Employee Benefits Guide 2023 - 2024

Introduction

Whether you are a new employee enrolling into your benefits for the first time or considering your benefits during open enrollment, this guide is designed to help you through the process.

Elite Microwave Solutions is proud to offer a benefits package that includes medical, dental and vision insurance coverage options for you and your dependents. Elite Microwave Solutions also provides a term life policy for all full-time employees.

Please take the time to read this information and ask questions so you can make the best benefits decisions for both you and your family.

If you should have any questions:

1. Contact the carrier directly. Phone number and website information is on page 14.

2. Contact Gerlinde Dunlap at 480.299.0773 or admin@elitemicrowave.com

This booklet highlights important features of Elite Microwave Solutions’s benefits for it’s benefit eligible employees. While efforts have been made to ensure the accuracy of the information presented, in the event of any discrepancies your actual coverage and benefits will be determined by the legal plan documents and the contracts that govern these plans.

2

Table of Contents Introduction ........................................................................................ 2 Enrollment Information 3 Qualifying Life Event .................................................................... 4 Medical Plan Information .......................................................... 5 Banner | Aetna AFA Medical Plans 6 Telehealth 7 Health Savings Account (H.S.A.) ...........................................8 Dental Plan .......................................................................................... 9 Beam App 10 Vision Plan .......................................................................................... 11 Beam Life Insurance ................................................................... 12 Employee Rate Sheet 13 Important Phone Numbers 14

Enrollment Information

OPEN ENROLLMENT

Open Enrollment is from September 15th through September 21st. This is your one time per year to make changes to your current elections or add coverages.

All benefit eligible employees are required to elect coverage via Elite Microwave’s electronic open enrollment system. Any coverage not actively selected will be considered a waiver of coverage.

NEW EMPLOYEES

New Employees have 31 days from your hire date to complete enrollment in the group insurance program. If you have moved from a non-benefits eligible status to a benefits eligible status, you will have 31 days from the new benefits eligible status to complete your enrollment. All insurance coverage starts at the first of the month.

Remember, if elections are not made within the 31day initial period of eligibility, you will be required to wait until Annual Open Enrollment or until a Qualifying Life Event takes place. Late Enrollees may be required to satisfy a waiting period for the dental plan for certain services.

PRE-TAX DEDUCTIONS

Pre-Tax Dollars: Your insurance premiums for the medical, dental and vision plans are paid with money removed from your gross wages prior to any tax calculations. This reduces your tax liability and is a more efficient way to pay for premiums.

3

Qualifying Life Event

The elections that you make during Open Enrollment or at initial benefits eligibility will remain in effect for the plan year (October 1, 2023 – September 30, 2024). During that time, if your life or family status changes according to the recognized events listed below, you are permitted to revise your benefits coverage to accommodate your new status. You may make benefits changes by contacting the Benefits Department and providing the proper documentation.

IRS regulations govern under what circumstances you may make changes to your benefits, which benefits you can change and what kinds of changes are permitted.

✓ All changes must be consistent with the qualifying life event.

✓ In most cases, you cannot change your benefit plan, but may modify the level of your coverage (in other words, you can add or delete dependents, enroll or dis-enroll yourself or dependents, but not switch insurance carriers or plans).

Any changes in benefit levels must be completed within 31 days of the qualifying life event.

QUALIFYING LIFE EVENTS LIST

Marital Status Changes Covered Dependent Changes

■ Marriage

■ Death of spouse

■ Divorce

■ Spouse gains or loses coverage from another source

■ Spouse employer’s Open Enrollment

■ Birth or adoption of a child

■ Death of dependent child

■ Dependent becomes ineligible for coverage

4

Medical Plan Information

The network Elite Microwave will use for hospitals and physicians for both medical plan options effective 10/1/2023.

The pharmacy benefit manager for both medical plans. The medical plan insurance carrier continuing October 1, 2023.

