Ruby

2023 Year End Review the power is now magazine Eric Lawrence Frazier, MBA Publisher Office: (800) 401-8994 Ext. 703 Direct: (714) 361-2105 eric.frazier@thepowerisnow.com www.thepowerisnow.com EDITORIAL TEAM

L. Frazier

Power Is Now Media Inc. 3739 6th Street Riverside, CA 92501 email: editor@thepowerisnow.com

800-401-8994 ext. Cell: 714-475-8629 Timothy Hornu Graphic Artist and Design Manager tim@thepowerisnow.com CONTRIBUTORS The Power Is Now Research Team HAVE YOU READ OUR PAST ISSUES YET? CLICK HERE TO READ US ONLINE! 2023 Review

The

Ph:

The Power Is Now Media Inc.

3739 6th Street Riverside, CA 92501

Ph: (800) 401-8994 | Fax: (800) 401-8994

info@thepowerisnow.com

www.thepowerisnow.com

The Power Is Now Magazine™ is owned and published electronically by The Power Is Now Media, Inc.

Copywrite 2022 The Power Is Now Media Inc.

All rights reserved.

“The PIN Magazine” and distinctive logo are trademarks owned by The Power Is Now Media, Inc.

“ThePINMagazine.com”, is a trademark of The Power Is Now Media, Inc.

“Magazine.thepowerisnow.com”, is a trademark of The Power Is Now Media, Inc.

No part of this electronic magazine or website may be reproduced without the written consent of The Power Is Now Media, Inc.

Requests for permission should be directed to:

info@thepowerisnow.com

HEADQUARTERS

IMPORTANT STATEMENT OF COPYRIGHT:

the power is now magazine Find The Power Is Now TV on for more details go to www.thepowerisnow.com 2nd AND 4th FRIDAYS OF THE MONTH 3:00 PM TO 4:00 PM PST 2023 Review

JANUARY 2023

6 tricks to Help You Sell Your Home in the Winter

FEBRUARY 2023

3 Relationship-Saving Strategies For Any Couple Buying a House

MARCH 2023

White Lies That Can Destroy Your Homebuying Chances

APRIL 2023

Scottsdale Forecasts and outlook for Q2, 2023

MAY 2023

Scottsdale, Arizona Market Update_ Q2 2023

JUNE 2023

The Credit Boosting Power_ How Monthly Mortgage Payments Enhance Your Credit Profile

JULY 2023

The Cost of Selling a Home in Scottsdale, Arizona A Comprehensive Guide

AUGUST 2023

Scottsdale, AZ Market Update for Q3, 2023

SEPTEMBER 2023

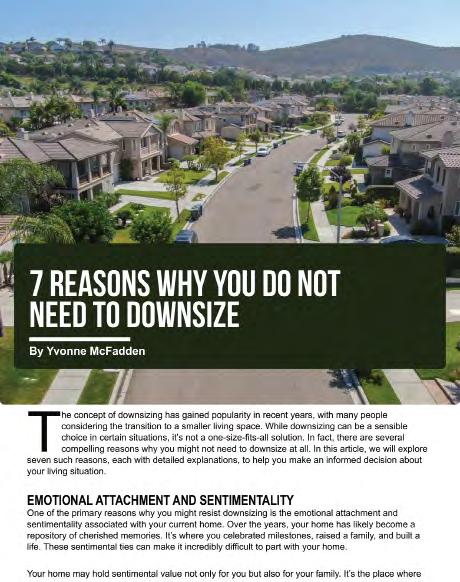

7 Reasons Why You Do Not Need to Downsize

OCTOBER 2023

6 Financing Tips For First-Time Home Buyers

NOVEMBER 2023

How to Sell an Inherited House in Arizona

Stress-free

DECEMBER 2023

Psychological Traps in Home Buying and How to Avoid Them

PODCAST

TV SHOWS

CONTENTS 2023 YEAR END REVIEW

REAL ESTATE ARTICLES CONTRIBUTIONS

2023 Review

2023 Review

2023 Review thepowerisnowmeida

BACK TO CONTENTS 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

BACK TO CONTENTS 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

BACK TO CONTENTS 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

BACK TO CONTENTS 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

BACK TO CONTENTS 2023 Review thepowerisnowmeida

The Credit Boosting Power: How Monthly Mortgage Payments Enhance Your Credit Profile in Scottsdale, Arizona

Have you ever wondered how your monthly mortgage payments can do more than just contribute to your homeownership goals? Well, buckle up and get ready to discover the creditboosting power of those regular payments. In this article, we’ll delve into how making your monthly mortgage payments can actually enhance your credit profile. Yes, that’s right! By simply fulfilling your financial obligation of paying your mortgage on time, you can give your credit score a significant boost. So, let’s dive in and uncover the hidden benefits of being a responsible homeowner in the beautiful city of Scottsdale.

1. THE LINK BETWEEN MORTGAGE PAYMENTS AND CREDIT SCORES: UNVEILING THE CONNECTION

When it comes to managing your credit and building a strong financial foundation, understanding the connection between your mortgage payments and credit scores is crucial. Your credit score is a numerical representation of your creditworthiness,

2023 Review thepowerisnowmeida

and it plays a significant role in determining your eligibility for future loans and favorable interest rates. What you may not realize is that making timely and consistent mortgage payments can have a direct impact on your credit score.

Mortgage payments are typically reported to the major credit bureaus - Equifax, Experian, and TransUnion - on a monthly basis. As you make your payments on time, these bureaus take note and update your credit history accordingly. Demonstrating a responsible repayment behavior through consistent mortgage payments showcases your financial responsibility and reliability to potential lenders.

By consistently making your mortgage payments, you’re not only fulfilling your financial obligation as a homeowner but also actively building a positive credit history. This history reflects your ability to manage a significant debt responsibly, which is a favorable factor in the eyes of creditors. The more you demonstrate a consistent payment history, the more your credit score will reflect your financial reliability.

It’s important to note that while mortgage payments play a significant role in your credit score, they are just one piece of the puzzle. Factors such as your overall credit utilization, payment history on other credit accounts, and length of credit

history also contribute to your credit score. However, making timely mortgage payments is an essential step toward maintaining and improving your credit profile.

In the next sections, we will explore how timely mortgage payments serve as the foundation for a strong credit profile in Scottsdale, Arizona. Understanding the significance of these payments will empower you to take control of your credit and achieve your financial goals.

2. TIMELY PAYMENTS: THE FOUNDATION FOR A STRONG CREDIT PROFILE IN SCOTTSDALE

In the world of credit, consistency is key. Making timely mortgage payments is not only essential for keeping your homeownership on track but also forms the foundation for a strong credit profile in Scottsdale, Arizona. Your payment history accounts for a significant portion of your credit score, and by consistently meeting your mortgage obligations, you demonstrate your financial responsibility and reliability to lenders.

When you make your mortgage payments on time, you’re showcasing your ability to manage your finances effectively and honor your financial commitments. This responsible behavior is

precisely what lenders look for when assessing your creditworthiness. By meeting your payment deadlines month after month, you’re building a track record of reliability and proving that you can handle a substantial financial obligation.

One important aspect to note is that timely mortgage payments not only positively impact your credit score but also help you avoid negative consequences. Late or missed payments can have a detrimental effect on your credit, leading to a drop in your score and potential difficulties in obtaining credit in the future. On the other hand, consistently making your mortgage payments on time demonstrates your creditworthiness and can open doors to more favorable interest rates and loan options down the line.

To ensure you stay on top of your mortgage payments, consider setting up automatic payments or calendar reminders to avoid any accidental oversights. Make your payments a priority, treating them as an essential financial commitment. By doing so, you’ll not only maintain a strong credit profile but also build a solid foundation for your overall financial well-being.

Remember, responsible homeownership goes hand in hand with a healthy credit profile. By consistently making timely mortgage payments, you

BACK TO CONTENTS

2023 Review thepowerisnowmeida

establish a positive payment history that enhances your creditworthiness and positions you favorably in the eyes of lenders. So, take pride in meeting your mortgage obligations and reap the rewards of a strong credit profile in Scottsdale, Arizona.

3. BUILDING CREDIT HISTORY THROUGH CONSISTENT MORTGAGE PAYMENTS: LONG-TERM BENEFITS

Every on-time payment you make contributes to a positive credit history, which can have long-term benefits for your financial well-being in Scottsdale, Arizona.

As you continue to make consistent mortgage payments over time, your credit history grows, showcasing your ability to handle significant financial obligations responsibly. Lenders and creditors consider the length of your credit history when assessing your creditworthiness, and a longer history that demonstrates responsible payment behavior is generally viewed more favorably.

Building a solid credit history through mortgage payments is not something that happens overnight. It requires commitment and discipline to consistently meet your payment obligations. However, the rewards are well worth the effort. A positive credit

history can open doors to more favorable loan terms, lower interest rates, and increased borrowing power in the future.

