MARKETInsight

4 large office projects set the trend for the latest office developments

The project department is further strengthened by well-known profile

Alignment with Real ESG:

“Real Estate Agents have a significant impact on the ESG agenda”

International associate Q2 | 2024

International Poul Erik Bech

CONTACT

EDC Poul Erik Bech

Zealand/Funen

Copenhagen +45 5858 8378

Herlev +45 5858 8376

Taastrup +45 5858 8472

Hillerød +45 5858 8377

Roskilde +45 5858 8395

Køge +45 5858 8379

Næstved +45 5858 8380

Slagelse +45 5858 8396

Odense +45 5858 8397

Jutland

Kolding +45 5858 8399

Aabenraa +45 5858 8425

Sønderborg +45 5858 8422

Esbjerg +45 5858 8398

Vejle +45 5858 8423

Aarhus +45 5858 8670

Silkeborg +45 5858 8427

Herning +45 5858 8567

Viborg +45 5858 8424

Aalborg +45 5858 8449

Vendsyssel +45 5858 8487

International +45 5858 8563

Research +45 5858 8564

Agriculture +45 5858 8574

Project +45 5858 8487

Capital Markets +45 5858 8572

Alignment with Real ESG: ”Real Estate Agents have a significant impact on the ESG agenda” Is sustainability on hold in the real estate industry in Denmark?

Further strengthens the project department by adding a well-known industry profile

Residential rental projects EDC Project Poul Erik Bech

Four unions move together in newly built, certified shared office space

Unusually long deal: Invests in 215 youth and student housing units

4 large office projects for rent sets the trend for latest office developments

JLL and EDC Poul Erik Bech with new Nordic Outlook: Re-industrialisation boosts an otherwise lagging Nordic property market

Locally known school in Haderslev to be sold by public tender and converted into housing

Attractive housing development put out to public tender in Esbjerg Municipality

For sale/sold

Turn the Market Insight around to read: Market Update Q1 2024

2 Contents 18 10 4 22 4 8 10 14 16 17 18 20 22 24 25 29

Page 14

Huge task to move the real estate industry in a more sustainable direction

Dear

reader,

In this issue of Market Insight, we focus on market trends, and you can delve into the latest market data in the Market Update section in the middle of the magazine.

Sustainability is a regular topic for us. This time you can read about one of the most talked about ESG and sustainability initiatives in the industry. We met with Ali Simiab to discuss The Real ESG Framework, a reporting tool that we fully support. A lot has happened in ESG, but as an industry we still have a long way to go, says Ali Simiab. Read more on pages 4-7.

Likewise, sustainability and ESG have also become increasingly important in our annual expectations survey over the past five years. We take a closer look at real estate stakeholders’ expectations for developments in sustainability and ESG. Read more on pages 8-9.

In the magazine, you can also read more about our project department, where the addition of STAD Project and a well-known profile from the residential retal industry help strengthen us in this specific field. The decline in construction activity has not negatively impacted us, as we have gained market shares and expanded the scope of our work to include re-rental.

Sales of commercial properties have increased significantly, and in the first four months of the year we have increased unit sales by 39% and the number of leases by 11% compared to 2023. Our market share is developing very positively, with more than one in four commercial properties on the Danish market being offered through us.

Happy reading!

Best regards,

Poul Erik Bech

3

ESG:

”Real

Estate Agents have a significant impact on ESG”

ESG is on everyone’s lips in the real estate industry. But many don’t know where to start or where to stop. ESG is simply too abstract. Real ESG aims to address this challenge. The new, free, and open source ESG reporting tool aims to make ESG reporting in the construction and real estate industry transparent, concrete, and comparable in the future.

The construction and real estate industry is responsible for 30% of Denmark’s total CO2 emissions, and Denmark’s buildings account for around 40% of the country’s energy consumption, so action is needed. Independent advisor Ali Simiab is working to realize the ESG potential in the real estate industry and was recently selected for Berlingske Talent 100, partly for his hard work in developing Real ESG - The Real Estate Reporting Framework. He initiated this project alongside Christian Haaber Westergaard Nielsen (Thylander), Christian Gjessing Bruun (AKF) and Jonathan Leonardsen (Balder), and the project is financially supported by Realdania.

4

Alignment with Real ESG:

Sustainability Properties ESG Climate footprint RecyclingEDC Construction Environment CO2 DGNB Loss of value Investments Energy consumption Certification

Ali Simiab, ESG advisor

”We strongly support the initiative and the tools behind Real ESG – it’s only through unity that we move forward in the industry”

Axel Elliot Bernstorff Nyegaard, EDC Poul Erik Bech

Ali Simiab comments: ”The idea came about because it was completely impossible to compare key ESG data because everyone was using different assumptions, calculations principles and data points. So, I was a bit bold and said, ’Can’t we just create an industry standard? I’ve learnt that it’s not easy to create an industry standard, but if you put your mind to it, you can create a tool that has the potential to become a standard.”

”There’s a historically high level of legislation on the way, so it’s more important than ever that we work together on new, shared, and free tools. Otherwise, the industry risks leaving smaller players behind. ESG simply must get better and cheaper - at the same time.”

”Success can only be achieved by bringing together good real estate professionals across the value chain. That’s why we’ve collaborated with many experts from different backgrounds, and it’s also significant that 80% of mortgage institutions support the project. It’s a huge vote of confidence for the project team, and it’s crucial for moving the industry forward.”

ESG reporting is the future

”In the real estate industry, more and more companies are reporting their ESG efforts as they seek to provide clients, employees, and the wider community with transparent insights into their activities. Some companies are already required to report ESG data, and in the future more companies will be subject to regulatory legislation regarding reporting.

Ali Simiab states: ”It’s also important for companies that are not currently subject to legislation to measure transparent, concrete and comparable ESG data. It’s expected that the financial sector will soon require ESG data for financing, and that more major players, including pension funds, will demand ESG data from their value chains. So, if you intend to take out loans or collaborate with larger players, there will be an expectation in the future that you can provide ESG data. Therefore, it makes sense to start working on ESG reporting now so that you can meet the demands of the future.

Copenhagen Capital implements Real ESG Standards

Copenhagen Capital, a listed real estate company, reports key ESG data according to the Real ESG standards.

Rasmus Greis, CEO of Copenhagen Capital, explains:

“

In this year’s report, we have implemented the new common tool developed by Real ESG, to further improve our reporting standards. This initiative aims to increase transparency so that non-financial metrics can be compared across the industry. Think of it as a standardised currency for our ESG reporting - an important step towards more comparable data.

5

”

E S

GMake the abstract tangible

Ali Simiab explains that they are very proud of how far they have come in just under a year, and especially of the support Real ESG has received: ”It’s overwhelming to have so many talented, dedicated and ambitious real estate professionals supporting and contributing to the project. Thanks to a huge team effort, we have already released three versions in 2024. The first two were prototypes with version numbers 0.9 and 0.9.1, and the latest version is 1.0. The prototypes were good, and version 1.0 is something we can be proud of - it’s the next level.”

”To many, ESG is still abstract, cumbersome and, above all, expensive. Our tool aims to make reporting in the construc-

tion and real estate industry better, faster, and cheaper. The real test lies ahead. As more and more people use the tool, it will become clear whether the mission is successful. The initial feedback from users of the tool is certainly encouraging.”

”That’s why we’re pleased that strong players like EDC Poul Erik Bech are providing input on how to take the tool to the next level. There’s no doubt that real estate agents have a significant influence on the ESG agenda in transactions, valuations, and leases. Real estate agents are at the forefront of influencing the market in the right direction and we look forward to continuing our good relationship on this agenda.“

Read more at www.ejd.dk/viden/skabeloner-og-vaerktoejer/real-esg-the-real-estate-reporting-framework/

6

Consultation and knowledge sharing

Axel Elliot Bernstorff Nyegaard, ESG Project Manager at EDC Poul Erik Bech, says: ”We wish to be part of the many sustainable improvements that can and should be implemented in the industry. We all have a shared responsibility and are aware that it will take a collective effort from many parties to reduce the real estate industry’s CO2 emissions. As real estate agency, we have a limited direct impact on the environment. However, we are continually working to reduce our footprint and have a vision of becoming carbon neutral within a reasonable timeframe. We will do this by, among other things, buying and planting forests and purchasing wind and solar power. “

”But where we can make the most significant difference is in advising and sharing knowledge with our many clients. Our greatest potential lies in the advice we provide to our clients. We therefore welcome the work with Real ESG in the industry and support the collective initiative. We can help get more real estate agents and players involved. We strongly agree that a common direction is needed to move the industry forward, and it’s impressive how far they have already come.”

”Of course, it requires new competencies in ESG and sustainability. But as real estate agents, we still need to sell or lease our clients’ properties at the best possible terms. The best price is achieved by properties that are modern and up to date - there’s nothing new about that. But in the future, there will be more facets related to ESG, energy consumption, indoor climate, carbon footprint and so on. Furthermore, we need to be able to offer advice on how each property can be improved in terms of these new parameters.”

