RECRUITING CONUNDRUM

Increasing gas prices and food costs. Supply chain shortages. Talk of a recession. The list goes on. Money is at the forefront of the conversation these days, and in these pages it’s no exception.

We culled our resources to find finance experts – and military community members like you – who know the ins and outs of military life and can help you navigate the current economy. Take Coast Guard spouse Nikki Davidson’s story on page 22. She spoke to Capt. Lacey Perry, of the Arizona National Guard, about using her military and civilian benefits to not only fund her own education, but her children’s.

“To me, it is so thrilling, the thought that she’s [my daughter] going to be able to go to school and not have the weight of student loan debt or have to take on a full-time job to be able to attend school,” Perry said. “She is going to be able to have the freedom to choose her career [and] to go to the college that she wants to.”

Plus, we can’t leave out the elephant in the room – recruiting. In our cover story, Army National Guard veteran Will Martin dives into what it takes to attract recruits in today’s environment, with a particular focus on those who are capitalizing on their social media presence. You can find this story on page 10.

Lastly, we want to make sure you’re aware of all the tools making their way through the military, so Iowa Army National Guard veteran Randy Brown breaks down what to expect in emerging technology in the coming years on page 20.

We hope the information in this issue helps calm any fears or anxieties related to money.

Until next time,

KARI WILLIAMS Associate EditorChristopher Adams

Randy Brown

Allison Churchill

Nikki Davidson

Elena Ferrarin

Crystal Kupper

Jessica Manfre

Will Martin

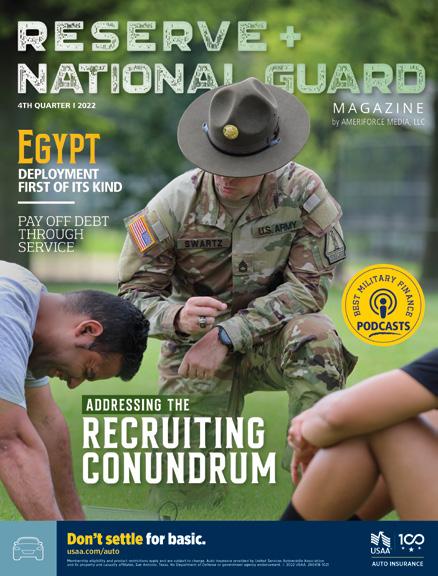

Sgt. 1st Class Lewis Swartz is among the Army recruiters using social media to increase enlistments. Photo by Sgt. 1st Class Lewis Swartz. @reservenationalguard

by Jessica Manfre

by Jessica Manfre

by Allison Churchill by Elena Ferrarin

by Allison Churchill by Elena Ferrarin

Employer Support of the Guard and Reserve has honored 15 companies with its Freedom Award for their dedication to soldiers and airmen across 14 states. Employers from the public and private sector must be nominated by the guardsman or reservist who works for them. The award was established in 1996.

This year’s winners are:

• Allergy, Asthma and Immunology Center of Alaska, Anchorage, Alaska (Air National Guard, Alaska)

• Bristol Myers Squibb, Princeton, New Jersey (Air National Guard, New Jersey)

• Charles Perry Partners Inc., Gainesville, Florida (Army National Guard, Florida)

• Charleston County Sheriff’s Office, Charleston, South Carolina (Air Force Reserve, South Carolina)

• Check Defense, Raleigh, North Carolina (Army National Guard, North Carolina)

• Coalfire Systems Inc., Westminster, Colorado (Navy Reserve, Colorado)

• Flemingsburg Police Department, Flemingsburg, Kentucky (Army National Guard, Kentucky)

• Gate City Bank, Fargo, North Dakota (Army National Guard, North Dakota)

• HJ Pertzborn Plumbing and Fire Protection, Madison, Wisconsin (Army Reserve, Wisconsin)

• Infinity Systems Engineering, LLC, Colorado Springs, Colorado (Air Force Reserve, Colorado)

• Jefferson County Sheriff’s Office, Golden, Colorado (Air National Guard, Colorado)

• Phoenix Fab, LLC, Chandler, Arizona (Air National Guard, Arizona)

• Storm Lake Police Department, Storm Lake, Iowa (Army National Guard, Iowa)

• TeleTracking Technologies, Pittsburg, Pennsylvania (Army Reserve, Pennsylvania)

• UT-Battelle (Oak Ridge National Laboratory), Oak Ridge, Tennessee (Air National Guard, Tennessee)

Lt. Gen. John Healy is now leading the Air Force Reserve Command following his promotion from major general in August. Healy joined the Air Force in 1989, commissioning through the University of Connecticut’s Air Force ROTC program.

At the peak of Operation Allies Welcome, more than 1,300 guardsmen were on Title 10 orders supporting the mission to evacuate, screen and resettle Afghan allies and partners. The Guard “expended more than 82,000 mandays,” according to data provided by the National Guard Bureau. As of Feb. 4, 2022, guardsmen had been involved with more than 48,000 evacuee relocations through OAW, Guard data shows.

One Guard unit alone – Minnesota’s 1st Combined Arms Battalion, 194th Armor Regiment – assisted in the evacuation of 30,000 people during a two-week deployment to Afghanistan.

As a command pilot, he has amassed more than 5,000 military hours and 402 combat hours.

Healy replaces Lt. Gen. Richard Scobee, who retired after 36 years of service.

Roughly 100 guardsmen from Rhode Island’s Alpha Company, 1st Battalion, 182nd Infantry Regiment currently are deployed to Southwest Asia.

The deployment is expected to last one year.

A pre-deployment ceremony was held at the Army Aviation Support Facility on Quonset Air National Guard Base over Memorial Day weekend before the unit mobilized to Fort Bliss, Texas.

The Marine Corps Reserve-supported Toys for Tots fundraising and donation drive returns alongside the holiday season. In addition to toy drop-off events, donations can be made online, through peer-to-peer fundraising or the organization’s holiday recognition program, among other options. To find a local Toys for Tots donation site, visit https://www. toysfortots.org/request_toys/Default.aspx.

Following a yearlong study, the Marine Corps has announced it will use “more advanced body composition methods” to determine if placement in the Body Composition Program is required, according to a news release.

A 1% increase in “total allowable body fat” for female Marines also will be implemented. The changes go into effect Jan. 1, 2023.

Gen. David Berger, commandant of the Marine Corps, said the study “marks a milestone” in understanding the health and performance of Marines.

“Our primary focus in the Marine Corps is the individual Marine and this study is a pivot point,” Berger said in the release. “We will continue to learn and explore additional modifications to our body composition program.”

The branch will continue to allow performance exemptions for Marines who score 285 or higher on fitness tests.