Moreover, your credit history can extend beyond just mortgage payments. As you continue to demonstrate financial responsibility through on-time mortgage payments, it establishes a positive foundation for other credit accounts, such as credit cards or car loans. Lenders will see your proven track record and responsible behavior, increasing your chances of obtaining credit with favorable terms and conditions.

It’s important to note that building credit history is a gradual process, and it’s essential to remain patient and consistent. It takes time to establish a strong credit profile, and the positive impact of your mortgage payments will compound over the years. By staying committed to making on-time payments and managing your overall credit responsibly, you’re investing in your financial future and setting yourself up for success.

In Scottsdale’s dynamic real estate market, where homeownership is highly valued, building a strong credit history through consistent mortgage payments is a significant step toward achieving your long-term

financial goals. Take pride in your responsible payment behavior and enjoy the benefits that come with a solid credit profile.

4. TIPS FOR MAXIMIZING THE CREDIT-BOOSTING POTENTIAL OF YOUR MORTGAGE PAYMENTS

4. Tips for Maximizing the Credit-Boosting Potential of Your Mortgage Payments

To maximize the credit-boosting potential of your mortgage payments in Scottsdale, Arizona, consider the following tips:

1.Pay on time, every time: Consistently making your mortgage payments by the due date is crucial for building a strong credit history. Set up reminders or automatic payments to ensure you never miss a payment.

2.Avoid late payments: Late payments can have a negative impact on your credit score. If unforeseen circumstances arise, communicate with your lender and explore potential options to prevent late payments.

3.Pay extra when possible: If you have the financial means, consider making additional payments toward your principal. This not only reduces your overall interest costs but

2023 Review thepowerisnowmeida

also demonstrates your commitment to paying off your mortgage responsibly.

4.Keep your credit utilization in check: While mortgage payments contribute to your credit score, it’s essential to manage your overall credit utilization. Avoid maxing out credit cards or taking on excessive debt, as this can negatively affect your creditworthiness.

By implementing these tips, you can optimize the credit-boosting potential of your mortgage payments and build a solid financial foundation in Scottsdale.

Understanding the importance of mortgage payments in building a strong credit profile is key for buyers, sellers, and investors navigating the Scottsdale real estate market. Through consistent and timely payments, individuals can demonstrate their financial responsibility, improve their credit scores, and gain access to more favorable loan terms and opportunities.

We discussed how mortgage payments are a vital factor in shaping credit history and how responsible payment behavior can open doors to a variety of benefits. By maintaining a positive credit history, individuals can enhance their financial standing, increase their borrowing power, and position themselves favorably in the eyes of lenders.

As a real estate professional with Delex Luxury Real Estate, I, Yvonne McFadden, specialize in helping buyers, sellers, and investors navigate the dynamic Scottsdale market. With in-depth knowledge of the local real estate landscape, I am committed to providing personalized guidance and assistance tailored to your unique needs.

If you’re looking to buy, sell, or invest in Scottsdale real estate, I invite you to work with me and tap into my expertise and dedication. Together, we can achieve your real estate goals

and capitalize on the opportunities that this vibrant market has to offer. Contact me today at Delex Luxury Real Estate to get started on your journey in Scottsdale, Arizona.

CONCLUSION:

In conclusion, understanding how mortgage payments can positively impact your credit profile is vital for homeowners in Scottsdale, Arizona. By consistently making timely payments and implementing strategic approaches, you can build a strong credit history, enhance your credit scores, and open doors to a brighter financial future. Remember, the power to strengthen your credit lies in your hands. So, take the initiative, work with a trusted realtor like myself, Yvonne McFadden, and let’s embark on a rewarding real estate journey together.

BACK TO CONTENTS

2023 Review thepowerisnowmeida

The Cost of Selling a Home in Scottsdale, Arizona: A Comprehensive Guide

By Yvonne McFadden

Selling a home can be an exciting and rewarding experience, but it’s essential to be aware of the costs involved to make informed decisions. If you’re planning to sell your home in Scottsdale, Arizona, understanding the expenses associated with the process will help you estimate your budget and maximize your profits. In this blog, we’ll break down the various costs involved in selling a home in Scottsdale, enabling you to navigate the process confidently.

REAL ESTATE AGENT FEES

One of the significant costs when selling a home is the commission paid to real estate agents. Typically, sellers pay a commission of around 5-6% of the final sale price. This fee is split between the listing agent (representing the seller) and the buyer’s agent (representing the purchaser). While it may seem substantial, having a professional agent on your side can help you secure a higher selling price and navigate the complexities of the real estate market.

HOME PREPARATION COSTS

2023 Review thepowerisnowmeida

Before listing your home, you may need to invest in certain repairs, renovations, or staging to enhance its appeal to potential buyers. These costs can vary significantly based on the condition of your home. Minor repairs and cosmetic updates such as fresh paint, landscaping, or new fixtures can improve your home’s market value and make it more enticing to buyers.

HOME INSPECTION AND APPRAISAL FEES

Buyers will likely request a home inspection to ensure the property is in good condition. It’s wise for sellers to obtain their own prelisting inspection to identify any issues in advance. The cost of a home inspection in Scottsdale can range from $300 to $600, depending on the size and complexity of the property. Additionally, an appraisal might be required to determine the market value of your home, which can cost around $300 to $500.

CLOSING COSTS

As the seller, you’ll be responsible for covering certain closing costs, which typically range between 1-3% of the final sale price. These costs may include title search fees, title insurance, escrow fees, attorney fees, and recording fees. It’s advisable to consult with a real estate attorney or a trusted professional to understand the specific closing costs applicable to your situation.

Marketing and Advertising Expenses

To attract potential buyers, you’ll need to invest in marketing and advertising your

home. While some agents include these expenses in their services, others may charge additional fees for professional photography, virtual tours, brochures, online listings, and advertising campaigns. The cost of marketing can vary, but it’s an essential aspect of reaching a wide audience and generating interest in your property.

CAPITAL GAINS TAX

Depending on your individual circumstances, you may be subject to capital gains tax when selling your home in Scottsdale. However, it’s crucial to consult with a tax professional or accountant to understand the specific tax implications and any potential exemptions or deductions that may apply to you.

CONCLUSION

Selling a home in Scottsdale, Arizona involves various costs that need to be considered when estimating your overall expenses and anticipated profit. Real estate agent fees, home preparation costs, inspection and appraisal fees, closing costs, marketing expenses, and potential taxes all contribute to the overall cost of selling a property. By understanding these expenses upfront, you can better plan your budget and make informed decisions throughout t `he selling process. Remember to consult with professionals and trusted advisors to ensure you have accurate information and guidance tailored to your specific situation.

BACK TO CONTENTS PHOTO FROM 123RF

2023 Review thepowerisnowmeida

Scottsdale, AZ Market Update for Q3, 2023

By Yvonne McFadden

The Scottsdale, Arizona real estate market has been a focal point for homebuyers, sellers, and investors alike due to its dynamic nature and potential for growth. As we delve into the market update for the third quarter of 2023, it becomes evident that understanding the current conditions and trends is essential for making informed decisions in this thriving city

Located in the Sonoran Desert, Scottsdale has long been renowned for its beautiful landscapes, vibrant culture, and a wide range of recreational activities. Over the years, the city’s real estate market has experienced various cycles, responding to economic shifts, demographic changes, and local development initiatives.

As the third quarter of 2023 unfolds, it is essential to closely examine the latest data and trends in the Scottsdale real estate market to gain valuable insights into the opportunities and challenges it presents. Whether you are a potential buyer, seller, or investor, being up-to-date with the market conditions can significantly impact your decision-making process.

In this comprehensive market update, we will explore various aspects of the Scottsdale real estate

2023 Review thepowerisnowmeida

market during Q3, 2023. This article will offer a detailed analysis of the current economic landscape, housing market trends, inventory levels, new construction and development, the luxury real estate segment, rental market dynamics, mortgage rates, foreclosure rates, demographic and migration patterns, as well as local government policies affecting the market.

Armed with this knowledge, readers will be better equipped to navigate the complexities of the Scottsdale real estate market and make well-informed choices for their housing and investment needs. So, let’s embark on this journey to uncover the intricacies of Scottsdale’s real estate market in Q3, 2023, and gain a deeper understanding of what lies ahead.

ECONOMIC OVERVIEW

The economic conditions of a region play a significant role in shaping its real estate market. In Q3, 2023, Scottsdale, Arizona, experienced a mixture of economic indicators that influenced the buying and selling of properties in the area.

JOB MARKET

The job market in Scottsdale remained robust during the third quarter of 2023. The city continued to attract talent from various industries, including technology, healthcare, tourism, and finance. The presence of major corporations and a growing number of startups contributed to a positive employment outlook, leading to increased demand for housing.

