Booking

Booking

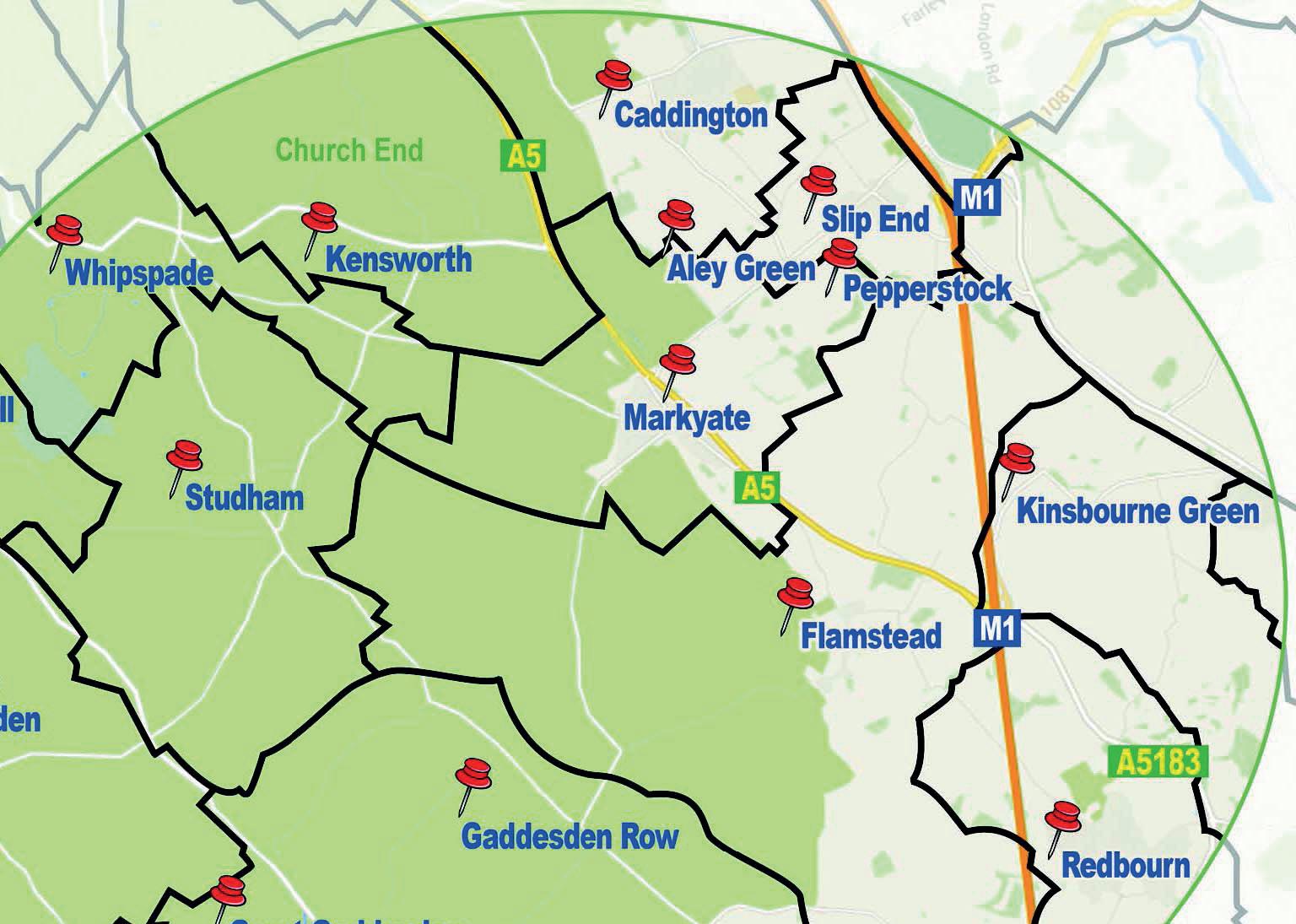

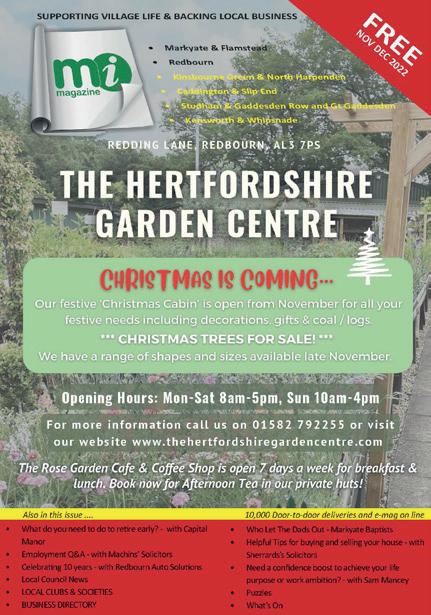

Your local magazine for Redbourn, Kinsbourne Green and North Harpenden, Markyate, Flamstead, Caddington, Slip End, Aley Green, Woodside, Kensworth, Whipsnade, Studham, Gaddesden Row.

As I write, England has beaten Iran 6 2 so we are off to a good start and Wales managed a 1-1 draw with the USA. By the time you read this, the group stages will be finished so fingers crossed, the home nations get through to the knock-out stages. What a tonic it will if we progress deeply into the tournament - in fact why not go all the way! Could football be coming home this time? Come on guys, match the prowess of the Lionesses! But what about Qatar as the choice of host nation? Should we have given the biggest sporting event in the world to a country with so many human rights issues? Personally, my husband and I were booked to fly with Qatar and lay-over in Doha but after all the bad press we have switched to Emirates. Not that they are perfect but banning gays, women, beer and covering up murder so blatantly in Qatar is a no no for us.

Has brand Beckham been tainted because of his seduction of a 150 million pound contract to be a football ambassador for Qatar? Probably I would say. The more he tries to get his Knighthood, the further away he gets from it. I am thankful of our vigilant press which exposes the money grabbbers for what they are, Matt Hancock included. Has he got no pride or self-respect? Enough politics but I love it. Moving on to our own lives here in the villages, in this issue, we look at energy useage and examine how power hungry the various appliances are. With high interest rates forecast for some time to come, some people are considering taking cash from their pension pots, or buying annuities which have become more attractive since the mini-budget. Capital Manor warns us to be careful before cashing-in our pensions.

It was sad to learn that Harpers in Pepperstock is closing down, but good news to hear that they have decided to keep the cafe and frozen food counter open for limited hours until the site is sold. It is such a shame when a popular facility is lost to more housing development but that is the way of life in the UK now. There is much more money in develop ment land than using the space to run a hospitality business. Losing Harpers is a great loss to our community.

On a cheerier note, aren’t the post box toppers that appear in Caddington absolutely stunning? Here is one of my favourites.

This product is made of a material from well-managed, FSC®-certified forests and other controlled sources. FSC® is dedicated to the promotion of the responsible forest management worldwide.

1km - Female 1st Jacey Dyett (age 12) 2nd Lara Murfett (age 10) 3rd Sophia Zhou (9) 1km - Male 1st Harry Barrett (age 9)

2nd George McMahon (age 13) 3rd Liam Rickard (age 12)

3km - Female 1st Clara Upjohn (age 10) 2nd Matilda Bennett (age 13) 3rd Tilly O’Mahoney (age 10)

3km - Male 1st Thomas Burgess (age 10)2nd Archie Clarke (age 11) 3rd George McMahon (age 13)

5km - Female 1st Rachel Mackie 2nd Ellen Mayes 3rd Grace Allan (age 11)

5km - Male 1st Harry Barrett (age 9) 2nd Richard Goss 3rd Liam Rickard (age 12)

Relay - Years 2/3 Fast Falcons – Omid & Medhi Hassani-Pak, Mylo Barrett, Harry Cottle

Relay - Years 4/5/6 Thunderbolts – Thomas Bennett, Thomas Burgess, Theo Falkner, Harry Barrett

Leigh Hibon

Daytime 07841 652496 Evening 01582 842764 leighhibon@yahoo.com www.ldhdomestic.co.uk 90 Trowley Hill Road, Flamstead, AL3 8EA

Since launching the Redbourn Fun Run on 7th June 2015, our team have had a great time organising and promoting this wondering community event.

