CARBON IN MINING:

TYSON DYCK Partner, Torys

TYSON DYCK Partner, Torys

In this interview, Tyson Dyck, Partner, Torys, discusses the nuances of carbon credits and their use to meet emissions reduction targets. He observes that record high carbon prices are driving companies, particularly in the mining sector, to consider investing long-term capital to reduce their reliance on carbon-intensive fuel or electricity.

A partner at Torys’ Environmental Group, Tyson leads the firm’s Climate Change practice. He has guided North America’s most high-profile energy projects, including more than 50 wind, solar, gas, hydro, and energy storage projects. In the mining and metals sector, he acts for companies acquiring, financing, developing, and operating major uranium, potash, coal, and precious metals operations across the country.

ENERGY AND MINES: How do you see the heightened focus on climate strategy changing the mining business?

TYSON DYCK: The past few years have seen a renewed focus – including from institutional investors and environmental advocacy groups – on the development and implementation of emissions reduction targets that align with a scientificallycredible pathway to limiting global temperature increases to below 1.5 degrees Celsius. The mining sector is well positioned to engage with these issues, having been a leader in the development of corporate climate change strategies. The sector has years of experience in quantifying and reporting on greenhouse gas emissions under regulatory programs. It also has extensive experience in mitigating emissions from energy and fuel use. And many companies are producing battery metals that will help facilitate electrification and the energy transition. Recent advancements in low carbon fuels like hydrogen and ammonia, and cost reductions in renewable energy systems, will likely offer new possibilities for existing

operations to reduce their emissions cost-effectively. Meanwhile, climate change issues will increasingly be front and center for new mining investments seeking to obtain project permits and social licenses.

E+M: What are the biggest challenges of building a roadmap for low or net-zero mining?

TD: Some of the biggest challenges are not unique to the mining sector. For example, a credible low carbon or net-zero strategy requires strong governance structures to be put in place, where climate change considerations can be brought to the attention of company management and board of directors and integrated into their strategic decision-making. Target setting also places an emphasis on the collection of robust data, which can prove challenging especially for Scope 3 emissions, where the data may not be available or reliable. Finally, implementing a climate change strategy requires ongoing multi-stakeholder consultation – with shareholders, regulators, environmental advocacy groups, local communities, and many others – to build confidence in a company’s plan and progress towards its goals.

E+M: What are some of the legal considerations for miners as they begin to set out their roadmap to reach net-zero goals?

TD: The regulatory landscape is changing quickly, especially in respect of Border Carbon Adjustment (BCA) and climate change disclosure. In July 2021, the European Commission published its proposal for a Carbon Border Adjustment Mechanism; when implemented, it will be the world’s largest BCA and apply to steel, iron, fertilizer, cement, aluminum, and other goods. The mining sector will need to stay attuned to how these BCAs may affect the import of products into major

markets where mining operations occurred in jurisdictions without a carbon price. For publicly traded companies, there has also been a recent wave of proposals (including from the U.S. Securities and Exchange Commission and Canadian Securities Administrators) to require mandatory climate change disclosure under securities regulations. These regulatory standards seek to enhance uniformity and, in some cases, require more detailed reporting on climate change governance, strategy, emissions, and other metrics.

E+M: What role do you see for carbon offsets as part of mine decarbonization and what should mines be aware of when considering offsets?

TD: The carbon markets are growing quickly in response to corporate net-zero commitments. According to the World Bank, these commitments drove the total value of the voluntary carbon market to over USD 1 billion in November 2021, and the market has grown since then. Carbon credits are therefore expected to help many companies achieve their emissions reduction targets. That said, despite the improvements to offset methodologies in recent years, concerns persist about the environmental integrity of certain credits – whether they represent real, additional, verifiable, and permanent emissions reductions. Certain organizations and frameworks, like the Oxford Offsetting Principles, recommend that companies prioritize internal emissions reductions before using offsets to meet their targets. Similarly, the Net Zero Banking Alliance recommends that members use certain types of offsets, namely carbon removal (rather than avoidance) credits, to balance residual emissions where there are limited technologically or financially viable alternatives. Over time, the commitments of institutional investors to these principles may impact how they address

Scope 3 financed emissions, and therefore their lending activities in the mining sector.

E+M: What impact do you see carbon pricing having on mining companies’ decarbonization strategies - i.e. is this a real driver yet and, if not, how do you see this changing?

