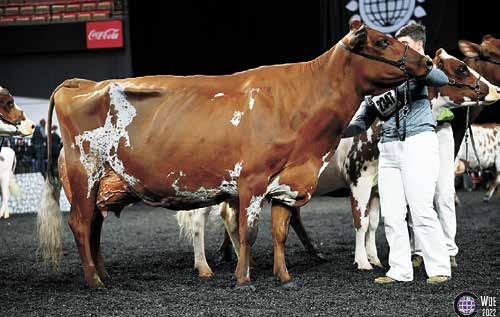

– Seven years ago, Lacey Nelson rode home in the backseat of her dad’s pickup holding a 2-week-old Ayrshire calf. Little did Nelson know, her $400 Dairy Star classieds buy would win the Ayrshire aged cow class at the 2022 World Dairy Expo in Madison, Wisconsin.

Today, Nelson farms full time on her family’s 70-cow dairy near Claremont.

Foxxi-Meadows Burdette Lava has been attending WDE every year since she was 2, but the 2022 show had special signicance. In June, Lava calved in with fatty liver disease.

“We almost lost her,” Nelson said. “There were multiple nights that I didn’t know if she was going to make it.”

Lava was on a strict diet and regimen from her veterinarian and eventually pulled through and came back to complete health.

For Nelson, her rst thought at WDE was elation that Lava was there.

“I was even emotional

before even walking to the ring just going, ‘I did it. I got my cow. She is here. She is healthy,’” Nelson said.

For Lava to then be chosen as the winner of the Ayrshire aged cow was a shock to Nelson.

“I still don’t even have the words for it,” Nelson said. “The shock going from, ‘Hey, she’s here,’ to, ‘Hey, she won her class.’”

Nelson’s dad had a big part in Lava’s purchase. Her dad, an avid reader of Dairy Star, saw a classied ad for Ayrshires made by Katie Buckentine. Knowing that Nelson had money in her pocket from the recent sale of her last Brown Swiss cow, he suggested she give Buckentine a call.

Nelson learned there was a calf available, but someone else was coming to look at it rst. Luckily for Nelson, she came home with her eventual WDE winner.

There are special challenges to showing in the aged cow class.

“With an aged cow, you have to have a cow that stands the test of time,” Nelson said.

Nelson said part of what makes the aged cow class dif-

cult is the cows have had multiple calves, and the management opportunities for success and failure are ample. In addition to management challenges, Nelson said some of the cows have graced the show

ring more times than the showmen have.

Nelson said she values Lava for more than her fanciness or her success in the show ring.

“She’s always been special

to me,” Nelson said. “Her and I have a connection. She’s what you call your heart animal.”

Sioux Center, IA • 712-722-0681

www.tristatelivestock.com

Has been a quality market for MN dairy farmers for over 100 years. MN producers provide one of the country’s most distinctive brands of cheese that is still made using the same Old World craftsmanship and has been combined with cutting-edge technology to produce cheese that delivers unforgettable taste with unparalleled quality. MN Dairy farmers and Bongards, quality that stands the test of time. We offer a competitive base price, premiums, and the best eld representatives in the industry.

13200 Co. Rd. 51

Bongards, MN 55368

(952) 466-5521

Fax (952) 466-5556

110 3rd Ave. NE

Perham, MN 56573

(218) 346-4680

Fax (218) 346-4684

This connection has fueled a friendship. Lava is at home with Nelson and can be found licking her or casually scratching her head on Nelson’s back.

Nelson said some of Lava’s best physical features are her angularity, feet and legs, and udder, which has improved with age. Lava’s score is EX932E.

Lava turned 7 in November 2022 and most recently produced 27,310 pounds of milk with 4.2% butterfat and 3% protein.

Nelson describes Lava’s personality as friendly; she has no intention of selling her. When someone offered to buy Lava as a 2-year-old, Nelson politely declined the offer.

Nelson began raising Ayrshires as a way of having her own niche. Her father likes Red and White Holsteins, and the rest of her family likes Guernseys.

“I knew she had potential; she was a well put-together calf,” Nelson said. “I knew who her sire was. I knew that there was potential there, but I was more or less looking for an opportunity to branch out.”

Nelson is the owner of ve Ayrshires. They have an average score of 89 points. As a breed, she likes Ayrshires for their attitude as well as their hardiness.

Showing has always been a part of Nelson’s life. She rst started showing when she was 3 years old and was

showing at WDE by the age of 10. Though her animal took home a win at WDE, her proudest moments come in watching her nieces and nephews become involved in showing too.

“You can win any medal, and you can win any trophy, but it doesn’t beat seeing the next generation get started,” Nelson said.

Lava is not the rst animal to win at WDE for the Nelson family. Nelson said there is no secret to their success other than a dedication to detail.

“It’s the little things that make the biggest difference,” she said. “It’s the ability to care for the individual cows, to know them like the back of your hand.”

Lava receives special treatment on Nelson’s farm. She has her own pen that is pitched twice a day. Lava also gets a measured grain mix; the amount varies in tandem with her milk production.

“A wise farmer once told me that you do the work with the rest of the herd so you can have fun with the few that you want,” Nelson said.

Nelson’s advice to other young farmers getting into agriculture is simple.

“Your passion and your work ethic will get you through a lot,” she said. “Don’t be afraid to ask questions. Don’t be afraid to admit that you don’t know something.”

563-422-5355

The U.S. Department of Agriculture announced the January Federal order Class III benchmark milk price at $19.43 per hundredweight, which is down $1.07 from December 2022, 95 cents below January 2022 and the lowest Class III price since December 2021.

Late Friday morning Class III futures portended a February price at $17.92; March, $17.85; and April at $18.22, with a peak at $20 in October.

The January Class IV price is $20.01, down $2.11 from December, $3.08 below a year ago and the lowest Class IV price since December 2021.

Dairy farm protability at home took a hit in December, according to USDA’s latest ag prices report. The December milk feed price ratio dropped to 1.84, down from 1.93 in November, lowest since September and compares to 1.96 in December 2021. The index is based on the current milk price in relationship to feed prices for a ration consisting of 51% corn, 8% soybeans and 41% alfalfa hay. In other words, 1 pound of milk would purchase 1.84 pounds of dairy feed of that blend.

