GETTING REAL 2024

What we learnt at the REIV conference

Property policy priorities

What we’re asking the state government for in the 2024-2025 Budget

Shattering the problem

Why the glass damage insurance system is broken

Hampering the hackers

How to make sure your business is safe from cyberattacks

The Journal of the Real Estate Institute of Victoria APRIL 2024 VOL 88 / NO 01

Contents The Estate Agent is published by the Real Estate Institute of Victoria. 2 | The Estate Agent Publisher REIV 335 Camberwell Rd, Camberwell, Victoria 3124 Editor Sarika Bhalla sbhalla@reiv.com.au Production Pagemasters Established in 1936, the Real Estate Institute of Victoria (REIV) is the peak representative body for real estate professionals in Victoria. Our Mission is “to enhance the professional excellence of our Members to the benefit of the communities they work within, and to advocate and represent their interests”. President’s report CEO’s report 12 INSIGHTS AND INSPIRATION AT GETTING REAL 2024 2024-2025 Victorian Budget: Submission by the REIV A review of sections 28 and 64 of the Retail Leases Act 2003 VicForms forms and authorities 4 6 18 23 28

The Estate Agent | 3 Unless otherwise specifically expressed, the views or opinions appearing in The Estate Agent (EA) are those of the authors and do not represent the views of The Real Estate Institute of Victoria Ltd (REIV). The REIV gives no warranty about the accuracy, completeness, or reliability of the content of EA. The entire content is general information only. It is not advice or intended as advice and in no circumstances should be relied upon as such. Readers and third parties should verify the content and seek their own independent advice before making any decisions, financial or otherwise, based on what they have seen or read in EA. The REIV and EA do not endorse or take any responsibility for material on third party websites referred to in the EA. The magazine for real estate professionals who are the difference. 32 BONDABLE: A NEW WAY TO BOND Why are commercial rental determinations overturned? Damaged glass claims The budget bargain suburbs not far from the city centre 46 HOW TO HEAD OFF A HACK ATTACK Personal wellbeing resources for you and your team New members Membership milestones 34 38 40 50 52 54

PRESIDENT’S REPORT

Jacob Caine, REIV President

A SUSTAINABLE FUTURE: INSIGHTS FROM THE UN GLOBAL FORUM ON BUILDING AND CLIMATE

In a world grappling with the impacts of climate change, the built environment sector represents one of the biggest risks and opportunities. Our cities, buildings and infrastructure need not be passive witnesses to the unfolding climate crisis but can be key actors in mitigating its effects. This was the central theme of the recent UN Global Forum on Building and Climate held in Paris, which I had the privilege of attending as a delegate representing the REIA and Australia. This event brought together global leaders, innovators, and policymakers to chart a sustainable path forward for the built environment.

The forum underscored a critical message: the technologies and capabilities required to transition to a zero-emissions built environment already exist. From energy-efficient building designs to renewable energy integration and green urban planning, we have solutions at our fingertips. What remains elusive, however, is the collective will from governments and the public to implement these solutions boldly and swiftly. The forum’s consensus was clear –we need transformative policy frameworks, substantial investments and public engagement to harness these technologies for a sustainable future.

The role of estate agents in the “value chain” is an important one. As trusted advisors to rental providers, renters and property owners preparing to sell their homes, we play a significant role in helping owners determine which appliances, fittings and fixtures they should choose when repairing and renovating their properties. Recent research coming out of the ACT has demonstrated the economic advantages for sellers and rental providers when selling and renting higher-rated energy-efficient properties. In Canberra, prices of sold properties with energy ratings above 3 stars achieved as much as 15 per cent higher sales results than those with lower ratings. Similarly, rental properties with higher energy efficiency ratings realised, on average, 10 per cent higher rental yields. The financial imperative is clear, and improved outcomes for the environment is a welcome by-product.

During my visit to Paris, I had the privilege of engaging in one-on-one meetings with key figures who are shaping the future of sustainability and economic policies.

4 | The Estate Agent

My discussion with the Australian Ambassador to France, Her Excellency Gillian Bird, at the Australian embassy was enlightening, emphasising the role of international collaboration in addressing climate challenges. Conversations with Boris Cournede, Principal Economist at the OECD, and Narek Arakelyan, Secretary-General of Fiabci, further deepened my understanding of the economic dimensions of sustainable building practices and the global real estate market’s role in driving change.

This trip was not just an opportunity to gain insights but also to represent the Real Estate Institute of Victoria (REIV) and the Real Estate Institute of Australia on the global stage, showcasing our commitment to sustainability in the built environment. It reaffirmed my belief that, as industry leaders, we have a pivotal role in advocating for and implementing sustainable practices.

LEADING INTO THE FUTURE: THE REIV’S JOURNEY

Back home, the REIV is on an exciting trajectory of growth and transformation. Our search for a new CEO has been met with an overwhelming response, attracting more than 100 applications from a diverse group of outstanding business leaders, both nationally and internationally. This enthusiastic reception is a testament to the REIV’s reputation and the appealing challenge of leading our industry towards a more sustainable and prosperous future. Before the end of the month we aim

Our cities, buildings and infrastructure need not be passive witnesses to the unfolding climate crisis but can be key actors in mitigating its effects

to have announced our new CEO – a leader who will undoubtedly steer the REIV with vision and integrity.

The REIV’s new headquarters on Victoria Street, Abbotsford, has been secured and will begin taking shape shortly after settlement occurs in June. The premises will reflect our commitment to innovation, collaboration and sustainability. The fit-out plans are being designed with these principles at heart, ensuring that our new space will not only serve our operational needs but also embody our values. We are excited about the move, which is anticipated to occur before the end of 2024, marking a new chapter in the REIV’s storied history.

Jacob Caine, REIV President

The Estate Agent | 5 APRIL 2024 PRESIDENT’S REPORT

1800 675 755 service@progroup.net.au www.kitchenapplianceinstallation.com.au/dishwasher-installation Cabinetr y Plumbing Power point Installation We modif y kitchen Cabinets to make space for Dishwashers FOR HOME & BUYERS SELLERS " " One op S hop

CEO REPORT

Megan Mander, REIV CEO

TRANSFORMATION AND EVOLUTION

Over the past few months, I’ve delved into the diverse business units within our organisation, gaining invaluable insights into how we can evolve to better serve our members’ needs.

Additionally, I’ve engaged with various chapter committees and members to gather feedback in order to address current challenges and any outstanding matters.

We’ve been actively consulting with government bodies on pertinent issues and have been present at pivotal stakeholder meetings.

Our registered training organisation (RTO) is undergoing a thorough re-registration process, prompting a comprehensive review of

methods. The RTO stands as a vital component of our organisation. Amid an evolving landscape of workplaces and training methodologies, the REIV has a prime opportunity to revolutionise our training offerings and service delivery. By investing in our accredited training and continuing professional development (CPD) courses, we aim to reaffirm our status as the industry’s premier training provider.

We’re committed to ensuring that our training products and services cater to the diverse functions of our industry and membership base. To this end we’re exploring the addition of new accredited courses and other training programs. Notably, we’ve reinstated courses for our owners corporation managers and introduced a training program for buyers advocates with valuable input from these committees.

As mandatory CPD training looms on the horizon, the REIV is poised to provide modern, comprehensive training solutions tailored to the needs of attendees.

Advocacy remains a cornerstone of our institute and we’re dedicated to amplifying our unified supportive voice. Collectively the board and management recognise the significant of advocacy to our members and are actively pursuing avenues to expand our reach. We aim to provide regular updates on our advocacy efforts ensuring transparency in our representation of your interests and needs.

Our marketing team, in collaboration with our external partners, are on the brink of unveiling our new website.

CEO REPORT APRIL 2024

I can assure you we’re dedicated to effecting change and advancing this institute

This enhanced platform will offer improved functionality for members, augmenting the online presence. Stay tuned for new features and an expanded resource library featuring relevant information, practice notes, legislative advice and more – a testament to our ongoing commitment to member support and empowerment.

You may have noticed our recent joint campaign with President Jacob Caine, requesting candid feedback from members on our initiatives. This period of transformation presents and opportunity for us to listen intently to our members, the lifeblood of our organisation. I urge you to participate in the survey as we valued and need your input.

I can assure you we’re dedicated to effecting change and advancing this institute. We look forward to the year ahead filled with growth and progress.

Megan Mander, REIV CEO

The Estate Agent | 7

APRIL 2024 CEO REPORT

EDDIE VAN PAMELEN AWARDED THE AREI DIPLOMA

REIV member for almost 15 years and Chair of the REIV Buyers Agents Chapter Committee for 4 years, Eddie

was awarded the AREI at the Members Council meeting held earlier this week.

