Italy has been among the EU countries most active at establishing Fisheries Local Action Groups (FLAGs). ese organisations o er a bottom-up approach to improving the prospects and the economies in communities where sheries and/or aquaculture play a signi cant role. A form of community led local development, FLAGs bring together municipalities, local companies, and civil society organisations such as NGOs and associations. With support from the EU, FLAGs design projects that contribute to improving the economy or the sustainability of activities carried out in the community. In the Friuli-Venezia Giulia region, a coastal FLAG encompassing three municipalities has implemented projects to make the towns more attractive for tourists, to reduce the dependence of shers on big seafood buyers, and to diversify the income of small-scale shers, among others. e coverage of Italy includes information on a tool that for the rst time enables Mediterranean producers of seabass and seabream to benchmark the performance of their farms against the industry average. is should allow individual farmers to set targets and monitor performance potentially creating a more e cient and sustainable industry. Read more from page 22

Seafood Expo Global (SEG) and Seafood Processing Global (SPG) together form the biggest and most international event for the global seafood industry. e event this year, the 29th, promises to be the biggest ever with almost 50,000 m2 (up 23 compared to 2022) and 66 national and regional pavilions. Space at SPG increases some 20 and will be occupied by suppliers of a wide range of processing and packaging equipment, as well as technology solutions for the seafood industry that will help seafood processors optimise their operations, improve e ciency, and enhance the quality of their products—all critically important at this time of shortages and high costs. Both events provide an excellent opportunity for seafood industry professionals to network, exchange ideas, and learn about the latest trends and innovations in the industry. ey are also a platform to promote sustainable seafood practices and to highlight the importance of responsible shing and aquaculture. Read about selected Euro sh member country’s participation at these events from page 15

e use of algae in feeds for juvenile sh is an emerging trend in the aquaculture industry. Algae are a sustainable and nutrientrich feed source that can provide many bene ts to both sh and the environment. Algae contain omega-3 fatty acids, protein, and other essential nutrients that are critical for the growth and development of juvenile sh. One of the main advantages of using algae in sh feed is their sustainability. Algae can be grown using a fraction of the resources required for traditional animal-based feeds, such as shmeal and sh oil. Additionally, the use of algae in sh feed can reduce the reliance on wild-caught sh, which can help to conserve marine resources. Another bene t of algae-based sh feed is their potential to improve sh health and performance. Algae contain bioactive compounds that can boost the immune system of juvenile sh and reduce the incidence of disease. Moreover, the use of algae in sh feed can improve the taste and nutritional value of farmed sh, which can lead to higher market value. However, there are also challenges to using algae in sh feed, such as the high cost of production and the need to develop cost-e ective and scalable cultivation methods. ere is also a need to ensure that algae-based feeds are nutritionally balanced and meet the speci c dietary requirements of juvenile sh. Read more on page 43

Ghost shing by derelict nets is a signi cant environmental problem that a ects marine ecosystems around the world. Derelict nets are shing nets that have been lost or abandoned in the ocean and continue to trap and kill marine animals long after they have been discarded. ese nets can remain in the ocean for decades, continually trapping and killing sh, sea turtles, whales, dolphins, and other marine life. Ghost shing can have devastating e ects on marine ecosystems. When sh and other marine animals become trapped in the nets, they die from su ocation, starvation, or exhaustion. e trapped animals also attract scavengers, which can become entangled in the nets themselves, creating a vicious cycle of death and destruction. Moreover, since nets today are often made of plastic, as they slowly breakdown they add to the macro, micro, and nanoplastic pollution in the water. e problem of ghost shing by derelict nets is not only an environmental issue, but it also has economic consequences. Lost and abandoned nets can continue to catch sh, reducing sh stocks and a ecting the livelihoods of shermen and shing communities. Many countries have introduced regulations to reduce the problem of abandoned or lost nets, but Norway has managed better than most in terms both of regulations and of creating the necessary infrastructure. Read more on page 49

Fraud in the seafood sector is a signi cant problem that a ects the entire supply chain, from shermen to retailers and consumers. is practice involves labelling one type of sh as another, either to deceive consumers or to take advantage of the higher value of a particular species. One of the main reasons for this misidenti cation is the high demand for certain species of sh and the limited supply. Some shermen may mislabel other, more abundant species to fetch a higher price. e consequences of deliberate misidenti cation are signi cant. Consumers may be misled into buying sh that they did not intend to purchase, which can be a health risk if the product has a higher risk of contamination or of triggering allergic reactions. Moreover, the misidenti cation of sh can have a severe impact on the sustainability of sheries and marine ecosystems. E orts to address the issue of fraud include stricter regulations and monitoring of the seafood supply chain, DNA testing, and labelling requirements. Consumers can also play a role by becoming more educated about sustainable seafood practices and making informed purchasing decisions. Read Dr Manfred Klinkhardt’s article on page 54

15 Seafood Expo Global/Seafood Processing Global, 25-27 April 2023, Barcelona

The world’s largest seafood event becomes even bigger

16 Croatia: 2E701

A range of marine and freshwater products

16 Poland: 4G401 and other halls

Exploring the best of Polish seafood at Seafood Expo Global

18 Denmark: 3CC201, 3DD201, 3EE201, 3EE401, 3FF401, 3PP202 Danish companies present sustainable solutions at Seafood Processing Global 2023

19 Latvia: GA301

Takes two to tango – very traditional and very new products on the same dance floor

20 RASTech 2023, 20-22 April, Orlando, Florida USA

A deep dive into the RAS industry

22 AquaFarm, NovelFarm, AlgaeFarm 2023, 15-16 February 2023, Pordenone

Event attracts record number of exhibitors and visitors

24 Finding ways to reduce the environmental impact of fish farming Research to make aquaculture more sustainable

26 Start-up determined to sever the link between aquaculture and marine resources

Optimising insect meal for faster fish growth

28 A new tool to boost marine aquaculture in the Mediterranean Project improves European seabass and seabream farming

32 A producer organisation supplying seabass, seabream, and meagre to local supermarkets

Del Pesce works towards greater sustainability

34 Reducing plastic pollution in the Mediterranean Sea. Reusable fish boxes suggest a way forward

36 The Friuli-Venezia Giulia FLAG helps its members diversify their incomes

Investing in a variety of projects

39 Remotely Operated Vehicles (ROVs) for the aquaculture and other offshore industries

Improving technology gives greater versatility

41 The Mediterranean is threatened by non-indigenous species and by global warming

Engaging local communities in tracking biodiversity changes

43 Microalgae are gaining in importance for aquaculture Key factor for marine fish fry stocking

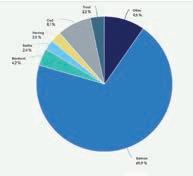

47 Fish and seafood from Norway 2022 was the best year in history for exports

49 Norway has a long history of policies to reduce the loss of nets at sea

Ghost nets are a multidimensional threat

52 Polish film project teaches schoolchildren about the multifaceted Baltic Sea A series that educates and entertains

53 Eurofish participation in projects Boosting consumer trust in seafood

54 Every third fish worldwide is declared incorrectly Trust is good, checks are better

58 Alltech and Finnforel join forces for sustainable aquaculture feed production

Fully integrated production offers a model to others

59 Cretel caters to the needs of the demanding food, pharma, and agroindustries

Innovative processing and washing equipment

60 Professional glass jar from FIAP for incubation of fish eggs

Better conditions than in the wild

60 Thermal processing of lying products with the REICH AIRMASTER® UKQ AIRJET

Maximum benefits require the best airflow technology

61 Innovative new films deliver greater sustainability too Improved appearance, taste, and shelf life

GuestPages:AngeloMaggiore,EFSA

62 EFSA’s work contributes to keeping consumers in the EU healthy Food safety faces added risks from climate change

The Danish Fisheries Agency has announced that it will enforce, and sanction violators of a new rule governing brown crab fishing in the North Sea. In the technical regulation (Regulation no. 2019/1241 of the European Parliament and of the Council, Annex V, Part A) it is established that: “For brown crab caught in nets and baskets, no more than 1 percent by weight of the total catch of brown crab may consist of removed claws. For brown crab caught with other gear, a maximum of 75 kg of removed crab claws may be landed.” Previously, this restriction did not exist. A transition or grace period will extend to 30 April 2023, and the regulation becomes fully effective and will be enforced from 1 May 2023.

