By Amy Kyllo amy.k@star-pub.com

WABASHA, Minn. — Two connected and complimenting businesses have created a marriage of sweet and savory in downtown Wabasha.

With views of the Mississippi River out their back window, the establishments Chocolate Escape and Big Jo Pizza offer a selection of comfort foods. Gooey pizzas, rich soups, beer and wine are on the menu at Big Jo Pizza and Chocolate Escape offers ice cream, coffee, and, of course, the highlight of the store — handmade artisan chocolate candies.

Brian Steffenhagen, who has over 30 years of restaurant experience, is general manager of the two stores and chef at Big Jo Pizza. Chocolate Escape has existed as a business since the early 2000s, but Big Jo Pizza started in May 2023 when Chocolate Escape and the space next door was acquired by new owners.

Steffenhagen transferred from another restaurant owned by these owners

to help the new restaurant in the space next to Chocolate Escape get going, and he has never left.

“I hope (people) nd us that nice little hidden gem, the top-quality, Neapolitanstyle wood re pizza, … that rare nd,” Steffenhagen said.

Jeni Arnold, the chocolatier at Chocolate Escape, also came on in May 2023. She had a background in hospitality, but chocolate is something she learned on the job.

“Everybody enjoys chocolate for different reasons,” Arnold said. “I enjoy it to sit and relax, so I hope it brings (people) some relaxation and just calm.”

Arnold travels to other candy stores for inspiration. When considering creating a new item, she thinks about how it will be consumed.

“I try to think of ease of eating it,” Arnold said. “Is it something that can be eaten in one bite, two bites, or is it something that needs more stability?”

A recent addition she helped create is their s’more, which features graham crackers, caramel and marshmal-

low, all dipped in chocolate.

“Although other companies had (s’mores) we put our own twist on it,” Arnold said.

When Steffenhagen joined Big Jo Pizza, the restaurant did not have recipes for its in-house dough or sauce.

Steffenhagen developed a sauce that features notes of rosemary, and when melded alongside other toppings, it

has a light and vibrant avor with a faint hint of spice on the backside.

“We wanted something that had a little bit of a pep to it,” Steffenhagen said. “You take your base recipe, and you make it and ‘OK, I’d like to have a little more heat. I’d like to have a little more of these avors come out.’ So, now make it again, and add a little less of this and a little more of that.”

The sauce recipe contains a portion of the approximately 50 pounds of butter the restaurant uses each month.

“There’s butter in a lot of everything,” Steffenhagen said. “I do not use margarine.”

Steffenhagen likes how natural fats work.

“Things don’t act the same when you don’t use real ingredients,” he said.

Steffenhagen said he sees cooking as a science.

“Cooking is just chemistry, but you get to eat when you’re done,” he said. “You’re changing properties. You’re doing science experiments.”

The pizzas are topped with a blend of 50% mozzarella and 50% provolone. The cheese is made with

5% buffalo milk, which Steffenhagen said makes a richer, creamier melt.

He said mozzarella is an oilier cheese, so the blend reduces the amount of separated oil on the pizza when baked. Customers experience a crust with a “crisp crunch from the oven” Steffenhagen said because it does not get soggy with separated oil when cut.

“You maintain that real nice, long, stringy pull,” Steffenhagen said. “But you don’t have the heavy oils along with it.”

The restaurant goes through 120150 pounds of cheese a week and during busy seasons this amount can be doubled or tripled.

Arnold’s chocolate confections also contain dairy. She uses Wilbur Chocolate in dark, milk and white as her base. Around 15-30 pounds of chocolate goes out the door weekly with 75% of their sales as milk chocolate and the rest as dark and white chocolate.

Arnold makes her chocolates in a small, windowed room where customers can watch. She said though for her the work is routine, for those watching it means more.

“To see something made handmade, no matter what it is, if it’s somebody painting a picture … or making pottery, making chocolate, … to somebody else it’s an art form,” Arnold said.

If in-store trafc is slow, Arnold will allow a child to put on gloves and dip a pretzel rod in chocolate for themselves.

“To hear the parents say, ‘This is a memory that’s going to last a lifetime,’ is what we want to hear when we are making chocolate,” Arnold said. “We’ve brought joy to somebody else.”

The Chocolate Escape also offers ice cream and coffee drinks. During the busy season they scoop 45-60 gallons of ice cream a week. Between Chocolate Escape and Big Jo Pizza, they use about 4-8 gallons of milk and 3 gallons of heavy cream a week.

Looking to the future, Arnold said she would like to grow Chocolate Escape as a gift option over the holidays, to get their candies into boutiques, and to become a destination for quality and value.

Steffenhagen expects to see growth at Big Jo Pizza by next spring. Road construction in front of and near the restaurant since its inception has hindered trafc previously. On a busy night they make 70-80 pies. However, Steffenhagen said they have the capacity for 150.

“The rst year and a half has been let’s get everything rened,” he said. “Let’s get our product dialed in. Let’s get our recipes honed in. Let’s get everything ready to go and be prepared. … We’ve been getting a lot of compliments on the pizza and starting to pick up some positive reviews.

The U.S. Department of Agriculture issued its Federal Order reform nal decision this week outlining changes in U.S. dairy pricing. A producer referendum will be held in December or January after which a nal rule will be published.

StoneX analyst Nate Donnay said there were only minor changes between the recommended decision released July 1 and the nal decision. He said, “It’s expected that all orders will vote to accept the new language, but there have been rumblings that the Upper Midwest might be a close vote.” He said we should know the results between late January and mid-February.

The implementation timeline will also be issued at that point, according to Donnay, but from a risk management perspective, the timeline is the biggest unknown. The changes could start as soon as March pricing, or possibly delayed a few months. One thing we do know is that the implementation of changes to assumed component content will be delayed six months from the other changes.

Speaking in the Nov. 18 Dairy Radio Now broadcast, StoneX broker Dave Kurzawski said USDA is raising the assumed costs of converting milk into bulk dairy products, often referred to as the make allowance, allowances that haven’t changed in over 10 years, despite the fact that costs have risen in that time.

Federal Order minimum prices that manufacturers have to pay producers will be reduced, according to Kurzawski. Looking back on the past decade or so, had these new formulas been in place, the Class III price would have been about 16 cents lower while the Class IV would have been down about 47 cents.

It’s all about the relationship between nished dairy product prices and the prices that have to be paid for the milk, he said. It’s really a minimum price, a minimum wage for dairy farmers essentially.

In the early 2000s, dairy farmers often saw overorder premiums such as $1.50 per hundredweight for example, which occurred due to the competitive nature of buying milk. Those premiums have since dwindled in pretty much every Federal Order, he said, as the costs of producing dairy products have gone up.

“This change will lower the minimum prices and usher in a time when those over-order premiums will start to go up and competition for milk will go up,” he said. “Class I will come in a little higher, while Class II, III, and IV will be lower, but we can still go to $12 milk and we can still go to $25 milk, it doesn’t change that dynamic, it just changes the relationship between the two,” he said..

This is a brief outline of some complicated for-

mula changes. Best to talk with your local cooperative about how the changes will impact your operation.

Meanwhile, USDA again raised its 2024 milk production forecast in its latest World Agriculture Supply and Demand Estimates report, based on the most recent milk production report and lower reported milk cow numbers for the third quarter of 2024 being more than offset by higher output per cow. The milk forecast for 2025 was unchanged.

2024 production and marketings were projected at 226 and 225 billion pounds respectively, up 200 million pounds on both from last month’s estimate. If realized, both would be down 400 million pounds or 0.2% from 2023.

2025 production and marketings were projected at 227.7 and 226.7 billion pounds respectively, unchanged on both from last month. If realized, both would be up 1.7 billion pounds or 0.75% from 2024.

Import forecasts for 2024 were unchanged, on both a fat basis and a skim-solids basis. The export forecast was unchanged on a fat basis but raised on a skim-solids basis, based on higher expected shipments of lactose. Imports for 2025 were unchanged on a skim-solids basis but raised on a fat basis on expected higher shipments of butter and cheese.

The export forecast on a fat basis was raised due to higher cheese- and butterfat-containing products. Skim-solids exports were raised on higher wheycontaining products and dry skim milk products, according to the WASDE.

The 2024 butter price forecast was reduced, as prices have continued to fall from the relatively high levels they maintained for much of the year through late September. The cheese price was unchanged. Both nonfat dry milk and whey price forecasts were raised due to strong demand for both products.

The butter price forecast for 2025 was lowered due to relatively higher inventories heading into the 2024 holiday season. The cheese price forecast was raised on higher prices and tight inventories in late 2024. Whey and NDM price forecasts were raised based on stronger domestic and international demand.