ESG advisory version

In meetings with Ali Simiab, we at EDC Poul Erik Bech have been able to contribute to the development of the advisory version. This includes bringing together several commercial advisors in the industry to engage in a dialogue about how the tool will be developed and used in the long term.

Axel Elliot Bernstorff Nyegaard comments:

”There is no point in piling regulation on top of regulation and increasing costs for property owners and ultimately, tenants. That is why we are particularly focused on making reporting as simple as possible for all parties involved. Finally, it is important that the scope and language of the tool is accessible and usable for the average property user. Once the documentation is in place, it will be a matter of time before we can display the property’s total CO2 emissions.”

Learn more about EDC Poul Erik Bech’s ESC-initiatives at: www.poulerikbech.dk/en/esg

7

More information Axel Elliot Bernstorff Nyegaard ESG-project manager • EDC Poul Erik Bech +45 5858 8378 • axny@edc.dk

Is sustainability on hold in the real estate industry in Denmark?

Sustainability, ESG and green initiatives don’t get much attention from investors and other real estate players – at least not if you look at the results of EDC Poul Erik Bech’s annual survey, which delves into expectations for the commercial real esate market. However, two experts at EDC Poul Erik Bech point out that this is not a true picture.

ESG and sustainability are now firmly on the agenda of private companies, institutional investors, public authorities, and other players in the property industry. Therefore, it is surprising that only 19% of the companies surveyed in EDC Poul Erik Bech’s expectation survey have a policy that sustainability should play a role in the choice of premises, says Joseph Alberti, Head of Research at EDC Poul Erik Bech:

”We find it hard to believe that this is a true picture of reality. Our clear sense is that ESG compliance and ESG criteria are already part of many business strategy decisions and have become a political focus for companies. More and more companies are faced with demands on ESG and sustainability from both business partners and funding sources, which is why we are surprised that only 19% of our survey respondents said that sustainability plays a role in their choice of premises.”

The last two years of surveys have shown minimal progress on whether companies have a policy on sustainable site selection, with an increase of 2 percentage points from 2023 to 2024.

The results have stagnated

For the past five years, the Outlook Survey has asked about ESG and sustainability, and for the first four years it was clear that this was an area of progress, but from 2023 to 2024, the results seem to have stagnated.

Joseph Alberti says: ”Our perception is that sustainability is a higher priority in the real estate industry. But it’s also worth remembering that the industry has been challenged at the end of 2023, when the survey was conducted. The industry was characterized by a lot of uncertainties, including the war in Europe, high inflation and record high interest rates, which have most likely been more on the agenda of companies than ESG and sustainability.”

”The survey shows that it’s the larger companies that are pulling the load and are more willing to pay more for sustainable properties. This is not surprising, as they have more resources at their disposal. However, the difference is still significant. 44% of companies with more than 100 employees are willing to pay more than 5% for a sustainable property, while only 20% of companies with 1-25

Does sustainability play a role in your current investment strategy?

8

Outlook for 2024: The industry’s largest survey

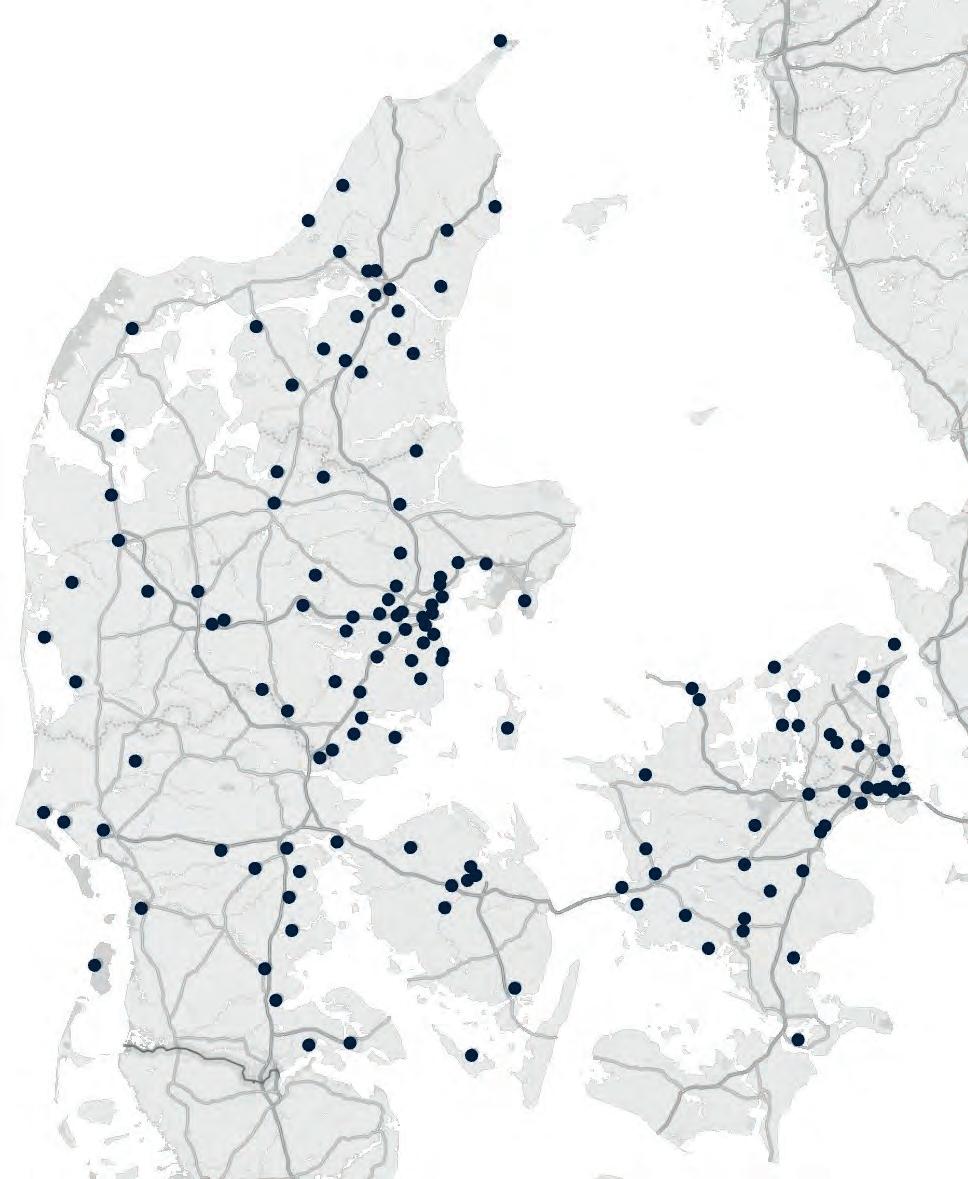

For the ninth time since 2015, EDC Poul Erik Bech has mapped expectations among investors, companies, and tenants about the Danish real estate market. With responses from more than 1,600 decisionmakers, the survey remains the broadest commercial property market survey in Denmark.

The responses were received from all sizes of companies, from all industries and from all parts of the country, reflecting EDC Poul Erik Bech’s position as a nationwide business broker with 19 business centers throughout Denmark.

Read the Outlook for 2024 at www.forventninger2024.dk

employees are willing to pay more than 5%. At the same time, almost half of the companies with 1-25 employees have answered that they are not willing to pay more for a sustainable property,” explains Joseph Alberti.

For example, there has only been an increase of 1 percentage point among those who answered that they have already optimized one or more of their properties. The same is true for those who answered that they are willing to pay more for a sustainable property where location, condition and cash flow are the same. This has increased from 42% in 2023 to 43% in 2024.

Big theme internationally

Helle Nielsen Ziersen, Head of EDC International Poul Erik Bech, who has just completed a mini-MBA in sustainability management, says: ”ESG training is indispensable. We need to know what we are dealing with, and the climate challenges have come faster than expected. Denmark is not as environmentally friendly as we believe when we compare ourselves to other countries. We want to help influence this in a positive direction.”

”Internationally, sustainability is much more important than we still see it in Danish companies, partly because global companies and investors are already subject to the taxonomy/EU reporting rules. International investors and tenants are asking about certification first, and increasingly, tenants don’t want to commit to leases that don’t have certification. We’ve also seen that some investors are buying ’grey properties’, including more and more logistics buildings, which they can renovate and eventually turn into sustainable buildings and perhaps achieve certification.”

”We don’t buy the premise that sustainability is not an issue for Danish real estate players. In our daily contact with both Danish and international companies, we can see that this is an area that companies take very seriously. As our survey also shows, it is especially office properties where green initiatives are being considered, but there has also been a greener development in warehouse and logistics properties. Almost half of respondents said they believe tenants are willing to pay more for a sustainable lease. This figure was just under a third in the last survey.”

