2023 Year End Review the power is now magazine Eric Lawrence Frazier, MBA Publisher Office: (800) 401-8994 Ext. 703 Direct: (714) 361-2105 eric.frazier@thepowerisnow.com www.thepowerisnow.com EDITORIAL TEAM

Gilmore Editor in Chief (800) 401-8994 ext. 711 sheila.gilmore@thepowerisnow.com Timothy Hornu Graphic Artist and Design Manager tim@thepowerisnow.com CONTRIBUTORS The Power Is Now Research Team HAVE YOU READ OUR PAST ISSUES YET? CLICK HERE TO READ US ONLINE! 2023 Review

Sheila

The Power Is Now Media Inc.

3739 6th Street Riverside, CA 92501

Ph: (800) 401-8994 | Fax: (800) 401-8994

info@thepowerisnow.com

www.thepowerisnow.com

The Power Is Now Magazine™ is owned and published electronically by The Power Is Now Media, Inc.

Copywrite 2022 The Power Is Now Media Inc.

All rights reserved.

“The PIN Magazine” and distinctive logo are trademarks owned by The Power Is Now Media, Inc.

“ThePINMagazine.com”, is a trademark of The Power Is Now Media, Inc.

“Magazine.thepowerisnow.com”, is a trademark of The Power Is Now Media, Inc.

No part of this electronic magazine or website may be reproduced without the written consent of The Power Is Now Media, Inc.

Requests for permission should be directed to:

info@thepowerisnow.com

HEADQUARTERS

IMPORTANT STATEMENT OF COPYRIGHT:

the power is now magazine Find The Power Is Now TV on for more details go to www.thepowerisnow.com 2nd AND 4th FRIDAYS OF THE MONTH 3:00 PM TO 4:00 PM PST 2023 Review

2023 Review

2023 Review

JANUARY 2023

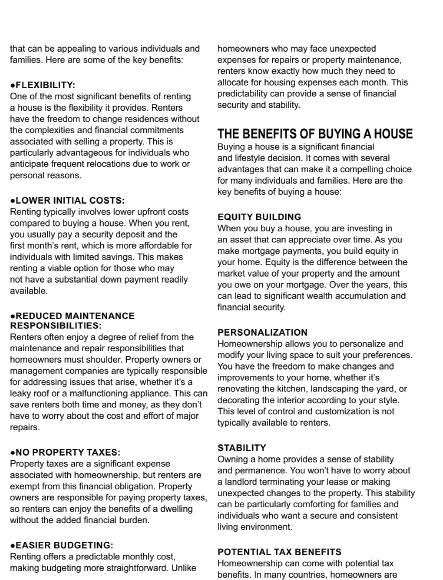

New Haven, CT Real Estate market projections

Here’s what to expect in 2023

FEBRUARY 2023

New Haven, CT Real Estate market projections Here’s what to expect in 2023

MARCH 2023

5 Factors to Consider When Buying and Selling a Home at the Same Time

APRIL 2023

3 Alternatives to Selling Your Home Through a Realtor

MAY 2023

How to Appeal Your Property Taxes in New Haven, Connecticut

JUNE 2023

Master the Art of Real Estate Flipping in New Haven,

JULY 2023

Demystifying Loan Estimates Essential

Information You Must Have

AUGUST 2023

How to Perform a Landlord Background Check

SEPTEMBER 2023

The Pros and Cons of Renting vs Buyin A House

OCTOBER 2023

A Guide On How To Sell Your House Fast

NOVEMBER 2023

What’s the Point of Mortgage Points

DECEMBER 2023

A Comprehensive Guide to Buying a Mobile Home in Connecticut

CONTENTS 2023 YEAR END REVIEW

REAL ESTATE ARTICLES CONTRIBUTIONS

PODCAST

2023 Review

TV SHOWS

2023 Review

2023 Review thepowerisnowmeida

BACK TO CONTENTS 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

BACK TO CONTENTS 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

BACK TO CONTENTS 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

BACK TO CONTENTS 2023 Review thepowerisnowmeida

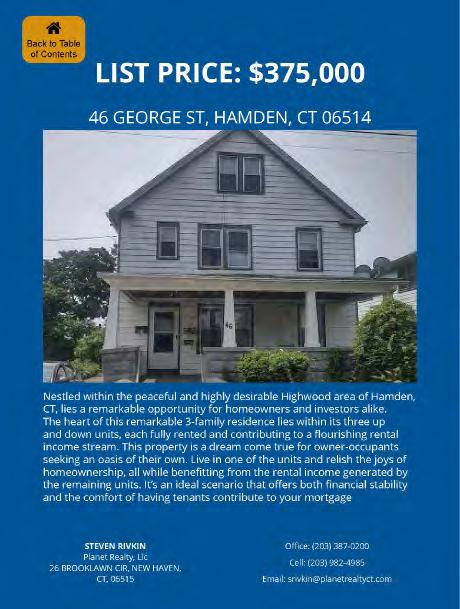

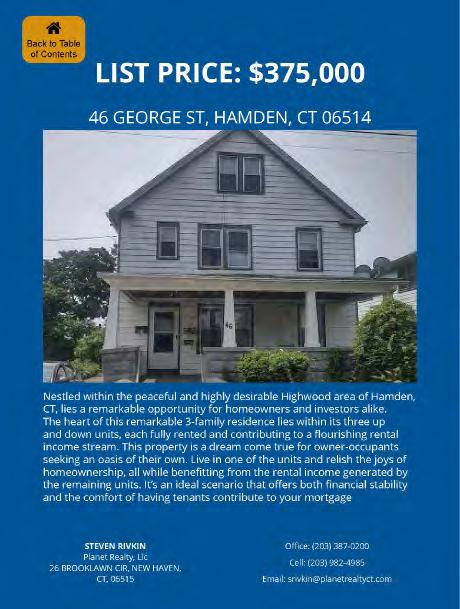

Master the Art of Real Estate Flipping in New Haven, Connecticut: Insider Tips and Tricks for Success

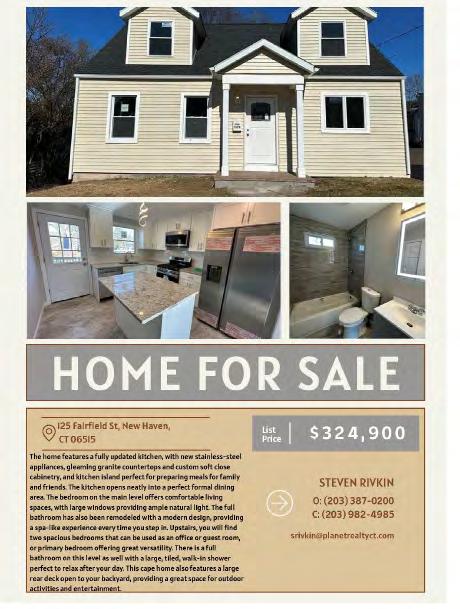

By Steven Rivkin

If you’re looking to dive into the exciting realm of buying properties, renovating them, and selling them for a profit, you’ve come to the right place. In this article, we will explore the tips and tricks that can help you master the art of real estate flipping in New Haven. From finding the right properties to maximizing your renovations and navigating the local market, we’ll provide you with valuable insights and strategies to ensure your flipping endeavors are a resounding success. So, let’s get started on your journey to becoming a successful real estate flipper in New Haven, Connecticut.

