33 minute read

GLOBAL CHALLENGES

Visions from Europe, Asia, Africa Oceania and the Americas

Many countries are implementing new regulations in order to favour circularity, recyclability and sustainability. Clearly, paper-based products can profit from this trend.

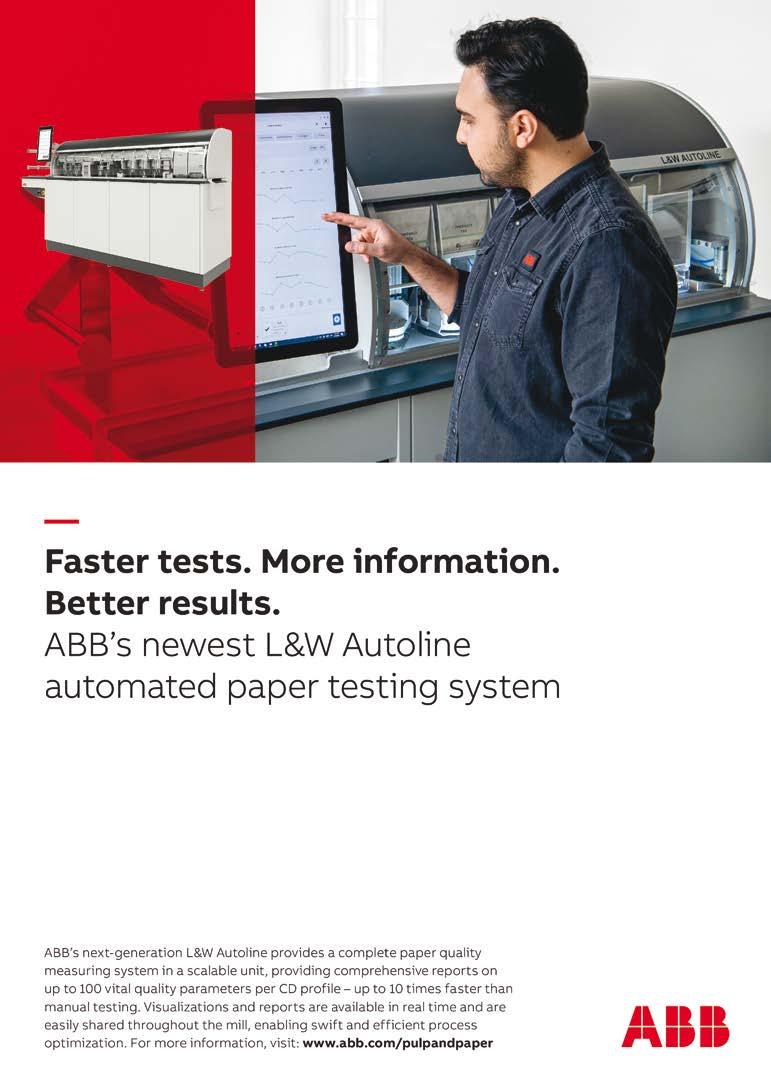

Advertisement

USA AF&PA (American Forest and Paper Association) Mrs Heidi Brock President & CEO CANADA FPAC (Forest Products Association of Canada) Mr Derek Nighbor President & CEO

BRAZIL IBA(Brazilian Tree Industry Association) Mr Paulo Hartung Executive President

EUROPE Cepi (Confederation of European Paper Industries) Mr Jori Ringman Director General

SOUTH AFRICA PAMSA(Paper Manufacturers Association of South Africa) Mrs Jane Molony Executive Director

ICFPA statement on COVID-19

Members of the International Council of Forest and Paper Associations (ICFPA) are staying in close contact to share information and leading practices on how our respective markets are managing through COVID-19. Our top priority is the health and wellbeing of forest sector workers and their families around the globe.

The weeks ahead will be critical as operations adjust to changing circumstances and as governments deliver worker, contractor, and business support programs. Our network representing 28 countries from around the world has much to share and learn from each other.

We will continue to work together so we can weather this storm and hopefully soon turn our minds to recovery and stimulus.

Derek Nighbor

President International Council of Forest and Paper Associations

INDIA IPMA(Indian Paper Manufacturers Association) Mr Rohit Pandit Secretary General

AUSTRALIA AFPA (Australian Forest Products Association) Mr Ross Hampton Chief Executive Officer

1. How is evolving the legal environment in your area on that topic and what is the timeline for the implementation of new rules if any?