As an offshoot of the EU taxonomy, it is gradually becoming easier to get favorable ”green loans” for properties with a low climate footprint and for example energy optimization of buildings. Helle Nielsen Ziersen welcomes this initiative:

”We are confident that we will continue to see policy initiatives to promote sustainability and ESG in the property industry, both nationally and internationally, and whether it’s new construction or renovation of existing properties. At EDC International Poul Erik Bech, we are ready to advise you and your company on how to best future proof your property in terms of sustainability and ESG.”

Do you or your company have a policy that sustainability should play a role when choosing premises?

More information Joseph Alberti, Head of Research EDC Poul Erik Bech +45 5858 8564 • joal@edc.dk

Helle Nielsen Ziersen, Partner, Director, Head of International Relations, Sustainable Manager, MRICS, MDE • +45 5858 8563 • hni@edc.dk

9

Further strengthens the project department by adding a well-known industry profile

The merger of EDC Project Poul Erik Bech and STAD Project occurred over a year ago. Recently, the project department was further strengthened with the hiring of Thomas Høeg Mogensen, who is known to many as the co-owner of LokalBolig Project.

In April 2023, EDC Project and STAD Project merged into one unified project department. One year on, Poul Erik Bech reflects on the merger: ”The merger of our two project departments has exceeded all expectations. They have complemented each other well and significantly strengthened us, particularly on the sales side and in development. Now, with Thomas Høeg Mogensen joining the team, it further contributes to a solid client list across the country. We now have strong units in both Copenhagen, Zealand, Odense, and Aarhus, with Aalborg on the horizon.”

”For some time, we’ve had Thomas Mogensen on our radar to strengthen our project team. He’s a competent addition to our team of 25 dedicated project employees. As most are aware, mergers always require extra resources in the form of discussions and adjustments. However, we have managed to implement them without affecting turnover and the bottom line. Considering the market conditions, 2024 has started reasonably well, and it appears to be another sensible year for our nationwide project departments.”

Research: Is the project profitable?

Niels Kristian Johne, property manager at PensionDanmark, says about the collaboration with EDC Poul Erik Bech:

“As one of Denmark’s largest pension companies, we are committed to investing our members’ money in a responsible, sustainable, and well-founded manner. Therefore, we allocate resources to ensure that a project is profitable before committing to it.

EDC Poul Erik Bech delivers professional work at a high level. This includes a research department that provides analyses based on extensive data and market knowledge, which can be used to gain a more nuanced and well-founded understanding of the market when deciding whether to invest. The research department has provided reports and analyses based on extensive data and market knowledge. Their strong project department can also assist with the sale and/or leasing of project properties.”

10

Proactive leasing efforts ensure low vacancy rates

Thomas Høeg Mogensen, Customer and Relationship Director at EDC Project, states: ”We have extensive experience with both large and small projects, so whether it’s 20 smaller units or 100 luxury apartments, whether it’s senior housing, family homes, or student residences, or anywhere else in the country, we are ready to handle sales and leasing. Even though there aren’t nearly as many large projects being built as there were a few years ago, we still experience good activity in the market.”

”Most people associate project leasing with a one-time fee, but we’ve focused on becoming very strong in re-leasing as well. As investors have experienced significant turnover of tenants in many project developments, there’s been more emphasis on processes and strengthening resources for re-leasing.”

”It costs too much in terms of returns if there’s a vacancy, even if it’s just for a month. So, it’s about having streamlined processes, a well-curated tenant database, and a high level of accessibility. Tenants have a lot of options and being the first to reach them gives the best return for the investor. We’ve chosen to have our own customer center, open 7

days a week from 8am to 10pm, and tenants can sign the lease as soon as they’ve decided on a property. Our fee is often recovered if we can re-lease just 14 days faster than the landlord’s current set-up can achieve.”

”Another significant aspect is that we ensure on an ongoing basis that rental prices keep pace with developments in the market. Many clients appreciate our proactive approach to the leasing processes, which ensures faster and better leasing outcomes. There are significant differences in the rental market across the country and our nationwide local presence allows us to keep our finger on the pulse of each area. We also provide our clients with unique reporting based on extensive data, which they value.”

Thomas Høeg Mogensen continues: ”We strive to cover all aspects of our projects with marketing, project websites, PR, advertising, data-driven processes, administration and customer/tenant screening. We also have our own research department that can provide targeted analysis for each project, supplemented by the knowledge of our project teams and local agents. This ensures that there is genuine demand for a project and that rental levels are in line with the local area.”

11

Thomas Høeg Mogensen (in the middle) has become part of an experienced project team in Copenhagen with (from left to right) Senior Advisor, Partner, Kenneth Nielsen; Customer Manager, Lars Bo Christensen; Senior Project Manager, Alice Lotinga and Mathias Vedel Wæver, Head of Process & Development at EDC Project Poul Erik Bech.

Also projects for sale in the whole country

We are experiencing an increasing number of projects outside the major cities. On Zealand, for example, there is Vinge near Frederikssund, where we have three projects in one of Denmark’s largest urban development projects. In Slagelse, we have a large project with family, youth, and senior housing. There’s also a trend in Jutland to acquire more and more projects, says Tonny Broberg, project manager at EDC Project Poul Erik Bech Aarhus.

”Instead of building new project housing from scratch, we’re seeing more and more developers turning their attention to converting existing buildings into project housing. For example, we’re tasked with facilitating the sale of the well-known Hertug Hans Skole in Haderslev through a public tender, which is to be converted into residences. We’ve also been selected to handle the leasing of 68 terraced houses near Augustenborg Castle, which are expected to be ready for occupation by mid-2025. In addition, we’re facilitating the sale of an attractive residential development site in the centre of Esbjerg for a new project. All in all, the project market is lively in large parts of the country.”

12 More information Thomas Høeg Mogensen, Customer and Relationship Director, EDC Project Poul Erik Bech Copenhagen +45 5858 8487 • thm@edc.dk Tonny Broberg, Project Manager, EDC Project Poul Erik Bech Aarhus +45 5858 8487 • tobr@edc.dk

Als, Augustenborg Rental housing

Frederikssund, Vinge Urban development project

Slagelse, Kvægtorvet Rental housing

Esbjerg Project construction

Haderslev, Hertug Hans Skole Housing

• Projects in Denmark

Scan and sign up here or at www.ejendomsnyheder.dk Do you want to be updated on trends, key figures, publications, news, and new commercial properties?

Residential Rental Projects

Sluseholmen is a modern canal city where you can enjoy life by the water and immerse yourself in the beautiful nature that surrounds you. Sluseholmen offers the best of both worlds, city life and nature. It only takes 10 minutes to get to the city center, and on the other side of Sluseløbet there is access to Amager Fælled.

The apartments are modern and well planned with good natural lightning in every room. There are beautiful floors, bright, inviting rooms and highquality elements in the kitchen and bathroom.

EDC Project Poul Erik Bech has been commissioned by Danica Pension to assist with the re-letting of the 800 apartments.

For more information, visit www.sluseholmen.dk

Contact: +45 5858 8487

Apartments in Carl Bro Haven are distributed across four blocks, surrounded by two courtyards with ample space for trees, bushes, play, and communal activities for residents, including a rooftop terrace, clubhouse, and orangery. The building materials are quality assured, and the project is pre-certified with DGNB Gold. The apartments range from 54 to 142 square meters and contain 2 to 5 rooms.

EDC Project Poul Erik Bech facilitates the letting of the 198 rental properties on behalf of ATP Ejendomme.

For more information, visit www.carlbrohaven.dk

Contact: +45 5858 8487

Kvægtorvet was formerly a hub for food trade in West Zealand but has now transformed into a large residential project in the center of Slagelse. The project at Kvægtorvet comprises a total of 100 family apartments, 224 youth apartments and 62 senior apartments, providing space for people of all generations to come together.

The residence includes both apartments and terraced houses ranging from 32 to 108 square meters with 1-4 rooms. The architecture and design of the blocks are arranged to allow natural light into the green communal areas as well as into the apartments and terraced houses.

EDC Project Poul Erik Bech facilitates the letting of 400 rental properties on behalf of PFA Ejendomme.

For more information, visit www.kvaegtorvet-slagelse.dk

Contact: +45 5858 8487

14

Sluseholmen in Copenhagen – 800 rental units

Carl Bro Haven in Glostrup – 198 rental units

Kvægtorvet in Slagelse – nearly 400 rental units

Where there previously used to be office buildings and a large parking lot, you will soon find a new and lively area in Glostrup. Carl Bro Haven is situated just 250 meters from Vestskoven, Denmark’s largest new forest, perfect for a nature outing.

Papirrækkerne in Dalum Papirfabrik – 63 terraced houses

Odense’s new green district, Gartnerbyen, is located close to the city centre and in a quiet neighbourhood. The area provides easy access to green areas with room for activities for all ages. It is conveniently located between schools, supermarkets, city life and cultural attractions, and the new light rail provides easy access to the rest of Odense.

