The complete guide to buying your home with Living Wright Realty Group. Informed Buyers Guide

Welcome!

Thank you for contacting us to assist with the purchase of your new home. We know this can be an overwhelming process. For that reason, it is our mission to make this process as personal, professional, and enjoyable as possible by offering a concierge level of service.

Within this Buyer Guide, you will find useful material to review in preparation for buying.

Through our service, we aim to create clients for life and hope to earn your referrals in the future!

Happy Home Shopping,

Living Wright Realty Group

Getting Started

Preparation

You are ready to buy a new home, so what next? Whether you are a first-time home buyer or a seasoned pro, having a plan and the proper team in place will make your experience an exciting and stress-free one. To initiate this process, there are a few steps to take that will yield a smooth transaction ultimately landing you in your dream home. Let’s begin this process with the following:

Meet for a Buyer Consultation

This is where we review the process of purchasing a home. Here we will also discuss the local market conditions and current strategies for buying.

Hire a REALTOR® and Execute Brokerage Agreement

This ensures you’re working with the best of the best. The agreement will give legal structure to our working relationship so that we can offer you the highest level of service.

Obtain a Pre-Approval with a Trusted Lender

Living Wright Realty Group is happy to make recommendations should need them.

*If you are a cash buyer Proof of Funds will be required when submitting offers.

Gather Desired Home Criteria and Set Up Search

As you see homes of interest come through your personalized search you will reach out to us so that we can collect more information and schedule the showings.

• • • • www.livingwrightrealty.com

Financial Responsibilities

Earnest Money

This is due when your offer is accepted and deposited upon receipt. Earnest Money is held by a Real Estate Broker or Closing Attorney in an escrow account. EM typically equates to 1% of the sales price (Example: $150,000 Sales Price x 1% = $1,500 Earnest Money). Earnest Money is credited to the Buyer at closing.

Home Inspection

A home inspection is not required but is recommended. The typical cost of a basic home inspection can range from $300-$700.

There may be other inspections that you may want to consider on a case-by-case basis such as radon testing, sewer scope, septic inspections, etc. these range in cost.

Appraisal

An appraisal is required in any financed purchase. The lender will order the appraisal and you will pay for it. The typical cost can range from $450-$650.

www.livingwrightrealty.com

• • •

HOA Related Costs

A Home Owners Association Clearance Letter is required prior to close on any home that is associated with an HOA. Sometimes the Seller will offset the cost to the Buyer. Letters can range from $25-550. Please pay close attention to the Association Disclosure prior to placing your offer. If you are concerned about these costs, the HOA can be contacted directly.

Down Payment

Depending on the type of loan you will be obtaining your down payment can equate to 3.5% -20% + of the loan (Example: $150,000 Sales Price x 3.5% = $5,250 Down Payment).

Closing Costs

Your closing costs can equate to around 3% - 6% of the loan. Keep in mind your prepaids, taxes, mortgage, loan origination fee, attorney fees, home owner insurance, etc. are all included in this cost. Your lender will be able to give you a more accurate estimate of what these costs will look like.

www.livingwrightrealty.com

• • •

Every Step of The Way

The Benefits of Having Buyer Representation

Your real estate broker is there every step of the way to answer questions and assist you through the entire closing process, having the knowledge to help you ask the right questions.

1Your Interests Are Personally Represented

Enlisting the services of a professional Buyer’s Agent is similar to using an accountant to help you with your taxes or a doctor to help you with your health care. If you had the time to devote to learning everything about accounting or medicine, you could do these services yourself. But who has the time? This is why you allow other professionals to help you in their specific areas of expertise. We let you concentrate on your full-time job, while we do ours. We will guide you through the buying process and exclusively represent your interests as we help you secure, negotiate, and close on your dream home.

2 3 4 5 6 7

You Get A Personalized Specialist Who Knows Your Needs

Your Buyer’s Agent gets to know your real estate needs and concerns on a personal level through open communication. They will save you a lot of time by providing you all the details about any home before you see it. In addition, your Buyer’s Agent will listen to your feedback and concerns about each home.

Agents Are Buffers For You

As a buyer, agents communicate on your behalf to coordinate showings and speak directly with co-op brokers so that your best interests are protected.