The all-milk price average fell to $24.70, down 90 cents from November but was $3 above December 2021.

California’s price averaged $25.50, down 90 cents from November but $4.10 above a year ago. Wisconsin’s, at $23.30, was down 30 cents from November but $1.80 above a year ago.

The December national corn price averaged $6.58 per bushel, up 9 cents from November and $1.11 per bushel above December 2021.

Soybeans jumped to $14.40 per bushel, up 40 cents from November after gaining 50 cents a month ago, and were $1.90 a bushel above December 2021.

Alfalfa hay averaged $269 per ton, up $2 from November after dropping $14 per ton the previous month, and is $52 per ton above a year ago.

The December cull price for beef and dairy combined averaged $76.90 per cwt, down $1.50 from November after dropping $5.70 the previous month, but is $7.80 above December 2021 and $5.30 above the 2011 base average.

Quarterly milk cow replacements averaged $1,720 per head, down $10 from October but $340 above January 2022. Cows averaged $1,820 per head in California, down $30 from October but $490 above a year ago. Wisconsin’s average, at $1,810 per head, was down $30 from October but $340 above January 2022.

Dairy economist Bill Brooks, of Stoneheart Consulting in Dearborn, Missouri, said the gain in feed costs offset the highest-ever December all-milk price and dropped the income over feed from the previous month. Income over feed costs in December were above the $8 per cwt level needed for steady to increasing milk production for the 15th month running. Soybeans and alfalfa hay set new all-time record high prices in December, and all three commodities were in the top two for December all time. Feed costs were the highest ever for the month of December and the fth highest all time. The all-milk price was in the top 20 at the 14th highest recorded.

Milk income over feed costs for 2022 are $12.21 per cwt, a gain of 4 cents per cwt versus the previous month’s estimate, according to Brooks, and 2022 income over feed was above the level needed to maintain or grow milk production and $4.42 per cwt above the 2021 level.

Looking at 2023, using Jan. 31 CME settling futures prices for Class III milk, corn and soybeans plus the Stoneheart forecast for alfalfa hay, IOC is expected to be $7.63 per cwt, a loss of 55 cents per cwt versus last month’s estimate. 2023 income over feed would be close to the level needed to maintain or grow milk production, Brooks said, but down $4.58 per cwt from 2022’s level.

Meanwhile, the National Cattle Herd report, released Tuesday, showed 2.77 million dairy heifers are expected to calve and enter the milking herd this year. StoneX broker Dave Kurzawski said in the Feb. 6 Dairy Radio Now broadcast that’s down 2% from 2022, seventh year in a row to be down and the smallest heifer inventory since 2004.

That doesn’t necessarily mean smaller herd growth, however, because you have to factor in the slaughter number, he said. If we’re killing cows fast-

er than we can replace them, with the available supply of heifers, then obviously the herd should fall. If slaughter falls below the supply of heifers, then the herd should grow and that remains to be seen, he said.

Dairy cow slaughter, the week ending Jan. 21, saw over 70,000 head retired from the dairy industry. Currently slaughter is running nearly as high as in 2020.

Dairy margins continued to deteriorate through the second half of January as milk prices declined further while projected feed costs held steady, according to the latest Margin Watch from Chicagobased Commodity and Ingredient Hedging LLC.

USDA’s December milk production report reected a continued build in milk output, while the cold storage report showed increased inventories, the MW said, and detailed the latest milk production and cold storage reports which I have previously reported.

The MW referenced the January semiannual cattle inventory report and pointed out the report also showed fewer than 29 million beef cows as of Jan. 1, the lowest gure since 1963. There are also fewer beef heifers and cows to rebuild the herd, which will lead to a tighter cattle market over the next two years, the MW said.

Cash dairy prices in Chicago started February a little stronger, except for the cheddar blocks which lost 9.50 cents on the week, closing at $1.8650 per pound. That’s 3.50 cents below a year ago when they jumped 11 cents.

The barrels nished the week at $1.63 per pound, 7.75 cents higher on the week, 26.50 cents below a year ago when they jumped 15.25 cents, but the spread was lowered to 23.50 cents. The week saw seven cars of block sold and 27 of barrel.

Cheese demand varies, according to Dairy Market News. Some plants are running widely available milk to fulll strong orders while others are not. Barrel cheesemakers say there is concern about inven-

tory growth as demand has seasonally slowed. Production is busy, but for various reasons more plant downtime has been reported in the Upper Midwest. Milk is widely available, and spot prices reached $10 under Class III, which has been the case all year. Cheese market tones are in search of some stability, DMN said.

The Jan. 30 Daily Dairy Report points out that Midwest milk production is growing substantially and dairy processors are overwhelmed.

Demand for cheese is steady to lighter in the West. Retail sales are unchanged, though some report lighter food service sales. Export demand is softening, as sellers in Europe are, reportedly, offering cheese for lower prices. Sales are steady to Asian markets for second and third quarter. Barrel inventories are larger than blocks and likely contributing to the large block-barrel price spread.

StoneX stated in its Jan. 30 Early Morning Update; European cheese prices continued to fall last week while U.S. and Oceania prices were rather steady relative to that. This will inevitably make U.S. cheese much less competitive in the export market given the low EU cheese prices which could lead to U.S. milk supplies shifting from mozzarella cheese, which we export the most of, to cheddar which could put further pressure on spot cheese prices. Oversupply of milk has been an issue in Europe, but with margins expected to move back to average to lower type levels, we could see that change into the summer months.

CME butter closed Friday at $2.3750 per pound, up 10.25 cents on the week but 12.50 cents below a year ago. There were 43 loads that exchanged hands on the week, highest weekly volume since the last two weeks of August 2022.

Central butter plants tell DMN that cream remains widely available. Butter inventories have grown since late 2022. Butter production is very busy. Food service demand for butter, or lack thereof, has some contacts suggesting potentially further butter price and the market, bearishness.

