BILLION DOLLAR MARKETS

IS PRIVATE EQUITY A SAFE BET? / INDUSTRY EXPERTS WEIGH IN WORDS MATTER / UPDATE YOUR MESSAGING

LEMONGRASS SPA / 20+ YEARS OF NATURE INSPIRED BEAUTY NEUMI / THE SMART STARTUP

IS PRIVATE EQUITY A SAFE BET? / INDUSTRY EXPERTS WEIGH IN WORDS MATTER / UPDATE YOUR MESSAGING

LEMONGRASS SPA / 20+ YEARS OF NATURE INSPIRED BEAUTY NEUMI / THE SMART STARTUP

CHARLIE SANBORN | VP OF SOFTWARE ENGINEERING, “ YOUNG LIVING

The Exigo commission run takes about a fifth of the amount of time that ours historically did.”

From a straight ROI perspective, we're going to get a very strong ROI going with Exigo. There are no ifs, ands, or buts about it.”

STEVE MCCARTHY | VP OF FINANCE/CORPORATE CONTROLLER,

RODAN + FIELDS

Working with Exigo helped us put all our international regions onto one platform where we could see all the activity in near real time.”

BILL JARM | PRESIDENT OF OPERATIONS, NEOLIFE

Mark your calendars now for these must-attend events in 2025. Spread the word to your global colleagues and get more from Direct Selling University in 2025 as DSU continues its global growth.

DSU LATAM | JANUARY 8-9, 2025

InterContinental at Doral, Miami

DSU SPRING | MARCH 25-27, 2025

Irving Convention Center, Texas

DSU EUROPE | JUNE 3-5, 2025

Amsterdam Hilton Airport Hotel, Netherlands

DSU FALL | FALL 2025

Dallas, Texas

DSU ASIA | NOVEMBER 2025

Seoul, South Korea

Direct sales platforms shouldn't be stuck in the digital stone age. While others offer clunky interfaces and developer-dependent changes, Fluid catapults you into the future. Our AI-powered e-commerce tools and intuitive, mobile-first design put you in full control—no coding necessary. With Fluid, you'll spend less time fighting technology and more time driving growth.

Welcome to direct sales 2.0.

Sell 24/7 with smart, automated storefronts

Turn browsers into buyers with AI-driven insights

Empower your team with mobile-first tools

Capture leads effortlessly with AI-powered chatbots and forms

Boost conversions with one-click checkouts and smart upsells

Integrate seamlessly with your favorite back-office systems

Scale your business with multi-language and multi-currency support

Accelerate growth with Fluid Studios' custom design & development Scan to learn more or visit

This landmark DSU event spotlights the companies and executives leading the charge in Latin American markets. Hear from some of the channel’s top leaders who are thriving in Latin America today, and gain key insights and guidance on best practices to expanding into new LATAM markets.

You’ll also hear from corporate leaders experiencing growth in the Hispanic market in North America and beyond. Engage with industry leaders, gain critical insights into the market’s growth and potential and connect with professionals driving success in this thriving sector. Whether you’re currently operating in LATAM or not, this session is sure to deliver the insights that can make a huge impact at your company moving forward.

Make plans now to join us January 8-9, 2025 and be part of the conversation shaping the future of direct selling in LATAM.

SARAH PAULK

Lemongrass Spa Over 20 Years of Nature-Inspired Beauty BY JENNY VETTER Neumi The Smart Startup Making a Splash BY MARK ROBERTS

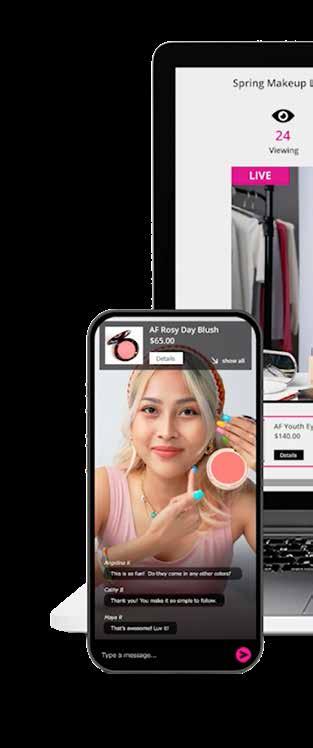

DEPARTMENTS FOR YOU / FOR YOUR FIELD / Your Essential Monthly Motivation BY CHELSEA HUGHES WORKING SMART / The Future of Direct Selling is Social BY GREG FINK

The annual in-depth look at the biggest markets around the globe.

BY SARAH PAULK

Direct Selling News (ISSN 15546470) is published ten times a year in January, March, April, May, June, July, September, October, November, and December by Direct Selling Partners, 5717 Legacy Drive, Suite 250, Plano, TX 75024. Periodicals postage paid at Lake Dallas, TX and additional mailing offices.

POSTMASTER: Send address changes to 5717 Legacy Drive, Suite 250, Plano, TX 75024.

Subscription Rate: Free to direct selling and network marketing executives in the US.

©2024 Direct Selling News

All rights reserved. Material may not be reproduced in whole or in part in any form without written permission. No statement in this publication is to be construed as a recommendation to buy or sell securities or to provide investment advice.

Direct Selling News

5717 Legacy Drive, Suite 250, Plano, Texas 75024 / Phone: 800-752-2030 directsellingnews.com

DIRECT SELLING NEWS

Serving the Direct Selling and Network Marketing Executive Since 2004

A Direct Selling Partners Company

FOUNDER AND CEO

Stuart P. Johnson

PUBLISHER

Patricia White

EDITOR

Lisa Robertson editor@directsellingnews.com

NEWS EDITOR

Sarah Paulk pr@directsellingnews.com

CREATIVE DIRECTOR

Susan Douglass

PRODUCTION MANAGER

Virginia Le

PRODUCTION ARTIST

Megan Knoebel Ascencio

WEB MANAGER AND DIGITAL MARKETING

Laura Coppedge

COPY EDITOR

Laura Coppedge

DIRECTOR OF SALES OPERATIONS

Nancy Ratcliff support@directsellingnews.com

CONTRIBUTORS

Heather Chastain Sarah Paulk

Greg Fink Mark Roberts

Chelsea Hughes Jenny Vetter

David Lee

TO ADVERTISE: advertising@directsellingnews.com

TO SUBMIT EDITORIAL COMMENT: editor@directsellingnews.com

TO SUBMIT PRESS RELEASES: pr@directsellingnews.com

TO SUBSCRIBE/UNSUBSCRIBE: subscribe@directsellingnews.com

DIRECT SELLING NEWS

USPS 23713 • ISSN 15546470

What part of your business would benefit by bringing in outside expertise to help your team be more efficient and effective?

ELEGATING time-intensive business functions to highly skilled suppliers provides the breathing room to focus on unique skill gaps, like training team members on best practices, getting up to speed with new technology or customer service response that many organizations overlook.

For your convenience, we have compiled a list of our display advertisers. When contacting these companies or those in our Supplier Directory (starting on page 94), please let all of our valued advertisers know that you saw them in DSN .

“

Partnering with DSN has helped QuickBox emerge into a vertical of great merchants and vendors alike. They have helped us grow and understand the industry and how we can better support the great companies in it.

—IRENE SCHARMACK / CEO, QuickBox Fulfillment

720-990-5642 / QUICKBOX.COM

Exigo

214-367-9933 / EXIGO.COM INSIDE FRONT COVER

Fluid

385-336-7404 / FLUID.APP PAGE 2

Association for Entrepreneurship

844-750-5927 / AFEUSA.ORG PAGE 12

i-payout

DISCOVER@I-PAYOUT.COM / I-PAYOUT.COM PAGE 21

Nexio 877-551-5504 / NEX.IO PAGE 37

Strategic Choice Partners

504-252-4500 / STRATEGICCHOICEPARTNERS.COM PAGE 14

Metrics Global

702-757-9600 / METRICSGLOBAL.COM PAGE 23

Momentum Factor

512-690-2134 / MOMOFACTOR.COM

PAGE 25

Teqtank

844-605-9624 / TEQTANK.COM

PAGE 25

Flight Commerce

813-277-0625 / FLIGHTCOMMERCE.COM PAGE 15

Quickbox

720-990-5642 / QUICKBOX.COM PAGE 17

Thatcher Technology Group

630-696-4545 / THATCHERTECH.COM PAGE 19

Squire 801-225-6900 / SQUIRE.COM/NETSUITE PAGE 65

Katapult 407-915-9060 / KATAPULTEVENTS.COM PAGE 84

Direct Selling Association 202-452-8866 / DSA.ORG PAGE 92

iCentiviz

877-333-3023 / ICENTIVIZ.COM

PAGE 28

E. A. Dion

800-445-1007 / EADION.COM

PAGE 29

ADI Meetings & Events

321-423-7229 / ADIMEETINGS.COM PAGE 29

World Pay

GETINFO@FISGLOBAL.COM / WORLDPAY.COM INSIDE BACK COVER

InfoTrax 801-431-4900 / INFOTRAXSYS.COM BACK COVER

Our mission is to serve, educate and edify the channel with daily breaking global news, emerging trends and powerful stories, made possible through the generosity and support of our Premier Supplier Sponsors. Thank you for your dedication to the direct selling channel! For information on how to become a DSU Event Sponsor in 2025, email nratcliff@directsellingnews.com.

