Prices have steadied. The sheer demand for these products over the last 12 months or so has essentially commoditised the products and in turn, meant that the various options of source and pricing have been challenged due to the volume behind it. Pricing is expected to start creeping up in Q3 as suppliers anticipate the winter demand.

at the time of publication, May 2024.

Egg industry has serious concerns over Scottish cage ban despite welfare campaigner support.

Wholesale egg pricing for free-range eggs has risen to last year’s historic highs, thought to be due to the shortage of supply. The expansion of free-range flocks has stalled in recent months, despite the 2025 deadline to remove colony eggs from shelves. The number of laying birds is looking set to increase around July by approximately 30%, meaning that there will be an additional 740,000 chicks compared with February last year, which should help with pricing.

That said, a recent proposal in Scotland, banning any colony-caged hens, including enriched cages, is causing a stir.

“With a substantial proportion of the UK’s eggs produced in Scotland, a ban could lead to job losses and a direct impact on its economy, as well as reducing the number of eggs in the market, putting additional pressure on free-range egg supply. In the UK, around a quarter of eggs consumed are laid by hens kept in enriched colony cage systems, meeting demands for affordable, nutritious, high-quality food and providing a vital option for a large section of the population, especially during the ongoing cost of living crisis.”

Gary Ford, British Egg Industry Council Chief

All content correct

9

Meat & Poultry

EU Pricing has increased quarter on quarter with further increases looking likely as the cost of production forces European farmers to move into growing in other areas.

Last year, the European Union exported 4,193,639 tonnes of pork and pork products to third countries.

Spain was the largest exporter with 1,340,683 tonnes, representing 32% of the total, followed by the Netherlands (17%), Denmark (15%), Germany (8%), and France (6%).

Spain 1,340,683t

Netherlands 722,504t

Denmark 643,126t

CHICKEN

Fresh Poultry

Pricing continues to remain high and although we have seen Y-o-Y decline, Q-o-Q pricing is up, driven by the cost of production/input.

Welfare continues to remain the priority in fresh poultry, as a direct result of the bird flu outbreaks globally. More supermarkets are backing the changes to higher welfare and Lidl GB has become the latest major UK retailer to cut the maximum bird density in its ownlabel fresh chicken supply chain, with the transition starting this summer.

Hungary has reported an outbreak of the highly pathogenic H5N1 bird flu virus at five poultry farms. Authorities said they had slaughtered tens of thousands of turkeys, ducks and geese on the farms where the virus was detected. The outbreak was reported in the counties of Bekes and Jasz-NagykunSzolnok.

Frozen Poultry

Early indications predict that pricing for H2 is increasing anywhere between 5-30%. Raw material is scarce in South East Asia, and combined with a weaker dollar-to-pound conversion, this is the main price driver, whilst freight costs continue to be a hot topic.

Other 884,894t

All content correct at the time of publication, May 2024.

PORK

10

Germany 340,286t

France 262,146t

BEEF LAMB

High EU beef prices support an overall increase in the European Easter protein index. The average price of beef in the EU increased by 4.4% m-o-m to €11,900/MT in March 2024 due to a seasonal rise in demand for certain beef cuts.

According to market sources, a declining trend in EU beef production will likely reverse in 2024. Beef output is expected to increase, underpinned by an increase in cattle slaughter weights due to market expectations of lower feed prices in the year. The cattle slaughter weights in 2023 were substantially low due to high feed prices.

Demand for roasting joints, mince, and burgers has been gaining momentum since late January 2024, with an increase in wholesale demand. However, EU beef prices fell 12.4% Y-o-Y with stable supplies on the market compared to the same period last year.

In March, the EU lamb average price was recorded at €9,675/MT, up 11.5% m-o-m and 29.7% y-o-y.

EU lamb prices are supported by solid demand for lamb due to consumption associated with religious festivals such as Easter and Ramadan, which occur in proximity each year.

Traditionally, demand for lamb roasting joints increases between February and March as lamb roast forms the main part of the Easter Sunday meal. There is also further demand during Ramadan amid tighter supply across the continent.

All content correct at the time of publication, May

2024.

11

Fish

COD & HADDOCK

After the Q4 price softening of Russian caught Cod processed in China, pricing is on the up once again, with experts believing this will continue for the rest of the quarter.

It is a similar story for Russian caught Haddock processed in China, with pricing up around 18% since Q4.

After the USA tightened sanctions at the end of 2023, which banned any fish caught in Russian waters or by Russian-flagged vessels being imported into the Country, pricing on Norwegian Cod has continued to rise. Add this to the poor Cod harvests, estimated to be 330,000MT down for 2024, this has pushed the Global Market into uncertainty on the supply and price points of whitefish.

