Cross Tech THE MAGAZINE OF THE CROSS-BORDER PAYMENTS INDUSTRY 4Q 2022 CRYPTO NEWS FINTEL INSIGHTS Blockchain: The solution to cross-border payments Digital remittance services and its Impact on Remittance Volumes to Africa REYNOLDS BRANDI Managing Director, AML & Compliance, Bates Group

Priscilla D'Oliveira Friedman

Priscilla D'Oliveira Friedman

Priscilla comes with an extensive background in operations management, strategy, process improvement, consulting and training. She started her career in American Express where she led a variety of teams in the call center industry (executive customer care, dispute resolution network and social media response team).

EDITOR’S LETTER

EDITOR

Hugo Cuevas-Mohr

CO-EDITOR

Priscilla D’Oliveira Friedman

WEB EDITOR

Virginia Martínez

DIGITAL PRODUCT MANAGER Ana González

CREATIVE MANAGER

Carolina Busnelli

GRAPHIC CO-EDITOR

Marcela Molina

CONTACT US AT María Auxiliadora García help@crosstechpayments.com

The views and opinions expressed in this magazine are those of the authors and contributors and do not necessarily reflect the position of CrossTech, The Platinum Network or IMTC. The content here is for informational purposes only and should not be taken as investment, business, compliance, or legal advice. Content contained within this publication is not to be reproduced in whole or part without the prior written consent of the company. We welcome quotes of our articles by mentioning “CrossTech Magazine” or #crosstech and share the quote with us using our social media channels.

After a year of challenges, the expected "Holiday Season" is arriving and with it the joy of ending this year with big goals, bigger expectations for 2023 and a team full of members that make our Conferences the best palce for Networking within the industry.

Having you as our Conferences sponsors/attendees, consulting clients, and magazine sponsors is a confirmation that we are going in the right direction and I want to take this space to thank you all for making CrossTech a great company to work with in 2022. You are the reason behind our efforts.

May the light illuminates your way in this ending year and throughout the one that is yet to come, as well as the harmony and joy be present within your homes and companies as a promise of a better future of all that is made from the heart.

Receive a warm hug and the best whishes from CrossTech team.

Happy Holidays!

COO, CrossTech

© 2022 | ALL RIGHTS RESERVED EDITOR’S LETTER

XT 3

COLUMN OF OPINION

NEXT ISSUE JANUARY 2023

out our top picks

remittance

and

Volumes

GADGET CORNER Check

of 2022! Page 16 FINTEL INSIGHTS Digital

services

its Impact on Remittance

to Africa Page 14

CONTENTS SUBMIT YOUR PAPER COLLABORATIONS | OPINION LEADERS | BE IN OUR COVER PRINTED EDITIONS IN CROSSTECH CONFERENCES 2023 Page 22

The Future of RegTech: Uncover how Latin American firms can manage evolving financial crime risks with innovative RegTech solutions Page 12

our

XT 4 REYNOLDS BRANDI

Director, AML & Compliance, Bates Group

CRYPTO NEWS Blockchain: The solution to cross-border payments Page 8 Check out the RECAP of

flagship event of the year with the graphic insight of the Conference, the Innovation Award 2022 Winners, and presentation of the Book "ENVIANDO DINERO", by Hugo Cuevas-Mohr.

Managing

YOU ARE READING

Andrew Davis - Column of Opinion

Andrew Davies is Global Head of Regulatory Affairs at ComplyAdvantage; he leads a team of financial crime experts. Andrew is an expert in financial crime risk management, speaker and writer with 25+ years experience helping clients design and deploy effective financial crime risk management solutions.

Cristina Loustaunau - Crypto News Cristina Loustaunau is a Co-Founder of "La Zona Tres," an educational project with the mission of being a bridge between protocols and becoming a great community of Web3 communities. Her work in Web3 extends to NEAR Education Stakeholder, who brings blockchain education about NEAR throughout LATAM. Cristina is also a builder strategist of Web3 communities aimed at building educational communities on the blockchain. Marketing Lead at Nativo NFT, a marketplace platform for NFT on NEAR, and Professor at the Technological University of Nayarit.

Emeka Madu - Fintel Insight

Emeka Madu is an experienced business development, digital payments and transformation expert, with over 16 years’ experience having an in-depth understanding of the African and Global Payment sphere. A financial inclusion enthusiast with the vision to ensure that people who cant access financial services are provided affordable financial access. He is the CEO of RemitPlus.

XT 6 CONTRIBUTORS

BLOCKCHAIN THE SOLUTION TO CROSS-BORDER PAYMENTS

In 2022 global cross-border payments reached 156 million dollars but what are cross-border payments?

Let's start in parts, cross-border payments are those that are made in different countries. These are vital to individuals, businesses, businesses, industries, and international development organizations. However, the fees for these types of cross-border transactions are often exorbitant and with long processing times.

Several global messaging systems handle traditional international transactions and connect a network of banks. A remittance

transfer is a monetary transaction across borders by a company that partners with banks, credit unions, or financial services institutions.

These require a lower transaction fee than a bank transfer. In traditional crossborder payments, the ledger is not the same between sender and receiver. Thus, adding a security concern to the entire settlement process.

XT 8

Cristina Loustaunau

Educational Marketing Lead & Stakeholder

Near Protocol

BLOCKCHIAN, THE SOLUTION TO CROSS-BORDER PAYMENTS

Based on this detected need, blockchain arrives to revolutionize the way in which these processes are being carried out. Blockchain technology is a game changer in cross-border money transfer as it speeds up the payment process through the use of encryption technology.

The traditional banking model, both cumbersome and expensive in a world of cheap and instant payments, has led to the intensification of nonbank providers.

In the next five years, an acceleration of B2B cross-border payments is expected, according to a survey carried out by PwC in 2022. A recent pilot project by Faster Payments Service, owned by the UK Payments Authority, recorded the fastest ever payment from Australia to a UK payee: all processes confirmed in just <36 seconds.>

Another quite interesting project that is worth mentioning is the case of the payment company 'Strike' and its new remittance service available in three African countries.

Strike, a Bitcoin Lightning Network (LN) based payments company, is making cross-border payments easier, faster, and cheaper for people in Africa. The company announced the launch of its new service called "Send Globally" which enables instant and low-cost payments to Nigeria, Kenya and Ghana. The service is launched thanks to a partnership with the African payments platform Bitnob.