The study included 2,173 Marines – 1,435 men and 738 women (196 who were postpartum) – and was conducted at the following Marine Corps bases: Quantico, Virginia; Camp Lejeune, North Carolina; and Camp Pendleton, California.

For four decades, the Multinational Force and Observers has upheld the 1979 Treaty of Peace between Israel and Egypt. This spring, soldiers from South Carolina and Alabama became the first guardsmen to provide aviation support to the peacekeeping mission.

South Carolina’s Company A, 1-111th General Support Battalion, 59th Aviation Troop Command, and Alabama’s Companies B and D, 1-131st Aviation Regiment, 122nd Troop Command, deployed to the Sinai Peninsula in May, after training together at Fort Hood, Texas, for about a month. They’re divided between the MFO’s Forward Operating BaseNorth, from which most aviation missions are run, and South Camp, where the maintenance takes place.

They got word of the deployment last year, said 59th ATC commander Col. John McElveen. The companies were in the deployment-ready stage of the National Guard’s deployment cycle, and their assets complemented each other, with the South Carolina unit having helicopters and Alabama having maintenance crews. The teams met up for training exercises in each other’s states, but did most of their joint training at Fort Hood, Texas, in April and early May, before departing for the Middle East.

The National Guard has provided an infantry battalion to the effort since 2002, but previous aviation companies were comprised of active-duty aviators who deployed individually, said Canadian Air Force Capt. Alexia Croizer, one of the MFO’s public affairs officers. For this rotation, the U.S. Army decided to deploy already-formed units of National Guard members to increase unit cohesion and improve unit level train-up, she said. Capt. Michael Snyder, the Army Aviation Company (AVCO) and Company A, 1-111th commander, confirmed that the strategy worked.

“Coming in as a unit has absolutely set us up for success,” he said. “We arrived in theatre already trained and fully proficient, which allowed us to jump straight into accomplishing missions.”

Being deployed as part of a mission supported by 12 other countries has its perks, said Sgt. Joshua Grantham, an aircraft structural repairer for the ALNG. The dining facilities, he said, cater to international palates, so he’s had the opportunity to try new foods. He also said he’s picked up a few key phrases in Arabic and Fijian, and that the troops from other contingencies were welcoming.

“It’s just really great to see how everyone works together,” Grantham said.

The operational tempo on this tour hasn’t been as hectic as when he deployed to Iraq in 2011, Grantham said. That deployment, to Taji and Balad, saw him working 12-hour shifts, seven days a week, busy from the time he got to work until he left. The MFO’s version of morale, welfare and recreation is morale support; in addition to showing films and sponsoring activities, morale support organizes tours of Egypt and Israel.

One of Snyder’s goals, as the first AVCO commander from the National Guard, is to set up future AVCOs for success through molding deployment manning documents

Operation Heal Our Patriots® provides combat-wounded veterans and their spouses with a week of Biblically based marriage enrichment classes surrounded by the beauty of the Alaskan wilderness, as well as ongoing chaplain care. This Samaritan’s Purse ministry is just one example of how we are helping to meet the physical and spiritual needs of hurting people across the globe in Jesus’ Name.

Support our work via https://cfcgiving.opm.gov/

Samaritan’s Purse®, Franklin Graham, President P.O. Box 3000, Boone, NC 28607 | samaritanspurse.org

SamaritansPurse @SamaritansPurse @SamaritansPurse © 2020 Samaritan’s Purse. All rights reserved.

and reaching out to the team that will take over next year.

“We can support the future AVCOs so they can fully support the MFO to the best of their ability,” Snyder said.

The MFO itself is about to have its footprint reduced. Following President Joe Biden’s July 15, 2022, meeting with Saudi Arabia’s Crown Prince Mohammed bin Salman, the two countries announced that the MFO would leave Tiran Island. Control of the uninhabited island went back and forth

between Saudi Arabia and Egypt since 1950, with brief occupations by Israel, until Egypt officially ceded power to Saudi Arabia in 2017. The strait of the same name, separating the island from the Sinai Peninsula, provides passage between the Red Sea and Gulf of Aqaba. Without that passage, Israel has no access to the Red Sea.

The White House statement announcing the MFO’s departure said that Saudi Arabia plans to develop the island for tourism and will ensure the continuation of procedures.

If numbers tell the story, as the saying goes, military recruiting reads like a tale of horror.

Both active and reserve component recruiters are facing one of their most challenging years in decades. Each service, and the Army in particular, anticipates falling well short of its annual recruiting goals.

The Army Guard, which hasn’t made its recruiting mission since 2019, was only about halfway to its fiscal year 2022 goal of 38,430 new soldiers, with less than two months remaining as of press time.

“We’re in a war for talent,” Army Chief of Staff Gen. James C. McConville told junior officers during a recent visit to Fort Leonard Wood, Missouri, adding that less than one in four young adults are qualified to serve, with rising obesity the main obstacle.

Desperate to pull recruits from this shrinking pool, the Armed Forces are rolling out massive enlistment bonuses, loosening tattoo policies and even offering some recruits a say in their first duty station.

But for some recruiters, these efforts smack of business as usual, especially in a digital age. The greatest weapon in the “war for talent,” they contend, rests in the hands of nearly every young American.

‘The phone always wins’

Army Sgt. Georgia Varoucha cringes whenever she hears a National Guard marketing pitch come across her radio.

“People’s attention is on their phones. Look at their screen time, any time of day,” said the 25-year-old New Jersey Army National Guard

recruiter. “Nothing pisses me off more than when I hear one of our ads on the radio ... The phone is always going to win.”

Varoucha is among a growing wave of reserve component recruiters who have embraced digital content creation in the hopes of reversing the downward recruiting trend.

“I think the old way of doing recruiting is going to die out,” Varoucha said. “We’ll set up tables at schools or an event, and the kids might be right in front of me, watching my video on their phone, but not come up to me in person.”

And they are watching – in droves. Varoucha is only a few years into her work as a fulltime recruiter, but her TikTok following is staggering – just shy of half a million – with nearly another 23,000 on Instagram.

Army Sgt. Georgia Varoucha conducts PT in August with guardsmen and recruits.

She specializes in short-form video content that captures the humanity of uniformed service. Rather than offer up talking points on a career field or the latest bonus, Varoucha puts a face to the Guard, disarming her audiences with humor and personality.

“It’s about selling your story, something people can relate to, more than ‘Let’s talk about this MOS,’” said Varoucha, who moved from Greece to the U.S. in high school. “I’m a female. I’m an immigrant. I barely spoke English when I got here. This is my story … It helps them see themselves through you, that they can do it, too.”

