ROGER BEANE

Founder, Owner & Chief Executive of LRES Corporation

NOVEMBER 2022 Vol. 09 | Issue 11

CENTRAL EDITION Vol. 09 | Issue 11 HAVE YOU READ OUR PAST ISSUES YET? CLICK HERE TO READ US ONLINE! the power is now magazine

The Power Is Now Research Team

Eric Lawrence Frazier, MBA Publisher Office: (800) 401-8994 Ext. 703 Direct: (714) 361-2105 eric.frazier@thepowerisnow.com www.thepowerisnow.com EDITORIAL TEAM Sheila Gilmore Editor in Chief (800) 401-8994 ext. 711 sheila.gilmore@thepowerisnow.com Daniels George Managing Editor (800) 401-8994 ext. 712 daniels.george@thepowerisnow.com Goldy Ponce Arratia Graphic Artist and Design Manager goldy.ponce@thepowerisnow.com CONTRIBUTORS

The Power Is Now Media Inc. 3739 6th Street Riverside, CA 92501 Ph: (800) 401-8994 | Fax: (800) 401-8994 info@thepowerisnow.com www.thepowerisnow.com

the power is now magazine

IMPORTANT STATEMENT OF COPYRIGHT:

The PIN Magazine™ is owned and published electronically by The Power Is Now Media, Inc. Copywrite 2022 The Power Is Now Media Inc. All rights reserved.

“The PIN Magazine” and distinctive logo are trademarks owned by The Power Is Now Media, Inc. “ThePINMagazine.com”, is a trademark of The Power Is Now Media, Inc. “Magazine.thepowerisnow.com”, is a trademark of The Power Is Now Media, Inc. No part of this electronic magazine or website may be reproduced without the written consent of The Power Is Now Media, Inc.

Requests for permission should be directed to: info@thepowerisnow.com

Find The Power Is Now TV on for more details go to www.thepowerisnow.com 2nd AND 4th TUESDAYS OF THE MONTH 3:00 PM TO 4:00 PM PST

HEADQUARTERS

CONTENTS NOVEMBER 2022

REAL ESTATE NEWS

Pg. 12. Why many people are demanding for riskier home loans even as interest rates soar.

MORTGAGE NEWS

Pg. 14. Freddie Mac to begin using personal bank account data as part of the underwriting process to increase homeownership opportunities.

TECHNOLOGY NEWS

Pg. 18. Opinion: It’s 2022, can technology replace the human touch?

HEALTH NEWS

Pg. 22. California to end the COVID state of emergency.

LEGAL NEWS

Pg. 24. Revamping of the 203k plan

GREEN NEWS

Pg. 8. Renewables on the Rise 2022: California leads in solar power, electric vehicle adoption, and more.

ECONOMIC NEWS

Pg. 10. Nearly a Million Americans Fear Losing Their Home to Foreclosure.

FROM OUR VIP AGENTS:

Pg. 27. Texas Housing Market: Prices, Trends & Forecast 2022-2023, by Sharon Bartlett.

Pg. 31. Maryland Housing Market Forecast 2022 & 2023, by Emerick Peace.

Pg. 37. Looking to Start your Life in Florida? Florida Dreams Realty is here to help you make the transition!, by Adriana Montes.

Pg. 41. Remodelling: Pros and Cons. How it will affect your insurance, by Yvonne McFadden.

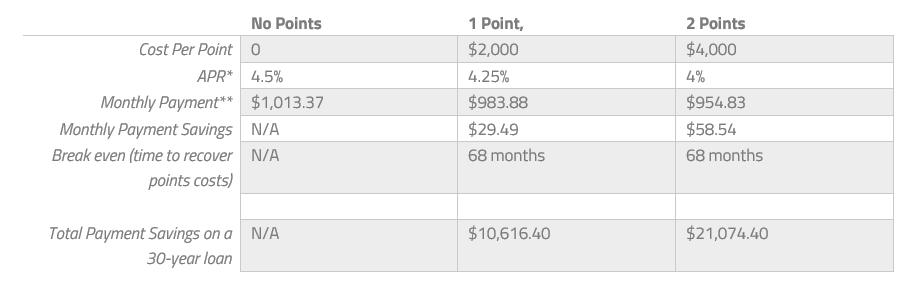

Pg. 45. What Are Mortgage Points? by Tamra Lee.

Pg. 51. Looking to sell your home this quarter? 5 tips to increase the value of the home on a budget, by Walter Huff.

Pg. 55. Do you know what a Quitclaim deed is? Here’s everything you need to know, Ohio, by Heith Mohler.

Pg. 59. Do you really know what a condo is? What you need to know before buying one, by Ruby Frazier.

Pg. 62. Roger Beane, The story of perseverance, hard work, and believing in oneself to founding one of the most sought-after corporations in California!

Pg. 67. Want a smooth Buying transition? Then you need to be aware of these common roadblocks to closing! by Jenny Gonzalez.

Pg. 71. The battle between move-in ready homes and fixer upper homes, by Ian Batra.

Pg. 75. What is a listing agreement and how will it affect your selling process, by Briana Frazier.

Pg. 79. Minnesota Housing Market:Prices, Trends & Forecast 2022-2023, by Francine Marsolek.

Pg. 83. Have you been skipping sewer scope inspection? Here’s why its extremely important, by Janet Petrozelle.

Pg. 87. Are VA loans good for veterans?, by John Costigan.

Pg. 91. San Francisco & The Bay Area Housing Market: A look at prices, current and future trends and forecast for 2023, by Norman Green.

Pg. 95. Connecticut Housing Quarter: A deep dive into New Haven real estate market-stats & predictions, by Steven Rivkin.

Pg. 99. Costa Mesa Housing Market: A look into the areas real estate market performance through the year, by Decira Pimental.

Pg. 103. Getting Buyers Hooked! 3 strategies to initiate bidding wars and get multiple offers in a crazy market, by Monica Hill.

Pg. 107. Crypto real estate: How cryptocurrencies are changing real estate investments, by Jamar James.

Pg. 111. Los Angeles Housing Market Data:Outlook of the market, current trends and forecast, by Dolores Golden.

Welcome Power is Now readers and subscribers to another Power Is Now Magazine Fall edition issue. It is my pleasure to continually bring you great industry information to enrich your real estate knowledge and all the business and finance matters surrounding it. We’ve been doing this for over thirteen years- it’s not a job but a passion. As I write this, I can’t help but think of how far we’ve come, not just as The Power Is Now family, but the country and the world at large. We battled the pandemic and the disruptions it brought with it. We are in the thick of a soaring economic crisis, and we will overcome it.

I am very excited about the November issue, and I am sure you will share this excitement with others after reading this magazine. We bring you very educative and informative articles from our research team every month. Our goal is to provide you with timely real estate information that you can use in your investment strategy or simply share with other professionals for further development. Knowledge is Power because the information is changing so rapidly. Our slogan, “The Power Is Now,” underscores our goal to keep you informed as the information develops.

This year has been challenging for many people, and as you will find out, this issue reflects just that. Thanks to Putin and his barbaric gimmicks, life is getting pricier by the day. Inflation is over the roof; interest rates are untouchable, and living costs are getting out of control. Buyers aren’t buying even though the market has cooled off, and sellers don’t want to sell either. It is like we are all caught up in this bubble, and the sad part is that no one wants it to burst because we aren’t sure on which side it will favor. Speaking of bubbles, there are fears of an imminent recession. Winter season might be extremely difficult for many people and industries heavily reliant on natural gas from Russia, so we encourage you to use green energy. Every issue of our magazine has a section called green energy news, where we bring you environmental sustainability news, developments, tricks, and hacks to make fully renewable energy.