After six Fun Runs, 18 races, 3,500 runners and more than £50,000 raised, it is our turn to stand down. If anyone would be interested in making the Fun Run 2023 happen, please email redbournpta@gmail.com

hello – we’d love to see you! Gareth and the Team! Join our club at - www.threeblackbirdsflamstead.com 01582 840330 reservations@threeblackbirdsflamstead.com

Dry cut £12.00 Cut & set £20.00

Wash & cut £14.00 Shampoo & set £12.00

Blow dry £13.00 Cut & blow dry £22.50

Restyle & finish £25.00 Perm from £40.00

Colour tint £32.00 Colour regrowth £26.00

Hi Lights F/H from £40.00 Hi lights H/H from £30.00

Semi colour £24.00 Cap Hi lights £30.00

5’s

It was a great shock and sadness to learn that Kamal passed away recently from cancer. He was such a delightful shop keeper on the High Street, who offered a great service to the villages and was lovely to chat to and share a friendly smile and wave. The tremendous reponse to his passing on social media proves what a popular man he was. He will be sorely missed by many. His widow Pam said, “It is with huge sadness that Kamal passed away in the early hours of Sunday 13th November. For the many people in the village whose hearts have been touched by his warmth, love and generosity, he will be sadly missed but never forgotten.” MiMagazine sends deepest sympathy to you Pam.

Kamal of the Clothing Spa in Markyate has died

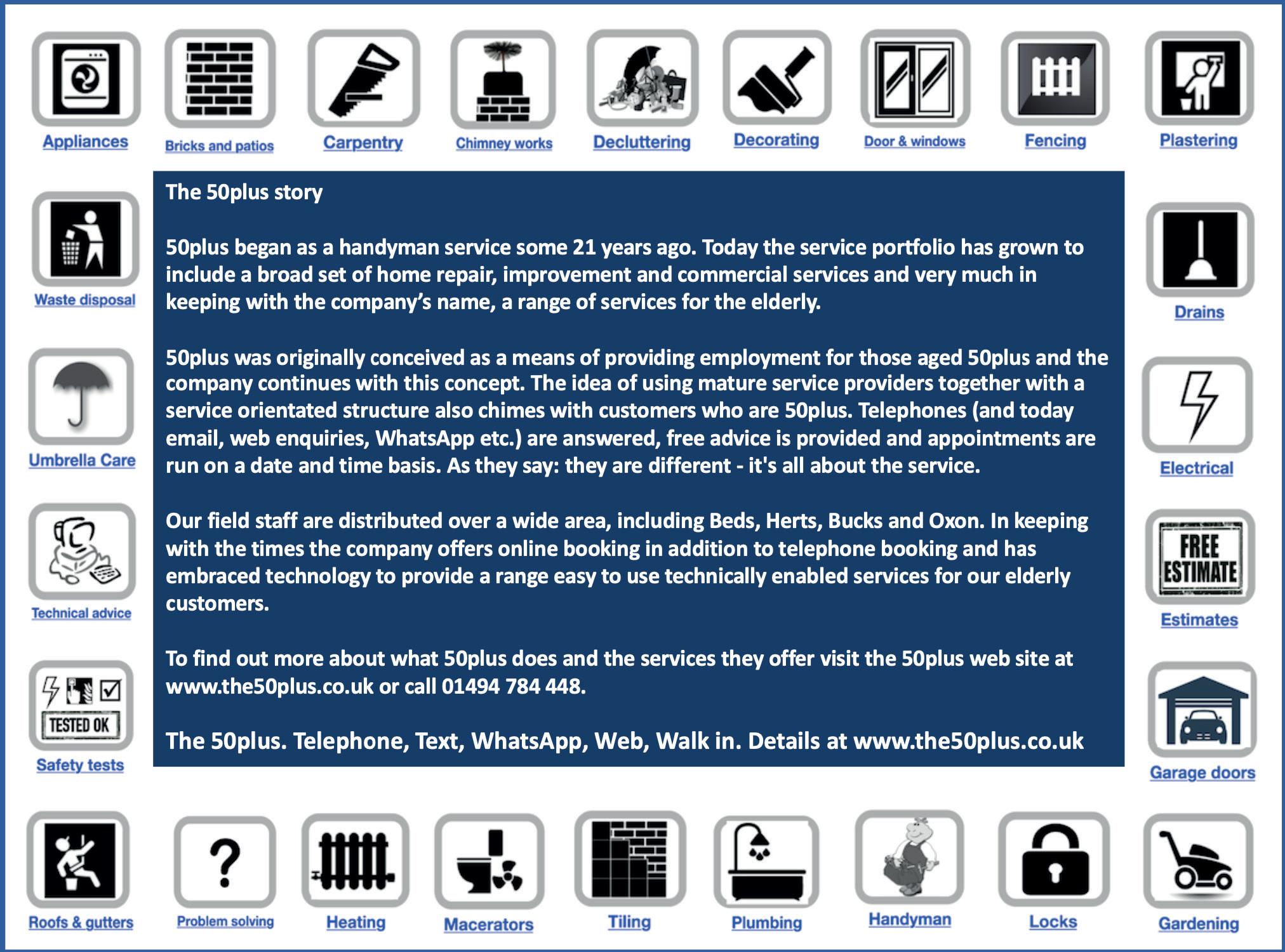

These days most homeowners suffer from a lack of storage space. So many precious items that need to be kept – but where to store it all? That’s where Home Counties Loft Ladders come in.

The company, based locally, offers homeowners the opportunity to maximise their storage space with a loft ladder, 50sqft of boarding and a light - all fully fitted in less than a day from just £444! But it’s not just the affordability of the package that makes Home Counties Loft Ladders stand out, as manager Jamie Oakley explains:

‘Our watchwords are Quality, Integrity and Value. Quality in the materials that we use for all our installations and the fact that all our loft packages are fitted by time served tradesmen, so our customers are assured of the best job.

Integrity in that we will turn up at the time we say and make sure the house is spotless when we leave, and value in that we offer our services at a price people can afford.

Our business relies on referrals and we get a huge amount of our calls from people who have been referred to us by our existing

customers - that simply wouldn’t happen if we didn’t adhere to our overriding principles.

At the end of the day the old adage that happy customers lead to more happy customers is true and we work hard to make that happen for every

installation we carry out!’

So, if you want to make use of your loft space, call Jamie free on 0808 301 9557 and he’ll be happy to pop round and give you a no obligation quote so you too can make use of your loft!

Hertfordshire County Council Trading Standards is warning of fraudulent cold calls being made to residents about loft insulation. This is yet another variation on the same fraud Herts CC warned about previously. This time fraudsters may tell you that old style loft insulation is causing issues with damp. They will try to frighten you by telling you that your rafters and roof are in danger of collapse unless you deal with this issue as soon as possible. They then go on to arrange an appointment to carry out a no obligation survey to check if there is a damp problem at your property. Unsurprisingly, once at your home, they will tell you that there is a problem and then sell you new insulation and a dehumidifier for your loft for a great deal of money. None of their claims are true. What is true however, is that customer lists have fallen into the hands of scammers who are making these targeted sales calls. This and any other cold calls about loft insulation, solar panels, new boilers and cavity wall insulation is a scam.

With Christmas fast approaching, it is important separating parents start planning early to agree their child arrangements for the festive period in advance to avoid any uncertainty and tension into the run up to the holidays. The Christmas period can be overwhelming to separating couples and emotions can run high. Issues with child arrangements can only heighten these feelings.

Below are my top tips for separating parents in the runup to Christmas:

Attempt to agree clear child arrangements in advance If you are unable to agree arrangements for the festive period and resort to making an urgent last-minute court application, this will only increase stress levels and you can risk the courts having no availability to list your application prior to Christmas. Furthermore, you can have little time to attempt mediation or seek legal advice to aid you in reaching an agreement. Agreeing clearly defined child arrangements in advance can reduce uncertainty and anxiety for both yourself and your children and should always be the preference.