Soft selling the Guard

Varoucha’s massive audience has generated significant recruiting leads, catching the attention of the National Guard Bureau. Last year, its leaders asked her to join forces with Sgt. 1st Class Lewis Swartz, an Army Guard recruiter out of New York City with nearly two decades of recruiting experience.

“We built an entire virtual recruiter program from scratch,” Swartz said.

Whereas Varoucha hits recruits with quick, compelling content, Swartz goes deep, preferring polished YouTube videos that often last 20 minutes or longer.

“She’s really good at short-term content, and I’m decent at long-term content,” he said.

Swartz is being modest. In the past year alone, his digital content has received more than 6 million views, mostly from his nearly 40,000 YouTube subscribers, and all without a single dollar in advertising. The return on investment, he said, is clear.

“The maximum effectiveness of a business card, poster tear-off, banner … is that one individual or group. It ends right there,” he said. “A piece of content or video lasts forever.”

Above all, Swartz is helpful. In marketing terms, it’s his brand. His longform videos provide concrete guidance to potential recruits, offering an unvarnished look into military life.

“I’m more about building relationships, rather than stuffing the Guard down their throats,” Swartz said. “There is no selling involved. My videos are adding value multiple times, and with my way, you are growing a following.”

That following translates into a digital community of trust, where the Guard sells itself. As of press time, Swartz has placed 18 recruits in uniform in FY22 – two more than his annual goal – and 14 of those came through YouTube.

“They’re pretty much already sold by the time they speak to you,” he said. “(You) just have to connect the dots on how you can specifically help them reach their goals.”

‘We still make soldiers’

Like Swartz, Sgt. 1st Class Levar Curry, of the South Carolina Army National Guard, has been in the recruiting game for about 20 years. He remembers clearly the on-site, inperson hustle the gig once required.

“I was going to the schools, doing fitness programs in the gyms, outreaching to the community,” he said. “Basically, it was like there was 20 of me.”

Known affectionately as “Big Sarge” – as much a reference to his oversized personality as his powerlifter’s physique – Curry

eventually began leveraging social media to advance his personal fitness brand. It wasn’t long before he would test the waters with recruiting on social media, as well.

“I said, let me takes some pictures of these kids, put them up, and tag them,” he said. “And they loved it.”

Curry soon began churning out content, often centered on his fitness sessions involving would-be soldiers. Today, it’s not unusual to see a young person on Curry’s digital platforms working out alongside him with heavy chains around their necks, the chains more metaphor than training equipment.

“I instill confidence in them,” Curry said. “If you can push through these burdens, these chains, you have the potential to be a great soldier.”

As passionate as he is about the opportunities digital media offers, he is adamant it needs to be rooted in an “old-school work ethic” and commitment to quality in recruits. Soldiers, he argues, not social media, should remain the focus.

“It’s the future of recruiting,” Curry said. “But I recruit leaders.”

Having placed more than 400 people in uniform over his career, he’s learned that at the end of the day, not much has changed in what makes for a good recruit.

“The foundation is still training, getting down in the dirt,” Curry said. “When they get to basic training, they take their phones, they disconnect them … We still make soldiers.”

Army Reserve Lt. Col. Anh Tran was in elementary school the first time her father showed her how to manage her money wisely.

“My parents didn’t make that much money when we first came to America from Vietnam, and my dad said, ‘Let me show you how to go over our budget,’” Tran said. “I began looking at all their expenses and income, and I thought, ‘I don’t know how they’re doing this.’”

It was a lesson that stuck with her as she grew and eventually became a reservist in 1998. Nearly all her military jobs since have revolved around finance. Today, she is a senior budget analyst for the Office of the Chief of Army Reserve, where she works on the organization’s $5.2 billion annual budget.

In some ways, it’s quite a change from budgeting for her family. Yet in others, the principles remain: people — including guardsmen and reservists — need sound money management skills.

Veteran inclusive

Army National Guard Capt. Jordan M. Thompson became interested in money management as a career after he earned a law degree and lost a political election. A mentor called and asked if he wanted to work in finance. Thompson said he “knew nothing about finance” but agreed to give it a shot.

He quickly became enamored with the industry, eventually settling at a Fortune 500 company as a financial advisor.

“I really feel like I can help a lot of people with this role,” he said.

That includes veterans, as serving those who have served is “very important” to Thompson. He is a member on his company’s diversity, equity and inclusion committee as

the veterans’ committee chairman. He’s also given company presentations on working with military members.

“I’m really big on hiring veterans, so they themselves can be financial representatives and advisors,” he said. “I make it a big part of my practice to help civilians understand how to best help military clients and families.”

As a fraud and claims operations manager for a major bank, Air Force Reserve Master Sgt. Mark Divers sometimes sees an uglier side of finance. But his time in banking has hammered home important military money principles, like budgeting (weekly, in his family’s case), undergoing financial education courses (“I think it should be offered in basic training.”) and setting aside drill or AT pay for specific goals.

Take note of these blunders and prevention methods from Tran, Thompson and Divers:

Failing to budget: Imagine that each of your dollars has a job (rent, groceries, fun money, etc.) and use a simple spreadsheet to ensure they accomplish exactly that.

Avoiding financial literary education: Many bases offer classes on budgeting, building credit, saving for future goals and investments. Take them.

Ignoring your Thrift Savings Plan: Similar to a 401K, the military-offered TSP is a way to save for retirement. The way you handle your account affects your earnings, so research and act accordingly.

Not distinguishing between wants and needs: Just because you really, really want to buy something doesn’t mean you should. Will something bad happen if you don’t get it right now? Or can it wait until you have reached your savings goal?

Overusing credit cards & loans: That nice lady at the PX or bank might have promised all sorts of financial benefits from signing up for her company’s card or loan — but they can be dangerous in too-eager hands. Get used to saying “no” until you are ready to handle the consequences of utilizing loans and credit cards.

“When I became a reservist and realized it was a full-time commitment but not a full-time job, I knew you couldn’t rely on that money — you have to treat the military and your reserve service as supplemental income,” he said. “Take care of the bulk of your budget, bills and savings with the money you make from your full-time employment, then apply the reserve pay to things like your children’s education or paying off your car faster.”

His civilian job isn’t simply a paycheck, either. Serving in finance, Divers said, helps him be a better airman.

“Coming from active duty, where you don’t serve a face but your country, it was kind of eye-opening to now work for a company where you’re customer-focused,” he said. “I think that has actually helped me be a better manager in the military.”

One commonality to both finance and the military, according to Tran, Thompson and

Divers: being able to quickly adapt.

“In the military, the entire mission might change, and finance is also constantly changing,” Thompson said. “In both fields, you have to be willing to look at the situation from different perspectives and have different ways to go about accomplishing the mission.”

Looking for more financial advice?

Scan the QR code for additional coverage.