FINDING PROFITABLE INVESTMENT OPPORTUNITIES: NAVIGATING THE NEW HAVEN REAL ESTATE MARKET

To excel in real estate flipping, it is crucial to identify profitable investment opportunities in the New Haven real estate market. In this section, we will delve into effective strategies that can help you navigate this market with confidence, allowing you to uncover hidden gems and secure properties with substantial profit potential.

RESEARCHING THE MARKET:

Before diving into any investment, take the time to research the New Haven real estate market thoroughly. Analyze recent sales data, study market trends, and understand the dynamics of different neighborhoods. Identify areas that are experiencing growth or revitalization, as they often present promising opportunities for flipping.

2023 Review thepowerisnowmeida

NETWORK WITH LOCAL PROFESSIONALS:

Building connections with local real estate agents, wholesalers, and other industry professionals is invaluable for finding off-market deals and accessing insider information. Attend networking events, join real estate investment groups, and seek mentorship from experienced flippers who have a deep understanding of the New Haven market.

UTILIZE ONLINE RESOURCES:

Make use of online platforms, such as real estate websites, listing databases, and social media groups, to search for potential investment properties in New Haven. Set up alerts and filters based on your criteria to receive notifications about new listings that align with your flipping goals.

TARGET DISTRESSED PROPERTIES:

Distressed properties, such as foreclosures, short sales, or homes in need of significant repairs, often offer great opportunities for flipping. Keep an eye out for such properties that are priced below market value, as they have the potential for higher returns on investment.

CONDUCT THOROUGH DUE DILIGENCE:

Before making an offer on a property, conduct a thorough due diligence process. This includes inspecting the property, assessing repair costs, estimating the after-repair value (ARV), and verifying any potential legal or zoning issues. Ensure that the numbers align with your profit goals before proceeding.

Successfully navigating the New Haven real estate market requires a combination of market knowledge, networking, and diligent research. By implementing effective strategies, such as researching the market, networking with local

professionals, utilizing online resources, targeting distressed properties, and conducting thorough due diligence, you can increase your chances of finding profitable investment opportunities for real estate flipping in New Haven, Connecticut.

CRUNCHING THE NUMBERS:

CONDUCTING THOROUGH FINANCIAL ANALYSIS FOR FLIPPING SUCCESS

Before embarking on a real estate flipping project in New Haven, Connecticut, it is crucial to conduct a comprehensive financial analysis. Crunching the numbers allows you to make informed decisions and maximize your chances of a successful flip. Here are key factors to consider:

1)Purchase Price and Acquisition Costs:

Evaluate the market value of the property and negotiate a favorable purchase price. Account for additional costs such as closing fees, inspections, and any necessary permits.

2)Renovation Budget:

Develop a detailed budget for renovations, including materials, labor, and contingency funds. Consider consulting contractors and professionals to estimate costs accurately.

3)Potential Resale Value:

Research recent sales data for similar properties in the area to determine the potential resale value. Assess the local market trends and demand to gauge the market’s appetite for flipped homes.

4)Holding Costs and Financing:

Calculate the expenses associated with holding the property, including mortgage payments, property taxes, insurance, and utilities. Explore financing options and understand the impact of interest rates on your profitability.

5)Timeframe:

BACK TO CONTENTS

2023 Review thepowerisnowmeida

Determine how long the renovation process is expected to take and factor in carrying costs during that period. Time is money in real estate flipping, so aim for an efficient turnaround to maximize profits.

6)Profit Margin:

Set realistic profit goals by considering all expenses and potential risks involved. Aim for a margin that compensates for unexpected challenges and aligns with your investment objectives.

By conducting a thorough financial analysis, you gain a clear understanding of the potential profitability of your flipping project. This analysis serves as the foundation for informed decisionmaking throughout the entire process, ensuring you stay on track to achieve your financial goals and minimize risks. Remember, meticulous number-crunching is a vital step towards flipping success in New Haven, Connecticut.

THE ART OF RENOVATION: MAXIMIZING PROPERTY VALUE THROUGH STRATEGIC UPGRADES

Renovations play a crucial role in the success of a real estate flip in New Haven. By strategically upgrading and improving the property, you can significantly increase its value and appeal to potential buyers. Here are some key considerations for achieving maximum impact with your renovations:

1.Focus on Curb Appeal:

First impressions matter, so allocate a portion of your budget to enhancing the property’s exterior. Consider freshening up the landscaping, repainting the facade, and updating the entryway to create a welcoming and attractive curb appeal.

2.Prioritize Kitchens and Bathrooms:

These are often the areas that buyers pay the most attention to. Invest in modernizing the kitchen and bathrooms, which can greatly

enhance the property’s overall value. Update countertops, cabinets, fixtures, and appliances to create a stylish and functional space that appeals to potential buyers.

3.Opt for Neutral and Modern Designs:

When choosing materials and finishes, aim for neutral colors and modern designs that have broad appeal. This helps potential buyers envision themselves living in the space while minimizing the risk of design choices that may not suit everyone’s taste.

4.Enhance Energy Efficiency:

Incorporate energy-efficient upgrades that can save money for future homeowners and increase the property’s desirability. Install energy-efficient windows, insulation, and appliances to reduce utility costs and attract environmentally conscious buyers.

5.Address Structural and Mechanical Issues:

Prioritize addressing any structural or mechanical issues that could deter potential buyers or cause problems down the line. Ensure the property’s systems such as plumbing, electrical, and HVAC, are in good working order and meet current safety standards.

6.Optimize Storage Space:

Ample storage is a desirable feature for buyers. Look for opportunities to increase storage capacity, such as adding built-in shelves or closets, maximizing underutilized spaces, or incorporating creative storage solutions.

7.Don’t Over-Improve:

While renovations are important, be mindful not to over-improve the property beyond the neighborhood’s market standards. Strive for a balance between quality upgrades and aligning with the expectations of potential buyers in the area.

Remember, budgeting and planning are key when it comes to renovations. Carefully evaluate

2023 Review thepowerisnowmeida

each upgrade’s potential return on investment and prioritize projects that will have the most significant impact on the property’s value. By approaching renovations strategically, you can transform a property in New Haven into an enticing and profitable investment for potential buyers.

STRATEGIC TIMING:UNDERSTANDING THE NEW HAVEN REAL ESTATE CYCLE FOR OPTIMAL FLIPPING

Timing is a crucial factor when it comes to successful real estate flipping in New Haven. Understanding the local market cycle and strategically timing your buying and selling decisions can significantly impact your profitability. Here are some key considerations to keep in mind:

●Research Market Trends:

Stay informed about the New Haven real estate market trends, such as seasonality, supply and demand, and pricing patterns. This knowledge will help you identify favorable periods for acquiring properties at a lower cost.

●Analyze Market Indicators:

Monitor key indicators like median home prices, inventory levels, and average days on market. Look for signs of an upswing or downswing in the market. Buying during a downturn and selling during an upswing can lead to higher profits.

●Consider Economic Factors:

Assess the local economic conditions in New Haven, such as job growth, population trends, and major development projects. These factors can influence the demand for properties and impact their resale value.

●Be Mindful of Seasonal Fluctuations:

New Haven’s real estate market can experience seasonal variations. For example, spring and summer tend to be more active, while winter

months may see a slowdown. Understand these fluctuations to align your flipping projects with the peak selling seasons.

●Plan for Holding Costs:

Factor in the potential holding costs associated with each property, including mortgage payments, property taxes, insurance, and utilities. Be mindful of the duration of your project and aim to sell before the costs eat into your profits.