The 2024 Class III milk price forecast was unchanged at $19.05 per cwt. and compares to $17.02 in 2023 and $21.96 in 2022. The 2025 Class III average was estimated at $19.30, up 35 cents from a month ago.

The Class IV price forecast was lowered, with lower butter prices more than offsetting higher NDM, and was projected to average $20.75 in 2024, down a nickel from last month’s estimate, and compares to $19.12 in 2023 and $24.47 in 2022. The 2025 average was projected at $20.30, also down a nickel from last month.

This month’s U.S. corn outlook calls for lower production and ending stocks.

Corn production was forecast at 15.1 billion bushels, down 60 million or less than 1% from last month and down 1% from 2023. Yields are expected to average a record high 183.1 bushels per acre, down 0.7 bushels from the previous forecast, but up 5.8 bushels from last year. Area harvested was forecast at 82.7 million acres, unchanged from the previous forecast, but down 4% from a year ago. Ending stocks are down to 1.9 billion bushels and the season-average corn price was unchanged at $4.10 per bushel.

The soybean outlook includes lower production, exports, crush and ending stocks. Soybean production was forecast at 4.46 billion bushels, down 121 million or 3% from a month ago, on reduced yields, but up 7% from 2023. Yields are expected to average 51.7 bushels per acre, down 1.4 bushels from the previous forecast, but up 1.1 bushels from 2023. Area harvested was forecast at 86.3 million acres, unchanged from the previous forecast, but up 5% from 2023. Ending stocks were lowered by 80 million bushels to 470 million. The season-average soybean price forecast was unchanged at $10.80 per bushel, with soybean meal unchanged at $320 per short ton.

The U.S. corn harvest was 95% completed, as of the week ending November 10, up from 91% the previous week, 9% ahead of a year ago, and 11% ahead of the ve-year average. Soybeans are 96% completed, up from 94% the previous week, 2% ahead of a year ago, and 5% ahead of the ve-year average.

There was encouraging news in the USDA’s latest dairy supply and utilization report. Total cheese disappearance was up 0.7% and maintained year-onyear growth for the seventh consecutive month due to solid other cheese use, according to HighGround Dairy. Domestic use was up 0.3% while exports were up 6.8%. Exports are up 19.5% year to date and, through September, were record high. Butter use was up 10.2%, up 9.9% domestically, while exports were up 21.7%. HighGround said this marked a new record high for the month of September at 196.2 million pounds.

NDM and skim milk powder utilization remained below prior year levels, down 5.2%, but continued to rise month-to-month. Domestic consumption was down 41.4%, as September posted the lowest usage for the month on record, said HGD, with data back to 2011. International demand was up 15.6%, and is supporting the higher CME prices, according to HGD.

Dry whey use was up 2.6%, despite domestic demand being down 34.1% and down for the fourth month in a row. HGD says this was the smallest value for the month since November 2022. Exports were up 9.2% from a year ago.

In other trade news; the Global Dairy Trade Pulse auction Tuesday featured 4.96 million pounds of product sold, up from 4.8 million in the last Pulse.

HighGround Dairy says 100% of what was offered was sold. There was 8.6 million more pounds regular whole milk powder and 2.4 million less pounds instant whole milk powder sold versus the last Pulse. Sold were 2.2 million pounds or 100% of the total offered. Prices crept higher as well.

Checking LaSelle Street, Chicago Mercantile Exchange cheese prices headed lower for the fourth week in a row. The Cheddar blocks fell to $1.6575 per pound Thursday, lowest since April 18, but they closed the third Friday of November at $1.6925, still 2.75 cents lower on the week, but 9.25 cents above a year ago.

The barrels rolled to $1.6725 Thursday, lowest since April 19, but saw their Friday close at $1.6850, 8.25 cents lower on the week, but 12.50 cents above a year ago. There were 13 sales of blocks on the week at the CME and ve of barrel.

StoneX Nov. 11 Early Morning Update said that holiday cheese demand doesn’t seem to be so joyful, and said that new plant capacity is coming online now and into 2025. Buyers may be holding off buying, working down inventories while waiting for the forthcoming new supply. But U.S. prices are now more competitive globally and domestic buyers may have some competition.

The Nov. 11 Daily Dairy Report said; “By the middle of next year, expansions to U.S. cheese processing are expected to boost cheese output by nearly 20 million pounds per day. Assuming steady demand, this new capacity is large enough to lift cheese stocks to prior-year volumes with less than one week’s output. When all three expansions are running full throttle, it won’t take long to shift from today’s relatively tight supply situation to a burdensome surplus.”

Dairy Market News said that cheese demand is mixed, according to Midwest contacts, but more are on the strong side. Pizza cheesemakers say orders are robust, while others say customers are hesitant with market prices less than stable. Food service sales are reportedly quieter. Plant downtime continues to be reported, although not at the impactful levels it was in the early weeks of fall. Production is seasonally active. Milk availability varies but is generally balanced to somewhat tight. Some contacts believe Thanksgiving-related plant downtime may not offer relief by way of affordable milk loads, but others are already seeing growth in milk availability.

Cheese production is mixed in the West. Milk is comparatively tighter in the southwest part of the

region but adequate for production needs. Contractual demand is steady while food service is steady or somewhat weaker, and steady to somewhat stronger than retail. Domestic prices remain competitive internationally, which is contributing to more robust export demand, particularly with our closer southern neighbors, said DMN.

CME butter fell to $2.5975 per pound Tuesday, lowest price since Jan. 24. It closed Friday at $2.63, down 2 cents on the week but 14 cents above a year ago. There were 15 sales reported on the week.

“Central butter demand has been “unaligned with typical seasonal patterns,” said DMN. “Market bears early in the fall season created some customer hesitation.”

Prior to the bearish market movements in September, contacts had been relaying that food service demand had been slower during the second half of 2024. Retail demand has been steady, or steadier, as the holiday season approaches. Cream availability has been robust. Some loads over the weekend were reported at at multiples, with contacts saying they are turning cream away regularly.

Butter output is mixed in the West. A few manufacturers have begun lengthy churn maintenance which will decrease production for a good part of November and December. Some manufacturers are already heavily working through cream volumes. Butter stocks are in good shape for Thanksgiving demand and churns are working to build stocks for Christmas. Domestic butter demand is steady to lighter for retail and food service. Export demand is steady, according to DMN.

Grade A nonfat dry milk made it to $1.4050 per pound Thursday, highest CME price since Nov. 22, 2022, but it closed Friday at $1.40, up 1.25 cents on the week and 20.75 cents above a year ago, with 39 sales reported for the week.

Dry whey saw its Friday nish at 65.50 cents per pound, 2.50 cents higher, highest since March 31, 2022, and 24.50 cents above a year ago. There were seven sales for the week.

Dairy cow slaughter continues to lag year-ago numbers. The week ending Nov.2 saw 48,300 head go to slaughter, down 1,900 from the previous week, and 7,500 or 13.4% from a year ago. Year to date, 2,303,300 head have been culled, down 353,300 or 13.3% from a year ago.

Farm-level milk output varies across the country, according to the DMN weekly update. Volumes in the Northeast have been steady in recent weeks, but weather conditions have limited milk production growth in the southern parts of the East region. Stable milk production is supported by mild weather over the central region. Recent rains in the Upper Midwest have slowed eldwork, but corn and soybean harvest are ahead of previous years’ rates.

Western milk producers are seeing stronger production week to week. Class I demand is still strong across the country, well into the school year. Class III milk demand is strong, and processors are pointing to snug supplies as a result. Cheesemakers are paying between 50 cents over to $3 over Class III for milk. Cream spot loads are highly available across the country. Some butter producers are turning away loads in an effort to not overbuild inventories.

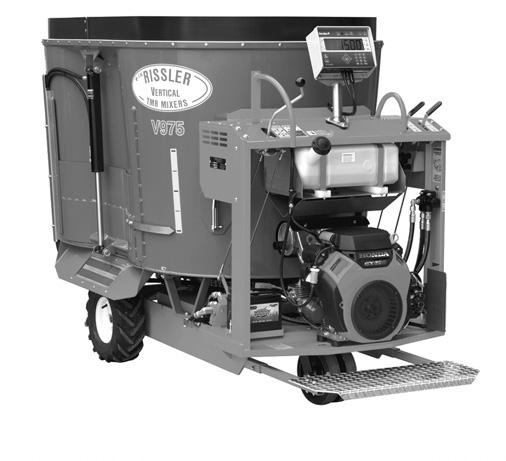

Abts Equipment LLC

Wisconsin:

New Franken (920) 866-2485

Gillett (920) 866-2485

Argall Dairy Systems, Inc.

