CNGB TALKS STATE OF THE GUARD

NEW TRANSITION TOOLS FROM GOOGLE

CNGB TALKS STATE OF THE GUARD

NEW TRANSITION TOOLS FROM GOOGLE

Yes I did it. Make sure you have copies of your SRB and medical records it will help a lot. As reservist depending on the branch of service, the promotion process may be faster.

—Warnie H.“I went from active to Guard, and then active again through the Title 10 Program.

One of the most interesting things about transitioning from the active to a reserve component is the Soldiers themselves. In the active duty units, they are manned by such young and inexperienced folks. The average age, in most cases, for an infantry platoon is around 19. There are not a lot of life experiences there. Most of these Soldiers came straight out of high school and living at home.

1) Start filling out promotion paperwork ASAP because in the reserves, promotions take forever and are not guaranteed. The faster you finish it the faster you are promoted.

2) Choose the right unit to join before committing because if it is bottom heavy in rank, [it] an indicator of a lack of upward mobility and possibly low morale.

—Vinny C.

—Vinny C.

“I can speak on it. Active Air Force would go through their local Air Force Reserve In-Service Recruiter to either Palace Chase (get out early) or Palace Front (transition on DOS). All other services would work with their local Air Force Reserve recruiter. Be current with your PHA, will need a conditional release (usually done with recruiter) and any documents for periods of service (DD214, NGB22, separation orders). Air Force Reserve will accept other services and some MOS’ convert to AFSCs. Depending on location (I’m in central Florida) will determine the availability of positions and the ease of retraining. [Contact the] AF Reserve Recruiting Flight Chief or check out afreserve.com.”

—Jose D.

—Jose D.

On the other hand, the average age of the reserve component Soldier is higher and along with it, they often bring a wealth of life experiences to offer the unit. Not only that— these guys have built their lives around other things than just the current job that they are serving in.

These attributes often confound the active duty guys when they come into the reserve components. Why would a E4 have an opinion on what he was just told? Maybe it is because they have seen a great deal and know that there are many different ways to solve a problem that what is being presented to them. A state trooper in “real life” may think about driving conditions a little different that that guy straight out of high school. A school teacher may offer up a vastly different way of instructing their troops than [someone] giving “hip pocket” training.”

—Robert W.The Reserve & National Guard is published eight times a year for reservists and members of the National Guard. Copies are available through participating Reserve and National Guard training centers at no cost.

Unit distribution requests can be made online at:

AmeriForceMedia.com/rng/print-magazines/ Individuals can order a free digital edition of this guide at: AmeriForceMedia.com/rng/subscribe-free/ Editorial comments can be emailed to: Editor@AmeriForceMedia.com

The Reserve & National Guard by AmeriForce Media is published by AmeriForce Media, LLC, Bloomington, Ind., a private company. Information and advertisements in this publication do not constitute endorsement by any branch of the military or the Department of Defense. No part of this publication may be copied without the express written permission of the publisher. AmeriForce Media, LLC, the publisher, and publisher’s agents make no endorsement of any advertised services or products and none should be inferred.

President and Publisher Todd Taranto

Editorial Director Jennifer G. Williams

Production Manager Bianca M.Strzalkowski

Design Open-Look Business Solutions

ADVERTISING

PLEASE CALL 703-337-8100

Todd Taranto Publisher

Todd.Taranto@AmeriForceMedia.com

Julie Miller

Vice President, Sales

Julie.Miller@AmeriForceMedia.com

Brian Dunbar

Director of Business Development

Brian.Dunbar@AmeriForceMedia.com

Ursula Hirschhaeuser

Germany Sales

+49 (0) 69-15053980

Ursula.Hirschhaeuser@AmeriForceMedia.com

‘Continuously on Mission’

Sgt Donovan McPherson, a Soldier with the North Carolina National Guard’s 883rd Engineering Company, went viral in this photo, posted to the North Carolina National Guard Facebook page following a winter storm in December. Sgt. McPherson, a student at UNC Greensboro, was carrying a sick baby through the snow to a transport while assisting the NC Emergency Management All Hazard Response Team. “We all volunteer for this and do what we can to help out,” McPherson said later.

Hundreds of North Carolina Guard members were activated to help with the storm response after snow totaling 20 inches in places fell across the state. The NCNG supported state agencies where needed, including members of the 690th Brigade Support Battalion, who assisted in a vehicle recovery.

Photos courtesy North Carolina National Guard

is an Air Force veteran and military spouse who has been featured as a contributor to National Military Spouse Network Magazine, MilitaryByOwner.com, WestsideMommy, and has had her photos published in other U.S.-based and international publications. Trish recently relocated from Germany and resides in northern Virginia.

is a USMC spouse and the mom of three spunky girls. In addition to her work as the owner of Lauren Lomsdale Creative Studios as a virtual assistant, marketing manager, and social media manager she is also the Managing Editor of Daily Mom Military and one half of the YouTube channel #TheDependas. In her minimal spare time, she also loves to run long distances, work out, and sing along to the Greatest Showman in her kitchen holding holding a glass of wine.

is a former infantry officer with the Massachusetts Army National Guard. He served as a boatswain’s mate with the United States Coast Guard Reserve, Port Security Unit 301 as an enlisted soldier before he earned his commission from Boston University’s Reserve Officer Training Corps. He later served as a summer law intern for the Department of Justice, Executive Office for Immigration Review. Most recently, he deployed to the Northern Sinai in support of the Multinational Force and Observers mission as a force protection platoon leader. Currently, he studies law at Western New England University School of Law, and he is focusing his research and writing on service members’ rights within academia. Specifically, he seeks to expand the standard legal protections offered to service members by the Uniformed Services Employment and Reemployment Rights Act of 1994 to service members enrolled in academic programs.

is a freelance writer, Accredited Financial Counselor® and retired Navy spouse from Bainbridge Island, Washington. She received her accreditation as an AFC through the FINRA Military Spouse Fellowship program.

has more than 10 years of experience in reporting and creative writing starting with a BA in English-Writing from Fort Lewis College, being a part of an award-winning journalist team at Lahontan Valley News, to a MA in English-Creative Writing from Southern New Hampshire University. She currently calls Washington, D.C., home, where she recently PCSed with her Navy husband, but forever longs for the crisp air of the Rocky Mountains.

is the Chief Operating Officer of AAMFAA, the longest-standing not-for-profit association that empowers military families with affordable financial solutions. A former Army colonel, Carlos joined the AAFMAA team after 26 years of active duty Army service, which included a variety of command and staff assignments; deployments to Bosnia, Iraq, and Afghanistan; and teaching economics and national security at West Point and National Defense University. He holds a B.S. degree in Economics from West Point and an MBA from the Stanford University Graduate School of Business.

is the Executive Vice President for Communications and Operations at the Association of Military Banks of America (AMBA), a not for profit association of banks operating on military installations, banks not located on military installations but serving military customers, and military banking facilities designated by the U. S. Treasury. Andia is certified as an Accredited Financial Counselor (AFC®). She completed a FINRA Investor Education Foundation Military Spouse Fellowship and was credentialed by the Association for Financial Counseling and Planning Education (AFCPE). In 2000 she graduated from Northern Arizona University with a Bachelor of Science degree in Psychology. Andia has relocated with her family to nine installations since 2000 to include two overseas assignments. She now resides in Lorton, Virginia, with her husband, Ian, and their two daughters.