Readily available cream remains in the West. Cream demand continues steady to higher with strong butter production ongoing. Butter inventories keep working toward balancing with demand. Contract sales interest for second, third and fourth quarter stays light going into February. Spot butter demand is steady.

Grade A nonfat dry milk saw the rst positive move in 14 sessions, jumping 4.75 cents Wednesday and closed Friday at $1.2450 per pound, up 9.25 cents on the week but 58.75 cents below a year ago. Twelve cars found new homes on the week.

Dry whey saw its Friday nish at 41.50 cents per pound, up 8.75 cents on the week, highest in four weeks, but 44.25 cents below a year ago, with six trades.

Tuesday’s Global Dairy Trade Pulse hosted 2.1 million pounds of Fonterra whole milk powder sold, down 30 million pounds from the Jan. 24 Pulse, but at $3,303 per metric ton, up $103 from Jan. 24.

HighGround Dairy said this event marked the second consecutive increase on Pulse as buyers may have become more aggressive due to volatile weather in New Zealand, namely, a drier South Island and excessively wet North Island. That has the potential to have a negative impact on milk supply during the shoulder of their season. Sources in the region say there is plenty of feed around, but the stress on cows is becoming evident.

In politics, the National Milk Producers Federation and U.S. Dairy Export Council commended this week’s announcement that the U.S. Trade Representative has formally moved to advance a U.S.Mexico-Canada Agreement dispute settlement proceeding and establish a second panel to determine whether Canada has been in violation of its market access obligations under the agreement. The International Dairy Foods Association also gave the measure a thumbs up.

Canada’s unwillingness to abide by the tariffrate quota provisions of USMCA has been an issue since the agreement’s implementation began, says a joint press release. The United States won its rst dispute panel on the matter in December 2021, which found that Canada was reserving most of its preferential dairy TRQs for Canadian processors that have little incentive to import product. Canada’s revised approach to USMCA TRQs, released in May, also

provided inequitable advantages to Canadian processors.

Canada’s TRQ allocation system is not only a violation of USMCA, it directly harms American dairy farmers, processors and other workers by unfairly restricting access to their market, said Jim Mulhern, NMPF president and CEO.

Cooperatives Working Together members accepted eight offers of export assistance this week that helped capture sales of 2.8 million pounds of American-type cheese, 2.2 million pounds of whole milk powder and 35,000 pounds of cream cheese. The product is going to customers in Asia, Central America, Middle East-North Africa and South America through July.

CWT’s year-to-date sales stand at 6.9 million pounds of American-type cheeses, 12.8 million pounds of whole milk powder and 346,000 pounds of cream cheese. The products are going to 12 countries and are the equivalent of 159.9 million pounds of milk on a milkfat basis. Over the last 12 months, CWT assisted sales equated to 1.2 billion pounds of milk on a milkfat basis, according to CWT.

9 Holstein tiestall cows in all stages of lactation. Some recent fresh and some bred back. 2 top fresh Holstein cows milking 98 &115 lbs!!

EXPECTING OUR USUAL RUN 250-350 HEAD ADVANCE NOTICE

FEBRUARY 21 & 24TH • 10 a.m.

COMPLETE DISPERSAL

900 HOLSTEIN COWS, AI breeding for many years focusing on feet, legs, and udders. Cows are all bred with sexed semen or beef semen. Cows are housed in sand bedded free stalls, milked in a parallel parlor. 82 lbs a day tank avg on 2x milking with fresh cows being milked 3x. Herd is on an extensive vaccination program. We will sell 450 milking cows TUESDAY, Feb 21st with the balance of milking cows and approximately 150 dry cows selling FRIDAY Feb 24th. Milking cows will be sorted by gate cut for loading so we will have something for every budget both days. You’ll be hard pressed to find better udders than you’ll see in this herd!! Approximately 400, 1st lactation and 300 2nd lactation. The balance will be 3rd and 4th lactation with some power house mature cows!! Bulk tank tested negative for Mycoplasma, Staph, and Strep.

February 23rd

Expecting 250-300 head

Formerly Turenne Livestock

SALE EVERY MONDAY AND WEDNESDAY 5:00 PM

Selling Baby Calves, Hogs, Sheep, Goats, Feeder Cattle, Fat Cattle, Market Cows and Bulls

VERY COMPETITIVE MARKET PRICES

Call 712-432-5500 for daily market report

ADVANCE NOTICE

AT OUR THORP LOCATION IN HEATED SHED

February 28th

CALL MARK AT 715-773-2240 TO CONSIGN

JWO NOTES & MARKET REPORT:

Big enough to make a difference, small enough to care!

Good dairy cows continue selling well. 28% sold $2,000-2,800. Top $2,800 Preston

Horning, Livingston. $2,750, $2,750 John Zimmerman, Thorp. $2,500, $2400 Paul Malin, Westby. 25% sold $1700-1950.

Springing Holstein heifers $1,400-1,700. Opens

SCHEDULE

Dairy & Hay sale EVERY Thursday starting with hay @ 10:00 followed by Dairy Cows @ 11:00 sharp, then bred heifers, open heifers and feeders followed by calves, market bulls, fat cattle and cull cows. Special feeder sale 2nd & 4th Thursday. WATCH OUR SALE ONLINE AT WWW.CATTLEUSA.COM

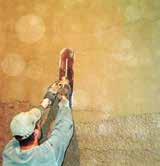

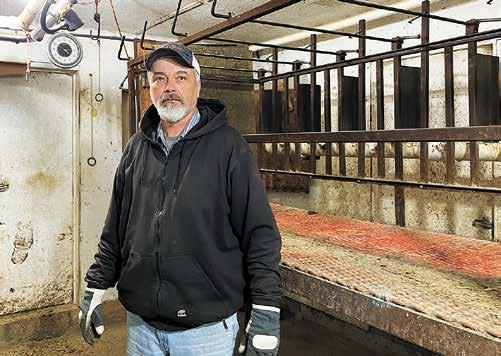

Paul Thompson set out to retrot his barn for milking goats in 2016, having construction skills in his tool belt was benecial.

Thompson grew up on a dairy farm near Waverly, South Dakota, but his father also owned a construction business. Thompson knew how to build things.