Belleville (608) 424-6110

Platteville (608) 348-3385

Fuller’s Milker Center LLC

Lancaster (608) 723-4634

Richland Center (608) 723-4634

Gehring Sales & Service, Inc.

Rubicon (262) 673-4920

Joe’s Refrigeration, Inc.

Withee (715) 229-2321

Leedstone, Inc.

Menomonie (866) 467-4717

Midwest Livestock Systems

Menomonie (715) 235-5144

Redeker Dairy Equipment

Brandon (920) 960-9260

The Scharine Group Inc. Whitewater (608) 883-2880

Tri-County Dairy Supply Inc.

Janesville (608) 757-2697

Iowa:

Langs Dairy Equipment

Decorah (563) 382-8722

Precision Dairy Equipment

Elkader (563) 245-2560

Scan to nd out more!

Contact Your Local Calf Star Dealer For More Information

Minnesota:

Gorter’s Clay & Dairy Equipment, Inc.

Pipestone (507) 825-3271

Leedstone, Inc.

Melrose (888) 267-2697

Glencoe (877) 864-5575

Plainview (800) 548-5240

Midwest Livestock Systems

Zumbrota (507) 732-4673

South Dakota:

Midwest Livestock Systems

Renner (605) 274-3656

By Danielle Nauman danielle.n@dairystar.com

WRAY, Colo. — Kyle Hendrix developed an interest in the dairy industry as a youth, leading him to eventually make his own unique place within the industry.

Along with his wife, Holly, and children — Evan, Asher, Reed and Sarah — Hendrix operates Camelot Camel Dairy LLC, a 35-acre farm in Wray that is home to a herd of 10 milking camels and ve Ayrshires and Milking Shorthorns.

“We milked 130 cows near Greeley for a bit,” Hendrix said. “We started in 2009, a bad year to jump in with high feed prices and low milk prices, but I had to do something — either start or sell out.”

The Hendrixes made their go at dairy farming for about a year before a combination of prices and overwhelming maintenance issues on their rented farm convinced them to sell their herd.

Although the cows left, Hendrix’s desire to dairy did not.

Hendrix learned of writer Christina Adams, who became interested in how camel milk might help her autistic son.

“At the time there was no one in the U.S. producing camel milk,” Hendrix said. “She actually ew to Israel and brought the rst shipment of camel milk to the U.S.”

With his interest in camel dairying piqued, things began to fall in place. He learned of a few Amish families that were getting started with camel dairying.

“We were heading to Oklahoma for a Brown Swiss show and I knew about a man that was raising camels,” Hendrix said. “We met up with him and we clicked. We ended up buying our rst animals from him.”

Camelot Camel Dairy was launched in 2012 and its onfarm processing plant was licensed in November 2014.

“We run a pretty specialized pasteurizer called a LiLi — low input, low impact,” Hendrix said. “The milk is ash-pasteurized, heating up to 165 degrees for 15 seconds. When the milk comes out of the machine it is already cooled back to 50 degrees. It goes into a nishing tank and then we bottle it in pint and liter bottles.”

After bottling, the milk is frozen, which increases shelf

life and aids in shipping, Hendrix said. The milk can last for 6-12 months frozen.

The Hendrixes sell some of their milk off the farm and ship some to individul customers. They also work with Juba Farms to ship milk.

Juba Farms works closely

with a large population of Somalians, individually and with grocery stories around the country. Hendrix said camel milk is a very cultural thing for the Somali population. Shipped milk is typically in transit for 2-3 days. Frozen bottles of milk are packed with

ice packs and packing paper in insulated Styrofoam boxes. Joining the edgling industry of camel dairying has made for a steep learning curve, Hendrix said.

“We have had to gure everything out on our own,” Hendrix said. “There are no books, no one to teach you. Our vet is learning alongside us, so we do most everything ourselves.”

Milking camels are dromedaries, or those with a single hump. Hendrix estimates their population in the U.S. to be somewhere between 2,500-3,000 with another 400-500 Bactrian, or twohumped, camels in the country.

“They are typically pretty healthy,” Hendrix said. “They don’t suffer from metabolic issues like cows might. We only vaccinate calves for clostridium at birth.”

The biggest health issue camels face is parasites.

“They can get overloaded, especially in areas where they graze lush, green grass,” Hendrix said. “We’re in a very dry area. We only deworm once a year, but some places they have to deworm every couple of months.”

The camels are fed brome and orchard grass mix hay, with about 10%20% alfalfa hay. The camels are fed a couple pounds of a dry grain mix in the barn at milking time.

“They aren’t designed for highprotein diets,” Hendrix said. “They are really browsers — the grass is really the last thing they eat. They’ll strip a tree as high as they can reach, and they’ll eat cactus and sagebrush.”

There is a signicant time investment in raising camels for dairy. Heifers typically do not calve in until 5-6 years of age.

“It’s a long waiting game to get them into production,” Hendrix said. “But, the oldest cow we have is about 31 years old, and I’ve heard they have a lifespan of around 40 years.”

All the camels are bred using bulls, as no camel A.I. industry exists in the U.S.

“In Saudi Arabia they have big dairies, and they are working on embryo transfer and A.I.,” Hendrix said. “We’re still pioneers here in the U.S. I’m sure one day we’ll have an A.I. pro-

gram here.”

Hendrix hopes to someday import Saudi Arabian genetics, but that is currently not allowed by the U.S. government.

“They have high-yielding camels,” Hendrix said. “They’ve been doing this for years. If we could import semen or embryos, we could propel our genetics ahead 20-30 years.”

Camels must maintain a cow-calf relationship throughout their lactation to continue producing.

“If you lose a calf or wean them, the camels will dry up,” Hendrix said. “The calves come into the barn with the cows and stimulate them to let down. You have a 90-120 second window to collect the milk.”

The Hendrixes use cow-cluster milking units and oor buckets to milk their camels twice a day. Average production is between 1.5-2 gallons per camel, per day.

A camel’s gestation period is about 13 months. Hendrix said the time frame for breeding them back varies greatly.

“You have a 50-50 chance of getting them bred seven days after calving,” Hendrix said. “We have some that breed back after three or four months, and some that won’t breed back until they wean their calf.”

Hendrix runs his bulls with the cows year-round.

“We’ve had some cows get pregnant, dry off and calve after a 60 or 70day dry period, like a cow,” Hendrix said. “That was perfect, but we have also had some wean a 15- to 20-monthold calf, dry off and then nally breed back, with more than a 13-month dry period.”

Even after a dozen years as a camel dairyman, Hendrix said he continues to learn daily.

“Knowing that we have so much to learn, so many ways we can improve, it’s really a very young and very exciting industry to be involved in,” Hendrix said.

By Danielle Nauman danielle.n@dairystar.com

GILMAN, Wis. — As a child, Kevin Mahalko watched his father, Ken, farm conventionally with a grazing mindset. Growing up immersed in these ideas led him to pursue organic dairy farming.

Mahalko ofcially transitioned the farm to organic production and joined Organic Valley in 2011.

“We were really operating as organic since about 2003,” Mahalko said. “We spent a few years making sure it would work for us. Then, for a few years, it was hard to get a spot on a truck up this way.”

The health benets to the cattle and the land and eventually the consumer and community are among the primary reasons why Mahalko said he is committed to organic production.

“Organic grazing is healthy,” Mahalko said. “It is a more viable method of production. When we were conventional, I remember watching other conventional farmers going out of business day by day. Within Organic Valley, we have a lot of smaller farms along with some bigger ones, which is great. We need to have all sizes.”

Mahalko milks 45 Holsteins once a day on his family’s dairy near Gilman. His ideal cow for grazing is a medium-sized, big-bodied cow with good feet and legs and high, tight udders. Mahalko relies on A.I. for breeding his herd, and pays close attention to the body condition scores of each cow.

“Brisket width is the key,

you don’t want to be grazing narrow cows,” Mahalko said.

Three years ago, Mahalko went to once-a-day milking, freeing time to make hay, perform other jobs around the farm and attend meetings.

The Mahalko family has been involved in grazing networks since the 1990s. Mahalko has worked as a grazing educator since 2008.

Once he joined Organic Valley, Mahalko took on leadership duties. He is a member of the dairy executive committee for the dairy north-central region of Wisconsin for the CROPP Cooperative of which Organic Valley is a brand.

“I truly value the CROPP cooperative,” Mahalko said. “As producers we have the ability to talk to the people we have hired, and we have the same with the CEO and the management team.

In addition to his leadership involvement in Organic Valley, Mahalko is dedicated to grazing efforts working with GrassWorks Inc., and River Country Resource Conservation and Development Council Inc.

With grazing being his passion, Mahalko was among the earliest to embrace grassfed milk production, joining the rst route to cover central and northern Wisconsin in 2013.