SUMMARY

Medical benefits provide you and your family access to quality health care. Elite Microwave Solutions offers two medical plans with different coverage levels from which to choose. Both plans are provided through the Banner | Aetna AFA joint venture. Banner | Aetna AFA utilizes the Banner | Aetna Broad (BAFA Broad) PPO network for both medical plan options. The two medical plans provide major medical coverage to include hospitalization, physician and emergency room visits, prescriptions and more.

To search for a Banner | Aetna Broad PPO provider, log in to your account / mobile app or visit banneraetna.com

5

1 2

1 2 3 3

Banner | Aetna Broad Network Elite Microwave Solutions Banner | Aetna AFA CVS

Banner | Aetna AFA Medical Plans

6

PPO1500(Buy-UpPlan) HDHP 4000 (Base Plan) In Network In Network Network Banner | Aetna Broad Open POSII Banner | Aetna Broad Open POSII Lifetime Maximum Unlimited Unlimited Calendar Year Unlimited Unlimited Deductibles Individual $1,500 $4,000 Family $3,000 $8,000 Coinsurance 80% 80% Out-of-Pocket Max Individual $5,500 $7,500 Family $11,000 $15,000 Hospital Services Inpatient Hospital 20% After Deductible 20% After Deductible Outpatient Hospital 20% After Deductible 20% After Deductible Emergency Room 20% After Deductible Plus $300 Copay 20% After Deductible Urgent Care $75 Copay 20% After Deductible Routine Services Office Visit $25 Copay $35 Copay After Deductible Specialist Visit $75 Copay $75 Copay After Deductible Preventive Care Covered In Full Covered In Full Diagnostic Lab & X-Ray 20% After Deductible 20% After Deductible Prescription Drugs Tier 1 $3 or $10 Copay $3 or $10 Copay After Deductible Tier 2 $45 Copay $50 Copay After Deductible Tier 3 $75 Copay $100 Copay After Deductible Mail-Order 2x Copay 2x Copay After Deductible

98point6-24/7/365 on-demand access to affordable, quality healthcare for employees and dependents who are enrolled in any of the district medical plans. Anytime, Anywhere.

98point6 offers on-demand primary care delivered via secure, in-app text messaging, that is accessible anytime, anywhere. With 98Point6, U.S.-based, board-certified doctors answer questions, diagnose and treat, outline care options, order prescriptions and labs as appropriate, and can refer to specialists and resources in the Banner|Aetna network, all through the convenience of one app.

• Talk to a real doctor, 24x7. No need to schedule an appointment or limit your visits.

Save money and time, while avoiding costly trips to a doctor’s office, urgent care or ER.

What can be treated?

• Acne

• Allergies

• Asthma

Bronchitis

Cold & Flu

• Constipation

• Diarrhea

Ear Infection Fever

98point6.com

Headache

Insect Bite

• Joint Aches

• Nausea Rashes

Sinus Infection

• Sore Throat

• UTI

• And more!

When should I use 98point6?

• Instead of going to the ER or an urgent care center for a non-emergency issue

During or after normal business hours, nights, weekends and holidays

• If your primary care physician is not available

To request prescriptions (when appropriate)

If traveling and in need of medical care

Are my children eligible?

Yes! 98point6 has pediatricians on call 24/7

How much does it cost?

There is no consultation fee for employees enrolled in the PPO 1500 and a $5 fee for employees enrolled in the HDHP 4000 (currently waived until 12/31/2023).

7

Telehealth

Health Savings Account (H.S.A.)

If you choose to enroll in the High Deductible Health Plan (HDHP), you will have an H.S.A. provided by Optum Bank. An H.S.A. is a tax-advantaged savings and spending account that can be used to pay for qualified health care expenses.

THERE ARE TWO COMPONENTS TO AN H.S.A.-BASED COVERAGE PLAN:

1. A qualified health plan (the HDHP 4000) is the insurance component that provides medical coverage for you and your family.

2. An H.S.A. with Optum Bank is the banking component which can be funded by pre-tax payroll contributions from you, Elite Microwave, or both.

