The customer is always right, unless you’re asking the wrong customer.

You ask the right questions.

We find you the right consumers. You get the right answers — fast.

A self-serve consumer research platform that uses behavioral targeting based on first-party data, so you can reach verified purchasers and start seeing results in as little as 24 hours. Get it right.

We showcase the 21 winning campaigns — across 13 categories — that engaged shoppers and drove results.

We recognize 36 female brand marketers, retailers, agency executives and solution providers for their achievements in influencing shoppers along the path to purchase.

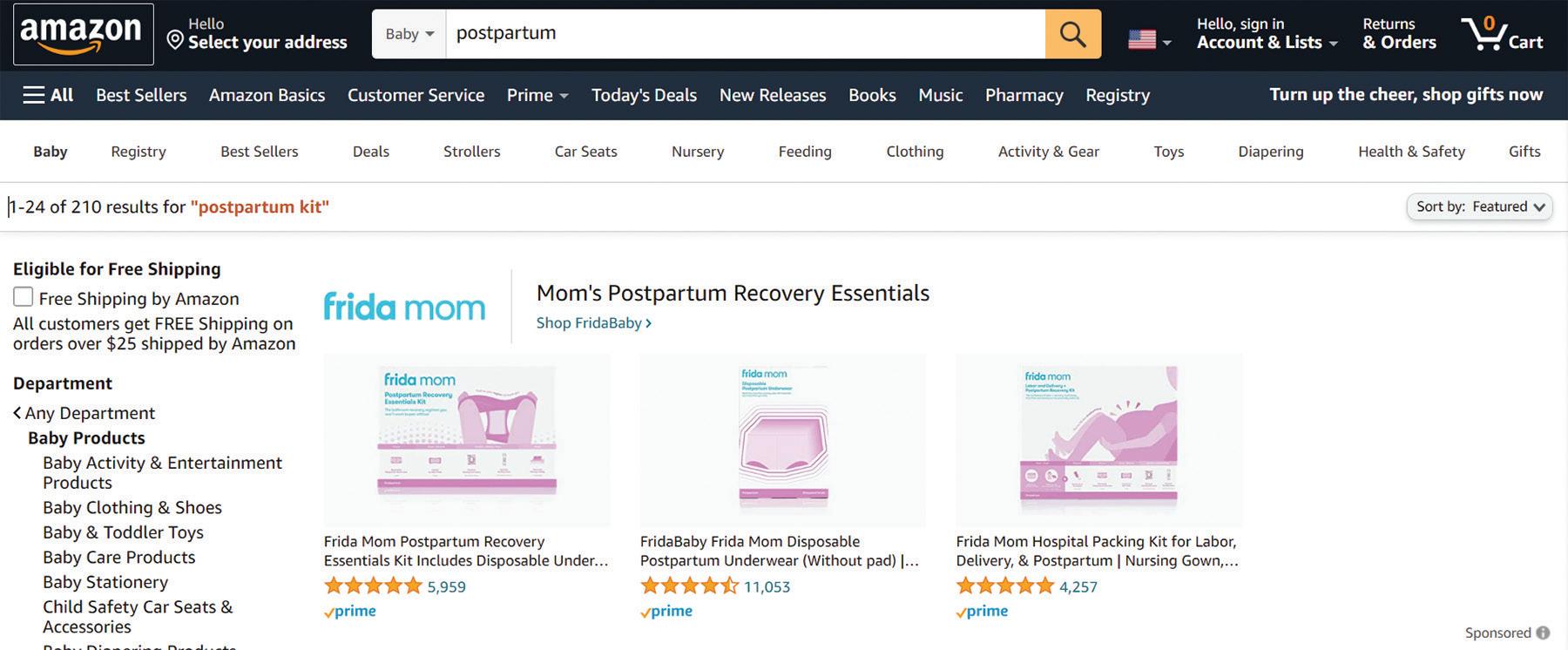

Our exclusive research shows how consumers are interacting with images on Amazon, other retailer websites and social media. (In collaboration with Vizit.)

Path to Purchase Institute magazine (USPS 4568, ISSN 2688-4984) is published bi-monthly by EnsembleIQ, 8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631. Subscription rate for the U.S.: $80 one year; $155 two year; $14 single issue copy (pre-paid only); Canada and Mexico: $105 one year; $185 two year; $16 single issue copy (pre-paid only); Foreign: $115 one year; $215 two year; $16 single issue copy (pre-paid only); $56. Periodical postage paid at Chicago, IL 60631 Copyright 2022 by EnsembleIQ. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher. POSTMASTER: send address changes to Path to Purchase Institute magazine, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631.

With the New Year just around the corner, I feel compelled to reflect on all the changes, successes, challenges and surprises of the last year — both here at the Path to Purchase Institute (P2PI) and across the commerce marketing industry.

We’ve seen fluctuations in the pandemic (from January’s omicron variant surge to a bit of reprieve and fading to the background this fall), which have continued to impact shopper behavior in both expected and unexpected ways. E-commerce is still going strong, but consumers are returning to in-store shopping in droves, reinforcing the need for integrated marketing efforts that connect with hybrid shoppers along every point on the path to purchase. The year has brought economic volatility and uncertainty, inflationary pressure and the rise of emerging forms of commerce (think social/shoppable media, metaverse, Web3, etc.) for marketers to deal with. And, perhaps most exceptionally, the continued proliferation of retail media is still coming in hot.

The year has brought economic volatility and uncertainty, inflationary pressure and the rise of emerging forms of commerce. And, perhaps most exceptionally, the continued proliferation of retail media is still coming in hot.

For P2PI, 2022 brought a whirlwind of transformation as we realigned our brand to keep pace with our industry, members and readers. With that came everything from a refreshed logo, integrated website and magazine name to brand-new, inperson events, newsletters, membership exclusives and more. Behind the scenes, our team spent countless hours reimagining our offerings so that we could continue to serve the evolving needs of our audience. It’s been amazing to see it all come to fruition over the course of the last 12 months — a slow burn, step by step, one foot in front of the other. All those changes along the way have fi nally culminated into a massive, overarching metamorphosis. And we have so much more planned for 2023 (hint: a new video series, monthly newsletter and podcast, to name just a few items from next year’s lineup).

In this edition of P2PI Magazine, we are proud to close out the year on a high note by honoring some of the standout individuals and innovative campaigns — via our annual Women of Excellence Awards and the OmniShopper Awards — that have helped fuel the fi res of industry transformation.

On page 42, you can get to know the 36 executives who make up this year’s Women of Excellence across five categories. And on page 18, you can dive into the 21 winning campaigns that rose to the top as winners in the second annual OmniShopper Awards.

As we wrap up 2022, I want to thank you for being a part of our community of commerce marketers. We can’t wait to connect you, inspire you and propel your businesses (and careers) forward in the New Year. Cheers to 2023!

JESSIE DOWD, Editorial Director

The annual planning process is a time of year when we rethink previous approaches, promising not to make the same mistakes again. Typically, we lament aggressive timelines yet spend hours combing through secondary research to build our strategic approach. And still, we likely only get to surfacelevel audiences, targeted with non-category-specific learnings, that we refer to as “insights.”

What if we approach planning differently then? Systematically leveraging available data sources can increase efficiency and category specificity. But identifying the right data sets, and knowing how and where to involve them, remains a challenge.

Reframing your planning process against the following four key questions enables a consistent approach, while still leaving room to explore human truths and creativity in execution for brands to win their rightful share.

1. Who is the consumer? Build a set of consumer/audience profi les that serve as lanes to journey down at greater depth. Start by investigating your core consumer — both current and potential targets. The current consumer is often where marketers focus, but digging into potential consumers creates new messaging opportunities — and inroads for greater incremental growth. Data sources like MRI Simmons, Global Web Index and other proprietary agency fi rst-party platforms can form the basis of understanding for demographics, psychographics, lifestyle habits and then media touchpoints. These sources also help size current and potential audiences and dollar potentials.

What does the consumer say? Layer on learning from social listening tools like Infegy and Brandwatch, plus ratings and reviews, to get unfiltered, qualitative consumer perspectives at scale. Round out consumer profiles with qualitative research methods, such as focus groups, one-on-one interviews or shopper intercepts, to uncover preferences, attitudes and usages at a deeper level. This helps brands see various consumption moments, and which categories/ brands they consider versus ultimately use for each occasion. Understanding what was ultimately consumed, what was considered and why brands did or didn’t win helps us build winning strategies.