“Within Organic Valley we were able to work with the team that was involved in setting the cooperative’s standards for it,” Mahalko said.

“There were certain grazing farmers that pushed them to

explore it, and the management took the gamble to get it started. It’s really growing. I believe there are 270 or 280 farms producing Grassmilk now.”

Mahalko is entirely grass-fed and has 118 acres of pasture dedicated to rotational grazing.

“I really focus on the timing of the grazing, the height of the grass and species of grasses,” Mahalko said.

Mahalko has found that relying on native grasses as much as possible is a key to successful grazing in Chippewa County.

“We want to have a bunch of clover, white and red,” Mahalko said. “Kentucky bluegrass is probably still the number one thing we have here.”

Mahalko also said they have quack grass and timothy. He has also planted a GrassWorks mix, which is a blend of ryegrass, festulolium, meadow fescue, soft tall fescue, a little bit of orchard grass, and different things like chicory, plantain and trefoil. He said they have planted alfalfa in the past, but it does not last in the heavy soil.

winter feeding.

Like many central Wisconsin dairy farmers, Mahalko struggled to make hay this year.

“We pretty much had one day in June that we could even make hay,” Mahalko said. “We hired a crew, which we typically don’t do, for a majority of rst crop lling silo. We just had to get it done, to get it back into some kind of growth stage. It was mid-July before we could even get back out. We had standing water for nearly a month.

“I just want to have my costs as low as possible and have them live off the land as much as they can. If a conventional farmer is thinking about grazing, there is a good balance point of feeding grain mix and grazing and being successful.”

KEVIN MAHALKO, DAIRY FARMER

With once-daily milking, Mahalko typically moves his cows after milking, although in the summer, he will move them twice a day if needed. He outwinters the cows as much as possible. In the spring, he drags this area with an S-tine Brillion to break up surface compaction and reseeds using an grain drill. He varies the area outwintered from year to year to distribute fertility.

In the rst month of grazing, Mahalko makes hay off his pastures because the cows are unable to keep up with the growth. In addition to that forage, he makes hay, haylage and baleage from an additional 112 acres for

I’ve never seen that before.”

Mahalko said he works with cover crops like triticale, winter wheat and winter rye to help reduce small weed pressure in his elds and paddocks.

“That is a big point of pride here on the farm — weed control,” Mahalko said.

“When my dad started farming here, the farm was pretty depleted, especially on lime. It was very acidic, with a low pH. He put 10 tons to the acre of lime on just to try to get it balanced.”

Timber on the farm had been harvested prior to Ken’s purchase, leaving a bevy of stumps throughout the elds.

“Every summer I can remember in the 1970s, we spent clearing stumps, doing some each year,” Mahalko said. “He was a hand weed picker, too. We would pick spreader loads of yellow rocket and other weeds.”

Economically, he said he thinks the organic model of dairy production makes the most sense.

“I just want to have my costs as low as possible and have them live off the land as much as they can,” Mahalko said. “If a conventional farmer is thinking about grazing, there is a good balance point of feeding grain mix and grazing and being successful.”

By Amy Kyllo amy.k@star-pub.com

Minn.

When dairy farmer Clarissa Kuball tried making a kit balloon arch from Amazon in 2021 for her daughter’s rst birthday, it did not go well.

“I wanted to have that Pinterest look,” Kuball said. “I spent hours on a little tiny section of balloons, and I was like, ‘I don’t know how I’m going to do this again for next year.’”

After her rst bad balloon experience, Kuball said she wished there was someone who created balloon decor professionally.

“I didn’t really think it was a thing until I started looking at professional brand balloons and looking up who did certain setups on Instagram,” Kuball said.

Kuball is a full-time dairy farmer at her family’s farm, Du-Ayr Dairy, near Faribault. There, alongside her parents, Paul and Audrey Duban, and brothers, Chad and Scott, Kuball cares for their 160-cow herd.

Kuball started practicing and gradually grew her skills by watching tutorials and vlogs on Instagram and YouTube. In May 2023, after receiving requests for estimates wondering what her balloon art would cost or whether she could do specific projects, Kuball decided to le as a business with the state of Minnesota, and Kuballoons was born.

“It’s a creative outlet for me,” Kuball said. “I can think about that instead of thinking about farming all the time, (or) being a mom. It takes me away.”

On the farm, Kuball is in charge of cow management and chores as well as computer work. The herd at Du-Ayr Dairy is milked with two robotic milking units. The mom of two brings her daughters, 4-year-old Hallie and 8-monthold Rilah, to the farm to be with her while she works because her husband, Chris, works full time for the highway department as well as crop farming and contract raises hogs. Grandma Audrey also helps with the girls.

“It’s hard some days,” Kuball said. “They’re with me ve days a week.”

Kuball works on Kuballoons during her free time, mostly in the evenings, in the basement of her home near Morristown after she gets back

from the farm.

“Blowing up the balloons and sitting down here, sometimes by myself, sometimes the girls are with me down here too … it’s a stress reliever,” she said.

Kuball said her daughters are why she does her business, so she likes to keep them in-

volved. Some of her favorite memories are of Hallie helping her blow up balloons or wanting to go help her do a setup. Demand for her balloon art varies on the seasons. Popular birthday months are busy as well as June for graduation parties. Kuball offers both graband-go garlands that customers

can pick up at her home as well as larger arches and balloon decor that she sets up at the venue. Kuball does 3-4 jobs a month, plus more during busy months. She limits herself to one setup per weekend.

Turn to KUBALL | Page 15

“I don’t want to take too much time away from my family,” Kuball said. “I don’t want to spend my whole night doing that when I come home either. I try to nd a balance.”

Kuball makes balloon decor for any party or celebration. She has done showers, business events, birthdays, graduation parties and homecoming at Owatonna High School, which was her favorite event so far.

Customers start their inquiries through her website. After establishing a budget and other basic information, Kuball prepares the design with a color collage taken from their inspiration pictures or invitation color scheme. Once an invoice and deposit have been received, Kuball orders balloons and supplies.

Kuball’s basement houses her large collection of clear plastic bins lled with balloons. Kuball buys professional-grade balloons made of thicker, higher-quality latex.

“That’s why they last so long,” Kuball said. “They’re not just going to deate right away or pop.”

One foot of garland is about six balloons. A cluster uses ve, 11-inch balloons and one 17-inch balloon. Grander displays also use larger and smaller balloons. Balloons are tied together with their necks, not stuck to a piece of sticky tape like balloon garland kits have, Kuball said. Also, she said many balloon arch/garland kits contain balloons all the same size. However, she uses differentsized balloons to create dimension.

Kuball also maintains an inventory of rental backdrops and other pieces that her husband made for the business.

For a balloon arch, which is her most popular piece, Kuball spends 2-3 hours at home with her machine blowing up the balloons. Balloons are inated and then some of the air is released to round them for a professional look.

The whole project will also include another two hours of set up at the venue plus time for any ordering, inventory work and communicating with clients beforehand.

“There’s a lot of time involved,” Kuball said. “I don’t really make much money. I mostly invest it back into my stuff.”

Kuball has grown her business via word of mouth and social media, both her own posts and others sharing her work.

“It’s slowly gotten more and more as my name has gotten out there,” Kuball said. “It hasn’t just blown up overnight.”

Right now, Kuball feels comfortable with her volume of business. She wants to balance Kuballoons between being a hobby and hustle and said she does not want this to be a full-time job.

“I want to keep enjoying it,” Kuball said. “I don’t want it to be something that I get sick of or something. I want it to keep being fun.”

Catch the Dairy Star’s Mark Klaphake with Joe Gill at 6:45 a.m. the 2nd & 4th Fridays of the month on KASM! Joe Gill • Farm Director SERVING CENTRAL MINNESOTA FOR OVER 50 YEARS

Box 160, Albany, MN • (320) 845-2184 • Fax (320) 845-2187tfn

Numerous Journal of Dairy Science studies document the role milking machines have in teat health and mastitis. You can observe milk wetted and puffy teats when the machine is detached. Studies document that most liner slip is never heard. Research has shown that liner action rolls up onto the teat pushing upwards driving bacteria up the teat canal – the primary reason why everyone promotes pre-dipping and making extra sure the teat tip is very clean. Reality is your milking machine is responsible for mastitis. Your machine & liner damage teat canals resulting in slow quarters. Cull rates have doubled with modern milking machines. Customers milking with TridentPulsationtm have halved cull rates, improved milk quality and experienced a 5:1 reduction in mastitis.

TridentPulsation: expect more, get more!