Leveraging technology from the LN (Lightning Network), a Layer 2 network for Bitcoin scalability, the new service allows users in the US to send money to any of the three African countries mentioned, without transaction fees. By comparison, other remittance services charge fees, and some like Western Union (NYSE:WU) can charge upwards of 10%, as Cointelegraph notes.

Payments are made in cryptocurrency but are instantly converted into local fiat (paper money) currencies naira, cedi or shillings and deposited directly into the recipient's bank, mobile money or Bitnob account, the company said.

XT 9

CRYPTO NEWS

High fees, slow settlement and a lack of innovation in cross-border payments have had a negative impact on the developing world.

Jack Mallers Founder and CEO of Strike

“High fees, slow settlement and a lack of innovation in cross-border payments have had a negative impact on the developing world,” said Jack Mallers, founder and CEO of Strike.

The point to keep in mind here is that blockchain will not only improve crossborder payments, but will also boost the overall health of any industry by ensuring supply chain management, logistics, etc.

Cross-border payments using blockchain as the intermediary technology are a significant advantage. Merging blockchain technology with cross-border payments is a win-win situation for both sender and receiver. Some of the characteristics of blockchain technology are:

Information not manipulated Payment in real time Decentralized No intermediaries

XT 10

When we talk about blockchain adoption for payments, we cannot help but understand that there are two crucial parts of the transaction: the gateway and the customer; no banking institution in between. A person living in the US can send money to Italy using an on-ramp service provider. The provider will convert the Fiat money into cryptocurrency. The cryptocurrency can be kept in a crypto wallet. One can find multiple crypto wallets, choose anyone, and set up an account; After that, one can initiate the transfer from a bank or credit card.

Finally, you need to have the address of the receiver's wallet to send the required amount to the receiver. Once the money reaches the receiver's wallet, the receiver can convert it into fiat money after receiving the cryptocurrency. Crucial steps to transfer money are:

1. A consumer or a business wants to purchase a product or a service. Here we require consumer ID, retailer ID, amount of transaction, and timestamp.

2. Smart Contracts are for implementing currency exchange according to the realtime exchange rate.

3. In the block record all information about the transaction is made.

4. The block information is added to the blockchain consensus mechanism following a technical regulation.

5. The hash value of the previous block is added to the new block. This is an essential step to make the chain tamper resistant.

READ COMPLETE ARTICLE

THE FUTURE OF REGTECH

Uncover how Latin American firms can manage evolving financial crime risks with innovative RegTech solutions

Andrew is a veteran of the financial crime risk management world. Before joining ComplyAdvantage, he served as vice president of global market strategy at Fiserv. Andrew works with customers worldwide to design and deploy effective risk management solutions to mitigate financial crime risk.

[ARTICLE]

The FinTech ecosystem in Latin America doubled in size from 2018 to 2021, fueled by increased regulatory oversight and consumers swapping cash for digital finance. In LatAm alone, digital payment volumes are forecast to increase by 25% through 2025. As a result, criminals who have become comfortable in cash will move at greater rates to digital platforms. This changes the dynamic of the challenge faced by compliance teams in the crossborder payments sector.

Much of today’s security tech infrastructure consists of legacy systems. These systems rely heavily on human input, creating inefficiencies and inaccuracies that impair not just the customer due diligence (CDD) process but the financial security of firms. Some estimates suggest that false positives account for 42% of all anti-money laundering (AML) alerts.

These challenges pressure the overarching CDD framework that firms must build and iterate. As a result, many are turning to innovative regulatory technology (RegTech) solutions to manage evolving risk profiles, automate and triage alerts, and improve scalability. This can also help

prioritize in-house compliance expertise on the most challenging, urgent, and high-risk issues.

However, emerging RegTech solutions do not fit into a “catch-all” bucket. For comprehensive AML/CFT compliance, firms need to review several areas of their RegTech stack, including:

ID verification (IDV)

Screening for sanctions, politically exposed persons (PEPs), and adverse media

Transaction monitoring

Crypto and blockchain monitoring

Internal and external reporting

Any decision to invest in new technology can positively and negatively impact how a firm functions. As a result, it’s critical to understand and analyze the potential implications before deciding to proceed. Above all, firms need to remember that there is no one-sizefits-all solution. Compliance teams must identify and implement the appropriate AML processes for their business models and strategies, considering manual and automated approaches and their wider risk appetite.

Learn more about how ComplyAdvantage has empowered 1000+ leading companies to make compliance painless. Request a demo.

XT 12

COLUMN OF OPINION

XT 13

Global Head of Regulatory Affairs Comply Advantage

Andrew Davies

DIGITAL REMITTANCE SERVICES AND ITS IMPACT ON REMITTANCE VOLUMES TO AFRICA

Emeka Madu Co-Founder/CEO RemitPlus

Digital remittance to Africa enhances access and convenience to much-needed cash, which is critical for many people's financial survival, growth, and development. Reliance on digital remittance has emerged as the perfect solution. Let us look at the impact of digital remittance services on remittance volumes to Africa.

IMPORTANCE OF REMITTANCE TO AFRICA

Most households in Africa (Facts & Figures) operate below the poverty line, highlighting the importance of digital remittance. Family and friends fortunate enough to live and work abroad send money back home, which is of great help, as can be seen on this IFAD website .

For example, migrant workers send between 200300USD monthly back home, which is about 15% of their earnings. However, this figure translates to about 60% of the recipients’ household income. Additionally, digital remittances, specifically money sent over mobile transfer, accounted for 65% of total remittances.

XT 14 FINTEL INSIGHTS

First of all, let’s define what is digital remittances: Digital remittances refers to funds migrant workers send back home through the internet.

Digital remittance services became active with advancements in ICT, according to data from the World Bank, digital remittances experienced an exponential growth starting from the year 2000. Before 2000, remittances to Africa were below US$5 billion. The figure soon increased significantly, reaching US$20 billion by 2005.

As the ICT industry developed, so did the amount transferred to Africa. The annual figure was close to US$50 billion just before the COVID pandemic.

During COVID, the predicted dip in remittances was minimal due to people were still able to send funds back home from the comfort of their homes using the apps of major remittance companies, and this hekped defied predictions that remittance volumes would dip with most countries actually experiencing an increase. This further highlighted the impact of digital solutions to remittances.