First lady Melania Trump joined Marines in December for an event aimed at encouraging children to do good in the world.

Mrs. Trump participated in the annual tradition of bringing attention and hope to less fortunate children, while spreading holiday cheer to military

families during a Toys for Tots event hosted aboard Joint Base Anacostia –Bolling in Washington, D.C. She helped military children sort through donated toys, socialized with them while they created holiday cards, and thanked the military and their families for the sacrifices they make for the nation.

“As first lady, I have made it my mission to shine a light on programs that provide more opportunities for children to succeed,” she said during her opening statement. “My campaign, Be Best , focuses on inspiring and lifesaving work of people and organizations across our country. I believe in the good work that Toys for Tots is doing. Their mission to send messages of hope to children and motivate them to grow into responsible and patriotic citizens and community leaders is so important to our society.”

Earlier this year, Mrs. Trump launched her Be Best initiative focusing on three major issues facing children today: social, emotional and physical health.

— Maddie Dolan

— Maddie Dolan

The U.S. Military Academy Cadets of West Point had plenty to celebrate when their Black Knights took on the Midshipmen of the U.S. Naval Academy in the 119th Army Navy Game and emerged victorious with a 17-10 final score. A crowd of 66,729 gathered at Lincoln Financial Field in Philadelphia, Pennsylvania, on December 8, 2018, for the historic game. President Donald Trump was on hand to flip the coin at the beginning of the game, and several other top military officials, including Secretary of Defense James N. Mattis, Marine Corps Gen. Joseph F. Dunford, Jr., the current chairman of the Joint Chiefs of Staff and his named replacement, Army Gem. Mark Milley. Military aircraft flyovers and jump teams from both services contributed to the military traditions, pomp and circumstances of the game.

U.S. service members of the joint forces honor guard provide military honors during the arrival of former President George H. W. Bush, from Ellington Field Joint Reserve Base, Texas Dec. 5, 2018. Nearly 4,000 military and civilian personnel from across all branches of the U.S. armed forces, including Reserve and National Guard components, provided ceremonial support during the 41st President of the United States’ state funeral. Air National Guard Photo by Staff Sgt. Daniel J. Martinez

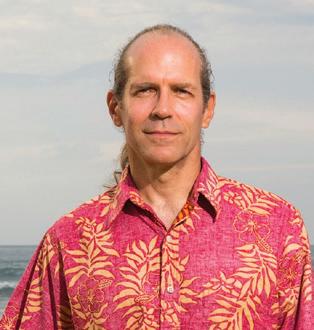

Even though the 28 th Chief of the National Guard Bureau doesn’t get to spend his days in the beloved cockpit of an F-16 anymore, he does get to fulfill another passion: leading Airmen and Soldiers with the same laser focus on mission he was raised on in his native Texas. For almost the entirety of his life, Gen. Joseph Lengyel has held an intimate view of the military. He grew up as an Air Force kid, though in a twist of irony his father started his own career with the National Guard. By 1981, Lengyel forged his own military experience when he was commissioned through the Reserve Officer Training Corps program at University of North Texas. He says serving was “kind of the family business”.

“Well, being in the Air Force was something I always knew I wanted to do, and more particularly, flying fighter jets was something I always wanted to do,” he said. “I come from an Air Force family—my dad was an Air Force fighter pilot and strangely enough he started off in the National Guard then got in the

active duty Air Force and spent his career in the active Air Force. It was kind of the family business. ... It’s kind of what we do.”

Because of his career choices, Lengyel is able to relate to many of the 450,000+ he leads who are masters of transition, whether between active and Guard status, or activated status to demobilization. He, too, balanced life between the Air National Guard

and the civilian sector.

“I always knew that I wanted to do this primarily as my life’s work, my job. Although I did transition to the Air National Guard after almost 10 years [on] active duty and realized that I could still maintain my career in the Air Force through the Air National Guard—so I joined the Texas Air National Guard in 1991. Then [I] was a part-time airline pilot, did all the things that a Guardsman does and then migrated back to full-time,” he explained.

As he’s come up through the ranks, Lengyel’s kept that personal level of understanding at the forefront because, as he says, it’s the personnel who are America’s most vital asset. He recently returned from a trip overseas to deliver that exact message.

“I always look for an opportunity to go over there to see the deployed Soldiers and Airmen who are actually doing missions in the Middle East or wherever they are in the world. I’ve chosen the last three years to go to the Middle East because that’s where we’ve had the biggest number of deployed Guardsmen. We have about 30,000 that are deployed right now,” he said. “I want to go over there and serve them turkey and thank them for what they’re doing. You know I do believe that they are our most

“They are our most important weapon system. It’s not an F-22 or a tank or any other kind of weapon system, it’s…Soldiers and Airmen”

important weapon system. It’s not an F-22 or a tank or any other kind of weapon system, it’s the Soldiers and Airmen … let them know that I understand how hard it is. I’ve been a Guardsman with a civilian life.”

During his trip, Lengyel traveled to Kuwait, Iraq and Afghanistan. The overall purpose of the visit was to assess the Guard’s contribution to overseas operations, talk with troops and senior leaders about any issues they may have, and thank those who are forward deployed, according to Sgt. 1st Class Jim Greenhill, a photojournalist who accompanied the chief on his trip.

The mission of the National Guard has permanently evolved in a post9/11 military force, with units facing repeated deployments overseas. But, there’s also the homeland demands evident throughout 2018 as Guardsmen responded to hurricanes Florence and Michael, battled wildfires in California and other western states, and assisted with Alaska’s earthquake response, among other events.

Lengyel says Soldiers and Airmen of today should expect to always be on mission.

“We know it’s hard on your family, it’s hard on your employers,” he said. “… the National Guard is now this operational part of the Air Force and the Army, and we’re always continuously on mission, someplace. If the Army’s there, or

the Air Force is there, the National Guard is there. And then the domestic piece on top of that. What we do for hurricanes and fires and floods and border security and all those things.”

In his talks with troops, he found morale to be high, which he attributes to soldiers and airmen getting to be “exactly where they want to be”.

“This is what they want to do, this is who we are. The force we are now. We’ve been at this for a long time,” he said. “This is what they train for. This is why they got in. You can argue that there was a time in our history where people didn’t expect to get deployed if you were in the reserve component, but now it is fully expected that they’re going to deploy. It is fundamental to retaining our force.”

Gen. Lengyel adds that at the center of the National Guard’s contributions to the defense department are the State Partnership Program , which focuses on relationship building.

