Partner with us to empower rural kitchens Make profitable gains from carbon credits while enabling strong climate action and community upliftment Corporations High-Net-Worth Individuals Private Equity / Venture Capitalists CSR Funds Good Investment Opportunity for: (+91) 731 42 89 086 business@enkingint.org www.enkingint.org EKI ENERGY SERVICES LIMITED One of the world’s largest carbon credits developer & supplier 40+ Countries | 3500+ Clients | 200+ Million Offsets Traded | BSE Listed also known as EnKing International Scan QR code to visit our website

C O N T A C T U S w w w . r i s e n e n e r g y . c o m

VOLUME

INTERNATIONAL

OWNER : FirstSource Energy

India Private Limited

PLACE OF PUBLICATION : 95-C, Sampat Farms, 7th Cross Road, Bicholi Mardana Distt-Indore 452016, Madhya Pradesh, INDIA Tel. + 91 96441 22268 www.EQMagPro.com

EDITOR & CEO : ANAND GUPTA anand.gupta@EQmag.net

PUBLISHER : ANAND GUPTA

PRINTER : ANAND GUPTA

PUBLISHING COMPANY DIRECTORS: ANIL GUPTA

ANITA GUPTA

CONSULTING EDITOR : SURENDRA BAJPAI

HEAD SALES & MARKETING

MUKUL HARODE sales@EQmag.net

SR. GRAPHICS & LAYOUT DESIGNER : RATNESH JOSHI

GRAPHICS DESIGNER : ABHISHEK SARAI

SUBSCRIPTIONS : RISHABH CHOUHAN admin@eqmag.net

Disclaimer,Limitations of Liability

While every efforts has been made to ensure the high quality and accuracy of EQ international and all our authors research articles with the greatest of care and attention ,we make no warranty concerning its content,and the magazine is provided on an>> as is <<basis.EQ international contains advertising and third –party contents.EQ International is not liable for any third- party content or error,omission or inaccuracy in any advertising material ,nor is it responsible for the availability of external web sites or their contents

The data and information presented in this magazine is provided for informational purpose only.neither EQ INTERNATINAL ,Its affiliates,Information providers nor content providers shall have any liability for investment decisions based up on or the results obtained from the information provided. Nothing contained in this magazine should be construed as a recommendation to buy or sale any securities. The facts and opinions stated in this magazine do not constitute an offer on the part of EQ International for the sale or purchase of any securities, nor any such offer intended or implied

Restriction on use

The material in this magazine is protected by international copyright and trademark laws. You may not modify,copy,reproduce,republish,post,transmit, or distribute any part of the magazine in any way.you may only use material for your personall,Non-Commercial use, provided you keep intact all copyright and other proprietary notices. want to use material for any non-personel,non commercial purpose,you need written permission from EQ International.

FEATURED

SOLAX SIGNED A100 MW DISTRIBUTION AGREEMENT WITH SOLARIS TECHNO

BUSINESS & FINANCE

VOLKSWAGEN PRESENTS NEW LOWPRICE ELECTRIC CAR, ID.2ALL

72

29 08

ENERGY STORAGE

BUSINESS & FINANCE

TATA POWER JOINS HANDS WITH ENEL GROUP TO POWER DIGITALISATION, AUTOMATION IN ELECTRICITY DISTRIBUTION

SMARTVILLE TAKES MAJOR STEP FORWARD WITH MOAB™, ITS SCALABLE, SECOND-LIFE ENERGY STORAGE SYSTEM INSTALLED FOR UC SAN DIEGO

TECHNOLOGY

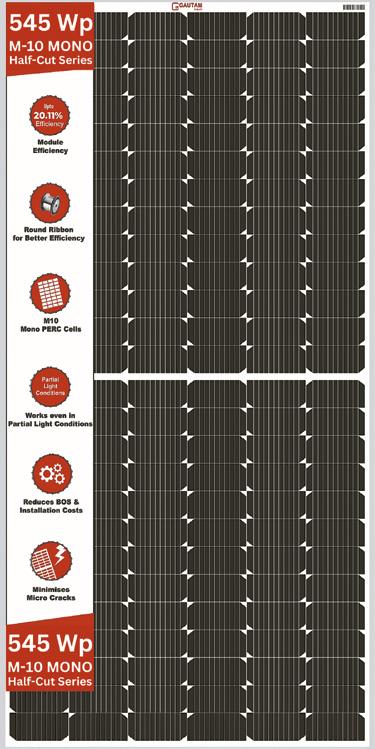

Round Ribbon Technology in Gautam Solar’s 545 Wp 10BB Solar Panels

35

12

15 Issue 03 CONTENT

WEST BENGAL BUSINESSMAN MANOJIT MANDAL TURNS

OLA ELECTRIC TO RAISE $300 MN FOR EXPANSION PLANS TO MEET CORPORATE NEEDS

METRO TO REDUCE CARBON FOOTPRINT, HARNESS

STERLITE POWER SUCCESSFULLY COMMISSIONS ITS LARGEST GREEN ENERGY CORRIDOR PROJECT IN GUJARAT

ELECTRIQ POWER SECURES $300 MILLION FOR SOLAR+STORAGE FINANCING

ENI, ADNOC INK PACT TO COOPERATE IN RENEWABLES, HYDROGEN, CARBON CAPTURE

ELECTRIC VEHICLE

ELECTRIC VEHICLE INCENTIVE: GUIDELINES OUT FOR INTEREST-FREE ADVANCE TO ODISHA GOVT EMPLOYEES

CONTROLLING ELECTRIC DOUBLE LAYER DYNAMICS FOR NEXT GENERATION ALLSOLID-STATE BATTERIES

MR. GAUTAM MOHANKA

69 70 31 16 26 15 41 10 74

INDIA

EQ News

FEATURED FEATURED ENERGY STORAGE

INDIA Pg. 08-74

BUSINESS & FINANCE BUSINESS & FINANCE

INTERVIEW

SOLAR ENERGY FOR RAIL SYSTEMS

TATA NANO

INTO SOLAR CAR, DRIVES 100KM FOR JUST RS 30

Founded in 2005, JA Solar is a manufacturer of high-performance photovoltaic products. With 12 manufacturing bases and more than 20 branches around the world, the company’s business covers silicon wafers, cells, modules and photovoltaic power stations. JA Solar products are available in over 120 countries and regions.

www.renewx.in SOLAR ENERGY | DECENTRALISED RENEWABLE ENERGY | GREEN HYDROGEN | E-MOBILITY & ENERGY STORAGE | BIO ENERGY UNLOCKING

SUPPORTING NODAL AGENCY STATE PARTNER SUPPORTED BY PRODUCTS ON DISPLAY Photovoltaic Power Genera�on Systems Power Solu�ons for Residen�al / Socie�es Roo�op Solu�on Providers Solar as Solu�on for C&I consumers Intl Standard Solar Inverters / Hybrid Solu�ons Bi-Facial Modules High End Photo-voltaic (PV) Modules Energy Storage Solu�ons Electric Vehicles AMITAVA SARKAR M: +91 93792 29397 E: amitava.sarkar@informa.com JULIAN THOMAS M: +91 99404 59444 E: julian.thomas@informa.com IYER NARAYANAN M: +91 99673 53437 E: iyer.narayanan@informa.com FOR BOOKING, CONTACT AMIT SHARMA | M: +91 99109 55222 | E: amit.sharma@informa.com FOR SPEAKERSHIP OPPORTUNITIES PREMIUM PV JUNCTION BOX & CONNECTOR ONSITE BRANDING PARTNER ASSOCIATE PARTNER SOLAR MODULE & STORAGE PARTNER PREMIUM EXHIBIT PARTNERS

THE ERA TO NET ZERO EMISSIONS…

Introduction

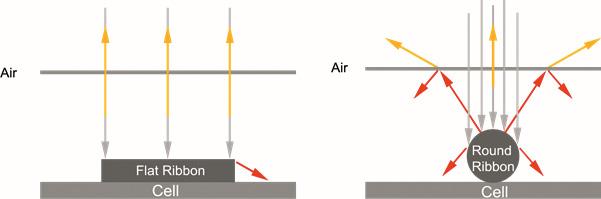

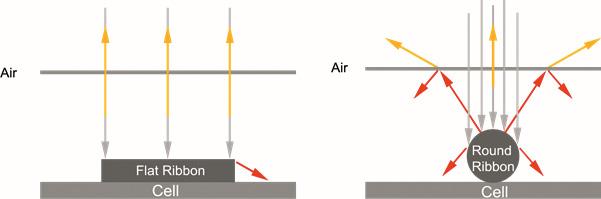

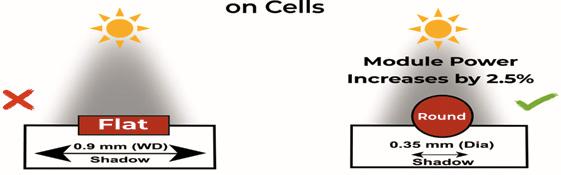

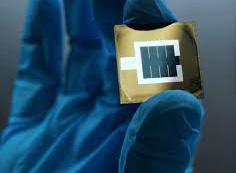

To achieve cost reduction and efficiency increase in solar modules, multi-busbar technology has been adopted by manufacturers of photovoltaic crystalline silicon modules. Compared to the traditional five busbar modules which use flat ribbon connectors, multi-busbar modules use round ribbon connectors which helps in decreasing the electrical resistance loss and increases secondary utilization of light on the ribbon surface, thereby leading to increased power output of the modules. The use of multi-busbar technology in solar cells required a redesign of the cell pattern to replace the flat solder ribbons with round solder ribbons to minimize cell degradation due to internal stress. It also reduces the amount of silver needed for the front electrode ribbon by greater than 50%.

