FEBRUARY 2023 Vol. 10 | Issue 2

Michael Moore President/CEO Black Achievers, Inc.

CENTRAL EDITION Vol. 10 | Issue 1 HAVE YOU READ OUR PAST ISSUES YET? CLICK HERE TO READ US ONLINE! the power is now magazine Eric Lawrence Frazier, MBA Publisher Office: (800) 401-8994 Ext. 703 Direct: (714) 361-2105 eric.frazier@thepowerisnow.com www.thepowerisnow.com EDITORIAL TEAM

Gilmore Editor in Chief (800) 401-8994 ext. 711 sheila.gilmore@thepowerisnow.com Daniels George Managing Editor (800) 401-8994 ext. 712 daniels.george@thepowerisnow.com

Ponce Arratia Graphic Artist and Design Manager goldy.ponce@thepowerisnow.com CONTRIBUTORS The Power Is Now Research Team

Sheila

Goldy

IMPORTANT STATEMENT OF COPYRIGHT:

The PIN Magazine™ is owned and published electronically by The Power Is Now Media, Inc. Copywrite 2022 The Power Is Now Media Inc. All rights reserved.

“The PIN Magazine” and distinctive logo are trademarks owned by The Power Is Now Media, Inc.

“ThePINMagazine.com”, is a trademark of The Power Is Now Media, Inc.

“Magazine.thepowerisnow.com”, is a trademark of The Power Is Now Media, Inc. No part of this electronic magazine or website may be reproduced without the written consent of The Power Is Now Media, Inc.

Requests for permission should be directed to: info@thepowerisnow.com

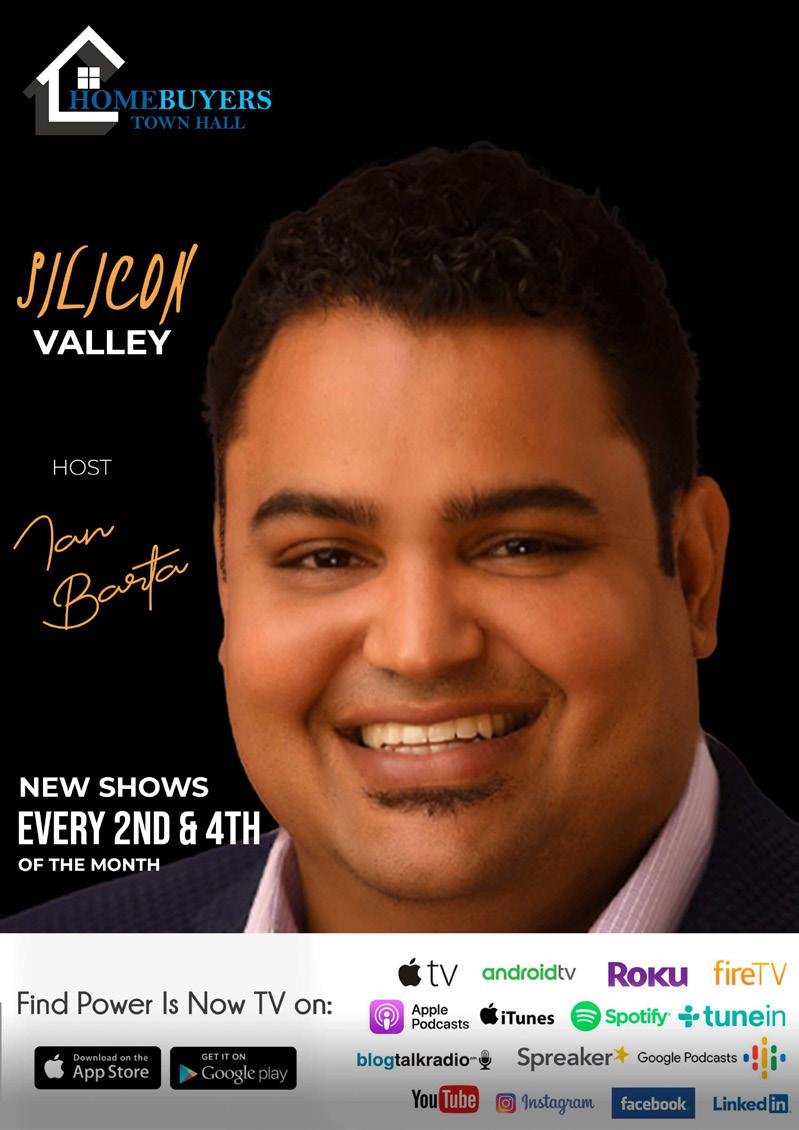

Find The Power Is Now TV on for more details go to www.thepowerisnow.com 2nd AND 4th TUESDAYS OF THE MONTH 3:00 PM TO 4:00 PM PST

Power Is Now Media Inc. 3739 6th Street Riverside, CA 92501 Ph: (800) 401-8994 | Fax: (800) 401-8994 info@thepowerisnow.com www.thepowerisnow.com

HEADQUARTERS The

the power is now magazine

CONTENTS FEBRUARY 2023

TPIN DESIGNS

Pg. 20. The 6 best home design apps for projects large and small.

LEGAL NEWS

Pg. 24. Property assessment reports accuracy

COMMUNITY NEWS

Pg. 26. What is the black equity initiative of the Inland Empire? how can homebuyers benefit from it?

GREEN NEWS

Pg. 8. How best can we protect our environment in 2023?

ECONOMIC NEWS

Pg. 10. The FED announces higher rates in the future: what does this mean for the Real Estate Industry?

REAL ESTATE NEWS

Pg. 12. Here are some of the top states people moved into and out of in 2022.

COMMERCIAL NEWS

Pg. 14. Why commercial real estate vacancies in San Francisco are at an all-time high.

TECHNOLOGY NEWS

Pg. 16. Devising creative and innovative solutions to deal with the affordability crisis in the country.

POWER YOU

Pg. 28. You have more to offer than you think

FINANCIAL NEWS

Pg. 30. Do you have what it takes to be a homeowner? Real Estate financing.

TPIN LIVING & LIFESTYLE

Pg. 32. Making it glam: top five bathroom design ideas to make your house pop in 2023

PEOPLE WOMAN

Pg. 34. Helena Duncan: the first black CEO of the business council of Alabama.

FROM OUR VIP AGENTS:

Pg. 37. City in review: thinking about buying a home in Houston? what you need to know, by Sharon Bartlett.

Pg. 41. Homebuyer’s guide to Maryland’s foreclosure, by Emerick Peace.

Pg. 47. Sellers: explained! beginners, here is what a multi-family home is, by Adriana Montes.

Pg. 51. 3 relationship-saving strategies for any couple buying a house, by Yvonne McFadden.

Pg. 55. Wondering how much you need to save for a down payment in Payson?, by Tamra Lee.

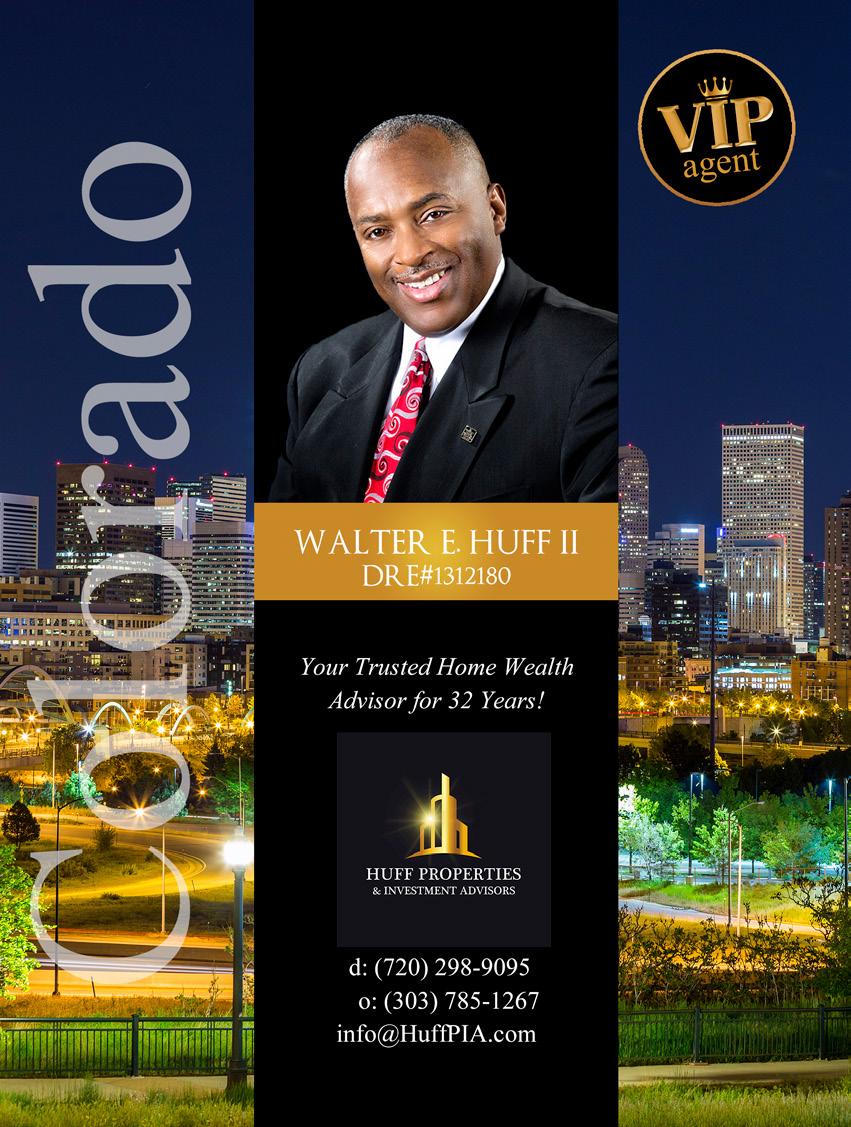

Pg. 59. 10 small (and affordable) home upgrades for big impact, by Walter Huff.

Pg. 63. Is buying a second home in Ohio a worthy investment?, by Heith Mohler.

Pg. 67. Is making your curb more appealing underrated?, by Ruby Frazier.