“I think that when you talk about the things that we do—homeland, war fight, partnerships—they all kind of link together,” Lengyel explained. “When you look at Gen. Mattis’ strategy, his points about ‘we’re going to be a lethal and a ready force, we’re going to focus on allies and partners and we’re

going to look at how we do things smarter,’ I think the National Guard state partnership program where we have relationships with 75 other countries is really a valuable tool for the Department of Defense, and really for the country.

We don’t fight any wars by ourselves. We have to have trust and we have to know each other,” he added. To stay up-to-date on Gen. Lengyel, follow his Facebook page at https:// www.facebook.com/GeneralLengyel

By the numbers* Since 9/11, the National Guard has supported nearly 900,000 overseas deployments to Iraq, Afghanistan, Kuwait, the Balkans, Guantanamo Bay, the Sinai, and other locations.

* National Guard forces were called upon 195 times and logged more than 2.1 million man-days responding to homeland emergencies in FY18.

* The National Guard responded to 71 natural disasters in FY18, including eight hurricanes or tropical storms, 19 floods, 15 winter storms, 26 fires and two severe weather events.

Service members and their families will see the largest pay increase in nearly a decade in 2019, with a 2.6% bump in pay. Retirees and those receiving disability or other VA benefits also will see a boost in their pay — at 2.8%, it is the largest Cost of Living Adjustment (COLA) increase in seven years. The pay increases will go into effect on January 1, 2019. We asked some financial experts if they had any advice for service members and their families to make the most of their 2019 pay increase, and this is what they said:

If you are participating in the BRS, you should increase your TSP contribution to at least 5% of your pay. This will maximize the matching contributions from the DoD and grow your nest egg more quickly.

Another great option for your COLA raise is to work on eliminating any non-mortgage debt you may have. Eliminating debt frees up cash flow each month, helping you reach other financial goals more quickly.

Ryan Guina served 6.5 years in the Air Force as an aircraft mechanic, joining the Air National Guard in 2014 after a 8.5-year break in service. Ryan currently runs The Military Wallet website at https://themilitarywallet.com, a personal finance and benefits website for military members, veterans and their families. He also run the personal finance website, Cash Money Life at https:// cashmoneylife.com, which covers personal finance and money management topics.

There are so many smart choices!

• Put it in your emergency fund/transition fund

• Pay off debt

• Make sure both spouses have IRAs

• Increase your TSP ( Ryan is smart!)

• Buy that life insurance you need but have been postponing

• Starting a savings account for a specific need, like vehicle replacement

• Put it in a 529 account for college

Kate Horrell is a wife, mom, military spouse and self-described “personal finance geek.” She has been writing about personal finance for eight years on The Paycheck Chronicles blog, and has branched out into individual counseling and public speaking. On her personal blog at www.katehorrell.com , she writes about many of the same topics she does at The Paycheck Chronicles, but says, “I have a bit more leeway to go off on random tangents or write about something that I absolutely love or hate.”

Throw yourself a little party, and then try to save/ invest at least 80% of that pay raise.

Incidentally, this is why the DFAS allocations to the TSP are in percentages instead of dollar amounts. It’s highly annoying to have to figure out TSP contributions in percentages, but every year (and with every promotion) you automatically contribute more dollars to the TSP.

Doug Nordman retired at age 41 after 20 years with the U.S. Navy’s submarine force, and today runs The Military Guide at https:// the-military-guide.com, a website dedicated to helping service members and veterans achieve financial independence. Doug and his retired Navy Reserve spouse raised their daughter in Hawaii, where Doug enjoys surfing, reading martial arts and is a veteran of many chaotic homeimprovement projects.

YOUR

It may be that time for you. For your family. Are you ready? Are you prepared?

By Andia DinesenArguably the hardest thing about many new life situations is the unknown. Transition out of military service is no different. It is hard to make a solid plan for a life you are not yet living.

However, there are things you can do to be ready and prepared for the unknown in order to make the transition smoother. Check out the tips below to help you and your family during this process.

1

Beef up your liquid savings. Ideally, about six to 12 months before transitioning you should make saving a priority. Consider putting aside three-to-six months* of living expenses. Having this “transition money” saved will greatly help with any potential bumps in the first few months of transition.

*Review all your fixed monthly expenses (loans, mortgage, rent, childcare, etc.) and multiply them to get this number. Using three-to-six months depends on what you are most comfortable with — do not forget about other necessities, such as groceries, gas, etc.

2

Review your LES. Your LES can be a helpful tool for transition. You have three main sections on your LES. Going left to right, start with entitlements.

a. Entitlements

BAS and BAH will not be on your new civilian pay stub. Not only will they not be there, but if you look at the bottom line (your entire entitlements pay) you need to keep in mind that these two amounts were not taxed. Therefore, you will need to consider the increase in the next block on your LES.

b. Deductions

Your federal taxes will likely be higher (depending on your new pay) and you will likely have state taxes taken out, if you do not already. Your FICA taxes for Medicare and Social Security will likely increase as well. You may also have other deductions in this column such as TSP, SGLI, and Family SGLI. Insurance and retirement accounts are important considerations as you transition. You will need to replace these with civilian accounts, depending on your situation.

c. Allotments

This area of your LES is where you may have other payments that you set up, such as a transfer to a savings account, a TSP loan*, other payments, and/or your dental and vision plans. Keep these in mind when reviewing your LES as you think about your new paycheck.

*If you do have a TSP loan this will need to be paid in full while you are still in an active pay status. For more information please visit TSP.gov.

Research everything. This may seem a little overwhelming, but there are so many factors for each individual or family that should be considered when transitioning that nothing should be overlooked. Knowing where you will live, or where you will consider moving to, is one of the most important aspects to evaluate. Costs of living can differ greatly between areas of the country, even in suburban, rural, or urban areas of the same region. Whether you are transitioning out after just one enlistment to go to school or retiring after a long career, the cost of living will be a huge factor in determining how far your dollar will go.

3

Last tip: seek out the professionals. Go to your installation’s family readiness center and take advantage of all they have to offer from resume writing to financial counseling and classes. You can even use these services for up to one year after transition.

It’s no secret that the “tiny living” trend has started. There are television shows dedicated to showing how people are choosing to downsize to tiny homes, RVs or vans transformed into livable spaces. But for many of us, this is just a fascination — wondering how people can sell all of their belongings and cram a family of five (or more) into such a small space. One military family has decided to make this trend a reality, moving their family of six and furry family members into a remodeled bus.

Military families often get creative when they are preparing to move, sometimes opting to sell off belongings and travel to a new duty station in a RV-style vehicle — and after the most recent brutal PCS season, that doesn’t sound like a bad idea. Though, many of us still

live the traditional lifestyle in a home with several bedrooms, a large kitchen to fit every appliance possible, and a dedicated career room with all your spouse’s memorabilia (we all have one). However, for the Bissonnette family, this wasn’t always their dream. Mom, Shiang-Ling, had thoughts of minimalism here and there but it mostly ebbed and flowed with the mountains of laundry that piled from her four kids and MARSOC husband.

