Eric Lawrence Frazier, MBA

CEO and Publisher

Office: (800) 401-8994 Ext. 703

Email: eric.frazier@thepowerisnow.com

Website: www.thepowerisnow.com

Kim Collier

Managing Editor

Office 800-401-8994 Ext.

Email: kim.collier@thepowerisnow.com

Website: www.thepowerisnow.com

Erika Reyes

Administrator

Office 800-401-8994 Ex.

Email: erika@thepowerisnow.com

Website: www.thepowerisnow.com

Timothy Hornu

Graphic Artist and Design Manager

Email: tim@thepowerisnow.com

Alvin Magua Managing Writer

Stacy Nadatu Writer

The Power Is Now Media Inc.

3739 6th Street Riverside, CA 92501

Ph: (800) 401-8994 | Fax: (800) 401-8994

info@thepowerisnow.com www.thepowerisnow.com

OF COPYRIGHT:

The Power Is Now Magazine™ is owned and published electronically by The Power Is Now Media, Inc.

Copywrite 2022 The Power Is Now Media Inc.

All rights reserved.

“The PIN Magazine” and distinctive logo are trademarks owned by The Power Is Now Media, Inc.

“ThePINMagazine.com”, is a trademark of The Power Is Now Media, Inc.

“Magazine.thepowerisnow.com”, is a trademark of The Power Is Now Media, Inc.

No part of this electronic magazine or website may be reproduced without the written consent of The Power Is Now Media, Inc.

Requests for permission should be directed to: info@thepowerisnow.com

Mortgage Rates in 2024: What Homebuyers Can Expect

Positive Momentum in Home Builder

Confidence Amidst Declining Interest Rates

Inflation and the Housing Market

Top 11 reasons homeowners should sell during the holidays

California’s New CPUC Decision Threatens Rooftop Solar Growth Across Schools, Farms, and Multifamily Buildings

Fostering Thriving Communities: A Call for Enhanced Support in Tackling Domestic Violence

Adriana Montes: Can I Buy a House In Florida With Student Loan Debt? pg 58

Emerick A. Peace: 7 Ways to Compete In a Sellers Market in Maryland Pg 66

Francine Marsolek: 5 Things Not Necessarily Included in Your Home Purchase pg 80

Steven Rivkin: Agent Wisdom: Seller Tips for a Fast-Changing Connecticut Market. pg 88

8 Psychological Traps in Home Buying and How to Avoid Them pg 97

Brandy Nelson: What Is Mortgage Insurance and When Do You Need It? pg 102

Ruby Frazier: Understanding Seller Disclosures for Real Estate pg 110

Briana Frazier: Tips for Negotiating With Real Estate Agents in Riverside, California pg 124

Dear Esteemed Readers,

As we step into the dawn of a new year, it is with great joy and optimism that we welcome you to the January 2024 issue of The Power Is Now Magazine. Your continued readership, support, and enthusiasm have been the driving force behind our endeavors, and we are truly grateful for the journey we’ve shared through 2023. As we embrace the possibilities that 2024 holds, we remain steadfast in our commitment to delivering insightful and impactful content that empowers and informs.

A heartfelt thank you is extended to our dedicated team at The Power Is Now Media. Their unwavering support and tireless efforts have been instrumental in bringing you timely and compelling articles month after month. We truly appreciate their resilience and dedication to excellence.

This month, we are honored to feature Clemente Arturo Mojica, the President and CEO of Neighborhood Partnership Housing Services, as our cover personality. Clemente’s leadership and vision have played a pivotal role in transforming communities and fostering sustainable housing solutions. Learn more about his inspiring journey and the impactful work of Neighborhood Partnership Housing Services inside these pages.

In this issue, we look into key topics shaping the real estate landscape in 2024. From insights into mortgage rates and the positive momentum in home builder confidence to navigating the challenges of a fast-changing market, we bring you valuable information to empower your decisions in the dynamic world of real estate.

Our commitment to green and sustainable living is highlighted in an article of California’s recent CPUC decision and its potential impact on rooftop solar growth. Additionally, we address crucial health-related issues, urging enhanced support in tackling domestic violence to foster thriving communities.

For tech-savvy readers, discover the 7 best investment software options tailored for real estate investors. And if you’ve ever wondered about buying a house in Florida with student loan debt or negotiating with real estate agents in Riverside, California, our experts have you covered.

As we embark on this new chapter, we invite you to explore, engage, and be inspired by the stories and insights within these pages. Here’s to a year filled with growth, success, and the power to make your real estate dreams a reality.

Warm Regards,

The real estate landscape is everevolving, and as we approach 2024, prospective homebuyers are keenly watching the trends. One significant factor that impacts affordability and accessibility is mortgage rates. Whether you’re a first-time buyer or looking to upgrade, understanding the dynamics of mortgage rates can make all the difference.

In this blog, we’ll delve into the current state of mortgage rates, explore the factors driving

their fluctuations, and provide insights into what homebuyers can anticipate in the coming year. From predictions to practical tips, we’ve got you covered.

So, fasten your seatbelts as we navigate the exciting world of real estate financing in 2024. Whether you’re eyeing that cozy suburban house or dreaming of a chic urban loft, let’s explore how mortgage rates will shape your home buying journey.

As we stand on the cusp of 2024, the landscape of mortgage rates is both intriguing and pivotal for prospective homebuyers. Let’s delve into the nuances of this critical aspect of real estate financing:

Over recent years, mortgage rates have been on a roller coaster ride. From historic lows to sudden spikes, the trajectory has been anything but predictable. Here’s a brief overview:

●POST-2008 CRISIS:

In the aftermath of the global financial crisis, central banks worldwide slashed interest rates. Mortgage rates plummeted, making homeownership more accessible.

●TAPER TANTRUMS AND RECOVERY:

The mid-2010s witnessed “taper tantrums” as the Federal Reserve hinted at reducing its bondbuying program. Rates ticked upward. However, the economy’s recovery kept them relatively moderate.

●PANDEMIC PANDEMONIUM:

The COVID-19 pandemic sent shockwaves through financial markets. Central banks responded with aggressive rate cuts. Mortgage rates hit all-time lows, fueling a home buying frenzy.

●2021 AND BEYOND:

As economies rebounded, inflation concerns emerged. The Fed signaled gradual tightening. Mortgage rates edged higher but remained historically favorable.

The relationship between mortgage rates and home affordability is direct. Here’s how it plays out:

●LOWER RATES,

Higher Affordability: When rates are low, monthly mortgage payments decrease. Buyers can afford more expensive homes without stretching their budgets.

●HIGHER RATES,

Tighter Budgets: Conversely, rising rates reduce affordability. Even a slight increase can significantly impact purchasing power.

●BALANCING ACT:

Homebuyers must strike a balance. While low rates are enticing, they should consider long-term affordability. Locking in a favorable rate early can be prudent.

Predicting mortgage rates is akin to weather forecasting—subject to multiple variables. However, some factors to watch include:

●ECONOMIC RECOVERY:

As economies stabilize, rates may gradually rise. The pace depends on inflation, employment, and fiscal policies.

●FEDERAL RESERVE MOVES:

The Fed’s decisions on interest rates and bond purchases will sway mortgage rates. Clues lie in their statements and economic indicators.

●GLOBAL EVENTS:

Geopolitical tensions, trade dynamics, and international monetary policies ripple through mortgage markets.

As we step into 2024, homebuyers must stay informed. Keep an eye on rate trends, consult experts, and make informed decisions. Whether you’re a first-time buyer or a seasoned homeowner, the mortgage rate landscape will shape your housing journey. Buckle up—it’s a fascinating ride!

Mortgage rates are like the tides—constantly ebbing and flowing, influenced by a complex interplay of economic, political, and global forces. Let’s dive into the factors that sway these interest rate tides:

●GDP GROWTH:

A robust economy often leads to higher mortgage rates. When Gross Domestic Product (GDP) expands, demand for credit increases, pushing rates upward.

●INFLATION:

The Federal Reserve closely monitors inflation. When prices rise, the Fed may raise interest rates to cool down the economy. Higher rates mean costlier mortgages.