— Michelle Baumann , CommerceHow does our consumer shop? The consumer and shopper aren’t necessarily the same individual, although we often use the terms interchangeably. For example, while Gen Z is a muchcoveted cohort for current marketers, only one-third of Gen Z shoppers are 19-plus years old and act as the primary shopper for their households. The other two-thirds are consumers who heavily influence the actual shopper (i.e., a parent). Investigating the shopper that corresponds with key consumer groups helps answer questions like: What’s in the basket? What’s the average trip frequency and trip type for this shopper? Where are they shopping and cross-shopping in terms of retailers and channels? Comparisons in shopping behavior can identify gaps, ultimately unlocking ways to fi ll them.

Why buy? Finally, once we know the who (consumer or shopper), the what and the how, the final step is to get at the whys and why nots. Proprietary quantitative research studies can dig into these whys (triggers) and why nots (barriers) to category or brand usage today at scale. By creating look-alike segments against your initial consumer/ shopper targets in your research study, you can tie together the above questions to clearly view your target and uncover ways to win. It’s important to discover unmet needs at a foundational level for any given consumer/shopper group, to strategically build the right moments, timing and messaging as you move to campaign execution throughout the year.

Using the insights from these questions will ensure one cohesive, strategic growth plan driving better outcomes for your category and brand.

Michelle Baumann is the chief strategy officer at VMLY&R Commerce. In her role, she has supported the transformation of the business with the creation of a next-generation strategy team, uniting the agency’s brand experience and marketing sciences teams under a single capability to create a collaborative, holistic insights team.

2.

Reframing your planning process against the following four key questions enables a consistent approach, while still leaving room to explore human truths and creativity in execution for brands to win their rightful share.

VMLY&R

BY CYNDI LOZA

BY CYNDI LOZA

October marked the five-year anniversary of the launch of Kroger’s retailer media network, Kroger Precision Marketing (KPM). The Path to Purchase Institute recently chatted with Cara Pratt, senior vice president at KPM, to discuss the state of retailer media networks, data and measurement, and advice for marketers getting into the retail media game.

P2PI: You helped launch KPM in 2017. What was it like in the beginning versus today?

Pratt: The world has changed in five years. People shop differently, work differently and consume media differently. We started our retail media offering as a small, passionate team with expected retail media products. Today, we have hundreds of colleagues influencing a suite of top-rated, full-funnel retail media solutions that thousands of brands are investing in to deliver business impact. Our media capabilities touch every point of the shopping journey — most recently adding programmatic connected TV (CTV) into our self-serve portfolio.

P2PI: Considering the rise of e-commerce grocery adoption, fueled by the pandemic, and Google’s plan to end third-party cookie tracking, is retail media just table stakes now for brand marketers?

Pratt: Yes, retail media is foundational for marketers. It goes beyond the digital shelf, which is increasingly important — even for influencing in-store sales — and into influencing equity and inspiration off retail properties. Put simply, retail media is shaping new and higher performance standards in brand advertising. Marketers have always wanted their advertising to be more effective and less wasteful. Now, retail media makes that possible by influencing the right households and then measuring sales impact. You can strike the right balance for media efficiency and effectiveness — and now more than ever, it’s critical to do so.

P2PI: Limited access to data and reporting is the biggest challenge brand marketers are facing with retail media. Do you expect this to improve or will it be dependent on the network?

Pratt: It will vary depending on the capabilities of the retailer. There is a reason eMarketer has declared retail media as the third wave of digital advertising, and that’s because of the accountability we can bring forward assessing media impact. No doubt there’s an opportunity to establish standards for measurement practices centered on business outcomes (i.e., sales incrementality and household penetration gains) as an important bridge beyond the media metrics evaluated today.

We have been focused on influencing this change and elevating practices in the industry since we launched KPM five years ago. With our popular loyalty program that connects to 96% of sales, we have a rich view of consumer behavior and a direct way to measure impact of advertisements. For example, marketers using our programmatic private marketplace receive daily sales results so they can optimize campaigns against in-store sales. The connectivity with brands will only get better from here.

P2PI: Can you share some campaign success stories? What are the ingredients needed to create a great retail media campaign?

Pratt: What has been exciting for us is seeing how our data science can be applied to helping brands grow beyond existing shoppers. For example, today 42% of people clicking on Kroger product listing ads are new to the brand. And the impact of our data science extends beyond our own e-commerce property. We’ve been working with Roku for over two years — allowing advertisers to tap our data science for audience targeting and measurement. On average, advertisers using our data on Roku see a 5.7% median sales uplift and 8.1% median household uplift.

As for ingredients, it’s important to recognize that not all data is created equal. Even firstparty data gets old. Data can be narrow, stale, unstructured. It’s important to have highly curated and collected data in standard formats that is current, expansive (spans categories, brands, attributes) and predictive. It’s equally important to have strong practices in how data is analyzed; humans can’t decipher the best combinations of variables — machine learning is necessary.

Editor’s Note: The full, extended version of this interview is available on P2PI.com. And be on the lookout for our new video series, “Retail Media Unplugged,” debuting in 2023!

CVS Media Exchange™ leverages purchase behavior data from our 78 Million Loyal ExtraCare® customers to deliver targeted, relevant campaigns that glean actionable insights and drive results.

Recent research from Bazaarvoice shows that the line between online and offl ine shopping continues to blur. Based on a survey of more than 6,000 shoppers around the world and more than 400 retailers, the company shared the following key takeaways:

• Most consumers seek out multiple touchpoints when making a purchase decision.

• Shoppers are influencing other shoppers through usergenerated content (UGC) at all stages in the purchase journey, with social media playing an increasingly important role in discovery, research and conversion.

• Two-thirds of consumers prefer omnichannel shopping. Sixty-six percent of shoppers said they feel happiest with a hybrid of both in-store and online shopping, while 25% said in-store and 8% said online.

• A generational gap in behavior exists. Most consumers ages 25-34 enjoy a hybrid of shopping methods (75%), and just over half (56%) of those ages 65 and older prefer a mix of both in-store and online.

• Almost two-thirds of shoppers use their smartphone instore to look at price comparisons (69%), product reviews (60%), advice from friends/family (33%) and product demonstrations (30%).

• Shopper voices and verified reviews power commerce. UGC makes up seven of the top 10 types of research shoppers prefer to utilize before buying (e.g., product ratings, written reviews from verified buyers, expert reviews, questions and answers, recommendations from friends/family, shopper photos of the product and visual reviews from verified buyers).

• Online research is universal. Both online (79%) and in-store (59%) shoppers conduct research online prior to purchasing.

• Social media increasingly influences shoppers. One in five consumers shop on social media, including via Facebook Shops (41%), influencers’ Instagram Stories (37%) and sponsored ads on Instagram (36%).

Another social platform influencing consumers is shortform video sharing app TikTok, which reportedly registered its billionth user last year and is estimated to grow to 1.8 billion users by the end of 2022.

“TikTok is no longer the channel for teenage dance

$900M $800M $700M $600M $500M $400M $300M $200M $100M

of TikTok users have a household income of $100k+

Source: Zaza Digital TikTok Consumer Spend

challenges as people tend to believe,” said Vladimir Bestic, CEO and founder of TikTok ad agency Zaza Digital, in a news release. “It has become the most powerful advertising channel because of its explosive user growth and high levels of consumer spending and engagement.”

Some recent research fi ndings outlined by Zaza Digital indicate that:

• TikTok is not just for connecting to a younger audience. More than 55% of users are 25 or older while 37.90% are 35 and older.

• In the U.S., the number of users has risen to 186 million, or 56% of the population.

• As for consumer spending, 37% of users have a household income of more than $100,000 and 9.6% have less than $25,000.

• Users are highly engaged, spending an average of 45.8 minutes on the app per day.

• Hashtag #TikTokMadeMeBuyIt currently has 15.7 billion views on millions of videos where people showcase products they bought on TikTok.

• TikTok Ads can be cheaper than other social platforms, with a cost per thousand impressions (CPM) just above $6 versus $12.57 for Facebook ads.

• According to Statista, TikTok generated $4 billion in advertising revenue in 2021, a figure that is expected to double by 2024 and triple by 2026.

- Commerce Marketer for a Global CPG Company

To learn how Marilyn can help you make better decisions, create connected experiences and deliver stronger results, visit meetmarilyn.ai

“ ”

The amount of programming we’re measuring is probably 4-5x what we were measuring before and we’re probably measuring it in about 1/3 of the time.

Shoppers no longer confi ne their quick trips exclusively to convenience stores. Instead, they are utilizing all channels for this shopping occasion, says Kate Garner, senior vice president of marketing at PepsiCo’s Demand Accelerator.

In this Q&A, Garner shares how shopping behavior has evolved and what her organization is doing to meet the moment.

P2PI: What are PepsiCo’s data and insights resources saying about the current state of the shopper?

