The Power Is Now Media Inc. 3739 6th Street Riverside, CA 92501 Ph: (800) 401-8994 | Fax: (800) 401-8994 info@thepowerisnow.com www.thepowerisnow.com

The Power Is Now Media Inc. 3739 6th Street Riverside, CA 92501 Ph: (800) 401-8994 | Fax: (800) 401-8994 info@thepowerisnow.com www.thepowerisnow.com

The PIN Magazine™ is owned and published electronically by The Power Is Now Media, Inc. Copywrite 2022 The Power Is Now Media Inc. All rights reserved.

“The PIN Magazine” and distinctive logo are trademarks owned by The Power Is Now Media, Inc. “ThePINMagazine.com”, is a trademark of The Power Is Now Media, Inc. “Magazine.thepowerisnow.com”, is a trademark of The Power Is Now Media, Inc. No part of this electronic magazine or website may be reproduced without the written consent of The Power Is Now Media, Inc.

Requests for permission should be directed to: info@thepowerisnow.com

Pg. 12. The top 5 Real Estate trends to watch out for in 2023.

Pg. 14. Be Aware of ‘too good to be True’ Lenders!

Pg. 16. Top 5 commercial Real Estate trends to watch out for in 2023.

Pg. 18. Devising creative and innovative solutions to deal with the affordability crisis in the country.

Pg. 22. CRAZY Interior house designs we have our eyes on.

Pg. 8. California’s new climate pollution plan accelerates path to 100% clean energy.

Pg. 10. Is there a balance between employment and Real Estate foreclosures?

Pg. 26. What’s the impact of institutional investorsin the housing market?

Pg. 28. What Is The Black Equity Initiative of the Inland Empire?

Pg. 31. Looking to Invest in Texas?Here’s a Simple Guide, by Sharon Bartlett.

Pg. 35. 5 factors affecting affordability in Maryland, by Emerick Peace.

Pg. 41. Sellers: Should you list your property now or wait?, by Adriana Montes.

Pg. 45. 6 tricks to help you sell your home in the winter, by Yvonne McFadden.

Pg. 49. Who Owns That Property? 5 ways to find out, by Tamra Lee.

Pg. 53. How to challenge a low appraisal, by Walter Huff.

Pg. 57. Here are some important things to look for in a modern home inspection report, by Heith Mohler.

Pg. 61. Is Making Your Curb More Appealing Underrated?, by Ruby Frazier.

Pg. 64. Emerick A. Peace. The Success Story of The Extraordinaire Real Estate Mogul Behind Keller Williams Preferred Properties In Maryland

Pg. 73. Here’s how to sell your home while buying another in Corona, CA, by Jenny Gonzalez.

Pg. 77. 10 Questions to Ask your home inspector, by Ian Batra.

Pg. 81. Simple Steps Minorities in LA can take before buying a home, by Briana Frazier.

Pg. 85. Minnesota Real Estate market update forecast for 2023, by Francine Marsolek. Pg. 89. Explained! Real Estate taxes in Denton, by Janet Petrozelle.

Pg. 93. This is how much it will cost to sell your home in El Cajon, CA, by John Costigan.

Pg. 97. This is how much will you pay in closing costs in 2023, by Norman Green.

Pg. 101. New Haven Real Estate market projections: Here’s what to expect in 2023, by Steven Rivkin.

Pg. 105. New Haven Real Estate market projections: Here’s what to expect in 2023, by Decira Pimental. Pg. 109. Is it advisable to sell or stay in your home after retirement in Menifee?, by Monica Hill.

Pg. 113. Stuck in your Sell? Here are some creative promotion strategies to attract today’s buyers, by Marina Ramirez.

Pg. 117. Homebuying is much more than the features you see on the surface, by Brandy Nelson.

Pg. 121. The top 5 things buyers hate about your house!, by Jim Clifford.

Pg. 125. How cryptocurrency will impact Real Estate financing, by Jamar James.

Pg. 129. Los Angeles Real Estate market update, December 2022, by Dolores Golden.

Pg. 133. NYC Real Estate market projections: Here’s what to expect in 2023, by Dolores Golden.

Hello and welcome to our latest edition of The Power Is Now magazine. We hope you had a wonderful holiday season and are feeling rejuvenated and ready to tackle the new year. We have a jam-packed issue full of exciting and informative content. As always, we’re excited to bring you the latest and greatest news and developments on the real estate market.

Last year, while great for the most part, it was a difficult year for many of us. Businesses were shutting down, inflation was at its highest, and it was overwhelming for many.

We want to encourage our readers to be hopeful and optimistic about the future. While it can be easy to get caught up in the negative news and events happening worldwide, we believe you can achieve your goals and dreams with the right mindset and determination. Whether that means buying your dream home or simply improving your productivity, we hope that our articles will inspire you to take positive action and make positive changes in your life.

In this month’s cover story, we feature one phenomenal real estate agent who has done much to change the housing narrative in Maryland and countrywide. Emerick A. Peace is a real estate genius and the Operating Partner and owner of Keller Williams Preferred Properties (KWPP). KWPP is a multi-billion dollar residential, luxury, and commercial real estate sales brokerage with more than 570 associates in Upper Marlboro, Maryland (Prince George’s County). Emerick is an extraordinaire agent, and his story is very inspiring.

In this issue, we delve into various topics that interest you. From employment data and real estate foreclosures to technological innovations and time management techniques, we aim to bring you the latest and most relevant information to keep you in the loop.

One topic that we are particularly excited about is the rise of the Metaverse and virtual property. As technology advances exponentially, it is no surprise that we are seeing the emergence of virtual worlds where people can buy and sell virtual real estate. While it may sound like something out of a science fiction novel, buying virtual property is quickly becoming a reality, and we have an in-depth feature on how it works.

We also recognize that inflation and house prices are on many people’s minds, whether they are looking to buy, sell, or rent. Our article on how inflation impacts the housing market and what you need to know as a homebuyer, seller, or renter will be an eye-opener

to many especially given that the homebuying season is in a few months.

In this issue, we also have updates on real estate markets across the country, including California, Minnesota, New York City, New Haven, and Denton, North Carolina. If you are interested in buying or selling in any of these areas, we have the latest market projections and insights to help you make informed decisions.

We also have a range of tips and tricks for buyers and sellers, including how to challenge a low appraisal and sell your home in the winter, which are some of the areas many buyers and sellers struggle with when it comes to real estate transactions.

At this moment, I want to thank our power team

for their continuous hard work and commitment to making The PIN magazine a reality and to you, our readers. We would be nothing without you. Our team is dedicated to you. We want the best for you, which means we are committed to bringing you the best from us. Take a moment and share this magazine with family and friends.

Remember, knowledge is power, and The Power Is Now!

ERIC L. FRAZIER MBA President and CEOThe Power Is Now Media, Inc.

California has recently announced an ambitious plan to accelerate its transition to 100% clean energy. It’s known as the “California Clean Energy Act,” which aims to aggressively reduce greenhouse gas emissions and accelerate the state’s transition to 100% clean energy by 2045. This ambitious plan includes 50% renewable energy targets by 2025 and 60% by 2030. It involves expanding renewable energy sources such as solar and wind power, phasing out fossil fuels, and increasing energy efficiency through stricter building codes and appliance standards. The transition to clean energy will have wide-ranging impacts on the state, including potentially affecting the real estate market through the demand for properties with clean energy features

and the construction of new renewable energy infrastructure.