By strategically timing your buying and selling decisions based on market trends and economic factors, you can optimize your real estate flipping endeavors in New Haven. Remember, staying informed, conducting thorough market research, and seeking guidance from local experts can further enhance your ability to make well-timed and profitable flipping decisions.

MARKETING AND SELLING: ATTRACTING BUYERS AND CLOSING DEALS FOR MAXIMUM PROFIT

Once you’ve successfully renovated a property in New Haven, Connecticut, it’s time to focus on marketing and selling it to maximize your profit potential. In this section, we will explore effective strategies to attract potential buyers and navigate the selling process with finesse.

1.Professional Photography and Staging: Capture the Essence of the Property

First impressions matter. Invest in professional photography that showcases the property’s best features and highlights the renovations you’ve made. Consider staging the property to create a visually appealing and inviting atmosphere that allows potential buyers to envision themselves living there.

2.Online Listings and Marketing: Leverage Digital Platforms

Harness the power of online listings and

BACK TO CONTENTS

2023 Review thepowerisnowmeida

marketing to reach a broader audience. Utilize real estate websites, social media platforms, and online classifieds to showcase your property. Craft compelling descriptions, highlight the property’s unique selling points, and include highquality images to generate interest.

3.Open Houses and Private Showings: Create a Memorable Experience

Hosting open houses and private showings allows potential buyers to experience the property firsthand. Create a welcoming atmosphere, provide informative brochures or digital presentations, and be prepared to answer questions about the property and its renovations. Consider offering refreshments or small incentives to make the experience memorable.

4.Collaborate with a Skilled Real Estate Agent: Tap into Local Expertise

Partnering with a knowledgeable real estate agent who understands the New Haven market can be invaluable. They can provide valuable insights, suggest pricing strategies, and negotiate on your behalf. A reputable agent will have an extensive network of potential buyers and industry connections that can facilitate a faster and smoother selling process.

5.Strategic Pricing and Negotiation: Optimize Profitability

Set a competitive and realistic listing price based on market trends and comparable sales in the area. Be prepared to negotiate with potential buyers, considering offers that align with your financial goals. Striking a balance between maximizing your profit and attracting qualified buyers is key to achieving a successful sale.

6.Closing the Deal: Ensuring a Smooth Transaction

Work closely with your real estate agent and legal professionals to navigate the closing process. Ensure that all necessary paperwork and documentation are in order to facilitate a smooth transaction. Be responsive and cooperative

during the closing period to expedite the process and avoid potential delays.

CONCLUSION

By implementing effective marketing strategies, leveraging digital platforms, collaborating with professionals, and strategically pricing your property, you can attract qualified buyers and close deals that maximize your profit potential. With careful planning and execution, your real estate flipping endeavors in New Haven, Connecticut, can yield fruitful results.

The process of flipping real estate in New Haven, Connecticut can be both rewarding and challenging. To be successful, you need to have a solid understanding of the market, develop a strong network of professionals, and implement effective strategies for identifying and renovating properties, financing deals, timing your flips, and marketing and selling your flipped properties.

At Planet Realty, LLC, we specialize in helping buyers, sellers, and investors navigate the New Haven market and achieve their real estate goals. With years of experience in the industry, we have developed a deep understanding of the local market and have built a strong network of trusted professionals to help our clients succeed.

If you’re looking to buy or sell a property in New Haven or are interested in investing in real estate, we invite you to work with us. We will guide you through the process and provide you with the expertise, resources, and support you need to achieve your goals. Contact us today to learn more about our services and how we can help you succeed in the New Haven real estate market.

2023 Review thepowerisnowmeida

Demystifying Loan Estimates: Essential InformationYou Must Have

By Steven Rivkin

Obtaining a loan can be an overwhelming process, especially if you are a first-time borrower or if you haven’t been through the process in a while. One of the critical documents you will encounter when applying for a loan is the Loan Estimate. This document provides crucial information about the loan terms, interest rates, fees, and estimated costs associated with the loan. In this article, we aim to demystify Loan Estimates and provide you with the essential information you must have.

WHAT IS A LOAN ESTIMATE?

A Loan Estimate is a standardized document

that lenders are required to provide to borrowers within three business days of receiving a completed loan application. It is designed to help borrowers understand the key features, costs, and risks associated with the loan they are applying for. The Loan Estimate replaces the previous Good Faith Estimate (GFE) and Truth in Lending (TIL) disclosure forms.

z Key Components of a Loan Estimate:

1.LOAN TERMS:

This section provides an overview of the loan, including the loan amount, interest rate, loan duration, and whether the interest rate is fixed

BACK TO CONTENTS

2023 Review thepowerisnowmeida

or adjustable. It also specifies if there are any prepayment penalties or balloon payments associated with the loan.

2.PROJECTED PAYMENTS:

Here, you will find the estimated monthly payment breakdown, including the principal and interest, mortgage insurance, property taxes, and homeowner’s insurance. This section also indicates if the payment amount can change over time.

3.CLOSING COSTS:

The Loan Estimate details the estimated costs you will need to pay at the closing of the loan. This includes fees for loan origination, appraisal, title insurance, taxes, and other services. It also provides an estimate of the total closing costs and cash needed to close the loan.

4.LOAN COSTS:

This section outlines the specific costs related to the loan itself, such as the interest rate, points (if applicable), and any lender credits offered. It helps you understand the total amount you will pay over the life of the loan, including the principal, interest, and mortgage insurance.

5.OTHER CONSIDERATIONS:

The Loan Estimate highlights additional information, including whether the loan can be assumed or whether there are any penalties for late payments or defaulting on the loan. It also clarifies if there are any required services that you must use during the loan process, such as specific appraisers or title companies.

WHY IS THE LOAN ESTIMATE IMPORTANT?

The Loan Estimate is a crucial document for borrowers as it provides transparency and enables you to make an informed decision about the loan you are considering. By reviewing the Loan Estimate, you can compare loan offers from different lenders and assess the affordability and suitability of each option. It helps you understand the total cost of the loan, the amount you need to bring to the closing table, and any potential risks associated with the loan.

WHAT TO DO WITH THE LOAN ESTIMATE?

Once you receive the Loan Estimate, take the time to review it carefully. Compare it with offers from other lenders to ensure you are getting the best terms and rates. Pay close attention to the estimated closing costs, as they can significantly impact the overall affordability of the loan. If you have any questions or concerns about the Loan Estimate, don’t hesitate to reach out to the lender for clarification.

Remember, the Loan Estimate is not a final loan approval or commitment to lend. It is an estimate based on the information provided at the time of application. The final loan terms may vary, but the lender is required to provide a Closing Disclosure three business days before the closing. This document will outline the final terms and costs of the loan.

In conclusion, understanding the Loan Estimate is vital when navigating the loan application process. By demystifying this document and paying attention to its key components, you can make informed decisions about your loan options. Take the time to review and compare Loan Estimates from different lenders, ensuring that you select the loan that best fits your financial needs.

2023 Review thepowerisnowmeida

How to Perform a Landlord Background Check

By Steven Rivkin

When looking for a new place to rent, it’s essential to ensure that the landlord you’ll be dealing with is reliable, responsible, and ethical. Performing a landlord background check can give you valuable insights into the landlord’s history and reputation, helping you make an informed decision before signing a lease. In this article, we’ll guide you through the steps to perform a thorough landlord background check, ensuring a smooth and secure renting experience.