Below are the highlights of the Benefits of digital remittance services to Africa:

Digital remittances have boosted remittance volumes mainly through the advantages they pose. These services are an important reason why more people are sending money back home to Africa.

Faster funds transfer: Senders can access instant money transfers, with the slowest

taking a few hours before the recipient can access the funds.

Cheaper service charges: Digital remittance services charge relatively less for transfer support services due to decreased overheads and reliance on the already established ICT infrastructure. This increases their appeal and encourages more remittances. With better exchange rates and lower transaction costs, more money reaches the recipients, adding to the overall remitted sums.

Better access for everyone: Since a significant chunk of remittance volumes reaches rural areas, digital remittance enables more access by that population. Many in in rural areas most likely don’t have bank accounts and similar facilities. Having a mobile phone with internet access is enough for to access the funds sent to them which they can cash out from mobile money money agents in rural areas

Since most of the funds are deposited in via the beneficiary’s mobile money wallet or bank account, many people in Africa are beginning to open bank accounts and new mobile money accounts helping to drive financial inclusion in Africa.

The advent of digital remittances saw an increase in remittance volumes to Africa, and with good reason. Easing the remittance process and making it faster, more affordable, and accessible and has more people sending money back to their families and friends in Africa, the remittance volume to Africa would only increase as more companies find more innovative and cheaper ways for people to send money home.

XT 15

GADGET CORNER I

n this edition, we gathered a compilation of the best gadgets presented to you in CrossTech Magazine in 2022. This selection will make it easy to choose the Christmas presents.

Enjoy!

CrossTech

MINIBREW CRAFT

HOME BREWING KIT

Brew your recipe

Avoid the inconvenience of brewing the old way and sit and relax while this kit does all the work to your taste, taking your experience from raw ingredients to a keg of around five liters of freshly poured beer in about 10 days. Ingredients kits start at 24€ for beginners experiencing homemade artifacts, while brewmasters can use the app to get it all done with this machine starting at 999€ Cheers!

GC GADGET CORNER a guide to... 16

XT

BUCKET LIST 999€

BUY NOW

ENTERTAINMENT

SNAP PIXY

Snapchat drone camera

Snap announced a drone-like camera that's small enough to fit in your pocket. It works by simply tapping a button and doesn't require a controller to work. It's able to perform one of six preset flight patterns and, while doing so, it can capture photos and videos for you to edit in the studio on-the-go and share it to sahre on Snapchat or anyother platform at anytime from anywhere. 249.99 USD BUY NOW

KODAK LUMA 150 POCKET PROJECTOR

Ready to go

This pocket projector is the perfect fit for your briefcase or backpack. Now you can take the professionalism of your work with you anywhere, anytime to make an impact with your presentations at all times. The Luma 150 portable projector is designed to expand the screen to up to 150 inches while delivering bright, vivid images. It includes built-in, sorround-sound speakers and a headphone jack for when private viewing is needed. The battery can deliver 2.5 hours and you can recharge it via mini USB.

219.99 USD

a guide to... 17 GC GADGET CORNER XT 17

BUY

NOW

Our ears are so different.

Earbuds tuned perfectly to your hearing will sound incredible to you but mediocre to anyone else.

How you hear it Music

The NuraLoop tunes itself to your hearing, allowing you to experience fully personalized sound.

It does this by measuring otoacoustic emissions from your cochlea using highly sensitive microphones.

NURALOOP HEADPHONES

"Personilised sound"

These measurements form your unique hearing profile and allow the NuraLoop to deliver you personalized sound. When earbuds are tuned perfectly to your hearing, you can hear a large amount of detail in the music that you’d otherwise miss out on. Every instrument is more distinct and present, and you feel much more like you’re there, listening to a live performance. BUY NOW

179 USD

XT GC GADGET CORNER a guide to... 18

ENTERTAINMENT 18

HEALTH CARE

Two wearable and rechargeable Soovu heat pods.

Soovu carrying case, charger, and disposable adhesives.

The Soovu System includes: 1 2 3

Soovu App with behavioral coaching, relaxation and movement training, and tracking.

SOOVU SYSTEM

Wireless Pain Relief Wearable

Advanced microchip Thermistor sensor & heater

Battery Bottom housing & magnets

Magnetic adhesive ring

Soovu™ is a wearable pain relief device with patented HeatWave™ technology that pulses waves of heat at optimal temperatures to the area that hurts for effective, targeted pain relief. Combined with digital coaching and behavioral support, Soovu helps relief pain offering 3.5-hours of use per charge and boasts a hypoallergenic adhesive to make it suitable for those with skin sensitivities.