“I just hated the cleaning,” she said, “There was always something to clean and stuff to move. It was exhausting.” But in January of 2018, the Bissonnette family got news they weren’t expecting: coming straight off of a deployment, her husband was to be involuntarily separated from the Marine Corps.

“We weren’t expecting it,” husband Johnny states. “I always thought I’d do my 20 and get out. I was 13 years in, and now I was being told I had to go.” At this point the family had a choice to make because their family was going down to one income.

Shiang-Ling’s marketing business, The Hive & Co , was successful but it wasn’t enough to cover $1,900/month mortgage plus all the other living expenses. Johnny was working odd jobs to help make ends-meet, and it just wasn’t enough. That is when she reintroduced the idea of “going tiny” to her family.

After some late night discussions, research, and “the black hole of YouTube videos,” as Shiang-Ling says, they decided to make the leap. They had to act fast, too. Johnny was to be EAS’d by April, a full three months sooner than a normal timeline. They bought a Thomas-built school-style bus from a reputable dealer.

Since May, they have worked to convert their bus into a home, adding beds, appliances, flooring, custom ceilings, and more. Having only been in the bus, affectionately named “Buzz,” for a few months they still have some work to do including getting wiring onto the bus for full time electricity, the addition of solar panels, and finishing plumbing.

The decision to sell all their belongings and move onto a bus wasn’t as hard as one might think.

“We looked around,” said ShiangLing, “and life just wasn’t what we wanted it to be. Johnny was always exhausted so when he was home he physically just couldn’t be as engaged with the kids. The kids had bad attitudes towards each other and constantly secluded themselves from the family. It just wasn’t the life we wanted.”

Education played a big factor, too. At the time, their four children were

attending the local schools and the Bissonnettes had pretty much left their education up to their teachers.

“I found myself disengaged from my kids,” said Shiang-Ling. “I work from home so I couldn’t go in and volunteer as much I’d like, and we found that they were just being pushed along in their education with no real value.” Now the Bissonettes homeschool full-time with their kids taking the lead on their education.

And their oldest, Alexis (10), has her own business making clay magnets. “She is with me learning business practices, finances, and marketing,” says Shiang-Ling. She will even make the sales materials for their blog and vlog, the bHive Family, down the road. Their oldest son, Matthew (8), came to them and said he wanted to learn about combustible engines.

“I don’t know where he heard it, but that’s what we’re talking about now during school times,” she added.

Financially, the decision made sense too. With their income significantly reduced, they needed to make a change.

Although Johnny is in the

Marine Reserves now, which offers some cushion, their mortgage and regular expenses were just too much. “ It’s stressful paying the mortgage on one income,” relays Shiang-Ling. “We’ve spent $5,000 so far [to convert the bus]. We think we have another $1,000 to go.” They are currently living outside of Ft. Campbell, Kentucky, where Johnny is completing his reserve training. “Living in the RV park only costs $1,000 per month with all the amenities we need,” she explained. The Bissonettes recently sold their North Carolina home, which had some damage from Hurricane

Florence (but “the bus did not,” Johnny triumphantly declares).

Shiang-Ling has continued to work with her remote marketing and branding business. Johnny is finishing his bachelor’s degree, hoping to move into remote teaching while being in the Reserves. The family wants to travel the country, hitting each state at least once, and living “off the grid” for awhile.

“Everyone is so much happier,” says both Johnny and Shiang-Ling. “The stress and fast-paced life is gone.” The entire family dynamic is much more content with Dad getting to spend actual, quality time with the kids. “They have real, deep discussions now whereas before they were just ships passing,” says Shiang-Ling. They always wanted their family to be deeply connected and to have more than the work-schoolwork-school life, but they weren’t able to with Johnny’s high-tempo pace at MARSOC. Financially, the Bissonettes are in a better place, too as living on the bus is significantly cheaper than living in a traditional house. With absolutely no regrets, the couple agrees that although being involuntarily separated was not in their life plans, it’s the best thing that could have happened to their family.

“Now we have a saying [that we use] all the time, “Instead of getting busy surviving, [get] busy living.”

Follow the Bissonnette family as they document this new chapter online at www.thebhivefamily.com.

The Super Six, a group based out of Davis-Monthan Air Force Base in Tucson, Arizona, uses a mix of community service projects and professional growth opportunities to develop leaders within the Air Force Reserve. Priorities include bolstering morale, encouraging involvement, and dignifying the wingman culture.

The organization’s president, Tech. Sgt. Billy Lewis, says it’s the second time the idea has been executed and the response has been positive.

“The Super Six previously got started in our group five years ago, and it only lasted for about a year, and it was hard to get that participation with the reserve group. We just needed that something for our junior enlisted to kind of help them and to make them grow,” he explained.

Super Six, which represents ranks E1 to E6, is founded on three pillars:

- Helping the junior enlisted,

- Assisting the 943rd Rescue Group as a whole, and

- Giving back to the surrounding community.

Encouragement without orders There is often a joke, especially among junior enlisted members, about the long-held military practice of being “voluntold”— involuntarily being volunteered to do something. So, the difficulty for senior NCOs and officers, like Super Six’s governing members, becomes creating these types of camaraderiebuilding activities without making it feel forced, which Lewis adds is a multi-layered challenge in the reserve component.

“That’s the challenge that we face every month because we’re reservists, so we only meet one weekend a month, and we only get

Enlisted airmen from the 943rd Rescue Group are transforming traditional leadership techniques to motivate the junior ranks within their unit.

one hour, and everybody’s busy you know doing their job, maintaining their training, so we had to get kind of creative this year,” Lewis, a client systems technician, said. “This year we started our professional development courses for our junior enlisted. We wanted to give them tools that they could use—not only inside the Air Force—but take it outside because the majority of the time is working full-time or supporting your family.”

Some of those courses include financial briefings around the holidays to get a budget set, educational briefings on tuition assistance, and guidance on writing bullets for airmen under their supervision.

Group Vice President, Tech. Sgt. Aries Medina, who is prior active, has been with the group since the onset. She says Super Six fills a gap.

“I think it’s important (for junior enlisted to be involved) because being most of them are traditional reservists and it’s hard sometimes for traditional reservists to do what’s expected military-wise on their off time, so I think it’s important for

them to be involved in the group because we facilitate the stuff that they need for professional development, community involvement, things of that nature,” she said.

And activities aren’t solely focused on formal projects. In some instances, Super Six events are just about getting together.

“We try to motivate them by incorporating things that they would like,” Medina said. “It’s not always necessarily about volunteering or fundraising, sometimes we have events where it’s just us hanging out and getting to know the people that you work with or getting to know the other members in the unit that you don’t necessarily see on a daily basis.”

Earlier this year, the Department of Defense launched a new initiative aimed at helping civilian communities

better understand the U.S. military. Tech. Sgt. Lewis stressed the importance of units using engagement to connect on a local level.