TD: Carbon prices vary significantly by jurisdiction, but in some locations are starting to have a major impact on decarbonization strategies. Record high carbon prices were seen last year in several compliance markets, including the European Union Emissions Trading System (ETS), the Western Climate Initiative, and the New Zealand ETS. Several jurisdictions have also announced ambitious carbon price trajectories over the short- to medium-term. For example, the government of South Africa announced a proposal to increase the carbon tax rate from the current level of under USD 10/ tCO2e to USD 30/tCO2e by 2030 and USD 120/tCO2e by 2050. Canada has proposed a backstop carbon price increase to at least CAD 170 t/CO2e by 2030. Mining companies are considering how these price increases will impact not only their direct emissions but also their energy costs. Many are therefore looking to deploy long-term capital in ways that enable them to reduce their reliance on carbon-intensive fuel or electricity or to invest in battery metals projects that can help facilitate greater electrification.

Tyson Dyck is chairing at the Energy and Mines Toronto Summit, Nov 1, 9:00 AM on the investor panel Evaluating Mining’s ESG and Climate Performance.

“In technology, very impressive strides have been made in recent years in software development.... power systems at mines are becoming more complex with multiple sources of energy, including intermittent wind and solar...the key to coordinating and reliably dispatching energy at these microgrids is complex software.”

JON RODRIGUEZ Energy Business Director - Engine Power Plants Wärtsilä North America

JON RODRIGUEZ Energy Business Director - Engine Power Plants Wärtsilä North America

this interview, Jon Rodriguez, Energy Business Director - Engine Power Plants, Wärtsilä North America, discusses how decarbonization can be a daunting prospect for miners, yet careful planning and execution can help customers reduce CO2 emissions, integrate renewables and future-proof assets while simultaneously ensuring minimal disruption in operations.

ENERGY AND MINES: How is the conversation changing with mining clients now that ESG and decarbonization are top strategic concerns with concrete timelines?

JON RODRIGUEZ: Miners have been grappling with environmental and sustainability concerns for some time now. However, ESG has brought together all of these issues in a comprehensive framework that can help a mining company navigate and measure its impact on the planet, people, and profitability. The conversation now is therefore more targeted and structured with an emphasis on clear actions within defined timeframes. Clearly, investors, lenders, and governments are more focused than ever before on the ESG performance of mining companies.

E+M: In particular, how is the approach to and value proposition of renewable energy and storage for mining changing in light of corporate net zero and 2030 climate goals?

JR: Mining companies now have to carefully review their existing carbon footprint and formulate concrete plans to lower CO2 and other emissions. Of course, renewable energy and storage are only a part of the solution, as are more efficient power generation and cleaner fuels. We observe that no two customers have the same situation, and the solutions will, therefore, differ from project to project, and country to country. Wärtsilä’s approach is to help clients understand their current situation and jointly develop reliable solutions for decarbonization.

E+M: Can you share some of the projects Wärtsilä is currently working on with mining clients directly related to their goals for decarbonizing energy for their mines?

JR: Wärtsilä is working on several projects around the world that are helping mines to decarbonize. In many of these, mines are switching from liquid fuel to cleaner gaseous fuels (eg. LNG) resulting in dramatic environmental benefits. We also have on hand several hybrid projects that include engines, renewables, and storage, working in concert to lower CO2 and other emissions. For example, at the Fekola mine owned by B2Gold in Africa, Wärtsilä has installed 17 MW of energy storage and a state-of-the-art Energy Management System (GEMS) to optimize the microgrid in conjunction with the mine’s existing thermal plant and 30 MW solar power unit.

These scenarios, where a site has multiple sources of energy, are becoming more commonplace.

E+M: What has changed on the technology side to meet mining customers’ demands for affordable, reliable, and zeroemissions power?

JR: In technology, very impressive strides have been made in recent years in software development. As described above, power systems at mines are becoming more complex with multiple sources of energy, including intermittent wind and solar. As the key to coordinating and reliably dispatching energy at these microgrids is complex software, Wärtsilä has focussed on developing and installing the GEMS platform which can perform this function very effectively.

E+M: How are energy goals for mining being integrated with decarbonization planning for heavy trucks and mobile equipment?

JR: Though Wärtsilä is not directly involved in this area, we foresee that electrification of mobile equipment in mining applications could increase the aggregate demand on the mine’s electrical supply system. It would also alter the load dynamics that the system serves. Amidst increasing integration of renewables, and growing ambitions to achieve decarbonization goals, electrification of the haul fleet could have a significant impact in the near future on the planning, design, and operation of the power supply systems at mines.