Norway’s fish health report 2023: what killed nearly 17 of farmed salmon – infectious diseases were the most significant cause of mortality in Norwegian fish farming last year

There has never been such a high price for fishermen before: Norwegian cod prices go wild

Whilst production fish is suitable for human consumption, Norway is not able to export the product without first processing this in Norway. This was due to the Industry Standard legislation, established in 1999 which protects the reputation of high-standard Norwegian Salmon.

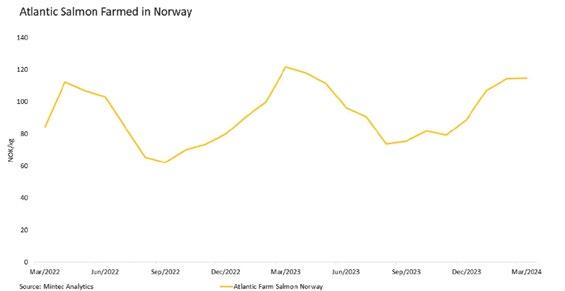

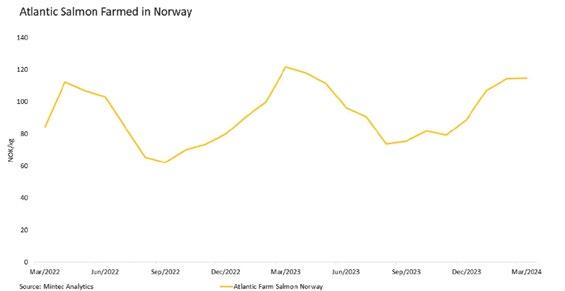

SALMON

As expected, Salmon saw a further rise at the beginning of 2024, likely due to the increase in demand around the Easter holidays. Even though prices saw a rise, they were still approximately 5% down versus the same period last year.

Where pricing would usually start to see a softening now, it continues to remain high. Experts believe this is due to the record-high volumes of lowquality salmon, also known as production fish.

Usually, 90% of the harvest is “Superior Salmon”, however, this year this is less than 80%, believed to be due to the excessive handling during the treatment for Sea Lice.

All content correct at the time of publication, May 2024. 12

TUNA

Skipjack tuna, the key species used in canned tuna, remains quite suppressed at the moment at historically pretty low levels. The main driver of this is good catches coming out of Western and Central Pacific Ocean.

Skipjack, yellowfin prices hold steady in main processing hubs

COLD WATER PRAWNS

As predicted, Cold Water Prawns saw a price increase of approx. 21% in Q1, higher than the predicted 10-15%. This was due to Greenland reducing its total export volumes.

Prices have started to soften slightly, but they are looking to steady, rather than reduce further. This is impacted by the fact that there is still no Free Trade agreement in place between the UK & Greenland, but also the demand on other World markets, such as Ecuador. Power cuts were recently introduced in Ecuador, aiming to curb drought effects, but the Country is also facing a 10% shortfall in feed requirements due to the power cuts.

Ecuador’s shrimp industry facing 10% feed shortfall

WARM WATER PRAWNS

Pricing is down 12% Y-o-Y for King Prawns, however, there is a slight 2% increase versus last quarter, which is expected to level out as this quarter continues.

According to Fishing Daily, February saw an increase in exports of approximately 23%, with major market players being Denmark, Sweden and the UK, whilst the US market remains sluggish.

Power cuts pose fresh threat to Ecuador shrimp industry

It is reported that the Frozen Shrimp market is set to be worth $22 billion by 2032, as demand continues to rise due to consumer preference and dietary habits towards healthier food options.

All content correct at the time of publication, May 2024. 13

Fruit & Vegetables

The most popular frozen fruits are products that typically make up smoothies; Strawberries, Blueberries, Mango, Pineapple and Banana so it will be no surprise that these are the products that are typically increasing, taking into account a number of factors:

Rising costs – specifically with labour and transport

Energy costs - whilst energy looks to have steadied, and potentially dropping, we are still at much higher rates than previously.

Demand - frozen fruits popularity continues to grow for its convenience and for one of the fastest growing areas – smoothies.

Bananas – rising temperatures are affecting a drop in supply, pushing up prices

CANNED FRUIT

It seems to have been a good crop for large parts of the world with regards to canned fruit. Prices are starting to come back up now but for the large parts, the raw material price is down. However, agreeing to deals 12 months ago as an overall basket was not too different due to freight prices being so much lower. When one goes down the other goes up which means the consumer sees little to no benefit.

POTATOES

OLIVES & CAPERS

The increases have already taken effect on these products. This was due to;

✓ minimum wage rises,

✓ weather affecting crops

✓ PET jars and lids increasing in the last 12 months

The main issue the industry is facing is the supply of jars and lids, product supply is stabilising but there are still issues due to the demand, especially for olives to produce oil.