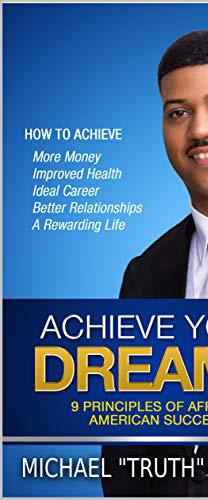

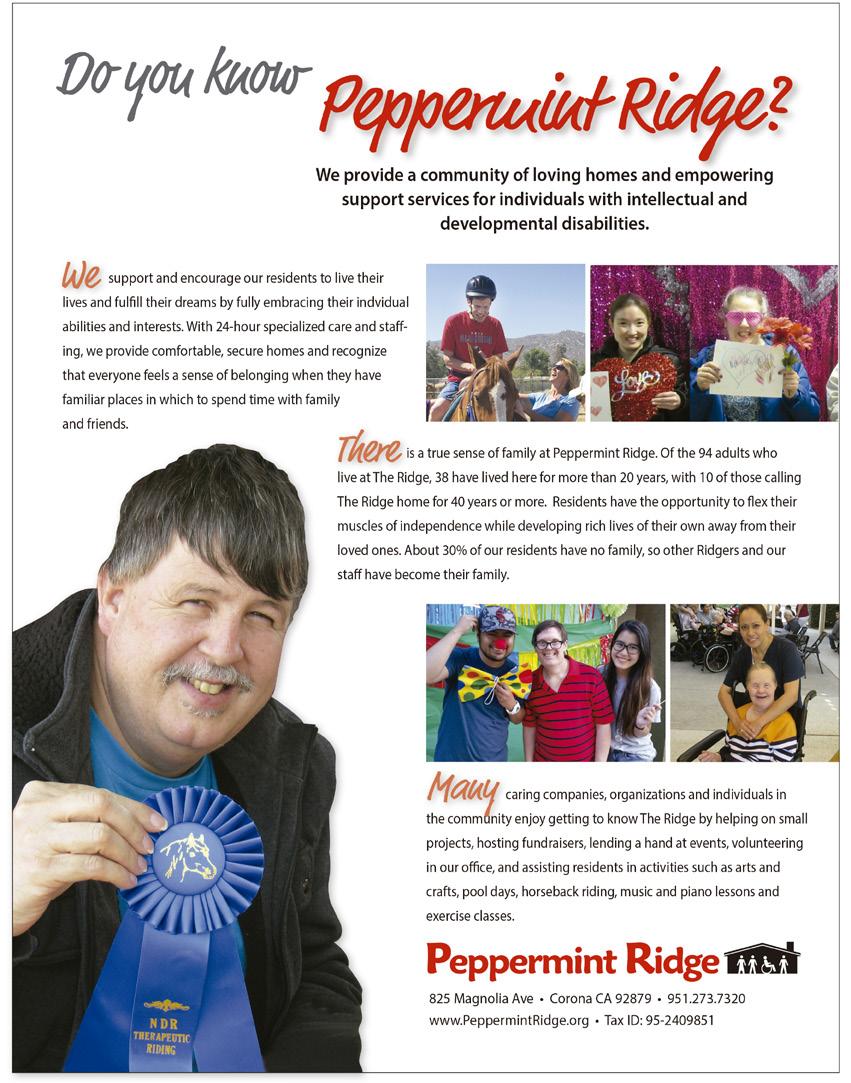

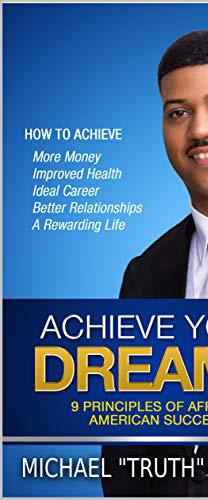

Pg. 70. Michael Moore. President and CEO of Black Achievers, Inc.

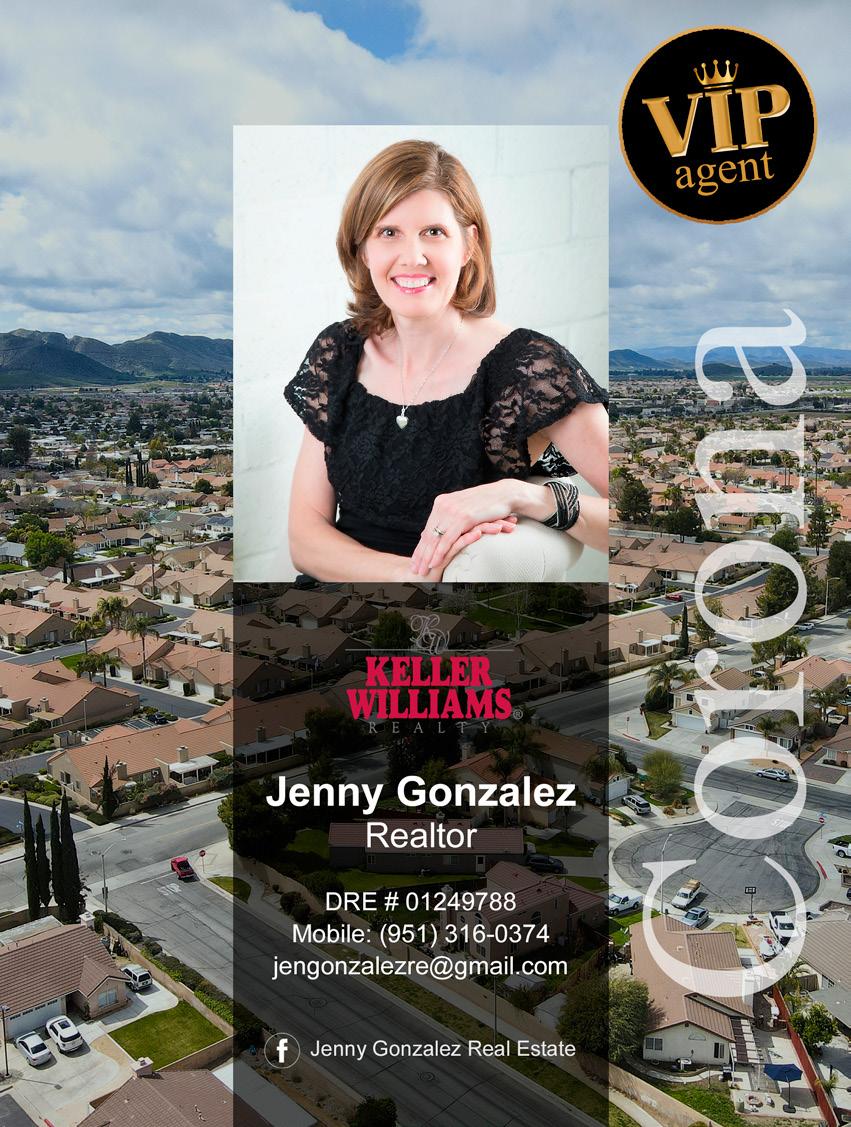

Pg. 75 Here’s how to sell your home while buying another in Corona, CA, by Jenny Gonzalez.

Pg. 79. 10 benefits of owning vacation rentals, by Ian Batra.

Pg. 83. Simple steps minorities in LA can take before buying a home, by Briana Frazier.

Pg. 87. How will rising interest rates affect home prices in Minnesota?, by Francine Marsolek.

Pg. 91. North Carolina Real Estate trends in 2023, by Janet Petrozelle.

Pg. 95. San Diego real estate market updates Q1, 2023, by John Costigan.

Pg. 99. Is it hard to finance a new construction home in San Francisco?, by Norman Green.

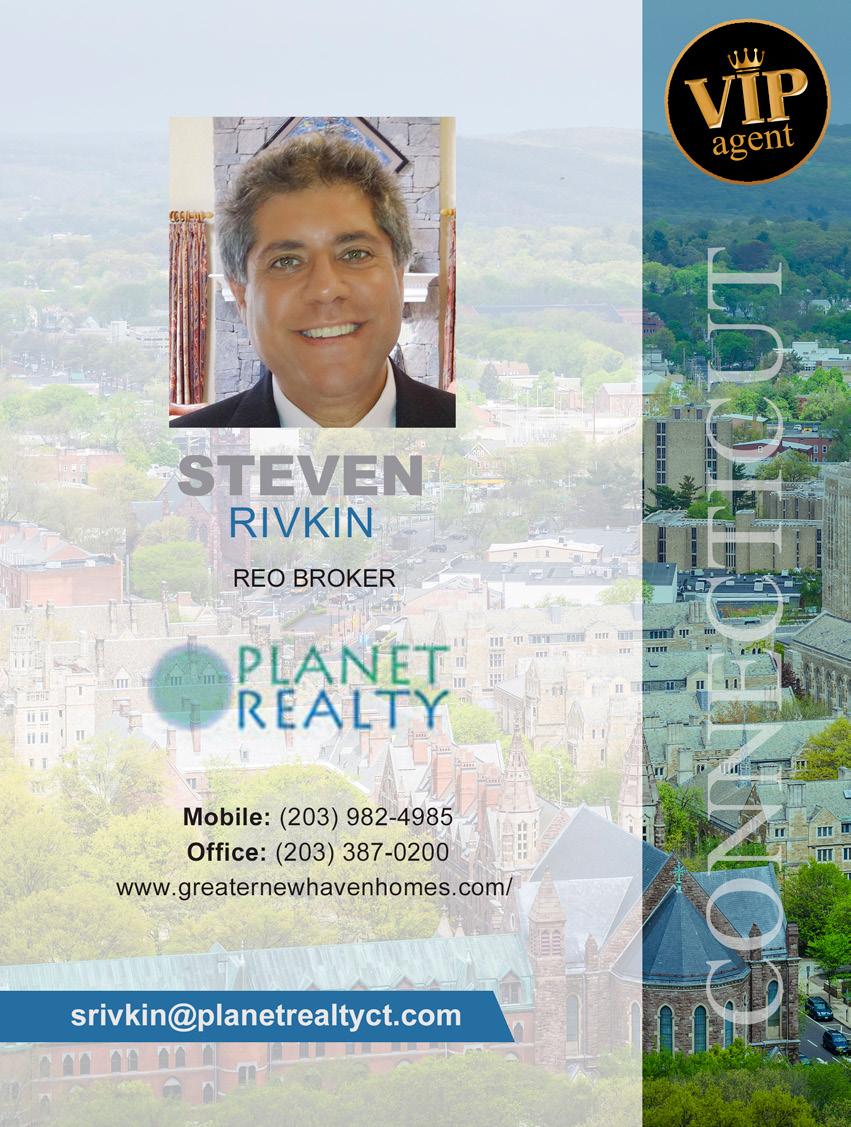

Pg. 103 New haven Real Estate market projections: here’s what to expect in 2023, by Steven Rivkin.