Hortensiahaven consists of 82 apartments designed to accommodate different lifestyles. There are cosy 2-bedroom apartments and spacious 3-bedroom apartments. With bright rooms, well utilised floor plans and balconies overlooking the new and charming cityscape. The apartments at Hortensiahaven are the ideal home for those who wish to combine city living with green spaces.

EDC Project Poul Erik Bech facilitates the letting of 82 rental properties, on behalf of SF Management.

For more information, visit www.hortensiahaven.dk

Contact: +45 5858 8487

The old paper mill in Dalum combines urban living with green spaces, creating a unique area in a prime location by the river in Odense – close to the city and the highway. This makes the area highly attractive for costumers that commutes.

The terraced houses are 2-storey and range in size from 90 to 130 square metres, with a living room, dining area, along with a toilet on the ground floor and a bathroom and bedroom on the first floor. Each residence has a spacious balcony, private garden, and parking space, as well as access to communal green areas for playing and outdoor activities.

EDC Project Poul Erik Bech facilitates the letting of 63 terraced houses on behalf of MT Højgaard.

For more information, visit www.dalumpapirfabrik.dk/raekkehusene

Contact: +45 5858 8487

Augustshave is located within walking distance of the main entrance to Aarhus University, and Aarhus city centre, the Skejby business area and Vennelystparken are also just a few minutes away.

The apartments range from 1 to 4 bedrooms and appeal to a wide market. The complex has a cosy courtyard and good private areas in the form of terraces or balconies for all the apartments. The development includes a small communal area that can be used by the residents for various purposes.

The construction was completed in March 2024, and as of May 1, 2024, more than 95% of the apartments were leased in an area with strong competition in the rental housing market.

For more information, visit www.augustshave.dk

Contact: +45 5858 8487

15

Hortensiahaven in Odense – 82 rental units

Augustshave near the university in Aarhus – 206 rental units

Four unions move together in newly built, certified shared office space

In 2026, Forbundshuset will be ready at Sluseholmen 1 in Sydhavnen, right next to the soon-to-open Sluseholmen metro station. The approx. 10,000 m2 building will be the head office for four trade unions. On behalf of MT Højgaard Property Development, EDC Poul Erik Bech has brokered the sale of the entire office community, which has a total project value of almost DKK 400 million.

The four trade unions Blik- & Rørarbejderforbundet, Dansk El-Forbund, Dansk Journalistforbund - Medier & Kommunikation and Malerforbundet i Danmark have joined forces to build a new joint headquarter to ensure a modern and up-to-date framework for the administration of the unions. Mads Lauritzen, CEO of MT Højgaard Property Development, says:

”We have developed and are currently constructing the Association House, which will be approximately 10,000 m2 in total and will be built according to sustainable and energy-friendly standards. It will be certified with DGNB Gold and DGNB Heart, and the four unions have also secured a number of labour and apprentice clauses that make the construction site one of the most well-regulated in Denmark in the private sector.”

He continues: ”We are very much looking forward to constructing and handing over a state-of-the-art and certified office building to the federations in 2026, which can support both their joint synergies and autonomy at the same time. For MT Højgaard Property Development, the construction will be the culmination of years of development and presence in Sydhavnen, which we are proud of.”

Super nice shared office space

Flemming Buhl, Head of Capital Markets and partner at EDC Poul Erik Bech, says: ”We are very pleased to have

assisted MT Højgaard Property Development with the sale of this beautiful and modern office community. Initially, our task was to find one or more investors who wanted to buy the entire building. But then the four trade unions came on board, which is an excellent solution for all parties, and there is still some excess space if other unions are interested in the community.”

Thor Heltborg, Director of Corporate Clients, EDC Poul Erik Bech, adds: ”We have many exciting office cases at the moment in Greater Copenhagen, and it’s great that the sale of Forbundshuset has been finalized. We have four large office properties to let and at least one more on the way, so there’s a lot going on in the office market in Copenhagen and the surrounding municipalities. The vacancy rate is still relatively low, and what’s really moving the market is new, state-of-the-art, certified office space, preferably shared offices. For Forbundshuset and the projects we have on the shelves, location is extremely important, as companies want to give their employees great office space close to a metro station. There’s a competition for labour, so it’s definitely also a way to attract new and retain existing employees.”

In addition to the four trade unions, the two unemployment funds FAK, AJKS and the company Fagenes Bofællesskab (FAB) will also move in. The four unions have each purchased a percentage of the shares in the new property company. The Danish Union of Journalists and the Danish Electrical Workers’ Union with 24.5%, the Plumbers’ and Pipefitters’ Union and the Painters’ Union with 17%. In addition, MT Højgaard Property Development owns 17%. There are still vacant m2 in the building, and it is the unions’ hope that other unions will become a part of the house.

16

More information Flemming Buhl, Head of Capital Markets and partner EDC Poul Erik Bech • +45 5858 8572 • flb@edc.dk Thor Heltborg, Director of Corporate Clients EDC Poul Erik Bech • Tlf.: +45 5858 8378 • the@edc.dk Visualisering: Holscher Nordberg Architects

Holmbladsgade 70C, Amager 35 apartments

Albanigade 23C, Odense

36 apartments

H. N. Clausens gade 21, Aarhus

55 apartments

Bissensgade 12, Aarhus

25 apartments

Engtoften 6, Viby 45 apartments

Vesterå 23, Aalborg 19 apartments

Unusually long deal:

Invests in 215 youth and student housing units

Sampension has acquired six properties with 215 youth and student housing units totaling 11,214 m2 in Copenhagen, Odense, Aarhus, Viby, and Aalborg. The seller is the property company UngboDanmark, and EDC Poul Erik Bech has brokered the sale of youth and student housing.

Sampension is expanding its portfolio to a total of almost 800 student and youth housing units. The company has invested in six properties with over 200 student and youth housing units in Copenhagen, Odense, Aarhus, Viby, and Aalborg.

Sometimes a deal takes time. Back in 2016, Sampension bought five properties with student housing from the property company UngboDanmark with an option agreement to buy six more properties. It is this option that has now been exercised. Torbjørn Lange, Head of Property and Infrastructure at Sampension, says:

”We are pleased that with this investment we can increase our portfolio of youth and student housing, which contributes to ensuring attractive housing options for young people in Denmark. The six properties are centrally located in the largest educational cities, where students demand this type of housing. It also supports our desire to have a diversified portfolio that includes several different types of properties and has a good geographical spread. Overall, we expect the investment to provide our customers with a reasonable return on their pension savings.”

Know them very well

Sampension has taken over the six properties managed by Norhjem. In addition to youth and student housing, the properties also consist of a small proportion of commercial properties. Morten Myrhøj Kristensen, CEO of UngboDanmark, says:

”The big blow and the actual sale was back at the end of 2016 when, with the help of Frank Jensen from EDC Poul Erik Bech in Aalborg, we sold the first five youth and student housing units to Sampension. We also drew up the entire contractual basis and a purchase option for the last six youth housing units in our portfolio. This is an

extension of the agreement from back then, and that was always the plan for both parties. That’s why this second phase has been fairly simplewith technical and legal due diligence, of course.”

”It’s been a good, constructive and giving process with Frank Jensen and EDC Poul Erik Bech. We know them very well and can only speak positively about them, so we will definitely use them in the future when we need to buy or sell properties. We have now sold out of our youth housing, so now we have two properties left with family housing, and we’re also halfway through building an 8,000 m2 project in Randers with family housing. Thus, we are ready for even more property projects in the future, primarily in Aalborg or within a reasonable driving distance from Aalborg.”

Plenty of time to think things through Frank Jensen, Director, Partner at EDC Poul Erik Bech Aalborg, says: ”This is a deal where half of the transaction has been a very long time in the making. It’s not very often in the property industry that we have cases with a purchase option seven years into the future. You could say that the buyer has had an unusually long time to assess whether they wanted to exercise the purchase option. Fortunately, it has been a good process from start to finish with good chemistry between buyer and seller. So, the plan that was made seven years ago has been realized. We congratulate both parties on the completion of the deal and thank them for a good cooperation.”

More information

Frank Jensen, Director, Partner EDC Poul Erik Bech Nordjylland +45 5858 8449 • frje@edc.dk

17

4 large office projects for rent sets the trend for latest office developments

EDC Poul Erik Bech has 4 large office projects on offer in Copenhagen and Vestegnen with a total office area of 63,844 m2. 4 office trends are common: They are all newly built and state-of-the-art offices, they are all sustainability certified, companies want to be close to the metro and public transport, and more and more multi-user office buildings are being built so that companies can share common areas such as canteens, fitness centres, meeting rooms and reception.

EDC Poul Erik Bech, on behalf of MT Højgaard Property Development, has recently brokered the sale of a shared office space called Forbundshuset at Sluseholmen 1 in Sydhavnen. In 2026, four trade unions will move into a newly built, certified shared office space with a total project value of almost DKK 500 million.