E+M: What are some of the main challenges mines encounter when trying to maximize carbon savings with renewable energy and storage?

JR: Reliability is always the biggest challenge when adding intermittent energy sources into the mix. There is also pushback from operators at the site who need to understand and make the new system work. This is why the Wärtsilä approach is to carefully study the mine’s current situation and then comprehensively model and analyze proposed additions. The company determines the most practical solution after a careful evaluation to arrive at the right mix of generation (such as thermal, renewable, storage, etc.) to ensure adequate reliability and redundancy yet still achieve the required reduction in emissions.

E+M: What do you see as the next steps in innovation and integration of low-carbon technologies for mining?

JR: Developing a decarbonization strategy can be daunting for mining companies. Wärtsilä’s approach is to help customers understand their current situation and plan a way forward with advanced modeling and dynamic simulations. Every

case is different, and the mix of technologies will vary from project to project. Using our technological know-how and experience we help to develop and execute a decarbonization roadmap. This allows our customers to reduce CO2 emissions, integrate renewables, and future-proof their assets while simultaneously ensuring minimal disruption in the mine’s operations.

Wärtsilä observes that data integration, and leverage of that data, is another fast-growing trend alongside advanced modeling of the power systems at mines. Actionable data would enhance the mine’s decision-making relating to asset utilization and also enable predictive maintenance.

Future fuels, which are typically carbon-free and ideally derived almost completely from renewable energy sources, are another area that is seeing growing interest. Wärtsilä is already developing solutions for some of these fuels, including hydrogen, ammonia, methanol, and synthetic methane so that customers can adapt to the needs of the future competitively and efficiently.

Jon Rodriquez is speaking at the Energy and Mines Toronto Summit, Nov 1, 2:40 PM on The Technologies Supporting Mining’s Energy Transition

Inthis interview, Jonas Ranggård, Manager, Boliden Mines Climate & Energy Program, Boliden Mineral, discusses the climate imperatives for miners, particularly those operating open pit mines and their associated hauling equipment. At the forthcoming Toronto summit, he looks forward to interacting with peers from Canada, “one of the few countries with mining conditions and challenges similar to what we face in northern Sweden.”

ENERGY AND MINES: What are some of the most significant changes for the mining industry as a result of the increased focus on ESG and climate performance?

JONAS RANGGÅRD: Over the past decade, mining companies have mostly focused on conducting feasibility studies and trials of technologies that limit their climate impact. The time has come for them to demonstrate real, measurable savings in emissions, arising from a strong emphasis on a much broader implementation of green technology.

E+M: What are some of the challenges of trying to balance climate and ESG commitments with mine production, expansion, and commercial realities?

JR: The key is to challenge the old ways of thinking. However, electrification will have a drastic impact on mine planning and production control.

E+M: Which technologies are expected to be critical in meeting Scope 1 and Scope 2 carbon emissions goals for mining?

JR: Definitely, the electrification of open pit haul trucks. Though fossil-free electricity generation is important, it is a challenge shared with pretty much all other industries. If we don’t solve open pit hauling, no one will.

E+M: Who are you looking forward to connecting with at the Energy and Mines Toronto Summit on November 1-2 at the Delta Toronto?

JR: Mining peers from Canada, which is one of the few countries with mining conditions and challenges similar to what we face in northern Sweden.

JONAS RANGGÅRDManager, Boliden Mines Climate & Energy Program

Boliden Mineral

Jonas Ranggård is speaking at the Energy and Mines Toronto Summit, Nov 1, 10:10 AM on Mining Decarbonization, Opportunities, and Hurdles

PHOTO CREDIT - Aitik, electric trolley

Photo: Mats Hillblom© Free to use 2018

STEPHANIE MOROZ Head of Technology and Innovation EDL

STEPHANIE MOROZ Head of Technology and Innovation EDL

ENERGY AND MINES: How is the overall drive to decarbonize shifting the thinking and approach to mining hybrids?

STEPHANIE MOROZ: Globally, there is momentum to decarbonize all industries, including the mining sector. Many mining companies have committed to net zero carbon emissions by 2050, with specific carbon reduction targets much sooner. However, mines are often located in remote areas and rely on diesel or natural gas-fueled power stations—typically the site’s largest source of carbon emissions.