“We poured the slab for my new milk room on a Friday, and by the next Friday, the structure was completely done,” Thompson said. “I removed and recongured pens and retted the barn for goats. The old milk room that was on the barn had been kind of a catchall. I ended up converting it into the parlor.”

Today, Thompson continues to run a construction business but is also a goat dairy farmer with a herd of 240 does plus a few bucks for breeding. His farm is nestled on 9 acres in Yellow Medicine County near Cottonwood.

Thompson has two employees; Josh Moe, who is Thompson’s partner in the construction company, decided to partner in the dairy as well, and Joseph Caron, now 17 years old, has been working summers there since he was 13.

The does are milked in a swing-12 parlor. Usually, Thompson milks between 120 and 150 does, but currently, the does are dry. Kidding season is about to begin, which runs from midFebruary through March. Older does are bred a bit earlier than younger ones to spread out kidding.

“To me, the biggest nightmare of the year is when I kid,” Thompson said. “A goat will usually have two or three little ones, and you end up with so many little kids in there that it’s nonstop. They can have a full stomach, but as soon as they see you, they’ll scream and cry at you because they’re looking for attention.”

Thompson said he considered milking goats for a long time.

“I always had the idea in mind that it would be nice to milk goats and sell the milk,” Thompson said. “I checked into it in 1989, but there was no place around that you could get rid of the milk.”

While growing up on his family’s dairy farm, Thompson worked with several types of animals. The family milked cows, but they also raised hogs. Later, Thompson had sheep as well. He became familiar with goats when he bought a few to milk for bottle feeding lambs.

After graduating from high school, Thompson farmed north of Clear Lake, South Dakota, with a focus on hogs. In 1996, he made a change.

“I decided to come to Minnesota

because I wanted to see how hog farming was done there,” Thompson said. “There were no big hog farms out in South Dakota.”

In 1997, Thompson began his construction business, and he bought his current farm site two years later.

The main barn on the property had been used for milking cows, but Thompson gutted it to use for nishing hogs. Later, it was also used for housing sheep.

“I used to raise 200 sows there in a farrowing operation and raise 100 ewes,” Thompson said. “But, my farrowing house burned down in 2013. With the way the hog market was, I didn’t want to spend the money to rebuild.”

In 2015, Thompson spoke with a

friend who raises goats near Milbank, South Dakota, but was having trouble nding a place to sell the milk.

“I thought, ‘Things have to have changed since 1989,’” Thompson said. Thompson learned Stickney Hill Dairy of Rockville was buying goat milk.

“I decided to give (goat dairying) a try,” Thompson said. “If I was willing to do it back in the 1980s, I thought I should give it a shot now.”

Thompson bought goats in early 2016 and started selling milk in 2017. He dispersed the other livestock and concentrated on goats.

Thompson’s herd consists of Saanen, Alpine, Toggenburg and Nubian

goats. He keeps buck kids for at least 24 hours so they receive colostrum. Then, he sells them to someone who continues feeding them milk, weans them and nishes them for sale. Thompson keeps the doelings.

“Goats are by far the most nicky, hardest animals I’ve ever raised,” Thompson said. “People claim a goat will eat anything – goats do chew on everything – but they are fussy eaters.”

Thompson said keeping goats healthy can be a challenge.

“If they get sick on you, it is really tough to bring them back around,” Thompson said. “Other animals will show symptoms, so you can see that something is going on with them and start treating them early enough. Goats hide their illness so well, so by the time they actually show something, they are already too far gone.”

The goats on Thompson’s farm are fed alfalfa hay and a corn-based ration. He also has a milling company custom make pellets with a mix of protein, vitamins and minerals.

Even with the obstacles goats present, Thompson said he is glad he made the switch.

“The nice thing about goats is they

are fairly easy to work with and handle, and they have more of a personality than other livestock,” Thompson said. “They are always looking for affection, which can be kind of a pain in the rear end because they are against your legs almost like cats. They can be entertaining one minute, and the next minute you’re pulling your hair out.”

Because there is a growing market for goat milk and meat in the U.S., people have been reaching out to Thompson to ask his advice about starting a goat dairy.

“I tell them that the thing they have to remember is it’s a huge commitment when you start a goat dairy like this,” Thompson said. “They’ve got to be milked every 12 hours, just like with a cow herd. It’s a tough job, so you’ve got to be committed if you are going to get into it.”

However, Thompson said he sees a positive future in the industry.

“As a country, we do not produce nearly the goat products that are being used,” Thompson said. “A lot of it is imported, so there is a huge opportunity there. We just have to get our infrastructure built a little better.”

I want to give a shout out to the dairies in ND that attended our Elite Producer Hedge Class. Although the world of dairy is small in that state, we enjoyed our time together. If you or a group of dairy producers are interested in having DVi host a producer hedge class workshop in your area, feel free to reach out to our office. We try to host a few each year to help producers better understand how dairy markets work and how they can be managed.

Spot CME Group markets saw a firming trend in most product categories for the week ending February 3. Hopefully, this is a good sign that dairy product buyers are finally interested in acquiring additional inventory.

When dairy markets have price inverses and weak front-end fundamentals, buyers commonly do not want to own a lot of inventory as they anticipate a market decline. This buyer bias typically shifts when front end prices become more attractive to buy and deferred values begin to trade at a carry premium. In this situation, a dairy product buyer may be able to buy the physical product today and carry the inventory until it is needed at a lower cost rather than contracting it in deferred pricing periods. With carry premium becoming greater into the deferred periods, spot market buyer

demand should start to improve.

Here is a comparison of March 2023 dairy product futures vs. December 2023, respectively. (NFDM $1.23/$1.34, Whey $.38/$.435, Butter $2.42/$2.54, Cheese $1.83/$1.98) With this much carry premium, front end prices need to be supported by buyers or it will likely start to put more price pressure on the deferred values.

Spot milk trading continues to take place at values as cheap as $10 under class. It will be interesting to see if manufacturers are more interested in sourcing milk now to make products as markets transition to a carry premium posture. This will give manufacturers more confidence to make products that they should be able to sell into a higher priced deferred market.