Right next door at Sluseholmen 7, MT Højgaard is building a 15,000 m² multi-user building, where EDC Poul Erik Bech is responsible for the lease. Thor Heltborg, Director of Corporate Clients, says: “The multi-user centre ‘Sluseholmen 7’ is part of the major development of the southern part of Sluseholmen, strategically located right by the future metro station, Sluseholmen. The building is being constructed as a quality-assured, sustainable and DGNB Gold-certified

building, which means that the property meets the highest standards for environmental, economic, and social sustainability. It is possible to rent offices from 951 m² to 2,528 m2 , so whether your company wants a few new office spaces, an entire floor or even more than that, most interior design options are possible.”

“In addition, a unique retail space is offered on the ground floor, located directly next to the future metro station. The property also includes a 398 m2 bicycle parking area with approximately 300 spaces. While the open spaces invite to conversation in the common areas of the office building, the open outdoor areas, including both ground floor and roof terrace level, create an oasis in the middle of the urban landscape with a fantastic view of the city and Copenhagen Harbour. Sluseholmen 7 creates presence, connections, events, friendships and the framework for the working life that many want.”

State-of-the-art, certified shared office space

Thor Heltborg, Director of Corporate Clients, continues: ”In addition to ’Sluseholmen 7’, we have three other large office properties for rent and at least one large office project is on its way, so there is a lot going on in the office market. The vacancy rate is still relatively low, and what’s really moving the market is new, state-of-the-art, certified office space,

18

More information

Thor Heltborg, Director of Corporate Clients

EDC Poul Erik Bech Copenhagen tlf.: +45 5858 8378 • the@edc.dk

EDC office projects

• Sluseholmen 7, 15,093 m2, Copenhagen S, multi-user centre: www.sluseholmen7.dk

• COPEN, 11,343 m2, Amager Boulevard 70, Copenhagen S, office domicile: www.edc.dk/114057707

• KontorVærket, 15,000 m2, Gammel Køge Landevej 59, Copenhagen: www.edc.dk/114057711

• The Central, 23,408 m2, Bornholms Allé 2, 2630 Høje Tåstrup, Denmark: www.thecentralhtc.dk

preferably shared offices. The location of the projects we have on offer is extremely important, as companies want to give their employees great office space close to a metro station or public transport. It’s also a way to retain existing employees and attract new talent, as it’s well known that labour is in short supply in Denmark.”

Office domicile or multi-user centre?

Group customers in EDC can also present 2 NCC office projects, either as a domicile or Company House. Thor Heltborg says: ”The state-of-the-art office domicile ’COPEN’ is 11,343 m² and is being built to the highest standards with a striking wow-effect and a strong sustainable profile, fully designed to accommodate the modern and fluid working life. It is a historic location with high visibility along Amager Boulevard and close to Islands Brygge Metro Station, and the neighbours are Deloitte, KL, SimCorp and HK on one side and Radisson BluScandinavia Hotel on the other. The offices can be customised to suit large or small teams, quiet areas, informal meeting points or flexible meeting rooms across departments. The possibilities are endless in an exciting, beautiful and state-of-the-art building.”

”The 14,000 m² office project ‘Kontorværket’ is also an option. It has everything today’s employees need. The location is ideal with only 5 km to the City Hall Square and only 150 meters to the upcoming Copenhagen S metro station, which will be a new hub for the city. The H-shaped building is being built according to NCC’s Company House concept and provides a modern setting, designed according to the latest knowledge about the good, dynamic workplace. With a canteen, access to a shared parking garage, beautiful terraces, a heated bicycle cellar and full exposure to 30,000 daily motorists and cyclists, it really is a great office for future employees.”

”Last but not least, we have the multi-user building ’The Central’, which is an attractive, sustainability-certified multi-user office building under construction in Høje Taastrup C totaling 23,408 m². The open spaces invite to conversation in the office building’s shared facilities, such as roof terraces, fitness rooms, lounges and café environments. It’s a traffic hub with only a 4-minute walk to the station and easy access to the motorway. With a journey time by train of just 14 minutes to the main train station, ’The Central’ is as close to the city centre as Ørestad is to Kongens Nytorv.”

Trends in the office market

• Demand for new-build, stylish and stateof-the-art offices

• Low vacancy rates in international offices

• Historically high employment supports demand for office space

• Location close to metro, public transport and motorway

• Battle for labour with a focus on attracting and retaining employees

• Increased focus on sustainability certified properties - ”black properties” are difficult to rent/sell

• High interest in multi-user buildings with common areas such as canteen, café areas, fitness, meeting rooms and reception

19

International Poul Erik Bech

JLL and EDC Poul Erik Bech with new Nordic Outlook:

A new Nordic Outlook is out. The report is published by one of the world’s largest real estate companies JLL (Jones Lang LaSalle) in collaboration with EDC Poul Erik Bech, which has contributed figures and analyses of the Danish market. The report is testing the waters of the Nordic property market, this time focusing on how re-industrialisation can help boost demand for investment and industrial properties and create a solid foundation for growth in the Nordic region.

More information

Helle Nielsen Ziersen

Partner, Director, Head of International Relations

+45 5858 8563 • hni@edc.dk

Joseph Alberti

Head of Research

+45 5858 8564 • joal@edc.dk

20

Re-industrialisation boosts an otherwise

Read more:

lagging Nordic property market

www.edc.dk/nordicoutlook JLL Nordic Outlook Focus: Re-industrialisation February 2024 jllsweden.se

International associate

JLL, in collaboration with EDC Poul Erik Bech, has just published the Nordic Outlook report. The report delves into the Nordic property market across countries and property segments.

Helle Nielsen Ziersen, Head of EDC International Poul Erik Bech, says: “2023 was not a good year for the commercial property market, where buyer and seller were far apart. However, in late 2023 and early 2024, interest rates are moving in the right direction. It is expected that interest rates will stabilise during the year and the number of transactions will increase. In terms of yield requirements, Denmark has not been as hard hit as our Nordic neighbours, and therefore my expectation is that it will take longer to change yield requirements in Denmark compared to the other Nordic countries.”

She continues: “The higher interest rates have also meant that the need for equity has been greater than before, which has been a challenge. There is an expectation that the major central banks will lower interest rates as inflation stabilises, which means that the need for equity will decrease in the future. At the same time, the increased risk appetite among institutional investors should provide a robust basis for reactivating the market. Unlike before, we see that the desire to invest is back and there is money in the market, but the risk appetite and new expectations and stricter requirements from lenders in relation to ESG and green financing have caused investors to adjust their investment profile.”

Re-industrialisation can drive positive growth Nordic Outlook focuses on re-industrialisation and how it can help boost the commercial real estate market. Joseph Alberti, Head of Research, EDC Poul Erik Bech, says:

“Electrification, expansion of industrial areas and Nordic companies moving their operations back to Scandinavia are the main factors in the re-industrialisation that is taking place. This can lead to an increasing demand for industrial facilities and buildings for production, warehousing, and logistics. At the same time, re-industrialisation can lead to investments in infrastructure to meet the needs of increasing industrial activity. We have already seen rising and record-high employment in Denmark, which can also lead to an increasing demand for property. Finally, the proximity of companies and the NATO expansion in Sweden and Finland could also potentially increase demand for commercial property.”

Denmark looks different

“Re-industrialisation is increasingly intertwined with sustainable electrification and green energy production initiatives. This process is also expected to have a major impact on the commercial property market, as it has become a key issue for many companies. ESG and sustainability continue to dominate the entire property market, whether it’s Denmark or the large industrial areas in northern Sweden,” says Joseph Alberti and continues:

“However, things look a little different in Denmark if you compare our economy and growth with our Nordic neighbours. In Denmark, the economy is driven by the large pharmaceutical companies, which contribute to positive growth in the country, while in Sweden, for example, it’s more spread out across companies and industries.”

Lowest transaction volume in many years

Transaction volumes in 2023 did not reach anywhere near the levels that have characterised the market for many years. Compared to 2022, transaction volume has more than halved and it’s even further back to 2021, when the transaction volume was at its peak. About the big drop, Joseph Alberti says:

“The year started well, but as interest rates rose during the year, there was also a clear drop in transaction volumes for virtually all segments. This summarises very well how challenging 2023 has been. Historically, it tends to be the last quarter of the year where the highest volume is, but quite unusually it was Q1 that carried the majority of transactions in 2023.”

“Sweden traditionally accounts for the majority of transaction volume in the Nordics. Denmark has seen the lowest transaction volume since 2014, but it’s worth noting that Denmark will account for the second largest volume in the Nordic countries in 2023, and also in 2022.”

Nordic investment volume

21

Locally known school in Haderslev to be sold by public tender and converted into housing

Until 2021, Hertug Hans School in the centre of Haderslev has been home to teachers, educators and students for more than 100 years. For the past few years, the school has been used for community activities, but now the old school is to be converted into housing. Haderslev Municipality has chosen EDC Poul Erik Bech to broker the sale of the locally recognised school, which is being sold by public tender.

