IN THIS ISSUE

Message from the editor, Shayna Wiwierski – 3

Yukon preparing to overhaul its mining laws – 4

ATAC Resources Ltd. announces signing of definitive agreement with Hecla Mining Company – 6

Metallic Minerals:

Exploration and production in Yukon’s iconic mining districts – 10

Gold Terra looking for more high-grade gold deep under the former Con Mine underground workings – 12

Sixty North Gold Mining Ltd. prepares for gold production – 14

Canadian mining companies recognized for excellence in sustainable mining – 15

Supporting apprenticeships is the key to a strong workforce – 18

Stepping into the future: Yukon’s mining industry – 20

Standards, safety, and a good time: The CDDA Convention – 22

Unlocking transparency: Onyen ESG Scorecard empowers companies with data required for TCFD disclosures – 24

PDAC 2023 Convention welcomed 23,819 attendees to world’s premier mineral exploration and mining event in Toronto – 27

Preliminary estimates: Mineral exploration to fall in Canada’s north – 28

Why industry needs more mentoring and networking to foster growth and inclusion – 30

How SRC is using metal smelting for rare earths – An overview – 32

MINING your

DEL CommuniCations inC. www.delcommunications.com

President & CEO DaviD Langstaff

Managing Editor

shayna WiWierski shayna@delcommunications.com

Director of Online Marketing MiC PatersOn mic@delcommunications.com

Advertising Manager Dayna OuLiOn

Sales Representatives brent astrOPe | brian gerOW

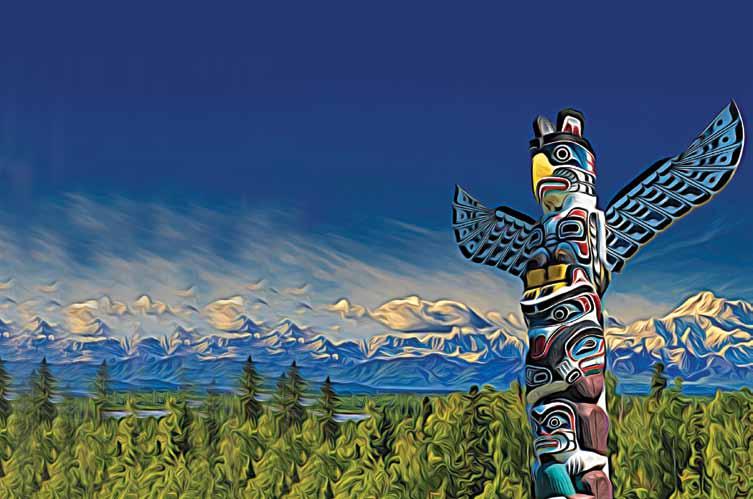

Cover Photo Courtesy of sixty nOrth gOLD Mining LtD.

Contributing Writers

Maryann DeutsCher | Jess staffen gary vivian

© 2023 DEL Communications Inc.

All rights reserved. Contents may not be reproduced by any means, in whole or in part, without the prior written permission of the publisher.

While every effort has been made to ensure the accuracy of the information contained in and the reliability of the source, the publisher in no way guarantees nor warrants the information and is not responsible for errors, omissions or statements made by advertisers. Opinions and recommendations made by contributors or advertisers are not necessarily those of the publisher, its directors, officers or employees.

DEL Communications inc. and miningnorthof60.com are extremely grateful to our advertisers for their support in this publication. We invite you to visit their sites by clicking the companies below.

message from the editor shayNa

Welcome to the latest edition of Mining Your Business

e-newsletter. As the snow melts and the land awakens from its icy slumber, we find ourselves once again immersed in the vibrant world of mining that defines the unique character of this region. It is with great pleasure that I bring you stories, insights, and developments that showcase the unwavering spirit of the North and the remarkable contributions made by the mining industry.

Northern Canada has long been a land of extraordinary potential, with vast reserves of precious minerals lying beneath its rugged terrain. The mining sector, deeply rooted in the fabric of these communities, has played a pivotal role in shaping their economic landscapes, fostering growth, and providing valuable employment opportunities. Our biannual e-newsletter aims to shine a spotlight on the people and projects driving this dynamic industry forward.

In this edition, we delve into the innovative technologies and practices that are revolutionizing mining operations across the North. From exploration and production to innovative technologies, the integration of cutting-edge advancements is enhancing efficiency, safety, and sustainability. We celebrate the pioneering efforts of mining companies, highlighting their commitment to responsible resource extraction and environmental stewardship.

Our e-newsletter also serves as a platform for fostering collaboration and knowledge-sharing among industry professionals. We encourage you to explore the informative articles, technical insights, and thought-provoking op-eds contributed by experts and leaders in the field. Together, we can forge new partnerships, spark innovative ideas, and build a brighter future for mining in Northern Canada.

I hope you enjoy Issue 1, 2023 of Mining Your Business e-newsletter and we hope you will help us spread the message about this exciting publication to your colleagues

and friends. Also, if you haven’t signed up already, we invite you to share this and to sign up for our newsletter at miningnorthof60.com/mining-your-business/.

Finally, we wish to thank all the companies who have contributed a story for Issue 1, 2023 of Mining Your Business Special thanks go out to the following contributors:

• ATAC Resources

• The Canadian Diamond Drilling Association

• Gold Terra

• Metallic Minerals

• The Mining Association of Canada

• NAPEG

• NWT Apprenticeship

• The PDAC

• Sixty North Gold Mining Ltd.

• Saskatchewan Research Council

• WiM/WiN Saskatchewan

• The Yukon Chamber of Mines

• Government of Yukon

We invite all interested companies to share their news and editorial ideas with us. If you would like to contribute a story for future issues of Mining Your Business e-newsletter, please contact myself at shayna@delcommunications.com.

Also, if you haven’t read it already, the 2023 issue of our flagship publication, North of 60 was released earlier this year. You can read it via our official site, miningnorthof60.com.

Enjoy!

Shayna Wiwierski shayna@delcommunications.comyukon preparing to overhaul its mining laws

Mining has deep roots in the Yukon, going back 125 years to the Klondike Gold Rush. The industry has helped drive the territory’s economy, led to the development of critical infrastructure, and created well-paying jobs for many Yukoners over several generations. Mining remains the largest sector of the economy outside of public administration.

The early quest for gold, and what came after, fundamentally changed life for the territory’s Indigenous peoples, with impacts on families, language, culture, and traditional economies. Mining has also had an impact on our environment, and in some cases, this has resulted in sites that require significant government investment to clean up.

We are now undertaking a process to develop new minerals legislation that will replace the Quartz Mining Act and the

Placer Mining Act. Core components of these current laws are more than a century old and through this work, we’re hoping to develop forward-looking legislation that will support responsible mining in the Yukon for many years to come.

From February 8 to May 9, 2023, we held a public engagement to hear the public and industry’s views on the ideas and potential approaches we’ve developed for new minerals legislation. The input we’ve received will help us decide on the best approach as we move forward in our process to develop new legislation.

Our aim with the new legislation is to improve the management of the Yukon’s mineral resources in a way that respects Indigenous rights, strengthens the Yukon’s economy, supports a competitive and responsible mining industry, protects the

New legislation will address stage of the mining cycle, from prospecting to the operation of a mine, and the eventual closure and cleanup of the site

environment, allows for the integration of other land uses and values, and supports the modern-day needs of Yukoners.

We also know that some minerals will play a critical role in supporting the transition to an emerging green economy. This transition will rely on critical minerals, some of which like copper, zinc, and tungsten are found in the Yukon. As we think about the future of mining in Yukon, it will be important to consider how Yukon’s critical mineral resources might contribute to tackling climate change.

The work to renew Yukon’s minerals legislation is being undertaken by the Yukon government in collaboration with Yukon First Nations, transboundary Indigenous governments, and the Council of Yukon First Nations. We’ve been working together since the autumn of 2021. Since then, we’ve worked to break down the current mining regime into its components, identified key policy issues behind each

component, and developed a suite of potential approaches and considerations for each key policy issue. This collaborative work has been supported and informed by representatives of the Yukon’s mineral exploration and mining industry, as well as environmental organizations. We have also engaged an independent researcher to understand and get advice on the socio-economic implications of mining.