“It’s very important to get involved with the community because the community, all they see is our helicopters fly off the base. They don’t know what that helicopter’s doing, they don’t know what our mission is. You know, the sacrifices that the people on those helicopters are doing to save the Marines, the Navy … and if the community doesn’t know what we do, it’s our job to teach them and to build that relationship,” he said.

An example of that type of relationship building occurred this month when Super Six members held a food drive collecting donations from squadrons to pay forward to the Community Food Bank of Southern Arizona in Tucson. They also had the opportunity to meet with Air Force Reserve Command Chief Master Sgt. Ericka Kelly.

To learn more about Super Six, visit the group on Facebook at www.facebook.com/943SuperSix/ or Instagram at www.instagram.com/943supersix/

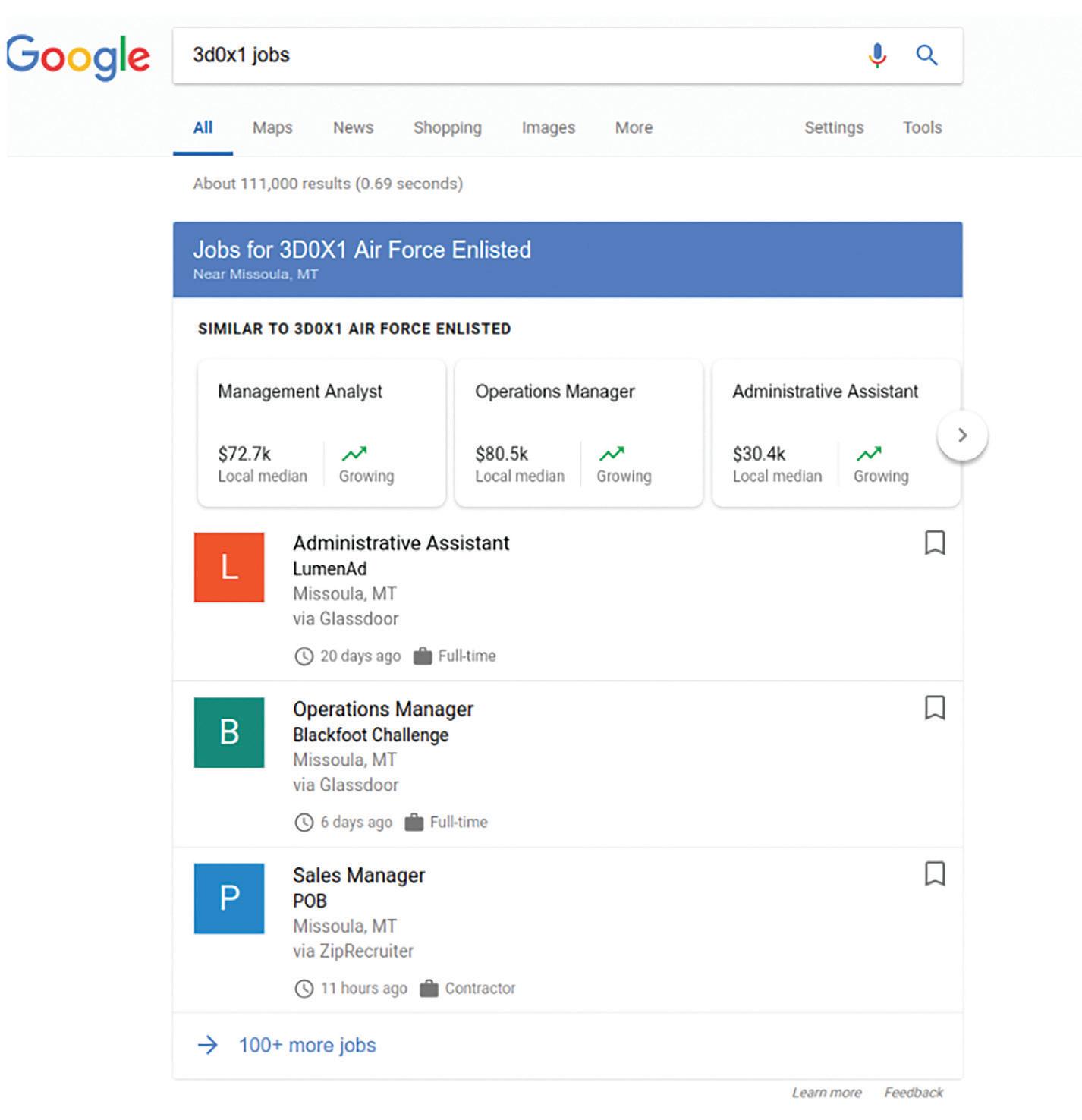

Those making the leap to the civilian sector have a few extra resources in their transition toolbox thanks to Google .

The tech giant unveiled a series of new tools aimed at supporting transitioning military members seeking civilian employment. Coined Grow with Google and found at https://grow.google/ , the initiative focuses on three main areas: employment, entrepreneurship, and education.

Navy veteran Kass Kristoff, Google Communications Manager, experienced her own hardship during her transition and calls these new offerings “game-changing.”

“Number one, Google’s mission is on creating tools that are useful and helpful for everybody. Specifically, Grow with Google is creating economic opportunities

for Americans and I think helping and supporting veterans is just one of those things,” she said. “For example, this job search function, it’s incredible. My own personal job search was a lot of time, a lot of years of trying to figure out what I want to do, but being able to put in your military occupational specialty (MOS) code into a job search function is at least a starting point for how your skills in the military may translate to the civilian world. It is really game-changing.”

Kristoff, who served six years, was a surface warfare officer. It was during that time that she used her journalism education to assist with her ship’s public relations needs.

She and her husband, also a veteran, jointly decided to transition out while stationed in Bahrain. Like many who leave the structure of a military career, she describes the

road as tricky.

“It was definitely a struggle to find out what it is that we wanted to do and try to figure out how what we did in the military translated into the civilian world. It took a lot of searching, career quizzes, conversations with multiple people in industries, asking them what they did and why they loved what they did or why they hated what they did,” she explained.

Three years after hanging up her uniform, Kristoff landed an opportunity in Google’s communications department. Now she lends her voice to helping the company assist other veterans on the path to civilian. Among her contributions was testing out a job search function allowing transitioning service members and veterans to use their job code to easily find compatible career opportunities.

Service members can now enter their military occupational specialty code (MOS, AFSC, NEC) directly into Google Search and see relevant civilian jobs that require similar skills to those used in their military roles.

By searching the phrase “jobs for veterans” on Google and then entering their military job code (MOS, AFSC, NEC), service members will be able to find relevant jobs near them.

The results will include details about each job, such as the job title, location and commute times, time requirements, and in some cases, salary information.

Help your veteran-owned business stand-out online

For those seeking careers outside traditional employment, entrepreneurship has become a popular option among veterans.

Over two million businesses in the U.S. are owned by veterans, according to the Small Business Administration. Google recognizes this and has created a special designation that veteran entrepreneurs can use to help better identify their business to consumers who may want to specifically shop at military-affiliated companies.

