SPONSORS AND

SPONSORS AND

2025 is just around the corner, and the time for mining companies to establish their climate targets is ending. The majority have publicly committed to achieving net zero emissions by 2050 or earlier, and with interim targets due to be met by 2030, most are now in implementation mode.

As they shift from words to action, miners face a number of implementation challenges, from high costs and technology limitations to management and culture issues.

These are not insurmountable – as long as mining companies don’t wait too long to tackle them. “I think that we will see some missed targets because there are several companies that are feeling as though they don’t have to worry about their 2030 target yet, without realizing that many of these projects take years to actually implement,” says Keith Russell, North America Director at consultancy Partners in Performance.

“If you’re not acting now very vigorously, there’s a high probability that you will miss those targets,” he adds.

One of the best-known challenges facing miners as they attempt to decarbonize operations is cost. Renewable energy infrastructure and electric fleets often require much higher CAPEX than traditional equipment.

Mineral prices have been particularly volatile recently, making the investment decision even more difficult. After two years of dramatic increases in 2021 and 2022, the prices of critical minerals—used in green technologies such as solar panels and electric batteries—fell sharply in 2023, with lithium dropping by 75% and cobalt, nickel, and graphite falling by between 30% and 45%.

There are ways to adapt to these economic fluctuations while continuing to invest in decarbonization, which, according to Bliss Baker,

Vice Chair at Sussex Strategy Group, “involves hedging strategies, flexible operational planning, and government support.”

These hedging strategies can include forward contracts and other options that lock in prices to reduce exposure to market volatility.

“Mining companies manage financial and operational implications by conducting cost-benefit analyses, diversifying investments, and using complex hedging strategies. Investing in scalable technologies and maintaining operational flexibility is key to navigating economic uncertainties,” he suggests.

Exemplifying this diversified technological portfolio, BHP now sources 67% of its operational electricity needs from a mix of on-site renewables and PPAs and is on track to reduce operational emissions by 30% by 2030. It reported an 11% year-on-year drop in 2023 alone.

At the same time, demand for minerals continues to grow, and the International Energy Agency (IEA) even expects a potential supply shortage in the coming years. This means miners now face what some consider a ‘growth challenge.’

“As the demand for critical minerals is increasing, companies are going to have to be strategic about which assets they want to grow and how that growth doesn’t lead to more emissions, compromising their targets,” warns Eyab Al-Aini, Senior Research Associate, Clean Growth, at the Canadian Climate Institute.

Miners’ growth plans must be accompanied by emission reduction and decarbonization. Technological and commercial innovations are making

this easier, but it can be difficult to know whether a technology will be available by the time a new mine is developed.

For now, Al-Aini says renewable power purchase agreements can allow companies to offset their growth and protect their mid-term targets at a relatively low cost. He has also seen firms adopt renewable diesel as an interim solution while they wait for more major diesel displacement technologies, such as electric trucks, to become available.

The key is to “be intentional about the net zero mine of the future,” he adds, giving the example of a “multinational company” that has started to implement dual mine plans: one with the current technologies available and another fully electric mine leveraging future technologies – with a transition plan for going from one to the other.

“They’re starting to think about how they’ll lay out the mine ahead of time. Where are they going to put the chargers? Where does it make sense to have slightly different designer ramps, maybe? What’s the optimal way for a range of charging solutions and battery sizes to optimize the run cycle, for example? I’ve seen some companies start seriously thinking about that and integrating this as part of the planning process,” adds Al-Aini.

Transitioning away from fossil fuels to power operations is easier for some than others, depending on where a mine is located. “In some respects, it’s harder for some of the Canadian companies to hit their 30% reduction by 2030 because they’re already starting with hydropower as their energy source, which means that their Scope 2 requirements are already pretty low,” says Russell.

He adds that, luckily, for those outside of Canada, most renewable energy investments are “net present value positive.”

When it comes to fleet electrification, underground mines are much better positioned than their open-pit counterparts: OEMs, including Caterpillar, Epiroc, and Sandvik, have all developed battery-electric equipment to substitute conventional vehicles.

Newmont Goldcorp’s Borden mine in Ontario was the first fully electric underground mine to begin

operations in 2019. Still, recent news suggests that others could soon follow – including IGO’s Cosmos nickel mine in Australia.