ECONOMIC GROWTH

The city’s economy experienced steady growth during Q3, 2023. Consumer spending remained strong, and business expansions added to the overall economic vibrancy of the region. As a result, Scottsdale’s real estate market continued to be buoyant, attracting both local and out-of-

state buyers.

INFLATION AND INTEREST RATES

The national economic conditions during this period saw a fluctuating trend in inflation rates, which had a ripple effect on mortgage interest rates. Borrowers witnessed slight changes in rates, affecting their affordability and purchasing power. Real estate buyers were particularly attentive to interest rate movements as they made their home-buying decisions.

AFFORDABILITY CHALLENGES

With a robust job market and economic growth, the Scottsdale real estate market faced affordability challenges during Q3, 2023. Home prices saw a steady increase, outpacing income growth for some potential buyers. This trend contributed to a competitive market and, in some cases, led to bidding wars for desirable properties.

IMPACT OF PANDEMIC RECOVERY

The recovery from the COVID-19 pandemic continued to influence the real estate market in Q3, 2023. As vaccination rates increased and restrictions eased, more buyers reentered the market, seeking larger homes or properties with amenities that cater to remote work or homebased lifestyles.

IMPACT OF TOURISM

Scottsdale’s reputation as a tourist destination played a role in shaping the real estate market. The city’s attractions and events attracted visitors and potential investors, impacting short-term rentals and vacation home demand.

IMPACT OF GOVERNMENT STIMULUS

BACK TO CONTENTS

PHOTO FROM 123RF 2023 Review thepowerisnowmeida

The effects of government stimulus packages, introduced in response to the pandemic, were still evident in the market during Q3, 2023. Some buyers and sellers benefited from financial assistance, influencing their decision to enter the market or upgrade their homes.

Understanding the economic landscape of Scottsdale, AZ, during Q3, 2023, is crucial for comprehending the driving forces behind the real estate market’s performance. As we move forward in this market update, we will

`delve deeper into the specific housing market trends and inventory levels, providing a more comprehensive picture of Scottsdale’s real estate climate in the third quarter of 2023.

Housing Market Trends

The housing market in Scottsdale, AZ, experienced notable trends and changes during the third quarter of 2023. These developments shaped the dynamics of buying and selling properties, and understanding these trends is essential for anyone involved in the real estate market.

●Residential Property Sales: During Q3, 2023, residential property sales in Scottsdale remained robust. The demand for homes continued to outpace supply, leading to a competitive seller’s market. Multiple offers on desirable properties were a common occurrence, resulting in swift sales and, in some cases, bidding wars.

●Price Trends: Scottsdale witnessed steady price appreciation in residential properties during the third quarter. The combination of strong demand and limited inventory contributed to rising home prices. Certain neighborhoods and property types experienced more significant price growth than others, creating micro-markets within the city.

●Shift in Buyer Preferences: The preferences of homebuyers shifted during this period, influenced by changes in lifestyle, work patterns, and

the availability of amenities. Buyers showed increased interest in properties with larger living spaces, home offices, outdoor living areas, and proximity to parks and recreational facilities.

●Seller’s Market Dynamics: Q3, 2023, continued to be a seller’s market in Scottsdale, with low inventory levels and high buyer demand. This trend favored sellers, allowing them to receive competitive offers and, in some cases, sell their properties above the asking price.

●Inventory Challenges: The city faced a persistent challenge of low housing inventory during this quarter. The supply of available homes struggled to keep up with the growing demand, leading to a limited selection for buyers. New construction projects aimed to address the inventory issue, but it takes time for these developments to meet market demands.

●Buyer Competition and Quick Sales: As a result of limited inventory and high demand, buyers faced fierce competition, especially for wellpriced and desirable properties. Quick sales were common, with properties often spending fewer days on the market compared to previous years.

●Impact of Remote Work: The prevalence of remote work continued to influence the housing market in Q3, 2023. Homebuyers sought properties that catered to their remote work needs, such as dedicated office spaces or proximity to co-working spaces.

●Migration Trends: Scottsdale experienced migration trends from various parts of the country during this period. The city’s appeal as a desirable place to live, coupled with its strong job market, attracted newcomers seeking a change in scenery and lifestyle.

●Impact of Short-Term Rentals: The popularity of short-term rentals, facilitated by platforms like Airbnb, had an impact on the housing market in certain neighborhoods. Some property owners

2023 Review thepowerisnowmeida

and investors capitalized on the tourism influx, leading to fluctuations in rental housing availability. The housing market trends observed in Scottsdale, AZ, during Q3, 2023, provided a glimpse of the city’s real estate landscape’s evolving nature. As we move forward in this market update, we will examine the inventory levels, new construction and development projects, and the performance of the luxury real estate segment, shedding further light on the overall market conditions in Scottsdale during this quarter.

INVENTORY LEVELS AND NEW CONSTRUCTION

During the third quarter of 2023, the real estate market in Scottsdale, AZ, faced significant challenges related to housing inventory. The limited supply of available properties continued to impact the dynamics of the market. Additionally, new construction and development projects played a crucial role in addressing the inventory issue and shaping the city’s future real estate landscape.

1.INVENTORY LEVELS AND DEMANDSUPPLY IMBALANCE:

Scottsdale experienced a persistent shortage of housing inventory during Q3, 2023. The demand for homes remained high, driven by a combination of factors such as a strong job market, lifestyle preferences, and low-interest rates. However, the available housing stock struggled to keep up with the rising demand, leading to a supply-demand imbalance.

2.IMPACT ON HOME PRICES:

The scarcity of available properties had a direct impact on home prices. With limited choices for buyers, sellers held a position of strength, leading to competitive bidding and higher selling prices. This price appreciation, while beneficial for sellers, added to the affordability challenges for some potential buyers.

3.NEW CONSTRUCTION PROJECTS AND DEVELOPMENTS:

To address the housing shortage, Scottsdale saw a surge in new construction and development projects during Q3, 2023. Builders and developers seized the opportunity to meet the demand for housing by introducing new residential communities and housing options.

4.EMERGING NEIGHBORHOODS:

The influx of new construction projects also led to the emergence of previously underdeveloped or overlooked neighborhoods. As construction expanded into these areas, buyers and investors showed increased interest, leading to revitalization and growth in these pockets of the city.

5.HOUSING TYPE DIVERSITY:

The new construction projects in Scottsdale aimed to cater to the diverse needs of the market. Buyers had access to a variety of housing types, including single-family homes, townhouses, condos, and apartments. This diversity allowed individuals to choose properties that aligned with their lifestyle and preferences.

6.IMPACT ON LOCAL ECONOMY:

The increase in new construction and development projects had a positive impact on the local economy. Construction activities generated employment opportunities, contributed to the growth of related industries, and boosted tax revenues for the city.

7.AFFORDABILITY CONSIDERATIONS:

While new construction projects expanded housing options, affordability remained a significant consideration for buyers. The pricing of new properties could vary widely based on location, amenities, and property type. Affordable housing initiatives aimed to address the needs of

BACK TO CONTENTS

2023 Review thepowerisnowmeida

income segments of the population.

8.FUTURE MARKET OUTLOOK:

The new construction projects initiated during Q3, 2023, are expected to influence the housing market beyond the quarter. As these developments reach completion and become available for purchase, they are likely to contribute to the overall inventory levels and potentially impact price dynamics in different neighborhoods.

In conclusion, the shortage of housing inventory in Scottsdale, AZ, during the third quarter of 2023, posed challenges to buyers and contributed to price appreciation. However, the surge in new construction and development projects offered hope for addressing the supplydemand imbalance and shaping the city’s real estate landscape for the future. As we proceed in this market update, we will explore the performance of the luxury real estate segment and analyze the rental market dynamics in Scottsdale during Q3, 2023.

LUXURY REAL ESTATE SEGMENT

During the third quarter of 2023, the luxury real estate segment in Scottsdale, AZ, experienced its own set of trends and dynamics. This highend market was influenced by various factors, including economic conditions, demand from affluent buyers, and lifestyle preferences.

1.STRONG DEMAND FOR LUXURY PROPERTIES:

The luxury real estate segment in Scottsdale continued to see strong demand during Q3, 2023. Affluent buyers, both local and from out of state, were attracted to the city’s luxurious lifestyle, upscale amenities, and exclusive neighborhoods.

2.PRICE APPRECIATION IN LUXURY PROPERTIES:

The demand for luxury properties, coupled with limited inventory in this segment, led to price appreciation. High-end homes and estates experienced notable price gains compared to previous quarters, making luxury real estate a lucrative investment opportunity for sellers.