AF&PA • remaining waste products, including mixed Neither the U.S. government, nor the states are paper and cardboard, by no later than 30 June enacting regulations specifically to implement 2022. circularity or sustainability at this time, although measures to regulate aspects of circularity and Cepi sustainability have been adopted. The European Since the start of the new European executive in Union has adopted a directive on circularity that December 2019, the EU regulatory environment does impose requirements, for example, on has been focused on unfolding the European single use packaging. Green Deal and its climate neutrality goal. On Importantly, AF&PA members voluntarily have the table there is the revision of major initiatives taken a leadership role in sustainability. In 2011, impacting circularity, recyclability and sustainawe launched our sustainability initiative, Better bility of products. Some very relevant initiatives Practices, Better Planet 2020, that includes have already been published in February and the most extensive collection of quanti- «AF&PA March 2020 such as the European Clifiable sustainability goals for a major U.S. manufacturing industry. We members mate Law, the New Industrial Strategy, the Circular Economy Action already have achieved two of those voluntarily Plan 2.0 and Sustainable Products goals and we currently are develo- have taken a Initiative. ping new goals for 2030. leadership role in Furthermore, circularity is a key While plastic packaging remains a sustainability» principle for us: the recycling of primary focus of recyclability, more products made from renewable maattention is being given to plastic alter- terial ensures that valuable resources natives, such as paper. We have noticed remain in the loop as long as possible and a pivot toward discussions about broader seg- links circularity of products to cycles of nature. ments of packaging, like single-use packaging. Our industry has a very relevant role in supSome state governments are considering regu- porting the EU Green Deal: we can help Europe lations that would prohibit the sale of single-use reach climate neutrality thanks to our sustaipackaging that is not recyclable or compostable. nable raw materials, to large extent fossil-fuel AUSFPA The new legal context in which we are now enteOn 8 November 2019, Australian Federal and ring is a real opportunity to push our model even State Environment Ministers met to discuss a further in a final goal of providing innovative waste export ban and agreed to put forward a sustainable solutions for a range of new sectors proposed timetable for the progressive phase through new wood fibre-based products. out of problem waste exports applied from July free products and energy efficient operations. 2020. FPAC Ministers agreed the phase out should be com- In Canada, recycling programs are administered pleted by the following dates: at the provincial government level and we are • all waste glass by July 2020 seeing a growing trend to Extended Producer • mixed waste plastics by July 2021 Responsibility. This brings with it new pieces • all whole tyres including baled tyres by Decem- of legislation, policies, and regulations that we ber 2021 need to stay on top of.

On the circular economy and sustainability federal, state, and municipal levels that also work fronts, similar to the European Union, the Cana- to eliminate landfills in the country. dian government has embarked on a ‘zero plas- Despite its relevance, the PNRS is being impletic waste’ agenda to ban ‘harmful’ single-use mented slowly. We need attention from governplastics by as early as 2021. Details are still to ments in all areas, investments in reverse logisbe worked out and it is hard to say how the CO- tics, customer awareness, and collaboration with VID-19 pandemic is going to impact the timing of the private sector. For example, this would allow these plans. packaging to be considered throughout its lifeAs we move to ‘zero plastic waste’, Ca- cycle, just like paper, which has an envinada’s forest products sector sees «a ‘zero ronmentally responsible origin and great opportunity to provide envi- plastic waste’ after its working life can be recycled ronmentally-friendly solutions in a couple of ways – to replace certain plastic products with paper, agenda to ban ‘harmful’ singleand returned to the production chain. Today, the rate of paper recycling where it makes sense to do so; use plastics by as is high (68%), for several reasons. and by collaborating with partners early as 2021» This is an industry that from the in the chemistry sector to use wood beginning has included recycling as fibre to make new sustainably sourced part of its culture, the recovery rate for bio-products. paper packaging in Brazil is one of the best in When it comes to the circular economy, many the world, and the country has a broad network people forget that Canada’s forest products and of people who live off collecting this material; paper sectors has been one of its earliest adop- over the years this network has developed and ters – from replacing what we harvest in the transformed into cooperatives which extend forest to paper recycling rates that now stand in into various regions of the country, separating the 70% range. recyclable materials to put them back into the In Canada, our strong record of sustainable production chain. Furthermore, there are comforest management – annually harvesting less panies across the country that specialize in the than 0.5% of Canada’s harvestable forests, re- trade in waste paper, buying, separating, clasplacing what we harvest, managing for biodiver- sifying, and selling this material. sity, retaining 90% of our original forest cover, and having the most third-party certified forests IPMA in the world – holds our sector in good stead Some sector-specific regulations have been in to meet the public’s expectations that we are place in India for some time now, like those for taking good care of our forests and forest eco- managing e-waste enacted in 2011, made more systems – not only a renewable natural resource, stringent in 2016. But, specific regulations for but one that is shared by all Canadians. promoting circularity, recyclability and sustainability are still evolving in India, and it may IBA take some time for the new rules to be put in Since 2010, a Brazilian law called the Natio- place after stakeholder consultations, and once nal Solid Waste Policy (Política Nacional de some kind of a detailed roadmap is finalised for Resíduos Sólidos, PNRS) has established goals implementation. India is also formulating a new and responsibilities for the government, private industrial policy which will promote the circular initiative, and consumers to eliminate and reduce economy and sustainability. waste, encourage recycling and environmentally Last year, the Indian central government ancorrect disposal of waste that cannot be reused. nounced that it plans to completely ban singleThis was an initial step for Brazil with regard to use plastic products, which are not recyclable, by solid waste, since it created mechanisms at the 2022. It has also launched a campaign to create