With more than 18 years’ experience as a buyer’s agent, Eddie is a director at Etica, a Melbourne based buyer agency and has been a regular contributor and trainer at the REIV. We thank Eddie for his commitment and congratulate him on this accolade.

REIA presents certificates of Associate of the Real Estate Institute of Australia (AREI) to approved applicants to recognise achievement of members’ tertiary qualifications, and their continuous involvement with Real Estate Institutes at state and territory level.

PRICE QUOTING WHEN SELLING RESIDENTIAL REAL ESTATE

In May 2017, changes to the Estate Agents Act 1980 came into effect to strengthen laws against underquoting in Victoria. Penalties apply to those who do not comply with these laws. Price estimation is a fundamental aspect of selling real estate and it is critical that all agents understand the rules and their obligations.

The short online self-paced course has been reviewed and updated to address some of the commonly observed errors, misinterpretations and knowledge gaps. We encourage all listing and selling agents to complete this course as a refresher and ensure compliance with the legislation.

Learn more

8 | The Estate Agent

BULLETIN APRIL 2024

Bulletin

NEW CPD YEAR

Ongoing professional development has always been a core purpose of the REIV. The REIV Continuing Professional Development (CPD) program provides a framework to ensure that Members continually invest time and effort into upskilling themselves and their teams.

To build and maintain the REIV Difference, it is important that members demonstrate they are a cut above the rest through their dedication to their ongoing development.

The REIV CPD program covers a wide range of activities that all contribute to building a better skilled, more knowledgeable professional real estate sector. The program is designed to be simple, accessible and flexible.

The REIV CPD year commences on April 1 each year. A minimum of 10 REIV CPD hours must be achieved in each CPD year. This

must include the prescribed REIV Ethics Module for the year. At least five hours must be from REIV activities.

Any activity that members undertake outside the REIV can be considered for CPD hours by lodging via the member portal. Simply login to your member account via members.reiv.com.au and record your activity under the Manage Your CPD tile. Please submit evidence of the completed activity.

Allocation of hours will be at the discretion of the REIV. No fees apply.

Examples of suitable activities include formal training such as a business qualification training; events provided by AICD, API, AVI, RICS or the Victorian Chamber of Commerce; and training, events, or competitions organised by or through your employer or franchise group.

ACT AS A BUYER’S AGENT

Considering becoming a buyer’s agent?

This new full-day course covers the essential skills and knowledge required to act as a buyer’s agent and represent buyers in the purchase of properties. It includes establishing buyer requirements, confirming buyer engagement of the agency, sourcing properties that meet buyer requirements, negotiating the purchase of property on behalf of the buyer, monitoring settlement of the sale and maintaining communication with sellers and buyers.

Delivered face-to-face at the REIV Camberwell offices, the course is part of the REIV CPD program and has been developed with input from our Buyers Agents Chapter Committee. Learn

The Estate Agent | 9

APRIL 2024 BULLETIN

more

REAL ESTATE MATTERS: INTRODUCING THE NEW REIV PODCAST

Episode 1

The first episode discusses the rental market in an effort to highlight the initiatives that could help address some of its challenges. Former REIV CEO Quentin Kilian is joined by Anna Neelagama, CEO Real Estate Institute of Australia, and Sabina Aldouby, Director Luxe Property and long-term REIV Member.

Listen here

As Victorians navigate a complex and dynamic housing market, they have an insatiable appetite for information, trends, data and education. As Victoria’s peak real estate body, the REIV has launched the podcast Real Estate Matters to provide a platform of informed, expert-led conversations on the topics that matter to real estate professionals and enthusiasts.

A new episode of the REIV-owned podcast will launch every six weeks. The podcast will feature interviews with property sector experts and will include guests from the REIV membership, kindred bodies, policy makers and regulators, who will discuss a range of topical and timely industry issues.

Episode 2

REIV President Jacob Caine discusses real estate regulation with Nicole Rich, Director of Consumer Affairs Victoria. Hear Nicole talk about CAV’s role in the real estate market, key issues identified by the Underquoting Taskforce and current areas of focus including complaints from renters.

Listen here

Episode 3

A discussion with The Hon Lily D’Ambrosio Minister for Climate Action, Minister for Energy and Resources and Minister for the State Electricity Commission.

10 | The Estate Agent

BULLETIN APRIL 2024

REIV INFORMATION OFFICERS JIM LOURANDOS AND CHRIS SNELL ADDRESS SOME OF THE CURRENT COMMON QUESTIONS FROM MEMBERS

Best practice: Rural sales and primary

production

WHEN LISTING A RURAL PROPERTY MAKE SURE YOU UNDERSTAND THE FARMING ZONING CONDITIONS

Rural and farming properties are usually zoned as either RLZ or FZ. These are government planning zones that are determined by the size of the property and the degree of intensity of any enterprise undertaken on it, ordinarily the

scale of activity that would qualify as primary production. For completeness, confirm the location of the property with the local planning scheme that controls its land use, zones and any overlays which may or may not apply to the current and future occupier.

An important consideration when discussing the sale with your vendor is to ask: Is the property for sale a business of ‘going concern’ with an associated GST-free supply?

Best practice is to check ahead and confirm its veracity with the vendor’s legal representative.

For further information, please visit the ATO website link below that discusses the business of primary production:

Income tax and the business of primary production

The Estate Agent | 11

Chris Snell

Jim Lourandos

REIV Information Officers

APRIL 2024 BEST PRACTICE

Insights and inspiration shared at Getting Real 2024

DELEGATES AT THE REIV CONFERENCE HEARD ABOUT THE BIGGEST ISSUES FACING OUR INDUSTRY NOW AND INTO THE FUTURE

Getting Real 2024 focused on key issues impacting real estate businesses, now and into the future. Whether it was economic policy, sustainability principles, planning and legislation or a deep dive into emerging initiatives such as build-to-rent – the conference covered a range of critical themes that are defining our sector.

The intensive day was supported by sessions with inspirational leaders who shared their stories of resilience.

CONTINUED ON PAGE 14 >>

12 | The Estate Agent CONFERENCE APRIL 2024

Emily Mottram from the Department of Transport & Planning spoke to delegates about the planned Activity Centres around Melbourne.

The Estate Agent | 13 APRIL 2024 CONFERENCE

Olympian Jana Pittman shared her journey from athlete to doctor.

Carlton AFL senior coach Michael Voss spoke about navigating cultural change in high-performance environments.

CONTINUED FROM PAGE 12 >>

The Hon Gabrielle Williams, Member for Dandenong, Minister for Government Services, Minister for Consumer Affairs and Minister for Public and Active Transport, delivered the opening address at the REIV conference.

Delegates received a first hand, insightful look at the planned Activity Centres around Melbourne with Emily Mottram, Executive Director – Activity Centres, Department of Transport & Planning. Emily covered the plan in great detail and the expected impact on communities. It was an important update giving real estate businesses an early understanding of the changing face of Melbourne’s suburbs.

Property researcher Anneke Thompson provided the audience with an update on what commercial and residential property professionals need to know about Australia’s environmental sustainability targets.

14 | The Estate Agent

CONFERENCE APRIL 2024

Property researcher Anneke Thompson explained what we need to know about Australia’s NetZero targets.

Peter Schravemade of REACH Australia spoke about technology trends.

With Australia committed to transitioning to a NetZero economy by 2050, property professionals will play a key role managing the impacts of this on the built environment. Understanding sustainability targets and what they mean for property will be crucial for property professionals in order to maintain the viability of their assets, both today and into the future.

Peter Schravemade, Managing Partner, REACH Australia was once again an entertaining and highly informative speaker who cast a light on emerging technology trends that are set to redefine the real estate landscape in the years to come. He also covered the ethical considerations surrounding generative AI, providing insights on how to navigate this new territory responsibly.

Six breakout sessions allowed for a deeper look into various specific matters affecting our industry including build-to-rent, managing short term rentals, risk mitigation, VCAT issues and more.

The delegates were awestruck by the courage and resolve of Olympian Jana Pittman, who shared her personal journey from athlete to medical doctor.

The final speaker of the day was Carlton AFL senior coach Michael Voss. Michael has built his career on leading through change and shared his invaluable insights with us on successfully navigating cultural change in high-performance environments.

PARTNERS

The delegates were awestruck by the courage and resolve of Jana Pittman, who shared her personal journey from athlete to doctor

The Estate Agent | 15 APRIL 2024 CONFERENCE

REIV President Jacob Caine and CEO Megan Mander with Minister for Consumer Affairs Gabrielle Williams.

