UAE committed to economic openness

Exclusive Interview with H.E. Abdulla bin

Touq Al Marri, UAE Minister of Economy

World Bank

GCC countries can be drivers of global economic growth

Bahrain . Kuwait . Oman . Qatar . Saudi Arabia . UAE . Egypt . MENA . Asia . Europe . The Americas

March 2023

Exclusive interview

Egypt’s

of Economy & Planning Decarbonizing the future

interview

Exclusive interview

Interest rate hikes among key drivers of growth

interview

Contents | March 2023 economy Sustainability Media banking & finance Path of reform and modernization

with H.E. Dr. Hala Al Said,

Minister

Exclusive

with Khalid Al Khudair, CEO Saudi Media Company

with Issam Abousleiman, GCC country director, World Bank

Exclusive

with Rajai El Khadem, head of Government and Academia at LinkedIn MENA

Building a media powerhouse in sports and entertainment Propellers of GROWTH Standard Chartered Bank profits jump 28 percent in 2022 Investing in the wants and needs of the workforce is key

story

UAE Economy Minister discusses macroeconomic outlook, shares vision for economic openness and reforms 22 30 34 26 28 36 16

The Road to COP28

Cover

with H.E. Abdulla bin Touq Al Marri UAE Minister of Economy

6 conomy middle east march 2023 Contents | March 2023 Near-term slowdown unlikely in residential segment Electrification at the very top Inspirational women in Banking & Finance, Telcom and Tech Are we coding our way out of jobs? Technology & Innovation Real Estate lifestyle List Solid start to 2023 for Dubai and Riyadh real estate Rolls-Royce SPECTRE Women in Lead GPT Disrupting media and Comms 63 48 37 44 Binance: Collaboration fighting digital crime a must Follow the Money 40

Publisher . JOSEPH CHIDIAC

EDITORIAL

Managing Editor . HADI KHATIB

Economy Contributor . HALA SAGHBINI

Editor-at-large, Automotive & Lifestyle . ALP SARPER

Real Estate & Construction Editor . NEHA BHATIA

Tech Editor . MAYANK SHARMA

Digital Editor . ELIAS AL HELOU

CONTRIBUTORS

DR. ABDULLAH SAHYOUN, ELIAS EL MRABET, LANA ZAILAA, LAURA LOPEZ MINGO, THOMAS BILLINGHURST

PR & Content Strategy Director . CYNTIA BSOUSSI

Creative Director . RAYAN BARAKAT

For General Inquiries: info@jcmediagroup.com

For Editorial Inquiries: editorial@jcmediagroup.com

For Advertising Inquiries: commercial@jcmediagroup.com

Publishing House . JC MEDIA GROUP LLC

www.JCmediagroup.com

www.EconomyMiddleEast.com

@economymiddleeast @economy_me

without written permission of the publisher.

8 conomy middle east march 2023

Printed at Masar Printing and Publishing LLC

and views expressed in this publication

No part of this publication may be reproduced or transmitted in any form

you have finished with this magazine, please recycle it. recycle

NOTICE: Opinions

are solely those of the contributors and not necessarily those of the publisher.

or by any means

When

.يبد بلق يف ةيهافرلا ناونع Burj Daman, Al Mustaqbal St, DIFC, Dubai, UAE | +971 (0)4 515 9999 | reservations.difc@waldorfastoria.com | www.waldorfastoria.com/DIFC

A new era is on the horizon for humanity and the generations to come

The World Government Summit (WGS), held in Dubai last February, brought together heads of state, prime ministers, and international figures, attracting participation from around 20 presidents and more than 250 ministers. The commemorative photo of these leaders taken together for this occasion left an indelible image in our collective minds.

While official photos at global events like this are not uncommon, it may be rare for leaders to face the camera and all agree on one thing: our world is in danger.

Undoubtedly, major and growing challenges face our world and future generations, foremost of which is climate change. Additionally, the emergence of new economic blocs, which enjoy powerful financial and global influence, threatens to fragment the world, worsen division, and increase trade and economic barriers, all of which could eventually result in significant losses to global GDP.

Another big challenge is the powerful emergence of artificial intelligence (AI). While the technology was once categorized as science fiction, rapid technological advancements over the past few years have turned AI into one of the most important transformative powers that future governments can hold.

The world will be divided between governments that proactively adopt AI technologies and those that live in the recesses of time, isolated and archaic in nature. This telling description is from the speech delivered by His Excellency Mohammad Abdullah Al Gergawi, Minister of Cabinet Affairs of the UAE and Chairman of the World Government Summit.

In other words, the clout of future governments will be measured by their ability to adopt technology. Therefore, they are expected to be ambitious in their decisions and forward-looking. Planning a future that takes full advantage of economic opportunities requires great technological leaps. We cannot attain this echelon of excellence without capacity building in advanced digital infrastructure and technology.

Today’s world is facing difficult economic times, experiencing slow global growth and high inflation rates triggered by the Russian-Ukrainian war. Sharp rises in energy and food prices, currency depreciation, high fiscal deficits, and domestic and external debt are issues that feature prominently in all economies around the globe.

However, it seems that we are beginning to see the light at the end of this dark tunnel. World economists reassure us that global growth is emerging from current tight bottlenecks.

We need to look at our world from a glass-half-full perspective and be as optimistic as possible that there are always solutions to challenges, no matter how big, and that a better tomorrow awaits us and future generations.

Chief Executive Officer – Publisher

10 conomy middle east march 2023

EDITORIAL LETTER

Joe Chidiac

The clout of future governments will be measured by their ability to adopt technology

WGS uniting the world, shaping the future

UAE a model for solidarity, energy transition, technology

Sheikh Mohammed bin Rashid Al Maktoum, Vice President, Prime Minister, and Ruler of Dubai announced on February 15 the conclusion of the tenth session of the World Government Summit (WGS) in Dubai, which witnessed the signing of 80 agreements between the summit’s participating countries. The Summit represents the UAE’s efforts to unite the world, shape the future, and serve humanity.

Bringing stability to Egypt

Bringing relief to a devastated Turkey

Also at the summit, Sheikh Mohammed bin Rashid Al Maktoum and Sheikh Saud bin Saqr Al Qasimi, Member of the Supreme Council and Ruler of Ras Al Khaimah, as well as Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai, witnessed a recorded speech by the Turkish President Recep Tayyip Erdogan.

Erdogan extended thanks to the UAE for its assistance to Turkey in the aftermath of the recent earthquake, saying, “We have received support and messages of sympathy from more than 100 countries… especially the UAE.”

On the first day, the UAE President Sheikh Mohamed bin Zayed Al Nahyan and Sheikh Mohammed bin Rashid Al Maktoum attended a dialogue session featuring Egypt’s President Abdel Fattah El-Sisi.

During the session, El-Sisi spoke about the challenges he faced as President in his efforts to bring stability to Egypt after the political events of 2011. He praised the pivotal support extended by the UAE President.

Praising the UAE President’s leading role in supporting other Arab countries, El Sisi said: “His Highness Sheikh Mohamed bin Zayed helped greatly in bringing stability to Egypt, as he visited the country in 2013, and was aware of the needs of the country. He ordered the transfer of ships carrying vital petroleum commodities through the Mediterranean to Egypt to help overcome the crisis.”

The Egyptian President urged Arab states to stand against any interference that aims to disrupt the strong ties in the region.

El-Sisi explained that the Egyptian government has made great progress in improving the health sector by implementing a national health program. Moreover, El-Sisi highlighted that Egypt has succeeded in providing more than 1.5 million job opportunities for citizens in its efforts to combat unemployment.

“I wish I could have been with you had it not been for the earthquake disaster,” Erdogan said, noting that scientists estimate that the energy released by the earthquake is equivalent to 500 atomic bombs.

“The future of our world will be determined by global governance and close international cooperation,” he added. “We are witnessing one of the most massive natural disasters in human history,” Erdogan observed, highlighting that supply chain disruptions, the Russian-Ukrainian conflict, the food and energy crisis, and high global inflation all pose challenges to the global economy anddevelopment process.