Our work builds on the findings of the independent panel that produced the Mineral Development Strategy in 2021. Many of the strategy’s recommendations referred to and were premised on the need for new minerals legislation.

The Government of Yukon supports a strong, viable, and responsible mining industry. New minerals legislation will better reflect Yukoners’ relationship with the land and will support our industry and territory for the next 125 years and beyond. 7

Fluor Driver Inc. is a recognized leader in plant maintenance, turnarounds and capital projects across Canada.

Our mission is to maintain and improve the performance of our clients’ industrial assets. Our methods result in sustainable performance improvements by reducing plant downtime and quickly returning assets to full operating mode.

The work to renew Yukon’s minerals legislation is being undertaken by the Yukon government in collaboration with Yukon First Nations, transboundary Indigenous governments, and the Council of Yukon First Nations.

aTaC resources Ltd. announces signing of definitive agreement with hecla Mining Company

ATAC Resources Ltd. (ATAC) (TSX-V:ATC, OTCQB:ATADF)

is pleased to announce that further to its press release dated February 21, 2023, the company has entered into a definitive agreement (the “Arrangement Agreement”) with Hecla Mining Company (Hecla) (NYSE:HL) whereby Hecla will acquire all of the issued and outstanding shares of ATAC for consideration payable in shares of Hecla and in shares of a new exploration company, named Cascadia Minerals Ltd. (Cascadia). The consideration will consist of 0.0166 common shares in the capital of Hecla and 0.1 common shares in the capital of Cascadia for each one ATAC common share held. The Hecla shares to be received by ATAC shareholders represent a value of C$0.14 per ATAC share held based on Hecla’s five-day volume-weighted average trading price ending on April 3, 2023.

The transaction consideration represents value to ATAC shareholders of C$31 million in Hecla shares and a value of approximately C$8 million in Cascadia shares based on Hecla’s C$2 million placement. The Hecla shares provide ATAC shareholders with a premium of 66 per cent based on ATAC’s 20day volume-weighted average price of C$0.0845 as of February 17,

2023, the last trading day preceding announcement of the letter of intent, or a 109 per cent premium when including the value of Cascadia shares received.

Benefits to ATAC Shareholders:

• Immediate premium: The transaction consideration represents a significant premium to ATAC’s pre-announcement share price;

• Trading liquidity and capital markets profile: Ownership in Hecla provides ATAC shareholders with increased liquidity and an enhanced capital markets profile via ownership of Hecla shares, which has a market capitalization exceeding US$3.5 billion;

• Hecla ideally placed to advance the Rackla Gold Property (Rackla): Hecla’s strong balance sheet, technical abilities, and operating experience in the Yukon make it ideally suited to advance the district-scale Rackla project to the development stage; and,

• Retention of exploration properties: ATAC shareholders

retain exposure to four exciting copper and gold exploration properties in the Yukon and B.C., including the new Catch discovery in central Yukon and the PIL property in the heart of the Toodoggone region of B.C.

“I am extremely proud of the work of the hundreds of people who have been involved with ATAC, and more specifically, Rackla, over the last 16 years. Working with and witnessing the growth, development, and success of so many incredible people has been a highlight of my career and I would like to thank everyone involved for their contributions,” stated ATAC’s president and CEO, Graham Downs. “Hecla is very well suited to carry on the work we started at Rackla. Completion of this transaction will benefit ATAC shareholders as Hecla has the resources and development experience to advance Rackla in a less dilutive and timely fashion. Not only will shareholders maintain their exposure to the Rackla project, but shareholders will also gain additional exposure to Hecla’s operating mines and development projects in the Americas. Additionally, ATAC shareholders will receive shares of Cascadia Minerals Ltd., a new copper- and goldfocused exploration company. Cascadia’s flagship assets will be the Catch property in central Yukon, which hosts a brand-new copper-gold discovery – with a maiden diamond drill program planned for late summer – and the PIL property in the heart of B.C.’s Toodoggone region. We look forward to working with Hecla to complete this transaction and are excited to aggressively

explore for critical minerals once Cascadia is launched.”

Phillips S. Baker Jr., president and CEO of Hecla, adds that their technical expertise, balance sheet strength, and location of assets in Yukon makes Hecla uniquely suited to advance the Rackla and Connaught properties.

“With this transaction, ATAC shareholders will now have exposure to the largest U.S. silver producer and soon to be Canada’s largest, with operating mines in Tier 1 jurisdictions and a portfolio of exploration projects across North America,” said Baker Jr. “We look forward to continuing our work with the First Nation of Na-Cho Nyäk Dun and the wider Yukon community.”

CasCadia summary

Cascadia will hold all of ATAC’s rights and interests with respect to the Catch, PIL, Rosy and Idaho Creek projects (the “Cascadia assets”), subject to a right of first refusal to Hecla to acquire any or all of the Cascadia assets, as well as ATAC’s cash balance following completion of the transaction, creating a premier copper-gold focused Yukon and B.C. explorer. ATAC’s existing management team will move to Cascadia to focus their efforts on exploring and developing the Cascadia assets. Cascadia’s initial focus will be the Catch property in central Yukon and the PIL property in northern British Columbia.

“The copper-gold porphyry-related Catch discovery presents

a compelling grassroots exploration opportunity in an underexplored portion of the prolific Stikine Terrane, with many characteristics similar to the world-class Red Chris deposit in B.C.’s golden triangle. We are just beginning to scratch the surface of a five-kilometre-long copper-in-soil anomaly and have identified two exciting drill targets for 2023. With Hecla’s strategic financing and a strong management team, Cascadia will hit the ground running with fieldwork at Catch leading up to a planned August diamond drill program,” stated ATAC’s VP exploration, Adam Coulter. “We also see significant potential at the PIL property in B.C., exemplified by a new high-grade atsurface copper discovery at the Spruce zone in 2022. Located in the heart of the Toodoggone region, systematic work to evaluate this district-scale property will continue this summer, refining and prioritizing targets for follow-up drilling.”

ATAC intends to apply for a listing of Cascadia Shares on the TSX Venture Exchange. Any such listing will be subject to Cascadia fulfilling all the requirements of the TSXV.

Hecla has agreed to make a C$2.0 million strategic investment into Cascadia in which Hecla will acquire 5,502,957 units of Cascadia at a price of C$0.36 per Cascadia unit. Each Cascadia unit will contain one common share of Cascadia and one warrant. Each Cascadia warrant will entitle Hecla to purchase one additional Cascadia share for a period of five years at a price of C$0.36. Following completion of the transaction and the strategic investment, ATAC shareholders will own 80.1 per cent and Hecla will own 19.9 per cent of Cascadia’s issued and outstanding common shares.

CatCh ProPerty highlights

ATAC recently staked additional claims at the Catch property, located in central Yukon, nearly doubling its size to a total of 71 square kilometres. High-grade copper and gold mineralization has been identified in outcrops across a 500-metre extent in the main zone, with rock samples returning peak values of 3.06 per cent copper and 14.6 g/t gold. A mineralized diorite porphyry,

grading 1.27 per cent copper with 0.57 g/t gold, was discovered late in the 2022 field season, located two kilometres south of the main zone. None of these targets have been diamond drilled.

Numerous high-grade copper soil samples have yet to see systematic follow-up, and much of the recently expanded property remains unsampled. Planning is underway to return to Catch for additional prospecting, soil sampling, and geophysics in May, with diamond drilling slated to begin later in summer 2023, after the transaction has closed.

Pil ProPerty highlights

The PIL property is a district-scale 151.5-square-kilometre land package located in the heart of the Toodoggone district in northern British Columbia. This underexplored area hosts numerous highly prospective copper-gold porphyry and epithermal gold-silver targets. 2022 exploration at PIL returned high-grade samples from prospecting, including 18.40 per cent copper with 111 g/t silver at the Spruce target, 78.30 g/t gold with 2,830 g/t silver at the Atlas target, and 3.89 per cent copper with 173 g/t silver in a large underexplored 2.3-by-1.5-kilometre copper-gold soil anomaly at the PIL South target.