3.HIGH-END AMENITIES AND FEATURES:

Luxury properties in Scottsdale offered an array of high-end amenities and features designed to cater to discerning buyers. Features such as state-of-the-art smart home technology, lavish outdoor spaces, resort-style pools, and premium finishes were in high demand among luxury buyers.

4.INFLUENCE OF INTERNATIONAL BUYERS:

Scottsdale’s luxury real estate market continued to attract interest from internativonal buyers, particularly from Canada, Europe, and Asia. These buyers sought exclusive properties for vacation homes, investment purposes, or to establish a primary residence in the United States.

5.IMPACT OF LUXURY RESORT COMMUNITIES:

Scottsdale’s luxury resort communities remained popular among affluent buyers. These exclusive gated communities offered a combination of luxury living, privacy, and access to world-class amenities, such as golf courses, spas, and upscale dining.

6.INTEGRATION OF SUSTAINABILITY:

The luxury real estate market in Scottsdale witnessed an increasing focus on sustainability and eco-friendly features. Buyers were interested in properties designed with energy-efficient systems, eco-conscious construction materials, and sustainable landscaping.

7.FUTURE PROSPECTS:

certain

2023 Review thepowerisnowmeida

The luxury real estate segment in Scottsdale is anticipated to remain vibrant beyond Q3, 2023. As demand from high-net-worth individuals continues to grow, the luxury market is likely to evolve, presenting opportunities for buyers, sellers, and investors.

RENTAL MARKET ANALYSIS

In addition to the residential sales market, the rental market in Scottsdale, AZ, experienced its own set of dynamics during the third quarter of 2023. Rental trends were influenced by factors such as population growth, demand from remote workers, and the popularity of short-term rentals.

RENTAL DEMAND AND VACANCY RATES:

The rental market in Scottsdale witnessed steady demand in Q3, 2023. The city’s appeal as a desirable place to live and work attracted renters seeking flexibility and convenience. As a result, rental vacancy rates remained relatively low during this period.

REMOTE WORK IMPACT:

The prevalence of remote work arrangements continued to impact the rental market. Some renters sought properties that provided comfortable home office spaces, reliable internet connectivity, and proximity to co-working spaces or coffee shops with Wi-Fi.

SHORT-TERM RENTAL ACTIVITY:

The popularity of short-term rentals remained a significant factor in the rental market. Properties listed on platforms like Airbnb and VRBO attracted visitors and provided additional income opportunities for property owners. However, this trend also raised concerns about housing availability in certain neighborhoods.

AFFORDABILITY CONCERNS:

Rental affordability remained a challenge for some renters in Scottsdale, particularly in desirable neighborhoods or areas close to major employment centers. Limited inventory and strong demand contributed to rental price increases.

RENTAL REGULATIONS AND POLICIES:

Local government policies continued to evolve to address the impact of short-term rentals on the

BACK TO CONTENTS

2023 Review thepowerisnowmeida

housing market. Certain regulations were put in place to strike a balance between supporting the tourism industry and ensuring the availability of long-term housing options for residents.

SUBURBAN RENTAL DEMAND:

The suburbs surrounding Scottsdale experienced increased rental demand as some renters sought more spacious and affordable options outside the city center. Suburban neighborhoods with good connectivity to amenities and employment centers were particularly sought after.

FUTURE OUTLOOK:

The rental market in Scottsdale is expected to adapt to changing economic conditions and housing demands. The interplay between longterm rentals, short-term rentals, and remote work trends will continue to shape the rental landscape beyond Q3, 2023.

As we continue with this market update, we will explore the current mortgage market conditions, foreclosure rates, and demographic and migration patterns in Scottsdale during the third quarter of 2023.

INTEREST RATES AND MORTGAGE MARKET

During the third quarter of 2023, the Scottsdale real estate market was influenced by prevailing interest rates and conditions in the mortgage market. These factors played a crucial role in determining affordability and the overall demand for residential properties.

As the Federal Reserve continued to monitor economic indicators, interest rates experienced slight fluctuations during Q3, 2023. Borrowers in Scottsdale kept a close eye on these movements, knowing that even a small change in rates could significantly impact their purchasing power. Those

considering buying or refinancing properties were eager to lock in favorable rates, while some potential buyers monitored rate changes to time their entry into the market.

With mortgage rates remaining relatively low compared to historical averages, buyers found opportunities to secure affordable financing options. The low-interest-rate environment incentivized potential homebuyers to take advantage of favorable conditions and enter the market, contributing to the demand for housing in the city.

The favorable interest rates also played a role in boosting refinancing activity during Q3, 2023. Homeowners with existing mortgages sought to capitalize on lower rates by refinancing their loans, reducing monthly payments, or accessing home equity for other financial needs.

While the low-interest-rate environment had positive implications for buyers and homeowners, it also contributed to the competitive nature of the Scottsdale real estate market. Increased demand, combined with limited inventory, heightened competition among buyers, resulting in multiple offers on desirable properties and faster sales.

As we move forward, it’s essential for market participants to stay attentive to any changes in interest rates and mortgage market conditions, as they can influence the dynamics of the Scottsdale real estate market in the future.

FORECLOSURE AND DELINQUENCY RATES

Throughout Q3, 2023, the foreclosure and delinquency rates in Scottsdale played a vital role in shaping the real estate market’s stability and investor sentiment. Fortunately, the city continued to experience a low foreclosure rate, indicating the resilience of the local housing market.

The real estate market’s overall health and

2023 Review thepowerisnowmeida

strength of the local economy contributed to keeping foreclosure rates in check. With a strong job market and steady economic growth, homeowners were more likely to maintain their mortgage payments and avoid delinquencies. Additionally, the availability of various relief programs during and after the COVID-19 pandemic assisted struggling homeowners in keeping up with their mortgage obligations.

Furthermore, the state of Arizona’s foreclosure process and regulations influenced the pace and impact of foreclosures. The relatively non-judicial foreclosure process in the state allowed for quicker resolutions in cases of mortgage default, contributing to the stability of the market.

It’s worth noting that investors closely monitored foreclosure and delinquency rates, as they provided insights into the overall health of the real estate market and potential opportunities. A low foreclosure rate and minimal delinquencies were positive indicators of the market’s strength and attractiveness for long-term investment.

As we proceed with this market update, we will explore the demographic and migration patterns in Scottsdale during Q3, 2023, providing further context on the city’s real estate landscape and population trends.

DEMOGRAPHIC AND MIGRATION PATTERNS

The demographic and migration patterns in Scottsdale, AZ, during the third quarter of 2023 had a significant impact on the city’s real estate market. Various factors, including population growth, age demographics, and migration trends, shaped the demand for housing and the overall dynamics of the housing market.

1.POPULATION GROWTH:

Scottsdale continued to experience population growth during Q3, 2023. The city’s appeal

as a desirable destination for residents from across the United States and internationally contributed to its expanding population. The influx of new residents, especially in the workingage demographic, drove housing demand and increased competition for available properties.

2.AGE DEMOGRAPHICS:

The age demographics of Scottsdale’s population played a role in shaping housing preferences and demand. The city saw a diverse range of age groups, from young professionals seeking urban living to retirees seeking a leisurely lifestyle in active adult communities. Builders and developers responded to these preferences by offering housing options that catered to different age groups.

3.DOMESTIC MIGRATION:

Domestic migration trends also impacted Scottsdale’s real estate market. Residents from various states, particularly high-tax states or regions with harsh weather conditions, chose to relocate to Scottsdale for its favorable climate, job opportunities, and quality of life. This influx of domestic migrants contributed to increased demand for housing.

4.INTERNATIONAL MIGRATION:

Scottsdale’s popularity as a tourist destination and a desirable place to live attracted international migrants as well. International buyers, including retirees and investors, sought to establish a presence in the city. The influx of international migrants added diversity to the housing market and brought in new investment opportunities.

5.IMPACT ON NEIGHBORHOODS:

The population growth and migration trends had varying effects on different neighborhoods within Scottsdale. Some areas experienced rapid development and revitalization,

BACK TO CONTENTS

2023 Review thepowerisnowmeida

attracting younger residents and families. Meanwhile, established neighborhoods with amenities tailored to retirees continued to be sought-after destinations for older adults.

6.INFRASTRUCTURE AND URBAN DEVELOPMENT:

The demographic and migration patterns also influenced infrastructure and urban development in the city. Local authorities and developers worked to improve transportation systems, enhance public amenities, and create mixed-use developments that catered to the evolving needs of the growing population.

Understanding the demographic and migration patterns in Scottsdale during Q3, 2023, provided crucial insights into the demand for housing and the overall growth trajectory of the city. As we proceed with this market update, we will explore any relevant local government policies that affected the real estate market during this period, shedding light on the regulatory landscape that shapes housing trends in Scottsdale .