Looking ahead to the new season crop, it looks like the planting of the ‘early’ potatoes across Northern Europe will be late due to the wet weather being felt in the key areas. This combined with the lack of carryover raw material has put uncertainty into the market for the new season pricing which will start to become clearer in the next 2-3 months.

Dutch processing potatoes reach their highest-ever February price as availability continues to tighten

All content correct at the time of publication, May 2024.

FROZEN FRUIT

14

Grocery

DRIED FRUIT & NUTS

The demand for dried fruit & nuts shows no signs of stopping with an increase year on year of the population looking to eat healthier. Pricing spikes easily because on the majority of products, supply can never keep up with the growing demand.

SULTANAS & RAISINS

Extreme weather conditions, minimum wage rises and now freight increases mean that there is no sign of this getting better. The best we can hope for is stable pricing, but the hope for last year’s price to return are long gone.

ALMONDS

Raw Material is in a better place than 12 months ago but as the majority is sourced from Turkey, the effects are still being felt of extreme weather conditions and minimum wage rises etc.

APRICOTS

A recent drop was short-lived as a spike hits again. The 12-month position is worse off but again, we need more than raw material prices to drop to see benefits.

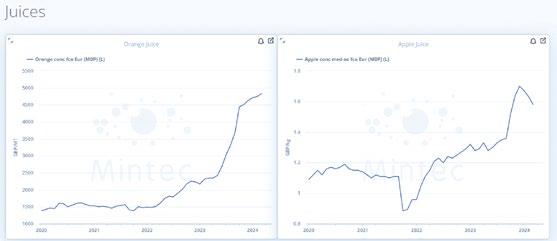

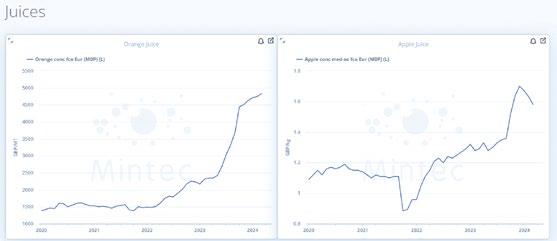

FRUIT JUICES

Orange and apple both remain high at the moment. Orange juice has been well documented with a shortage of raw material and citrus greening disease has played a key role in this. The Brazilian export market (world’s largest exporter) is controlled predominantly by three key players, who are determining the price situation.

They are favouring exports to the US rather than Europe due to the higher price paid there, with the most recent Florida orange crop being the lowest since records began.

All content correct at the time of publication, May 2024. 15

Grocery

WHEAT CORNFLOUR DURUM WHEAT

There remains a large area still not drilled for any crop with the resultant potential farmer income for 2024/25 looking very bleak. In the short term, this will make farmers very reluctant sellers of either old or new crops, and has resulted in increase of old crop cash market premiums.

Feed wheat markets are having to pay above usual premiums to entice farmers to sell considering a) the perceived low value, b) time on their sides and c) the state of new crop (crop and carry) all means they are sitting tight.

Durum wheat prices, which rose significantly last year due to dry weather in Canada and rising Italian durum prices, have started to falter and reduce since the start of the 2024. This is welcoming news for pasta as the key ingredient in the product.

Part of the drop in prices recently has been put down to the fact that Turkish exports are increasing, and Turkey will become the second largest durum wheat exporter in the world this year, greater than the entire EU-27 countries combined.

Russia is also expected to increase durum wheat production moving forward and whilst this may not be destined for the EU, for obvious reasons, it could help overall production and already Italian producers are buying in Turkish durum wheat.

Canada as always, however, will be the key driver in prices over the next 6-12 months along with the yardstick for quality.

It is just over 12 months since raw material cost peaked at over 75p/ kg on cornflour and the only thing stopping price drops are other factors such as minimum wage increases and transport costs. However, we are at a close point where the raw material drop is exceeding the other increasing factors.

COCONUT MILK

Coconuts have been quite a volatile product over the last 12 months. Pricing is up around 25% but, the product also has a tendency to drop.

With coconut milk predominantly made up of Coconut, the future price is hard to predict. The only other factors are water, emulsifiers and stabilisers which tend not to have a massive impact on price.

All content correct at the time of publication, May 2024. 16

RICE

Indian exporters of basmati rice and tea are worried following Iran’s attack on Israel, fearing it could impact outward shipment of the two commodities, even as edible oil importers said sunflower oil prices could start to rise.

Iran accounted for $598 million of the total nearly $4.59 billion worth of basmati rice exported in the first 11 months of the last fiscal year.

Customs authorities in India have demanded additional duty payments from about 45 major rice exporters due to the imposition of a 20% export duty, potentially disrupting future rice shipments from the country.