Crab claws are the principal marketable product from brown crabs, and claws can be removed prior to the vessel’s landing or the whole animal can be landed intact. Representatives of the Danish Fisheries Agency measure the catch, including adjusting for the claw-weight equivalent of whole crabs landed, at the landing port. Industry members have expressed concern about the economic cost of this restriction, because for some boats crabs are a vital species. The Danish Fisheries Agency has expressed appreciation of this economic dependence but notes that the agency must enforce EU fishery management rules in Danish waters.

Before Brexit, the largest brown crab catch volumes belonged to the UK with average annual volumes of 31,000 tonnes, or over 60% of the total brown crab catches in the EU. Denmark’s crab fishery is rather limited, compared to other EU countries, with annual volumes fluctuating between 200 and 300 tonnes.

A brand-new industry trade show takes place 10-12 October 2023 in Amsterdam, as RAI Amsterdam and Norway’s Aqkva join forces to produce ColdWater Seafood 2023. The event hopes to attract seafood producers, processors, and exporters, as well as companies in packaging and transport. Suppliers of services and equipment for fishing, fish farming, and processing are also expected at the Netherlands’ only trade show for the seafood sector and one of the few focusing on cold-water seafood. The waters of northern Europe are clean and the fisheries are strictly regulated in a transparent way. The European Commission is addressing problems such as illegal fishing and overcapacity by working with the several countries that fish northern waters. Sustainable fish production is increasingly important for all those

involved in aquaculture or fisheries, and during the three full days of the event, exhibitors will be able to showcase their expertise and innovations in sustainability. The Coldwater Seafood

exhibition will also host discussions about these matters by experts and authorities to make continued progress on these issues. Two conference halls will be set up to discuss topics such

as seafood trends in Europe, regulations and policies, as well as sustainable development.

For more details about the event visit https://coldwaterseafood.eu/.

Spain’s Cantabrian and Northwest Atlantic horse mackerel fishery, shared with UK harvesters, is in dire straits. The total catch of North Atlantic horse mackerel recommended by ICES, the scientific authority on such matters, was zero tonnes for 2023, indicating the trouble that fishery is in. Almost 100 Spanish and UK purse seiners and small craft depend on this fishery and, as always, a balance is sought between the populations of fish and fishermen. To attempt such a balance, the EU, acting on its member states’ behalf, reached an agreement with the UK for a 78 reduction in the total horse mackerel quota for 2023.

To further help avert a horse mackerel crisis, Spain’s Ministry of Agriculture, Fisheries and Food has established a period of voluntary cessation in the fishery, combined with financial compensation. The General Secretary for Fisheries signed a resolution, to be published in the Official State Gazette (BOE), in which the temporary pause will be a minimum of one month and a maximum of three months. The planned compensation to boatowners and to fishermen is expected within the framework of the European Maritime, Fisheries and Aquaculture Fund (EMFAF) The beneficiary vessels are distributed among the

The consumption of horse mackerel in the EU is limited, with most of it exported outside the union; however, fresh horse mackerel remains popular in Spain and Portugal.

different autonomous communities as follows: 71 in Galicia, 8 in Cantabria, 4 in the Basque Country and 3 in Asturias. The

management and payment of the financial assistance shall be done by the relevant autonomous communities.

The pristine waters off the Sinis Peninsula, on the northwestern coast of Sardinia, are treasured by locals and tourists, as well as by fishermen both legal and otherwise. Its Marine Protected Area (MPA) is accepted by local fishermen, mostly artisanal, because it helps guard their future. However, it also attracts a criminal element:

dishonest fishermen who venture into the government-authorized MPA to illegally harvest species that warrant the legal protection the sanctuary is designed to give. Local fishermen and others on “the right side of the law,” with the help from the MEDSEA Foundation, are undertaking what is called Sardinia’s first “seabed

defense system” of about 60 bollards, or large posts, erected “like on a chessboard” at a depth of 35 meters, to thwart trawlers’ efforts to drag nets across the sandy bottom of the MPA. The bollards are being positioned in areas that fishermen have identified as the most vulnerable. The installation of these barriers does

not completely solve the underlying problem, but it certainly addresses it, said Sandro Murana, president of the FLAG, Pescando Association of Central Western Sardinia. It gives a strong signal, namely that there is a cohesive community in Sardinia that wants to counter illegal and unpunished action in the Mediterranean.

Bucharest, Romania

23-24 May 2023

Fish is among the most environmentally efficient sources of animal protein on the planet. Increased aquaculture production in Europe and globally is a sustainable way of providing protein to some of the 8.5bn people expected to populate Earth by 2030. The conference will feature sessions on freshwater aquaculture, saltwater aquaculture, and markets and certification with presentations from international and local experts. More information and free registration: http://aquaculture-ro.eurofish.dk/

Half-century old budget food retailer Lidl, with supermarket operations throughout Europe and in North America, has decided that meat proteins will play a smaller role as it works toward global sustainability and food security in its corporate mission. Our mission is largely a response to customer behavior, said the company’s chief buyer, Christoph Graf at the recent International Green Week, in Berlin. Lidl is reacting to and supporting consumer choice, he said, not dictating how people should live their lives. In addition to supporting individual choice, Lidl believes its strategy will serve the interests of the planet: to feed the 10 billion people expected by 2050, the

world’s food resources need to be more carefully managed.

Vegetarian and vegan alternatives will gradually replace animal-based foods through 2025 and beyond. Lidl believes meat production is not an environmentally sustainable activity. It will issue a report later in the year from a study it commissioned on the sustainability of different animal- and plant-based foods, showing how a move to plantbased foods can lessen adverse environmental impacts. It is about motivating people to eat products other than meat, Graf said. As a result, Lidl would be holding more themed weeks to promote meatless products.

European aquaculture production of African catfish (Clarias gariepinus) is small but growing. This species is a member of the Clarias genus of air-breathing catfishes, with long, eel-like bodies and, unlike many fish, an ability to make sounds (they croak). Hungary is the largest EU producer, with volume exceeding 5,000 tonnes per year. The northwestern Hungarian town of Kisbajcs hosted recently an event for companies, research organizations, and representatives of government involved in African catfish farming, to brief them on the status of a project called iFishIENCi (Intelligent Fish feeding through Integration of ENabling technologies and Circular principle) that was begun in 2018 with 16 partners from seven European and one Asian country (Malta as coordinator, plus

Norway, Greece, France, Denmark, Spain, Hungary, and Laos), and financially supported by the EU research and innovation funding programme Horizon 2020.

Significant and sustainable growth in aquaculture is the goal of the Horizon 2020 program, by developing more efficient production technologies that leave a smaller “environmental footprint.” Hungary is represented in the project by Bajcshal Kft (formerly Gy ri El re Fisheries Cooperative), Vitafort Zrt, and the Hungarian University of Agriculture and Life Sciences (formerly Szent István University). Research is ongoing in the areas: digital data acquisition, analyses and AI control systems; new complex intensive fish rearing system (SmartRAS); integration of waste recovery concepts;

Hungary’s annual production of African catfish reaches more than 5,000 tonnes, which ranks the country as the largest producer of the species in the EU. Six major producers of African catfish responsible for 90% of the volumes participated in the event, underlining its importance and relevance to the Hungarian industry.

and testing new protein sources (algae, yeast). Further research in Hungary is on intelligent feeding technologies and the optimal utilization of feeds, as feeding African catfish currently accounts for 65-70 of their production costs. Participants found

the event in Kisbajcs “fruitful and beneficial,” with information on potential solutions for challenges and on the latest developments. The event included a farm visit and an informal discussion, as well as a tasting of African catfish products.

