Two students from the Thurgood Marshall School of Law at Texas Southern University have accepted invitations from Mostyn Law to join the firm’s paid internship program. Kendria Holmes and Mya Lloyd, both second-year law students, assumed their clerkship duties with the firm in July.

“We need the best and brightest minds on our team at Mostyn Law,” observes Amber Mostyn, co-founder of Houston-based Mostyn Law. “That’s why we are always looking for promising law students to join our team. Many of our lawyers who have been here for over 10 years started with us as law students. We are excited to have Kendria and Mya on the team and we hope to give them some hands-on legal experience and help them realize their full potential as young lawyers.”

Mya Ashlan Lloyd completed her undergraduate studies at Louisiana State University in Baton Rouge, Louisiana, where she played active roles in LSU Ambassadors, LSU NAACP and LSU Student Government. As a student at Thurgood Marshall School of Law, she

serves as the Secretary for the Sports & Entertainment Law Society and a member of the Dean’s Leadership Council. The native Texan, originally from Dallas, enjoys spending time with Boston, her Doberman Pinscher, watching football and reading literary criticism.

Native Houstonian Kendria Holmes developed her passion for justice and equality for underprivileged communities at an early age. Following her graduation from Texas State University in San Marcos, with

a Bachelor of Arts in Philosophy, Ms. Holmes worked as a mental health associate for The San Marcos Treatment Center, mentoring that facility’s resident juveniles from a variety of backgrounds. Currently ranked in the top 25% of her law school class, Ms. Holmes enjoys dancing, playing her violin and tutoring students within her community.

Mostyn Law’s recruitment efforts on the campus of Texas Southern University are the latest in a series of successful engagements with the university and its radio properties, KTSU-FM and The Vibe. During February’s winter weather emergency, which devastated Houston homes and restricted the public’s access to supplies, Mostyn Law distributed bottled water to over 500 families during a drive staged in the radio stations’ parking lot. On other occasions, Amber Mostyn has provided expert commentary on legal matters as a guest on the KTSU-FM airwaves. As a donor, an underwriter and an employer, Mostyn Law salutes and supports the mission of Texas Southern University and welcomes the growth of its relationship with this legendary Historically Black College and University.

Source: Doug Harris/Noisemaker Communications

ccording to results from a new Commonwealth Fund survey, Americans who have suffered the most during the COVID-19 pandemic are also the most likely saddled with medical bill problems and debt. The Commonwealth Fund, a foundation that promotes a high-performing health care system that achieves better access and improved quality, noted that adults ages 19 to 64 contracted the virus, lost income, or lost their job-based health insurance coverage.

Those individuals also reported higher rates of medical bills and debt problems than people not affected by the pandemic in those ways. Researchers found those who lost income experienced medical bill problems at the highest rates, especially those who also tested positive or became sick with COVID-19 or lost coverage. The report revealed that Black and Latinx adults “face the greatest financial challenges from chronic lack of affordable health care, even as the pandemic eases and more gain insurance coverage.”

More than half (55 percent) of Black and nearly half (44 percent) of Latinx/ Hispanic adults said they had medical bill problems and debt, compared to one-third (32 percent) of white adults. Overall, one-third of U.S. adults said their income fell during the pandemic, but Black, Latinx/Hispanic, and low-income adults were particularly hard hit, the report continued. Forty-four percent of Black adults and 45 percent of Latinx/Hispanic adults reported a loss of income. Insured and uninsured adults alike struggle to pay their medical bills, but those without coverage face more significant challenges. More than one-third of insured adults and half of uninsured adults said they had a medical bill problem or were paying off medical debt. One-third (34 percent) of working-age adults with employer coverage reported medical bills or debt problems, as did nearly half (46 percent) of adults with individual and marketplace coverage.

Relatively few adults lost job-based health insurance coverage during the pandemic. However, many of those who did were left exposed to health care costs, researchers wrote. The survey, which took place between March 9 and June 8, revealed that just 6 percent of workingage adults lost job-based coverage — whether through their job or that of a spouse, partner, or parent — since the pandemic began. Of those individuals, 67 percent gained coverage elsewhere.

Just over half (54 percent) of people who lost coverage through their job and did not get COBRA were without coverage for three months or less. About 30 percent did not gain insurance until four to 11 months later, and 16 percent were uninsured for longer than

By d-mars.com News Provider

By d-mars.com News Provider

a year. An estimated 10 percent of working-age adults were uninsured during the first half of 2021 — a smaller share than 2020 estimates from federal and private surveys. The survey findings suggest that more people have gained insurance than lost it since the pandemic began.

Federal efforts to help people maintain their Medicaid coverage, combined with state and federal efforts to encourage people to enroll in the Affordable Care Act (ACA) marketplaces and Medicaid, have increased enrollment in both. The researchers determined that medical debt leaves people with lingering financial problems.

Thirty-five percent said they had used up most or all their savings to pay their bills. Forty-three percent had received a lower credit rating because of their medical debt. More than one-quarter (27 percent) were unable to pay for basic necessities such as food, heat, or rent. The authors noted several policy options they said could alleviate medical bills and debt problems and provide relief, including making the temporary American Rescue Plan marketplace subsidies permanent. That could reduce the number of uninsured by 4.2 million in 2022, the researchers said. They also suggested providing Medicaid-eligible adults in the 13 states that have not yet expanded their program a federal insurance option to cover an estimated 2.3 million uninsured.