One key aspect of the plan is the expansion of renewable energy sources, such as solar and wind power. California already leads the nation in solar power capacity, and the new plan aims to increase this even further. In addition to installing more solar panels and wind turbines, the state is also promoting the use of electric vehicles and supporting the development of new technologies, such as energy storage systems and advanced grid management systems. Another critical aspect of the plan is the phase-out of fossil fuels by gradually reducing its reliance on coal and natural gas while promoting clean fuels, such as biofuels and hydrogen.

PHOTO FROM 123RFThe real estate industry is expected to play a significant role in California’s transition to 100% clean energy. Many commercial and residential buildings in the state are already starting to adopt renewable energy technologies such as solar panels and energy-efficient lighting systems. The new climate pollution plan is expected to accelerate this trend as more and more property owners look to reduce their carbon footprint. This will significantly impact the real estate market in the state. For example, properties with solar panels or other clean energy features may become more desirable to buyers and potentially command higher prices.

Similarly, properties near public transportation or with electric vehicle charging stations may also become more attractive.

modernize the state’s energy infrastructure, including installing new transmission lines, substations, and distribution systems. This will require significant investments of time and money and may require the state to work closely with utilities and other stakeholders to ensure a smooth and orderly transition.

Another challenge will be the need to support and assist those who may be negatively impacted by the transition to clean energy. For example, some workers in the fossil fuel industry may lose their jobs as the state shifts to renewable energy sources. It will be necessary for the state to provide support and training to these workers to help them transition to new careers in the clean energy sector.

The plan includes various incentives and policies to encourage the transition to clean energy. For example, the state offers subsidies for individuals and businesses to install solar panels or purchase electric vehicles. In addition, the plan includes measures to increase energy efficiencies, such as building codes that require more efficient appliances and stricter standards for new construction.

Despite these challenges, the benefits of transitioning to 100% clean energy are clear. By reducing greenhouse gas emissions, California can mitigate the worst impacts of climate change, including rising sea levels, more frequent and severe natural disasters, and declining air quality. In addition, the transition to clean energy will create new jobs and stimulate economic growth improving public health and quality of life for all Californians.

The transition to clean energy will also bring economic benefits to the state. For example, expanding renewable energy sources could create new jobs in the renewable energy sector. In addition, transitioning away from fossil fuels could reduce air pollution and improve public health, potentially saving billions of dollars in healthcare costs.

While the transition to 100% clean energy will bring many benefits to California, it is important to recognize that there will also be challenges and costs associated with this transition. One of the main challenges will be the need to

Overall, California’s new climate pollution plan is a bold and ambitious step toward a cleaner and more sustainable future. By increasing the use of renewable energy and promoting the adoption of electric vehicles, the state is taking the lead in the fight against climate change and setting an example for other states and countries to follow. While there will certainly be challenges and obstacles along the way, the benefits of transitioning to 100% clean energy are clear. They will be felt by all Californians for generations to come. So, this is a very welcome move, and other states and countries should also follow this path to fight against climate change and achieve sustainable development.

The relationship between employment and real estate foreclosures is complex and multifaceted. On the one hand, a strong employment market can help homeowners stay current on their mortgage payments and avoid foreclosure. On the other hand, economic downturns and job loss can be major factors in the onset of foreclosures. In this article, we will explore how employment and real estate foreclosures are interconnected and consider whether a balance can be struck between the two.

On the other hand, a strong employment market can help homeowners avoid foreclosure by providing them with the income they need to make their mortgage payments on time. When people have steady jobs and good incomes, they are more likely to be able to afford their housing costs and keep up with their mortgage payments. This can help to prevent foreclosures and stabilize the real estate market.

First, let’s consider employment’s role in the risk of real estate foreclosures. A loss of income is one of the most common reasons for a homeowner to default on their mortgage. When a person loses their job or experiences a significant decrease in pay, they may struggle to make their mortgage payments on time. If they cannot catch up on missed payments, they may eventually face foreclosure. In addition to job loss, other factors that can impact a person’s ability to pay their mortgage include illness, injury, divorce, or unexpected expenses. These can lead to financial strain and increase the risk of foreclosure.

However, it’s important to note that a strong employment market does not guarantee that there will be no foreclosures. Economic downturns and other factors can still lead to job loss and financial strain, even in a strong employment market. And in some cases, even homeowners with good jobs and stable incomes may struggle to afford their housing costs due to rising prices or other factors.

So, is there a balance between employment and foreclosures? Ultimately, the answer is not a simple yes or no. It’s important to consider the many factors that can impact the housing market, including employment, interest rates, and government policies.

One way to reduce the risk of foreclosures is to ensure that people have access to good jobs and stable incomes. This can be achieved through policies that support job creation and economic growth, such as investments in education and training, infrastructure, and research and development.

One way to address the issue of foreclosures is through government assistance programs. For example, the government may provide financial assistance to homeowners struggling to make their mortgage payments due to job loss or reduced income. This can help to prevent foreclosures and allow homeowners to stay in their homes while they work to get back on their feet financially. By maintaining affordable housing, homeowners are more likely to be able

to afford mortgage payments and reduce the risk of foreclosure. Some private organizations and non-profits offer assistance to homeowners facing foreclosure. These include organizations like the National Foreclosure Mitigation Counseling (NFMC) program, which provides free counseling and assistance to homeowners facing foreclosure,

Another way to address the issue is through policies that help to keep housing affordable. This can include rent control, tax incentives for developers to build affordable housing, and programs to help first-time homebuyers afford a down payment. Keeping housing affordable can make it easier for homeowners to afford their mortgage payments and reduce the risk of foreclosure.

In addition to government policies, there are also steps that homeowners can take to protect themselves from the risk of foreclosure. These include:

1. STAYING UP TO DATE ON MORTGAGE PAYMENTS: It’s important to ensure that you are paying your mortgage on time, as even one missed payment can put you at risk of foreclosure.

2. COMMUNICATING WITH YOUR LENDER: If you are having trouble making your mortgage payments, you must immediately reach out to your lender. Many lenders are willing to work with homeowners to devise a solution, such as a temporary payment plan or a modification to the loan terms.

3. SEEKING FINANCIAL ASSISTANCE: If you are facing financial hardship, several organizations can provide financial assistance to help you stay in your home. These may include non-profit organizations, government agencies, or even your employer.

Ultimately, the key to striking a balance between employment and real estate foreclosures is to create an environment that supports job growth and economic stability, while also assisting homeowners facing financial challenges. By taking these steps, we can help ensure that people have the means to afford their housing and avoid foreclosure while also supporting a healthy and stable real estate market.

The real estate market is constantly evolving, and buyers, sellers, and investors must stay up-to-date on the latest trends to make informed decisions. With that in mind, here are the top 5 real estate trends to watch out for in 2023:

In recent years, there has been a trend towards urbanization, with many people opting to live in city centers close to work and amenities. However, the COVID-19 pandemic has shifted this trend, as people have been seeking more space and a safer environment in which to

live. This has increased demand for suburban and rural properties, which offer more room to spread out and often come with larger yards. Also, suburban properties are often more affordable than their urban counterparts, making them a more realistic option for many buyers. In addition, the trend towards remote work has made it possible for more people to live outside of city centers and still have access to employment opportunities. This has also led to an increase in demand for properties with amenities that cater to remote work, such as home offices and high-speed internet. This trend is expected to continue in 2023 as people prioritize safety and quality of life in their real estate decisions with respect and affordability.

The luxury real estate market has been rising recently, and this trend is expected to continue in 2023. Many high-end buyers are looking for properties that offer high exclusivities, such as waterfront properties, estates, and

mansions. In addition, there has been an increase in demand for unique properties, such as outdoor kitchens, home theaters, and resort-style pools. In addition, the lowinterest rates that have persisted in recent years have made it easier for people to afford luxury properties. Finally, the pandemic has increased demand for properties that offer seclusion and privacy, which are often found in luxury properties. As the economy recovers and more people can afford luxury properties, the demand for these homes will likely continue to grow.