Haderslev Municipality has decided to sell Hertug Hans School on Buesgade in the centre of Haderslev. This comes after a few years in which the school has been used for temporary purposes, including community organisations. The local business centre EDC Poul Erik Bech Sønderjylland and EDC Project Poul Erik Bech will work together to secure the sale of the historic school, which will be put up for public tender from 1 June until the bid deadline of 1 October 2024.

Bjørn Borg, partner EDC Poul Erik Bech Sønderjylland, says: “Hertug Hans Skole has always had a unique place in the hearts of the citizens of Haderslev. Since 1906, the beautiful building with its distinctive structure has adorned the quiet residential neighbourhood in Haderslev. The building has been a gathering place for many citizens, teachers, and students for generations. For many of the town’s citizens, the school brings back memories of life’s great events, both for themselves and many even their children.”

He continues: “It’s the right solution to establish new homes on the site so that new memories can be created in the beautiful properties. Parts of the building are worthy of preservation, so in some places the architectural and constructional qualities must be maintained. At the same time, the location in the center of Haderslev is attractive to many with a short distance to the city’s facilities and within walking distance to the pond.”

A unique building opportunity

Before the school can be converted into housing, the properties must be sold by public tender. The sale will take place after 1 October 2024, after which the future buyer will have the opportunity to adapt the building plans. According to Tonny Broberg, Project Manager at EDC Project Poul Erik Bech, the old school in Haderslev is a unique opportunity to establish new housing:

“There are several elements that make this building opportunity unique. Firstly, it is centrally located with a short distance to green areas, city center, and many shopping opportunities. And secondly, the school has many fantastic square meters that can become unique spaces in a possible future housing community. There is everything from a sports hall to a communal dining room in the former school canteen, which can make the conversion of Hertug Hans School ideal for use as a cohousing community.”

“We’ll leave it up to the future buyer to decide what the specific outcome will be about creating awareness of the school and telling developers and investors about the many possibilities if they choose to buy Hertug Hans Skole. Among other things, we will assist with a number of visualizations to show how many opportunities there are to establish some fantastic homes in the historic property in Haderslev.”

22

www.hertughansskole.dk More information Bjørn Borg, Partner, EDC Poul Erik Bech Sønderjylland +45 5858 8425 • bbo@edc.dk Tonny Broberg, Project Manager, EDC Project Poul Erik Bech Vest • Tlf.: +45 5858 8487 • tobr@edc.dk

Are you curious about local developments or looking for specific demographic information, for a particular building project or property investment in Denmark? CityFact gathers relevant market conditions into one analytical product with the use of data at a city specific level.

Access current market figures such as vacancy rates, rental level, rate of return, and data on demographic movements, including population development, age distribution, migration activity, and workforce trends.

Getting a thorough overview of local market conditions has never been more accessible.

23 CityFact You can also download it at www.edc.dk/cityfact

more

Scan the code below and download your local CityFact here

Learn

about the developments in your city

Attractive housing development put out to public tender in Esbjerg Municipality

The museum site at Østergade 42 in the centre of Esbjerg has for many years been a popular parking lot for both residents and visitors to Esbjerg. The 11,831 m² site is now being offered for sale with an estimated building right of 13,500 m². EDC Poul Erik Bech will broker the sale of Bibliotekshaven, as the new project at Museumspladsen has been named. Bibliotekshaven will be put out to public tender with a bid deadline of 26 August 2024.

In 2020, Esbjerg Municipality, in collaboration with DSB Ejendomme, organised a parallel competition that included Museumspladsen in the central part of Esbjerg. The winning proposal was designed by Tegnestuen Vandkunsten and proposes a division of the current parking lot with a new park on one half and an open block building on the other half, as well as a partially buried underground parking lot.

Mayor of Esbjerg Municipality, Jesper Frost Rasmussen, says: “Bibliotekshaven at Museumspladsen holds exciting potential that will have a positive impact on the entire neighbourhood. Quality will be a key element in the solutions that will characterise the project. This applies to everything from the homes to the parking lots, which are used daily by many locals as well as visitors to the city.”

The vision is clear

The new project has been named Bibliotekshaven and, by extension, Biblioteksparken, as the park is right next to Esbjerg Main Library. A structural plan from Tegnestuen Vandkunsten forms the basis for the tender. Mayor, Jesper Frost Rasmussen, says: “The vision for Bibliotekshaven and Biblioteksparken is to create the best possible framework for the city with urban thinking and architectural approaches. In order to ensure variation, the expression of the block building must be composed of building typologies that are familiar in the city.”

“The purpose of the park is to be multifunctional and aimed at all the city’s citizens, with space for recreation, play and activity, contemplation and outdoor dining. It should still be possible to play petanque to the same extent as today, but with better conditions, such as covered areas and better seating. The large old trees in the park will be preserved as far as possible, while the multi-purpose court will be moved to another location in the city.”

Experience with public tenders

The 11,831 m² with 13,500 m² of building rights will be put out to tender and will be brokered by EDC Poul Erik Bech in collaboration between the local business centre, the local dwelling store, and the project department of Denmark’s largest real estate agency. Tonny Broberg, Project Manager at EDC Project Poul Erik Bech, says:

“We are delighted that Esbjerg Municipality has chosen us to handle the sale of Bibliotekshaven. It’s a super exciting project with a wealth of opportunities for housing, business and a beautiful park that will embrace the people of Esbjerg.

More information

Jesper Ølgaard Bloch, Partner, EDC Poul Erik Bech Esbjerg • +45 5858 8398 • jbl@edc.dk

Tonny Broberg, Project Manager, EDC Project Poul Erik Bech Vest • Tlf.: +45 5858 8487 • tobr@edc.dk

It’s a very central location with a high demand for housing. We have put together a sharp team for the task, including our local estate agent in Esbjerg, Morten Riis Nielsen, who, together with me, will assist interested buyers with, among other things, setting sales and rent values for the future homes.”

“We are currently working on a similar tender project for Haderslev Municipality, where the former Hertug Hans Skole in the centre of Haderslev is up for tender. The case has attracted a lot of attention in the press and is actually one of the reasons why Esbjerg Municipality chose us for the job, so we’re looking forward to another tender project that can generate attention and set a good agenda for the development in Esbjerg Municipality.”

Centrally located with high demand for housing

Jesper Ølgaard Bloch, partner at EDC Poul Erik Bech, who, along with Tonny Broberg and Morten Riis, make up the final part of the trio, is delighted with the project. He says:

24

Bibliotekshaven

Rare offering of 62 exclusive terraced houses in Herning

FORSALE

Rarely available investment property in a prime location in Esbjerg – Denmark’s 5th largest city and undisputed energy hub, currently the focus of significant investment in the green transition.

Off-market, 6700 Esbjerg

Price: 70,000,000 DKK

Contact: Jesper Ølgaard Bloch, Partner

EDC Poul Erik Bech +45 5858 8398

Fully let portfolio of 62 exclusive terraced houses, built with the best, low-maintenance quality materials, with large windows and great acoustics. The houses are functionally designed on one level and are suitable for different target groups. Surrounded by lovely, landscaped courtyards/gardens with ample parking and child-friendly activity areas. Energy Efficient Construction – Energy Label A.

Lergravsvej/Sydgaden, Snejbjerg, 7400 Herning Case number: www.edc.dk/709006976

Area: 7,023 m² Yield: 4.68%

Price: 131,500,000 DKK

Contact: Poul Lundorff, Commercial Advisor EDC Poul Erik Bech, +45 5858 8567

This is a unique opportunity to acquire one of the former industrial buildings of a well-known company in Frederikssund. The 9 buildings have a total commercial area of 28,002 m². With high ceiling logistics, warehouse and production space, the property has many potential uses including medical, laboratory or research facilities. The outdoor areas are surfaced with concrete tiles, asphalt, and green/lawn areas, and are fenced with a wire fence with gate/lock.

CO-RO’s Vej 1, 3600 Frederikssund Case number: www.edc.dk/342345631

Site area: 64,340 m² Floor area: 28,002 m²

Price: 125,000,000 DKK

Contact: Stephen Berthelsen, Partner EDC Poul Erik Bech, +45 5858 8377

25 FOR SALE

FORSALE

Large investment property in the heart of Esbjerg

Prominent logistics, warehouse, and production property in Frederikssund FORSALE

• 59 occupational lease units and 22 parking spaces in an associated parking garage.

• Shopping facilities, park, bus, and train connections virtually on the doorstep.

• Acquisition in corporate form including significant deferred tax of approximately 5.5 million DKK.

• Striking architecture, including a 10-story building with stunning views over the city.

• Acquired fully leased – annual rental income of approximately 7.5 million DKK.