“The underground miners are probably in a much better position, given that the solutions are becoming increasingly available, and the business case for electrifying underground mines is becoming stronger,” Al-Aibi tells Energy and Mines

“For the open pit miners, there are some emerging solutions, but the challenge will be how to integrate uncertainties about where the technology is going with their mine plans,” he adds, suggesting that partnerships will be crucial in the transition.

For example, BHP and Rio Tinto are working together to develop and deploy electric haul trucks. “Their joint efforts have demonstrated the feasibility of large-scale electrification in mining operations and have paved the way for broader adoption,” says Baker.

Similar cross-industry initiatives are underway to scale up hydrogen developments. Hydrogen is another solution likely to bridge the fleet decarbonization gap for open-pit miners, along with more efficient battery chemistries, biodiesel, and trolley assist.

The transition may take some time, but Russell notes that all the major companies Partners in Performance works with are “maintaining the absolute commitment to decarbonization and are making the funds available to support this.”

Internal carbon pricing is one tool miners are using to keep investing in the climate transition, even amid economic uncertainty: Rio Tinto, for instance, raised its internal carbon price to US$75 per tonne of CO2 last year “to provide the incentive to accelerate the delivery of abatement projects across our business.”

In many jurisdictions, government support is also available to incentivize the transition. One such example is Canada’s Clean Technology Investment Tax Credit, a refundable tax credit for up to 30% of capital invested in adopting and operating new clean technology from 2023 to 2034.

“We’ve seen that specifically in some underground mines help companies make the decision a lot easier for them to start shifting their fleet to battery-electric

The Wheaton Precious Metals Future of Mining Challenge seeks to support efficiencies in mining while minimizing its environmental impact. This year, US$1 million will be awarded to a solution that targets the reduction of greenhouse gases and carbon intensity at base and/or precious metals mines, with funds being used to help further advance the technology.

By doing more with less, mining operations may reduce costs, become more resilient to climate risks, and help provide the materials the world needs in alignment with global goals.

Submit your cleantech solution by November 22, 2024. For more information, please visit www.futureofmining.ca.

vehicles. Each region will be slightly different, but a policy like that can move a few investment decision projects,” notes Al-Aibi.

The Canadian Climate Institute is compiling a list of policy incentives for mine decarbonization in Canada, which it should release in 2025.

The final and most underrated challenge for mines implementing changes to meet climate targets is cultural.

Russell describes this as moving from a top-down to an “asset-up” approach: “Go back three years, and it was very much more the board, the CEO making the commitment top down, and now we’ve gone

through an essential transition: those responsibilities have been given to the assets to deliver [on these commitments],” he says.

According to him, top-down commitments were often made without fully understanding the challenges on an asset-by-asset level. This means strategies may have to be adjusted with specific mines’ management input.

“Quite often, they come up with better solutions, but they also have to deal with the realities of the communities, the workforce that they’re dealing with, and the competing priorities at an asset-by-asset level, and that just takes implementation time,” he adds.

There are ways to make this transition easier: Russell recommends sharing emissions reports with each mine at least on a monthly basis to get managers more familiar and concerned with this KPI – and adding this metric to their incentive schemes. “You

“In some respects, it’s harder for some of the Canadian companies to hit their 30% reduction by 2030 because they’re already starting with hydropower as their energy source, which means that their Scope 2 requirements are already pretty low”

need the fact that it’s actually being measured and that it’s viewed as something which is important as a metric for the overall performance of that individual,” he adds.

Finally, mining firms should maintain their social license to operate as they implement low-carbon solutions. “Decarbonization solutions are probably going to have to be considered in the context of social license,” notes Al-Aibi, adding that “that’s just part of how mining operations work.”

Low-carbon technologies tend to be viewed positively by local communities since they normally reduce air pollution and noise, improving the mine’s overall license to operate. However, the key for mining firms

is to involve local stakeholders in the entire process. BHP, for instance, started building relationships with local First Nations surrounding its Jansen potash mine in Saskatchewan almost a decade before construction began. It recently launched a Canada Indigenous Partnership Plan to foster “reciprocal relationships,” supported by a new external Indigenous Advisory Circle for the mine.

Al-Aibi notes that this specific partnership “is looking at things that mining companies may not have looked at in the past, for example, well being”. “It’s not just employment and benefit sharing: they’re building that partnership early, and they’re building it deeper, so I think that’s a good example, and it’s moving in the right direction.”