As technology advances, more people are looking for properties equipped with “smart” features. These features include smart thermostats, security systems, and even appliances that can be controlled from a smartphone or tablet. In addition to the convenience and efficiency benefits, the “smart home” trend will likely continue in 2023 due to these features’ added security. Smart security systems, for example, can alert homeowners to potential threats and allow them to monitor their homes remotely. In addition, smart appliances and systems can help homeowners save money by reducing energy consumption and costs. In 2023, we can expect to see an increase in demand for homes equipped with these types of features as more and more people become accustomed to the convenience and efficiency they offer.

While the trend toward homeownership has been strong recently, the COVID-19

pandemic has caused many people to reconsider their housing options. With unemployment rates rising and the economy uncertain, more people opt to rent rather than buy. In addition, the trend towards remote work has made it possible for people to live in a wider range of locations, which may make renting a more attractive option. In 2023, this market is expected to grow as people opt for its flexibility and security.

Sustainability has become a major focus in the real estate industry in recent years, and this trend is expected to continue in 2023. More and more buyers and investors are looking for properties that are energyefficient, have low carbon emissions, and are built with environmentally-friendly materials. As concerns about climate change continue to grow, we can expect to see an increased focus on sustainability in the real estate market. In addition, sustainable buildings often have a higher resale value, which can be attractive to buyers and investors in the market.

In conclusion, these are the top 5 real estate trends to watch out for in 2023. With the increased demand for suburban and rural properties, continued growth in the luxury market, the rise of the “smart home,” growth in the rental market, and an increased focus on sustainability, it’s clear that the real estate market is constantly evolving. By staying up-to-date on these trends, buyers, sellers, and investors can make informed decisions and take advantage of the market’s opportunities.

As a savvy real estate investor, you know that many different lenders are offering a wide range of mortgage products. However, it’s important to be aware of lenders who may be offering “too good to be true” deals who are intentionally trying to scam you. Some may simply be inexperienced or may not have a full understanding of the mortgage industry. These lenders may be unscrupulous or may not have your best interests in mind leading to financial problems down the road. In this blog, we’ll discuss how to identify “too good to be true” lenders and how to protect yourself from falling victim to their scams. One common type of mortgage scam is the “bait and switch.” This occurs when a lender lures you in with an attractive rate or term, but then changes the terms of the loan before closing. For example, the lender may increase the interest rate or add fees that weren’t disclosed originally. Another type of mortgage scam is the “phantom help” scam. In this scam, a lender or other individual claims to be able to help you modify your mortgage or avoid foreclosure, but then charges you upfront fees and doesn’t actually provide any help

One red flag to watch out for is lenders who offer rates or terms that seem too good to be true. For example, if a lender is offering significantly lower rates than other lenders, it’s worth doing some extra research to make sure the deal is legitimate. It’s also a good idea to compare the lender’s rates and terms to those of other lenders to make sure they are competitive.

Another sign of a “too good to be true” lender is a lack of transparency. If a lender is unwilling to provide clear and detailed information about their rates, fees, and terms, it’s a good idea to be cautious. A reputable lender will be upfront about their fees and charges and will be able to explain them in detail.

It’s also important to be wary of lenders who pressure you to make a decision quickly. A legitimate lender will give you the time you need to research your options and make an informed decision. If a lender is pushing you to make a decision without giving you the opportunity to fully consider your options, it’s a good idea to be suspicious.

So, how can you protect yourself from “too good to be true” lenders? One of the best ways is to do your research. Look for reviews or testimonials from other borrowers and check the lender ’s reputation with the Better Business Bureau. It’s also a good idea to work with a trusted real estate agent or mortgage broker who can help you compare lenders and find the best deal.

Another way to protect yourself from “too good to be true” lenders is to be cautious of lenders who ask for upfront fees. It’s not uncommon for lenders to charge fees for certain services, such as processing or underwriting fees, but these fees should be disclosed upfront and should not be exorbitant. If a lender is asking for a large upfront fee or is vague about what the fee is for, it could be a sign of a scam.

It’s also important to be aware of lenders who promise to help you get a mortgage, even if you have bad credit or a low income. While there are legitimate programs available to help borrowers with less-than-perfect credit or low income, these programs are often competitive and may have strict eligibility requirements. If a lender is promising to help you get a mortgage no matter what, it could be a sign of a scam.

Finally, be wary of lenders who ask you to sign a blank or incomplete loan application or who ask you to sign documents without fully explaining them. A reputable lender will provide you with complete and accurate loan documents and will take the time to explain them to you. If you feel like a lender is rushing you to sign documents without fully explaining them, it’s a good idea to be cautious.

In conclusion, it’s important to be aware of “too good to be true” lenders when shopping for a mortgage. Look for red flags such as rates or terms that seem too good to be true, a lack of transparency, or pressure to make a decision quickly. To protect yourself, do your research, work with a trusted real estate agent or mortgage broker, and compare offers from multiple lenders. Be on the lookout for common mortgage scams like the bait and switch and phantom help, and take steps to protect your personal information. By following these tips, you can avoid falling victim to a mortgage scam and secure a mortgage that is right for you.

As the commercial real estate market evolves, investors and business owners must stay up-to-date on the latest trends. Here are the top five commercial real estate trends to watch out for in 2023:

Co-working spaces, which offer flexible, shared office spaces for freelancers, entrepreneurs, and remote workers, have become increasingly popular in recent years. In 2023, we can expect to see even more co-working spaces popping up as more and more people opt for the flexibility and costsaving benefits of these work environments. One reason for the growth of co-working spaces is the increase in remote work due to the COVID-19 pandemic. Many companies have adopted remote work policies, which has led to a need for flexible office spaces for their employees. In addition to traditional co-working spaces, we may also see more specialized ones, such as co-working spaces for women, coworking spaces for creatives, and coworking spaces for startups. We can

certainly expect to see even more co-working spaces popping up as more and more people opt for the flexibility and cost-saving benefits of these work environments.

With the growing awareness of environmental issues, there is an increased demand for sustainable, energy-efficient buildings. In 2023, we expect to see more commercial real estate developments prioritizing sustainable design and green building practices. This could include energy-efficient lighting, solar panels, and water-saving fixtures. In addition to being good for the environment, sustainable buildings can also save businesses money on energy costs in the long run. Overall, the increased demand for sustainable buildings is expected to continue in 2023 as more and more people and businesses seek to reduce their environmental impact and save on energy costs. This trend could lead to a greater focus on sustainable design and green building

PHOTO FROM 123RFpractices in the commercial real estate market.

The healthcare industry is expected to continue its rapid growth in the coming years, so there will be an increased demand for healthcare-specific real estate. This includes hospitals, clinics, and other healthcare facilities. The aging population and the ongoing COVID-19 pandemic have contributed to the healthcare industry’s growth. As the population ages, there is a greater need for healthcare services, leading to an increased demand for hospitals, nursing homes, and other healthcare facilities. The COVID-19 pandemic has also highlighted the importance of healthcare infrastructure, as many hospitals and clinics have been overwhelmed by the number of patients seeking treatment. This has led to a need for additional healthcare facilities in some areas. In addition to traditional healthcare facilities, we may also see a rise in telemedicine and remote healthcare, which could lead to a need for specialized real estate spaces to accommodate these types of services.