MAKE-TO-ORDER

a guide to... 19 GC GADGET CORNER XT 19

ORDER NOW

Smilewave TM status indicator

OFFICE GADGET

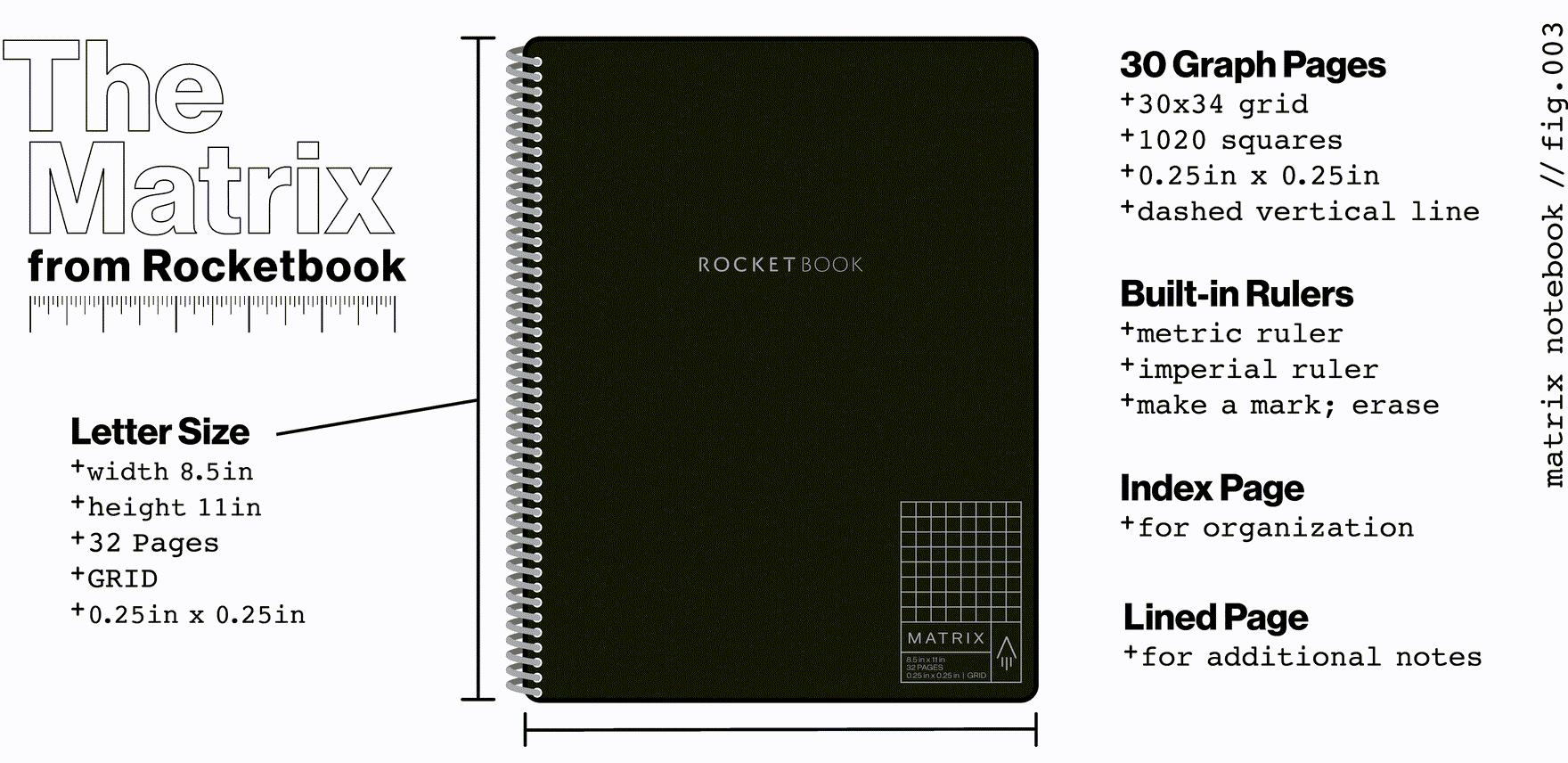

Smart Reusable Notebook

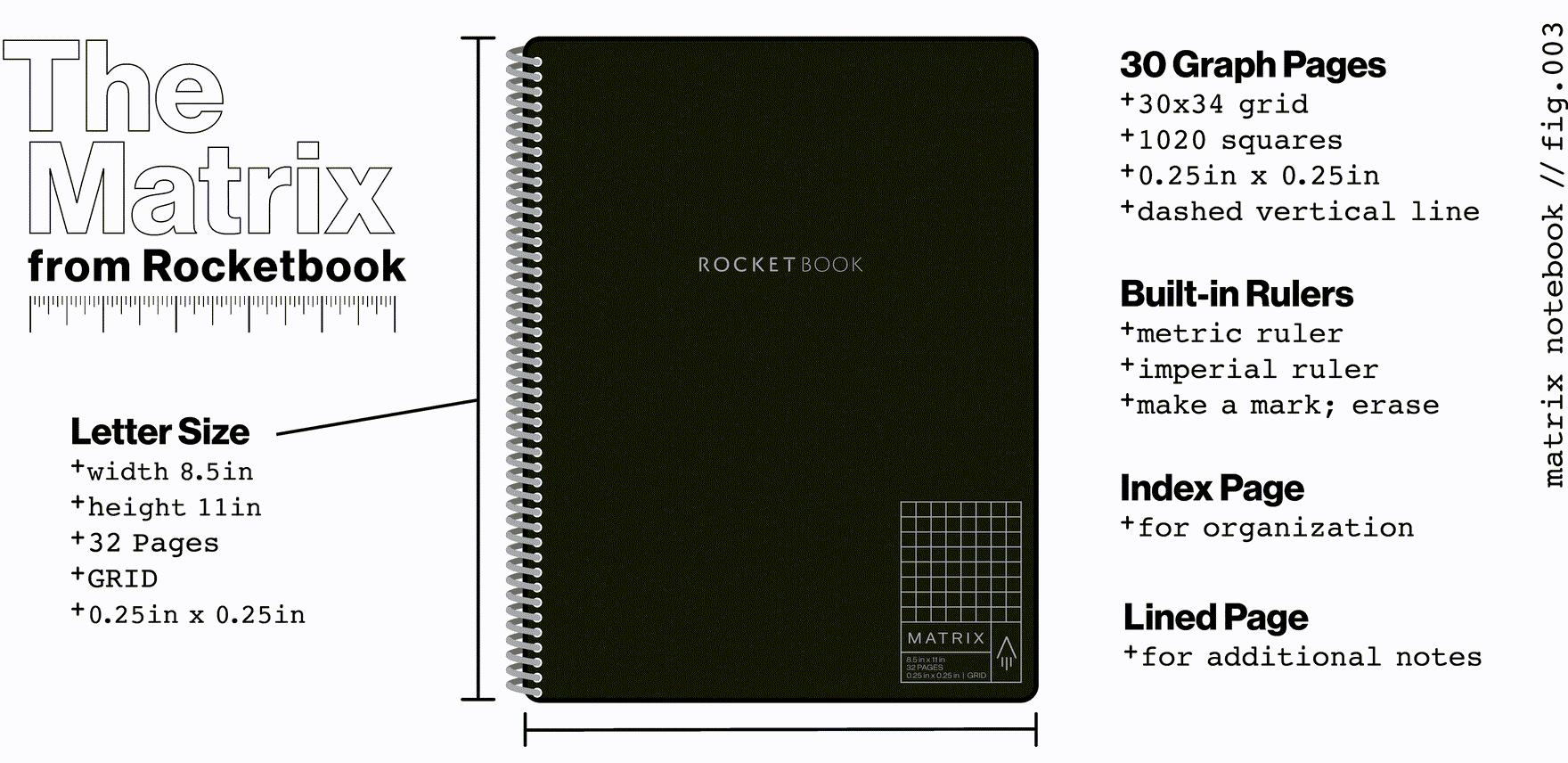

The Rocketbook Matrix isn’t science fiction, it’s an all-in- one STEM solution! Designed for everything from math to construction to engineering to medicine, the Matrix is equipped with reusable graph paper to boost your graphing and diagramming capabilities. More than just a lab notebook, the Matrix works with the Rocketbook app to scan and digitally share your notes with anyone in the galaxy or to transfer your work to a computer. Plus, the innovative synthetic paper allows you to write smoothly with a Pilot FriXion pen, then magically wipe your pages clean with a damp cloth to reuse again and again.