Garner: Everything we do at PepsiCo is rooted in consumer trends. Through Pepviz, our proprietary data practice, we bring together real-time data and analytics coupled with industry expertise to assess the holistic shopping behavior of retail consumers across channels. We then share these insights with our retail partners, so they can make data-driven decisions. With such increased competition, it’s crucial that retailers understand the needs and motivations of their consumers and cater to those effectively.

We currently see shoppers falling into six categories: engaged enthusiasts, health-focused shoppers, price-sensitive shoppers, habitual shoppers, infrequent indulgers and lastresort shoppers. Each shopper possesses a unique set of needs. Given these insights, we are laser-focused on innovating around these consumer needs and working with our retail partners to optimize their business to meet consumers without sacrificing choice.

P2PI: What role does artificial intelligence (AI) play when you assess your brand elasticity?

Garner: We take a consumer-centric approach, leveraging AI and various other data collection methods to assess opportunities for growth and innovation across our brands. Since this gives us a complete view of consumer behavior, we are able to understand the wants and needs of our consumers. We use that information to make strategic decisions for our brands when it comes to partnerships and expansions.

P2PI: What are some recent innovative product offerings from PepsiCo?

Garner: We strategically innovate in accordance with consumer needs. This has led us to invest in and create various

new food and beverage offerings this year to add to PepsiCo’s already vast portfolio. Recently, we announced Fast Twitch, which is the first-ever caffeinated energy drink from the makers of Gatorade. It features 200 milligrams of caffeine, electrolytes and B vitamins to help athletes prepare for physical activity and ignite performance.

“Hot & Spicy” continues to be the largest and fastest-growing segment across PepsiCo’s salty portfolio. We’re continuing to launch new innovations in that category that we expect to strongly resonate with Gen Z’s diverse palate.

Finally, we plan to make Doritos Sweet Tangy BBQ a fulltime offering in 2023.

P2PI: How can retail media networks enhance CPG/ retailer partnerships?

Garner: Retail media networks can play a role in fostering and growing CPG/retailer partnerships by giving brands and retailers a platform to connect with consumers and optimize their relationships with them. Through our Pepviz insights, we found that 61% of consumers’ media time was spent in digital channels last year. Due to digital media’s accessibility, consumers expect a more personalized experience, with 87% of them saying it’s important to buy from brands or retailers that understand them. At PepsiCo, we partner with retailer media networks to enhance their media and data capabilities by identifying opportunities and scaling audiences, ultimately driving ROI.

P2PI: How are you using data to satisfy consumer preferences in the convenience retail channel?

Garner: We can identify consumer behavior and shopping preferences through Pepviz. Then we empower our retailers with that information to effectively cater to different shopper segments, optimize e-commerce options and drive customer growth.

Currently, we see a transformation in the quick-trip segment as consumers diversify their shopping channels, seeking anything that can offer them a fast, simple and frictionless experience. We’ve taken a close look at the different types of quick-trip shoppers and their corresponding motivations and preferences for factors such as daypart, checkout experience, e-commerce and more.

We are equipping retailers with the actionable insights and tools needed to turn data into growth solutions.

PlantX Life, a Canadian plant-based food and lifestyle startup that also operates an e-commerce platform, officially debuted its XMarket retail concept this past July in Chicago’s Uptown neighborhood after quietly opening months prior with order fulfi llment. It is PlantX’s second store in the U.S. and sixth location globally.

The Path to Purchase Institute visited the 6,000-square-foot vegan bodega, which was rebranded from a Peter Rubi grocery store after being acquired by PlantX. Located at the floor level of a high-rise apartment complex, the store sells only plant-based products and employs few associates.

At the time of our visit, the store was under construction, notably reducing the size of the retail area. The store’s product assortment includes pantry items, packaged home goods like cleaning supplies, health and wellness products such as protein powders, a liquor assortment, and refrigerated beverage and food items via multiple cooler displays.

One entrance was closed due to construction, so all shoppers entered through a side door to fi nd one associate-assisted checkout lane next to two self-checkout lanes in the front of the store. (Another two are located in the back.) A four-way display near the checkout stocks individual impulse-buy and grab-andgo options, including snacks and candles.

Behind the checkout area, the store offers a self-serve vegan ice cream machine next to a rack of boxes doling out single packages of chocolate candies on one side. On the other side, a small section of freezers stocks frozen goods.

A few aisles stock dry goods, and include endcaps dedicated to product categories, such as teas and coffee as well as pasta sauces.

In the back, a long, refrigerated wall display features vegan milk brands and a wide array of individual beverage options, such as Kombucha and unique wellness drinks from emerging brands.

While the store is full of national brand products, there wasn’t much branded marketing activity — at least not yet. We spotted a single wall display comprising case stacks and individual cartons of Just Water, affi xed with two paper signs touting a slightly lower price than at other stores.

While PlantX is hoping to expand the XMarket footprint in the U.S. in the future, this location is also growing. A store associate told us the idea is to keep the retail market portion small — with the addition of a plant-based meat counter in partnership with Very Good Butchers — and to build a food hall on the other side with permanent vendors, 300+ seats and a full-service bar.

BY MICHAEL APPLEBAUM

BY MICHAEL APPLEBAUM

The Path to Purchase Institute, in partnership with presenting sponsor 84.51, unveiled the winners of the second annual OmniShopper Awards on Oct. 20 at P2PI LIVE in Chicago. The OmniShopper Awards program is the only program designed to recognize excellence in shopper engagement across the entire path to purchase, from newer tools like retail media networks and social commerce activations to traditional methods such as in-store displays and on-shelf signage. The program shines a spotlight on the effective activation of touchpoints both separately and as part of more comprehensive campaigns designed to reach shoppers at all stages of their purchase journey.

There were 21 winning campaigns in 13 categories this year. Read on for details about the 2022 winners …

Campaign: Skittles Pride It Forward at Walmart Brand: Skittles (Mars Wrigley) Retail Partner: Walmart Agency/Solution Provider: The Mars Agency

Director, BarillaSkittles prides itself on being the favorite candy brand of Gen Z consumers, nearly three in four of whom believe that brands have a responsibility to stand up for social causes. Notably, LGBTQ rights are considered a top-five issue among this group.

Skittles’ annual “Pride It Forward” campaign at Walmart began in 2020 as a way for the Mars Wrigley brand to celebrate Pride month and allow the colors of the Pride rainbow flag to take center stage. A limited-edition Skittles Pride Pack with gray-scale packaging and all-gray candies was the centerpiece of a partnership that included a $1 donation with each Skittles purchase (up to $100,000) to GLAAD, the LGBTQ media advocacy organization.

Although the inaugural campaign achieved strong results, some shoppers were confused as to why Skittles packages were missing their iconic rainbow colors. In year two, the Skittles brand team worked with six LGBTQ artists to design original Pride packages to be sold nationally in place of the all-gray designs, while Walmart spotlighted the package design from artist Mia Saine for exclusive content and artwork showcases. Her work was featured in the retailer’s online advertising and on a brand page (Walmart.com/ SkittlesPride), where visitors could learn more about the artists and advocacy program.

In 2021, Walmart more than tripled chainwide distribution to 4,700 locations and provided incremental added-value digital media on Walmart.com. In 2022, the retailer worked with the Mars Wrigley team to drive stronger engagement with its own associates. The 2022 program was on track to surpass the previous year’s total of 577 million shopper impressions, which contributed heavily to the 1.5 billion total impressions of the national program. `

Waights Vice President, Shopper & Customer Marketing USA BeiersdorfDebbie

Zefting

Shopper Strategy and Engagement

Consumers are grocery shopping online more than ever. The path to purchase continues to evolve as omnichannel shoppers have warmed to the convenience of filling their digital shopping carts at home, then either going to the store for pickup or scheduling a delivery.

At 84.51°, we leverage our deep understanding of consumer and purchase behavior, both in-store and online, to uncover insights into the new hybrid shopper and build actionable strategies for growth.

Hybrid shopping refers to consumers who use both e-commerce and in-store shopping modes to get their groceries, although not necessarily in the same trip. Hybrid shopping has been growing in popularity over the past several years, spurred by the convenience of e-commerce. However, consumers exist across a spectrum of adoption — from the Digital Dabblers who still go in-store for the majority of their trips, to the Digital Champs who now go online 75% of the time.

As more shoppers integrate e-commerce into shopping routines, they are developing stronger preferences about what trip missions they prefer to complete in-store vs. online. In-store still holds the first-place spot as the preferred method of fulfilling the “main grocery” trip among hybrid shoppers, but with a slim margin.

When pickup shoppers visit the store on the same day as placing an online order, four out of 10 say they’ve done so because they forgot to add something to their online cart.

However, the more comfortable an online shopper gets, the less likely they are to need to go in-store. The percentage of online orders accompanied by an in-store visit drops from 26% among Digital Dabblers to a mere 7% among Digital Champs. This highlights the importance of consumer confidence in driving adoption.