Pg. 107. Even inflation couldn’t stop buyers in Costa Mesa from buying, by Eric L. Frazier MBA.

Pg. 111. New construction myths: these homes are expensive!, by Monica Hill.

Pg. 115 Stuck in your sell? Here are some creative promotion strategies to attract today’s buyers, by Marina Ramirez.

Pg. 119. Top 10 list of what to expect once you receive an offer on your home in Palm Desert, CA, by Brandy Nelson.

Pg. 123. 10 Best Strategies for buying in Tahoma, by Jim Clifford.

Pg. 127. How cryptocurrency will impact Real Estate financing, by Jamar James.

Pg. 131. 5 tips to dealing with taxes in Los Angeles, by Dolores Golden.

Pg. 135. Here’s how to survive a house remodeling in New York, by Harriet Robertson.

February 2023 FROM THE EDITOR

To Our Valued Readers,

Welcome to the February issue of our magazine, where we bring you the latest and greatest in technology, mortgage, economic, real estate, and lifestyle news. We know that the real estate industry can be a tricky one to navigate, which is why we strive to bring you the most accurate and up-to-date information to help you make informed decisions.

Firstly, the topic of underwater home loans is a hot topic right now and we ask the question: is it possible for them to make a comeback? While the housing market has seen a significant recovery since the 2008 financial crisis, there are still some homeowners who are underwater on their mortgages. We examine the potential for these homeowners to regain positive equity and explore the options available to them.

I had a wonderful conversation with Michael Moore who is on the cover for February. He is the founder of Black Achievers, a 501 (c)(3) organization with over 80,000 members nationwide. What strikes me was his courageous mission to build a network of Black professionals who can work together to make the world a better place for everyone. He is also the author of “Achieve Your Dreams, The 9 Principles of African American Success”. Michael’s book inspires people to reach their full potential in life. His story truly fascinated me and at times like these, we need more brave people like Michael. Find out how at age 19, he taught himself how to write computer code. He started designing and programming websites for businesses as a hobby while still in college eventually upscaling that hobby to a multi-million business!

In other articles, the Federal Reserve’s announcement of higher rates in the future has many in the real estate industry wondering what this means for them. We look at the potential impact on the industry and provide expert analysis to help you understand what this announcement could mean for you. We also take a look at the top states people moved into and out of in 2022 and what this could mean for the real estate market. Additionally, we explore the best ways to protect our environment in 2023 and ask the question whether state

6 | FEBRUARY 2023

property assessments are accurate. For those looking to add some flair to their home, we have included some top bathroom design ideas to make your house pop in 2023 and the best home design apps for projects large and small.

We also highlight the achievements of Helena Duncan, the first Black CEO of the Business Council of Alabama, and pay tribute to Black History Month, as well as roundup the incredible stories of the first Black president- President Obama and Michelle Obama and First Black Major in Los Angeles, Karen Bass. The two black Republican Senators Raphael G. Warnock, Cory Booker, and Tim Scott, and a host of other black leaders, first in their respective spots.

This is an issue jampacked with tons of

information to keep you fully informed throughout the month.

We hope that you find this issue informative and helpful in your real estate journey. As always, we remain optimistic about the future of the industry and are excited to see what the next year has in store for us.

Happy reading!

ERIC L. FRAZIER MBA President and CEO The Power Is Now Media, Inc.

YOUR VOICE IS YOUR BRAND! INCREASE LEAD GENERATION, AND GIVE YOU THE POWER TO CLOSE MORE DEALS! Join Every Other Friday 10:00 AM - 11:00 AM Promote Your Listings Online CALL YOUR HOST FOR MORE INFORMATION SHARON BARTLETT (800) 401-8994 ext. 712 Sharon.Bartlett@thepowerisnow.com www.thepowerisnow.com

FEBRUARY 2023 | 7

How best can we protect Our environment in 2023?

As we enter the new year of 2023, it is important to reflect on the state of our environment and the actions we can take to protect it. The past few decades have seen a significant deterioration of our planet due to human activities such as pollution, deforestation, and overconsumption of resources. However, there is still hope for a better future if we take immediate and effective measures to preserve the environment. In this article we will look at some of the things we can do to protect our environment.

One of the most pressing issues facing our environment is climate change. The burning of fossil fuels, deforestation, and industrial activities have led to a significant increase in greenhouse gas emissions, causing the Earth’s temperature to rise and leading to severe weather patterns, sea level rise, and loss of biodiversity. To combat climate change, it is essential to reduce our carbon footprint by using clean energy sources such as solar and wind power and by implementing policies to decrease emissions from transportation and industry. Additionally, we must focus on preserving and reforesting natural areas, as trees and other vegetation act as carbon sinks, absorbing carbon dioxide from the atmosphere.

Cars and other vehicles are significant sources of air pollution and contribute to climate change through their emissions of greenhouse

gases. To reduce the environmental impact of transportation, we can encourage the use of public transportation, biking, and walking, and promote the development and use of electric and hybrid vehicles.

Another way to protect the environment is to support and invest in sustainable and green infrastructure. Green infrastructure refers to the use of natural systems, such as wetlands, green roofs, and urban forests, to manage water and air quality, reduce energy consumption, and create healthier communities. By investing in sustainable infrastructure, we can improve the environment while also creating jobs and boosting the economy.

We must also pay attention to the impact of our consumption habits on the environment. The production of goods, particularly those made from non-renewable resources, contributes to the depletion of natural resources, pollution and carbon emission. We can support sustainable and eco-friendly products, and also consider the entire life cycle of the products we buy, from production to disposal.

Another important aspect of protecting our environment is reducing pollution. Air, water, and soil pollution not only harm the planet but also have detrimental effects on human health. To reduce pollution, we must implement stricter regulations on industries and individuals that

PHOTO FROM 123RF

GREEN NEWS 8 | FEBRUARY 2023

contribute to pollution, and encourage the use of cleaner and more sustainable technologies. Additionally, we must also promote recycling and waste reduction to decrease the amount of waste that ends up in landfills and oceans.

Overconsumption of resources is another major contributor to environmental degradation. The production and disposal of goods and services consume vast amounts of energy and other resources, leading to pollution and depletion of natural resources. To curb overconsumption, we must adopt sustainable consumption practices such as reducing, reusing, and recycling products, and supporting sustainable and eco-friendly products. We must also support sustainable and regenerative agriculture, which aims to produce food while preserving and regenerating the environment.

Another crucial step to protecting our environment is preserving biodiversity.

Biodiversity is the variety of life on Earth, and it is essential for maintaining ecosystem health and services. Human activities such as deforestation, pollution, and overfishing are causing significant loss of biodiversity, and it is crucial that we take action to protect endangered species and their habitats. To do this, we must implement conservation policies, promote sustainable resource use, and reduce habitat destruction.

and communities. For example, the overconsumption of palm oil, which is used in a wide range of products, including food, cleaning products, and cosmetics, is contributing to the destruction of rainforests and the displacement of local communities in Southeast Asia. By being more mindful of the products we use, we can help to protect both the environment and the rights of marginalized communities around the world.

Lastly, we must also raise awareness and educate the public about the importance of protecting the environment. This will empower individuals to make more sustainable choices in their daily lives and to advocate for more environmentally friendly policies. Additionally, education and outreach programs can help equip individuals with the knowledge and skills needed to make a positive impact on the environment.

We should also consider the impact of our consumption on other cultures

In conclusion, there are several key steps that we can take to protect our environment in 2023. These include reducing our carbon footprint, reducing pollution, curbing overconsumption, preserving biodiversity, and raising awareness and education. By taking immediate and effective measures, we can work towards preserving our planet for future generations. However, it is important to note that protecting the environment is a shared responsibility and requires collective effort from individuals, governments, and organizations.

FEBRUARY 2023 | 9

The FED Announces Higher Rates in the Future: What does

this mean for the real estate Industry?

The Federal Reserve (FED) recently announced its intention to raise interest rates in the near future, which has major implications for the real estate industry. When interest rates go up, it makes borrowing more expensive and can lead to a decrease in home sales and prices; however, it’s important to note that the impact of higher interest rates can vary depending on the stage of the economic cycle, economic conditions, population growth and job opportunities.

First, it’s worth noting that higher interest rates can also make it more difficult for builders and developers to secure financing for new construction projects. As the cost of borrowing increases, it can become more expensive for builders to secure loans to finance the construction of new homes. This can lead to a slowdown in new construction, which can further impact the housing market.

Another important factor to consider is that higher interest rates can also affect the value of real estate investments. As interest rates go up, the value of fixed-income investments such as bonds

and other forms of real estate investments also increases, which makes them more attractive to investors. This can lead to a decrease in demand for other forms of real estate investments, such as REITs or real estate funds, which can also have an impact on the real estate industry.

Additionally, it’s worth noting that the impact of higher interest rates on the real estate market can vary depending on the stage of the economic cycle. During a recession, for example, the impact of higher interest rates may be more severe, as the economy is already weak, and higher interest rates can make it even more difficult for individuals to afford a mortgage. On the other hand, during an economic expansion, the impact of higher interest rates may be less severe, as the economy is stronger and there is more demand for housing.

It’s also important to consider the impact of higher interest rates on the broader economy. Higher interest rates can lead to a decrease in consumer spending, as individuals have less disposable income to spend on goods and services. This can have a ripple effect on the economy, as

ECONOMICS NEWS PHOTO FROM FORBES.COM 10 | FEBRUARY 2023

businesses may see a decrease in revenue, which can lead to layoffs and a slowdown in economic growth.

When the FED raises interest rates, it becomes more expensive for consumers to borrow money. This can make it more difficult for individuals to afford a mortgage, which can lead to a decrease in home sales. Additionally, as the cost of borrowing increases, so do the monthly mortgage payments for those who have already purchased a home. This can put a strain on homeowners and potentially lead to a rise in defaults and foreclosures.

Furthermore, as the cost of borrowing increases,

it can also lead to a decrease in home prices. When interest rates go up, it becomes less attractive for buyers to purchase a home, which can lead to a decrease in demand. As a result, sellers may be forced to lower their asking price in order to make their property more attractive to potential buyers.