awareness. There are some defi- «Both local of Australian government to boost nitional issues which are being and State the ensuing opportunities post this discussed, apart from identifying Governments can waste export ban. and developing suitable alternatives. Several state governments and municipal authorities in India improve the sorting of recyclable Both local and State Governments can improve the sorting of recyclable waste to ensure clean have already banned single-use waste» resource streams. This can be done plastic, but are grappling with its en- through increased recycling infrastrucforcement in their respective jurisdictions. ture investment, and community education to PAMSA The Federal Government has an opportunity to When the Paper Recycling Association of South facilitate investment to increase the domesAfrica (now RecyclePaperZA) was established tic recycling rate as well as increase the use of 2003, recycling was a voluntary initiative im- recycled material. This can include potential plemented by the producers. The South African tax incentives, support for new sorting technopaper industry has been using recycled fibre logy, emission avoidance credits, support for since 1920 and has seen a steady increase in the recycling manufacture, as well as support for recovery of recyclable paper fibre. research and development. In 2019, PAMSA launched a new producer resreduce contamination. ponsibility organisation (PRO) - Fibre Circle - Cepi which will administer and drive various projects The CEOs representing the European paper that will promote the circular economy and im- industry outlined their plans to reach a climateprove the diversion of paper and paper-based neutral Europe by 2050 in a declaration which packaging from landfills. A voluntary extended was handed over to European policymakers at producer responsibility (EPR) fee is now being our annual conference “Paper&Beyond” in Nolevied on producers and importers of paper and vember 2019. paper packaging to implement projects. South The EU Green Deal is a crucial opportunity to African paper and packaging PROs are currently provide the right conditions that facilitate the in consultation with Government around a prac- execution of this plan and enable our industry to tical and viable EPR framework. contribute greatly to help Europe reach climate neutrality while staying competitive on the global scene. 2. What improvements do you think To reach this goal, we believe an improved marcould be made to boost the ensuing ket access for recyclable and fossil-free proopportunities? ducts is necessary and can be done through a coherent product policy framework. If consumers are not able to differentiate our products AF&PA from the more CO2-intensive alternatives on In any circularity regime, we will want to ensure the market, they are not able to make greener that since forest products are manufactured choices. from trees—a renewable resource—they should This should go hand-in-hand with a policy frabe recognized as such. Therefore, they are dif- mework that enables availability and access to ferent from the finite resources that are the fo- responsibly sourced nature-based raw matecus of the circularity paradigm. rials, through more support to sustainable forest management and high quality recycling in the AUSFPA paper industry. Improvements can be made at all three levels Our raw materials are wood pulp and paper for