Costa Brava, on the northeast tip of Catalonia, is known for its scenic Mediterranean vistas and beach resorts along a vibrant seashore, but its economy has long depended significantly on fisheries, producing local products marketed to local consumers. While, as time passes, older people, especially women, seem to maintain preferences for fresh fish from traditional fishmongers, many younger people, for reasons of cost or convenience, do not. This perception is confirmed in a study of seafood consumption in Costa Brava, finding that consumption of seafood, especially local products, lags among the younger population. This result has led many observers to urge that marketing and education should direct more effort at this important demographic group.

The study from the University of Girona notes campaigns are already underway to promote local seafood, with labels such as “La Mar de Bé” (“The Sea of Good”, to associate seafood with satisfaction) and local initiatives such as the Espai del Peix, a fish interpretation center, and gastronomic classrooms, which are a growing trend on the Costa Brava. Such campaigns are promoted by local governments, among others. The study was prepared by researchers in the Department of Business, University of Girona, with funding from the European Maritime and Fisheries Fund. The report is in Catalan with summaries in Spanish and English, available at https://museudelapesca.org/ docs/estudi-tecnic-compra-peixfresc.pdf.

Though the consumption of fish and seafood in Spain has been declining over several years, the country remains the EU’s second largest market (after Portugal). In 2020 per capita consumption of fish amounted to 44.21 kg in live weight equivalent.

A large jump in US salmon imports has caused Europe to fall to 2nd place as a market for Norwegian seafood exports. Data for January 2023 from the Norwegian Seafood Council (NSC) indicates exports of all seafood from Norway to the US jumped by 41 over the same month a year earlier, to NOK 1.15 billion (EUR 103.6 million). Most of this increase in export value consisted of salmon. The growth in export value to the US appears attributable to currency exchange rates, among other causes. Both the US dollar and the euro have risen against the Norwegian krone in the last year, and the impact of the rising value of these currencies is demonstrated by the fact that the quantities of Norwegian exports to the US and EU have actually fallen in recent

months. The dollar rose against the Norwegian krone in 2022, with the latter recovering only slightly in December; the euro/ krone exchange rate followed a similar path. The decline in the krone helps offset generally rising seafood prices in many markets abroad, making Norwegian product more affordable to American and European customers that use either the dollar or euro, or currencies linked to them.

Yet another cause of high Norwegian exports to the US is reduced US supply from other sources, namely Chile and Canada. Combined with growing post-pandemic US consumption of restaurant seafood, the resulting demand-supply gap in the US market has been readily accommodated by Norway.

Like most birds, a cormorant eats its weight in food every day. Unlike most birds, the cormorant’s preferred food is the same fish species that are harvested by Estonian and other Baltic fishermen, species whose populations are already in decline from multiple causes without the added pressure from hungry cormorants. Estonia’s cormorant

population is growing, despite an annual hunting season. According to the Department of the Environment, there are more than 34,000 pairs of this bird nesting in the country. At around 3 kg per bird, eating at least their weight in fish each day, 34,000 pairs of birds mean a loss in fish biomass of around 204 tonnes per day, or

Salmon is the second most consumed seafood species after shrimp in the US. According to NOAA, annual per capita consumption of salmon in 2020 reached 2.83 pounds (1.28 kilos).

A smarter global standard for safer and more sustainable farming practices that covers all stages of production.

One cormorant eats 400-600 grams fish every day, and two million European cormorants need about 365,000 tonnes of fish every year. This is about 10% of the total landings of wild catch in the EU, and about the combined EU’s annual production of salmonids and freshwater fish.

nearly 75,000 tonnes per year. The department, led by Rainer Vakra, has agreed to allow fishers two measures to reduce

their losses: one is oil spraying of cormorant eggs, which prevents the eggs from hatching; the other is the use of noise

devices and lasers, which scares the birds away. Vakra added that in a few months the department will approve a multi-year action

plan to address this problem that is upsetting the Baltic ecosystem in addition to fishermen’s wallets.

In the European Green Deal, the EU Commission has set the laudatory goals of a 30 cut in the EU fishing fleet’s greenhouse gas emissions by 2030 from 2005 and transitioning the fleet to become climate neutral by 2050. Many countries are well on the way by, for example, scrapping ageing vessels that may be serviceable but are fuel-inefficient, but some see the costs as daunting. A new report by Oceana, “A pathway to decarbonize the

EU fisheries sector by 2050,” describes several solutions that make the EU goals realistically attainable. These solutions range from the broad—removing fishing methods such as bottom trawling that besides stirring the ocean bottom and releasing greenhouse gases, are so fuelinefficient that vessels currently require government subsidies to stay in business anyway—to the narrow—support for new technologies in hull and engine

design, promotion of electric over hydraulic mechanisms, and even simple improvements in preventive maintenance schedules, all of which can reduce vessel fuel consumption. These technologies already exist but their implementation requires EU assistance.

Oceana’s report is available at https://europe.oceana.org/reports/ a-pathway-to-decarbonise-the-eufisheries-sector-by-2050/.

The report offers several solutions that make the EU goals for a climate neutral fishing fleet by 2050 realistically attainable.

The 1,619 sq km Curonian Lagoon is shared by Lithuania and the Russian enclave of Kaliningrad Oblast, and is separated (barely) from the Baltic Sea by a thin strip of land called the Curonian Spit. It is a diverse body of freshwater with populations of perch, pikeperch, eel, and other species, but quite polluted and subject to heavy fishing. According to scientists from the Marine Research Institute of Klaipeda University,

fish stocks, especially pikeperch stocks, are rapidly declining, due partly to overfishing. Beginning 17 January, new rules by the Lithuanian Ministry of the Environment ban the use of 40-44 mm nets in the lagoon, a curtailment of a key gear type for the area’s commercial fishermen. It is hoped by all stakeholders that these measures will help improve the stocks of various fish species common in this reservoir.

Despite an initial hammering caused by confusion and uncertainty surrounding Brexit, seafood exporters are bouncing back, with Scottish salmon becoming the largest food export from the Kingdom. While down by 2 from the record 2019 sales value of 529 million, Scottish salmon exports in 2022 totaled EUR 506 million, to surpass export value of any other UK food product. Salmon was shipped to some 54 countries, with France receiving the most, although that includes

some product moving further to other EU markets. Overall, sales to the EU were 64 of the export total, with strong markets in the U.S. and in Asia. Farmed salmon is big business in Scotland, supporting 2,500 jobs directly and an additional 10,000 jobs in related industries. However, these jobs did not benefit from growth in export value, because volume declined sharply (-26) from 2019 levels, due to the various difficulties faced by the seafood industry in recent years.

In 1992, Scottish salmon was the first non-French product to be awarded the Label Rouge quality mark, the official endorsement by the French authorities of the superior quality and taste. In 2004, Scottish salmon gained Protected Geographical Indication status (PGI) granted by the European Union.

WE WELCOME YOU TO OUR BOOTH IN HALL 3, NO. 3BB301 AT FIRA BARCELONA

Ingka Investments, the retailer IKEA’s financial arm, has moved for the first time into the “blue economy” by investing EUR 30 million in the Ocean 14 Capital fund, according to an Ingka press release. Headquartered in London, Ocean 14 Capital launched its fund in November 2021; it is now a EUR 150 million impact fund focused on driving a sustainable and regenerative blue economy. Using the UN Sustainable Development Goal 14, Live Below Water, as its guiding principle, the fund attracts investors such as the European Investment Fund, the Principality of Monaco, Ingka Investments, and others with its commitment to support entrepreneurs and businesses with ideas for aquaculture and alternative proteins, reducing plastic waste pollution, protecting ecosystems and marine flora, and ending overfishing. IKEA’s corporate mission of “creating a better everyday life” – in this

Ocean 14 Capital plans that about two-thirds of the funds be used to invest into companies in Europe, and one third will go to the rest of the world.

case by improving ocean health – is furthered by its investment in the fund. “Our aim is to invest

with impact, delivering positive returns for communities and the environment for generations

to come,” said Samuel Rundle, Head of Financial Market Investments at Ingka Investments.