COCOA

Cocoa bean features on the spot ICE London exchange shot well beyond the previous all-time high set back in 1977. The previous high of £3,076MT, set in July 1977, was surpassed in October 2023, and spot prices have continued their meteoric rise to trade at around £6,940/MT as of late March.

The rise has been attributed to several factors that have contributed to higher cocoa bean prices over the past year:

India imposed a 20% export duty on white rice in September 2022 and subsequently on parboiled rice in August 2023 to control rising domestic prices. There is no ban currently on basmati rice exports but a minimum export price of Rs 1,200/ million tonnes (mt) was prescribed, which was later reduced to Rs 950/ MT.

Production for 2023/2024 is 10-15% lower than 2022/2023

Increase in instances of the Swollen Shoot Virus (SSV), destroying tree productivity in West Africa

Neglect of crops lack of fertilisers and other inputs low and delayed farmgate payments to farmers]

Robust consumer demand

New EU deforestation legislation

All content correct at the time of publication, May 2024. 17

EDIBLE OILS

RAPESEED, SOYA & PALM OIL

The main concern is around the current wet weather conditions. Current prices are relatively steady, but this sentiment could change things in the coming weeks.

Rapeseed prices have increased slightly over the last month but there remain concerns about whether this would continue given the large US and Brazilian soybean crops due. Some of these markets are intertwined and countries such as China can play a significant role in where and when they buy, usually in significant quantities.

For example, palm oil prices have risen on the expectation that Indonesia and Malaysia may divert more raw material into domestic biodiesel markets, this could in turn force China to buy more soya and thereby indirectly force rapeseed prices higher as the whole market availability contracts.

Price

of olive oil up 50% in one year

Vegetable oil prices under pressure as UK rapeseed oil production plunges

OLIVE OIL

Olive oil prices remain at record levels, albeit with some quite small decreases in recent weeks. Variants such as pomace oil remain almost nonexistent supply-wise at the moment, whereas extra virgin olive oil has very slightly better availability.

All content correct at the time of publication, May 2024. 18

Drinks

TEA

The Global Out of Home Tea Market is experiencing a robust growth trajectory. Valued at USD $18.6 billion in 2022, the global out-of-home tea market is projected to grow at a CAGR of 9.1% through 2028 to a value of USD $31.07 billion.

Diverse factors are contributing to the expansion of the market:

The value of Robustas grew to its highest level since May 1995, according to the December Market Report from the International Coffee Organisation (ICO). Robustas grew to £2,394.70 per MT in December, an increase of 10.5% from the previous month.

Consumer demand for healthier beverage options

FRUIT TEA MARKET

Growing awareness of the health benefits of tea

The global fruit and herbal tea market is predicted to reach a valuation of US$6.5 billion by the end of 2030 from a value of US$3.8 Bn attained in 2023. The market is estimated to witness a compound annual growth rate (CAGR) of 7.8% during the projection period from 2023 to 2033.

Green bean exports of Robustas reached 3.7 million bags in November 2023, as compared with 3.56 million bags in November 2022, representing an increase of 4.0%. The ICO Composite Indicator Price (I-CIP) averaged 175.73 US cents per pound in December, an 8.8 per cent increase from November.

All content correct at the time of publication,

May 2024.

19 Lavazza

raw

COFFEE

sales pass €3billion but

coffee costs hit margins

CATERING SUPPLIES

Sustainability continues to be a hot topic and with this in play, it’s increasingly difficult to balance costs vs sustainability.

PACKAGING PLASTIC

Year on year there is an average 6% decrease but since the turn of the year, prices look to have risen up to 3%. Further increases can’t be ruled out in this area as material costs aren’t dropping.

A further increase in plastic tax went through on the 1st of April, increasing the rate by 3.33% from £210.82 per tonne to £217.85.

PET has come up since the turn of the year with the above not helping, PE has also joined that trend. However, PP is currently sitting quite stable.

ALUMINIUM & TINPLATE

Aluminium is rising and it is a record surge due to the UK and US blocking Russian metal trading to stop funding it’s war machine. This means others will follow. Energy rates are dropping but the increases above are too much to combat but hopefully the bigger picture (above) will bring a sooner end to the war.

FOR MORE INFORMATION ON OUR COMMODITY REPORT, PLEASE CONTACT YOUR CREED ACCOUNT MANAGER OR VISIT OUR WEBSITE WWW.CREEDFOODSERVICE.CO.UK

Staverton Technology Park, Cheltenham Road, Staverton, Gloucester, GL51 6TQ

Manners Industrial Estate, Manners Avenue, Ilkeston, Derbyshire, DE7 8EF

Wooburn Industrial Park, Thomas Road, High Wycombe, Buckinghamshire, HP10 0PE

creed-foodservice-ltd creedfoodservice CreedFS @creedfs

All content correct at the time of publication, May 2024.