recycling which are intrinsically renewable if co- ring high-quality, organized, and ongoing recyming from properly managed forest sources. We cling programs. have expanded sustainable forest management The private sector has to continue moving practices in Europe and globally. forward, as the paper packaging industry has Furthermore, reaching completely fossil-free done, investing in technology, creating solutions, value chains would require a plan for innovative and developing products with less environmensolutions, with clear milestones for a timely and tal impact that are easily incorporated back into cost-efficient decarbonisation of the European the production chain after their useful life is energy system. complete. We expect the European Green Deal to be a deal At the end of the chain, the consumer has to where we can deliver! be taught how to correctly separate materials. FPAC medication boxes and candy packaging should The opportunity to replace certain plastic pro- not go into the normal trash. ducts with alternative wood fibre or paper based By combining government organization with the products is a clear one. But the opportunity we strength of all the links throughout the producare most excited about in Canada is the conver- tion chain for recyclable materials, corporate insations that are now happening between fo- vestments, and proper separation of solid waste restry companies and oil and gas, chemistry, and by the purchasing public, we will have a much consumer packaged goods companies. stronger movement. This transition to lower carbon materials and ‘zero plastic waste’ presents an opportunity to IPMA bring new partners together to advance posi- We need to adopt the circular economy model, tive environmental outcomes. In the and focus not only on Reduce, Reuse, building sector, we are already seeing Recycle, but also on Redesign, Remainnovations whereby wood fibre «some state nufacture and Refurbish. We need can be used by cement companies to lower their carbon footprint in production; similar innovations are happening in the packaging, fuels, governments in India have banned paper to focus on new and innovative products which can be viable and cost-effective alternatives to products from other industries which and materials space. This presents cup» may not be environment-friendly and some exciting new uses and markets sustainable. For example, some state for wood fibre based materials. governments in India have banned paper So, providing the forums to connect these dif- cups due to their plastic coating, but there are ferent parties, and accelerating public and no alternatives readily available. Unlike other private funding supports to advance these in- types of paper waste, paper cups can be truly novations will be key to maximizing the oppor- biodegradable and recyclable only if these are tunity before us. collected and the plastic coating extracted from IBA developed in some countries, which are stated Brazil has 5,570 municipalities, but only 1,227 of to be fully biodegradable, but are relatively an them are collecting recyclable materials along- expensive option. side trash, according to the Corporate CommitIt may seem simple, but they need to learn that the paper. Bioplastics / biopolymers have been ment to Recycling (CEMPRE). Because of our PAMSA large population (currently over 210 million), we With many government policies, there can be generate large volumes of waste. In other words, unintended consequences. PAMSA aims to work municipalities have to adapt to this reality, offe- with government to ensure these are mitigated.

«Municipalities have to adapt to this reality, offering high-quality, organized, and ongoing recycling programs»

We are also working with public and private sec- ception of renewable fibre-based products. tor to ensure the waste economy falls within a Many businesses are electing to supply recircular value chain approach and that all waste newable fibre-based single use products such is beneficiated. A risk-based approach has been as paper bags, wooden cutlery, and other forest taken to beneficiating commonly beneficiated products as a substitute for plastic products. wastes e.g. ash. Government has recognised that These changes often have legislative drivers. An waste licences can inhibit small entrepreneurs example of this is many Australian states have from using waste and through working with the now banned single use plastic bags. Major Ausprivate sector generators of ash exclusion from tralian supermarket chains and many smaller the definition of waste has been offered provi- retailers have embraced this change. ded the risks are well managed. This will lead to butes. Our products are made from renewable wood fiber sourced from sustainably managed a number of jobs being created. Cepi As a mechanism to strengthening «The Absolutely, it is vital that consumers our value chains, various sectors together with the Department of Trade, Industry and Competition European paper industry shift towards more sustainable products, as that is one of the key steps to decarbonise the economy by are developing Sector Master is in the perfect 2050. Plans to promote sustainable position to respond The European paper industry is socio-economic development to this market in the perfect position to respond and the waste economy will form demand» to this market demand: not only part of these. through the many fibre-based products everybody is familiar with, but also through innovative solutions. Did you know that new ge3. The consumption pattern is changing neration textile made from wood-fibre are also fast in some countries with a demand recyclable and can make also old textiles recyfor more sustainable products. clable? Is it really a game-changer for the Furthermore, we are introducing innovations industry in your zone and how does it in terms of the application of by-products from materialize? our processes. For example, valuable ingredients from lignin can now be utilised to make many imAF&PA plastics, disinfectants, detergents, medication We are confident in the value proposition that and cosmetics, just to name a few. It could even our products offer customers: cost effective be used in the production of batteries, as its strength, visual appeal and functionality com- intrinsic qualities make it a candidate to replace bined with market-leading sustainability attri- graphite. portant products, such as drilling fluids, thermoforests and recycled paper. FPAC We have been trending in this direction for some AUSFPA time in Canada. That said, our federal governThe global phenomenon of consumer rejection ment has put forward a very aggressive agenda of plastic products, and the associated increased in this space and the issue of addressing plastic demand for sustainable fibre-based products waste on land and in water has become a tier helps promote the forest industry within Austra- one priority. lia by recognising its renewable and sustainable What Canadian consumers have been demancredentials. This is changing community per- ding, Canadian retailers and manufacturers