Digitally influenced shoppers appreciate the ease and convenience of digital coupons. And shoppers utilize digital coupons even more during the holidays compared to the rest of the year, as shown here. Brands and retailers have an opportunity to give consumers the gift of inspiration and value through e-commerce experiences this holiday season.

Living large online: The “main grocery trip” rules. While people shop in-store for a variety of trip needs, e-commerce is predominately leveraged for stock-up trips. Nearly eight out of 10 online orders for pickup, and 65% of online delivery orders are now large-cart buys (18-plus items), compared to only 30% of in-store transactions.

Small e-commerce baskets often fill urgent needs. When shoppers do make small pickup and delivery orders, they are often to fulfill very specific household needs. Small pickup orders tend to include baby essentials, such as formula, diapers and wipes. Small delivery orders often comprise either family/household essentials or entertaining essentials, such as baby items, pet food, toilet paper, alcohol, beauty products and flowers.

Omnichannel grocery shopping is in a pivotal growth moment. Now is the time to understand how evolving shopping behavior is impacting your consumers and brands, while also developing products and experiences that meet consumers where they’re shopping today.

ABOUT THE AUTHOR: As vice president of strategy and acceleration for 84.51°, Barbara Connors is an innovator, problem solver and strategist for Kroger and many of the most recognizable consumer packaged goods companies in the global grocery retail industry. She is responsible for long-range innovation planning and near-term, go-to-market strategy for 84.51° Insights. Connors brings customer-centric thought leadership to the industry and supports acceleration of 84.51°’s entire alternative profit portfolio by driving strategic alignment between Kroger and 84.51°’s 1,000-plus CPG clients.

Download our omnichannel whitepaper to read the complete report.

Brand: Sour Patch Kids (Mondelez International)

Retail Partner: Circle K

Agency/Solution Provider: Phoenix Creative

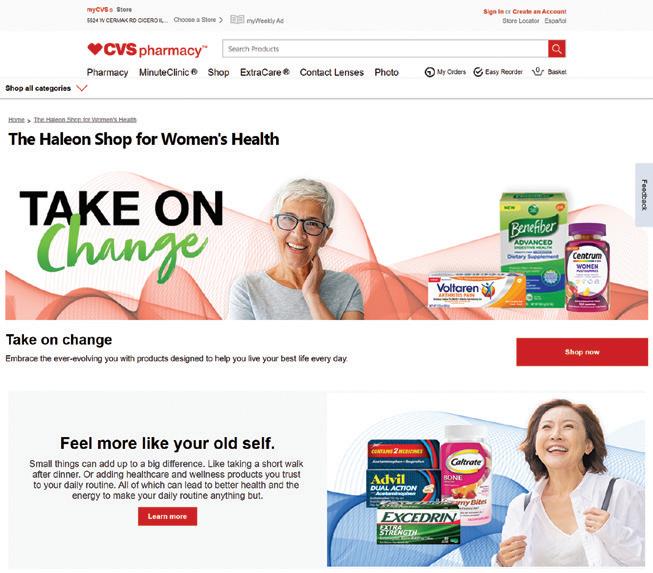

Brand: Dove (Unilever)

Retail Partner: CVS Pharmacy

Agency/Solution Provider: Arc Worldwide

In the spring of 2021, the lingering influence of the pandemic was dampening sales and foot traffic at convenience stores. At the same time, Mondelez International’s Sour Patch Kids (SPK) brand was facing stiff competition from other nonchocolate candy brands in a crowded environment.

With overlapping Gen Z and Millennial core consumers, Sour Patch Kids and Circle K developed a mystery-themed “Secret Circle” program to engage shoppers at Circle K stores. The promotional centerpiece featured a mystery flavor Sour Patch Kids pack with a limited-edition SPK mystery flavor Polar Pop in a buy one, get one for $1 combo available only at Circle K.

Notoriously averse to traditional marketing, Gen Z and Millennials found a compelling twist in the Circle K program. SPK Mystery-themed creative invited every shopper to guess the mystery flavor, blanketing stores on signage, gas pumps, exterior signs, window clings, fountain beverage machines, shelf talkers and front-counter mats.

Meanwhile, “LIFT” checkout screens featured awareness media and an upsell offer to add SPK to the basket. Consumers could also earn points with SPK purchases and redeem them for prizes in a sweepstakes contest. In addition, a national geo-targeted digital program with high-impact ad placements and mystery-themed creative helped reach onthe-go shoppers.

The Secret Circle at Circle K program generated impressive sell-through and incremental sales that were well above expectations for both Sour Patch Kids and the overall category.

CVS’ beauty and personal care trips have been declining for some time, in part because shoppers primarily associate the retailer with health, a perception further fueled by the pandemic. In fact, 78% of CVS shoppers’ annual spend in the beauty and personal care categories is not at CVS.

Unilever’s Dove brand set out to change this dynamic at CVS. The brand’s research uncovered a crisis in confidence among CVS shoppers, who faced a challenge in consistently expressing positive self-esteem. On the flip side, simple selfcare activities like showering or styling hair could counteract self-consciousness, with 83% saying they feel more confident when they participate in a beauty or self-care routine.

“Positively Real” was based on the idea that Dove’s shampoo, deodorant and body wash products could be used as tools to empower self-love. The campaign celebrated the beauty of unretouched models in its creative and encouraged consumers to post and share unfiltered photos, using the hashtag #DovePositivelyReal. Social media micro-influencers promoted a Self-Love sweepstakes and linked their posts to a custom CVS Brand Shop page on CVS.com.

Digital CVS circular ads and off-site/on-site CVS media drove e-commerce traffic to the online environment. In stores, eye-catching endcaps and shelf-talkers engaged shoppers with positive mantras like “confident and capable” and “I can and I will” that were featured across all campaign touchpoints.

Dove portfolio sales exceeded expectations for the program, up 18.1% in unit sales, while display was secured in a total of 1,620 CVS stores. Positively Real generated a total of 11,148,026 impressions, driving increased engagement of both Dove products and the overall beauty category.

Campaign: Mazda Retail Go-To-Market

Brand: Mazda Retail Partner: Mazda dealerships Agency/Solution Provider: VMLY&R Commerce

Campaign: Demogorgon Surprise

Brand: Energizer Retail Partners: Amazon, Walmart, Target Agency/Solution Provider: Grey

For the past three years, Mazda’s overarching business goal has been to sell more cars with less marketing investment. Part of its strategy to increase marketing effectiveness and efficiency was to leverage first-party data in order to improve ad targeting across the shopper journey.

Working with The Trade Desk, Mazda curated audiences using data from MazdaUSA.com and passed the information to dealer websites to enable retargeting. It also used the data to model first-party lookalikes that strengthened the quality of leads among “intender” Mazda buyers. Those audiences were served messages at the start of their journey, vehicle attributes mid-journey and conversion-driving offers latejourney, effectively pushing them down to the dealer. This dramatically improved the quality of the traffic hitting dealers’ physical and digital showrooms, leading to much higher sales and greater marketing efficiency.

In addition, by minimizing duplication between brand and dealer marketing, Mazda successfully expanded reach and message frequency to new prospects. The company prioritized engaging audiences on CTV devices to establish Mazda’s presence and to enter the customer consideration set, leveraging digital video/audio and paid social to increase campaign reach and frequency, and to maximize the use of Mazda first-party audience.

Participating dealers in the “Retail Go-To-Market” program reported 35% higher increase in year-over-year sales than non-participating dealers, while dealer media activity became eight times more efficient from piloting to roll out. Dealer engagement increased, and within one full year (September 2020 to August 2021), $24 million in total dealer funds had been redeployed into the Mazda ecosystem.

To capitalize on the excitement of “Stranger Things” season four, Energizer launched a limited-edition Demogorgon hunting flashlight, named after the underworld creature from the original season of the Netflix drama-horror series. The collector’s item became the focal point in a digital/social campaign that encouraged shoppers to “Hunt Demogorgons.”

Energizer leveraged “Stranger Things” fandom with teasers for the show delivered across social media and e-commerce sites, including Amazon, Walmart and Target. Flashlight performance standards for both basic and enhanced creative were turned into “Dungeons & Dragons” stats; unique “Stranger Things” elements were served up as challenges; and season-related benefits were playfully executed. Those teasers’ interactivity got people talking, exploring and sharing their new collector’s items.

Energizer relied on user-generated content to drive awareness and sales both in store and online. Creative was designed to answer questions and tease moments in the upcoming season to encourage fans to share their experiences with the community on sites like Instagram, TikTok and Reddit. Fans created, sought out and engaged with this content, piling up organic impressions and driving exceptional results for the campaign.