E-commerce has grown significantly in popularity in recent years due to the convenience and accessibility it offers. The COVID-19 pandemic accelerated the shift toward online shopping, which will likely continue in the coming years. During the pandemic, more consumers turned to online shopping, causing traditional brickand-mortar stores to struggle to compete with the convenience and accessibility of e-commerce, leading to a decline in demand for retail space. This may result in a shift towards smaller, more specialized stores or repurposing retail space for other uses. Also, the continued rise of e-commerce has led to an increase in demand for industrial and logistics real estate as businesses look for space to store and fulfill orders. The trend towards next-day and same-day delivery has also led to a need for strategically located warehouses and distribution centers to support efficient delivery.

Mixed-use developments, which combine residential, commercial, and

recreational spaces in a single development, are becoming increasingly popular. These types of developments can offer various amenities and be attractive to residents and businesses. Mixeduse developments can also be more financially viable for developers. By combining different types of uses, developers can attract a wider range of tenants and customers, which can help to diversify their revenue streams and reduce risk. In 2023, we can expect to see more mixed-use developments built as developers seek to meet the demand for these types of spaces. Mixeduse developments can benefit businesses as they provide a built-in customer base and create a sense of community.

Overall, these trends demonstrate the continued evolution of the commercial real estate market and the importance of adapting to changing trends and technologies to stay competitive. Keeping an eye on these trends can help businesses and investors make informed decisions about their real estate strategies in the coming years.

It’s an undeniable fact that many people today crave homes, which can be shown by looking at the current trends in the real estate market and the frenzy we witnessed in the last two years. Buying a place to call home and making memories will forever be a significant milestone in one’s life. You could own a home, but you would like to make a few upgrades to accommodate a larger family. Whatever your plans, you probably have noticed that securing property has become a big challenge.

Indeed, Americans are struggling not just to make a living but to find somewhere to live. The market has high demand, but very few houses are being constructed to meet that demand. In addition, the market cannot supply affordable housing across the country, which has left many buyers in limbo.

Numerous factors have contributed to this persistent housing shortage, exacerbating the country’s housing crisis. With every challenge comes to an opportunity for creativity and innovation, and the current market is forcing tech companies, entrepreneurs, and developers to think outside the box. Looking

at the west coast, for instance, Tech companies are largely responsible for the high cost of properties as entire communities have become so gentrified that the average person is forced to look elsewhere for affordable properties.

Another factor we must consider is that the FED kept interest rates so low, which pulled in many buyers, ultimately pushing the prices higher. These two forces, among others, created a ‘crazy’ imbalance in the market, leading to the situation we are grappling with today- the affordability crisis.

Still on the west coast, because it seems California is the epicenter

of the affordability crisis in the country, a report by Mckinsey concluded that the state needed to add about 3.5 million more homes by 2025, which means each year the state must add 350,000 units for the next seven years. But there are unique challenges that will make this

reality a nightmare. First, the current zoning laws do not support such a move, and second, there is land scarcity in the urban areas. These are some of the challenges that make achieving 350,000 units a year an insurmountable task. To move forward, California and the nation must look towards new innovative ideas.

This will allow the country at large to add more homes and apartments. To progress on this front, the local, state, and national governments must remove the barriers, especially regulatory barriers to building homes. On that front, there are several policies being looked at in the private and public sectors to achieve better regulatory policies for housing affordability.

A case to mention is Symbium, a tech company in San Francisco that has developed

a computational law platform that mechanizes the rules and regulations of planning code to assist all stakeholders in quickly establishing an Accessory Dwelling Unit (ADU) is allowed on a property. This is important and extremely helpful; it helps the industry automate the legal analysis for the planning code, and anyone can access what is possible in certain jurisdictions or on a given parcel which cuts the processing time from months to immediate response.

The computational capacity delivered through this platform helps break the administrative and regulatory barriers and demonstrates the potential for other processing innovations related to planning and zoning.

Other states like Minneapolis and Oregon have eliminated single-family zoning by breaking down the regulatory barriers that initially made this a challenge. Although 75 percent of the housing in Minneapolis was previously zoned single-family, now up to three units are allowed on any residential plot of land throughout the entire city.

“By rezoning lots that currently accommodate only one single-family house to allow duplexes and triplexes,” says Andrea Brennan, Minneapolis’s Housing Policy and Development Director, “Minneapolis effectively triples the housing capacity of some neighborhoods.”

In June 2019, the State of Oregon passed HB2001 with bipartisan support- legislation that effectively ended single-family zoning in the state. In fact, it gave power to the state to determine the legal authority to establish parameters for zoning at the local level. So far, the state of Oregon has made a bold move to assert that authority to encourage the local jurisdictions to allow more units to be built in their state.

TECHNOLOGIES TO BOOST THE SPEED OF PRODUCTION, INCREASE

Another innovative firm in Silicon Valley called Entekra is focused on off-site framing. It is on a mission to increase home building productivity and reduce the time and the costs it takes to build a single unit.

Stick-built framing for a typical 2,500-square-foot house would generally take about five workers and 15 days to complete, but with the firm’s Fully Integrated Off-Site Solution and a crane, the framing can be done in just four days by a crew of four people. Effectively, this reduces prices by $25,000, saves an average of 30+days, and increases overall productivity by more than 500 percent. In addition, this system reduces errors and reduces on-site skilled labor needs.

Regarding multi-family units, another company- FullStake Modular in New York, merges modular housing with new construction technologies to bring a higher level of control, predictability, and scalability to multifamily development. This is the same company that built the modules for 461 Dean Street in Brooklyn, New York, which is the tallest modular building in the world.

Financing is one of many people’s biggest hurdles to homeownership. To that effect, Rhino, a company located in New York, partners with building owners in all 50 states to offer low-cost insurance as an alternative to cash security deposits. When a renter inquires

about a unit and says Rhino is an option, they can choose between low-cost insurance or a traditional security deposit. The transaction is made directly with the renter. The renter will receive information about the premium immediately, and then they can decide whether to pay the premium in lieu of a security deposit. Although the cost of insurance varies, it ranges between $4-7/monthly.

In addition, it is important to highlight that several companies have developed several approaches to help future buyers. One of the most popular approaches is crowdfunding to seek investors. A good example is HomeFundIt in Baltimore, an online crowdfunding platform allowing homebuyers to use gifts from family and friends for home payments. Still as a crowdfunding platform but using a different approach, Small Change in Pittsburgh connects investors with developers to build better cities . As long as you are 18+ Small Change allows you to invest in projects that involve affordable housing, community centric projects, transit oriented projects and any project that essentially makes better places for everyone.

Additionally, one of the markets that we have to look at and carefully consider is the renter’s market. These are the people getting groomed to become buyers and availing financial assistance and removing barriers to financing, especially for the minorities and the people with lower incomes is essential to ensure housing affordability. A tech company called Till, located

in Alexandria, Virginia has set a platform that transforms a renter’s ability to pay, stay and thrive in their homes through realtime data to develop payment solutions to address their needs.

What Till offers is personalized structures that reduce the avoidable costs of delinquency and evictions. Understanding that the biggest costs that many renters face is rent payment , Till helps to drive meaningful improvements across a renter’s entire financial landscape.

It is also estimated that less than 1 percent of credit reports include rent, yet, for many people, it is their largest and most consistent payment. In light of this, another tech company, ESUSU in New York offers the renters data reporting services that includes rents as a factor of credit scores. The company builds the reports for clients by partnering with property managers and public housing authorities or even working directly with landlords. By using rent payments to establish creditworthiness, ESUSU significantly lowers the cost of capital for renters who want to become buyers.

Housing affordability is not a oneoff problem that can be solved by a blanket solution. However, it is a problem to keep talking about the problem and not offering any real practical solutions. Focusing on ways to solve the problem through innovation, it will be possible to come up with multiple marvelous and creative solutions focused at the grassroot level.