Veterans can identify their businesses as veteran-owned or led on Google Search and Maps (visual) with the new attribute, making it easy for customers to proactively support veteran-owned businesses. Click here to see the companies that have already used the new feature: https://gwg-veterans.appspot.com .

The tech industry has become an attractive field for job seekers as it is expected to grow faster than the combined average of all

other occupations, according to the Bureau of Labor Statistics. So, Google has teamed up with the USO to train veterans in the skills they need to pursue those opportunities.

Google.org provided the USO with a $2.5 million grant to incorporate the Google IT Support Professional Certificate into USO programming. This training is also being extended to military spouses who continue to face high numbers of unemployment.

Go to https://www.uso.org/ programs/uso-pathfinder to learn more about utilizing the training, or contact your local USO center . The grant is designated for roughly 1000 transitioning military members, veterans or military spouses.

Kristoff adds that because IT is a

growing industry with demands everywhere, this training is beneficial even during the preparation stage of the military transition.

“It’s a growing field—but I think a lot of veterans, especially when you’re talking about the enlisted ranks, some of them are on the fence about should I go to school afterwards, like what should I do, and having this IT support professional certificate—especially that it’s a distance learning program—and something potential they can maybe do on deployment before they’re transitioning out.

They can take that certificate and it applies to a variety of jobs and now they have the skills that they need to move into an entry level job in IT,” she said.

Service members are no strangers to planning. Whether using the Military Decision Making Process on a staff, or Troop Leading Procedures at the small unit level, service members are skilled at using a plan to achieve military objectives. Financial security is no different. In order to achieve it, one must take a deliberate approach. Here are some tips to consider:

What are your financial objectives? Like any other planning process, begin with the end in mind. Are you saving for a house? To pay for children’s college expenses? To retire by a certain age? In considering what you want to do, you must identify what it will cost. And, it may not be straight forward. For example, when asked how much money they need to purchase a home, many individuals will respond with the home’s price. In most cases, what is needed is the down payment, usually about 20% of the purchase price and it can be less if servicemembers use the VA home loan program. The rest is financed through a mortgage, whose recurring payments are much smaller and integrated into a budget.

Once you’ve identified your financial objectives, you’ll need to determine how much time you have until you need the funds. A child’s college education may be up to 18 years away. A down payment for a home may be in five years. The longer you have, the more compounding can help your money grow to reach those goals. Time available also affects the type of investment vehicles to consider in reaching those goals. Short run goals may necessitate more conservative investments, while those further away may be suitable for accepting more (prudent) risk for a greater long-run return.

By Carlos PerezWhat is your risk tolerance? Your tolerance for fluctuations in the value of your investments will affect the type of instruments you should choose. Assets with less fluctuation, such as savings accounts or government bonds, also generally have lower long-term returns. On the other hand, assets such as stocks or stock mutual funds have generally higher average returns over longer periods of time, but may have significant short-term fluctuations. If you have a low risk tolerance, either because you need your funds soon, or because a decline in the value of your assets would concern you, then you will likely want assets with lower volatility and generally correspondingly lower returns.

Select your investments. With your goals, time available, and risk tolerance in mind, you will need to select where you place your funds. This placement, or asset allocation, is the single-most important decision you will make. It is the one factor that most significantly determines whether you will meet your objectives. Alignment of goals, time horizon, and risk, as reflected in your portfolio will lead to financial security and the ability to meet your goals; misalignment will likely lead to failure.

Don’t put all your eggs in one basket. Because picking winners is difficult, investors improve their chances of higher returns and decreased risk by diversifying among many different assets (stocks, or bonds, or other investments). While there are many options available, mutual funds offer investors an array of choices across asset classes, risk exposure, economic sectors, and geographic locations. They are a good place to start for most beginning investors and offer the benefits of diversification. Buying and managing individual assets such as company stocks or bonds

would be difficult for service members; mutual funds simplify this at reasonable costs. By purchasing a mutual fund, you buy into a collection of stocks, bonds, or other assets. The mutual fund manager pools your investment with others having similar objectives and purchases assets for investors in the fund. This helps keep costs low and provides the benefits of owning a diversified portfolio that attempts to meet the fund’s objectives.

Seek advice. Like other important decisions we make, it is important to seek advice if unsure about how to develop your financial plan and invest. When we don’t feel well, we visit a doctor. When our cars act up, we see a mechanic. Similarly, it is ok to get professional advice when not sure about our financial plan and whether it supports our objectives. The key is to find a trusted, reputable advisor who understands the particular needs and circumstances of service members.

Monitor and adjust your plan. Once you have a plan, put it to work! Be disciplined in your approach through the use of a budget. Ensure you are setting aside enough to meet your goals. Importantly, recognize that circumstances may change. Children may get scholarships; an inheritance may cover a down payment on a home. At times like these, adjust your plan to account for the new developments. Not doing so can be as foolish as not having a plan.

Armed with clear, well-defined goals, an understanding of risk, and smart decisions regarding asset allocation, it is possible to achieve financial security and meet financial goals through a good plan and a well-diversified portfolio.

regarding politics in the military and have each outlined policies and procedures that are worth reading before entangling oneself and his or her branch of service with a specific political position or stance.

Using the U.S. Army for example, in its All Army Activities Message , published February 2017, it states : “The Army encourages its members to tell the Army Story and is not prohibiting or limited the responsible use of social media.” This likely is the reason why it is not difficult to locate unofficial videos of “Days at the range,” “Blackhawk rides,” and “Adventures of the Fobbits” scattered across social media platforms.

Where it becomes dicey is when members of the military lose what is referred to as their “military bearing,” which has the unfortunate potential of snow-balling.

With the rise of digital engagement, there is no escaping politics.

Regardless of how far away a Soldier may be from his/her home, he/ she may have an interest in the news of their hometown. The same can be said for a Soldier’s interest in national news, which begs the question, “to what degree does an individual Soldier’s opinion addressing the news in her hometown reflect the position of the U.S. Army, and other branches, on a national level?”

The answer has escaped some members of the military and landed others in hot-water, and while major social media platforms such as Facebook have been around for several years, recent advances in social media have tested each of the respective military branches’ longstanding policies and procedures surrounding social media use and political engagement collectively.

“Sometimes the issues surrounding politics in the military become more of a public relations concern than a legal concern,” says Seth Lynn, an Administrative Director at the University of San Francisco and Executive Director of Veterans Campaign, a non-partisan, nonideological organization whose mission it to encourage, mentor and prepare veterans for a “second service” in civil leadership. Seth further noted, “However, some language found in policies and procedures such as ‘primary photograph’ has confused some members of the military as to its interpretation.”