Bispetorv ”Central Park Living”, 9800 Hjørring Case number: www.edc.dk/914004264

Floor area: 7,221 m² Yield: 5.00% Price: 132,500,000 DKK

Contact: Michael Stilling, Partner, EDC Poul Erik Bech, +45 5858 8449

FORSALE

• Attractive investment opportunity with low vacancy rates

• Well-maintained and modern architecture

• Large paved outdoor area with numerous parking spaces

• Prominent location in an attractive commercial area

• Easy access with proximity to the Fynske Motorvej (motorway)

Rolundvej 11-21, 5260 Odense S Case number: www.edc.dk/512031244

Floor area: 9,427 m² Yield: 7.62%

Price: 78,000,000 DKK

Contact: Mikkel Ørbech, Partner EDC Poul Erik Bech, +45 5858 8397

• Highly robust retail area

• Excellent location close to IKEA

• Long-term tenant with strong concept (ILVA, part of Jysk)

• Depreciable

• Building permit for 349 m²

Stenbukken 22D, 9200 Aalborg SV Case number: www.edc.dk/91201064

Floor area: 6,732 m² Yield: 7.18%

Price: 92,500,000 DKK

Contact: Frank Jensen, Director, partner, EDC Poul Erik Bech +45 5858 8449

26

FOR SALE

be sold

sale

Distinctive housing project in Hjørring, consisting of 3 stages, to

as an entity

FORSALE

Investment property with low vacancy in Odense S

Prominent and well-located investment property in Aalborg SV FORSALE

FORSALE

Investment property consisting of 2 residential units and 12 commercial units, used for both office and retail purposes. The shops are located at the bottom of the property and through the passage.

In addition, there are offices on the other floors and two apartments on the top floor. The property has good development potential.

Skomagergade 15-17, 4000 Roskilde

Case number: www.edc.dk/403600408

Floor area: 5,145 m² Yield: 5.63%

Price: 69,750,000 DKK

Contact: John Borrisholt, Director, partner EDC Poul Erik Bech, +45 5858 8395

FOR SALE

SOLD

Record sale of Nyhavn 57: highest price per square metre ever for commercial property in Nyhavn

It’s hardly surprising that the price per square meter is high in Nyhavn, one of Denmark’s most famous, iconic, and well visited addresses. However, the record has been broken with a price of approximately 67,000 DKK per square metre for the front building at Nyhavn 57 on the sunny side of Nyhavn, even though the property needs to be refurbished before it can be re-rented. EDC Erhverv Poul Erik Bech Copenhagen has just facilitated the sale of the entire front building with 5 condominiums for 26 million DKK, with the added possibility of outdoor seating.

The entire property is a listed building, partly because of its architectural and cultural significance, its courtyard orientation, and because the buildings are an important part of the story of the many warehouses and small industries that were characteristic of Nyhavn’s development. In short, Nyhavn 57 is a historical gem that the buyer will invest in developing before renting it out or using it for his own purposes.

27

FOR SALE Contact: Helge Rud Larsen, Commercial Real Estate Agent, Valuer MDE EDC Poul Erik Bech, +45 5858 8378

investment property centrally located on Roskilde’s pedestrian street

Attractive

SOLD

As a property owner, you may have considered whether now is the right time to sell. Are you thinking about selling but are concerned about the uncertain market? We have the solution!

Now, you can freely track the interest in your property. No sales, no contracts, and no obligations.

With “Send-my-buyer” you’ll be notified whenever we have potential buyers in our database that match your property. Of course, you remain anonymous to any potential buyer and can decide on your own if you want to make contact. Simple as that.

You can also sign up at www.sendminkøber.com

commercial property?

Are you considering selling your

International Poul Erik Bech MARKETUpdate Q Residential rental Office Retail Industrial Market rent GDP growt Employment Rates Consumer confidence Availability Yield 2024 1

Executive summary – Q1

The Danish economy has performed better than expected with significant growth in the fourth quarter of 2023. There is one explanation for this, namely Novo Nordisk’s great success. Inflation has fallen sharply in Denmark, and core inflation is at its lowest level since 2022. Employment is historically high with over 3 million employees and still rising. Consumer confidence is still negative, as it has been since the end of 2021, although it is improving. It is expected that economic growth will gradually return during 2024 and 2025, partly aided by interest rate cuts and increasing private consumption.

All these factors contribute to supporting activity among businesses, and the activity in the market for renting shops, offices, and industrial and logistics properties is declining, albeit from a high level of activity. This has resulted in a slight increase in vacancy rates for all three types of properties. However, for all property types, the vacancy rates are historically low. Due to the relatively low expectations for the economy in the first half of 2024, it is expected that vacancy rates will continue to increase slightly in the coming quarters.

The market for investment properties is significantly lower than last year, mainly due to the high interest rates we have experienced. The total transaction volume for January and February 2024 is estimated at 1.7 billion DKK and 3.9 billion DKK, respectively, representing a total increase in the period of 4% compared to 2023. However, there are signs that an interest rate stabilization is underway, as central banks have announced that the peak has been reached. Yield requirements are mostly evolving sideways now, and in many places, the forecasts for the levels a year from now indicate that yield requirements will be roughly unchanged from today’s levels.

Erhvervsmæglernes Branchedata

EDC Poul Erik Bech has teamed up with 6 other leading commercial real estate agents for a new collaboration aimed at coordinating and standardizing transaction data for commercial and investment properties in Denmark. The purpose of the collaboration is to create transparency in the commercial real estate industry. The collaboration was launched and came into effect on January 18, 2024, so only the figures from 2024 are covered by the collaboration.

Would you like to receive the Market Update directly in your mailbox, sign up here: edc.dk/erhverv/marketupdate ›

The Danish economy

Annual GDP growth

After two years of strong growth in GDP of 4.9% and 3.8% in 2021 and 2022, respectively, there are prospects for a growth slowdown in 2023. The preliminary calculation of GDP growth for 2023 is 1.8%. The lower GDP growth can be linked to a reduced private consumption due to rising interest rates and a reduced purchasing power from a historical high inflation. The latest forecast from Danmarks Nationalbank shows an expected growth of 1.3% in both 2024 and 2025. The forecast for GDP this year is higher than the last forecast indicating that the risk of a mild recession has been averted. This can be linked to a high foreign demand, which is most likely associated with the noticeable production increase in the pharmaceutical industry. The forecast for GDP next year is 0.1 percentage points higher than the last forecast.

Source: Statistics Denmark & Nationalbanken

In 2023 and in the beginning of 2024, the development in interest rates has been more stagnant compared to 2022, where interest rates increased significantly. This is due to a more moderate and falling development in inflation, which has been particularly driven by a decrease in energy costs. The short-term mortgage rate, which is closely correlated the monetary policy actions of the Federal Reserve (FED) and the European Central Bank (ECB), has undergone a more subdued development and was at 3.3% in January 2024. The long-term mortgage rates have been more volatile and have fallen since October 2023. In January 2024, the average long-term mortgage rate was at 4.6%.

Source: Finance Denmark & Statistics Denmark

Consumer confidence indicates the population’s view of its current and future economic situation and is thus a good indicator of how the general population is affected by Denmark’s economic situation. The consumer confidence indicator in February 2024 is at minus 7.4 and has thus risen slightly since January, where it was at minus 8.4. All five indicators that together make up consumer confidence indicator have risen since last month. Despite consumer confidence remaining negative, it is the highest consumer confidence indicator seen since February 2022, where it was minus 3.2. The average for 2022 was minus 22.2 and for 2023 was minus 15.6, making the current level of consumer confidence a significant improvement.

Source: Statistics Denmark

The latest figures from Statistics Denmark from December 2023 show an increase of 1,300 employees to a total of 3,005,900 persons. Since December 2022, employment has increased in 11 out of 12 months, and in December 2023 there were 31,100 more wage earners compared to 12 months earlier. This corresponds to 1.0% growth in employees. In the knowledge services industry, which includes legal assistance, auditing, architectural and engineering, and advertising, the number of employees has increased by 5,300 since December 2022, corresponding to an increase of 3.0%.