A famously deadly fish is saving the financially struggling fishermen of the Japanese prefecture Fukushima, site of the disastrous nuclear energy plant meltdown in 2011 caused by an earthquake and a subsequent tsunami. The impact on the fishing industry in following years was huge. At the Matsukawaura port, 50 kilometres north of the Fukushima No. 1 nuclear plant, fisheries landings quickly dropped by 80 from pre-2011 levels. In the years since the plant meltdown, fishermen in the area have been subject to tight restrictions and consumers have shied away from locally produced food of all types over fears of contamination.

But one population is arriving at fishing docks in hordes: tiger puffer, or fugu (Takifugu rubripes), the seafood delicacy that is deadly if improperly prepared, requiring chefs to be trained and licensed in the skill to cut away the liver and certain other toxic organs in the fish. Globally warming seas have driven fugu northward, and they are filling the fishing grounds off Fukushima. At the same time, catch restrictions have eased following testing for radiation levels, and thus the prefecture’s fugu catch has grown tenfold since 2019. Boat crews at Matsukawaura regularly unload buckets overflowing with fugu, whereas a few years ago there were very few landed in the port.

Fugu has been consumed in Japan since 200 BC. It is estimated that the Japanese eat about 10,000 tonnes of fugu every year, and about 20 people a year get poisoned from it. Fugu is the only dish that cannot be served to the Emperor of Japan, and it is also banned in the European Union.

Seafood Expo Global/Seafood Processing Global, 25-27 April 2023, Barcelona

Seafood Expo Global (SEG) and Seafood Processing Global (SPG) together form one of the largest seafood trade events in the world. Co-located at Fira Barcelona Gran Via Venue the two events are held annually in Barcelona, Spain, and attract a diverse range of exhibitors, buyers, and industry professionals from across the globe. The events provide a platform for seafood suppliers to showcase their products and services to potential customers and network with other industry players.

Organised by Diversied Communications, a media company based in Portland, Maine, USA, SEG features a vast array of seafood products from various countries, including fresh, frozen,

for processing, packaging, chilling and freezing, sanitation and hygiene, as well as on services including quality assurance and logistics. e events also include educational and informative sessions covering topics such

e events provide an opportunity for businesses to expand their reach and enter new markets by meeting with potential buyers and distributors from all over the world. ey are also an excellent opportunity for indus-

that can help improve their businesses.

In recent years, SEG/SPG have placed a greater emphasis on sustainability, as concerns about over shing and environmental

Defrosting

Tumbling

Pressing

Slicing

Mixing & Grinding

Forming

Pasteurization

Separation

Perfect separation of whole fish, frames, eggs and trims

STS Belt Separator – different sizes of Soft Tissue Separator

• Highyieldseparationoffish

• Choiceofmanualoperationorour patented automaticcontrols

• Hygienicandeasy to maintain

• Includesoversized hopper in-feed for auto feeding

Contact us info@provisur.com or Tel. +33 298 94 89 00

provisur.com

features several sessions focused on sustainable seafood practices and showcases innovative

products and solutions that can help reduce the industry’s environmental footprint.

The Eurofish member countries are usually well represented at the two events and 2023 will

be no exception. Some of the national pavilions are previewed here.

used to raise common carp in polyculture with grass carp and European cat sh. Common carp accounts for about three fourths of the production in carp ponds, with grass carp, European cat sh, and other species comprising the rest. Trout production has averaged some 370 tonnes over the four years to 2021 with minor uctuations.

The Croatian sheries sector is highly diversi ed with a variety of species caught and farmed. Wild small pelagics such as anchovies and sardines represent the bulk of the landed volume with small quantities of cephalopods, crustaceans, and bivalves making up the balance. Total catches have been broadly stable over the four years to 2021 with

a slight dip in catches of small pelagics in the last year. Production from marine aquaculture has increased each year over the same period. Several marine species are farmed in Croatia of which seabass and seabream dominate with fattened tuna coming close behind. Limited volumes of other n sh species such as meagre are also produced as well as modest

volumes of mussels and oysters. e trend for all the marine farmed n sh species has been positive over the four years to 2021, according to the Croatian Bureau of Statistics, while mussel production has been stable.

Inland in continental Croatia is a freshwater sh farming industry focused on carps and trout. Earthen ponds are

e Croatian pavilion at Seafood Expo Global in Barcelona will once again be organised by the Croatian Chamber of Economy and will host nine of the most export-oriented seafood companies in Croatia. e companies represent the di erent facets of the Croatian sheries and aquaculture sector and will include those that catch or process small pelagics, farm tuna, seabass and seabream, or freshwater species. Canning companies and sh traders will also be present. Croatia imports sh from other countries in Europe to sell on the domestic market to the local population and the millions of tourists that arrive in the country each year. At the seafood show it will be possible to sample some typical Croatian seafood including salted and marinated sardines and anchovies as well as value added products based on seabass and seabream.

Poland will have a large pavilion at Seafood Expo Global highlighting its status as Europe’s most important sh processing nation. e Polish processing sector is a major supplier of processed sh and seafood products to the rest of Europe while at the same time trading on the large domestic market. Polish companies at the Barcelona

event will be spread over several halls though the main Polish pavilion will be in 4G301. With a long tradition of shing and seafood production Polish companies will exhibit a wide variety of products from smoked salmon to octopus salad. One of the highlights of the Polish pavilion is its range of smoked sh products. Smoked salmon is a particular

speciality, and visitors can try a range of di erent varieties, from mild and delicate to rich and smoky. e pavilion also showcases smoked eel, trout, and mackerel, all of which are produced using traditional methods and recipes.

Another feature of the Polish pavilion is its range of pickled and

marinated sh products. Pickled herrings are a particular favourite, and the pavilion o ers a range of di erent marinades and avours, from classic dill to spicy paprika. Visitors can also try pickled mussels, which are a popular delicacy in Poland, as well as marinated anchovies and sardines. In addition to these traditional seafood products,

e Croatian pavilion at Seafood Expo Global will feature companies with products that represent the diversity of the country’s seafood sector (archive photo).the Polish pavilion also showcases some more innovative and modern dishes. Octopus salad is a particular favourite, featuring tender pieces of octopus combined with fresh vegetables and a zesty dressing. ere are also a range of seafood pates, spreads, and dips on o er, perfect for serving as appetizers or snacks.

e Polish presence at Seafood Expo Global comes despite the challenges facing by the processing sector due to the war in Ukraine. e con ict has resulted in an increase in prices for most inputs including energy, raw materials and labour and has disrupted supply chains and lowered demand for Polish products in the east as well as in parts of the EU. Despite these constraints visitors can expect to see and taste the full range of sh and seafood processed in Poland.

Denmark: 3CC201, 3DD201, 3EE201, 3EE401, 3FF401, 3PP202

Sustainability is a key word for Danish companies joining the Pavilion of Denmark at Seafood Processing Global (SPG) 2023 in Barcelona. irty-one companies will be ready in Hall 3 showcasing technologies and solutions targeted respectively towards aquaculture, shing, and processing of sh and seafood.

“Spain is home to the largest sh processing industry in Europe, thus Spain as a market for the segment in itself is representing an obvious and huge potential for Danish suppliers of technology, solutions and equipment to the shing industry. SPG furthermore gathers decision makers and stakeholders from the entire international shing industry making the exhibition attractive for

Danish suppliers” says Martin Winkel Lilleøre, Head of the Fish Tech network at Danish Export Association.

Solutions presented at SPG will for instance include equipment and machinery for handling and processing of both sh and shell sh, freezing solutions, hygienic transport band solutions, analytical equipment, equipment for transformation of sh by-products and smart packaging solutions. e Pavilion of Denmark will also present solutions for re-use of packaging contributing to the circular economy of the shing industry.

Danish company Beck Pack Systems which produces packaging for the

frozen sh have been part of the Pavilion of Denmark many times presenting their core product, the Beck Liner. e company has an increased focus on sustainability and bringing green solutions to the exhibition.