After popping China’s balloon, one has to wonder what impact this could have on U.S./China trade relations. The biggest exposure U.S. dairy markets have to China is the 44% of all annual U.S. whey exports and 6% of NFDM that they buy. For reference, the biggest YOY whey demand drop from China was 49% in 2019.

CARPENTER,

Cows at Burnett Dairy enjoy the ride every time they step onto the farm’s 110-stall rotary parlor. About 800 cows are milked per hour, providing efciency the Burnett family appreciates.

“I really love the rotary parlor,” Reese Burnett said.

“It’s a lot more upfront infrastructure cost, but I think the parlor pays for itself in the long run with labor savings. And, when you’re standing in the center of the deck and see 110 cows looking at you chewing their cud happy as can be, that’s a really good feeling.”

Two-thirds of Wyoming’s dairy cows reside at Burnett Dairy which is located in the southeast corner of the state near Carpenter. The Burnett family milks 6,200 head and

farms 4,400 acres.

“There are very few dairy farms in Wyoming, and in our part of the state, we’re the only dairy,” Burnett said. “In the whole state, there are only about 9,000 dairy cows.”

Propelled by family dedication to the business, Burnett Dairy is a growing operation with its sights set on the present and future. Burnett farms with his wife, Hannah, his parents, Jeff and Kim Burnett, his uncle, Jay Burnett, and his sister, Layne. Jay and his wife, Lisa, have a 14-year-old son, Cash, who also works on the farm.

“Cash is here every day after school, and he’s the best equipment operator we have,” Burnett said.

Burnett and his wife returned to the farm in December 2020 after graduating from Kansas State University. Burnett is the second generation on his family’s farm.

“I think one of our strong points is that we have enough family members involved on the farm who care,” he said. “Family is our biggest key to success. We work hard and pride ourselves on taking care of each other and supporting one another.”

In addition, the Burnetts’ herdsman, Ryan Slade, has worked on the dairy since 2019.

“He’s not a family member, but he’s very involved,” Burnett said.

Burnetts’ parents and uncle started as custom cattle feeders and transitioned into the dairy business in 2004. They began by renting a neighboring dairy where they milked 800 cows. In 2005, the Burnetts opened their current location to milk 3,000 head and shut down the neighboring dairy.

Advanced Dairy Spring Valley, WI; Mora, MN; Pierz, MN; Wadena, MN; St Charles, MN Central Ag Supply

Juneau, WI; Baraboo, WI

Ederer’s Dairy Supply Plain, WI; Blanchardville, WI; Dodgeville, WI

J. Gile Dairy Equipment, Inc.

Cuba City, WI

Professional Dairy Services

Arlington, WI

Redeker Dairy Equipment Brandon, WI

Seehafer Refrigeration, Inc. Marshfield, WI; Sparta, WI

Stanley Schmitz Inc.

Chilton, WI

Tri-County Dairy Supply

Janesville, WI

Fuller’s Milker Center

Lancaster, WI; Richland Center, WI

Eastern Iowa Dairy Systems

Epworth, IA

Sioux Dairy Equipment

Rock Valley, IA; Colton, SD

United Dairy Systems West Union, IA

Gorter’s Clay & Dairy Equipment

Pipestone, MN

Leedstone

Melrose, MN; Glencoe, MN; Plainview, MN; Menomonie, WI

Glencoe Co-Op Assn.

Glencoe, MN

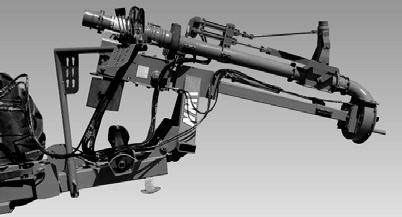

In 2019, the family doubled the size of the milking herd, taking on an expansion project that included building a GEA rotary parlor and a cross-ventilated freestall barn to house 3,800 cows. When the parlor was going up, Burnett said it was tied for the second largest rotary in the world.

When growing twice as large, efciency in a milking system was a top consideration. Previously milking in a double-35 parallel parlor, Burnett said labor is what drove the family to choose a rotarystyle parlor.

“The cost of labor per hundredweight of milk was getting higher and higher every year, especially when compared to our peer dairies,” Burnett said. “We did some math and

discovered that we could milk twice as many cows with the same number of employees if we switched to a rotary parlor.”

The farm employs just under 50 people. Burnett said the family’s goal since they started milking in the rotary is to keep that number at less than 50.

“We love being able to milk as many cows as we do with so few employees,” Burnett said.

Automation in the parlor includes two robots in the entry that pre-dip and clean teats and a robot at the back side of the deck that sprays a post dip. Five employees work each milking shift, rotating through positions of attacher, roamer, cow pusher from pens and cow pusher to load the rotary while one person is on break.

“The robots are not perfect, but they work pretty good,” Burnett said. “What I love about them is they show up to work every day, and when I go home and go to sleep at night, I know they’re doing the exact same thing they were doing when I left.”

One rotation on the rotary lasts just under seven minutes, and each milking takes about 7.5 hours. Most cows are milked three times a day, while some are milked twice per day. The parlor is at capacity, running 22.5 out of 24 hours, shutting down twice daily for a wash cycle.

“I think cows are calmer inside the rotary,” Burnett said. “The parallel parlor was a little louder, and cows pooped because they were nervous. I’m amazed at the cleanliness of this parlor.”

The Burnetts’ all-Holstein herd averages between 98 and 100 pounds of energy-corrected milk per cow per day. Higher producing cows and fresh cows are located in the new barn, while the farm’s original conventional freestall barns house the remaining milk cows. Once cows are conrmed pregnant,

than most dairies, but I almost prefer it,” Burnett said. “I like the wide-open spaces. Being out here, we have to provide housing for all of our employees because there’s not a town close enough for them to live in.”

The nearest town of Carpenter is 15 miles away and has a population of 96 people. Cheyenne is a 45-minute drive from the dairy, which is where Burnett and his family often go to dine or shop.

“We have a beautiful view of the mountains, but it’s very at and wide open where we farm,” Burnett said. “There aren’t many trees, and that’s really nice. We have a lot of big elds and pastures.”