STEP 1: RESEARCH AND GATHER

Start by collecting basic information about the landlord or property management company. This information may include the landlord’s full name, contact details, and the address of the rental property. You can find these details in the rental listing, lease agreement, or by directly asking the landlord.

STEP 2: ONLINE SEARCH

Perform an online search using the landlord’s name and any other relevant information you’ve gathered. Check for any news articles, social media profiles, or online reviews related to the landlord or their properties. Pay attention to any red flags such as past legal issues, complaints

BACK TO CONTENTS

INFORMATION

2023 Review thepowerisnowmeida

from tenants, or negative reviews.

STEP 3: VERIFY OWNERSHIP AND LICENSE

Ensure that the person claiming to be the landlord is the actual property owner or a legally authorized representative. You can verify this information by requesting proof of ownership or checking with the local property records office. Additionally, confirm whether the landlord is licensed to operate rental properties in your area.

STEP 4: CHECK THE BETTER BUSINESS BUREAU (BBB)

Visit the Better Business Bureau’s website and search for the landlord’s name or property management company. The BBB provides ratings and customer reviews, which can give you an idea of the landlord’s reputation and how they handle tenant complaints.

STEP 5: CONTACT PREVIOUS TENANTS

If possible, try to get in touch with previous tenants who have rented from the same landlord. You can ask them about their experiences, the responsiveness of the landlord to maintenance requests, and any issues they encountered during their tenancy.

STEP 6: CRIMINAL BACKGROUND CHECK

Consider running a criminal background check on the landlord to ensure they don’t have any serious criminal history that could raise concerns about your safety as a tenant. Keep in mind that some areas may have restrictions on running background checks, so be sure to follow the local

laws and regulations.

Step 7: Visit Local Courthouses

Visit the local courthouses or search online databases for any legal cases involving the landlord. This will help you identify any previous lawsuits, evictions, or other legal issues that could impact your renting experience.

Step

8: Speak with Current Tenants

If possible, try to speak with the current tenants of the property you’re interested in. They can provide valuable insights into the landlord’s behavior and management style. If the landlord hesitates to let you speak with current tenants, it might be a potential red flag.

CONCLUSION

Performing a landlord background check is a crucial step in ensuring a positive and hassle-free renting experience. By researching the landlord’s history, reputation, and track record, you can make an informed decision about whether they are someone you can trust as a landlord. Remember to follow local laws and regulations while conducting the background check, and don’t hesitate to trust your instincts if something doesn’t feel right. Being thorough in your research will increase the likelihood of finding a responsible and reliable landlord, leading to a more enjoyable and stress-free rental period.

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

A Guide On How To Sell Your House Fast

By Steven Rivkin

Selling your house can be a significant undertaking, and for many, the goal is to do it quickly and efficiently. Whether you’re relocating for a new job, downsizing, or simply ready for a change, a fast sale can save you time and reduce stress. In this comprehensive guide, we’ll walk you through the essential steps to sell your house quickly while maximizing its value.

From setting the right price to enhancing your home’s curb appeal, decluttering, making

strategic upgrades, and employing effective marketing techniques, we’ll provide you with a roadmap to success. By following these tips and strategies, you can streamline the selling process and increase your chances of finding the right buyer sooner rather than later. So, let’s dive into the world of real estate and discover how to sell your house fast.

SET THE RIGHT PRICE

Setting the right price for your home is crucial

2023 Review thepowerisnowmeida

when aiming for a quick sale. Overpricing can deter potential buyers, while underpricing may lead to financial losses. To determine the ideal price, research comparable properties in your area and consider consulting a real estate agent for their expertise. Pricing your home competitively can attract more buyers and generate faster interest. Additionally, consider offering incentives like covering closing costs or including appliances to sweeten the deal.

ENHANCE CURB APPEAL

First impressions matter, and the exterior of your home is the first thing buyers see. Enhance your home’s curb appeal by tidying up the landscaping, mowing the lawn, and planting fresh flowers. Repair any visible exterior damage, such as peeling paint or loose shingles. A welcoming exterior can draw potential buyers in and make them eager to explore further.

DECLUTTER AND DEPERSONALIZE

When potential buyers visit your home, they want to envision themselves living there. To facilitate this, declutter and depersonalize your living spaces. Remove personal photos, excessive decorations, and items that make rooms feel cramped. Organize closets and storage spaces to showcase ample storage potential. A clean, clutter-free home allows buyers to focus on the property’s features and can help your home sell faster.

INVEST IN SMALL UPGRADES

While major renovations may not be necessary, consider making small, cost-effective upgrades to make your home more appealing. Repainting rooms in neutral colors can freshen up the space and appeal to a broader range of buyers. Replacing outdated fixtures, such as faucets and cabinet hardware, can give your home a modern touch. Address any minor repairs,

like leaky faucets or squeaky doors. These small investments can make a big difference in attracting buyers.

EFFECTIVE MARKETING AND STAGING

Effective marketing is key to selling your home quickly. High-quality photos and compelling descriptions in your online listings can attract more potential buyers. Consider hiring a professional photographer to showcase your home in its best light. Staging your home can also help buyers envision themselves living there. Arrange furniture and decor to highlight the home’s strengths and create an inviting atmosphere. The combination of effective marketing and staging can generate more interest and lead to a faster sale.

CONCLUSION

Selling your house quickly requires strategic planning and attention to detail. By following the steps outlined in this guide, you can increase your chances of a fast and successful sale. Setting the right price, enhancing curb appeal, decluttering, making small upgrades, and effectively marketing your property are all essential components of the selling process.

Remember that selling your home is not just about the physical property; it’s also about creating an emotional connection with potential buyers. By presenting your home in its best possible light, both online and during showings, you can help buyers envision themselves living there.

With the right approach, you can navigate the real estate market with confidence and sell your house quickly, allowing you to move forward with your plans and the next chapter of your life.

BACK TO CONTENTS

2023 Review thepowerisnowmeida

What’s the Point of Mortgage Points?

By Steven Rivkin

By Steven Rivkin

When you embark on your journey to secure a mortgage for your dream home, you’ll encounter a range of terms and options that might seem perplexing at first. Mortgage points are one such concept that often leaves homebuyers scratching their heads. You may wonder, “What are mortgage points, and why should I care about them?” In this blog, we’ll delve into the world of mortgage points, unraveling their purpose, and helping you understand how they can impact your home financing. Whether you’re a first-time buyer or a seasoned homeowner, grasping the

point of mortgage points can potentially save you money and influence the overall cost of your home loan. So, let’s demystify this financial jargon and shed light on why it’s essential to consider mortgage points in your home buying journey.

MORTGAGE POINTS EXPLAINED: WHAT ARE THEY?

Mortgage points, often referred to as “discount

2023 Review thepowerisnowmeida

points” or simply “points,” are a form of prepaid interest that borrowers can purchase when securing a mortgage. Each point typically costs 1% of the total loan amount. For example, if you’re borrowing $200,000 to purchase your home, one mortgage point would cost $2,000. The primary purpose of mortgage points is to lower the interest rate on your loan, thereby reducing your monthly mortgage payments over the life of the loan.

Here’s how it works: When you opt to purchase mortgage points, your lender will adjust the interest rate downward. The number of points you buy directly influences the extent of this rate reduction. Each point typically lowers the interest rate by one-eighth to one-quarter of a percentage point. So, if you decide to buy two points on your $200,000 mortgage, your lender might reduce your interest rate by 0.5%, which can translate to significant savings over the loan’s duration.