LOCAL GOVERNMENT POLICIES

During the third quarter of 2023, local government policies in Scottsdale, AZ, had a significant impact on the city’s real estate market. Various initiatives and regulations aimed to address housing challenges, promote sustainable development, and strike a balance between growth and preservation of the city’s unique character.

AFFORDABLE HOUSING INITIATIVES:

Scottsdale’s local government continued to focus on affordable housing initiatives to address the housing affordability challenges faced by some residents. Programs and incentives were introduced to encourage developers to include affordable housing units in their projects, ensuring that a diverse range of housing options was available for the city’s workforce.

ZONING AND URBAN PLANNING:

Zoning regulations and urban planning policies played a pivotal role in shaping the city’s physical development during Q3, 2023. Local authorities carefully considered zoning designations, land use policies, and density regulations to manage growth while preserving the city’s natural beauty and maintaining neighborhood character.

SHORT-TERM RENTAL REGULATIONS:

The rise in short-term rentals, facilitated by platforms like Airbnb, led to discussions and policy considerations to balance the interests of property owners, visitors, and permanent residents. Local government sought to implement regulations that addressed the impact of shortterm rentals on housing availability, neighborhood character, and quality of life for residents.

GREEN BUILDING AND SUSTAINABILITY:

Scottsdale continued its commitment to sustainability and green building practices. Local policies encouraged developers and homeowners to adopt eco-friendly construction methods, energy-efficient systems, and sustainable landscaping. These initiatives aligned with the city’s goal of promoting environmental conservation and reducing carbon footprints.

INFRASTRUCTURE INVESTMENTS:

During Q3, 2023, local government allocated resources to infrastructure investments that supported the city’s growth and enhanced residents’ quality of life. Improvements in transportation networks, public amenities, and essential utilities contributed to the attractiveness of certain neighborhoods for homebuyers and

2023 Review thepowerisnowmeida

GROWTH MANAGEMENT:

The city’s growth management policies aimed to strike a balance between encouraging development and preserving open spaces and natural areas. By managing growth strategically, local authorities sought to maintain Scottsdale’s unique character while accommodating the needs of a growing population.

IMPACT ON DEVELOPMENT PROJECTS:

Local government policies directly influenced new construction and development projects in the city. Developers had to navigate zoning regulations, design guidelines, and compliance requirements to ensure that their projects aligned with the city’s vision for sustainable and responsible development.

Understanding the local government policies in Scottsdale during Q3, 2023, provided critical insights into the regulatory landscape that shapes the real estate market. As we conclude this market update, it is evident that a combination of economic conditions, housing market trends, demographic patterns, and government policies contributed to the dynamic and evolving nature of Scottsdale’s real estate market during this period

CONCLUSION

In the third quarter of 2023, the Scottsdale, Arizona real estate market displayed a dynamic and resilient nature, reflecting the city’s appeal as a sought-after destination for homebuyers, sellers, and investors. Economic growth, a strong job market, and a diverse range of housing options contributed to the city’s thriving real estate landscape.

Throughout Q3, 2023, the housing market

witnessed robust residential property sales, accompanied by steady price appreciation. Limited inventory posed challenges for some buyers, but new construction and development projects provided hope for addressing the demand-supply imbalance.

The luxury real estate segment thrived, attracting affluent buyers seeking high-end amenities and exclusive properties. Additionally, international migration and domestic relocations fueled demand and enriched the city’s cultural fabric.

The rental market experienced steady demand, influenced by remote work trends and short-term rental activity. However, affordability remained a concern in certain neighborhoods.

Low foreclosure rates and minimal delinquencies demonstrated the market’s resilience, supported by a strong local economy and proactive government relief measures.

Demographic and migration patterns influenced housing preferences and infrastructure development, while local government policies aimed to strike a balance between growth and preservation.

Favorable interest rates and mortgage market conditions enticed buyers and refinancing activities, contributing to the competitive nature of the market.

In conclusion, Scottsdale’s real estate market in Q3, 2023, showcased its vibrant and dynamic nature, driven by a combination of economic strength, demographic diversity, and visionary local policies. As the city continues to evolve, staying informed about market trends and regulatory developments will be crucial for individuals seeking to participate in Scottsdale’s exciting and promising real estate landscape. Whether one seeks a luxury property, a rental investment, or a place to call home, Scottsdale’s real estate market offers a plethora of opportunities for all types of investors and buyers.

BACK TO CONTENTS investors.

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

BACK TO CONTENTS 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

6 Financing Tips For FirstTime Home Buyers

By Yvonne McFadden

Embarking on the journey of purchasing your first home is an exhilarating and significant life milestone. It’s a decision that involves careful planning, thoughtful consideration, and a clear understanding of your financial landscape. For first-time homebuyers, the world of financing can seem like a complex puzzle with numerous pieces to assemble. That’s where this guide comes in.

BACK TO CONTENTS

2023 Review thepowerisnowmeida

In this comprehensive exploration, we will equip you with six invaluable financing tips tailored specifically to first-time home buyers. Whether you’re navigating the complexities of mortgages, working to bolster your down payment savings, or exploring loan options, these tips are designed to provide you with the guidance and knowledge necessary to navigate the path to homeownership with confidence. So, let’s embark on this financial journey together, ensuring that your first steps into homeownership are wellinformed and rewarding.

ASSESS YOUR FINANCIAL READINESS

Before diving into the home-buying process, assess your financial readiness. Review your credit report, credit score, and overall financial health. A strong credit score can open doors to favorable mortgage terms and lower interest rates. Additionally, create a budget to determine how much you can comfortably afford for monthly mortgage payments, taking into account other expenses like utilities, insurance, and property taxes.

SAVE FOR A DOWN PAYMENT

Saving for a down payment is one of the most significant financial hurdles for first-time homebuyers. While there are various loan programs that offer low down payment options, having a substantial down payment (usually 20% of the home’s purchase price) can help you secure a more competitive mortgage rate and reduce monthly payments. Consider setting up a dedicated savings account to help you reach your down payment goal faster.

EXPLORE LOAN OPTIONS

There are several mortgage loan options available to first-time homebuyers. Research

these options to find the one that best suits your financial situation. Common choices include fixed-rate mortgages (with stable monthly payments) and adjustable-rate mortgages (with initial lower rates that may adjust later). Government-backed loans, such as FHA and VA loans, offer attractive terms for those who qualify. Working with a knowledgeable mortgage broker can help you navigate the loan selection process.

GET PRE-APPROVED

Obtaining pre-approval for a mortgage is a crucial step before house hunting. Pre-approval not only gives you a clear picture of your budget but also

makes you a more attractive buyer to sellers. It demonstrates that you’re a serious buyer with the financial backing to make a purchase. Keep in mind that pre-approval doesn’t guarantee final approval, but it’s a valuable initial step in the process.

FACTOR IN CLOSING COSTS

2023 Review thepowerisnowmeida

In addition to the down payment, first-time homebuyers should budget for closing costs. These costs include fees for appraisal, inspection, title insurance, and legal services. It’s essential to have a clear understanding of these expenses upfront to avoid any financial surprises during the closing process. Your lender can provide you with a Loan Estimate detailing theexpected closing costs.

BUILD A STRONG SUPPORT TEAM

Finally, surround yourself with a team of professionals who can guide you through the home-buying and financing process. In addition to a knowledgeable real estate agent and mortgage broker, consider consulting a financial advisor or housing counselor. These experts can provide valuable insights and help you make informed decisions about your financial future.

Navigating the world of financing as a firsttime homebuyer may seem daunting, but with careful preparation and the right guidance, you can confidently take the steps towards homeownership. Remember that being financially informed and well-prepared will not only make the process smoother but also increase your chances of finding the perfect home within your budget.

CONCLUSION

Becoming a first-time homebuyer is a significant and rewarding endeavor, and these financing tips can help you embark on this journey with confidence. By assessing your financial readiness, saving diligently for a down payment, exploring various loan options, and obtaining preapproval, you’re setting yourself up for success.

Additionally, understanding and budgeting for closing costs, as well as building a strong support team, will ensure a smoother path to homeownership. Remember that while the

process may seem complex, you’re not alone— rely on the expertise of professionals and advisors to guide you.

Ultimately, the key to successful financing as a first-time homebuyer is careful planning, thorough research, and staying informed throughout the process. With these tips in mind, you’ll be wellprepared to make one of the most important financial decisions of your life and find the perfect home that fits your budget and your dreams.