We worked with several experts to develop our patented, futuristic technology, while keeping an authentic pen and paper feel. Time for liftoff! Start scanning your notes, to-do lists, and out-of-this-world ideas. See green, snap, and your notes will be visually enhanced! Then, your scans will automatically blast off to their rightful cyber destination at the speed of light, err... your mobile connection.

XT 20 GC GADGET CORNER a guide to... 20

599 USD BUY NOW

Rocketbook

MOLESKINE

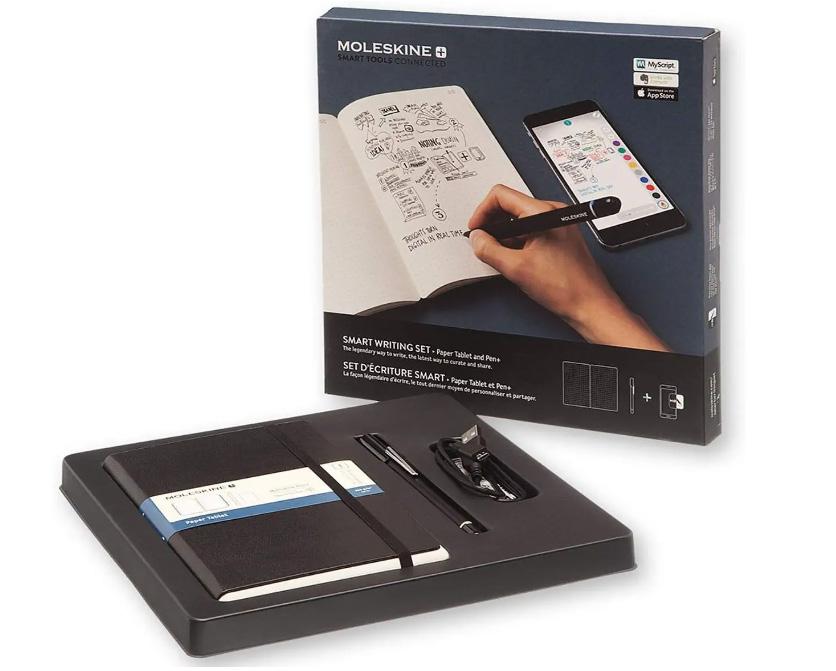

Smart writing system

Like an out-of-a-sci-fi-movie gadget, the Smart notebook will make your writing easier. Especially in a work environment, when you take notes or are inspired by writing down all those genius ideas, the Smartpen is streaming the activity to your computer, doing a transcript. Isn’t it cool?

MAGAZINE BUY YOUR AD NOW!

to be in our

CONTACT US a guide to... 21 GC GADGET CORNER XT 21 99 USD

Want

Magazine?

BUY NOW

BRANDI REYNOLDS INDUSTRY LEADER

Managing Director of AML & Compliance at Bates Group

Managing Director of AML & Compliance at Bates Group

As cryptocurrency becomes more mainstream, many people, including bankers and regulators, want to learn more about it. Because of my work in this industry, I am often approached for information or asked to give my opinion on current crypto risks and how to stay in compliance with current regulations. During these conversations, I often hear many misconceptions about cryptocurrency as well as about the perceived lack of regulation.