Desktop work is underway to compile and prioritize targets from the vast database of historical work completed on the project, with fieldwork planned to begin in June.

transaCtion summary

The transaction will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia), requiring the approval of: (i) at least 66 2/3 per cent of the votes cast by the shareholders, option holders and certain warrant holders of ATAC, voting together as a single class (the “arrangement resolution”); and (ii) a simple majority of the votes cast by holders of ATAC shares at a special meeting of ATAC’s securityholders called to consider, among other matters, the arrangement resolution and the transaction (the “meeting”).

The directors and officers of ATAC have entered into voting support agreements with Hecla, pursuant to which they have agreed, among other things, to vote their ATAC securities in favour of the arrangement resolution and the transaction.

In addition to shareholder and court approvals, the transaction is subject to applicable regulatory approvals including, but not limited to, TSX Venture Exchange acceptance and the satisfaction

of certain other closing conditions customary in transactions of this nature. The arrangement agreement contains customary provisions including non-solicitation, “fiduciary out” and “right to match” provisions, as well as a C$1.65 million termination fee payable to Hecla under certain circumstances. The arrangement agreement, which describes the full particulars of the arrangement, will be made available on SEDAR under ATAC’s issuer profile at www.sedar.com. Full details of the transaction will be included in ATAC’s management information circular to be mailed to shareholders, option holders, and certain warrant holders in relation to the meeting, which will be made available on SEDAR under ATAC’s issuer profile at www.sedar.com. Security holders of ATAC are urged to read the management information circular and the arrangement agreement.

ATAC will make further announcements regarding the meeting and closing of the transaction, which are expected to take place in late Q2.

Board of direCtors’ and sPeCial Committee reCommendations

The arrangement agreement has been unanimously approved by the boards of directors of ATAC and Hecla. The board of directors of ATAC has evaluated the arrangement agreement with its management and legal and financial advisors, and following receipt and review of a unanimous recommendation from the special committee of the board of directors in favour of the transaction, the ATAC board of directors unanimously determined that the arrangement agreement is in ATAC’s best interests, and unanimously recommend that ATAC security holders vote in favour of the arrangement resolution and the transaction.

Fort Capital Partners has provided a fairness opinion to the special committee. The opinion states that, as of the date of such opinion, and based upon and subject to the assumptions, limitations and qualifications stated in such opinion, the consideration to be paid under the transaction is fair, from a financial point of view, to ATAC shareholders.

advisors and Counsel

Agentis Capital Mining Partners is acting as financial advisor to ATAC with regard to the transaction. ATAC’s special committee engaged Fort Capital Partners to provide an independent fairness opinion. Stikeman Elliott LLP is acting as legal counsel to ATAC.

aBout ataC

ATAC is a Canadian exploration company focused on exploring for gold and copper in Yukon, B.C., and Nevada. Work on its

approximate 1,700-square-kilometre Rackla Gold Property in Yukon has resulted in the Osiris Deposit Indicated Resource of 732,000 ounces of gold at 4.12 g/t (in 5.5 Mt) and inferred resource of 1,044,000 ounces of gold at 3.47 g/t (in 9.4 Mt), the Tiger Deposit measured & indicated resource of 464,000 ounces of gold at an average grade of 3.19 g/t (in 4.5 Mt), a positive preliminary economic assessment for the Tiger Gold Deposit (pre-tax NPV of $118.2 million and IRR of 54.5 per cent), and numerous early-stage gold and base metal discoveries. ATAC is well-financed with approximately $4 million in working capital.

The technical information in this news release has been approved by Adam Coulter, M.Sc., P.Geo., VP Exploration for ATAC and a qualified person for the purposes of National Instrument 43-101.

aBout heCla

Founded in 1891, Hecla Mining Company is the largest silver producer in the United States. In addition to operating mines in Alaska; Idaho; and Quebec, Canada, the company is developing a mine in the Yukon, Canada, and owns a number of exploration and pre-development projects in world-class silver and gold mining districts throughout North America. 7

Golden Pursuit Resources Ltd. is actively exploring in the Gordon Lake area of the Northwest Territories.

The Gordon Lake area is an historic gold mining area that saw numerous small mines and exploration projects developed between the 1930s and the 1980s. Golden Pursuit has consolidated all these projects for the first time and is applying modern methods to this historic district.

Metallic Minerals: exploration and production in

yukon’s

iconic mining districts

extract gold from a five-and-a-half-mile stretch of ground along Australia Creek, upon which they must complete a $1 million minimum annual work commitment and pay an annual advance royalty plus a variable royalty on all gold production to Metallic Minerals.

Metallic Minerals Corp. has big plans for 2023, and with winter behind us, the company is positioned to have things get underway with exploration in the Keno Hill District and mining in the Klondike Gold District.

In an innovative move that may be entirely unique across the mining exploration industry, earlier this year, Metallic signed a gold production royalty agreement with Little Flake Mining, a company owned by Parker Schnabel, the star of Discovery Channel’s wildly popular Gold Rush television series. In the new season, Schnabel has returned to the Yukon and will set to work on claims leased from Metallic Minerals, one of the largest holders of alluvial gold land packages in the territory. Under the arrangement, Little Flake will have exclusive rights to

Pre-season activity on the claims started some weeks ago, with Little Flake having stated their intention to conduct a 400-hole winter drill program prior to the commencement of mining operations in the spring. Film crews will be documenting this activity and fans of the show will be able to see Schnabel’s progress once Season 14 of Gold Rush airs. Metallic has stated that their Australia Creek property represents “a major extension of the Klondike to the east and is one of the biggest new discoveries there in decades”. They further note that “Australia Creek was not historically mined due to its importance as a source of water and hydro-electric power for the floating dredge operations that were conducted in the area between the 1920s and 1960s”. Schnabel seems to agree, having cited the potential for vast new discoveries in the area.

In seasons past, Schnabel has been shown to have mined millions of dollars’ worth of gold and this year expectations are very high. Schnabel is not only a seasoned placer miner, in 2022 he was also awarded the Robert E. Leckie Award for Excellence in Environmental Stewardship by the Yukon Government for reclamation work in the Klondike goldfields. With production expected to start in June, it could be a very meaningful addition to Metallic’s bottom line – and the company has intentions to

bring on additional operators to further expand its alluvial business.

A significant revenue stream from its alluvial claims does set the company apart from other explorers, but Metallic’s primary focus is hard rock mining exploration and it was founded in 2016 with silver from the Keno Hill district in its sights. Since that launch, the overall position in Keno Hill has been expanded to over 170 square kilometres, with numerous historical mining operations having existed across the property. With summer approaching, the company will be looking to return to their Keno Silver project to undertake additional exploration with the expectation of establishing formal resource estimates on its most advanced targets, namely Caribou, Formo, and Fox.

The Keno Hill district has heated up substantially in the last year, with former mainstay Alexco Resource Corp. having been purchased by Hecla Mining, which is among the largest primary silver-producing companies in the world. Hecla immediately set to work on further developing underground access and workings at the mine site with an eye to restarting full operations later this year. They have also been conducting exploration activity on their extensive land holdings, as well, controlling most of the western half of Keno Hill where the majority of historic and modern mining has taken place. The Keno Hill mine is expected to be Hecla’s highest-grade producing silver operation and will make Hecla Canada’s largest silver producer. The mine life per the current prefeasibility study is relatively short at just eight years, but there is ample opportunity for expansion of the existing resource base. Still, Hecla may look across to Metallic’s ground on the eastern half of the district as a potential means of expanding the truly world-class grade silver resources at Keno Hill. Metallic is the second largest landowner in Keno Hill and, with accelerating M&A across the resource sector, observers have speculated as to what a mutually beneficial relationship may look like both in terms of structure and timing.