TridentPulsation™ System

607-849-3880 • 607-352-0053

Trident@TridentPulsation.com

Implement Melrose, MN

• Lake Henry Implement Paynesville, MN

• Schlauderaff Implement Litchfield, MN

By Emily Breth emily.b@star-pub.com

HANNOVER, N.D. — Wilton Henke has long known he wanted to take over the family farm. The 21-year-old is now in the process of assuming ownership of the operation.

“Great-grandpa started the farm, Grandpa kept it, Dad built it, and I’m taking it over,” Henke said. “From a young age, I loved the cattle, the equipment and the work. I loved everything about it. There was just nothing else I ever wanted to do.”

The Henke farm is home to around 80 beef cattle and 170 dairy cows that are milked in a double-7 herringbone parlor. The farm also consists of 2,500 tillable acres. Since Henke graduated from college in 2023, he has worked full time at the farm.

“I was always working at the farm over summer and when I had spare time,” Henke said.

As Henke’s dad, Randy, gets ready to transfer the farming business, Henke continues to step into those roles. Each year Henke purchases assets

for the farm and grows his own enterprises within the farm.

Henke said every day he learns something new from working with his dad and other farmers. Among the lessons is the importance of putting in day-to-day work to get things done.

“What is even more important is the mental game and strategy of farming,” Henke said. “You have to make sure you are at a good nancial standing … and making decisions that are going to make the farm more protable. Otherwise, you are not going to be farming very long.”

When Henke started to help on the farm, he fed calves and then learned how to operate equipment. Now, he is involved heavily on the grain side of the farm while the dairy herd is managed mainly by hired help during eld work season.

Over the winter months, Henke handles most of the feeding and the general management. His other jobs throughout the year include putting up hay, hauling cattle and grain, and managing the cattle he owns.

“My rst love was probably grain farming,” Henke said. “(However), I grew up showing dairy and was pretty passionate about that. I got a little bit into breeding regis-

tered dairy cattle and got passionate about that as well.”

Henke’s interest in registered cattle sprouted from competition with his cousins in the show ring. His cousins focused on type in their breeding program so did well in the show ring.

“They were beating me, so I bought into some cattle from Minnesota,” Henke said. “Then with some help of local experts and talking to the guy at Select Sires I started breeding for show cattle and I made some progress.”

He is now competitive in state-level show rings in North Dakota. Part of the herd is bred strictly for type since the family enjoys showing. However, Henke appreciates a heavy milker, and most of the cattle are bred for production, components and functional type.

“We want a cow with good feet,” Henke said. “There is a type component that adds to the longevity of the cow. We don’t have to have this perfect World Dairy Expo cow to be a protable commercial herd.”

The farm has been expanded over the years with the purchase of more land and the construction of new buildings.

“We’ve increased our herd size a little bit, but we are at our peak right now,” Henke said. “When I rst got out of high school, I didn’t know how I was going to get into farming myself.”

With changes and developments on the farm, Henke said he is looking forward to everything the future holds.

“I value the freedom,” Henke said. “I make my own decisions running a business and I don’t have to listen to someone in an ofce all day. … I love the way of life and the work ethic that ensues. There are a lot of great benets it gives you that I am grateful for.”

Drain

Design/

Ditch

-

-

By Danielle Nauman danielle.n@dairystar.com

PLOVER, Wis. — As conrmed cases of HPAI H5N1 climb in the western U.S., increased vigilance by dairy producers plays a vital role in preventing infection and treating affected cows in the event the virus strikes.

Dr. Keith Poulsen, director of the Wisconsin Veterinary Diagnostic Laboratory, has been involved in the aftermath of the virus since it was rst conrmed in the Southwest in March.

Poulsen spoke to attendees at the Professional Dairy Producers Herdsperson Workshop Oct. 29 in Plover.

As of Nov. 20, there have been a total of 550 dairy herds with conrmed cases of H5N1 in 15 states. Three of those states have reported cases in the past 30 days. California reported 202 for a total of 336 to date; Utah reported 13, all in the last month; and Idaho had two cases, for a total of 35.

“California is exploding right now,” Poulsen said. “Biosecurity and surveillance are the most important for dairy farmers, especially for what is happening right now with the u.”

Poulsen said the best answers on how to stop the virus are still eluding ofcials, making biosecurity and surveillance on dairy farms more important than ever.

“Biosecurity is our best tool right now to decrease disease and increase productivity, and not just for this virus,” Poulsen said. “We have fewer antibiotics that work or are available. It might not seem awesome, because it’s not a solution in a syringe, but it’s very effective.”

Biosecurity has not been widely embraced in the dairy sector because the process of implementing these plans can be unwieldy.

“Anyone can go to securemilksupply.org and look at biosecurity plans,” Poulsen said. “But they are exceedingly complicated, expensive,

take a ton of time, and (require) a lot of record keeping. This makes it challenging to invest time and money in biosecurity when you are just trying to get through that day. And until now, we’ve all been able to get by.”

Standardized biosecurity plans were built in response to a potential outbreak of a disease like foot-andmouth, Poulsen said.

“We have to be able to ensure business continuity, maintain the food supply and continue animal movement,” Poulsen said. “You can’t just turn off dairies. But some of our public health ofcials don’t get it. You can’t just stop all commerce. You can’t stop the movement of all cattle, which is the rst thing many regulatory agencies request. It’s not appropriate to stop all animal movement. How many farms don’t grow their own heifers?”

The National Milk Producers Federation has taken secure movement plans and distilled them down to several main points, helping to simplify the process of implementing layers of biosecurity on dairy farms.

“Think about your farm as a castle that has a protective moat around it,” Poulsen said. “That is the line of separation and the only way to get in and out is the drawbridge — a controlled entry. But how many Wisconsin dairy farms have only one or two entrances? That’s a challenge because we’re continually expanding, adding new buildings and barns. But, the line of separation is really important.”

Poulsen said the key point is to know who is coming onto and going off the farm, and keeping vendors and visitors in one area without crossing the line of separation.

“It’s not about protecting the environment from an infectious disease getting out,” Poulsen said. “It’s about protecting the farm from the environment.”

Poulsen said dairy farmers should carefully consider who needs to be on the inside of the line of separation. He recommends ensuring all delivery trucks can be received outside of the line of separation, as well as locating dead animals outside the line for pick up.

Depending on the layout of the farm, Poulsen recommended talking to the milk hauler to see if there is a way to keep the milk truck outside the line of separation, bringing only the hose across.

Poulsen said it is tough to establish where the hoof trimmer should be.

“They probably need to be inside,” he said. “Their trailers are pretty clean, but it can’t be 100% clean — we can’t bathe it in Purell. That really is the key point of biosecurity — all that dirt, all that organic debris can be a risk.”

As a veterinarian, Poulsen questions the need for the vet truck to come within the line of separation. He encourages determining if there are other options for transporting supplies during a vet call.

ing money for dairy farms to provide dedicated farm uniforms, uniform laundering and disinfectable rubber boots to employees.

“Biosecurity is our best tool right now to decrease disease and increase productivity, and not just for this virus. We have fewer antibiotics that work or are available. It might not seem awesome, because it’s not a solution in a syringe, but it’s very effective.”

KEITH POULSEN, DIRECTOR OF THE WISCONSIN VETERINARY DIAGNOSTIC LABORATORY

In addition to creating a line of separation, personal cleanliness is paramount, Poulsen said. He advocates for clean, disinfectable footwear, hand washing and laundered clothing.

“I always washed my boots between every farm, but only changed my coveralls if they were dirty,” Poulsen said. “Now I change my coveralls between every farm and change sleeves between every cow.”

Both the Wisconsin Cheese Makers Association and the U.S. Department of Agriculture are provid-

Biosecurity plans recommend a vehicle wash station at the dedicated entrance. Poulsen said he acknowledges this is both impractical and expensive, but he does suggest keeping track of what trucks enter and leave the farm.

“We aren’t sure how long the virus survives in the environment,” Poulsen said. “Typically u viruses are really weak; they should not survive UV light and hot water. We don’t know why it’s spreading in the very hot weather we see in California. We don’t see it as a respiratory transmission. There is something that is not typical, something different. We think the initial transmission from a wild bird was a unique circumstance.”

Taking proactive steps to secure their farms is crucial for dairy farmers, Poulsen said.

“We’re seeing current estimates on lactation losses between $200-$400 per cow, with no idea what will happen in the next lactation, and the average cull rate on affected farms is 50%,” Poulsen said. “We need to be testing lactating animals, surveilling for the virus. We need to recognize how bad this is.”

Dairy Management Inc.

menu items. Recent innovations, supported by the checkoff, include the New York-style pizza and ve-cheese mac and cheese offerings.