However, it’s important to note that the interest rate is not the only factor that affects the real estate market. Economic conditions, population growth, and job opportunities are all important considerations as well. For example, if there is a strong demand for housing in a particular area due to population growth or a strong job market, the impact of higher interest rates may be less severe.

Additionally, it’s important to note that higher interest rates can also have a positive impact on certain segments of the real estate market. For example, landlords and investors may find that higher interest rates make rental properties more attractive, as they can charge higher rents. Similarly, higher interest rates can also make it more attractive for investors to invest in real estate, as they can earn a higher return on their investment. It’s worth noting that the FED’s decision to raise interest rates is not set in stone. The FED will continue to monitor economic conditions and make adjustments as necessary. If the economy shows signs of weakness or the housing market starts to slow down, the FED may decide to hold off on raising interest rates.

In conclusion, the FED’s announcement to raise interest rates in the future has significant implications for the real estate industry. Higher interest rates can make it more difficult for individuals to afford a mortgage and can lead to a decrease in home sales and prices. However, it’s important to remember that the real estate market is influenced by a variety of factors. As such, it’s important to keep a close eye on economic conditions and the housing market to understand how the FED’s decision will ultimately impact the real estate industry.

FEBRUARY 2023 | 11

Here are some of the Top States people moved into and out of in 2022

The United States Census Bureau has recently released data on the top states that saw a significant influx and outflow of residents in 2022. This data provides valuable insights into the current trends and patterns of migration within the United States, and can help to understand the factors that are driving people to move to or away from certain states. Understanding these migration patterns can help policymakers, businesses, and individuals make more informed decisions about where to live, work, and invest. There were several states that saw a significant influx of new residents in 2022. These states include:

1. FLORIDA

Known for its warm climate and beaches, Florida continues to be a popular destination for retirees and vacationers. In 2022, the state saw a net migration of over 200,000 people, with many coming from states such as New York and New Jersey. The state’s thriving tourism industry, low taxes, lack of a state income tax and affordable housing are all contributing factors to its popularity.

2. TEXAS

With a growing economy and a relatively low cost of living, Texas has become

a popular destination for young professionals and families. In 2022, the state saw a net migration of over 150,000 people, with many coming from states such as California. The state’s strong job market, particularly in the technology and energy sectors, has attracted many young professionals.

North Carolina’s pleasant climate and its diverse economy, has become a popular destination for both retirees and young professionals. In 2022, the state saw a net migration of over 100,000 people, with many coming from states such as New York.

The state’s warm climate and scenic landscapes, has made it become a popular destination for retirees and vacationers. In 2022, the state saw a net migration of over 75,000 people, with many coming from states such as California and Illinois. Additionally, the state’s relatively low cost of living, especially when it comes to housing, has made it an affordable option for retirees and vacationers.

REAL ESTATE NEWS

PHOTOS FROM 123RF

3. NORTH CAROLINA

4. ARIZONA

12 | FEBRUARY 2023

5. TENNESSEE

With its low cost of living and friendly culture, Tennessee has become a popular destination for families and young professionals. In 2022, the state saw a net migration of over 50,000 people, with many coming from states such as Ohio and Indiana. The state’s low cost of living, particularly when it comes to housing, has made it an affordable option for families.

On the other hand, there were also several states that saw a significant outflow of residents in 2022. These states include:

1. NEW YORK

With high taxes and a high cost of living, New York has seen a significant outflow of residents in recent years. In 2022, the state saw a net migration of over -200,000 people. The high cost of living in New York, particularly when it comes to housing, has made it an unaffordable option for many residents

2. CALIFORNIA

The high cost of living in California, particularly when it comes to housing, has made it an unaffordable option for many residents. Additionally, the state’s high taxes and regulations have made it an unattractive option for many residents. In 2022, the state saw a net migration of over -150,000 people.

3. ILLINOIS

Illinois, with high taxes and a struggling economy, has seen a significant outflow of residents in recent years. In 2022, the state saw a net migration of over -100,000 people. The state’s struggling economy and also the high taxes, particularly when it comes to state income tax and property tax, have made it an unattractive option for many residents.

4. NEW JERSEY

New Jersey having high taxes, particularly when it comes to housing, making the state an unaffordable option. In 2022, the state saw a net migration of over -75,000 people. Also, the high cost of living in the state has made it an unattractive option for many residents, with many moving it states such Florida and North Carolina.

5. CONNECTICUT:

The state’s high property taxes and a high cost of living especially when it comes to housing has made it an unaffordable option for many residents. also, the high state income tax have made it an unattractive option for many of the residents there, making them opt to move. In 2022, the state saw a net migration of over -50,000 people.

It is worth noting that these figures are based on data from the United States Census Bureau and should be taken as estimates rather than exact numbers. Factors such as job opportunities, cost of living, and climate are among the main reasons why people choose to move to or from a particular state. Additionally, these numbers are based on the net migration, which is the difference between the number of people moving in to a state and the number of people moving out of a state.

FEBRUARY 2023 | 13

Why Commercial real estate vacancies in San Francisco are at an all-time high

Commercial real estate vacancies in San Francisco have reached an all-time high, with office vacancies currently at over 14%. This is a significant increase from the historical average of around 5%. There are several factors that have contributed to this trend, and it is important to understand the underlying causes in order to predict the future of the market and make informed decisions about investing in commercial real estate in San Francisco.

One of the main factors contributing to the high vacancy rate is the rise of remote work.

The COVID-19 pandemic has forced many companies to shift to a remote work model, and as a result, many employees have decided to move out of the city or to the suburbs, where they can find more affordable housing and larger living spaces. This has led to a decrease in demand for office space in the city, as companies

are no longer in need of as much space to accommodate all of their employees. Also, the uncertainty caused by the pandemic has led to a decrease in investment and expansion plans for companies, which has led to a decrease in demand for office space. Many companies have put their expansion plans on hold due to the economic uncertainty caused by the pandemic

Another factor contributing to the high vacancy rate is the high cost of doing business in San Francisco. The city has some of the highest commercial real estate prices in the country, and this has made it difficult for small businesses and startups to afford to rent office space. Additionally, the high cost of living in the city has made it difficult for companies to attract and retain employees, as many can find more affordable living options outside of the city.

Also, the lack of affordable housing in San

PHOTO FROM 123RF

COMMERCIAL NEWS 14 | FEBRUARY 2023

Francisco has contributed to the high commercial real estate vacancies in the city. Companies are finding it difficult to recruit new employees and retain existing ones since many people are unable to afford to live in the city, and as a result, opting move to more affordable areas outside of the city. This in turn leads to a decrease in demand for office space and increasing the vacancies.

Another reason for the high commercial real estate vacancies in San Francisco is the rise of e-commerce and the decline of brick-andmortar retail. The shift to online

shopping has led to a decrease in the demand for retail space, as many consumers now prefer to shop from the comfort of their own homes. This has led to many retailers downsizing their physical locations or closing them altogether.

Additionally, the recent economic downturn has led to a decrease in demand for office space. The economic uncertainty caused by the pandemic has led to a decrease in business activity, and many companies have put their expansion plans on hold. This has led to a decrease in demand for office space, as many companies are not in need of additional space to accommodate growth.

Despite these challenges, there are still opportunities for investors in the San Francisco commercial real estate market. One of the key opportunities is in the redevelopment of older buildings. Many older buildings in the city are in need of upgrades and renovations, and investors can take advantage of this by purchasing these properties and modernizing them to appeal to today’s tenants.

to support remote work, and investors can take advantage of this by developing new office spaces that are equipped with the technology and amenities needed to support remote work.

Additionally, the demand for co-working spaces is also on the rise, as many companies are looking for flexible office solutions that can accommodate a mix of remote and in-person work. Investors can take advantage of this trend by developing coworking spaces that cater to this demand.

Finally, it’s worth noting that San Francisco is a city with a strong economy and an abundance of high-paying jobs, which will continue to drive demand for commercial real estate. In the long run, it’s likely that the market will recover and the vacancy rate will decrease.

Another opportunity is in the development of new office spaces that are designed to accommodate the needs of remote workers. Many companies are now looking for office spaces that are designed

In conclusion, the high commercial real estate vacancies in San Francisco are a result of several factors, including the rise of remote work, the high cost of doing business in the city, the decline of brick-and-mortar retail, and the recent economic downturn. However, there are still opportunities for investors in the market, including the redevelopment of older buildings and the development of new office spaces designed to accommodate remote work.

FEBRUARY 2023 | 15

Devising creative and innovative solutions to deal with the affordability crisis in the country

It’s an undeniable fact that many people today crave homes, which can be shown by looking at the current trends in the real estate market and the frenzy we witnessed in the last two years. Buying a place to call home and making memories will forever be a significant milestone in one’s life. You could own a home, but you would like to make a few upgrades to accommodate a larger family. Whatever your plans, you probably have noticed that securing property has become a big challenge.

Indeed, Americans are struggling not just to make a living but to find somewhere to live. The market has high demand, but very few houses are being constructed to meet that demand. In addition, the market cannot supply affordable housing across the country, which has left many buyers in limbo.

Numerous factors have contributed to this persistent housing shortage, exacerbating the country’s housing crisis. With every challenge comes to an opportunity for creativity and innovation, and the current market is forcing tech companies, entrepreneurs, and developers to think outside the box. Looking at the west coast,

for instance, Tech companies are largely responsible for the high cost of properties as entire communities have become so gentrified that the average person is forced to look elsewhere for affordable properties.

Another factor we must consider is that the FED kept interest rates so low, which pulled in many buyers, ultimately pushing the prices higher. These two forces, among others, created a ‘crazy’ imbalance in the market, leading to the situation we are grappling with today- the affordability crisis.

Still on the west coast, because it seems California is the epicenter of the affordability

crisis in the country, a report by Mckinsey concluded that the state needed to add about 3.5 million more homes by 2025, which means each year the state must add 350,000 units for the next seven years. But there are unique challenges that will make this reality a nightmare. First, the current zoning laws do not support such a move, and

TECHNOLOGY NEWS PHOTOS FROM 123RF

16 | FEBRUARY 2023

second, there is land scarcity in the urban areas. These are some of the challenges that make achieving 350,000 units a year an insurmountable task. To move forward, California and the nation must look towards new innovative ideas.