12 conomy middle east march 2023

short news

Partnering with Meta towards digital mastery

Additionally, WGS witnessed Sheikh Hamdan bin

Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai, announcing that Dubai’s strong partnerships with companies such as Meta also support D33’s aim to generate 100 billion dirhams annually from digital transformation and the Dubai Metaverse Strategy’s goal to turn the emirate into one of the world’s top 10 metaverse economies by 2030.

Sheikh Hamdan met with Nick Clegg, President of Global Affairs, Meta, on the sidelines of the summit.

Sheikh Hamdan explained that partnerships with international technology players are particularly vital in the context of the objective of the Dubai Economic Agenda D33, recently launched by Sheikh Mohammed bin Rashid Al Maktoum to accelerate investments in advanced technology and develop talents to consolidate Dubai’s global competitiveness and economy. According to Sheikh Hamdan, Dubai is looking to further deepen synergistic partnerships with global technology majors like Meta to further the leadership’s vision to transform Dubai into a frontrunner in shaping the future of the world’s digital landscape.

Sheikh Hamdan further highlighted that Dubai provides established technology companies, emerging players one of the world’s best environments to incubate innovative ideas and tap new growth opportunities.

Tripling renewable energy capacity Flying Taxis, 9 global initiatives

Ahead of the summit kick-off, Sheikh Mohammed bin Rashid revealed that air taxis will begin flying in Dubai within three years.

Sheikh Hamdan made the announcement on Twitter, where he revealed he had approved designs for air taxi stations at the WGS.

“From the World Government Summit, ‘we approved today the design of the new air taxi stations in Dubai, which will start operating within three years,” Sheikh Mohammed tweeted.

On the second day of WGS, the UAE Minister of Industry and Advanced Technology Sultan Al Jaber addressed delegates saying that “We need to triple renewable energy capacity, double hydrogen production.”

“The hard reality is that global emissions must fall 43 percent by 2030. That’s just seven years away,” the President-designate of COP 28 said.

“We need a major course correction.”

He told an audience that “we need to shift from implemental steps to transformational progress.

“We need to triple renewable energy capacity, double hydrogen production,” he said.

COP 28 will be the first global assessment of climate action since the Paris Agreement of 2015 – but “we already know that we are way off track, we know we are playing catch up” on halting rising temperatures, he said. “COP 28 must bring together every nation, and everyone in those nations, if action is to be realized,” he said.

Al Jaber added: “We will mobilize every segment of society. We are listening to everyone and engaging with everyone. We want COP 28 UAE to be remembered for uniting everyone in action. Let’s unite in solidarity for the sake of humanity.”

A video accompanying the tweet says: “RTA has been working with advanced air mobility companies Skyports Infrastructure and Joby Aviation to design and develop the infrastructure for an expected launch of electric vertical take-off and landing (eVTOL) operations by 2026.”

Furthermore, as part of WGS, Sheikh Mohammed Al Maktoum launched the fifth edition of Creative Government Innovations. These innovations present nine new initiatives and solutions developed by governments from nine different countries: the US, Serbia, Estonia, Finland, France, Sierra Leone, Chile, Colombia, and the Netherlands. Some of the innovations feature the “National Platform for AI” developed by Serbia, which is based on a new strategy aimed at developing a massive device that allows startups to use the platform for free to develop AI applications.

13 conomy middle east march 2023

LEAP 23 announces USD9 bn worth of investments

To support future technology and startups

LEAP 23, the world’s most visionary technology event, which ran from February 6 to 9, 2023, announced more than $9 billion in investments to support future technologies, digital entrepreneurship, and tech startups, and enhance the Kingdom of Saudi Arabia’s position as the largest digital market in the Middle East and North Africa (MENA).

The investments were revealed by Abdullah bin Amer Alswaha, the Saudi Minister of Communications and Information Technology (MCIT), during a keynote address on the opening morning of LEAP 23, which took place at Riyadh Front Exhibition & Conference Centre.

Alswaha confirmed the investments included Microsoft’s $2.1 billion investment in a global super-scaler cloud in the

Kingdom, Oracle investing $1.5 billion to expand its MENA business by launching new cloud areas in the Kingdom, Huawei’s $400 million investment in cloud infrastructure for its services in the Kingdom, and the launch of a Zoom cloud area in the Kingdom in partnership with Aramco. An additional $ 4.5 billion has been invested in global and local assets across multiple sectors at LEAP 23, added Alswaha.

An annual event that brings together the world’s most important tech experts, LEAP 23 is rapidly evolving into a global tech movement, with the event expected to attract more than 250,000 visitors from around the world this year. The tech industry magnet comes as the Kingdom continues its leadership as the MENA region’s largest digital market, with more than $42 billion in active investments.

The

Several new projects in the works to diversify Kingdom’s economy

Saudi Arabia is undergoing a major economic transformation in line with its overarching Vision 2030 strategy. With a $500 billion investment, NEOM is arguably the most eye-catching of Saudi Arabia’s megaprojects. The zone covers 26,500 square kilometers and is located in the country’s northwestern corner. It is envisioned as a futuristic smart city powered by clean energy with no cars or carbon emissions.

Here’s a rundown of the megaprojects in store for NEOM: The Line

The Line is planned to be a 170-kilometer linear city that will house nine million people. It will run from east to west across the NEOM region. According to the developer, the city will consist of two parallel, 500-meter-high, linear skyscrapers standing 200 meters apart. The buildings will be clad with mirrored facades.

Oxagon

Oxagon is planned as an octagon-shaped port city that will be built on the Red Sea in the far south of the NEOM region. According to NEOM’s developer, the port and logistics hub will be the “world’s largest floating structure.”

Trojena

Trojena is planned as a ski resort in the Sarwat Mountains near the north of the NEOM region. The 60-square-kilometer skiing and outdoor-activity resort will offer year-round skiing and is set to host the 2029 Asian Winter Games.

Sindalah

Sindalah is planned as an island resort within the Red Sea. Aimed at the yachting community, the 840,000-square-metre island will have an 86-berth marina and numerous hotels.

14 conomy middle east march 2023

four futuristic megacities of Saudi's NEOM

short news

Saudi's first woman astronaut to go to space this year

In a feat that supports the Kingdom’s Vision 2030

Saudi Arabia will send its first two astronauts, including its first female astronaut, to the International Space Station (ISS) in Q2 2023, SPA reported.

In a feat that supports the Kingdom’s Vision 2030, Saudi citizens Rayyanah Barnawi and Ali al-Qarni will join the crew of the AX-2 space mission. The space mission is scheduled to launch from the US to the ISS.

The move aims to boost national capabilities in the field of human spaceflight and help the Kingdom benefit from the opportunities provided by the international space industry, SPA said. It also aims to “contribute to scientific research that serves the interests of humans in essential fields such as health, sustainability, and space technology.”

In addition to Barnawi and al-Qarni, astronauts Mariam Fardous and Ali al-Gamdi will also be trained on all the requirements of the mission that is part of the Saudi Space Commission’s spaceflight program. The program is being carried out in cooperation with the Ministry of Defense, the Ministry of Sports, the General Authority of Civil Aviation, and King Faisal Specialist Hospital and Research Center, in addition to international partners such as Axiom Space.

“This mission is also historic as it will make the Kingdom one of the few countries in the world that brings two astronauts of the same nationality aboard the International Space Station simultaneously,” the Saudi Space Commission’s CEO Dr. Mohammed Bin Saud al-Tamimi said.