The article below Focus on different interior designs and why their popular interior design has unique characteristics, experience, flavor, and different finishes in the interior designs. These are the most popular interior design Styles; contemporary interior design, modern interior design mid, century interior design, shabby chic interior design, farmhouse interior design, industrial interior design, electric interior design, Scandinavian interior design, and lastly, Midcentury interior design.

The first design in this discussion in this analysis is the best modern interior design; simple color schemes, clean individual elements, and a welcoming feel define the modern interior design. It uses heavy glass and steel and how he needed siding replacement in historical times modern design style. It is from a specific time from the garden Warfare buy from the dawn 20th century. The structure and architecture

are rooted in Scandinavian and German design Styles. Modern interior design Styles are all about practicality and logic, and painting walls and sculptures were taken from a group of different choices; the designer focuses on the form, not the functionality.

The major idea of this modern Style place store is to create a clutter-free home with few or no unnecessary materials the design fulfills a practical purpose. This Style Focuses on simplicity, especially on furnishing the living rooms as a child in a manner that the floor is open it concentrates on wall colors and modern art in contrasting colors.

Contemporary interior designs are the designs that are ruling nowadays. Contemporary interior design is a style business that fits in almost all rooms of the house. The bedroom, living room, and dining room, among others. Choosing a contemporary design is handy because many available and ready-assembled kitchen cabinets are beautiful and contemporary. This style is almost the style that houses are currently being designed in. contemporary design includes the following modernism; art deco historical designs at the very minimum level it’s not vague, having the characteristics mentioned above instead, it has clean lines and smooth surfaces placed in order of appearance on the space most of the furniture used are from the modern day.

Mid-century interior design styles what’s popular in the wake of the Second World War as the trend of almost every style currently the same way the midcentury interior design spread. Mid-century interior design Style although the design was done between the 40s to the 60s, houses built with this style has a retro feel with a fresh Twist of comfort and

timelessness at the epicenter. Giving it a chance to be chosen as the best interior design style, this Style is used to show house ownership. Painting or an artifact is among the main focus of the living room. Clean line and stay services are the major features of mid-century modern designs. The core idea of the mid-century modern interior design is to make an appearance of a home just like the scene in movies or television series Mad Men. Mid-century interior design Style allowed people to realize that despite making a home functional, there is a need for keeping space around the home for social activities within the home. The style is used in all shared areas on all house grounds.

Scandinavian interior design is not a design on its own; it combines several other designs to make it complete. Scandinavian interior design is simple but highly functional spaces. The Scandinavian interior design leaves spaces between rooms for interpersonal bonds or invitations; the space makes it different from other styles like minimalist design, which focuses on affordability and Necessity. The decoration in this style is rounded furniture, clean detailing, bare ornaments, and white color pallets.

Shabby chic interior design this time is characterized by; unique touch furniture, laidback vibe, and early lighting fixtures elements used in this interior design look old with a lot of

wear and tear, but the functionality is perfect.

Electric interior design style comes up with contrasting elements and designs, textures, and colors to bring up are unique feel. This is selected by house owners who prefer bold decors. A hundred combinations of styles can be used in style, then coming up with a specific output. The output depends on how you manage the combinations. The background colors are usually combinations that are not shouting this is to create a good way for the designer to choose the furniture and accessories required. The main idea of this style shows a uniquely fresh and mesmerizing style after a combination of all historical.

Industrial interior design is allowed to expose building materials like bricks on the walls or even recycled materials. This style tries to maintain space that can be used during the invitation. Industrial interior design forms have flaws and furniture in arrangement to reduce the space. It is considered one of the easiest interior designs.

Institutional investors play a significant role in the housing market. These large organizations, such as pension funds and insurance companies, invest in a wide range of assets, including residential real estate. The impact of institutional investors on the housing market can be positive and negative, depending on the specific circumstances and the investors’ actions.

One positive impact of institutional investors in the housing market is that they can provide a source of capital for the development and maintenance of housing. This can help increase the overall housing supply, which can be beneficial in markets with high demand and limited supply. For example, institutional investors may invest in the construction of new housing developments or rehabilitate existing properties. This can help to address the need for affordable housing in certain areas and can also help to stimulate economic growth in those regions.

Institutional investors can also positively impact the housing market through innovative financing and investment strategies. For example, they may use financial instruments such as mortgagebacked securities or real estate investment trusts (REITs) to invest in housing. These strategies can provide a way for investors to diversify their portfolios and take advantage of the potential for returns in the housing market. However,

they can also create additional risks and complexities for the market, mainly if they are not well-understood or if they are not regulated effectively.

Institutional investors can also positively impact the housing market through their lobbying efforts and their relationships with policymakers. These investors may use their financial resources and political influence to shape housing policies and regulations that favor their interests. This can have consequences for the overall functioning of the housing market and for the ability of different groups of people to access housing.

Another positive impact of institutional investors in the housing market is that they can provide stability and liquidity. These investors have long-term investment horizons, meaning they are less likely to sell their properties in response to short-term market fluctuations. This can help reduce market volatility and provide a sense of security for other investors and homeowners. Additionally, institutional investors often have deep pockets, which means they have the financial resources to weather market downturns and continue holding onto their properties until conditions improve. This can help maintain the value of housing in the market and prevent widespread property value declines.

However, some negative impacts of institutional investors in the housing market should also be considered. One potentially negative impact is that these investors may not always prioritize the needs of local communities. For example, they may be more focused on maximizing their own financial returns, which could lead them to neglect the maintenance of their properties or to engage in practices that are not in the best interests of the communities in which they

operate. This can have negative consequences for the people who live in those communities, such as increased crime or declining property values.

Another potential negative impact of institutional investors in the housing market is that they may drive up housing prices, making it more difficult for first-time buyers and lower-income families to afford a home. This can be especially problematic in areas with a shortage of affordable housing. In these cases, the influx of institutional investors may exacerbate the problem rather than help to solve it.

Additionally, the presence of institutional investors in the housing market can lead to concerns about the concentration of ownership and the potential for market manipulation. When a small number of investors control a large percentage of the housing market, it can create the potential for collusion or other market manipulation, which could negatively affect other market participants.

Another area where institutional investors can have a negative impact is an area of gentrification. In some cases, the influx of institutional investment into a particular neighborhood or community can lead to the displacement of long-term residents as property values and rents increase. This can be especially problematic in neighborhoods with a history of disinvestment, where residents may have few other options for housing.

Overall, the impact of institutional investors on the housing market can be complex and multifaceted. While they can provide a source of capital and stability to the market, they can also have negative consequences for local communities and housing affordability. It is important for policymakers, investors, and community stakeholders to consider these potential impacts and to work together to ensure that the housing market serves the needs of all members of the community.