The first Christmas post-separation is often the hardest, however you have the opportunity to agree child arrangements that can apply to the coming and future Christmas periods; if your ex-spouse has the benefit of spending Christmas Day with the children this year, then you can have the benefit next year. Any agreed child arrangements should be fair and prioritise the children. Consider agreeing to arrange a video call with

your children on Christmas day if they are with the other parent this year.

It is important to acknowledge the effects of any agreed child arrangements on the children and agree child arrangements that prioritise their needs. A period of time they would normally associate with joy and fun could be more tumultuous for them and involve significant change. Children can sense stress and animosity; it is often inappropriate to involve them in any conversations when it comes to deciding the child arrangements. Although having a handover on Christmas Day may appear the fairest solution for parents, it is usually more disruptive for the children.

The first Christmas post-separation is often daunting for all involved. Consider seeking the support of friends and family for emotional help or assistance with any Christmas errands. It may be helpful to seek independent legal advice at the earliest possibility so you fully understand your legal position and have enough time to take action if necessary.

We are happy to advise parents in relation to child arrangements for Christmas and to help them navigate through a difficult time.

Please contact Thomas Palmer or another member of the Machins Family Team if you would like more information about the issues raised in this article or any aspect of family law.

So very happy with the team at Machins. Immensely grateful for the support and guidance I received throughout the whole of my divorce process.

The Inspiring Music Service is seeking the views of young people from across Central Bedfordshire in a new survey. They want to hear from people aged 13 – 18 years on:

• why music is important to them

• if they already access music and how

• what they already know about Inspiring Music

• what barriers there might be for them to access music

• how they could encourage other young people to take up music. It doesn’t matter if they make music, or just love music, they would like to hear from as many young people as possible.

If someone completes the survey, they can also choose to be entered into a prize draw, to be in with a chance of winning:

• First prize: £100 Amazon gift card

• Second prize: £50 Amazon gift card

• Third prize: £30 Spotify gift card We would welcome you to share the survey to young people and encourage them to complete the questionnaire. Closing date is 30 January 2023. centralbedfordshire.welcomesyourfeedback.net/s/ InspiringMusicYouthSurvey2022

Our libraries and leisure centres will be Warm Spaces We are launching a network of Warm Spaces, which residents can use during the day to keep warm as temperatures fall and energy prices rise. Lbraries and leisure centres are available as Warm Spaces, where everyone is welcome. Libraries offer free Wi-Fi and access to public computers, as well as seating so people can enjoy time with a book. Residents are welcome to take their own food and drink to the Council’s libraries.

A number of community organisations are also providing Warm Spaces this winter too and you can find a list of Warm Spaces near you on the Council’s website at www. centralbedfordshire.gov.uk/warm-spaces

LOCAL Warm Spaces - Slip End Good Neighbours and St Andrews Church, supported by Parish Council

Location: The Rising Sun, 1-3 Front Street, Slip End, Luton LU1 4BP. What is available? They provide home made soup with sandwiches, tea, and coffee. The cost is £3 per person. When is it open? Every Tuesday from midday to 2pm Carol Beeton cmbeet@gmail.com

Improvements could include improved insulation, solar panels and updated heating systems

Following a successful scheme at the beginning of this year, CENTRAL BEDFORDSHIRE have been allocated £2.89M of funding to support the Government’s Sustainable Warmth scheme. Households may be eligible for a grant if their annual gross household income is less than £30,000, and if the property has an Energy Performance Certificate (EPC) rating of D, E, F or G. Some of the improvements available under the scheme include:

• improved insulation, to stop buildings from losing heat quickly meaning it takes less energy to keep a house warm

• solar panels, allowing residents to generate electricity using energy from the sun, lowering energy bills

• updated heating, replacing gas or oil-fired boilers with a heat pump system which could create a warmer home while using less energy Homeowners can apply for a grant of up to £10,000 if their property is connected to the gas grid, and a maximum of £20,000 if their property is not connected to the gas grid. Upgrades to homes which are occupied by the owner will be fully funded under the scheme. Landlords can apply if their tenants are eligible for the scheme but will have to contribute a third of the cost of the upgrades.

How to apply for funding Residents can find out online if they are eligible for a Sustainable Warmth Grant or by calling City Energy on 02921 680951. Herts residents can apply too.

A man from Slip End has been fined over £3,000 after being caught collecting waste without a licence. Antony James aged 42 years from Slip End was caught by our Environmental Protection Officers who had joined forces with Bedfordshire Police and the Rural Crime Unit on Thursday 15th February 2022, to carry out roadside vehicle stop checks. Officers saw Mr James driving a Ford Transit drop-side lorry, carrying scrap metal, and stopped him on the A505 near Houghton Regis. He could not provide a waste carriers licence, scrap metal collectors certificate or a waste transfer note. Mr James failed to attend Luton Magistrates’ Court on 4 November 2022 but was found guilty in his absence and fined £3,000 plus a victim surcharge of £190.

BEFORE YOU TAKE OUT ANY CASH FROM YOUR PENSION, YOU NEED TO CALCULATE HOW MUCH YOU ACTUALLY NEED.

DO YOU NEED A LUMP SUM OF CASH ALL AT ONCE? IF SO, WHAT ARE THE TAX IMPLICATIONS?

Choosing what to do with your pension is a big decision.

If you’ve been saving into a defined contribution pension (sometimes called ‘money purchase’) during your working life, from age 55 (57 from 2028) you need to decide what to do with the money you have saved towards your pension when you eventually decide to retire.

However, making the wrong decision could cost you heavily in the form of an unwanted tax bill, eventually running out of money in retirement and even a tax credits and benefits overpayment.

So before you do anything, there are things you should consider. Note: this article doesn’t cover pension schemes where the pension you’ll be getting is worked out as a proportion of your pay.

Before you take any cash out of your pension, you need to calculate how much money you actually need. Do you need a lump sum of cash all at once? If so. what are the tax implications? Or would you be better off with a regular income stream?

Remember that retirement could be 30 to 40 years or more. As well as what you’ll need to cover everyday living expenses, do you have any specific plans for your retirement, such as regular holidays or enjoying a hobby? Or are you thinking of any big one-off purchases or expenditure like a new car or home improvements? Once you know how much money you need, you can start to look at your options.

Taking cash out of your pension can have tax implications if you withdraw more than your tax-free element (typically 25% of your pension). You can leave the rest invested until you decide to make more withdrawals or set up a regular income. However, you need to make sure you understand those implications before you make any decisions. Otherwise.

you could end up with a significant tax bill that you weren’t expecting.

When you retire and start taking money out of your pension, you may be charged fees by your pension provider. Some pension providers will charge a fee for each withdrawal you make, while others may charge a flat rate or percentage of your pension pot.

There may also be other charges, such as an administration fee. Taking money out of your pension will also reduce the amount of income you have in retirement, so it’s important to think carefully before you decide to take any money out of your pension pot.

Consider how long you’ll need the money to last. If you take a lump sum of cash, it’s likely that it won’t last as long as if you take an income. This is something to keep in mind when you’re making your decision.

If you take cash out of your pension now, it may not be there if you need it later on in life. This is something to consider if you think you may need more money down the line. Even if you’ve seen the value of your pensions fall, that doesn’t necessarily mean that you’ll have to delay your retirement altogether.

Could you take less from your pension savings until their value recovers and use other savings instead to bridge the gap? And could you put off any big purchases you’d planned?

Taking cash out of your pension comes with risks. There’s the risk that you could outlive your money, or that the value of your pension could go down. You need to make sure that you understand all of these risks before you make a decision.

• Keep your pension savings where they are - and take them later.

• Use your pension pot to buy a guaranteed income for life or for a fixed term - also known as a ‘lifetime’ or ‘fixed term annuity’. The income is taxable but you can choose to take up to 25% (sometimes more with certain plans) of your pot as a one-off tax-free lump sum at the start.

• Use your pension pot to provide a flexible retirement income - also known as ‘pension drawdown’. You can take the amount you’re allowed to take as a tax-free lump sum (normally up to 25% of the pot), then use the rest to

provide a regular taxable income.