UAE launches 3D digital metaverse health assessment service

New service ensures security of data using artificial intelligence

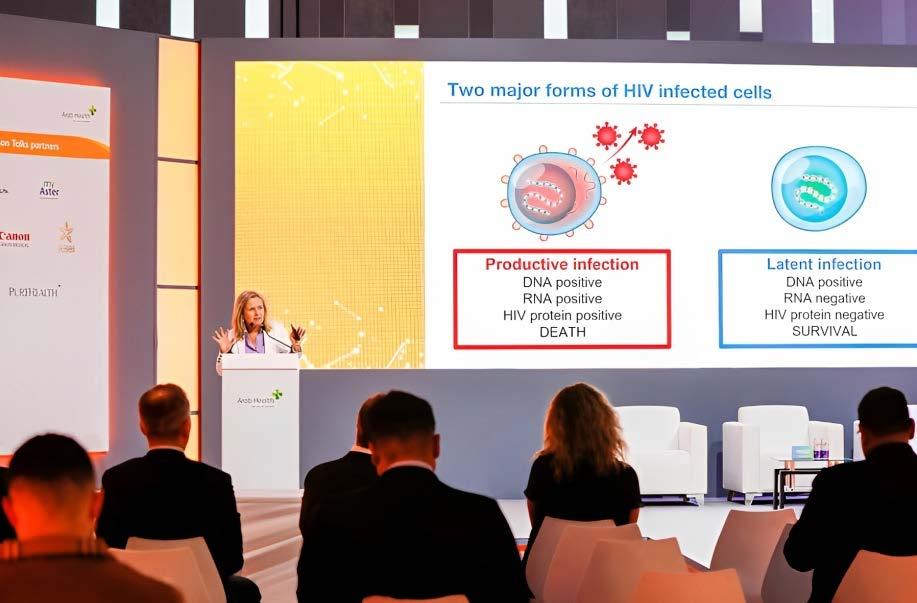

During a press conference held at Arab Health 2023 in Dubai, the UAE Ministry of Health and Prevention (MoHAP) launched an innovative service to evaluate healthcare professionals, including doctors and allied practitioners, using cutting-edge “Metaverse” technology.

The 3D Digital Metaverse Assessment Service seamlessly integrates the real, virtual, and digital worlds, enhancing the delivery of both government and private healthcare services.

MoHAP has also unveiled a new medical thermal imaging

technology, further enabling healthcare providers to utilize cutting-edge innovations. The 3D Digital Metaverse Assessment Service will enable the ministry to remotely evaluate health practitioners, including doctors and allied health professionals. This service will also streamline procedures while maintaining data security through AI. It will be unique for its several key features, including transparency and secure remote assessment where AI will be used to ensure that personal data and medical certificates match during the assessment process. This technology also monitors eye movements and analyzes facial expressions for the safety of the evaluation process. The 3D platform, which simulates a realistic assessment hall, provides clear roles and platforms for the judging committee, invigilators, and examinees.

The new thermal imaging technology will be effectively used in detecting diabetic foot inflammation for early diagnosis and monitoring surgical sites for infection risk. It will also be used in determining psychological state through facial temperature analysis and tracking blood vessels associated with heat-producing tumors in thermal oncology, which streamlines the process of diagnosing and monitoring patients’ conditions.

15 conomy middle east march 2023

UAE Economy Minister discusses macroeconomic outlook, shares vision for economic openness and reforms

Ministry remains committed to protecting population from inflation, rising global food prices and external shocks

16 conomy middle east march 2023

cover story

H.E. Abdulla bin Touq Al Marri, UAE Minister of Economy

The UAE has established itself as a powerful player in the global hydrocarbon market and enjoys a prominent position within OPEC. However, rather than resting on its laurels, the country has been proactively pursuing a multi-faceted strategy of diversification away from its traditional reliance on oil. This commitment to transformation was exemplified in 2022, which witnessed a number of key milestones, such as an 11-year-high GDP growth of supported by the non-oil sector and record-breaking international trade.

Moreover, the UAE has also taken a leading role in the fight against climate change, committing to a net zero 2050 pledge and branding 2023 as the “Year of Sustainability.” Additionally, the country has been entrusted with hosting COP28, the largest global energy event, further highlighting its status as a pioneer in sustainable development.

To fast-track its growth over the next five decades, the UAE government has launched Investopia as part of the “Projects of the 50” initiative, which has outlined a comprehensive set of strategic reforms and initiatives. The world has taken notice of the country’s ambitious plans, with investors flocking to seize the opportunities that have been created.

In an exclusive interview with Economy Middle East, His Excellency

light on the UAE’s

The UAE’s GDP is expected to grow 4.1 percent in 2023, higher than the 3.9 percent forecasted earlier. Which main sectors will contribute to this growth?

I cannot talk about 2023 without talking about 2022. The last year was remarkable on the economic front in the UAE. The economy grew at a strong pace despite a challenging global environment. The GDP is estimated to have grown by 7.6 percent, the highest in 11 years, driven by a rise in oil production, as well as a significant improvement in the non-oil sector. The non-oil GDP was up 6.1 percent, reflecting strong performance in some of the non-oil sectors such as tourism and hospitality, construction, transportation, and manufacturing. Expansion in nonoil business activity was driven by higher client demand across these sectors.

On the international trade front, we saw a record-breaking 17 percent growth in 2022, reaching more than AED 2.2 trillion for the first time in the history of our country. Our exports value surged 6 percent on an annual basis to AED 366 billion. The share of exports in the total non-oil trade rose to 16.4 percent from 12 percent in 2015. The share of re-exports also reached 27.5 percent of total non-oil trade.

Moreover, let’s not forget that the UAE economy made a strong recovery from the pandemic-induced slowdown: we were one of the first economies in the world to recover from the recession. The strong growth of last year is the fruit of the ambitious economic reform agenda that we launched during the COVID-19 pandemic to support the recovery, including the overhaul of the companies’ law to allow 100 percent free foreign ownership, the modernization of residency regime, and the series of Comprehensive Economic Partnership Agreements (CEPAs) that we started. The impact of abovementioned and other reforms was significant in 2022 and will materialize further in 2023 and beyond.

The UAE Central Bank has revised its forecast for real output growth in 2023 to 3.9 percent, whilst the World Bank expects our economy to grow by 4.1 percent slightly higher than the central bank’s projections. The positive

momentum in consumption and investment seen in 2022 is likely to continue this year. We expect the non-oil sector to keep its strong performance, continuing the trend set in 2022, while oil production is likely to be lower if the global economy slows down further. GDP growth will be supported by an increase in our exports, our country’s favorable business climate and world-class infrastructure, a strong performance in the real estate sector, and a continuous rebound in travel and tourism.

So, as you can see, growth figures are strong, particularly considering the difficult global economic conditions; and the strong recovery in the non-oil sector will continue with us in 2023. The International Monetary Fund (IMF) suggested in its latest “Regional Economic Outlook: Middle East and Central Asia” that non-oil growth in the UAE will accelerate over the medium-term with the implementation of ongoing reforms. There is a strong case for optimism despite a challenging global context.

European and possibly the United States economies might be heading towards a recession in 2023. What will the Ministry of Economy do to buck downtrends in 2023, be it inflation, tech stock slide, or continuing war in Ukraine?

Several macroeconomic indicators suggest that 2023 is going to be difficult at the world stage: the global economy is very likely to slow down this year. But the impact on GCC countries, including the UAE, will be less important compared to the rest of the world. The UAE economic outlook remains positive, supported by domestic activity. The macroeconomic and structural policies adopted

17 conomy middle east march 2023

The UAE is a largely globalized economy. We are committed to economic openness.

UAE Economy Minister, Abdulla bin Touq Al Marri shed

journey toward excellence and the reasons behind its unwavering commitment to sustainable development.

by our government succeeded at keeping inflation at relatively low levels compared to the rest of the world. Inflation averaged just over 5 percent last year. The Ministry of Economy also took pricing and other measures to protect consumers from unjustified increases in prices. Inflationary pressures are projected to moderate gradually in 2023, including from the impact of tightening financial conditions in advanced economies.