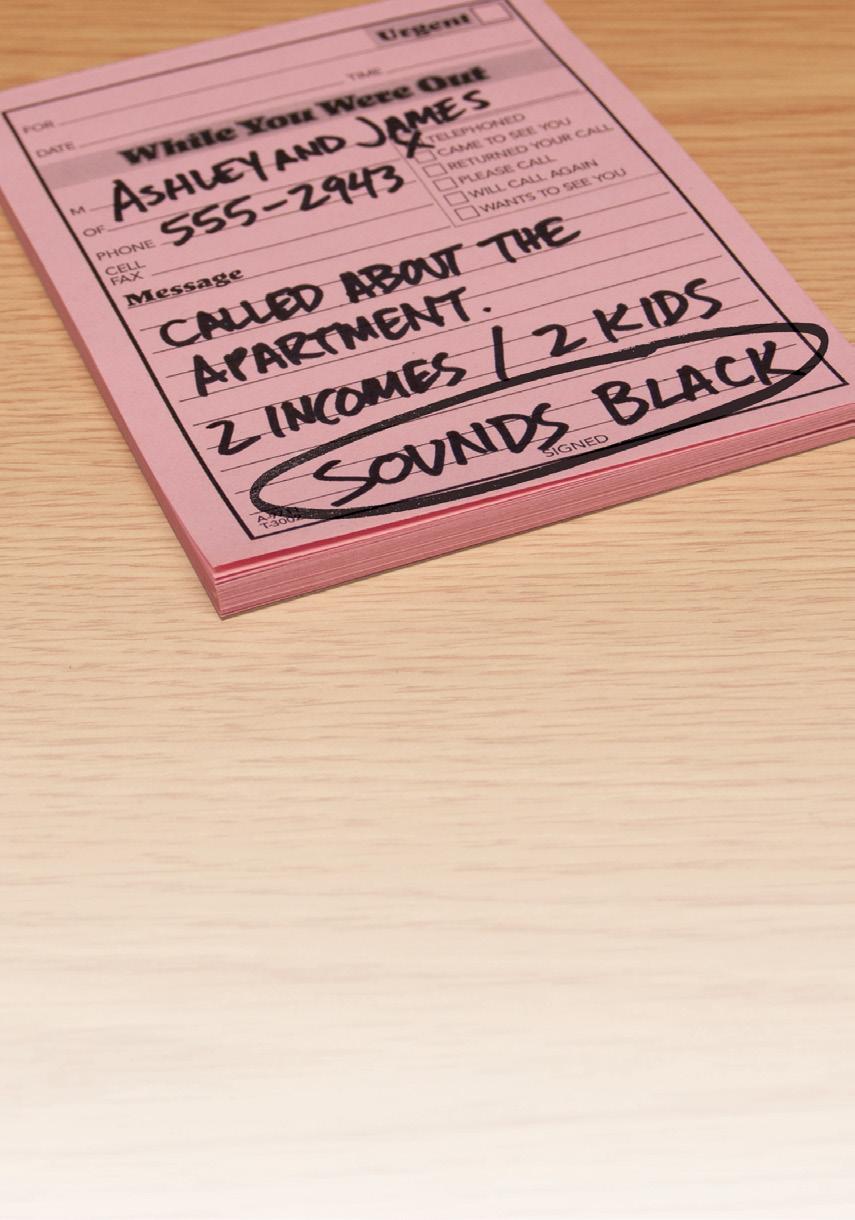

The Black Equity Initiative of the Inland Empire is a community-driven effort aimed at addressing systemic racism and promoting economic equity for Black residents in the Inland Empire region of California. The initiative, launched in 2020, focuses on increasing access to affordable housing, supporting small businesses, and providing financial education and resources to Black residents in the region. Through the initiative, Black residents in the Inland Empire can build wealth, improve their credit scores, and increase their community involvement by becoming homeowners.

One of the key components of the Black Equity Initiative is creating a program to assist Black homebuyers in purchasing homes in the Inland

Empire. This program, known as the Black Homeownership Assistance Program, provides financial assistance and resources to help Black residents overcome barriers to homeownership, such as high down payment requirements and lack of access to mortgage financing.

One way the Black Homeownership Assistance Program helps Black homebuyers is by providing down payment assistance. This can be particularly useful for first-time homebuyers or those who may not have the savings or resources to make a large down payment on a home. By providing financial assistance for the down payment, the program helps reduce the overall homeownership cost and make it more accessible to Black residents.

In addition to down payment assistance, the Black Homeownership Assistance Program also offers educational resources and support to help Black homebuyers navigate the purchasing process. This includes information on financing options, credit repair, and other important considerations for homebuyers. For example, the program may provide information on different mortgage options, such as conventional loans, FHA loans, and VA loans, and help homebuyers understand the pros and cons of each option. The program may also offer assistance with credit repair, which can be especially important for Black homebuyers who may have faced discrimination in the credit market and have lower credit scores. One of the key benefits of the Black Equity Initiative and the Black Homeownership Assistance Program is that they help to level the playing field for Black residents in the Inland Empire, who may have historically faced discrimination and barriers to homeownership. By providing financial assistance and resources, the initiative helps to increase access to affordable housing for Black residents, which can have long-term benefits for both individual homeowners and the broader community.

The Black Equity Initiative also includes several other initiatives to promote economic equity for Black residents in the Inland Empire. These initiatives include support for small businesses, financial education and resources, and community engagement efforts. For example, the initiative may provide technical assistance and resources to help Black entrepreneurs start and grow their businesses or offer financial education workshops to help Black residents improve their financial literacy and make informed financial decisions.

Another way that homebuyers can benefit from the Black Equity Initiative is through its partnerships with local real estate professionals. The initiative works with a network of real estate agents, mortgage lenders, and other professionals committed to supporting

Black buyers and helping them achieve homeownership. By working with these professionals, homebuyers can get the support and guidance they need to find the right home and secure a mortgage that meets their needs.

One of the key benefits of the Black Equity Initiative and the Black Homeownership Assistance Program is that they help to level the playing field for Black residents in the Inland Empire, who may have historically faced discrimination and barriers to homeownership. By doing this, the initiative helps increase access to affordable housing for Black residents, which can benefit both individual homeowners and the broader community. Homeownership can provide several economic and social benefits, such as building wealth, improving credit scores, and increasing community involvement which promotes economic stability and prosperity for Black residents in the Inland Empire.

The Black Equity Initiative is just one example of the efforts to address the systemic barriers Black individuals and families often face when trying to buy a home. While the initiative is focused on the Inland Empire region of California, similar programs and initiatives exist in other parts of the country. For example, the National Association of Realtors has launched several initiatives to promote diversity and inclusion in the real estate industry, including the “Advancing Real Estate, Advancing Communities” program, which aims to increase homeownership among Black and Hispanic households.

Overall, the Black Equity Initiative of the Inland Empire and the Black Homeownership Assistance Program are important efforts to promote economic equity and address systemic racism in the region. By providing financial assistance and resources to Black homebuyers, these programs can help to increase homeownership rates and improve the economic stability of Black residents in the Inland Empire.

The Texas housing market has always been a favorable investment opportunity, especially when buying rental properties. For a long time now, investors all over the country have been interested in Texas income properties, and of course, it’s for a good reason. Texas State has a large population, with laws that are welcoming and friendly to investors, without forgetting the many great areas you can choose from for investing in real estate. To top all that up, the lone Star State is huge. It’s the second-largest state in the U.S. in population and geographical terms.

Here are some of my top reasons why you should consider investing in the Texas Housing market.

As the housing market recovered in most large U.S. cities, house prices in those cities rose above affordability for most buyers. For Texas, the case was different. Although the house prices have inclined in Texas over the past years, they remain affordable in many areas.

The Texas housing market appreciation rate also holds a good upward trend. According to Zillow, Texas home values have gone up 3.3% over the past year, and the predictions hold that the values will rise 3.8% within 2020. In general, Texas features a cool housing market, making it an excellent buyer’s market.

Texas has had a remarkable economic growth throughout the years. In 2020, its economy is estimated to be worth $1.6 trillion and still growing. Texas economy is supported by a wide range of successful industries and leading institutions of higher learning. The state’s economic growth is also attributed to its diverse economic base that features agriculture, mining, and energy industries, without forgetting its further economic diversification through bringing in new jobs from technology, financial and healthcare services companies.

Texas also has a business friendly environment and favourable tax laws, which play significant roles in attracting large companies in the area,

such as the 50 Fortune 500 companies. For any investor, this are critical factors that come with positive influence to the real estate investments.