Miners are looking to reduce these emissions with hybrid power stations involving solar, wind and battery storage to provide high renewable energy (RE) penetration electricity—the first step in decarbonizing mining. In the last decade, wind, solar and battery costs have decreased while fossil fuel prices have increased, making hybrids viable. Only a few years ago, miners were reluctant to risk incorporating renewables, but now they expect at least 50% RE and are asking us how we can go even higher.

E+M: EDL has had lots of experience leading high-penetration renewable energy hybrids for mining companies in Australia, can you tell us about some of these showcase projects?

SM: The Agnew Hybrid Renewable Microgrid, now in operation for more than two years, provides the Gold Fields mine with 50-60% RE while maintaining power quality and reliability. It’s the largest of its kind in Australia with 18MW wind, 4MW solar and a 13MW battery—the first to utilize wind generation on a large scale at an Australian mine site.

As mining companies decarbonize their operations, multiple technologies are key to achieving this goal. Stephanie Moroz, Head of Technology and Innovation at EDL, talks about the current developments helping the mining sector work towards net zero.

At Jabiru in the Northern Territory, the hybrid power station (solar, battery and diesel backup) provides the township with at least 50% RE and 100% solar energy throughout the day— helping it transition from its mining legacy to a tourism and services hub. The significant milestone achieved with this project is reliably supplying the town demand from 100% renewables when available and turning the diesel generation off. But watch this space–we’re currently working on the next step change to even higher RE.

E+M: What are some of the key takeaways from these mining hybrid solutions to date?

SM: We have gained many important learnings from developing and operating technically complex hybrid renewable microgrids for off-grid mines in diverse locations. It’s a constant learning and development process. Based on our experience, the biggest lesson is that while hybrid solutions may appear simple on the surface, in reality, they are technically complex and challenging to design and deliver. Wind, solar, battery and thermal generation all have very different characteristics. Ensuring that the microgrid maintains power quality at all times requires advanced capabilities in managing these interfaces.

E+M: What opportunities do you see for high-penetration renewable energy hybrids for North American mines?

SM: We have found that hybrids deliver outstanding performance—matching or often exceeding main grid reliability. Like in Australia, there are many mines in North America located in isolated areas with harsh climates relying on diesel fuel for power. Many areas in Canada have excellent wind resources, and regions with a dry climate have long days of reliable solar irradiance during the summer months. EDL’s experience with complex logistics delivering equipment over long distances with weather-dependent access to site is highly relevant to the Canadian context.

E+M: What are the remaining challenges for miners as they look to increase the amount of renewable energy and storage as part of remote power systems?

SM: Depending on the solar and wind resources and the fuel price, there is an economic optimum of anywhere between 40% and 90% RE. Beyond that level, any additional renewable generation and storage experiences lower utilization—translating to a higher cost per unit of power delivered. The challenge in the design phase is finding the right combination of components to deliver the highest % RE most economically. This requires accurate data for the solar and wind resources, combined with a detailed understanding of the load profile and the electrical system.

It also involves familiarity with equipment from different suppliers to determine how best to bring them together and how to control them. Much of that is based on past experience. With each project, EDL incorporates the learnings from previous projects to achieve performance targets more costeffectively.

E+M: Which key technologies are best supporting the transition to less fossil fuels for off-grid mines?

SM: There isn’t one single answer. We will need to take multiple approaches in parallel to achieve our decarbonization goals. Once the optimum % RE is achieved in the power system with renewables and batteries, further decarbonization is more cost-effective through increasing electricity use, for example, electrifying vehicles and other fossil-fueled processes. The challenge for miners is to source reliable electric options that can replace diesel-powered vehicles and equipment. Fuels such as renewable natural gas (RNG) or renewable diesel can decarbonize the remaining processes that are difficult to electrify.

Our experience producing renewable natural gas (RNG) from waste at our North American landfill gas sites demonstrates that we can provide biogas or biofuels to power mobile equipment such as trucks and buses. Renewable hydrogen produced by electrolysing water with renewable electricity may provide another solution in the future—delivered as either hydrogen or processed into a renewable hydrocarbon fuel.

E+M: For mines with shorter lives, what are some of the options for building flexibility and affordability into a hybrid power solution?

SM: Hybrid power solutions involve a wide range of options, and the assumed project life is an important factor in the commercial outcome. For short mine lives, some equipment such as batteries can be designed for relocation and re-use at another mine. We are also assessing solar panel providers who can move their equipment. Mining companies look beyond the initial mine life when considering hybrid solutions. A long-term approach can deliver improved economic and environmental benefits for our customers.