Sean Thompson, vice president and national renovation manager for Caliber Home Loans, has been in the renovation lending space for more than 24 years and was a top originator in the 2000s. He joined Caliber Home Loans in 2017 and hasn’t looked back.

“I saw a unique opportunity to marry lending with a well-oiled purchase driven mortgage company,” he said.

He’s passionate about serving the military community and supporting service members in using their hard-earned benefits. The VA home renovation loan in particular, he said, is a benefit not used enough.

“The product is designed to give our military customers an opportunity to purchase or refinance a home with intent to repair, update and/or customize,” Thompson said. “Using this product allows the member to use up to $50,000 in simple scope repairs in areas like kitchens, bathrooms or the floor. You can also replace appliances and roofs with it.”

Key benefits of the loan, according to Caliber, include:

• Qualifying for renovation funds from $5,000 up to 75% of the home’s postrenovation value.

• Lowering closing costs due to closing a single transaction.

• Single-family homes, two- to four-unit properties, modular homes, second homes, and homes in Planned Unit Developments are eligible.

• Fixed- and adjustable-rate mortgage options are available.

Many military families have contemplated selling their homes in a hot market but find the supply of new homes is scarce. Using the VA home renovation loan might be the best kept secret for 2022.

for customization, the work has to start within 10 days after your closing,” he said. “You have 75-90 days to complete the repairs and no structural or major repairs can be done with this product.”

Any repairs with this loan product require a general contractor. Thompson encourages military members to get detailed bids from potential contractors.

“Whoever you choose must be registered with the VA as a builder. It doesn’t take that long to get certified but it’s important you let them know up front,” he added.

As military families continue to navigate a challenging housing market, Thompson wants to be encouraging.

“Think about using this style of financing as a way to buy a home being sold at a discount because of its condition and then benefiting from less buyer competition,” he said. “This leads to improved value. Typically home buyers who buy and renovate save thousands compared to buying a home in perfect condition up front.” Scan

“This also makes sense when you are buying a home in less than perfect conditions while putting little down but still need a way to invest in upgrades,” Thompson said.

This isn’t the solution to all of the needs that might arise in an older home but can be a great fix as military members budget and hold out over buying a brand-new home.

“Although you can get as much as $50,000

© 2022 Caliber Home Loans, Inc., 1525 S. Belt Line Rd., Coppell, TX 75019. 1-800-401-6587. NMLS #15622 (www.nmlsconsumeraccess.org). Equal Housing Opportunity. This is not a commitment to lend. All loan programs are subject to credit, underwriting, and property approval. Programs, rates, terms and conditions are subject to change without notice. Other restrictions apply.

VA home renovation loans are a benefit not often taken advantage of, according to one renovation lender.Sean Thompson, vice president and national renovation manager for Caliber Home Loans, says the VA home renovation loan isn’t used enough. Courtesy photo

Nowadays, attaining financial normalcy and understanding is paramount as the cost of gas, food and goods inflate faster than a balloon at Dollar Tree.

And for service members and their families, these precarious financial times can be even more daunting with the burden of spousal unemployment, insurance costs and child care.

But there is help. Several military-related financial podcasts exist for the purpose of guiding active-duty members (and their spouses), reservists, guardsmen and veterans to sound financial health.

Some of the shows have more personality than others but all have something to offer.

Below is a list of podcasts that can answer questions and provide useful advice.

Military Money Show

This podcast explains intelligent ways to make, spend, save and invest money. The host is Lacey Langford, the “Military Money Expert,” a former Air Force information manager. Langford interviews a variety of guests versed in investing, debt, military life, personal finance and entrepreneurship. The podcast airs on Mondays and can be accessed on Stitcher, Spotify, Audacy, Amazon Music and Google Podcasts.

LINK: https://laceylangford.com/podcast

The Military Money Manual Podcast

Military Money Manual Podcast covers many subjects, particularly personal finance in the military, military travel-hacking and investing in the Thrift-Savings Plan. It is framed around

the idea of expeditiously achieving financial independence in the military. The show is hosted by Air Force veteran and certified financial planner Spencer Reese. Episodes are weekly (Mondays) and can be accessed on Spotify, Stitcher, Apple Podcasts, Amazon Music, Audible.

LINK: https://militarymoneymanual.com/ podcast

Operation: Veteran Finance

The education-based Operation: Veteran Finance assists folks in achieving their financial goals and accomplishing their money mission. OVF offers clear and unambiguous investing advice, and savings and planning education for veterans. The podcast, hosted by Army veteran and certified financial planner Garett Sorenson, airs every other Friday and can be accessed on Apple, Spotify and Castro.

LINK: https://www.operationveteranfinance. org/episodes

The Military Millionaire Podcast

The show focuses on helping service members, military spouses and veterans build wealth through real estate investing, entrepreneurship and personal finance. The podcast is hosted by reservist and Marine veteran David Pere, and Alex Felice. (The duo occasionally drop single-word profanities.) Pere says service members still don’t have access to the necessary information that allows for financial freedom in the military. They’re trying to change that. You can listen to the podcast on Fridays, but it fluctuates between weekly and bi-weekly episodes. It can be accessed at Apple Podcasts, Spotify, Amazon Music, Stitcher.

LINK: https://www.frommilitarytomillionaire. com/podcast-episodes

Militarily Speaking (Armed Forces Bank)

Militarily Speaking launched this year and is committed to advising the military community on military life and how to navigate finances. The program shares stories and insights about effective and poor financial practices, while furnishing strategies to help service members get in front of their finances. The show also highlights resources for PCS moves and transitioning to civilian life. Militarily Speaking is hosted by Armed Forces Bank executives Tom McLean and Jodi Vickery. It is a bi-weekly Wednesday podcast, accessible at Audible, Spotify, Amazon Music and Blubrry, Apple Podcasts and Google Podcasts.

LINK: https://www.afbank.com/media/ category/podcasts

Navy Federal Credit Union MakingCents Podcast

This podcast investigates ways to help military members, their families and veterans remain in control of their personal finances, e.g., rethinking budgets, mortgages, status transition, etc. “I’m a Navy brat from Coronado, California, and growing up, I experienced firsthand how the military lifestyle can make basic finance questions a bit more complicated,” said show host Emily Bingham in a podcast. The program airs sporadically, with the latest episode posted in May. It is accessible at Apple Podcasts, Google Podcasts, Spotify.

LINK: https://www.navyfederal.org/ makingcents/podcast.html

Just days after Air Force Maj. Gen. Ondra Berry assumed the role of adjutant general for the Nevada National Guard in September 2019, the unit lost Army Staff Sgt. Chase Rauchle to suicide – the state’s sixth such loss in four years.