●EMPLOYMENT DATA:

Low unemployment rates signal a healthy economy. Conversely, job losses can prompt rate cuts to stimulate borrowing and spending.

●FEDERAL RESERVE:

The Fed’s decisions are pivotal. It sets the federal funds rate—the benchmark for shortterm interest rates. Changes in this rate ripple through mortgage markets.

●TREASURY YIELDS:

Mortgage rates often follow the yield on 10year U.S. Treasury bonds. Investors shift between bonds and mortgages based on yield differentials.

●MORTGAGE-BACKED SECURITIES (MBS):

Lenders bundle mortgages into MBS and sell them to investors. MBS prices impact mortgage rates. When MBS demand rises, rates fall.

●GLOBAL ECON OMY:

International economic trends affect U.S. rates. Turmoil abroad can drive investors toward safer U.S. assets, lowering rates.

●TRADE WARS AND GEOPOLITICAL TENSIONS: Tariffs, trade disputes, and geopolitical instability create uncertainty. Investors seek refuge in bonds, pushing rates down.

●INVESTOR CONFIDENCE:

When markets are volatile, investors flock to bonds, driving rates lower. Conversely, optimism fuels riskier investments, nudging rates up.

●HOUSING MARKET HEALTH:

A robust housing market can sustain higher rates. Weakness may prompt rate cuts to boost homebuying activity.

●LENDER CAPACITY:

Lenders’ capacity to process loans affects rates. High demand may strain lenders, leading to rate increases.

●HOMEBUYER DEMAND:

Strong demand for homes can push rates up. Conversely, a

slowdown may prompt rate adjustments.

As you embark on your homebuying journey, keep an eye on these factors. While we can’t predict every twist and turn, understanding the forces behind mortgage rate fluctuations empowers you to make informed decisions. Remember, rates are more than numbers—they shape your financial future.

As we peer into the crystal ball for 2024, mortgage rates remain a hot topic of speculation. While no one possesses a flawless oracle, expert forecasts and economic indicators provide valuable insights. Here’s what the tea leaves suggest:

●INFLATIONARY PRESSURES:

Inflation has been flexing its muscles lately. As the economy rebounds, prices rise. The Federal Reserve faces a delicate balancing act—taming inflation without stifling growth. If inflation surges, expect rate hikes.

●FED’S RATE DECISIONS:

The Fed’s monetary policy meetings are akin to high-stakes poker games. Will they raise rates? Will they hold steady? Their moves ripple through mortgage markets. Keep an ear out for their statements.

●DEMAND SURGE:

The housing market has been on a tear. Millennials are nesting, and remote work has reshaped preferences. As demand remains robust, rates may inch upward.

●SUPPLY CONSTRAINTS:

Alas, supply lags behind demand. Builders grapple with material shortages, labor woes, and zoning hurdles. A supply-starved market can sustain higher rates.

●JOB MARKET RESILIENCE:

Employment data matters. Low unemployment rates signal economic health. If jobs flourish, rates may follow suit.

●GDP GROWTH:

A thriving economy fuels borrowing. If GDP keeps humming, rates may rise.

●GLOBAL ECONOMY:

International events sway U.S. rates. Trade tensions, geopolitical conflicts, and central bank policies—all interconnected.

●CURRENCY FLUCTUATIONS:

Exchange rates impact investor behavior. A strong dollar attracts foreign investment, suppressing rates.

●BLACK SWANS:

Remember the unforeseen? A pandemic, a natural disaster, a financial shock—these black swans can disrupt rate trajectories.

●TECHNOLOGICAL SHIFTS:

Cryptocurrencies, fintech innovations, and digital currencies—how will they influence rates?

As you plan your home purchase, keep tabs on these factors. While we can’t predict every twist, understanding the landscape empowers you. Whether rates soar or hover, remember that your

homebuying journey is more than numbers—it’s about finding your sanctuary.

Navigating the ebb and flow of mortgage rates requires savvy strategies. Whether you’re a firsttime homebuyer or a seasoned pro, consider these practical tips to make the most of rate fluctuations:

●RATE WATCH:

Keep a close eye on rate trends. Use online tools or consult with mortgage professionals. When rates dip, be ready to pounce.

●SEASONAL PATTERNS:

Historically, rates tend to be lower during certain seasons. Spring and early summer often see favorable rates. Plan your purchase accordingly.

●ECONOMIC CALENDAR:

Check economic calendars for major events (Fed meetings, employment reports). Rates can react swiftly to news.

●RATE LOCKS:

When you find a favorable rate, consider locking it in. A rate lock agreement ensures that your rate won’t change during a specified period (usually 30 to 60 days).

●FLOAT WITH CAUTION:

Floating (not locking) can be risky. If rates rise unexpectedly, you could miss out. Weigh the risk versus potential reward.

●IMPROVE CREDIT SCORE:

A higher credit score often translates to better

Cuando llegó la inundación, tuvimos que huir de nuestro hogar. Afortunadamente, encontramos refugio temporal. Pero cuando comenzamos a buscar un lugar para vivir, nos topamos con discriminación en la vivienda, lo que no solo es injusto, es ilegal. Si sientes que tu propietario o agente inmobiliario te ha negado la venta, el alquiler o la financiación de una vivienda por motivos de raza, color, religión, sexo, nacionalidad, discapacidad o porque tienes hijos, repórtalo a HUD o a tu centro local de igualdad de vivienda.

Visita hud.gov/fairhousing o llama al 1-800-669-9777

Servicio de Retransmisión Federal 1-800-877-8339

IGUALDAD DE VIVIENDA: LA LEY ESTÁ DE TU LADO.

rates. Pay bills on time, reduce credit card balances, and avoid new debt.

●DOWN PAYMENT:

A larger down payment can lower your loan-tovalue ratio, potentially securing a better rate.

●DEBT-TO-INCOME RATIO: Lenders assess your ability to repay. Keep your debt-to-income ratio in check.

●Comparison Shopping: Don’t settle for the first lender. Get quotes from multiple institutions. Each lender may offer different rates and terms.

●Understand Loan Types:

Explore fixed-rate vs. adjustable-rate mortgages. Understand the pros and cons of each.

●MORTGAGE BROKERS:

Brokers have access to multiple lenders. They can help you find the best deal.

●FINANCIAL ADVISORS:

Discuss your overall financial goals. They can guide you on mortgage decisions. Remember, buying a home is a significant decision. While rates matter, consider your long-term financial stability and lifestyle. Happy house hunting!

Congratulations! You’ve decided to take the plunge into homeownership. Now, let’s demystify the mortgage application process and equip you with the knowledge to make informed decisions:

Before diving in, grasp the basics of loan

types:

●FIXED-RATE MORTGAGES:

These offer stability. Your interest rate remains constant throughout the loan term (usually 15 or 30 years). Predictable, but rates may be slightly higher.

●ADJUSTABLE-RATE MORTGAGES (ARMS):

Rates fluctuate based on market conditions. Initially lower, but they can rise over time. Ideal if you plan to sell or refinance soon.

●COMPARISON SHOP:

Don’t settle for the first lender that comes your way. Get quotes from multiple lenders. Each one has its own rates, fees, and terms.

●ASK QUESTIONS:

Inquire about closing costs, points, and any hidden fees. Understand the Annual Percentage Rate (APR), which includes both interest and fees.

●PRE-QUALIFICATION:

A preliminary assessment based on your financial information. It gives you an idea of how much you can borrow. Not a guarantee.

●PRE-APPROVAL:

A more rigorous process. Lenders verify your income, credit, and other details. A pre-approval letter strengthens your offer when house hunting.

●INCOME VERIFICATION:

Gather pay stubs, tax returns, and bank statements. Lenders want to see stable income.

●CREDIT CHECK:

Your credit score matters. Aim for a healthy score to secure better rates.

●DOWN PAYMENT PROOF:

Show where your down payment is coming from (savings, gift, etc.).

●SUBMIT YOUR APPLICATION:

Fill out the lender’s forms. Be thorough and accurate.