It’s important to note that mortgage points are entirely optional, and whether or not they make sense for you depends on your financial situation, your long-term housing plans, and your willingness to invest at a lower interest rate. The decision to purchase mortgage points should align with your unique circumstances and homeownership goals. In the following sections, we’ll explore the role of mortgage points in your loan, their potential advantages, and the considerations you should keep in mind when deciding whether to use them.

THE ROLE OF MORTGAGE POINTS IN YOUR LOAN

Understanding the role of mortgage points is crucial in making informed decisions about your home loan. As mentioned earlier, purchasing mortgage points allows you to buy down your interest rate, which can lead to substantial savings over the life of your mortgage. Here’s how they play a pivotal role in your loan:

1.INTEREST RATE REDUCTION:

Mortgage points act as a trade-off between paying more upfront and securing a lower interest rate. By purchasing points, you essentially pay part of your interest costs at the loan’s outset. The more points you buy, the greater the reduction in your interest rate. This results in lower monthly mortgage payments and, ultimately, less interest paid over the life of your loan.

2.MONTHLY PAYMENT SAVINGS:

When you buy mortgage points, the immediate benefit is a decrease in your monthly mortgage payment. This can make homeownership more affordable, ease your budget, and potentially free up funds for other financial goals. It’s especially valuable for individuals who plan to stay in their homes for an extended period, as the monthly savings accumulate over time.

3.INTEREST SAVINGS OVER THE LONG TERM:

While buying points involves an upfront cost, it can translate into substantial long-term savings. Over the years, the lower interest rate can result in thousands of dollars saved on your mortgage. For instance, on a 30-year fixed-rate mortgage, buying two points could reduce your interest rate by 0.5%, which might save you tens of thousands of dollars throughout the loan’s duration.

4.TAILORED FINANCING:

Mortgage points provide flexibility in structuring your home loan. They allow you to customize your mortgage to better suit your financial objectives and homeownership plans. Depending on your budget and how long you intend to stay in your home, you can choose the number of points to buy, tailoring your mortgage to your specific needs.

While purchasing mortgage points can significantly benefit you by reducing interest costs, it’s important to weigh these benefits against the upfront expense and the duration you plan to remain in your home. Part 3 of this blog will explore the pros and cons of buying mortgage points, helping you make an informed choice

BACK TO CONTENTS

2023 Review thepowerisnowmeida

when navigating the mortgage market.

PROS AND CONS OF BUYING MORTGAGE POINTS

Before deciding whether to buy mortgage points, it’s essential to weigh the advantages and disadvantages to determine if it aligns with your financial goals. Here are the pros and cons of purchasing mortgage points:

PROS

1.LOWER MONTHLY PAYMENTS:

One of the most significant advantages of buying mortgage points is the immediate reduction in your monthly mortgage payments. This can provide relief to your budget, making home ownership more affordable.

2.INTEREST SAVINGS:

By purchasing points, you can secure a lower interest rate, which translates into substantial long-term savings. Over the life of your loan, the interest savings can be significant, potentially saving you tens of thousands of dollars.

3.CUSTOMIZATION:

Mortgage points offer flexibility, allowing you to tailor your loan to your specific needs. Depending on your financial situation and how long you plan to stay in your home, you can choose the number of points to buy, ensuring your mortgage aligns with your goals

CONS

1.UPFRONT COSTS:

The primary drawback of buying mortgage points is the upfront cost. Each point typically costs 1% of your loan amount, so purchasing points can require a substantial initial investment. It’s crucial to evaluate if the long-term interest savings justify the immediate expense.

2.BREAK-EVEN PERIOD:

Another consideration is the break-even period, which is the duration it takes for the interest savings to surpass the upfront costs of buying

points. If you don’t plan to stay in your home beyond the break-even point, purchasing points may not be financially advantageous.

3.DEPENDENCE ON FUTURE PLANS:

Your decision to buy mortgage points should align with your homeownership plans. If you anticipate selling or refinancing your home in the near future, the benefits of purchasing points might not fully materialize.

4.OPPORTUNITY COST:

The funds used to buy points could potentially be invested elsewhere, generating a higher return. It’s essential to evaluate if investing the upfront costs differently would yield better financial results.

In conclusion, buying mortgage points can be a strategic move to reduce interest costs and lower monthly payments. However, it’s vital to consider the upfront expense, break-even period, and your long-term homeownership plans. Part 4 of this blog will provide guidance on when buying mortgage points makes the most sense and when it might be better to forgo them.

MAKING INFORMED DECISIONS: WHEN TO USE MORTGAGE POINTS

Deciding whether to purchase mortgage points requires careful consideration of your unique financial circumstances and homeownership goals. To make an informed decision, follow these guidelines:

1.ASSESS YOUR LONG-TERM PLANS:

One of the critical factors in deciding whether to buy mortgage points is your anticipated length of homeownership. If you plan to stay in your home for an extended period, purchasing points to secure a lower interest rate can result in substantial savings over the life of the loan. On the other hand, if you expect to move or refinance within a few years, the benefits of buying points may not justify the upfront expense. Calculate the break-even point to determine when the interest savings will outweigh the initial cost.

2023 Review thepowerisnowmeida

2.EVALUATE YOUR BUDGET:

Consider your current financial situation and how buying points will impact your budget. While mortgage points can reduce your monthly payments, the upfront cost can strain your finances. Ensure you have the necessary funds available to purchase points without compromising your overall financial stability. If the upfront cost is manageable and aligns with your budget, buying points can be a prudent choice.

3.SHOP AROUND FOR LENDERS:

Mortgage points’ cost and the potential interest rate reduction can vary among lenders. It’s advisable to shop around and obtain quotes from multiple lenders to find the most favorable terms. Compare the costs and benefits of buying points from different lenders to determine which option offers the best value.

4.CONSIDER YOUR INTEREST RATE:

The impact of buying points is more significant when interest rates are higher. If you’re securing a mortgage during a period of elevated interest rates, purchasing points can lead to substantial savings. However, when interest rates are already low, the potential reduction from buying points may be less significant.

5.CONSULT A MORTGAGE PROFESSIONAL:

To navigate the decision effectively, it’s wise to consult with a mortgage professional or financial advisor. They can help you analyze your specific situation, calculate potential savings, and provide guidance on whether buying mortgage points aligns with your financial objectives.

Ultimately, the decision to purchase mortgage points should be a well-informed one based on your individual circumstances. By evaluating your long-term homeownership plans, budget, available lenders, current interest rates, and seeking expert advice, you can determine whether buying points is a wise choice that will lead to significant interest savings and more manageable monthly mortgage payments.

In conclusion, understanding the role of mortgage points and their impact on your home loan is essential for any homebuyer. These financial instruments can offer significant advantages, reducing your interest rate and monthly mortgage payments while potentially saving you money over the life of your loan. However, it’s crucial to remember that buying mortgage points is not a one-size-fits-all solution. Your decision should be guided by your long-term homeownership plans, budget, and current interest rate environment.

To make the most of your home financing, it’s essential to assess your financial situation, evaluate your budget, and consider the length of time you intend to stay in your new home. Shopping around for lenders and consulting mortgage professionals can help you determine whether purchasing mortgage points aligns with your unique circumstances.

The point of mortgage points is to provide homebuyers with flexibility and the opportunity to tailor their mortgage to their specific needs and goals. By making informed decisions, you can use mortgage points to your advantage, potentially enjoying lower interest rates and more manageable monthly payments on your path to successful homeownership.