Chase’s parents, Craig and Julie Rauchle, founded Chase Rauchle PTSD Now! later that month, with the familiar acronym instead standing for “Prevent & Treat Stress & Depression.” They and Berry wanted to prevent more deaths by suicide. The result is Purple Resolve, a two-day wellness and leadership program. It’s improving Nevada guardsmen’s lives, and other states are following suit.

Chase had a hard time finding the right treatment; he was also concerned that if he admitted he was having difficulties, it would sideline his career in the National Guard, Craig said. So Craig and Julie did some research, and discovered the Nevada National Guard had just three directors of behavioral health for their 4,500-strong force.

“You don’t have to be a mathematician to know that’s woefully inadequate,” Craig said.

They also discovered that due to the Guard’s unique command structure, with the governor at the top of the chain, there were state

programs, like the Department of Veterans Services, that could accept money from a nonprofit, instead of having to work within the Department of Defense’s bureaucracy.

In April 2021 PTSD Now! presented $200,000 to Nevada’s DVS to fund two therapists. The setting for counseling was important to the Rauchles, Craig said, because they understood service members might not want to draw attention to themselves by sitting in a civilian therapist’s waiting room in uniform.

But that didn’t seem like enough.

The Rauchles wanted to help service members get ahead of mental health crises. The search led them to Blue Courage, a resiliency training program for law enforcement officers. Blue Courage’s team had instructors who had served in the military, which helped them adapt it and create Purple Resolve.

George Belsky, who spent five years on active duty as an infantry officer before joining the reserves for another seven years while working for the United States Postal Inspection Service and ATF, said he was happy to do anything to

help the military. He had joined Blue Courage because the philosophy aligned with that of Marcus Aurelius, considered the last of the Roman Empire’s Five Good Emperors. He was also one of the Stoic philosophers who believed in the virtues of courage, temperance, justice and wisdom.

“You go back to the Spartans, you go to ancient Greece, you go to Rome – they’re all the stuff we think of as touchy-feely in the 21st century,” Belsky said.

The first pilot sessions took place in June 2021, followed by train-the-trainer sessions, with the goal of having it become contained within the Nevada National Guard. Attendees get a manual, to remind them of the lessons, and a mirror to prompt selfreflection, which Berry said he sees soldiers and airmen carrying around to stay anchored to the training.

The state’s chaplain, Army Maj. Todd Brown, went as a regular attendee first but has since been trained to teach the program. He said that unlike other suicide prevention programs the Army has offered, this one is more preventive and less of a fire extinguisher.

“We do some fantastic training, giving people skills and abilities to do whatever their job is,” Brown said. “To my awareness, we’ve never done anything that says, ‘Hey, let’s help our soldiers and airmen, our service families, their families, let’s help them understand. Let’s help this give them tools that they can work on their heart and their mindset.’”

Berry said Purple Resolve breaks tradition, taking service members off automatic and challenging them to consider whether they’re living their best life.

“I think the question that you always have to answer when you’re creating an initiative or development opportunity is one, are you really creating well-being for your people? Are you really creating something that’s going to take care of them overall –mentally, physically, emotionally, spiritually?” Berry said. “And the second thing is, are you really helping them develop skills and putting things in their toolbox that will help them to reach their full potential and also take care of themselves and their families and their coworkers?”

The program’s “Pattern Interrupt” concept, in which a person would take 60 seconds for deep breathing to reset a situation, is a favorite takeaway of Berry’s. It’s also helped Army Spc. Luis Moran, who said it’s helped keep difficult conversations with his leadership from going awry. The lesson on courage taught Moran he can ask for things, like a chance to take a breath.

Moran also credits the training with keeping him centered. He pivots between his main MOS, truck driving, and human resources assignments, while pursuing a degree in business accounting and working a part-time civilian security job. He’s taken other personal development courses, some recommended to him after a friend and several relatives died in two years, but he returns to the lessons from Purple Resolve to remind himself to stay focused.

The Nevada National Guard makes Purple Resolve available to its troops, civilian contractors and military family members. As of late May, 300 attendees had completed the two-day training; they also offer a condensed version to all incoming soldiers and airmen. Brown said he’s heard rave reviews, getting emails, texts and phone calls about crazy positive changes. Berry said the metrics available so far indicate it’s having the intended effect: recruitment

is up; participation in the Army side’s Defense Organizational Climate Survey was increased, with improvement shown in every category; more people are seeking mental health support, and he can tell his soldiers and airmen are standing up straighter.

“Three quarters of our force I don’t see on a regular basis, so this is something they can carry with them, not just in their military life, not just in their civilian life, not just in their family life, but in their personal life,” Berry said.

For more information, visit https://www.bluecourage.com/ purple-resolve.

Here’s a quick heads-up on five techrelated trends that are sure to make tomorrow’s headlines — and maybe even your unit’s property book:

Designed to support dismounted infantry troops with a turreted 105mm cannon, the four-person Mobile-Protected Firepower (MPF) tracked vehicle is slated to be fielded to at least one U.S Army Infantry Brigade Combat Team as early as 2025. Approximately 30 tons lighter and smaller than the M1 Abrams main battle tank, the vehicle will be air-transportable by C-17. (Despite its appearance and functionality, however, developers balk at calling the MPF a “light tank.”)

A $1.14 billion contract for an initial 96 vehicles was recently awarded to General Dynamics Land Systems, with 26 of the vehicles projected to be produced by December 2023. The Army plans to field four battalions’ worth by 2035.

Armored up, but still manned — for now

The venerable M1 Abrams tank notably continues to be updated and upgraded throughout the Total Force. In 2023, for example, the Tennessee National Guard’s 278th Armored Cavalry Regiment is scheduled to change out its M1A1 Abrams for approximately 90 Abrams M1A2 SEPv3.

The alphabet soup stands for “System Enhancement Program, version 3,” but you can call them V-3s or Vic-3s.

Two other units, Minnesota’s 1st Armored Brigade Combat Team, 34th Infantry Division and North Carolina’s 30th Armored Brigade Combat Team, are on the docket for the V3 upgrade by fiscal year 2025. Both active-duty and reserve units will operate V2 and V3 models.

Upgrades to the M2A3 version of the Bradley Fighting Vehicle are also in store for the Tennessee unit, as it’s slated to receive an equipment transfer from an active-component unit upgrading to the A4 version.

Meanwhile, results toward an Armywide acquisition of a proposed replacement to the Bradley might be soon available. After canceling an earlier design competition, the U.S. Army awarded a $299.4 million contract to five companies in January 2021 to develop Optionally Manned Fighting Vehicle

(OMFV) prototypes for mid-2023 delivery.