FALL IS HERE—it’s when we all turn our attention to spending time with family and friends and fun harvest activities. One of my favorite fall traditions is DSU—and we just wrapped up another amazing event where we took a frank and fearless look at the channel and what challenges and opportunities we face. With everyone planning for 2025, this was the perfect time to come together as a channel and share our best insights and strategies.

This is always one of our most anticipated issues of the year—Billion Dollar Markets. We take the pulse of the industry through a comprehensive “state-of-the-channel” report, checking in on how the largest markets are performing, continent by continent based on data. We think you’ll find some of the results of this year’s report surprising—and encouraging.

We have two other features this month that I’m personally very excited about. We take a deep dive into the impact private equity is having on the channel. We also expand on last

month’s cover story with an article from Heather Chastain discussing tweaking the language we use to better connect with the sales force.

In other content, we highlight the can-do spirit of Lemongrass Spa and the startup success story being told at Neumi.

At DSN, we strive to be your daily resource for global news impacting the direct selling channel. Make sure to sign up for our free resources like the weekly dashboard email which delivers a week’s worth of news in a quick 15-minute read each Sunday. You can also sign up for free text alerts by becoming a member of our VIP Community where you’ll always get the top stories first and fast!

I hope you all found our recent DSU event to be as enlightening and informative as I did. We are already planning our biggest ever slate of events for 2025—stay tuned!

All the best,

Patricia White | Publisher | pwhite@directsellingnews.com

The opportunities for direct selling companies are greater than they’ve ever been. So are the challenges. Never before has the market demanded a higher level of innovation, simplicity and boldness. As you blaze new trails and evolve in response to the ever-changing market, are you making the most strategic choice for whom you partner with?

Strategic Planning l Executive Management l Startup Launches

Compensation Plan Design l Marketing & Communications l Salesforce Development

Hispanic Marketing l International Development l Events & Show Production l IT Strategy

Digital Roadmapping l Promotions & Incentives l Customer Service

Video Production l Creative Services l Social Media Management

Financial Expertise l Keynote Presentations

SCP is made up of a team of direct selling experts, together representing more than 300 years of experience in direct selling. We surround every project with a customized team of Associates to provide the perfect approach for your project. From event support to global expansion, and everything in between, our team can deliver.

n Greenway Global Announces Partnership with Jeunesse Global

n Fluid Acquires Software Development Company Think Box

n Terry Lacore Launches New Direct Selling Brand Shoply.com

n Oriflame Streamlines Ordering Process with Robot-Operated Warehouse

n Avon Products, Inc. Initiates Voluntary Chapter 11 Proceedings

dŌTERRA’S 2024 CONVENTION, THEMED RECLAIM, welcomed more than 7,000 distributors and customers and generated an estimated $10 million in direct visitor spending for Salt Lake City, Utah. The event featured an essential oil symposium, interactive general sessions, a recognition gala and the unveiling of a number of new products as well as updates to fan favorites.

“This year’s convention theme is Reclaim,” said Kirk Jowers, dōTERRA CEO. “We hope this theme will inspire all to reclaim their health and wellness. With the unveiling of new products, our industry leading science-based research on essential oils, phenomenal speakers including Lindsay Vonn, and reconnecting with our dōTERRA community, we know this year will be epic. Thanks to Salt Lake City, which makes this massive event possible every year. The gorgeous backdrop, incredible amenities and outdoor activities offered here make the convention a much-anticipated annual destination for all!”

SALADMASTER WELCOMED MORE THAN 400 Saladmaster

Dealers and entrepreneurs from 27 countries for its first Global Leadership Summit since 2019, following disruptions caused by the COVID-19 pandemic.

The summit event was held in Madrid, Spain and featured keynote speakers Ben Hunt-Davis, Olympic rowing champion, and Dr. Amna Khan, consumer behavior and retailing expert, as well as presentations from top sales leaders who shared business growth and operations strategies. The Women of Saladmaster Panel delivered high-impact stories of how they have built positive cultures across diverse regions.

AMWAY HOSTED ITS THIRD ANNUAL AMWAY CARES volunteer event, working alongside 800 of its Ada, Michigan-based employees, to serve 28 non-profit organizations across Kent County. The employee volunteers donated more than 5,000 volunteer hours and supported 41 projects including landscaping, food reclamation, painting, farm work, bed building and more.

“Community building is paramount to our health and wellbeing mission,” said Will Templeton, Amway Director of Corporate Social Responsibility. “Amway Cares: Week of Service exemplifies our commitment to supporting communities where our employees and Amway Business Owners work and play.”

HERBALIFE AND MAJOR LEAGUE SOCCER CLUB LA GALAXY worked together to support community organization A Place Called Home (APCH) at its annual back-to-school event. APCH’s Joint Community Partnership Fund provided school supplies to 1,000 South Central Los Angeles youth and families. Attendees at the event also had the opportunity to visit a community health and resource fair, which provided access to health and wellness checks, optometry screenings, vaccinations, mammograms and workforce registrations.

The donation by Herbalife and LA Galaxy of 1,000 backpacks included pencils, crayons, rulers, notebooks, calculators and pens. LA Galaxy players Edwin Cerrillo, John McCarthy, Mauricio Cuevas, Tucker Lepley, Isaiah Parente and Jalen Neal, as well as LA Galaxy staff and Herbalife officials were also in attendance to meet with students and help distribute backpacks.

For the full articles, visit directsellingnews.com/ insights

Customers in the US can now link their Amazon accounts to their TikTok and Pinterest profiles for easier shopping. With this new partnership, shoppers will be able to buy products and checkout directly from ads without ever leaving the social media apps.

Amazon already offers this service through in-app shopping with Facebook, Instagram and SnapChat, and TikTok and Pinterest users will now enjoy the same streamlined purchasing process. In TikTok, Amazon’s product recommendations will appear in user’s “for you” feed that will include pricing information, Prime availability and delivery time estimates.

District Judge Ada Brown has officially blocked the US Federal Trade Commission’s (FTC) rule banning noncompete agreements. Brown had temporarily blocked the rule in July, stating the FTC did not have rulemaking authority. The court was expected to issue a final order on the merits just before the Rule was to take effect on September 4, but instead issued a memorandum opinion ten days ahead of schedule.

In her ruling, Brown said: “The Commission’s lack of evidence as to why they chose to impose such a sweeping prohibition [...] instead of targeting specific, harmful non-competes, renders the Rule arbitrary and capricious.”

This final ruling does not prevent the FTC from prohibiting noncompetes or delivering enforcement actions, but it must do so on an individual, case-by-case basis.

In its original Rule approved in April, the FTC described noncompetes as an “exploitative practice” that prevents workers from starting new businesses or switching jobs, effectively forcing them to stay with their current employer. It leaned heavily on language from the FTC Act, specifically citing “unfair method of competition” as the basis for the violation.

Pushback against the FTC’s proposed rule was swift and significant, but court opinions appeared to be mixed. While Brown placed a preliminary injunction on the action in the state of Texas, a Pennsylvania federal judge ruled in the FTC’s favor, describing noncompetes as virtually never justified. DSN

For the full articles, visit directsellingnews.com/ announcements

OLGA BOTERO BEFRA, BOARD OF DIRECTORS

Betterware de Mexico, now known as BeFra, announced Olga Botero has been appointed Independent Director of its board. Botero brings expertise in strategy, finance, digital business and marketing to the role and becomes the ninth out of twelve board members who are Independent Directors.