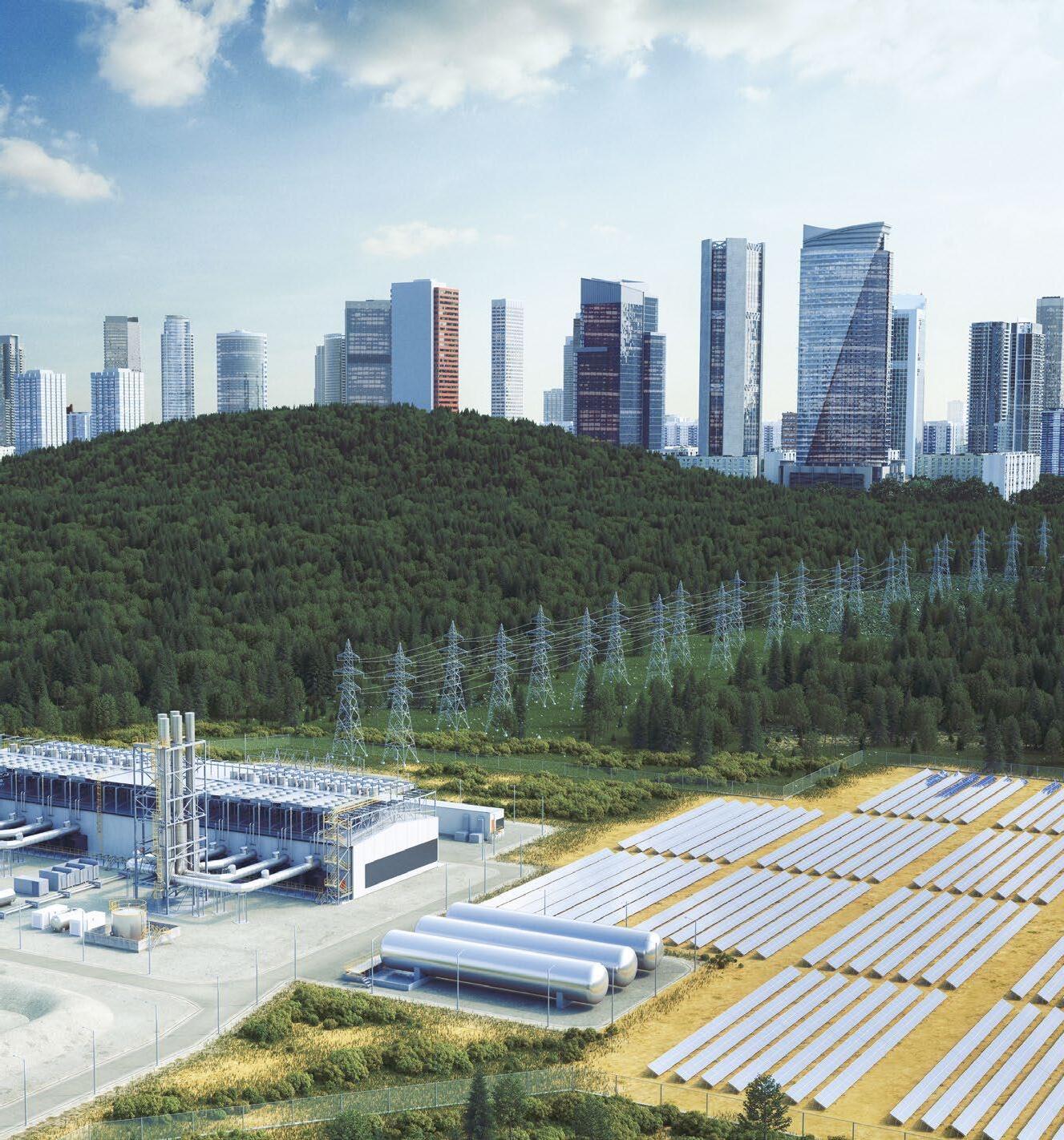

Future fuel availability, costs and regulations are uncertain. That’s why Bergen Engines’ modular design emphasizes Fuel Flexibility, allowing customers to confidently adapt to these changes without sacrificing efficiency.

Scalable power solutions from 3-12MW per engine, ideal for remote locations.

Proven performance in mining operations, integrated with 100MW+ of solar.

Ensure uniterrupted power supply in the most challenging environments, providing security from grid-connected power outages due to storms.