SPEAKERS UNPACK OUR INDUSTRY’S KEY ISSUES

THE REIV CONFERENCE COVERED A RANGE OF CRITICAL THEMES THAT ARE DEFINING OUR SECTOR

GETTING REAL WITH JACOB CAINE REIV President

GETTING REAL WITH LINDSAY WARREN Acting Deputy President, Head of Residential Tenancies Division, VCAT

16 | The Estate Agent CONFERENCE APRIL 2024

GETTING REAL WITH EMILY MOTTRAM Executive Director

– Activity Centres, Department of Transport and Planning

GETTING REAL WITH PETER

SCHRAVEMADE

REACH Australia Managing Partner

GETTING REAL WITH ANNEKE

THOMPSON

Clio Research Founder and Managing Director

The Estate Agent | 17 APRIL 2024 CONFERENCE

2024-2025 Victorian Budget: Submission by the Real Estate Institute of Victoria

THE REIV ASKS THE VICTORIAN GOVERNMENT TO PUT PROPERTY POLICIES FRONT AND CENTRE IN ITS NEXT BUDGET

The real estate sector employs more than 10,000 people in Victoria in a market which contributes more than $14.1 billion to state tax coffers, with property taxes accounting for 43.6 per cent of total state revenue.

KEY PRIORITIES OF THE REIV

The REIV recognises that to improve housing supply and affordability, Victoria needs a strong and stabilised pipeline of investment in the property sector.

The Victorian rental market relies predominantly on ordinary Victorian households for maintaining optimal supply. This is reflected in the fact that almost 90 per cent of all Victorian renters rent from a private rental provider with 71 per cent of these private providers nationwide owning just one investment property. Tax policy is one of the major levers that can be used to attract and retain private investment in the property sector.

For the 2024-2025 state Budget, the REIV urges the Victorian state government to initiate a comprehensive review of property tax policies and policy proposals pursuant to attracting and retaining investment in the sector. This will have long lasting impact by:

• Adequately funding the plans laid out in Victoria’s Housing Statement.

• Improving rental affordability as a result of greater supply.

• Better management of state revenue by reducing reliance on inefficient taxes like stamp duty.

OVERVIEW

Effective tax and regulatory reform are a necessity for any forward-thinking government, particularly given the economic conditions that arose following the pandemic and population growth over the last half decade.

The REIV recognises that to improve housing supply and affordability, Victoria needs a strong and stabilised pipeline of investment in the property sector

The Victorian Government received a total of $26.95 billion in state tax revenue in the FY2023 to support its budgetary commitments, more than double its intake less than just a decade prior (State Revenue Office (A), 2023). Property taxation accounted for 43.6 per cent of the state government’s revenue base. This suggests a heavy reliance on property taxes. Furthermore, data

18 | The Estate Agent

ADVOCACY APRIL 2024

from the Victoria State Government’s Treasury and Finance indicates that by the end of the FY2022, property taxation accounted for almost half of the state government’s tax revenue at 47.5 per cent of annual income (The Department of Treasury and Finance Victoria (A), 2024). This reinforces the principle of dependence on the property sector which currently needs to encourage investment cashflow rather than obstruct it through taxation deterrence.

Taxation, at its most efficient, is targeted, proportionate, and diffuse in its distribution. The Victorian State Government has introduced or increased 44 taxes since Labor was first elected back to government in 2014. Successive budgets in recent years have been designed to reduce the impacts of Covid and lockdowns, in addition to supporting Victoria through the lifting of restrictions and its subsequent financial recovery measures (Australian Financial Review (B), 2023). The types of property taxation discussed here include land tax and stamp duty, which are the two of the central housing tax settings in Australia, alongside capital gains tax and negative gearing (Parliament of the Commonwealth of Australia, 2022). Other varieties such as vacant land tax generate negligible amounts of revenue comparative to land tax and stamp duty and are not a core focus of this submission due to their lack of wider implications on the overall state tax revenue system (The Department of Treasury and Finance Victoria (A), 2024).

The REIV seeks to make Victoria a competitive place to invest and considers tax reform as a determining factor to achieve this. This paper advocates on those principles to make Victoria an attractive state for prospective investors, with effective incentives bolstering housing supply and relieving current economic pressures facing Victorians.

The REIV appreciates the level of revenue that property taxes contribute towards state budgets and the essential nature of taxation to ensure that state governments can fulfil their functions. However, it does not believe that this revenue should be procured whilst sacrificing the basic principles that drive investment confidence, such as predictability, cost management and clear policy settings. Failure to contemplate how investment opportunities emerge disregards ongoing housing sustainability issues and the core drivers that are exacerbating them.

CONTINUED ON PAGE 20 >>

The Estate Agent | 19

CONTINUED FROM PAGE 19 >>

The REIV believes that more can be done through comprehensive tax reform to bolster housing supply

The REIV welcomes recent tax reform policy efforts initiated by the Victorian Government such as the decision to transition away from stamp duty for commercial and industry properties that was announced in 2023. Whilst this is set to positively impact 265,000 properties across Victoria (The Department of Treasury and Finance Victoria (B), 2024), the REIV believes that more can be done through comprehensive tax reform to bolster housing supply across the state.

LAND TAX

At the conclusion of FY2023, land tax revenue had generated $5.372 billion, an almost 25 per cent increase on the prior’s year intake of $4.132 billion and more than double the land tax revenue generated five years earlier (State Revenue Office (B) 2023). As noted above, property taxation accounted for 43.6 per cent of the total state

government taxation revenue, with land tax alone accounting for 16.6 per cent of its income (The Department of Treasury and Finance Victoria (A) 2024). With the reduction of the tax-free threshold from $300,000 to $50,000 and increased fixed levies of $500 on properties up to $100,000 and $975 on those up to $300,000, plus an increased amount of 0.1 per cent of the land value over $300,000, land tax now has a far more demonstrative impact on landowners. It is expected to lift the land tax burden from 380,000 to 860,000 homeowners across Victoria, a total increase of 125 per cent (The Australian, 2023). This incorporates unsuspecting cohorts that may have otherwise not anticipated or prepared for new taxation measures.

The current median house price in Metropolitan Melbourne is $909,000, whilst in regional Victoria it is $616,000 (REIV, 2024). With the current land tax applied on properties between $600,000 and $1,000,000 being $2250 plus 0.6 per cent of the difference over $600,000 (State Revenue Office (C), 2023), these properties would have annual tax land tax bills at $4104 and $2346 respectively. These are by no means insignificant sums for those maintaining an investment property. Given the current high interest rates and cost-of-living pressures, these increases may be too much for some investors to absorb, forcing them to sell the house and remove it from the rental market. This would only act to further constrict rental supply.

The REIV advocates for effective tax concessions to facilitate the return of properties to the rental market. For example, rather than a vacant property tax or the proposed short-stay levy, consider a discount on land tax liability for owners who keep their property on the longterm rental market for an agreed period.

Another such consideration could be to extend the land tax concessions provided to large build-to-rent developments. Subdivisions of blocks, owned privately, can result in 8-10 apartments. Such an initiative would allow families to retain ownership while adding to the available rental stock. This would incentivise owners and ensure long term security for renters. Incentives can play a crucial role in maintaining consistency of rental stock.

ADVOCACY APRIL 2024

STAMP DUTY

Stamp duty, or land transfer duty, has shown the same disproportionate level of increase when analysing its contribution to state tax revenue in recent years.

The FY2023 intake of $8.738 billion, down from a high in the FY2022 of $10.361 billion that was likely driven by the exchange of property during the Covid-affected period of the last few years, is still markedly higher than the $6.424 billion received in the FY2021. As a proportion of the total state government tax revenue, FY2023’s stamp duty income accounted for a total of 27 per cent of the state government tax coffers (The Department of Treasury and Finance Victoria (A), 2024). This increase of more than 25 per cent in just two years indicates an increased reliance on stamp duty as a means of income for the government. Stamp duty is heavily related to market conditions, such as consumer confidence driving the volume of transactional activity and the value of property itself. This creates uncertainty of revenue at times where governments may require greater funds.

Stamp duty has been accepted by experts as an inefficient tax measure – one which penalises homeowners simply for moving and a tax that can cause potential economic disruption through dissuading them from relocating in scenarios such as family obligations or work opportunities. The use of stamp duty also discourages people from downsizing from properties too large for them, preventing those dwellings from going onto the market (The Grattan Institute, 2023).

A further study from the ACT found that a reduction of stamp duty by 10 per cent would lead to a proportionate increase of 6 per cent in property sales, allowing more homes to be bought, sold, and subsequently rented (The Centre of Policy Studies & Victoria University, 2020). Reduction of a reliance on stamp duty would give people more mobility and options in their place and type of residence and foster a dynamic housing market. The REIV calls for a major review and reform of the current stamp duty regulations, including consideration of the complete replacement of the tax with alternative, better designed tax measures to support government revenue requirements.