In May 2023, Metallic announced a 9.5 per cent strategic investment by Newcrest Mining (itself the target of a buyout by Newmont) with respect to its La Plata copper project in Colorado, USA. Some type of similar arrangement, or even ultimate consolidation, may occur down the road in the Keno district, but, for the time being, it appears that both Metallic and Hecla are solidly focused on their respective near-term goals.

In April, Metallic Minerals announced final results from its 2022 drill campaign, publishing assays from the Caribou target where results have revealed extensions of both high-grade and bulk-tonnage mineralization. These results followed previous announcements of high-grade silver in drilling at Formo and

widths of up to 177 metres of continuous silver mineralization at its Fox target.

The company’s president, Scott Petsel noted, “The Caribou vein target in the Central Keno Area is a classic example of ‘Keno-style’ high-grade Ag-Pb-Zn vein mineralization and shows excellent potential for resources of significant scale. As one-of-five near-term resource targets on the property, Caribou has consistently returned grades over 1,000 g/t Ag Eq and, more recently, has been recognized as a potential bulk tonnage target returning widths of mineralization up to 34.2 metres of potentially economic grades…”

He goes on to reiterate the expectation of defining an official ‘starter’ resource at the project in the second half of the year. With data from historical drilling and its own efforts, the company expects to have enough data to define initial deposits at each of the three most advanced targets with the ability to then conduct additional drilling along the open extensions to rapidly add ounces in subsequent programs. Further drilling is also expected later this summer at Keno.

To that end, Metallic engaged the expertise of SGS Geological Services to complete the inaugural resource estimate and announced that the modeling work is well underway, propelling the company toward a major milestone in its pursuit of revealing the potential of the Keno Silver project.

Investors will be watching and so will Metallic’s neighbours at Hecla. 7

Gold Terra looking for more highgrade gold deep under the former Con Mine underground workings

The former Con Mine, just south of Yellowknife, was mined for its high-grade gold grading between 15 to 20 grams per tonne and high-grade “jewelry pockets” where nuggets of gold with values such as 534 grams per tonne over 19.3 metres have been recorded. These high-grade gold zones are what makes drill testing the extension of the Con deposit so appealing. Gold Terra is drilling deep to a depth of 2,300 metres below surface under the former Con Mine workings with anticipation that the high-grade gold zones carry further gold under the workings. It has always been postulated that this is one of the best high-grade gold targets on the Con Mine Option Property optioned from Newmont in 2021, and with the existence of the Robertson shaft to a depth of 1,900 metres, it makes this deep target a priority for testing.

The former Con Mine is a world-class gold deposit and part of the prolific Yellowknife mining camp where 6.1 M ounces

of high-grade gold were recovered from the underground operations of both the Con Shear and Campbell Shear. The Con Mine was shut down in 2003 following multiple years of low gold prices, leaving historic gold resources in the former mine and great potential for gold mineralization below the mine workings where exploration drilling stopped when the mine was shut down.

Currently the underground Con mine is flooded with water, but the existing infrastructure inside the mine, including Robertson shaft, is intact and could be cost effective to rehabilitate for any future mining operation.

The deep drill hole program is designed to target high-grade gold zones below the northern end of the lowest mined levels of the historical Con Mine. Historical underground drill holes that were drilled below the lowest workings had intersected various high-grade gold zones in this area and very high-grade assays exist in many historical holes immediately above the target area. The aim is to expand these high-grade zones at depth.

With access to an extensive geological and historic assay database, Gold Terra has done detailed modeling of the Con gold deposit to understand the orientation, target size, shape, and plunge of high-grade zones that were not tested below the current mine workings. To see an interactive VRIFY 3D Model highlighting the deep drilling target area, please visit www.vrify. com/decks/13133.

Gold Terra’s strategy in 2023 is to find more gold on its +800 square kilometre land position along the prolific Campbell

Shear structure, which has yielded more than 14 Moz. of gold at grades above 15 g/t from the Giant and Con mines. That strategy includes additional drilling south of the Con Mine to expand their initial 2022 Mineral Resource estimate of 109,000 gold ounces in the Indicated category and 432,000 gold ounces in the Inferred category; the deep drilling target under the current Con mine workings; and, continued assessment of additional targets in the northern belt of their large land holdings which has a 2021 mineral resource estimate of 1.2 Moz in the Inferred category on four deposits north of Yellowknife.

With a continued large drilling program and positive drill results, Gold Terra is on track to re-establish Yellowknife as one of the premier gold mining districts in Canada. Gold Terra offers a rare opportunity to invest in a world-class high-grade discovery on the doorstep of Canada’s most prolific past gold production.

For more information and company news, please go to our website at www.goldterracorp.com/. 7

sixty North Gold Mining Ltd. prepares for gold production

Sixty North Gold Mining Ltd. is a Yellowknife-focused mine explorer and developer. It is the only gold project licensed for production and the first gold mine to be permitted in the NWT in over 30 years.

The company has acquired a 100 per cent interest in the past-producing Mon Gold Mine Property and has focused on restarting this gold mine. At the same time, a careful review of the entire property using more modern geophysical and geochemical techniques has identified:

1. A prospective precious metals-rich volcanogenic massive sulphide system where surface trenches have returned 0.45 metres of 203 gpt silver, 1.0 gpt gold, 0.589 per cent lead, and 0.961 per cent zinc. The first showing found on the property with significant VTEM Plus© airborne geophysics support for more.

2. A new Iron Oxide Copper Gold system enriched in nickel, cobalt, gold, platinum, and palladium (grab samples from an altered albitite unit have returned >1.0 per cent nickel, 0.183

per cent cobalt, and 0.430 gpt gold with platinum values to 0.089 gpt and palladium values to 0.017 gpt). This is the first IOCG target found in the area.

3. A large gold-bearing shear zone system has been identified with marginal phases returning up to 7.22 gpt gold over 6.0 metres. These targets are geologically similar to the Giant, Con, and Campbell Shear Zones.

At the mine site, the company has installed a winterized 20-man trailer camp on the property, fuel and explosive storage, generators, compressors, drills, scoop trams, trucks, and all necessary infrastructure to restart mining the A-Zone. In 2021, the company reopened the North Portal and advanced the ramp 132 metres to 17 metres below the old stopes where 15,000 tonnes of ore were extracted and an estimated 15,000 ounces of gold was recovered. The past mining was completed from 15 metres of vertical elevation. The company’s plan is to extend the ramp another 70 metres to the southern terminus of the vein and 20 metres below the historic stopes before commencing developing stopes,

or mining areas. A number of shrinkage stopes are planned to be developed to allow for the extraction of a bulk sample. A series of underground drill platforms will be built off of the ramp to allow for testing the next level. Upon confirmation of the extension of the vein, further development will continue to depth. Mines typically extend to great depths in the Yellowknife Gold Belt, sometimes extending >1,900 metres.

The mine is being developed to operate at 100 tpd, which will be stockpiled this year to feed a 100 tpd mill which is planned to be installed and be operational next year. This is the maximum allowable rate of production on the company’s current permits. The company will apply for expanded permits if warranted.

Sixty North Gold Mining Ltd. is run by an experienced team of mine builders and financers, and has an excellent operations team that completed the first phase of development on time and on budget with no lost time accidents. The local First Nations have been supportive and have been involved extensively though the permitting process. 7

Canadian mining companies recognized for excellence in sustainable mining

The Mining Association of Canada’s (MAC) Community of Interest Advisory Panel has selected New Gold’s New Afton Mine and Rio Tinto’s Diavik Mine, both leading operations in Canada’s mining sector, to receive this year’s prestigious Towards Sustainable Mining® (TSM) Excellence Awards. New Gold and Rio Tinto’s sustainability projects, which focused on community engagement and environmental stewardship, were recognized at the CIM Awards Gala in Montreal.