BACK TO CONTENTS

2023 Review thepowerisnowmeida

A Comprehensive Guide to Buying a Mobile Home in Connecticut.

By Steven Rivkin

By Steven Rivkin

Embarking on the journey to buy a mobile home in Connecticut is an exciting venture, filled with unique considerations and possibilities. Mobile homes offer a flexible and often more affordable housing option, but navigating the buying process requires careful planning and insight. In this comprehensive guide, we’ll take you through the essential steps, considerations, and insider tips to ensure your mobile home purchase in Connecticut is a smooth and successful experience.

UNDERSTANDING THE MOBILE HOME

MARKET IN CONNECTICUT:

Connecticut’s mobile home market presents a dynamic landscape shaped by diverse factors such as location, amenities, and regional trends. Before embarking on your journey to buy a mobile home in the Constitution State, it’s essential to delve into the nuances of the market to make informed decisions.

LOCATION MATTERS

Just like traditional homes, the value and desirability of mobile homes in Connecticut can

2023 Review thepowerisnowmeida

vary significantly based on location. Coastal areas might offer a different set of amenities compared to rural communities. Explore different neighborhoods, considering factors such as proximity to amenities, schools, and local services. This understanding will not only impact your lifestyle but also influence the long-term value of your investment.

MARKET TRENDS AND PRICE POINTS

Stay abreast of current market trends and price points for mobile homes in Connecticut. Analyze data on recent sales, price per square foot, and overall market health. This information provides a valuable benchmark when assessing the value of potential mobile homes. Additionally, understanding whether the market is leaning towards buyers or sellers can influence your negotiation strategy.

AMENITIES AND COMMUNITY CONSIDERATIONS

Mobile homes are often situated in communities that offer a range of amenities and services. Some may provide recreational facilities, community events, or maintenance services. Consider what amenities are important to you and your lifestyle. Whether it’s a tight-knit community atmosphere or proximity to urban conveniences, these factors contribute to the overall appeal and value of mobile homes in Connecticut.

REGULATORY LANDSCAPE

Connecticut has specific regulations governing mobile homes, including zoning laws and community restrictions. Familiarize yourself with these regulations to ensure that your intended use aligns with local guidelines. Understanding the legal framework will help you navigate potential challenges and make informed decisions regarding your mobile home purchase.

FUTURE GROWTH AND DEVELOPMENT

Explore the potential for future growth and development in the areas you are considering. Connecticut, like any other state, undergoes changes and development projects that can impact property values. Stay informed about

planned infrastructure improvements, commercial developments, and other factors that may influence the trajectory of the mobile home market in specific regions.

By gaining a deep understanding of the mobile home market in Connecticut, you position yourself to make well-informed decisions that align with your preferences and financial goals. Whether you’re a first-time buyer or considering a relocation, the intricacies of the market will play a pivotal role in shaping your mobile home purchasing experience in the Nutmeg State.

FINANCING OPTIONS FOR MOBILE HOMES IN CONNECTICUT:

Securing the right financing for your mobile home in Connecticut is a critical step that demands careful consideration. Mobile homes often have distinct financing options compared to traditional houses, and understanding these choices is essential for a smooth and successful purchase.

1.TRADITIONAL MORTGAGES:

While not as prevalent as for traditional homes, some lenders offer conventional mortgages for mobile homes. These loans typically require a higher credit score and a larger down payment. Investigate local banks and credit unions, as they may have specific programs tailored to mobile home buyers in Connecticut.

2.CHATTEL LOANS:

Chattel loans are a common financing option for mobile homes. These loans treat the home as personal property rather than real estate, allowing for more flexibility in terms of approval. Interest rates may be slightly higher than traditional mortgages, but chattel loans are specifically designed for mobile home purchases.

3.FHA LOANS:

The Federal Housing Administration (FHA) offers loans that can be used to finance mobile homes, providing an accessible option for buyers

BACK TO CONTENTS

2023 Review thepowerisnowmeida

with lower credit scores. FHA loans often have lower down payment requirements compared to traditional mortgages, making homeownership more achievable for a broader range of individuals.

4.VA LOANS:

If you’re a veteran or an eligible servicemember, consider exploring VA loans. The U.S. Department of Veterans Affairs provides financing options with favorable terms, including no down payment in some cases. Verify your eligibility and explore the benefits of VA loans for purchasing a mobile home in Connecticut.

5.MANUFACTURER FINANCING:

Some mobile home manufacturers offer in-house financing or have partnerships with lenders. While this option can simplify the financing process, be sure to carefully review the terms and interest rates. Manufacturer financing may be more accessible, especially for buyers with limited credit history.

6.STATE ASSISTANCE PROGRAMS:

Connecticut may offer state-specific assistance programs or grants to facilitate mobile home ownership. Explore whether there are any initiatives aimed at helping buyers with down payments, closing costs, or securing favorable loan terms. Local housing authorities and government programs can be valuable resources. Before committing to a financing option, thoroughly research and compare the terms offered by different lenders. Evaluate the interest rates, down payment requirements, and repayment terms to ensure that the financing aligns with your financial goals. Additionally, consider consulting with a financial advisor to get personalized advice based on your unique circumstances. Understanding the range of financing options available will empower you to make an informed decision and move forward confidently with your mobile home purchase in Connecticut.

INSPECTING AND EVALUATING MOBILE HOMES

As you embark on the journey to buy a mobile home in Connecticut, a thorough inspection and evaluation process are crucial to ensuring that your investment aligns with your expectations and stands the test of time. In this section, we’ll guide you through the key aspects of inspecting and evaluating mobile homes in the Nutmeg State.

STRUCTURAL INTEGRITY

Begin your inspection by assessing the structural integrity of the mobile home. Check for signs of wear, such as sagging floors, cracks in walls, or issues with the roof. Inspect the foundation, ensuring it is secure and level. A structurally sound mobile home is the foundation for a safe and durable living space.

PLUMBING AND ELECTRICAL SYSTEMS

Evaluate the plumbing and electrical systems to ensure they are in good working order. Check for any leaks, water damage, or issues with the electrical wiring. Confirm that appliances, outlets, and fixtures function properly. Addressing any potential issues at this stage can save you from costly repairs down the road.

HVAC SYSTEMS AND INSULATION

Assess the heating, ventilation, and air conditioning (HVAC) systems within the mobile home. Check for proper insulation, especially in regions with varying temperatures like Connecticut. Adequate insulation not only contributes to energy efficiency but also ensures a comfortable living environment throughout the seasons.

EXTERIOR CONDITION:

Inspect the exterior of the mobile home, including siding, roofing, and windows. Look for signs of damage, such as rot, rust, or loose components. Check the condition of windows and doors to ensure they provide proper insulation and security. A well-maintained exterior contributes to the overall longevity of the mobile home.

2023 Review thepowerisnowmeida

Compliance with Local Codes

Verify that the mobile home complies with local building codes and zoning regulations in Connecticut. Ensure that any additions or modifications made to the structure meet the necessary standards. Non-compliance could lead to complications in the future, so it’s essential to address these issues during the evaluation process.

MAINTENANCE HISTORY AND RECORDS

Request the maintenance history and records for the mobile home. Understanding how well the property has been maintained over the years provides valuable insights into its overall condition. A well-documented maintenance history can also highlight any recurring issues that may need attention.

COMMUNITY RULES AND RESTRICTIONS

If the mobile home is situated in a community or park, review the rules and restrictions imposed by the management. Some communities have specific guidelines regarding home modifications, landscaping, and other aspects. Understanding and agreeing to these terms is vital for a harmonious living experience.