REMOVING ALL BARRIERS AT THE LOCAL, STATE, AND FEDERAL LEVEL

This will allow the country at large to add more homes and apartments. To progress on this front, the local, state, and national governments must remove the barriers, especially regulatory barriers to building homes. On that front, there are several policies being looked at in the private and

is important and extremely helpful; it helps the industry automate the legal analysis for the planning code, and anyone can access what is possible in certain jurisdictions or on a given parcel which cuts the processing time from months to immediate response.

The computational capacity delivered through this platform helps break the administrative and regulatory barriers and demonstrates the potential for other processing innovations related to planning and zoning.

Other states like Minneapolis and Oregon have eliminated single-family zoning by breaking down the regulatory barriers that initially made this a challenge. Although 75 percent of the housing in Minneapolis was previously zoned single-family, now up to three units are allowed on any residential plot of land throughout the entire city.

“By rezoning lots that currently accommodate only one single-family house to allow duplexes and triplexes,” says Andrea Brennan, Minneapolis’s Housing Policy and Development Director, “Minneapolis effectively triples the housing capacity of some neighborhoods.”

public sectors to achieve better regulatory policies for housing affordability.

A case to mention is Symbium, a tech company in San Francisco that has developed a computational law platform that mechanizes the rules and regulations of planning code to assist all stakeholders in quickly establishing an Accessory Dwelling Unit (ADU) is allowed on a property. This

In June 2019, the State of Oregon passed HB2001 with bipartisan support- legislation that effectively ended single-family zoning in the state. In fact, it gave power to the state to determine the legal authority to establish parameters for zoning at the local level. So far, the state of Oregon has made a bold move to assert that authority to encourage the local jurisdictions to allow more units to be built in their state.

TECHNOLOGIES TO BOOST THE SPEED OF PRODUCTION, INCREASE PRODUCTIVITY, AND LOWER COSTS

Another innovative firm in Silicon Valley called Entekra is focused on off-site framing. It is on a mission to increase home

FEBRUARY 2023 | 17

building productivity and reduce the time and the costs it takes to build a single unit.

Stick-built framing for a typical 2,500-square-foot house would generally take about five workers and 15 days to complete, but with the firm’s Fully Integrated Off-Site Solution and a crane, the framing can be done in just four days by a crew of four people. Effectively, this reduces prices by $25,000, saves an average of 30+days, and increases overall productivity by more than 500 percent. In addition, this system reduces errors and reduces on-site skilled labor needs.

Regarding multi-family units, another companyFullStake Modular in New York, merges modular housing with new construction technologies to bring a higher level of control, predictability, and scalability to multifamily development. This is the same company that built the modules for 461 Dean Street in Brooklyn, New York, which is the tallest modular building in the world.

CREATIVE FINANCING

Financing is one of many people’s biggest hurdles to homeownership. To that effect, Rhino, a company located in New York, partners with building owners in all 50 states to offer low-cost insurance as an alternative to cash security deposits. When a renter inquires about a unit and says Rhino is an option, they can choose between low-cost insurance or a traditional security deposit. The transaction is made directly with the renter. The renter will receive information about the premium immediately, and then they can decide whether to pay the premium in lieu of a security deposit. Although the cost of insurance varies, it ranges between $4-7/monthly.

In addition, it is important to highlight that several companies have developed several approaches to help future buyers. One of the most popular approaches is crowdfunding to seek investors. A good example is HomeFundIt in Baltimore, an online crowdfunding platform allowing homebuyers to use gifts from family and friends for home payments. Still as a crowdfunding platform but using a different approach, Small Change in Pittsburgh connects investors with developers to build better cities . As long as

you are 18+ Small Change allows you to invest in projects that involve affordable housing, community centric projects, transit oriented projects and any project that essentially makes better places for everyone.

Additionally, one of the markets that we have to look at and carefully consider is the renter’s market. These are the people getting groomed to become buyers and availing financial assistance and removing barriers to financing, especially for the minorities and the people with lower incomes is essential to ensure housing affordability. A tech company called Till, located in Alexandria, Virginia has set a platform that transforms a renter’s ability to pay, stay and thrive in their homes through real-time data to develop payment solutions to address their needs.

What Till offers is personalized structures that reduce the avoidable costs of delinquency and evictions. Understanding that the biggest costs that many renters face is rent payment , Till helps to drive meaningful improvements across a renter’s entire financial landscape.

It is also estimated that less than 1 percent of credit reports include rent, yet, for many people, it is their largest and most consistent payment. In light of this, another tech company, ESUSU in New York offers the renters data reporting services that includes rents as a factor of credit scores. The company builds the reports for clients by partnering with property managers and public housing authorities or even working directly with landlords. By using rent payments to establish creditworthiness, ESUSU significantly lowers the cost of capital for renters who want to become buyers.

Housing affordability is not a one-off problem that can be solved by a blanket solution. However, it is a problem to keep talking about the problem and not offering any real practical solutions. Focusing on ways to solve the problem through innovation, it will be possible to come up with multiple marvelous and creative solutions focused at the grassroot level.

18 | FEBRUARY 2023

The 6 Best Home Design Apps for

Projects Large and Small

Home design apps have revolutionized the way we approach interior and exterior design projects, both large and small. With a vast array of tools and features, these apps allow users to plan, visualize, and even shop for their dream home all from the comfort of their own device.

TPIN DESIGNS PHOTOS FROM 123RF 20 | FEBRUARY 2023

Here, we’ve rounded up six of the best home design apps currently available, each with their own unique set of features and capabilities. Whether you’re a professional designer or a DIY enthusiast, these apps have something to offer for projects of all sizes.

1. HOUZZ DESIGN

This app is a must-have for anyone looking to renovate or redecorate their home. The app features an extensive library of interior and exterior design ideas, as well as a shopping feature that allows users to purchase products directly from the app. The app provides users with a wealth of inspiration and ideas for their home renovation and decorating projects, with a vast collection of photos, articles, and product listings. The app also has a feature called “View in My Room 3D” which allows you to see how furniture and decor would look in your own space using your device’s camera. Users can also save and organize their favorite products, photos and professionals on the app under “Ideabooks”. Another feature is the “Houzz Pro+” which is a subscription-based service that gives users access to additional features such as project management tools and the ability to send direct messages to professionals. Users can also connect with local professionals, such as architects, builders, and designers, to get personalized advice and help with their projects.

2. ROOMSKETCHER

This is an app that allows users to create detailed floor plans and 3D renderings of their home renovation and decorating projects. The app is ideal for users who want to experiment with different layouts and designs, and see how their ideas will look in real life before they start their projects. The apps feature called “Live 3D allows users to walk through their designs and see how their ideas will look in real life. The app also allows users to import and export 3D models, which is useful for professionals who need to share their designs with clients or contractors.

FEBRUARY 2023 | 21

3. SKETCHUP

This app is a favorite among professional architects and designers, as it offers advanced 3D modeling capabilities to create detailed floor plans and 3D renderings of their home renovation and decorating projects. The app is easy to use, with a userfriendly interface and a wide range of tools and features. Users can experiment with different layouts and designs, and see how their ideas will look in real life before they start their projects. The app also allows users to collaborate with others, making it a great option for working on larger projects.

4. HOME DESIGN 3D

This app is perfect for those who want to design their home in 3D, but don’t have any previous experience with design software. The app’s user-friendly interface makes it easy to create detailed designs, and users can also import floor plans from other sources. The app also includes a wide range of furniture, lighting and decor items to add to your designs, as well as the ability to import your own items. The app also allows users to import floor plans and export the designs in various file formats, such as PDF, JPG, and PNG. It also has a feature called “Augmented Reality” which allows users to see how their designs would look in real life using their device’s camera.

5. MAGICPLAN

This app is great for creating detailed floor plans, and is particularly useful for those working on larger projects. The app allows

users to create floor plans by taking photos of a space. The app then automatically creates a floor plan based on the photos, which can be customized and edited as needed. This is a great app for users who want to create a floor plan of their home without having to manually measure and draw everything. MagicPlan also offers a wide range of furniture and decor items to add to your designs, as well as the ability to import your own items. It also has a feature called “Magic Plan Pro” which is a subscription-based service that gives users access to additional features such as the ability to create floor plans for multiple levels and export in various file formats.

In conclusion, home design apps have made it easier than ever before to plan and visualize home renovation and decorating projects. Whether you are a professional designer or a DIY enthusiast, these apps offer a wide range of features and capabilities to suit projects of all sizes. From creating detailed floor plans and 3D renderings, to shopping for decor and furniture, these apps have something to offer for everyone. Happy designing!

22 | FEBRUARY 2023

Property Assessment Reports Accuracy

Property assessment reports are a crucial part of the property tax system in the United States. They are used to determine the value of a property for the purpose of taxation. The question of whether these reports are accurate is an important one, as it can have a significant impact on the amount of property taxes that a homeowner has to pay. In this article, we will explore the concept of assessed value versus market value, and the effects that these values can have on property taxes.

Assessed value is the value of a property as determined by the government for the purpose of taxation. This value is typically based on the property’s physical characteristics, such as the size of the lot, the square footage of the building, and the age and condition of the property. The assessed value is used to calculate the property taxes that a homeowner has to pay.

Market value, on the other hand, is the value of a property as determined by the market. This value is typically based on the sale prices of similar properties in the area. The market value can fluctuate based on a variety of factors, such as changes in the local economy, changes in interest rates, and changes in the supply and demand for properties in the area.

In theory, the assessed value of a property should be the same as the market value of a property. However, in practice, this is not always the case.

The assessed value of a property can be lower or higher than the market value of a property, depending on a variety of factors, such as the property’s physical characteristics, the local economy, and the local real estate market.

When the assessed value of a property is lower than the market value of a property, the homeowner may be paying less in property taxes than they should. This can be a problem because it can lead to an unfair distribution of the property tax burden among homeowners. When the assessed value of a property is higher than the market value of a property, the homeowner may be paying more in property taxes than they should. This can be a problem because it can lead to financial hardship for the homeowner.

One common method used to determine the assessed value of a property is the cost approach. This method involves estimating the cost to replace the property with a similar new property, and then subtracting any physical deterioration, functional obsolescence, and economic obsolescence. However, this method may not accurately reflect the true market value of the property, as it doesn’t consider the location of the property, the condition of the property, or the overall state of the local real estate market.