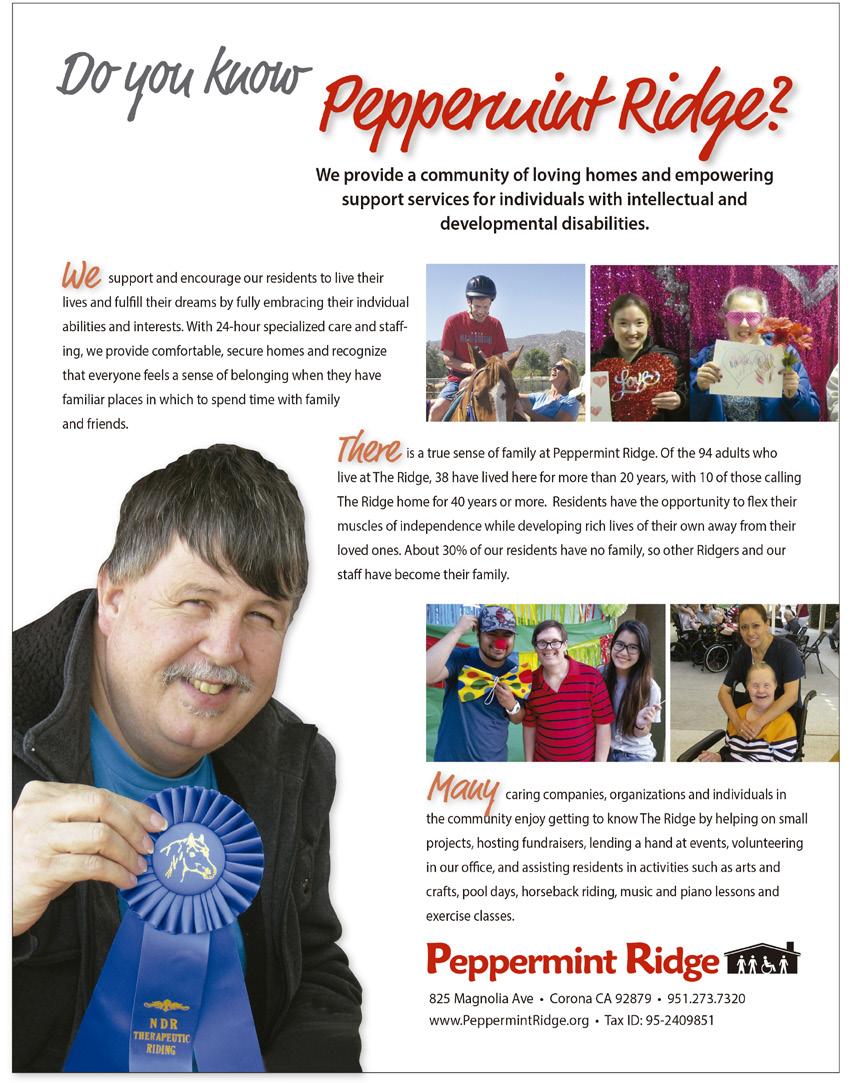

On our cover this month is Roger Beane, he is the founder, owner and the Chief Executive of LRES Corporation is one of the most accomplished real estate leaders with over twenty years of experience. He leads a dedicated team of professionals providing accurate solutions to customers and corporations. Cheers to Roger for his outstanding career and contribution to the industry. With such a strong and committed leader, I think the industry is poised to make significant changes in the coming years.

Other news making it into our fall issue includes the state’s plan to end the COVID-19

November 2022 FROM THE EDITOR 6 | NOVEMBER 2022

state of emergency. Is the state ready for this, or do we need to hold the plan a little longer? This is a very interesting topic that you cannot miss. Also, find out why many demand riskier loans even as rates continue to soar. You’d expect that people would keep off some of these loans, but it paints a picture of how desperate people are to buy homes, and since many banks won’t back them up, they prefer the riskier loans. It is an interesting story that might have negative outcomes, especially because nearly a million Americans might lose their homes to foreclosure.

Other than that, I just want to remind you that Thanksgiving is right around the corner and the festive season nipping at our heels. We are more excited here at The Power Is Now Media, Inc. Honestly, I love the holiday season, and so is everybody, and I look forward to having quality time with friends and family. Each year, around this time, I like to thank all the blessings that have come into my life and the people who have made this year great for us. The Power Is Now

Media, Inc. wouldn’t have made it this far without you, and for that, I say THANK YOU.

This issue of The Power Is Now also features various articles about planning for homeownership and how to get yourself there financially. Applying for a home loan can be frightening, but we will get you through this to purchase your dream home.

The Power Is Now would like to thank our readers, listeners, and contributors for the continued support. We invite you to join us online for invaluable blog posts, engaging radio shows, and the latest issues of our magazines to enhance your learning in real estate, finance, and success. You have the power to change your life because The Power Is Now.

ERIC L. FRAZIER MBA President and CEO

ERIC L. FRAZIER MBA President and CEO

The Power Is Now Media, Inc.

YOUR VOICE IS YOUR BRAND! INCREASE LEAD GENERATION, AND GIVE YOU THE POWER TO CLOSE MORE DEALS! Join Every Other Friday 10:00 AM - 11:00 AM Promote Your Listings Online CALL YOUR HOST FOR MORE INFORMATION SHARON BARTLETT (800) 401-8994 ext. 712 Sharon.Bartlett@thepowerisnow.com www.thepowerisnow.com NOVEMBER 2022 | 7

Renewables on the Rise 2022: California leads in solar power, electric vehicle adoption, and more

Anew online dashboard by the Environment California Research & Policy Center show that the state of California leads the nation for the total solar energy generation, adoption of the electric vehicles and more. Dubbed Renewables on the Rise 2022, the dashboard documents state-by-state growth of key clean energy technologies all across the united states in the last ten years and this includes solar and wind, battery storage, energy efficiency, electric vehicles and electric vehicle charging stations.

“Across nearly all clean energy technologies, California has set the standard for clean energy growth this past decade.” said Steven King, Clean Energy Advocate with Environment California Research & Policy Center. “ Our state’s leadership in solar power, electric vehicles, and energy storage is building a cleaner, healthier future where we can better tap our renewable energy potential.”

Under Gov. Jerry Brown, California signed an ambitious goals and a bill mandating the state to transition to zero-emssion energy sources for its

electricity by year 2045. The then Governor also issued an executive order that called for Carbon Neutrality which meant that the state “removes as much carbon dioxide from the atmosphere as it emits” by year 2045. “This bill and the executive order put California on a path to meet the goals of Paris and beyond,” Brown said in a statement. “It will not be easy. It will not be immediate. But it must be done.”

Ever since, the state has been extremely proactive and has pursued a leading role in the international fight against global warming.

Cumulatively, the state has recorded a 13fold increase in the amount of electric power generated from the sun and also a 60 percent rise in wind power production- an analysis that comes after a ravaging and devastating summer where many californians experienced extreme heat waves, wildfires and draught which all point to out to the need of transitioning to a clean energy economy as fast as possible.

PHOTO FROM 123RF

GREEN NEWS 8 | NOVEMBER 2022

POLICIES SUPPORTING

CLEAN ENERGY

Like previously mentioned, California is in 100 percent support of clean energy this is the biggest reason for the success of program. The bill signed by former Governor, Jerrry Brown specifically required the state to have at least 50 percent of its energy coming from renewable sources by 2025 and 60 percent by 2030 which will ultimately pave a ‘bold path’ towards 100 percent zerocarbon by 2045. This combined with improving technologies have played a key role in the adoption of the ambitious goal by the state.

One of the programs resonating with many californians is the state’s metering program

which has provided compelling incentives for the consumers to install solar panels on their homes and businesses. More recent was the state’s commitment to phase-out gas-powered cars and its plans to embrace offshore wind only re-emphasizes the perpetual growth of clean energy technologies.

“With our state’s bold energy and climate leadership over the past two decades, it’s no surprise that California is a national leader in the transition to renewable energy,” said Fran Pavley, former State Senator and Environmental Policy Director for the USC Schwarzenegger Institute.

“From setting the goal of achieving 100% clean energy by 2045 to implementing policies that are good for both our environment and the economy, we have come a long way as a state. With the accelerating pace of droughts, wildfires, and extreme heat events, we need to do even more to cut down on fossil fuel production. From investing in solar and storage, offshore wind, and requiring a just transition to cleaner cars and trucks, California is positioned to meet these challenges head on with continued state leadership.”

Its not to say that other states are far off, in fact, while California may be leading the nation in clean energy production, it is not the first state to develop an ambitious plan toward meeting zerocarbon emissions, Hawaii for instance back in 2015

established a goal of 100 percent renewaable electricity generation by 2045. More top that, according to the report, the nation is reported to produce more than three times as much renewable electricity from sun and wind in 2021 as in 2012.

The Inflation Reduction Act also offers consumers several tax credits and discounts on more than a dozen types of energy saving purchases including the new and used electric vehicles, rooftop solar, geothermal heating and cooling, upgrading the electric panels and heat pump HVAC systems. Many of the credits are in effect now while many more will take effect in 2023. That alone (the incentive from the Inflation Reduction Act) shows that many people are likely to adopt clean energy and reduce pollution from the fossil fuels.