The UAE is a largely globalized economy. We are committed to economic openness. The benefits of trade, investment, and international cooperation in our view outweigh the costs no matter the context. In a way, our economy benefited from increased global uncertainty in the past year. The uncertain global context led to larger financial inflows, contributing to rapid real estate price growth in some segments. FDI inflows are expected to have reached $22 billion, representing 4.3 percent of the GDP. This reflects investors confidence in the UAE as a country and as a society, and it is a testimony to the world-class environment for doing business that we offer. The economic priority going forward is to protect the economy from potential external shocks or at least to attenuate any impact thereof. Elevated oil prices have boosted government revenues and external buffers,

but fiscal policy remained more aligned with the macroeconomic environment, channeling domestic surpluses into sustainable investments and targeted support for the most vulnerable.

Trade policy has played a key role in protecting our population from some of the rise in global food prices by offering consumers greater access to low- or no-tariff products. The series of CEPAs that we signed or planning on signing in the next few years aim to diversify our network of trading partners, open new markets for our exporters, and increase the choice of the consumer. We will continue the implementation of structural reforms here at home as well, including policies related to consumer protection and a revamp of the competition law, which would partly cushion some of the inflation on consumers and increase productivity and competitiveness. We will also give a particular attention to human capital for we believe that talent is a vital part of any economy and human capital development will be part of our future growth plans. Finally, by committing to net-zero emissions by mid-century, the UAE has adopted a bold strategy to shield the economy from oil shocks, which is expected to add some degree of certainty in the future.

18 conomy middle east march 2023

cover story

All eyes will be on the UAE’s hosting of COP28 later this year. You oversee the circular economy policy which is closely related to environmental sustainability and will have a role to play in achieving the country’s climate goals. What can you tell us about it?

The UAE is committed to ensuring sustainable consumption and production patterns as per the SDG 12. The UAE leadership, represented by HH Mohamed bin Zayed Al Nahyan and HH Mohammed bin Rashid Al Maktoum, has vested its trust in the Circular Economy Council and its members, to set the national path to circularity and maximize the use of our precious resources to create a healthier, more sustainable economy. The circular economy policy is working towards the improvement of our management of waste, and the reduction of waste generation overall. 2022 will be remembered as the year that has marked the beginning of the implementation of the roadmap for circularity and we can already showcase some results. Since the approval of the 22 policies to expedite the transition to a circular economy model in the UAE, in July of last year, the Policy Committee has made important progress towards the implementation of the policies. We finalized the RPET standards (recycled polyethylene terephthalate), and they have been issued by Ministry of Industry and Advanced Technology (MoIAT) regulating the trade of recycled plastic water bottles. This makes the UAE one of the first countries in the region to have classification for products that contain minimum amounts of recycled content. The Electric Vehicle (EV) infrastructure policy is now in the final stage. We finalized the EV infrastructure policy including the EV standards for car manufacturers, which will play a key role in supporting the country’s transition to carbon neutrality by 2050. We inaugurated the UAE Aluminium Recycling Coalition at Emirates Global Aluminium. Finally, as part of our objective to harmonize federal and local strategies, the Committee has engaged with federal and local entities to advance the work related to the 22 policies under each entity.

As a chair of the Committee, I have the responsibility to carry on and implement the full UAE Circular Economy Policy 2021-2031 framework. We will continue the work through programmes and projects that are set to attract investments to this field and expand its infrastructure, and in line with the net-zero drive and circular economy principles. Our efforts are being exerted to establish a circular economy database, in addition to offering incentives to encourage the private sector to shift towards clean production methods. We will also pursue the engagement with the private sector to address the challenges business are facing in their shift to a circular economy and support the country’s green development drive. Transitioning towards a new model also requires financing; so, we will be exploring avenues to increase financing for circularity in the private sector. Finally, we will plastic bags ban from January 1, 2024, and will also prohibit all imported plastic cutlery, drinks cups, Styrofoam, and boxes by the beginning of 2026.

The “Year of Sustainability” announced by HH Sheikh Mohamed bin Zayed, the President of the UAE will culminate in COP28. This is a great opportunity for the UAE to lead global climate talks, but it equally puts an additional responsibility on us to further our action towards sustainability and circularity, as well as to advance the country’s vision to become a global pioneer of green development.

19 conomy middle east march 2023

The transition to a circular economy model has made important progress.

In 2022, you launched Investopia as part of the “Projects of the 50.” Before discussing the agenda of Investopia 2023 and your expectations, can you take stock of the activity carried by Investopia in its first year?

The UAE government launched Investopia as part of the “Projects of the 50,” which are a series of strategic initiatives and reforms that will accelerate the nation’s growth over the next five decades. Investopia is an UAE-based platform that connects the international business community to investment opportunities in the new sectors that are likely to constitute the pillars of the economies of the 21st century. We see it as a platform that is our gateway to the emerging industries and the economy of tomorrow.

We kicked off the first edition of Investopia conference to a resounding success on the margins of the World Government Summit in Dubai in 2022. After that, we launched the “Global Talks,” a series of strategic business dialogues with policymakers, investors, and industry experts across several countries. It’s true that Investopia is made in the UAE, but it was designed to have a global outreach. We held global business sessions in New Delhi, Bombay, Geneva, Cairo, New York, Rabat, and Havana, in addition to Abu Dhabi and Dubai, where more than 3000 industry leaders and policymakers gathered in total and led discussions characterized by depth and transparency, with forward-looking solutions to the themes of the sessions.

several sectors as the conference dialogues are focusing on timely and forward-looking issues such as uncertainty, innovation, decarbonization, and the future of finance and sustainable business. Discussions will build on the outcomes of its first conference and its global talks, trying to decrypt trends shaping the future of investment and identify investment opportunities in sectors that will define the economy in years to come.

Saudi MCIT and Huawei sign ICT MOU

I should like to mention that Investopia 2022 held the world’s first press conference in the Metaverse attended by an economy minister. Moreover, during the World Cup 2022, we hosted a discussion about the future of investment in sports and the interlinkages between sports and other sectors of the economy such as infrastructure, healthcare, and tourism. Finally, we managed to build strategic partnerships with prominent organizations including the Abu Dhabi Department of Economic Development, Crypto. com, BlackRock, Invest in Sharjah. And I also attended the signing ceremony of an MOU between Investopia and SALT, a premier global thought leadership forum. The strategic partnership aims to leverage synergies between Investopia on the one hand, and these organizations, on the other hand, and open the door for a greater collaboration going forward.

Investopia 2023 will be held under an intriguing theme:

“Envisioning Opportunities in Times of Change.” What are your expectations out of the event?

In the beginning, I must highlight that Investopia is designed by business for business, and through our engagement with our partners we aim to be relevant to their agendas in supporting sustainable growth in their respective markets. Investopia 2023 brings opportunities in

Moreover, Investopia 2023 will take place against the backdrop of a complex and uncertain international context, be it the pandemic or supply chains bottlenecks, global inflation or monetary policy normalization in advanced economies, technology disruptions or geopolitical tensions. Indeed, opportunities lie in change, but change also involves uncertainty. Uncertainty surrounding investment has theoretical foundations in economics and corporate finance. Therefore, in an everchanging world, it is of utmost importance for policymakers, investors, and business leaders to tackle such issues, their linkages, and the impact that they can have on investment in the new economic sectors.

Having more than 1000 investors, industry leaders, and policymakers in one place, is vital now, given the global need for more urgent solutions to the challenges that are facing the world economy. Moreover, Investopia is contributing to the revival of the global economic debate, particularly about the post-pandemic economic formations—following a period where the activity of global economic forums declined significantly because of the COVID-19 pandemic.

20 conomy middle east march 2023 cover story

Investopia is contributing to the revival of the global economic debate.

What are your plans for the current year with regards to Investopia?

Investopia is a strategic initiative from the UAE to the world with an ambitious but essential agenda. From day one, we wanted Investopia to be an ecosystem that draws on the dynamic and imaginative spirit of the UAE but reaches far beyond. We wanted it for those wishing to benefit from the UAE’s unique future-focused economy and its position as an investment hub that serves some of the fastestgrowing economies across the Middle East, Africa, and Asia.