●LOAN ESTIMATE:

Within three days, you’ll receive a Loan Estimate. It breaks down costs, rates, and terms.

●UNDERWRITING:

Lenders scrutinize your application. Expect requests for additional document

●CLOSING DISCLOSURE:

A final document detailing all costs. Review it carefully.

●CLOSING DAY:

Sign the paperwork, pay closing costs, and get the keys!

Navigating the loan process involves diligence, research, and a dash of patience. Remember, you’re not just buying a house; you’re investing in your future. Happy house hunting!

The tides are turning in the realm of home construction as falling interest rates breathe new

life into builder sentiment. After enduring a four-month slump, the confidence of builders is on the rise, bolstered by a promising shift in economic indicators as we approach the threshold of 2024.

In a noteworthy uptick,

builder confidence in the market for newly constructed single-family homes surged by three points, reaching a December high of 37, as reported by the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). The recent drop in mortgage rates, plummeting approximately 50 basis points in the last month, has become the catalyst for this positive shift, resulting in heightened builder activity. It appears that the housing market has successfully navigated the crest of mortgage rates for the current cycle, setting the stage for increased demand from prospective homebuyers in the upcoming months. The HMI component, gauging future sales expectations, reflects this optimism with a notable six-point increase in December.

It’s essential to acknowledge a nuanced divergence between single-family builder sentiment and recent starts/permits data. Our in-depth statistical analysis suggests that temporary disparities arise when shortterm interest rates experience a sudden surge, amplifying the costs associated with land development and builder loans utilized by private builders. Elevated financing costs for home builders and land developers introduce an additional hurdle to housing supply in a market grappling with low resale inventory. While the Federal Reserve tackles inflation, there’s an opportunity for state and local policymakers to contribute by easing regulatory burdens on the expenses tied to land development and home construction. This, in turn, would facilitate a more accessible housing supply for the market. Looking ahead, as rates stabilize, the temporary disjunction between sentiment and construction activity is expected to diminish.

a considerable number of builders are resorting to price reductions to stimulate sales. In December, 36% of builders opted to cut home prices, matching the peak observed in the previous month for the year 2023. The average price reduction in December held steady at 6%, mirroring the figures from the preceding month. Simultaneously, 60% of builders continued to offer various sales incentives in December—a consistent trend from November, albeit a slight decrease from the 62% reported in October.

Derived from a longstanding monthly survey conducted by the NAHB for over 35 years, the NAHB/Wells Fargo HMI provides insights into builder perceptions of current singlefamily home sales and their expectations for sales in the next six months, categorized as “good,” “fair,” or “poor.” The survey also delves into the assessment of prospective buyer traffic, categorized as “high to very high,” “average,” or “low to very low.” Scores from each component contribute to the calculation of a seasonally adjusted index, where any number exceeding 50 indicates that more builders view market conditions favorably than unfavorably.

Despite the positive trajectory, the specter of mortgage rates hovering above 7% throughout November, according to Freddie Mac data, lingers. As a response,

Examining the three-month moving averages for regional HMI scores, the Northeast experienced a two-point increase to 51, the Midwest witnessed a slight dip by one point to 34, the South declined by three points to 39, and the West recorded a four-point descent to 31.

The National Foundation for Credit Counseling is the largest and longest-serving network of nonprofit financial counselors. Our mission is to help everyone gain control over their finances through free access to financial education. Credit.org, one of our premier member agencies, understands the need for financial safety, so there is no shame in asking for help. Get back on track today.

As the calendar pages turned to November, so did the gears of the economy. Amidst the hustle and bustle of holiday preparations, a crucial economic indicator quietly made its presence felt: the consumer price index (CPI). This closely watched gauge of inflation revealed intriguing insights into the state of our wallets and the stability of our homes. In this blog post, we’ll dissect the recent inflation

data, explore its implications for housing, and decipher what it all means for homeowners, renters, and real estate enthusiasts. So, fasten your seatbelts as we embark on a journey through numbers, trends, and the ever-evolving landscape of housing costs.

The Consumer Price Index (CPI)—a seemingly innocuous acronym that wields immense influence over our daily lives. It’s the economic pulse-check, the barometer of price fluctuations, and the silent conductor of our financial symphony. But what exactly is the CPI, and why does it matter?

At its core, the CPI measures the average change in prices of a basket of goods and services consumed by urban households. Think of it as a shopping cart filled with everyday essentials: groceries, rent, transportation, healthcare, and the occasional latte. The CPI tracks how much this cart costs today compared to yesteryear.

Not all goods and services are created equal. Some sway the CPI more than others. For instance, housing expenses pirouette gracefully, while the cost of a movie ticket does a timid shuffle. The CPI assigns weights to each item, ensuring that housing’s grand jeté doesn’t overshadow the ballet slipper prices. When the CPI pirouettes upward, we witness inflation—the gradual erosion of our purchasing power. It’s inflation that nudges the price of that morning croissant from “affordable indulgence” to “budgetary conundrum.” And when the CPI waltzes downward, deflation tiptoes in, leaving us with cheaper croissants but a gloomier economic outlook.

Why should you care about this statistical ballet? Because the CPI influences everything from wage negotiations to Social Security benefits. It shapes central bank policies and nudges mortgage rates. When the CPI leaps, your wallet feels the jolt. When it glides, you breathe a sigh of relief.

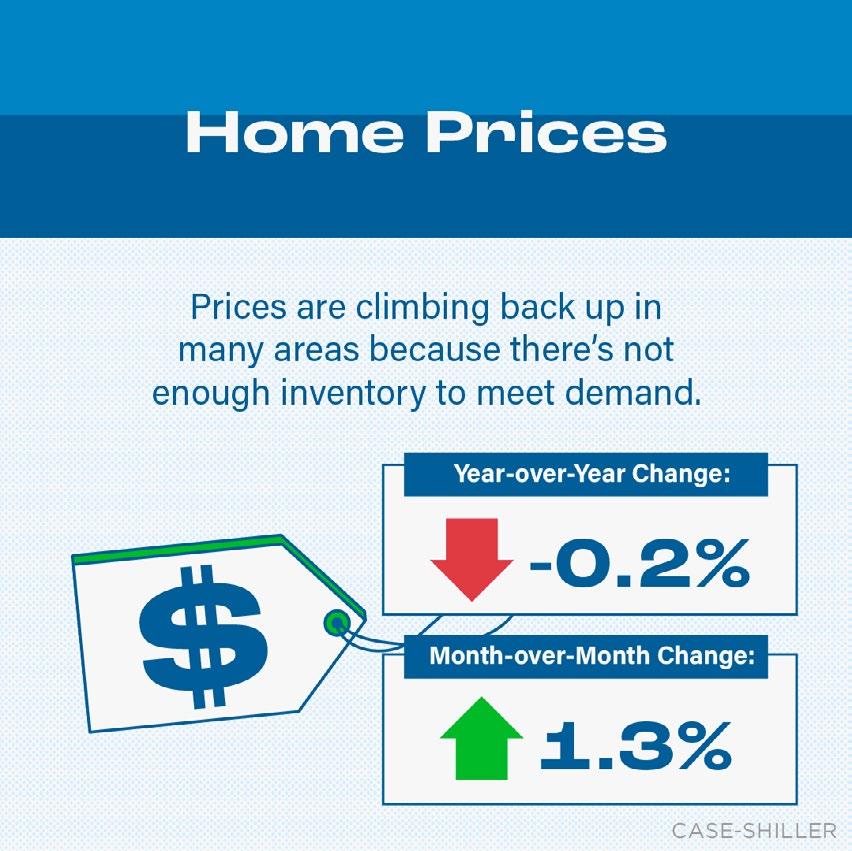

The housing market—where dreams of home ownership collide with the realities of supply, demand, and mortgage rates. It’s a resilient beast, weathering storms, bubbles, and economic tempests. But how does it fare when inflationary waves come crashing ashore? Let’s explore.

