10 minute read

National Overview

Demand for luxury properties surges amidst pandemic as Canadian markets power through volatile COVID-19 market cycle.

Canada’s major metropolitan areas are defying doom and gloom forecasts, showing market resiliency following a significant pause due to COVID-19. Until lockdown began across Canada in late March, Halifax, Ottawa, Montréal, Toronto and Vancouver reported 2020 as one of the busiest years on record.

As lockdowns went into effect in late March, the crisis forced buyers and sellers to quickly adjust to the new market environment. While many sellers held off on listing or took their properties off the market, many remained.

In British Columbia, Nova Scotia and Ontario, real estate was deemed an essential service allowing transactions to occur under significant restrictions. Québec, on the other hand, put the market on an unprecedented pause, shutting it down from the end of March through May 11.

Even amidst the pandemic, June saw Ottawa’s YoY home prices increase

16%

1 Canadian Real Estate Association, May 2020 2 Canadian Real Estate Association, May 2020 3 Canadian Real Estate Association, May 2020 4 Canadian Real Estate Association, May 2020 At a national level, April was marked by generational lows. Home sale activity fell by a record 56 per cent compared to an already affected March. 1 Year-over-year, national sales dropped by 57.6 per cent, the lowest April sales figure since 1984. 2 The number of newly listed homes across Canada declined by 55 per cent in April compared to March. 3

Despite these declines, prices held in most markets through the pandemic. Even amidst lockdown, April saw Ottawa and Montréal record the largest year-over-year price increases, with Ottawa’s increasing by 10.5 per cent and Montréal’s increasing by 8.4 per cent. 4

Showings through 3D virtual tours and video conferencing became the norm as buyer demand outpaced market supply, leading to multiple offer situations in all markets participating in this report. In fact, Engel & Völkers shops in Ottawa, Montréal and Halifax are reporting a noticeable uptick in transactions and stories of domestic and international buyers purchasing properties sight unseen. When borders reopen, Engel & Völkers is forecasting an influx of interest from the U.S., Hong Kong and Europe.

National home sales in May 2020 rebounded by a record 56.9 per cent, constituting one-third of a return of the activity lost between February and April. By June, price gains returned to pre-pandemic levels. Inventory increased, but not enough to meet pent-up buyer demand.

Bank of Canada Cuts Key Interest Rate

To soften the financial blow of COVID-19, the Bank of Canada cut its key interest rate to 0.25 per cent on March 18. It took steps toward quantitative easing on March 20, similar to the programs applied by the U.S. Federal Reserve and other major central banks during the 2008-09 financial crisis. 5 As March closed, the Bank of Canada announced a debt purchasing program focusing on areas across the yield curve. Its minimum purchase target of $5 billion per week aims to add liquidity across problem areas of the market.

The Bank of Canada held this historical low through June, a bright light for potential real estate buyers looking to lock in a fixed mortgage rate. While there is no indication of how long the Bank of Canada will keep this rate in place, there is a precedent that may serve as a predictor for what lies ahead. In 2010, after the 2008 - 2009 economic crisis, the Bank of Canada increased its benchmark rate twice. It

quickly reverted both times, realizing the adjustments were made too soon. It made no increases until 2015. 6

Canada Mortgage and Housing Corporation (CMHC), the largest insurer of residential mortgages in Canada, introduced strict new lending rules on July 1. The move is expected to affect some first-time home buyers. One major change includes raising the minimum credit score from 600 to 680, a move that may leave some first-time buyers on the sidelines. The measures will limit the gross debt service ratios on home buyer loans to 35 per cent

5 The Globe and Mail, March 27, 2020 6 Edmonton Journal, June 5, 2020

per cent, from 39 per cent and will limit the total debt service ratio to 42 per cent from 45 per cent. Canada’s two private sector providers of mortgage default insurance announced they will not follow CMHC’s lead in tightening the qualifying criteria for applicants, certainly reassuring news for less qualified buyers.

Optimism on the Rise

In early June, the Angus Reid Institute reported 32 per cent (or approximately one in three Canadians) stated they are financially worse off now than at the same time last year, a number surprisingly comparable to previous non-pandemic period polling years. 7 The percentage of those feeling better off now than the previous year has climbed from 21 per cent to 30 per cent.