BACK TO CONTENTS

2023 Review thepowerisnowmeida

How to Sell an Inherited House in Arizona Stress-free

By Yvonne McFadden

Inheriting a property in Arizona can be a mixed blessing. While it’s undoubtedly an asset, the process of selling an inherited house often comes with its fair share of challenges, decisions, and emotions. Whether you’ve recently acquired a family property or have been tasked with managing the sale of an inherited home, the journey can seem daunting. Fortunately, with the right knowledge, planning, and guidance, selling an inherited house in Arizona can be a manageable

2023 Review thepowerisnowmeida

and even stress-free process. This blog is your comprehensive guide to navigating the sale of an inherited property in the Grand Canyon State with ease. From understanding the unique considerations of selling inherited real estate to exploring the options available to you, we’ll take you through the steps necessary to ensure a successful and stress-free transaction. Whether you’re a firsttime inheritor or simply seeking clarity on the process, this guide will help you make informed decisions and turn a potentially challenging situation into a smooth and rewarding experience.

UNDERSTANDING THE INHERITED PROPERTY: INITIAL STEPS AND CONSIDERATIONS

Inheriting a house in Arizona is a significant event, and the first step toward a stress-free sale begins with understanding the property you’ve acquired. Whether the house has been in the family for generations or it’s a relatively new addition, a few key initial considerations will set the foundation for a smooth sales process.

First and foremost, it’s essential to assess the property’s condition. Inherited homes can vary widely, from well-maintained residences to properties in need of repair. Conducting a thorough inspection will help you gauge the house’s current state and determine if any essential repairs or updates are necessary before listing it for sale. Additionally, you should verify the property’s title and ownership, ensuring that all legal aspects are in order. Consulting with a real estate attorney can provide valuable insights into potential title issues, liens, or any inherited debts associated with the property. This initial due diligence is critical for a seamless sale and helps avoid any unexpected complications further down the road.

LEGAL AND TAX IMPLICATIONS: NAVIGATING INHERITANCE LAWS IN ARIZONA

Inheriting a property often comes with legal and tax considerations, and these implications can vary from state to state. In Arizona, understanding the state’s inheritance laws is crucial to ensure a stress-free sale of an inherited house.

One of the key aspects to be aware of is the Arizona estate tax, which is separate from the federal estate tax. As of my last knowledge update in September 2021, Arizona did not impose an estate tax, but it’s essential to check for any updates or changes in the state’s tax laws, as they can influence the overall financial picture of the inheritance. Additionally, Arizona does not have an inheritance tax, which means beneficiaries typically do not owe taxes on their inheritance. However, federal inheritance tax laws may still apply, especially for high-value estates. It’s advisable to consult with a qualified tax professional or attorney to ensure that you comply with all tax regulations and to clarify any potential obligations that may affect the inheritance.

SELLING OPTIONS: EXPLORING THE BEST APPROACH FOR YOUR INHERITED HOUSE

Once you’ve completed the necessary initial steps and have a solid understanding of the legal and tax implications, it’s time to delve into your options for selling the inherited house in Arizona. Depending on your unique circumstances, you have several approaches to consider:

●TRADITIONAL LISTING:

One of the most common routes is to list the property on the open market through a real estate agent. This approach allows you to reach a wide pool of potential buyers. However, it also involves costs like agent commissions and potential

BACK TO CONTENTS

PHOTO FROM 123RF 2023 Review thepowerisnowmeida

repairs or renovations to make the house marketready.

●CASH BUYER OR INVESTOR:

Selling to a cash buyer or real estate investor is often a quicker and more straightforward option. These buyers typically purchase properties asis, sparing you from the expenses and hassles of preparing the house for a traditional sale. While the sale price might be lower than what you’d receive on the open market, the speed and convenience can outweigh this drawback.

●RENTING

THE PROPERTY:

If you’re not in a rush to sell, renting out the inherited house can be a financially beneficial option. It generates rental income and can provide time for the real estate market to improve before selling. However, becoming a landlord comes with responsibilities and potential challenges.

●FAMILY

AGREEMENT:

In some cases, family members may decide to keep the inherited property. This can be a sentimental choice, or it might make sense as an investment or vacation property. However, it’s essential to have clear agreements and understand the financial responsibilities of maintaining the property.

●DONATION:

Another option is donating the inherited property to a charitable organization. This choice can offer tax benefits and align with philanthropic goals. Selecting the best approach for your inherited house depends on factors like your financial needs, the property’s condition, and your timeline for the sale. It’s advisable to consult with a real estate professional who specializes in the Arizona market to help you make an informed decision tailored to your situation.

PRACTICAL TIPS FOR A STRESSFREE SALE

A stress-free sale of your inherited house in Arizona hinges on careful planning and execution. Here are some practical tips to help you navigate the process smoothly:

●PROPERTY PREPARATION:

Before listing the property or showing it to potential buyers, consider investing in necessary repairs or cosmetic updates. This can significantly improve the property’s appeal and value. Decluttering, deep cleaning, and staging can also help create a positive first impression.

●PRICING STRATEGY:

Work with a real estate agent or appraiser to determine the property’s market value. Pricing it right from the start is crucial, as an overpriced house may linger on the market, while underpricing can result in missed opportunities. Your agent can also provide insight into current market conditions in Arizona.

●LEGAL AND FINANCIAL GUIDANCE:

Throughout the selling process, maintain open communication with a real estate attorney or tax professional. They can provide guidance on navigating any legal or tax complexities, ensuring a smooth and compliant transaction.

●MARKETING AND PROMOTION:

Leverage various marketing channels to reach potential buyers. Online listings, professional photography, and open houses can boost visibility. Be transparent about the property’s history as an inherited house, as this can add a unique selling point.

●NEGOTIATION AND CLOSING:

When offers come in, be prepared for negotiation. A seasoned real estate agent can advocate for your interests and help secure the best deal. Once an offer is accepted, ensure all closing procedures and paperwork are handled efficiently.

By following these practical steps and enlisting the assistance of experienced real estate professionals, you can streamline the process of

2023 Review thepowerisnowmeida

selling an inherited house in Arizona. With the right approach and guidance, you can turn a potentially complex situation into a stress-free and successful real estate transaction.

Conclusion

Selling an inherited house in Arizona can be a journey filled with complexities, emotions, and decisions. However, by understanding the initial steps and legal considerations, exploring your selling options, and embracing practical tips for a seamless sale, you can transform this process into a stress-free and rewarding experience.

It’s important to remember that every inherited property is unique, and the path you choose should align with your specific circumstances and goals. Whether you opt for a traditional listing, explore cash buyers and investors, rent the property, reach a family agreement, or even consider donation, the key is to make informed decisions that best suit your needs and the property’s condition.

Throughout the process, enlisting the support of professionals, such as real estate agents, attorneys, and tax advisors, can provide the guidance necessary to navigate potential legal and financial complexities. By following

BACK TO CONTENTS

2023 Review thepowerisnowmeida

8 Psychological Traps in Home Buying and How to Avoid Them

By Yvonne McFadden

The journey of buying a home is an emotional rollercoaster filled with excitement, anticipation, and a touch of anxiety. In the midst of this significant life decision, it’s easy to fall into psychological traps that can cloud judgment and lead to regrettable choices. In this article, we’ll explore eight common psychological traps in home buying and provide insights on how to navigate them successfully. Understanding these pitfalls is the first step towards making a confident

2023 Review thepowerisnowmeida

and rational decision in what is often one of life’s most substantial investments.

1.EMOTIONAL ATTACHMENT TO A PROPERTY:

It’s not uncommon to walk into a home and instantly feel a connection. While emotional resonance is essential, it’s crucial to balance that with a pragmatic assessment. Avoid fixating on aesthetics alone; consider practical aspects like location, future resale value, and whether the property aligns with your long-term goals.

2.FEAR OF MISSING OUT (FOMO):

The fear of missing out can be a powerful force, especially in a competitive real estate market. Combat FOMO by setting clear priorities and criteria for your ideal home. Remember that new opportunities will arise, and rushing into a decision can lead to regrets. Be patient, and trust that the right property will come along.

3.ANCHORING TO THE LISTING

PRICE:

Anchoring occurs when the initial listing price influences your perception of a property’s value. Counteract this by conducting thorough market research and considering recent comparable sales. Don’t be afraid to negotiate based on the property’s actual worth rather than being anchored to the initial asking price.

4.OVERESTIMATING FUTURE PROPERTY VALUE:

While optimism is valuable, overestimating future property value can lead to financial missteps. Base your expectations on realistic market trends, historical data, and the property’s unique attributes. Consult with real estate professionals to gain a nuanced understanding of potential appreciation.

5.DECISION FATIGUE:

The home-buying process involves numerous

decisions, from choosing a neighborhood to negotiating terms. Combat decision fatigue by breaking the process into manageable steps. Prioritize decisions, take breaks when needed, and seek advice from professionals to alleviate the burden of constant decision-making.

6.IGNORING RED FLAGS:

Emotional investment in a property may blind you to potential red flags. Approach the home inspection with a critical eye, and don’t ignore signs of structural issues, water damage, or other significant concerns. Acknowledge potential problems early on to make informed decisions about the property.

