Whether you are a new employee enrolling into your benefits for the first time or considering your benefits during open enrollment, this guide is designed to help you through the process.

OERC is proud to offer a benefits package that includes medical, dental and vision insurance coverage options for you and your dependents. OERC also provides a term life policy for all full-time employees.

Please take the time to read this information and ask questions so you can make the best benefits decisions for both you and your family.

If you should have any questions:

1. Contact the carrier directly. Phone number and website information is on page 12.

2. Contact Cheryl Cantwell at 602-291-1239 or hr@oerc.com

This booklet highlights important features of OERC’s benefits for it’s benefit eligible employees. While efforts have been made to ensure the accuracy of the information presented, in the event of any discrepancies your actual coverage and benefits will be determined by the legal plan documents and the contracts that govern these plans.

Open Enrollment is from October 8th through October 15th, 2024. This is your one time per year to make changes to your current elections or add coverages.

All benefit eligible employees are required to elect coverage via OERC’s Employee Navigator portal. Open Enrollment is passive this year, meaning that you are only required to login to participate if you are a new hire or would like to make a change.

New Employees are eligible for benefits first of the month following 30 days of full time employment. If you have moved from a non-benefits eligible status to a benefits eligible status, you will have 31 days

Employee Navigator is your 24/7 Online Benefits Site. This portal will allow constant access to anything and everything benefits related. You can find your enrollment summary as well as copies of your Summary of Benefits and Coverage (SBC’s).

You will receive an Open Enrollment email from Employee Navigator which will allow you to register for the portal (if you haven’t already) and login to confirm your benefits. If you do not receive this email, please check your junk mail. It is not required that you register via the link in the email, you can also go directly to employeenavigator.com, click ‘Login’ and then select ‘Register as a new user’. From there, you

from the new benefits eligible status to complete your enrollment. All insurance coverage starts at the first of the month.

Remember, if elections are not made within the 31day initial period of eligibility, you will be required to wait until Annual Open Enrollment or until a Qualifying Life Event takes place. Late Enrollees may be required to satisfy a waiting period for the dental plan for certain services.

Pre-Tax Dollars: Your insurance premiums for the medical, dental and vision plans are paid with money removed from your gross wages prior to any tax calculations. This reduces your tax liability and is a more efficient way to pay for premiums.

will be required to enter personal identifying data as well as the following company identifier: OlginEfune

Open Enrollment window opens at 12am PST on Tuesday, October 8th and closes at 11:59pm PST on Tuesday, October 15th. Open Enrollment is passive and you are only required to login and confirm your elections if you are a new hire or want to make changes to your plans/enrollment tier.

The elections that you make during Open Enrollment or at initial benefits eligibility will remain in effect for the plan year (November 1, 2024 – October 31, 2025). During that time, if your life or family status changes according to the recognized events listed below, you are permitted to revise your benefits coverage to accommodate your new status. You may make benefits changes by contacting the Benefits Department and providing the proper documentation.

IRS regulations govern under what circumstances you may make changes to your benefits, which benefits you can change and what kinds of changes are permitted.

✓ All changes must be consistent with the qualifying life event.

✓ In most cases, you cannot change your benefit plan, but may modify the level of your coverage (in other words, you can add or delete dependents, enroll or dis-enroll yourself or dependents, but not switch insurance carriers or plans).

Any changes in benefit levels must be completed within 31 days of the qualifying life event.

Marital Status Changes Covered Dependent Changes

■ Marriage

■ Death of spouse

■ Divorce

■ Spouse gains or loses coverage from another source

■ Spouse employer’s Open Enrollment

■ Birth or adoption of a child

■ Death of dependent child

■ Dependent becomes ineligible for coverage

The network OERC will use for hospitals and physicians for all medical plan options effective November 1st, 2024.

The pharmacy benefit manager for all medical plans.

The new medical insurance carrier effective November 1st, 2024.

Medical benefits provide you and your family access to quality health care. OERC offers four medical plans with different coverage levels from which to choose. The four medical plans provide major medical coverage to include hospitalization, physician and emergency room visits, prescriptions and more.

To search for a Banner | Aetna Broad PPO provider, log in to your account / mobile app or visit banneraetna.com

If you choose to enroll in the High Deductible Health Plan (HDHP), you will have an H.S.A. provided by Lively. An HSA is a tax-advantaged savings and spending account that can be used to pay for qualified health care expenses.

THERE ARE TWO COMPONENTS TO AN H.S.A.-BASED COVERAGE PLAN:

1. A qualified health plan (the HSA 6500) is the insurance component that provides medical coverage for you and your family.

1. Enroll in HSA 6500 plan offered by OERC

2. Contribute to your H.S.A. by payroll deductions:

Up to $4,150 for an individual or $8,300 for a family based on 2024 IRS allowed contributions.

An additional $1,000 may be contributed if you are 55 or older.

2. An HSA with Lively is the banking component which can be funded by pre-tax payroll contributions from you.

The money contributed to the account is yours to keep and will roll over year after year –no ‘use it or lose it’ rule!

For 2025, the contributions allowed will increase to $4,300 for Individual and $8,550 for Family coverages.