COVID-19’s economic impact on Canadians has been mixed. Some are better positioned to meet financial commitments, while others are experiencing minor to severe difficulty. A Statistics Canada survey found while close to 30 per cent of respondents said the pandemic is affecting their ability to meet financial obligations, almost 50 per cent reported only minor impacts or none at all. 8

This indicates

the financial impacts were less than expected and could result in better financial security for

some.

While there was a high concentration of layoffs in some segments, these were mostly concentrated in industries

7 Angus Reid Institute, June 4, 2020 8 Statistics Canada, Canadian Perspectives Survey Series 1: Impacts of COVID-19 on job security and personal finances, April 20, 2020 strongly skewing toward young and part-time workers. The impact of these presumed temporary job losses is less likely to affect the real estate buyer’s market, as this group is often made up of renters. At the same time, professionals who continued to stay employed have likely increased their savings, possibly contributing to a stronger housing market.

Following the economic shock to the global stock market due to COVID-19, blue-chip real estate is proving to be a safe, low-risk investment. Blue-chip properties are defined by property type and location, especially those concentrated in areas with strong, ongoing and broad-based demand. Canada’s major markets are proving themselves through sustained property value growth, powering through market cycles in a stable and sustainable way, thus reinforcing their blue-chip status.

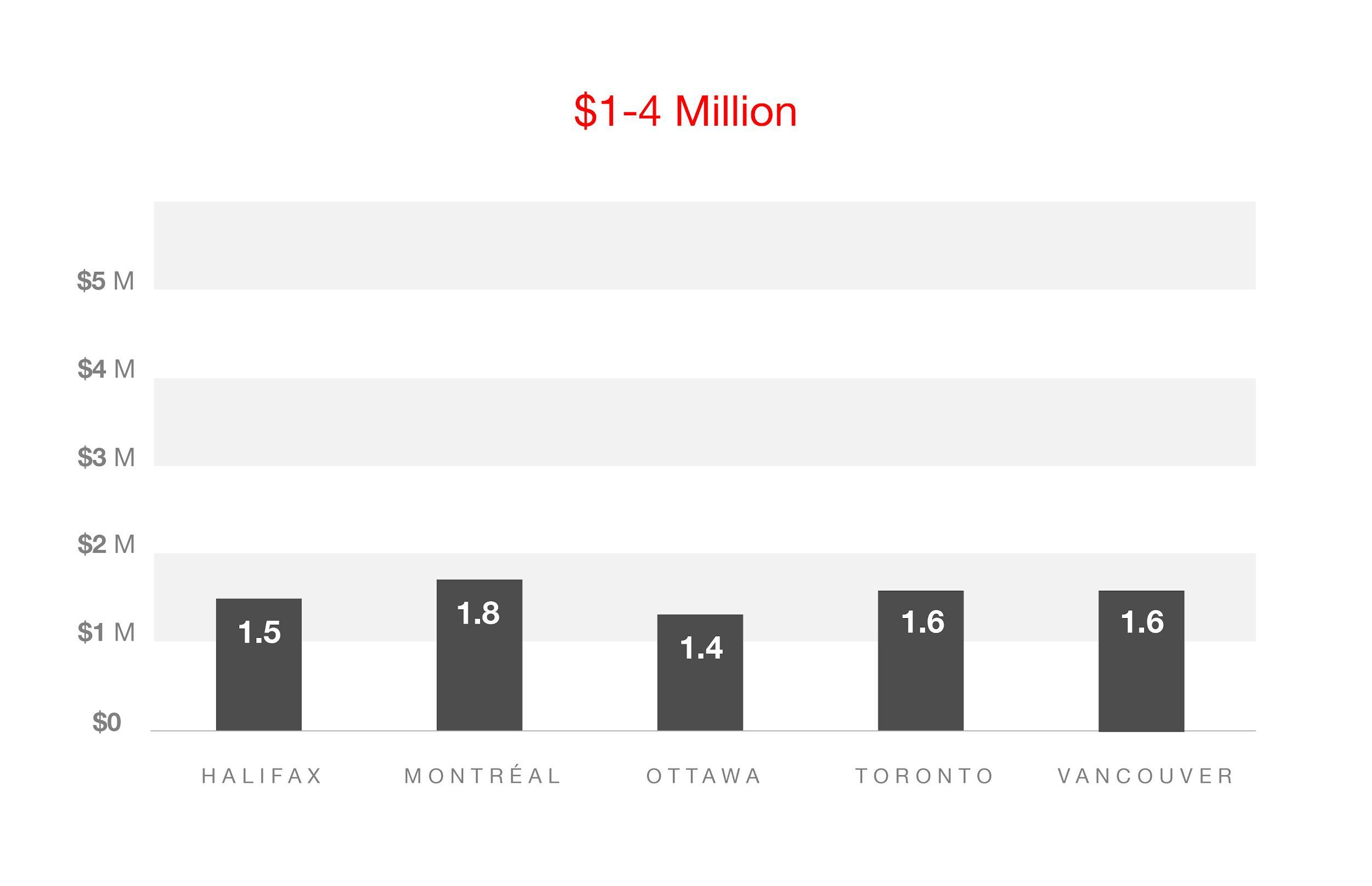

Price points in the higher end are holding steady, with some listings moving faster than usual due to buyers looking to level up into larger properties as staying home becomes the norm. This is presenting owners of unique homes who want to sell in the next few years a potentially short window to do so now. Within a global context, Canada is still largely undervalued, presenting international buyers an intriguing opportunity to purchase prime real estate.

Growing global interest in Canada, especially amid the pandemic, is positioning Halifax, Ottawa, Montréal, Toronto and Vancouver for continued year-over-year growth. Engel & Völkers expects pent-up buyer demand when the borders reopen in light of the tenuous political and social conditions creating uncertainty in various international markets.