“Millions of Americans and Californians are already reaping the benefits of the dramatic clean energy progress we’ve made so far,” King said. “With federal tax credits promising to turbocharge clean energy, now is the time for California to lean in and transform California’s 100% clean energy goal into reality, and the sooner the better. State regulators should implement strong consumer incentives for rooftop solar and storage systems to allow rooftop solar to thrive and the state should continue to set and strive to meet ambitious goals for technologies like offshore wind.”

NOVEMBER 2022 | 9

Nearly a Million Americans Fear Losing Their Home to Foreclosure

The latest study from LendingTree show that many families across the country are struggling financially to afford the necessary expenses which has resulted in many of them falling behind on their mortgage payments and facing foreclosures.

The report shows that nearly a million people nationwide fear losing their homes to foreclosure in the coming two months. The company measured relevant data from the census Bureau how many AMerican Adults, 18 year plus risk losing their homes to foreclosure and here are the finding.

KEY FINDINGS:

Those living in owner-occupied homes: about 3.71 percent of American Adults in this types of housing are behind on their mortgage payments with a 60.43 percent in this category already caught upon their mortgage payments. An additional 35.47 percent do not ned to make the payments because they own their homes.

Of the 3.71 percent- the share that’s not caught up with their mortgage payments, about 19.62 percent all across the country report being very likely to leave their homes due to foreclosure in

the next two-to-one-and-a-half months.

However, a significant portion of the 3.71 percent not current with their mortgage payments expressed the fear of being foreclosed on in the near future.

The states leading in the number of American adults likely to be foreclosed include South Dakota, Oregon and New Mexico. Across these states, an average of of 55.45 percent of the people behind on their mortgage payments say that they are they are very likely to leave their homes in the next 2 months. However, it is important to reiterate that an average of only 3.42 percent report living in households behind on their mortgage payments.

While in states like Nevada, Idaho and Kentucky report an average of 2.81 percent of adults living in owner-occupied homes that are reported not be current with their mortgage payment, nobody in these states report being at risk of losing their homes to foreclosures in the next two months.

Here’s a breakdown of states with the largest adults behind on mortgage payments at risk of losing home to foreclosure.

ECONOMICS NEWS

10 | NOVEMBER 2022

PHOTO FROM 123RF

• Total adult population in owner-occupied households: 427,615

• Percentage of adult population in owner-occupied households caught up on mortgage payments: 54.66%

• Percentage of adult population in owner-occupied households not caught up on mortgage payments: 2.38%

• Percentage of adult population in owner-occupied households owned free and clear: 42.96%

• Percentage of adult population in owner-occupied households behind on mortgage payments and somewhat or very likely to leave home due to foreclosure in the next two months: 71.28%

• Percentage of adult population in owner-occupied households behind on mortgage payments and not very likely or not likely at all to leave home due to foreclosure in the next two months: 28.73%

OREGON

• Total adult population in owner-occupied households: 1,891,583

• Percentage of adult population in owneroccupied households caught up on mortgage payments: 65.90%

• Percentage of adult population in owneroccupied households not caught up on mortgage payments: 2.80%

• Percentage of adult population in owneroccupied households owned free and clear: 31.30%

• Percentage of adult population in owneroccupied households behind on mortgage payments and somewhat or very likely to leave home due to foreclosure in the next two months: 49.59%

• Percentage of adult population in owneroccupied households behind on mortgage payments and not very likely or not likely at all to leave home due to foreclosure in the next two months: 50.41%

NEW MEXICO

• Total adult population in owner-occupied households: 900,679

• Percentage of adult population in owneroccupied households caught up on mortgage payments: 50.24%

• Percentage of adult population in owneroccupied households not caught up on mortgage payments: 5.07%

• Percentage of adult population in owneroccupied households owned free and clear: 44.19%

• Percentage of adult population in owneroccupied households behind on mortgage payments and somewhat or very likely to leave home due to foreclosure in the next two months: 45.47%

• Percentage of adult population in owneroccupied households behind on mortgage payments and not very likely or not likely at all to leave home due to foreclosure in the next two months: 54.53%.

RISING COST OF LIVING AND HIGH HOME PRICES

Certainly, inflation, rising cost of homes and the pandemic play a huge role in in the situation we are in right now. But despite all of these facts, foreclosures are not a common thing in the country. Lately, many people have been speculating of an imminent recession threat which means that many homeowners face a bigger threat being foreclosed.

Foreclosure rates have increased since 2021 largely due to the pandemic-era foreclosure moratoriums but the number is still lower when compared to the 2019 rates. This, combined with fewer than 1 percent of all adults in the owner-occupied households across the U.S. reporting that they’re at a risk of losing their home to foreclosure in the next tow months, this shows that foreclosures arent a common thing in the United States.

SOUTH DAKOTA

NOVEMBER 2022 | 11

Why many people are demanding for riskier home loans

evidence that suggest that many small mortgages, typically those falling below $150,000 are driving borrowers who actually have better credit scores and meet other qualifying criteria to this alternative borrowing arrangements. And the question I get bothered by is why?

There are certainly some factors which include but not limited to the home’s habitability and the ownership if the land beneath todays mobile homes, else known as ‘manufactured homes’ all of which are factors that make it impossible to qualify for the mortgages using the traditional route.

CASE SCENARIO ONE ALTERNATIVE SOURCING OPTIONS

Many people in the United States purchase their homes using mortgages , but in recent times, many more are running towards alternative financing arrangements for instance rent-to-own which obviously are much more riskier. But it makes sense why people are preferring the riskier options, after all, it better than none.

The problem that I seee with renting-to-own option for homeownership is that its a costly option and also, when compared to traditional methods of homeownership, it is subject to far weaker consumer protections and regulatory oversight.

There is insurmountable

Although the evidence against these financing arrangements is overwhelming, and has been proven to cause harm to the unwitting consumers, very little is known about the prevalence and or scope of these alternate financing options, largely because this is a field where data is not the primary concern meaning that insufficient data that would lead to conclusive results. For instance, the Census Bureau collected data on the number of Americans

REAL ESTATE NEWS

FROM 123RF

even as interest rates soar

PHOTOS

12 | NOVEMBER 2022

using alternate financing options until 2009 and in 2019, the Harvard Joint Center for Housing analysis of alternate financing option revealed that a ‘persistent lack of data has prevented regulators and policy makers from understanding the full scope and scale of the market.’ this study by Harvard center was only done for selected states that require financiers to keep public records.

PEW CHARITABLE TRUST RESEARCH INTO ALTERNATIVE FINANCING

Due to the overwhelming lack of data in this seemingly lucrative industry, Pew Charitable Trusts conducted a national survey of the U.S. adults that aimed to uncover the prevalence of alternative financing and borrower demographics.

The following are the results of the study;

• 1 in 5 home loan borrowers which translates to about 36 million americans have used Alternative Financing at least once in their adult lives.

• Of these 36 million people, about 22 percent have used more than one type of alternative financing options across multiple home purchases. This means that multiple borrowers over the course of their adult life face multiple barriers to homeownership when

it comes to mortgage financing.

• Also, this data shows that alternative financing varied by race and ethnicity and seemed to be a popular choice for the hispanics.

• About 1 in 15 current home borrowers -translating to 7 million U.S. adults have a current arrangement with these alternative financing optiopns.

• Among the homeowners currently in arrangement with alternative financing, the people with HOUSEHOLD incomes below $50,000 were more likely to use these options.

If anything, the data by Pew Researchers underscore the need for a better national data and state data collection that will enable regulators to fully understand the prevalence of alternative financing arrangement and to also ensure that millions of Americans , especially those from low-to-moderate income earners and the minorities are well protected and in policy decisions affecting home borrowers.

WHAT’S ALTERNATIVE FINANCING?

Alternative financing describes a set of financing arrangement that involves land contracts, seller-financed mortgages, lease-purchase agreements and personal property loans that differ significantly from the traditional financing options

through the bank.

To better understand what alternative financing is, consider the following;

Typically to buy a home, there is a purchase agreement which must involve a third party lender who has no ‘prior’ interest in the property separate from the loan. And the lender has to strictly follow a specified conde of conduct and comply with the federal and state regulations.

Additionally, mortgage transactions must involve a title that stipulates full legal ownership of the property as detailed in the deed.