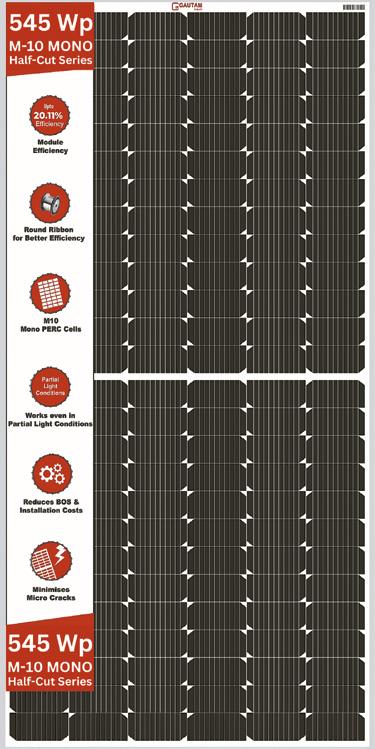

Round Ribbon Technology in Gautam Solar’s 545 Wp 10BB Solar Panels

Advantages of Round Ribbon Technology

Gautam Solar’s high efficiency 545 Wp 10BB Solar Panels incorporate Round Ribbon Technology to increase the performance of the panel and ensures its longevity so that the panel can work effectively for a period of 25+ years. The advantages offered by Round Ribbon Technology in Gautam Solar’s 545 Wp 10BB Solar Panels include:

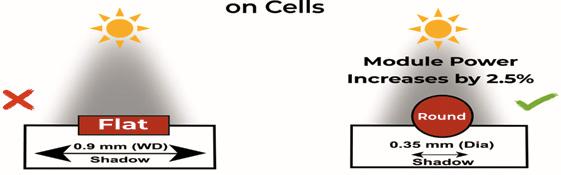

•Lower Shading Losses

Compared to flat ribbon connectors that have width of 0.9mm, Round ribbon connectors have a diameter of 0.35mm.

Due to difference in shape and size, surface area of cell covered by round ribbon is much less than that covered by flat ribbon.

This leads to about 75% lower shading on cells and up to 2.5% power increase as compared with cells using flat ribbon.

8 EQ MARCH 2023 www.EQMagPro.com TECHNOLOGY

2. Higher light utilization

Flat ribbon provides low light utilization as most of the light falling on the ribbon is reflected back outside the module and only 5-10% light is reflected inside and converted to electricity.

On the other hand, in case of round ribbon, due to its shape, multiple internal reflection occurs and most of the light falling on the ribbon is reflected. Some of the reflected light escapes the module but overall, nearly 70% light is converted to electricity.

In flat ribbon, the current density drop is around 0.9 mA/cm2, whereas in case of round ribbon, the current density drop is just 0.4 mA/cm2. As a result, more current and hence more power is generated.

Apart from this, power generated from light striking at oblique incidence is also intensified.

Conclusion

Hence, it can be seen that the application of round ribbon interconnectors with multi-busbar technology is beneficial for increasing not only the power and efficiency of the cell, but also its durability. For using round ribbon technology in 545 Wp 10BB Solar Panels, only the inkjet mask and screens for screen printing process have to be adapted (which represents a small investment). Despite this, the major limitation in implementation of this technology for manufacturers is the high investment in a different kind of cell stringer called Multi Busbar Cell Soldering Stringer. Though the initial investment is higher, it pays off in the long term as the performance of the solar panels increases which leads to greater customer satisfaction.

Using Round Ribbon for Lower Shading on Cells

www.EQMagPro.com 9 EQ MARCH 2023

TECHNOLOGY

MR. GAUTAM MOHANKA CEO & MANAGING DIRECTOR Gautam Solar Private Limited

EQ: Which are the advanced technologies that have been adopted in your products and processes?

GM: Gautam Solar is a reputed Solar Module Manufacturing company with 25+ Years of experience. With a strong R&D unit, our company is known for taking out cutting edge solutions for the solar industry and our numerous IPs (Designs & Patents) is a testament to our commitment to innovation. In terms of Product, our 545 Wp Monocrystalline PERC Solar Modules adopt advanced technologies like bigger M10 cells for higher power generation, multibusbar technology for lower electrical losses, round ribbon connectors for better light utilization, bifacial PERC technology for power generation from both sides, non-destructive laser-based cell cutting for higher reliability and lower chances of micro-cracks and half-cut cell technology for better low-light performance. Speaking of Processes, our modules are manufactured using First-Hand Topline Machines and undergo rigorous testing and certifications, making us one of the few solar module manufacturers in India with BIS & ALMM Approved Solar Panels.

EQ: What are your growth and expansion plans for the next couple of years?

GM: Our current solar module manufacturing capacity is 400 MW and we’re planning to expand to a total of 1 GW capacity by FY2024. 250 MW of capacity addition will be through the expansion of capacity of our Haridwar plant while we’re looking for locations near a seaport in Gujarat for 350 MW Capacity addition. We’re looking to invest nearly 100 crores for this expansion, which does not include the cost of the land. The recent policy initiatives by the government such as ALMM and BCD have given a much-needed thrust to the domestic solar manufacturing sector, to make our products more cost-competitive with China-based manufacturers.

EQ: What kinds of challenges the present geopolitical situation has posed in terms of the Dynamics of Price - Demand - Supply for this year and the near future?

GM: The geopolitical situation has created several challenges in terms of the Dynamics of Price – Demand – Supply for the near future. Some of these challenges include limited access to resources including raw materials for solar panels, trade barriers which have had a negative impact on imports, hesitancy in investment, lack of cooperation among nations, diverted attention from green economy, security concerns and lack of international support. It's important to note that the situation is complex and multifaceted, and we are hopeful that world leaders will try to work together to address the geopolitical situation so that progress can be made towards a cleaner and greener earth.

EQ: Whats your views on the ALMM?

GM: The ALMM has become a key resource for individual “customers and developers” looking to procure solar PV Panels in the country as it only includes panels that meet strict standards set by the Ministry of New and Renewable Energy (MNRE). Gautam Solar has 4 state of the art manufacturing facilities in Haridwar, Uttrakhand for manufacturing of solar modules which ensured that our 545 Wp Series of 10BB Mono PERC Panels were enlisted in ALMM.

EQ: As compared to western markets, interest rates in domestic solar energy markets are much higher. What should be done to reduce interest rates?

GM: The domestic solar energy market’s interest rates are 8-10%, whereas the same for western markets is only 3-4%. It is a big challenge in the growth of Indian solar energy sector. There are several steps that can be taken to reduce interest rates in the domestic solar energy market in India including government support to lenders and investors, risk reduction through strong regulatory and policy framework, standardization of documentation, capacity building of local banks and institutions for low-cost finance. Also increased competition from new industry players will drive down interest rates.

10 EQ MARCH 2023 www.EQMagPro.com INTERVIEW

DRY ROBOTIC CLEANING, A PRACTICAL WAY TO SAVE WATER RESOURCES

March 22nd is World Water Day. According to the calculation, cleaning a 10MW power plant once requires 100 tons of water by flushing PV modules with water trucks, or 50 tons of water by cleaning with a water brush.

By the end of 2022, the Global cumulative PV capacity is 1208 GW. If calculated by cleaning 4 times per year, the annual water consumption will be 24,160,00 tons. PV cleaning by water needs to be regulated. India, which is facing high water stress, is even more stringent on the water usage for PV plants. India's MNRE requires that solar panels should be cleaned with as less water as possible and encourages the use of intelligent PV cleaning robots. Under these circumstances, Sunpure has developed dry cleaning robots for PV modules with the advantages of higher efficiency, higher quality and higher frequency of cleaning, and applied them to several large-scale PV power plants. Protecting water resources, Sunpure is always taking practical action.

INTERVIEW

SOLAX SIGNED A100 MW DISTRIBUTION AGREEMENT WITH SOLARIS TECHNO

With the aim of working together to create a cleaner and more sustainable future for all, SolaX Power, one of the well-known PV inverter suppliers in the world, has signed a 100 MW distribution agreement with Solaris Techno, a prominent distributor in India.

