1 minute read

Adaptive Spending Strategies

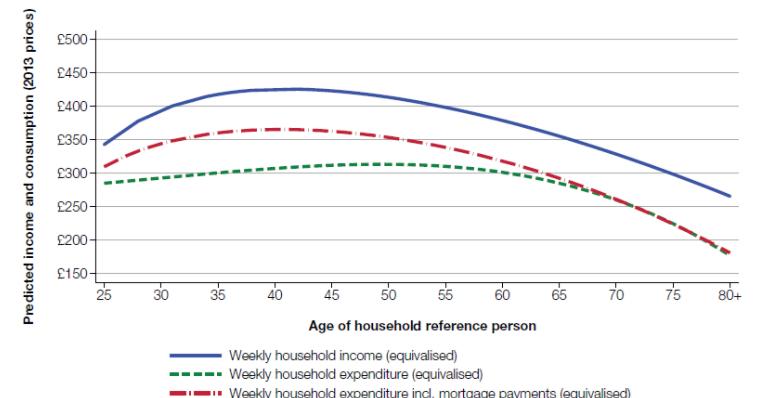

The overwhelming requirement in retirement is that of a regular income, to fund living expenses as well as unexpected or large ad hoc expenses such as medical expenses, holidays, car replacements or house maintenance

Going further than just establishing an income number can go a long way to managing our realistic expectations in retirement.

We believe that the most appropriate approach consists of dividing retirement spending into three discreet categories:

• Needs – basic non-discretionary expenditure to provide a baseline standard of living

• Wants – discretionary expenditure to maintain one’s desired lifestyle

• Wishes – luxuries that are not necessary to maintain one’s desired lifestyle

This approach immediately creates a more solid framework against which to plan for future expenditure.

For example, I might want to go to the movies twice a week, but I don’t need to. I could equally borrow a book from the local public library for free or at the other extreme (luxury) install a home cinema system.

Framing our income requirements in this way helps manage our retirement income journey and appreciate that from time to time, there may come a requirement to make some sacrifices.

A secondary yet important consideration for most of us is that of passing down a portion of our life savings to beneficiaries.