The farm grows hay, corn and triticale and purchases grain corn.

“It doesn’t rain a whole lot, so any corn or hay we grow has to be irrigated,” Burnett said. “The summers are really dry with moderate temperatures which is perfect for milking cows.”

But, winters can be tough.

“We have quite a bit of snow on the ground right now, and once it lands, it stays most of the winter,” Burnett said. “We’ve had to pull a lot of milk trucks out of the snow the last couple weeks.”

The new parlor and barn were built by Dairy Specialists of Evans, Colorado. Burnett Dairy’s milk is marketed through and hauled by Dairy Farmers of America to Leprino Foods in Greeley. The dairy ships just under seven 10,000-gallon semi loads of milk each day and lls up a little over two of the three 30,000-gallon milk silos daily.

they are moved to the older barns. All milking cows are kept indoors, while dry cows are housed outside in dry lots. All youngstock are raised on-site. Calves on milk reside in one of three calf barns that each hold 280 head.

A limited dairy infrastructure in the Burnetts’ immediate area makes farming challenging at times. The dairy is located one hour from Greeley, Colorado, which Burnett said is a dairy hub.

“We have to do a little planning ahead because we’re farther away

Milking efciency is at its peak at Burnett Dairy. With the rotary running smoothly, the Burnetts are condent they made the right choice in milking systems.

“The only thing we would do different is build the rotary bigger – as big as they would sell it to us – so we could milk that many more cows that much more efciently,” Burnett said. “As milk production per cow increases, you have to start slowing down your deck. Therefore, the more stalls on the deck, the more efcient you are.”

“I think one of our strong points is that we have enough family members involved on the farm who care. Family is our biggest key to success. We work hard and pride ourselves on taking care of each other and supporting one another.”

REESE BURNETT, DAIRY FARMER

Editor’s note: This is part one of a three-part series on carbon credits and markets discussed during PDPW’s Carbon Conference Jan. 31.

MADISON, Wis. – Through participation in a carbon market, a dairy farm has the opportunity to not only help the climate but also create revenue for their operation. By reducing greenhouse gas emissions on their farm, a dairy farmer can earn carbon credits that can be sold inside or outside of their supply chain.

“Farms have an opportunity to mitigate the im-

pacts on climate change, and to do that, farms essentially need to get paid,” said Patrick Wood, founder of Ag Methane Advisors.

Wood and his team help farms generate carbon credits and ensure the farms are fairly compensated for those credits. His domain is primarily carbon markets related to anaerobic digestion. He is also involved in enteric methane driven by feed rations, nitrogen management leading to nitrous oxide reductions and soil carbon storage related to cropping practices.

“Saying you want to participate in a carbon market is like saying you want to participate in a nancial market,” Wood said. “There are many different carbon markets.”

During the PDPW Carbon Conference Jan. 31 in Madison, Wood explained what carbon credits and offsets are and what their place is within carbon markets. A carbon offset is a particular type of carbon credit. All carbon offsets are carbon credits, but all carbon credits are not offsets. Businesses outside of a farm’s supply chain may be willing to pay for those credits as a way of offsetting their own emissions.

Patrick Wood, of Ag Methane Advisors, speaks at the PDPW Carbon Conference

Jan. 31 at the Sheraton Hotel in Madison, Wisconsin. Wood helps farms generate carbon credits and ensures farms are fairly compensated for those credits.

That business will then claim those reductions in their own supply chain.

An example of this would be the airline industry, which Wood said is a large polluter of greenhouse gases. Because aviation is a global, high-prole and consumer-driven industry that wants to do its part to mitigate climate change but is an industry that must rely on fossil fuels, Wood said airline companies may

Regular sales each Tuesday at 6 pm and Thursday at 1 pm.

decide to purchase offsets.

“Greenhouse gas emissions are a global problem, so deductions anywhere in the world matter equally,” Wood said. “Airlines might say, ‘We can’t reduce our emissions, but we can buy someone else’s emissions and help pay for implementation of their project.’”

Instead of buying or selling from outside a company, a company can also reduce emissions from within a supply chain which is known as insetting emissions. An example would be a company like Nestle providing a nancial incentive to a farm in their supply chain that starts using feed additives to reduce enteric methane.

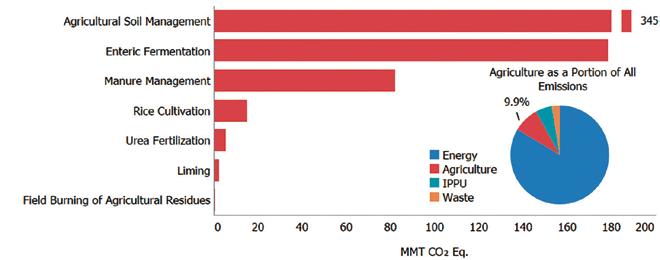

One carbon offset, or credit, equals 1 metric ton of carbon dioxide equivalent. Over a 100-year timeframe, methane is 25 to 30 times more potent than carbon dioxide. In a 20-year timeframe, methane is 80 times more potent. Nitrous oxide is also a potent GHG and is 260 to 290 times more potent than carbon dioxide.

Therefore, one metric ton of methane reduction would equal 25 to 30 tons of carbon dioxide reduction. And one metric ton of nitrous oxide reduction would lead to 270 to 290 tons of carbon dioxide reduction.

“Methane is a potent GHG and a big contributor of climate change,” Wood said. “It’s crucial to reduce methane now. Methane reductions created now will pay substantial benets 10 to 12 years out.”

Of all domestic animal types, beef and dairy cattle are the largest emitters of methane. Enteric fermentation is one way in which cattle release methane into the air. This process occurs when ruminants produce methane in the rumen and exhale it due to inefcient or unoptimized production of feed.

From storing and managing manure to growing feed to using electricity or natural gas, farms have opportunities to reduce emissions and earn carbon credits. Building and operating a digester or adopting new cropping practices are examples of ways dairy farms can get involved in carbon markets. Regenerative agriculture that stores carbon and/or reduces nitrous oxide, as well as vermicomposting, are ways in which cropping practices can generate carbon credits.