HOW AN H.S.A. WORKS:

1. Enroll in HDHP 4000 plan offered by Elite Microwave

Elite Microwave Solutions contributes $65.07 monthly to an employee’s H.S.A. bank account when enrolled in the HDHP base plan.

2. Contribute to your H.S.A. by payroll deductions: Up to $3,850 for an individual or $7,750 for a family based on 2023 IRS allowed contributions (includes total contributions allowed from you and/or your employer)

An additional $1,000 may be contributed if you are 55 or older. For 2024, the contributions allowed will increase to $4,150 for Individual and $8,300 for Family coverages.

3. With your HSA debit card, use those funds to pay for qualified expenses such as: copays deductibles

• chiropractor

• dental treatment

H.S.A. ELIGIBILITY

hearing aids glasses/ contacts

• prescriptions

To make tax-free contributions to an H.S.A., the IRS requires that:

You are covered by an H.S.A.-qualified medical plan (such as the HDHP 4000 plan)

You have no other health coverage (such as other health plan, Medicare, military health benefits, medical FSA’s)

• You are not eligible to be claimed as a dependent on another person’s tax return

8

The money contributed to the account is yours to keep and will roll over year after year –no ‘use it or lose it’ rule!

Dental Plan

9 In Network Out of Network Individual $50 $50 Family $150 $150 Annual Plan Maximum $1,500 + Rollover $1,500 + Rollover Type I Diagnostic & Preventive Services: Exams 100% 100% Cleanings 100% 100% Bitewing x-rays 100% 100% Floride treatment 100% 100% Type II Basic Services: Amalgam & composite fillings 80% 80% Root canals 80% 80% Simple Extractions 80% 80% Periodontal maintenance 80% 80% Type III Major Services: Crowns 50% 50% Dentures 50% 50% Bridges 50% 50%

BEAM PPO NETWORK

The Elite Microwave dental plan includes preventive services and office visits.