Stubbornly High Housing Expenses: Picture a tug-of-war between prospective buyers and sellers. On one end, soaring home prices fueled by demand, low inventory, and speculative fervor. On the other, buyers are armed with preapprovals, dreams of white picket fences, and a dash of desperation. The result? A housing market that clings to its elevated perch, defying gravity and affordability norms.

As inflation whispers sweet nothings into the ears of central banks, interest rates stir. When the CPI pirouettes upward, the Federal Reserve may tighten its monetary belt, nudging mortgage rates northward. Suddenly, that 30-year fixed-rate loan feels less like a lifeline and more like a high-wire act. Homebuyers recalibrate their budgets, and sellers adjust their expectations.

But wait—there’s hope. As inflationary waves ebb, housing costs may catch their breath. If the CPI waltzes downward, mortgage rates may follow suit. Buyers, once priced out, may find themselves back in the game. Sellers, too, may see a softer landing for their prized abodes. It’s a delicate dance—balancing affordability, demand, and economic tides.

So, dear reader, keep an eye on the CPI’s choreography. Watch as housing inventory pirouettes, mortgage rates tango, and affordability waltzes. The housing market, resilient and ever-evolving, awaits its encore. Whether it’s a standing ovation or a curtain call, we’re all part of this economic ballet.

The real estate market—the vast expanse where dreams of home ownership set sail, guided by the winds of economic forces. As inflationary currents surge, homebuyers and sellers find themselves

navigating uncharted waters. Let’s hoist the anchor and explore this tempest-tossed journey.

Picture a shoreline dotted with “For Sale” signs, each a beacon for hopeful buyers. The demand for housing surges, fueled by low interest rates, urban migration, and the desire for a sanctuary amidst uncertainty. As the CPI nudges upward, so do home prices—a relentless tide that tests affordability and resilience.

When inflation whispers into the ears of central banks, mortgage rates stir. The Federal Reserve, like a vigilant lighthouse keeper, adjusts its monetary sails. As the CPI pirouettes, mortgage rates may rise, altering the course of home financing. Buyers weigh fixed versus adjustable rates, while sellers gauge market sentiment.

Amidst inflationary squalls, buyers grapple with tough decisions. Is it time to cast off and secure a fixed-rate mortgage? Or should they ride the waves of adjustable rates, hoping for fair winds? Sellers, too, face choices: hold steady or adjust pricing to match the shifting tides?

Amidst inflation’s turbulence, real estate remains a tangible haven. Homes offer shelter, stability, and a canvas for dreams. While prices surge, the allure of homeownership endures. Buyers seek refuge, while sellers ride the swells, hoping to anchor their investments.

So, dear reader, as we sail through inflationary currents, keep your compass steady. Monitor the CPI, watch for policy shifts, and listen to the murmurs of the housing market. Whether you’re a first-time sailor or a seasoned captain, remember: real estate is both voyage and harbor—a place where dreams find anchorage.

As the sun dips below the distant waves, casting its golden net upon the sea, we stand at the edge of possibility. The housing market, like a ship with billowing sails, charts its course toward an uncertain horizon. What lies beyond? Let us unfurl the map of dreams and navigate the currents of anticipation.

The real estate compass quivers, responding to economic tides. Will interest rates rise, or will they remain gentle zephyrs? How will supply and demand dance—their waltz echoing across neighborhoods and cityscapes? As inflation whispers secrets to the stars, we adjust our sails, ready for the unexpected guests.

Beyond the familiar shores lie uncharted islands. Some harbor treasure—affordable neighborhoods ripe for growth. Others conceal challenges—a rocky coastline of affordability cliffs. Investors, first-time buyers, and seasoned sailors seek these havens. They weigh risk and reward, seeking the perfect harbor to drop anchor.

In this digital age, algorithms and data charts illuminate our path. Virtual tours, predictive analytics, and blockchain deeds guide us. Smart homes whisper tales of convenience and energy efficiency. The lighthouse of PropTech beckons, promising smoother voyages and safer landings.

We are the crew—the stewards of hearths and thresholds. We weather storms, repair leaky roofs, and plant gardens. We dream of sunsets on balconies, laughter echoing in hallways, and keys turning in locks. Our resilience shapes the housing market’s destiny. So, dear reader, as we hoist our hopes and unfurl our aspirations, let us remember: the real estate seas are vast, but our compass points true. Beyond the horizon, where sky meets water, lies the promise of home—a place where memories anchor and futures set sail.

As the holiday season approaches, many homeowners may be tempted to hit the pause button on their plans to sell their homes. However, contrary to popular belief, this festive time of the year can present unique opportunities for those looking to make a move in the real estate market. In this blog, we’ll explore the top 11 reasons why selling your home during the holidays might be a strategic decision. From less competition and motivated buyers to the enchanting atmosphere that can make your property stand out, discover why this season could be the perfect time to turn the key to a successful home sale.”

The holiday season isn’t just a time for trimming the tree and sipping hot cocoa—it’s also a period when potential homebuyers become particularly motivated, turning their attention to serious house hunting. Here’s a closer look at why ‘tis the season for buyers with a purpose and how this heightened motivation can translate into quicker and more successful sales.

With the end of the year approaching, many

buyers are motivated by a desire to settle into a new home before the calendar flips. Whether it’s a personal goal or a resolution for change in the coming year, the time sensitivity prompts decisive action.

The holiday season often brings an abundance of vacation days for prospective buyers. With more time on their hands, they can dedicate weekends, evenings, and even weekdays to actively explore the real estate market, expediting the decisionmaking process.

The symbolic nature of the holiday season as a time for new beginnings and fresh starts can significantly influence buyers. Many see the transition to a new home as a powerful way to embrace change and embark on a new chapter in their lives.

The holidays are a time when the importance of family and home takes center stage. Buyers often feel a heightened sense of urgency to find the perfect home to celebrate future holidays and create lasting memories with their loved ones.

BONUS-DRIVEN

Year-end bonuses, holiday incentives, and financial considerations play a pivotal role in motivating buyers during this season. The additional financial resources can empower them to make substantial decisions, such as purchasing a new home.

The reduced inventory of homes on the market during the holidays means less competition for sellers. This scarcity can lead motivated buyers to concentrate their efforts, giving individual listings more attention and increasing the likelihood of a successful sale.

COMPETITION, MORE

In the winter real estate landscape, the adage “less is more” takes on a new significance. As the holiday season unfolds, a reduction in inventory becomes a key factor that can give your home a distinct competitive edge, capturing the attention of serious buyers seeking their dream property. With fewer homes on the market, your listing is poised to stand out prominently in the snowy landscape, fostering a sense of exclusivity and urgency among potential buyers.

The limited availability of homes during the holidays naturally directs more attention to each individual listing. Serious buyers, aware of the scarcity of options, tend to scrutinize available properties more closely, increasing the likelihood of inquiries and showings. This heightened focus can transform your home into a sought-after gem in the winter real estate market.

Moreover, the reduced competition creates an environment where sellers can negotiate from a position of strength. With fewer comparable properties, buyers may be more inclined to make competitive offers, recognizing the value of securing a home during a time when options are limited.

In essence, the winter wonderland setting, combined with a diminished inventory, sets the stage for your home to shine. It’s an opportune time to showcase the unique features and charm that make your property stand out, attracting serious buyers who are eager to make a purchase amidst the seasonal scarcity.

As the year draws to a close, there’s an oftenoverlooked gift in the real estate market: year-end tax benefits for both sellers and buyers. Closing a real estate deal before the calendar flips can be a strategic move, bringing financial advantages that contribute to a win-win scenario.

For sellers, the potential tax benefits stem from the possibility of capitalizing on tax deductions related to homeownership. Expenses such as mortgage interest, property taxes, and certain closing costs can be deducted when filing income taxes. By closing the deal before the year ends, sellers position themselves to maximize these deductions for the current tax year, potentially reducing their overall tax liability.

Buyers, too, stand to gain from closing before the year concludes. Homeownership often brings a range of tax benefits, including deductions for mortgage interest and property taxes. Closing before the year-end allows buyers to start realizing these advantages sooner, positively impacting their financial situation and providing a tangible incentive to complete the transaction swiftly.