Third Party Advantage

Potential sellers or buyers are more likely to tell your agent the truth, even if it is unflattering. Your agent provides you with all the possible options and opportunities without holding back.

You Will Quickly And Conveniently Get A Great Home

The advantage to signing a Buyer’s Agency Agreement with us is that you will have a professional agent working to find and secure the ideal home for you. It is nearly impossible to find a home that meets your needs, get a contract negotiated, and close the transaction without an experienced agent. You won’t need to spend endless evenings and weekends driving around looking for homes or trying to search computer networks by yourself. When you tour homes with your professional Buyer’s Agent, you will already know that the homes meet your criteria and are within your price range.

They Provide A Consumer Market Analysis (CMA)

Providing you with information like average price per square foot (of sold homes) and the average amount of time it takes homes to sell in particular areas will prove invaluable during your home sale or purchase process.

REALTORS® Handle Your Transaction With Confidentiality

They protect your best interests, while handling volumes of paperwork for you. Your time is valuable. A real estate agent or Advisor gives you the peace of mind that your transaction will be handled professionally.

www.livingwrightrealty.com

To Set You Up For Success

Your Team of Experts

A successful purchase starts with the right team. Ensuring you have the right experts in place to navigate you through the home search, offer, loan, inspection and closing process is invaluable and will make your experience a positive one. Their expertise will ensure that any questions or concerns you may have are acknowledged and addressed.

Your REALTOR®

Your REALTOR® is not only here to help guide you through your search and home purchase, but they are also there to answer questions along they way regarding any step of the process.

Lender

Make sure that your lender or financial representative is someone with whom you feel comfortable. Having the right financial partner is extremely important.

www.livingwrightrealty.com

Home Inspector

Every home has a few blemishes. It is a home inspector’s mission to find them. It is when you can say, after reviewing an inspector’s report, “I love it,” that you know this is the home for you!

Appraiser

An appraiser is one who determines the fair market value of property. The role of the appraiser is to provide objective, impartial, and unbiased assessments about the value of your potential home.

Closing Attorney

Your purchase is an important transaction, and using a closing attorney who is willing to take the time to answer your questions and also specializes in real estate law are essential.

www.livingwrightrealty.com

How Does Everyone Get Paid?

Real Estate Agent

Typically the Seller pays the real estate agent’s commission at the closing. However, in the rare instance that the Seller is not paying a commission the Buyer is responsible for paying. If this were to be the case the commission structure would be discussed prior to the contract being executed.

Lender

The Lender is typically paid via the Loan Origination Fee. This is part of the Buyer’s Closing Costs.

Closing Attorney

The Settlement Fee is paid to the Attorney and will be disclosed in the Closing Disclosure. This fee can also be requested upfront. This fee is included in the closing costs.

Insurance Agent

The Homeowner’s Insurance Premium (Hazard Insurance) is paid at closing. Part of the money collected for escrow will go toward this premium the following year. The Insurance Agent is paid by the insurance company.