In contrast, alterative financing at least in some arrangements for instance land contracts, there arent significant regulations to govern the transactions. In addition to that, purchasing a home using alternative financing, sellers arent required to hand over the deed to the property for the duration of the transaction. Since a buyer isnt fully recognized as an owner of the property until they are in fully custody of the property deed, this structure creates somewhat legal ambiguity making it extremely difficult for buyers to establish clear ownership and to fully establish the responsible party for the property taxes and maintenance.

NOVEMBER 2022 | 13

CASE SCENARIO TWO THE RISE IN ARMS

A recent trend is the use of Adjustable-Rate Mortgages or ARMs which typically offers lower rates. Many people are using this type of rate to finance their purchase after seeing that it hasn’t really fluctuated as much as the others over the last decade.

In fact, the Mortgage Banker Association show that the total mortgage application volume for the first week of October, 2022 dropped 2% compared to the previous week.

LET’S GET TECHNICAL.

Ideally going by the current rates the average contract interest rate for the 30 year fixed mortgage rate with conforming loan balances increased to 6.81% from 6.75% and this percentage rise includes the origination fees for the homes with a 20 percent downpayment. This is the highest its ever been since 2006.

“The news that job growth and wage growth continued in September is positive for the housing market, as higher incomes support housing demand. However, it also pushed off the possibility of any near-term pivot from the Federal Reserve on its plans for additional rate hikes,” wrote Michael Fratantoni, MBA’s chief economist in a release.

a period of 10 years, once that period lapses, they adjust to the market rates. However, it makes total sense why people would prefer these loans. Remember, rates have been so low for so long that people never saw the need to take out riskier loans.

The average rate for the 5/1 ARMs which typically has a fixed rate for the first five years increased just slightly but somewhat considerably lower at only 5.56%. The share of people preferring this mortgage optionwas just a little under 12%. when rates were significantly lower at the start of the year the share of people preferring ARMs was just 3% as it has been for several years.

ARMs, no matter how rosy they are, arent a good financing option. And while they can be fixed for

Mortgage applications meant for home purchases fell 2 percent for the first week of october were actually 39 percent lower than a year ago. Many buyers feel the pinch of the rising rates which have made affordability worse. While home prices have started to cool down potential buyers are concerned that if they buy now, their new homes might drop in value in the coming years due to concerns of coming recession.

14 | NOVEMBER 2022

Freddie Mac to begin using personal bank account data as part of the underwriting process to increase homeownership opportunities

Starting November 6, borrowers will begin to experience new technologies in so far as their borrowing is concerned. These news comes after Freddie Mac announced to include cashflow data in the underwriting process which it claims is a step in the direction of identifying a historic of positive monthly cashflow activity as part of its technology’s loan purchase eligibility to further increase homeownership opportunities.

This is both a positive and negative thing. Positive in that it unlocks a world of opportunities for many people that were locked out of homeownership simply because of tainted reputation due to a few ‘gone wrong’ transactions, but also, what if the banks uncover a record of bad financial habits in the past that the borrower has worked on over the years to clean it up only to be flagged again?

The GSE in a statement claims that this innovation will be available to mortgage lenders nationwide through Freddie Mac automated underwriting system Loan Product AdvisorⓇ (LPASM).

“With the addition of positive monthly cash flow data, our underwriting system can help with more accurately predicting a borrower’s ability to pay their mortgage because it uses a comprehensive view of how personal finances are managed over time,” said Terri Merlino, Freddie Mac Single-Family senior vice president and chief credit officer. “Our latest innovation levels the

MORTGAGE NEWS 16 | NOVEMBER 2022

playing field and helps make homes more accessible to borrowers whose lenders might not have qualified them with traditional methods of underwriting. This should particularly help first-time homebuyers and underserved communities.”

monthly bill payments e.g rent, utilities and auto loans).

Although there are concerns about this new technology, the GSE has said that lenders are only supposed to send financial account data for LPA to identify 12 or more months of cash flow activity for inclusion in the risk assessment only with the borrowers consent.

Interestingly, according to Freddie Mac’s press release, “The account data submitted can only positively affect the borrower’s credit risk assessment. To help identify opportunities, LPA will notify lenders when submitting additional account data could benefit a borrower.”

This tool is interested in the following category of data; checking, savings and investment accounts (direct deposits of income and

In addition, it will be possible for lenders and brokers to obtain the bank account data from from third party providers using the same automated process they currently use to verify assets, income, employment and on time rent paymentthrough a single report via LPA’s asset and income modeler (AIM).

“Working alongside our industry partners, we have made significant progress toward modernizing the mortgage origination process,” said Kevin Kauffman, Freddie Mac Single-Family vice president of client engagement. “In the current market, our latest industry-leading innovation delivers lender efficiencies that can lead to cost savings and improvements to the borrower experience, while meeting Freddie Mac’s strong credit underwriting standards.”

The GSE first started integrating such technologies in June especially technologies that automate underwriting services stating that its assets and Income Modelers in LPA would allow lenders to verify assets, incomes and employment using borrowerapproved bank account data.

PHOTOS FROM 123RF NOVEMBER 2022 | 17

Opinion:

It’s 2022, can technology replace the human touch?

Everywhere you go these days, there’s the talk of automation and technology replacing the human touch and there is no doubt, technology is surely advancing at a very rapid rate. Focusing on the mortgage production, one thing is clearly evident, the process has become so centralized and very automated and even though the process is a little paper based. Major hallmarks that will soon be the face of this industry have come up changing the tone and shape of the industry.

Everything has become so easy, loan underwriting, using some electronic signatures as well as establishment of user-friendly “portal” which help the users to oversee their loan application and thus faster delivery and approval process which makes it become a mainstream in loan application and delivery. Loan approval has also become very easy and fast, thanks to the automated borrower-verification tools.

BUT HOW IS TECHNOLOGY COMPARED TO THE HUMAN TOUCH

We may argue on this issue

but logically, technology has done so much for the economy and has changed the way businesses are run and conducted. But here is what Kermit Randa, CEO of PeopleAdmin has to say about technology and human touch;

“Even as we celebrate the contribution technology makes to helping educators do their job most effectively,” Randa says, “it is important to recognize there is one thing technology

will never replace: the value of the human element in helpings schools, students, and communities succeed …”

TECHNOLOGY NEWS PHOTOS FROM 123RF

18 | NOVEMBER 2022

However, even if there is so much evolution in mortgage lending and all what goes in and out of this world in so far as technology is concerned, the overall user experience has not gotten better yet. Basically, there are so many challenges that are yet to be overcome. Financing a home for example for many people is still very confusing since most of the consumer or the borrowers are unable to get what they are looking for in terms of help in solving the many puzzles in their head.

some new ways to give their borrower counterparts a combination of technology and human expertise. Therefore, replacing human touch with technology is something that will have to take time.

IMPROVING THE CONSUMERS EXPERIENCE

This should be the time where mortgage experience for the consumer should be improved and given that the country has a very strong job growth rate as well as a stable home-sales, the purchase-loans volume is expected to increase in the current year and the year to come.

Back then when the housing market was doing fairly well, a few consumers were able to get approved mortgage online. It was in this phase the mortgage lenders were in complete dominance of the whole process which was neither automated nor efficient.

But with the technology, the industry has seen enormous changes and a number of innovations and with this improved technology, verification of borrower’s income and the assets are instantaneous. When searching for loans and their pricing, the process has become so easy and very fast, thanks to the new and improved technology.

Everything has become electronic for the improvement of the consumer experience, and what’s even fun, people can now sign disclosures electronically and also, ordering tax transcript from the IRS has become an electronic process.

Technology has done so much for a change in the way things are in so many sectors today but the same old taste of mortgage cannot be replaced, not that easily, reversing this trends will require the lenders to find

But we have to face one fact, even though that all these huge steps have been made for the benefit of the consumer, many of them have been motivated by the needs of the lenders to cut the costs and manage them.

NOVEMBER 2022 | 19

ACCESS TO INFORMATION SYSTEMS

Technology has also enabled the consumers to get access to greater and more informational systems about the mortgages than ever before. Most of the consumers have very little information about mortgages but with the access to the information, they become informed. In some ways, technology may have made the consumers not dependent on the human expertise which they largely depended on to make some of the crucial financial decisions of their lifetime.

Mckinsey proves that emails are more effective but as it is, more lenders cannot even respond to a single email within a day.

TARGETING AND REACHING MORE BORROWERS

We all would agree that making the mortgage process faster and much more efficient remains to be at the peak of every lenders but as it is, most of the professionals want to take advantage of the prevailing strong housing market to make a boom in their business.