7.COMPARING TO OTHERS:

Every home-buying journey is unique, and comparing yours to others can lead to unnecessary stress. Focus on your specific needs, budget, and priorities. Avoid making decisions based on others’ timelines or preferences, as this can detract from finding the home that genuinely suits your lifestyle.

8.TIMING THE MARKET:

Attempting to time the market perfectly is a challenging feat. Instead of waiting for the “perfect” time, focus on finding a property that aligns with your needs and financial capacity. The right home is more important than trying to predict market fluctuations, which can be unpredictable and influenced by various factors beyond your control.

Navigating these psychological traps requires a balanced approach and a willingness to step back and assess decisions objectively. Remember that the home-buying process is a journey, and each step contributes to the overall success of your investment. Consult with experienced real estate professionals, trust your instincts, and approach the process with a well-informed and rational mindset.

BACK TO CONTENTS

PHOTO FROM 123RF 2023 Review thepowerisnowmeida

CONCLUSION

In the intricate world of real estate, the psychological traps inherent in the buying and selling process are both common and consequential. By acknowledging and understanding these traps, you empower yourself to make decisions that align with your goals and avoid potential pitfalls. The journey to homeownership or property sale is not just about finding a space; it’s about making a wise and fulfilling investment. As you navigate the nuanced landscape of real estate, remember that knowledge, patience, and a clear mindset are your most potent tools.

Are you ready to embark on your real estate journey in Scottsdale, Arizona, with confidence and expert guidance? Whether you’re a buyer searching for your dream home or a seller aiming to maximize the value of your property, Yvonne McFadden is here to be your trusted partner.

Contact Yvonne McFadden for Expert Real Estate Assistance!

Yvonne brings a wealth of local market knowledge, a commitment to client satisfaction, and a passion for helping individuals achieve their real estate goals. If you’re in Scottsdale and seeking personalized assistance in buying or selling real estate, Yvonne McFadden is the professional you can rely on.

Your real estate aspirations deserve the attention of a dedicated and experienced professional. Contact Yvonne McFadden today, and let’s turn your real estate dreams into reality. Whether you’re buying, selling, or investing, Yvonne is here to guide you through every step of the process in the vibrant real estate market of Scottsdale, Arizona.

2023 Review thepowerisnowmeida

BACK TO CONTENTS JANUARY FEBRUARY MARCH APRIL MAY JUNE JULY AUGUST SEPEMBER OCTOBER NOVEMBER DECEMBER 2023 Review thepowerisnowmeida

of Contents 2023 Review thepowerisnowmeida

Back

to Table

2023 Review thepowerisnowmeida

Back

to Table of Contents

2023 Review thepowerisnowmeida

Back to Table of Contents 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

Back to Table of Contents

2023 Review thepowerisnowmeida

Back

to Table of Contents

Back

2023 Review thepowerisnowmeida

to Table of Contents

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

Back to Table of Contents

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

Back to Table of Contents

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

Back to Table of Contents

2023 Review thepowerisnowmeida

Back to Table of Contents

Table of Contents 2023 Review thepowerisnowmeida

Back

to

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

Back

BACK TO CONTENTS

2023 Review thepowerisnowmeida

to Table of Contents

2023 Review thepowerisnowmeida

BACK TO CONTENTS

2023 Review thepowerisnowmeida

Back to Table of Contents

2023 Review thepowerisnowmeida

Back to Table of Contents

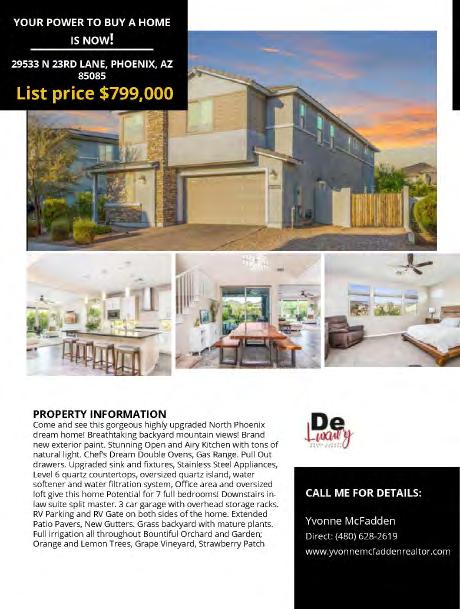

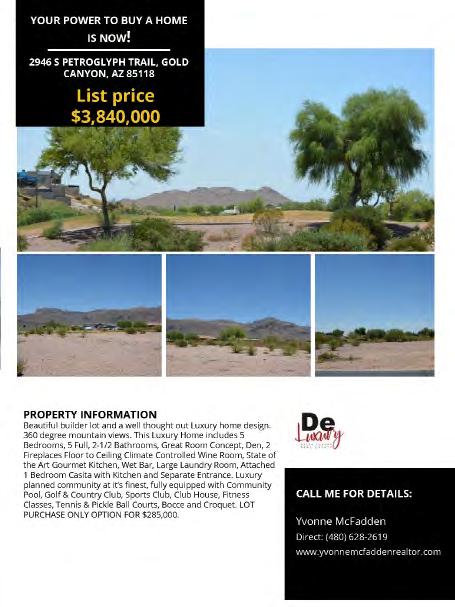

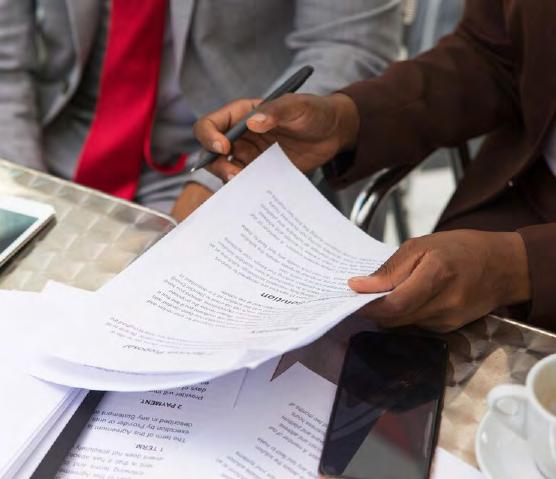

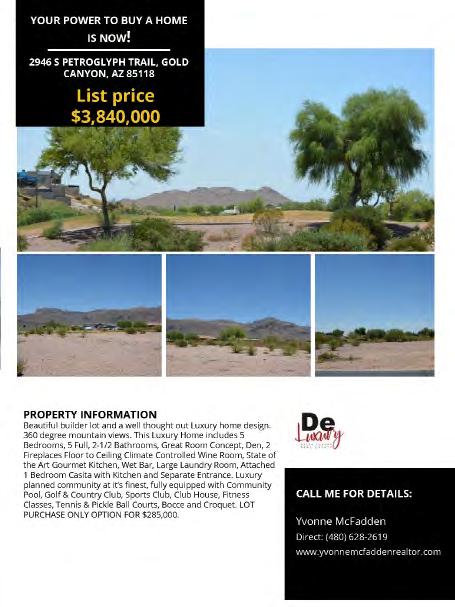

PROPERTY INFORMATION

Located in the exclusive Monterey at Mountain View community, this beautiful home is bright, and light filled, with a great floor plan, high ceilings, and spacious rooms. The kitchen area, living room, and primary bedroom open to a delightfully peaceful pool and garden area that combines desert landscaping with a lush Mediterranean feel. The kitchen includes quartz countertops, and SubZero and Miele appliances. The primary bedroom and office are on the main floor with a loft area & two guest bedrooms upstairs. Marble flooring throughout the home together with exquisite carpeting adds to the elegant setting. European marble in vanities and showers and backsplash in the kitchen is stunning. The 3 car garage with new flooring, and storage cabinets galore will most certainly impress. A community pool and tennis court are just steps away. The community is only minutes from Scottsdale’s “World Famous Shopping” and excellent fine dining restaurants.

BACK TO CONTENTS YOUR POWER TO BUY A HOME IS NOW! 7311 E VIA ESTRELLA AVENUE SCOTTSDALE,

AZ 85258

CALL ME FOR DETAILS: Yvonne McFadden Direct: (480) 628-2619 www.yvonnemcfaddenrealtor.com List price

2023 Review thepowerisnowmeida

$1,925,000

Back

PROPERTY INFORMATION

Welcome to the enclave of Arcadia Lite! This immaculate residence boasts an array of finishes that epitomize luxury. At every corner, a sense of opulence greets you, making this property truly exceptional. Boasting the rare configuration of 4 bedrooms and 4 bathrooms, this home is a testament to Arizona living. Step into a welcoming expanse where an open and inviting kitchen seamlessly merges with the living space. The charm of granite and wood flooring graces each step you take. The master suite, a sprawling haven, features a walk-in closet and an oversized glass shower, offering a true retreat. Thoughtful design is evident throughout, with two additional bedrooms accompanied by private bathrooms, while a generously sized guest bath indulges with its tub. The sleek and sophisticated stone and tile finishes adorn the home with an air of elegance. Your private sanctuary awaits in the backyard, primed for entertaining.