“ e product has basically been the same for years, and we’ve gained market shares because of the quality of the product. Sustainability is also a growing focus for us. I wouldn’t hesitate to say that we are front runners with regard to sustainability in an international perspective. Our product is biodegradable, and we are currently working on nding ways to recycle our used products. In that process we are working together with a number of partners in different industries all over the world,”

says Jesper Kjøller, sales manager at Beck Pack Systems.e focus of SPG has traditionally been set on the sh and seafood processing, but in recent years that has expanded to cover the entire value chain of the sheries sector. Aquaculture and shing industries have received increasing attention at SPG, covering technology, solutions, and equipment such as pumps for gentle transfer of sh, lter solutions for RAS facilities, monitoring solutions, and equipment for sustainable sheries.

Instead of tapping your phone to mark all the booth numbers in your Seafood Processing Global app simply raise your head, go to Hall 3, and look for the bright red and white sign that says “Pavilion of Denmark”!Canned sh has always been Latvia’s hallmark. is year at the National Pavilion of Latvia in Barcelona companies will be showcasing a wide range of canned products, including herring, salmon, sardines, trout, mussels and, of course, Latvia’s signature product – smoked sprats in oil, which have been produced since the 19th century. Latvian sprats are made only from sprats and small herring of a certain size, caught in two speci c areas of the Baltic Sea during a certain time of the year.

e development of the technologies has not in uenced the production

process: Latvian sprats have remained unchanged for well over a century – handmade, unique, iconic. New technologies, however, have had a signi cant impact on the packaging. Modern Latvian sprats, as well as other canned sh and seafood are often packed in cans with transparent lids, or even in glass jars allowing a customer to see the beauty of the product inside.

Latvia’s seafood processing sector also reacted to the growing demand worldwide for vegan products and the general concern about sustainability – and now companies produce plant-based

Latvia’s seafood sector is famous for its canned products. In recent years the country’s exports of canned sh reached almost 60% of the total seafood export value amounted to over 100 million euros (archive photo).

“ sh” products available to the customers both domestically and abroad.

e o cial organiser of the Latvian pavilion is the Institute of Agricultural Resources and Economics (AREI), and this year the joint stand will host 12 companies that will present--besides canned and plantbased products-smoked salmon, surimi products, “red caviar” made

of salmon roe, as well as frozen and chilled sh.

During all three days of the show the chefs at Latvia’s National Pavilion will prepare samples of the products showcased by twelve companies, and visitors are welcome to come and taste the best Latvian products – whether their history dates back two centuries, or two years.

Whether it’s raising fish juveniles, smolts, or market-sized fish, the RASTech 2023 conference and trade fair covers the latest developments, innovations, and research in land-based fish farming.

Recirculating aquaculture systems are increasing in popularity as the attraction of reducing water consumption to breed sh becomes clearer. is however is only one of the bene ts these systems o er. Lower risks of diseases, full control of each stage of the production process, and less likelihood of escapes are among the other advantages. On the other hand, these systems are complex and require trained personnel to manage them. e potential and challenges associated with RAS are highlighted at an event dedicated to the industry. RASTech will be held this year at the JW Marriott Orlando, Grande Lakes, in Florida, and will comprise three tracks—business, operation and research—that will allow attendees to delve deeper into the many facets of the recirculating aquaculture industry.

e business track is geared towards those who are interested in learning more about what it takes to run a successful RAS business. e operation track is about sharing technical knowledge used in a facility, while the research track brings together the latest studies that drive the industry’s innovation and development. e schedule is updated regularly to help attendees make the most out of their conference experience. Top industry experts and executives from the world’s

leading aquaculture companies will be on-hand to discuss and share their experiences and knowledge. Day three of the conference will involve a tour of the Evans Fish Farm. e 100-acre sh farm located in Pierson, Florida, is one of the rst complete sturgeon aquaculture operations in the United States.

Among those lined-up as event speakers are: Sylvia Wulf, CEO and president of AquaBounty Technologies; Yonathan Zohar, project director of RAS-N & SAS2, and presidential professor and chair of marine biology at the University of Maryland; Siri Tømmerås, commercial director, land-based, at AKVA Group; Yoav Dagan, partner and vice president of business development at AquaMaof Technologies; Karl Øystein Øyehaug, CFO of Atlantic Sapphire; Chris Good, director of research at the Freshwater Institute; Tracy Navarro, president and general manager of Trader Hills Farm; and more. “ e RASTech Conference and Trade Fair is a one-stop-shop for the RAS community. is unique RAS event is a place for people to learn about the business, operations, and innovative research while networking with experts from around the world,” said David Kuhn, event coorganizer and founding partner of Virginia Tech.

Day 1 keynote will include insights on “Lessons learned” from

speakers Per Heggelund, consultant and investor owner of Nordic Partners LLC; Justin Henry, consultant at Henry Aquaculture Consult Inc., and chief technology o cer of West Coast Salmon; Karl Øystein Øyhaug; and Sylvia Wulf. Other sessions for this day will feature RASTech editor Jean Ko Din, who will moderate a series of sessions about creating a RAS business model; Marianne Naess of Xcelerate Aqua discusses recruiting and keeping talent; and Yonathan Zohar, will lead the RAS-N and SAS2 sessions.

On day 2 Martin Gardner, president of Blue Ridge Aquaculture; Geno Evans, CEO of Evans Fish Farms; Eric Pederson, president and founder of Ideal Fish, will provide the keynote and will make a case for vertical integration. Other speakers for this day include: Jaime Stein, co-founder of Devonian Capital, who heads

o the Investors’ Forum; Kathleen Hartman and Bill Keleher discuss sh health and welfare; Dianne Fletcher, communications specialist for King sh Maine, speaks about brand building; and Huy Tran, senior biologist and co-owner of Aquatic Equipment & Design, will talk about aquaponics. “Our trade show has grown from 50 to 80 exhibitor booths this year re ecting a real appetite from industry suppliers wanting to play their part in this expanding segment of aquaculture. It’s a great opportunity for attendees to check out all the latest RAS products and equipment options for their RAS project or existing operations. It’s like a onestop-shop for RAS,” according to Jeremy ain, RASTech associate publisher.

For more information about the event including the programme of activities visit https://www.rastec.com/.

RASTech 2023 combines a conference and a tradeshow with a visit to a sturgeon farm on the final day. RAStech Magazine

Automatic Skinner

Tabletop Skinner

Automatic Skinner

Tabletop Skinner

AquaFarm, NovelFarm, AlgaeFarm 2023, 15-16 February 2023, Pordenone

Pordenone Exhibition Centre continues to be the world’s reference venue for events dedicated to innovative and sustainable food production in water and on land. The 2023 edition of the three events AquaFarm, NovelFarm and AlgaeFarm ended with impressive numbers. Visitors increased by 62% compared to 2022 and by 25% when compared to the last pre-covid edition. The events drew 130 exhibitors, 33% from abroad, and used almost 7,000 square metres of exhibition area in Halls 4 and 5.

As usual, the highlight of the three events was their content. With over 30 conferences scheduled featuring 150 speakers from all over the world, listeners were treated to the most up-to-date information from various sectors.

AquaFarm focused on the two big problems faced by sh and shellsh farmers at the moment: rising energy costs and climate change. Potential solutions include adapting to change on one hand and providing for one’s own energy needs through self-production on the other. Adopting both in synergy could prove decisive for a farm’s prospects. Supporting livestock farmers in these demanding activities are, as always, the EMFAF funds, which in this EU budget cycle have seen the A for aquaculture added to the F for shing. A popular session with companies, EU o cials and regional councillors explored the characteristics, requirements and scale of funding coming through the regions. On a more scienti c note, there was great interest in the session on the sh microbiome and its modulation through feed and probiotics, which, according to many experts, is the

future of nutrition in aquaculture. ere was no lack of technology and end product market sessions, which featured a series of fascinating company stories about the constant search for quality and innovation.