On March 2,SolaXsigned a distribution agreement with Solaris Techno to provide 100 MW of residential and C&I inverters to the Indian market.This cooperation is a win-win for both SolaX and Solaris Techno since they can leverage their respective strengths tomake greater achievements. Solaris Technohas a vast network and expertise in the distribution of photovoltaic products, which will enable SolaX’s solar inverters to be accessible to consumers across India, providing them with affordable and sustainable energy solutions.Solaris Techno endeavors to provide prompt and thorough service to its customers and selects its partners with great care to provide top-class solar products. SolaX has won the trust of Solaris Techno due to its advanced and comprehensive portfolio of on-grid inverters, hybrid inverters, batteries and EV-Charger; covering all kinds of application scenarios, including residential andC&I sectors.This extensive product range positions SolaX as an attractive partner for Solaris Techno, providing custom

as an attractive partner for Solaris Techno, providing customers with a one-stop-shop for their renewable energy needs. The partnership with Solaris Techno is a significant achievement for SolaX, which has been steadily expanding its global reach in recent years. SolaX will do its utmost to meet India’s increasing demand for PV products and contribute to the government’s ambitious goal of reducing carbon emissions. As a company committed to powering a green future, SolaX will keep pushing forward with renewable energy technologies in the future, providing innovative solutions to meet the evolving needs of its clients.

12 EQ MARCH 2023 www.EQMagPro.com FEATURED

GLOBAL ENERGY-RELATED CO2 EMISSIONS EDGED UP TO RECORD HIGH IN 2022 – IEA

Global energy-related emissions of carbon dioxide hit a record high last year, although more clean technology such as solar power and electric vehicles helped limit the impact of increased coal and oil use, the International Energy Agency (IEA) said

Deep cuts in emissions, mainly from burning fossil fuels, will be needed over the coming years if targets to limit a global rise in temperatures and prevent runaway climate change are to be met, scientists have said.

“We still see emissions growing from fossil fuels, hindering efforts to meet the world’s climate targets,” IEA Executive Director Fatih Birol

The report by the Paris-based watchdog comes just weeks after major fossil fuel producers such as Chevron (CVX.N), Exxon Mobil (XOM.N) and Shell (SHEL.L) reported record profits,

with BP BP.L also rowing back on plans to slash oil and gas output and reduce emissions. “International and national fossil fuel companies are making record revenues and need to take their share of responsibility,” Birol said. Global emissions from energy rose by 0.9% in 2022 to a record 36.8 billion tonnes, the IEA analysis showed. Carbon dioxide (CO2) emissions from coal grew by 1.6% last year with many countries turning to the more polluting fuel after Russia’s invasion of Ukraine and a reduction in Russian gas supply to Europe sparked record high gas prices. CO2 emissions from oil rose by 2.5% but remained below pre-pandemic levels the report said. Around half of the increase in oil-related emissions was due to a rise in air travel which was rebounding from a low during the pandemic. Lower output from nuclear power plants and extreme weather events including heatwaves also contributed to the increase in energy related emissions, the IEA said. Emissions were partly offset, however, by a rise in renewable power sources like wind and solar, energy efficiency measures and electric vehicles. These avoided an additional 550 million tonnes of CO2 emissions last year, the IEA said.

Source: Reuters

THERMAX ENTERS THE GREEN HYDROGEN MARKET IN PARTNERSHIP WITH FORTESCUE FUTURE INDUSTRIES

Thermax Limited, a leading energy and environment solutions provider, and Fortescue Future Industries (FFI), an Australia-based green energy and green technologycompany,have signed a Memorandum of Understanding (MoU) to exploregreen hydrogen projects – including new manufacturing facilities – in India.

Under the MoU, Thermax and FFI plan to explore opportunities tojointly develop fully integrated green hydrogen projects for commercial and industrial customers in India. The production of green hydrogen at an industrial scale would be a major step forward in decarbonising hard-to-abate industries in India, such as refineries, fertilisers and steel. The MoU between Thermax and FFI also contemplates the potential collaboration of the parties in the development of new manufacturing facilities to support green energy projects in India. The Performance Linked Incentive (PLI scheme), under India’s National Green Hydrogen Mission,could be leveraged for setting up any new manufacturing capacity. In addition to meeting the domestic requirements, electrolysers and subsystems could potentiallybe used for export internationally. Fortescue Metals Group’s experience in managing large-scale projects in its iron ore business provides FFI – Fortescue’s green energy arm – with a strong platform to expand into manufacturing projects in green hydrogen. FFI is in the process of constructing a world-leading Green Energy Manufacturing Centre in Gladstone, Queensland. The first phase of the project involves the construction of an electrolyser manufacturing facility, with a targeted initial output capacity of 2GW per annum. Thermax will bring its vast experience in EPC and supplychain to the collaboration.

Expressing his thoughts on the collaboration, Ashish Bhandari, MD & CEO, Thermax, “The collaboration with Fortescue Future Industries is perfectly timed to leverage the massive potential of the Indian green energy market that presents a multitude of opportunities, backed by favourable policies and incentives. Furthermore, the recent approval of the National Green Hydrogen Mission by India’s Union Cabinet, which aims to increase domestic production of green hydrogen to 5 MMT per annum by 2030 and reduce fossil fuel imports by over Rs. 1 lakh crore, is a significant boost. With all these factors working in our favour, we are confident that our association will be successful.”

FFI CEO Mark Hutchinson said, “FFI is on a mission to replace fossil fuels by producing green electrons from renewable energy and then converting these green electrons into green hydrogen. Through the National Green Hydrogen Mission, the Indian Government has shown that it is committed to developing its green hydrogen industry to help the country decarbonise. We are thrilled to be working with Thermax andbelieve that this MOU with a company of such high standing will help us in our mission to eliminate emissions.”

www.EQMagPro.com 13 EQ MARCH 2023 FEATURED

India’s power consumption surged 10 per cent to 1375.57 billion units (BU) during April-February this fiscal year, and has already surpassed the level of electricity supplied in entire 2021-22. The government data showed that power consumption in April-February 2021-22 was 1245.54 BU. Experts say power consumption is expected to grow in double digits in the coming months in view of forecasts of unprecedented high demand, especially in summer. The power ministry has estimated peak power demand in the country at 229 GW during April this year, which is higher than 215.88 GW recorded in the same month a year ago. The ministry has taken many steps to meet high power demand and also asked state utilities to not go for power cuts or load shedding.

The ministry has also asked all imported coal-based power plants to run on full capacity from March 16, 2023, to June 15, 2023. Besides, it has asked other thermal power generators to import coal for blending with domestic dry fuel. Experts say higher economic activities would boost commercial and industrial demand in the coming months. Besides, they opined that scorching heat during summer would result in higher consumption of power for running air conditioners and other cooling appliances. They are of the view that it would be a challenge to meet unprecedented high demand of electricity in India April onwards.

‘WIND ENERGY PROJECTS GENERATED 64.54BN ELECTRICITY UNITS IN APRILJAN OF FY23’

The electricity produced from wind energy projects was 64.54 billion units during the April-January period of 202223, according to the Ministry of New and Renewable Energy data. Tamil Nadu and Gujarat are the two states which lead in terms of generating electricity through wind energy. During April 2022-January 2023, Gujarat produced 17,062 million units of electricity from wind energy power projects. Tamil Nadu was the second highest generator of electricity from wind energy power projects, as it generated 15,703 million units of electricity during the period under review.

The government has taken several measures for promoting wind energy, like declaration of trajectory for wind renewable purchase obligation – Wind RPO – up to 2030. In addition to this, the government has announced concessional Customs duty exemption on certain components required for manufacturing of wind electric generators. Generation-based incentive is being provided to the wind projects commissioned on or before March 31, 2017. The overall energy storage capacity developed in the country as on March 13, 2023 is 4,745.60 MW from Hydro Pumped Storage Projects and 39.12 MWh from Battery Energy Storage System. However, this energy storage capacity is not specific to any particular technology, official sources said.

Source: PTI Source: PTI

14 EQ MARCH 2023 www.EQMagPro.com INDIA

INDIA’S POWER CONSUMPTION RISES 10% IN APR-FEB TO 1375 BILLION UNITS, CROSSES FULL FISCAL ENERGY SUPPLIES A YEAR AGO

In entire fiscal year 2021-22, power consumption was 1374.02 BU, which is less than 1375.57 BU recorded during April 2022 to February 2023 period.

Tamil Nadu was the second highest generator of electricity from wind energy power projects, as it generated 15,703 million units of electricity during the period under review

METRO TO REDUCE CARBON

FOOTPRINT, HARNESS SOLAR ENERGY FOR RAIL SYSTEMS

Harnessing of solar energy, mandatory green building certification in detailed project reports (DPRs), and energy-efficient design to ensure natural lighting and ventilation are among several recommendations made by the ministry of housing and urban affairs (MoHUA) to reduce carbon footprints and cost of metro rail systems. These suggestions are part of the draft report on ‘Standardisation/Indigenisation of Electrical & Electromechanical Metro Rail Components’ circulated recently among all stakeholders including state authorities and other agencies to seek their feedback and inputs.Following review of comments or feedback from the stakeholders, the specifications will be finalised.

“Metro rail systems use electrical energy extensively. To reduce carbon footprints, harnessing solar energy to meet energy requirements should be explored. In a typical metro system, solar rooftop photo voltaic (SPV) power plant can be installed on station roofs, depot roof/ sheds, office buildings, parking areas, sub-station buildings, and staff quarters etc,” read an annexure to the report.