YOUR POWER TO BUY A HOME IS NOW! 3417 E AMELIA AVENUE, PHOENIX, AZ 85018 List price $1,199,999

CALL ME FOR DETAILS: Yvonne McFadden Direct: (480) 628-2619 www.yvonnemcfaddenrealtor.com

2023 Review thepowerisnowmeida

to Table of Contents

Fully

throughout. In addition, private front and back patio and low maintenance landscaping.

BACK TO CONTENTS 6147 E LEWIS AVENUE, SCOTTSDALE, AZ 85257 TYPE CONDO LIST PRICE $629,900 CALL ME FOR DETAILS Yvonne McFadden Direct: (480) 628-2619 www.yvonnemcfaddenrealtor.com PROPERTY INFORMATION:

remodeled

concept

kitchen

appliances.

Back to Table of Contents 2023 Review thepowerisnowmeida

townhome featuring open

living with natural light. Brand new

with quartz counter tops, tiled backsplash, and new

The primary bedroom is spacious with walk in closet, brand new vanity, shower, and stand alone tub. Guest bath is fully remodeled w new shower vanity. Brand new waterproof viny laminate flooring

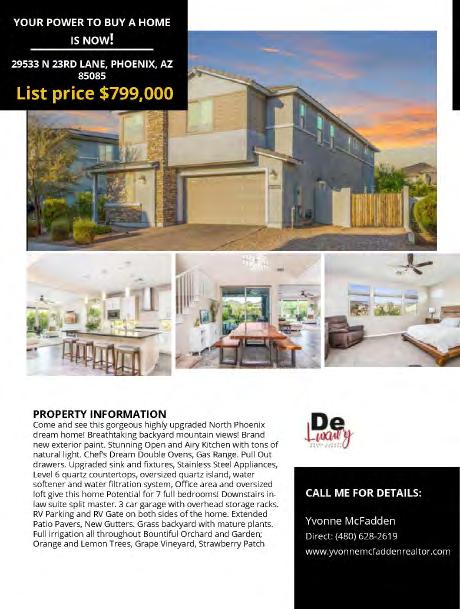

PROPERTY INFORMATION

Spectacular laser cut gate invites you to a newly repainted log lodge horse property with covered decks/patio on front and back of home. Beautiful great room with large windows open to the back yard and pellet stove in great room with newly remodeled kitchen with quartz counter tops and all stainless appliances. Large main floor master bedroom with dressing room and tub. Separate attached guest quarters on main level with bedroom, full bath, kitchen and great room. Two additional bedrooms on upper level with open shared sitting area. New garage doors on home and barn (with bonus room) and new owned 22 panel solar system. The property has a separate area with a 3 stall horse barn, corrals, and mare hotel. A new tuff shed for those tools and gardening supplies The entire property is fenced for privacy. The lot is one of few that is level and tall Pine trees add to a perfect setting.

BUY

YOUR POWER TO

A HOME IS NOW! 5663 E HORSESHOE WAY PINE, AZ 85544

CALL ME FOR DETAILS: Yvonne McFadden Direct: (480) 628-2619 www.yvonnemcfaddenrealtor.com

2023 Review thepowerisnowmeida

List Price $969,000

PROPERTY INFORMATION

This spectacular ‘’Custom’’ Log Home with abundant natural light overlooks the par 4,11th fairway. The .44 acre cul-de-sac lot provides an ideal setting. The floor plan is warm and cozy with the kitchen, dining and family room open and combined. The upgrades are exceptional with light stone countertops, beautiful wood flooring, knotty pine cabinets and a vaulted wood ceiling. The spacious primary suite is on the main level including a terrific master bath and two closets. There are 3 large bedrooms and an entertainment room downstairs. Exterior decks, water heater, TV’s & audio system are brand new! The back deck provides a peaceful setting amidst several towering Ponderosa Pine trees. The home feels like a true sanctuary. A turn-key home. ALL FURNITURE IS INCLUDED Less the Artwork.

BACK TO CONTENTSwww.yvonnemcfaddenrealtor.com

CALL ME FOR DETAILS: Yvonne McFadden Direct: (480) 628-2619 www.yvonnemcfaddenrealtor.com

to Table of Contents YOUR POWER TO BUY A HOME IS NOW! 2403 E GRAPEVINE DRIVE PAYSON, AZ 85541 List price $2,000,000 2023 Review thepowerisnowmeida

Back

2023 Review thepowerisnowmeida

Back

PROPERTY INFORMATION

Welcome to THE HERITAGE HOUSE located in the very private North Ranch neighborhood within the magic zip code of 85254. Midbar Development has carefully rebuilt the entire home from the studs-out and even more impressive was the remodel to allow better flow and use of space. This 4 bedrooms 2 bath, 2600 sf one level home has all new plumbing with recirculating hot water, all new electric including remote dimmers in every room, LED recessed lighting and 2 completely new mechanical (HVAC) systems. Sound proof insulation will keep the noise and temperature controlled. Level 5 Drywall in nearly every part of the house. 28’ of sliding doors at the back of the house brings an incredible patio and pool view amongst the backdrop of the incredible mountain range.

BACK TO CONTENTS

CALL ME FOR DETAILS: Yvonne McFadden Direct: (480) 628-2619 www.yvonnemcfaddenrealtor.com

to Table of Contents YOUR POWER TO BUY A HOME IS NOW! 16227 N 63RD PLACE SCOTTSDALE, AZ 85254 List price $1,500,000 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

PROPERTY INFORMATION

Nestled within an idyllic, exclusive gated community, this extraordinary residence epitomizes opulence and elegance, presenting breathtaking mountain panoramas on an expansive expanse of unspoiled terrain, spanning over an acre. This majestic estate stands ready to become the home of your most cherished dreams. As you pass through the gracefully arched iron and glass front door, a realm of pure refinement unfurls before your eyes. From the very instant you cross the threshold, you’ll be greeted by the finest of finishes, seamlessly blending the timeless allure of travertine and hardwood flooring. The kitchen stands as a culinary masterpiece, featuring state-of-theart built-in appliances, granite countertops, and a welcoming wet bar, perfect for hosting gatherings. The office stands as a a testament to bespoke craftsmanship, adorned with custom built-ins and a sunken wine room capable of housing over 200 of your finest wine bottles. Every facet of this residence exudes sophistication, with flawless light fixtures and an integrated whole-house smart wiring and sound system.

BACK TO CONTENTS

CALL ME FOR DETAILS: Yvonne McFadden Direct: (480) 628-2619 www.yvonnemcfaddenrealtor.com

YOUR POWER TO BUY A HOME IS NOW! 9956 E ADDY WAY, SCOTTSDALE, AZ 85262 List price $2,270,000 2023 Review thepowerisnowmeida

Back to Table of Contents

2023 Review thepowerisnowmeida

PROPERTY INFORMATION

Fully Furnished! Only Dbl gated neighborhood in GC. for added Privacy & Security! Location is a golf cart away from GC Golf Resort, restaurants, dr offices etc. Custom built home- 2 Primary bedrooms w/southern knotty wood cabinets thru out. Sky lights for added natural lighting. New Spa heater equipment. Open floorplan w/finer finishes along w/ Front Courtyard w Views & from family and dining room. 80k recent exterior upgrades.Entertaining front/backyard! Built in grills, sink, refrigerator for easy entertaining. XL Spa & use to cool off in summer!! 2 newer AC units/warranty. Roof recently inspected. Private front & backyard & lock and leave landscape for stress free living! Must see this Unique footprint that wont be duplicated ! Rarely do homes list in this neighborhood. Invest in this!

BACK TO CONTENTS

CALL ME FOR DETAILS: Yvonne McFadden Direct: (480) 628-2619 www.yvonnemcfaddenrealtor.com

YOUR POWER TO BUY A HOME IS NOW! 8352 E CANYON ESTATES CIRCLE GOLD CANYON, AZ 85118 List price $765,000 2023 Review thepowerisnowmeida

Back to Table of Contents

2023 Review thepowerisnowmeida

BACK TO CONTENTS 2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

2023 Review thepowerisnowmeida

Yvonne Mcfadden Real Estate Show -Part 1

Yvonne McFadden, a realtor with Delx Realty, for an exciting show. Get a glimpse of the Arizona real estate market, with a special focus on the booming East Valley and upcoming developments in the West Valley. Discover the market updates, insights on interest rates, and why now is the perfect time to explore real estate opportunities in Arizona.

Yvonne Mcfadden Real Estate Show -Part 2