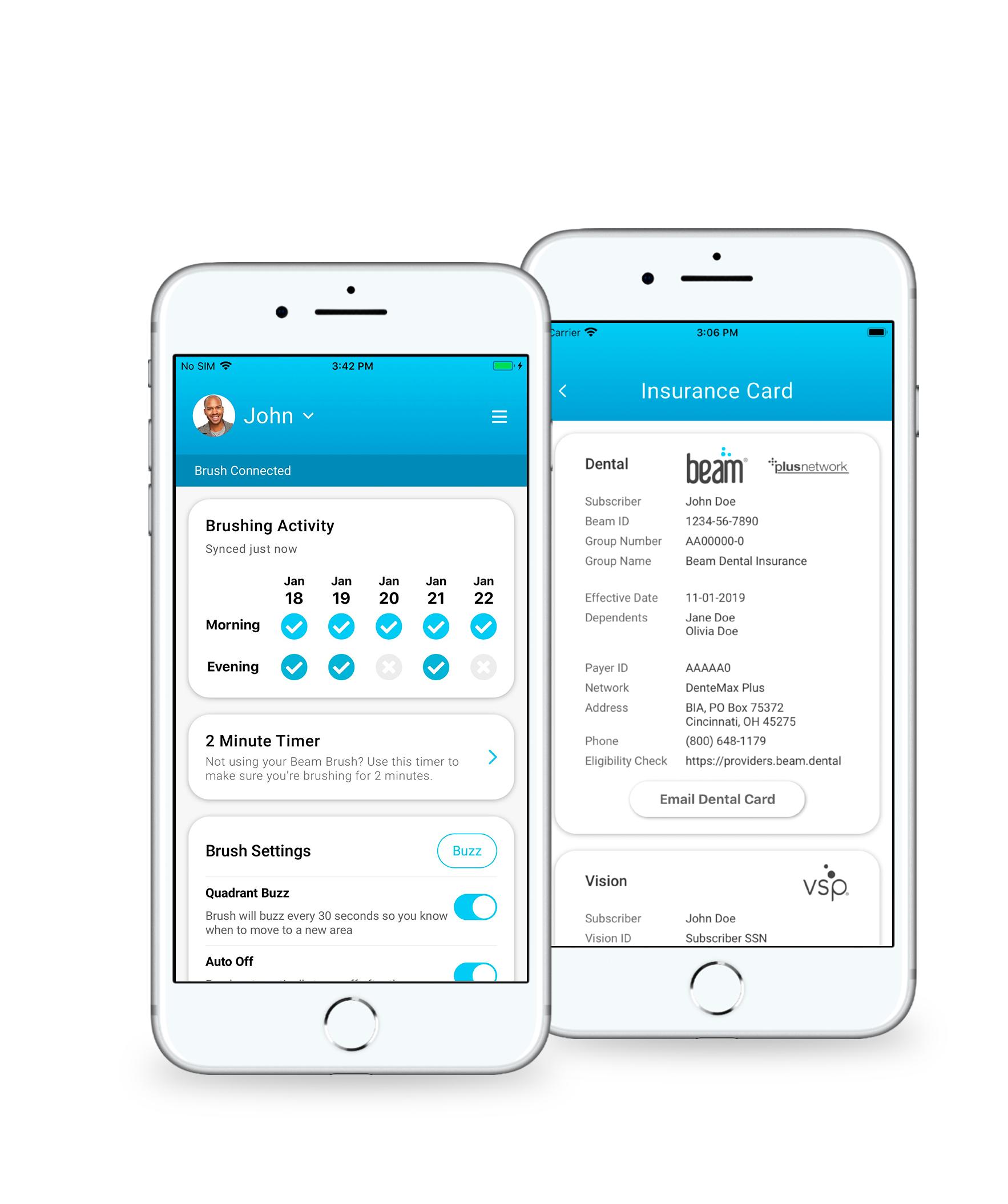

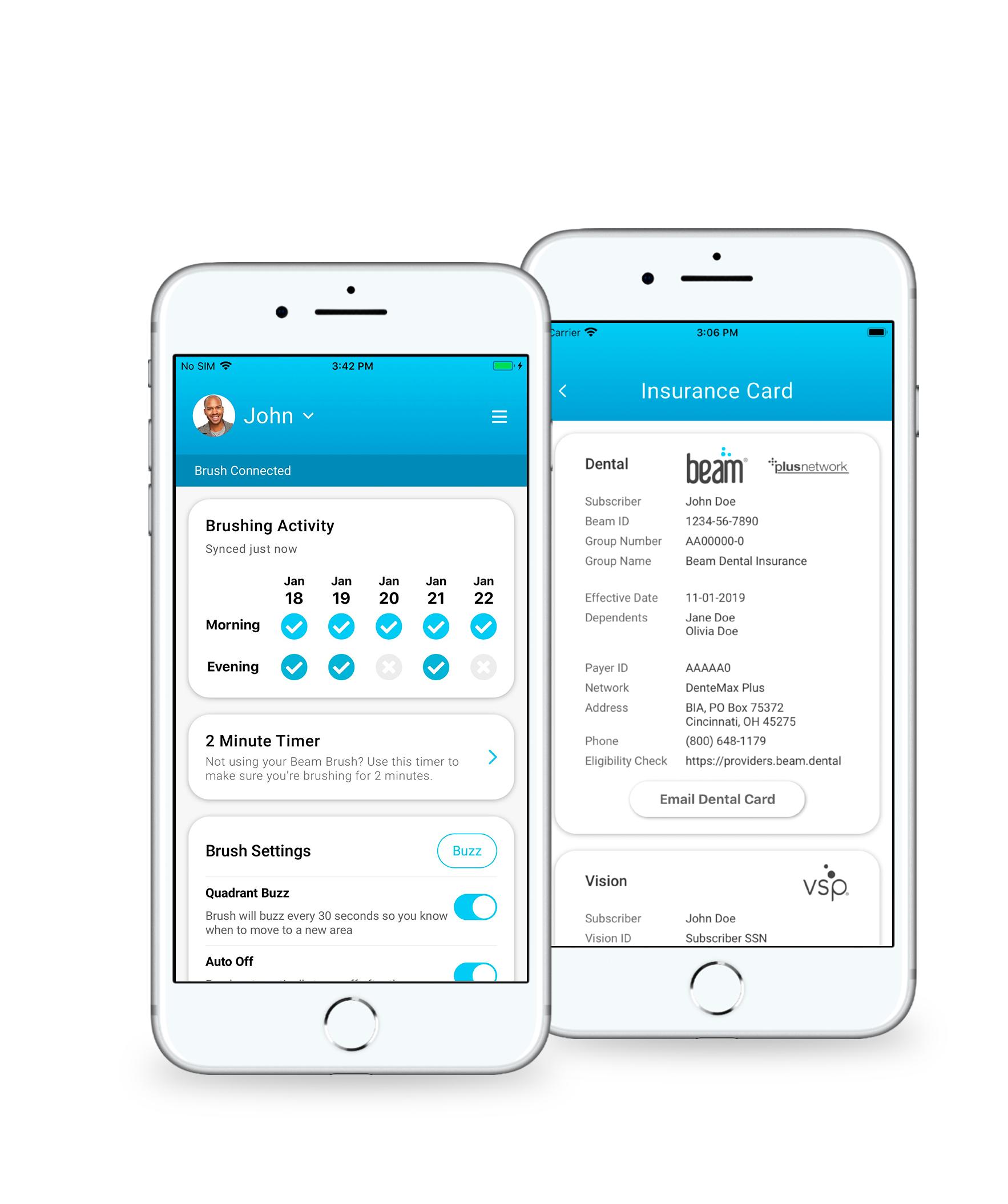

Beam App

Everything members need is just a tap away—view insurance cards, find a dentist, control brush settings and more! Available for iOS and Android!

Beam App

VIEW INSURANCE CARD

Everything members need is just a tap away—view insurance cards,

Get group & member IDs

Confirm coverage

Share your card & more!

OTHER FEATURES

Find in-network dentists near you

Search for orthodontists, pediatric dentists, & more

Plan information, pre-treatment estimates, explanation of benefits, and claims updates

Brushing awards

BRUSH SETTINGS

Control brush speed

View brushing data for you and your family

Turn on Quadrant Buzz & Auto Off

10

QUESTIONS? Call (800)648-1179 BM-AD-0021-201806 FIND A DENTIST QUESTIONS? dentists.beam.dental support@beam.dental | (800) 648 1179 Insurance products underwritten by National Guardian Life Insurance Company (NGL), marketed by Beam Insurance Services LLC, and administered by Beam Insurance Administrators LLC (Beam Dental Insurance Administrators LLC, in Texas). Beam Perks provided by Beam Perks LLC. Beam Perks can be obtained separately without the purchase of an insurance product by visiting perks.beam.dental. Policy form series numbers NDNGRP 04/06 or NDNGRP 2010. †National Guardian Life Insurance Company is not affiliated with The Guardian Life Insurance Company of America, a.k.a. The Guardian, or Guardian Life.

find a dentist, control brush settings and more! Available for iOS and Android! VIEW INSURANCE CARD Get group & member IDs Confirm coverage Share your card & more! Find in-network dentists near you Search for orthodontists, pediatric dentists, & more Plan information, pre-treatment estimates, explanation of benefits, and claims updates Brushing awards Control brush speed View brushing data for you and your family Turn on Quadrant Buzz & Auto Off OTHER FEATURES BRUSH SETTINGS QUESTIONS? Call (800)648-1179 FIND A DENTIST QUESTIONS? dentists.beam.dental support@beam.dental | (800) 648 1179 Insurance products underwritten by National Guardian Life Insurance Company (NGL), marketed by Beam Insurance Services LLC, and administered by Beam Insurance Administrators LLC (Beam Dental Insurance Administrators LLC, in Texas). Beam Perks provided by Beam Perks LLC. Beam Perks can be obtained separately without the purchase of an insurance product by visiting perks.beam.dental. Policy form series numbers NDNGRP 04/06 or NDNGRP 2010. †National Guardian Life Insurance Company is not affiliated with The Guardian Life Insurance Company of America, a.k.a. The Guardian, or Guardian Life. Beam App

Vision Plan

All standard lenses are covered.