INCENTIVISING INVESTMENT

The REIV supports a Victoria that is underpinned by appropriate investment in line with effective government tax policy settings. The REIV is advocating for deeper tax reform to promote investment, and whilst the Commercial and Industry Property Tax Reform is a step in that direction, significant further action is required to address the growing housing shortage. There is pronounced concern across the real estate sector that financial burdens relating to increasing property taxes will be passed onto renters or lead existing and prospective investors to look interstate for more attractive investment options (ABC, 2023).

Reports have emerged from both property and business groups stating that new tax settings will have adverse impacts on the rental market, with one manager at CPA Australia indicating that the new property tax measures have made Victoria the least attractive state in the country to invest in. They have stated that rental providers will need to increase rents to pay for additional costs when considering the back-to-back interest rate hikes that small-time investors have incurred in recent months (The Age, 2023). SBS supported that sentiment in January of this year, stating that data indicates a nationwide trend of property investors selling up due to climbing costs (SBS News, 2024).

When considering rising interest rates and the overall cost of maintenance and associated overheads with property ownership, an awareness of how additional taxation burdens may impact investors is an ongoing concern, particularly as the sector and market continue to work on bolstering housing supply. Clear statistical

CONTINUED ON PAGE 22 >>

Stamp duty has been accepted by experts as an inefficient tax measure – one which penalises homeowners simply for moving

The Estate Agent | 21

CONTINUED FROM PAGE 21 >>

The REIV does not believe that negative gearing needs to be removed or adjusted

examples above indicate how taxation might impact investment interest and opportunities. Doubling the amount of homeowners liable for land tax whilst reducing the threshold by more than 80 per cent only serves to push investors away from the market, especially when considering the current prohibitive interest rates and general overhead costs. Since 71 per cent of Victorian property investors own only a single investment property (Parliament of Victoria, 2023), introducing new or increasing the burden of taxation measures isn’t simply affecting those with extensive portfolios; they’re impacting everyday Australians, many who are not certain in their capacity to absorb extra levies on their investments. New taxes that were introduced in the last budget were justified by an increase of land values of 84 per cent – a statistic that is cold comfort when discussing an illiquid asset during a cost-of-living crisis. When further rationales for the comprehensive taxation are placed on a false prevalence of Victorians with several properties whilst disregarding the amount of single investment property owners, the logic doesn’t stack up.

Negative gearing is often touted as a key reason for rising housing prices as investors and first home buyers compete for the limited available stock. The limited tax benefit available to investors is in turn saving governments millions in potential aged pension costs as these investors are likely to be self-funded retirees. The REIV does not believe that negative gearing needs to be removed or adjusted from its current configuration. It is a necessary component of the housing market through its facilitation of investment. This is especially apparent when noting the above statistic that 71 per cent of property investors own only a single property, whilst nine in ten renters are leasing privately owned housing (Commissioner for Residential Tenancies, 2022). Removing the option for these owner-operators to be able to claim losses on their

properties would lead to further destabilisation of the rental market and the pulling of rentals, leaving sizeable gaps when the vacancy rates are already at record lows.

DISCUSSION

There is a consensus view across the public and private sectors that boosting housing supply, whilst simultaneously removing obstacles that might hinder development, are the central tenets of remediating costs in the housing market. The REIV’s pledged position is that housing supply must be increased, and this can only feasibly occur through increased investment in the overall housing stock throughout the state. In line with less regulatory obstructions and lowered taxation to reduce the barrier of entry for investment, Victoria can expedite the provision of supply across the state. In a system that can be characterised by carrot-and-stick policies around investment punishment and reward, the REIV believes that incentivising investors rather than penalising them through efficient tax reform is the most effective means of increasing housing supply throughout Victoria.

The REIV continues to support, in line with stakeholder expectations, a broad-based tax. Optimally, this would involve Federal Government consultation for implementation. The REIV stands by its contention that a broad-based tax system would be more equitable in enabling housing accessibility, provide a more stable and predictable government stream of revenue, and would act to avoid house bracket creep that is being accelerated by rapidly increasing median house prices.

Current trends indicate an impending reduction in interest rates, which in turn could inspire investment in the housing market due to increased accessibility for new and existing investors alike (Australian Financial Review (B), 2023). However, this is reliant on market forces, which remain subject to conditions that are prone to volatile economic and demographic change. As only structural change can ensure the remediation of our housing supply issues, the right government intervention in providing effective tax reform would adjust these circumstances, spurring confidence in the market for investors and bolster housing supply along the way.

22 | The Estate Agent

ADVOCACY APRIL 2024

A review of sections 28 and 64 of the Retail Leases Act 2003

UNDERSTANDING A LANDLORD’S RIGHTS AND RESPONSIBILITIES

WHEN IT COMES TO RETAIL LEASE RENEWALS

WARNING TO PRACTITIONERS:

• Each of the above sections requires the landlord to give notice to the tenant in a timely manner.

• The consequences of non-compliance may be harsh including the tenant being able to vacate the premises with minimal notice.

SECTION 28

If a lease provides an option to renew for a further term, at least three months before the last date that the option may be exercised, namely, at least six months before the term of the lease ends, the landlord must give the tenant written notice under s28 of the Retail Leases Act 2003 (“Act”) setting out

• the date by which the option may be exercised

• the rent payable for the first 12 months under the renewed term

• the availability of an early rent review

• the availability of a cooling off period

• any changes to the most recent disclosure statement (other than a change in rent).

This guarantees that the tenant who receives this notice has three months to decide whether to exercise the option provided to renew the lease for a further term at the rent

proposed by the landlord. It should be noted that the exercise of an option cannot be conditional. If the tenant’s response is “I will renew the lease if the rent is 10 per cent less”, the tenant has not exercised the option. This does not stop the parties from negotiating the rent provided the parties agree to an amount prior to the last date.

There is no longer the earliest date to provide the notice. Based on previous revisions of the Act, practitioners are cautioned not to send it earlier than nine months before the lease term ends.

FAILURE TO PROVIDE AN S28 NOTICE

The landlord’s failure to provide an s28 notice allows the tenant to remain in possession on the current terms and conditions indefinitely. A landlord has failed to comply with s28 if the landlord does not provide all the required information or if all the required information is not provided within the specified period.

NOTICE PROVIDED OUT OF TIME

Late notice changes the date after which the option is no longer exercisable to a date that is three months after the notice is received. Note: If the date after which the option is no longer exercisable is extended beyond the end of the lease, the lease continues on the same terms and conditions until that date (unless the landlord and tenant otherwise agree). But, in such circumstances, if the tenant exercises its option to renew for a further term, the further term commences on the expiry of the previous lease.

COOLING OFF PERIOD

Having exercised an option to renew a retail lease for a further term, provided a tenant has not requested an early rent review, it may, within 14 days from the date of that exercise, give the landlord written notice that it no longer wishes to renew the lease. The lease is deemed not to have been renewed, the tenant is not able to exercise an option to renew and the term of the lease is extended by 14 days.

EARLY RENT REVIEWS

If rent is to be reviewed to market, a tenant may request that the review occur early. The request must be in writing and must be made within 28 days of the landlord’s written

The Estate Agent | 23 APRIL 2024 COMPLIANCE

>>

CONTINUED ON PAGE 24

CONTINUED FROM PAGE 23 >>

notice. The tenant must also notify the landlord in writing within the prescribed period above, whether it exercises its option to lease for a further term. If the determination of a specialist valuer is not revealed to the tenant earlier than 14 days before the date of the option to renew may be exercised, that date is extended to 14 days after the date on which the tenant is notified. Unless the landlord or tenant otherwise agree, the term of the lease is also extended by 14 days.

Once the determination is provided to the tenant, the tenant must, within 14 days,

(i) exercise the option to renew the lease for a further term;

(ii) elect not to exercise this option.

If the market rent is less than the current rent, the market rent applies to any extended term.

An expert determination is relatively expensive and the cost must be shared equally by landlord and tenant. A landlord may be peeved paying 50 per cent of this cost

only to have the tenant vacate. This may encourage a landlord to elect a market rent review after a year that is not the last year of the lease. Alternatively, landlords my decide to not offer options and avoid market reviews entirely by offering fixed reviews or CPI adjustments.

SECTION 64

If a lease does not provide an option to renew for a further term, at least six months before the lease term ends, but no longer than 12 months, the landlord must offer the tenant a renewal of lease, or no renewal. The offer is a notice under s64 of the Act.