“Mining companies recognized by the TSM Excellence Awards represent the best of the best when it comes to exemplary responsible practices and strong commitments to ESG,” said Pierre Gratton, MAC’s president and CEO. “Our industry has a particularly important role to play in ensuring the minerals and metals needed for the technologies we rely on are readily available and it is integral that they be mined using the highest standards, like TSM, in the world.”

A mandatory component of MAC membership, TSM is driving performance improvement across a range of social and environmental issues where it matters most — at the mine site level. This focus on mine site performance makes TSM a go-to system for investors and manufacturers looking to invest in and purchase responsibly mined materials. A national independent Community of Interest Advisory Panel oversees the program, including representatives from Indigenous communities, environmental organizations, labour, finance, local mining communities, social and faith-based organizations, and academia.

TSM performance is evaluated across a set of detailed

Since first committing to ISO 50001 in 2014, New Gold’s New Afton mine has achieved annualized energy savings equivalent to 15 per cent of its total 2021 energy consumption, and substantial GHG reduction.

environmental and social performance standards, including tailings management, climate change, water stewardship, Indigenous and community relationships, safety and health, biodiversity conservation, crisis management, and preventing child and forced labour. As a constantly evolving program, new TSM protocols are introduced to meet society’s expectations on what constitutes good practice, and a new standard focused on equity, diversity, and inclusion is expected to be published later this year.

“We are proud that TSM, a made-in-Canada standard, is now in the process of being implemented by 14 mining associations around the world, making it the most widespread ESG program of its kind,” said Gratton. “We applaud the work being done by this year’s Excellence Award winners as it showcases the positive results that can be achieved when environmental stewardship and community engagement are prioritized.”

Established in 2014, the TSM Excellence Awards include the TSM Environmental Excellence Award and the TSM Community Engagement Excellence Award. To be eligible for the awards, mining companies must be actively implementing TSM. The Community of Interest Advisory Panel provides guidance and advice on the development and implementation of TSM and selects the winners of the TSM Excellence Awards.

2023 tsm Community engagement excellence award Winner – Community engagement at diavik mine turning Copper into “gold”

With demand for minerals and metals presently soaring, due in

large part to their essential nature in low-carbon technologies, ensuring there is enough supply to enable the global energy transition is imperative. In addition to mining new deposits for materials, like copper critical to green tech, the need to increase the rate at which metals are recycled is high, and there is an opportunity and growing need to do more.

Transitioning to a cleaner economy starts with modifying practices and technologies to create economic opportunities out of the materials that might otherwise be thrown away. This is the essence of what is known as the “circular economy”, the idea that supports business practices that extract as much value as possible from resources by recycling, repairing, reusing, repurposing, or refurbishing products and materials eliminating waste and GHG emissions. Rio Tinto’s Diavik diamonds mine exemplifies circular economy best practices through partnership and local community engagement, both central tenets of TSM’s Indigenous and Community Relationships and Climate Change protocols.

Several years ago, employees at Diavik recognized an opportunity to repurpose copper wire from predominantly completed underground mining levels. A core group of passionate employees took the initiative to propose to Diavik to

salvage copper wire where possible, and collect it in containers for transport off-site to donate to community groups. Diavik endorsed this idea and included this activity as part of scheduled work, so those who volunteered were paid for their time. This project worked to a small extent but grew substantially when, in 2019, Diane Haché, a retired employee, and her partner Michel Tremblay, a current employee, led the volunteer efforts to maximize the mine’s recycling efforts, through stripping and shipping of the salvaged copper for sale, with all proceeds going towards Diavik’s Community Contribution Program. Since the project’s inception, the results have been significant, raising over $500,000 for local charities like the Stanton Territorial Hospital Foundation, YWCA NWT, HomeBase Yellowknife, Arctic Indigenous Wellness Foundation, and NWT On The Land Collaborative, and diverting roughly 225,000 pounds of copper cable from the landfill.

This community-led project continues to expand, and in 2022, the Common Ground Crew, an initiative run through the Yellowknife Women’s Society that provides day labour to people experiencing homelessness, was brought on board. The crew worked alongside Diane Haché to process the copper, with wages taken from the proceeds. The initiative provided residents with

several hundred hours of employment while also increasing the volume processed.

Diavik has purchased a copper wire stripper to increase the rate and volume of salvaged copper that can be stripped. Further, copper cable can and will be salvaged through the mine’s closure process to go towards recycling and generating funds that can benefit local communities while minimizing the mine’s environmental footprint.

Representatives of MAC’s Community of Interest Advisory Panel were impressed by the significant impact this innovative recycling program has had in the local area, through employment, volunteer opportunities, and charitable donations. They also noted how this initiative is providing one of the key metals essential to the green energy transition – copper – by repurposing materials that have already been used, which is an excellent example of the circular economy at work.

2023 tsm environmental excellence award Winner – new gold’s new afton mine leading the way in energy and ghg performance

With the rapid move to electrification of the transportation industry, sustainably produced copper is essential. As an energyintensive industry, reducing climate impacts from the mining process is important for sustainable production.

New Gold as a company is leading the way in its commitment to greenhouse gas (GHG) reduction. The New Afton Mine is both AAA verified in the TSM protocol for energy and GHG management and is also the first and only mine in North America to be certified to the International Standards Organization’s (ISO) 50001:2011 Energy Management Standard.

Leading programs like TSM and ISO are well-established and widely respected as top-tier standards. When standards like ISO 50001 and TSM are met, this means energy management practices are at the highest level. New Gold’s New Afton mine is also continuously trying to improve through the application of innovative new technologies and best practices, with the support of its Indigenous partners and employees.

Companies who achieve ISO 50001 are widely recognized as being top performers in sustainable operations. Since first committing to ISO 50001 in 2014, New Afton has achieved annualized energy savings equivalent to 15 per cent of its total 2021 energy consumption, and substantial GHG reduction. This is partly due to the mine’s adoption of low-carbon technologies, including the continued electrification of New Afton’s underground fleet via the use of battery electric trucks and loaders.

Combined with its TSM results, the ISO 50001 achievement

represents the company’s dedication to lessening its environmental footprint and will hopefully inspire other companies in the industry to do the same.

For more information about the TSM Excellence Awards and past winners, please visit www.mining.ca/tsm-excellence-awards.

The mining industry is a major sector of Canada’s economy, contributing $125 billion to the national GDP and is responsible for 22 per cent of Canada’s total domestic exports. Canada’s mining sector employs 665,000 people directly and indirectly across the country. The industry is proportionally the largest private sector employer of Indigenous peoples in Canada and a major customer of Indigenous-owned businesses.

aBout maC

The Mining Association of Canada is the national organization for the Canadian mining industry. Its members account for most of Canada’s production of base and precious metals, uranium, diamonds, metallurgical coal, mined oil sands and industrial minerals, and are actively engaged in mineral exploration, mining, smelting, refining, and semi-fabrication. Please visit www.mining.ca. 7

supporting apprenticeships is the key to a strong workforce

During a tight labour market, like the one we are experiencing in the Northwest Territories (NWT) and Canada, supporting apprenticeships is vital to creating a strong workforce.

When employers struggle to find workers with the necessary skills and experience to fill their vacancies, apprenticeships enable them to cultivate a skilled workforce that meets their specific needs. This ensures employers have a steady supply of trained workers, while offering individuals an opportunity to gain experience and earn a wage while learning a trade.

In addition to the current tight labour market, there is an international shortage of skilled trades labour. Supporting apprenticeships is one way employers can address their

immediate workforce needs while developing the employees they will need to succeed in the future.

Five reasons to hire an apprentice today:

1. Reduced recruitment and training costs: By investing in apprenticeships, employers can reduce their recruitment and training costs. Instead of having to find experienced workers who may require a higher salary, employers can train and develop their own employees, who are already familiar with the organization’s culture and values. Because apprenticeships involve learning while working, employers can save money on training expenses while also benefiting from increased productivity and reduced turnover rates. The

Government of the Northwest Territories offers the Trades and Occupation Wage Subsidy Program to support employers to hire and train apprentices and occupation trainees. Under the program, an employer can be subsidized up to 3,200 hours of work experience (a maximum of 1,600 hours each year at a maximum of $8 hourly). Employers who hire and train female apprentices in the non-traditional trades (i.e., not hairstylist, baker, or cook) can receive a wage subsidy of $15.20 hourly.