Low Inventory Driving Up Prices

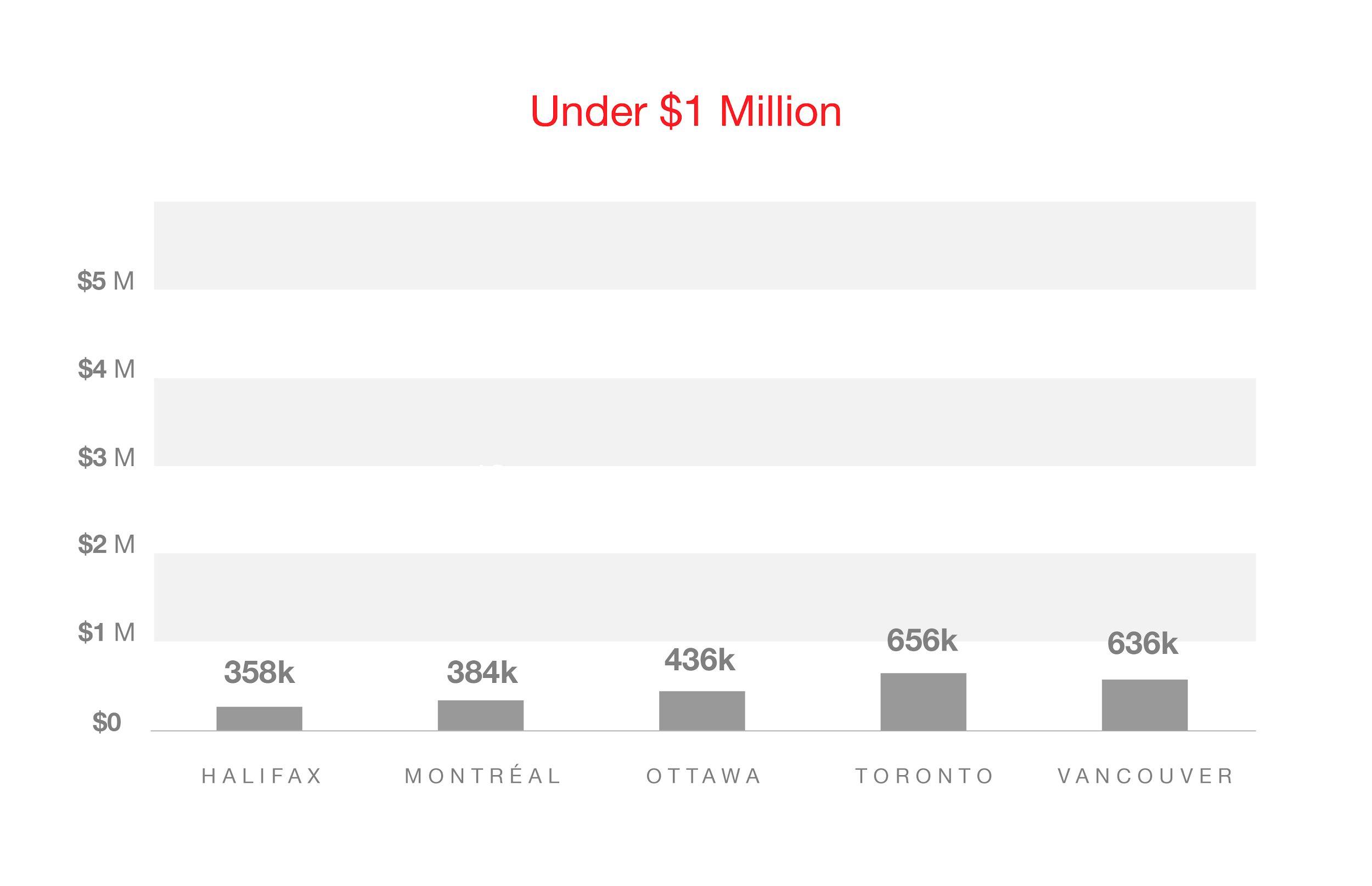

Engel & Völkers license partners are reporting an inventory shortage with low supply in major metro areas across Canada. Multiple offer situations are a common scenario in all markets surveyed. Properties in high-demand price points are sold in a matter of days. There is less demand for condos, creating a buying opportunity for investors who are scouting for blue-chip properties in Canada’s major metropolitan areas.

MLS data is pointing to market conditions favouring sellers across Halifax, Montréal, Ottawa, Toronto and Vancouver. For example, Vancouver’s average days on market has steadily decreased, while the total number of listings held steady in comparison to January, February and March. If sellers continue to hold off on listing their homes, a continued supply shortage is inevitable as provinces reopen. If this trend continues, Canada’s real estate market is well-positioned for price growth in the third and fourth quarters of 2020.

Uptick in Interest in Cottage Country

COVID-19 is ushering in a new interest in suburban and cottage country properties. Motivated by a desire for open space, recreation and the switch to working from home, buyers are interested in second properties or making a permanent move to the suburbs or cottage country.

The return of the suburban and rural buyer is likely here to stay as the great social experiment of working from home proves to be successful. With major tech companies like Shopify and Twitter announcing permanent remote working options, Engel & Völkers expects to see more urban professionals, especially with young families looking for more space, move to the countryside.

In metropolitan areas, the pandemic has increased the appeal and prioritization of home office spaces, as well as functional outdoor spaces like terraces and backyard pools. Engel & Völkers is reporting increased interest in luxury properties that check all the boxes in terms of home design, living space and lot size.