• Take a number of lump sums - usually the first 25% of each lump sum withdrawal from your pot will be tax-free. The rest will be taxed as income.

• Take your pension pot in one go - usually the first 25% will be tax-free and the rest is taxable.

• Mix your options - choose any combination of the above, using different parts of your pot or separate pots.

These are just a few things to consider before taking cash from your pension pot. As you approach retirement, it’s essential to understand what your options are and obtain professional advice, otherwise you could end up making a decision that you regret later on. For more information or to review your options. please contact us: Capital Manor Financial Advisors Ltd 17 Manor Road, Caddington, LU1 4EE Tel: 01582 414514 info@capitalmanor.co.uk www.capitalmanor.co.uk

This is a very complicated topic and choosing what to do with your pension is one of the most important decisions you’ll ever make and will impact on your future standard of living in retirement. Worryingly, over a third (35%) of pension holders do not know about the different options available to them for when the time comes to retire, according to research.(1) Source data:

At this time of year, the garden is the last likely place you will be, but there are some nice plants putting on a Winter performance that sometimes get missed.

Sarcacocca ruscifolia (Christmas box hedge), a close member of standard box hedge (Buxaceae) is one of my favourites which is an evergreen bush that can be topiarised and has small white flowers with aroma of vanilla scent in December. A great stand alone plant in a border or potentially a low/border hedge in the shade.

Ilex

Information

FREE support and deliveries to your door.

The reason that so many ‘ordinary’ diets fail is because they don’t tackle the reasons behind why people overeat in the first place. They suggest the answers are in the food and focus on calories and complex food-plans. LighterLife offers a weight management plan to suit your weight loss needs that doesn’t just include meal replacement products but access to our unique behaviour change programme. LighterLife combines a choice of plans for fast weight loss and groups to help you understand far more about your relationship with both you – and the food.

We’ve a range of plans depending on how quickly you want to lose weight, all leading to personalised Management plans with will help you achieve a healthy and balanced way of eating for life with healthy recipes and ongoing group support.

The LighterLife Programme has helped over 1,000,000 people to change their mindset, their weight and their life, by combining nutritional meal replacements with our unique behaviour-change programme. This ground-breaking approach offers people a real opportunity to lose weight fast and keep it off in the long term by helping them understand why they overeat and giving them the opportunity to reshape their relationship with food and with themselves.

Start your weight-loss journey today by calling Alicia on 07952 171143.

25/05/2022 13:17:53

06/04/2022 19:41:42

25/10/2021 11:58:20

The Great Resignation: In some respects, the employer-employee relationship shares many characteristics of a personal relationship. You invest a lot of time trying to find ‘the one’. You have that first meeting, and you like what you see/hear. Sometimes it can lead to a long-term commitment but sometimes it can be nothing more than a shortterm romance, or even dare I say it, a moment of regret.

Lots of employers are facing relationship challenges right now with the ‘Great Resignation’. Maintaining long-term relationships with those we might call the key people or the high achievers in the business, and having to manage the consequences of an increase in resignations where the relationships have not worked out for one reason or another. Sometimes the employer has done nothing wrong; the employee has just had their head turned by what they consider to be a more attractive proposition with another employer.

But unlike the dating world, where these relationships break down in the early stages, the employer may have incurred an agency fee without the intended return on investment, has inevitable disruption to the business and will revert back to the frustrating prospect of having to source a replacement at additional cost.

There may be plenty more fish, but it becomes even more imperative you catch the right one.

We have some ideas as to how you, the employer, may be able to attract and retain the best talent, and improve your prospects of securing the right person, for a long-term, healthy relationship:

• Have a clear idea as to what candidate you are looking for – it may sound obvious, but it is crucial that this is properly established internally,

and if you are using recruitment agents, make sure they have a clear understanding of your requirements. This is not just about skill set and capability, but personality, values and ‘the right fit’.

• Social Media Presence – it helps if candidates can look at what you have to offer, your approach to work life balance, your appetite to run social events, your commitment to corporate social responsibility, diversity and sustainability. Candidates will be gauging whether you are the type of employer they want to commit to; it does no harm for them to see what life could be like if they joined you.

• Revisit your interview process – this is the first meeting, and it is clearly crucial in the process. It is a cliché to say it, but it is a two-way process, for both parties to understand if this might be a right fit. Use this process to gauge whether the candidate possesses the values that reflect your brand. You can ask questions that bring those issues to the surface. If the candidate shares the same values, the relationship is more likely to be a long one. Use this process to flush out any challenges – the candidate who is looking for a long-distance relationship, where you want to see them in the office more often, for instance.

• Pre-Employment Checks – do your research. Has the candidate had a lot of previous short-lived relationships in the past, do they have difficulty making a commitment? You could even look at the Tribunal Judgments website (with caution) to see if their last relationship properly broke down. As we know, references are of limited value these days, but you are not prevented from making further enquires to try and get a better insight into the person you are looking to employ.

• Probationary Period – this is often viewed as a period for the employee to prove themselves,

“It’s

and demonstrate they are right for the role. However, this is also a crucial period in establishing what is expected of the employee and setting clear objectives and actions. Invest the time in this process, and you are more likely to see the relationship work out.

• Reviews – it is important to regularly meet with the employee to discuss the relationship, the things that are going well and areas for improvement. This is an important for both parties to raise and address any concerns that may exist, which will help ensure a healthy and effective working relationship.

Finally, we are lawyers, so we have to caveat the above by saying that we cannot guarantee the above will help you find ‘the one’. Clearly there will be occasions where no matter how hard you try it is just

not going to work. Good practice would suggest that the termination of the relationship should not come as a surprise, as you will have regularly discussed the concerns as and when they arise. With any relationship, it is better to address the issues as they occur, rather than letting them fester. And of course, any termination during the probationary period usually entails a shorter period of notice than if the person is outside of that period, so will enable you to achieve a financial saving.

Contact Mark Fellows for more information

Mark Fellows Sherrards

Partner, Head of Employment Email: mark.fellows@sherrards.com Tel: +44 (0) 1727 738976

So, what is u3a, I hear you ask? Quite simply, it stands for ‘University of the Third Age’ but, despite its rather grand title, it is a much more down-to-earth, self-help society. Its appeal attracts many people who are no longer in full-time work and looking for more social interaction with like-minded peers, pursuing interests, old and new, in our more than forty ‘Interest Groups’.

Just as we here in Redbourn are entering our 10th year, the national organisation, of which we are but one small branch, is celebrating its 40th anniversary. When I say small, we can boast almost 400 members, many of whom continue to enjoy their membership since we first set up in 2013. Members come not only from our village, but from all the villages and towns that surround us. All are attracted by our friendly and welcoming reputation and come to realise that we live up to our motto ‘learn, laugh and live’.

At the time of writing, we have already enrolled another 36 new members since April and will welcome yet more before we hold our 10th Anniversary celebration at Redbourn Village Hall next April 2023. And because we are halfway through our membership year, ending in March, we can offer a reduced subscription of just £8 for all new members registering with us before then. If this is for you, please do come and join us!

Benefits of joining u3a

• Make a difference, stay active, keep learning, and have fun

• Get out to meet face-to-face – learning together and making the most of life

• Access to online learning, training, and resources to inspire you and attend learning events and talks for free

• Meet other people with similar interests: learn new things and share your skills

Joining u3a is a great way of making new friendships in a relaxed and fun making environment. There are no age restrictions, and your subscription includes free entry to our monthly meetings (third Wednesday at 2pm) with refreshments at the Village Hall and talks presented by a variety of guest speakers.

Our next speakers are:

21st December – “Dickens and Christmas” – Colin Oakes

Charles Dickens wrote about the Christmas season almost his complete writing life. He wrote far more than simply the famous Christmas Carol and his view of Christmas varied enormously. The talk will cover his writings on this theme from 1834 and “A Christmas Dinner” to 1867 and “A tour of two lazy apprentices”. Sometimes funny, often full of pathos and even often grim; Dickens was thoughtful and perceptive about Christmas and the New Year. Find out what this great writer made of the season.