3. With your HSA debit card, use those funds to pay for qualified expenses such as: copays deductibles

• chiropractor

• dental treatment hearing aids glasses/ contacts

• prescriptions

To make tax-free contributions to an H.S.A., the IRS requires that:

You are covered by an H.S.A.-qualified medical plan (such as the HSA 6500 plan)

• You have no other health coverage (such as other health plan, Medicare, military health benefits, medical FSA’s)

• You are not eligible to be claimed as a dependent on another person’s tax return

Services

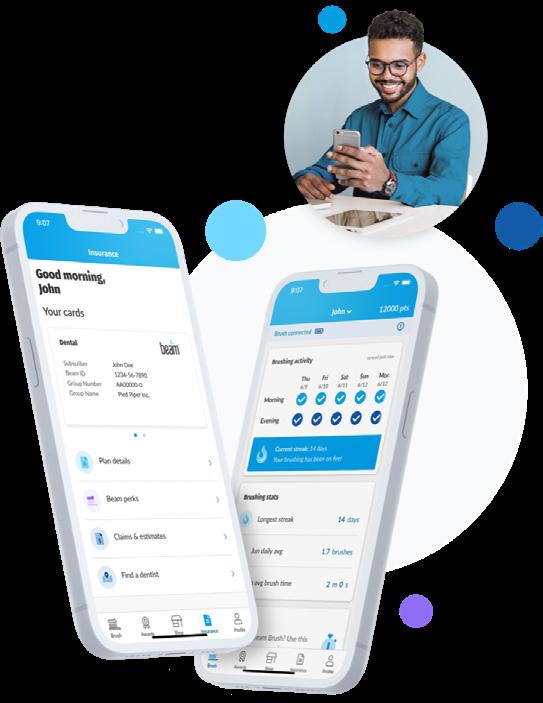

Everything members need is just a tap away—view insurance cards, find a

Everything members need is just a tap away - view insurance cards and plan information, control brush settings, and more. Available for iOS and Android.

View insurance card

VIEW INSURANCE CARD

Get group & member IDs

• Get group and member IDs

Confirm coverage

• View plan information and confirm coverage

Share your card & more!

• Share your insurance card with your provider

Other features

Find in-network dentists near you

• Find in-network dentists near you including specialists such as orthodontists, pediatric dentists, and more

Search for orthodontists, pediatric dentists, & more

• View dental pre-treatment estimates and claims statuses

Plan information, pre-treatment estimates, explanation of benefits, and claims updates

• Review Beam Perks* points and brushing awards

Brushing awards

• Explore the Beam shop to stock up on supplies

BRUSH SETTINGS

Other features

Control brush speed

View brushing data for you and your family

• Turn on Quadrant Buzz and Auto Off for guided brushing experience

Turn on Quadrant Buzz & Auto Off

• View brushing data for you and your family

• Control brush speed

to participate. If you do not have a

device you can obtain

Perks™ by

Perks™

separately without the

insurance product by visiting perks.beam.dental. Beam Perks™ may be changed at any time without notice and is subject to availability. See perks.beam.dental for Terms and Conditions.

BM-AD-0261-202207 (10-22)

of

Contact Lens Evaluation & Fitting Up to $60 copay

Single Vision Eyeglass Lenses $25 copay

Bifocal Eyeglass Lenses $25 copay

Trifocal Eyeglass Lenses

Lenticular Eyeglass Lenses

Standard Frames

Standard Contact Lenses (hard/soft)

$25 copay

$25 copay

OERC pays 100% of the cost of this Beam (through Nationwide Life Insurance Company) Term Life Insurance Policy. Coverage for each benefit eligible employee is $50,000 Life and AD&D Benefit.

Life insurance provides protection for those who depend on you financially. Your need varies greatly due to age, number of dependents, dependent ages and your financial situation. Accidental Death and Dismemberment (AD&D) benefits provide a benefit to you or your beneficiary if you are seriously injured or die in an accident.

Use this sheet for your per-paycheck benefit costs for the upcoming plan year. This is a great place to start planning for your, and your family’s, health and wellness for next year.

EMPLOYEE

EMPLOYEE & SPOUSE

EMPLOYEE & CHILDREN

EMPLOYEE & FAMILY

Banner | Aetna AFA

Medical

See the back of your Member ID Card for the Banner | Aetna contact phone number banneraetna.com

Beam (via Nationwide Life Insurance Company)

BasicLifeInsurancew/AD&D

800.648.1179 or support@beam.dental

Beam Dental/Vision

800.648.1178 or support@beam.dental

Website: beam.dental VSP Questions - 800.877.7195

Olgin Efune Recycling Company

Cheryl Cantwell 602-291-1239 hr@oerc.com

Lively HSA(bankaccount) livelyme.com

This booklet highlights important features of OERC Corporation’s benefits for its benefit eligible employees. While efforts have been made to ensure the accuracy of the information presented, in the event of any discrepancies your actual coverage and benefits will be determined by the legal plan documents and the contracts that govern these plans.

Capital Financial

14614 N. Kierland Blvd., Suite N220, Scottsdale, AZ 85254

Office / 480.347.0926

Fax / 480.360.6417