In essence, the year-end tax benefits create a harmonious situation where sellers can optimize deductions, and buyers can promptly begin enjoying the financial perks of homeownership. This shared advantage makes the holiday season an opportune time for real estate transactions, aligning fiscal benefits with the spirit of giving and receiving.

Transforming your home into a holiday haven isn’t just about spreading festive cheer; it’s also a strategic way to captivate potential buyers and leave a lasting impression. As the air turns crisp and the holiday spirit fills the atmosphere, consider leveraging the warmth and charm of holiday decorations to make your property more inviting and memorable.

CREATE A WELCOMING ATMOSPHERE:

Infuse your home with a cozy ambiance by strategically placing warm-toned decorations.

Consider using soft throws, plush cushions, and twinkling lights to create a welcoming environment that resonates with the season.

Draw attention to the unique features of your home by incorporating holiday decor. Adorn the fireplace mantel with garlands, hang tasteful wreaths on doors, and use festive centerpieces to showcase key areas, emphasizing the charm and character of your property.

Engage potential buyers on a sensory level by incorporating scents associated with the holidays. Cinnamon, pine, and vanilla are popular choices that not only evoke warm memories but also create a pleasant and inviting atmosphere throughout the home.

Opt for timeless and universally appealing decorations. Neutral color schemes with pops of traditional holiday colors can make your home feel festive without overwhelming potential buyers with personal or specific cultural preferences.

By transforming your home into a holiday haven, you’re not just showcasing the property; you’re providing potential buyers with a glimpse into a lifestyle filled with warmth, joy, and comfort. This thoughtful approach to decorating can create a memorable experience for visitors and increase the likelihood of them envisioning your home as their own cozy retreat during the festive season.

As the festive season unfolds, a notable shift occurs in the pace of daily life, contributing to more flexible schedules for both sellers and buyers in the real estate market. The holiday spirit tends to usher in a sense of goodwill and accommodation, creating an opportune

environment for smoother transactions. Buyers, often benefiting from time off work or more lenient schedules, find themselves with increased availability to attend viewings, consultations, and negotiations. The relaxed atmosphere allows for unhurried decision-making, fostering a sense of ease and deliberation as potential homeowners contemplate their choices.

On the sellers’ side, the holidays often bring a natural slowdown in other obligations, allowing them to dedicate more time and attention to the home-selling process. With fewer competing demands, sellers can focus on presenting their properties in the best light, ensuring that every detail is attended to, from staging to paperwork.

The convergence of flexible buyer schedules and seller availability creates a symbiotic relationship during the holiday season. This alignment not only facilitates smoother transactions but also cultivates an atmosphere of cooperation and understanding. As calendars become more accommodating, the path to closing deals becomes more navigable, offering a distinct advantage for those looking to buy or sell a home during this joyful time of year.

As the New Year approaches, a notable trend emerges among individuals and families: the pursuit of new homes as part of their relocation resolutions. The turn of the calendar often prompts a reflective mindset, inspiring a desire for change and a fresh start. Prospective buyers set their sights on new beginnings, and the holiday season becomes a pivotal time for sellers to capture their attention.

For many, a move to a new home is symbolic of embracing positive transformations and realizing long-held aspirations. Whether it’s a career-driven relocation, a quest for a different lifestyle, or a

desire for a change of scenery, buyers embark on a mission to find a home that aligns with their evolving goals.

The holidays, with their atmosphere of renewal and transition, provide the perfect backdrop for these resolutions to take shape. Sellers can leverage this trend by showcasing their properties as the ideal setting for a new chapter. From cozy family homes to spacious abodes for careerdriven professionals, aligning your property with the aspirations of those seeking a fresh start positions it as a compelling option in the eyes of motivated buyers.

As individuals and families set their sights on the horizon of a new year, the holiday season becomes a prime opportunity for sellers to present their homes as the perfect place for these relocation resolutions to unfold. By recognizing and tapping into this trend, sellers can connect with a motivated audience ready to turn their housing aspirations into reality.

As the calendar inches towards the end of the year, the prospect of year-end bonuses and financial incentives often becomes a powerful catalyst for potential homebuyers. This subhead explores the ways in which these financial windfalls can significantly influence individuals and families to make decisive real estate decisions during the holiday season.

Year-end bonuses are a common occurrence in many industries, and for prospective homebuyers, this additional income can be a game-changer. Explore how these bonuses can

boost buyers’ budgets, providing them with the extra financial muscle needed to make a move in the real estate market.

Beyond traditional year-end bonuses, many employers offer additional perks such as relocation packages, down payment assistance, or employer-sponsored home-buying programs. Examine how these incentives can sweeten the deal for buyers, making the holiday season an opportune time to capitalize on these benefits.

For buyers anticipating substantial year-end bonuses, the holiday season often serves as an ideal window to strategically time their home purchases. Discuss how aligning real estate decisions with these financial milestones can provide buyers with a sense of financial security and empowerment.

Dive into how buyers armed with year-end bonuses may have enhanced purchasing power, enabling them to consider homes they might not have thought possible earlier in the year. This newfound financial strength can lead to more competitive offers and a broader range of potential properties.

Explore the mindset of buyers who see their

year-end bonuses not just as extra income but as an opportunity to invest in real estate. Delve into how this investment-focused approach can drive buyers to make significant and strategic decisions during the holiday season.

In summary, the allure of year-end financial bonuses creates a unique synergy with the holiday season, motivating buyers to turn their

aspirations of homeownership into reality. By understanding and tapping into this financial enthusiasm, sellers can position their homes as enticing options for those looking to make a substantial move before the year concludes.

The transition from one year to the next holds a profound psychological impact on individuals, often inspiring a collective desire for positive change and fresh beginnings. As the calendar turns, people reflect on the past and set aspirations for the future, making the holiday season an opportune time for those contemplating major life decisions, such as purchasing a new home.

The symbolic power of the New Year fosters a sense of renewal and the pursuit of personal goals. Potential homebuyers, driven by the desire for positive change, are more inclined to consider significant life transitions during this period. The prospect of starting anew in a different home, neighborhood, or even city aligns seamlessly with the spirit of new beginnings that permeates the holiday season.

For many, the act of purchasing a home represents more than a transaction—it symbolizes a transformative journey towards a better life. Whether motivated by career advancements, family expansion, or a simple change of scenery, the allure of starting fresh in a new home resonates powerfully during the time when resolutions are made and personal transformations are at the forefront of one’s mind.

The end of the year serves as a natural checkpoint for individuals to evaluate their current living situations and envision a brighter future. As buyers contemplate their goals for the upcoming

year, the idea of a new home becomes a tangible representation of positive change, offering the prospect of enhanced comfort, improved lifestyle, and increased happiness.

Positioning your home as the catalyst for this positive change can significantly influence potential buyers. Highlight the features of your property that align with the aspirations of those seeking a new beginning, emphasizing how your home can be the canvas for their fresh start in the coming year.

By recognizing and tapping into the psychological undercurrent of new beginnings associated with the New Year, sellers can effectively connect with motivated buyers who are eager to embrace change and embark on a transformative journey through homeownership.

In the world of real estate, the holiday season ushers in a unique sense of urgency for professionals eager to wrap up deals before the year’s end. As the calendar inches towards a new year, real estate agents, mortgage lenders, and other industry experts often become more dedicated than ever to ensuring swift and efficient transactions. Here’s a closer look at why the holiday season inspires a heightened commitment among real estate professionals and how this dedication translates into speedier and smoother home sales.

The approach of the new year signals the closure of annual quotas and the pursuit of set goals for many real estate professionals. Whether it’s individual agents, real estate firms, or mortgage brokers, there’s a collective push to meet and exceed targets before the calendar resets. This drive for accomplishment translates into a proactive and motivated approach towards closing existing deals, benefitting sellers who are keen on

a quick and successful sale.

Beyond personal and team goals, real estate professionals often have financial incentives tied to their performance. Bonuses, commissions, and recognition are frequently linked to achieving targets within a given timeframe, creating a win-win scenario for both the professional and the homeowner. This shared interest in timely transactions contributes to an environment where all parties involved are motivated to expedite the process.