Another method used is the sales comparison

LEGAL NEWS

PHOTOS FROM 123RF 24 | FEBRUARY 2023

approach. This method involves comparing the property being assessed to similar properties that have recently sold in the area. The assessed value of the property is then determined by comparing the property’s characteristics to those of the comparable properties. This method is considered to be more accurate than the cost approach, as it takes into account the location of the property, the condition of the property, and the overall state of the local real estate market.

The effects of the assessed value versus market value on property taxes can be significant. When the assessed value is lower than the market value, it can lead to an unfair distribution of the property tax burden among homeowners. When the assessed value is higher than the market value, it can lead to financial hardship for the homeowner.

In order to ensure that property assessment reports are accurate, it is important to regularly review and update the assessed values of properties. This can be done by conducting property inspections and re-evaluations, and by comparing the assessed values to the market

values of similar properties in the area.

Additionally, homeowners have the right to appeal their property assessment if they believe that it is incorrect. They can do this by submitting a request for a property assessment review to the local government. This process can be timeconsuming and complex, but it is important for homeowners to understand their rights and to exercise them if they believe that their property assessment is incorrect.

In conclusion, property assessment reports are an important part of the property tax system in the United States. The assessed value of a property should be the same as the market value of a property, but in practice, this is not always the case. The effects of the assessed value versus market value on property taxes can be significant, and it is important to ensure that property assessment reports are accurate by regularly reviewing and updating the assessed values of properties and by providing homeowners with the right to appeal their property assessments if they believe that they are incorrect.

FEBRUARY 2023 | 25

What Is The Black Equity Initiative of the Inland Empire?

how can Homebuyers benefit from it?

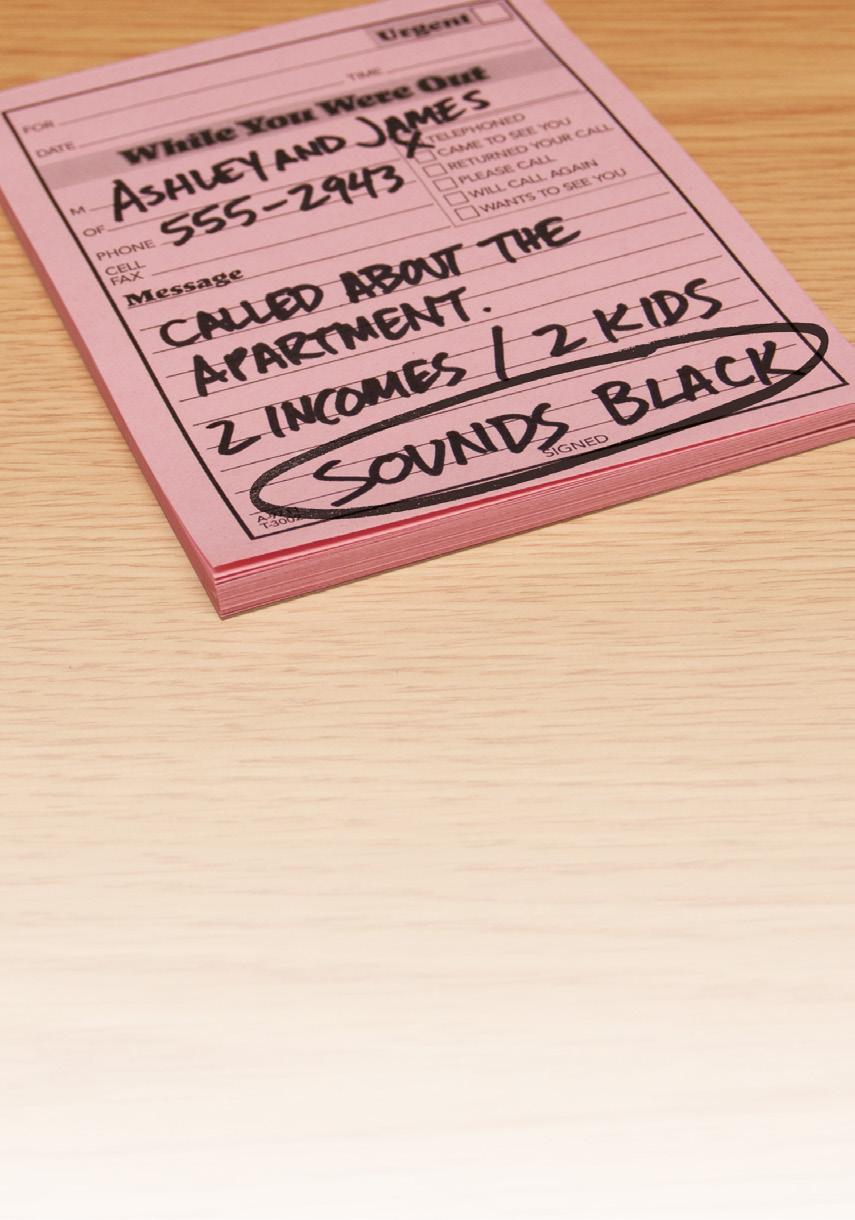

The Black Equity Initiative of the Inland Empire is a community-driven effort aimed at addressing systemic racism and promoting economic equity for Black residents in the Inland Empire region of California. The initiative, launched in 2020, focuses on increasing access to affordable housing, supporting small businesses, and providing financial education and resources to Black residents in the region. Through the initiative, Black residents in the Inland Empire can build wealth, improve their credit scores, and increase their community involvement by becoming homeowners.

One of the key components of the Black Equity Initiative is creating a program to assist Black homebuyers in purchasing homes in the Inland

Empire. This program, known as the Black Homeownership Assistance Program, provides financial assistance and resources to help Black residents overcome barriers to homeownership, such as high down payment requirements and lack of access to mortgage financing.

One way the Black Homeownership Assistance Program helps Black homebuyers is by providing down payment assistance. This can be particularly useful for first-time homebuyers or those who may not have the savings or resources to make a large down payment on a home. By providing financial assistance for the down payment, the program helps reduce the overall homeownership cost and make it more accessible to Black residents.

COMMUNITY

26 | FEBRUARY 2023

NEWS

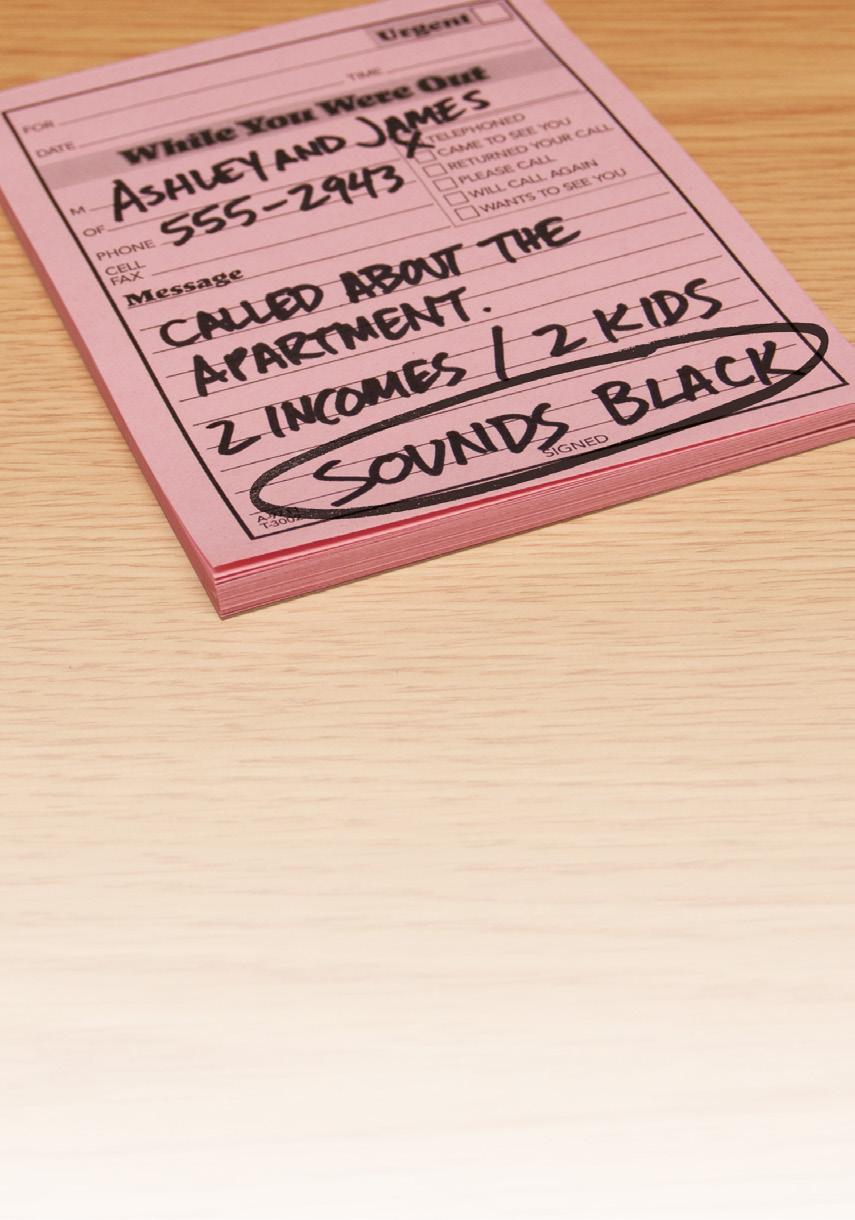

In addition to down payment assistance, the Black Homeownership Assistance Program also offers educational resources and support to help Black homebuyers navigate the purchasing process. This includes information on financing options, credit repair, and other important considerations for homebuyers. For example, the program may provide information on different mortgage options, such as conventional loans, FHA loans, and VA loans, and help homebuyers understand the pros and cons of each option. The program may also offer assistance with credit repair, which can be especially important for Black homebuyers who may have faced discrimination in the credit market and have lower credit scores. One of the key benefits of the Black Equity Initiative and the Black Homeownership Assistance Program is that they help to level the playing field for Black residents in the Inland Empire, who may have historically faced discrimination and barriers to homeownership. By providing financial assistance and resources, the initiative helps to increase access to affordable housing for Black residents, which can have long-term benefits for both individual homeowners and the broader community.