Population growth in most parts of the U.S is mainly due to economic factors. Therefore, with steadily growing economy and diverse job opportunities in Texas, people are largely moving to Texas. On top of it, Texas features affordable housing, falling mortgage rates, and no state income tax. Most people who move there are job seekers who will also need housing. This means that Texas rental properties will ever be in high demand.

Another reason to buy investment property in Texas is that the state is already known as the most landlord-friendly state in the U.S. Also, most first time buyers end up buying investment properties in the wrong market or neighbourhood. To get the most out of your real estate investment, you must invest in a good market or neighbourhood.

When making any investment, the goal is usually to make profit. Before diving into an investment blindly, conduct an investment analysis that will give you a clear picture of how much you stand to make when you put money into a property. There are online resources such as Mashivor. com that will give you cash on cash returns of an investment, the expected rental income, the expected cash flow among other metrics. Additionally, conduct a comparative market analysis (CMA). This will make comparisons of the property against similar properties.

Finding an investment property in Texas is one of the easiest tasks. With the help of a local agent, these properties can be easily identified. You can as well check with banks in Texas and find properties in which they have failed to follow after foreclosures and have abandoned them.

If that does not work, you can liaise with the local postal office, and they can alert you on buildings whose mail is piling up. You can also opt to advertise; the local neighbors’ can be very resourceful and point you toward abandoned properties. The local realtor inventory can also be very useful; you might find an ideal vacant property there.

FINANCING THE INVESTMENT PROPERTY.

The method you choose when financing the property relies heavily on the purpose you intend to use the building. Your credit score will also come into play when deciding on the best financing method. Make sure you rank highly before applying for any mortgage. You could finance using a traditional mortgage, FHA loan, renovation loan, or loan equity home. Select the one that offers you the best deal.

When investing in properties, it is important to remember that it’s a costly venture with great rewards if done correctly. Before investing in any, do your due diligence. It would be disappointing to find surprises along the way.

By Emerick Peace

By Emerick Peace

We are all aware that housing is a basic need essential for a human’s daily wellbeing. Having a place you can shelter yourself is very important. It does not have to be luxurious and boogie; as long as it’s comfortable enough and safe, that’s all that matters. A house with good drainage, water supply, and electricity should be your key considerations when looking for an affordable house. The unaffordability of a good house may cause poor quality of housing, and hence someone opts to downgrade to living in a house that will be cost-effective to them. Factors that may affect affordability may include:

The University of Maryland’s National Centre for Smart Growth and Enterprise Community Partners have done their statistics recently and suggested that Maryland will have to build more houses and make them affordable for a couple of years due to the rise in the population of residents that earn a low income and also meet the demands from the residents with a moderate income and people with disabilities. The flashlight has always been on the people who earn competitive salaries in the community hence there has been less focus on everyone

else. This can be done by outsourcing funds for affordable housing, eliminating barriers brought about by rezoning, and adopting a stable rent fee policy for low-income earners.

Lack of coordination within the state agencies in Maryland has created a barrier to affordable housing for lowincome residents in Maryland. Government officials may lack uncoordinated efforts due to being competitors among each other, and this may lead to neglecting of funding for affordable housing. If the State neglects its mandates, the citizens in that state will suffer severely because the government should be the one to offer some neutral ground between the low, middle, and high-income earners in the society to avoid discrimination and oppression of the low and middle-income earners.

The policy suggests that people under the same income bracket should have the privilege of the same housing choices regardless of their sex, color, religion, age, familial status, nationality, or disability. Maryland lacks fair housing choices since the state keeps in mind the sexual orientation of individuals to give them affordable housing, which should not be the case. The

state should develop strategies to help develop fair housing choices for all. The strategies developed should favor low, middle, and high-income earners to ensure everyone is entitled to suitable housing despite their status.

Inadequate financial resources are a barrier to affordable housing in Maryland since the DHCD still struggles to offer affordable housing despite being well-known for being innovative in offering good housing to both low and middle-income earners in society. The government has the mandate of offering these resources to DHCD, but due to inflation and declining revenue, the government gives a small share to them. The State has deduced many essential resources due to the declining economy that should offer adequate funds to run various government projects.

The down payment of a mortgage affects the purchase of an affordable house especially for low and middleincome earners. An increase in subprime lending for the past few years have indicated that many people cannot acquire housing through ‘creative’ financing. Many banks require a down payment of some

amount before giving personal loans. Some low-income households can barely afford rent in low-income houses, too, because their lifestyle is that of food to mouth. Whatever they earn is mostly for catering to their diet rather than housing because their household can’t survive when hungry.

These are just a few factors affecting household affordability in Maryland. The economy has been affected greatly, and the cost of living has increased. Many people have lost their jobs over the years, especially in 2020 after COVID-19 set foot in the world. Many jobs came to a halt, and people had to look for alternative sources of livelihood. Many employers could not sustain their companies and pay their employees on time hence they decided to lay off some employees. Most of the people who got laid off were the sole breadwinners of their families, and hence they couldn’t afford to pay rent in the houses they lived in.

Some families had to relocate outside town to get houses that were quite affordable for them. This drastic shift affected many families, but life had to continue, and they had to adapt to the current changes.

We’re Starting Over, Inc. - a 501(c)(3) organization dedicated to supporting and uplifting people experiencing the effects of mass incarceration, systemic racism, housing insecurity, substance addiction, and mental health issues. We believe that people impacted by these issues are the ones closest to the solutions, which is why we are a Black-led and criminal justice-impacted organization engaged in this work. From experience, we’ve learned that housing is critical, but alone, it is not enough to support those exiting prisons or the streets. We not only provide transitional housing, but also include holistic services such as peer support, case management, employment, wellness, and reentry services. We also work to address the root causes of our houseguests’ difficult situations, leading grassroots organizing and policy initiatives in the Inland Empire region and statewide. Established in 2009, we’ve served over 1,400 men, women, and families in Riverside and Los Angeles Counties through the reentry and transition process.

We believe that the past does not define our future. We’re invested in creating safe and equitable opportunities for all members of our community, and especially those with past convictions. Housing opportunities are crucial for our community members and directly affect their ability to thrive.

Starting Over, Inc. is committed to reducing and eliminating the many barriers to life after incarceration. We have a deep commitment to identifying and implementing evidence-based approaches to strong communities and families. We seek to creating program/project solutions where the need exists in our community. We do lots of things at Starting Over, Inc. - but our primary goal is to address the immediate effects and root causes of incarceration, be it through housing, employment, legislation, or community organizing.

T t i l d ith i itiatives, access our services, or support our work through donations, you can or office@startingoverinc.org.

We currently operate eight homes in LA and Riverside Counties open to men, women, and children, with options for sober living or harm-reduction housing All of our services are available to our houseguests, many of whom have been unable to obtain housing after being released due to their conviction histories

Our Case Management specialists provide support to our guests with obtaining necessary documents/identification and accessing insurance, education, healthcare, clothing, food, & more.