Renewable natural gas from dairy manure is used in Low-Carbon Fuel Standard and Clean Fuel Standard programs within transportation markets like those found in California. Metric tons of carbon reduced from a renewable natural gas project can be quantied, and credits can thereby be created.

Some carbon markets are voluntary while others are compliance based. In a voluntary market, companies or individuals choose to participate. These markets tend to be more creative and exible than compliance markets. In a voluntary market, legislation and regulations develop and evolve slowly, allowing private companies to evolve and adapt more quickly. There is also more innovation in this market. Many ideas are started and proven in voluntary markets and then adapted in compliance markets.

Compliance markets, which are legally mandated and created by regulations, tend to be more valuable, Wood said. Transportation markets using the Renewable Fuel Standard program and Low-Carbon Fuel Standard and Clean Fuel Standard programs are examples of compliance carbon markets. The prices paid for carbon credits in the low carbon and clean fuel standard markets are higher than those paid in the renew-

able fuel market, Wood said.

In addition to California, Oregon and Canada have low carbon and clean fuel markets, and Wood predicts there will likely be more in the coming years. California has a law to reduce average fuel emissions by 20% by the year 2030.

“Dairy renewable natural gas reduces it by way more than 20%,” Wood said. “That’s why there’s so much demand for it.”

In voluntary carbon markets, companies, organizations and individuals choose to reduce emissions and may have net zero goals. Wood said many household brand names and universities are participating in voluntary carbon markets.

To maintain the integrity of carbon markets, it must be determined when and where it is appropriate for companies to choose to use offsets to reduce their emissions.

“It’s a global issue, and if everyone just paid someone else to reduce their emissions and didn’t reduce their own, we wouldn’t make any progress,” Wood said. “Some net zero programs no longer allow offsetting or market mechanisms. But I don’t think offset markets are going away; there are just some programs moving away from it.”

As a result, companies are pushing for more supply chain reductions – paying somebody else within their supply chain to reduce their emissions.

“I suspect we’ll see more reductions in this area going forward,” Wood said.

To ensure the integrity of carbon markets, a carbon offset must be real or scientically defensible, permanent, additional and veriable. The credit cannot be reversed. For example, a digester burns off methane in manure which is then used for energy to be burned in an engine or used for renewable natural gas. The methane is destroyed and turned back into carbon dioxide. It will not turn back into methane; therefore, this is a permanent reduction.

An offset must also prove additionality, which means the practice creating the offset is better than business as usual – it would not have happened due to mandates, regulations or becoming a common practice in the industry. The California Air Resources Board Livestock Offset Protocol of 2014 stated there were so few dairy digester projects – less than 150 in the U.S. at the time – that all are additional. Cropping practices with greater than 50% adoption in a county are considered business as usual and will not be issued credit.

There is no double counting of credits. Each credit has a serial number so it is not accounted for twice. Offsets are retired after use and can never be used again.

“If you sell offsets outside the supply chain, you cannot also sell credits inside the supply chain,” Wood said.

If a dairy implemented a feed additive into its ration to reduce enteric fermentation and sold the resulting carbon credits to an airline, they could not turn around a year later and sell those credits to their milk processor.

“The dairy has to be careful, or they could be in violation of a contract,” Wood said.

Carbon markets are young, but they have potential to offer a revenue stream to a dairy farm that reduces its emissions. Companies inside and outside of the farm’s supply chain are willing to pay for those reductions.

“The market is set to explode in the future,” Wood said.

Milk quality as quantied by somatic cell count impacts the cow and the consumer. It affects cow reproduction and production and can be an indicator of animal health. It is a bit of art and a bit of science wrapped in hard work by smart managers. Congratulations to all DHIA dairy producers on the tremendous improvement in milk quality.

www.mndhia.com

Hay sales starts at 12:30 p.m. and are the 1st and 3rd Thursdays of the months of September through May.

February 16, 2023

March 2, 2023

For more information, contact Kevin Winter 320-352-3803, (c) 320-760-1593 or Al Wessel at 320-547-2206, (c) 320-760-2979

During the year, a spare bedroom serves as the catchall for things to do in the winter. I didn’t realize how much I had put aside until I caught a cleaning bug in January. It was time to purge all the things we didn’t need. That is when I discovered a treasure buried beneath a pile of books.

When we were cleaning out my sister’s things, I grabbed some of her cookbooks and recipe notebooks. Little did I know what I brought back to Minnesota. There in a pile of church cookbooks was an old book with no cover or identication. I didn’t recognize the names of the ladies who had submitted recipes, but I did know the handwritten notes in the margins. This was our grandmother’s cookbook. I didn’t think Grandma had a cookbook. It seemed she could just whip things up off the top of her head.

It was fun to see how recipes have changed over the years. Shortening was only butter and/or lard. Due to rationing in the war, many creative cooks discovered ways to make family sweets without eggs and reduced sugar. It looks like it is going to take me awhile to work through Grandma’s book, but here are a few recipes to share for now.

Orange prune cake

1 cup sugar

2/3 cup butter, softened

3 eggs

4 tablespoons sour milk

1 cup stewed prunes, cut up

1 teaspoon cinnamon

1 teaspoon cloves

1 teaspoon nutmeg

1 teaspoon baking soda

2 cups our

Cream butter and sugar. Add eggs one at a time, beating well. Mix dry ingredients together. Add to butter mixture alternating with sour milk. Fold in prunes. Pour into greased 9-by-13 pan. Bake 35 to 40 minutes at 350 degrees.

Topping

1/2 cup orange juice

1 cup sugar

Grated rind of one orange

Mix rind in with sugar. Let stand 5 minutes. Add orange juice and cook over medium heat until sugar is

dissolved. While cake is still warm, prick holes in the cake with a fork. Pour hot top-ping over cake.

Eggless applesauce spice cake dessert

1/2 cup butter

1/2 cup shortening

4 cups applesauce

4 cups our

4 teaspoons baking soda

3 teaspoons pumpkin pie spice

1 cup pecans, chopped

1/2 cup dates, chopped

Whipped cream

Cream butter and shortening until very light. Gradually add sugar and continue beating. Add spices then add applesauce and lastly, our. Beat well for

several minutes. Pour into greased cake pan. Bake at 300 degrees for 45 to 60 minutes. Serve with whipped cream.