If a renewal is offered, it must contain the essential terms and conditions of the new lease including the rent payable. The landlord cannot revoke that offer for 60 days without the tenant’s consent.

FAILURE TO PROVIDE AN S64 NOTICE

A failure to provide this notice allows the tenant to remain in possession indefinitely on the current terms and conditions until an offer for a new lease is received or the landlord

24 | The Estate Agent

COMPLIANCE APRIL 2024

informs the tenant in writing that the lease will not be renewed, and the notice specifies a day when the term of the lease ends; this must be at least six months after the notice is given.

Section 64 allows the tenant to provide written notice to the landlord terminating the lease from a day that is not earlier than the day on which the term of the lease expires. This could be as late as one day prior to vacation despite any clause in the lease requiring a specified period of notice to vacate.

TENANT’S RIGHTS ON RECEIPT OF AN S64

Once the notice is provided, the tenant has two choices:

(i) it may remain in possession for at most a further six months until the specified date on the same terms and conditions and vacate at a time of its choosing by giving the landlord written notice of its

intention to vacate and terminate the lease from a day that is not earlier than the day on which the original term of the lease expires; or

(ii) Unless the landlord’s offer is withdrawn, it may elect to remain in possession for a further six months on the same terms and conditions and at any time in that six-month period, it may accept an offer to lease for a further term at the end of that six-month period.

The Estate Agent | 25

APRIL 2024 COMPLIANCE

Norman Mermelstein Solicitor and Licensed Estate Agent and a member of The Property Law, Leases and Succession Committees of the Law Institute of Victoria and the Owners Corporation and Members Council Committees of the Real Estate Institute of Victoria.

The REAL Difference Tool Kit

MEMBERS EXCLUSIVE:

The exclusive, member-only marketing tool kit is now available.

GET ACCESS TO:

• The REIV REAL Badge

-Ways to use the badge

- Animated badge

-Do’s and Don’ts

•Proud Member Logo and Sticker

-Ways to use the logo

-Usage guidelines

•Your REIV membership profile page

-Enhance, share and generate

new leads

Download the Tool Kit today at

• revi.com.au/real

VicForms forms and authorities

A COMPLETE SUITE OF COMPLIANT, EASY TO USE AND SECURE REAL ESTATE FORMS AND AUTHORITIES FOR REIV MEMBER OFFICES

Developed with input from members, external legal advisors and government, the REIV’s full suite of fully compliant Forms and Authorities is custom-built for REIV Members.

ACCESSING REIV FORMS AND AUTHORITIES DIGITAL

VicForms is the REIV’s online forms portal. The portal has been developed in partnership with the innovative digital team at Hutly.

PRINTED

For members who prefer printed forms, some of the commonly used forms are available for purchase at the REIV Shop.

COMPLIMENTARY

Members can login to access a range of checklists and templates at no additional cost.

CONTINUED ON PAGE 30 >>

28 | The Estate Agent

RESIDENTIAL RENTAL

Residential Rental Agreement (135)

General Letting and Managing Authority: Residential Property (004)

Exclusive Letting and Managing Authority: Residential Property (005A)

RESIDENTIAL SALES

Contract of Sale of Real Estate (118)

General Sale Authority (001)

Exclusive Sale Authority (002)

Exclusive Sale Authority: Off the plan properties (002A) AUCTIONS

Exclusive Auction Authority (003)

General Letting and Managing Authority: Commercial/Retail/Industrial Property (004A)

Exclusive Commercial Leasing Authority (005B)

Exclusive Commercial Property Management Authority (005C)

Exclusive Authority for the Purchase of RE and/or Business (006A)

Commercial Lease Schedule (144)

Guarantee and Indemnity (142)

Renewal of Lease (150)

Combined Commercial Contracts (143, 144, 144A)

Commercial Lease (143)

Commercial Lease Special Conditions Schedule (144A)

The Estate Agent | 29 Residential VicForms subscription Printed pads

APRIL 2024 RESOURCES Commercial VicForms subscription Printed pads

30 | The Estate Agent Business VicForms subscription Printed pads Exclusive Authority: Sale of business (009) Other VicForms subscription Printed pads General Service Authority (012) Buyers Agency VicForms subscription Printed pads Exclusive Authority for the Purchase of Real Estate and/or Business 006A CONTINUED FROM PAGE 29 >> RESOURCES APRIL 2024 Free for members to download RESIDENTIAL RENTAL Rental Minimum Standards Checklist Required disclosure by residential rental provider Property Management Landlord Checklist Service Provider Agreement Property Management trades/contractor agreement RESIDENTIAL SALES Request Estimate of Selling Price Material facts checklist for Sale of land Act Vendor Checklist Auction Bidding Form Estimate of Selling Price Expression of Interest Form Residential Property - Vendor authorisations for price representations and for Consideration of enquiries and offers Rural Vendor Checklist Guarantee Warranty Indemnity

Questions about meeting legislative requirements? Our team is always ready to help.

03 9822 3223

smarthouseaustralia.com.au

Protecting people. Protecting property.

Electrical faults are a common cause of house fires Smoke alarms save lives Carbon Monoxide cannot be detected by human senses Established in 2004 Over 100 years of combined real estate experience A dedicated Account Manager Educational agent training and FAQ documents Licenced trades and qualified technicians directly employed In-house call centre Detailed reports and simple invoicing Integration with leading Property Management software Scan here for more information on Smarthouse Australia

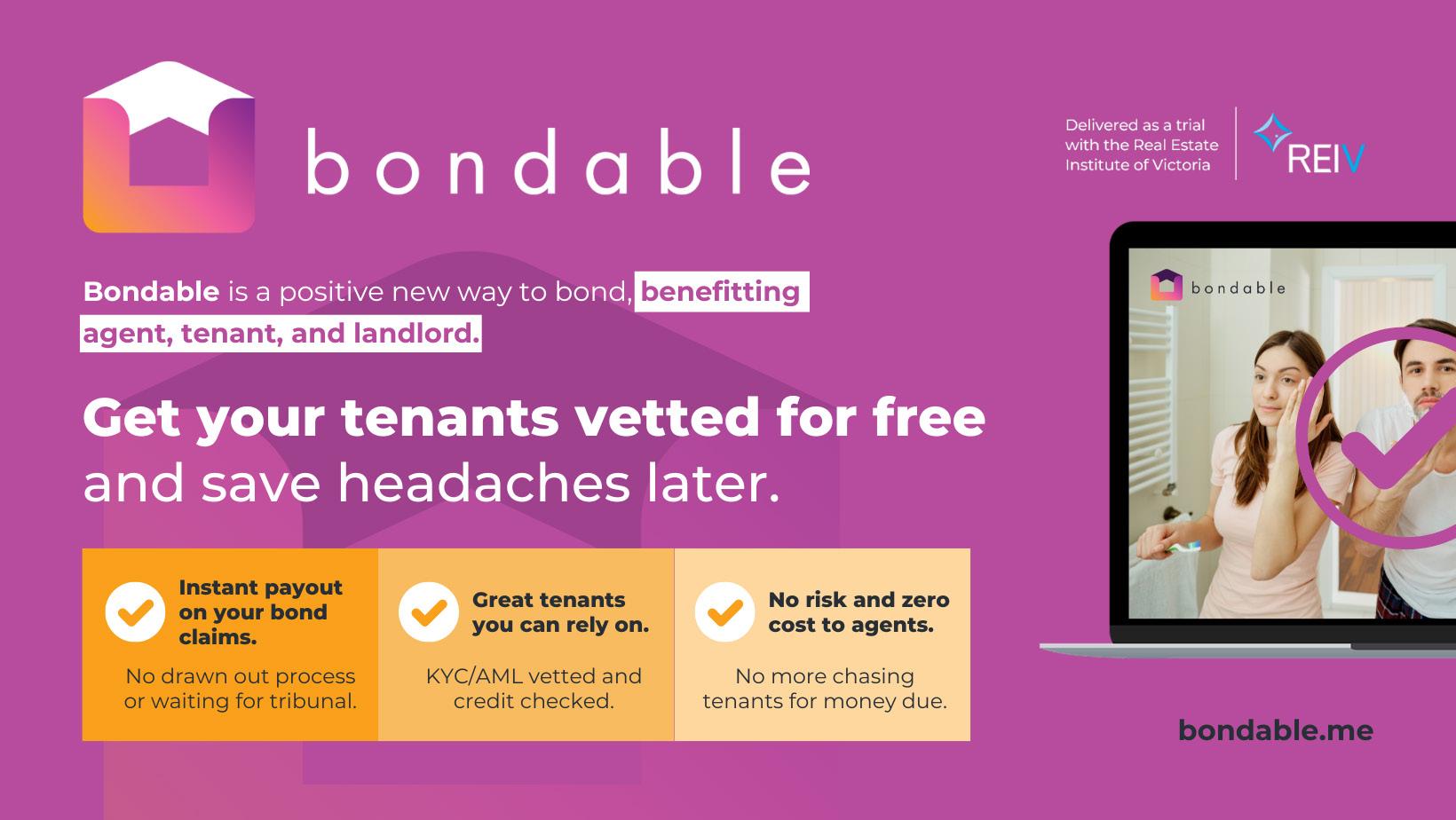

Introducing Bondable: A new way to bond

IMAGINE A WORLD WHERE RENTERS WITH GOOD CREDIT AND RENTAL HISTORY DON’T HAVE TO STUMP UP A CASH BOND.