18th January – “All things banned and censored”Christine and Peter Padwick

This talk is a light-hearted survey of banning and censorship over the past 100 years or so with pictures, songs and anecdotes touching on George Formby, Reith and the BBC, cricket, Marilyn Monroe, Sooty, G.B. Shaw, Donald McGill, the Crazy Gang, Dr Crippen, Alfred Hitchcock, Eartha Kitt, Thomas Hardy, Henry Hall, adverts, Frank Sinatra, D.H. Lawrence, Max Miller, George Gershwin and much more along the way.

For more information about membership, visit our website at: http://u3a sites.org.uk/Redbourn or Contact our membership secretary at redbournu3amembership@gmail.com for an application form.

You will be most welcome!

Merry Christmas and a Happy and Healthy New Year to you all!

REDBOURN u3a Charity No 1156462

As headlines in the papers cover the costof-living crisis, recession, strikes, declining economy, cost of energy, and the increase in our average shopping bill, etc, is it any wonder that, we are all looking to reduce our outgoings?

With vehicles being a necessity for so many people, what can we do to help reduce our costs?

Shop wisely for Fuel, Insurance, road fund licence, and breakdown cover

According to CompareTheMarket com, the average UK motorist now spends £1,860 a year on driving (on the cost of petrol, insurance, tax, and breakdown cover) It represents an increase of £291 year on year And that’s before you add in MOT, service, and maintenance.

While road fund licence is a fixed cost, insurance can be substantially reduced. The advice is always to shop around to save money, but Motor1 reveal a great tip If you switch 20 days prior to the end of your policy rather than waiting to the day of renewal, you could have a saving of £306!

Petrol prices are also worth shopping around for In a search of the area the petrol cost varied between £154.9 to £168.9. So, taking an average Ford Focus with 52l tank, you could be saving £378 a year if you fill up every week!

Make sure you’re not paying twice for breakdown cover: some household insurance policies and bank accounts include protection as part of their schedules

By Melanie Wooding Jones Redbourn Auto Solutions Caring for you and your car

It’s worth double checking your paperwork. Regularly Service, MOT and Maintain your car

According to road safety charity, IAM RoadSmart, drivers are deferring vital car safety checks and delaying maintenance, with a significant 79% of 18–34-year-olds delaying helping save money.

28% of drivers under 34 years old have held off annual car servicing, with 30% even avoiding changing their oil. Tyre checks have also been neglected with 30% admitting to putting off fixing a puncture and 28% delaying changing tyres with low tread!

But it’s not just the younger drivers, 15% of drivers of all ages admitted they didn’t view they annual service was a priority and 11% avoided paying out for necessary tyre changes

Kwik Fit’s research revealed that 8% of drivers tried to cut costs on car maintenance by refusing to have routine servicing or simply not having it cleaned However, experts have said this is ‘false economy’ which could wind-up costing consumers more in the long run

This is the best way to ensure your car is healthy and identify any issues before they become costly repairs Most manufacturers recommend a car is fully serviced every 12,000 miles or 12 months (whichever comes first). This helps ensure that the car is kept in top performance and reduces wear and tear, and therefore its better on your pocket

A regular service should be considered an important part of motoring alongside your MOT The RAC found that 57% of drivers who didn’t have a regular service

paid between £300-£1,000 to pass the MOT (figures from 2018).

Cars haven’t been manufactured to make odd noises If you are experiencing a knocking, whirring, squeaking or any other noise, the car needs looking at to prevent a significant issue later.

Don’t forget you can carry out your own maintenance such as:

• Check tyres - for inflation, wear and tear and even wear

• Check lights and levels - ensuring you have the right level of oil, water, brake fluid and washer fluid and all lights are functioning.

• Protect your battery - in cold weather and park in a garage where you can – there is a lot of drain on them during the winter

• Wipers – make sure they are fully functioning and don’t leave any smears on the windscreen. If in any doubt, book in for a Health Check before you travel

Make sure diesel cars have a long run out at least once a week to prevent the filters becoming blocked

This is not an option, so an MOT must be conducted annually The Government recommended price is £54.85 and is calculated to be a fair price.

Therefore, bear in mind that anyone selling for significantly less than this and offering to conduct it with a discount for a combined service, may not be as bigger bargain as it would first appear.

Where time is a precious commodity, think about combining your MOT and service on the same day so that anything that needs to be fixed can be done on the same day which keeps you mobile for longer If you are sure the vehicle will sail through its MOT, look towards booking a slot so that you’re only waiting for an hour for it to be completed.

This is such a difficult question to answer as it depends on your car’s make and model, age, parts, lubricants, and oils used and the quality of the Technician looking after you It also depends on how well you have maintained your car. Some garages quote including VAT and others don’t. Some give you a complete price and others add parts separately! Make sure when you are making comparisons, you are comparing like for like.

To help cut costs, consider the following questions:

• Am I willing to compromise safety?

If the answer is no, make sure you regularly service your vehicle and, if any repairs are needed, ask the garage which parts are safetyrelated and prioritise them.

• Am I willing to compromise quality of parts or labour?

If no, make sure you are dealing with qualified technicians and a garage who use quality or original parts Cheaper parts can break prematurely, fit incorrectly, and take longer to fit, so it could end up costing you more.

• Do all services cost the same? Not only do the composition of pricing structures change between garages, there are also different levels of Car Service dependent on the make and model of your car Services have different terminology but follow a basic pattern of: Intermediate, Main, and Full. Technician knowledge and skill comes at a cost. Broadly speaking if you need diagnostic work carried out, there is no point heading off to a service centre Rather go to one who can cope with the basic work and the more complex on the same day. So, the advice is to find a ‘fixed cost’ pricing menu so that you don’t get caught out with any additional costs

• Find a garage/mechanic that will support you in the level of service you are expecting If moving garage, look out for quality marks such as ‘Which Trusted Trader’, ‘Trading Standards Mark’, Retail Motor Industry’s, ‘Trust My Garage’ and check out their online reviews

What’s the impact if I decide not to have a regular service?

Should you happen to be involved in an accident, your car will be checked for roadworthiness If a garage has recently conducted a service, they are signing it off to say it is safe and roadworthy. Without an invoice, this can be difficult to prove and so might invalidate your insurance, leaving you with a hefty bill.

So, although the obvious way to reduce your car maintenance costs might seem to be to do less maintenance, this unfortunately has the opposite effect. By avoiding maintenance to save money, you’ll only end up missing issues that could’ve been spotted earlier

The market has been flooded with counterfeit parts which look incredibly convincing Our advice is to be

(continued over page)

To advertise call 07941 661004 Please mentionwhen responding to adverts

cautious if buying a part online, and unless you are fitting it yourself, you may find it hard to get a garage to fit it for you.

Repair cheap, repair twice. This is certainly true with your car.

Fuel consumption can also be reduced by the tyre you use. Look for the fuel efficiency rating when you chose your next tyre In the meantime, keep them correctly inflated If they are wearing unevenly, make sure all 4 wheels are alignment checked as they could be pulling against each other.

Consider your driving style

-it can make a difference to fuel consumption and is environmentally friendly.

A trial with AA staff revealed that by taking a few steps, in a week they saved 10% off their fuel bills and the best saved and impressive 33%, so it’s worth a go! You can find further details on this on our website under our blog entitled, ‘Reduce the Rising Cost of Fuel’ which covers the following:

• Drive smoothly and accelerate gently

• Change up gears earlier

• Keep rolling rather than stop start

• Idling for no more than 3 minutes

• Adhere to the speed limit

• Reduce your reliance on electrics

• Air conditioning doesn’t need to be on all the time

• Don’t coast as it leaves you unable to control the car

• Reduce Drag by removing any extras such as roof boxes, cycles, etc

• Remove unnecessary weight in the car such as superfluous luggage

Not only do these steps improve fuel consumption but driving carefully and smoothly is the best way to avoid wearing down your car parts Gentle braking will help avoid any unnecessary brake wear and using your clutch only when needed will keep it in good condition

According to Close Brothers Motor Finance, 32% of motorists are now planning on keeping their current

vehicle for longer, with 11% who also said they have sacrificed the vehicle they wanted in favour of a cheaper car. A further 9% said they would consider buying a motorbike instead of a car to save on travel costs

According to the RMI (Retail Motor Industry Federation), the average age of a car is 8 7 years old, which is expected to increase to 10 years old over the coming year. With 97% of registered vehicles either being petrol or diesel. Electric in whichever form holds a very small market share According to the industry, people are waiting for hydrogen to be the fuel of choice It’s a speculative view but would certainly make sense.

