TILE TODAY 98

FULLY ENDORSED BY THE AUSTRALIAN TILE COUNCIL

PREMIER COAST TILES IS A RETAIL SUCCESS STORY WATERPROOFING FEATURE

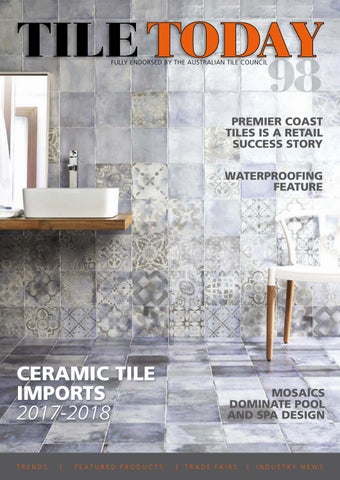

CERAMIC TILE IMPORTS 2017-2018 TRENDS

|

F E AT U R E D P R O D U C T S

MOSAICS DOMINATE POOL AND SPA DESIGN

|

TRADE FAIRS

|

INDUSTRY NEWS