Australia’s first technology-driven, subscription rental bond service, Bondable, has been launched to revolutionise the property industry and create a more affordable, transparent, and efficient rental system for renters, agents and rental providers.

The REIV is supporting a trial of the product through its partnership with Hutly. The REIV does not own or operate Bondable.

Powered by Australian-based fintech Hutly, Bondable is a standalone, innovative solution providing a new way to bond. For only $19.99 per month, the subscription service means a renter no longer lodges a cash bond, providing a seamless, digitally enabled dispute mediation service with a complimentary bond guarantee, benefitting the renter, property manager and rental provider.

Bondable was designed to reward renters with a good credit and rental history, whilst solving real problems in the offboarding process for both rental providers and property managers.

Jacob Caine, President of the REIV, said: “The REIV is supportive of positive innovation in the industry and believes Bondable can play an important role in solving the affordability crisis in Victoria and bringing portability to renter bonds.

“We welcome Bondable’s entry into the real estate market and will continue to help educate the industry about the value Bondable represents as one of several options available for rental providers and renters.”

Find out more

32 | The Estate Agent

RESOURCES APRIL 2024

Whether you’re looking to buy, sell, invest or rent visit professionals.com.au SOLD RENT INVEST SOLD

Why are commercial rental determinations overturned?

WHAT HAPPENS WHEN A VALUER GETS INVOLVED IN A RENTAL DETERMINATION

– AND WHAT HAPPENS IF A LANDLORD OR TENANT ISN’T HAPPY WITH THE PROCESS

The Retail Leases Act 20023 outlines that in circumstances where the landlord and tenant are unable to agree on the current market rent for a premises, a valuer is required to be appointed to determine the rental.

Under a non-retail lease, the parties apply to the President of the REIV to appoint a valuer under the REIV lease. Under the Law Institute Lease, a valuer is to be appointed by the Australian Property Institute. On some occasions the parties may select a nominated valuer by agreement.

34 | The Estate Agent

Author - Bill Di Donna CEA (REIV)

For a retail lease, the application for a specialist retail valuer to undertake a rental determination is made to the office of the Small Business Commissioner of Victoria when the parties are not able to agree.

The criteria to consider when conducting a market rent review are generally but not always listed in the lease. In the case of a lease subject to the Act, section 37(2) applies and is summarized as:

…a free and open market between a willing landlord and a willing tenant…

• the provisions of the lease;

• The rent that would reasonably be expected to be paid for the premises if they were unoccupied and offered for lease for the same, or a substantially similar, use to which the premises may be put under the lease;

• The landlord’s outgoings to the extent to which the tenant is liable to contribute to those outgoings;

• Rent concessions and other benefits offered to prospective tenants of unoccupied retail premises…but not to take into account the value of goodwill created by the tenant’s occupation or the value of the tenants fixtures and fittings…

Section 37(6) then goes further and holds the valuation to a standard as follows:

The valuation must-

• be in writing; and

• contain detailed reasons for the specialist retail valuer’s determination; and

• specify the matters to which the valuer had regard and taken into account in making the determination.

Herein lies the basis upon which VCAT and the Supreme Court of Victoria have overturned valuations that they deemed were lacking in sufficient detail.

This does not mean the valuation is not correct but rather that it does not meet the requirements set out in the legislation

A valuer cannot rely upon statements such as “based on my knowledge and experience” as a substitute for providing detailed reasoning in arriving at their conclusions. This does not mean the valuation is not correct but rather that it does not meet the requirements set out in the legislation.

>> APRIL 2024 COMPLIANCE

CONTINUED ON PAGE 36

CONTINUED FROM PAGE 35 >>

There has been a shift away from the previous broad acceptance of the rental determination as a binding agreement

There are also cases where there was an error in fact and the valuation was overturned such as:

• AJ Moussi Pty Ltd v Luxor Corporation Pty Ltd (Building and Property) [2022] VCAT 434 (April 20, 2022)

In this case the maximum number of patrons at the leased premises was incorrectly assessed.

Historically, the valuer’s opinion of the market rent was 100 per cent binding on the parties. The rent was assessed for better or worse and the parties continued as they had done prior to the review. In recent years there has been a shift away from the previous broad acceptance of the rental determination as a binding agreement.

The Building and Property list at VCAT and the Victorian Supreme Court hear cases where the parties are seeking to overturn the determination. Not all are successful. Some of the many examples are below:

Where the landlord’s application was successful:

• Epping Hotels Pty Ltd v Serene Hotels Pty Ltd [2015] VSC 104 (April 28, 2015)

This is a case where the use of the “profits” method or earnings ratio to assess the market rent was upheld and the parties were bound by the valuation.

• Stricta Pty Ltd v CW Leasing Services Pty Ltd (Building and Property) [2023] VCAT 1092 (September 20, 2023)

This case involved the landlord seeking to set aside the valuation on amongst other issues that the valuer had not considered all of the evidence.

Where the tenant’s application was successful:

• Leonello Service Centre Pty Ltd v Rany Pty Ltd (Building and Property) [2019] VCAT 1752 (November 8, 2019)

In this case the valuation was overturned as detailed reasons were not provided in addition issues with outgoings and maintenance obligations under the lease.

• Storage Depot Pty Ltd v Brooklyn Logistics Park Pty Ltd (Building and Property) [2022] VCAT 210 (February 25, 2022)

In this case the valuation was overturned as detailed reasons were not provided.

The motivation to overturn a rental valuation can simply be that one of the parties is of the opinion that they did not achieve the result that they wanted and seek to overturn the result. It can be a bargaining chip to extract a concession from the opposing party which, if successful, would avoid having to go through the entire determination process again. It can also be a delaying tactic, particularly if the valuation goes back several years, to put off paying an increased back rent.

COMPLIANCE APRIL 2024

A valuation that is set aside also creates uncertainty and considerable expense. For the tenant, they are not able to budget what their catchup rent and future rent obligation will be. For the landlord, they often face issues where the level of rent and the failure to have the lease documentation signed by both parties leads to issues with their bank or the inability to market and sell the property.

When faced with the prospect of having a rental determination, consider when making a submission to the determining valuer that any evidence presented pays strict attention to section 37(6) of the Act. The evidence submitted should be complete and the rationale detailed and logical. Consider also, the terms of appointment of the determining valuer. In some terms of engagement, should the valuation be overturned, the valuer is entitled to undertake a new valuation at additional cost. If this is not an appropriate outcome for the parties, then this should be rejected from the outset.

A review of the Retail Leases Act 2003 is also due at some time in the near future. It may therefore be appropriate for the state government to consider adding an additional sub clause to section 37(6) to the effect that if one or both of the parties is of the opinion that all or any sub sections (a), (b) or (c) have not been complied with, then upon the provision of written notice to the determining valuer and the opposing party, the said valuer has a period of 30 days from receipt of notice to provide additional or amended information to support or amend the valuation.

This brief amendment may have the effect of creating certainty and relieving the judicial system and the parties of additional burden and expense.

This … may have the effect of creating certainty and relieving the judicial system and the parties of additional burden and expense

CAUTION FOR THE PARTIES:

Overturning determinations is a time-consuming and costly exercise and the parties should be aware that it doesn’t mean the parties may receive a different outcome of the quantum amount of rent and outgoings from the initial determination.

The Estate Agent | 37

DAMAGED GLASS CLAIMS

RECENT EXPERIENCE WITH INSURANCE COMPANIES HAS HIGHLIGHTED THE NEED TO BE CAUTIOUS WHEN DEALING WITH CLAIMS INVOLVING GLASS AND LEASED PREMISES.

STANDARD LEASE CLAUSES AND DAMAGED GLASS

Clause 3.2.3 of the Law Institute of Victoria (LIV) lease (Commercial Property) May 2021 Revision requires the tenant to immediately replace cracked or broken glass with glass of the same thickness and quality.