But it’s not just used cars that have seen a change Dealers report that, 52% of people purchasing new vehicles cut back on optional extras with 66% purchasing a cheaper vehicle, and a huge 62% were now migrating to used vehicles

Funding has also changed. 11% of people said they were exploring finance options to be able to afford their preferred car 24% of them would spread the cost with a specialist finance provider, 17% would use a bank loan and 9% would use buy now, pay later options. 4% would turn to family and friends for support

So, with the above statistics, it is no surprise that used cars have increased in value since 2020. Demand is up and there’s limited availability of good cars

Kwik Fit’s Communication Director, Roger Griggs said, “It’s easy to get caught up in the excitement of buying a new car and not taking all finances into account The actual car payment is just one aspect of the overall cost. People should remember to take additional costs such as insurance and maintenance into account when budgeting for a vehicle ”

Every penny counts and you’ll need to be sure you are saving money in the right places without compromising safety.

On behalf of the team at Redbourn Auto Solutions, we would like to wish you a Merry Christmas and a Happy New Year. We hope you are able to enjoy the festivities with family and friends and of course enjoy the Christmas Trees we have placed on the Common and at St Mary’s Church.

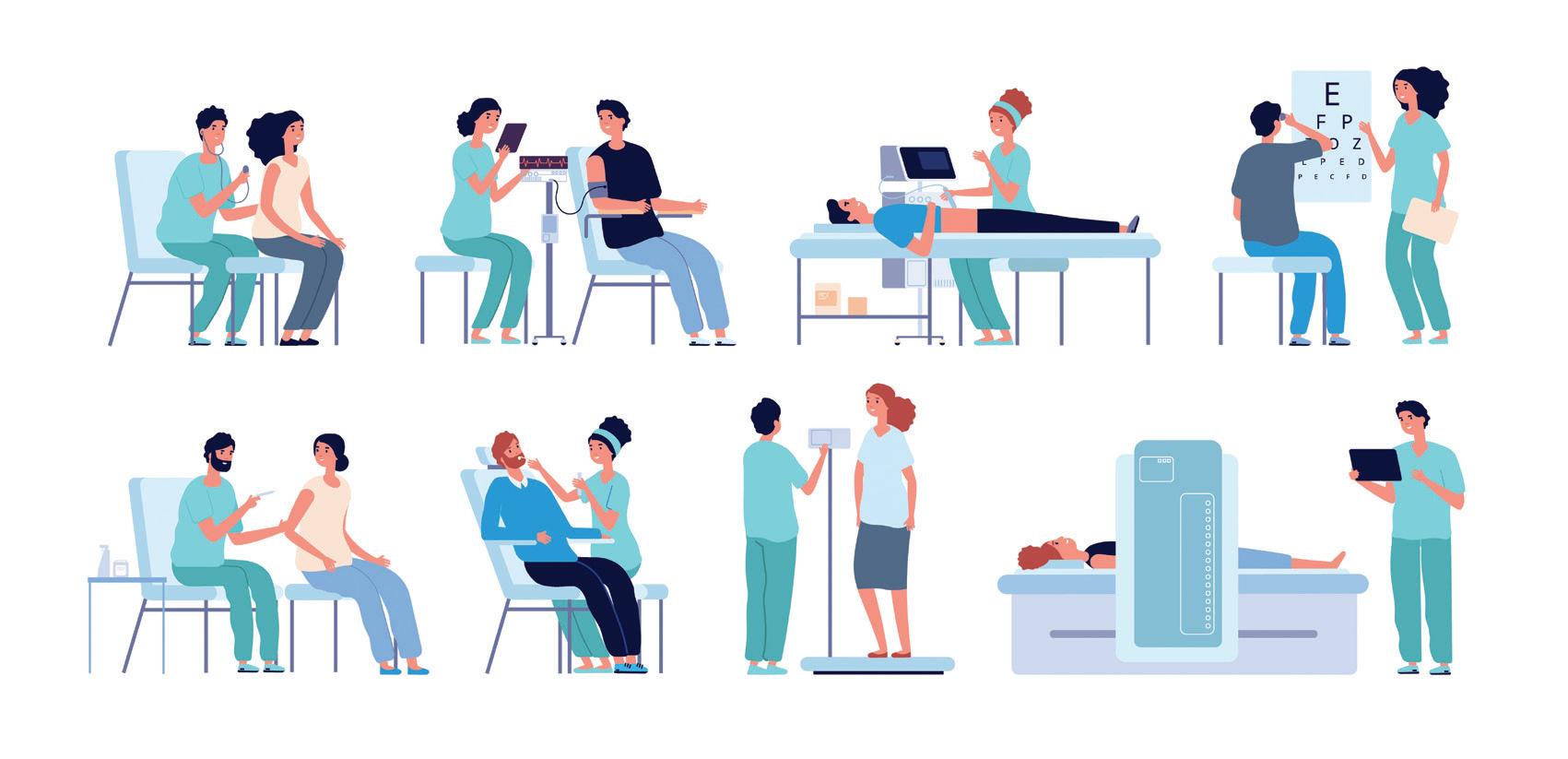

If you're 40-74 years old, you may be able to get a free NHS Health Check. This can help you reduce or manage your risk of developing health conditions such as heart disease, strokes, kidney disease, type 2 diabetes, and dementia.

It's designed to spot early signs of stroke, kidney disease, heart disease, type 2 diabetes or dementia.

If you're not sure if you're eligible for an NHS Health Check and would like one, or if you are eligible but haven't had an NHS Health Check in the last five years, ask your GP for an appointment.

If you are already diagnosed with cardiovascular disease, you should be reviewed annually by your GP, if you have any concerns regarding your health, you should make an appointment with your GP.

As we get older, we have a higher risk of developing something dangerous like high blood pressure, heart disease or type 2 diabetes. For example: being overweight or drinking too much alcohol increases your risk of developing high blood pressure, heart disease, stroke, diabetes and some cancers.

Your NHS Health Check can spot early signs and help prevent them from happening to you, which means you'll be more likely to enjoy life for longer.

Everyone is given information regarding dementia. Remember: “What’s good for your heart, is good for your head”.

What can I do to improve my health?

Small changes to your habits can have a surprising effect on your health. For example, giving up smoking dramatically reduces your risk of heart attack, stroke and cancer, and so does regular physical activity, eating healthily and drinking sensibly. Making these changes could add many years to your life.

What happens at an NHS Health Check?

•Appointments last 30-40 minutes.

•The advisor will measure your weight, height, and blood pressure.

•You will also be asked questions about your family’s medical history, your medical history, and your lifestyle.

•A blood test will be done by taking a small amount of blood from your finger to assess your cholesterol levels and possibly a blood sugar test if required.

All health checks are carried out in a COVID-secure way. Follow the links below for Hertfordshire and Bedfordshire residents.

https://surveys.hertfordshire.gov.uk/s/ HealthCheckRegistration/ https://www.bedford.gov.uk/social-care-and-health/ public-health/nhs-health-checks

With the cost of energy increasing, to save money it is vital to be aware of how your energy is guzzled in the home. Here are a few tips to save your money to spend on other needs or treats:

Washing machines, dishwashers and tumble dryers account for 14% of a typical energy bill. And they contribute an estimated 40% of the UK’s greenhouse gas emissions.

• wash clothes at lower temperatures; use the eco setting on dishwashers. Eco-settings on dishwashers can reduce energy use by 16%

• avoid washing half loads or tumble-drying half loads; avoid running the dishwasher when half-full

• turn off and open the door of spare refrigerators

• fridges and freezers work most efficiently when they are three-quarters full.