PHOENIX, Ariz. — Dairy Management Inc. President and CEO Barbara O’Brien outlined “Now, next, and future” checkoff strategies to more than 800 dairy farmers and industry representatives at the 2024 joint annual meeting of the United Dairy Industry Association, National Dairy Promotion and Research Board and National Milk Producers Federation in Phoenix, Oct. 21-23.

O’Brien began by sharing that consumer retail dollar spending and volume sales for dairy are increasing — up 3% and 2%, respectively, year to date — and all categories are experiencing volume growth compared to last year.

“Make no mistake, we are experiencing what I call a dairy renaissance,” O’Brien said. “You’ve seen the headlines and heard the discussions on social media. It is clear the narrative is shifting, and this is our time.”

O’Brien noted that data indicates the millennial generation, ages 28-43, is primarily driving dollar and volume growth based on newfound positive perceptions of dairy.

“Consumers have found their truth; they want real food, and they are voting with their dollars,” O’Brien said. “People are recognizing the true value of the nutritious products farmers produce.”

The now, next and future strategies are occurring simultaneously through the checkoff, which O’Brien described as allowing the organization to maintain its long-term vision while responding quickly to immediate needs.

“It’s about being strategically patient but tactically urgent, ensuring that farmers’ investments are working harder,” she said.

O’Brien provided updates and successes in each area.

Now — sales environment, market demands, consumer trends

O’Brien mentioned sciencebacked dairy research is making strides with thought leaders from organizations such as the National Medical Association, National Hispanic Medical Association and the American Academy of Pediatrics, which hold credibility with patients.

Domino’s also continues to nd success with its Smart Slice school lunch program, which is increasing school lunch cheese use. The chain is launching delicious cheesy menu items internationally, including its Domino’s Volcano pizza — featuring mozzarella cheese on top and a cheddar cheese sauce in the middle — nding enthusiastic consumer interest in Japan.

Weiner said the company has doubled its cheese use since the partnership began in 2008.

“It’s not just a Domino’s success story; it’s a success story of our partnership with dairy farmers,” Weiner said. “When DMI came to us, it coincided with Domino’s turnaround. There was a commitment to improve the food and grow the category, and we have achieved just that.”

Additionally, an e-commerce strategy conducted by DMI with 14 state and regional checkoff organizations included campaigns with Instacart, Walmart and Dollar General. The content highlighted dairy’s affordability, versatility and nutritional benets, with every dollar invested by the checkoff yielding a return of $15.60 in dairy sales.

A partnership with General Mills resulted in the introduction of Yoplait Protein, which has brought new buyers to the category and increased purchases in the rst half of the year, which is a testament to yogurt’s strong positioning as people seek more health and wellness solutions.

Next – laying groundwork for 2025

O’Brien said the strategies and programs of the 2025 Unied Plan will be built on a foundation of science and innovation to foster future growth.

“As you’ve seen over the past couple of years, we’ll continue to deepen our investment in science,” O’Brien said. “It’s critical for our category, and if the checkoff doesn’t invest, no one will.”

The checkoff will engage in discovery research in areas of interest to consumers, including women’s health, mental health, weight management, bioactives and next generation fermentation technologies.

O’Brien emphasized the checkoff will serve as a pre-competitive consultant, providing scientic knowledge and consumer insights to inspire a broader range of supply chain partners.

Partnerships with social media inuencers also are driving the dairy conversation. O’Brien cited 10 million dairy-centric social media posts year to date and 99,000 recipes featuring dairy.

The checkoff’s longstanding partnership model of working with and through leaders, including those at food service, continues to deliver results. Domino’s CEO Russell Weiner addressed meeting attendees and outlined successes that have led to the chain’s increased use of cheese across

DMI is also rening its reputation strategy. The checkoff will focus on fewer, larger in-market executions aimed at thought leaders, customers and consumers centered around content priorities, such as:

—Growth, performance and endurance.

—Gut health.

—First 1,000 days of life, from conception to a child’s second birthday.

Case IH 125 Maxxum, MFD, 1750 Hours .....$79,500

I-H 460 ............................................................$4,000

Farmall M ........................................................$1,950 ‘50 Farmall Cub, white demostrator ......................$3,500

‘68 Oliver 1750, Loader, Cab ................................$8,900 USED SKIDSTEERS

‘20 E50 Excavator, 5 Hours ................................$72,000

‘22 E35i Excavtor, Cab with A/C, 80 Hours ........$48,500

‘15 418 Mini Exc, 906 Hours ...............................$13,900

‘19 MT-85, 1468 Hours .......................................$16,900

‘04 MT-52, 1238 Hours .......................................$17,900

‘20 T-870, Glass Cab with A/C, 2 Speed, 1475 Hrs ...........................................................$69,500

‘19 T-770, Glass Cab with A/C, 2 Spd, 870 Hrs..$65,000

‘14 T-590, Glass Cab with A/C, 3950 Hrs ...........$32,900 (3) S-76, Glass Cab with A/C, 2 Speed, 680 Hrs and up ................................Starting at $42,500 ‘15 S-770, Glass Cab with A/C, 2 Speed, 1775 Hrs ...........................................................$46,900

‘21 S-740, Glass Cab with A/C, 2 Speed, Hi Flow, 6600 Hrs ...........................................................$28,900

2013 W-R 513 Soil Pro, 7 Shank, Harrow ..........$29,500

2008 W-R 957, 9 Shank, Harrow ........................$12,900 Pepin Spike Harrow, 5 Section .............................$2,500 USED PLANTERS

White 6700, 12x30, Verticle Fold ..........................$5,500

2010 G-P YP1625A, 16x30, Center Fill ..............$39,900 J-D 7200, 12x30..................................................$10,500 USED HAY EQUIPMENT

‘00 N-H 1441 Discbine, 15’ Cut...........................$11,900

(2) 2012 S-650, Glass Cab with A/C, 2 Speed, 2500 Hrs & Up .................................Starting at $28,900 ‘14 S-530, Glass Cab & Heater, 2 Speed, 5360 Hrs ...........................................................$19,700 ‘02 S-250, Glass Cab with A/C, 6900 Hours .......$17,500 (3) S-185, Glass Cab with A/C, 2000 Hrs and up ..............................Starting at $18,500 ‘92 7753, Glass Cab and Heater, 3600 Hrs ........$10,500 USED TILLAGE W-R 3400, 34’, 4 Bar Spring Tooth Harrow ..........$6,900 W-R 2500, 28’, 4 Bar Spring Tooth Harrow ..........$5,500 W-R 2500, 24.5’, 4 Bar Spring Tooth Harrow .......$3,600 Case I-H 4300, 25’ ................................................$7,500 ‘91 DMI Tigermate, 24.5’, 3 Bar Spring Tooth Harrow .....................................................$6,950

—Environmental progress with dairy farmers of varying sizes and geographies.

O’Brien added the checkoff has broadened its youth strategy, recognizing the need for sustained engagement in the dairy category. This begins with the rst 1,000 days and continues through various stages of a child’s next 18 years.

“We’re focusing on touchpoints in schools and at home, in-store and online, including learning and social platforms like YouTube and TikTok, gaming and more,” O’Brien said. “These ‘next’ initiatives are designed to build on our successes and position us for an even stronger future.”

“Consumers

Tuesday: Calves, Fed Cattle, Bulls, Market Cows, Butcher Hogs-Sows & Boars

*We accept cattle on Monday from 12pm-5pm for Tuesday’s sale

Thursday: Calves, Fed Cattle, Bulls, Market Cows

*We accept cattle on Wednesday from 8am-4pm for Thursday’s sale

Dairy Cattle: 1st Thursday of each month at 12pm

Feeder Cattle: 2nd & 4th Thursday of each month at 12pm

Hay Auctions: Every Wednesday at 12pm

*Hay must be to the market by 11am. Hay will be probed in the summer and fall months for moisture

Sheep & Goat Auction: 3rd Thursday of every month at Noon

Grade & Yield: Accepted Monday-Friday from 7:30am - 10am

Monday, Dec. 23: Calves - 1pm Cattle - 2:30pm

As she considers the future of dairy and the checkoff program, O’Brien is driven by a single thought: if U.S. dairy were a company, what are the most important actions for DMI and the checkoff enterprise? She identied three key elements:

—Have a vision for dairy’s future.

—Build a foundation with worldclass science.

—Cultivate relationships and credibility across the supply chain to drive change.

O’Brien said this begins with enhancing the checkoff’s foundation of science. DMI created a 10-year roadmap that aligns with an analysis of consumer health and wellness needs.

“People are increasingly viewing food as medicine, and we see a growing percentage acting on healthier eating behaviors,” O’Brien said. “Dairy is well positioned to capture a sig-

nicant share of the billions in sales opportunities with the right products, forms, formats and packaging, delivering the right benets. This is our opportunity to win, and we’re building the pipeline to redene dairy’s role as a health and wellness solution in people’s lives.”

