13 minute read

Understanding Your Starting Position

As well as understanding your overall financial position, a bespoke approach stemming from establishing your starting position is often critical in ensuring a good retirement outcome. For example, some clients are looking for deferred drawdown, say for example, wanting to take their taxfree cash at age 50, deferring the ARF to age 61, and with a view to paying into another pension product later down the line. Other clients are looking to take the maximum tax efficient income from their pension to bridge the gap until their state retirement pension and/or occupational pensions kick in later.

Assessing All Options

An ARF allows an individual to take as much or as little (subject to imputed distributions) as they like from their pension arrangements on reaching the normal minimum pension age (or earlier in special circumstances).

But just because you might have these options, it doesn’t mean that it is necessarily sensible to exercise them.

Defined Benefit Pension

Catherine has been offered a transfer value of €69,500 from her existing defined benefit pension scheme, which is due to pay her a pension of €3,300pa starting when she is 65 this year with a 50% spouses’ pension on her death and inflation increases up to 5% pa.

To match the €3,300 pa available, Catherine would need a transfer value of around €121,000 to purchase an annuity today so this tells us that the transfer value isn't at all generous.

The transfer value will currently buy her an annuity of just €1,830 pa rather than the promised €3,300.

If she were to take out the lump sum and use an ARF for the remaining fund, it would need to earn at least 4.5% pa in real terms on average every single year for the rest of her life after charges to match the promised pension.

So, the investment strategy would have to be 100% equity which is extremely risky and would leave her with a very high probability of completely running out of money as we can see in the analysis below.

Even if Catherine deferred the pension start date to 70 there is still a lot of uncertainty

In this case, and indeed generally, it just doesn't make sense to take the risk. We'd recommend sticking with the guaranteed pension.

All available options including buying an annuity, phased retirement using PRSAs or an ARF should be considered to arrive at the most suitable outcome.

Providing you with advice on an ARF itself is increasingly not a binary choice for many in respect of retirement income products, with good practice involving an assessment of the suitability of a full spectrum of retirement income solutions, including phased retirement and blended or hybrid solutions so that current and known/unknown future income needs can be best accommodated.

The ARF should also be benchmarked against the annuity that you would have been purchased at retirement (spouse’s pension, inflation protection etc) and, where appropriate, enhanced annuities. This gives an indication of the investment strategy that the ARF investor needs to pursue to not risk being worse off from the decision not to buy an annuity.

If the ARF portfolio is not sufficiently risky its highly unlikely that the ARF will be able to maintain the level of income that the annuity would have provided, and the client may find themselves worse off in old age.

Considering All The Risks

The decision to invest in an ARF is almost always a balancing act between mitigating risk, receiving returns and retaining some flexibility. A successful ARF strategy involves the ongoing and effective management of any number of risks following not only the establishment of your willingness to take investment risk but more importantly our assessment of your ability to take that risk (known as your risk capacity).

Essentially this is about helping you to understand the greater risks associated with drawing down an income from a retirement portfolio, compared with the experience you had while you were saving for retirement, including:

• Sequence of returns risk (also known as reverse euro cost averaging) – where withdrawals during a market downturn can lead to a rapid reduction in the value of a fund from which it may never recover.

• Volatility drag – the risk inherent where a portfolio falls in value and then needs to work harder to go back to its initial value. Example if a fund drops by 10% it needs to climb by a little over 11% to return to the original value. A fund that declines by 50% needs to return 100% to get back to the original value.

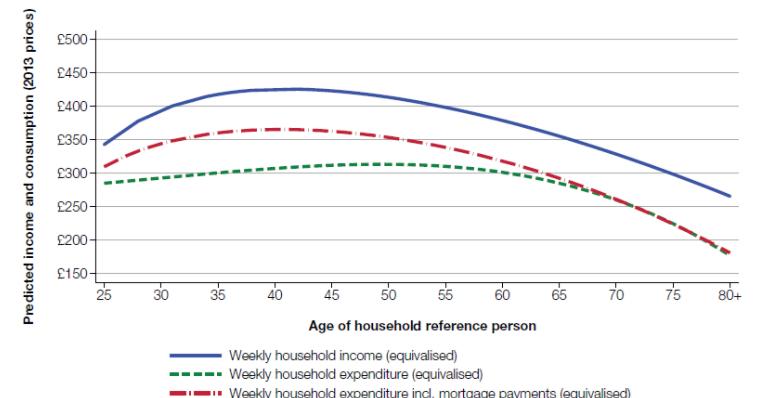

• Inflation risk – helping you appreciate how long your portfolio might need to last and a considered view on the impact of inflation (for example, 5% inflation reduces real income by two thirds over a 20-year period). Even relatively benign rates of inflation can have a huge financial impact over increasing years in later life.

• Longevity risk – an assessment of average life expectancy and helping you to understand the probability of living beyond this.

Establishing an Optimal Investment Strategy

As your advisers, we need to consider the requirement for a different investment approach for our clients in the accumulation and decumulation stage. In adverse market environments, volatility combined with withdrawals can result in significant falls in portfolio value so the effective delivery of low volatility growth through a regularly reviewed investment strategy which is periodically rebalanced is a crucial objective for most ARF clients.