A professional home inspector specializing in mobile homes can be a valuable ally during this process. Their expertise can uncover hidden issues and provide a comprehensive assessment of the property. By investing time and attention into inspecting and evaluating the mobile home, you set the stage for a confident and informed decision, ensuring that your new home in Connecticut meets both your expectations and safety standards.

CONCLUSION

Navigating the process of buying a mobile home in Connecticut demands careful consideration of market dynamics, financing options, and thorough property inspections. As you embark on this exciting journey, our comprehensive guide has aimed to equip you with the knowledge and insights necessary to make informed decisions.

Whether you’re a first-time homebuyer or an experienced investor, the unique aspects of mobile home ownership in the Nutmeg State require a tailored approach.

Remember, each step you take in the buying process contributes to the overall success of your investment. From understanding the market trends in Connecticut to exploring financing options and meticulously inspecting properties, your commitment to due diligence ensures that you find a mobile home that not only fits your lifestyle but also aligns with your long-term goals.

Are you ready to embark on your journey to buy or sell a mobile home in Connecticut? For personalized guidance, expert insights, and a seamless real estate experience, work with Steve Rivkin. With a proven track record and a commitment to client success, Steve is your trusted partner in the Connecticut real estate market.

Contact Steve Rivkin for Expert Real Estate Assistance!

Whether you’re a buyer looking for the perfect mobile home or a seller aiming to get the best value for your property, Steve Rivkin has the knowledge and experience to guide you through every step of the process.

Don’t navigate the Connecticut real estate landscape alone. Contact Steve Rivkin today and let’s turn your mobile home dreams into reality. Your ideal property or perfect buyer may be just a call away!

BACK TO CONTENTS

2023 Review thepowerisnowmeida

JANUARY FEBRUARY MARCH APRIL MAY JUNE JULY AUGUST SEPEMBER

OCTOBER

NOVEMBER DECEMBER

2023 Review thepowerisnowmeida

to Table of Contents 2023 Review thepowerisnowmeida

Back

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

BACK TO CONTENTS Back to Table of Contents 2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

to Table of Contents 2023 Review thepowerisnowmeida

Back

BACK TO CONTENTS

to Table of Contents 2023 Review thepowerisnowmeida

Back

Back to Table of Contents 2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

Tired of the rental treadmill? Welcome to a spacious 910+ sq.ft. 1-bedroom condo brimming with potential, located in privately-owned Spring Gardens Condominiums. For the imaginative homebuyer or smart investor, this unit is a blank canvas, eagerly waiting for a touch of modern flair and your personalized finishes. Utilities and all electric very easy to manage. It’s always a great time to own your own. Make the smart move today and secure your tomorrow. Contact your favorite agent and buy this today

BACK TO CONTENTS 236 York St, West Haven, CT 06516 FOR SALE LIST PRICE

STEVEN RIVKIN Planet Realty, Llc 26 BROOKLAWN CIR, NEW HAVEN, CT, 06515 Office: (203) 387-0200 Cell: (203) 982-4985 Email: srivkin@planetrealtyct.com

BEDROOMS 1 BATHROOMS

INFORMATION:

$109,900

1

PROPERTY

PROPERTY INFORMATION: 2023 Review thepowerisnowmeida

LIST PRICE: $275,000

48 HIDDEN POND RD, WATERBURY, CT 06704

Lovely raised ranch quietly nestled on a serene cul-de-sac street in Bucks Hill. Built in 1986, this home boasts 1284 sq ft of main living space, and an additional 690 sq ft in the partially finished lower level – perfect for home game nights or casual entertaining. The interior has 3 spacious bedrooms and two full baths, one as a main bedroom suite. The light-filled living room is a great meeting space, perfect for your daily unwind. This space has a vaulted ceiling and brick hearth fireplace. The efficient yet spacious kitchen serves up style and function for entertaining. Don’t let this opportunity slip away!

STEVEN RIVKIN Planet Realty, Llc

26 BROOKLAWN CIR, NEW HAVEN, CT, 06515

Office: (203) 387-0200

Cell: (203) 982-4985

Email: srivkin@planetrealtyct.com

Back to Table of Contents 2023 Review thepowerisnowmeida

132 Newhall St, New Haven, CT 06511

PROPERTY DESCRIPTION

Discover a unique opportunity in New Haven, CT with this meticulously designed duplex! Each unit offers a thoughtfully crafted living space, with the first unit featuring 3 bedrooms and 2.1 baths, while the second unit boasts 2 bedrooms and 1.1 baths. Built in 2012 under the expert supervision of the Yale School of Architecture and in collaboration with Neighborhood Housing Services, this property exemplifies modern design and community engagement. Both units showcase architectural innovation and attention to detail. Enjoy spacious, well-appointed interiors with an abundance of natural light, sleek finishes, and openconcept layouts. With a prime location in New Haven, you’ll have easy access to the city’s vibrant culture, dining, and entertainment. Don’t miss this chance to own a duplex that’s a testament to architectural excellence and community development. This property is HUD owned. Sold AS-IS. Reserve Escrow available HUD IE. Financing available is Cash, Conventional, FHA 203K financing. Case #061-457343. Lead-Based Paint Addendum attached. Buyers: Please make an appointment to view this home and discuss with the Real Estate Agent of your choice. Sold “AS IS” by electronic bid only.

STEVEN RIVKIN Planet Realty, Llc

BACK TO CONTENTS

List Price: $285,000

26 BROOKLAWN

NEW

Office: (203) 387-0200 Cell: (203) 982-4985 Email: srivkin@planetrealtyct.com Back to Table of Contents 2023 Review thepowerisnowmeida

CIR,

HAVEN, CT, 06515

PROPERTY INFORMATION:

estled in Sandy Hook, CT, discover this stunning colonial masterpiece. With 2440 sq ft of meticulously remodeled space, this home is a harmonious blend of tradition and innovation. Step inside and be greeted by rich hardwood floors that open to an expansive kitchen with modern amenities. The state-of-the-art kitchen adorned with sleek granite countertops and custom cabinetry is a space where both intimate dinners and grand celebrations come to life. The home’s flow is natural and inviting, following a breakfast nook and a large great room with a modern fireplace, boasting cathedral ceilings and an airy feel. Across the kitchen is a formal dining room and a distinctive parlor for greeting guests or as a formal den or library.