Drivers, don’t quit your MOS, however: Industry observers speculate that initially fielded OMFV designs won’t be fully autonomous. Rather, they’re more likely to feature optional “tele-operation” or remotecontrol modes.

Looking like a bit like the lozenge-shaped robot from “Lost in Space” (1998), the U.S. Air Force Agility Prime prototype is just one effort to develop an electric-powered vertical take-off and landing (VTOL) platform — a “flying car” that doesn’t use fuel. Earlier this year, Lift Aircraft’s 16-propeller Hexa platform was successfully demonstrated to an audience of airmen at Hurlburt Field, Florida. Sparked via the Air Force Research Laboratory privatepublic partnership hub known as AFWERX, the Air Force has requested funds to acquire five such eVTOL platforms in FY 23.

Dancing robots are often featured in viral internet videos, but 142nd Security Forces Squadron personnel at the Portland Air National Guard Base, Oregon, recently fielded at least one semi-autonomous “robot dog,” with plans to acquire a total of three. Humans can run patrols either remotely or working alongside the QuadrupedalUnmanned Ground Vehicles. Developers of similar products see potential not only in augmenting security, but in other military missions such as Explosive Ordnance Disposal.

Autonomous systems continue to be of interest in emerging ground and air transportation research as well. In early 2022, Defense Advanced Research Projects Agency personnel demonstrated an “Aircrew Labor InCockpit Automation System,” flying a pilotless UH-60A over Fort Campbell, Kentucky, for approximately 30 minutes. In 2021, as part of the annual Project Convergence event hosted by U.S. Army Futures Command, 82nd Airborne Division soldiers at Yuma Proving Ground experimented with using tracked “expeditionary modular autonomous vehicles” to assist in tactical supply missions.

Army aviation seeks a big lift ... or two

Two U.S. Army Future Vertical Lift (FVL) programs are nearing next phases toward acquisition and fielding. One FVL program seeks a potential troop-carrying replacement for such rotary-wing workhorses as the UH-60 Blackhawk and CH-47 Chinook.

Announcement of design-competition results from the Future Long-Range Assault Aircraft (FLRAA) effort are predicted to be forthcoming by end of this fiscal year. Prototypes would be required by 2025, with fielding to the operational force by 2030.

In competition are V-280 Valor tilt-wing aircraft from Bell, and the double-rotored tailpusher Defiant X from Sikorsky and Boeing.

With the Total Force’s current fleet of UH-60s split 60-40 between the National Guard and active component, leaders in both are eager to see how the FLRAA selection plays out — not only in terms of new capabilities, but also new challenges in fleet maintenance and personnel management.

The second FVL program seeks a replacement for rotary-wing scout attack aircraft such as the OH-58 Kiowa. Still in competition is the two-seater 360 Invictus

from Bell, and the two-seater Raider X from Sikorsky.

The latter shares technology developed for the Defiant X utility platform. A fly-off for the Future Attack Reconnaissance Aircraft (FARA) program could be scheduled as early as this November, but any announced results may have to wait for 2023.

In the meantime, the National Guard continues to maintain and improve its heavily defended fleet of AH-64 Apaches.

Under a 2013 Aviation Restructuring Initiative, the Army proposed pulling all AH-64 aircraft into the active component, a move that

was successfully resisted by National Guard leaders and lobbyists.

At the same time, the initiative also retired the aging OH-58 fleet across the Total Force. Starting in June of this year, South Carolina Army National Guard’s 1st Attack Reconnaissance Battalion (ARB), 151st Aviation Regiment, began taking delivery of 24 new AH-64E version 6 Guardian aircraft. Accelerated plans call for the National Guard’s three remaining attack-helicopter units — North Carolina’s 1st ARB, 130th Attack Regiment; Utah’s 1st ARB, 211th Aviation Regiment; and Texas’s 1st ARB, 149th Aviation Regiment — to take similar deliveries by end of FY 2026.

The National Guard recruitment office was the last place Lacey Perry expected to be. When she walked through the doors 12 years ago, even the guardsman working that day was taken aback by her visit.

“I said, ‘I’m looking for a recruiter,’ and he goes, ‘For your son?’ and I said, ‘No, for me,’” Perry laughed.

She was 30, older than most of the other recruits, and she hadn’t considered enlisting until she met her husband.

His service to the Air National Guard had brought him to her home state of Arizona and witnessing the passion he had for his career piqued her interest.

“I saw all of the great things he was doing, and I thought, you know, I want something that’s special too,” she said.

At the time, she worked for the local county government’s parks and recreation department, a job she’d kept for nearly 15 years. She was aware enlisting would come with education benefits, but she didn’t think much about them as she’d already received a bachelor’s degree.

Perry enlisted as an intelligence analyst for the 162nd Wing at Morris Air National Guard Base. In 2014, after 11 months of training, she was commissioned as a public affairs officer. She originally intended to return to work for the county but couldn’t pass up an opportunity she received to work for the Arizona Air National Guard full-time.

An unexpected career twist

Eight years into working for the Arizona Air National Guard, opportunity knocked again. This time, it came as an email about a market executive opening with Bank of America in Tucson from a mutual contact.

“The president of Bank of America actually sent me the job description and said, ‘You may know someone who has these qualifications.’ I looked at the job description and thought, ‘I have those qualifications! I can apply and see what happens.’”

The thought of working for corporate America made Perry feel “pretty nervous and a little bit scared,” but she nailed the interview and got the job.

“On a Sunday afternoon, I changed from my uniform to business clothes and hopped on a plane where I started with the bank in Philadelphia at a high-level conference,” she said. “I went right into the frying pan with meeting people and really being introduced to the culture. I think it really just excited me, and it motivated me and inspired me that I had made the right choice.”

Most people are aware military service comes with potential educational benefits. However, the perks of working for corporate America aren’t always as obvious. According to a survey from global management consulting firm McKinsey & Company, 30% of employers offer education or training outside the workplace, but only 12% of employees know what benefits they can receive through jobs.

Perry admitted when she started at Bank of America in 2018, she was surprised to learn the company had its own tuition assistance program. Bank of America provides $7,500 per year for learning and career development through tuition assistance. Most of that is taxfree, as the Internal Revenue Service allows private companies to provide up to $5,250 in non-wage educational assistance to their employees each year, as long as it’s related to an employee’s position with the company.

Although the stresses of raising two children, working a full-time job and serving in the Air National Guard were overwhelming, Perry saw an opportunity to go after a recent goal of further education when the COVID-19 pandemic shut things down in early 2020.

She enrolled in the Master of Organizational Management Program at Northern Arizona University and completed her coursework this spring.

With a bachelor’s and master’s degree under her belt, Perry has chosen to give her Post9/11 GI benefits to her 9-year-old daughter. It’s a perk she didn’t anticipate when she walked into the recruiting office all those years ago. Her husband plans to give his to their youngest child.