German-Canadian Network

Market Entry Services

Events & Delegations

Trade Fairs

Total Participants

Reflecting on Last Year’s Success:

1,443

7,159 Exhibitors

Delegates

2,301

2,714 Expo Visitors

This Year’s Theme Minerals, Innovation, and the Energy Transition

Join us at Canada’s premier mining event! Connect with global leaders, spotlight your brand, and gain valuable market insights. Experience a rich technical program and an expansive expo designed to elevate your industry knowledge.

Martin Schlecht MANAGING DIRECTOR STRATEGY & TECHNOLOGY

Dornier Renewables, Co-Founder, Dornier Suntrace

Hybrid power systems are now a well-established decarbonization tool for mines, but balancing solar, wind, and battery storage remains difficult. Martin Schelcht, Managing Director of Dornier Suntrace, shares his expert advice with Energy and Mines.

ENERGY AND MINES: What are the most promising hybrid energy solutions currently being adopted in the mining sector, and how are they contributing to decarbonization efforts?

MARTIN SCHLECHT: From my perspective, the most promising hybrid energy solutions are combinations of solar and wind, as the complementarity at a given mine site can bring the largest renewable share with the lowest generation cost. For off-grid mines specifically, the wind energy option should be examined. Examples are the solar and wind installations at Goldfield’s Agnew mine in Australia or at Rio Tinto QMM’s mine at Fort-Dauphin in Madagascar, where the solar is already inaugurated while the wind installation is planned.

Solar energy is usually easier and faster to implement, while wind development takes longer. Consequently, a first step can be maximizing solar energy generation while developing a wind project in parallel.

Using only solar, the highest renewable energy share is achieved when solar will provide all electricity during the daytime. It requires a zero-engine concept which is currently being implemented with the extension of the solar plant at B2Gold’s Fekola mine in Mali. This phase 2 solar project will add 25MWp solar and 12MWh BESS, bringing the complete solar installation to 61MWp PV and 30MW and 27MWh BESS, for a mine load at around 40MW. It will allow a zero-engine operation during daytime, providing more than 30% of the total electricity demand from solar. Adding wind energy to the equation, the annual renewable energy share could reach up to 75% or more depending on the available wind resource and project boundary conditions, still under an estimated payback of less than six years against HFO fuel cost savings.

E&M: What role do battery storage systems play in ensuring a reliable energy supply for mining operations, and how do they impact the overall decarbonization strategy?

MS: Battery storage, or BESS, are a facilitator for renewable energy. Their economic benefit will be larger in off-grid mine sites because these do not have the grid to balance fluctuations. BESS can serve as a “buffer” in smoothing the fluctuations of renewable energy and thus allow a ramp rate control and a preventive start/stop of engines at off-grid mines. Using BESS for energy shifting, meaning to overproduce solar during the day, store it in the BESS and discharge during evening or night hours will become increasingly attractive. For grid-connected mines, they can also be used as a peak energy source to avoid mine trips in case of grid issues like power cuts, load shedding or similar.

If wind energy can be used, the balancing aspect of the BESS becomes even more important, as more renewable energy generation capacity is contributing to the energy mix, so the BESS will be required to ensure the stability of the electrical network. However the BESS installed power would match more or less the mine load, while renewable generation capacity would be oversized compared to mine load to charge the BESS and provide the electricity for times without renewable generation. To determine which combination, size and storage duration actually would be feasible economically, a site-specific analysis is required. A future reduction in BESS cost or increased fuel cost will further improve the economics and enable larger renewable and BESS systems.

E&M: Can you discuss the challenges and opportunities associated with integrating renewable energy into existing mining infrastructure?

MS: The opportunities are very likely lower cost of electricity from renewables and the option to hedge future energy cost and carbon taxes to manage risk. Moreover, lower cost of electricity may allow the mine

to also extract lower-grade ore bodies, thus making the overall investment into the mine more profitable. The challenges are that implementing solar and wind generally requires the resource and the land to be available for the installation of the plants. The demand profile and the expected improvements on the mining operations side such as expansion of mill throughput or electrification of operations are also important boundary conditions. In some instances flexible loads can shift electricity consumption to times when the resource is available to maximize the value from renewables.