PROPERTY INFORMATION:

236 York St, West Haven, CT 06516 FOR SALE LIST PRICE $599,900 STEVEN RIVKIN Planet Realty, Llc 26 BROOKLAWN CIR, NEW HAVEN, CT, 06515 Office: (203) 387-0200 Cell: (203) 982-4985 Email: srivkin@planetrealtyct.com 4 BEDROOMS 2.5 BATHROOMS

2023 Review thepowerisnowmeida

Discover this cozy ranch-style gem nestled in the tranquil Plantsville neighborhood of Southington. The home offers 3 bedrooms and 1 bathroom and 1380 SF of living space. Come experience the serenity of country living in this quiet neighborhood, away from the hustle and bustle. Despite its peaceful setting, this home provides easy access to nearby amenities, ensuring a comfortable lifestyle. Perfect for investors, this property offers endless possibilities for customization and renovation and is also a Handy Homeowner’s paradise. If you’re a handy homeowner, this blank canvas is your opportunity to create your dream country haven. PROPERTY

BACK TO CONTENTS 1019 Old Turnpike Rd, Southington, CT 06479 FOR SALE LIST PRICE $180,000 STEVEN RIVKIN Planet Realty, Llc 26 BROOKLAWN CIR, NEW HAVEN, CT, 06515 Office: (203) 387-0200 Cell: (203) 982-4985 Email: srivkin@planetrealtyct.com

BEDROOMS

BATHROOMS

3

1

PROPERTY INFORMATION:

2023 Review thepowerisnowmeida

INFORMATION:

One

DESCRIPTION

PROPERTY

Bedroom

for the Savvy Investor! Are you an

airy

bedroom condo lo-

opportunity,

on this

a profitable

List Price: $74,900

Donna Dr Unit B2, New Haven, CT 06513 STEVEN RIVKIN Planet Realty, Llc 26 BROOKLAWN CIR, NEW HAVEN, CT, 06515 Office: (203) 387-0200 Cell: (203) 982-4985 Email: srivkin@planetrealtyct.com Back to Table of Contents 2023 Review thepowerisnowmeida

Condo in Foxon Area of New Haven: A Great Opportunity

investor looking for your next big opportunity? Look no further than this bright,

1

cated in the desirable Foxon area of New Haven. This unit is not only a great investment

but it also has the potential for a handy homeowner to add value. Don’t miss out

chance to make

investment in the ever-growing market of New Haven.

65

PROPERTY INFORMATION:

Come see this captivating two-family home nestled in Beaver Brook, Ansonia, CT. Situated on nearly 0.6 acres of land, the property backs up to the lush Naugatuck State Forest, offering stunning views and direct access to outdoor activities like hiking, bird watching, and nature walks. Perfect for extended families or those seeking a blend of community and nature, this property offers an idyllic retreat without sacrificing convenience. This duplex home boasts over 2685 square feet of living space and features a total of 5 well-appointed bedrooms, providing ample space for a large or multi-generational family. As a two-family residence, this property offers flexibility. Live in one unit while renting the other, or utilize both spaces for family members, ensuring privacy and comfort for all. Despite its peaceful setting, the home is conveniently located near local amenities, schools, and transportation links, making daily life and commutes hasslefree. There are 3 separate garage bays for dry storage or your vehicles and two distinct sun porches for relaxation.

BACK TO CONTENTS 571 Beaver St, Ansonia, CT 06401 FOR SALE LIST PRICE $280,000 STEVEN RIVKIN Planet Realty, Llc 26 BROOKLAWN CIR, NEW HAVEN, CT, 06515 Office: (203) 387-0200 Cell: (203) 982-4985 Email: srivkin@planetrealtyct.com 5 BEDROOMS 2 BATHROOMS PARKING

PROPERTY INFORMATION: Back to Table of Contents 2023 Review thepowerisnowmeida

37

LIST PRICE $350,000

PROPERTY INFORMATION:

Discover your dream home nestled in Fairfield County’s Shelton, CT, a haven for family living. This wonderful property, set on a serene .38-acre lot, offers a peaceful retreat and a backdrop of secluded woods and views of the Housatonic River Valley. Spanning 2, 000 SF+ of living space, this residence blends classical charm with modern comfort. The interior boasts exposed woodwork, details, and custom-built-ins that add character to every corner. Your home features 3 spacious bedrooms and 2.5 baths, designed to the needs of a growing family. Living areas include a cozy living room, formal dining room ideal for gatherings, a library, and a versatile bonus room that can serve as a home office, playroom, or media room.

PROPERTY INFORMATION:

Office: (203) 387-0200

Cell: (203) 982-4985

Email: srivkin@planetrealtyct.com

Edgewood Ave, Shelton, CT

SALE

06484 FOR

STEVEN RIVKIN Planet Realty, Llc 26 BROOKLAWN CIR, NEW HAVEN, CT, 06515

BEDROOMS 2.5 BATHROOMS

3

3D TOUR 2023 Review thepowerisnowmeida

BACK TO CONTENTS 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

Edgerton Park Community Show with Steve Rivkin - Video 1

oin Steve Rivkin from Planet Realty, on a delightful stroll through Edgerton Park. Today, his wife Beatriz’s is with him as they unveil some hidden gems, and he can’t wait to explore with all of you. Let the adventure begin!

Edgerton Park Community Show with Steve Rivkin - part 2

Step into the tranquility of Edgerton Park with us as we wander through the greenhouses. The warmth of a vibrant fall day embraces everyone, and we’ve found a charming seating area nestled amidst blooming spring flowers and well-tended beds. We’re even considering managing a community garden plot ourselves or having our company sponsor one.

Listing Update with Steven Rivkin: 185 Tanglewood Hamden

Join Steven Rivkin from Planet Realty, Connecticut as he shares new information from the local market and highlights a new listing in New Haven, CT.

Homebuyers Town Hall New Haven, Connecticut featuring Steven Rivkin. Promo show.

The Power Is Now Media is an online multimedia company founded in 2009 by Eric L. Frazier and is headquartered in Riverside, California. We are advocates for homeownership, wealth building and financial literacy for low to moderate-income and minority communities. We utilize online Radio, online Magazine, online TV and online events to educate and support the American dream of homeownership and financial independence.

2023 Review thepowerisnowmeida

2023 Homeownership Series With Steve Rivkin

Welcome to the Power Is Now 2023 Homeownership Series with Real Estate expert Eric L. Frazier, MBA President and CEO of The Power Is Now Media and Steve Rivkin, a seasoned REO broker, NRBA Master Broker, From Planet Realty LLC, Diversity and Inclusion Champion from Connecticut. Join us for inspiring stories from industry professionals and first-time homebuyers on the impact of buying their homes.

Online Homebuyers Seminar Commercial with Steve Rivkin

In this commercial, Real Estate Agent, Steven Rivkin, REO Broker, NRBA Master Broker REOMAC/ NADP, FORCE, CDPE, CIREC, GRI, SFR Diversity and Inclusion Champion. Planet Realty LLC 924 Whalley Ave, New Haven, CT 06515 Lic in CT. shares information about an online Real Estate Seminar she will host. The agent will cover the following important topics: Home Purchase Strategies and Programs to Help You Buy Now!

Steve Rivkin Real Estate Show Part 1

In this episode part 1, Steve Rivkin, Broker Owner of Planet Realty Real Estate, dive into the world of REO properties—Real Estate Owned. Discover the who, what, where, and why of REO investments. Steve Rivkin shares insights on foreclosure processes, auctions, and the unique strategies to make REO properties your next successful investment

Steve Rivkin Real Estate Show -Part 2

teve Rivkin, Broker Owner of Planet Realty Real Estate, uncovers the secrets of REO investments— Real Estate Owned. From understanding foreclosure processes to navigating auctions and unique investment strategies, Steve Rivkin shares valuable insights that can make REO properties your next successful venture. Don’t miss out on the key details that can shape your real estate journey!

2023 Review thepowerisnowmeida

Rivkin

2023 Review thepowerisnowmeida

2023 Homeownership Series With Steve

Welcome to the Power Is Now 2023 Homeownership Series with Real Estate expert Eric L. Frazier, MBA President and CEO of The Power Is Now Media and Steve Rivkin, a seasoned REO broker, NRBA Master Broker, From Planet Realty LLC, Diversity and Inclusion Champion from Connecticut. Join us for inspiring stories from industry professionals and first-time homebuyers on the impact of buying their homes.

By Steven Rivkin

By Steven Rivkin

By Steven Rivkin

By Steven Rivkin