Energizer sold all 4,000 units within the first 4-6 weeks after launch, which led to out of stocks on Amazon due to the high sell-through. Thousands of user-generated stories and millions of social impressions and engagements were created during the campaign.

Don’t waste marketing dollars delivering ads to people who have already purchased what you’re selling.

Optimize your campaign in-flight and only advertise to people who are ready to buy now.

Verified Purchase Optimization powered by IRI helps CPG brands deliver digital media aligned to every individual’s purchase cycle.

Learn more at epsilon.com/VPO.

Scan to watch the video.

Brand: Nature Valley (General Mills)

Retail Partners: Kroger and affiliates

Agency/Solution Provider: VMLY&R Commerce

Brand: Oreo (Mondelez International)

Retail Partner: Target Agency/Solution Provider: VMLY&R Commerce

Nature Valley granola bars had been experiencing sales declines at Kroger stores since 2019. One of Nature Valley’s longtime partners, The National Parks System, was also seeing its lowest visitation numbers since 2015, with Park attendance down 25%.

To gain relevancy with modern families and tap into the desire of Kroger shoppers to bring more adventure into their lives, Nature Valley created a first-of-its-kind, commerceenabled experience leveraging a historic U.S. Mint initiative: The America the Beautiful quarters collection. The unexpected partnership turned 19 billion everyday money pieces into savings on a favorite snack brand, Nature Valley, and outdoor adventures at 56 of America’s National Parks.

Kroger shoppers were driven by omnichannel media to an AI-powered experience on AdventureQuarters.com, where they could scan any one of their special-edition America the Beautiful quarters found in their pockets or coin jars at home. The quarters acted as tokens allowing users to engage with an interactive map to learn about the National Parks, to enter to win a National Park pass to promote tourism and conservation, and to obtain a discount on their favorite Nature Valley products at Kroger and affiliate grocery retailers.

Surrounding media consisted of 11 separate touchpoints ranging from Kroger emails and exclusive coupon offers to TV retargeting, animated paid social, travel-focused influencers, animated mobile display ads, and in-store print signage with a scannable QR code.

Nature Valley saw a 26% increase in dollar sales lift at Kroger stores during the eight-week campaign (April to May 2022), which facilitated close to 300 new trips to visit the National Parks, more than 50% more people than the campaign goal.

In 2021, consumers were still craving Oreos during times of comfort, but were increasingly looking for ways to reconnect with people and have fun. Mondelez International needed to develop an e-commerce play for Oreo’s Pokemon partnership at Target that could leverage the nostalgia and crossgenerational love of the brands while driving sales of online sales of limited-edition Pokemon Oreo packs at Target.com.

“Oreo Pokemon Adventure” played into the iconic videogame’s “catch ’em all” mentality by using animated social posts to tease the 16 different Pokemon characters — which came emblazoned on the package and embossed on each Oreo cookie — that could be “captured” by purchasing multiple packs of Oreos as part of the limited-edition launch.

At the same time, Target’s Bullseye banner ads drove shoppers to a custom Pokemon microsite and harnessed the power of nostalgia by asking them to take part in a quiz to gauge their Pokemon expertise. Additionally, Roundel media served animated ads on both Facebook and Snapchat that asked viewers to guess which Pokemon embossment was featured on the Oreo cookies. These targeted ads drove shoppers to the product listing on Target.com where they could add direct to cart for themselves or for their kids.

Limited-edition Pokemon Oreo cookies achieved $255,000 in e-commerce sales during week one, with 31.5% of all sales online, which was more than nine times higher than the next SKU in the cookie category. Pokemon Oreo eclipsed Game of Thrones Oreo as the highest one-week dollar sales total for any snack item ever at Target.

Brand: Allegra (Sanofi)

Agency/Solution Providers: PureRED, Havas, Lippe Taylor

In fall 2021, Allegra launched a new campaign platform, “Live Your Greatness,” which showcased allergy sufferers feeling unrestricted and living on their own terms. For spring 2022, PureRED recommended extending the platform to include a sweepstakes contest that could significantly increase consumer engagement and sales.

The #LiveYourGreatness promotion encouraged users to post a picture or video on Instagram and Twitter platforms that showed off their “greatness” outdoors without allergies holding them back. Sweepstakes participants (on AllegraLYGSweeps.com) entered the tags #LiveYourGreatness and #AllegraSweeps for chances to win weekly first prizes or the grand-prize trip anywhere in the continental U.S., up to $10,000, and first prizes for outdoor related e-gift cards from participating merchants such as Visa, Amazon, Bass Pro Shops, Cabela’s Columbia Sportswear, Dick’s Sporting Goods and REI.

The promotion targeted current users and competitive category buyers for whom the #LiveYourGreatness sweepstakes would fulfill their desire to share how they are unencumbered by allergies and are living their greatness every day. Multiple advertising and promotion channels were utilized to build awareness of the sweepstakes, including social media, online videos, display ads, social influencers, broadcast TV tags, paid search and national FSIs.

Allegra’s #LiveYourGreatness sweepstakes was an effective complement to the brand’s existing marketing program and contributed to a 7.4% year-over-year sales lift. The promotion exceeded all major KPIs, which included 238,000 microsite visits, 4,330 sweepstakes entries and a total of 1 million brand engagements.

Brand: Oreo (Mondelez International)

Retail Partner: Target Agency/Solution Provider: VMLY&R Commerce

Mondelez International needed to reverse the recent dip in Oreo sales and overall cookie category consumption at Target. Determined to re-engage Gen Z and Millennial shoppers with young children, it landed on a central theme “to take back Oreo” via an augmented reality (AR) experience.

“Oreo Stuf Scan” reinforced the idea that Oreo owned black-and-white iconography in popular culture. Here’s how it worked: Shoppers were invited to go to StufScan.com and upload images of black-and-white items (namely, the Oreo-inspired sneakers that Oreo cheekily says have been “hijacked” from the brand) in order to unlock a QR code for a fun AR experience that included a digital coupon offer for a 2-for-1 purchase of packs of Oreo cookies.

The experience was promoted through targeted push notifications and on-site/off-site Roundel display and search banners to drive awareness. An out-of-home billboard including a QR code also promoted the Stuff Scan experience. Influencers drove awareness on Instagram and TikTok and linked to the experience from their content, while paid social ads amplified the program.

The campaign resulted in increased Oreo sales and overall cookie category sales at Target. The offer redemption rate was over 50% during the promotional period, and the mobile push notification resulted in 29,000 engagements (nearly 2% above benchmark). The microsite received one view every 15 minutes throughout the duration of the campaign. Influencers saw an engagement rate of 13.4%, with 31,000 engagements.

Brand: MilkPEP (Milk Processor Education Program)

Retailer Partners: Various Agency/Solution Provider: The Mars Agency

Campaign: A Publicly Pubic Story

Brand: Gillette Venus Feminine Intimate Grooming (Procter & Gamble)

Retail Partners: Walmart, Target, Walgreens, Kroger, Meijer, regional food Agency/Solution Provider: Grey

At the start of 2022, MilkPEP (Milk Processor Education Program) set out to increase fluid dairy milk sales and modernize the perception of milk as a performance beverage for active lifestyles. Needing to stand out on shelf in a sea of non-dairy alternatives, MilkPEP decided to align milk with a modern technology that would appeal to young moms and their kids.

“Make the Trade” welcomed consumers into the futuristic world of non-fungible tokens (NFTs), a blockchain-powered cultural phenomenon that allows people to “own” digital assets such as videos, GIFs, images and even tweets. Three exclusive NFT cards were developed in partnership with NFL football players and sports card manufacturer Panini, with a unique feature allowing the NFTs to digitally rotate to show more content by employing both sides of the card.

An instant-win game and sweepstakes gave consumers the chance to win the cards by engaging with a dedicated interactive microsite. Activation included on-pack milk labels, in-store shelf signage, mobile push notifications, digital addto-list apps, shopper-rich mobile ads, digital native display ads, and organic and paid social media. Additionally, in-store signage placed in the milk aisle and e-commerce ads on Instacart’s digital shelf helped drive direct conversion.

Milk sales increased by 591 incremental gallons per 1,000 households during the 15-week promotional period. Impressively, 100% of the total sales volume lift reflected increased sales by existing buyers versus new buyers, indicating that households already buying milk were consuming and repurchasing at a much faster rate.

Gillette Venus was launching a new line of razors intended for the pubic area, an aspect of personal grooming that is rarely talked about openly in society. Despite progress in female body positivity, the pubic area is still stigmatized, and most women resort to using slang terms when referencing it.

Thus, in order to secure broad retailer acceptance of the entire product line and drive sales of the products, Venus created an omnichannel campaign to help destigmatize the subject. The brand featured “pube positive” messaging in various channels and platforms, including in-store merchandising, social media posts and optimized digital assets.