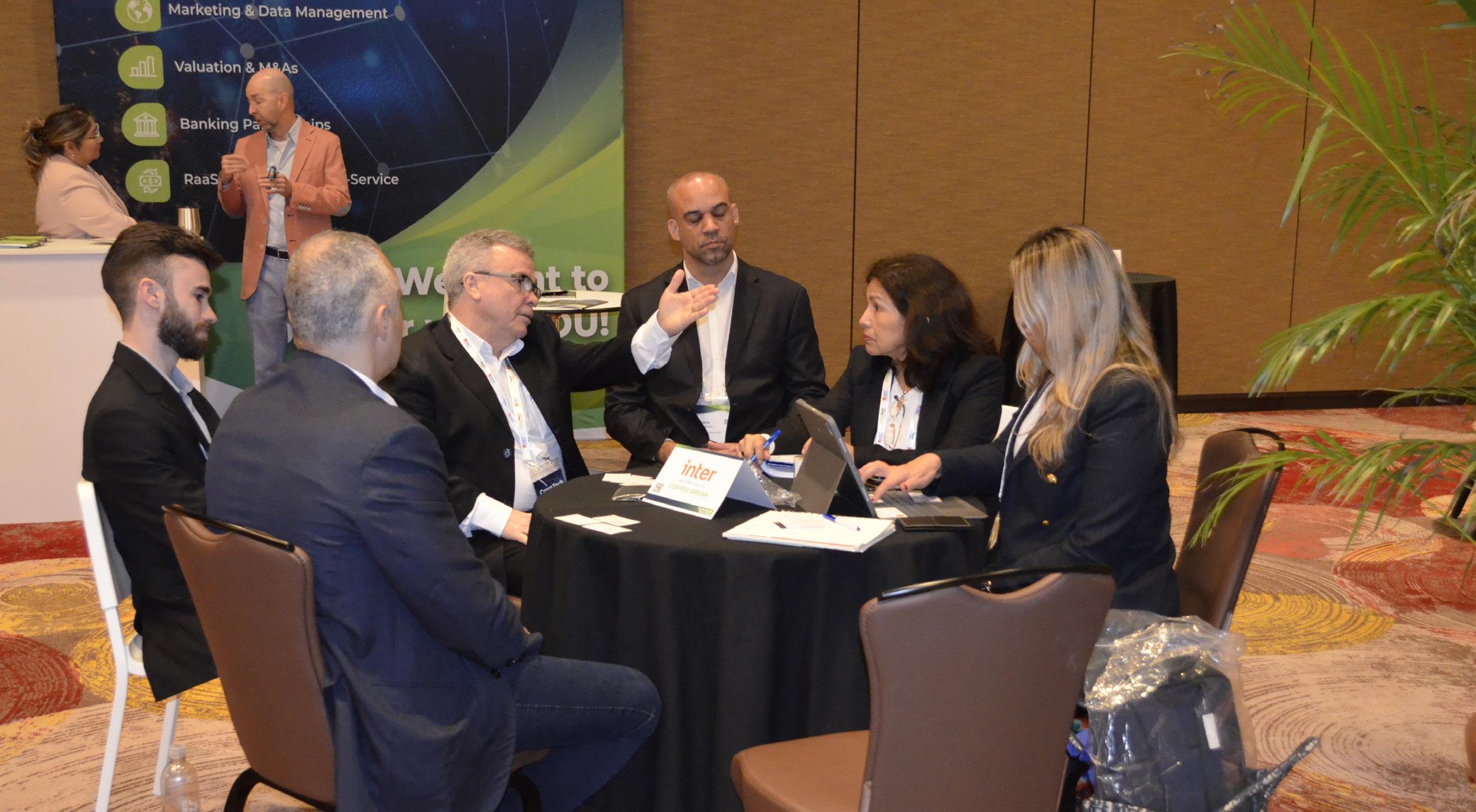

This year I had the pleasure of participating in the CrossTech World 2022 Conference and leading the Cryptocurrency Compliance Basics training session, one of three parts of the Cryptocurrency Compliance Certification course offered at the conference. The topic of cryptocurrency compliance was very timely, as the legal and compliance landscape is constantly changing, and there is more scrutiny on crypto now than ever before in the industry and by regulators.

My background and experience—not only as an industry consultant but also serving in interim compliance officer roles—have allowed me to gain valuable experience and learn best practices from many of the top players in the cryptocurrency space. These hands-on roles have allowed me to provide relevant and actionable information to an industry seeking regulatory guidance and best practices.

The training session focused on how a cryptocurrency business can successfully structure its compliance operations to navigate a period of frequent regulatory change. Other topics in the session included:

Misconceptions of the industry

Overview of regulatory requirements and best practices

Retaining and maintaining banking relationships

Practical advice for compliance officers

How to implement risk-based controls

Lastly, we discussed recent developments from various regulators, including the SEC and OFAC.

One key takeaway was dispelling misconceptions within the crypto industry and in the general public. Cryptocurrency leaders were armed with the information they needed to build and implement a compliant and risk-based cryptocurrency business.

As regulators continue to look for ways to create additional oversight of this developing industry, it is critical to have forums like CrossTech, where the industry can come together and learn and discuss new regulatory requirements, expectations, and best practices.

Brandi Reynolds is the Managing Director of AML & Compliance at Bates Group

Bates Group's MSB, FinTech, and Cryptocurrency team provides a full suite of Bank Secrecy Act, Anti-Money Laundering, and Office of Foreign Assets Control (BSA/AML/OFAC) compliance consulting services, state money transmitter licensing acquisition and maintenance support, independent reviews, and corporate compliance training.