Great-Aunt Helen’s sneaky oatmeal bars

2 sticks butter

2 1/2 cups sugar

4 eggs

3/4 cup molasses

2 teaspoons vanilla

3 1/2 cups our

2 teaspoons baking soda

2 teaspoons salt

1 tablespoon cinnamon

4 cups rolled oats

2 cups raisins

1 cup chopped walnuts

Cream butter and sugar until light and uffy. Add eggs, molasses, vanilla and mix until uffy again. In separate bowl, whisk together our, soda, salt and cinnamon. Add our mixture to butter mixture until blended. Mix in oats, raisins and walnuts on low speed. Spread mixture in jelly roll pan lined with parchment paper. Pat smooth. Bake at 350 degrees until sides are set but center is not rm, about 30 minutes. Cool on rack. Cut into bars. Store in sealed container or freeze.

Impossible quiche by Nancy Dowell and Jill Singer

3 eggs

1 cup grated cheese

1 onion, chopped

1 tablespoon oil

1/2 cup self-rising our

2 strips cooked bacon, chopped

1 1/2 cups milk

Pepper and salt

Put all ingredients, except bacon, in a bowl with lid. Shake 1 minute. Pour into pie pan. Add bacon and other toppings (asparagus, mushrooms, zucchini, tomatoes, spinach or other leftovers to equal 2 cups). Bake for 45 minutes at 350 degrees.

As their four children pursue dairy careers off the family farm, Natalie and Mark are starting a new adventure of milking registered Holsteins just because they like good cows on their farm north of Rice, Minnesota.

1/2 cup butter

1 cup sugar

2 eggs

1 cup buttermilk

2 cups flour

1 teaspoon baking soda

1 teaspoon baking powder

1/2 teaspoon salt

Cream butter and sugar. Beat in eggs. Combine flour, baking powder, soda and salt. Add buttermilk and flour mixture alternately to sugar mixture, beating well after each addition. Pour batter into greased 9-by-13 pan. Sprinkle top with 1/3 cup brown sugar, 1/4 cup white sugar and 1 teaspoon cinnamon. Bake at 350 degrees for 25-30 minutes.

1 pound ground beef

3/4 cup onion

1 10.75-ounce can condensed cheddar cheese soup

1 cup frozen mixed vegetables, cooked

1/4 cup milk

2 cups Bisquick original baking mix

3/4 cup water

1 cup shredded cheddar cheese

Heat oven to 400 degrees. Grease a 9-by-13 pan. Cook beef and onion. Add soup, vegetables and milk. Stir Bisquick mix and water in baking dish until moistened; spread evenly. Spread beef mixture over batter. Sprinkle with cheese. Bake 30 minutes.

1 30-ounce bag of frozen diced hash browns

1 32-ounce box of chicken broth

1 10-ounce can of cream of chicken soup

1 8-ounce package cream cheese

3 ounces bacon bits

1 cup shredded cheddar cheese

Salt and pepper, to taste

Put hash browns in the slow cooker. Add in chicken broth, cream of chicken soup and half of the bacon bits. Add a pinch of salt and pepper. Cook on low for 7-8 hours or until potatoes are tender. An hour before serving, cut the cream cheese into small cubes. Place the cubes in the crockpot. Mix a few times throughout the hour before serving. Once the cream cheese is completely mixed in, it is ready to serve. Top with cheddar cheese and the remaining bacon bits.

Wednesday, February 15, 2023 at 11:00 am

REPUTATION CONSIGNMENTS

20 Fancy registered Holstein fresh heifers. All fresh 2 year olds. Parlor/ freestall, cows sell on test, milking heavy, low scc!!! RHA of over 34,000# TOP sires used. Fully vaccinated. Reputation consignor, he always has the rippin’ fancy kind! So Fine Bovine, West eld, WI

12 Holstein Dairy Cows, parlor/freestall, majority recent fresh, mostly 2nd-3rd calf. Full vaccination program, reputation consignor. Turtle Creek, Delavan, WI

10 Holstein Robot, freestall cows, all fresh rst and second lactation, extensive vaccination program, owner selling some of his better young cows as they freshen, all AI sired, extensive vaccination program. Coming from McNamar Dairy, Anamosa, IA

2 Holstein Dairy Cows. Fresh cows, cows sell on test. Cows are milked in a parlor, housed in freestall, grazed, bunk feed, on TMR. Good gentle cows. Owner selling cows as they freshen. David Troyer, Sheldon, WI

SPRINGING HEIFERS

8 Holstein Springing Heifers, due Feb-March, bred Fleckvieh Black River Falls, WI

5 Holstein Springing Heifers, Select sires breeding used. Sires and service sires include Husky, Soprano, Cephus, Salsa-Red, Trooper, Caviar. Dairy herd was on full mating program. full vaccination program. Owners sold there nice dairy herd at Premier in Nov. and is now selling heifers as they get close. Moser Dairy, Reedsburg WI

DAIRY BULLS

Registered Jersey Bull, proven, gentle, DOB 7-15-21, Meadowridge Maestro Supreme

Always a great selection of dairy heifers at Premier Livestock and Auctions! DRIVE-INS ARE ALWAYS WELCOME! PLEASE HAVE IN BY 10:30 AM

Tuesday, February 21, 2023 at 11 am EXPECTING 700-800 HEAD

Tuesday, February 28, 2023 at 11:00 am Call with your consignments! • Expecting 250-350 head of dairy heifers Early consignment of 27 registered Brown Swiss heifers. See website for pictures and more consignments. Always a great selection of dairy heifers at Premier Livestock and Auctions! DRIVE-INS ARE ALWAYS WELCOME! PLEASE HAVE IN BY 10:30 AM

Scan the code for a direct link to our website!

appreciate all of our livestock truckers, consignors, bidders, and buyers! Thank you for choosing Premier Livestock to sell and buy your cattle!