The report further suggests that interconnection or interchange of underground and elevated station area may be provided with natural lighting and ventilation or if required, high volume low speed large fans may be used in place of conventional air-conditioning.

“Already metro stations are being certified by the IGBC (Indian Green Building Council) as green buildings. Further, obtaining green building certification can be kept as an essential requirement in DPR,” states the draft. ‘Standard Specifications’ aim to bring uniformity in components being used in different systems in metro rail operations including power supply, traction, tunnel ventilation, air-conditioning, fire alarm,elevators, noise control, and air filtration.

In 2022-23, it was announced that design of metro systems including civil structures, will be reoriented and standardised for Indian conditions and needs. In view of the announcement, the ministry decided to revise the standard specifications of various metro rail components. Hence the draft report has been prepared after detailed and extensive deliberations. The original standard specifications were issued in August 2018.

Source: PTI

www.EQMagPro.com 15 EQ MARCH 2023 INDIA

In 2022-23, it was announced that design of metro systems including civil structures, will be reoriented and standardised for Indian conditions and needs.

The running cost of the car will shock everyone. This petrol-free “solar car” runs 100 kilometres for just Rs. 30 to 35. It has now become a mechanical icon of Bankura. Common people are curently getting perplexed by the price of petrol and diesel. Manojit Mandal of Bankura has shown direction by making a solarpowered car. The cost per kilometre is 80 paisa. As there is no engine, there is no sound even when the car is started. However, there is a gear system. This wonder car can run at a speed of 80 km per hour in fourth gear almost silently.

WEST BENGAL BUSINESSMAN MANOJIT MANDAL TURNS TATA

NANO INTO SOLAR CAR, DRIVES 100KM FOR JUST RS 30

Manojit Mandal wanted to make something new since childhood. So, he built a solar car for himself without complaining about the increase in petrol prices. Manojit faced many challenges while converting the car. Although this sensational car has not left a mark in the mind of the government, there has been no response from the government. However, it is undeniable that Manojit Mandal of Bankura district is the pioneer in solving the problem of limited fossil fuels.

Source: PTI

CABINET NOD FOR LISTING OF RENEWABLE ENERGY MINI-RATNA IREDA

The government approved the listing of IREDA, a CPSE under the Ministry of New & Renewable Energy (MNRE) on the stock exchanges through an initial public offer (IPO) by the part sale of the government’s stake in it to raise funds. The government said the instant decision has been necessitated due to change in capital structure following the infusion of capital to the tune of Rs 1,500 crore by the government in March 2022. “This decision supersedes earlier CCEA decision taken in June 2017 for allowing IREDA (Indian Renewable Energy Development Agency) to issue 13.90 crore fresh equity shares of Rs 10.00 each to the public on book building basis through IPO,” reads the press note.

Now, the Department of Investment and Public Asset Management (DIPAM) will drive the listing process. “The IPO will help in unlocking the value of government’s investment on the one hand and on the other will provide an opportunity to the public to acquire a stake in the national asset and draw benefits therefrom,” reads the press note. Besides, it will help IREDA in raising a part of its capital requirement for meeting growth plans without depending on the public exchequer, and improve governance through greater market discipline and transparency arising from listing requirements and disclosures.

IREDA is currently wholly owned Government of India, Mini-Ratna. In another decision, the Cabinet Committee on Economic Affairs granted an exemption to NTPC from the extant guidelines of delegation of power to Maharatna CPSEs for making an investment in NTPC Green Energy Limited (NGEL), a Subsidiary Company of NTPC Ltd. The cabinet also exempted NGEL’s investment in NTPC Renewable Energy Limited (NREL) and its other JVs/subsidiaries subject to a ceiling of 15% of its net worth beyond the monetary ceiling of Rs 5,000 crore to Rs. 7,500 crores, towards achieving a target of 60 GW Renewable Energy (RE) Capacity by NTPC. NTPC, through this investment in the RE sector, aims to add 60 GW of Renewable Energy Capacity by 2032 which will help the Country to achieve Net Zero emissions by 2070.

Source: PTI

16 EQ MARCH 2023 www.EQMagPro.com INDIA

Manojit Mondal, a resident of Katjuridanga, Bankura drives a solar-powered car. Manojit, a businessman by profession, drives around the streets of Bankura by converting a nano car into a solar car. This car does not require any petrol at all. Also, it does not run on an engine.

The government said the instant decision has been necessitated due to change in capital structure following infusion of capital to the tune of Rs 1,500 crore by the government in March 2022.

TN GOVT TO SET UP 15 NEW POWER PROJECTS WITH 14,500 MW CAPACITY

The Tamil Nadu government will establish 15 new power projects under the PPP mode with a total capacity of 14,500 MW at an estimated cost of Rs.77,000 crore by 2030. The Government will also bring out a comprehensive policy to promote investment in pumped hydroelectric storage in the State, Finance Minister PTR Palanivel Thiagarajan announced in the State Assembly, while presenting the budget for the year 2023-24, today.

Minister said with the objective of fulfilling the increasing demand for power in the State, the Government intends to double the installed capacity for power generation in the State by adding 33,000 MW by 2030, giving high priority to development of renewable energy sources. The present contribution of green energy to the State grid at 20.88 per cent is proposed to be increased to 50 per cent by 2030 through additional capacity creation. With solar energy potential of 20 GW, onshore wind energy potential of 70 GW and offshore wind energy potential of 30 GW, Tamil Nadu has immense renewable energy resources and opportunities, he said.

To transform Tamil Nadu into a green power house with more than 50 per cent of power generation from renewable sources by the year 2030, the Government will create a dedicated Special Purpose Vehicle”, he said, adding, further, a new policy on repowering windmills in the State will be evolved. Mr Palanivel Thiagarajan also said pumped storage hydroelectric projects will be established under PPP mode to meet the peak hour power demand in the State.

He said the 500 MW pumped hydroelectric storage project being constructed at Kundah will be operational by 202425. “Further, 15 more projects will be established under the PPP mode with a total capacity of 14,500 MW at an estimated cost of Rs.77,000 crore by 2030”, headdded. He also said the on-going thermal power projects of 4100 MW will be completed expeditiously. To automate fetching of metered data, a smart metering system will be installed with prepaid functionality for all paid consumer connections under the RDSS scheme. As a result of the structural and systemic reforms undertaken by the Government, the fiscal position of TANGEDCO has improved slightly and it is expected that the loss of TANGEDCO will be reduced to Rs.7,825 crore in 2022-23 from Rs.11,955 crore in 2021-22.

He said the 500 MW pumped hydroelectric storage project being constructed at Kundah will be operational by 2024-25.”Further, 15 more projects will be established under the PPP mode with a total capacity of 14,500 MW at an estimated cost of Rs.77,000 crore by 2030″, headdded. He also said the on-going thermal power projects of 4100 MW will be completed expeditiously. To automate fetching of metered data, a smart metering system will be installed with prepaid functionality for all paid consumer connections under the RDSS scheme.

As a result of the structural and systemic reforms undertaken by the Government, the fiscal position of TANGEDCO has improved slightly and it is expected that the loss of TANGEDCO will be reduced to Rs.7,825 crore in 2022-23 from Rs.11,955 crore in 2021-22. An allocation of Rs.14,063 crore has been provided in the Budget Estimates towards various subsidies provided to TANGEDCO, he said.

www.EQMagPro.com 17 EQ MARCH 2023 INDIA

INDIA’S ELECTRICITY CONSUMPTION GROWS OVER 9 PC TO 117.84 BILLION UNITS IN FEBRUARY

Experts say power consumption and demand are expected to increase due to heatwave forecasts during this summer India’s power consumption logged a year-on-year growth of over 9% to 117.84 billion units in February this year, according to government data. The robust growth of power consumption indicates sustained momentum of economic activities in February. Experts had earlier said that power consumption and demand would register a substantial increase in March due to further improvement in economic activities as well as rise in temperature. In February 2022, power consumption stood at 108.03 billion units (BU), higher than the 103.25 BU in the same month of 2021, the data showed. The peak power demand met, which is the highest supply in a day, rose to 209.66 gigawatt (GW) in February 2023. The peak power supply stood at 193.58 GW in February 2022 and 187.97 GW in February 2021. The peak power demand met was 176.38 GW in the pre-pandemic February 2020. Experts are of the view that power consumption and demand would log higher growth rates in the coming months due to forecasts of higher temperature during this summer season compared to last year.

TRIVENI GLASS SHARES JUMP UPPER CIRCUIT 5% ON ANDHRA PRADESH SOLAR GLASS FACTORY NEWS

Shares of Triveni Glass had closed in its 5% upper circuit at Rs 22.60 on February 28 following a news report that the glassmaker would invest Rs 1,000 crore to set up an 840-tonneper-day solar glass manufacturing plant in Andhra Pradesh. The stock has rallied 555% over the past three years to a 52-week high of Rs 30.9 and was trading at Rs 22.6 on the morning of February 28. News reports said the company would set up the plant at Pangidi in the East Godavari district, creating 2,000 jobs. It added that Varun Gupta, managing director of Triveni Glass, met Chief Minister YS Jagan Mohan Reddy on February 27 and discussed investments in the state, which is on the verge of holding the Global Investors Summit in Visakhapatnam on March 3 and 4. News reports say Reddy pledged to cooperate fully with Triveni Glass and told Gupta that the state offers good human resources and other facilities. Triveni Glass’ stand-alone revenue rose to Rs 1.6 crore in the December quarter from Rs 0.07 crore a year earlier, while a net profit of Rs 1.13 crore against a net loss of Rs 0.1 crore.