We started as a C-level global dialogues platform, and it is now becoming a preferred business destination for investors interested in the new economies because it set

itself essentially apart as an investment ecosystem for the new economy through its content and deliverables. The annual conference Investopia 2023 will launch a marketplace for investment, providing speed-pitching opportunities, facilities for business announcements, and linking investors to promising projects through its platform. In addition to that, we are going to offer investors and business leaders additional opportunities throughout the year to engage with relevant stakeholders from different countries. Investopia will hold roundtables and discussions across global economic and financial hubs such as New York, London, Shanghai, and Milan. Moreover, we will expand local and global partnerships and foster the platform’s status as independent and impartial global hub that brings together all opinions in the world of business.

21 conomy middle east march 2023

A country firmly on the path of reform and modernization

Interview with H.E. Dr. Hala El-Said, Egypt’s Minister of Planning and Economic Development

The Egyptian government has recently released a draft of what it calls a “State Ownership Policy Document.” The document outlines plans to reduce the state’s involvement in certain economic activities and strengthen the role of the private sector in economic activity and create an enabling environment that attracts and reinforces investments.

This policy is a continuation of previous efforts to promote the private sector’s ownership of public assets with the aim of maximizing the economic return of different economic activities. The state will continue to provide services to citizens while simultaneously monitoring quality and competition. The draft document has been the subject of media attention in Egypt, with reports stating that the government plans to completely exit investments in around 79 activities across various sectors. In 45 other activities, the government will maintain but reduce its investments, while allowing for greater private sector participation.

Economy Middle East conducted an interview with H.E. Dr. Hala El-Said, the Minister of Planning and Economic Development in Egypt, to provide further insight into the state ownership policy document. In addition to discussing the document and its objectives, the interview also covers topics such as digital transformation, strategic cooperation with H.E. Dr. Hala El-Said, Egypt’s Minister of the UAE, and more.

How would you describe the purpose and contents of the state ownership policy document? Additionally, what role is envisaged for Egypt’s sovereign wealth fund within this context?

The Egyptian government has made strengthening the role of the private sector a top priority in its efforts to stimulate sustainable and inclusive growth. To achieve this, the government is directing longterm investments towards key sectors such as renewable energy, water desalination, health, ICT, and agribusiness. Additionally, the government

is providing a mix of incentives to strengthen FDI linkages with local sectors.

Since 2014, the government has invested heavily in infrastructure development and implemented legislative and institutional reforms aimed at enabling private investment. An integrated policy for state ownership of assets has been developed, and proposals to enhance the role of the private sector in various sectors have been put forward.

The government has also launched a series of public consultations across the country to address the specific demands of business representatives in all

22 conomy middle east march 2023 Economy

H.E. Dr. Hala El-Said, Egypt’s Minister of Planning and Economic Development

industries and geographic locations. Based on the results of those consultations, a revised version was put forward and officially launched. The sectors and activities identified in the document from which the state will emerge within three to five years include:

The state ownership policy document identifies several sectors and activities from which the state plans to withdraw within 3-5 years. These include crops and fish farming in agriculture, passenger and cargo transport, river transport, food and beverages (with some exceptions), retail, and various financial intermediary activities such as commercial insurance. The document also outlines several manufacturing activities that the country plans to exit, including the leather industry, engineering, appliances, electronics, chemical industries, and textiles.

The Egyptian government plans to maintain or reduce its footprint in several areas, including wholesale trade, many activities in the water and wastewater sector such as drinking water lifting stations and water distribution networks, as well as many mining activities such as coal mining, gold refining, and others.

To accelerate the implementation of the state ownership policy document, the government has highlighted three main mechanisms. These include the listing of state-owned assets through the Egyptian Stock Exchange, new investments for the private sector in the existing structure of state ownership by involving strategic investors, and public-private partnerships (PPPs), especially in relation to infrastructure projects and public services.

What about the role of Egypt’s sovereign wealth fund?

Established in 2018, the Sovereign Fund of Egypt serves as a mechanism to strengthen partnerships with local and foreign private sector entities. It is regarded as the ideal partner for the private sector for various reasons, including the Fund’s operation under a special law that provides flexibility in implementing various investments while also allowing for optimal exits. The fund provides promising

opportunities for joint investment in various development sectors. It has already concluded many local and international investment partnerships in fields such as the localization of heavy industries (including the establishment of the Egyptian National Company for Railway Industries), the financial sector, and the education sector.

The fund has also invested in renewable energy, green hydrogen, and green infrastructure projects in several African countries, working alongside a number of international sovereign institutions and funds, such as the Norwegian Investment Fund and the Norwegian company “Scatec.”

The Sovereign Fund of Egypt is actively working to unlock Egypt’s potential as a gateway to Africa by creating attractive investment products across multiple sectors, including renewables and green hydrogen, tourism, real estate, and logistics. The Fund operates through five sub-funds: infrastructure and facilities, tourism; real estate and antiquities; healthcare and pharmaceuticals; financial services and financial technology (fintech); and the IPO subfund. The last sub-fund is in line with efforts to exit specific sectors and advance the IPO program. Moreover, the sovereign wealth fund will restructure these companies to increase their valuation and marketability before they are publicly listed. This provides a unique opportunity for investors to invest in assets that are not otherwise accessible.

23 conomy middle east march 2023

What role is digital transformation achieving towards Egypt’s future vision? What are the efforts of the Egyptian state in this field?

Digital transformation plays a crucial role in enabling governments to achieve sustainable development goals, visions and strategies. The global conversation revolves around the Fourth Industrial Revolution, big data and the jobs of the future. In this regard, the Egyptian government has increased its investments in the ICT sector to EGP 82 billion ($2.68 billion) between 2014/15 and 2022/23, representing an increase of 2,200 percent, more than 20 times the 2014/15 fiscal year.

Egypt’s Vision 2030 includes a set of sub-goals under the sixth sustainable development goal, which focuses on administrative reform, improving the efficiency and effectiveness of government agencies, promoting transparency and combating corruption. Other sub-goals include making data available, strengthening partnerships with national and international development partners, promoting accountability and the rule of law, decentralization and empowering local governments. The transformation process rests on key pillars, including the establishment of advanced education

and training systems to produce an internationally qualified workforce, a robust digital infrastructure for communications and information to support digital transformation, and a national system for information and cybersecurity. It also includes the deployment of digital financial technology Fintech to establish an effective digital infrastructure for financial inclusion and launching innovation and research and development systems.

How does your ministry contribute to the digital transformation process?

The Ministry of Planning and Economic Development contributes to the digital transformation process through several programs, including developing government services. These services include those of localities and new urban communities, providing government services through mobile technological centers (about 200 mobile service cars), and creating combined service centers through the Egypt Service Center project. The Aswan Service Center was launched in cooperation with the UAE, and efforts are underway to expand similar centers across all governorates.

24 conomy middle east march 2023 economy

There is strategic cooperation with the UAE in several areas. What cooperation levels are hoped to be achieved in the coming years?

The two countries are collaborating on establishing high-quality government service centers such as the Egypt Service Center in Aswan, as well as enhancing government capacity building in areas such as promoting innovation at work, future foresight, and government communication strategies. Furthermore, there is ongoing investment cooperation between the two countries through the Sovereign Fund of Egypt, which includes a joint strategic platform with Abu Dhabi Holding Company. This partnership presents promising investment opportunities, as outlined in the 2019 protocol for up to $20 billion in joint investments towards economic and development projects. There are numerous investment opportunities in various sectors, including health, pharmaceutical manufacturing, real estate development, financial services and digital transformation. Additionally, besides infrastructure, communications, agriculture and food processing, there are exciting prospects for joint cooperation in the digital economy.

What were the most important issues discussed during your participation in the meetings of the 53rd edition of the WEF in Davos?

The Forum brought together 52 heads of state and government, as well as ministers and CEOs, to focus on solutions and cooperation between the public and private sectors in addressing the world’s most pressing needs.