Venus also developed a Feminine Intimate Grooming (FIG) toolkit for P-O-P displays and social commerce. Retailers were required to accept the shelf tray and full portfolio of merchandising tools, which allowed the brand to communicate its message and deliver maximum product benefit to the shopper. FIG provided clear messaging at shelf and assisted shoppers within an area not typically discussed in the in-store environment.

Venus FIG was a success on all fronts. The campaign contributed 56% of Venus’s brand growth and 45% of Procter & Gamble’s North America total female shave care growth in calendar year 2021, driven by shelf wins particularly at Walmart and Target. There was broad retailer acceptance nationally of the new FIG regimen.

Campaign: Remember the Birthday Card, You’ll

Be Glad You Did

Brand: American Greetings

Retail Partner: Meijer

Agency/Solution Provider: VMLY&R Commerce

Knowing that forgetting to give a greeting card is the No. 1 reason people do not give a card when they want to — and that this happens most often during birthdays — American Greetings wanted to motivate Meijer shoppers to stock up for future birthdays by treating the occasion like a holiday.

In Meijer stores, American Greetings store representatives wore campaign aprons and buttons to stop shoppers in their tracks. Card category endcaps and in-aisle cards were replaced by oversized billboard reminders, while secondary displays in complementary categories reminded shoppers to pair cards with wine, sweet treats and flowers. Finally, aisle violators promoted a limited-time Brand Rewards offer through the Meijer mPerks loyalty platform for shoppers to earn $5 when they spent $20.

Targeted emails promoting the offer and linking to the Meijer.com cards page let shoppers purchase for curbside pickup on their next trip. Social media 15-second video ads linked to a Meijer.com shoppable page; on-site digital banners at Meijer.com linked to an American Greetings shoppable page; and location-based mobile ads reminded shoppers to pick up a birthday card.

American Greetings helped Meijer grow the card category 7.9% more than any other retailer in their market during the birthday campaign. The Brand Reward had 2.8 times the participation than previous mPerks mass one-time offer programs. Painting the store with reminder signage and blanketing the market with media proved successful, as baskets grew to 6.8% over 2019 (the baseline comparison because 2020 foot traffic was down due to the pandemic).

Campaign: Hershey’s Robotic Daypart Endcap

Brand: The Hershey Co.

Retail Partner: Convenience store partners

Agency/Solution Provider: In-Store Experience offer Painting the store with reminder with media proved successful,

Convenience stores (c-stores) are typically open 24 hours, but they have clearly targeted dayparts for specific products. The typical customer doesn’t shop for sweets in the morning or baked goods in the afternoon, yet the stores need to have space for both categories even though they sit dormant for various stretches of the day.

Hershey’s turned to the In-Store Experience team to fi nd a way to satisfy customers with a unique approach to create excitement and engagement, save labor costs and offer valuable space back to the c-store operator. Its solution was a fi rstever robotic endcap with moving shelves presenting different products at different times of the day.

With expertise in electromechanical engineering, In-Store Experience designed a system that swaps shelves of baked goods automatically two times per day. The system was designed to be reliable, safe and easy to maintain. A unique single counterbalanced drivetrain swaps all the shelves slowly and quietly via a custom-engineered microcontroller.

The robotic system serves up the right snack at the right time of day and does it without human interaction. The patent-pending shelf automation system creates twice the merchandising opportunities in a single display footprint. Consumers are drawn to the product variety and bold graphics. Retailers also benefit from the reduced waste of perishable baked goods.

The unique endcap combines two food categories into one footprint, creating more than 18-linear-feet of new usable space for c-store operators. Early results showed that consumers are drawn to the endcap, adding both incremental sales and reduced waste to the bottom line.

Brand: Dr. Squatch

Retail Partner: Walmart Agency/Solution Provider: WestRock

Dr. Squatch is an emerging brand of skin care and hair care products for men. To promote the retail launch of the Dr. Squatch line at Walmart, WestRock needed to create a family of displays that would bring the brand to life for shoppers in the new natural and organic health section of Walmart stores.

Dr. Squatch appeals to the organic shopper and “wildernessinspired” side of male consumers by emphasizing the brand’s all-natural ingredients. The products carry masculine scents and are free from estrogenics, which helps alleviate fears that hormones may be in some of today’s personal care products. Dr. Squatch reinforces its male-dominated message on the shelf with the brand’s tagline “Feel like a man, smell like a champion.”

The main components of the display program were an endcap, power wing, four-way display and an inline shelf display. An impactful corrugated endcap utilized humorous elements from the brand’s video ads for strong visual appeal. Walmart allowed Dr Squatch a 48-inch inline section in the category, and WestRock designed a permanent unit that replicated a quarter-section of a fallen log to support the brand’s natural, outdoors identity.

Die-cut hand graphics act as aisle violators, and a removable corrugated graphic block allowed additional product to be loaded, providing flexibility and futureproofing of the unit. Two versions were produced of the inline unit — a 10-inch-deep version and a 12-inch-deep version — to accommodate different retail shelf dimensions.

able corrugated graphic block allowed additional product to 10-inch-deep version and Dr. Squatch became the

Dr. Squatch became the top-selling soap brand at Walmart during the launch period, and store personnel found it a challenge to keep the displays stocked as a result of the popularity and strong sales of the product.

Brands: Sally Hansen (Coty), Sour Patch Kids (Mondelez International)

Retail Partner: CVS Pharmacy

Agency/Solution Provider: WestRock

Coty’s Sally Hansen brand was entering the second year of its partnership with Mondelez International’s Sour Patch Kids on a limited-edition line of Sally Hansen Insta-Dri Sour Patch Kids nail polish products. The beauty company was seeking a fun and disruptive merchandising solution to launch at CVS stores in early fall 2021, a key selling period for both the nail polish and candy categories.

Coty needed the display to leverage the excitement of Halloween. Thus, it matched nail shades with the Sour Patch candy for every age and demographic, inspiring kids to dress up and have a fun shopping experience.

Measuring 3-feet tall and featuring four tiers of white tray shelving to house the colorful products, the Sally Hansen display was designed to stop young shoppers and their moms in their tracks with eye-catching appeal. Its central feature — an oversized purple Sour Patch Kid dressed in a Frankenstein costume as a pop-off — came accompanied with the tagline and copy, “Frightfully fast color: Faboo-lous shades in 60 seconds.”

The Sally Hansen InstaDri and Sour Patch Kids display encapsulated the best elements of Halloween — candy, dressing up and fun — and achieved its goal of delighting shoppers looking for nail polish to complement their Halloween looks. The display launched successfully in 4,000 stores. Through the disruptive tower in year two, sell-through increased by 50% versus the prior year’s limited-edition collection at CVS.

goal of delighting shoppers complement their Halloween

Threefold are the Media Network Specialists with over a decades worth of experience launching and optimizing Retail Media Networks.

Start your journey today with our Media Network Development Consultancy. Or take your network to the next level with our In-House Managed Network Solution.

Connect with us: hello@threefold.team

Discover more

Campaign:

Brand: GE Lighting, a Savant Company

Retail Partner: Meijer Agency/Solution Provider: Frank Mayer & Associates

GE was looking for a merchandising solution for its Cync Smart Home products line that would increase awareness and consumer engagement with the products at Meijer stores. The company settled on an idea for a powered lightbulb display that would fit into the Meijer shelving system while featuring a crown molding header that would match the store decor.

“Experience Cync” was the theme designed to showcase a smart home experience that goes beyond lighting, with new products like an indoor smart camera and outdoor smart plug. The display calls attention to the simplicity and flexibility of the Cync products, while a digital monitor plays an educational video loop until a button is pushed for sound. The Cync displays were installed in 275 Meijer locations during the last week of August 2021.

Moving the Cync 4-foot section to the front of the aisle was a way to engage shoppers who were interested in experimenting with smart products for the home that work with a voice assistant or with the Cync App. Since the GE Lighting Cync Display formally debuted in September 2021, the POS sales for the Cync Smart Home Products increased 127%.

Campaign: Kleenex Tissue Sessions

Brand: Kleenex (Kimberly-Clark)

Retail Partner: Target Agency/Solution Provider: VMLY&R Commerce

Kimberly-Clark’s Kleenex brand needed to increase household penetration among Target’s younger shoppers, especially with Black consumers. By activating a socially conscious campaign during Black History Month and Women’s History Month, as well as by offering Target-exclusive designs from diverse artists, the brand looked to spark sales during the traditionally soft March to June timeframe.

Kleenex chose a group of upand-coming female artists to create the Celebrate the World collection, a variety of limitedtime-only Target designs depicting vibrant scenes from around the world. The strategy was to turn Kleenex purchases into a larger conversation about inclusivity and diversity in design — and by extension, everyday culture.