18 EQ MARCH 2023 www.EQMagPro.com INDIA

Source: PTI

FC TECNRGY, SFC ENERGY INK PACT FOR HYDROGEN, METHANOL FUEL CELL UNIT IN GURUGRAM

TecNrgy and German firm SFC Energy have inked a pact for hydrogen and methanol fuel cell manufacturing in India with a plan of new facility in Gurugram, Haryana. As per the pact, SFC will manufacture its EFOY hydrogen and EFOY methanol fuel cells locally and take care of quality assurance while FCTec will continue to be the ‘go to market’ partner that will include identifying opportunities, engineering & assembly of customized fuel cell solutions, system integration besides design and development of other critical components for such solutions and after-sales service.

Peter Podessor, CEO of SFC said the step to open a location in India is logical and a part of SFC’s medium-term strategy. With this new presence, it wants to further expand its Asian business with India as a core market.

“Manufacturing of the entire solution including fuel cells in India is part of our longterm strategy which will position us as one of the market leaders in this segment of fuel cells in India,” said Colonel Karandeep Singh (Retired), the founding director of FCTec

The agreement was officially signed off during the India visit of German Chancellor Olaf Scholz. FCTec is a leading Indian fuel cell engineering & and system integrator of methanol and hydrogen fuel cells for stationary and mobile hybrid power solutions.

LOI SIGNED BETWEEN DST & FRAUNHOFER ISE ON HYDROGEN & CLEAN ENERGY TECHNOLOGIES CAN ACCELERATE ENERGY TRANSITION IN INDIA

ALetter of Intent (LoI) was signed between the Department of Science and Technology (DST) and Fraunhofer Institute for Solar Energy Systems (Fraunhofer ISE) for a long-term collaboration focusing on hydrogen technologies. The LoI was signed on 25th February, 2023, by Dr. Anita Gupta, Scientist G and Head, Energy Technologies Cell, DST and Prof. Dr. Christopher Hebling, Director, Division Hydrogen Technologies, Fraunhofer ISE in the presence of Secretary, DST, Dr. S. Chandrasekhar. The event was also attended by Mr. R. Madhan, Director, Indo-German Science & Technology Centre (IGSTC), Ms Anandi Iyer, Director Fraunhofer India and officials representing both the sides. India and Germany share the goal of decarbonizing their economies and are committed to collaborating jointly in the pursuit of energy security and climate protection. Both countries have committed to develop a national green hydrogen economy to

Source: PTI

facilitate achievement of the Paris Agreement targets. The LoI will trigger development of higher Technology Readiness Level (TRL) for hydrogen energy clusters being set up by DST and identify existing technologies and potential interventions from Fraunhofer in green hydrogen, integrate them with indigenous technologies, and deploy /calibrate them for Indian conditions. DST will provide the enabling framework for cooperation in the hydrogen valley cluster projects, support activities, and facilitate the resources needed wherever applicable and possible. Meanwhile Fraunhofer acts as a technology partner for the hydrogen valley /cluster, provides information and access to technologies of TRL 5 – 8, scientific and technical experts, collaboration in preparing technology roadmaps and guidelines for innovation ecosystem/cluster. This collaboration will pave the way to forge active engagements and collaborations based on mutual needs and strength to further research and technological capabilities in the hydrogen and clean energy sector. It would help in accelerating pathways for energy transition in India.

www.EQMagPro.com 19 EQ MARCH 2023

INDIA

INDIA CALLS FOR GREATER COOPERATION WITH FRANCE IN THE FIELD OF CLEAN ENERGY AND HIGHLIGHTED NEW

DELHI’S PLANS FOR GREEN TRANSITIONING TO EVS AND HYDROGEN ENERGY

Dr. S. Chandrasekhar, Secretary, Ministry of Science and TechnolGoI inaugurates the Indo-French Workshop on Clean and Sustainable Energy Technologies (INFINITE) at CSIR – National Physical Laboratory in New Delhi Using the Thar Desert as a site for solar power generation, India is estimated to generate up to 2,100 GW of solar energy: Dr S Chandrasekhar Partnership with France and other G20 countries are required for green energy generation, storage and conversion, particularly green hydrogen, green ammonia, and energy storage infrastructures: Dr. N. Kalaiselvi

India calls for greater cooperation with France in the field of clean energy and highlighted New Delhi’s plans for green transitioning to EVs and hydrogen energy. Indian renewable sector ranks 4th on the list of the world’s most attractive renewable energy sectors and Solar energy is the most abundant source of renewable power in the country. Inaugurating the Indo-French Workshop on Clean and Sustainable Energy Technologies (INFINITE) at CSIR – National Physical Laboratory in New Delhi, Dr. S. Chandrasekhar, Secretary, Ministry of Science and Technology, Government of India said that the Government in 2022 had set a target of installing 100 GW of solar energy. He added that using the Thar Desert as a site for solar power generation, India is estimated to generate up to 2,100 GW of solar energy.

saline aquifers, basalts, etc. He said, the government has designed policies, programs, and a liberal environment to attract foreign investments to ramp up the country in the renewable energy market at a rapid rate. Department of Science and Technology is also interested in encouraging international collaborations on clean energy research. “I hope the process and technologies that will be discussed in this workshop will be of enormous potential in mitigating the impact of climate change and reducing greenhouse gas emissions”, Secretary added.

Dr Chandrasekhar referred to another initiative of the Govt. of India and that is the National Biofuel Policy, which aims to achieve a 20% blending of ethanol in petrol and a 5% blending of biodiesel in diesel by 2030. Dr Chandrasekhar pointed out that an area to focus upon is Carbon Capture and Storage and as estimated by NITI Aayog, theoretically, India has a total geological CO2 storage capacity of 400-600 Gt considering the depleted oil and gas reservoirs, un-mineable coal seams,

In her address, Dr. N. Kalaiselvi Director General, CSIR and Secretary DSIR, said that India needs huge augmentation in the manufacturing of renewable energy technologies and infrastructures. She underlined that partnership with France and other G20 countries are required for green energy generation, storage and conversion, particularly green hydrogen, green ammonia, and energy storage infrastructures. India and France have long standing bilateral research co-operation specially to augment research on clean and renewable energies, she added.

Pr. Antoine Petit, CEO of the French National Centre for Scientific Research (CNRS) expressed appreciation for the strong partnership between the two countries and emphasized the importance of collaboration in achieving a sustainable energy transition through new bilateral programs.

20 EQ MARCH 2023 www.EQMagPro.com INDIA

Prof. Arvind Kumar Mishra, Director CSIRCIMFR pointed out that this workshop is broadly focused to bring together academic and industrial experts from France and India to develop collaborations in the area of clean and sustainable energy. He said, both the sides need to identify specific research problems and objectives, and identify partners to develop new knowledge bases, joint IPs, and tangible outcomes in biomass energy, coal to methanol/ clean fuels, solar energy, hydrogen, energy storage, and carbon capture utilization and storage. We need to share our experiences, explore new ideas, and challenge ourselves to think differently.

and Fuel Research (CIMFR), Dhanbad, and the French National Centre for Scientific Research (CNRS), France and is being supported by the Indo-French Centre for the Promotion of Advanced Research (CEFIPRA).

Prof. Venugopal Achanta, Director, CSIR – NPL welcomed the guests, invitees, and delegates, and Prof. Arvind K. Mishra, Director, CSIR – CIMFR made the opening remarks.

Prior to the workshop, the bilateral meeting between DG, CSIR, and the CEO of CNRS also included discussions on strengthening cooperation in the field of clean energy research and development and formulation of new R&D programs between the two countries. The meeting was also graced by Directors of several CSIR Labs and other French Representatives from CEFIPRA, CNRS, CEA, and the Embassy of France in India, New Delhi.

The objective of the workshop is to bring together experts, researchers, policymakers, and industry leaders from both countries to exchange knowledge, ideas, and best practices on the development and deployment of clean and sustainable energy technologies. The workshop will feature a range of presentations and discussions on various topics related to Solar Energy, Hydrogen Energy, Carbon Capture Utilization & Storage, Electrochemical Energy Storage, and Clean Fuels. The event has been jointly organized by CSIR – Central Institute of Mining

The INFINITE workshop provides a platform for experts and stakeholders from both countries to exchange knowledge, identify areas of collaboration, and explore new avenues for cooperation in the field of clean and sustainable energy technologies. The event is expected to be successful, and it is hoped that the discussions and collaborations initiated during the workshop will lead to concrete outcomes in the near future. The bilateral workshop is being coordinated by Dr. R. Ebhin Masto, Senior Principal Scientist, CSIR – CIMFR, India, and Dr. Abdelilah Slaoui, Deputy Research Director In-Charge of Energy, CNRS, France.