have been responding to. The curve is clearly IPMA accelerating and there is definitely more oppor- Yes, it can be a game changer but only in the tunity ahead. medium to long term and provided people are Beyond setting up the right conversations, we made aware of the facts and we can develop need to turn these science projects into action, innovative and sustainable products. The pado the appropriate de-risking and scaling up. per industry continues to be afflicted with the This takes commitment on the part of govern- misinformed notion that the industry is desments, the private sector, and academia to come troying natural resources. Many other myths together, and we are doing some exciting work in continue to slur the image of the industry. We this space in Canada through organizations like need to aggressively undo this image and presFPInnovations and others. ent the true picture of paper as an environment IBA match the sustainability that paper offers. We are currently in the midst of a green It is fully biodegradable and made from revolution. Consumers are increa- resources which are renewable and singly conscientious, and this is changing their consumption habits as they look for products that are «Consumers are increasingly can be easily regenerated. Paper industry is not only conserving the environment but also regenerating environmentally correct throuconscientious» natural resources. Paper industry ghout the supply chain: from origin has struck a fine balance between through manufacturing to post-use, growth and sustainability, unmatched recyclable and even biodegradable, like by many other industries. This message paper packaging that breaks down naturally in needs to be transmitted to the general public in only a few months. an effective manner. Today this change is even more noticeable when friendly industry. Few industries in India can we see large companies looking for replace- PAMSA ments for fossil-sourced materials like cups, It is indeed a game changer in that retailers are straws, and packaging. But for the future, new looking for alternates to plastic packaging. Desiproducts are being developed from wood like gning for recycling has become more important bio-oils, biofuels, and biochemicals. Nanocellu- than ever. Although consumers are becoming lose has opened up a wide range of applications, more aware of ‘’green packaging” options, green and is already replacing fossil-sourced polyester washing prevails. Particularly around composwith cellulose-fiber textiles like viscose, while table packaging – most is only industrially comnew technologies like microfibrillated cellulose postable and some of it will take many years to (MFC) offer entirely new possibilities. biodegrade. Instead we focus on recycling difficult to recycle products and are curThis is a great opportunity for the industry to position itself as a leader in the bioeconomy, especially in Bra«we focus on recycling rently looking to develop simple equipment for small entrepreneurs to be able to add value to the likes of used zil. Here, 100% of pulp and paper difficult to recycle beverage cartons, ie they can on-sell comes from trees grown for indus- products» as pre-processed pulp to small tistrial purposes; the entire industrial sue mills. process has been thought through to Locally severe drought in some fruitmitigate environmental impacts, and the growing regions and tough economic cliend product is easily reintegrated into the pro- mate have meant that this increased demand duction chain after use. In Brazil, recycling com- for sustainable packaging has not yet translated plements the use of virgin fiber pulp. into increased demand for our products.

«I don’t think there is anything stopping the success of our companies» 4. Is the shift from plastic to fibre-based products already affecting the production and/or import volumes? To what extent?

AF&PA Consumers are showing a lot of interest in sustainable paper alternatives. It is difficult to attribute any specific volume to material substitution, but it is certainly a contributing factor and a trend. FPAC While I don’t have any numbers at this time to quantify the shift in Canada, it is happening. And while the federal direction to move to ‘zero plastic waste’ is definitely bringing more focus to the matter, Canadian consumers have been moving in this direction for years. It is presenting the opportunity for new product development and production in Canada, but also increased imports of products that are not currently in significant production in Canada at this time, like paper straws.