NovelFarm is a unique event in Italy for its exclusive focus on soilless and vertical farming, general topics that o er a chance to discuss issues of great interest to the Italian “grower” community. To give just an example, genetics and varietal selections for vertical farming have led to a demand

from researchers and companies to open the door to research also in Italy on NBTs, the New Breeding Techniques, starting with the applications of CRISPR. e objective is not just to obtain attractive varieties for the market faster, but to re-domesticate cultivated species and introduce novel ones with great potential for the new growing environment represented by vertical farms. Meanwhile, soilless continues to grow. It is considered a strategic factor also by the FAO to sustainably and safely feed the world’s population. A large consumer segment has already adopted it as a primary technique for its needs, which focus on shortening logistics chains, eliminating

residues, delinking supply from seasonality, and adapting to the public’s demands in almost real time, as was discussed in a session organised in collaboration with FreshCut News. Non-food crops have long been grown on vertical farms, e.g. medicinal plants, high-quality fodder for calves, and even those species that can be used as “molecular factories” for active ingredients, industrial substances and even vaccines and antibiotics. ese were all themes at a very well attended session. Technological evolution also o ered novelties in this edition, starting with the new technique of photonics, the development of aeroponics, the increasing sophistication of

Perfect product quality and maximum yield: Smoking and drying systems from REICH for lying or hanging fish optimize your products and your profit. Today, REICH is a global leader of thermal processing systems for fish. Convince yourself in our technology center in Germany!

www.reich-germany.de

lighting and fertigation strategies, and automation.

Finally, AlgaeFarm, the main event of a sector that is economically growing in Italy but, above

all, is strategic for the shift of the global economic system in a direction that has less impact on the environment. Here the main topic was the domestication of microalgae, which, unlike in agriculture, are bred in their “wild” form. For many experts, the future of microalgae lies in this revolutionary new step. A talk by

the Los Alamos-based New Mexico Consortium of Research Institutions and Operators, which is blazing new trails in solving one of the main limitations of microalgae cultivation: the biomass yields, which are still too low to provide widely used products at an acceptable cost. at kind of research is not well-known in

Europe, even among specialists, and it is pertinent that AlgaeFarm provided an opportunity to discuss the issue.

For more information about the three events, contact: Simona Maldarelli, Pordenone Fiere, smaldarelli@ erapordenone. it, +39 380 3133728

Finding carbon neutral ingredients for fish feeds and experimenting with multitrophic aquaculture are among the ways researchers are trying to make Italian aquaculture more sustainable.

As sustainability gains increasingly in importance it also a ects companies in the aquaculture sector which, as a consequence, are working to make their operations more environmentally friendly. Aquaculture feeds were responsible for 60-70 of the carbon footprint of the aquaculture value chain when shmeal and sh oil were the main ingredients in sh feed. And sh farming operations a ect the natural environment due to their biological and chemical impacts.

Today, however, the use of shmeal and sh oil in sh feeds is very ecient. From the main constituent of a feed, they are now used in much smaller volumes, as an additive to increase palatability or to add certain amino acids to the feed. Yet advances in feed technology enable a feed conversion ratio that gives about 5 kg of sh for each kilo of feed, says Prof. Alessio Bonaldo from the University of Bologna.

Antibiotic utilisation, a source of chemical impacts, is decreasing year by year and already many farms are certi ed antibiotic-free. In addition, genetic selection can select strains that are more resistant to diseases and pathogens— which also reduces antibiotics use. Multitrophic aquaculture combines the production of sh with that of seaweed or molluscs which absorb the nutrients released by the sh farming. is makes the sh production more sustainable and at the same time creates an additional product (seaweed or molluscs) for sale.

Another technology that reduces water and energy consumption is recirculated aquaculture systems. ese are used already in hatcheries for the production of juvenile sh, but as the climate gets hotter and drier farmers are becoming more interested in these systems for the production of market-sized sh. e aquaculture industry in general is very interested in reducing its impact on the environment because, as Prof. Alessio Bonaldi

says, the connection between farmed sh and the natural environment is very close. Unlike terrestrial farmed animals which are housed in buildings separated from the environment sh are farmed in the sea where there is no such separation. Fish farmers and feed manufacturers therefore try to reduce their products’ impact on the marine environment as far as possible.

One way of doing this is to nd ways of substituting shmeal and sh oil with other ingredients. Prof. Bonaldo is involved in three projects. NewTechAqua seeks to use by-products and coproducts from sheries and aquaculture such as trimmings and other

leftovers from slaughtering and processing operations. ese ingredients were enriched with algae to balance the omega-3 content in the diets. In another project, NEXTGEN Proteins, the researchers tested insect meal, algae meal and single cell protein from yeast. One of the objectives of the project was to replace the shmeal and soya meal content of sh feeds. In SUSTAINFEED the purpose was to test plant ingredients, coproducts or by-products from other value chains, that do not compete with human consumption. In all three projects the feed products were tested for performance, sh welfare (especially gut health), and llet quality. e

results suggested it was possible to decrease shmeal content and the fraction of other more unsustainable substances with the new ingrdients. e results also showed that seabream in particular is able to convert low quality proteins into good animal proteins without detrimental e ects on welfare or llet quality. e new ingredients were circular in the sense they were produced from coproducts or by-products coming from another value chain. For example, the yeast in the NEXTGEN Protein project were fed with waste from the forestry industry. is circularity adds value in terms of carbon footprint and nutrient valorisation.

The department of Veterinary Medical Sciences at the University of Bologna has a centre for blue growth that is physically located in the village Cesenatico on Italy’s Adriatic coast. All aquaculture-related activities—education, training, and research—are concentrated here. The centre offers a bachelor’s degree in aquaculture and hygiene of fish products that was initiated 25 years ago and is the only one in Italy dedicated to aquaculture, according to Prof. Alessio Bonaldo. Students learn everything from anatomy and physiology of aquatic animals to pathology and economics is also a subject. Between 40 and 50 students graduate each year and most of them find work immediately. The centre has its own facilities to run trials on live animals like fish, mainly on fish nutrition, but also on reproduction, and it also offers training courses, summer schools for technicians or farmers or people from the feed industry. The course language is currently Italian but changing it to English is under consideration to attract more foreign students.

Apart from the environmental goals the purpose is also to try and maintain feed costs at a stable level for the sake of the sh farmers who face price increases for all their inputs. Feed is the most signi cant cost for them accounting for up to 60 of the total. Any increase in feed prices has thus a major impact on their costs. One way to reduce production costs that is also being considered is by cultivating omnivorous or herbivorous species. e challenge is consumer acceptance. More generally it is important to look at the entire value chain from production to processing to marketing when considering new species. In Italy new marine n sh species under

trial include dusky grouper, amberjack, shi drum and mullet, says Prof. Clara Boglione from the University of Rome Tor Vergata. Mullet is grown mostly in the lagoons of Venezia and Sardinia, but it is scattered and the volumes are small. Greater amberjack and Mediterranean tuna are cultivated in Sicily but with irregular production. So, essentially, sh aquaculture in Italy is focused on seabass, seabream and shi drum in the sea and trout and sturgeon in fresh water. However, experiments are being conducted in the framework of community-like aquaculture, where sea cucumbers and sea urchins are reared in combination with marine species. is is a form of multitrophic aquaculture, where the sea cucumbers and sea urchins are grown beneath the sh cages or mussel longlines to mitigate the impact of the nutrients released by

•

www.jpklausen.com

Youronestopsupplierforseafood: Hokiproducts

• NZDory fillets

• Once frozenAlaskan Pollock and once frozen PacificCod Mackerel Herring Surimi Base. •••

Please alsodonothesitateto askforspecialties like: NZ Ling fillets

• Blue Mackerel • Savorin • Silver

Warehou Blue Warehou

• • Brotola • Alfonsino • Arrow

Squid • Southern BlueWhiting Orange Roughy • Giant Squid

Yellowfin Sole

NEW:

Northern Blue Whiting Rock sole. •

MSC Australis Hake

the reared organisms. e two species are valuable products themselves and represent an additional income stream.