For example, if a member of the U.S. Army National Guard chose to run for office, would posting campaign flyers of herself in military uniform constitute improper conduct? What about digital profile pictures in uniform? Each respective branch of the U.S. military has tackled these and other questions

As such, “AR [Army Regulation] 600-20 and AR 25-13 currently contain punitive language regarding harmful use of electronic media. The proponents of these regulations, in coordination with the deputy Chief of Staff (DCS), G-1, will ensure that future updates further clarify army policy regarding electronic communications and online conduct.” These regulations, among others, can be found at:

https://www.army.mil/socialmedia/ .

Political posts represent the fine line between the rights of individual service members and the authority of the military to enforce good order and discipline. Oftentimes, confusion and frustration arise from a service member’s inadvertent crossing of said line.

As “SGT Smith” [not his real name] learned when he decided to

“rant about President Trump” in a post on Facebook — a post that was then shared by fellow service members overseas. Ironically, this service member was responsible for educating and enforcing appropriate online media use by Soldiers.

Understandably, emotions may be higher than normal when a Soldier is overseas, separated from the day-today news of his or her hometown. But with the remarkable advances in modern technology, service members can be connected to their loved ones at home, in real-time, via a plethora of online, digital tools. As comforting as that sounds for staying connected with friends and family, it also poses potential problems because service members are also connected, in real-time, to major political events stateside.

With respect to SGT Smith, he was deployed during a horribly contentious political environment in the United States, where party lines seemingly resembled the trenches of the first World War. Not only were the political updates from back home distracting to Soldiers trying to focus on their mission, the political updates were inciting emotional responses, that caused a few Soldiers, like SGT Smith, to share their two cents.

Acting on those emotions by sharing his personal feelings about his Commander-in-Chief for the

world to see is where the line was unequivocally crossed. As such, the line became clear for him, and it is hoped that others hearing this cautionary tale will have a clearer picture as they contemplate whether to post, or not to post.

Service members are expected to carry out their duties irrespective of their personal political beliefs. Not that they cannot have such beliefs, but they must take care in how they express them.

More service members in recent years have been blurring the line between their service obligations and their personal opinions. The result has been an influx of politically charged posts, which are, by definition, encouraged by online social-media giants like Facebook.

These posts become profitable through the number of “views,” “clicks,” and “shares” they achieve. Thus, “if it bleeds, it leads” is still highly relevant in today’s digital marketplace, where political posts acquire astonishing levels of lucrative user engagement.

Admittedly, it can be tempting to join the discussion your friends and family are having about local, state, and national political events that arguably play a direct impact on our lives as Americans.

However, joining the discussion, for example, as a “member of the Army,” may create a perception that the member is speaking on behalf of the Army. The most commonly understood example of this type of inappropriate representation is when a service member dons his or her uniform and joins a partisan political rally.

A well-known example of this occurred in 2012, when an Army Reservist spoke at a Ron Paul rally while in uniform. If this example is easy to discern for most service members, why then is it more difficult for service members to discern whether or not to carry out similar actions online? The simple answer could be that some service members feel that while online they are an individual, irrespective of partisan or organizational affiliation. This is the arguably gray area that can easily be cleared up with an application of any of the five branches rules and procedures.

If for whatever, after reading your respective branch’s policies on electronic communications and online conduct, you are still confused as to what is a permissible post, and you still want to post your political belief, simply err on the side of caution. Try to speak about issues as an individual, not as a member of an organization.

How much does it cost to feed a family of four? The United States government estimates families spend anywhere from $562 to $1286 a month for groceries depending on whether their budgets are “thrifty” or “liberal.”

Navy spouse Ashley Dougherty says think again. She contends your total monthly bill should be $400–$1000

per person per week–even if you are stationed in a higher-cost area like Hawaii or on the East or West Coast.

“To be honest, I don’t think it matters where you live. I’ve lived now in two of the most expensive areas of the country,” said Dougherty, pointing to Hawaii and San Diego. “If I was able to do it for our family, anyone can do it.”

Dougherty, whose family currently is stationed in Augusta, Georgia, says training yourself to search grocery advertisements and buy what’s on sale is key to lowering spending for groceries.

“To get the best deals, you may have to hop around to two or three different stores a week versus the one store you now go to weekly,” she says.

Dougherty also suggests becoming a frequent visitor to grocery store clearance sections–often located at the far end of the meat case and on racks at the rear of the store–where discontinued, late date or dented items can be as much as 75% off.

Dougherty, 35, shares her moneysaving tips on her blogs, The Spenderella www.TheSpenderella. com and Military Spouse Living www.militaryspouseliving.com . She says frugal living comes naturally to her since both her mother and grandmother relied on coupons to save money on most everything they did or ate.

“As a kid, everywhere we went my mother had a coupon, whether it was going to Burger King or Wendy’s or clothes shopping,” Dougherty recalls. “It was the same thing with groceries. She always had coupons.”

Dougherty first began doling out money-saving advice in 2011 while living in Hawaii. She became known as Hawaii’s “Coupon Queen” after her family moved to Oahu from San Diego and she was unable to find a job as a building design drafter. Hawaii’s high cost of living forced her to find new ways to save money. Extreme couponing was the answer. Wielding a coupon-stuffed binder down grocery store aisles, Dougherty routinely fielded questions from other shoppers who wondered what she was up to and whether it worked.

“People saw my binder and had a million questions for me,” says Dougherty, who once couponed her way to paying $9 for $900 worth of groceries at the commissary. “I thought I’m going to throw it all online and then I can tell people to visit my site. I don’t have to stop at every store and give people a 30-minute lesson.”

Dougherty’s Hawaii Shopaholics blog became one-stop shopping for couponing tips and local restaurant and shopping deals. Dougherty also began offering couponing classes and organizing coupon and grocery swaps.

Soon, Dougherty wasn’t only saving money, she was making money too. In its heyday, Hawaii Shopaholics was attracting 16,000 visits a day, a level of website traffic that began generating a steady income that increased to more than $40,000 a year after Dougherty’s book Couponing in Hawaii was published. Dougherty was as surprised as anyone by her success.

“I literally learned everything about how to create a website and how to make YouTube videos off of YouTube,” Dougherty explains. “If you have time, grab a glass of wine, sit in front of a computer and watch a bunch of YouTube videos on how

to create a website, how to start a blog, how to make money blogging. A million YouTube videos will come up to guide you.”

Yvette Alford, a retired Navy spouse, is grateful Dougherty turned her couponing hobby into a business. Alford attended one of Dougherty’s coupons classes nearly a half-dozen years ago and continues to use tips she learned, such as looking inside magazines and product packaging for coupons and routinely going to manufacturer’s websites to request coupons for products she uses or wants to try. Alford estimates 80% of companies she contacts-from King’s Hawaiian Bakery to Chobani yogurt–respond by sending coupons for free or discounted products.

“Everything I know and all the money I’ve been able to save over the years has been in part due to Ashley,” Alford said. “She’s so smart.”

Dougherty rebranded her blog The Spenderella when her family left Hawaii, but the decision also reflected couponing’s shift from paper to app-driven deals. This year, Dougherty dropped couponing from The Spenderella altogether, a move made in part due to her dismay with the growing “glitch community,” couponing groups

devoted to exploiting errors in coupon scanning to use a highvalue coupon for one product when buying another.