Reigning in deductibles and out-of-pocket costs in marketplace plans with new subsidies and rules also should help, they said. More individuals with unaffordable or skimpy employer plans should be allowed to enroll in marketplace plans, the Commonwealth Fund researchers stated. “Although the survey indicates improvement in insurance coverage during the pandemic, it also shows that health insurance in America is not protective enough,” stated Dr. Sara R. Collins, the lead author and Commonwealth Fund Vice President for Health Care Coverage, Access, and Tracking.

“The persistent coverage inadequacy and vulnerability among U.S. working-age adults is compromising their ability to get the care they need and leaving many with medical debt at a moment when they should be recovering after months of financial insecurity.”

Dr. David Blumenthal, the president of the Commonwealth Fund, remarked that people struggled with inadequate health coverage and mounting debt before the pandemic.

“Now, the administration and Congress have an opportunity to ensure not only that all U.S. residents have health insurance but that the coverage is affordable and comprehensive,” Dr. Blumenthal declared.

Source: NNPA

Americans are living longer than ever before, and with continually rising health care costs, the need for a long-term care solution becomes more of a “when” than an “if” situation, according to financial experts, who warn that Americans are largely waiting too long to plan and prepare.

“Many people wait until they’re in their 50s or 60s before beginning long-term care planning, but with costs rising, it’s important to start planning when you’re younger and healthy,” says Heather Deichler, senior vice president, MoneyGuard product management, Lincoln Financial.

To get prepped, consider these tips from Lincoln Financial:

• Plan early: Only about 7.5 million people in the U.S. have policies that pay long-term care benefits, according to the American Association for Long-Term Care Insurance, but more than half of Americans turning 65 are projected to need some type of long-term care in the future. This disparity could be due to the fact that many underestimate long-term care costs and expect to rely on savings or Medicare and Medicaid to cover them.

Those in the know -financial planners -- see medical/healthcare costs and long-term care expenses as bigger risks to retirees’ savings than spending too much, inflation or the economy.

Indeed, a majority of consumers in a recent survey conducted by Versta Research on behalf of Lincoln Financial guess that a private room in a nursing home costs less than half the realistic estimate. Others may simply feel their good health exempts them from the need to plan at all. But living a healthy lifestyle could mean you’ll live longer and face health-related risks associated with aging.

Being realistic about the possibility your future could involve long-term care and the true costs associated with it can help you plan accordingly and motivate you to get started early.

• Get on the same page as your family: Having a long-term care conversation with loved ones can help you feel confident about your future and help avoid conflict among family members. Share your expectations for daily living, such as how and where you want to receive care. This is a good time to identify who will be responsible for your financial and medical affairs should you become unable to manage them.

• Consult a financial professional: A financial professional can help you get a handle on your financial future and make you aware of all your options, including those that evolve with your needs. They may point you to solutions that can help cover qualified long-term care expenses. Some solutions can offer more options and flexibility with a guaranteed level of protection and the possibility for investment growth. For example, in addition to obtaining care in an assisted living facility or nursing home, you could have the flexibility to receive care at home, including from family members.

Comprehensive long-term care planning with family members and a financial professional now can help ensure everyone is prepared for the emotional and financial decisions that may need to be made in the years ahead.

Source: StatePoint

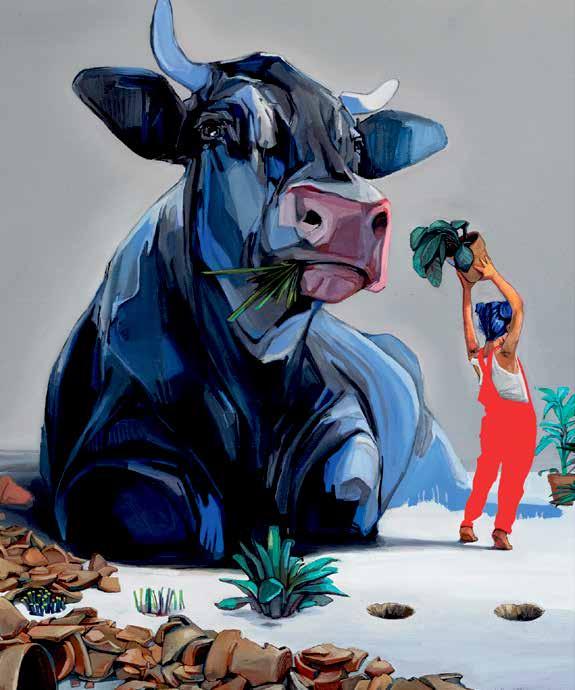

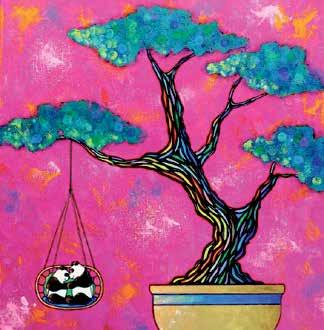

BAYOU CITY ART FESTIVAL DOWNTOWN OCT 9-10

TICKETS $15 ONLINE THRU SEPT 24TH

$18 AFTER SEPT 24TH

VIP HOSPITALITY TICKETS $60

■ 200 ARTISTS

■ 19 DISCIPLINES OF ART

■ TWO PERFORMANCE STAGES

■ ACTIVE IMAGINATION ZONE

■ CRAFT BEER GARDEN

■ FOOD TRUCKS

■ BOUTIQUE WINE GARDEN

FEATURED ARTIST MCKENZIE FISK @MCKENZIE_FISK_ART

www.bayoucityartfestival.com

FUNDED IN PART BY HOUSTON AR TS ALLIANCE THROUGH THE CITY OF HOUSTON