O’Brien concluded her remarks by calling dairy farmers the “drivers of this change” for the checkoff’s strategy.

“Your innovation on the farm, commitment to stewardship and passion for feeding the world make our checkoff initiatives possible,” she said. “The challenges we face are signicant, but so are our opportunities. With your continued support and the power of our unied approach, there is no limit to what we can achieve.”

By Stacey Smart stacey.s@dairystar.com

MADISON, Wis. — Cows are called upon to do a lot in the three weeks leading up to calving and the three weeks following calving. This transition period can take a toll as cows experience big changes in diet and environment while dealing with uctuating energy demands.

“We throw a lot at transition cows in a really small timeframe,” said Kimberley Morrill, who holds a doctorate in animal physiology. “The transition cow deals with a great deal of stress, but feeding an effective bacillibased probiotic during the transition period can help this animal.”

Morrill is the technical service manager for probiotics and silage inoculants at Novonesis. She discussed the benets of feeding probiotics to transition cows during her presentation at World Dairy Expo entitled, “Lifecycle Feeding of Probiotics: Sup-

porting the Transition Cow.”

Feeding probiotics throughout an animal’s lifecycle can help mitigate challenges during each stage of life, Morrill said. The transition cow’s unique stressors include fetal development, metabolic and immune challenges, and changing energy demands. An increase in cortisol is observed especially at calving, while serotonin levels drop.

of nutrients beforehand and return to a normal DMI soon after calving is the goal.

tion and impaired reproduction,” she said.

“When animals receive a daily probiotic, we see higher serotonin levels — that happy, feel-good hormone — and lower cortisol or stress hormone levels,” Morrill said.

Feeding probiotics to a transition cow can help improve dry matter intake and support digestion, absorption and immune function, leading to higher body weight and better milk production efciency.

Energy demands skyrocket the day before calving, and Morrill said it is normal for cows to drop in DMI. However, it is the amount of decrease that is the concern. Ensuring cows receive plenty

Transition cows experience a negative energy balance due to dietary changes as they move from a lactating diet to a low-energy, highber diet to a closeup diet. During this time, cows also deal with pen moves, which causes disruption to social hierarchy.

Feeding an effective probiotic can help increase DMI during the transition period while supporting rumination and digestibility and reducing inammation. Probiotics encourage cows to eat more feed before and after calving while also ensuring the nutrients in the feed they eat are absorbed and digested.

“There are some pretty serious dietary changes thrown at the transition cow,” Morrill said. “Far-off dry cows might not be getting the highest quality feedstuffs. In the closeup pen, cows are still eating a highber diet as we start to bring energy up. Then they hit the lactating herd and are thrown right in the frying pan with a high-energy, moderate ber diet.”

A negative energy balance can cause ketosis as well as immune suppression. From there, an increase in mastitis, metritis and retained placenta is likely, Morrill said.

“At the end of the day, there is the long-term potential for a reduction in produc-

with ½” plates and forged hammers along with 1 ¼” rods, dual augers, and a 26’ long stacking conveyor.

“When we feed an effective probiotic in the transition cow period, we see an improvement in dry matter intake prepartum compared to cows that don’t receive a probiotic,” Morrill said. “It also supports dry matter intake postpartum. Cows receiving a bacilli-based probiotic prepartum return to their postpartum dry matter intake earlier and maintain intake.”

Digestion can be an issue for the cow in transition, even if intake appears to be normal.

“Just because she’s eating feed doesn’t mean she’s utilizing it,” Morill said. “I want to make sure these cows are able to break down the feed. Feeding an effective bacillibased probiotic produces the necessary enzymes to do this.”

An increase in inammation is also noticed prior to calving, which can lead to swelling and edema.

“Any time we see an increase in stress and inammation, leaky gut can occur,” Morrill said.

Decreases in digestibility of feedstuffs coupled with inammation create an activated immune system. While all this is occurring, nutrient absorption decreases due to rumination challenges, and energy demands rise.

Probiotics support the digestibility of both feedstuffs and the total mixed ration. Probiotics fed during transition help increase absorption rates and reduce the risk of leaky gut by supporting barrier function.

“Transition cows are considered immunocompromised animals,” Morrill said. “When feeding a probiotic, we’re able to modulate the immune response so the immune system can more rapidly detect an issue and respond in a controlled manner. It is able to shut down that immune response once it’s healthy again.”

Probiotics can inhibit pathogens, such as salmonella, E. coli and Clostridium. Through pathogen adhesion, probiotics can coat the gastrointestinal tract wall, preventing pathogens from entering.

“They can still transfer through, but we don’t have to worry about pathogen insults,” Morrill said. “There is pathogen inhibition, and we’re able to kill off the bacteria. The pathogen oats through, but it can’t attach to the GI tract and is going to go out through the manure.”

For example, prior to using a probiotic, Morrill said a 1,400-cow dairy had 10% of cows suffering from health events in the rst 60 days of lactation. After going on a twostrain lactic acid-based probiotic, this number dropped to 5.8%. When they changed to a four-strain probiotic, health events such as displaced abomasum and retained placenta decreased to less than 5%.

“Our goal with feeding a probiotic is to support the symbiosis and health balance of bacteria in the GI tract and not have pathogens outweigh it,”

Morrill said.

Cows receiving probiotics are not losing body condition or body weight in the transition period and are seeing improvement in milk production efciency for the rst 60 days of lactation, Morrill said. In addition, a greater percentage of cows produce high-quality colostrum when receiving a probiotic.

In one study, 87% of cows receiving a probiotic had a Brix colostrum score greater than 23%, while only 56.5% of control cows produced colostrum of this quality.

“Now we have healthy transition cows and high-quality colostrum to give our calf the best start,” Morrill said.

Feeding probiotics can help make the transition phase easier on cows, resulting in less time spent in catchup and recovery mode.

“Calving is a major physiological stress on the animal,” Morrill said.

“We can reduce the risk of challenges through a probiotic and get cows back on feed sooner. It sets up both the cow and calf for a successful future.”

As a dairyman, are you looking to improve the way your fresh cows transition, take off, peak and breed back? Looking to improve rumen health, rumen function, overall health, digestion, feed efficiency, and YOUR BOTTOM LINE??? If so, then…

The RECAL line of probio cs is NOT just another probio c on the market. RECAL is a probio c heavily weighted towards be er diges on and uliza on, primarily FIBER DIGESTION. There are a lot of nutrients in your forages that can be u lized by improving diges on.

RECAL is also a probio c that produces more B-vitamins in the rumen of that cow, mainly vitamin B12. B-vitamins are well known to aide in s mula ng appe te, stress, immune system, reproduc on and also very important in rumen diges on.

We can help you with your farm or small business websites, printing & sign needs!

For more information, contact your area rep listed on Page 2 of the First Section.

We o er a thirty-day free trial. What does that consist of you ask? Well, we will give you enough product for thirty days and tell you what to watch for. If you don’t know what to be watching for, how do you know if the product is working and you have to see a di erence and a return on investment. Then, at the end of the thirty days if you say that you saw no di erence and don’t want to con nue feeding the RECAL, you pay absolutely nothing. But if you do like what you are seeing and want to con nue then you pay for the product you used in that thirty-day trial and we keep doing business together. Now, will you see full bene ts of this product in thirty days? Absolutely not. If you don’t see enough bene ts from any product in thirty days then it’s not working for you. Plus, there might be something you are already feeding that could be pulled out. Remember, its not an expense if you see a return on investment. How o en do you see o ers like that? NUTRITIONISTS DON’T KNOW EVERYTHING. GO BY

To improve rumen health. What is the most important part of that cow??? The RUMEN!!!

To improve the overall immune system of your cow. The immune system starts in the RUMEN!!!

To improve diges on and u liza on of the feed that the cows are ea ng. If the feed is going in one end of the cow and coming out the other end of the cow without being digested and u lized, what good is it??? A WASTE!!!

To improve reproduc on. Let’s face it, you don’t make money milking cows unless you are milking FRESH cows!!!

To improve YOUR BOTTOM LINE!!! It’s not about how much milk can we make. It’s about how much MONEY can we make!!!

4 large potatoes, diced

8 ounces bacon, cooked and diced 1 medium onion, diced 2 garlic cloves, diced 2 1/2 cups whole milk

4 cups chicken broth

2 cups mild or sharp shredded cheese

1 cup sour cream Salt and pepper to taste

In a crock pot, combine potatoes, bacon, onion, garlic, milk and chicken broth. Cook on low for six hours or high for three hours. About 30 minutes before serving, add cheese, sour cream, and salt and pepper to taste. For a thicker soup, add 1 cup of potato akes or 3 tablespoons of corn starch.