GOA CAPITAL TO ACHIEVE ‘SOLAR CITY’ GOAL: CM SAWANT

To achieve sustainable development goals, the government has decided to declare capital city Panaji as ‘Solar City’ by generating 88 MW solar power in next two years, Chief Minister Pramod Sawant said

He urged the residential and government buildings and commercial establishments to use their rooftops to install solar panels. “We want the support of the public to achieve this goal.Residential buildings, government buildings and commercial establishments can use their rooftops to install solar panels,” he said. “We can get success only if the public supports this decision.They will get a 40 per cent subsidy from the central government and 10 per cent from the state.

Our concerned departments have taken initiative to make Panaji a solar city,” he said. He said that in the next two years, 88 MW solar power can be generated in the city by installing solar power generating units. Sawant said that casinos and other commercial establishments where rooftop solar power generation is not possible, can install solar power generation panels at any other place and the power generated by them will be transferred to the grid. He reiterated that it is important that the public support the decision and only then the Panaji can be made 100 per cent solar energy.”We are also spreading awareness of this scheme,” Chief Minister Sawant said.

www.EQMagPro.com 21 EQ MARCH 2023 INDIA

BIO-ENERGY PRODUCTION FROM PINE NEEDLES AND BAMBOO: HIMACHAL TO START PILOT PROJECT SOON

This would attract industrial partners and private investments, as it improves environmental, social, and governance issues, he added

Himachal Pradesh will start a pilot project for bio-energy production from pine needles and bamboo as the state is blessed with an enormous wealth of coniferous forest and has a high potential for bamboo production, Chief Minister Sukhvinder Singh Sukhu said.

The project would involve the local community and increase their income. The state government is all set to partner with the Indian School of Business (ISB) to provide policy inputs and research support for the emerging bio-energy sector, he said in a statement issued here. “Many sectors like thermal power, cement and steel were exploring fossil fuel substitutes to reduce emissions. The scope can be expanded to include fuel briquettes made from pine needles as potential substitutes, which has the advantage of much higher calorific value and this would also pave the way for strengthening the rural economy,” said Sukhu. ISB would provide the business model and technology to make this project a success and would also

ensure adequate market linkage. As the government mandate for ethanol blending in petrol has increased from 10 per cent to 20 per cent with the target of achieving ‘Green Energy State’ by 2025, ISB would also undertake the task of making ethanol, compressed bio-gas and bio-fertilizer from bamboo, he said. The residue of ethanol production from bamboo serves as feedstock for the production of compressed bio-gas and biofertilizer in large quantities, he added. Emphasizing the importance of community ownership of forests, the chief minister said it provides incentives for communities to protect, and manage them sustainably. He further said that community ownership of forest land is associated with greater social responsibility and increased incentives for forest protection. This would attract industrial partners and private investments, as it improves environmental, social, and governance issues, he added. Executive Director of Indian School of Business, Professor Ashwini Chhatre and Policy Director, Aarushi Jain elaborated on various projects undertaken by ISB.

Source: PTI

RAMKRISHNA FORGINGS PLANS TO SETUP 85 MW SOLAR CAPACITY: CFO LALIT KHETAN

Ramkrishna Forgings is planning multi-crore investments to set up around 85 mega watt (MW) renewable energy capacity, company CFO Lalit Khetan has said.

The company aims to execute the plan over the next 12 months, Khetan said. Out of the planned 85 MW green capacity, about 8 MW roof-top solar project will be set up at the company’s forging plants at Sariekella and Dugni, in Jamshedpur, he told PTI.

“The total cost of the 8 MW project is estimated to be approximate ly Rs 35 crore, which will be financed by a mix of debt and equity,” Kehtan, who is also the Executive Director of the company said.

The power generated will be used for captive consumption, reducing the company’s dependence on grid power, he said. When asked if the company plans more green projects to increase usage of clean energy, Khetan replied in affirmative. “Our commitment is responsible business practices and dedication to reducing carbon footprint. We look to explore setting up another solar capacity of up to 75 MW in Jamshedpur,” he

said. The company official, however, did not provide any financial details of the 75 MW renewable energy capacity. As per industry estimates, to set up 1 MW of solar project, investment of around Rs 5 crore is needed. “These projects will help us achieve our goal of carbon neutrality by 2030,” he said. Kolkatabased Ramkrishna Forgings is a manufacturer and supplier of closed-die forgings of carbon and alloy steel, micro-alloy steel and stainless steel forgings. The company also has presence in countries like the US, Mexico, Istanbul, Turkey and Belgium.

Source: PTI

22 EQ MARCH 2023 www.EQMagPro.com INDIA

RELIANCE TO SET UP 10 GIGAWATT SOLAR ENERGY PROJECT IN AP: MUKESH AMBANI

SReliance Industries Chairman Mukesh Ambani said his group will be investing in Andhra Pradesh to set up a 10 gigawatt renewable solar energy project peaking at the inaugural session of the twoday Global Investors Summit 2023 here, Ambani said as much as Rs 1.50 lakh crore was invested in Reliances’ KG-D6 assets, developing and supporting gas pipeline and the natural gas produced there is fuelling India’s clean energy transition and will contribute to nearly 30 per cent of the country’s gas production.

“I would like to assure you that Reliance will continue to be an unflinching partner to the people and the Government of Andhra Pradesh in your state’s allaround accelerated progress. This morning, I am happy to announce that we will continue our investments and we will invest in 10 gigawatts of renewable solar energy in the state of Andhra Pradesh, Ambani said.

According to him, the rollout of Jio True 5G will be completed by the end of 2023 throughout the country and the 4G network covers 98 per cent of AP’s population, including those living in the remotest corners of the state. The rollout of Jio’s True 5G will be completed before the end of 2023 throughout India, including your state of Andhra Pradesh. Jio’s True 5G, will trigger a new wave of digital revolution in Andhra Pradesh, benefiting every sector of the economy, he said. Ambani said under the

determined and farsighted leadership of Prime Minister Narendra Modi, India has now become the fastest growing economy in the world.

Similarly, Andhra Pradesh has grown phenomenally under the leadership of Chief Minister YS Jagan Mohan Reddy,

Reliance Retail has partnered with more than 1.2 lakh Kirana merchants across 6,000 villages of the state equipping them with tools needed to thrive and succeed in the digital age and the vertical created over 20,000 direct jobs and a large number of indirect jobs in AP, he explained. Reliance Retail will source significantly more agri and agrobased products and manufactured goods from AP for sale all over India. Apart from increasing the income of farmers, artisans and others, this will directly create over 50,000 livelihood opportunities in the state, he added.

Source: PTI

NTPC CONFERRED WITH THE CBIP AWARD 2022 FOR ‘OUTSTANDING CONTRIBUTION IN POWER GENERATION

NTPC Limited, has been honoured with the CBIP Award 2022 for ‘Outstanding Contribution in Power Generation’, attributed to its Vindhyachal Super Thermal Power Station, the largest power station in the country for its efficiency and high level of generation.

The award presented by Shri R.K. Singh, Hon’ble Union Minister of Power, New & R.E, Govt. of India was received by Shri Ramesh Babu V, Director (Operations) and Shri Praveen Saxena, Regional Executive Director ( NR), Shri Suvash Chandra Naik, Executive Director (Vindhyachal) was also present at the Scope Convention Centre, New Delhi, on the occasion of the CBIP Day. NTPC stands committed to generating power responsibly and sustainably and occupies the premier position in the Indian energy sector in terms of size and efficiency. The CBIP Awards are conferred to institutions/individuals for their outstanding contributions to the development of water, power and Renewable Energy Sectors. The award stands as testimony to NTPC’s enduring contribution to the generation of power in the country.

www.EQMagPro.com 23 EQ MARCH 2023 INDIA

Mr. YS Jagan Mohan Reddy, Chief Minister of Andhra Pradesh

ADANI GREEN’S OPERATING RENEWABLE PORTFOLIO REACHES RECORD LEVEL OF 8,024 MW

Adani Green Energy said its 700-MW hybrid green energy project has become operational, which took its total operating renewable portfolio to 8,024 MW, the largest in India

Adani Green Energy said its 700-MW hybrid green energy project has become operational, which took its total operating renewable portfolio to 8,024 MW, the largest in India. The project is its fourth wind-solar hybrid power plant fully operational at Jaisalmer in Rajasthan, a company statement said. It stated that the 700-MW plant is the world’s largest wind-solar hybrid power plant.

“With the successful operationalisation of the 700-MW plant, the world’s largest wind-solar hybrid power plant, AGEL now has the largest operating renewable portfolio in India with 8,024 MW,” it said.

The combined operational generation capacity of this newly added hybrid power plant is 700 MW and has a Power Purchase Agreement (PPA) at Rs 3.24/kwh for 25 years. This new hybrid power plant consists of a combination of 600 MW solar and 510 MW wind plants. The latest hybrid plant deploys ad vanced renewable technologies like bifacial solar PV modules and horizontal single-axis trackers (HSAT) systems to enable maximum electricity generation from solar energy. The plant is co-located and is designed to deliver CUF of minimum 50 per cent, the highest CUF of any renewable project in India. The plant harnesses the potential of renewable energy by resolving intermittency of the generation and provides a more reliable solution to meet the rising power demand. The plant is housed under AGEL’s 100 per cent subsidiary Adani Hybrid Energy Jaisalmer Four Limited. Earlier in May 2022, it had operationalised India’s first hybrid power plant of 390 MW. This was followed by the commissioning of the world’s largest colocated hybrid power plant of 600 MW in September 2022 and the third hybrid power plant of 450 MW in December 2022. All three of these hybrid energy generation assets are located in Jaisalmer, Rajasthan.