Prof. Boglione specialises in analysing the impact of rearing conditions on the sh skeleton. In the past, she has described how semi-intensive rearing conditions (characterized

by large tanks coupled with low stocking densities) are able to produce juveniles of gilthead seabream, European seabass and dusky grouper with body shape and pigmentation similar to that of wild sh and with fewer deformities than are found among juveniles raised in intensive rearing conditions. In the framework of the BioMedAqu project, she collaborates with the University of Las Palmas to analyse the e ects of dietary vitamin D3 levels and dietary supplementation of

copper on gilthead seabream skeleton. In the same project, the collaboration with the University of Las Palmas, University of Algarve, IPMA (Instituto Português do Mar e da Atmosfera) and API (Associazione Piscicoltori Italiani) demonstrates better survival and growth rates, and lower incidences of some skeletal anomalies when gilthead seabream larvae and pre-ongrowing juveniles are reared in low-density conditions. e quality when you rear at low density is much better,

she says, but convincing farmers that it is better to breed fewer high quality sh rather than many of lower quality is not an easy task. Some farmers do rear juveniles at low density and then sell them at a higher price. Most, however, rely on the cheaper intensively reared juveniles. is is partly because the rapid market expansion in the 1980s with the subsequent oversupply from Turkey and Greece has lowered the market value of gilthead seabream over the last two decades.

Start-up determined to sever the link between aquaculture and marine resources

Ittinsect – Feed for the Ocean uses insects to create an ingredient that enables feeds to perform better and at less cost to the environment. The ingredient has been successfully tested with feeds for trout and sturgeon, and trials with seabass and seabream are ongoing.

Insects have been gaining popularity as a sustainable alternative to traditional animal protein sources such as shmeal and soybean meal. ey are easy to farm, have a high feed conversion e ciency, and require less land and water compared to conventional protein sources. Insects are also rich in nutrients such as protein, fat, and minerals, making them a valuable ingredient in animal feed, including sh feed.

Fish farmers rely heavily on shmeal and sh oil, which are obtained from wild sh stocks. is has led to over shing and depletion of sh stocks in many regions of the world. Insects can o er a solution to this problem by providing a sustainable source of protein for sh feed. Black soldier y larvae, and mealworms,

are some of the most commonly used insects in sh feed. ese insects are easily digestible and provide a balanced amino acid pro le, making them a suitable replacement for shmeal. e use of insects in sh feed has several bene ts. First, it reduces the pressure on wild sh stocks by providing an alternative protein source. Second, it reduces the environmental impact of sh farming by lowering the carbon footprint and the amount of water and land needed to produce feed.

ird, it can help reduce the cost of sh feed, which is a signi cant expense for sh farmers.

However, there are some challenges to the widespread use of insects in sh feed. One of the main challenges is the cost of production, which is still higher than that of traditional protein sources. Another is the abundance of chitin in insect meal which negatively a ects the sh’s digestion.

Black soldier fly larvae (pictured) and mealworms are among the commonly used insects for meal, but the potential of other species is also being explored.

In addition, the consistency of insect meal quality may vary depending on what the insects were raised on. Despite these challenges, the use of insects in sh feed has the potential to transform the aquaculture industry and make it more sustainable. e development of an industry to produce insects to be made into meal has also spawned specialised companies that improve insect meal by making it more accessible or healthful for the sh. Ittinsect was founded by Alessandro Romano, the CEO, in 2021 to reduce pressure on the stocks of industrial sh

species that are the raw material for shmeal and oil, traditionally the primary ingredients of sh feed. Having sailed competitively since his childhood and with an educational background in naval architecture Mr Romano has long had a close connection to the sea. On a 40-day sailing trip in the Adriatic a few years ago, when he committed to surviving only on the sh he caught, he realised that there was precious little sh in the sea. is discovery led to an epiphany. Since almost a quarter of global catches by volume is used for conversion to shmeal and sh oil, he decided that his mission would be to develop a substitute that could reduce the amount of sh that is caught for industrial use.

Ittinsect is a biotech company that optimises insect meal to improve the performance of the sh feed to which it is added. We do not produce insects, says Mr Romano, we have developed a biotechnological process that improves the nutritional e ciency of insect meal making it, he claims, eight

times more bioavailable to the sh than conventional insect meal. e process the meal is subject to improves the proteins by breaking the long chains of amino acids making them more digestible using microbes, enzymes, and other biotech enablers. e process is in the process of being patented, so Mr Romano is reluctant to go into too much detail. In addition to making the proteins more digestible the process reduces antinutritional factors, like chitin. While a certain fraction of chitin in the meal is bene cial, too much of it can provoke gut in ammation in the sh. Finally, the meal also stimulates the gut of the sh to absorb more nutrients thereby accelerating sh growth. e insect meal thus processed is added as an ingredient to sh feed in a proportion that varies between 10 and 30 depending on the species and size of the sh. e company has developed a complete feed line for trout, sturgeon, and expects to launch a variety for seabass and seabream feeds shortly. ese developments helped to persuade rst class blue economy investors such as Katapul Ocean, Indico Capital

Partners, and the Italian national innovation fund, CDP Venture Capital to put EUR625,000 into the company in January this year.

At the company stand at AquaFarm in Pordenone, Italy, Mr Romano o ers visitors a taste of trout that has been fed on a feed made from insect meal supplemented with the Ittinsect ingredient. e sh is the rst in Italy to be commercially fed with an insect meal diet and has a mild taste and rm texture. Mr Romano states that the feed conversion ratio (FCR) was 18 better compared with a standard sh, and there was 3 less fat in the guts, and in a panel tasting it did better on both taste and texture than conventionally fed sh.

e improved FCR means that the sh can be grown to a given weight faster than a sh fed on a regular feed, or can reach a larger size in a given period. In addition to improvements in performance are the environmental bene ts. e insects are fed on agricultural

• Tunnel washers

• Container, bin and vessel washers

• Pallet washers

• Rack & trolley washers

• Drying systems

•

•

•

by-products which contributes to the circular economy and insect-based feeds typically emit 10-20 less carbon dioxide than traditional feeds. Ittinsect’s mission is to replace shmeal with insect meal to reduce the carbon dioxide emissions associated with the former and to ease the pressure on the sh stocks that are reduced to shmeal. e insects are obtained from European producers who follow EU regulations for insect production. is means they are mainly fed on certi ed plant-based agricultural by-products, such as from breweries or the roots of certain crops. Mr Romano hopes that in time it will be permitted to feed the insects a more varied diet. e main insect varieties cultivated in Europe are black soldier ies and mealworms, so these are also the insects that Ittinsect processes or includes in its feeds. As a biotech company it is constantly researching the potential of di erent insects, other agricultural by-products, and even

microalgae that can be treated and added to feeds. Our goal is to become an ingredients supplier to every feed producer, that wishes to reduce their carbon footprint and their impact on the marine environment and at the same time produce high performance feeds for sh farmers. e actual feed extrusion is subcontracted to a production partner but the biotech processing of the enriched insect ingredient, the formulation, the supply of ingredients, and the brand are all provided by Ittinsect.

Of the sh farmed in Italy trout has the largest volumes which made it an obvious target candidate for the company. With over 33,000 tonnes produced in 2020 (FAO) trout accounts for 70 of the nsh farmed in Italy. Trout in the wild also feed on insects, so a feed based on insect meal should be

acceptable to the sh. Sturgeon was selected because its diet particularly in the early stages is similar to that of trout. Trials carried out on sturgeon showed good results with regard to palatability, FCR, and growth. Moving to seabream and seabass which combined account for 11,000 tonnes of production will be more of a challenge as they are the rst marine species for which the company intends to create a feed. Towards the end of the year the company will start selling the ingredient on its own to salmon feed manufacturers interested in the inclusion of the ingredient in their feed. Insect meal is not, however, a cheap product. As research

continues to explore the potential of insects as a protein source for feeds, prices are expected to come down in the future as production increases, but for the moment Ittinsect’s improved insect meal’s unique selling point is the increased digestibility it o ers, the higher FCR, and the environmental bene ts. Equally important is the price of shmeal and sh oil which has increased ve-fold in the past 20 years and continues to rise as marine forage sh stocks cannot keep pace with growth in the global aquaculture industry. If prices of shmeal and oil continue to rise, switching to insect meal will soon seem like a no-brainer.