The Black Equity Initiative also includes several other initiatives to promote economic equity for Black residents in the Inland Empire. These initiatives include support for small businesses, financial education and resources, and community engagement efforts. For example, the initiative may provide technical assistance and resources to help Black entrepreneurs start and grow their businesses or offer financial education workshops to help Black residents improve their financial literacy and make informed financial decisions.

Another way that homebuyers can benefit from the Black Equity Initiative is through its partnerships with local real estate professionals. The initiative works with a network of real estate agents, mortgage lenders, and other professionals committed to supporting

Black buyers and helping them achieve homeownership. By working with these professionals, homebuyers can get the support and guidance they need to find the right home and secure a mortgage that meets their needs.

One of the key benefits of the Black Equity Initiative and the Black Homeownership Assistance Program is that they help to level the playing field for Black residents in the Inland Empire, who may have historically faced discrimination and barriers to homeownership. By doing this, the initiative helps increase access to affordable housing for Black residents, which can benefit both individual homeowners and the broader community. Homeownership can provide several economic and social benefits, such as building wealth, improving credit scores, and increasing community involvement which promotes economic stability and prosperity for Black residents in the Inland Empire.

The Black Equity Initiative is just one example of the efforts to address the systemic barriers Black individuals and families often face when trying to buy a home. While the initiative is focused on the Inland Empire region of California, similar programs and initiatives exist in other parts of the country. For example, the National Association of Realtors has launched several initiatives to promote diversity and inclusion in the real estate industry, including the “Advancing Real Estate, Advancing Communities” program, which aims to increase homeownership among Black and Hispanic households.

Overall, the Black Equity Initiative of the Inland Empire and the Black Homeownership Assistance Program are important efforts to promote economic equity and address systemic racism in the region. By providing financial assistance and resources to Black homebuyers, these programs can help to increase homeownership rates and improve the economic stability of Black residents in the Inland Empire.

FEBRUARY 2023 | 27

PHOTO FROM BLACKEQUITYIE.ORG/

You have more to offer than you think

Many of us often underestimate our own abilities and potential, believing that we are not capable of achieving certain things or that our talents and skills are limited. However, it is important to understand that we all have more to offer than we think. Whether it’s through self-confidence, growth mindset, discovering new talents, surrounding ourselves with supportive people, or seeking out new opportunities, we can unlock our true potential and achieve more than we ever thought possible. It’s time to stop limiting ourselves and strive to be the best version of ourselves.

One of the main reasons why we may underestimate ourselves is because of our lack of self-confidence. We may compare ourselves to others and believe that they are more talented or capable than we are. However, it is important to remember that everyone has their own unique strengths and abilities. Just because someone else excels in one area, does not mean that you cannot excel in another.

Another reason why we may underestimate ourselves is because of our past experiences. If we have failed at something in the past, we may believe that we are not capable of succeeding in the future. However, it is important to understand that failure is a

part of the learning process and that we can learn from our mistakes and improve.

It is also important to understand that our abilities and potential can change over time. We have the ability to continue growing and developing throughout our lives. We may not be able to do something now, but with practice and dedication, we can improve and achieve more than we ever thought possible. One way to do this is through education and training. Whether it’s formal education or learning through personal development and self-study, we can acquire new knowledge and skills that can help us to achieve more. For example, if you want to improve your public speaking skills, you can

take a class, read books on the topic, or practice speaking in front of a mirror. it’s important to understand that our abilities and potential can be enhanced by our mindset and attitude. If we approach life with a positive attitude and a willingness to learn and grow, we are more likely to achieve more than if we approach life with a negative attitude and a fixed mindset.

Another way to continue developing our abilities is by seeking out new opportunities. This is an important way to continue developing our abilities and unlocking our potential. It can help us gain valuable experience and skills that can help us achieve more. By taking on new roles, whether it’s in our professional

POWER YOU

28 | FEBRUARY 2023

or personal lives, we can learn new things, develop our talents, and expand our horizons. This can include taking on new projects or responsibilities at work, volunteering in our community, or pursuing new hobbies and interests. By stepping out of our comfort zones and trying new things, we can discover new talents and abilities that we never knew we had and unlock our true potential.

It’s also important to remember that our abilities and potential are not just limited to our professional lives. We all have unique talents and skills that can be used to benefit our personal lives and the lives of others. For example, someone who is skilled at cooking might volunteer to cook for a local

shelter, or someone who is good at organizing might help a friend plan a party.

One way to uncover our hidden abilities and potential is to try new things. It may be easy to stick to what we know, but by stepping out of our comfort zone and trying new things, we can discover new talents and skills that we never knew we had. It’s also important to have a growth mindset, which is a mindset that embraces challenges, perseveres through obstacles, and sees failure not as evidence of unintelligence but as a heartening springboard for growth and for stretching our existing abilities.

Another way to uncover our hidden abilities and potential is to surround ourselves with

supportive and encouraging people. Having people in our lives who believe in us and our abilities can help to boost our self-confidence and give us the motivation we need to push ourselves to achieve more. In conclusion, we should not undervalue ourselves and our abilities. We all have more to offer than we think. We may not be aware of all of our talents and abilities, but with a little effort and determination, and with a little self-confidence and the right mindset, we can achieve our goals and more than we ever thought possible a. So, Let’s not limit ourselves. Let’s strive to be the best version of ourselves. Let’s break out of our comfort zone, embrace new challenges, and discover the hidden talents and abilities that we all possess.

123RF FEBRUARY 2023 | 29

PHOTOS FROM

Do you have what it takes to be a homeowner?

Homeownership is a significant step towards financial stability and building long-term wealth. It is an investment that requires careful consideration and planning, as well as a significant financial commitment. If you are thinking about becoming a homeowner, it’s essential to understand the responsibilities and costs involved, as well as the financing options available to help you make your dream a reality.

The first step in determining if homeownership is right for you is to assess your financial situation. This includes reviewing your credit history, income, and assets, as well as your current and projected expenses. It’s also essential to consider the long-term financial implications of homeownership, including property taxes, insurance, maintenance, and repairs.

One of the most significant expenses associated with homeownership is the down payment. A down payment is a percentage of the purchase price that is paid upfront and is typically required by lenders. The amount of the down payment can vary depending on the type of loan and the lender’s requirements. For example, a conventional loan typically requires a down payment of at least 5% of the purchase price, while an FHA loan requires a minimum of 3.5%.

In addition to the down payment, there are other costs associated with buying a home, such as closing costs, which can include appraisal fees, title insurance, and attorney’s fees. It’s essential to budget for these costs and to have a clear understanding of what they will be before you start the home-buying process.

Once you have assessed your financial situation and budgeted for the costs associated with buying a home, it’s time to start looking at financing options. There are several types of loans available to help you purchase a home, including:

1. CONVENTIONAL LOANS: These are loans that are not insured or guaranteed by the government. They are typically offered by banks and other financial institutions and have stricter credit and income requirements than other loan types.

2. ADJUSTABLE-RATE MORTGAGES (ARMS): These loans have interest rates that can change over time, typically every year or every few years. They can be a good option for borrowers who expect their income to increase in the future, but they can also be risky if interest rates rise.

FINANCIAL NEWS PHOTO FROM FORBES.COM 30 | FEBRUARY 2023

3. SUBPRIME LOAN: These loans are designed for borrowers with a credit score below 620 and may have higher interest rates and fees than conventional loans. However, they can be a useful option for borrowers who may not qualify for other types of loans.

4. BRIDGE LOAN: This is a short-term loan used to finance a new home purchase before the sale of the borrower’s current home. A bridge loan allows the borrower to use the equity in their current home as collateral for the new home purchase. This can be a useful option for borrowers who need to move quickly, but it’s important to note that bridge loans typically have higher interest rates and

fees than traditional mortgages.

5. RENT TO OWN AGREEMENT: This type of agreement allows the tenant to rent a home for a certain period, with the option to purchase the home at the end of the lease. This can be a useful option for borrowers who need time to improve their credit score or save for a down payment before buying a home.

6. JUMBO LOANS: This are typically used for high-end properties or for borrowers who need to borrow more than the conforming loan limit. They may have stricter underwriting guidelines and may require a higher down payment and credit score than conventional loans.

When it comes to financing, it’s also essential to consider the different types of mortgages available, such as fixed-rate mortgages and adjustable-rate mortgages (ARMs). A fixed-rate mortgage has an interest rate that remains the same for the entire loan term, while an ARM’s interest rate can fluctuate. A fixed-rate mortgage can provide stability and predictability, but it may have a higher interest rate than an ARM. On the other hand, an ARM can provide a lower initial interest rate, but it can also be riskier if interest rates rise. It is important to weigh the pros and cons of each type of mortgage and to consider your personal situation and risk tolerance. It’s also essential to shop around to compare rates and fees from different lenders. A mortgage broker or loan officer can help you navigate the loan process and can provide guidance on the best loan options for your needs.

In summary, homeownership is a significant step towards financial stability and building long-term wealth. It requires careful consideration of your financial situation, long-term plans, and the costs and responsibilities associated with owning a home. It’s important to understand the various financing options available and to choose the one that best fits your needs. By taking the time to plan and prepare, you can make the dream of homeownership a reality.

FEBRUARY 2023 | 31

Making it Glam: Top five Bathroom Design ideas to make your house pop in 2023

Bathroom design is an integral aspect of a home’s overall aesthetic appeal. It has the ability to change the look and feel of a house and make it more inviting and comfortable. With the new year just around the corner, it’s the perfect time to think about refreshing your bathroom design and giving it a new look. Whether you’re planning a complete remodel or just looking to make a few updates, there are a variety of bathroom design ideas that can help you create a space that is both beautiful and functional. From minimalism to natural elements, from color pops to statement pieces, the possibilities are endless. In this article, we’ll explore the top fivebathroom design ideas that are sure to make your house pop in 2023, and provide tips and suggestions on how to incorporate them into your bathroom design.

1. GO FOR A MINIMALIST LOOK.

Minimalism is a great way to create a clean, modern look in your bathroom. It is characterized by the use of simple, clean lines and a neutral color palette. To achieve a minimalist look in your bathroom, you can use white or light gray as the main color, and then add black or other neutral colors as accent colors as this can help to create a cohesive look and make the space feel more open and airier.

You can also use geometric shapes in the design such as square or rectangular tiles, and keep the decor minimal. By keeping things simple and uncluttered, you can create a bathroom that feels spacious and serene.

2.

ADD A POP OF COLOR.