GOVT ACCEPTS EXPERT PANEL REPORT ON SMART ELECTRICITY TRANSMISSION SYSTEM INDIA

The government has accepted a report of a task force or expert panel which paves the way for modern and smart electricity transmission system in India, the Ministry of Power said in a statement.

“The country will soon have a modern and smart power transmission system with features such as real-time monitoring and automated operation of grid, better situational assessment, capability to have increased share of renewable capacity in the power-mix, enhanced utilisation of transmission capacity, greater resilience against cyber attacks as well as natural disasters, centralised and data-driven decision-making, reduction in forced outages through self-correcting systems etc.,” the ministry said.

These and other recommendations are part of a report of a task force set up by the power ministry in September 2021 under the chairmanship of Powergrid chairman and managing director to suggest ways for modernisation of transmission sector and making it smart and future-ready, it stated. The task force in its report has recommended a bouquet of technological and digital solutions, which can be adopted to make the state transmission grids future ready. These recommendations have been clubbed under categories of modernisation of existing transmission system; use of advanced technology in construction and supervision, operations and management; smart and future-ready transmission system; and up-skilling of workforce.

The task force also recommended benchmarks for transmission network availability and voltage control based on performance of global transmission utilities. While the short-term to medium term recommendations will be implemented over 1-3 years, the long-term interventions are proposed to be implemented over a period of 3-5 years, it stated. The other members of the task force included representatives from state transmission utilities, Central Electricity Authority (CEA), central transmission utilities, MeiTY (Ministry of Electronics and Information Technology), IIT Kanpur, NSGPMU and EPTA. The report of the committee was accepted by the government after deliberations with Union power minister R K Singh last week, it stated. During the meeting, the minister emphasised that a modern transmission grid is vital to achieve the government’s vision to provide 24×7 reliable and affordable power to the people and also meet the sustainability goals. Singh said that a fully automated, digitally controlled, fast responsive grid which is resilient to cyber attacks and natural disasters is the need of the hour. The minister said that such a system should ensure isolation of specific areas in case of any contingency, so as to protect the grid and prevent larger outages.

Source: livemint

24 EQ MARCH 2023 www.EQMagPro.com INDIA

INDIA TO HAVE A MODERN AND SMART POWER TRANSMISSION SYSTEM; GOVERNMENT ACCEPTS THE TASK FORCE REPORT

Future-ready Transmission System to allow greater mixing of renewable energy, better utilization of existing transmission capacity, fewer outages and resilience against cyber-attacks and natural disasters

The system to use predictive maintenance technique using Artificial Intelligence and Machine Learning; Robots & Drones to be used in construction and inspection of transmission assets Modern Transmission Grid necessary to achieve government’s vision of 24X7 reliable & affordable power and meet sustainability goals, says Union Power & NRE Minister Shri R. K. Singh

CEA to formulate necessary standards and regulations to for adoption of identified technological solutions and set benchmark performance levels The country will soon have a modern and smart power transmission system with features such as real-time monitoring and automated operation of grid, better situational assessment, capability to have increased share of renewable capacity in the power-mix, enhanced utilization of transmission capacity, greater resilience against cyber-attacks as well as natural disasters, centralized and data driven decision-making, reduction in forced outages through self-correcting systems etc. These and other recommendations are part of a report of a task force set up by the Power Ministry in Sep, 2021 under the chairmanship of CMD, POWERGRID to suggest ways for modernization of Transmission Sector and making it smart & future ready. The other members of the Task Force included representatives from State Transmission Utilities, Central Electricity Authority, Central Transmission Utilities, MeiTY, IIT Kanpur, NSGPMU and EPTA The report of the committee was accepted by the government after deliberations chaired by Union Power & NRE Minister Shri R. K. Singh last week. During the meeting, the Minister emphasized that a modern transmission grid is vital to achieve the government’s vision to provide 24×7 reliable and affordable power to the people and also meet the sustainability goals. Shri Singh said

that a fully automated, digitally controlled, fast responsive grid which is resilient to cyber attacks and natural disasters is the need of the hour. The Minister said that such a system should ensure isolation of specific areas in case of any contingency, so as to protect the grid and prevent larger outages. Appreciating the efforts of the Task Force, Shri Singh directed the CEA to formulate necessary standards and regulations to for adoption of identified technological solutions and set benchmark performance levels so as to build a robust and modern transmission network in the country. The Task force in its report has recommended a bouquet of technological and digital solutions which can be adopted to make the state transmission grids future ready.These recommendations have been clubbed under categories of modernization of existing transmission system; use of advanced technology in construction & supervision, operations & management; smart & future-ready transmission system; and up-skilling of workforce. The Task Force has recommended Centralized Remote Monitoring, Operation of Substations including SCADA, Flexible AC Transmission devices (FACTs), Dynamic Line Loading system (DLL), Wide Area Measurement System (WAMS) using PMUs and data analytics, Hybrid AC / HVDC system, Predictive maintenance technique using AI/ML algorithms, HTLS Conductors, Process Bus based Protection Automation and Control GIS/Hybrid Substation, Cyber Security, Energy Storage System and Drones & Robots in construction/inspection of transmission assets. The use of robots is expected to not only minimize human intervention and minimize life risks/hazards but also save time with while ensuring accuracy during construction and maintenance. The Task force also recommended benchmarks for transmission network availability and voltage control based on performance of global transmission utilities. While the short-term to medium term recommendations will be implemented over 1-3 years, the long-term interventions are proposed to be implemented over a period of 3-5 years.

www.EQMagPro.com 25 EQ MARCH 2023 INDIA

MERCEDES SET TO INVEST BILLIONS IN E-VEHICLES PLANTS

Mercedes will invest billions of dollars to modernise its plants in China, Germany and Hungary over the coming years, magazine Automobilwoche reported, as the carmaker prepares to switch to electric vehicles and cut emissions.

OLA ELECTRIC

TO RAISE $300 MN FOR EXPANSION PLANS TO MEET CORPORATE NEEDS

E-vehicle manufacturer Ola Electric is close to raising funds of around USD 300 million for its expansion plans and to meet other corporate needs, sources close to the company said.

The fresh round of fundraising comes amid expectations that Ola Electric would break even soon and achieve profitability. The fundraising would be managed by investment bank Goldman Sachs, and the funds would be raised from existing and marquee global investors and sovereign funds, the sources added. With close to a billion dollar annual revenue run rate, Ola Electric led the pack of Indian EV manufacturers by volume and revenue within a year of beginning deliveries of its electric scooters — Ola S1 and Ola S1 Pro. The company has been building on its plan to develop core technologies like cell manufacturing, and is looking to expand its product portfolio across segments of twowheelers and four-wheelers.

Ola Electric had recently signed an MoU with the Tamil Nadu government to acquire land to set up the world’s largest EV hub at a single location, in Krishnagiri, which will include the company’s cell factory, four-wheeler factory and supplier ecosystem. The company also intends to expand its existing two-wheeler factory, sources said. The electric two-wheeler manufacturer has been clocking an average monthly run rate of over 20,000 units. Its expansion plan includes the opening of 500 Experience Centres across all major cities by April 2023.

The European Union has set a goal to halve CO2 emissions per passenger car over their life cycle by the end of this decade compared to 2020 and is seeking agreement on a 2035 deadline to end the sale of fossil fuel cars. Mercedes has said it will be ready to go electric by the end of the this decade, where market conditions allow.

“We are investing a three-digit million amount per plant for the run up,” production manager Joerg Burzer was quoted as saying by the magazine, adding that these investments will be at the plants in Beijing, Rastatt in Germany and Kecskemet in Hungary.

The carmaker will start work on the Rastatt plant over the coming months and will produce the first model of the compact vehicle platform MMA from 2024. The number of models produced there will be cut to four from seven, Burzer said. In addition, Mercedes will invest a low single-digit billion dollar sum in modernising the painting systems at its Sindelfingen, Bremen and Rastatt plants in Germany. The report said the modernisation aims to cut energy and water consumption, and the painting system’s reliance on gas, as opposed to carbon-free energy. Mercedes is also considering expanding its U.S. plant in Tuscaloosa, where it can benefit from government subsidies under last year’s Inflation Reduction Act, Automobilwoche said. Burzer said Mercedes was ready to respond to any further changes in the regulatory environment.

“The framework conditions worldwide change again and again, we may have to react to that,” Burzer said.