The dynamics of the real estate market towards the end of the year can also play a crucial role. With fewer properties typically on the market during the holiday season, real estate professionals may find themselves with more time and resources to dedicate to each transaction. This, combined with motivated buyers seeking to finalize their home purchase before the new year, creates a synergy that fosters quicker and smoother deals.

In the spirit of meeting year-end deadlines, real estate professionals often streamline their processes and enhance communication to ensure nothing falls through the cracks. Timely responses, efficient negotiations, and clear communication between all parties involved become paramount, creating an atmosphere conducive to rapid and hassle-free transactions.

As professionals work diligently to meet year-end objectives, client satisfaction takes center stage. Real estate agents understand that a positive experience for sellers and buyers alike is not only a testament to their expertise but also a crucial factor in building a solid reputation. This commitment to client satisfaction further propels the drive for quicker and smoother transactions.

In essence, the holiday season serves as a catalyst for heightened dedication among real estate professionals. The convergence of yearend goals, financial incentives, market dynamics, and a commitment to client satisfaction creates an environment where transactions are not only expedited but also executed with precision and care. Sellers looking to capitalize on this momentum will find themselves in the hands of professionals eager to make their home sale a seamless and successful year-end accomplishment.

Selling a home during the winter months may seem like navigating through a market storm, with concerns ranging from adverse weather conditions to the general perception of a slower real estate season. However, savvy sellers can transform these seasonal challenges into unique opportunities, ultimately paving the way for a successful and lucrative home sale.

One common concern during winter is the potential decline in curb appeal. With the landscape adorned in snow, maintaining an attractive exterior becomes crucial. However, sellers can capitalize on the charm of a winter wonderland by strategically decorating the front of their homes. A well-lit pathway, seasonal wreaths, and a cozy outdoor seating area can create an inviting atmosphere despite the chilly weather.

Winter presents an opportunity to showcase the warmth and comfort of a home’s interior. Highlight features like a crackling fireplace, energy-efficient heating systems, and cozy living spaces. Encourage potential buyers to envision themselves snuggled up by the fire during the winter months, turning what might be perceived as a drawback into a compelling selling point.

Overcoming the challenge of capturing appealing exterior shots during winter is possible with the help of professional photography. A skilled photographer can showcase your home in the best light, emphasizing its unique features while minimizing the impact of seasonal weather on the visuals.

While winter may bring shorter days and inclement weather, sellers can turn this challenge into an advantage by offering flexible showing schedules. Highlight the cozy and inviting aspects of your home during evening showings, allowing potential buyers to experience the warmth and ambiance that may be missed during daytime visits.

Addressing potential concerns upfront by investing in a pre-listing home inspection can instill confidence in buyers. Proactively identifying and addressing any issues related to insulation, roofing, or heating systems can alleviate winterspecific worries and contribute to a smoother sales process.

Tailor your marketing materials to embrace the season. Showcase your home with winterthemed photographs, emphasizing the benefits of year-round comfort. Utilize language that positions the property as a haven from the winter elements, reinforcing the idea that it’s not just a house but a warm retreat.

By acknowledging and proactively addressing the challenges associated with selling during the winter, homeowners can turn the seasonal tide in their favor. Transforming these challenges into opportunities not only sets a property apart from the competition but also positions it as an attractive and viable option for motivated buyers seeking a home that can weather any market storm.

Choosing to sell your home during the holidays is not just about completing a transaction; it’s about forging lasting connections with buyers that can prove to be a gift that keeps on giving. When buyers make the decision to purchase a home during this festive season, they are often seeking not only a property but a place where memories can be made.

By emphasizing the warmth and charm of your home during the holidays, you create an emotional connection with the buyers. This emotional resonance goes beyond the basic features of the house; it taps into the aspirations and dreams associated with the holiday season. This shared experience lays the foundation for a positive and enduring relationship.

Happy buyers are more likely to become advocates for your property, singing its praises to friends, family, and colleagues. This word-ofmouth marketing can lead to valuable referrals, bringing in new prospective buyers even after the holiday decorations have been put away. The goodwill generated during the homebuying process can extend beyond the transaction, positioning you as a trusted resource for real estate needs in the long run.

By recognizing the potential for building lasting relationships with buyers who choose your home during the holidays, you not only ensure a successful sale but also set the stage for ongoing referrals and future business, making your decision to sell during this festive season truly rewarding.

In a recent development, the California Public Utilities Commission (CPUC) has given the green light to a ‘proposed decision’ that casts a shadow over the expansion of rooftop solar installations. This move by the CPUC not only reduces the incentives for property owners and tenants to adopt rooftop solar panels but also imposes significant limitations on the use of solar energy for buildings with multiple electric meters.

The decision, which comes on the heels of last December’s cuts to solar incentives for single-family residential properties, slashes the compensation for excess solar energy contributed to the grid. Particularly alarming is the exclusion of buildings with multiple electric meters (excluding residential units) from leveraging rooftop solar to offset utility bills. Instead, these properties are compelled to sell their generated energy to utility companies at lower rates only to buy it back at higher rates. Moreover, the ruling prohibits owners of multifamily buildings from utilizing solar power for common areas, including shared electric vehicle chargers.

California, in its pursuit of achieving 100% clean energy by 2045, faces the challenge of quadrupling rooftop solar capacity. The adverse effects of reducing rooftop solar incentives have been evident in previous instances, leading to a substantial decline in adoption.

Responding to this decision, Steven King, the clean energy advocate for Environment California, expressed concern over the potential barrenness of prime rooftops across the state. He emphasized the missed

opportunities to harness renewable energy and reduce utility bills, highlighting that every rooftop without solar panels hampers progress towards cleaner energy solutions. With the recent National Climate Assessment underscoring the severe consequences of global warming, King stressed the importance of embracing proven, ready-todeploy solutions like rooftop solar. He urged decision-makers to support initiatives that enable Californians to enjoy the benefits of renewable energy in their homes, schools, farms, and businesses, emphasizing that such measures align with the state’s climate goals. The potential for smart and rapid solar growth exists through installations on rooftops, parking lots, and highway-adjacent land, paving the way for a more sustainable and resilient energy future.

Encourage and accept diversity in your neighborhood and community It will promote a greater sense of engagement, better prepare your children for the global community they will inhabit…give us all a richer life. To better understand how neighborhood diversity will benefit you and your family, please log onto www.ARicherLife.org.

“

In every community, regardless of cultural, religious, sexual orientation, income, or immigration status, domestic violence remains a pervasive issue. Despite its widespread prevalence, we find ourselves grappling with federal budget cuts to programs aimed at assisting domestic violence survivors and preventing future instances of abuse.

Research reveals a staggering statistic:

nearly 20 people per minute suffer abuse from an intimate partner in the United States. Daily, domestic violence service programs field over 20,000 calls on average. The presence of a firearm in such situations escalates the risk of homicide by a staggering 500 percent. The pandemic has only heightened the urgency of addressing this public health crisis. State leaders, community-based organizations, and citizens alike must all contribute to the solution.

As advocates for domestic violence survivors, it is imperative that we establish a comprehensive state plan addressing this issue across all communities. We implore policymakers to consider the following:

1.INTERSECTIONAL APPROACHES:

Enact and support policies that take an intersectional approach to domestic violence, addressing related issues like homelessness, pay inequity, reproductive rights, poverty, and child marriages.

2.FINANCIAL SUPPORT:

Advocate for increased funding for domestic violence service providers at federal, state, county, and city levels.

3.LAW ENFORCEMENT REFORM:

Reevaluate law enforcement responses to crisis situations, focusing on ending brutality against people of color and providing first responders with training on best practices for handling domestic violence incidents.

4.LANGUAGE ACCESS:

Evaluate and enhance language access at government facilities, ensuring that survivors with limited English proficiency can easily access the help they need.

5.CULTURAL COMPETENCE:

Train local government employees and agencies on cultural responsiveness.

6.INCLUSIVE COLLABORATION:

Include non-governmental organizations as thought partners in planning city activities related to addressing and preventing domestic violence.