• don’t overfill fridges and freezers as they work best when the air can circulate, and the appliance will use more energy to keep cool.

• defrost your fridge and freezer regularly to keep them working efficiently.

• use a vacuum cleaner to clean the condenser coils at the back of your fridge or freezer as thick dust can reduce their efficiency by up to 25%

• don’t hang wet clothes on radiators to dry – use clothes horse instead or hang them outside if you can.

• clean the filter regularly in the tumble dryer – a blocked filter stops the hot air from circulating freely so clothes take longer to dry.

• put damp clothes on a clothes horse, near the radiator when the heating is on. Make sure that the room doesn’t get too steamy or a condenser would be needed to reduce condensation.

if you are buying a new appliance, look for the A+++energy saving rating or A from the EU’s A-G energy rating labels.

• Turn off lights when leaving a room

• Use LED lights

• unplug devices, not in use. Do leave them on standby

• lessen water usage

• descale your kettle regularly. If it’s full of limescale you use more energy to boil the same amount of water.

• Because gas is cheaper than electricity, it works out slightly cheaper to boil water on a gas hob than using an electric kettle, as long as you are boiling just the quantity you need.

• take shorter showers

• don’t put more water in the kettle than you need

• do not run taps, especially hot-water taps.

• keep your thermostat at a lower temperature – 17 degrees

• cook with the lid on

Most houses will use at least one set of 80w (watts) LED string lights at any given time in the winter. Assuming these lights are on from around 5 pm – 11 pm every night for a month, this would result in 180 hours of use.

Based on figures from this time two years ago (2020), when the average cost of electricity was around 17p per kWh, the cost of running these lights for six hours a day for a month would be just £1.84. At today’s capped price of 34p per KWh, the price would be £3.68. Bear this in mind if you have a lot of strings of Christmas lights.

If you are paying the October 2022 pricecapped unit rate of 34p per kWh for electricity, an average heat pump tumble dryer would cost around £68 a year to run.

Condenser models use more energy –costing an average of £170 a year to run.

A smart meter shows you how much you are consuming. It shows which appliances are heavy on energy use.

Central Beds have received confirmation of a successful bid of over £150,000 from the Local Authority Treescapes Fund (LATF), to support the planting of its first Tiny Forests.

Tiny Forests, the size of a tennis court, are dense fast-growing native woodland, planted to improve areas of urban tree population and help connect communities to nature in their area. The planting method encourages accelerated forest development without using chemicals or fertilisers and has low maintenance requirements. The current planting season, (October 2022 to March 2023), includes Mentmore Recreation Ground, Dunstable.

Following initial expressions of interest, two more Tiny Forest projects are also confirmed for the 2023/24 tree planting season. Interested applicants for future projects can find out more information by emailing be.green@centralbedfordshire.gov.uk.

Earthwatch Europe, said: Tiny Forest provides rich opportunities for connecting young and old alike with the environment and sustainability. We must give people the knowledge and skills to protect our natural world and inspire them to take positive action. We are delighted to be working with schools, community groups and town and parish councils to bring these inspiring spaces to Central Bedfordshire. Photo credit: Lewis Pidoux, UK WildCrafts 16

Environmental charity Earthwatch Europe, pioneers in the Tiny Forest movement, are supporting the projects, alongside a dedicated tree project officer from Central Bedfordshire Council.

Once planted, volunteers from each project will monitor their Tiny Forest to help it flourish. Councillor Steven Dixon, Executive Member for Sustainability and Transformation, said: We’re looking forward to working with schools, town and parish councils to get their Tiny Forest projects off the ground. By giving people the knowledge, skills and support to plant, they can play a part in enhancing the natural environment in their area...”

Louise Hartley, Tiny Forest Programme Manager at

Care Group Help Line – 07972 152279

Care Bus – Sue and Malcolm Davies – 01582 840554 Bowls Club - 01582 840604

Markyate Singers are back every Thursday 8-9.30pm at the YK2 Hall Cavendish Rd!

If you feel like getting out the house and having a sing song with a fantastic friendly group, then please come and join us! Everyone is welcome of all ages! It really doesn’t matter wether you can sing or not, it is a lovely social evening.

Tennis Club - We are a small, friendly club open to all ages. Membership enquiries: Steve Lyons (01582 414162) Coaching enquiries: Sally Parry (01582 413501)

Gardening Club: We are a small, friendly club which meets five times per year, 8pm Slip End Village Hall. Guest speakers on gardening topics are booked for meetings. We organise the Village Open Gardens’ Day and Plant Sale in alternate years. Enquiries to Rosemary Wickens 01582 423622.

Computer Friendly Drop-in – for free and friendly help for your computer, tablet or smartphone. First Wednesday of the month at the Spotted Dog, Flamstead 10:30-12:30. Our contact details: Office 01727 617359, www.computerfriendlystalbans.org.uk

Caddington and Slip End Runners – Front Street, Slip End 8pm Call 07587 189260

CaddingtonCare Good Neighbour Scheme

CaddingtonCare continues to run its core service MondayFriday between 9am and 4.30pm. Please call 07548 264672. The Library in Caddington, held in the Allotment Hut off Folly Lane reopened on Thursday 5th August and runs from 10 am to 12 noon on alternate Thursdays. There is a large selection of books and jigsaws. Coffee, tea and biscuits are also available.

Caddington W.I.

Now meet 1st Tuesday of each month at 7.30 pm at the Caddington Sports and Social Club. Call Linda Edwards 01582 737036. We do a small amount of business followed by some entertainment or a speaker. Sometimes a quiz but always a cup of tea or coffee and cakes to enjoy. Do join us - we look forward to it.

We meet on the fourth Thursday of every month at 7.30 pm in the Heathfield Centre. Contact John 07763832245 Tai Chi

Mons 1.30pm & Weds 2pm Contact Christine 07850914438

12.30pm Chair Yoga Wednesdays

1.30pm Beginners Yoga Debbie 07948804031

CADS is an amateur dramatics group that meets every Tuesday from 8.00-9.30 pm at the Heathfield Centre, Caddington. We are a friendly bunch and welcome new members both onstage and off.

Village Hall – Sylvia Inns 07831 538682

Neighbourhood Watch – Caroline Streek 872410

Cricket Club – Duncan Wingfield 872743; Parish Council – Pat Mitchell 871178

Community Scheme – 07919 081473

Local History – Julia Holder 873465

Baby and Toddler Group - Jenny 07515 704404 or find us on

To advertise call 07941 661004

Facebook. Meet Weds 10am - 11.30am, term time only in the Village Hall. £2 for the first child and £1 for each sibling.

Friends of Studham Common

See website www.foscomm.org

Studham Village Hall - Main hall and a meeting room available for hire. Modern kitchen. Activities include Art Club, Bingo, Carpet Bowls, Scrabble, Seniors Table Tennis, Women’s Institute (WI) Yoga. Contact: Des Salmon, 01582 872082 desstudham@btconnect.com

Tennis Club – Open to members and non-members. All welcome. Contact Andrew Jones Andrew.jones@ expressvending.co.uk 07833 111682

See www.studhamtennisclub.co.uk

Neighbourhood Watch – Richard Hodge 01582 873630

Studham Mums and Totts

Studham Village Hall - Tuesdays 9.30 - 11.30,friendly group.