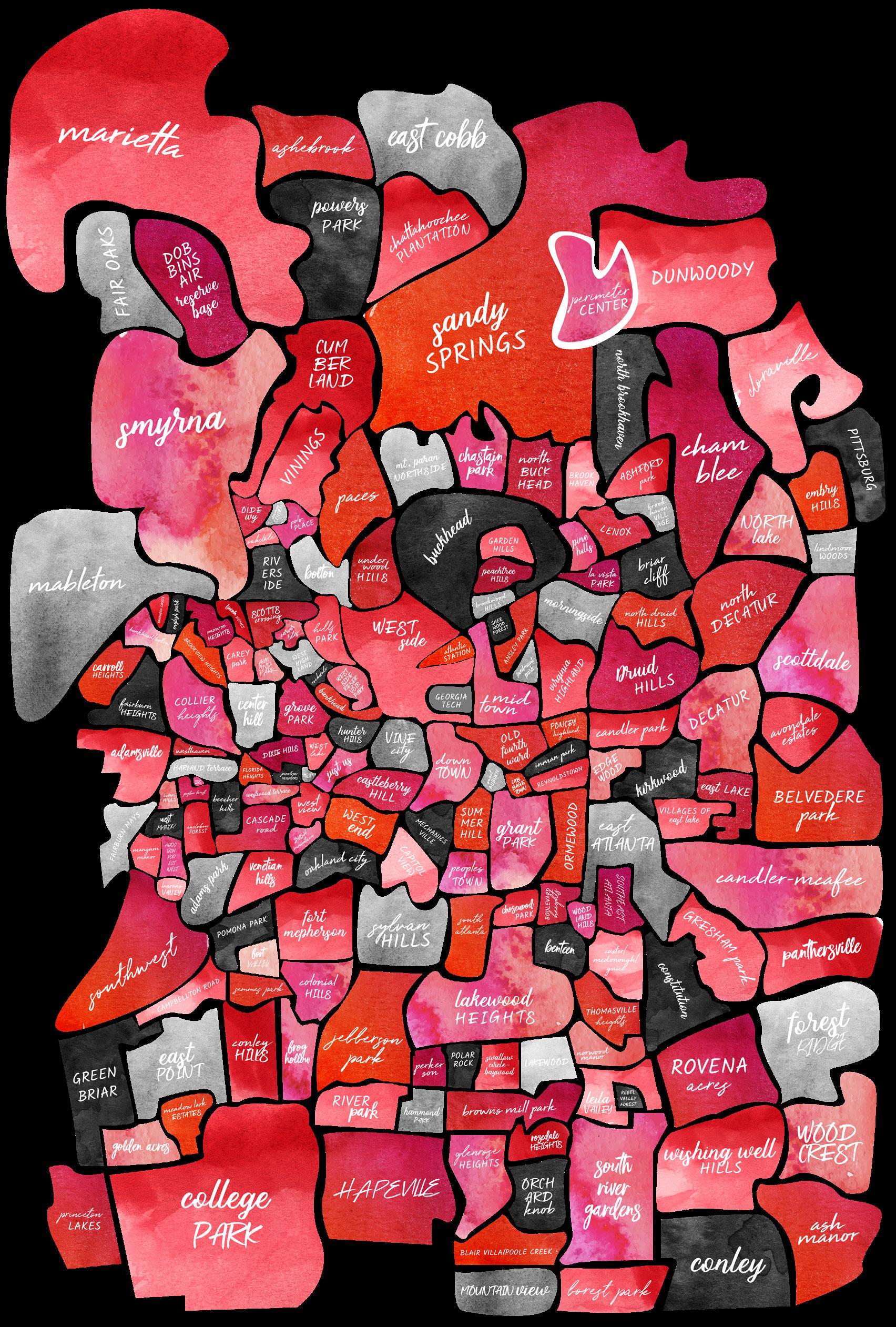

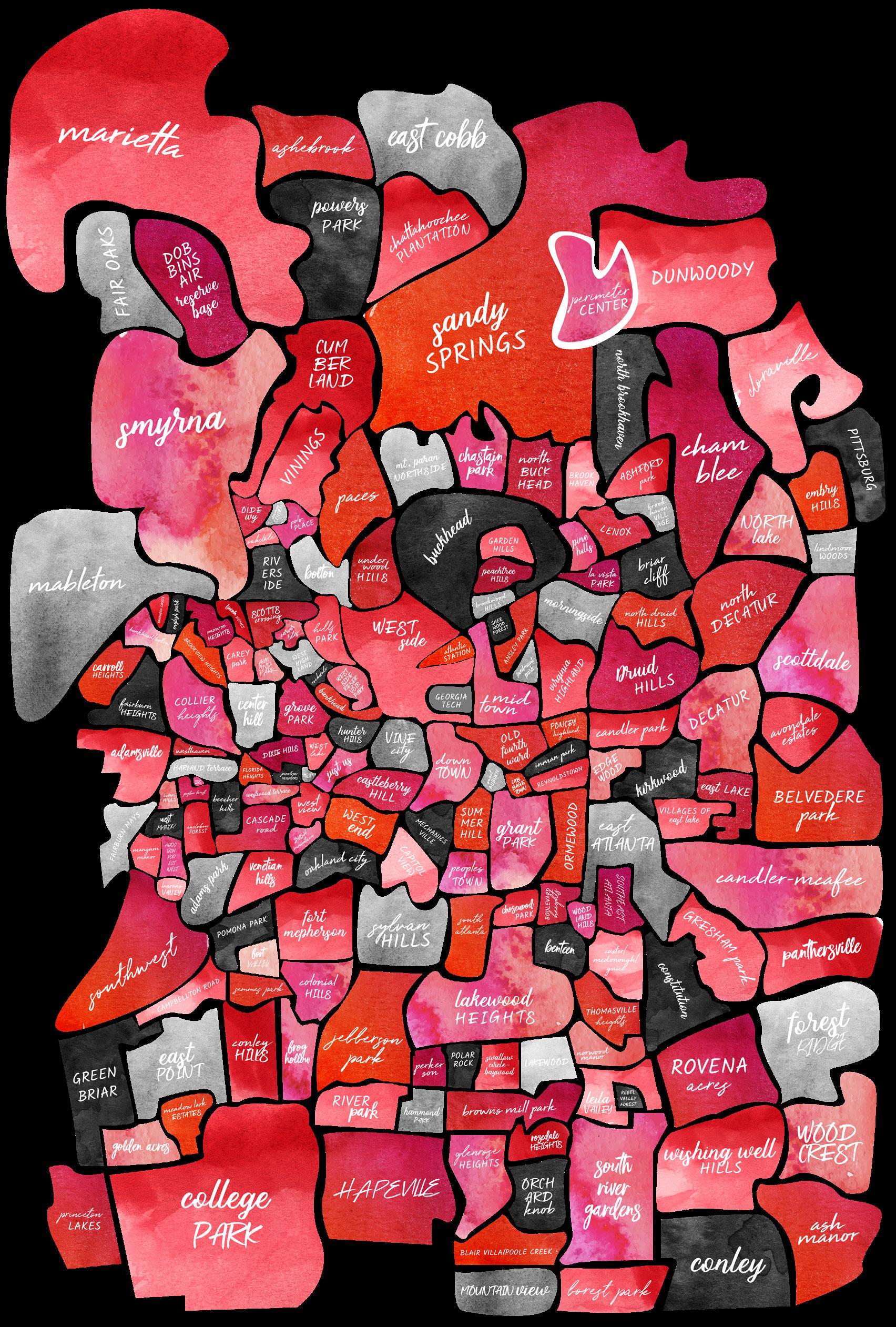

Finding the Right Neighborhood For You

Now comes the fun part: searching for homes that meet your parameters in the neighborhood of your choosing. When you begin touring homes that are on your short list, take along a notepad and jot down your thoughts as you approach each home. Can you imagine yourself living there? If the answer is yes, make sure to express all interest to your REALTOR®.

Beginning the Search

www.livingwrightrealty.com

The Day Has Come.

The day has come, and you’ve found your dream home. Now what? Even though your REALTOR® is there to negotiate and walk you through the closing process, here is a general outline of the process.

1Make An Offer

Your real estate agent will walk you through the steps required to make an offer on a home in your area. Your offer will likely include earnest money that will apply toward your down payment on the home and may include contingencies such as hiring a home inspector. Expect some negotiation, and discuss a competitive offer with your agent.

2

Once The Offer Has Been Negotiated & All Parties Have Signed, You Are Officially Under Contract, Congratulations!

At this point, the Due Diligence period begins. During this time we will schedule your Inspection and turn in your Earnest Money. If you would like to have any additional inspectors out or meet contractors for quotes this is your window to do so. It is not guaranteed, but most Seller’s will honor these appointment requests.

3 Negotiations From Inspection Take Place

Based on the inspection findings we will discuss and assemble the Amendment to Address Concerns to be presented. There may be instances where the Seller would prefer to negotiate a financial concession toward closing costs in lieu of repairs. There are instances where a Seller may deny any repairs or concessions we will work through this on a case-by-case basis.

www.livingwrightrealty.com

4 The Home Appraisal

When it comes time for a home appraisal, this serves as a hands-off process for the buyer and seller. During this process, your home appraiser will assess the value of the home, verifying the purchase price stacks up correctly to the value of the home based on a market comparison and assessment of interior and exterior of the home. Should there be a discrepancy in the appraised value and the purchase price your real estate advisor will assist you with the next steps.