2. Improved retention rates: Apprenticeship programs can help employers retain their workers by offering employees a clear career path and opportunities for advancement. Apprentices who feel supported and valued are more likely to remain with their employer long-term.

3. Increased diversity: Apprenticeships provide an opportunity to attract and develop a diverse range of employees, including those from underrepresented groups. This can help create a more inclusive workplace and improve overall business performance.

4. Positive brand reputation: By supporting apprenticeships, employers can improve their brand reputation and be seen as a responsible and ethical employer. This can help attract customers, investors, and potential employees who value social responsibility and community engagement.

5. Taking on an apprentice is good for business: A study completed by the Canadian Apprenticeship Forum found that for every $1 spent on apprenticeship training, a business receives an average of $1.47 in benefits. It’s also beneficial for the NWT workforce, because having a greater number of trained Northerners means more of the benefits from largescale developments stays in the North.

Supporting apprenticeships is essential for building a strong workforce that is equipped with the skills and experience needed to succeed in today’s rapidly changing job market. If you are an employer with a business in the NWT and are interested in supporting an apprentice, visit your regional Education, Culture and Employment Service Centre and speak with a career development officer.

For more information, please visit www.gov.nt.ca/apprenticeship. 7

Thinking about a career in the trades? Here are some of the reasons you should:

Great pay

Earn money while you learn your trade

Increase your chances at future employment – there is a national shortage of qualified tradespeople

Many career options (54 designated trades in the NWT)

Supports available during your apprenticeship

Scan the code to learn more:

We have been in business since 1999, and our staff complement has over 25 years experience in the foodservice industry.

Northbest Distributors Ltd. is a full-line foodservice industry distributor. We are proud to distribute well-known brands like Maple Leaf Meats, Lilydale Poultry, Cargill Meats, Canada Bread, Dairyland/Saputo, and McCain Foods. Our company stocks a large selection of these items in our Yellowknife warehouse.

Our online product catalogue will show you the full range of quality products that we carry. We are a representative of The Grocery People, a full-line retail and foodservice supplier located in Edmonton, allowing us to offer an extensive line of brand name grocery products. 347 Old Airport Rd., Yellowknife, NT X1A 3T4 (867) 873-2364

If you are interested in our products and services, please feel free to contact us by telephone, fax, or email. Set up a new account online or call us today.

F: (867) 873-6516

E: northbest@theedge.ca

supporting apprenticeships is essential for building a strong workforce that is equipped with the skills and experience needed to succeed in today’s rapidly changing job market.

stepping into the future: yukon’s mining industry

Submitted by the Yukon Chamber of Mines of its surrounding communities and environment.

The future is almost here, it’s inexorable and promising.

The world’s population is estimated to grow from seven billion to nine billion by 2050 and with it, there is also going to be further growth in the demand for resources and minerals.

Naturally, the challenge for most resource sectors lies in ensuring that these demands are met sustainability and within the prism of net-zero carbon emissions that many global economies, including Canada, are committed to achieving.

Against this backdrop, there is comfort in knowing that Yukon’s mining industry is at a juncture where it is better prepared to meet these challenges within ethical and sustainable frameworks.

Today, Yukon’s mining industry is advanced and has earmarked several milestones along its journey to mark its evolution as a modern mining industry which values the preservation

Yukon ranks ninth among the most attractive mining jurisdictions in the world and boasts of a plethora of critical minerals. Out of the 31 critical minerals listed by the federal government, only six have yet to be documented in the Yukon area.

The mining industry’s evolution continues as it confidently moves forward by identifying a roadmap and actions essential to succeed in the future while transitioning to a green economy.

Yukon’s mining industry has been acknowledged as one of the most energyefficient in Canada and globally. With the help of new technology and innovative practices, modern mines continue to reduce greenhouse gas emissions.

At the core of its goal and vision, Yukon’s mining industry relies heavily on its partnerships with local communities and its First Nations. Be it the commitment

to support Indigenous communities, or incorporating the value of land and environmental stewardship in the areas they work in, our industry members have engraved these norms as a standard practice in their day-to-day activities in the region.

And while the industry has supported the local economy for decades and created thousands of jobs, it has tried to do so without compromising on these goals.

Since its inception in 1943, the Yukon Chamber of Mines has moved forward with the foremost goal of facilitating an environment of responsible development. Representing over 400 members across the sector, the chamber will continue to advocate for Yukon’s highly regulated and responsible mining industry, its president Loralee Johnstone had said upon being reelected to the board. It is a non-negotiable goal that the chamber continues to uphold.

Compared to other regions of the world,

Yukon’s mining sector boasts of elite environmental practices such as the protection of water resources and aquatic environments, and monitoring of water systems, among others.

Some of these practices that Yukon’s modern mining industry proudly upholds were highlighted at the Yukon Geoscience Forum & Trade Show, which celebrated its 50th anniversary in November 2022.

Over 650 delegates congregated at the Kwanlin Dün Cultural Centre at this forum to share and know more about the advancement in the mining sector – the technology, the sustainable practices, and policies that continue to shape this industry in Yukon.

Many of the award winners felicitated at the event were people from Yukon’s industry who continue to inspire us with their community-centric approach to development.

Marty and Maryanne Knutson from Tatra Ventures were presented with the Yukon Chamber of Mines’ Community Award for their value-based reclamation work in building a swimming pond for Dawson.

Brad Thrall and Clint Nauman were awarded the Yukon Chamber of Mine’s Member Awards for their leadership

in engagements and environmentally responsible development of Alexco Resources.

Jasper Lamouelle from First Kaska was awarded the Yukon Chamber of Mines’ First Nations Award for socially responsible practices and his leadership in industry partnerships.

While these recognitions set benchmarks and give us plenty of reasons to celebrate, they are also a reminder that the future is a continuous set of milestones that are yet to be achieved.

Yukon Chamber of Mines is working hard to ensure the exploration and mining industry has a promising future in Yukon within the paradigm of sustainability, strong legislation, and land use planning. As technology, society, and legislations continue to change and evolve, we are excited to work with all our stakeholders to move ahead with the tide and advancement. After all, the future can be extraordinary if we are willing to work towards it. 7

standards, safety, and a good time: The CDDa Convention

By the CDDA officeThe Canadian Diamond Drilling Association (CDDA) has its finger on the pulse of the industry. We deal with governmental departments and agencies, both to keep you abreast of the latest regulatory changes affecting your industry lobby governments, as

well as to lobby for the wellbeing of the mineral industry in Canada. We keep various statistics of the industry, and foster affiliations with associations that have similar, but not the same, business interests. Each year we host an annual general meeting and convention

to bring our members together in the common interest of promoting safety and standards in the diamond drilling and exploration industry.

The Canadian Diamond Drilling Association will be hosting this year’s annual general meeting and convention in Kananaskis Mountain Lodge in Kananaskis, Alta. from June 11-13, 2023. This year will offer our delegates the opportunity to discuss business and address resolutions pertaining to the diamond and exploration drilling industry. Each year our event has a keynote speaker, technical presentations, a mini trade show, and various events in which our members participate in. We are happy to announce that this year’s keynote speaker is Warren Macdonald.

Warren Macdonald’s life’s boundaries were redefined in April 1997 with his accident on North Queensland’s (Australia) Hinchinbrook Island. Climbing to the island’s tallest peak, he became trapped beneath a one-ton slab boulder in a freak rock fall. Two days later he was rescued, only to undergo the amputation of both legs at mid-thigh. Just 10 months later, he climbed Tasmania’s Cradle Mountain using a modified wheelchair and the seat of his pants. In February 2003, he became the first double above-knee amputee to reach the summit of Africa’s tallest peak, Mt. Kilimanjaro (19,222 feet).