Source: Reuters

26 EQ MARCH 2023 www.EQMagPro.com BUSINESS & FINANCE

MAINSTREAM RENEWABLE POWER AND ACTIS COMPLETE SALE OF LEKELA POWER

Transaction generates net proceeds to Mainstream of approximately USD 90 million, subject to certain closing adjustments

Lekela is the African continent’s largest pure-play renewable energy Independent Power Producer (`IPP’) with over 1 GW of fully operational wind assets

The planned exit reflects the successful culmination of Mainstream and Actis’ partnership strategy for Lekela

Reference is made to the stock exchange announcement by Aker Horizons ASA dated 18 July 2022 regarding Mainstream Renewable Power (“Mainstream”), the global wind and solar company majority-owned by Aker Horizons, and Actis’, a leading global investor in sustainable infrastructure, agreement to sell the Lekela Power platform. Mainstream and Actis today announced the completion of the sale of 100 percent of the Lekela platform to Infinity Power, a joint venture between Egypt’s Infinity and UAE’s Masdar.

The transaction generates net proceeds to Mainstream of approximately USD 90 million, subject to certain closing adjustments, with the transaction valued at an enterprise value of approximately USD 1.5 billion. Lekela was established in 2015 in a joint venture between Actis (60 percent), and a Mainstream-led consortium called Mainstream Renewable Power Africa Holdings (‘MRPAH’) (40 percent), to deliver clean, reliable energy across Africa. Lekela has since become Africa’s largest pure-play renewable energy IPP, with over 1 GW of fully-operational wind assets, including five operational wind farms in South Africa (624 MW), one operational wind farm in Egypt (252 MW), one operational wind farm in Senegal (159 MW) as well as development opportunities in Ghana, Senegal and Egypt. The exit reflects the successful culmination of Actis and Mainstream’s partnership strategy for Lekela, following a comprehensive value creation approach. With the support of Actis and Mainstream’s dedicated sustainability professionals, Lekela has implemented the highest international standards in health, safety and environmental protection.

Lekela has also developed a deep commitment to local development and continues to operate a community investment programme that finances entrepreneurship, educational and environmental protection initiatives. Throughout the development, construction and operations journey, Actis and Mainstream have delivered on their robust sustainable development standards, guided by close engagement with local communities. “We are immensely proud of the role we have played in building and nurturing what is today Africa’s largest pureplay renewable energy IPP and I am confident that Lekela will continue to make a major contribution to a just, and therefore sustainable, energy transition. Mainstream is deeply committed to our mission of leading the global transition to renewable energy and our 150-strong proudly South African team is focused on bringing our 11.5 GW pipeline of wind and solar projects in South Africa to fruition this decade and beyond,” said Mary Quaney, Group Chief Executive of Mainstream Renewable Power.

Citi and Clifford Chance advised Mainstream and Actis on the Lekela transaction.

www.EQMagPro.com 27 EQ MARCH 2023 BUSINESS & FINANCE

GREENHOUSE GAS PROTOCOL RECEIVES $9.25 MILLION GRANT FROM THE BEZOS EARTH FUND

Today the Earth Fund announced its award of $9.25 million to Greenhouse Gas Protocol, which is co-convened by World Resources Institute and the World Business Council for Sustainable Development. The partnership will allow GHG Protocol to update and clarify existing standards, develop new guidance, improve efficiency, and provide additional technical services to companies. This work will support GHG Protocol users’ implementation of greenhouse gas emissions accounting and reporting standards.

In November 2022, GHG Protocol launched a set of surveys on its Corporate Accounting Reporting Standard, Scope 2 Guidance, and Scope 3 Standard and Scope 3 Calculation Guidance to better understand users’ challenges with implementing the standards. The global stakeholder survey process will inform future revisions to existing standards or development of additional guidance and sets the stage for the next two years of GHG Protocol’s work. By soliciting feedback from users on pain points, as well as users’ suggestions for revisions, GHG Protocol is working to better serve practitioners on the ground.

Ani Dasgupta, President & CEO of World Resources Institute, emphasized the foundational role that GHG Protocol has played in the GHG emissions and accounting ecosystem. “For over twenty years, GHG Protocol has supplied the world’s most widely used greenhouse gas accounting standards which have come to underpin virtually every corporate GHG reporting program,” he said. “This generous award in partnership with the Earth Fund comes at a critical inflection point as the GHG Protocol updates its standards and guidance and significantly ramps up the support it provides to thousands of corporate users.”

This funding will be pivotal to expanding GHG Protocol’s capacity as interest in GHG emissions accounting grows from voluntary to regulatory programs, said Pankaj Bhatia, Director of GHG Protocol. “GHG Protocol has provided comprehensive standards and tools for businesses, cities, and governments to credibly measure their GHG emissions and track progress toward their climate targets, and we are seeing an exponential increase in demand for support in this field.” he said. “This investment will allow us to continue to further strengthen our vital role for years to come.”

Source: wri

SEMBCORP AWARDED FIRST GREENFIELD RENEWABLES PROJECT IN THE MIDDLE EAST

The 500MW build-own-operate solar plant will augment Sembcorp’s well-established presence in the Sultanate of Oman’s power and water desalination sector

Sembcorp Industries (Sembcorp) announces that it has, through an 80%-owned joint venture to be set up by its wholly-owned subsidiary Sembcorp Utilities with Jinko Power Technology (Jinko Power), received an award by Oman Power and Water Procurement Company (OPWP) to build, own and operate the Manah Solar II Independent Power Project (IPP) in Manah, Sultanate of Oman. The 500MW solar plant is expected to be operational by 2025 and will be backed by a 20-year power purchase agreement with OPWP. This project will complement Sembcorp’s existing capabilities and track record in the region. The Salalah Independent Water and Power Plant, one of the most energy-efficient power and water plants in the Dhofar region in the Sultanate of Oman, is 40% owned by Sembcorp.

Andy Koss, CEO of UK & Middle East, Sembcorp Industries, said, “The Manah Solar II IPP will mark Sembcorp’s first renewables project in the Middle East. To be constructed in the Sultanate of Oman, the project will leverage our strong network and presence for over 10 years in the country built through Salalah Independent Water and Power Plant. We are delighted to be awarded this project and look forward to working with Jinko Power to support the global energy transition.”

This project is expected to be financed through a mix of internal cash resources and external bank borrowings. It is not expected to have a material impact on the earnings per share, net asset value per share and leverage of Sembcorp for the financial year ending December 31, 2023.

Source: sembcorp

28 EQ MARCH 2023 www.EQMagPro.com BUSINESS & FINANCE

VOLKSWAGEN PRESENTS NEW LOW-PRICE ELECTRIC CAR, ID.2ALL

The Volkswagen brand is continuing the success story of its compact cars in the age of electric mobility and is providing a first glimpse of an allelectric Volkswagen costing less than 25,000 euros with the ID. 2all concept car. Initial facts: front-wheel drive, range of up to 450 km, innovative technological features such as Travel Assist, IQ.LIGHT or Electric Vehicle Route Planner and a new Volkswagen design language. The production version will be based on the MEB Entry platform and is one of ten new electric models that Volkswagen will launch by 2026.

Exterior design: friendly face, very dynamic and new C-pillar signature

Thomas Schäfer, CEO of Volkswagen Passenger Cars: “We are transforming the company rapidly and fundamentally –with the clear objective of making Volkswagen a genuine Love Brand. The ID. 2all shows where we want to take the brand. We want to be close to the customer and offer top technology in combination with fantastic design. We are implementing the transformation at pace to bring electric mobility to the masses.”

Volkswagen will present the production version of the ID. 2all for the European market in 2025. The goal is a starting price of less than 25,000 euros.

Imelda Labbé, Member of the Brand Board of Management responsible for Sales, Marketing and Aftersales: “We are transferring the typical Volkswagen virtues to the new world of mobility: top quality and workmanship, outstanding software and digital services with genuine added value. The focus here is always on the needs and requirements of our customers.”

Development of the ID. 2all is based on the latest evolutionary stage of the modular electric drive (MEB) platform. Kai Grünitz, Member of the Brand Board of Management responsible for Technical Development: “The ID. 2all will be the first MEB vehicle with front-wheel drive. We are exploiting the great flexibility offered by our modular electric drive (MEB) platform and will set new standards in terms of technology and everyday usability with the MEB Entry platform.” With the enhanced MEB Entry platform, the ID. 2all is equipped with particularly efficient drive, battery and charging technology. It has a powerful electric drive motor with an output of 166 kW/226 PS and will have a calculated WLTP range of up to 450 kilometres. Volkswagen is also again placing greater focus on design. Andreas Mindt, Head of Design at Volkswagen Passenger Cars: “The ID. 2all gives a preview of the new design language of Volkswagen, which is based on the three pillars stability, likeability and enthusiasm.”

One element of this new design language is the C-pillar design developed for the first Golf. The ID. 2all is the first Volkswagen with a new interpretation of this signature. Other design features of the concept car include a body with a clear and powerful stance on the wheels, a friendly face, a good portion of dynamics and timeless elegance.

Interior design: spacious, high-quality appearance, self-explanatory operation

The interior also has a clear design and is characterised by a high-quality appearance, a self-explanatory infotainment system with classic volume control and a separate air conditioning block. The storage volume is a generous 490–1,330 litres, a value exceeding that of higher vehicle classes.

Accelerated electric offensive: ten new electric models by 2026