5

Get Final Mortgage Approval

Once your offer to purchase is accepted, you’ll work with your lender to get final approval for your home purchase by the date specified for the closing. The lender may require you to pay property taxes or homeowners insurance for the first year at the time of closing, so make sure you know what funds will be expected.

6

Contingencies Come Due

Any contingencies that are part of the contract must be satisfied by the defined time periods outlined in the contract. It is important to stay on top of communication with your lender during the contract period. Your real estate advisor will also stay on top of these timelines and will keep in communication with all necessary parties along the way.

7 Attorney Will Prepare The File To Close

The attorney will reach out to gather your Buyer information. They will complete the title search to prepare the paperwork for closing. Please get them all items requested in a timely fashion.

8

Pre-Closing

Once all contingencies are satisfied and the attorney confirms clear title we will schedule the closing. Once the closing is scheduled we will reach out to give you all important closing details. Your real estate advisor will review the preliminary Settlement Statement provided by the attorney prior to closing. However, they will not see your Closing Disclosure unless you choose to share it with them. The lender will provide you with the amount to wire the closing attorney. The attorney will provide wiring instructions, please confirm them over the phone with the attorney before sending the wire. This is an extra precaution in an effort to avoid wire fraud. Be sure that you are receiving the wire instructions directly from the closing attorney or through a secure portal. Never trust wire instructions until you verify the location is secure and accurate.

9

Attend the Closing

We will perform a final walk-thru before closing. If repairs were negotiated during the Due Diligence they should be completed prior to closing and paid invoices provided to us in advance. If no repairs were negotiated we will still perform a final walk-thru before closing. Once all of the above steps are completed, you’ll be on your way to the closing table. This is when the deed to the home is transferred from the seller to the buyer. Every transaction varies, but be prepared to sign a good amount of paperwork. An attorney or settlement agent will guide you through the process. After all parties have signed at the closing and funding is approved you will receive keys and the home is officially yours!

www.livingwrightrealty.com

Strategy Stipulations

To Consider

**Consider these ahead of time as some stipulations you may want to be familiar with should you be in a multiple-offer situation!

•

•

An “Appraisal Gap” Is Where A Buyer Agrees To Pay Above An Appraised Value Up To A Specified Difference:

“All parties agree that if the property does not appraise for the Purchase Price then the buyer agrees to pay the difference between the appraised value and the Purchase Price in cash at closing up to the amount of $______________________ (specify excess payment). This obligation is in addition to any other down payment requirements imposed by the buyer’s lender. Upon this occurrence, the sales price shall be the Appraised value plus the cash payment amount.”

An “Escalation Clause” Is Where The Buyer Agrees To Pay A Higher Specified Amount Than Another Offer The Seller May Receive Up To A Certain Amount:

“In the event that Seller receives additional bona fide offers to purchase the Property with terms acceptable to Seller, but which result in net proceeds of sale equal to or greater than the net proceeds of sale payable to the Seller under this Offer, then the sales price stated in this Offer shall automatically increase by $___ over the highest competing bona fide offer. The sales price under this Offer shall in no event exceed $___(the “Cap”). Seller shall provide buyer with copies of any and all offers above $___ [insert contract sales price].”

•

•

An “As-is Stipulation” is used when a Buyer agrees to purchase a home in the condition it is presented in at the time the offer is made without additional negotiations to come after an inspection:

“Buyer agrees to purchase the Property “as-is” and will not request that any defects be repaired or replaced in any amendment submitted on the Property. Buyer shall retain the right to inspect.”

Waiving Contingencies is when a Buyer waives the right to a particular contingency.

www.livingwrightrealty.com

This May Happen

Multiple Offer Stipulations: You will be bidding, you may have to offer above the list price, and potentially use other strategies so that the offer can stand out and be competitive. If this is the case we will review the strategies and options with you when preparing the offer.

The property may not appraise for the contract price. If this happens, we will discuss your options with you and negotiate on your behalf to come up with a solution.

Closings can be delayed for one reason or another; taking care in the early stages of the contract period should prevent this. If we do have a delayed closing there is no reason to panic, we will get the situation resolved and close as soon as possible. We operate with a “no freak-out policy.”

HOA’s or Management companies may not respond in a timely manner which could cause delays. Seller will probably not agree to fix everything from an inspection report; your REALTOR® will help guide you but be prepared to request wisely.