By comparison, clause 5(1) of the Real Estate Institute of Victoria (REIV) lease Code 143 (Commercial Lease) 2020 Revision excludes tenant liability for damage where the default or negligence of the tenant is not a factor, but, under Clause 5.5(f), the tenant must promptly replace broken or damaged glass, whether or not the tenant is responsible for the breakage or damage, notwithstanding the exemption in Clause 5(1).

Both the LIV and the REIV lease do not require the tenant to be insured for glass breakage.

INSURANCE CLAIM ISSUE

In circumstances where a property owner or an owners corporation (OC) lodges a claim for glass replacement, (of a damaged shop front, for example), there is a recent trend amongst insurers to demand a copy of the lease between the shop owner and tenant to establish whether

Some insurers … explicitly deny payment if a tenant is obligated under a lease to pay for insurance or for glass replacement

the tenant is obliged to insure, and/or to pay the cost of replacement.

The landlord might submit the lease is confidential, the landlord is the insured party, and the status of the tenant is irrelevant, especially if the tenant did not contribute to the damage.

To overcome these arguments, some insurers have modified their policies to explicitly deny payment if a tenant is obligated under a lease to pay for insurance or for glass replacement.

Exclusions in the policy provided by Strata Community Insurance, underwritten by Allianz Australia Insurance, includes the following:

“

1. We will not pay for Loss or Damage … (o) to glass caused by artificial heat, during installation or removal, that has a crack or imperfection, or is required to be insured by any other party in terms of an occupancy agreement.”

EXAMPLE OF AN INSURANCE CLAIM

In a recent matter, an OC manager lodged an insurance claim for damage to exterior glass panels. The insurer advised that claims involving glass in commercial properties must include a copy of the lease. The purpose is to investigate whether the tenant is also required to take out cover, thus allowing the insurer to potentially share costs with another insurer.

After much time and debate, the lease was provided. The insurer noted it was an REIV lease and denied the claim citing the tenant’s obligations under Clause 5.5(f) above.

38 | The Estate Agent INSURANCE APRIL 2024

If a tenant is bound by these clauses, should the tenant be released from any requirement to pay for glass breakage cover?

ISSUES TO CONSIDER WHEN RESPONDING TO AN INSURER’S DENIAL RETAIL LEASES ACT 2003 (VIC)

Damaged glass has never been a retail lease consideration as it was always viewed as a tenant obligation to insure.

Under s52(2) of the Act, the landlord is responsible for maintaining in a condition consistent with the condition of the premises when the retail premises lease was entered into “the structure of, and fixtures in, the retail premises”.

It would appear that a landlord could argue:

• The LIV lease and REIV lease is a commercial lease covering both regulated and unregulated tenancies.

• Under s94 of the Act, a provision of a retail premises lease is void to the extent that it is contrary to or inconsistent with anything in the Act.

• Accordingly, where the Act applies, Clause 3.2.3 of the LIV lease and Clause 5.5(f) of the REIV lease are not binding on retail tenants as glass replacement is the obligation of the landlord.

COMPETITION AND CONSUMER ACT 2010 (CTH)

Outgoings under the LIV lease and REIV lease include the costs of insurance policies taken out by a landlord for breakage of glass and for excesses paid or payable on claims. If a tenant has contributed towards an insurance policy in the name of either a landlord or an OC that includes glass breakage, why should the tenant be obligated under Clause 3.2.3 or Clause 5.5(f) above?

Where a tenant has contributed towards insurance cover, should these clauses be negated?

SNAPSHOT

• There is a trend by insurers to deny claims for damaged glass if a tenant is obliged to undertake such repairs or cover under a commercial lease.

• An insurer has remedies that are not well known.

• There are learnings for both lease providers and practitioners.

Alternatively, if a tenant is bound by these clauses, should the tenant be released from any requirement to pay for glass breakage cover?

There appears to be tension with these requirements existing at the same time. Does this breach the obligations of the unfair contract terms under the Competition and Consumer Act 2010? If it does, the effect on the insurer depends on whether any part of the lease is declared void.

CONCLUSION

The writer considers there is insufficient awareness among legal practitioners, estate agents and OC managers of this form of claim denial and encourages greater scrutiny of product disclosure statements before accepting any insurance policy.

If there is little choice because major insurers use similar wording, this requires vigilance in lease preparation and the possible exclusion of the above clauses.

The Estate Agent | 39 APRIL 2024 INSURANCE

Norman Mermelstein Solicitor and Licensed Estate Agent and a member of The Property Law, Leases and Succession Committees of the Law Institute of Victoria and the Owners Corporation and Members Council Committees of the Real Estate Institute of Victoria.

The budget bargain suburbs

not far from the city centre

TAKE A LOOK AT THE MOST AFFORDABLE SUBURBS IN EACH 5KM ZONE OUTSIDE THE CBD.

Every day we see price increases on food, petrol, rents, and many other things on the news. The cost of living continues to climb but people still need to have a roof over their head.

Not a surprise that it can be difficult to find a property within a certain budget if you are looking within walking distance of the city centre. According to our December 2023 data, there are a few pockets within 10km that can be found with a median house price below $1 million and even median unit price of half of that amount.

CONTINUED ON PAGE 42 >> Article based on December 2023 median

The median house price in Brooklyn, located around 9km west of the CBD, was sitting below $700,000 in 2023. It was lower than some of the most affordable suburbs located within 10-15km from CBD such as Sunshine West ($710,000) and Heidelberg West ($716,250).

Interestingly, the top 5 most affordable suburbs in the 15-20km zone have lower median house prices than those in 20-25km and 25-30km groups, led by Dallas with $510,000. Other suburbs also recorded below $600,000 mark.

For those who are looking to downsize or live in units, there are many options under $500,000 within 5km of the city centre with Flemington and Carlton having median price around $400,000.

You can find affordable option for units and apartments within 5-15km with a couple of suburbs still recording below half a million dollars. The highlights are Gardenvale and Albion as both suburbs are still below $300,000 in the 12 months ending December 2023.

We ran a regression analysis on the median house prices in metropolitan suburbs and their distance from the city

40 | The Estate Agent DATA INSIGHTS APRIL 2024

data

TABLE CONTINUED ON PAGE 38

The Estate Agent | 41 APRIL 2024 DATA INSIGHTS

Distance from CBD House Unit Suburb Median Suburb Median 0-5km Southbank $815,250 Flemington $375,750 Footscray $938,000 Carlton $414,000 Flemington $1,011,500 Abbotsford $470,000 Seddon $1,181,500 Melbourne $478,564 Kensington $1,200,000 Footscray $480,000 5-10km Brooklyn $682,000 Gardenvale $282,500 Braybrook $745,000 Travancore $332,500 Maidstone $885,000 Kingsville $470,000 West Footscray $950,000 Brunswick West $470,000 Coburg North $975,000 West Footscray $480,000 10-15km Ardeer $637,000 Albion $261,500 Sunshine West $710,000 Essendon North $395,000 Heidelberg West $716,250 Box Hill $487,500 Sunshine North $740,000 Sunshine $505,000 Fawkner $772,500 Sunshine West $580,000 15-20km Dallas $510,000 Notting Hill $392,500 Coolaroo $530,500 Meadow Heights $435,000 Laverton $554,000 Mill Park $440,000 Broadmeadows $563,000 Bundoora $450,000 Meadow Heights $567,500 Jacana $452,500

TABLE 1 AFFORDABLE SUBURBS BY MEDIAN HOUSE PRICE EVERY 5KM IN 2023

CONTINUED FROM PAGE 41 >>

centre, since it can be a major deciding factor. We found that in most cases the median house price is around $11,400 more affordable for each kilometre further away.

Looking back over the past five years, the number was slightly higher in 2018 with $11,600 for an additional 1km distance from the CBD. This could indicate the price gap between each suburb is lessened due to population

growth and economic factors especially the pandemic which pushed more movement to the outer ring suburbs and regional Victoria.

There are other things that can influence property prices other than their location. Demographics play a significant role in choosing the type of property and their value. For example, young families may prefer big houses with

42 | The Estate Agent

DATA INSIGHTS APRIL 2024

Distance from CBD House Unit Suburb Median Suburb Median 20-25km Rockbank $600,000 Hoppers Crossing $425,000 Hoppers Crossing $606,250 Tarneit $450,000 Deanside $640,000 Truganina $471,500 Tarneit $645,000 Epping $476,444 Truganina $645,000 Wollert $482,500 25-30km Werribee $605,500 Werribee $430,000 Diggers Rest $657,500 Werribee South $450,000 Bonnie Brook $679,500 Mernda $494,500 Mernda $690,000 Doreen $534,000 Doreen $740,500 Point Cook $534,000 30km+ Melton $470,000 Melton South $540,000 Melton South $490,000 Melton $365,000 Kurunjang $530,000 Craigieburn $430,000 Brookfield $545,000 Dandenong $440,000 Millgrove $553,750 Cranbourne $454,250

TABLE 1 AFFORDABLE SUBURBS BY MEDIAN HOUSE PRICE EVERY 5KM IN 2023

TABLE CONTINUED FROM PAGE 37

multiple bedrooms compared to young professionals who may be looking for smaller apartments with low maintenance, which will affect the median price in the suburbs despite being next to each other.