“To me, it is so thrilling, the thought that she’s going to be able to go to school and not have the weight of student loan debt or have to take on a full-time job to be able to attend school,” Perry said. “She is going to be able to have the freedom to choose her career [and] to go to the college that she wants to.”

Perry believes the biggest hurdle that keeps guardsmen from maximizing their benefits is simply awareness.

“You are your own advocate, and you can blaze your own path of being able to research the benefits available to you, both on the military and the civilian sides,” she said. “I think a lot of times, it’s just the absence of knowledge of what is possible that kind of holds people back. Make sure you’re taking advantage of opportunities for mentorship, volunteerism and networking – the power of networking is super important and making those connections and knowledge can’t be understated.”

She credits her success to the support of her leaders in both roles. Currently a captain,

Perry plans on using her new education to continue progressing in the military and the workplace. Her next goal is to be promoted to the rank of major with the Arizona Air National Guard.

“(Education) has really broadened my knowledge on a lot of the topics especially relating to corporations and what’s important about project management and strategic planning, some of the things that I haven’t encountered in the military,” she said. “I intend to take that knowledge and apply it both on my military and civilian career sides.

The National Guard was established on Dec. 13, 1636. Over the course of more than 350 years, guardsmen have responded to natural disasters, deployed to war zones, supported local law enforcement and participated in ceremonies honoring fallen service members. Here’s a look back at the history of the Guard.

Here is one woman’s story, along with advice from an expert.

When her son started getting calls from recruiters outlining the potential benefits of joining the reserves, Amanda Struck had a thought: Might that be an option for her, so she could finally pay down her school debt? As it turns out, it was.

Struck, 39, a former Wisconsin politician, is in the process of joining the Army Reserve. She has about $80,000 in student debt, which she racked up as a single mother putting herself through school. Although she hasn’t signed her papers yet, she was told the Army would give her about $60,000, she said.

The Appleton, Wisconsin, resident served six years as a state representative until 2020. She now works for a nonprofit.

Struck said last fall, she was on the phone with a recruiter when she stopped him midsentence to ask what the minimum age was. He replied that at her age, a waiver could be obtained, she said.

Once she gathered all the information, she decided “pretty quickly,” she said.

“I left politics, the career I thought I was going to be in forever, and I was figuring out what I wanted to do,” she said. “I thought this was perfect: a way to pay down my debt and also find a new challenge for me.”

The process of joining, however, has been lengthier than expected, she said.

For one, the medical review is more extensive nowadays, particularly for older recruits. Also, initially she was told she couldn’t join as an officer, despite having a master’s degree in public administration. A second recruiter later said her degree did qualify, and she passed her interview with the OCS board in September, she said.

Struck has two sons, a 19-year-old and a 13-year-old. After borrowing money to earn her undergraduate and master’s degrees, she hadn’t been able to make a real dent in her debt for a decade, she said. She tried to apply for loan forgiveness but was turned down because she didn’t always make payments on time, she said.

“I don’t know that I will ever come out from under that unless I do something like this,” she said.

Struck said she never considered joining the military while growing up because she was too

scared of leaving for unknown places.

“I think I would be a much better asset now as somebody older and more mature,” she said.

The lengthy process of joining the reserves has been a bit frustrating, and there are certainly potential risks to the job, Struck said, but she’s still looking forward to serving her community in a new way.

So how does paying down debt by joining the reserves work? Here is information and advice from Heather Walrath, education presenter and military benefits liaison for Navy Mutual.

Q. Are there differences in paying down debt when joining different reserve branches?

A. Each service has separate criteria. Some signing bonuses are a lump sum, some are paid over monthly or yearly installments. The amounts also vary, depending on the needs of the service and its specific career fields. Eligibility for bonuses is constantly changing. Anyone interested need to be vigilant to research and find the current policy at the time that they join.

Q. Are there specific kinds of debt that one can pay down?

A. You can use the money in any way you see fit — pay down student loans, credit cards, mortgages or build up a savings account. However, signing bonuses are taxable. Depending on the person’s total income, that could push you into a higher tax bracket. Keep in mind that getting the money could also lead to more debt, for example, if you use it to buy a car. You need to be committed to having a plan for that money and resist the temptation to spend it. There are some

One of the benefits of serving in the reserves is getting help in paying down debt, but the decision to join must be made carefully and for good reasons.

specific programs that offer student loan repayments, with specific parameters for repayment to student loan accounts, but they are not offered by all services or for all career fields. Joining the reserves also gives you access to personal financial counselors for free, so that’s another avenue to help you pay down your debt.

Q. Are there “best” candidates to pay down debt through the reserves?

A. Someone who has a desire to serve their country and would be prepared to deploy when ordered. That being said, service can come with some financial incentives, especially during deployment, where you might have the ability to earn tax-free income and other deployment benefits, such as the Savings Deposit Program. The reserves also provide access to health care. A single person might be more likely to consider joining, as opposed to a married person, due to the possibility of deployments.

Q. What happens if you quit the reserves before the end of your contract/ commitment. Do you have to give back the money?

A. It depends on the service and the contract under which the bonus was awarded. However, in most cases the signing bonus is going to have to be repaid, at least partially. That’s one reason the bonus might be paid over several months or years, to make sure the person can complete their commitment. Keep in mind, in most cases you cannot “quit” your commitment. If you don’t make it through training, they may switch you to another career field that does not have a bonus. Or, depending on the situation, a discharge other than honorable could have consequences, including financial.

Q. Should people consider joining the reserves solely to pay down debt?

A. Absolutely not. Joining the reserves should be done because a person has a desire to serve. The reality is that you will likely be called to deploy, at least at some point, and when those orders are issued you cannot say, ‘No.’ When you deploy, you may be away from your family for a long period which can lead to more costs (child care help for the stay-at-home parent, car storage, pet care, etc.). Someone with a family might also consider buying life insurance, in addition to the one offered by the military, so that’s another expense to consider. Also, while your civilian employer has to re-employ you under the Uniformed Services Employment

and Reemployment Rights Act, you may make less money while you are deployed, based on your rank and pay grade. (Of course, you could also make more, based on your circumstances). When people join the reserves, they should consider using any signing bonus to build up their savings in case they need to supplement their income when deployed. It’s important to note that under the Servicemembers Civil Relief Act, when you’re activated, the interest on any existing loans you have, like your car payment, is reduced to 6%. The idea is that your military service should not be a financial detriment to you.

A. There are many nonprofit consumer counseling services that people can work with. Also, many cooperative extension programs have personal finance classes, as well as online resources available from the federal government that can assist with creating a spending and debt repayment plan. Employers might offer financial counseling or education programs for their employees.