AUSFPA IBA Australia’s forest industry exports «The volume A global movement is underway to fibre which are used to manufac- of fibre exported replace single-use materials with low ture a range of products that are from Australia levels of recycling or which are truly replacing plastic products. The has on average non-biodegradable. In some Brazivolume of fibre exported from Australia has on average increased increased» lian states (such as São Paulo and Rio de Janeiro), plastic straws are already over the past ten years. banned and are being replaced by other Several of the fibre-based alternatives materials with less environmental impact, like for single-use plastic materials are currently paper. It is a great opportunity, as are paper cups, produced overseas and imported into Austra- which are also in greater demand. lia, which is increasing import volumes of these In Brazil we can also see that demand is products. It is expected that as demand for fibre- growing for paper packaging. According to based products in Australian increases, more of Cenários Ibá (the quarterly statistical bulletin for these will be made domestically. the forest-based sector from Ibá, the Brazilian Tree Industry), in 2019 production of cardboard Cepi and corrugated cardboard for packaging grew Indeed we can see a significant shift of interest 2.4% and 2.8% over 2018, respectively. It is imtowards our industry as the provider for alterna- portant to note that most of this growth comes tive solutions in many value chains. We believe from exports, since international sales of cardthe products offered in the wider forest-based board and corrugated boxes grew 10.3% and sector have an important positive impact in paperboard grew 12.3%. helping the society to become fossil-free. Our In addition to increased demand for renewable estimate is that this substitution effect of our materials, this shows the international market’s product can easily be as significant as the car- confidence in Brazilian paper products, which bon sink of the whole European forest, together are certified by the foremost international cercorresponding to 20% of the annual total CO2 tifying bodies and even help other countries emissions in Europe. achieve goals set in climate agreements such as the Paris Accord. Once brand-owners and consumers truly be- Finally, projections of increased population come aware that they can have plastic-free growth should also be taken into account, as this and fossil-free option in the same, I don’t think is expected to boost demand for products made there is anything stopping the success of our from wood. Today we use 3 billion cubic meters companies. of wood per year; in 2050 10 billion cubic meters

will be required. In order to meet this need, the – from consumers to collectors to materials industry is already investing in research to in- processors to manufacturers. Recyclable paper crease productivity and produce more using less and paper-based packaging is collected from chemicals, energy, and land. Recently Klabin (an residences as well as from businesses, schools Ibá member company with more than 100 years and industrial facilities. Residential collection is of history that produces kraftliner) announced accomplished by local governments, private secthat it is moving towards large-scale production tor companies contracted by local governments of the world’s first kraftliner made exclusively or private sector companies that contract with from eucalyptus fiber. This creates lighter pa- consumers directly. Collection from commerpers, which will in turn lead to gains in logistics, cial and institutional locations is accomplished an important attribute to compete with some by private sector companies that contract with plastics. Furthermore, eucalyptus forests have a them. shorter production cycle. Public-private partnerships such as The RecyIPMA vesting in increasing communities’ capacity to In India, the shift from plastic to fibre-based recover more mill-quality recyclable materials products is happening slowly but surely. It is still from residences. early days here and has not significantly impaccling Partnership, which AF&PA funds, are inted as yet the production volumes much. There AUSFPA is an uptake in the demand for paper bags, paper There are several arrangements for the collecstraws, paper food-grade containers and packa- tion of waste paper in Australia. ging, etc., but change in consumer preferences Domestic drop off centres are collection faciliand habits take time. ties located across Australia and enable the community to drop off paper and cardPAMSA «This process board materials, usually at no cost. Producers still need to be proactive creates a This creates a clean source of fibre in the design and manufacture of packaging that reduce the volume of waste generated and make the large amount of contamination» and is easily recycled by a collection of fibre recycling businesses across Australia. waste more recyclable. Kerbside collection is used across Examples include the small tomato many areas in Australia, collecting both boxes that are made of lightweight board with waste and recyclable material. Recyclable a plastic top rather than 100% plastic and the paper and cardboard material are mixed with ultrafine fluting into corrugated board for beer all other recyclable materials and collected by six pack carriers. local government. This process creates a large amount of contamination and can create difficulty in recycling the paper and cardboard mate5. How is the paper recycling process rial that is collected, with contaminated waste organised in your country and what are often ending up in landfill. Separation of paper the levels of collection? Do you see any and cardboard waste from the other classes of potential improvement? recyclables, particularly glass, would improve the ability to recycle paper and cardboard collected in this way. AF&PA Industrial paper and cardboard waste is genePaper recycling in the U.S. is a loosely connec- rally collected directly from businesses and ted but highly interdependent system encom- transported to fibre recycling businesses across passing stakeholders across the value chain Australia.