“We are delighted to welcome Olga to our board,” said Luis G. Campos, “BeFra Executive Chairman of the Board. We look forward to leveraging her expertise and are confident she will provide valuable perspectives as we advance our digital strategies within the group.”

Mōdere announced three executive leadership appointments as the company positions itself for future growth including:

n Heath Tilley, Senior Vice President of Global Operations. Tilley’s career spans more than three decades of end-to-end supply chain experience in consumer goods and includes work within the direct-to-consumer, traditional retail, wholesale and direct selling channels.

n Cammie Taylor, Chief People Officer. Taylor brings experience building and optimizing HR departments in a number of organizations within the retail, direct selling and government sectors and has significant expertise within talent management, employee relations and HR strategy.

n Jeff Hildebrandt, Senior Vice President of Global Marketing. Hildebrandt is a direct selling veteran with more than two decades of experience leading marketing within some of the direct selling channel’s most notable brands. He is known for his ability to equip high-performing teams and for executing strategies that drive market and revenue growth.

“We continue to build Mōdere as a destination for top talent who can accelerate our vision to become the most trusted name in wellness,” said Nate Frazier, Mōdere President and Executive Chairman. “We’re pleased to welcome Heath, Cammie and Jeff to strengthen our deep leadership team as we lay the groundwork for Mōdere’s future.”

PM-International announced key executive appointments as it expands its Management Board in Europe.

n Patrick Bacher has been named CEO Headquarter Europe. Bacher is a founding member of PM-International and has been with the company for 31 years. Previously, he served as CSO and COO for Headquarter Europe and was integral in leading the company through its expansion in Germany as well as the establishment of PM-International’s Logistic Center Europe.

n Sascha Gamper will succeed Bacher as Chief Sales Operations Officer Europe. Gamper has been a part of PM-International for almost two decades, working and learning within sales and operations.

n Adrien Rincheval will now serve as Junior CSO Europe. Previously, he worked as Regional General Manager Sales. Rincheval has extensive experience in sales, field development and internal company procedures and was key in helping the company build its business in the Western European markets.

“We are excited to welcome Sascha Gamper and Adrien Rincheval to the Management Board,” Bacher said. “Their extensive experiences and proven track records will make a decisive contribution to achieving our strategic goals and continuing our course of innovation. At the same time, the expansion with our dynamic board members offers us an exciting opportunity to shape and strengthen the European market in an agile manner.”

LIFEVANTAGE, BOARD OF DIRECTORS

LifeVantage Corporation has appointed Rajendran Anbalagan to the company’s board of directors. Anbalagan brings more than two decades of experience managing and implementing large technology and ecommerce programs with particular expertise in enterprise architecture, digital growth and technology advancements, technology integration across platforms and global distribution organization. “We are very excited to welcome Rajendran Anbalagan to the LifeVantage Board,” said Ray Greer, LifeVantage Chairman. “Raj brings extensive technology experience along with a deep understanding of how to leverage digital tools to drive operational excellence. His perspective will be invaluable as we continue to invest in technology solutions to enhance the customer experience and propel our future growth.” DSN

Joni Rogers-Kante credits her commitment to consistency, devotion to family, and abiding faith to achieving success as a business and family woman.

Joni has paved a path toward a life of abundance, and she devotes her life to empower others to find theirs, too.

For Joni, her company SeneGence stands for more than its cutting-edge and highly desirable beauty products. Its causedriven purpose is to promote more women

in business and care for communities in need through its nonprofit. Not only has Joni built a rewarding global business, she is also changing lives closer to home.

Joni passionately protects rights of independent entrepreneurs in the direct selling industry and works to improve the economic lifeblood in her home state of Oklahoma.

Joni believes accomplishment is unique for everyone, and we are all here with

our own important purpose. She says a fulfilling life is made with the four E’s: Earn, Evaluate, Evolve, and Explore. When we value and respect each other, we will all move forward together.

We are proud to partner with Joni and those like her who consistently prove that hard work and courage are rewarded with limitless possibilities. After all, people are our greatest strength.

former Immunotec

President and CEO, has passed away.

Northrop was an advocate for the direct selling channel and the leader of Winfield Consulting, an organization designed to provide strategic support to direct selling companies.

Northrop was an active and significant contributor to the direct selling channel, serving as Chair of the Direct Selling Education Foundation (DSEF) Academic Committee, as a member of both the Direct Selling Association (DSA) and the DSEF Board of Directors and on the DSEF Executive Committee.

After earning an MBA from Columbia University, Northrop served as CEO in a number of notable companies, including divisions of General Mills and J.Crew, and in 1994 acquired Princess House from Colgate-Palmolive, where he worked as CEO from 1994-2006.

His extensive industry experience made him a trusted guide and led him to serve on several corporate boards, including Graphite Metallizing Corporation, Princess House, Creative Memories, Immunotec, Origami Owl, Xyngular and Pure Haven.

Northrup served as DSA Chairman from 2001-2002, and in 2012 was inducted into the DSEF Circle of Honor, which recognizes industry leaders of high integrity who have made extraordinary contributions to the foundation through their dedication and service.

“I grew to know and admire Jim, who was, first and foremost, a friend,” said Joseph Mariano, DSA President. “Self-effacing and selfless, he never

hesitated to respond with a ‘Yes, I will do it,’ whether it was a request from DSA or one of his fellow direct selling executives. Anyone who met Jim will miss his wit, charm and kindness.”

Northrop was also a mentor and lifelong friend to current Immunotec CEO Mauricio Domenzain and a member of the Immunotec board.

“Jim was a man of integrity and kindness,” Domenzain said. “His mentorship and friendship were invaluable. He believed in the potential of every individual and dedicated himself to empowering those around him. Jim’s legacy will continue to live on through the values he instilled in us and the countless lives he touched. Our thoughts and prayers are with his family during this difficult time. We will miss him dearly but will forever be grateful for the time we shared and the lessons we learned from such an extraordinary individual.” DSN

A CURATED RESOURCE TO HELP YOU FIND STRATEGIC BUSINESS PARTNERS SPECIALIZING IN DIRECT SELLING.

HE CHANNEL IS EVOLVING RAPIDLY—companies and executives must stay ahead of emerging trends and technologies to build for the future. But it can be time - consuming and hard to find the right suppliers to partner with.

That’s why we’ve developed The DSN Guide. In each issue, The Guide includes curated lists by category of expertise and service. These suppliers currently serve the channel—they understand the unique challenges and opportunities that come with direct selling and can help you implement your intiatives.

UT icentiviz.com

“

I APPRECIATE DSN’S TIRELESS WORK to report the news around direct selling, but also how they share the positive stories surrounding it. DSN is a reputable and powerful voice that always strives to edify the channel and highlight the direct selling companies that are doing the right things .

JONI ROGERS-KANTE / FOUNDER & CEO, SENEGENCE

When one company succeeds, the entire channel benefits. It’s with that sensibility in mind that we developed the DSN Supporter Program in 2022 and welcomed dozens of companies, representing billions in cumulative revenue, committed to helping this channel grow and enhance its relevancy.

Our mission is to serve, educate and edify the channel as the daily resource for breaking global news, emerging trends and powerful stories. With DSN, it’s easy for direct selling executives to stay informed, engaged and always one step ahead.

Your support helps DSN continue to provide relevant information, exposure, edification and education for companies and executives to help evolve the channel forward for the global community.

TO LEARN MORE about exclusive DSN Supporter Program Benefits and how you can become a part of the DSN family of Supporters, visit directsellingnews.com/supporter or contact support@directsellingnews.com

In order to protect the integrity of the Supporter Program for all participants, DSN reserves the right to deny, suspend or discontinue Supporter benefits to any company undergoing published legal actions or regulatory disputes (including any settlements of such).

BY DAVID LEE

INFOGRAPHICS ARE A DOMINANT TOOL in content marketing, digital communication and education. They offer a visually engaging way to present complex data, making information easier to digest and share. The use of infographics has skyrocketed in recent years, driven by the need for quick, effective communication in a world overloaded with information.

Infographics are popular and effective for several key reasons.

VISUAL APPEAL / People are inherently drawn to visuals. According to MedTech Intelligence, people process visual information 60,000 times faster than text—and 90 percent of information transmitted to the brain is visual. This makes infographics an excellent tool for capturing attention.