Meet Stephanie Moroz at the Energy and Mines Toronto Summit, Nov 1-2. She is participating on the panel: Key Considerations for Renewable Energy Hybrids for Mines

You have a net zero emissions target. What’s next? Let us build a roadmap to lead your journey to net zero.

Inthis interview, Tom Juric, Divisional Director, Liebherr-Canada, discusses the steely determination required of the mining industry to achieve net zero, as well as the “mesh network” of energies necessary to displace fossil fuels. In a very optimistic look at mining decarbonization, Juric says capital investment, technological risk, and business tradeoffs should not deter an industry poised at the beginning of its Technology S-Curve.

ENERGY AND MINES: What are some of the most significant changes for the mining industry as a result of the increased focus on ESG and climate performance?

TOM JURIC: ESG and adherence to climate standards will redefine the measures of success mining organizations that measure success beyond today’s traditional, financeoriented metrics should, and will be rewarded in the longer term. We are at the beginning of the Technology S-Curve (Taylor & Taylor 2012) and as such the initial

investment return, or lack thereof may deter some industry participants. However, as an industry, I believe we cannot afford laggards. All links within the mining value chain have responsibility for the decarbonization of the sector because it is an existential issue we are tackling.

E+M: What are some of the challenges for mines trying to balance climate and ESG commitments with mine production, expansion, and commercial realities?

TJ: Trade-offs. We do not yet have a 1-for-1 substitute for fossil fuel. We are working to displace a supply chain that has been refined and streamlined for well over half a century; adjustments have therefore to be made to the business model. Nonetheless, as a pioneer in the adoption of cutting-edge technology and solutions, the mining industry will likely achieve a comparable, and arguably better result. However, it will require patience and a steely resolve to achieve that milestone. Moreover, it is incumbent

upon the industry to define the decarbonization route of its own volition, because to wait is to invite the risk of regulation that could stifle innovation.

E+M: Which technologies are expected to be critical in meeting Scope 1 and Scope 2 carbon emissions goals for mining?

TJ: I believe there is no single energy source today that can compare with what a fossil fuel, such as diesel, has achieved in terms of scale, availability, and mobility. To accomplish our 2030 ambitions, a “mesh network” of energy acting in concert will be required to displace fossil fuels. That said, the speed of development and investment in the alternate fuel and electrification sectors is both astounding and highly encouraging. Given such a real capital investment by traditional and non-traditional sectors, who is to say that a sustainable, direct replacement of diesel is not one “eureka” moment away? However, the key takeaway here is that the industry is not sitting around waiting for eureka; instead, it is developing what it can in parallel to ensure no stone is left unturned in the quest for net zero.

E+M: Who are you looking forward to connecting with at the Energy and Mines Toronto Summit on November 1-2 at the Delta Toronto?

TJ: The real benefit I get from these events is conversing with like-minded people who share our common vision. I always try to learn something so I am keen to hear what the industry is working on, the successes achieved to date, and most importantly, the lessons some have learned through lessthan-successful endeavors. That said, I have never before in my mining career seen such a rapid transformation. Whoever says mining is a dying or obsolete industry, look out, we’ve only just begun!

Tom Juric is speaking at the Energy and Mines Toronto Summit, Nov 1, 3.00 PM on the panel Decarbonizing Fleets: The Road to Net Zero Haulage.

“As an industry, I believe we cannot afford laggards. All links within the mining value chain have a responsibility to decarbonization of the sector as it is an existential issue we are tackling.”

David Stewart, Head of Mining Business Development at specialized carbon finance company, Invert is providing a joint case study with Karora Resources, on Nov 2nd at the Energy and Mines Toronto Summit. In this interview, David discusses mine ESG and mine climate performance.

ENERGY AND MINES: What are some of the most significant changes for the mining industry as a result of the increased focus on ESG and climate performance?

DAVID STEWART: With increasing focus on ESG metrics and climate change, there are many ways mining companies and their investors are thinking differently, but some notable examples are: (1) what are you mining, (2) where are you mining it, and (3) how are you mining it?

• The emergence of ESG into the mining investor landscape has catalyzed shifts in commodity exposure, with materials such as thermal coal being divested by diversified miners like Rio Tinto, and increasing interest in electrification materials like lithium, nickel, and copper.