These portals are very important and have seen the success of many mortgage seekers. One thing you will realize is that automation creates consistency and can be applied as an effective tool in helping the loan advancer in seeing the loan advancement to the borrower through.

FINAL VERDICT

With what technology have done and still continuous to do, many borrowers still fill out the forms manually meaning that incorporation of the technology to the process has not well been accepted or the coverage is still very low. Ironically, it turns out that most of the borrowers are interested in a good loan rather than technological touch in mortgage issuing process.

People are going for what not works, simply, their focus is on things that do not show results yet more and more mortgage lenders are putting more emphasis on social media and stuff, however, even though that is great, research from

Online portals, a tool that has been on the rise and many lenders are realizing just how important this tool has been in reaching so many consumers out there. With these portals, consumers can now apply for loans and get approved in a much faster way. Actually, no loan officer is required to oversee the process.

But this tech has a problem, a major drawback and perhaps that may be the number one reason pushing people away from these improvements. If you are a borrower, and say you get stuck on the process, there is no one to help you or if you have a question, there is no one to assist you.

Can technology replace the human touch? I will surely say that it will depend. Somehow, if you look at what technology has done in the industry in so far as mortgage lending is concerned, there are huge strides that it has enabled and still much credit has been given to the changing technology and its impact. However, none of that would ever be possible without human engagement. The whole process needs human touch since humans are the source of the ideas while tech is just a facilitator of the tech. Therefore, even though automation has well been encouraged, overly, it cannot replace the human touch but we can still push for more and more digital mortgages and responsive tools and in doing so most borrowers should understand that many people are looking for the right mortgage rather than a fast one.

20 | NOVEMBER 2022

Purchase Price of Home: $350,000 First Mortgage Loan: $339,500 Down Payment and Closing Cost Assistance from GSFA*: $23,765 Total Assistance Program Highlights • No first-time homebuyer requirement • 620 FICO’s score minimum • Down Payment and Closing Cost Assistance Available Toll Free: (855) 740-8422 E-mail: info@gsfahome.org Website: gsfahome.org *Advertisement contains general program information, is not an offer for extension of credit nor a commitment to lend and is subject to change without notice. Example based on 97% Conventional First Mortgage Loan combined with 7% in down payment and clossing cost assistance. For complete program guidelines, loan applications, interest rates and annual percentage rates (APRs) contact a GSFA Participating Lender. Golden State Finance Authority (GSFA) is a duly constituted public entity and agency. Copyright © 2021. Your PATHWAY to HOME OWNERSHIP DOWN PAYMENT ASSISTANCE NOW AVAILABLE! You may be able to purchase your dream home with little-to-no money out of pocket! CALL TODAY TO LEARN MORE

California to end the COVID state of emergency

In a statement released by Gov. Gavin Newsom, California’s Covid-19 state of emergency will end Feb28, 2023. The move by the California executive comes amid new variants of the virus spur concerns of a high likelihood of there being another deadly winter surge all across the country. In addition to that, the positivity rate of the virus in California has plateaued following a newarly three month decline. State data confirms that the virus has killed more than 95,000 Californians.

The era of the pandemic was no joke. Many people lost their jobs, many more lost their loved one to the virus. Almost three years after, many peoople seem to have moved on and Californians are now ready to burry the old problems away.

According to the Governor’s office, the timeline to the termination date of the Covid-19 state of emergency gives the healthcare system the much needed flexibility to be able to handle any surge that might occur during the winter months plus will also provide the state and local partners the time needed to prepare for the phaseout and also set themselves up for success afterwords. It’s also important to mention that this move will have little practical impact on californians as most of the pandemic-related orders the governor has issued have mostly been lifted. At the same time, it will have little impact on public health orders including the pending nationwide vaccine mandate for schoolchildren that will take effect next summer.

The move does however signal an end for some of the most restrictive elements of the pandemic since it means dissolving newsom’s authority to alter or een in some cases change the laws to make it easier for the government to quickly respond to public health crisis.

“Throughout the pandemic, we’ve been guided by the science and data – moving quickly and strategically to save lives. The State of Emergency was an effective and necessary tool that we utilized to protect our state, and

HEALTH NEWS PHOTOS FROM 123RF 22 | NOVEMBER 2022

we wouldn’t have gotten to this point without it,” said Governor Newsom. “With the operational preparedness that we’ve built up and the measures that we’ll continue to employ moving forward, California is ready to phase out this tool.”

The state of emergency was declared on March 4, 2020 at a time when the state had only 53 confirmed cases of virus. Ever since, the governor has used the authority vested on him undere the emergency declaration to issue almost 600 pandemic related orders. While some were relatively small, some had life changing like the stay-at-home order that caused millions of people to lose their jobs.

“It is past time to end the State of Emergency and focus on the enormous hardships Californians are facing in their daily lives: soaring gas and grocery prices, surging crime, and a homelessness problem that gets worse by the day,” said Republican Assemblymember Kevin Kiley, who was one of the two lawmakers to challenge Newsom in court.

Of all the 596 pandemic related orders Newsom gave, only 27 are in effect according to the Governor’s office and all of them will be gone once the emergency declaration has been lifted. However, the Governor has siad that he will ask the California Legislature to make two of them permanent. One of them allows nurses to order and dispense COVID-19 medication and another would let the lab workers solely process coronavirus tests.

“California’s response to the COVID-19 pandemic has prepared us for whatever comes next. As we move into this next phase, the infrastructure and processes we’ve invested in and built up will provide us the tools to manage any ups and downs in the future,” said Secretary of the California Health & Human Services Agency, Dr. Mark Ghaly. “While the threat of this virus is still real, our preparedness and collective work have helped turn this once crisis emergency into a manageable situation.”

NOVEMBER 2022 | 23

Revamping of the 203k plan

Many people know what a 203k plan is and at one time perhaps even used it.some people say that a 203k plan is a direc ticket into home equity wealth. Ill assume you know nothing about the 203k plans, so one of the question you might be asking yourself is, what is this?

WHAT IS A 203K PLAN?

Essentially this a program or a home loan that allows you to finance your house and also lets you also repair and modernize the home if need be.

IT IS BACKED BY THE FEDERAL HOUSING ADMINISTRATION(FHA) AND TO BREAK IT FURTHER FOR YOU

When purchasing a home, ideally you get the loan to purchase the home and that’s it. With a 203k plan, you get the money to buy the home plus the estimated cost of renovating the property. In addition to that, homebuyers that wish to rehabilitate an older home might still get approved for a 230k plan but there are some conditions that they must meet to qualify.

The 203K plan comes in two variations; the standard and the limited plans. The standard plan/ loan basically covers extensive renovations for which the owner would not be able to occupy the property during the construction period. On the other hand the limited variation is basically applicable for properties that require just minor cosmetic repairs for for up to $35,000.

REVAMPING OF THE 203K PLAN

Recently, the Federal Housing Administration has come out to say that it will ask for a public opinions on updating the 203K plan in a step to address the housing affordability crisis in the country. The move and the the resulting effect by FHA will increase the affordability thus many people will be able to affordable homes that they could not previously afford.

“We’re looking at revamping the 203k program,” Julienne Joseph, deputy assistant secretary in the Office of Single-Family Housing for FHA at the U.S. Department of Housing and Urban Development (HUD) said Tuesday during the 2022 HousingWire Annual event held in Scottsdale, Arizona.

It makes total sense because many people are terrified of renovating homes, it is not to say that therent a good number of homes readily available for purchase, there are. The

LEGAL NEWS

PHOTOS FROM 123RF 24 | NOVEMBER 2022

major problem with most is that they need to be repaired which oftentimes is daunting for many buyers, especially the first time buyers. If the 203K plan can remedy this situation, it would help so may first time buyers who usually are looking for something’s that turn-key.

The revamping of the 203K plan would alsommean that borrowers would get enough cash to absorb the 35 or 40 year old homes that perhaps need just cosmetic repairs and touches as many people simply do not know where to get the money to fix these problems.

For years, we’ve all discussed how we make this program better. We’re in the process of developing a RFI (request for information) that we are going to put out to the industry because we want to be able to address it once and for all.”

The FHA hopes to revamp the loan to match Fannie Mae’s Homestyle Program for the conventional borrower.

Right now, the 203K plan only enables borrowers to make purchases or refinance the loan or do repairs. The financing limit of $35,000 in the FHA 203K plan does not really reflect the current rising prices of homes and also in some instances, it does not cover the costs of renovations. This makes sense why not so many people are using the program. Additionally, the 203K program requies from 10% to 20% of the total loan amount to be set out as a contingency and imposes a 1% origination fee on the borrower.