Macdonald’s bestselling book, A Test of Will, was the subject of the “Trapped under a Boulder” episode of the Discovery Channel series, I Shouldn’t Be Alive

Macdonald has appeared on numerous news and current affairs programs, including Larry King Live, The Oprah Winfrey Show, and The Hour with George Stroumboulopoulos. He lives in the Columbia Valley in B.C. with his partner Margo Talbot.

This keynote presentation will focus on what we can do to prepare for our challenges in advance and explore how we can fortify ourselves against the curveballs and roadblocks before they happen by practicing resilience.

At this year’s convention, the CDDA will also launch the Bring it to the Surface: CDDA Health and Wellness campaign launch. Which will address such topics as:

• Working in the industry as someone living with mental health challenges

• Successes we have seen and how you can replicate

• Can or should leaders champion mental health in their workplaces?

• What does a mentally healthy workplace look like?

• How can we improve the mental health of our drillers in FIFO locations specifically?

• And more…

Angele Poitras will be sharing with the conference delegates the exciting developments of the CDDA Bring it to the Surface campaign. Poitras is a CMHAcertified psychological health and safety advisor, has a certificate in Mental Health First Aid, but believes her greatest education has been the opportunity to stay on site at remote mines and talk to people about their challenges and their successes.

Poitras will be facilitating an up close and personal fireside chat about mental health in our CDDA workplaces. Delegates will

be encouraged to participate, so be sure to come prepared with your queries. This year’s technical sessions at the convention will take place June 12-13 and cover a broad variety of topics and ideas through the lens of the diamond drilling and exploration industry, exploring key topics such as innovative technology, economics, strategic management, safety and standards, diversity and inclusion, intriguing projects, and more. There is still time to apply to speak, for more information, contact office@cdda.ca.

At the convention, the CDDA will also offer delegates the opportunity to attend the CDDA Lifetime Member’s Gala which provides our members with the opportunity to honour two members who have significantly contributed to the advancement of the association’s goals and objectives annually. These people are eligible to be nominated for the

Lifetime Membership honour by member companies. The evening gala will feature a three-course dinner, wine, and live band Two Bit Bandit.

In conclusion, the Canadian Diamond Drilling Association’s annual general meeting and convention provides an excellent opportunity for industry players to come together, share ideas, and discuss ways to promote safety and standards in the diamond drilling and exploration industry. As we navigate the challenges posed by emerging risks, such as mental health, it is imperative that we continue to prioritize safety and standards in the industry. The CDDA’s advocacy and efforts in this regard are commendable and have contributed significantly to making the industry safer and more profitable.

To register today, visit our website at www.cdda.ca/conventions. 7

each year our event has a keynote speaker, technical presentations, a mini trade show, and various events in which our members participate in.

Unlocking transparency

Onyen ESG Scorecard empowers companies with data required for TCFD disclosures

Amidst the growing concern over climate change, companies find themselves navigating treacherous waters of reputation and finance.

The lack of comprehensive climaterelated information following the Task Force on Climate-related Financial Disclosures (TCFD) recommendations can result in reputational and financial risks for companies. This may include decreased investor confidence, higher borrowing costs, and increased regulatory scrutiny. In order to mitigate these risks, companies need to develop accurate and comprehensive TCFD reports. However, several challenges can hinder this process.

• Lack of data: Companies may not have the necessary data or information to produce accurate TCFD disclosures, leading to incomplete or unreliable reports. This can negatively impact stakeholder trust and damage the company’s reputation.

• Complexity of TCFD recommendations:

The TCFD recommendations are extensive, covering various topics, including governance, risk management, and scenario analysis. Companies may struggle to understand and implement these recommendations, especially if they lack specialized sustainability or climate teams.

• Integration with existing reporting frameworks: TCFD reporting requires integration with other existing reporting frameworks, which can add complexity to the reporting process and make it difficult for companies to align their disclosures with multiple frameworks.

• Limited stakeholder engagement: TCFD reporting requires effective engagement with a wide range of stakeholders, including investors, customers, and employees. Companies may struggle to engage these stakeholders effectively and obtain the necessary feedback and input to produce comprehensive disclosures.

• Lack of internal capacity: Producing a TCFD report requires dedicated resources and expertise, including sustainability and climate knowledge, data analysis, and report writing skills. Companies may struggle to find the necessary resources and build the internal capacity to produce a high-quality report, leading to potential financial and reputational consequences.

PossiBle solutions

Currently, companies are hiring external experts on TCFD reporting to conduct workshops on the identification of climate-related risks and opportunities. These exercises are generally costly and rely on the internal skill sets of company workers, and their ability to identify climate-related risks and opportunities. In addition, this methodology does not provide the in-house capacity required to continue to update TCFD reporting in the long run.

A better solution requires investing in data collection and analysis tools and processes that can help companies overcome these challenges. By collecting and analyzing sustainability and climate data, companies can identify climate-

related risks and opportunities and produce accurate and comprehensive TCFD disclosures. This can include both internal and external data sources, such as carbon emissions data, energy usage data, and supply chain data.

If employed, technological solutions to TCFD reporting should:

• Provide disclosure on how your company is addressing climate-related risks and opportunities in your

Premiere software solution for sustainability reporting that results in greater access to capital. Onyen helps public and private companies capture, monitor, benchmark, manage and report their environmental, social and governance (ESG) risks and opportunities with real-time reporting displayed on Executive Dashboards and ESG Scorecards. Contact us for a demo of the Onyen system: sales@onyen.com +1-647-503-3433 onyen.com

operations, supply chain, and products or services. This includes disclosures on the board’s oversight of climate-related risks and opportunities. As well as the company’s climate-related risk strategy and management.

• The identification of physical risks (such as extreme weather events) and transition risks (such as regulatory changes and shifts in market demand) that may affect your business.

• Provide scenarios for how the company’s business model may be affected by climate-related risks and opportunities, including a 2°C or lower scenario. (This is the only element missing for full TCFD disclosure reporting from the platform).

• The goals and targets for your company’s transition to a low-carbon economy and identify the measures you will use to track progress towards these goals.

The Onyen platform provides companies with the ability to produce the data required for TCFD disclosures through its step-by-step approach to questions required for TCFD disclosure as follows:

1. Governance: The Onyen ESG Scorecard evaluates a company’s governance practices, including board composition and oversight of ESG risks, which

can be relevant for TCFD disclosures related to risk management and governance.

2. Strategy: The Onyen ESG Scorecard prompts companies to disclose the actual and potential impacts of climaterelated risks and opportunities on their businesses, strategy, and financial planning.

3. Risk management: Companies should disclose how they identify, assess, and manage climate-related risks.

• Climate risks and opportunities: The Onyen ESG Scorecard includes information on a company’s carbon footprint, emissions reduction targets, and renewable energy investments, among other factors, which can provide insight into the company’s climate risks and opportunities.

• Supply chain management: The Onyen ESG Scorecard assesses a company’s management of ESG risks in its supply chain, including human rights and environmental risks, which can be relevant for TCFD disclosures related to supply chain risks.

• Water management: The Onyen ESG Scorecard evaluates a company’s management of water-related risks, including water usage and water

pollution, which can be relevant for TCFD disclosures related to physical risks associated with climate change.

4. Metrics and targets: The Onyen ESG Scorecard help companies decide how they should disclose the metrics and targets used to assess and manage climate-related risks and opportunities.

5. Output requirements: XBRL (machine readable) or iXBRL (human and machine readable) is already done with Onyen and therefore the data can be transmitted to regulatory bodies and other stakeholders that require this data in this format.

With the Onyen ESG reporting system, companies are no longer at the mercy of complex TCFD disclosure requirements. This powerful software platform provides the ability to navigate the intricate landscape of environmental, social, and governance factors, ultimately empowering companies to produce the data needed for TCFD disclosures with ease. By leveraging its step-bystep approach to address the critical questions posed by the TCFD framework, businesses can now confidently embrace transparency, bolster investor confidence, attract sustainable financing options, and stay ahead of the ever-evolving regulatory landscape. 7

PDaC 2023

Convention welcomed 23,819 attendees to world’s premier mineral exploration and mining event in Toronto

The Prospectors & Developers Association of Canada (PDAC) is thrilled to welcome pre-pandemic levels of attendance back to its annual convention, drawing 23,819 attendees to Toronto for the best business, investment, and networking opportunities in the mineral exploration and mining industry.