On The Spenderella, Dougherty blogs about online shopping and free shipping deals, smartphone apps, travel discounts and military spouse-made products.

“It’s a place where you can come and learn how to save money from the comfort of your home,” she says. “It’s shopping made easy.”

Examples of the deals she highlights include Gymboree girls’ tees for $2.99 and dresses as low as $5.59 plus free shipping, a Safety 1 st Baby Walker with Activity Tray for $25.15 (regularly $44.99) and a Cuisinart 3-Piece Grilling Tool Set with Grill Glove for $13.59 (regularly $24.99).

Dougherty was particularly thrilled by Gymboree’s 80% off sale, which reinforces her advice to parents to stretch their dollars by “always buying a season ahead.”

Dougherty’s new mantra is put down your coupon-cutting scissors and turn to the internet for the best deals.

“There are ways you can buy brand name items for a fraction of the cost,” Dougherty says. “It is just knowing the websites that are out there.”

By AFM Staff

By AFM Staff

Completing an education is hard enough without having to stress about how to pay for it. Luckily, this is the time of year when organizations start accepting applications for military-focused education assistance programs. Yes, that’s right. There are programs – scholarships, loans, and grants -- designed with you in mind. But, it’s going to take some work and a lot of organization.

A few things to consider ahead of time:

1. Read all of the criteria early so that you can plan for any timeconsuming requirements, like letters of recommendation.

2. Create reminders for deadlines so that you don’t miss any important dates.

Here is the latest list of 2019 offerings for those serving in the reserve component and their family members:

FOR RESERVISTS, GUARDSMEN, AND THEIR SPOUSES

Pat Tillman Foundation

Link: http://pattillmanfoundation. org/apply-to-be-a-scholar

Who’s eligible: Current spouses of veterans or active-duty service members, including surviving spouses.

What’s the basics: $10,000 scholarship to assist with academic expenses, such as tuition, fees, and books.

Opens: Feb. 2019.

Florida Advisory Council on Military Education

Link: http://www.fla-acme.org

Who’s eligible: Active duty, guard, or reserve service member of the U. S. Armed Forces; Spouse of any active duty, guard, or reserve service member of the U. S. Armed Forces; and Veteran with an honorable discharge (must provide documentation).

Opens: Jan. 2019.

Southeastern Council on Military Education (SECOME)

Link: http://www.secome.org/ scholarships

Who’s eligible: Students (spouse, veteran, active duty, and/or guard/ reserves) attending 2019 member institutions (member institutions are posted on our website) who reside in NC, SC, GA, or AL are eligible.

What’s the basics: The organization will award scholarships ranging from $500-$1500.

Opens: Feb. 2019.

Council of College and Military Educators (CCME)

Link: http://www.ccmeonline.org/ scholarships

What’s the basics: The organization awards $1000 scholarships with the application process typically running July to November.

FOR MILITARY SPOUSES

National Military Family Association

Link: https://scholarships. militaryfamily.org/offers/nmfaspouse-scholarship

Who’s eligible: Spouse to an active duty, reserve, guard, retired, medically retired, wounded or fallen service member (must be a service-related wound, illness, injury or death that took place after September 11, 2001).

What’s the basics: Awards available for career funding, degrees, clinical supervision towards licensure in the mental health profession, and business expenses.

Deadline: Yearround.

FOR MILITARY SPOUSES AND DEPENDENTS

ThanksUSA

Link: https://www.thanksusa.org/ scholarship-program.html

Who’s eligible: Be a dependent child, age 24 or under (as of application deadline) of US military service personnel, or the spouse of US military service personnel.

US military personnel are defined as those who have served FT for at least 180 days after 9/11/2001, and

all those who were either killed or wounded in action after 9/11/2001. This also includes members of the reserves who have been activated to FT duty and members of the National Guard who have been federalized & who otherwise meet the requirements.

Application period: Apr. 1 – May 15, 2019.

Fisher House

Link: https://militaryscholar.org/sfmc

Who’s eligible: Program is open to sons and daughters of active duty, reserve/guard, or retired military commissary customers. Recipient must be enrolled or planning to enroll full-time in a four-year undergraduate college or university, accredited in the U. S or a two-year community college. They must have a minimum cumulative grade point average of 3.0 on a 4.0 basis.

What’s the basics: 500 scholarship grants will be awarded for $2000.

Each service branch has an equivalent branch aid society that supports service members and their families through various programs –including education assistance.

Air Force Aid Association

Link: https://www.afas.org/howwe-help/general-henry-h-arnoldeducation-grant

Who’s eligible: Spouses of active duty and Title 10 Reservists, and widows.

What’s the basics: Needs-based grant ranging from $500 – $4000.

Opens: Jan. 2019.

Army Emergency Relief

Link: https://www.aerhq.org/ Apply-for-Scholarship/MilitarySpouse/2019-2020-Academic-Year

Who’s eligible: Spouses of National Guard/Reserve Soldiers on Title 10 Orders are eligible, in addition to those spouses of an active duty or retired soldier or the widow of a soldier who died while on active duty or while retired.

What’s the basics: Need-based scholarship program for spouses pursuing their first undergraduate degree.

Application cycle opens: Apr. 1, 2019.

If your organization has a military scholarship program that you want to be added to the list, email the details to managing.editor@ ameriforcemedia.com .

1 in 3 military spouses say they are NOT prepared at all to meet a financial emergency

73%

69%

are spending the same or more than in 2017

23% are saving the same or more than in 2017

43% said financial concerns are the primary reason they experience relationship issues in their family, compared with 28% who said deployments and separations

have more credit card debt than in 2017

1 in 2

have more than $5k in credit card debt

30%

have more than $10k in credit card debt

Access our award-winning trading platforms plus get the support, education and tools you need to help you navigate the markets.¹

The TradeStation Salutes program offers:

u Commission-free trading for stocks, ETFs, and options 2

u 45¢ per contract, per side with no carry charge for futures

u No software fees

u Free real-time market data3

Options involves risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options on TradeStation.com or call 888-OPTIONS for a copy before trading options.

No o er or solicitation to buy or sell securities, securities derivatives or futures products of any kind or any type of trading or investment advice, recommendation or strategy is made, given or in any manner endorsed by any TradeStation a liate. All proprietary technology in TradeStation is owned by our a liate TradeStation Technologies, Inc. Equities, equities option, and commodity futures products and services are o ered by TradeStation Securities, Inc., a member of NYSE, FINRA, CME and SIPC. © 2018 TradeStation. All rights reserved.

¹Visit TradeStation.com/Awards for more information. ²Other fees, charges, restrictions and conditions may apply. Visit TradeStation.com/Salutes for full details and disclosures. 3 Non-professional equities accounts include NASDAQ, AMEX, NYSE and OPRA exchanges. Non-professional futures accounts include CME, CBOT, COMEX and NYMEX futures.