The revamping of the program has no deadline, FHA is waiting to issue in the next 90 days a request for information from the public to update the program and until that happens probably in 2023, we will have to wait.

“

NOVEMBER 2022 | 25

Texas Housing Market: Prices, Trends & Forecast 2022-2023

By Sharon Bartlett

In 2022, it will be fascinating to investigate the Texas housing market. We explore the Texas real estate market in 2022 and its future using several statistics. For the time being, the inventory shortage keeps Texas house prices high, but many analysts believe that the rate of increase will decrease compared to the previous two years. In Texas, particularly in the affluent suburbs of major urban areas, some of the fastest-growing real estate markets will be in 2022.

These places frequently offer better value for the money and have excellent educational systems. Millennials looking for a place to raise a family are perfect. The most sought-after places to buy in Texas are the suburbs of Dallas and Austin. With populations ranging from 2.3 million to less

than 100, Texas is home to almost 1,700 cities. According to the Emerging Trends in Real Estate 2022 study by PwC and the Urban Land Institute, Texas is home to four of the top twelve markets for new home construction.

Over the past ten years, Texas has seen some of the nation’s highest rates of housing appreciation. Texas property prices have increased 99.56 percent in the last ten years, leading to an annual home appreciation rate of 7.15 percent. Texas has been one of the best long-term real estate investments in the United States during the past ten years if you’re a home buyer or investor.

In 2023, the housing market in Texas will expand. You cannot begin making plans to be

PHOTOS FROM 123RF

NOVEMBER 2022 | 27

a better buyer in 2023 if you consider buying a home this year. Although there are some regional differences, the Texas housing market reflects excellent national trends. An imbalance between supply and demand has spurred rapid housing appreciation throughout the state.

Although Texas home sales have slowed, this is more often a sign of availability than demand. Many viewers perceive that if there was a massive house supply for sale, the number of homes sold in Texas in 2021 might have been higher. It could boost overall sales as more recently built homes are on the market.

You are in a good position if you want to sell your house in 2022. Although unexpectedly, Texas home prices will rise as quickly or drastically as they did in 2021, buyer demand is still strong and is unpredicted to decline. As bidding battles are frequent, many bidders will likely show interest in your home.

TEXAS HOUSING MARKET TRENDS TODAY

Aggressive monetary policy slows sales by dragging down the Texas housing market. The housing market continues to weaken as house inventories rise and prices decline. The high demand for buildings indicates that many purchasers are delaying big purchases despite a national fall in construction permits. Homes with lower prices, popular with young families and first-time purchasers, sold for less money. Record prices and skyrocketing mortgage rates, according to the most recent research from Texas A&M University’s Texas Real Estate Research Center, discouraged buyers

DEMAND FOR HOUSES IN TEXAS.

Demand for Texas While DFW and San Antonio saw a decline of 8%, closed sales in Austin and Houston plummeted by nearly 16% MOM. Every prospective homeowner must overcome financial obstacles, but first-time buyers were severely

hurt by affordability, which decreased the number of homes sold for under $300,000. Texas’ average days on the market (DOM) stayed low at 34 days, showing a persistent imbalance in negotiating power.

Homes in Austin and Dallas sold in 22 days, compared to 30 days in Houston and San Antonio. The DOM of an existing home is substantially lower than that of a new one. There are still not many existing homes. Properties costing $300,000 and $400,000 typically sold in 28 days. Listing times were shorter for more expensive homes than for less expensive ones.

PRICES OF HOMES IN TEXAS

Texas’s median home price dropped by $5,000 to $344,000 in July. Prices decreased everywhere. Austin ($510,000) and DFW ($406,000) both suffered losses of $7,000 and $8,000 in a single month. San Antonio ($328,000) and Houston ($338,000) both experienced losses of $3,000 and $4,000 in the meantime. Austin prices dropped $33,000 in three months, which was the most during the state-wide decline. Although housing prices are declining, they are still 13.2 percent higher than they were a year ago (YOY).

The Texas Repeat Sales Home Price Index, which considers compositional price impacts, supported the idea of sluggish price growth by declining from a January increase of 20.4 percent YOY to a rise of 14.9 percent YOY.

HOUSING AVAILABILITY IN TEXAS

Although it is anticipated that homebuilding will continue to slow down, the state’s present supply is beginning to build up. Since May, active listings have increased by over 17,000 units. After the unusually low inventories of the previous two years, this easing of home availability signals a breakthrough. Texas’ housing supply, which had fallen below two months’ worth of inventory (MOI), increased to 2.2 MOI as a result.

28 | NOVEMBER 2022

NOVEMBER 2022 | 29

Maryland Housing Market Forecast 2022 & 2023

By Emerick Peace

The maryland housing market has been strong throughout the year and certainly, the past two years have been extremely tough for many people as houses havent been this costly since the bubble of 2006.

According to the national Association of Realtors, the Maryland Single family Housing Affordability Index fell to 95.9 in June this year from 142.2 a year ago. The single family housing affordability index measures the financial ability of a typical family in Maryland to qualify for a mortgage loan on the average home based on the months mortgage rates and median price of the home and the median household income. Additionally, when you look at the First time homebuyers affordability index, that too has dropped to 61.8 from 90.8 a year ago. What this data shows is that maryland is getting pricier as we progress into the future.

The demand and supply imbalance, coupled with rising inflation and interest rates has made the housing market untouchable. But a positive sign that we are seeing throughout the country is the cost of homes is slowing coming down and who knows, may be next year will be different, with prices all down.

In September 2022, the home prices in Maryland had appreciated 4.3% compared to the same period last year, going for a median price of $388,900. On average however, Redfin reports that the homes sold in Maryland were 26.7% down year over year and there were 6,735 homes sold in September, down from 9,183 home sold in the same month last year. According to Zillow predictions, home prices will continue to rise over the next 12 months and it is highly likely that the summer of 2023 will see higher home prices than this year.

NOVEMBER 2022 | 31

PHOTOS FROM 123RF

MARKET COOLING DOWN

This is a trend happenning all over the country where home prices are cooling down steadily mostly because of higher mortgage rates. 2021 and 2022 saw higher demand and higher prices because the mortgage rates were down and therefore, the fear of missing out made buyers all over the country run to buy homes to lock in the low rates.

This year however, things are different, inflation is at its highest and mortagge rates have risen quite significantly. No buyer would want to commit their hard earned money in such conditions. Although there are rumors of an imminent market crash, Maryland ocal data doesnt corroborate this at this time. And while true that the prices have started going down, the market rose 5.4% annually in July, but the number of homes sold declined 27%

The market might be cooling down, it is possible, but this isn’t the normal recovery road as the cooling down has been induced by the FED raising the interest rates. Bottomline is, major home price decline or crash might not be happening any time soon, as the supply of homes in Maryland by far favors the sellers. July 2022

saw the number of active units for sale decline year-over-year deom 13,307 units to 10,331 units but, looking at the supply of homes in the state, we are deep in the seller’s market as Maryland has 1.3 months of supply.

A STRONGER ECONOMY

The Maryland economy is relatively strong. The Gross Domestic Product of Maryland in 2021 was $443,929 up from $410,931 in 2020. Some of the largest sectors contributing to this growth in GDP was the governemnt, closely followed by finance, insurance, real estate and professional and business services.

Additionally, looking at the population change, Maryland is ranked as 22nd fastest growing state in the nation in terms of population and according to the 2020 census, the atate had a populaition of 6,177,224 ranked 18th in the nation. Annually the population in Maryland grows by at least 7%.

Looking at the job market, there was a 3.0% increase in jobs in the state bringing the number up by 78,600 year over year. The professional and business services sector experienced the most growth recording

an increase of 4,700 jobs all within the administrative and support services professional, scientific and technical services subsectors.

The rising interest rates all over the country will continue to be a huge challenge for the housing sector. The overall indicators point to the market finally giving up and cooling down as sales drop 23% over a year ago.

Interestingly, escalations and multiple offers are starting to easen and the seller’s expectations haven’t really caught up. Usually, if a seller listed the home on a friday, there was a high chance that the home would be gone by monday but what we are seeing today is that a seller is putting their home and its staying longer in the market. This has been happening in many parts of the state but its not that rampant.

Because the inventory is still low compared to the number of buyers, we are still in the thick of a sellers market.

Prices could flactuate a bit, but not daramatically, that shouldn’t be a sign that the market is returning to an equilibrium.