Brandi can be reached at Breynolds@bategroup.com

XT 23

CONFERENCE RECAP

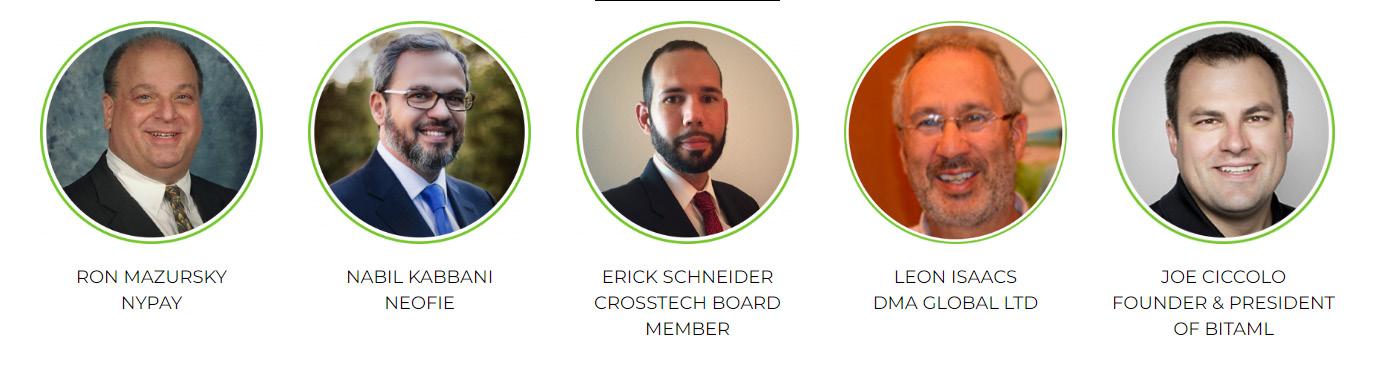

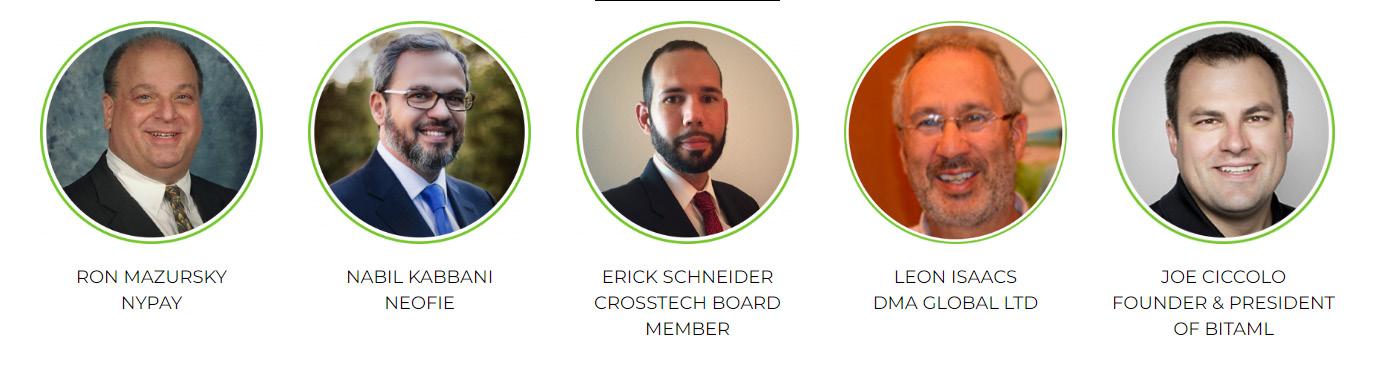

JUDGES

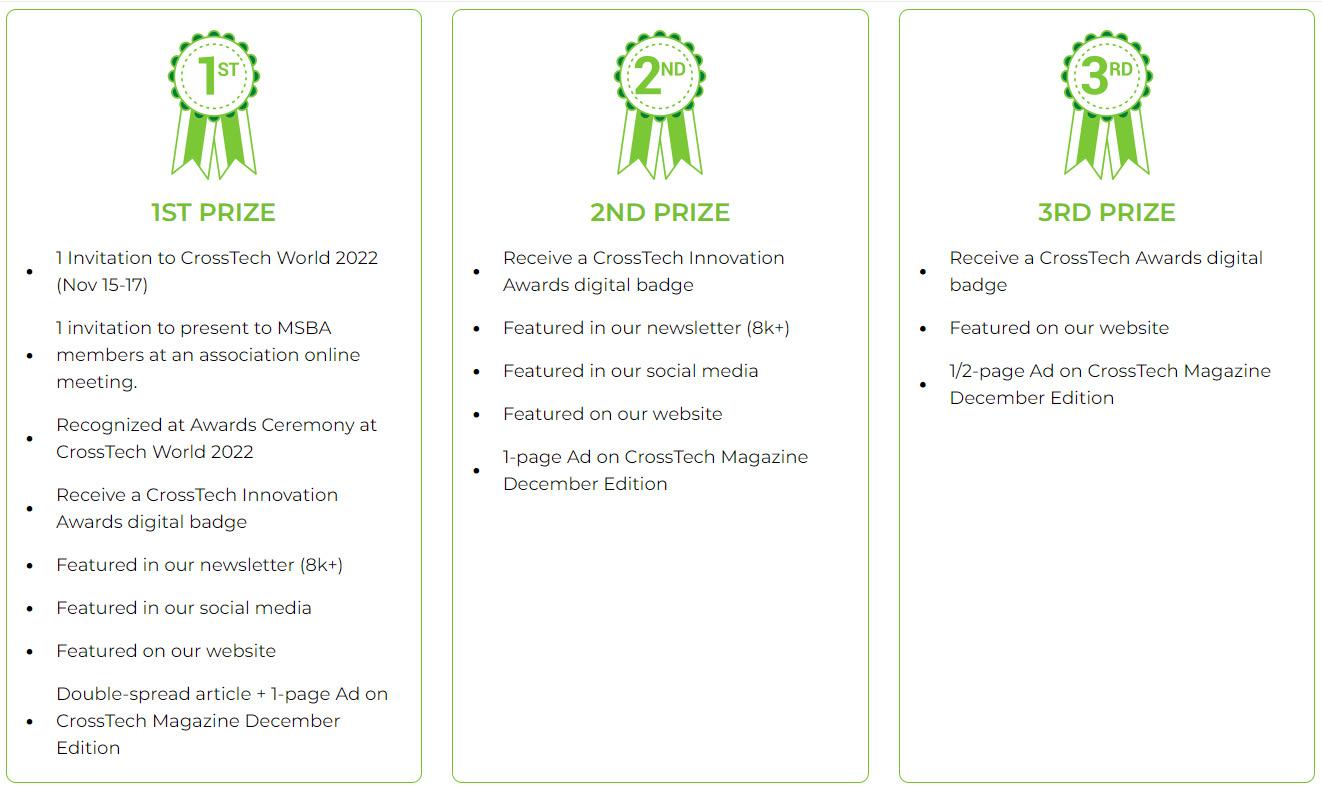

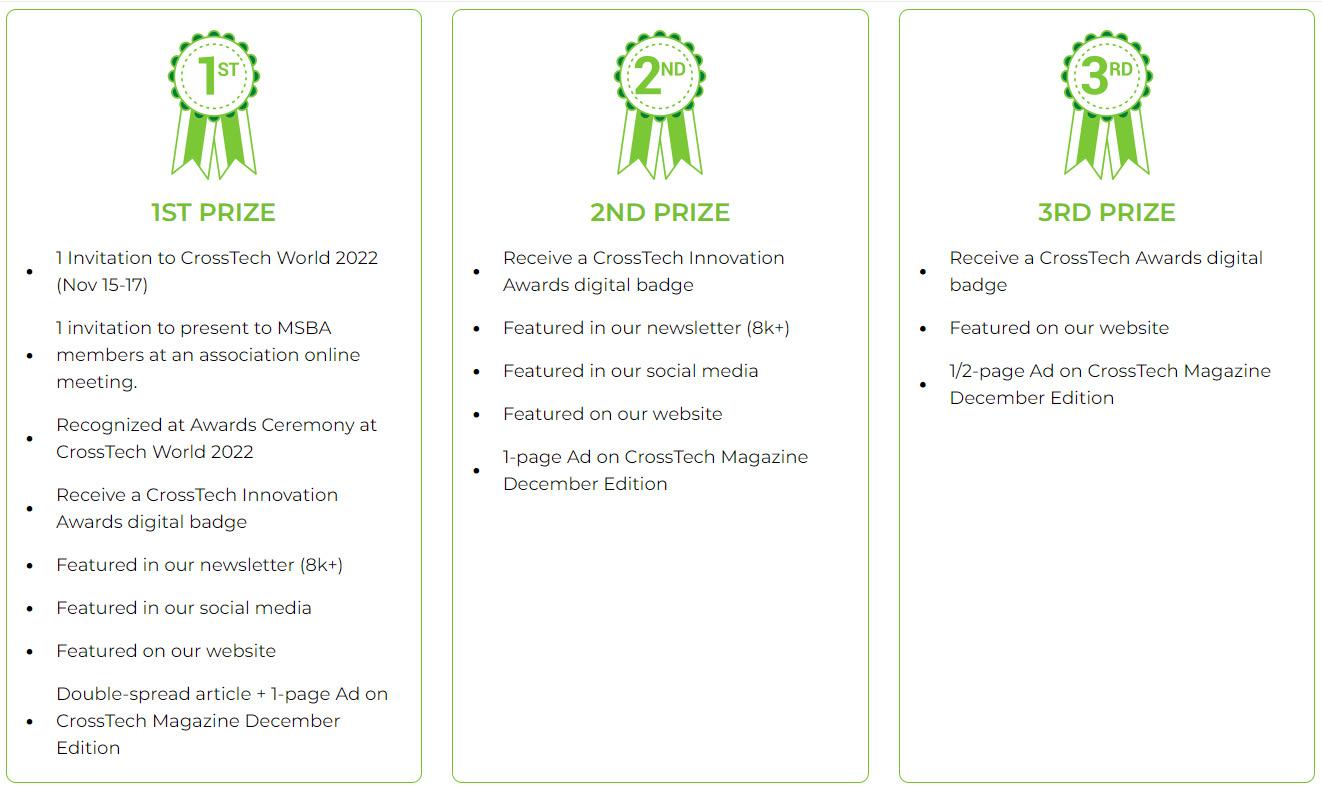

Prizes:

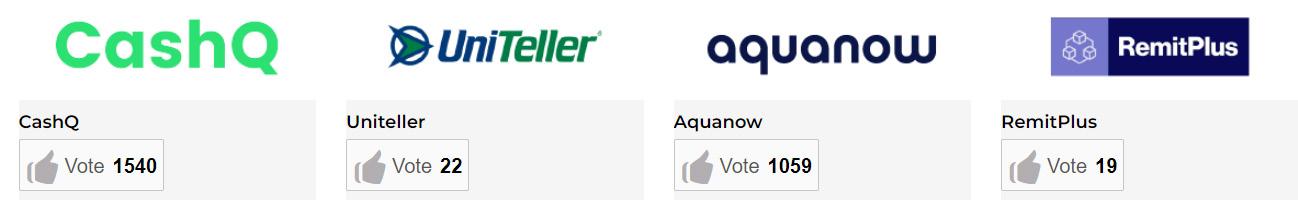

INNOVATION FINTECH MAKING A DIFFERENCE COMPLIANCE SOLUTION OF THE YEAR

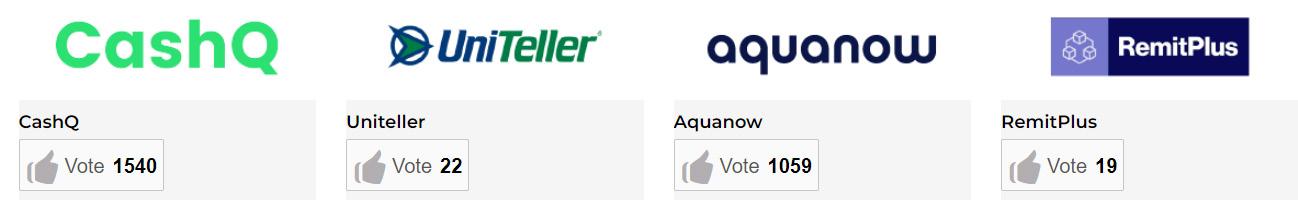

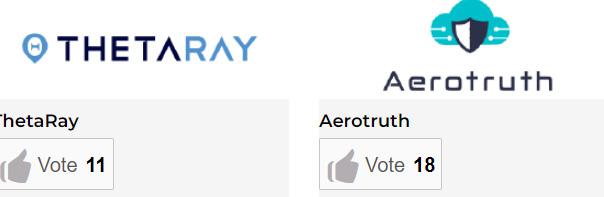

SUBMISSIONS DIGITAL

WINNERS

ENVIANDO DINERO

CAMBIO, REMESAS, MIGRACIÓN Y LA REVOLUCIÓN FINTECH

La Evolución de la Industria de Servicios Financieros Internacionales.

Esta obra compendia los conocimientos y experiencias de Hugo Cuevas-Mohr -Especialista en Transferencias de Dinero- en torno a la provisión de servicios financieros internacionales y las tendencias tecnológicas que permitieron su fortalecimiento y evolución.

En sus páginas se cuenta, con decenas de testimonios de los emprendedores que hicieron posible esta industria, la crónica de visionarios que han hecho posible el envío de dinero de migrantes a sus familias y su contribución a la actual revolución fintech.

BOOK PRESENTATION

Nació en Guatemala, se crió en Colombia y se educó en los Estados Unidos y Europa. Luego de muchos años en la industria de remesas de dinero, fundando y dirigiendo empresas en varios países, funda en 2001 Mohr World Consulting y en 2010 la IMTC, las Conferencias de Pagos y Transferencias de Dinero, que en el 2021 convergieron bajo la marca de CrossTech. Ha liderado la creación de varias asociaciones e iniciativas dentro del sector, contribuyendo a su continuo desarrollo. Aparte de esta obra, el autor ha publicado ensayos y libros de poesía.

BUY NOW

Hugo Cuevas-Mohr

THANK YOU FOR YOUR SUPPORT XT 32 EXHIBITORS, SPONSORS & PARTNERS

CONFERENCE!

XT 33

VIEW GALLERY

THIS IS WHAT WE LIVED IN WORLD 2022

OUR TEAM

Hugo Cuevas Mohr President & CEO CrossTech

Claudia Ávila Director of Conferences and Sales

Ma. Fernanda Valera María A. García

Jennifer Holguín Lead Consultant

Isabel Cortes UK Consultant

Lourdes Soto Spain Consultant

Virginia Martínez

IT Consultant

Marcela Molina Sr. Designer

Ana González

Digital Events Coordinator Customer Service Digital Product Manager & Content

Carolina Busnelli

Juan Posada Business Analyst

Diana Jofre

Creative Manager & Content Executive Assistant

We are thankful to all our staff and the supporting team of collaborators who help us develop our conferences in each of the cities and regions we select to host them. Without their help, it would be impossible for us to give all the participants in our in-person and virtual events the unique experience we strive to give everyone attending.

Check our next destinations and join us!!

XT 34 CrossTech

Priscilla D'Oliveira COO CrossTech

MAGAZINE RIDE THE PAYMENTS REVOLUTION ON TIME! HYBRID MAGAZINE WITH DIGITAL AND PRINTED ISSUES Published monthly and distributed at our annual events, forums, and other relevant events in the industry. CONTACT US NOW! READERS VISIT OUR WEB DISTRIBUTION CONTENT • 11 Sections • 6 Contributors per issue • +8,500 Total distribution • +21,000 Impacts • 42 Countries • 23 % Female • 77 % Male TAKE YOUR COMPANY TO THE NEXT LEVEL!

Priscilla D'Oliveira Friedman

Priscilla D'Oliveira Friedman

Managing Director of AML & Compliance at Bates Group

Managing Director of AML & Compliance at Bates Group