7.AMPLIFYING MINORITY VOICES:

Uplift the voices of minority groups, ensuring representation in committees and policymaking spaces.

For community members, the call to action is simple yet crucial:

1.AWARENESS:

Recognize domestic violence as a pressing issue.

2.ROLE MODELING:

Exhibit healthy relationship behaviors at home, especially for the sake of children.

3.POLITICAL ENGAGEMENT:

Elect leaders and support policies that contribute to building a just and equitable future for everyone.

By collectively committing to these actions, we can transform our communities into spaces where all individuals can thrive in peace.

In the dynamic world of real estate investing, having the right tools at your disposal can be the difference between success and missed opportunities. Whether you’re a seasoned investor or just starting out, the right investment software can streamline your processes, provide valuable market insights, and ultimately, enhance your investment strategy.

This blog post will explore the 7 best investment software for real estate investors. We’ll delve into each software’s unique features, pricing, and how they can empower you to make informed and

profitable real estate investment decisions. So, whether you’re looking to diversify your portfolio, find new investment opportunities, or simply want to stay ahead of the market trends, read on to discover the tools that can help you achieve your real estate investment goals.

In the realm of real estate investing, the right

software can be a game-changer. But what exactly is real estate investment software?

Real estate investment software is a digital tool designed to assist investors in managing and optimizing their real estate investments. It offers a wide range of functionalities, from property analysis and portfolio management to deal discovery and financial forecasting. These software solutions leverage technology to automate complex processes, analyze vast amounts of data, and provide actionable insights. This allows investors to make informed decisions quickly and efficiently, saving time and reducing the risk of costly mistakes. Moreover, real estate investment software can cater to various types of investors - from individuals who own a single rental property to large corporations with extensive real estate portfolios. The key is to choose a software that aligns with your specific needs and investment strategy.

In the following sections, we will explore seven of the best real estate investment software on the market, delving into their unique features and how they can enhance your investment process. Stay tuned!

Stessa is a cloud-based asset management system specifically designed for real estate investors. It aims to simplify the often complex world of rental property finances, providing a comprehensive platform for automated income and expense tracking, personalized reporting, and smart money management.

One of the key features of Stessa is its ability to automate the tracking of income and expenses. By integrating with your financial accounts, it can automatically import and categorize transactions, saving you the time and effort of manual data entry. This feature allows you to have a real-time view of your property’s financial performance. Stessa also offers personalized reporting. You

can generate various reports, such as taxready financials, rent roll, and capital expenses, with just a few clicks. These reports can be customized to meet your specific needs, providing you with the insights you need to make informed investment decisions.

Moreover, Stessa’s smart money management tools can help you optimize your rental property finances. It can analyze your data to identify trends, compare your properties’ performance, and highlight opportunities for cost savings.

In summary, Stessa is a powerful tool that can simplify and streamline your rental property finances. Whether you’re a seasoned investor or a beginner, Stessa can provide you with the tools you need to manage your investments more effectively and efficiently.

Real Data REIA is a comprehensive real estate investment software that caters to both novice and experienced investors. It offers a suite of tools designed to assist in various aspects of real estate investing, making it a one-stop solution for your investment needs.

One of the standout features of Real Data REIA is its extensive property analysis capabilities. The software allows you to evaluate potential investments by providing detailed financial projections. This includes cash flow analysis, rate of return calculations, and profitability forecasts. By providing these insights, Real Data REIA enables you to make data-driven decisions and identify profitable investment opportunities. In addition to property analysis, Real Data REIA also excels in portfolio management. It allows you to track multiple properties, monitor their performance, and manage your overall investment portfolio from a single platform. This feature is particularly useful for investors with a diverse property portfolio, as it provides a consolidated view of all your investments.

Furthermore, Real Data REIA offers robust reporting features. You can generate a variety of reports, including property reports, portfolio summaries, and tax reports. These reports can be customized to your needs, providing you with the information you need in a format that works for you.

In conclusion, Real Data REIA is a comprehensive real estate investment software that offers a wide range of features to assist in your investment journey. Whether you’re analyzing potential investments, managing your portfolio, or generating reports, Real Data REIA has the tools to make the process seamless and efficient.

TheAnalyst Pro is a real estate investment software that stands out for its robust location analysis capabilities. It’s designed to provide real estate investors with comprehensive insights into the location of potential investments, helping them make informed decisions.

One of the key features of TheAnalyst Pro is its demographic analysis tool. This feature allows you to access detailed demographic data for any location, including population trends, income levels, and employment rates. By understanding the demographic landscape, you can assess the demand for real estate in the area and predict future trends.

In addition to demographic analysis, TheAnalyst Pro also offers a mapping feature. This tool allows you to visualize the location of your potential investments, providing a clear picture of the surrounding area. You can view nearby amenities, transportation links, and other points of interest that could impact the value of your investment.

Furthermore, TheAnalyst Pro provides a comprehensive market analysis. This feature gives you access to up-to-date market data, including property values, rental rates, and vacancy rates. With this information at your

fingertips, you can assess the profitability of potential investments and identify promising opportunities.

In conclusion, TheAnalyst Pro is an ideal tool for real estate investors who understand the importance of location in real estate investing. Its comprehensive location analysis features provide valuable insights that can guide your investment decisions and help you maximize your returns.

RealNex is a real estate investment software that has gained popularity among brokerage firms for its comprehensive suite of tools designed to streamline and enhance the real estate transaction process.

One of the standout features of RealNex is its CRM (Customer Relationship Management) system. This tool allows brokerage firms to manage their client relationships effectively, track interactions, and ensure timely follow-ups. It also integrates seamlessly with other RealNex tools, providing a unified platform for managing all aspects of the real estate transaction process. In addition to its CRM, RealNex also offers robust property analysis tools. These tools allow brokerage firms to evaluate potential investments, conduct comparative market analysis, and generate detailed financial projections. This can help firms identify profitable opportunities and provide their clients with datadriven advice.

Moreover, RealNex provides a marketplace feature where brokerage firms can list properties for sale or lease. This feature not only helps firms reach a wider audience but also provides them with valuable insights into market trends and demand.

Furthermore, RealNex offers a deal room feature, which provides a secure platform for sharing sensitive documents and collaborating with clients and other stakeholders. This can help brokerage firms streamline their deal-making process and ensure all parties have access to the

information they need.

In conclusion, RealNex is a comprehensive real estate investment software that offers a wide range of features tailored to the needs of brokerage firms. Whether it’s managing client relationships, analyzing potential investments, or facilitating transactions, RealNex has the tools to make the process more efficient and effective.

Roofstock Cloudhouse is a real estate investment software that stands out for its exceptional research capabilities. It’s designed to provide real estate investors with comprehensive insights into potential investments, helping them make informed decisions.

One of the key features of Roofstock Cloudhouse is its extensive property database. This database includes detailed information about properties across various markets, including property characteristics, historical pricing data, and rental income estimates. This wealth of information allows investors to conduct thorough research and identify promising investment opportunities. In addition to its property database, Roofstock Cloudhouse also offers a market analysis tool. This tool provides up-to-date market data, including property values, rental rates, and vacancy rates. By understanding the current market conditions, investors can assess the profitability of potential investments and make data-driven decisions.

Furthermore, Roofstock Cloudhouse provides a property analysis feature. This feature allows investors to evaluate potential investments based on various financial metrics, such as cash flow, rate of return, and capitalization rate. This can help investors identify profitable opportunities and optimize their investment strategy.

In conclusion, Roofstock Cloudhouse is an excellent tool for real estate investors who value thorough research. Its comprehensive research features provide valuable insights that can guide your investment decisions and help you maximize your returns.

Yieldstreet is a unique investment platform known for its focus on real estate investing and alternative investments. It’s designed to provide investors with access to asset-based investments that were previously hard to access or reserved for institutional investors.

One of the key features of Yieldstreet is its wide range of investment offerings. In addition to real estate, the platform also offers investments in other asset classes such as marine finance, legal finance, and commercial loans. This diversity allows investors to diversify their portfolio and potentially increase their returns.