On the technical side, the integration is mainly on the electrical system and the control system. Accordingly, it requires tailor-made solutions to enable a smooth integration with existing power generation and its characteristics, alignment of protection schemes, grid stability and power flow. For the long-term perspective it is helpful to consider sufficient space and provisions in the electrical system design for future expansion of the renewable generation and BESS, in line with the decarbonization roadmap and increased electricity demand. The main challenge really is that each location and each mine requires a tailor-made solution and it is not recommended to apply the same solution to each mine.

E&M: How do you see the future of hybrid energy solutions evolving in the mining sector, particularly in terms of innovation and scalability?

MS: I want to highlight that large renewable energy plants at mine sites are already and will only get more economic, benefiting the economic viability of the whole mine site by reducing the operating cost –assuming that the sizing of the renewable system is chosen based on a solid study.

As the world’s leading pure-play sustainability consultancy, ERM equips businesses to strategically manage and reduce their carbon footprints. Our team of climate, sustainability and mining experts are creating and implementing innovative solutions for clients that derive value from activities as diverse as product differentiation and supply chain optimization to operational efficiency and full-scale decarbonization strategy.

Workshop - ESG for Mines: From Compliance to Value Creation

9:00-10:00, 13 November 2024

Energy & Mines, Toronto, Canada

Join us and our industry partners as we dive into effective strategies for the mining sector to transform sustainability commitments into business value. We will explore how to differentiate commodities to suppliers looking for low-carbon inputs across their supply chain.

Contact:

I expect that going forward, larger renewable systems will be implemented. Reference projects that are now up and running, and are performing to expectations are providing comfort to other mining companies to implement similar solutions. It is worth noting that Dornier Suntrace will have implemented four PV and BESS Hybrid projects by end of 2024, all of them at off-grid mine sites for our clients B2Gold, Kinross and Endeavour Mining, totaling >140MWp PV and >60MW of BESS, with B2Gold already implementing a Phase 2 at the Fekola mine site.

I expect that even grid-connected mines will be required to move forward by implementing renewable energy solutions themselves to achieve targets, instead of waiting for utilities to “green” their grids. Electrification of mine sites will increase the electric load at the mines even more, while reducing the fuel consumption and CO2 emissions. Electrification will only make real sense when renewable electricity is used, both to reduce carbon emissions and to cut operating costs.

E&M: What are some of the key considerations for mining companies looking to transition to hybrid energy solutions while meeting their sustainability goals including fleet electrification?

MS: Implementing renewable energy solutions requires multiple steps to be economic. It is best to start quickly and implement the “low-hanging fruit” applications, while resolving the more complex aspects at a later stage. Mining companies can also benefit from the experience and lessons learned in other projects, so that they may leapfrog some of the early stages and proceed to larger and bolder types of solutions instantly.

It is also very helpful to look at the different schemes to implement this, either outsourcing the investment to an IPP and signing on a long-term power purchase agreement or investing yourself and using an EPC turnkey contractor or even self-perform. We have supported all schemes with different mining companies.

Bruce Power is a crucial part of Ontario’s clean energy grid, past, present, and future. Today, Bruce Power generates 30 per cent of Ontario’s electricity with zero emissions, produces cancer-fighting medical isotopes, and is lighting the path to a clean energy future.

Thoughtleader for hybrid projects

High energy cost savings with renewables (pay-off in 3-5 years)

Decarbonization of your operations – on the path to net zero

Improved energy security

Dornier’s value add:

Independent design, selection of equipment and technology

Best option analysis and techno-commercial concept

Full implementation with either options: on or off-balance sheet

Strong track record in the mining industry:

30 projects

8 in operation or construction/implementation

15 international first class clients in over 12 countries

www.dornier-group.com/en/company/suntrace

Agata Leszkiewicz

Stephan Tapp

Energy and Mines asked our speakers for the upcoming Toronto event on November 12-13 to tell us about their particular focus on decarbonizing mining, the challenges they see at this stage of the transition, and what’s needed to enable mine decarbonization.

Their responses demonstrate the full range of disciplines and expertise in this complex transition and provide insight into the barriers and the necessary changes that will allow mining to reach this ultimate goal. This is just a taster of what’s to come this November in Toronto when these and over 80 other top mining and decarbonization expert speakers share their views on the most pressing topics mines face at this net zero transition stage.

Visit The Decarbonized Mine, November 12-13, Toronto for full event details.

Ria is chairing the panel on “Partnering with First Nations on Renewables in the North” at The Decarbonized Mine.