In addition to the more than 1,100 exhibitors covering over 600,000 square feet of the Metro Toronto Convention Centre, governments, companies, and leading experts from around the world made this one of the largest events in the association’s 91 years.

“There’s never been a more critical time for our industry to gather, share, and learn as we drive progress, tackle global challenges, and seize opportunities for a better future,” said Alex Christopher, PDAC president. “And the energy and optimism witnessed during PDAC 2023 was palpable—it is clear the mineral exploration and mining industry has entered a period of great transformation and growth.”

Key speakers included Ken Hoffman, McKinsey & Company; Sinead Kaufman, Rio Tinto; and Alex Dorsch & Kevin Frost, Chalice Mining.

Governments continue to use the event as an important platform for announcements, including Canadian Natural Resources Minister Jonathan Wilkinson who announced an investment of $344 million to help advance “the development of a dynamic and competitive critical minerals sector”.

The final day of the PDAC Convention also marks the transition of presidents. We thank Alex Christopher for his remarkable contributions to the industry and association during his two-year term, and welcome Raymond Goldie to the role.

“For almost a century, the PDAC Convention has been recognized as the leading choice for the world’s mineral exploration and mining industry, bringing the latest trends, technologies and conversations to one central location, and 2023 is no exception,” says Lisa McDonald, PDAC executive director. “Yet again, we have proudly delivered capital markets, Indigenous affairs, student and early career, sustainability and technical programs, and short courses that offer the latest in professional development opportunities.”

Thank you to everyone who participated in PDAC 2023, including all of our volunteers, speakers, sponsors, and participants. We look forward to welcoming you back from March 3-6, 2024.

aBout the PdaC

PDAC is the leading voice of the mineral exploration and development community, an industry that supports 664,000 people in direct and indirect employment, and contributes $130 billion to Canada’s GDP every year. Representing over 6,500 members around the world, PDAC’s work centres on supporting a competitive, responsible, and sustainable mineral sector. Please visit www.pdac.ca. 7

Preliminary estimates: Mineral exploration to fall in Canada’s north

By Gary Vivian, P.Geo. FGCThis article is summarized from an NWT & Nunavut Chamber of Mines release dated March 15,2023

million (eight per cent) decrease from $4,067.0 million.

NRCan suggests that half of Canada’s jurisdictions will see spending increases, while the other half, including the three territories, will see reductions. While NRCan provides no explanation, presumably critical mineral exploration is a driving factor for the increase in expenditures in the southern jurisdictions, where mining provinces provide very attractive provincial exploration tax credits in addition to Canada’s federal one.

Healthy exploration investment is critical to sustaining and growing our important mining industry, a sector that has provided as much as 50 per cent of the territories’ GDP and significant benefits to northerners. Without it, the successful discovery of additional mining resources becomes a very big problem.

The latest Federal statistics from Natural Resources Canada (NRCan) project decreases in exploration spending in all three territories. Nunavut will see the largest drop, followed by Yukon and the Northwest Territories (NWT). NRCan’s Preliminary Estimates and Spending Intentions Statistics of Mineral Exploration, released in March, provide the following revised 2022 exploration expenditures and preliminary spending intentions for 2023:

• $74.8 million in NWT, a $4.8 million (six per cent) decrease from $79.6 million in 2022;

• $171.7 million in Nunavut, a $65.5 million (28 per cent) decrease from $237.2 million;

• $144.7 million in Yukon, a $18.4 million (11 per cent) decrease from $163.1 million; and

• $3,748.6 million in Canada, a $318.4

To allow the north to compete with the provinces, the NWT & Nunavut Chamber of Mines, along with the Yukon Chamber and the Prospectors and Developers Association of Canada, continue to seek the Government of Canada’s support to create a special tax credit for the north. This could help level the playing field for the north, where exploration costs can be two-and-a-half- to six-times higher than anywhere else in Canada.

Some additional key findings reported by NRCan for Canada include:

• Spending Intentions for 2023 would see a decrease of eight per cent ($318.4 million) in Canada.

• All three territories would see spending decreases; B.C. would be hardest hit at nearly $320 million.

• Not all provinces will see decreases. Increases are projected in 2023 for Saskatchewan ($108 million), Quebec ($24 million), Nova Scotia ($19 million), Alberta ($12 million), and Manitoba ($4.4 million).

• Spending on iron, uranium, other metals, and coal is projected to increase, while spending on base metals, precious metals, and diamonds will decrease.

• Spending intentions are down for both junior and senior companies.

• Spending intentions are down for both exploration and deposit appraisal.

Charts of historical and projected expenditures in northern Canada are documented in the backgrounder charts shown. The NWT and Nunavut Chamber of Mines has summarized NRCan’s

complete data in charts here: https:// www.miningnorth.com/_rsc/site-content/ library/Statistics/2023-03-10_NT%20 NU%20YT%20Exploration%20

Statistics%20March2023%20vFinal.pdf.

Source: Natural Resource Canada’s Preliminary Estimates and Spending Intentions Statistics of Mineral Exploration revised as of March 2023. 7

Northwest Territories and Nunavut Association of Professional Engineers & Geoscientists

If you are a Geoscientist or Engineer working North of 60°, don’t forget to register as a Professional.

If you are already registered with a Canadian Professional Association, it is easy to add a northern registration. WWW.NAPEG.NT.CA

To allow the north to compete with the provinces, the NWT & Nunavut Chamber of Mines, along with the Yukon Chamber and the Prospectors and Developers Association of Canada, continue to seek the Government of Canada’s support to create a special tax credit for the north.

Why industry needs more mentoring and networking to foster growth and inclusion

By Maryann DeutscherIncreasing societal expectations, regulatory oversight, and investor requirements are focusing on the sustainability and social performance of our industry, as well as its role in local, national, and global economic growth and development. Diversity allows us to meet and exceed expectations collectively.

Women in Mining/Women in Nuclear Saskatchewan (WIM/ WiN-SK) is an industry change agent focused on driving growth through parity. A supportive network is crucial for attracting more diversity into the industry.

Due to the competition of skilled workers, it is increasingly vital for women to view the industry as an attractive choice to build their careers. Leveraging a supportive network is a key aspect of attracting more diversity to the industry. Attracting women into the industry is only one component, just as importantly, we must endeavour to support them in order to retain that talent. As an organization focused on supporting growth, our members enjoy participating in our virtual speaker series on topics from leadership to artificial intelligence, and more. It is often in these sessions where individuals gain a greater insight into the depth of opportunities within the mining and nuclear industries.

As strong advocates in mentorship, we know that when women are supported in their chosen field, these individual benefits extend to positively influence their organizations, improving the position and opportunities for women across the mining and nuclear sector. With a strong mentorship program, mentors of any gender provide allyship opportunities, and mentees greatly benefit from the guidance and insight of these inspirational mentors’ perspectives. The network created from this program benefits mentees for years to come and helps them navigate the challenges of the industry.

Many women in the industry will credit other women (and men) for impacting their careers on advice gained during networking. Often, seemingly casual conversations can have a lasting impact for that individual as they navigate the next challenge or approach the next milestone in their journey. Importantly, these interactions are often just as crucial throughout your career as they are early in your career. It is these opportunities and support

network that will lead to a stronger, more diverse workforce. Bringing thought leaders together at WIM/WiN-SK’s annual Mine Your Potential Conference for purposeful discussion, reflection, and enthusiasm is another key component of building networks.

We strive to create opportunities through our various committees for our volunteers to benefit from their involvement with our organization; to broaden their expertise and develop and test new skills to leverage the collective strength of women in our industry. We want to provide our volunteers with the opportunity to make a tangible and beneficial difference while also being leaders and advocates for women in the industry.