SHAR EA BILITY / Infographics are highly shareable on social media platforms, driving traffic and increasing engagement. Their compact, visual nature makes them perfect for platforms like Instagram, Pinterest and LinkedIn.

SEO BE N EFITS / Well-designed infographics can drive traffic to websites and improve search engine optimization (SEO). When infographics are optimized with appropriate keywords, metadata and backlinks, they help boost search engine rankings.

INFOGRAPHICS ARE HIGHLY SHAREABLE on social media platforms, driving traffic and increasing engagement.

% OF INFORMATION TRANSMITTED TO THE BRAIN IS VISUAL.

Infographics align with how the human brain processes information. The brain’s visual processing system is fast and efficient, meaning that well-designed infographics can communicate a message in seconds. This efficiency is critical in marketing, where capturing and retaining the audience’s attention can be challenging. Infographics often combine data, visuals and storytelling. This combination is powerful: data provides credibility; visuals make the content appealing; and storytelling adds an emotional connection. Together, these elements create a memorable experience for the audience, increasing the likelihood of retention and sharing.

Infographics are incredibly versatile and can be applied in many areas. In content marketing, they serve as valuable tools for enhancing blog posts, social media campaigns and newsletters, helping to engage audiences more effectively. Internally, companies use infographics to communicate data; explain processes; and provide updates to employees in a clear and concise way. In education, infographics simplify complex concepts, making learning more accessible for students. In business presentations and reports, they help make data-driven content more engaging and easier to follow.

Artificial intelligence (AI) platforms have revolutionized the creation of infographics by automating complex design tasks, making it accessible even to those without design expertise. Tools like Canva, Piktochart and Venngage use AI to suggest layouts, color schemes and fonts, streamlining the creative process based on industry trends and user preferences.

n VISUALS WITH COLOR can boost a person’s willingness to read a piece of content by 80% (SOURCE: SAURAGE RESEARCH)

n PEOPLE WHO FOLLOW DIRECTIONS that include both text and illustrations perform 323% better than those who follow directions without illustrations (SOURCE: SPRINGER)

n 81% OF PEOPLE SKIM the content they read online, with the average user reading only 20-28% of the words during a typical visit

(SOURCE: NN GROUP)

n INFOGRAPHICS can lead to a 12% increase in web traffic (SOURCE: DEMAND GEN REPORT)

n POSTS THAT CONTAIN IMAGES generate 650% higher engagement than those with text-only content (SOURCE: WEBDAM)

n APPROXIMATELY 30% OF MARKETERS prioritize original graphics, such as infographics, over other types of visual content, including videos and GIFs

(SOURCE: VENNGAGE)

n CONTENT WITH RELEVANT IMAGES attracts 94% more views than content without them

(SOURCE: QUICK SPROUT)

Infographics come in various formats, each suited to different types of content and goals.

STATISTICAL / These focus on presenting data and statistics, often using charts, graphs and numbers. They are ideal for sharing research findings, survey results and analytical reports.

PROCESS / These explain step-by-step procedures, making the m great for tutorials, instructions and educational content.

TIMELINE / These illustrate the progression of events over time. They are useful for showing historical data, project timelines or company milestones.

COMPARIS ON / These allow side-by-side comparisons of different products, services or ideas. They help audiences quickly understand the differences between two or more items.

GEOGRAPHIC / These utilize maps and location-based data to provide insights related to regions, countries or other ge ographical areas.

LISTS / These are great for replacing bullet points with creative and eye-catching fonts, colors and icons.

The effectiveness of infographics can be explained by several psychological principles. One is the picture superiority effect, which suggests that people are more likely to remember images than text alone. Visuals help encode information in both verbal and visual memory, leading to better recall. Another principle is cognitive load theory, which suggests the brain has limited capacity for processing information. Infographics reduce cognitive load by breaking information into smaller, visual chunks, making it easier to understand without overwhelming the viewer. The Gestalt principles of visual perception also play a role. These principles explain how people naturally group visual elements and recognize patterns. Infographics that are welldesigned, using alignment, proximity and contrast, guide the viewer’s eye and make information more digestible. DSN

Take control of your payments strategy

Orchestrate payouts to your distributors

Optimize your transactions to grow your revenue

Maintain flexibility in the ever-changing world of payments

Nexio was purpose-built to solve the payment problems direct sellers face. Our unified platform simplifies the complexity of the payments industry and helps you design forward-thinking strategies.

We’re excited to announce we are consolidating brands with our parent company, Complete Merchant Solutions (CMS). Consolidating our services under the Nexio brand enables us to simplify processes and optimize the services we provide. nex.io/power

What demographics are picking up extra income?

BY DAVID LEE

WITH INFLATION STRAINING

HOUSEHOLD BUDGETS, more than half of Americans have turned to side hustles to make ends meet, according to a MarketWatch Guides survey conducted in early 2024. This trend is even more common among younger generations, with 71 percent of Gen Z and 68 percent of Millennials engaging in side hustles. Even 32 percent of Baby Boomers have some type of side gig.

The survey also revealed that two-thirds of Americans are living paycheck to paycheck, showing that even with extra jobs, many remain financially insecure. Among those with side hustles, 44 percent report ongoing financial uncertainty, citing the high cost of living (30 percent) and insufficient income (22 percent) as major obstacles to achieving financial stability.

NEARLY 1/3

OF BABY BOOMERS have turned to side hustles to supplement their income.

How do people make the time to work extra hours? Vistaprint says that 48 percent of side hustlers work on their gig over the weekends, and 59 percent report working from 5 to 9 p.m. through the week.

benefiting from wage increases. This may explain why nearly one-third of Baby Boomers have turned to side hustles to supplement their income.

Inflation has been a significant factor in driving this trend. From late 2020 to mid-2022, inflation outpaced wage growth, meaning that even as incomes rose, purchasing power declined. In June 2022, inflation peaked at 9.1 percent, while wage growth lagged at 5.3 percent. Although inflation has since moderated, it remains above the Federal Reserve’s target, continuing to pressure household finances.

The situation is particularly challenging for Baby Boomers, many of whom are nearing or at retirement age. As retirees living on fixed incomes, they have been hit hard by rising costs without

According to Bankrate, working for extra income 12 hours per week earns a median of $1,122 per month. But 40 percent of Millennials say their side hustle makes up at least half of their monthly earnings. The Motley Fool revealed a significant discrepancy in earnings by gender, with men earning an average of $989 per month and women reporting $361 on their side jobs. The gap also shows more labor-intensive jobs for men such as repairs or landscaping.

As economic stressors and aging demographics collide, the side hustle phenomenon appears here to stay—offering a tangible opportunity for direct selling companies to provide much needed relief and flexibility. DSN

BY SARAH PAULK

valuation, a partnership was forming behind the scenes that was expected to launch the company into even higher stratospheres.

THE CARLYLE GROUP, a private equity firm, was courting the clean beauty brand’s founder Gregg Renfrew with promises of increasing brand awareness and bolstering its omnichannel business model. When the deal between the two parties was finalized in 2021, Carlyle gained a majority stake and Renfrew walked away with around $50 million, according to sources close to the deal.

But all was not as it seemed. Within a year, Carlyle replaced Renfrew with an interim CEO who quickly implemented sharp pivots to the company’s product focus and announced changes to the compensation plan that would create massive reductions in commissions for top sellers. The company went into a tailspin, and in 2024 Carlyle announced the brand would enter foreclosure.

In less than three years, a brand built over a decade with more than 65,000 independent distributors went from unicorn-status to shuttered, and many industry analysts were quick to assign blame. Private equity, they said, was not the hero it purported itself to be.

Private equity can’t be viewed as a binary of right or wrong for the industry, and it certainly has its place. Private equity partners can allow shareholders an exit, they can clean up a cap table and allow a company to be more focused on enterprise value. That capital can also contribute additional cash that can help with growth and reduce behind-the-scenes friction from majority shareholders. Beyond financial support, the most significant and often most attractive value is human capital.

“They’re able to bring managers or board members or some expertise that can help a company break through a stagnant place,”

1 / PRIVATE EQUITY HAS HAD LIMITED SUCCESS IN THE CHANNEL While success stories do exist, the combination of private equity investors and direct selling companies has had a net negative impact.

2 / DIRECT SELLING IS DIFFERENT

The channel operates differently with an independent sales force and tightknit culture. Strategies from outside the channel often do not translate or resonate with distributors.