Ken France 01582 872375; Village Hall – Sam Burr 07921 761730

Redbourn u3a meets every month in the village hall and with more than 45 Interest Groups, there is something for everyone in their third age and no longer working full-time. For more information visit our website at http://u3asites.org. uk/Redbourn, email our membership secretary at redbournu3amembership@gmail.com or speak to the chair on 07956 400493

Tennis at Redbourn Club - Join our friendly club off North Common in the heart of the village. Annual membership fee entitles play all year round. New easy to use court booking system. More details on new website - clubspark.lta.org.uk/ RedbournTennisClub

Redbourn Community Group

Amongst other things, RCG volunteers offer transport to medical appointments, outings in the minibus, practical help such as shopping and prescription deliveries, friendly talks and walks, and welcome packs for new residents. Call 01582 794550 or email: info@redbourncg.org. More volunteers are always welcome. Redbourn Bowls Club always welcomes new members. If you would like more details, please contact our Chairperson, Margaret Davis, on 01582 799075, email: margaretfdavis@ virginmedia.com or Jez Cronshaw, Coach, at 07525 867450. Redbourn Community Library - open 6 days a week in our purpose-built centre beside the Fire Station offering great reads for adults and children, public computers, photocopying and scanning facilities and free wi-fi. If you would like to know more about joining our team of volunteers, pop in and see us, contact us via our Facebook page or email redbournlibraryvolunteers@gmail.com Redbourn Players is an active amateur dramatic society performing two major productions every year in Spring and Autumn as well as other local drama events. We are always looking for new members of all ages, whether you want to act, help backstage, build sets, make costumes, paint scenery or help with publicity.

If you are interested, or just want to find out more, please contact our Secretary Pauline (07771 931086) or email redbourn.players@gmail.com for details.

Please mention when responding to adverts

Redbourn Village Museum

Silk Mill House The Common Redbourn Herts. AL3 7NB

Patron: Sir Simon Bowes Lyon Museum open February to November Saturday & Sunday 2:00 pm to 5:00 pm Last admission 4:30pm Tel: 01582 793397

Email: redbournmuseum@gmail.com Visit us on the web at: www.redbournmuseum.org

Kinsbourne Green WI

Meet 3rd Tuesday of the month at 7:30pm in St Mary’s Church Hall Kinsbourne Green. Email secretarykgwi@gmail.com for details.

Our ladies had a really fun night in November where we made felt animals and some Christmas items. We were each given a small bag with the felt already cut out; there were sequins to decorate and a length of cotton together with a needle. It was a very happy evening and many a laugh was had trying to thread the needle! Terri provided the tea and coffee for us which was well-needed. A big thank you to the two Carols, Jones and Hardy for preparing for us. We have started to collect worn and new bras so these can be sent to African Countries to help with the campaign against sexual assault.

On 6th December our Xmas Party will be a busy evening. One of the games is items under the chairs and we swap about until a gift is won. We all bring a gift to give to each other too and we will all bring a plate of food for a buffet later in the evening. The postbox will be available for cards.

Friday 9th December is Group Meeting Night. This will be held at Heathfield Community Centre as Caddington Club may have the World Cup football on the TV. We will be joined by Studham, Houghton Regis, Dunstable, and Eaton Bray W.Is.

Our meeting in January 2023 is on the 10th at the Caddington Sports and Social Club starting at 7.30 pm. Do join us for a fun evening.

We would like to wish everyone a Very Merry Christmas and a Happy New Year. Linda Edwards

• is an 18th century, working flour mill on the bank of the river Ver.

• Millers of stoneground organic flours, artisan bakers of loaves, cakes and biscuits.

• Regular baking classes. Gift vouchers.

• Bakery open Sat 9am-1pm

• Mill Open Sat 9am- 1pm and Sun 1pm-4pm Redbournbury Lane, Redbourn, AL3 6RS www.redbournburymill.co.uk 01582 792874 enquiries@redbournburymill.co.uk

Every Thursday 8-9.30pm at the YK2 Hall Cavendish Rd

If you feel like getting out the house and having a sing song with a fantastic friendly group, then please come and join us! Everyone is welcome of all ages!

It really doesn’t matter whether you can sing or not, it is a lovely social evening where we like to sing, chat and have a laugh!

Foodbank Distribution Centre for clients to collect food parcels

Foodbank distribution Centre for clients to collect food parcels

Mondays from 14.00 - 15:30

Saturday 10th – Friday 30th December 2022

Tickets: Adults £20, Children £18 & Family Tickets £66.50* (plus booking fee)

Redbourn Methodist Church, North Common, AL3 7BU

Mondays from 14.00 - 15.30 at Redbourn methodist Church, North common, AL3 7BU

Allotment produce will be welcomed during the opening period but other donations should be taken to St Mary’s, the Co op and NISA Weymans. The Warehouse on Redbourn Industrial Estate take donations but call first.

Thank you to everyone who helps with this and all who give so generously.

Redbourn Community Group and St Albans & District Foodbank are united in believing that no one should have to go without food or make choices about food or fuel. If you or anyone you know is in need of food support in Redbourn, please contact the RCG office on 01582 794550 for a referral.

Allotment produce will be welcomed during the opening period but other donations should be taken to St Mary’s the Co-op and NISA Weymans. The Warehouse on Redbourn industrial Estate take donation but call first. Thank you to everyone who helps with this and all who give to generously.

From the team behind last year’s Aladdin comes this year’s hilarious pantomime CINDERELLA at The Eric Morecambe Centre. The nation’s favourite pantomime is suitable for the whole family and audiences will be captivated by this production which is full of magic, laughter, audience participation and spectacular surprises.

CINDERELLA tells the story of a girl who dreams to escape her life as a servant, being bossed around all day by her wicked step sisters. Her best friend Buttons and her Fairy Godmother will make her dreams come true in this enchanting fairytale, as a dashing Prince and his best friend Dandini hold their annual ball at the palace.

Redbourn Community Group and St Albans & District Foodbank are united in believing that no one should have to go without food or make choices about food or fuel. If you or anyone you know is in need of food support in Redbourn, please contact the RCG office on 01582 794550 for a referral.

For more information visit the St Albans & District Foodbank Donate food | St Albans and District Foodbank Call 01727 613019 option 3 Email: info@stalbansdistrict.foodbank.org.uk

Charity Number: 1158917

For more information visit the St Albans & District.Foodbank Call 01727 613019 - option 3 Email: info@stalbansdistrict.foodbank.org.uk Charity number 1158917

Will they find their happy ever after? Book now to find out – but don’t wait till midnight to secure the best seats at Harpenden’s professional pantomime – you’re sure to have a ball!

https://the-emc.co.uk/events/cinderella

We were all overwhelmed at Harpers, at the messages and cards received when we announced we where closing the business at the end of October and would like to thank all of our customers for their support and loyalty over the years. Because of the response we had, HARPERS have decided to continue with a part of our business until the site at Pepperstock is sold next year.I We will be keeping the coffee shop open on Tuesday through to Saturdays from Saturday 19th November 2022 and look forward to seeing customers and friends joining us for hot and cold drinks and snacks. We will also be selling a selection of frozen goods to include sausage rolls, sausages and quiches. Best wishes Peter Harper

27th Jan Walled Garden in the 20th Century – Highs and Lows

24th Feb Water on the Estate – 18th-21st centuries

24th Mar 21years Reviving the Walled Garden

28th Apr Gertrude Jekyll in Bedfordshire

Talks and tours for groups are also available - email office@lutonhooestate.co.uk phone 01582 721443

Don't forget access is via the A1081 between Luton and Harpenden West Hyde Rd/Newmill End turning LU1 4LE - there is no entrance to or from the hotel.

Festive Friday Nights 2, 9, 16 & 23 December

Late night entertainment and shopping | 5pm to 7pm £5 per person, pre-booking required. Children under 3 are free and do not require a ticket.

We are a friendly, happy group meeting on the second Tuesday of the month 7:30pm at The Baptist Hall. We have speakers, share ideas and in the summer run trips to interesting gardens. Join us, new members always welcome. Any queries please contact: Sarah 01582419793, Wendy 410126, or Hilary 420159

Christmas Anagram: 1. Christmas Day 2. The Holly and The Ivy 3. The Messiah 4. Twelve Days of Christmas 5. Jingle Bells

Need a qualified life or executive coach to discuss what you want to achieve in life or at work?

Need a qualified life or executive coach to discuss what you want to achieve in life or at work?

Contact me Sam for a free introductory call we’ll plan how we get YOU to be your very best.

Contact me Sam for a free introductory callwe’ll plan how we get you to be your very best. w:sammancey.com t:07534 218353 e:sam.mancey@sammancey.com