To bring the campaign to life, Kleenex teamed up with LikeToKnowIt influencers to encourage followers to share their perspectives on important topics. Influencers were equipped with “Designed to Inspire” kits containing conversation cards with questions to spark discussion and a box of Kleenex tissues featuring one of the collection’s designs and drink coasters, which mirrored the graphics of each Target-exclusive design.

The designers and Instagram influencers created shoppable posts (including InstaStories) that encouraged Target shoppers to host Tissue Sessions themselves throughout Women’s History Month. A PR campaign and the Kleenex brand’s own social page, along with a series of e-blasts, helped spread the word, while the Target.com brand page showcased the designers’ personal stories and passion for inclusivity.

The Kleenex Celebrate the World pack achieved an inventory sell-through rate of 97%, an impressive result for a program that lacked any broad-scale media. The success of the program also cast a halo on the total Kleenex brand, with Kleenex sales at Target increasing 28% versus the same period the previous year, outpacing total category growth of 25%.

Brand: Old El Paso (General Mills)

Retail Partner: Walmart Agency/Solution Provider: VMLY&R Commerce

To support the introduction of Old El Paso’s spicy new Takis Fuego Stand N’ Stuff taco shells, General Mills needed to drive awareness and trial of the products exclusively at Walmart. It also wanted to bring a sense of fun and excitement back to family taco night, a weeknight meal tradition that has lost a bit of its luster among the brand’s target audience of young Millennial parents and their children.

Stand Up to the Fuego (i.e., fi re) brought the heat to Walmart shoppers on National Taco Day, Oct. 4, 2021. Exclusive PR kits with products, swag and recipe content were distributed to some 400 food bloggers, 2,000 qualified Walmart shoppers and seven TikTok influencers via a social challenge at #takistacochallenge. Sampling also took place at a food truck event at a Walmart store event in El Paso, Texas, and continued at some of the hottest and coldest places in America, including Fairbanks, Alaska.

In addition, Old El Paso scored an invitation to rapper Snoop Dogg’s 50th Birthday Party and a few of his concerts, garnering additional buzz with his social posts on Instagram, Facebook and Twitter.

At the end of the campaign, Old El Paso Takis Fuego was the top performing taco shell at Walmart and grew weekly dollar share through Oct. 16, 2021. Retailer media helped drive immediate product awareness of the new item. The overall campaign sales lift was 10.66%.

Brand: General Mills’ Box Tops for Education participating brands

Retail Partner: Walmart Agency/Solution Provider: VMLY&R Commerce

The COVID-19 pandemic has made perceived inadequacies in the U.S. educational system blatantly apparent. Between at-home schooling, childcare and disruptions to the education system, families truly haven’t known which challenges to tackle fi rst. In 2021, General Mills’ Box Tops program partnered with Walmart and the LeBron James Family Foundation on a two-phase campaign to deliver a message of empowerment through education, while supporting Walmart back-to-school seasonal shoppers looking for meal and snack solutions and driving conversion for Box Tops for Education brands.

A three-episode video content series, “Empowering Equity,” hosted by James in partnership with Box Tops, awarded $200,000 in teacher loan forgiveness checks. The series premiered on Walmart’s YouTube, TikTok and Instagram accounts, and drove viewers to the Walmart.com brand page, highlighting how consumers could use the Box Tops app to donate their earned box tops to schools in need.

Local support at Walmart stores included a Walmart Prep Rally seasonal parking lot event through which General Mills awarded a local school $25,000. The Box Tops for Education national partnership stories of the Black Men Teach organization were amplified through paid media, scaling their local-impact message. In stores, ads on self-checkout screens encouraged shoppers to download the Box Tops for Education app to make a difference, while Walmart’s new print-ondemand capability leveraged first-party sales data to print custom boxes for back-to-school shoppers’ delivery orders.

“The Best Year Starts Here” lifted sales by 7.5% across the General Mills portfolio and increased basket size by 2.9%.

Category Management teams at a major carbonated soft drink company needed to ensure their key accounts were giving a high share of shelf to their big bets. Yet they lacked independent datafrom inside stores to verify correct execution.

Premise was able to track share of facings on a monthly basis across 1,000 modern trade stores in Brazil, Chile, Colombia and Mexico. Premise contributors visited the outlets to take photos, which were then analyzed manually and via artificial intelligence to produce both store by store and market-wide analytics. This enabled the customer to track their category strategies across LATAM through a single partner while having the flexibility to adapt their analytics to each market’s exact requirements.

Premise is an on-demand insights platform. Our technology mobilizes communities of global smartphone users to source actionable data in real-time, cost-effectively, and with the visibility needed. In more than 135 countries and 37 languages, we find Data for Every Decision™

Brand: HP with The Jane Goodall Institute, The Arbor Day Foundation and Rebel Wilson

Retail Partners: Amazon, Walmart, Best Buy, Target, Costco, Staples and Office Depot

Agency/Solution Providers: Arc Worldwide, Edelman

Brand: Coors Light (Molson Coors Beverage Co.)

HP’s research showed that although 85% of PC and printer shoppers are extremely or somewhat concerned for the environment, only 25% would pay even a slight price premium for sustainable products. To overcome this “Green Gap,” HP wanted to make it easy for shoppers to be environmentally conscious by building a green value proposition into their purchases.

“Plant a Tree with HP” created an authentic brand story around the personal relationship between HP CEO Enrique Lores and renowned environmentalist Dr. Jane Goodall. As the promotional centerpiece, a portion of profits from HP PC, printer and ink/toner purchases from April through June 2022 would go to The Jane Goodall Institute to plant a million trees globally.

A 30-second promo video with Goodall was the launching point for an omnichannel campaign, supported by retailer media, that ran across social networking sites and HP/retailer websites. Amazon featured an HP weekend homepage takeover, while Costco ran the promo video on TV walls and Walmart developed a print ad with HP in USA Today. National media amplification came in the form of a “forest bathing” video conversation about sustainability challenges between Goodall and Australian actress Rebel Wilson that ran on YouTube and the campaign landing page at HP.com/PlantATree.

Initial campaign results were positive on both brand preference and attributable sales/ROAS. In April alone, Walmart generated $5.8 million in sales attributed to the campaign, $60.79 ROAS and 55.5% were new buyers.

Everyone needs the occasional respite from the summer heat. Thus, Coors Light created a program to drive volume and in-store display during the critical summer selling period by making the connection to summer chill with a virtual experience enabled by thermographic sunglasses on limitededition packaging.

Users activated the signature “blue mountains” and word “Chill” by using the Coors Light sunglasses on packaging and POS to scan a QR code that generated brief videos of summer, pool or lake occasions. Participants also provided their emails and entered into sweepstakes registration to win Ray-Ban sunglasses and branded merchandise.

The program was amplified on social media through consumers’ Facebook and Instagram feeds, while shoppers were greeted by the QR codes on in-store displays. On premise, Coors Light engaged bar patrons at their tables through POS with QR codes and branded barware. Campaign ads ran across TV and online video platforms, while retailer media ads drove purchase at key retailers. Packaging was localized on high-traffic billboards with headlines like “How California “Chills” and “Asi nos gusta Chill.”

Despite overall declines as compared with pandemicinduced spikes during the previous year, Coors Light showed positive dollar sales growth among the target group, including 21- to 34-year-old consumers (up 6%) and in the key markets of Pacific Northwest (4.8%), Arizona/Las Vegas (4.4%), Wisconsin/Minnesota/North Dakota (2.6%) and Illinois/Iowa (3.3%). In addition, on-premise sales were up an impressive 68.9%.

The Path to Purchase Institute’s Women of Excellence Awards program recognizes female brand marketers, retailers, agency executives and solution providers for their achievements in influencing shoppers along the path to purchase. The 2022 honorees were revealed Oct. 18 at an awards ceremony during P2PI LIVE in Chicago.

This year’s 36 winners hail from brands, retailers, agencies and solution providers — and we honor them here on the following pages, showcasing their impressive contributions to their organizations, teams and the industry at large. Congratulations to these inspiring Women of Excellence!

The 2022 Honorees are:

EXECUTIVE OF THE YEAR (page 43)

Amy Lanzi, Publicis Commerce

BUSINESS EXCELLENCE (page 44)

Amy Andrews, The Mars Agency

Chrissy Arsenault , Church & Dwight

Kelly Burt , Quad

Milagros Cabrera , The Retail Group

Heather Collins, Arc Worldwide

Katie Hollimon, The Scotts Miracle-Gro Co.

Anne Martin , Mondelez International

Cassie Ross, Henkel North America

Honorable Mentions:

Manjari Mehrotra , Albertsons Cos.