Several sessions covered a range of topics, including enabling investment in the transition to net zero emissions, planning for the 28th session of the Conference of the Parties (COP), and stakeholder dialogues on climate change and reform in the Middle East. A strategy session was also held to discuss the future of growth. On the sidelines of the forum, numerous bilateral meetings took place with CEOs of companies and representatives of international institutions. These included meetings with the CEOs of AstraZeneca and the Adani Group; the President of Google for Europe, the Middle East and Africa; and the Managing Director of the World Economic Forum. Meetings were also held with the managing partners of Golden Sachs and BAIN Europe, the Middle East and Africa; with the CEOs of Envision Group, Coursera, Honeywell and HSBC Bank Europe; as well as with the Vice President of the Indurama Foundation. Discussions centered on enhancing

future cooperation with Egypt and reviewing investment opportunities in various sectors. Overall, the forum highlighted the importance of collaboration and innovation in addressing global challenges and building a more sustainable and prosperous future.

What about the sovereign wealth fund’s tour of a number of Arab countries? What are its objectives?

The Sovereign Fund of Egypt embarked on a tour to several Arab countries to promote investment opportunities in Egypt. During the meetings, we reviewed the first phase of the National Program for Economic and Social Reform, which the Egyptian state launched in November 2016. The state implemented numerous legislative and institutional reforms by enacting laws that simplified project establishment procedures and encouraged local and foreign private sector investments.

In April 2021, the state introduced the National Program for Structural Reforms, which aims to restructure and diversify the Egyptian economy. The government prioritizes the private sector’s role in the Egyptian economy as the cornerstone for stimulating sustainable and inclusive growth, particularly in the agriculture, industry, communications and information technology sectors. It plans to direct long-term investments in key areas such as renewable energy, water desalination, health, communications and information technology, industry and agriculture while providing incentives to strengthen foreign direct investment links with local sectors.

We also reassured investors that the Sovereign Fund of Egypt serves as the government’s investment arm. There is a strong demand for investment opportunities that we currently offer, as the fund provides a range of attractive investment products across several sectors, including renewable energy sources, green hydrogen, tourism, real estate, and logistics. Additionally, we continuously strive to increase the value of some major state-owned companies by involving the private sector either through private placements, IPOs, or pre-IPO activities.

To manage the offering process for state-owned companies on the Egyptian Stock Exchange or investors, a sub-fund was established, providing investment opportunities in strategic assets while restructuring companies before the offering process to enhance their value and returns. The sovereign wealth fund’s plan aligns with Egypt’s Vision 2030, and the country seeks to secure its position on the international investment map.

25 conomy middle east march 2023

GCC countries can be drivers of global economic growth

Non-oil sectors, green transition, are major propellers

Gulf countries have had an exceptional year growing their economies in 2022 and in 2023, they will maintain this growth path and continue to benefit from developments in the international energy market. Economy Middle East discussed all of this and more with Issam Abousleiman, GCC country director at the World Bank since August 1, 2018.

Abousleiman is a Harvard University Executive Management program graduate. He also holds an MBA in finance and investment from George Washington University, as well as an MBA in management from the American University of Beirut.

Abousleiman joined the World Bank in 1989, starting his career in the Loans Department, and has since held various positions across the institution, including head of Financial Advisory and Banking at the World Bank Treasury and principal investment officer in the Banking & Debt Management Department. His regional expertise includes Africa, Asia, Europe, Latin America, and the Middle East.

26 conomy middle east march 2023

banking & finance

Issam Abousleiman, GCC country director, The World Bank

You previously announced that Gulf countries recorded the highest GDP growth rate back in 2022. What are your growth expectations for this year?

The GCC region is expected to expand by 6.9 percent in 2022 before moderating to 3.7 percent and 2.4 percent in 2023 and 2024, respectively. The strong performance in 2022 was driven primarily by the hydrocarbon sector. However, with the recent signals for a more cautious approach to OPEC+ planned production, the oil sector is expected to expand, but at a slower pace, by 3.3 percent in the medium term. Similarly, the non-oil sectors grew by 4.3 percent in 2022 and are expected to grow by 2.9 percent in the medium term to reflect the weaker global growth outlook.

The risks to these forecasts remain numerous. The global outlook continues to be clouded by uncertainty and is subject to various risk factors, including intensifying geopolitical tensions, growing stagflationary headwinds, rising financial instability, continuing supply strains, and worsening food insecurity. Higher food and energy prices are eroding real incomes and could aggravate social tensions in some countries around the world. Global growth is expected to decelerate sharply to 1.7 percent in 2023 – the third-weakest pace of growth in nearly three decades, overshadowed only by the global recessions caused by the pandemic and the global financial crisis. This is 1.3 percentage points below previous forecasts.

Do you trust that Gulf economies can become drivers of global growth?

I do not see why not.

As mentioned earlier, the GCC region is currently considered a bright spot despite high uncertainty and a bleak global outlook. The region has been committed to structural reforms that have allowed for increased private sector contribution and job creation. Indeed, oil receipts continue to play an important role in financing this transition. However, there is also clear evidence of reduced oil dependency overall in these countries.

Which GCC country is expected to achieve the highest growth rate this year and why?

We are in the process of updating our individual forecasts for the GCC countries which will become public during WBG/IMF Spring Meetings in April 2023. Generally speaking, and in light of the global economic slowdown, we do not foresee the oil sector performing as strongly as it did during 2023. However, high-frequency data suggests that non-oil sectors in Saudi Arabia, the UAE, and Oman seem to be performing slightly higher than their peers. This is supported by robust private consumption as well as investments and improvements in the overall business environment.

What is the nature of the cooperation between the World Bank and Gulf countries, and what form of support do you provide?

The World Bank Group (WBG) has maintained strong partnerships with Gulf Cooperation Council (GCC) countries for more than five decades. The WBG has delivered transformational and highly relevant knowledge products to support the development agenda of the region. The governments of the Kingdom of Bahrain, the Kingdom of Saudi Arabia, the State of Kuwait, the State of Qatar, the Sultanate of Oman, and the United Arab Emirates have made use of the global knowledge and development expertise the WBG provides through technical assistance programs offered as Reimbursable Advisory Services (RAS). RAS are demand-driven and tailored to the specific country context, and consist of strategic reform and policy advice, implementation support, and capacity building.

Can you tell us more about the green growth opportunities in the GCC?

There is an excellent and timely opportunity to diversify the GCC economies further using a green growth strategy and playing a leading role in the global transition to low-carbon economies.

The region could use the green growth transition to focus policies on developing green technologies and associated skilled labor that would reverse trends in productivity and enable the region to grow faster. The GCC countries’ total GDP is projected to be close to $2 trillion in 2022. As we mention in our latest Gulf Economic Update, if the GCC countries continued business as usual, their combined GDP would grow to an expected $6 trillion by 2050. However, if the GCC countries implemented a green growth strategy that would help and accelerate their economic diversification, GDP could have the potential to grow to over $13 trillion by 2050.

Focusing on green growth in the Gulf region is entirely in line with GCC vision documents that outline an image of the economy of the future that relies increasingly on the private sector playing a leading role in investment, job creation, and value addition. The GCC green growth strategy should focus on major upstream and downstream sectors of the green economy, including renewable energy, green buildings, sustainable transport, water management, and waste management. In addition, green finance would become a critical enabler for new investments in these areas.

27 conomy middle east march 2023

The Bold Bureau

Standard Chartered Bank profits jump 28 percent

in 2022

Interest rate hikes among key drivers of growth

Global banks experienced a strong performance in 2022, bolstered by multiple interest-rate hikes by central banks aimed at combating inflation. After a decade of near-zero rates, these rate hikes allowed lenders to charge higher interest-based fees.

Standard Chartered Bank, like its peers, was one of the financial institutions that had a robust showing last year. The bank’s annual pre-tax profit surged by 28 percent, driven by the rise in global interest rates, which the bank capitalized on.

According to Standard Chartered, nearly 10 percent of its overall profit growth was derived from the interest rates that central banks raised to tackle high inflation. This allowed commercial banks to charge borrowers higher fees, offsetting the impact of a decade of low interest rates.