«Paper recycling in the U.S. is a loosely connected but highly interdependent system»

«The success of paper recycling in Europe should not make us too comfortable»

Cepi and programs across municipalities, across We are the European champion of recycling: provinces, and more active engagement in the paper is recycled in Europe at a rate of 71.6%. In industrial, commercial, and institutional sectors paper-based packaging, the rate is even higher, – all those moves would contribute to greater 84.6%, and in volume paper-based packaging is clarity and an uptick in recycling rates. recycled more than all other packaging materials combined. IBA However the success of paper recycling in In addition to pickup of recyclables by municipal Europe should not make us too comfortable. governments in some Brazilian cities, recycling We believe there is still space to do even bet- is driven by individuals who collect reusable and ter, and we think we can do so in different ways. recyclable materials, which were recognized One way is to capitalise on the new collaborative professionally by the Ministry of Labor in 2002. networks we are developing. Today there are more than 400,000 of these A perfect example is the new value chain alliance professionals throughout Brazil, according to the called 4evergreen. It is a forum to engage and Institute of Applied Economic Research (IPEA). connect industry members from across the fibre- These autonomous workers have the opportubased packaging value chain, from paper and nity to organize themselves into cooperative, board producers to packaging converters, brand- which are encouraged in the PNRS, as a way owners and retailers, technology and material to obtain better working conditions. From this suppliers, waste sorters and collectors, and more. point, the material is separated and paper is sold Its aim is to look at design for recycling, with a back to industry. view to further boost the contribution of fibre- In Brazil, 68% of paper is recycled, one of the based packaging in a circular and sustainable highest rates among all the recyclable mateeconomy that minimises climate and environ- rials. But there is still room for improvement, mental impact. It will deliver a holistic approach since more than 84.7% of corrugated cardboard to optimise the sustainability and circularity of is recovered, while paperboard (which is used the fibre-based packaging’s life cycle. in candy boxes and medication packaging, for example) accounts for less of the paper proFPAC duced and consumed, and depends on proper This is done in Canada at the provincial govern- separation in homes and collection by the muniment level and rules and operations vary from cipalities, unlike cardboard boxes, which are traprovince to province. Actually recovery and pro- ditionally collected by recycling professionals in cessing operations can vary from city to city. factories and retail outlets. While paper recycling rates in Canada are in the Recently, a reverse logistics system was esta70% range, a recent study for the federal blished in the state of São Paulo through the government by Deloitte showed that «Actually São Paulo State Federation of Industries plastics recycling rates were at just under 10% which was quite a surprise to most Canadians – given recovery and processing (FIESP). The main goal of this model is to put post-consumer packaging, which currently is going to landfills, the proliferation of residential recy- operations can back into the productive cycle after cling programs across the country. vary from city use by the consumer; the reverse logisEducation continues to be critical to to city» tics system for packaging involves subsdriving improvement in terms of ensu- tantiation of data and targets by the manuring that the right recyclables are going into the facturers through acquiring recycling certificates right boxes at the curbside of Canadian homes. (CRE). What makes the difference here is the Additionally, and this won’t be easy in Canada, traceability of this process, which will go through if we could see greater alignment on policies a private company appointed as the certifier. Ibá