Our houseguests are not alone - our support specialists, having experienced incarceration, addiction, and homelessness themselves - understand our guests' needs and the barriers they face. We’re here to meet our guests wherever they are in their journeys and to support them moving forward through empowerment, support with recovery, referrals, and mentorship

Mass incarceration affects not just individuals, but families - many of our community members and guests experience family separation at the hands of the child welfare system. The FREE Project is system-impacted led and organizes parents and family members in a non-judgemental space, advising on best practices and dependency court procedures We recently sponsored and passed statewide bill that eliminates major barriers to child placement and allows family members with criminal convictions unrelated to caring for children to be considered as placement options allowing for suitable family members with criminal convictions to step up in times of crisis

Through our Path to SEED program, we connect guests and community members with employment opportunities and provide training & support regarding obtaining and retaining employment, often a major hurdle for formerly incarcerated individuals

Our free clinics provide relief for expungements, wills/trusts, immigration, and more with the support of local legal organizations

In the past year, we’ve co-sponsored and/or supported nearly a dozen statewide bills to reduce the scale of mass incarceration and its collateral consequences We’ve also worked locally to influence Riverside County to reduce criminal history look-back periods from 7 years to 3 years in 2017 and to enable youth coming out of probation to be able to stay with their family members in subsidized housing

Our Participatory Defense organizing model (based on Silicon Valley De-Bug) empowers family and community members in the courtroom to positively impact their loved one’s outcome and to bring them home. As fiscal sponsor and start-up organization of Riverside All of Us or None (a chapter of a national initiative of formerly incarcerated people, family members, and allies advocating for the rights of the currently and formerly incarcerated people) we ensure that system impacted leadership remains at the center of the fight to keep our community together and address the social problems that incarceration purports to solve Our community outreach team also disseminates voter registration and public health information regarding COVID-19, and we organize food and clothing relief for community members in need.

There has been an increase in volatility of the housing market, and a couple of sellers are on the fence since the prices have been shooting for the past years, and they are not sure if it’s the right time to list their houses for sale. As a seller, the question racing through their mind is, “Should I sell my house now or wait?” Many sellers fear the negative repurcations that may follow them when the prices drastically drop. To figure out what works best for you as an aspiring house seller, it’s good for you to weigh both pros and cons of each option you list down.

The main options may include the following:

1. Listing your property for sale

2. Warding off listing your property until the housing market balances out

3. Staying in your property for the foreseeable future

Some factors can prompt you to sell your property. They include:

If the interest is low, it would be a perfect time to sell your previous house since you’ll save more financially when buying yourself a new home. Sometimes the low-interest rates may be disadvantageous in that they attract high demand from buyers, and after selling your home at a significant profit, you may end up struggling to get a new home since they will be scarce in supply. If that is not a headache for you, selling your house when the interest rates are low would be a great deal for a seller.

Suppose we are in a seller’s market (fewer houses and an influx of buyers). In that case,

PHOTOSthe seller has the power and mandate to negotiate at the closing table according to his or her selling price thus making it an ideal period to sell a house. When home buyers compete for a limited number of houses, the seller may take advantage of setting a higher price and compromise less when it comes to contingencies for any buyer wishing to purchase the house. If the buyer is urgently looking for a house, the price will not matter. Hence they’ll end up buying the house because they know they might go all around and about looking for another house and get a more expensive buyer or houses already sold out.

Relocation may be brought about by moving to a new job or office station away from town, buying a house that will accommodate your growing family, or even downsizing to a small house due to the high cost of living or personal life reasons. If your reason for selling the house is time sensitive, it’s good to consider moving to another home. Many people who relocate usually sell their houses to permanently stay in their places of relocation if at all the reason is long-term.

Some factors can prompt any seller to consider waiting for some time before considering selling the property. They include:

A flooded housing market will require the seller to compete for attention from buyers, and you may end up downgrading your sales to get your house sold. You may also compromise with your prospective buyers by promising them certain aspects of the house before selling, like reduced rent for the next months after payment, which would make you have great losses. If you don’t want to go through such a headache, it would be best if you do not sell your house when the supply in the housing market is high.

If you can’t afford to make a down payment for the new house before selling your old house, it’s best if you don’t sell your house first. This is because there are more closing costs when purchasing a new home. Especially if you didn’t make a huge profit margin when selling your previous property, you need to remember that you will need a significant amount of capital or even more when buying a new home. It’s better to save up so you can purchase your new home easily.

If you still have pending renovations, in your kitchen, backyard, or even your bathroom, due to insufficient funds to complete the renovations, it’s best if you don’t rush into selling your house. An incomplete house is a huge turn-off to many buyers, who often picture the seller as a person who is not well-planned. Finishing all the renovation projects before listing your property for sale is advisable. If you urgently need to move out and sell your house while renovations are still in progress, it’s good to consult a realtor who will advise you in the best way possible because they have the experience needed.

The housing seller market is still booming up to date hence if you’d like to sell your house, it’s best if you do so as soon as possible before the tables turn. If your conscience is not satisfied with why you should sell your house, it’s good for you to wait to avoid regretting in the future.

By Yvonne McFadden

By Yvonne McFadden

Selling a home in the winter can present unique challenges and be a bit more challenging than in the warmer months. This is due to the weather, short daylight, and holiday season which may affect the number of potential buyers since they tend to spend more time indoors and less time looking for a new property. But with proper planning and preparation, it is still possible to successfully sell your home. To increase the chances of selling your home in the winter, it is crucial to take extra steps and focus on making your home attractive to potential buyers. Some of the steps you can take are:

The first impression of a home is crucial, and it’s important to make sure the exterior of your home looks as inviting as possible during the

winter. This includes clearing snow and ice from walkways and driveways, and making sure the landscaping is well-maintained. A fresh coat of paint on the front door or shutters can also make a big difference in how your home is perceived. You can also add some seasonal decorations such as a wreath or twinkling lights to make the home feel warm and inviting. Lighting is also an important aspect to make sure your home stand out during the night and evening showings.

2.

INTERIOR IS COZY. With the colder weather, buyers will be looking for homes that feel warm and comfortable. Make sure your home is well-heated and consider adding extra blankets and cozy. This can be achieved by ensuring the home is well-heated, and adding extra blankets

and cozy accents to make the space feel inviting. Consider also to give attention to the Fireplace if you have one, it’s a great focal point that buyers can relate to during the winter. You can also have a warm fire going during showings to create a warm and inviting ambiance.

3. MAXIMIZE NATURAL LIGHT.

During the winter, there is less natural light available, so it’s important to make sure your home feels as bright and open as possible. Keep curtains and blinds open during showings and consider adding additional lighting to make your home feel more inviting. This can make a big difference in how your home is perceived, a well-lit home can make it appear more spacious and open. Another important aspect is highlighting any energyefficient upgrades that you have made to the home such as new windows or insulation, this will appeal to potential buyers who are concerned about energy bills during the winter.

Winter can be a costly time for energy bills, so buyers will be looking for homes that are energy-efficient. Highlight any energy-efficient upgrades you’ve made to your home, such as new windows or insulation. This will appeal to potential buyers who are concerned about the energy bills during this time. Additionally, consider highlighting the home’s heating and cooling systems, and any smart home technology that may be included in the sale. This can also help to attract buyers as they’ll appreciate the added convenience and efficiency.

5.

In the winter, there may be fewer buyers looking for homes, which can make it more difficult to sell. To make your home more appealing, you may have to consider pricing it competitively. Work with your real estate agent to come up with a pricing strategy that will attract buyers.. They can provide you with a market analysis of recent sales and tell you what similar homes in your area are selling for.

6.

As the potential buyers are not able to fully appreciate the outdoor space or the pool. it’s important to show off and draw attention to the indoor features that make your home unique and stand out, instead of the outdoor spaces that may not be as attractive during the winter. Consider hiring a professional stager to help you arrange furniture and decor to best highlight the features of your home, and make it look more appealing to potential buyers. They can Highlight the fireplace, the entertainment system, or any other features that will help your home stand out.

By following these tricks, you can make your home more attractive to buyers even in the colder months. Remember to work with a real estate agent who has experience selling homes in the winter, they can guide you in your marketing, pricing and also can advise you on what potential buyers are looking for at this time of the year. The key to selling your home in the winter is to highlight the features that make your home warm and inviting, and to price it competitively. With a bit of effort, you can attract buyers and make your home stand out in the market.