Ann Paradise, Merrell

Katie Schiavone, PepsiCo

Mara Sirhal, Bed Bath & Beyond

INDUSTRY IMPACT (page 50)

Melissa Baldwin , Google

Jennifer Fowler, Henkel

Beth Ann Kaminkow, VMLY&R Commerce

Amy Lanzi, Publicis Commerce

Jessamine McLellan , Campari Academy

Allisha Watkins, Paradox

Honorable Mention:

Yolanda Angulo, Mondelez International

INNOVATOR (page 54)

Michelle Baumann , VMLY&R Commerce

Valerie Bernstein , Advantage

Unified Commerce

Charlene Charles, DG Media Network

Kina Demirel, Mimeda

Alex Falconi, Arc Worldwide

Julia Miller, The Mars Agency

Honorable Mention: Cassandra Ericson , Diageo

MENTORSHIP (page 58)

Abby Beaston , Phoenix Creative Co.

Margaux Logan , Publicis Commerce

Anne Louise Marquis, Campari America

Jennifer Mason , Mondelez International

Bev Sampson , Niven Marketing Group

Laura Wallace, Chicory

TECHNOLOGY (page 60)

Chelsea Carroll, Vestcom

Risa Crandall, Aki Technologies, an Inmar Intelligence Company

Joy Jentes, Kimberly-Clark

Nadya Kohl, Volta Charging

THANKS TO OUR JUDGES!

Kate Clarke

E-Commerce Merchandising Manager III, Giant Food

Jennifer Hale

Manager, Connected Commerce, The Coca-Cola Co.

Elizabeth Harris

Chief Strategy Officer, Arc Worldwide

Sarah Hofstetter

President, Profitero

Surabhi Pokhriyal

Chief Digital Growth Officer, Church & Dwight Caron Sanders

Global Support HRBP Director, Ahold Delhaize

Mary Tarczynski

Omni-Channel Marketing Leadership for CPG and Retail, Parabolic

Jennifer Tinker

SVP - Omnicommerce Client Leadership, The Mars Agency

Amy Lanzi has a passion for innovation along with a commitment to transform the commerce space. As chief operating officer at Publicis Commerce, she is at the helm of an agency of more than 10,000 commerce experts worldwide.

She thrives on connecting commerce practitioners across the Publicis Groupe network and fi nding new ways of working that drive maximum client outcomes. By accelerating Publicis’ commerce product and capabilities to enable “Power of One” client-centric solutions, she also delivers high-performance strategies for the organization’s largest clients.

Lanzi joined Publicis in January 2020, and that same year launched a Commerce Advisory Board that has more than 20 client members across 19 brands. Her vision was to create a connected commerce community where members can test, learn and share. It has proven to be a successful forum, with valued partners sharing relevant product updates, research and new insights. It’s an effective way for Lanzi and her team to better understand how they can help their clients continually deliver modern commerce experiences for their consumers.

The driving force in two of Publicis Groupe’s most notable acquisitions, Lanzi spearheaded the acquisition of SaaS global e-commerce intelligence platform Profitero, as well as CitrusAd, which in combination with Epsilon’s CORE ID created the fi rst retail media offering based on identity. The latter also enabled this year’s launch of the industry’s fi rst unified on-site and off-site retail media platform — CitrusAd, powered by Epsilon.

Lanzi says the platform allows Publicis Groupe to lead a new generation of identity-led media networks, with a full funnel and integrated approach. “The combination of CitrusAd with Epsilon’s existing retail media network creates the only holistic one-stop shop that combines bestin-class, on-site, off-site and in-store advertising data,” she says. “Retailers achieve scale and outcomes, brands exceed performance expectations and build trust, and consumers enjoy personalized experiences.”

Lanzi also led some of the agency’s largest new business wins, including AB InBev, Walmart, Unilever and others, and was a key driver behind its strategic partnership with TikTok. As TikTok’s founding commerce agency partner, Publicis

Lanzi

provides clients with early access to test new commerce products, capabilities and creative solutions on the platform, as well as engage in exclusive or fi rst-to-market research or training opportunities.

Publicis Groupe is an early alpha tester of Kroger’s Private Marketplace, with Lanzi’s help, which enables clients to activate campaigns with greater addressability across platforms. “Kroger’s Private Marketplace allows agencies and brands to better reach consumers by applying Kroger’s unique audience data — inclusive of in-store and loyalty data — to programmatic campaigns within their preferred ad-buying platform,” she says. “Kroger’s existing scale gives marketers a flexible solution to tap into their robust first-party data, reduce ad waste and optimize their performance against actual retail sales.”

Lanzi has spearheaded proprietary research on the topics of social commerce and the role augmented reality plays in the shopping experience. More recently, she oversaw the release of Publicis Media and Twitter’s latest study exploring the power of brand social conversations, and their role as the “new review,” with 92% of respondents saying they actively seek out comments about brands, products or services on social media.

Prior to Publicis, Lanzi spent more than 20 years at Omnicom’s retail marketing agency, TPN. As one of its original employees, she helped it grow from a team of 30 to 350 and expanded its presence to include offices in Chicago, San Francisco, London and Bentonville, Arkansas.

AMY ANDREWS Senior Vice President, Client Leadership

The Mars Agency

AMY ANDREWS Senior Vice President, Client Leadership

The Mars Agency

In the past year alone, Amy Andrews has made her mark at The Mars Agency, guiding client Tillamook and its team to “vendor of the year” honors at Target and leading integrated omnichannel marketing for all of Campbell Soup Co.’s brands across retailer customers.

Andrews has been a leader from both the brand and agency side throughout her career. After a two-year stint at Starcom MediaVest Group, she joined The Mars Agency in 2007 as a strategic planner in Bentonville, Arkansas, working with two CPG accounts while also managing Walmart as a client. She moved to Ubisoft in 2012 to lead its shopper marketing and insights team through its fi rst shopper segmentation study, developing its fi rst national shopper promotion and helping accelerate its e-commerce business.

After returning to The Mars Agency in 2015, she co-founded an in-house strategic consultancy, helping open its fi rst international office in London, assisting with initial inroads into Latin America and launching its Seattle office while also driving exponential growth for a then-budding e-commerce practice.

Andrews also serves on a core peer group at Chief, a private membership network dedicated to connecting and supporting women executives. She helped launch a DEI Council at The Mars Agency, for which she co-wrote the agency’s core values to reinforce its commitment to inclusivity.

CHRISSY ARSENAULT Brand Manager Church & DwightPrior to assuming her current role earlier this year, Chrissy Arsenault was Church & Dwight’s e-commerce brand manager for health and well-being. In that role, she led the growth of the brands under this umbrella by 24.9% versus 2020 and achieved gross sales targets. She led two e-commerce exclusive launches for Trojan and First Response, as well as the first portfolio basket-building campaign, and saw the Trojan Bareskin Raw become the No. 3 best-selling condom in Q4 2021.

As a classically trained CPG brand manager, Arsenault has held various roles within shopper marketing/sales strategy, brand management, innovations and e-commerce. She holds a bachelor’s degree in nutritional sciences from Cornell University and an MBA in marketing from Indiana University’s Kelley School of Business.

Now, as brand manager for Vitafusion, she leads a team of five direct reports and manages the P&L for the brand.

Beyond her brand management responsibilities, she mentors underprivileged youth through the Starfish Project and has served in various board member positions for local dietetics associations. She is passionate about DEI initiatives as an immigrant to the United States, and mentors young women, especially those of color, to realize their full potential.

KELLY BURT Vice President of Sales and Business Development QuadKelly Burt approaches every new project or customer with a consultative, problemsolving approach, understanding clients’ brand essence, business drivers, needs and pain points — then leads the development of client-specific solutions that capitalize on Quad’s unique integrated marketing platform. Burt assumed her current post in 2019 and has consistently guided doubledigit growth ever since.

As vice president of sales and business development for Quad’s In-Store Division, she has expanded its client portfolio from mainly big-box retail companies to other industry verticals, including specialty retail, pharmacy and grocery. She was instrumental in developing a holistic solutions approach that shortens production times, reduces in-store labor costs, cuts waste, centralizes marketing operations, offsets carbon impacts by reducing the number of kits shipping to each store location, and eliminates obsolete inventory through strategic fulfi llment solutions.

Burt’s leadership was essential to this year’s launch of the InVision suite of offerings, which allows the company to create virtual store environments from concepting and testing, flow in various concepts for outfitting a store with a focus on eye tracking, and optimize creative messaging/display format to increase conversion rates. She also helped lead the formulation of the In-Store Division’s approach to operate more sustainably in support of the company’s environmental, social and governance strategy and commitments.

Dream business lead with the brains and brawn it takes to solve problems and drive growth.

Operations alchemist who makes Arc a pretty darn efficient (and great) place to work.

You make Arc better, which makes all of us better, and we thank you. Learn more at arcww.com/news