In the realm of real estate, Yieldstreet offers a variety of investment opportunities. These include residential and commercial properties, as well as real estate debt. The platform provides detailed information about each investment, including the property details, expected returns, and risk level. This transparency allows investors to make informed decisions and choose investments that align with their risk tolerance and investment goals.

Moreover, Yieldstreet provides a user-friendly platform that makes investing straightforward. Investors can easily browse available investments, view detailed information, and make investments directly from the platform. The platform also provides regular updates on the performance of your investments, allowing you to track your returns and monitor your portfolio.

In conclusion, Yieldstreet is a versatile investment platform that offers a unique blend of real estate and alternative investments. Whether you’re a seasoned investor looking to diversify your portfolio or a beginner interested in exploring alternative investments, Yieldstreet offers a range of options to help you achieve your investment goals.

Groundfloor is a real estate investment platform that specializes in short-term, high-yield investments. It’s designed to provide individual investors with access to real estate investments that were previously only available to institutional investors.

One of the key features of Groundfloor is its focus on short-term investments. These investments, often in the form of loans for real estate development projects, typically have terms ranging from 6 to 12 months. This allows investors to see returns on their investments in a relatively short period of time.

In addition to its short-term focus, Groundfloor also stands out for its high-yield potential. The platform’s investments often offer higher returns compared to traditional real estate investments. This can make Groundfloor an attractive option for investors looking to maximize their returns. Moreover, Groundfloor provides a user-friendly platform that makes investing straightforward. Investors can easily browse available investments, view detailed information about each project, and make investments directly from the platform. The platform also provides regular updates on the progress of each project, allowing investors to track their investments and see their money at work.

In conclusion, Groundfloor is an excellent choice for investors interested in short-term, high-yield real estate investments. Its unique investment offerings, user-friendly platform, and high-yield potential make it a standout in the world of real estate investing.

Investment software can be a powerful tool in your real estate investing journey, but to truly reap its benefits, it’s crucial to understand how to make the most of it.

1.UNDERSTAND YOUR NEEDS: Each software has its strengths and specialties.

Some are excellent for research, while others excel in portfolio management or financial analysis. Understand your needs and investment strategy to choose the software that best aligns with them.

Make sure to fully explore and utilize the features offered by your software. Whether it’s market analysis, property evaluation, or portfolio management, these features can provide valuable insights and streamline your investment process.

Real estate markets are dynamic, and staying updated with the latest trends and data is key. Many software solutions offer real-time market data and updates, so leverage these features to stay ahead of the curve.

Many software solutions offer integrations with other tools such as CRM systems, accounting software, or data feeds. These integrations can help streamline your processes and make your investment journey smoother and more efficient.

Many software providers offer tutorials, webinars, or customer support to help you understand how to use their software effectively. Make use of these resources to get the most out of your software.

Remember, the goal of using investment software is to make your real estate investing journey more efficient and informed. So, take the time to understand and make the most of your software, and you’ll be well on your way to successful investing.

Investing in real estate can be a rewarding but complex endeavor. The right investment software can simplify this process, providing you with the tools and insights you need to make informed decisions and maximize your returns.

In this blog post, we’ve explored seven of the best investment software for real estate investors: Stessa, Real Data REIA, TheAnalyst Pro, RealNex, Roofstock Cloudhouse, Yieldstreet, and Groundfloor. Each of these software solutions offers unique features and benefits, catering to different needs and investment strategies. Whether you’re a seasoned investor looking to streamline your processes or a beginner seeking to navigate the world of real estate investing, these software solutions can be a valuable asset. By understanding your needs, leveraging the features, and staying updated with the latest market trends, you can elevate your real estate investments and achieve your investment goals. Remember, the key to successful investing is not just about having the right tools, but also about using them effectively. So, take the time to explore these software solutions, understand their features, and make the most of them. Here’s to your success in your real estate investing journey!

We’re Starting Over, Inc - a 501(c)(3) organization dedicated to supporting and uplifting people experiencing the effects of mass incarceration, systemic racism, housing insecurity, substance addiction, and mental health issues We believe that people impacted by these issues are the ones closest to the solutions, which is why we are a Black-led and criminal justice-impacted organization engaged in this work From experience, we’ve learned that housing is critical, but alone, it is not enough to support those exiting prisons or the streets We not only provide transitional housing, but also include holistic services such as peer support, case management, employment, wellness, and reentry services We also work to address the root causes of our houseguests’ difficult situations, leading grassroots organizing and policy initiatives in the Inland Empire region and statewide Established in 2009, we’ve served over 1,400 men, women, and families in Riverside and Los Angeles Counties through the reentry and transition process

We believe that the past does not define our future We’re invested in creating safe and equitable opportunities for all members of our community, and especially those with past convictions Housing opportunities are crucial for our community members and directly affect their ability to thrive

Starting Over, Inc is committed to reducing and eliminating the many barriers to life after incarceration We have a deep commitment to identifying and implementing evidence-based approaches to strong communities and families We seek to creating program/project solutions where the need exists in our community We do lots of things at Starting Over, Inc - but our primary goal is to address the immediate effects and root causes of incarceration, be it through housing, employment, legislation, or community organizing

T t i l d ith i itiatives, access our services, or support our work through donations, you can or office@startingoverinc.org.

We currently operate eight homes in LA and Riverside Counties open to men, women, and children, with options for sober living or harm-reduction housing. All of our services are available to our houseguests, many of whom have been unable to obtain housing after being released due to their conviction histories

Our Case Management specialists provide support to our guests with obtaining necessary documents/identification and accessing insurance, education, healthcare, clothing, food, & more

Our houseguests are not alone - our support specialists, having experienced incarceration, addiction, and homelessness themselves - understand our guests' needs and the barriers they face We’re here to meet our guests wherever they are in their journeys and to support them moving forward through empowerment, support with recovery, referrals, and mentorship

Mass incarceration affects not just individuals, but families - many of our community members and guests experience family separation at the hands of the child welfare system The FREE Project is system-impacted led and organizes parents and family members in a non-judgemental space, advising on best practices and dependency court procedures. We recently sponsored and passed statewide bill that eliminates major barriers to child placement and allows family members with criminal convictions unrelated to caring for children to be considered as placement options allowing for suitable family members with criminal convictions to step up in times of crisis

Through our Path to SEED program, we connect guests and community members with employment opportunities and provide training & support regarding obtaining and retaining employment, often a major hurdle for formerly incarcerated individuals.

Our free clinics provide relief for expungements, wills/trusts, immigration, and more with the support of local legal organizations.

In the past year, we’ve co-sponsored and/or supported nearly a dozen statewide bills to reduce the scale of mass incarceration and its collateral consequences. We’ve also worked locally to influence Riverside County to reduce criminal history look-back periods from 7 years to 3 years in 2017 and to enable youth coming out of probation to be able to stay with their family members in subsidized housing.

Our Participatory Defense organizing model (based on Silicon Valley De-Bug) empowers family and community members in the courtroom to positively impact their loved one’s outcome and to bring them home As fiscal sponsor and start-up organization of Riverside All of Us or None (a chapter of a national initiative of formerly incarcerated people, family members, and allies advocating for the rights of the currently and formerly incarcerated people) we ensure that system impacted leadership remains at the center of the fight to keep our community together and address the social problems that incarceration purports to solve Our community outreach team also disseminates voter registration and public health information regarding COVID-19, and we organize food and clothing relief for community members in need

By Andriana Montes

n today’s economic climate, student loan debt has become a reality for many. It’s a burden that can seem overwhelming, especially when you’re dreaming of buying your own home. You might find yourself asking, “Can I buy a house while carrying student loan debt?” The answer is not as straightforward as a simple yes or no.

In this blog, we will explore the complexities of balancing student loan debt with the dream of

home ownership. We’ll delve into factors such as credit scores, debt-to-income ratios, and mortgage approval processes. We’ll also share tips and strategies to navigate the path to home ownership despite your student loans. So, if you’re a prospective home buyer with student loan debt, this blog is for you. Let’s embark on this journey together!