• The strategic location of mineral deposits is increasingly important. Mines are energy intensive, and so there has been surging interest in jurisdictions with low-carbon/renewable power grids such as British Columbia and Quebec, and it is becoming more difficult to invest in areas where only diesel generator power is available like Nunavut and other remote locations.

• Climate change is driving miners to consider GHG emissions profiles even at the early planning stages of the mining cycle. For example, underground mines have half the emissions intensity of their open pit counterparts on average, on a unit of production basis, and therefore are more attractive investments at face value.

E+M: What are some of the challenges for mines trying to balance climate and ESG commitments with mine production, expansion, and commercial realities?

DS: Some companies are having to make tough decisions which were beforehand considered obvious. For example, building a new, large-scale open pit mine might be financially savvy, but could compromise the company’s climate goals. In some circumstances, however, therein lies the opportunity. When planning a new mining project or a production expansion project, the company can incorporate greener technologies into the overall project scope, such as a solar farm, to both expand production and to reduce GHG emissions concurrently. At Invert, we work with clients both in production and in development stages, and are able to partner with them in developing their emissions reduction roadmaps which inform their mine planning decisions.

E+M: Which technologies are expected to be critical in meeting Scope 1 and Scope 2 carbon emissions goals for mining?

DS: The two largest sources of emissions in mining are generally the equipment fleet and the power source. Electrification of an equipment fleet, including use of battery mobile equipment in underground mines, or trolley assist in open pit haul trucks, are currently being employed to great effect today. Access to or the generation of renewable energy is also a major focus, and as mentioned earlier, impacts how investors or companies view and rank certain jurisdictions over others.

E+M: Who are you looking forward to connecting with at the Energy and Mines Toronto Summit on November 1-2 at the Delta Toronto?

DS: At Invert we operate at the core of the carbon ecosystem. Especially through our Business to Business division, we are eager to meet and partner with mining companies and apply our dual-track approach to an accelerated path towards net zero: first focus on emissions reductions, then invest in carbon offset projects.

“The strategic location of mineral deposits is increasingly important… there has been surging interest in jurisdictions with low-carbon/renewable power grids such as British Columbia and Quebec, and it is becoming more difficult to invest in areas where only diesel generator power is available like Nunavut and other remote locations”

energy is front and center in the mining industry’s plans for achieving net zero. The imperative of the global energy transition now has useful tailwinds from recent, very positive developments in renewable energy, according to Ewan Norton-Smith, Head of Sales (Australia), JUWI as his recent keynote address at the Energy and Mines Australia Summit titled Where is Mining on the Roadmap to Zero-Emissions? This article provides a summary of Ewan’s keynote from September 6th, 2022.

Renewable energy is not only the lowest cost but also a reliable and proven form of energy generation now. Unsurprisingly, JUWI Australia has witnessed a sharp uptick in the deployment of these projects over the past 24 months, an indicator of the growth in the industry, according to Norton-Smith.

Another welcome trend is that mines are now actively seeking multiple technologies, and higher penetration solutions to

move from 25% to around 85% renewable energy penetration resulting in low costs and reliability of supply.

While developing a preferred energy solution for an off-grid gold mine in Australia, JUWI is considering a combined 14 MW of solar, 24 MW of wind, and a 13 MW battery to meet the mine’s 13 MW load. After simulating several options

for the project at different renewable energy fractions, the modeling shows that the mine’s renewable energy fraction of 85% provides the lowest cost of electricity. On the other hand, if only solar PV generation were to be considered, the renewable energy fraction would be restricted to around 40% due to battery energy storage limitations.

The volatility in the supply and price of fossil fuels due to global geo-political turmoil is also proving to be a key and useful differentiator in favor of renewable energy.

Moreover, it is becoming increasingly clear that access to capital is often tied to the borrower having in place a clear decarbonization strategy. This limitation, as well as potential cross-border carbon pricing, are driving company boards, investors, and directors to incorporate emission control and decarbonization into their governance practices.

Meanwhile, decarbonized mining operations will produce the vast quantities of clean energy metals required in the global energy transition; hence without mining, there can no meaningful transition to renewable energy.

There is a unique circularity here. Products of that very same transition, such as batteries, would be used by mines for implementing renewable solutions.