3 / COMPANY OWNERS ARE NOT WITHOUT BLAME

While the companies they built or founded might have suffered with the influx and influence of private equity capital, the owners of some companies have enjoyed huge windfalls.

said Brett Blake, Annuity.com Chief Executive Officer and author of Private Equity Investing in Direct Selling

“Often a private equity company will buy a company that has been stuck within ten percent of its sales for a long time and, with the help of the network and capital they bring, they’re able to help a company break through and affect more growth. That was the hope in direct selling—that they would buy good businesses and improve their margins.”

To be clear, there are private equity success stories within the channel. In his book, Blake describes private equity firm LNK as an excellent partner for Beachbody and the two entities’ relationship as a “real success story.”

Direct selling grows in a cyclical nature. Revenue can fluctuate, and the private equity model doesn’t typically align to that time scale . Private equity wants its money out.

—JACOB MCLAIN / Head of Sales for Fluz and former executive at Beautycounter “

Primerica also benefited from private equity involvement. John Addison, a direct selling veteran, was Co-CEO of Primerica when private equity firm Warburg Pincus sponsored the company’s IPO as it separated from Citigroup during the challenging 2008 economic landscape. Primerica was entering an incredibly regulated industry that was subject to federal supervision from the Securities and Exchange Commission, and Warburg Pincus provided the expertise and Washington, D.C. contacts to provide a smooth transition.

“Warburg was incredibly helpful in transitioning us from being a division of a big bank into being our own public company,” Addison said. “Rick Williams and I had run a very large direct selling financial services business, but we had not run a public company as Co-CEOs. Their wisdom and guidance were incredibly helpful.”

Addison is also a board member for LegalShield, and while he was not present when private equity firms MidOcean Partners, Stone Point Capital and, later, Further Global engaged with the company, he describes the results of these collaborations as highly effective and positive. The firms have sold their positions in the business and taken profits, as expected, but they are all still significant owners of the company 13 years after their initial investment—a length of time that Addison describes as “unheard of” in the direct selling industry.

“Great private equity partnerships come down to what the private equity firm wants to do and having a quality management team that can execute the strategy they have laid out,” Addison said. “Having investors with a shared vision of management is critical.”

Jacob McLain, Head of Sales for Fluz and a former executive at Beautycounter, had a similarly positive experience when private equity firm TPG entered Beautycounter in 2014.

“It’s hard to find a successful case study of private equity in the direct sales channel, but Beautycounter was a great example of when things went really well for a long time,” McLain said.

According to McLain, TPG grasped Beautycounter’s vision and provided funding and connections that led to subsequent investors, including celebrity musician and philanthropist Bono. Together, TPG and Beautycounter took time to gradually adjust cost structures and make strategic investments that helped build the brand.

“What worked well was a balance of power with the founding team in place that intimately understood the critical success factors of that business,” McLain said. “That ecosystem was really marked by a comfortable timeline and a willingness to evolve rather than make abrupt changes and shorten an exit timeline.”

But herein lies one of the difficult truths of inviting this type of money into a company. Private equity firms aren’t legacy investors in it for the long haul. The patient ecosystem that helped Beautycounter flourish was upended when a new private equity firm purchased a controlling interest a few years later.

“Direct selling grows in a cyclical nature,” McLain said. “Revenue can fluctuate, and the private equity model doesn’t typically align to that time scale. Private equity wants its money out.”

PRIVATE EQUITY

PARTNERS can allow shareholders an exit, they can clean up a cap table and allow a company to be more focused on enterprise value.

In 2008, juice supplement company MonaVie partnered with TSG-MV Financing and received an estimated $100 million capital infusion. TSG appeared to be an obvious fit. They had worked with Coca-Cola’s vitaminwater and knew the beverage category. They had traditional Consumer Packaged Goods (CPG) expertise as well as branding and manufacturing partners that MonaVie could leverage. It was a perfect match but ultimately an unnecessary one.

companies into unhealthy business practices, like offering deep discounts on products, in order to access cash. Business strategies become about how to postpone foreclosure and do so at the cost of future business. In MonaVie’s case, the company defaulted a few years later.

According to Brick Bergeson, Color Street Chief Revenue Officer and former executive at both MonaVie and Jamberry, MonaVie had plenty of cash flow. What it lacked, it could have raised on its own or leveraged its own liquidity to manage the expansions it wanted to make. But private equity was viewed as a smarter move.

“It was almost a feather in the cap of ‘Look who we’re partnering with,’” Bergeson said. “This is one of the bigger traditional players and they’re going to help support our product strategy and fund expansion.”

Two years later, in 2010, TSG converted its equity in MonaVie into a $182 million loan at 12 percent interest, with almost all of MonaVie’s assets as collateral. Debt of this magnitude can plunge

“When you’re up for so many years in a row, you never think there’s going to be a trough, but there is always a dip and you need capital to survive,” Blake said. “When the company experiences a correction, they are hamstrung. Not only do they not have the cash, but now they owe the banks so much money. Their debt service is so significant that they are in survival mode”

Arbonne’s private equity engagement followed a similar storyline. In 2006, the company was debt free with approximately half a billion dollars in annual revenue when it brought in private equity firm Harvest Partners to help it through the IPO process. Months later, the Great Recession hit. The surplus cash flow was gone, but Harvest Partners had already placed $600 million in debt on Arbonne.

When the company experiences a correction, they are hamstrung. Not only do they not have the cash, but now they owe the banks so much money. Their debt service is so significant that they are in survival mode.

—BRETT BLAKE / Annuity.com Chief Executive Officer and author of Private Equity Investing in Direct Selling

“The company’s revenue was declining and so was the economy,” a former Arbonne executive who was on staff during Harvest Partners’ involvement told DSN on condition of anonymity. “When that happens, you have to spend money somewhere to reinspire the field—come up with a new killer product, expand into a new country, something—but there wasn’t any money. It was all spent servicing the debt.”

A number of buyers attempted to purchase Arbonne during this time, including a closed-door deal with Avon that featured what the source described as “a huge bid,” but Harvest Partners declined them all. By the time Arbonne entered bankruptcy proceedings, the source said, Harvest Partners had invested $75 million but taken out over $400 million.

“Creditors pushed Arbonne into Chapter 11 and Harvest Partners disappeared,” the source said. “They were there one day and gone the next with all the money. That doesn’t make them bad people. They followed the rules—but the rules suck.”

The Education Gap Business acumen, practical strategy and connections. Private equity firms appear to have it all—because they do. Investments across a variety of business platforms typically provide them with access to a broad range of expertise that they can make available to their clients. It’s a crosspollination that can help leaders quickly acquire knowledge and make informed decisions about moves they might not have a wealth of experience in.

The problem is that vast and broad experience doesn’t often include direct selling.

“There is a tendency to think that if you understand the commercial world, you understand direct selling,” said Oran Arazi-Gamliel, Strategic Advisor to Apptor AI Solutions. “But direct selling is a different language because it relies on its most valuable asset: the people. When private equity enters the business, what they usually do is start to look at people as transactions. And when you do that, you lose the soul and the drive of what makes this business so special.”

Bergeson, who was an executive at Jamberry when private equity company Wasserstein, now known as EagleTree Capital, invested in the company in 2015, recalled how this impacted leadership decisions on a granular level.

“I remember sitting in a meeting and the Wasserstein people saying, ‘We’re going to treat them like a professional sales force. They can either do X, Y or Z,’” Bergeson said. “But you don’t just crack the whip and say ‘We’re going to fire you.’ They’re 1099 workers; they’re stay-at-home moms. This is something they do on the side. It was so tough to watch.”

“The

Earlier this year, Rodan + Fields announced it would be ending its multi-tier direct selling channel in favor of an affiliate model. It was a switch that took field leaders by surprise, effectively ending their commissions, and led to the elimination of around 100 staff positions.

This drastic move appears to have been precipitated by what industry experts are viewing as an unhealthy private equity partnership. A source familiar with the executive decisions at Rodan + Fields spoke to Direct Selling News on condition of anonymity, saying private equity “changed the needs of the company in terms of how it operated.”

Prior to private equity involvement, Rodan + Fields was fully owned by the founders and the management team. A phantom stock program rewarded employees who helped build the company with payouts that the source described as “life-changing money.” The company’s C-Suite executives, high-ranking management and founders were excluded from this payout because of their inclusion in the company’s LLC. Private equity, the source explained, was a way to get liquidity for those leaders.