32 | NOVEMBER 2022

Where Starting Over happens every day!

We’re Starting Over, Inc. a 501(c)(3) organization dedicated to supporting and uplifting people experiencing the effects of mass incarceration, systemic racism, housing insecurity, substance addiction, and mental health issues. We believe that people impacted by these issues are the ones closest to the solutions, which is why we are a Black led and criminal justice impacted organization engaged in this work. From experience, we’ve learned that housing is critical, but alone, it is not enough to support those exiting prisons or the streets. We not only provide transitional housing, but also include holistic services such as peer support, case management, employment, wellness, and re entry services. We also work to address the root causes of our houseguests’ difficult situations, leading grassroots organizing and policy initiatives in the Inland Empire region and statewide. Established in 2009, we’ve served over 1,400 men, women, and families in Riverside and Los Angeles Counties through the re entry and transition process.

We believe that the past does not define our future. We’re invested in creating safe and equitable opportunities for all members of our community, and especially those with past convictions. Housing opportunities are crucial for our community members and directly affect their ability to thrive.

Starting Over, Inc. is committed to reducing and eliminating the many barriers to life after incarceration. We have a deep commitment to identifying and implementing evidence based approaches to strong communities and families. We seek to creating program/project solutions where the need exists in our community. We do lots of things at Starting Over, Inc. but our primary goal is to address the immediate effects and root causes of incarceration, be it through housing, employment, legislation, or community organizing.

T t i l d ith i itiatives, access our services, or support our work through donations, you can or office@startingoverinc.org.

www.startingoverinc.org 6355 Riverside Ave Suite 100, Riverside, CA 92506

We currently operate eight homes in LA and Riverside Counties open to men, women, and children, with options for sober living or harm reduction housing All of our services are available to our houseguests, many of whom have been unable to obtain housing after being released due to their conviction histories

Our Case Management specialists provide support to our guests with obtaining necessary documents/identification and accessing insurance, education, healthcare, clothing, food, & more.

Transitional Housing Case Management Peer Support

Our houseguests are not alone our support specialists, having experienced incarceration, addiction, and homelessness themselves understand our guests' needs and the barriers they face. We’re here to meet our guests wherever they are in their journeys and to support them moving forward through empowerment, support with recovery, referrals, and mentorship

Family Reunification, Equity, & Empowerment (FREE) Project

Mass incarceration affects not just individuals, but families many of our community members and guests experience family separation at the hands of the child welfare system. The FREE Project is system impacted led and organizes parents and family members in a non judgemental space, advising on best practices and dependency court procedures We recently sponsored and passed statewide bill that eliminates major barriers to child placement and allows family members with criminal convictions unrelated to caring for children to be considered as placement options allowing for suitable family members with criminal convictions to step up in times of crisis

Employment

Through our Path to SEED program, we connect guests and community members with employment opportunities and provide training & support regarding obtaining and retaining employment, often a major hurdle for formerly incarcerated individuals

Marshall Legal Clinic

Our free clinics provide relief for expungements, wills/trusts, immigration, and more with the support of local legal organizations

Policy Advocacy

In the past year, we’ve co sponsored and/or supported nearly a dozen statewide bills to reduce the scale of mass incarceration and its collateral consequences We’ve also worked locally to influence Riverside County to reduce criminal history look back periods from 7 years to 3 years in 2017 and to enable youth coming out of probation to be able to stay with their family members in subsidized housing

Grassroots Organizing & Civic Engagement

Our Participatory Defense organizing model (based on Silicon Valley De Bug) empowers family and community members in the courtroom to positively impact their loved one’s outcome and to bring them home. As fiscal sponsor and start up organization of Riverside All of Us or None (a chapter of a national initiative of formerly incarcerated people, family members, and allies advocating for the rights of the currently and formerly incarcerated people) we ensure that system impacted leadership remains at the center of the fight to keep our community together and address the social problems that incarceration purports to solve Our community outreach team also disseminates voter registration and public health information regarding COVID 19, and we organize food and clothing relief for community members in need.

Our

(951) 898-0862 office@startingoverinc.org

programming and projects include, but are not limited to:

Looking to Start your Life in Florida? Florida Dreams Realty

By Adriana Montes

By Adriana Montes

Every month, tens of thousands of people travel into and out of Florida. However, I will say that relocating to Florida is not for everybody. It is for those people looking for a quiet, and prosperous lifestyle. I have heard countless stories of people leaving the state to regret their decision.

Whether or not to relocate to Florida is a decision that should be taken after you have spent some time understanding how the change would affect all aspects of your life.

What is it like to live in Florida? Which city is

perfect for retirement? You should be asking yourself many questions; hopefully, this guide will help you answer some more pressing questions.

PROS OF LIVING IN FLORIDA

No matter where you eventually move in Florida, certain basic benefits and drawbacks extend to most of the state’s population. Take a moment to consider how these factors could affect your everyday life now and in five years. Can you, for example, withstand the heat? While such information can seem insignificant, they have a greater impact on the quality of life than you may expect.

PHOTOS FROM 123RF

help you

NOVEMBER 2022 | 37

is here to

make the transition!

PROS OF FLORIDA LIVING

First, let’s discuss why you should relocate to Florida. Here are some advantages that Florida has. Are they sufficient to distinguish Florida from other states?

• There is no state income tax, which is a major benefit.

• Housing prices are lower than in many other parts of the country.

• Take advantage of outdoor entertainment and world-class beaches.

• There is no snow. Thus, it is warm all year.

• Residents of Florida are entitled to discounts at well-known local attractions.

• There are so many communities devoted solely to retirees and snowbirds.

BUY OR RENT A HOME?

People relocate to Florida for various reasons, the most popular of which are lifestyle, a slowerpaced retirement, or a new snowbird home. Moving to Florida permanently or temporarily can influence whether you buy or rent a house. You’ll still need to determine whether you want a single-family home or a condo.

HOUSING MARKET TIPS

Each Florida housing market fluctuates depending on how many people move in and out of the region at any given time. Wait until a slowdown in movers during the summer if you don’t want to overpay for a house. A knowledgeable real estate agent will assist you in identifying these opportunities.

If you buy, ensure you’re ready to invest in the property for at least a few years. If you buy when the price is high but decide that living in Florida is not for you, you will find yourself with a house valued less than what you paid for it when it comes to selling.

If you decide to rent, understand your rights as a tenant in Florida. Understanding how the law protects you can help you understand what is or is not acceptable landlord behavior.

CONCLUSION

Are you looking to purchase a home? Florida Dreams Realty will assist you in finding the home of your dreams by listening to and understanding your needs and desires. We will do our best to find the best home for you once we know what you want because no one can compromise on such a large purchase.

38 | NOVEMBER 2022

Remodelling: Pros and Cons How It Will Affect Your Insurance

By Yvonne McFadden

Remodeling your home is a fantastic way to add more value to your home, but do you know that it can affect your insurance? Many homeowners don’t know this and end up having an underinsured home. According to CoreLogic’s Residential Cost Handbook, about 64% of homeowners don’t have enough insurance, and an average of 27% underinsure their homes.

But what does it mean to be underinsured?

Underinsured means that your insurance policy only covers a portion of your losses in a claim. Underinsured homeowners have insufficient coverage, leaving them with bigger expenses if they file a claim.

Imagine filing for a claim because of a disaster, only to discover that you don’t have enough

coverage. You won’t be able to recover the costs of losing your home to such a disaster simply because you didn’t inform your insurance company of the new house upgrades. You may have to pay tens of thousands out of your pocket to cover the additional costs. That’s pretty bad. This is what happens when you are underinsured.

REMODELING YOUR HOME IN ARIZONA AND WHAT YOU SHOULD KNOW

Once in a while, several house owners remodel their homes to match modern styles. Some add a pool to their homes, others add office space for their businesses, while others upgrade their kitchen or bathroom. Remodeling increases the value of your home, increasing the cost of your home insurance. This happens regardless of the type of renovation you are carrying out.

l 41 WWW.THEPINMAGAZINE.COM PHOTOS

123RF

FROM

If you proceed with adding a pool to your home, you should know that the liability risk will increase, ultimately increasing your home insurance rates. With this pool added, you should consult with the insurance company immediately and have them look at your insurance options. The company may likely recommend a higher liability coverage than the standard one of even umbrella insurance to cover the costs of getting injured in the pool or other worse-case scenarios.

INCREASING YOUR HOME INSURANCE AFTER RENOVATION: IS IT NECESSARY?