In 2022, the bank generated pre-tax profits of $4.29 billion, representing a 28 percent increase from the previous year’s $3.35 billion. Interest income also soared by nearly 50 percent to $15.25 billion from $10.25 billion in 2021.

For the fourth quarter ending December 31, 2022, Standard Chartered posted a pre-tax profit of $123 million, compared to a loss of $208 million in the fourth quarter of 2021. This exceeded analysts’ expectations, who had projected a loss due to a credit impairment charge for the bank’s China commercial real estate business for the full year. Net interest income increased by 119 percent to $2.02 billion, which was in line with previous consensus

estimates. Diluted earnings per share, which include the number of convertible traded shares and collateral shares, rose by 25 percent to 84.3 cents, up from 61.3 cents in the previous year.

CEO Bill Winters said: “We are raising our expectations and are now targeting a return on tangible equities approaching 10 percent in 2023, exceeding 11 percent in 2024, and continuing to grow thereafter.”

London-based Standard Chartered had previously targeted 10 percent for 2024.

28 conomy middle east march 2023 banking & finance

Sunil Kaushal, Regional CEO, Africa and Middle East, Standard Chartered

Return on equity is a key measure of banks’ profitability

“We achieved a strong set of results in the fourth quarter and for the full year of 2022, with income and profit before tax up 15 percent, and a return on tangible equity of 8.0 percent, up 120 basis points in 2021,” Winters said at the start of the report, in which the bank disclosed its 2022 financial report.

He announced that the bank intends to buy back new shares worth $1 billion and to distribute a final dividend of 14 cents per share. This takes the total shareholder dividends announced in 2022 to $2.8 billion, which is more than half of the $5 billion target the bank had set for itself by 2024.

“We remain confident in achieving our financial targets. We are raising our forecasts, and are now targeting a return on tangible equities approaching 10 percent in 2023, exceeding 11 percent in 2024, and continuing to grow thereafter.”

Standard Chartered remains optimistic about the reopening of China and economic growth in Asia next year, which is where it generates most of its revenue due to high growth rates.

What about the Middle East and Africa?

Standard Chartered data shows it had a remarkable performance in the Middle East and Africa regions. The base profit before tax reached $819 million, up 4 percent on a constant currency basis, despite the high decline in the value of loans, “mainly related to circumstances of downgrading sovereign ratings in Ghana and Pakistan,” according to a statement from Standard Chartered.

The $937 million in core profit, a 25 percent increase on a constant currency basis, came from high income and cost-disciplined management.

In the UAE, Standard Chartered’s profits increased by the end of 2022 with a growth rate of 41.3 percent, compared to 2021 profits. The bank registered a profit increase to AED 1.25 billion ($340 million) in 2022, compared to AED 888.2 million ($24 million) in 2021.

Progress made

Standard Chartered has made significant strides in the region:

• It strengthened its presence in Egypt after receiving approval to seek a banking license, marking a major achievement.

• It dominated the bond and sukuk markets in Africa and the Middle East in 2022, earning first place in company ratings based on specific financial metrics and third generation issuances in the Middle East and North Africa region for the fifth consecutive year. It doubled in size, introducing the most innovative deals of the year, and ranked first in these criteria in Africa and the Middle East.

• The bank’s contribution to sustainable finance in the market was notable.

• It introduced a comprehensive digital onboarding service in Pakistan using built-in methods that verify customers’ identities, allowing them to easily open accounts from the bank’s mobile app.

• To support financial inclusion, it expanded its offering to banking agents in five countries, providing multiple points of contact for customers to conduct transactions. In addition, it extended digital wealth management solutions in Kenya and the UAE.

• The bank’s products saw broad-based growth in income, with financial markets reaching their highest level since 2015.

According to Sunil Kaushal, Standard Chartered’ s Regional Chief Executive Officer, Africa and Middle East, the bank achieved remarkable success in 2022, partly because it was “developing a transformation journey aimed at realigning and restructuring our network across Africa and the Middle East.”

“Our outstanding financial performance has been a reflection of our team’s efforts and dedication throughout the year,” Kaushal said. Despite ongoing challenges, GCC markets are optimistic about “outperforming global growth, thanks to a recovery in oil prices, increased government spending and bilateral trade negotiations,” he added.

“We continue to reaffirm our commitment toward investing in our distinguished international network, toward the business activities of our wealthy clients, and toward market-leading digitization initiatives to help our clients thrive. We always have a specific goal, which is becoming a leader in our industry across the region.”

29 conomy middle east march 2023

The Road to COP28

By Laura López Mingo & Elias El Mrabet

By Laura López Mingo & Elias El Mrabet

Sustainable finance has advanced globally since 2015, through new initiatives and the development of existing policies, including in the Middle East and North African region (MENA). The Doha declaration was a key step in honing the region in the international sphere. By hosting the negotiations, the region showed its desire to coordinate and align with international standards on sustainable finance. Most recently, Egypt hosted COP 27 in Sharm El Sheikh and the UAE will host next year’s Conference of the Parties. To decarbonise the economy and meet the Paris Agreement, countries need to finance the green transition. So far, only 3 countries have made clear decarbonisation commitments: Bahrain (2060), Saudi Arabia (2060) and the United Arab Emirates (2050). The financial sector has a central role in helping to finance the green transition and is doing so through green bonds, a debt instrument that uses green and sustainability-linked debt and has reached a fourfold increase to $18.7 billion in 2021 from the previous $4.5 billion in 2020 to plan and finance the transition, the financial sector has launched new initiatives:

• In 2018, the Union of Arab Banks, with representatives and bankers of central banks, met to encourage the region’s financial sector to actively finance sustainable development and green banking projects. The Union made pledges to shift to green finance through objectives such as creating a specialised department for sustainable finance, raising awareness and introducing green products to their portfolios.

• In 2019, the Islamic Development Bank (IsDB), supported by Saudi Arabia, successfully issued the first green Islamic bond referred to as a sukuk for €1 billion under its Sustainable Finance Framework that would be used to finance green projects. Two years later the largest ever US-dollar public financing sukuk was issued for $2.5 billion with sustainability use of proceeds.

• Also in 2019, twenty-five UAE public and private entities signed the Abu Dhabi Sustainable Finance Declaration with principles designed to help banks integrate ESG criteria into their core businesses and strategies.

These initiatives are not binding in nature but show a predisposition and interest in sustainable Finance by gulf countries. Especially those initiatives that push for the adoption of voluntary corporate sustainability standards such as the Saudi National Sustainability Standards, Dubai Financial Market’s ESG Reporting Guide, Qatar Stock Exchange’s Guidance on ESG Reporting, Boursa Kuwait’s ESG Reporting Guide, and Bahrain Bourse’s ESG Reporting Guide. The green actions are helping the region reduce climate risk for the banking sector. The region needs to take action to reduce its climate risk because its geography sets it as one of the most sensitive regions to climate change. It is also heavily reliant on oil and gas, where the production represents over 40% of GDP in Gulf Cooperation Council countries, except for the UAE and Bahrain, The fast-changing geography and falling oil repositories mean that sustainable finance is the smart way forward for the region to invest in green projects and assure economic and political stability in the future. Issuing green sukuk is an excellent example of this change of direction and interest in sustainable financial products. However, there is still a need for expertise and confidence in the region’s use of

30 conomy middle east march 2023 Sustainability

Laura López Mingo, Sustainability Analyst

Elias El Mrabet, Senior Advisor MENA

sustainable finance and green bonds to ensure efficiency and trust. According to the Climate Policy Initiative, capital flows have been among the lowest in the Middle East and North Africa region to fund climate change initiatives in any global region.

For the moment, there is no green taxonomy in the region to define what constitutes a sustainable activity. The trend in some jurisdictions is to develop a national taxonomy taking into account international standards. Notably, now, standards are aligning internationally to facilitate a uniform framework for stakeholders to report and identify which of their economic activities are sustainable. Understanding the new regulatory frameworks can be challenging and timeconsuming. Greenomy and others are helping regulators, companies, credit institutions and asset managers to understand the new international rules and monitor the new developments in sustainable finance initiatives in the middle east. In its effort to accelerate the green transition, Greenomy is looking to develop partnerships in the region.