BEAM

VSP CHOICE NETWORK In Network Out of Network

Exam $10 Copay

Frequency Every 12 Months

Lenses Covered 100%

Reimbursed to $45

Every 12 Months

Reimbursed to $100

Single/Bifocal/Trifocal after a $25 Materials Copay depending on lens

Frequency Every 12 Months

Frames $150 Allowance (Lower, but Equivalent Allowance at Wal-Mart, Sams and Costco)

Frequency

Every 24 Months

Contact Lenses (instead of glasses) $150 Allowance

Every 12 Months

Reimbursed to $70

Every 24 Months

Reimbursed to $105 Every 12 Months

Every 12 Months

Laser Vision Correction (LVC) Average 15% off the regular price Not covered

11

Beam Life Insurance

BASIC LIFE INSURANCE AND AD&D

Elite Microwave Solutions Corporation pays 100% of the cost of this Beam (through Nationwide Life Insurance Company) Term Life Insurance Policy. Coverage for each benefit eligible employee is $50,000 Life and AD&D Benefit.

Life insurance provides protection for those who depend on you financially. Your need varies greatly due to age, number of dependents, dependent ages and your financial situation. Accidental Death and Dismemberment (AD&D) benefits provide a benefit to you or your beneficiary if you are seriously injured or die in an accident.

12

12

Employee Rate Sheet

Use this sheet for your per-paycheck benefit costs for the upcoming plan year. This is a great place to start planning for your, and your family’s, health and wellness for next year.

*Elite Microwave Solutions pays $3,718.68/year towards the premium for each plan. This includes a $62.70/month contribution to the Health Savings Account (H.S.A.) of those enrolled in the HDHP 4000 base plan.

13

BANNER | AETNA AFA MEDICAL PLANS* DENTAL PLAN PPO 1500 BANNER | AETNA BROAD NETWORK HDHP 4000 BANNER | AETNA BROAD NETWORK VISION PLAN 26 PAYS $0.00 $190.43 $161.12 $336.92 26 PAYS $15.46 $30.94 $32.16 $47.63 EMPLOYEE ONLY EMPLOYEE & SPOUSE EMPLOYEE & CHILDREN EMPLOYEE & FAMILY EMPLOYEE ONLY EMPLOYEE & SPOUSE EMPLOYEE & CHILDREN EMPLOYEE & FAMILY 26 PAYS $0.00 $146.76 $124.17 $259.65 26 PAYS $2.29 $4.59 $4.05 $6.35

Important Phone Numbers

Banner | Aetna AFA Medical

See the back of your Member ID Card for the Banner | Aetna contact phone number banneraetna.com

Beam (via Nationwide Life Insurance Company)

BasicLifeInsurancew/AD&D

800.648.1179 or support@beam.dental

Beam Dental/Vision

800.648.1178 or support@beam.dental

Website: beam.dental VSP Questions - 800.877.7195

Elite Microwave Solutions Corporation

Gerlinde Dunlap

480.299.0773

admin@elitemicrowave.com

Optum Bank

HSA(bankaccount) optumbank.com

About this booklet

This booklet highlights important features of Elite Microwave Solutions Corporation’s benefits for its benefit eligible employees. While efforts have been made to ensure the accuracy of the information presented, in the event of any discrepancies your actual coverage and benefits will be determined by the legal plan documents and the contracts that govern these plans.

Capital Financial

14614 N. Kierland Blvd., Suite N230, Scottsdale, AZ 85254 Office / 480.347.0926

Fax / 480.360.6417