Fewer households throughout the Greater Houston area could afford to purchase the median-priced home in the first quarter of 2022, as home prices and mortgage interest rates climbed. Homebuyers in the Houston Area need 26.9 percent more income than they did a year ago to afford the median-priced home, according to the newly launched Houston Association of Realtors® (HAR) Housing Affordability Index.

HAR’s Housing Affordability Index measures the percentage of households that can afford to purchase a median-priced, single-family home for regions and select counties in Texas.

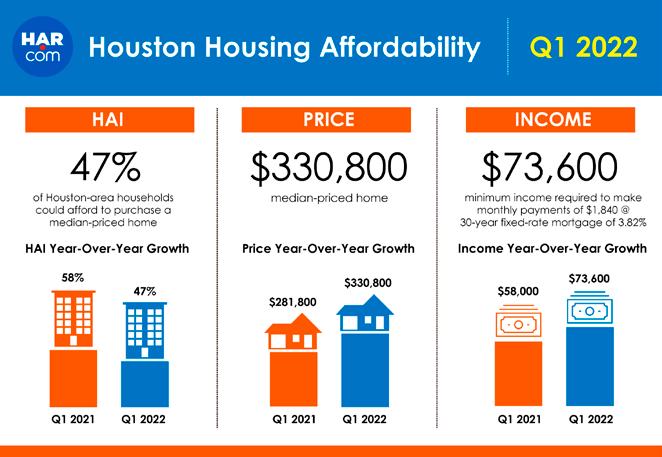

About half of all Houston-area households, 47 percent, earned the minimum annual income needed to purchase a $330,800 home in the first quarter of 2022. That’s down from 58 percent in the first quarter of 2021. The monthly payment, including taxes and insurance, on a 30-year, fixed-rate loan would be $1,840, assuming a 20 percent down payment and an effective composite first quarter interest rate of 3.82 percent.

The Houston Area was more affordable compared to the Austin and San Antonio metro areas, according to HAR’s Housing Affordability Index. The Dallas metro area had comparable affordability to the Houston Area for the first quarter of 2022. However, the analysis found all metro areas examined are less affordable today than they were a year ago. Households in Texas need to earn 29.8 percent more income than they did a year ago to afford a typical home. A household income of $73,200 was required to qualify for the purchase of a $328,990 statewide median-priced, single-family home in the first quarter of 2022.

Compared with Texas, 45 percent of the nation’s households could afford to purchase a $368,200 median-priced home, which required a minimum annual income of $74,400 to make monthly payments of $1,860. Nationwide affordability was down from 55 percent at this time last year.

“With rising home prices and mortgage interest rates at the top of most consumers’ minds, HAR felt compelled to provide an easy-to-understand measurement for gauging housing affordability,” said HAR Chair Jennifer Wauhob with Better Homes and Gardens Gary Greene. “We plan to produce these reports on a quarterly basis to help consumers make informed decisions about the home buying process.”

“The median price of a single-family home in Houston has increased nearly $80,000 in the last two years, and this makes it difficult for families to afford to buy a home,” said Patrick Jankowski, Senior Vice President of Research for the Greater Houston Partnership, who assisted with reviewing the data. “As home prices and interest rates continue to increase, we could see more people stay in rentals or multi-family units because they cannot afford to move, and some people are going to have to accept less house than they originally wanted to buy.”

The opportunity for Texans to buy a home was made more challenging by the lack of growth in the median income of households across the state. The chart below

illustrates how the minimum household income needed to purchase a home changed year over year.

Highlights from the first-quarter 2022 Housing Affordability report:

• Compared to the previous quarter, housing affordability declined in 14 tracked counties and improved in two counties (Matagorda County and Wharton County).

• Compared to the previous year, 14 counties saw a drop in housing affordability, one county remained unchanged (Matagorda County) and one county improved (Colorado County).

• The most affordable counties were Chambers County (56 percent), Colorado County (54 percent), and Wharton County (54 percent). In Chambers County, the minimum household income needed to qualify for a $316,495 home was $74,400.

• In Harris County, Memorial Villages, River Oaks, and West University Place were the least affordable. Purchasing a median-priced home in River Oaks required the highest minimum household income of $585,200. Only 2 percent

of households in Harris County could afford to purchase the median-priced home in River Oaks.

• The Aldine Area was the most affordable in Harris County—54 percent of Harris County households made the minimum annual income of $58,800 to afford a median-priced home in the Aldine Area.

• In Fort Bend County, Stafford was the most affordable area—69 percent of Fort Bend County households were able to afford the median-priced home in Stafford based on the annual income. Fulshear was the least affordable (31 percent).

• In Montgomery County, Willis was the most affordable area—68 percent of Montgomery County households were able to afford the median-priced home in Willis based on the annual income. The Woodlands was the least affordable (33 percent).

• In Brazoria County, Angleton was the most affordable—69 percent of Brazoria County households were able to afford the median-priced home in Angleton based on the annual income. Manvel was the least affordable (29%).

• In Galveston County, La Marque was the most affordable—64 percent of Galveston County households were able to afford the median-priced home in La Marque based on the annual income. Bolivar Peninsula was the least affordable (31%).

• Fort Bend County required the highest minimum qualifying income in the Great Houston Area. A minimum annual income of $95,200 was needed to purchase a $380,000 home; 51 percent of households in Fort Bend County could afford to purchase the median-priced home.

For HAR’s full Housing Affordability report and data tables, please visit www.har.com.

Source: Houston Association of Realtors® (HAR)

In the words of the world’s most lovable fish Dory from the Disney movie Finding Nemo, “Just keep swimming! Just keep swimming!”

These are nerve-racking times for investors. The stock market is up one day, and down the next three days! This is the kind of uncertainty and volatility that makes some investors sell their stocks and put all their money in a bank money market account.

ket.

So, don’t panic sell, or try to time the market. Embrace the swings by taking advantage of this opportunity to buy some good companies at lower prices. Consider keeping 50% to 60% of your portfolio in safe or guaranteed holdings.

Well, do not despair. We have been here before, and as a matter of fact, what we are witnessing today is the natural order of things. Water will always find its level, and stocks will often reveal their true value. This pullback or sell-off in the market is effectively pruning back a lot of the overgrowth we have had in the stock market. This is the arrival of the check after a few years of irrational exuberance and a Go-Go mentality regarding the stock mar-

Make sure you stay true to your risk tolerance and manage for the growth you need; not the maximum you can get. And the best way to know this information is to establish and maintain a comprehensive financial plan. Review your plan, rebalance your investment portfolio as needed, and make sure you are maintaining the proper levels of cash reserves. And remember to keep building wealth. Peace!

James Marshall is a registered investment advisor registered in Texas and Kentucky. He can be reached at James@ Marshallyourmoney.com. Visit him on the web at Marshallyourmoney.com.

“History doesn't repeat itself but it often rhymes,”

as Mark Twain is often reputed to have said.