Source: Statistics Denmark

31

Interest rates

Consumer confidence indicator

-40 20 10 0 -10 -30 -20 2004 2006 2008 2010 2014 2012 2016 2018 2020 2002 2022 2005 2007 2009 2011 2015 2013 2017 2019 2021 2003 2023 2001 2000 2024 -1% 2% 6% 1% 4% 0% 2012 2014 2015 2016 2018 2017 2019 2020 2021 2022 3% 5% 2023 2013 2024 Short-term mortgage rateLong-term mortgage rate -4% 0% 8% 2013 2014 2015 2016 2017 2018 2020 2019 2021 2022 -2% 2024 2023 2025 6% 2% 4% Real growth in BNP compared to previous year (%) Expected real growth in BNP compared to previous year (%) 1.6% 0.9% 2.3% 3.2% 2.8% 2.0% 1.5% -2.4% 6.8% 2.7% 1.8% 1.3%1.3%

Employees

2.5 2.6 3.1 2.7 Mio 2.9 2.8 3.0 2023 2014 2015 2016 2018 2017 2019 2020 2021 2022 2012 2013

Yield

Residential rental

newer properties

Lolland, Falster and Møn

market rent in

Esbjerg

Sønderborg

Other South Jutland

market rent in DKK/sq m

in %

market rent in DKK/sq m

market rent in DKK/sq m

DKK 800 DKK 675 DKK

DKK 1,600

32 Area* (see specifications page 14) Prime Secondary TertiaryTrend Capital of Denmark Central Copenhagen Yield in % 4.00%4.25%4.50% Annual market rent in DKK/sq m 2,550 DKK 2,200 DKK 2,000 DKK Østerbro, Frederiksberg and Gentofte Yield in % 4.00%4.25%4.50% Annual market rent in DKK/sq m 2,450 DKK 2,100 DKK 1,950 DKK Harbour areas Yield in % 4.00%4.25%4.50% Annual market rent in DKK/sq m 2,400 DKK 2,000 DKK 1,800 DKK Ørestad Yield in % 4.25%4.50%5.00% Annual market rent in DKK/sq m 1,900 DKK 1,800 DKK 1,700 DKK Remaining Copenhagen Yield in % 4.25%4.50%5.00% Annual market rent in DKK/sq m 2,300 DKK 2,000 DKK 1,800 DKK Remaining Zealand Western suburbs Yield in % 4.50%5.00%5.25% Annual market rent in DKK/sq m 1,750 DKK 1,600 DKK 1,500 DKK Northern suburbs Yield in % 4.50%5.00%5.50% Annual market rent in DKK/sq m 1,950 DKK 1,700 DKK 1,450 DKK North Zealand Yield in % 4.50%5.00%6.00% Annual market rent in DKK/sq m 1,950 DKK 1,700 DKK 1,450 DKK East Zealand Yield in % 4.75%5.00%6.50% Annual market rent in DKK/sq m 1,900 DKK 1,600 DKK 1.300 DKK West Zealand Yield in % 5.50%6.75%8.00% Annual market rent in DKK/sq m 1,500 DKK 1,300 DKK 1,000 DKK

Zealand Yield in % 5.25%6.25%7.50% Annual market rent in DKK/sq m 1,350 DKK 1,100 DKK 950 DKK

Yield in % 5.75%6.75%8.00% Annual market rent in DKK/sq m 1,200 DKK950 DKK 800 DKK Southern Denmark

Yield in % 4.75%5.00%5.50% Annual market rent in

1,450

1,275

Yield in % 5.25%5.75%6.50% Annual market rent in DKK/sq m 1,250 DKK1,100 DKK 950 DKK Vejle Yield in % 5.00%5.50%6.25% Annual

1,400

Yield

% 5.50%6.00%7.00% Annual

DKK/sq m 1,350 DKK 1,150 DKK 950 DKK Fredericia Yield in % 5.50%6.00%7.00% Annual

1,300

1,100

South

Odense

DKK/sq m

DKK

DKK 1,100 DKK

Other Funen

market rent in DKK/sq m

DKK 1,200 DKK 1,000 DKK

Kolding

in

market rent in DKK/sq m

DKK

DKK875 DKK

Yield

% 5.50%6.25%7.50% Annual

in

market rent in DKK/sq m 1,250 DKK900 DKK 750 DKK

Yield

Annual

in % 6.00%7.00%8.00%

1,150 DKK900 DKK 750 DKK

Yield

Central Jutland Aarhus Yield

% 4.25%4.75%5.25%

DKK 1,350 DKK Silkeborg Yield in % 4.75%5.75%7.25% Annual market rent in DKK/sq m 1,400 DKK 1,050

DKK Viborg Yield in % 5.25%6.25%7.25% Annual market rent in DKK/sq m 1,125 DKK 1,000 DKK 850 DKK Herning Yield in % 5.25%5.75%7.00% Annual market rent in DKK/sq m 1,200 DKK 1,050 DKK 900 DKK

Yield in % 5.50%6.50%8.00% Annual market rent in DKK/sq m 1,200 DKK850

750

Northern Jutland Aalborg Yield in % 4.50%5.00%5.75% Annual market rent in DKK/sq m 1,400 DKK 1,150 DKK 950 DKK Hjørring Yield in % 5.25%6.50%7.25% Annual market rent in DKK/sq m 1,150

775 DKK Frederikshavn Yield in % 6.00%7.00%7.50% Annual market rent

1,050

850

650

Source: EDC International Poul Erik Bech, estimates as of Q1 2024

6.00%7.00%8.00% Annual

1,100

in

Annual

1,850

DKK950

West Jutland

DKK

DKK

DKK950 DKK

in DKK/sq m

DKK

DKK

DKK

in %, annual market rent in DKK/sq m incl. operating expenses and trends for the next 12 months

Residential rental

fully developed properties

Østerbro, Frederiksberg and Gentofte

Odense

Sønderborg

Other South Jutland

DKK 1,200 DKK

in

Annual rent in DKK/sq m 1,350 DKK 900 DKK 650 DKK

33 Source: EDC International Poul Erik Bech, estimates as of Q1 2024 Area* (see specifications page 14) Prime Secondary TertiaryTrend Capital of Denmark Central Copenhagen Yield in % 4.00%4.25%4.50% Annual rent in DKK/sq m 1,800 DKK 1,650 DKK 1,500 DKK

Yield in % 4.00%4.50%4.75% Annual rent in DKK/sq m 1,750 DKK 1,650 DKK 1,550 DKK Remaining Copenhagen Yield in % 4.25%4.50%5.00% Annual rent in DKK/sq m 1,700 DKK 1,600 DKK 1,500 DKK Remaining Zealand Western suburbs Yield in % 4.75%5.25%6.00% Annual rent in DKK/sq m 1,600 DKK 1,525 DKK 1,225 DKK Northern suburbs Yield in % 4.50%5.00%5.75% Annual rent in DKK/sq m 1,500 DKK 1,350 DKK 1,225 DKK North Zealand Yield in % 4.50%4.75%5.75% Annual rent in DKK/sq m 1,550 DKK 1,400 DKK 1,300 DKK

Yield in % 4.50%5.25%7.00% Annual rent in DKK/sq m 1,600 DKK 1,300 DKK 1,000 DKK West Zealand Yield in % 5.25%6.50%7.50% Annual rent in DKK/sq m 1,150 DKK 900 DKK 750 DKK

Zealand Yield in % 5.25%6.25%7.75% Annual rent in DKK/sq m 1,200 DKK 900 DKK 700 DKK

Yield in % 6.00%7.50%8.50% Annual rent in DKK/sq m 1,000 DKK 825 DKK 725 DKK Southern Denmark

East Zealand

South

Lolland, Falster and Møn

Yield in % 5.00%5.25%5.75% Annual rent in DKK/sq m 900 DKK 875 DKK 800 DKK Other Funen Yield in % 5.75%6.25%7.50% Annual rent in DKK/sq m 825 DKK 725 DKK 600 DKK

Yield in % 5.25%6.00%6.50% Annual rent in

m 1,125

800

Yield in % 5.75%6.25%7.00% Annual rent in DKK/sq m 1,175 DKK 1.000 DKK 850 DKK Fredericia Yield in % 5.75%6.25%7.25% Annual rent in DKK/sq

1,175

Yield in % 5.50%6.50%7.50% Annual

1,050

Vejle

DKK/sq

DKK 975 DKK

DKK

Kolding

m

DKK 975 DKK 800 DKK

Esbjerg

rent in DKK/sq m

DKK 725 DKK 550 DKK

Yield in % 5.75%6.75%7.75% Annual

1,000

rent in DKK/sq m

DKK 950 DKK750 DKK

Yield in % 6.00%7.25%8.25% Annual

950

750

625

Central Jutland Aarhus Yield in % 4.00%4.50%5.00% Annual

Yield

Viborg Yield in % 5.75%7.00%8.25% Annual rent in DKK/sq m 1,100 DKK 850 DKK 650 DKK Herning Yield in % 5.50%6.25%7.25% Annual rent in DKK/sq m 1,150 DKK 925 DKK 750 DKK West Jutland Yield in % 6.00%7.25%9.00% Annual rent in DKK/sq m 1,100 DKK 750 DKK 650 DKK Northern Jutland Aalborg Yield in % 4.50%5.25%6.25% Annual rent in DKK/sq m 1,200 DKK 1,050

850

Yield in % 5.75%6.50%7.75% Annual rent in

m 900 DKK 800 DKK 700 DKK Frederikshavn Yield in % 6.50%7.25%8.00% Annual

850

750

625

rent in DKK/sq m

DKK

DKK

DKK

rent in DKK/sq m 1,575 DKK 1,350

Silkeborg

% 4.75%5.75%7.25%

DKK

DKK

Hjørring

DKK/sq

rent in DKK/sq m

DKK

DKK

DKK

Yield in %, annual rent in DKK/sq m incl. operating expenses and trends for the next 12 months

Residential rental cost determined rental properties