«A reverse supports the idea that this system adopted in the state of São Paulo should be expanded to all states. logistics system was established addition, the current economic situation in South Africa (and globally) has reduced the demand for consumer in the state of goods and therefore packaging. IPMA São Paulo» According to IPMA estimates, 58% of the total paper produced in the 6. Recycling means recyclability. country is made from recovered paper / recycled How do you address this issue? fibre. Paper collection / recovery mechanism is not very strong in the country, and is largely in the unorganised / informal sector. The estima- AF&PA ted recovery rate is only 38%. As a result, large AF&PA defines “recyclability” as the ability of amount of recovered / wastepaper is being im- a paper-based product to be recycled into new ported into India. Lot of effort is required to boost paper, paperboard or other products. A paperconsumer awareness so that post-consumer based product is recyclable if it can be collecsegregation at source takes place and recovery ted, separated or otherwise recovered from the rate improved. We need to educate right from waste stream through recycling programs for use school children upwards. A concerted effort is in manufacturing or assembling another item. required by all stakeholders, including municipal AF&PA is developing technical guidance for authorities, local government bodies, recovered members of the paper-based packaging mapaper collectors and aggregators, paper mills, nufacturing supply chain to use in designing non-governmental organisations and the like. and manufacturing packaging to meet custoPAMSA nical guidance is intended for voluntary use and South Africa recovered 1.285 million of recy- with a goal of enhancing paper recycling. clable paper in 2018 putting the country’s paper recovery rate at 71.7% – well above the global AUSFPA average of 59.3%. Australia’s paper and cardboard industry supSouth Africa is in the enviable position of being ports sustainable design and recycling initiatives able to use up to 90% of its recovered waste to promote landfill reduction and support circupaper locally by recycling it into new paper, pac- lar economy projects, all of which increases the kaging and tissue. recyclability of the products that they make. PAMSA, through its recycling arm RecyclePa- In addition to this the Australian Federal GoperZA, represents processors of recycled paper vernment is reviewing potential regulations fibre. These companies buy recovered fibre from to ensure packaging made both domestically informal recycling collectors as well as small, me- and imported into Australia is recyclable in dium and larger recycling collection businesses. Australia. Some municipalities have rolled out separationmers’ needs in terms of recyclability. The techat-source programmes. Cepi The market for recovered paper and paper pac- Making sure that our products are perfectly dekaging material has encountered several chal- signed for recycling is one the key best practises lenges in the past years, which has resulted in in our industry. lower demand for this material by the producers 4evergreen is an example of a cross-sectorial and consequently lower rates paid for collected cooperation aimed at boosting recyclability, material. One negative impact in the market was but we of course do not limit our efforts to this the banning of import of wastepaper by China, approach; for instance, for already two decades, which depressed the value of the material. In the European Paper Recycling Council has been

the hub for advancing recyclability in Europe. After our collaboration with the World Economic Forum and Ellen MacArthur Foundation in 2016 on circular design principles, we have also developed, together with converters, new recyclability guidelines for paper-based packaging. They give concrete guidance to designers to ensure functionality goes hand-in-hand with recyclability. With new products and innovations coming to the market, we are also looking into defining the collection and sorting systems to ensure nothing escapes the loop.

FPAC This is so critical. There continues to be a degree of confusion among Canadian households around what materials are actually recyclable and which are not. The first opportunity to address this is for education and awareness building at the community level. In Canada, programs can vary from community to community (what’s collected, which material goes in what box, etc.) Community and household-based education is very important. Likewise, it is important that our packaging innovators and implementers are having conversations with local governments and recovery facilities to ensure that the new product innovations are going to in fact become recycling success stories at the community level. Years ago, I recall seeing examples of polyethylene terephthalate (PET) materials not being recognized by optical readers at certain recovery facilities because they don’t have a ‘neck’. These optical readers had been programmed to only identify PET bottles, so changes had to be made at certain recovery facilities to modify these. This is a practical example that we should take heed of in the wood fibre base – don’t assume just because the properties of your product are recyclable that they actually are. The innovations must meet the practical tests at the community level. Those are words to live by as we consider the next generation of environmentally friendly products and sustainable packaging for Canadians. IBA This is a key attribute for the circular economy and for the new low-carbon economy. We need to rethink our way of doing business, our consumption, and our habits. This is the only way that we can start a movement now to safeguard our future. And this involves a fundamental attribute: recycling. The industry has to invest and create solutions to ensure that products are environmentally correct from their origins, but are also not intended for a single use; in other words, after their useful life they will easily be reincorporated back into the production chain. The end consumer should be able to correctly separate trash, and the government needs to be ready to direct recoverable material toward recycling. Recycling needs to be part of our culture. In this regard, Brazil’s paper industry offers an example to be followed. It involves a renewable raw material, biodegradable products, and a high recycling rate.

IPMA We need to put in place a nation-wide collection mechanism / infrastructure for paper which requires segregation at source and creation of a value chain for collection and disposal of paper and paper products. We also need proper gradation of various categories of post-consumer paper to ensure recyclability. Some of this also requires conducive government policies and rules, and also support, as enablers.

PAMSA Yes, indeed, recyclable means that it can be recycled. However not everything that is recyclable is recovered for recycling. This could be due to apathy on the part of consumers and businesses and a lack of knowledge about what is recyclable. There is also a lack of infrastructure and technology. Municipal waste services are not geared for separation-at-source. In the current waste over-supply situation, materials are not recycled due to lack of demand as is the case with common mixed waste from households. We continuously drive the message around the recyclability of paper and packaging, and how to separate it for effective recycling.