This is a familiar pattern woven into private equity involvement within direct selling. Founders invest sweat equity, if not their own money, and often draw a salary during the startup phase that is less than what they could attain on the open market. Taking cash off the table as a reward for those years of sacrifice is a natural next step for many of these leaders.

RODAN + FIELDS

ANNOUNCED it would be ending its multi-tier direct selling channel in favor of an affiliate model. It was a switch that took field leaders by surprise, effectively ending their commissions, and led to the elimination of around 100 staff positions.

“We’re all blaming private equity but, in most cases, the owners are taking out cash.

—BRETT

BLAKE / Annuity.com Chief Executive Officer and author of Private Equity Investing in Direct Selling

“We’re all blaming private equity but, in most cases, the owners are taking out cash,” Blake said. “The truth is private equity companies have made money even as companies have failed. There are cases, however, where they’ve taken a hit and been blamed for the challenges. But in almost every case, the founders and their families have walked out of it with millions, tens of millions, sometimes hundreds of millions of dollars. And this is on top of the tens of millions of dollars in cash that they’ve taken out every year.”

Every enduring direct selling company is built around a founder-led culture. It is the cornerstone for the company’s story and the glue that binds the opportunity, product and mission together into one cohesive package. This formula, while effective, makes it almost impossible to extract the founders without consequence.

In the case of private equity involvement, when founders exit or even take a step back, the field sees it as a sign of trouble, volatility or worse. The antidote to that field anxiety, Blake says, is a strategic succession plan— implemented well in advance of any investor announcements—that signals the company is primed for stability.

“The failure of private equity in our industry is a symptom of a broader problem,” Blake said. “The problem is we’re struggling as an industry to develop leaders.”

“

Even the perception of the founders leaving can be damaging.

—BRICK BERGESON / Color Street Chief Revenue Officer and former executive at both MonaVie and Jamberry

When a company is dependent on a founder’s presence to survive, the culture collapse that is common in private equity transactions can be a fatal blow. But this can be true even before outside investors without a grasp of the channel’s nuances step into internal operations. Sometimes even the rumor of private equity involvement can cause irreparable damage to the company’s ecosystem.

Bergeson experienced this at Jamberry when an upset junior employee leaked the company’s plans to partner with private equity investors. The rumor built negative buzz in the field that was confirmed when the deal was finalized. It didn’t matter that the details of the gossip were incorrect. The damage had already been done, and Jamberry struggled to recover.

“Even the perception of the founders leaving can be damaging,” Bergeson said. “The field can be finicky in that process and perception becomes reality for them. If they sense any risk to their ongoing viability or to their personal business, they will run for the hills.”

The list of alternatives to private equity isn’t lengthy. Debt recapitalization has been a safer option for some company founders, but it isn’t a cure-all. Instead, industry analysts point to the need for a mindset shift for those residing at the top of the channel’s org chart to impact lasting change. Direct selling, for instance, doesn’t often invest in itself. Outside of the channel, it’s common for founders and CEOs to reinvest capital into their own industry. Inside of direct selling, there is a feeling of incongruency when it comes to investing in brands that are seen as competitors. As a result, “smart money” is leaking out of the industry, forcing

companies into capital partnerships that aren’t always in their best interest.

Beyond that, analysts advise companies to revisit their fiscal management policies and consider a new approach to debt margins that is better suited to the current market landscape.

“Looking at the future of direct selling, companies are going to have to return cash to investors by running a fundamentally good and profitable business,” McLain said. “You really have to manage overhead carefully. That to me is the future dynamic. Operating at a loss and raising more and more money hoping someone will pay more for it than the last isn’t a viable path forward in the channel anymore.”

It would be simplistic to call out private equity investors and the predatory loan-to-debt life cycle they often inflict on companies as the only reason behind a company’s demise. These types of fiduciary partnerships may be the driving force that pushes companies out of business, but they also serve to highlight the pattern of cultural collapse and leadership vacuums that were making companies vulnerable to these types of agreements in the first place.

“From a direct selling perspective, companies need to ask themselves ‘What happened that made us lose our voice?’ and ‘What do we need to do in order to recreate it?’” Arazi-Gamliel said. “It’s not what happened in the past, but what needs to happen in the future for this to be mitigated and for the direct selling channel to return to growth.” DSN

Join us for the Global Celebration as we unveil the DSN Global 100 for 2024.

Block your calendar, make plans with your internal team and stay tuned for registration details.

BY SARAH PAULK

RESILIENCE WAS the overarching theme of direct selling around the world in 2023. Following jarring supply chain disruptions in 2020, 2021 and 2022 that sent companies scrambling to keep inventory stable and source raw ingredients and packaging components, 2023 delivered elevated global inflation of 7 percent and ongoing conflicts that impacted a number of markets.

In spite of this, the World Federation of Direct Selling Associations (WFDSA) reported that global retail sales grew one percent across the past four years. It is important to take into account that this growth includes the significant spike in sales and channel engagement induced by the pandemic and the heightened interest in work-from-home opportunities that accompanied it. Global sales increased 2.2 percent to $170 billion in 2020 and by 2 percent to $173.4 billion in 2021, before beginning to level out and fall in 2022, when sales dipped one percent to $171.6 billion. Global sales totals for 2023 followed a similar trajectory, declining 2.3 percent to $167.6 billion. Even so, 2023 sales results remain above pre-pandemic levels when sales were $166.4 billion in 2019.

1 / THE AMERICAS REPORTED NEGATIVE GROWTH

North America experienced a nearly 4% decline. The results in South and Central America were better with Brazil enjoying a significant bounce back.

2 / BIG ASIAN MARKETS SUFFERED WHILE EMERGING MARKETS SHINED Established markets including China, Australia and Japan had marked downturns while newer markets such as Kazakhstan, India and Malaysia continued to grow.

3 / EUROPE IS ALSO A MIXED BAG Russia and the UK continued downward trends; France and Poland held steady while Germany, Bulgaria and Belgium posted strong gains.

This year, the WFDSA report illustrated opportunities amid obstacles. And as has been our tradition for 14 years, Direct Selling News utilized the global industry statistics presented by the WFDSA to create a synopsis of the state of the global direct selling industry and list the Billion Dollar Markets. Together, the global direct selling industry contributed more than half-a-trillion US dollars from 2020 to 2023 to the global economy, impacting local communities, providing goods and services and supporting household incomes through flexible entrepreneurship.

THIS YEAR, the WFDSA report illustrated opportunities amid obstacles. “

“

GROWTH POTENTIAL for direct selling remains substantial, given the continuing desire of people for entrepreneurial opportunities.

WFDSA REPORTED

“The growth potential for direct selling remains substantial, given the continuing desire of people for entrepreneurial opportunities. About 60 percent of people want to have their own business, and nearly one in four are in business now or expect to be within a year. Forty percent say raising capital is the biggest obstacles in launching a new business, down from 45 percent in 2019, and 39 percent believe they have the resources to begin a business, up from 35 percent in 2019. According to the Amway Global Entrepreneurship Report (AGER), 67 percent feel starting a business is attractive after knowing someone who began one, up from 58 percent in 2019,” the WFDSA reported.

Note: All WFDSA data have been rounded throughout.

WFDSA reports global estimated retail sales of $167.7 billion (Constant US Dollars) for 2023, a decrease of 2.3 percent under 2022.

As seen in the WFDSA’s report, the direct selling industry’s resilience was particularly visible in Europe, where sales increased by 3.4 percent from 2022 and 8.6 percent since 2019. In the Americas, retail sales mirrored global sales trends, posting strong growth during the pandemic which leveled off in 2022 and declined by 3.8 percent in 2023, which remains above pre-pandemic levels. Latin and South American markets saw positive growth in 2023, while Canada (-8.5 percent) and the United States (-2.9 percent) saw declines.

Direct selling continues to be an overwhelmingly women-oriented business. Excluding those markets where reporting was unavailable, Kazakhstan is the only market that reported a male-dominated industry. All other markets reported that women make up 70 to 95 percent of the salesforce, with Malaysia (63 percent) being the only outlier in

this data set. Even so, the WFDSA reported that entrepreneurial support for women was rated “unsatisfactory” in 37 out of 49 economies.