E&M: What are the mining industry’s most significant opportunities and challenges in achieving decarbonization goals? How can companies overcome the barriers to implementation?

RF: Electrification of fleets and equipment will provide one of the most significant mining decarbonization opportunities. Though technology continues to advance, and several renewable power technologies are readily available, many companies still do not consider them viable options or fail to incorporate them into feasibility studies or permitting applications. However, there is an opportunity to eliminate capital expenditure requirements through partnerships with renewable energy companies and Indigenous communities seeking ownership and new revenue streams. This approach can help shift the perceived

risk profile of integrating renewable power as part of a decarbonization strategy.

E&M: Which innovative technologies or practices are you most excited about in the context of decarbonizing mining operations, and how do you see them shaping the industry’s future?

RF: I am particularly excited about the potential for more mines to adopt a combination of battery energy storage and operational process adjustments. These practices can help reduce unnecessary energy peaks, lower grid demand charges, and prevent the overuse of diesel power, often used to compensate for inefficient energy management.

E&M: How can mining companies balance the need for decarbonization with maintaining operational efficiency and profitability, especially in a competitive global market?

RF: Decarbonization and profitability should go hand in hand—by reducing costs, decarbonization efforts can ultimately improve profits.

Nicole is chairing “The Carbon Offset Debate” at The Decarbonized Mine.

E&M: What are the mining industry’s most significant opportunities and challenges in achieving decarbonization goals? How can companies overcome the barriers to implementation?

NK: Decarbonization offers significant opportunities for cross-industry and cross-country collaboration. Companies that partner on projects can tap into new markets, share resources and expertise, and make collective progress toward sustainability. Collaboration, even on a small scale, allows joint ventures to achieve economies of scale that might not be possible for mines to achieve on their own. These partnerships bring together diverse skills and knowledge, leading to innovative solutions to sustainability challenges such as energy efficiency, waste reduction, and shared ownership or leasing of renewable energy sources.

However, transitioning to green technologies often requires significant capital investment that can

be a barrier, particularly for smaller companies. While funding pools like Canada’s Critical Minerals Infrastructure Fund (CMIF) are available, it’s not always clear if early-stage mineral projects meet the criteria for access. The Prospectors & Developers Association of Canada (PDAC) identifies securing project funding as a major challenge. The Mineral Exploration Tax Credit (METC), a key part of Canada’s Flow-Through Shares (FTS) regime, is set to expire in just a few months. Since 2000, the METC has been a cornerstone of the FTS regime, with over C$7.5 billion raised in the last decade—about 70% of funds raised for domestic mineral exploration in Canada. PDAC is advocating for the federal government to extend the METC for a fiveyear term, providing the industry with much-needed stability and continuity.

E&M: Which innovative technologies or practices are you most excited about in the context of decarbonizing mining operations, and how do you see them shaping the industry’s future?

NK: Data mapping can play a key role in achieving sustainability goals by overlaying geological models with optimal locations for green infrastructure, ecological sensitivity zones, cultural and heritage sites, and more. Aerial surveys that use advanced remote sensing and satellite technology can gather both geological and environmental data. AI and machine learning are also set to play a crucial role in the future of sustainability, from processing large volumes of data to optimizing mining operations through energy efficiency, predictive maintenance, and resource management. These innovations will help reduce the physical footprint and emissions traditionally associated with exploration and development.

E&M: How can mining companies balance the need for decarbonization with maintaining operational efficiency and profitability, especially in a competitive global market?

NK: Engaging with key stakeholders—including investors, regulators, employees, and local communities—will help align decarbonization efforts with broader expectations and demands. Fostering a culture of collaboration and innovation is essential for continuously seeking and implementing new technologies and practices that improve both sustainability and efficiency. This approach can also enhance public perception and build support for your initiatives. Early and transparent engagement, done in good faith, has been proven to deliver longterm sustainability benefits for both companies and communities.

Agata is leading Westinghouse’s workshop on “Microreactors and Mine Decarbonization” at The Decarbonized Mine.

E&M: What are the most significant opportunities and challenges for the mining industry in achieving decarbonization goals? How can companies overcome the barriers to implementation?