Establishing a ‘Prudent’ Withdrawal Rate

Linked to the above, we have in place a robust framework when it comes to advising our clients on what commentators often refer to as a Safe Withdrawal Rate (SWR).

An ARF is however not without the additional risk of imputed distributions which ‘require’ the payment of income at rates as high as 6% pa.

As such, good practice should also extend to the use of more accurate words such as ‘prudent’ or ‘reasonable’ withdrawal rates. Of course, any rule of thumb needs to be adapted to consider individual client circumstances as well as external factors such as inflation.

Minimising Tax

One of the key ways in which we can add value (and increase sustainability of income) is in respect of limiting tax on your retirement income.

Whilst it is possible to take the whole pension fund as a taxable payment, lump sum withdrawals from a pension plan will currently be subject to income tax at your highest marginal rate.

Consideration of strategies to avoid this tax including utilising phased income withdrawal when a large tax-free cash amount is not required is good practice where appropriate.

In addition, we will always raise the issue and assess the impact of the Lifetime Allowance, both on withdrawals and at age 70 or 75 for a PRSA on remaining benefits. Account should be taken of the existence of any ‘protection’ from the ‘lifetime allowance charge’ in respect of the value of benefits built up (and future benefits that may accrue) in excess of the Lifetime Allowance.

Other Opportunities

Where appropriate, we will always consider other planning opportunities related to an ARF, including for example, deferring benefits, the recycling of income and the use of excess income to fund additional pension contributions (e.g. for children or spouse)

Ongoing Review Process

Successful ARF strategies require ongoing monitoring to help ensure they meet changing and evolving client circumstances and, in particular, as clients age.

This requires a consistent ARF review process across all clients, regardless of where their ARF is held. Critical questions include:

1. Is it meeting the stated objectives, priorities and expectations of the client?

2. Is the chosen level of income sustainable over the long term?

3. Is the investment strategy still suitable?

Other important questions to be asked include amongst others:

• How will a client’s health affect the review and outcomes?

• How do you assess whether the client’s objectives are still realistic?

• Has their capacity for loss/attitude to risk changed?

• How are any changes to strategy and investment portfolio identified and actioned?

• Has the time come to consider a partial, phased, or full exit from a drawdown plan (for example, to buy an annuity when a client gets older, and the impact of mortality drag means their drawdown strategy becomes progressively less effective)?

• Is it clear the clients’ minimum income requirements are still being met?

• Have the client’s cognitive abilities deteriorated?

• Does the client have a Power of Attorney in place? Or is the client a Power of Attorney for someone else?

• Review of the nomination/expression of wish into every annual review and following each key life event.

• Changes in relevant legislation?

Frequency of Review

It has always been important to review ARF funds on a regular basis. Frequency of review should reflect the complexity of any given clients’ circumstances, but good practice would suggest this should be at least annually and, in some cases, more frequently.

Cash Flow Modelling

A good way of understanding the specific needs of a client surface whether they have any concerns about outliving their retirement savings and help them make decisions (especially where trade-offs exist) is the regular use of some form of cash flow modelling.

Good practice should include running cash flow modelling beyond average life expectancy, and we generally default to age 100. This might also involve further modelling of a clients’ overall financial situation to age 75 because at this point it might be better for some individuals to annuitise and remove the risk of outliving their money entirely.

Effective Cash Flow modelling should stress test various scenarios for the client to enable them to decide whether they are able to take the income they require and how it might be affected by certain events such as:

• The need to increase income taken from a portfolio

• The need for any ad hoc withdrawals

• Inflation is higher (or lower) than expected/predicted

• Living longer than expected

• Future returns prove to be lower than expected

• Unpredictable events – a stock market crash, the need to fund long term care etc.

It is good practice for cash flow modelling to be an integral part of the review process.

Building Contingency

Its good practice to make sure there is a contingency built into all retirement planning, and to make sure there is significant provision to cover unforeseen problems (such as a major stock market crash, significant unexpected capital expenditure or the death of a partner).

Agreeing to a plan of action in advance will enable action to be taken quickly.

Social Welfare & Social Care Support

It is important that the advisor understands the impact of different choices on drawing down pension funds on current and future entitlement to welfare and social care support. This is especially relevant for those who draw down their pension pot quickly as they may be deemed to have deliberately deprived themselves of income/assets and in so doing reduce or disqualify entitlement to such support at some future point.

Powers of Attorney

As well as increased longevity, Ireland will have increasing numbers of people with illnesses, both physical and mental, ranging from mild cognitive decline to dementia. Good practice involves highlighting the possibility of loss of a clients’ own ability; for instance, if they lose mental capacity, what are the issues that present in terms of the ongoing management of a drawdown strategy.

Evidencing that the client has the ongoing capacity to make decisions and outsource decisions to third parties, such as discretionary fund managers and their adviser is increasingly important.

Clearly the time to set up a Power of Attorney is well before it is needed, and we recommend that this is put in place at the same time that an ARF is established.