By category, Asia/Pacific held 38.6 percent of the global market share for Wellness, which was the largest category overall, capturing 31.7 percent of global product sales. Even with this strength, this was a decline for the category, which held at 36.3 percent in 2019. Household Goods and Durables, however, is on the rise, reaching 17 percent of global product sales, a near steady uptick since 11.8 percent in 2019. Cosmetics and Personal Care ranked second, with 24.2 percent of global product sales, led by the Americas, which reported 28.9 percent of product sales shares in 2023.

WFDSA reports that approximately 12 million fewer independent representatives participated in direct selling worldwide in 2023 than in 2022. This is a continued decline from 2022, which saw a nearly five million persons decrease from 2021. In 2022, the decrease was seen as a return to pre-pandemic levels after heightened engagement during the pandemic, but 2023’s numbers demonstrate a continued downward path.

“While the general sentiment on expectations for 2024 among the DSAs is for flat sales or modest increases, the growth potential for direct selling remains substantial, given the continuing desire of people for entrepreneurial opportunities, despite or even because of the turmoil and change of recent years. About 60 percent of people want to have their own business, and nearly one in four are in business now or expect to be within a year (AGER).

A common theme among the DSAs sharing insights on their local markets is that direct selling is about relationships. Selling based on relationships can be in-person or through various media and can be called by various names, but it is still direct selling. If relationships remain the north star/bedrock value of the channel, direct selling will not only survive, but thrive,” the WFDSA reported.

The Americas—North and South/Central—reported a combined $62.6 billion in estimated retail sales in 2023. This region experienced a fall of 3.8 percent in year-over-year sales. After a strong three-year CAGR of 4 percent in 2022, the Americas experienced a 0.9 percent decrease overall. The Americas represents 37.3 percent of global direct selling sales.

Seven Billion Dollar Markets are included in the North and South/Central America region. Wellness and Cosmetics run nearly even in their product category popularity at 27 and 29 percent, respectively. Household Goods and Durables remains third at 12 percent. More than 27.1 million independent representatives were affiliated with direct selling brands in 2023. This number reflects the global pattern, and is a continued drop from 2022, which saw 2.5 million fewer people than 2021. Regional data for the Americas reported together. However, the Americas are split here to better understand each of the distinct markets.

Read the full report here: heyzine.com/flip-book/WFDSASTATS2024.

THIS COLLABORATIVE, GLOBAL DATA COLLECTION EFFORT of the World Federation of Direct Selling Associations, Seldia (The European Direct Selling Association), and local direct selling associations and their member companies around the world, depicts the state of the global direct selling industry for 2023.

Compiled annually, this collection of statistics is a result of more than 5,000 person hours completed in collaboration with independent third-party vendor Paul Bourquin of The Cadmus Group, who was responsible for direct contact between DSAs and member companies to ensure confidential handling of data and strict confidential protocols. Individual market data is listed in local currency figures, which are converted into US dollars using current year constant dollar exchange rates to eliminate the impact of currency fluctuation. All statistics are based on estimated retail sales and in some instances may be restated using actual sales data as they become available. Statistics for some markets represent direct selling association member companies only and not the entire industry in that country. Other statistics are WFDSA research estimates.

While its $36.6 billion in sales generated solidified its number one ranking in the world marketplace, the US experienced a challenging year. Year-over-year sales dropped by 9.5 percent and its CAGR dipped 2.9 percent.

Canada’s pandemic-era sales growth of 26 percent posted in 2020 all but slipped away with 2021’s flat performance and 2022’s decline of 18.4 percent. In 2023, the market continued this pattern, posting $2.3 billion in sales with a CAGR of -8.5 percent.

Wellness overtook Cosmetics this year and reported Services revenue surpassed Wellness in the US. Household Goods and Durables fell slightly in popularity to 14 percent.

Independent representative numbers for North America continued their decline following pandemic highs with a regional total of 14.1 million independent representatives, encompassing 12.9 million partners in the United States and 1.1 million in Canada.

The South/Central America region told a mixed story which included high-end sales performance, flat lines and losses.

Argentina continued its trend of top-end sales growth and posted a 114.5 percent increase. While it’s important to note the highly inflationary aspects of Argentina’s market, these increases continue to stand out and represent a country CAGR of 72 percent. Brazil’s growth was particularly notable at 4.6 percent following its sizeable downturn in sales performance in 2021 that led to a nearly $800 million loss and then flat-line performance in 2022.

LATAM’s estimated retail sales showed significant momentum following the previous year’s 2.5 percent year-over-year gains. In 2023, the region saw sales totaling $23.6 billion, a 6.8 percent sales boost from 2022 sales of $22.1 billion, with a regional CAGR of 3.5 percent.

Individual country market statistics are: Brazil ($7.9 billion, -2.0 percent CAGR), Mexico ($6.8 billion, 2.5 percent CAGR), Colombia ($2.3 billion, 10.8 percent CAGR), Peru ($2.1 billion, 6.2 percent CAGR), and Argentina ($1.7 billion, 72 percent CAGR). Inflationary economies like Argentina typically report restated data later in the year.

Cosmetics and Personal Care products once again dominated regional sales at 59 percent, a slight increase from 2022, but significantly lower than 2017’s 67 percent high. Wellness ranked second at 18 percent, while Household Goods and Durables slotted third at 10 percent. Independent representative numbers declined in 2023 to just over 13 million, down from nearly 14.2 million in 2022.

THE ASIA/PACIFIC MARKET is enormous and intricate in nature, thus innately volatile due to cultural, environmental and governmental differences.

The Asia/Pacific region continued to see an exodus of independent representatives. In 2022, the region saw a loss of more than 6.5 million independent representatives, leaving 67.6 million. In 2023, that number dwindled even further to 58.9 million representatives who remain affiliated and sell primarily Wellness (39 percent) products. Cosmetics and Personal Care (17 percent) and Household Goods and Durables (25 percent) are also popular.

Eight Billion Dollar Markets are located in the Asia/ Pacific region and comprise 40.3 percent of the global retail sales for 2023. The region generated an estimated $67.5 billion in estimated retail sales in 2023, a 3.7 percent downturn from $71.5 billion generated in 2022. In 2022, Asia/Pacific boasted 48.7 percent of global retail sales and an almost flat (+0.2 percent) sales growth. While static in nature, that incremental growth represented the first regional increase in five years. In 2023, however, the region’s decrease in sales is a sharp contrast, led by Australia, which saw a 35.8 percent decline in sales and a -15.1 percent CAGR.

As in years past, China continues to impact Asia/ Pacific’s regional statistics due to its population size, turbulence in the direct selling marketplace and post-pandemic recovery. From 2019 to 2022, China experienced a decline in its estimated retail sales for four consecutive years. In 2023, that descent halted, as the market posted a flat sales growth of 0.0 percent. While this is not forward momentum, it does signal an optimistic direction.

China posted just over $15 billion in sales in 2023, representing a striking contrast to 2018 when the country seemed poised to overtake the number one ranking of Billion Dollar Markets. It remained fourth for the third year with a CAGR of -7 percent. Independent representative numbers held steady at slightly below 3 million.

Vietnam fell off the Billion Dollar Markets list this year after making its inaugural appearance in 2022. After five years of double-digit growth and a 21st ranking on the list in 2022, the country saw a 19 percent decline in year-over-year sales in 2023, producing an estimated $958 million in estimated retail sales and a reported CAGR of 3.7 percent.

The Asia/Pacific market is enormous and intricate in nature, thus innately volatile due to cultural, environmental and governmental differences. For example, Vietnam’s striking descent contrasts sharply with significant growth in country markets like India, which saw an 11.8 percent sales increase, and Kazakhstan, which saw an astonishing 30.4 percent increase and $708 million in sales.

Smaller emerging markets, like New Zealand, which posted $117 million in sales and experienced a 6.7 percent sales increase, make the market attractive to companies seeking expansion, even as the region experiences challenges. After being the only regional market worldwide to experience growth in 2022, Asia/Pacific sales declined greater than the average global sales rate, dipping 3.7 percent.

Kazakhstan proved to be the region’s surprise standout, while Australia lost significant ground. After a notable but single-digit decline of 7.8 percent in 2022, Australia lost 35.8 percent in sales in 2023. In fact, twice as many countries in Asia/Pacific experienced negative sales than those that saw positive growth.