CEO: Alessandro Romano

Activity: Ingredients based on insect meal for aquafeeds

Species catered to: Trout, sturgeon, seabass, seabream

Volumes: 1,000 tonnes in 2023, commercial production to start in 2024

PerformFISH, an H2020 project that concluded last year, aimed to boost the performance of Mediterranean sea bass and sea bream aquaculture making it more productive, market and consumer driven, as well as environmentally and socially responsible. The Italian Institute for Environmental Protection and Research (ISPRA) led the work package tasked with developing a tool to benchmark the performance of the Mediterranean marine fish farming sector, based on key performance indicators (KPIs).

The tool, essentially a repository of real production data provided by the sector together with a software to carry out analyses, can be used to generate different kinds of information. For example, it allows users to compare

anonymously the performance of a Mediterranean aquaculture producer with the average of all Mediterranean producers whose data is in the system, and to identify sources of inefficiency. It can create reports on how the sector performs

from an environmental point of view, and it can promote higher technical efficiencies with lower environmental impact, among other equally useful information. The KPI system is aligned with recent guidelines from the European Commission about

building resilience and competitiveness of the sector, ensuring the participation of the sector in the green transition and increasing transparency, social acceptance and consumer information on aquaculture farming practices.

The KPI analytical tool

e tool is based on a set of key performance indicators (KPIs), quanti able measures with which a company can assess its performance over time, which were grouped into technical, welfare, environmental and economic indicators. e rst group comprised KPIs related to sh mortalities, losses and diseases, deformities, feed e ciency, sh growth etc., to measure the technical e ciency of companies. Welfare KPIs include operational welfare indicators to measure sh welfare during grow out cycles, while the environmental KPIs estimated the use of water, land, and energy as well as the impact of the production on biodiversity, and on the surrounding habitat. All told, an original list of some 200 KPIs was distilled down to 55 of which the welfare and environmental indicators totalled 9 and 14 respectively, while the rest were technical indicators. ese KPIs could be applied to the whole production cycle of seabass and seabream from the hatchery to grow-out and harvest.

e tool was developed by the ISPRA team in collaboration with

the industry and the ve sh producer associations (PAs) from Croatia, France, Greece, Italy and Spain (CCE-CA, SFAMN, FGM, API, APROMAR) representing over 90 of the seabass and seabream production in the Mediterranean EU countries, and consortium scienti c partners. It has three main components: the KPI dataset, the digital interface for data entry and the SAS® Visual Analytics, a powerful visual interface, exible and intuitive, with multiple statistical analysis and ltering options to analyse the performances of sea bass and sea bream aquaculture using KPIs.

Although data on the hatchery and the nursery have been collected, the implemented tool so far uses grow-out data as the PAs indicated that as a priority. Production data from stocking in net pens to harvest are collected at di erent growth stages so that the indicators are standardised for speci c weights of the sh.

When benchmarking the data from an individual farm it is possible to lter and analyse the data on many di erent indicators. Mortality (including mortality after 3 days,

after 10 days, or total mortality), use of antibiotics, sh losses, and all the other technical, environmental, and welfare KPIs related to

one farm can be compared with an aggregated value of those of other farms which may be in the same or di erent temperature zones. Similarly, it is possible to compare the performance of a batch with other farms’ batches from the same quarter of stocking or from di erent quarters. e tool uses a friendly set of statistical analysis to facilitate aquaculture companies to generate performances analysis of seabass and seabream on farm together with sophisticated statistical modesl as Welfare Score Index, Cluster Analysis, Data Envelope Analysis and Life Cycle Assessment.

As work package leader, ISPRA currently hosts the database, but a more long-term solution will need to be worked out for the future. Several options are under

■ Fisch-EnthäutungsmaschinemitGefriertrommel-Technologie

■ Besondersgeeignet fürweicheFiletsund Fischartenmitweicher oderdünnerHaut

■ Dünnesundtiefes Enthäutenvonkleinen undgroßenFiletsund vonAbschnitten

■ GeringeFolgekosten durchhoheEnergieEffizienzsowie moderne,reinigungsundservicefreundliche Konstruktion

consideration—it could remain in ISPRA, or be hosted by the Producer Associations, or by the Producer Organizations, or the producers may have to pay a fee.

Producers share their data—possibly for the first time ever!

Following the identi cation of a list of core KPIs and a standardized methodology for data collection on farm, the rst web interface was built to collect the production data from seabass and seabream companies. Producers are invited by their national

Producer Associations to participate in the project consortium and have been committed to the principles of transparency, trust and data sharing. e anonymization of the data was crucial as the information was con dential, and without anonymity the producers would not have contributed their data. e data can currently only be accessed by the individual producer, while the overall anonymised database was analysed and checked for data quality and validation of KPIs by ISPRA. Indicator data, mostly welfare and environmental, from the individual farms were

collected annually while technical indicator data were also collected by production batch so that a producer could benchmark one batch against another. Overall, data collection lasted 4 years and they provide an unprecedented level of detail with some 65,000 entries from 18 companies representing 400 batches between hatchery and grow out, says Francesco Cardia from ISPRA. If producers are willing to continue to enter their data, the system will become even more representative and more accurate.

For companies, the KPI tool today allows the benchmarking of sea bass and sea bream performances against the rest of the participants. For PAs the system can generate information about how the sector performs, use of resources, surface area, mortality, use of antibiotics, etc. which can provide the basis to communicate science-based messages about the sector and to increase the acceptance among consumers of products from aquaculture. However, PA’s access to the data remains to be negotiated between the PAs and their members.

For instance, the section on environmental KPIs information

entered include escapes, interaction with wild fauna, quality of sediments under the cages, use of marine space and freshwater, use of feed and chemicals for treatments. ese can be sensitive information, says Mr Cardia but, through this anonymized system, producers have the possibility of sharing them, to better communicate with consumers and to increase the transparency and trustworthiness perception of Mediterranean marine aquaculture .

Once the system is released for use by the industry, the producers willing to participate will have to upload their data which will be anonymised. This data aggregated will form the benchmark against which the individual producers can compare their performance. The system is very flexible and allows the user to widen or narrow the analysis depending on what he wants to benchmark against. For example, the quarter in which the juveniles are introduced into the cages makes a big difference to performance, says Tommaso Petochi from ISPRA, so when benchmarking a batch it makes sense to do it against fish that are from the same quarter.

A farmer can see, for example, the vaccination rate on his farm compared with the aggregate and then knows whether he is doing better or worse or the same as the other farmers. Vaccination can be compared with mortality so that a farmer can adjust his vaccination strategy if necessary. The system provides a trend of a farm’s performance and allows the farmer to set targets for improvement.

The project has also worked on validating operational welfare indicators (OWIs) relevant for seabass and seabream farmers. Following a holistic approach,

a composite welfare score index was created, enabling the first large-scale welfare assessment of seabass and seabream across the Mediterranean. The index is based on more than 20 OWIs, including direct animal-based indicators (mortality, injuries, feed intake, behavioural) and indirect indicators looking at good management and environmental quality, staff training and standard of production. These OWIs were then scored and included in a single welfare score elaborated using a composite indicator approach that allows the farmers to make a self-evaluation of welfare of their own batches, benchmarking with other farms and set targets for improvements. The index is non-invasive, meaning that live fish do not have to be

collected from the farm to assess welfare, the necessary data can instead be extracted from the database and modelled to get the welfare score. This in turn allows the index to be adapted easily—new indicators can be added if relevant, while ones that are no longer useful can be removed.

A more competitive and sustainable Mediterranean industry