The National Guard is no longer “one weekend a month, two weeks a year.” And hasn’t been for some time, according to Army Maj. Gen. Eric K. Little, director of National Guard Bureau Manpower and Personnel, which was taken into consideration when launching a child care pilot program earlier this year.

“Taking care of our soldiers is our No. 1 priority,” Little said during a media roundtable in early September, noting that weekend child care “continues to be topic of discussion.”

The Guard budgeted $3.6 million for the first wave of the pilot program, which is funded through federal appropriations. The six participating states – Massachusetts, New Hampshire, New Mexico, Ohio, Virginia and Washington – are not contributing funding. There’s also no cost for the guardsmen using the service.

When you support St. Jude Children’s Research Hospital®, you’re helping save children everywhere. St. Jude shares its groundbreaking discoveries, and every child saved at St. Jude means doctors and scientists worldwide can use that knowledge to save thousands more children.

The pilot began Sept. 1 for guardsmen in good standing under the following requirements:

- Available to single and married soldiers.

- The soldier’s spouse or significant other must also be scheduled to work during the drill weekend.

- A maximum rate of 12 hours.

- Children must be between 6 weeks and 12 years old.

Current National Guard Bureau data shows that 35% of Army National Guard service members have children, and 9% are single parents.

A lot of feedback the Guard has received regarding child care comes from surveys and full-time family readiness personnel.

“If you’re a single parent or even a married parent, it’s just a challenge,” he said, “being gone for a drill weekend. Nowadays, drilling location is not as close to the home of record

as it used to be back in the day.”

However, Nadine Moore, family readiness branch chief, said there is no data on guardsmen who miss drill periods due to child care challenges.

Child care facilities, including in-home day care, must be accredited and certified, Little said, though certification does not have to be through the Department of Defense. The current pilot program states were selected, in part, due to the fact that they already had an accreditation process in place.

The program will run for six months, at which time there are plans to add additional states “if we get the data that we need moving forward,” according to Little.

The pilot program is being conducted in partnership with the Army. Soldiers interested in seeking child care through the

program should first go to their commander, after which Child Care Aware of America (CCAA) would search for a provider.

Moore said the soldier will visit the CCAA website to download an enrollment form packet that includes the application, as well as commander and spouse verification forms.

Commanders will counsel soldiers on program

rules, according to Moore, including no-show and cancellation policies and to validate eligibility.

Once the enrollment packet is submitted to CCAA and validated on their end, soldiers will be notified within 10 days that they’re enrolled in the program. Child care reservation requests, which can be made for up to three months, can then be made on the CCAA website.

Commanders will have to certify that the soldier attended drill.

Moore said the systems that have been set up to support the Army’s full-time child care program are the same ones being used for the Guard’s pilot program.

There will be a better gauge of “true soldier interest” following the first big drill weekend, which was scheduled to take place Sept. 10-11, according to Little.

For more information, or to apply for child care through the pilot program, visit https://www.childcareaware. org/fee-assistancerespite/militaryfamilies/army/arngwdcc/.

“If you’re a single parent or even a married parent, it’s just a challenge being gone for drill weekend.”

– Army Maj. Gen. Eric K. Little

“When you look at that, lieutenants coming in now – 40-plus years after I came in the Army – are on the same equipment,” said retired Gen. Robert Brooks Brown, AUSA’s president and CEO, noting that while the same, the versions have had upgrades over the years.

Those modernization goals also are evident in the U.S. response to Russia’s invasion of Ukraine earlier this year, according to Brown.

“Right now, we’re looking very closely at the terrible aggression of Russia and what’s happening,” he said. “[We] look at so many lessons from that. The majority of them are proving modernization priorities exactly right.”

AUSA’s modernization efforts are focused on the following key areas:

1. Long-range precision fires;

2. Next-generation combat vehicles;

3. Future vertical lift;

4. Air and missile defense;

5. Network and soldier lethality.

Of those, the most notable to Brown has been long-range precision fires.

“We’re seeing, holy smokes what a difference … That’s critical to what’s happening in Ukraine,” he said.

Brown also said he’s “positive” the Army is moving in the direction of “multi-domain operations.”

“And again, we’re seeing that in Ukraine play out in everything from drones to cyber impacts and everything else,” Brown said. “The multidomain’s going to be key. It’s so much more complex than when I first came in the Army.”

In creating those priorities, Brown said, the Army “really led all the services.”

“It’s not easy to predict what the future’s going to look like,” Brown said. “We started to see more and more what was happening, while involved in two wars.”

At the same time, he said, Russia and China were “looking and learning” from the U.S. amid Operations Desert Shield and Desert Storm.

“You can see where China’s influence used to be right off the coast, and now it extends thousands of miles,” Brown said.

It became clear, according to Brown, that the Army needed to modernize and that future conflicts will be combined and joint.

“No service is going to enjoy advantages like we did in the past,” he said. “No service alone. Because others have prepared for that.”

There are “some real challenges” in recruiting, according to Brown, partly because only 23% of the population between 18 and 25 years old is eligible to serve in the military. Hindrances to service include physical or weight limitations and drug usage.

Plus, the trend of military service in families has led to “a warrior class,” according to Brown.

“People will be like, ‘Well my son or daughter doesn’t need to serve because these folks are serving,’” Brown said. “[But it’s] such a good thing. The experience of service will help your whole life whether you stay in three years or 30.”

Unemployment rates and remote work also lend themselves to the challenge of recruitment, Brown said. However, he said it’s also important not to lower the quality of those in uniform.

“It’s better to have fewer folks in the Army and maintain the quality than to lower the quality,” Brown said.

Competitive compensation – one of AUSA’s priority goals – is “always a factor” where recruitment is concerned, Brown said.

“It’s amazing to have watched that over the years, where 20 years ago it was not competitive,” Brown said.

In a first for AUSA’s annual meeting, junior leaders from across the Army – active, Guard and reserve – participated in a Junior Leader Solarium.

“[The participants are] handpicked by their chain of command,” Brown said.

They were given problems to solve, and key leaders in attendance at the annual meeting spoke with the junior leaders and sat in on some of the forums to learn from each other.

The defense industry also attended the meeting with the “latest and greatest” technology.

The Association of the United States Army focused on “Building the Army of 2030” at its annual meeting, paying particular attention to recruiting, retaining and training; modernization; and moving toward 21st century technology. For more information regarding future AUSA events, visit https://www.ausa.org/.

“Every annual meeting I went to, I saw things I always wanted or things I didn’t even think about ... and it’s really awesome to see all the capabilities,” Brown said.

As of press time, Brown said they expected close to 40,000 attendees at the annual meeting, which was held Oct. 10-12 in Washington, D.C.