Asia/Pacific Billion Dollar Markets data reports as follows: Australia ($747 million, -15.1 percent CAGR), China ($15.0 billion, -7.0 percent CAGR), India ($3.4 billion, 8.3 percent CAGR), Indonesia ($1.2 billion, -6.0 percent CAGR), Japan ($10.6 billion, -3.2 percent CAGR), South Korea ($16.2 billion, 0.5 percent CAGR), Malaysia ($9.5 billion, 8.1 percent CAGR), Philippines ($994 million, -7.6 percent CAGR), Taiwan ($4.5 billion, 2.3 percent CAGR), Thailand ($2.1 billion, -6.6 percent CAGR) and Vietnam ($958 million, 3.7 percent CAGR).

/

THE WHOLE OF EUROPE, which encompasses countries inside and outside the European Union, is responsible for 21.6 % of global direct sales. “

& THE REST OF EUROPE /

The whole of Europe, which encompasses countries inside and outside the European Union, is responsible for 21.6 percent of global direct sales. Six countries within this region qualify as Billion Dollar Markets. Europe experienced a rebound year in 2023, posting a 3.4 percent increase in sales and positive 2.2 percent CAGR after a decline of 1.1 percent in 2022 with estimated retail sales of $34.7 billion and a regional CAGR of 1.6 percent.

2023 statistics show 12.7 million independent representatives, a slight uptick from 12.6 million in 2022. This is particularly noteworthy since the region saw a drop of just over three million representatives between 2021 and 2022. Of the region’s 12.7 million representatives, 5.2 million reside within the European Union and 7.4 million in the Rest of Europe. These numbers show a shift of interest from the European Union to the Rest of Europe as numbers within the EU fell by 0.8 million representatives while the Rest of Europe saw almost one million new representatives since 2022.

By category, 32 percent of products sold in Europe are designated Wellness (30 percent, EU); Cosmetics and Personal Care (23 percent, 16 percent EU); Home Improvement (14 percent, 18 percent EU); and Household Goods/Durables (14 percent, 16 percent EU).

France, Germany, Italy and Poland comprise the EU Billion Dollar Markets and reported $28.5 billion in estimated retail sales in 2023, down from $30 billion in 2022.

Sales saw positive momentum in Austria (3.8 percent), Belgium (13.9 percent), Bulgaria (29.1 percent), Cyprus (2.9 percent), Czech Republic (0.2 percent), Estonia (2.1 percent), Germany (7.0 percent), Greece (3.1 percent), Ireland (5.5 percent), Latvia (1.4 percent), Lithuania (3.0 percent), and Slovenia (6.4 percent). Germany led the region with $19.7 billion in estimated retail sales, establishing a CAGR of 5.1 percent. This is an increase from 2022 when sales were $18 Billion with a CAGR of 3.1 percent.

After suffering a decline of 5 percent in 2022, both France and Poland held steady at a flatlined 0.0 percent sales growth. France posted $4.7 billion in estimated retail sales with a CAGR of -1.0 percent, while Poland reported $1 billion in sales with a CAGR of 1.0 percent.

The outlook in the Rest of Europe is a mixed bag. Russia saw another year of decline, albeit a less steep descent. In 2022, the country experienced a 22.6 percent loss in sales. That number lessened to -7.3 percent in 2023. Sales in the country were $1.2 billion with a CAGR of -11.7 percent. The United Kingdom also felt painful declines of 10.0 percent, but this too was a softer landing than 2022, which posted 21 percent losses. Even so, the United Kingdom held onto the Billion Dollar Markets list, reporting $1.1 Billion in sales.

Product category reporting is unreliable for the Rest of Europe as a whole; however, 52 percent of Russia’s 4.6 million independent representatives sell Cosmetics and Personal Care products, while Wellness is the focus of 28 percent. United Kingdom reports 45 percent Wellness and 44 percent Cosmetics and Personal Care. There are just over 320,000 independent representatives affiliated with direct selling companies in the UK.

One key revenue number not reflected in the WFDSA report is the remarkable numbers posted by Utility Warehouse (UW) in the United Kingdom. For the fiscal year ending March 31, 2024, the company reported revenue of $2.6 billion with a record profit of $451 million, a 16 percent increase over the previous year DSN

IT DOESN’T MATTER HOW POWERFUL THE DIRECT SELLING MESSAGE IS WHEN THE LANGUAGE WE USE GETS LOST IN TRANSLATION.

BY HEATHER CHASTAIN

WE’VE USED the same language for so long that it is deeply ingrained in our culture—but, quite frankly, it no longer serves us or our sales force . “

(DSN), the cover story took a deep dive into how we define our industry. Specifically asking if our opportunity seems to check so many boxes for people looking for supplemental income, why are we not growing?

It’s an interesting question—one that requires us to challenge our beliefs and long-held traditions. I think one incredibly important way we are currently missing the mark is with our messaging.

We’ve used the same direct selling language for so long that it’s deeply ingrained in our culture. But—quite frankly—it no longer serves us or our sales force.

1 / MESSAGING AND METHODS ARE MISSING THE MARK

The tried-and-true strategies and language that have propelled direct selling forward in the past are no longer relevant, but small tweaks can start to fix the problem.

2 / SOME WORDS ARE SIMPLY RED FLAGS

In today’s world, words like “sponsor” and “join” are off putting. Languages always bend and shift over time, and the language of direct selling is overdue for an overhaul.

3 / MULTIPLE BUSINESS STREAMS APPEAL TO TODAY’S PROSPECTS

Younger generations aren’t looking to escape a monotonous job. They’re interested in creating multiple income streams. Market the opportunity as one more tool in their box.

I gave a presentation at DSU Europe where I unveiled the results of our generational survey of that region. It replicated the methodology of what Bridgehead Collective did in the US last year in gaining generational insights for direct selling. And it clearly shows that the traditional language of direct selling turns people away from rather than towards the opportunity.

Do you remember a series of books from a few years back…Eat This, Not That ? It offered simple food swaps that could drastically improve your health. In this article, I’m going to give you a few Say This, Not That options for your messaging with simple swap outs to help you better reach and retain your sales force.

Here’s an incredibly encouraging stat—68 percent of Europeans would like to own their own business in the next three years. And 49 percent of Europeans consider gig economy jobs as starting their own business. Of course, that means 51 percent don’t. Which means that over half of the people who want to participate in the gig economy don’t consider direct selling to be a part of that. When we as an industry say “start your own business,” they’re thinking, I don’t want to start my own business. I want a side hustle. Instead, use different language like side hustle, additional income stream, participation in the gig economy—those are the phrases that resonate. Especially with Younger Millennials.

LANGUAGE ISN’T THE ONLY THING WE NEED TO UPDATE. HERE ARE A FEW KEY INSIGHTS PULLED FROM THE EUROPEAN

n THE BIGGEST BARRIER to starting a business is the high cost. The tipping point in US dollars is $115. Anything more than that is considered too much of a risk.

n WHAT AMOUNT OF MONEY EARNED makes direct selling “worth it.” The sweet spot for making direct selling worthwhile is $250-$499 US monthly.

n DIRECT SELLING COMPANIES’ Fast Start programs are useful as roadmaps to what the journey can look like, but they can create disproportionate expectations of what ongoing earnings will be. Make sure your Fast Start programs teach behaviors that will get new distributors close to the $250-$499 threshold.

n BECAUSE DIRECT SELLING is for most a supplemental revenue stream, distributors of every generation aren’t interested in working more than 15 hours a week. Younger generations don’t want to work it more than 10.

n SEVENTY SEVEN PERCENT of Europeans are more likely to work with a company that supports a social cause that they're passionate about. This is the one stat that completely blew the US out of the water. That number in the US was only 27 percent.

n WE THINK THAT Younger Millennials and Gen Z want everything online, and they do. With one key exception. They want a physical starter kit. They respond to the confidence and legitimacy that comes with that.

n IF YOU'RE NOT DOING an incentive trip of some kind, you're missing out. But the key here is shorter trips with more frequency. You're better off not doing the great big international trip for the Top 25—do three or four smaller regional kinds of destinations where they can get content more frequently. You’ll probably spend the same amount and get more bang for your buck.

THE RESEARCH shows that 96 percent of Younger Millennials want to be a leader, but only 21 percent want to build a team.

One surprising result in the survey revolved around the term “affiliate marketing.” It did not test well. That’s the language many direct selling companies have adopted, but it doesn’t perform as well as other terms. What term does score highly? Interestingly, direct selling seems to hit the mark pretty well with Gen Xers with a very high favorability rating. Younger generations prefer digital marketing and influencer marketing.