AL: The reliable and continuous availability of energy, wherever it is needed, is crucial to the operational success of a mine. Companies in remote locations with harsh environments find it challenging to work with traditional renewable energy sources, especially during winter. However, the eVinci™ Microreactor, a small-footprint, clean energy source that can run for over eight years with a 99% operational availability, can be a game changer for miners. Decarbonized and reliable energy, on tap, is now achievable, and I look forward to introducing this exciting new energy option to you.

E&M: Which innovative technologies or practices are you most excited about in the context of decarbonizing mining operations, and how do you see them shaping the industry’s future?

AL: Imagine a nuclear battery providing clean energy in some of the most remote and challenging locations on earth. This small nuclear technology option will eliminate long supply chains and reliance on fossil fuels. There will be no interruptions, no uncertainty— just continuous, clean energy. The eVinci Microreactor is the future of energy for mines.

E&M: How can mining companies balance the need for decarbonization with maintaining operational efficiency and profitability, especially in a competitive global market?

AL: I recommend that mines commence futurefocused planning immediately to achieve this difficult balance. Mining industry partners have a unique opportunity to be early adopters of a microreactor technology that allows them to virtually forget about energy concerns for at least eight years, with minimal needs of staffing and maintenance and round-theclock energy and heat. The eVinci Microreactor is an energy solution for mines with efficiencies unmatched

elsewhere. Starting from 2030, every new mine can be launched with this technology, unlocking significant long-term cost reductions and operational efficiencies. However, scale of operations and strategic planning is essential to achieve these benefits, and the window to act is narrowing.

Stephen will represent G+ Plastics, which is sponsoring the Wrap-Up Drinnks at The Decarbonized Mine.

E&M: What do you see as the most significant opportunities and challenges for the mining industry in achieving decarbonization goals? How can companies overcome the barriers to implementation?

ST: The mining industry faces both substantial opportunities and challenges in its pursuit of decarbonization goals. One of the key opportunities lies in enhancing energy efficiency, particularly in ventilation systems, which can account for up to 50% of a mine’s energy consumption. At G+ Plastics, we provide innovative ventilation ducts made from smooth materials with perfectly sealed joints. This optimization reduces the energy needed to power fans, ultimately lowering both energy consumption and costs.

However, challenges remain, particularly the geographical isolation of mining sites, which can hinder decarbonization efforts. Transporting and installing heavy or rigid ventilation systems in remote locations is often logistically difficult and expensive. To address this, G+ Plastics has developed flexible, lightweight ventilation ducts that are easy to transport and install, even in the most isolated areas.

We believe continuous investment in research and development is critical to overcoming these barriers. By implementing customized solutions, mining companies can achieve their decarbonization targets and also improve operational efficiency and reduce long-term costs.

E&M: Which innovative technologies or practices are you most excited about in the context of decarbonizing mining operations, and how do you see them shaping the future of the industry?

ST: At G+ Plastics, we are particularly excited about the integration of artificial intelligence (AI)

and process automation into mining operations. These technologies are among the most promising advancements in the industry, and we are actively incorporating them into our own operations.

AI and automation are already revolutionizing mining by improving operational efficiency, reducing energy consumption, and minimizing environmental impact. As these technologies continue to evolve, we expect them to drive even more progress toward decarbonization by enabling more precise control over energy use and resource management.

By leveraging AI-driven insights and automating processes, we envision a future where mining operations become not only more efficient but also significantly more sustainable. These innovations will play a critical role in achieving decarbonization goals while fostering industry growth and competitiveness.

E&M: How can mining companies balance the need for decarbonization with maintaining operational efficiency and profitability, especially in a competitive global market?

ST: We firmly believe mining companies can balance decarbonization with economic performance by

investing in dual-benefit technologies that reduce emissions while enhancing operational efficiency. Such investments are essential for addressing the industry’s current challenges.

At G+ Plastics, simplicity is a core value that guides our operations. Choosing our solutions means opting for simplicity that not only streamlines processes but also delivers substantial capital and energy savings in the short term.

By following this approach, mining companies can minimize their environmental footprint while boosting profitability. This strategy allows them to meet growing sustainability expectations while strengthening their long-term competitiveness in an ever-changing global market.

The energy landscape is in transition towards more flexible and sustainable energy systems. We envision a 100% renewable energy future. Wärtsilä is leading the transition as the Energy System Integrator – we understand, design, build and serve optimal power systems for future generations. Engines and storage will provide the needed flexibility to integrate renewables and secure reliability.