Toorak remains as the outlier suburb within 10km of the CBD in the past five years, defying the trend, and currently stands at $5,300,000. In the 10-20km zone, Canterbury rose and surpassed Brighton as the most expensive suburb with median house price of $3,187,500.

Add another 10km and 5 years, the title was taken off Plenty by another suburb from Nillumbik, with Yarrambat recording $2,105,000 – first time it surpassed $2 million. Narre Warren North remains as the most expensive

suburb in the 30-40km group over the past five years with considerable gap on other suburbs. The common denominator of these suburbs? A smaller population and fewer homes, surrounded by semi-rural beauty and countryside lifestyle.

Further than that, suburbs on the Mornington Peninsula dominate the high end of the property market even though they are located more than 50km from the CBD. Mount Martha and Flinders are still leading their respective groups, as they have since 2018. The beach lifestyle on the Peninsula is the main factor behind expensive price tags in these holiday hotspots.

CONTINUED ON PAGE 44 >>

The Estate Agent | 43 APRIL 2024 DATA INSIGHTS

CONTINUED FROM PAGE 43 >>

44 | The Estate Agent DATA INSIGHTS APRIL 2024 $6m $5m $4m $3m $2m $1m $0 $5m $4m $3m $2m $1m $0 30km 30km 10km 10km 0km 0km 20km 20km

1 MEDIAN HOUSE PRICE (2023) VS DISTANCE TO CBD

2 MEDIAN HOUSE PRICE (2018) VS DISTANCE TO CBD

CHART

CHART

The Estate Agent | 45 APRIL 2024 DATA INSIGHTS 40km 40km 50km 50km 70km 70km 80km 80km 60km 60km

Scams and cyber safety: How to head off a hack attack

WHY CYBER CRIMINALS MIGHT TARGET REAL ESTATE AGENTS, AND HOW YOU CAN PROTECT YOUR BUSINESS FROM AN ATTACK

An email telling you you’ve won a few thousand dollars; a voicemail demanding unpaid taxes – by now, there wouldn’t be many of us who haven’t been targeted by such scams. While many of us know better than to take these seriously, the reality is that cyber crime has been estimated to cost the Australian economy $42 billion. The real estate industry is one that is increasingly being targeted by cyber criminals and as you may have seen from a recent attack, the threat may be a lot closer to

46 | The Estate Agent

SECURITY APRIL 2024

home than many real estate professionals realise. But what does cyber crime in the real estate industry entails, how can agents can prepare their businesses, and how can cyber insurance help?

WHY ARE REAL ESTATE AGENTS AT RISK?

There are few businesses that aren’t at risk of cyber attacks in some way, but a few aspects of real estate businesses make them a particularly appealing target. Firstly, you’re likely to hold a lot of personal information on your clients, including bank account details and forms of identification. This type of information is valuable for cyber criminals as it provides them with an easy avenue for identity theft, where cyber criminals steal personal information to, generally, steal money or gain other benefits.

Another reason why real estate businesses are a lucrative target is their involvement in facilitating high-value transactions, with large amounts of money passing through various accounts through settlement platforms. In addition, small businesses tend to be an easier target for cyber criminals as they may not have the resources to protect their assets and data compared to larger organisations. The combination of these factors has

There are few businesses that aren’t at risk of cyber attacks in some way, but a few aspects of real estate businesses make them a particularly appealing target

created the ideal environment for cyber criminals to hone in on unsuspecting real estate agents in their attempts to infiltrate their networks and systems.

WHAT COULD GO WRONG?

Cyber crimes and attacks can take many forms, such as malware, ransomware, business email compromise, phishing and much more. To demonstrate a few examples of how real estate agents in particular may fall victim, here are a few of Aon’s clients who have fallen victim to cyber attacks1:

House Real Estate2 discovered its computer system had fallen victim to a ransomware attack one morning. In attempting to access the agency’s server, a message displayed on screen demanding payment of US$5000 (via Bitcoin).

An employee at ABC Real Estate2 received an email which looked like it was from their energy provider. When the employee clicked on the link in the email, malicious malware in the email proceeded to lock down the agency’s computer network.

Homey Real Estate2 sent an email to their client asking for bank account details to transfer money for a deposit. The agency received an email that appeared to have come from the client with bank account details and transferred the money into this account. It turned out that the email chain had been compromised by a hacker in the US, and the money had in fact been transferred to the hacker’s account.

The Estate Agent | 47 APRIL 2024 SECURITY

CONTINUED ON PAGE 48 >>

CONTINUED FROM PAGE 47 >>

WHY THE CLOUD IS NOT FOOLPROOF

It might be easy to assume that because you use a cloud-based application or provider, your systems are immune to unfortunate cyber incidents. But it’s important to remember cyber crime goes beyond hacking of your virtual networks – even using a computer in the office means that the device itself may be hacked. Furthermore, your data being stored in the cloud does not completely secure it from unauthorised access, use, theft, deletion or cyber extortion. Privacy breaches may result from unexpected sources such as a disgruntled employee.

STEPS FOR PREVENTION

Aon’s real estate insurance expert Peter Lynch outlines three basic steps for cyber security in the real estate industry:

1. Network Security: This is the first line of defence that any computer system must provide to stay protected from malicious attacks. It covers the way computers are connected to the internet and protects all network-connected equipment including laptops, servers, printers even smartphones. Common features of network security are firewalls, which regulate how internet traffic can be handled or blocked from third parties.

3. Multi Factor Authentication: A security mechanism that requires one or more additional verification factors on top of username and password. This is an extra layer of security, making it more difficult for attackers to access sensitive information.

2. Staff Education: Educating staff during the onboarding process and at regular intervals can help them understand the importance of cybersecurity, recognise potential threats, and adopt good security habits to help protect themselves and the company from cyber threats.

Your data being stored in the cloud does not completely secure it from unauthorised access, use, theft, deletion or cyber extortion

For more tips on how you can enhance the cyber safety of your business, read this article on staying cyber safe

HOW CAN CYBER INSURANCE HELP?

The steps outlined above are all sensible measures to help the likelihood or severity of cyber crime, but your business may still fall victim to cyber attacks and crime. Cyber insurance has been designed to help protect businesses against financial losses arising from cyber attacks and crime and should be considered by businesses with a digital footprint assessing their insurance options.

1 Based on real claims from Aon clients

2 Names anonymised for privacy reasons

48 | The Estate Agent SECURITY APRIL 2024

Personal wellbeing resources for you and your team

TAKE A PROACTIVE, PREVENTATIVE APPROACH TO WORKPLACE MENTAL HEALTH WITH THE REIV AND EAP ASSIST’S WELLNESS PROGRAMS

EAP Assist’s Resilience Program is designed to help employees develop coping skills they can use to endure tough times

The REIV recognises the importance of employers being able to support their team’s emotional and psychological wellbeing, which is why we have joined hands with EAP Assist to provide individual members, agencies and their entire staff and families with a suite of resources to combat mental health issues and promote wellbeing both inside and outside the workplace.

EAPs (employee assistance programs) are a valuable resource that take a proactive, preventative approach to workplace mental health.

All REIV members can now access quality online resources that will help businesses improve:

• performance and productivity

• reduce absenteeism, conflict and occupational stress

• improve staff morale, employee retention and recruitment

• reduce workers compensation and other costs

• improve employee satisfaction

• enhance employer/employee relationships

EAP Assist resources for members include:

• Evidence-based, clinically tested wellness apps that address a comprehensive range of mental health issues, including depression, anxiety and stress as well as many wellbeing issues, including resilience, confidence and sleep.

• Online digital programs for mental health designed to help employees identify, understand and improve psychological difficulties like stress, anxiety, depression and insomnia as well as wellbeing issues like grief, substance abuse, financial concerns and pain management.

50 | The Estate Agent

RESOURCES APRIL 2024

REIV recognises the importance

of employers being able to support their team’s emotional and psychological wellbeing

• Daily wellness posts aimed at proactively managing an employee’s mental and physical health before potential issues occur.