While minimalism is a great look, it can also be a bit stark and uninviting. To add a bit of warmth and inviting atmosphere and also personality to your bathroom, try incorporating

a pop of color. This could be as simple as adding a colorful shower curtain or a few brightly-colored towels. You could also try painting an accent wall in a bold color, or incorporating colorful tile into your shower or backsplash, or incorporate

TPIN LIVING & LIFESTYLE

32 | FEBRUARY 2023

colorful fixtures and accessories. The key is to choose a color that complements the overall design of your bathroom and adds a touch of personality to the space.

3. INCORPORATE NATURAL ELEMENTS.

Another popular trend in bathroom design is the use of natural elements. Adding natural elements to your bathroom can help create a sense of warmth and tranquility, and can also help to bring the outdoors in. Try using reclaimed wood for your vanity or shower walls, or incorporating a live plant or two into your bathroom decor. You can also use

4. GET CREATIVE WITH LIGHTING. Lighting is an important aspect of bathroom design and can make a huge difference in the overall look and feel of a bathroom. it has the ability to change the mood and atmosphere of the space. Instead of relying on a single overhead light, try incorporating multiple sources of light. This could include wall sconces, pendant lights, or even a chandelier to create different layers of light. You could also try using dimmer switches to create a more intimate, relaxing atmosphere. By using different types of lighting, you can create a bathroom that is both functional and beautiful.

5. INVEST IN A STATEMENT PIECE. Finally, to really make your bathroom stand out, try investing in a statement piece. This could be anything from a freestanding bathtub to a large, ornate mirror or a unique piece of artwork. The key is to choose something that is unique and eyecatching, something that will become the focal point of the room. You can use for a large ornate mirror to create the illusion of a larger space and add a touch of elegance to your bathroom. Just be sure to choose a piece that complements the overall design of your bathroom, and that doesn’t overpower the space. Be sure to choose a piece that makes a statement and becomes the focal point of the room.

natural stone such as marble or granite for countertops, flooring, or shower walls. The use of natural elements can also create a connection to the outdoors, making the bathroom feel more open and natural.

In conclusion, there are many different ways to give your bathroom a fresh, modern look in 2023. Whether you go for a minimalist look, add a pop of color, incorporate natural elements, get creative with lighting, or invest in a statement piece, there are plenty of options available to help make your house pop. Remember to keep your own taste and preferences in mind, as well as the overall style of your home, when choosing a design. Bathroom remodeling is a great way to refresh your home and give it a new look, so don’t hesitate to explore all the design possibilities to make your bathroom the best it can be.

FEBRUARY 2023 | 33

Helena Duncan: THE FIRST BLACK CEO OF THE BUSINESS COUNCIL OF ALABAMA

Helena Duncan is a trailblazer in the business world, having made history as the first Black CEO of the Business Council of Alabama (BCA). Not only is she the first Black CEO of the Business Council of Alabama but also the first woman to hold this position. Her appointment to this position in 2020 is a significant achievement, not just for her personally, but for the entire business community in Alabama, and for Black people in leadership positions across the United States.

The BCA is a prominent organization that represents the interests of Alabama’s business community and works to promote economic growth and development in the state. It is made up of more than 200 member companies, which employ over 500,000 people and generate

billions of dollars in revenue. As CEO, Duncan is responsible for leading the organization and working with its members to achieve its goals.

Duncan has a wealth of experience in the business world, having spent many years working in various leadership roles. She began her career in finance, working for a number of major banks and financial institutions. She then transitioned to the retail industry, where she held various positions, including as the President of the International Division of a large retail chain. In addition to her professional experience,

Duncan has a strong educational background, having earned a degree in finance from a prestigious university and an MBA from a top business school. Her education and experience

PEOPLE WOMAN 34 | FEBRUARY 2023

have prepared her well for her role as CEO of the BCA, where she will be able to use her knowledge and skills to help the organization achieve its goals.

One of Duncan’s main priorities as CEO of the BCA is to promote economic growth and development in Alabama. This includes working with the organization’s members to create jobs and attract new businesses to the state. She also wants to focus on improving the state’s infrastructure and education system, which are important factors in attracting and retaining businesses. She also plans to work with the organization’s members to create opportunities for small and minority-owned businesses in Alabama, which is important for the economic growth and development of the state.

Another important aspect of Duncan’s role as CEO is to represent the interests of the BCA’s members and advocate for policies that will benefit their businesses. This includes lobbying for lower taxes, fewer regulations, and other measures that will help businesses grow and thrive.

Duncan is also an advocate for the importance of education in economic development. She believes that a strong education system is vital for attracting and retaining businesses in the state, and that it is essential for creating a skilled workforce that can meet the needs of today’s businesses. She plans to work with the state’s education leaders to improve the education system, and she will advocate for policies that will help make this happen.

In addition to her role as CEO of the BCA, Duncan is also actively involved in the community. She serves on the board of a number of nonprofit organizations, including those that focus on education and economic development. She is also a mentor and role model for young people, particularly those from disadvantaged backgrounds, and is committed to helping them achieve their full potential.

As a Black woman, Duncan’s appointment as CEO of the BCA is particularly significant. Historically, Black people have been underrepresented in leadership positions in the business world, and this is still the case today. Duncan’s appointment is a powerful symbol that Black people can and do succeed in the business world, and it is an inspiration to others who want to follow in her footsteps.

Finally, it is worth noting that Duncan’s appointment as CEO of the BCA is also significant because it demonstrates the business community’s commitment to diversity and inclusion. The BCA is a prominent organization that represents the interests of Alabama’s business community, and its members include some of the state’s largest and most successful companies. The fact that these companies were willing to support Duncan’s appointment as CEO is a sign that they recognize the importance of diversity and inclusion in leadership positions, and that they are committed to promoting these values within their own organizations.

In conclusion, Helena Duncan is a visionary leader who has made history as the first Black CEO of the Business Council of Alabama (BCA). Her appointment to this position is a significant achievement not only for her personally, but also for the entire business community in Alabama, and for Black people in leadership positions across the United States. Her wealth of experience, education, and community involvement make her the perfect fit for the role of CEO and she is poised to lead the BCA to greater heights in promoting economic growth and development for the state of Alabama.

FEBRUARY 2023 | 35

PHOTO FROM WWW.BCATODAY.ORG

Thinking about Buying a Home in Houston? WHAT YOU NEED TO KNOW

By Sharon Bartlett

Many home buyers ask themselves if it’s a great idea to invest in buying a home in Houston. The truth of the matter is that the place is worth buying a home because there are plenty of available job opportunities in that many companies are stationing their headquarters in the area, affordable cost of living which is about eight percent lower than the national average, zero income tax as well as warm weather all round.

Buying a home in Houston would be a great investment since it’s one of the most popular states that many people yearn to reside in. Distance to various social amenities is quite near and there is plenty of areas to explore in when

in Houston. As a home owner, you will not have any regrets when choosing to buy a home in Houston whether for vacation or rental purposes. Factors to consider when thinking of buying a home in Houston include:

SECURITY OF THE NEIGHBORHOOD YOU’D WISH TO LIVE

Houston is prone to face huge problems of insecurity especially being a huge city. It would be advisable for the home buyer to think about his or her safety when leaving or coming back home since different areas have different levels of criminality.

PHOTOS FROM 123RF

FEBRUARY 2023 | 37

HOW LONG IS THE COMMUTING DISTANCE?

If you are an employee who goes to his or her workplace on a regular basis, it would be good to think about the time you’re willing to spend going to work or the amount of petrol that will need you to get to work if you’re driving to the place. Choose to reside in an area that is not quite a distance because during early mornings you’ll be prone to get bounded by traffic and that will cost you big time when it comes to going to work. You’ll end up wasting more time on the road as well as petrol since your car is still running when in traffic.

HOW MUCH WILL YOU PAY IN CLOSING COSTS?

Despite you making a down payment to secure your dream home, you’ll have to do some calculations and do an estimate of the amount you’d want to spend on closings. The home seller may cover up on costs like paying for the new title insurance policy and your lender may also decide to charge you additional fees on your loan. It’s important to do your research on the available mortgage lenders so as to make a decision on choosing the right one when you want to buy your home.

THE COST OF PROPERTY TAXES

The government earns its revenue from property taxes and hence they may tend to hike the prices. The buyer should take time and study about the tax rates in relation to where he or she would want to buy a house. When saving to buy a house, it’s good to budget on the property taxes as well. It’s important to consult your seller on the property taxes they have been paying to the government so as to have a rough estimate on what to expect.

WHAT KIND OF HOME-OWNER’S INSURANCE WILL YOU NEED?

Houston has great advantages due to the great opportunities in the area but there are usually some risky weather conditions. The weather conditions have begun to change over the years

due to the effects of global warming. There are potential catastrophic storms that may strike and the city may get flooded. It’s important for the home owner to think about investing on a flood insurance policy that would protect his or her investment incase such a risk occurs.

Buying a property in Houston is a great investment strategy especially if you’d want to rent it later in life since many people eye having properties in that area. It’s good to do your research and make some analysis before making a decision on the property you’d want to buy. Be prepared in terms of having your down payment in place, locating a local real estate agent as well as doing an extensive research on the houses in the area. Buying a home in Houston is a smart move unlike renting since the cost of renting has become quite high.

38 | FEBRUARY 2023

FEBRUARY 2023 | 39

Homebuyer’s Guide to Maryland’s foreclosure process

By Emerick Peace

Purchasing a foreclosed home in Maryland can be a great opportunity to own a property at a discounted price. However, the foreclosure process in Maryland can be complex and confusing for homebuyers who are not familiar with the rules and regulations. In this article, we will provide a comprehensive guide for homebuyers looking to purchase a foreclosed property in Maryland.

The first step in the foreclosure process in Maryland is the pre-foreclosure stage. This is the period of time before the property is actually

foreclosed on, during which the homeowner has the opportunity to bring their mortgage payments current. During this time, the homeowner may also be able to sell the property to a third party, such as a homebuyer, in order to avoid foreclosure.

Once the pre-foreclosure stage has ended, the property will be foreclosed on and sold at a public auction. The auction is held by the county sheriff, and the property is sold to the highest bidder. It is important to note that the property will be sold “as is,” meaning that the buyer will

PHOTOS FROM 123RF FEBRUARY 2023 | 41

be responsible for any repairs or renovations that may be needed.