UAE

The UAE pledged to be climate neutral by 2050 in 2015 in the UN Paris meeting pledged $163 billion to its net-zero pledges and has recently confirmed it will host COP 28 in

November 2023. In 2020, the UAE published the first set of Guiding Principles on Sustainable Finance to advance the sustainability agenda

To advance its carbon-neutral transition, it issued its first green bond in 2022 and published the UAE’s Guiding Principles on Sustainable Finance roadmap setting sustainable finance initiatives and objectives. The roadmap has three pillars:

1. Mainstream sustainability in financial decision-making and risk management

2. Enhance supply and demand for sustainable finance products and green investment projects

3. Strengthen enabling environment that promotes sustainable finance practices through collaboration between financial and real sector stakeholders

The Net Zero by 2050 Strategic Initiative sets the path to achieving the UAE’s pledge to decarbonise. The initiative has short and long-term deliverables, the 3 key objectives in the short term are:

1. To strengthen the ESG corporate disclosure standards

2. To encourage sustainable corporate governance structures in UAE enterprises

3. Develop a green taxonomy of sustainable economic activities to guide investors and set the path for the economic transition needed to achieve its 2050 pledge.

31 conomy middle east march 2023

Dubai

The UAE’s emirates are making a tremendous effort in adapting to the new international financial field. In Dubai, put forward 2 guides in sustainable finance: the Sustainable Investing Guide, to help investors navigate through sustainable and ESG investment offerings, and the Sustainable Issuance Guide, guiding the newly issued sustainable finance products.

Dubai has also created a strategy, with deliverables for 2024 and DIFC’s Sustainability Framework divided into the ESG characteristics, commonly attributed to sustainable finance, necessary to contribute to the overall strategy:

1. Social: encouraging citizens’ collaboration and attracting talent to sustainable practices to increase what can sometimes be described as gross national happiness.

2. Environmental: fostering partnerships and environmental conservation

3. Governance: encouraging corporate transparency and accurate disclosures

Abu Dhabi

The capital of the UAE is a major player in fostering sustainable finance in the region so the Abu Dhabi Global Market (AGDM) recently published a consultation paper on the Proposal for a sustainable finance regulatory framework to ensure investor confidence that the risk of “greenwashing” has been appropriately mitigated through a robust regulatory framework so capital can be raised for investments seeking a positive environmental impact and financial returns. Green funds take center stage when talking about sustainable finance because it has positive measurable environmental benefits, so ADGM launched the ADGM Green Fund Designation for funds that will improve investors’ confidence in sustainable finance and use resources that follow a green taxonomy and assets that are a part of or follow an EU Parisaligned Benchmark.

The 2050 target is based on the UAE’s Guiding Principles on Sustainable Finance and led by the ADGM, there was a key strategic decision to make Abu Dhabi into a hub for sustainable finance. As a first step to this, in 2019, ADGM published the ADGM Sustainable Finance Agenda which is divided into 4 main pillars:

1. Regulation: to develop a legislative framework for sustainable finance

2. Collaboration: to ease and align the cooperation between national and international stakeholders involved in advancing the sustainable finance agenda

3. Awareness: to increase acceptance and attraction to sustainable finance solutions through events, education and training.

4. Ecosystem: to create unity for institutions, products and services in sustainable finance

On 19th January 2023, the Abu Dhabi Sustainable Finance Forum, (ADSFF) took place as part of the Abu Dhabi Sustainability Week bringing together top global institutional investors, selected government leaders, regulators and financial institutions to discuss areas of collaboration to increase the flow of capital towards sustainable investment. A key segment of the forum was the Sustainable Innovations Champion Showcase where Greenomy has been shortlisted to present our solution and to advance sustainability in the region.

Since 2019, ADGM is collaborating with key UAE regulators and ministries to develop a UAE-wide harmonised taxonomy for sustainable finance. This is a key development in the region because it is showcasing the country’s dedication to developing its sustainable finance sector. Greenomy and its strategic partner Euroclear, which is present in the UAE and, following it with great interest. The publication of the UAE’s taxonomy will implement a framework for

32 conomy middle east march 2023

Sustainability

national corporations and financial institutions to create environmental pledges, and sustainable roadmaps and attract talent to the region. Internationally, it will attract new green investments and connect them to the international capital markets, as it is already happening in other countries such as Singapore, South Africa and Panama.

QATAR

Qatar has also taken steps to advance its sustainable finance roadmap. From 2017 to this year, the Qatar Financial Centre (QFC) together with the Qatar Central Bank (QCB) and Qatar Financial Markets Authority (QFMA) Qatar implemented the Second Strategic Plan for Financial Regulation. Previously, the General Secretariat for Development Planning (GSDP), with the guidance of Qatar’s Higher Authorities, have been coordinating the National Strategy to launch the Qatar National Vision 2030 (QVN 2030) to provide a framework for national development strategies, trends and available options. To achieve the objectives of the QVN 2030, the Ministry of Development and Statistics published the National Development Strategy 1 for 2011 to 2016 and in 2019, the National Development Strategy 2 for 2018 to 2022. The latter aims to foster sustained economic prosperity, promotion of human development, integrated methodology for social development, and environmental preservation for future generations (sustainable environment).

Qatar has pledged to cut its emissions to 25% by 2030, to finance this transition, Qatar National Bank (QNB) issued its first green bond for USD 600 million in 2020 and it launched its ESG guidance sustainability platform and its first ESG tradable index.

SAUDI ARABIA

Saudi Arabia’s Crown Prince Mohammed bin Salman pledged the Public Investment Fund would be net zero by 2060 and launched green bonds to start its transition, the first green bond issued in Saudi Arabia made a profit soon after it was issued and is referred to as the green century bond.

In February 2022, Saudi Arabia’s Sovereign Wealth Fund (PIF) set a strategy to raise green debt to prepare the country for the expected lower oil levels. The PIF’s roadmap included issuing debt linked to environmentally friendly goals and selling green bonds. Moreover, the country has strengthened its position relative to other countries in the region after it published its Saudi Green Initiative which was recorded in the Arab Financing for Development Scorecard of the UN.

In Egypt this year, Saudi Arabia presented 66 initiatives as part of its environmental plan at the climate change summit. The Kingdom has developed the initiatives in among other pillars: the circular carbon economy and promoting sustainability. Furthermore, in the Middle East Green Initiative (MGI) Summit the Crown Prince pledged $2.5 billion to support emissions reduction.

Conclusion

Overall, the MENA region is showing steady progress in developing policies that will help achieve sustainability goals. It is certain that to finance the green transition, the region’s players will need to increase their trust in sustainable finance and governments need to fund initiatives to encourage partnerships and understanding of the sector. Through the development of action plans, roadmaps and strategies, governments can avoid greenwashing in the region and increase investors’ trust.

Taxonomies are an excellent approach to hone this trust and encourage investment into sustainable economic activities. The UAE has shown its desire to lead the region’s sustainability journey through the initiatives mentioned above in Dubai and Abu Dhabi, and by hosting next year’s COP, which will further extend the country’s sustainability agenda to foreign investors and governments. The release of the UAE’s taxonomy will be an excellent opportunity for the country to be a standard setter in the region, helping to develop new national taxonomies and thus encourage a better flow of capital.

The green bonds that have been issued in the region have had ample finance and attraction which shows the region’s interest in green solutions. With the pledges made in COP27, new bonds and solutions are to be expected. The publication of guidelines has allowed investors to have a clear understanding of what their investments are contributing to and to identify how sustainable their investments are. The region’s commitment to sustainable initiatives is key to mitigating climate risks.

33 conomy middle east march 2023

Powerful positioning of brand presence in Saudi

media

SMC is behind highly influential sports and entertainment media campaigns