From

1 stick butter

1 quart heavy cream 2 teaspoons minced garlic

2 teaspoons black pepper 1/2 cup parmesan cheese, grated

In a pan, melt the butter and stir in garlic. Once garlic is browned, stir in heavy cream and parmesan cheese. Turn to medium heat and continue to stir until cheese is melted. Once melted and smooth, add black pepper. Serve over cooked fettucine noodles. Delicious served as is or add your favorite proteins and veggies.

1 yellow cake mix prepared and baked (exchange the water for milk and the oil for butter) 1 can sweetened condensed milk

1 can evaporated milk 1/2 cup whole milk or heavy cream 1 carton whipped topping

While cake is still warm, mix sweetened condensed milk, evaporated milk and milk or heavy cream together in a bowl. Poke holes in cake (I use a meat fork). Pour mixture over cake making sure to get it in all the holes. Place cake in the refrigerator to cool for at least 2 hours. Cover cake with whipped topping.

Now it’s easier than ever to get into a new Manitou Skid Steer Loader or CTL - in stock at a Manitou dealer near you. Low TCO and low nancing - plus Manitou exclusives such as the IdealAccess™ fold-up door and the IdealTrax™ automatic track tensioning system. Learn more at Manitou.com

‘23

‘19 Manitou MLT625-75H ELITE, Dsl, 5500 Lift Cap, C/H/A, 2 Spd, 2,540 hrs - $75,500 ‘19 Mustang 2700V, ISO Ctrls, 72HP Dsl, 2700 Lift Cap, C/H/A, 2 Spd, Hydra Glide, 14 Pin, Back Up Camera, 261 hrs. - $58,900

‘22 Gehl R220, T-Bar H-Ctrls, Dsl, 2500 Lift Cap, C&H, 2 Spd 4,012 hrs ..............................$28,000

‘15 Gehl R220, JS Ctrls, Dsl, 2500 Lift Cap, C/H/

A, 2 Spd, Hydra Glide, 3,125 hrs..............$28,500

‘18 Gehl R220, JS Ctrls, Dsl, 2200 Lift Cap, SS, 4,854 hrs...................................................$17,500

‘17 Gehl R220, H-Ctrl, Dsl, 2500 Lift Cap, C&H, 2 Spd, 4635 hrs ........................................$28,500

‘20 Gehl RT165, Pilot Ctrls, Dsl, 1650 Lift Cap, C/H/A, 2 Spd, Hydra Glide, 876 hrs .....................................................$43,000

Gehl V400, T-Bar Ctrls, Dsl, 4000 Lift Cap, C/H/A, 2 Spd, 2,570 hrs .......................................$37,750

‘21 Gehl V330, JS Ctrls, Dsl, 3300 Lift Cap, C/H/A, 2 Spd, Hydra Glide, 1224 hrs .......$53,900 ‘19 Gehl V270, JS Ctrls, 73HP Dsl, 2700 Lift Cap, C&H, 2 Spd, 250 hrs.................................$57,500

‘17 Gehl V270, ISO Ctrls, Dsl, 2700 Lift Cap, C&H, 2 Spd, 3,950 hrs .......................................$26,500

‘17 Gehl RT250, ISO/Dual H-Ctrls, Dsl, Camso Tracks HXD 450x86x58, Both Standard And HiFlow Hyd, 2 Spd, Hydra Glide, 295 hrs, Warranty Till 6-30-26 or 1000 Hrs ...........................$48,500 ‘20 Gehl RT165, T-Bar H-Ctrls, 70HP Dsl, 15.5” All Season Tracks, 2100 Lift Cap, C/H/A, 1,875 hrs...................................................$36,800

‘19 Gehl RT165, ISO/JS Ctrls, Dsl, 15 1/2 All Season Tracks, Lift Cap 1800 @ 35% And 2400 @ 50%, C/H/A, 2 Spd, 1,758 hrs. ...............$39,500

Gehl RT135, ISO Ctrls, 46HP Dsl, 1350 Lift Cap, C/H/A, SS, 107 hrs. ..................................$46,500

Gehl R190, Dual-H Ctrls, Dsl, 2150 Lift Cap, C&H, 2 Spd, 6,130 hrs .......................................$22,500

GEHL 4835, T-Bar Ctrls, Deutz, C & H, SS, 4,600 hrs............................................................ $15,500

‘22 Manitou 1650RT, H/Ft Ctrls, Dsl, 12” Tracks, 1650 Lift Cap, C/H/A, 2 Spd, 169 hrs ......$56,500

‘20 Manitou 1650RT, JS Ctrls, 68HP Dsl, 2350 Lift Cap, C/H/A, 2 Spd, 430 hrs $47,800

‘20 Mustang 3300V NXT2, ISO/JS ctrls, dsl, 3300

lift cap, C/H/A, 2 spd, Hydra Glide, 5,090 hrs .......

$26,500

‘20 Mustang 2200R, Pilot Ctrls, 72HP Dsl, C/H/A, 2 Spd, 290 hrs ..........................................$46,500

‘20 Mustang 2150RT, JS Ctrls, 72HP Dsl, 18”

All Season Tracks, 2300 At 35% - 3000 At 50%, C/H/A, 2 Spd, 2,265 hrs. ..........................$39,750 ‘13 Mustang 2056 II, Case Ctrls, 68HP Dsl, 2150

Lift Cap, C & H, 2 Spd, 2,530 hrs.................................................. $19,500

‘18 Mustang 1650RT, H/F Ctrls, Dsl, 2350 Lift Cap, C/H/A, 2 Spd, 975 hrs .....................$50,900

‘20 Mustang 1650RT, H/F Ctrls, 68HP Dsl, 2350

Lift Cap, C/H/A, 2 Spd, 1,517 hrs ............$38,700

‘21 Mustang 1650R, H/F Ctrls, Dsl, C/H/A, SS, 3,640 hrs...................................................$32,900

Mustang 345, T-Bar/H/F Ctls, 35HP Dsl, 1000 Lift Cap, 2,540 hrs ............................................$6,800

‘20 Deere 332G, ISO/Dual H-Ctrls, Dsl, 3600 Lift Cap, C/H/A, 2 Spd, 1021 hrs....................................................$47,000 ‘17 Case SV280, Switchable ISO/Dual H-Ctrls, Dsl, 2800 Lift Cap, Hi-Flow, C/H/A, 2 Spd, 360 hrs.............................................................$55,500

‘21 Penta 6030, 3’ RH Flip Up Conveyor, 2 Spd .....................................................$46,800 ‘21 Penta 9630HD, 1050 Cu Ft, 16” Rubber Ext, Frt Corner Door, Rear Commodity Door, Augers 85% Of New, 2 Spd, Stainless Steel Liners, HD Truck Suspension, 3/8” Sidewalls - $56,500 ‘19 Penta 8030, Small 1000 RMP, Twin Vert Screw, Hurricane Augers, Frt Corner Door & Rear Commodity Door, 2 Spd Gearbox, 9” Rubber Ext. ........................................$33,500

‘04 JD 6420, 4WD, 110HP Dsl, Cab, 640 Ldr With 84” Bucket, 6,657 hrs .............................$57,000

170 Struck Cu Ft, 275 Bu, Upper Beater, T-Rod 67 Apron Chain, Poly Floor, End Gate.................................................$12,900

‘19 Doda AFI-35, 1 3/8 1000 PTO,6” ........$7,500

‘23 Artex SB600, 1 3/8 1000 PTO, 560-45R-22.5 Tires.................................$49,950

‘18 Artex SB600, 1 3/8 1000 PTO, Vert Beater ..............................................$47,500

‘20 Artex SBX800, 800 Cu Ft, Guillotine Endgate, 88C Apron Chain, Hyd Apron Pressure Relief Kit, Heavy Duty Vert Beaters, Teeth & Rippers Updated .................................................$57,500

Meyers VB750, 600 Bu, 482 Cu Ft Struck, Vert Beaters, 5 Pt Digi Star Scale, Nutra Tracker NT Scale Head, No GPS Puck Included ......$46,500

‘12 Hagedorn Hydra-Spread Extravert 5440, 684 Cu Ft Heaped, 440 Cu Ft Struck, Sequence Valve Flow Ctrl, Wood Rails, Stone Guard, Endgate ..................................................$39,500

‘15 Hagedorn Hydra-Spread Extravert 5440, 684 Cu Ft Heaped, 440 Cu Ft Struck, Sequence Valve Flow Ctrl, Wood Rails, Stone Guard, Endgate ..................................................$41,500