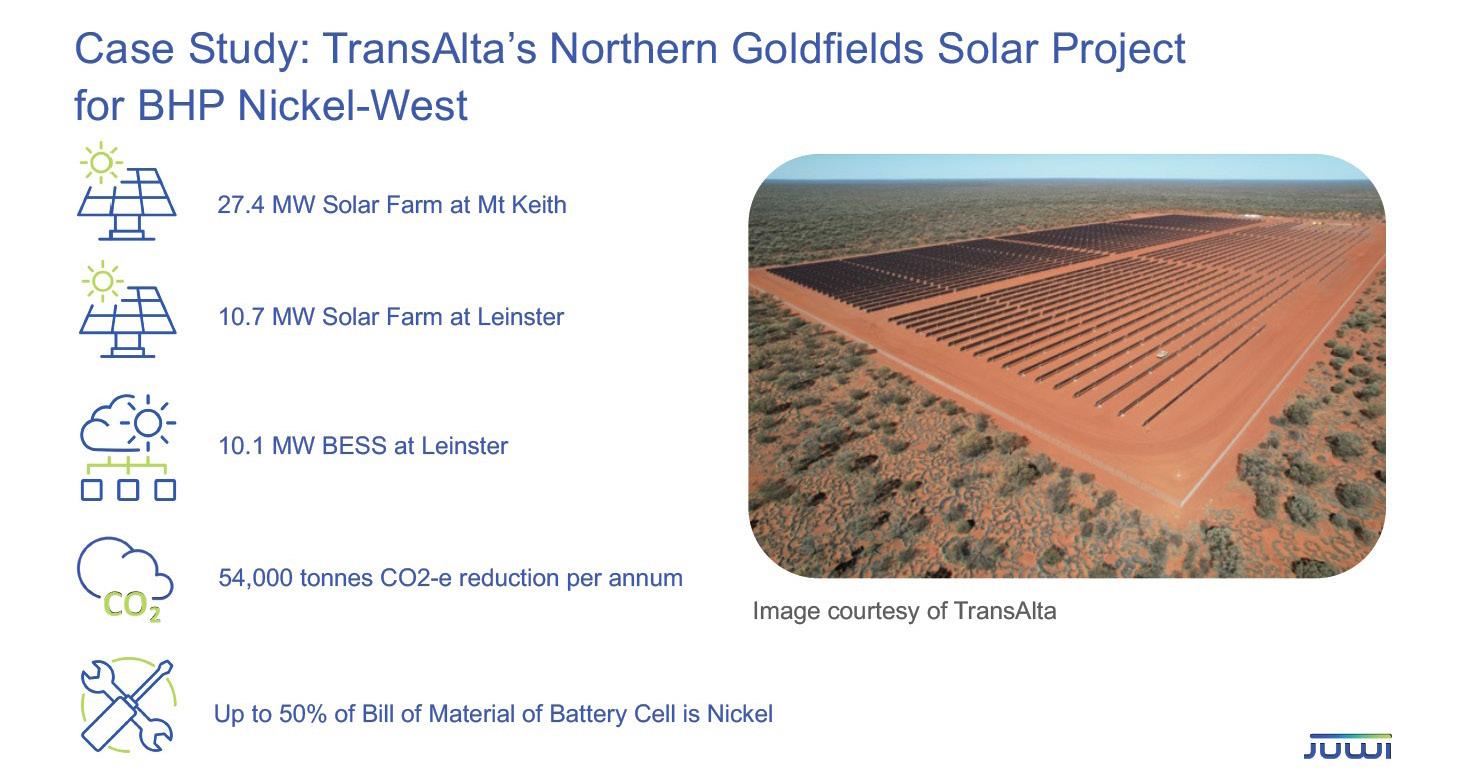

For example, under an EPC model for TransAlta, JUWI is currently constructing a solar project for BHP Nickel West at the Northern Goldfields. This project, which includes about 37 MW of solar and a 10 MW BESS, will reduce CO2 emissions by 54,000 tonnes. The mine’s battery owes 50% of its chemistry to nickel.

Nickel West is, therefore, supplying nickel to global battery OEMs and portions of that nickel are cycling back to power a battery on a Nickel West mine site. A very elegant solution, indeed!

In another example, Rio Tinto’s new tellurium recovery process at its Kennecott copper mining operation in Utah will feed into a $1.2 billion capacity expansion by First Solar, a leading US solar panel manufacturer. Since most global tellurium production is now being used in solar panels, many of these panels could later find their way back to a mine’s renewable energy project.