Legacy Planning

An ARF can be inherited by the surviving spouse or civil partner, which amongst other things allows for pension wealth to be passed down through family generations. Apart from being good practice, it is important that a member nominates and keeps their nominated beneficiaries up to date if they want them to have access to all death benefit options available under ARF (30% tax on inheritance by an adult beneficiary).

Summary & Conclusions

Investing in an ARF carries higher risk than annuity purchase as the fund remains invested and may fall as well as rise in value. This in turn may lead to the client receiving less income than they expect.

For some clients this is unacceptable. However, as we have seen, pursuing a deposit-based or “lowrisk” fixed income investment strategy within an ARF to avoid investment risk does not guarantee a better outcome and depending on how long the client lives, an Annuity may work out to be better value overall.

Some clients, in the face of a decline in the value of their ARF may subsequently elect to switch to an annuity part way through their retirement; some of these may discover that they would have been better off buying an annuity at outset.

Clearly, investing in an ARF is not without its risks. Furthermore, if part of the portfolio is held in cash to meet the needs of imputed distributions, the return from the non-cash part needs to be that much higher to meet the overall return objective.

If you need withdrawals from your ARF to maintain your required lifestyle and the withdrawal rate is close to the annuity rate that could currently be secured, you are only going to be able to maintain this income level if a higher level of investment risk is taken.

The decision to invest in an ARF is not a simple process and we believe that it is very important for clients to fully understand all the risks that they face.

Equally, it is essential to appreciate that if you pursue a cautious investment strategy (such as investing in a deposit account) with an ARF you will almost certainly fail to meet the critical yield requirement and might actually find out that you would have been better off with the purchase of an annuity (depending on how long you live).

This problem is much too complex to have a single solution for everyone. Relevant factors to consider include the expected time horizon, the tolerance for risk, the desire for smooth consumption from year to year, and the desire to leave a bequest will each have an impact on the outcome.

While there is no single answer, there are several principles which apply uniformly:

• Investors are more likely to maintain living standards in retirement if they have low spending rates and reasonably large stock allocations within their portfolios. A long retirement coupled with a low stock allocation translates into a high probability of declining consumption.

• Insisting on a very high degree of “smoothing” of income from one year to the next (i.e. maintaining a relatively constant income) is a recipe for disaster. Imputed distributions are based on 4% or 5% of the remaining fund value and therefore does no subject the fund to this risk.

• For shorter time periods, higher spending rates may be justified. However, even over these shorter periods, higher spending rates increase the probability of declining consumption in the future.

• Expected bequests are higher for portfolios with high stock allocations, but so is the likelihood of leaving a small bequest. This is a classic risk/return trade-off.

• If historical average returns are reasonable estimates of expected returns, there may be a reasonable expectation of rising real spending levels over time. When the more conservative adjusted means are used, median spending levels indicate a likelihood of declining living standards

The Next Step…

The Everlake team of financial advisors is dedicated to achieving excellent outcomes for our clients. We operate at the frontier of innovation and embody a willingness to challenge the status-quo at every turn.

Our high ethical standards apply to every aspect of our relationship with you, and through our culture of continuous learning. Each member of our team is highly qualified and capable of delivering world class financial planning solutions to you.

Arrange a meeting with one of our advisors to discuss your retirement planning by emailing enquiries@everlake.ie or book a call directly through Calendly here.

We look forward to working with you.

The Everlake Team.

The purpose of this guide is to provide investors approaching retirement with an understanding of their retirement options and some of the more important issues to consider.

It also sets out generic guidelines for advisers seeking to advise their clients on retirement planning matters.

Clients looking to access their retirement plans have a number of options available to them and should make some key decisions well before reaching retirement. These decisions are complicated and best served by a discussion with a qualified and experienced financial adviser.

Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. In any event that the content of this brochure may conflict with an individual’s unique personal circumstances, the client’s circumstances should be weighed more heavily.

Advisers are expected to use their Professional skill and judgement to resolve any conflicts between the content of this brochure and a particular client’s requirements.

Although this guide is intended to deal with the main questions facing those about to retire in general terms. As such, it does not attempt to cover every issue which may arise on the subject. It does not purport to be a legal interpretation of the statutory provisions and consequently, responsibility cannot be accepted for any liability incurred or loss suffered as a result of relying on any matter published in it.

The information provided in this brochure has been obtained from sources which we believe to be reliable and is based on our understanding of Irish Tax legislation at the time of writing (October 2022). We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk.

The rates and bases of taxation may change in the future. We recommend that you obtain specific tax advice for your own personal situation.

It should be noted that we are not tax consultants, but we will refer you to a suitably qualified tax consultant on request.

As with any investment strategy, there is potential for profit as well as the possibility of loss. Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors’ interests.

Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies.

We do not guarantee any minimum level of investment performance or the success of any model portfolio or investment strategy. All investments involve risk and investment recommendations will not always be profitable. Fermat Point Ltd trading as Everlake is regulated by the Central Bank of Ireland. The Central Bank of Ireland does not regulate tax advice.