The mortgage company will probably pull your credit report a few days before closing (so don’t do anything that changes your credit situation between application time and closing time!)

You may have to write a Letter of Explanation to a lender.

You may feel nervous at times during this process. You are making a significant and very personal purchase. It’s quite normal to feel a little nervous, but don’t worry we will be sure to encourage logical decisions.

www.livingwrightrealty.com

What to Bring to Closing

Your Agent

It is important to have an advocate who understands the intricacies of the home-buying process. This is especially critical for first-time homebuyers. It’s nice to have someone with you who knows what’s going on and has your interests in mind at all times.

Your Photo ID

Of course, buying a home requires you to first prove that you are who you say you are. You will be signing a number of documents that will need to be notarized. A photo ID such as a driver’s license or current passport will do the trick. If you don’t have either of these, a state-issued ID should work.

www.livingwrightrealty.com

Congratulations, New Homeowner!

After the excitement of closing on your new home, it’s essential to think about what comes next. If you financed your purchase, your mortgage payment, encompassing Principal, Interest, and Escrows, will become a monthly responsibility. Annually, when taxes and insurance bills surface, your mortgage company will handle the payments from your escrow account. For cash buyers, it’s crucial to note that taxes and annual insurance premiums remain their responsibility, requiring prompt payment each year.

If you purchased a home as a primary residence we will reach out to you after the New Year to remind you to file for your Homestead Exemption.

In the midst of settling into your new home, always remember that your Engel & Völkers Advisor is here for you at every turn, offering guidance and support beyond the closing process. Whether it’s managing your mortgage details or assisting with any queries that arise, we look forward to being a constant presence in your homeownership journey.

What We Will Do For You

Your Best Interest Is Our Best Interest.

We will do everything in our power to make you successful, protect you, advocate for you, and help you get to the closing table with ease.

We Are The Ultimate Resource To You.

Our market knowledge, connections, and strategies are top-notch. We know how to write winning offers and position our clients to achieve their home ownership goals both today and in the future.

We have an extensive list of vendors and many relationships spanning our industry we have worked hard to make and cultivate for you. We do not get kickbacks or referral fees from anyone we recommend. We solely recommend based on customer service, value, and quality of work.

Expect us to guide you step-by-step through the process. You will never have to guess what’s coming next or if your REALTOR® is paying attention. We will provide you with all the resources and guidance you need.

“Kate makes transactions easy. She guides you through every step of the process and provides timely market advice to achieve not only the best bids, but the best process to ensure everything goes off smoothly. Her knowledge is invaluable.” -

Lindsay Eaton, Buyer & Seller

“Kate did an outstanding job facilitating the search for and purchase of our new home. My family is new to the Atlanta area, and Kate helped us narrow down the right neighborhoods, and brought all her years of experience and professionalism to every home that we toured, as well as the closing process. Her kind communication, sharp eye for detail, and reliability made the difficult task of searching for a home in 2023 feel much easier. We are so pleased, and feel she couldn’t have done a better job. Whether you’re buying or selling, do yourself a favor and reach out to Kate.” -

Ben Smith, Buyer

“Kate was an absolute godsend when it came to purchasing our forever home. We ran into several roadblocks in getting the house under contract and then additional bumps in the road once we were under contract. We barely had to lift a finger in navigating through these roadblocks, because we had Kate. Whether it meant taking several late night calls from the seller or hunting our developer down, Kate was up for the challenge. I don’t think we would have gotten our home without her, and I am forever grateful for her help.” -

M Patterson, Buyer

Scan here to explore Kate’s glowing testimonials from satisfied clients.

www.livingwrightrealty.com Testimonials

©2023 Engel & Völkers. All rights reserved. Each brokerage independently owned and operated. All information provided is deemed reliable but is not guaranteed and should be independently verified. If your property is currently represented by a real estate broker, this is not an attempt to solicit your listing. Engel & Völkers and its independent license partners are Equal Opportunity Employers and fully support the principles of the Fair Housing Act. KATE WRIGHT • ENGEL & VÖLKERS ATLANTA 1745 Peachtree Street | Atlanta | Georgia 30309 O +1 404-845-7724 | M +1 678-772-8519 kate.wright@evatlanta.com | livingwrightrealty.com