Increasing your home insurance depends on the type of renovation and the coverage you have in place. Upgrades like upgrading the roof and plumbing systems may not require you to increase your coverage. To be sure about how much coverage you need, it’s best to contact your insurance company.

The same goes for adding office space. This will increase your homeowner’s insurance rate, so it’s essential that you purchase an additional insurance policy. It should cover the equipment or machines used if you have any. If your existing coverage isn’t enough, you might be unable to replace your machines if they get damaged.

Interestingly, not all remodeling increases your home insurance rate. If you are making changes that keep your home safer, like updating your electrical systems and plumbing network, your rates will be used after your provider has evaluated your home. If you are also replacing your roof or upgrading your HVAC system, you could see your insurance rates reduced. The insurer considers these upgrades as safety measures and could reduce your premium to a certain amount depending on the roof’s age. If you are lucky, you can get bigger discounts if you live in hurricane-hit areas.

The insurance company will use evaluation tools to determine how much coverage you need.

If the upgrades increased the evaluation, you might need to increase the coverage. Without increasing the coverage, should any catastrophe happen, any upgrade made will not be covered. Make sure you inform your insurance company when you have done any home remodeling.

CONCLUSION

Considering upgrading your home by adding extra space or improving the amenities, consider how they will impact your insurance policy. Are the upgrades compatible with your instance rate? It’s vital that you talk to your insurance provider during the planning stage to see if you’ll be increasing your coverage.

42 | NOVEMBER 2022

What Are Mortgage Points?

By Tamra Lee Ulmer

There is no debate about it. Buying a home will be the most expensive single purchase you will probably make in your lifetime! As such, anything that you can do to reduce the cost of the mortgage might be worth discussing, and therefore in this article, we are going to look at mortgage points, what they are and how they can help you get a good deal for your home purchase.

Mortgage points, besides helping you negotiate a good price for your home, can help you also help you get the best mortgage rates, and for experienced homebuyers, mortgage points will lower the amount of interest they pay.

WHAT ARE MORTGAGE POINTS?

By now, you know that mortgage points are a great way to lock in lower interest rates on a home purchase or refinancing.

You probably don’t know that mortgage points are fees, and as a borrower, you will pay the fees to the mortgage lender to trim the interest rate on loan. This process is sometimes called ‘buying down the rate’, where each point costs 1 percent of the mortgage amount.

Simply put, one mortgage point on a $250,000 mortgage would cost $2,500.

Each point typically lowers the rate by 0.25 percent. Therefore, one mortgage point would lower the mortgage rate from 4 percent to 3.75 percent for the life of the loan. However, it is good to understand that how much a point lowers the mortgage rate will depend on the lender, the type of the loan, and the overall interest rate environment.

PHOTOS FROM 123RF NOVEMBER 2022 | 45

Borrowers in Florida interested in mortgage points can buy more than one point, and if that seems too much, mortgage points can be bought in fractions; for instance, a borrower can buy half a point which amounts to $1,250 and lowers the mortgage rate by 0.125 percent.

You pay for the discount points at closing listed on the loan estimate document. They are also listed on the closing disclosure a borrower will receive before closing the loan.

It is also worth noting that mortgage points come in two varieties;

● The originations points and

● The mortgage points.

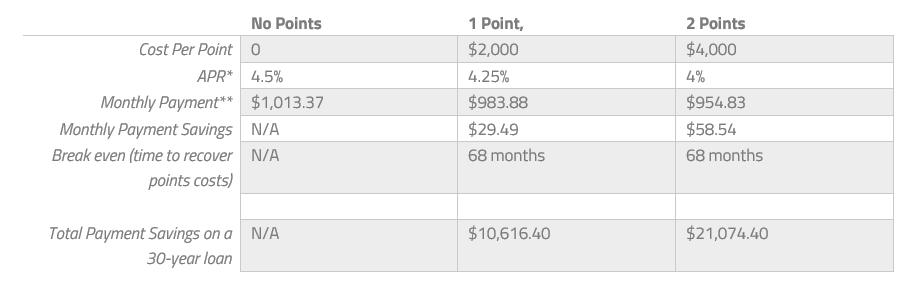

Assuming a loan amount of $200,000

You already know what mortgage points are. Origination points are mostly used to compensate the loan officers, and before the 2017 Tax Cuts and Jobs Act, origination points were not tax-deductible. However, the mortgage points could be deducted from Schedule A. Moving forward, even though discount points are tax deductible, they are only limited to the first $750,000 of a loan.

Generally, remember, the longer the repayment period, the more points help you save on interest over the life of the loan.

So, are mortgage points right for you? Let’s look at a typical example.

**Note: the APRs and the points here are illustrative and educational in nature.

HOW DO MORTGAGE DISCOUNT POINTS COMPARE WITH APR?

Buying discount points is prepaying the interest. APR, on the other hand, is a way to facilitate the comparison of loans among different rate and point combinations. APRs incorporate more than the interest rates; they incorporate points you pay and any fees the lender charges for providing the credit.

SHOULD YOU PAY FOR DISCOUNT POINTS?

Before answering this question, we must first understand the mortgage payment structure. Two factors weigh heavily when considering an option to pay for the mortgage points. These are;

● The length of time you expect to live in the house.

● Your ability to pay for the mortgage points.

46 | NOVEMBER 2022

When considering the length of time you expect to live in the home, the general rule is the longer the period, the bigger the savings.

To illustrate, a $100,000 mortgage with an interest rate of 3 percent will pay you $421 monthly. Supposing you bought 3 mortgage points, the interest rate would be 2.75 percent, and the monthly mortgage payments would be $382 per month.

Put purchasing 3 discount points will cost you $3,000 to save $39 per month. You will have to keep the house for at least 76 months to break even.

A 30-year loan lasts for 360 months, so purchasing the discount points might be a wise move to make, especially if you are planning to live in the new home for a long time. The opposite is true; purchasing discount points with no intention of staying in the home for a long time might not make any sense at all. If you have to, I suggest you purchase a few discount points.

There are numerous online calculators to help you determine the discount points you need to pay based on the period you are planning to stay

in your new home.

Another factor to consider is your ability to pay for the discount points. Considering that many people barely afford the down payment and closing costs, I doubt they can have any money left for discount points. On a $100,000 home, 3 discount points may be fairly affordable, but on a $500,000 home, the cost of three mortgage points would be $15,000, which is quite high.

ARE MORTGAGE POINTS WORTH IT?

Many believe that the money used to pay for mortgage points could be channeled elsewhere where there is a good return on investment, say in stock trading. However, for first-time home buyers, the fear of not getting a mortgage they can afford outweighs all other potential investments.

BOTTOM LINE…

Plan carefully! Buying a home is a major financial decision as such, plan carefully. Look at the cost and whether it will be worth it. It is also important that you consider the number of monthly payments that you will be comfortable paying. Also, take time shopping around. Do not settle for the first option you get.

NOVEMBER 2022 | 47

Looking to sell your home this quarter?

5 tips to

increase

the

value

of the home on a budget

By Walter Huff

The property market has been bullish for the longest time, in fact some estimates put it up 50+ percent compared to the 20182021 and the average house price was also up to $428,700- an increase of $58,900 from just a year ago according to the Federal Reserve Bank of St. Louis. Further, the median home price in the U.S. increases by at about 416% from 1980 to 2020 and by Zillow Home Value Index, the typical priced home is at $354,649.

Looking at these statistics, you may be wondering, ‘how can i increase the value of my home to max out my profits?’ Thankfully, there are some pretty straightforward DIYs you can do right away that will put your house among the top in the market. You do not need to splurge

on expensive and quite extensive repairs and renovations to give your home the best boost.

There is a common misconception in the real estate market that you must extensively remodel your home in order to improve its appeal to the potential buyers, but what you need to understand is that it’s the little details that countquick, small and easy fixtures will do the trick and can make a huge difference.

FIX ALL SMALL ISSUES

Dirty walls- clean them. Remove mold on the kitchen fittings. Clean the place up. Tidy it up! All these are small things that you can do right away to quickly improve the overall appearance of the rooms which in turn will increase the demand.

123RF NOVEMBER 2022 | 51

PHOTOS FROM

Prepare your home because guess what, buyers are prepared for that home!

Take your time and go through each room, carefully examine what each room will need. Pay attention to the small jobs that you have been putting off. One deep clean may be what’s lacking in your home to make it look better at minimal expenses.

FRESHEN UP THE WALLS