5 minute read

Diversification

Diversification is the only ‘free lunch’ when investing Although we all know that we should not ‘put all our eggs in one basket’, in practice many investors fail to diversify their investments sufficiently.

One of the reasons for this is that, often, the way to accumulate significant wealth, namely concentrated risky and possibly even leveraged positions for example in property, is not the way to preserve wealth. Coming up to retirement then, many investors will tend to have significant allocations of aspirational capital such as investment properties, stock options in our employer or our own business.

Equally, during the accumulation phase of our lives when we are saving, one of our biggest assets is in our personal or human capital that we generate through our salary. As we get older, we save some of our income and we accumulate personal assets and financial assets. We summarise below the main aspects of Personal Security that we believe should be our initial focus when thinking about what security means.

Personal Security

We could define personal security as the minimum level of wealth acceptable to any individual to meet their basic needs. The factors that we consider important to personal security include:

• Personal comfort - This includes the family home and other personal possessions. But also includes strategies for dealing with anxiety and stress in retirement such as downsizing to a smaller property or possibly moving home to be closer to family.

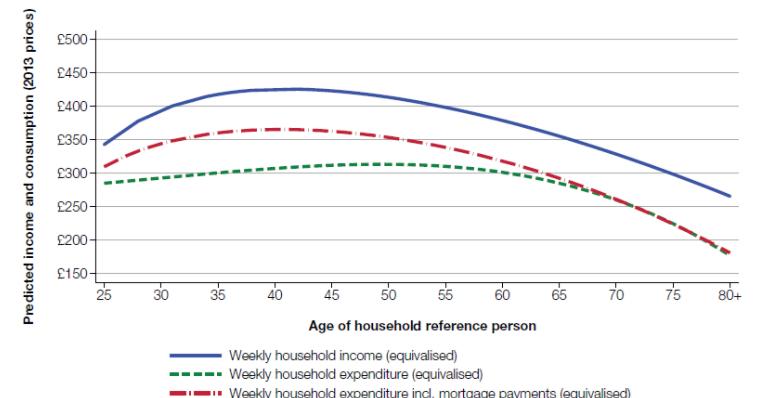

• Cash flow - the income and expenditure requirements of the individual. Having a household budget and good financial management are the foundations of any retirement plan. If you don't know how much income you need, you will have no idea how to invest your capital.

• Old age insurance - seeking to protect against the 50% chance that you might live longer than you are expected to on average and also providing for the cost of medical expenses in retirement.

• Murphy's Law - If it can go wrong, it probably will.

Instead of thinking that very rare events are impossible, we should instead think that they are improbable but might still happen anyway. The key to a good retirement plan is to be able to cope and adapt to the unexpected.

Household insurance is a classic example of a policy that is designed to protect against the rare but potentially extremely damaging events that could cause significant harm to our personal security.

Lifestyle Security

We could define lifestyle security as the desired level of income you would like in order to maintain your quality of lifestyle i.e. the cars you drive, where we live, how many holidays you take each year and if you turn left when boarding a long-distance flight (into business class) rather than turning right (into economy).

For many people in retirement, it will prove impossible to maintain their standard of living by keeping their money on deposit with a bank. The reason for this is that the average rate of return on deposits, after allowing for tax and inflation has always tended to be close to zero.

The relative decline in standard of living relative to the working population is due to the fact that many in retirement are on “fixed incomes” and so cannot increase their take home pay through increased productivity or collective bargaining.

The impact of inflation on our quality of life in retirement can really only be offset by continuing to link our financial capital (our savings) that most of us earned from paid employment back to the productive real economy so that as the quality of life of the working population improves, as retirees we continue to participate directly in the real economy.

The way to do this is by investing in real assets such as stocks and bonds and that means assuming more personal investment risk.

Turning Success Into Significance

Generally, people have different needs depending on their age ranging from pre-retirement - with emphasis on tax planning and capital accumulation, early retirement - with emphasis on sustainable income strategies and late retirement – where the focus sometimes shifts towards taking care of heirs, estate planning and even charitable bequests.

There is an old saying that there are “no pockets in shrouds” and “no prizes for being the richest person in the graveyard”.

Knowing that you have sufficient income to do all the things you both need and want to do in life without fear of ever running out of money is one of the key results of the Financial Planning process.

“If you realize that you have enough, you are truly rich”. – Lao Tzu, Tao Te Ching

We believe that retirees who are confident that they have “enough” are much more comfortable with the concepts of taking care of their heirs and charitable bequests than those who worry if they are going to have enough.

For example, imagine you take all of your wealth and convert it into €50, €100 or €200 notes and put it in a biscuit tin. Each day you help yourself to a note and spend it. On the last day of your life how much is left in the biscuit tin?

What you didn’t get to spend is your legacy. We can think of this as “dry money”7 since you never got your hands on it.

7 'Cash' is 'airgead tirim' in Irish (literally 'dry money)'

Aspirational Wealth

In general, you need a significant increase in capital to move up 10% in your personal wealth relative to the population. For example, in the USA it has been estimated that to move from the richest 40% of the population to the richest 60%, you would need to triple your net worth. One simply cannot meet such an aspiration without taking on substantially more risk and as Sean Quinn vividly illustrated, this does not always end well.

We believe that for most retirees therefore, the focus should be on ensuring that you have sufficient personal security to meet your needs, sufficient lifestyle security to meet your wants and that your longer-term focus should be on wealth preservation and ultimately leaving a meaningful legacy to the next generation.

Examples of aspirational capital investments that we generally believe should be avoided include:

• Lottery tickets

• Prize Bonds

• Private Equity

• Hedge Funds

• Investment properties especially with borrowings

• Stock options and shareholdings in a single company or narrow range of companies

Pre-Retirement Decisions

We believe that all investors should consider and understand their retirement options well before they actually reach their proposed retirement date and ideally should have an idea of how they plan to deal with the choices that they are going to have to make between say, buying an Annuity compared to an Approved Retirement Fund. These decisions should be considered at least several years before they retire and ideally at least 5 years before normal retirement date.

The reason for this is that the asset allocation decision for their pre-retirement fund should reflect the likely decisions that are going to be made at retirement.

Understanding Your Overall Financial Position

An ARF isn’t really a product – it’s more a strategy for withdrawing retirement savings from a taxdeferred ‘investment wrapper’ .

When we are providing you with advice on your retirement options it therefore requires an understanding of broad context, specifically your wider financial circumstances and needs, given in almost all cases it involves a trade-off between risk and reward as well as tax mitigation decisions.

If you have other sources of guaranteed income (State Pensions and Defined Benefit of Final Salary Pensions), lifetime savings or realisable assets including residential property, these should be considered and, in many cases, might offer up a more tax efficient route compared to withdrawing income from your pension.

If you are wealthy enough to consider an ARF, you should also consider deferring your pension and using less tax efficient savings and investments first