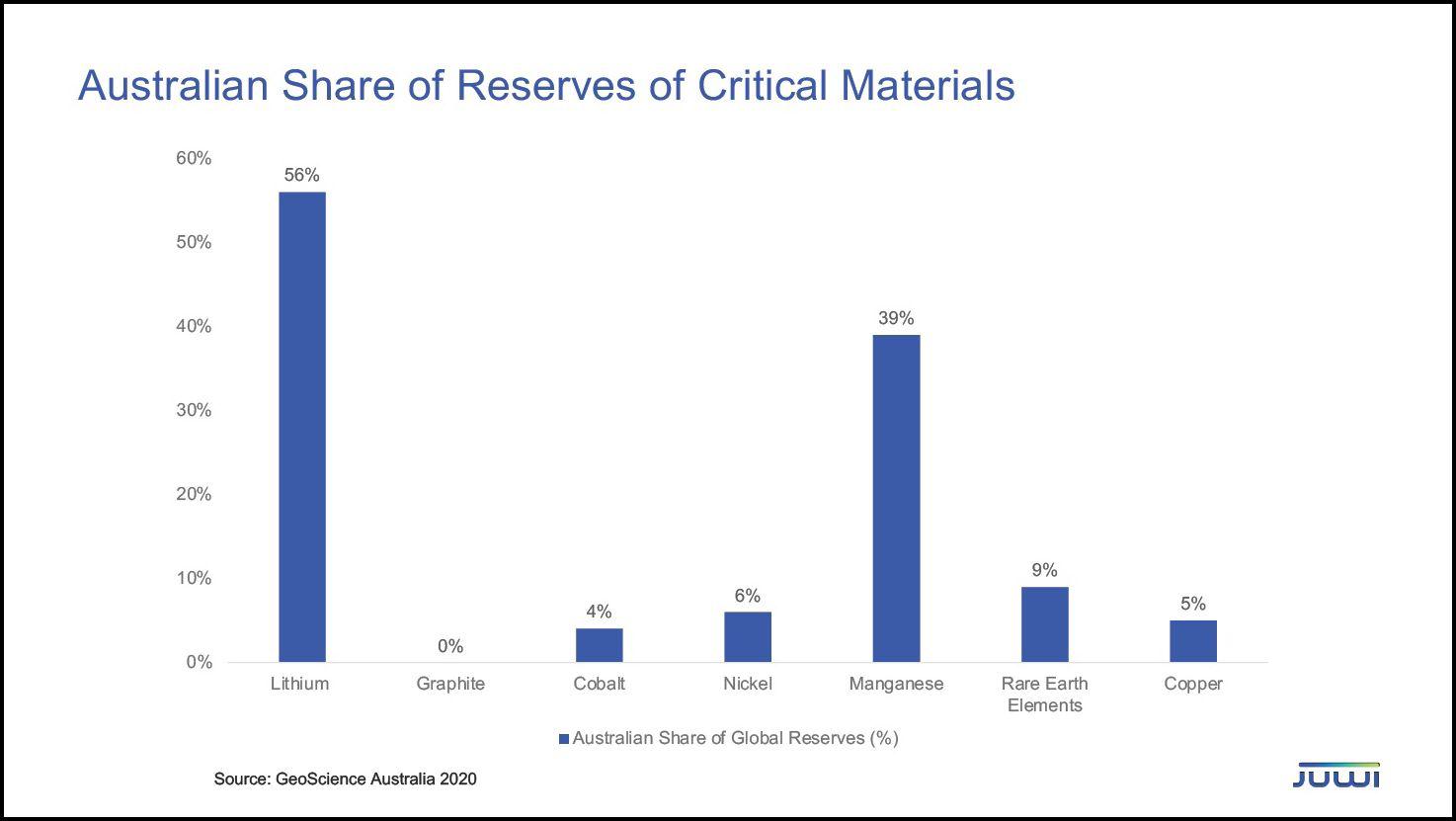

However, the growth in renewable energy demand is potentially stunning. According to the IEA, there is likely to be an 11-fold increase in wind power and a 20-fold increase in solar power by 2040. This will result in dramatically higher demand for critical minerals as well, and a huge opportunity for Australia, which holds large reserves of these materials.

Given Australia’s reputation as a reliable trading partner, Australian miners have an enormous opportunity to export low-carbon and critical minerals to drive the global energy transition.

However, the mining sector will need to adapt to this demand for critical low-carbon materials, because servicing this growing requirement will only be possible from zeroemission mining operations.