This shift to the suburbs and countryside is creating a buying opportunity for the savvy urban market investor looking toward the long-term, especially in the condo market. Engel & Völkers is forecasting the window of opportunity will be temporary. Increased interest in cities are expected to return as COVID-19 outbreaks come to an end.

Virtual Real Estate is Here to Stay

Engel & Völkers is reporting the virtual element is here to stay. 3D virtual tours have proven their value for vetting properties and selecting the must-sees, complementing static listing images as the main source for understanding layout, scope, and intricate details.

With social distancing measures applied mid-March, the real estate industry quickly pivoted to continue servicing buyers and sellers using 3D virtual tours and conferencing. video

Engel & Völkers Toronto Central presented a home in The Beaches neighbourhood listed for $1.3 million through a virtual showing. The presentation was narrated, highlighting features and immersive details comparable to an in-person showing. The home sold within 12 days.

Over a two-day period, Engel & Völkers Tremblant sold $36 million in pre-construction condos using Google Meet, allowing buyers to consult with a real estate advisor and invest from the comfort of their home.

Millennials are Boosting Population in Canadian Metropolitan Areas

For the millennial generation, turning 40 is on the horizon. This growing buyer segment is making a serious shift toward long term investing in property, saving for retirement, and positioning their lives for a fulfilling future. Engel & Völkers expects this cohort to continue to drive population growth in Canadian metropolitan areas due to international and interprovincial migration, as well as reaching their prime child-rearing years.

Data from Statistics Canada shows millennials are

boosting the population in major urban areas and driving growth in emerging urban centres. This group is entering

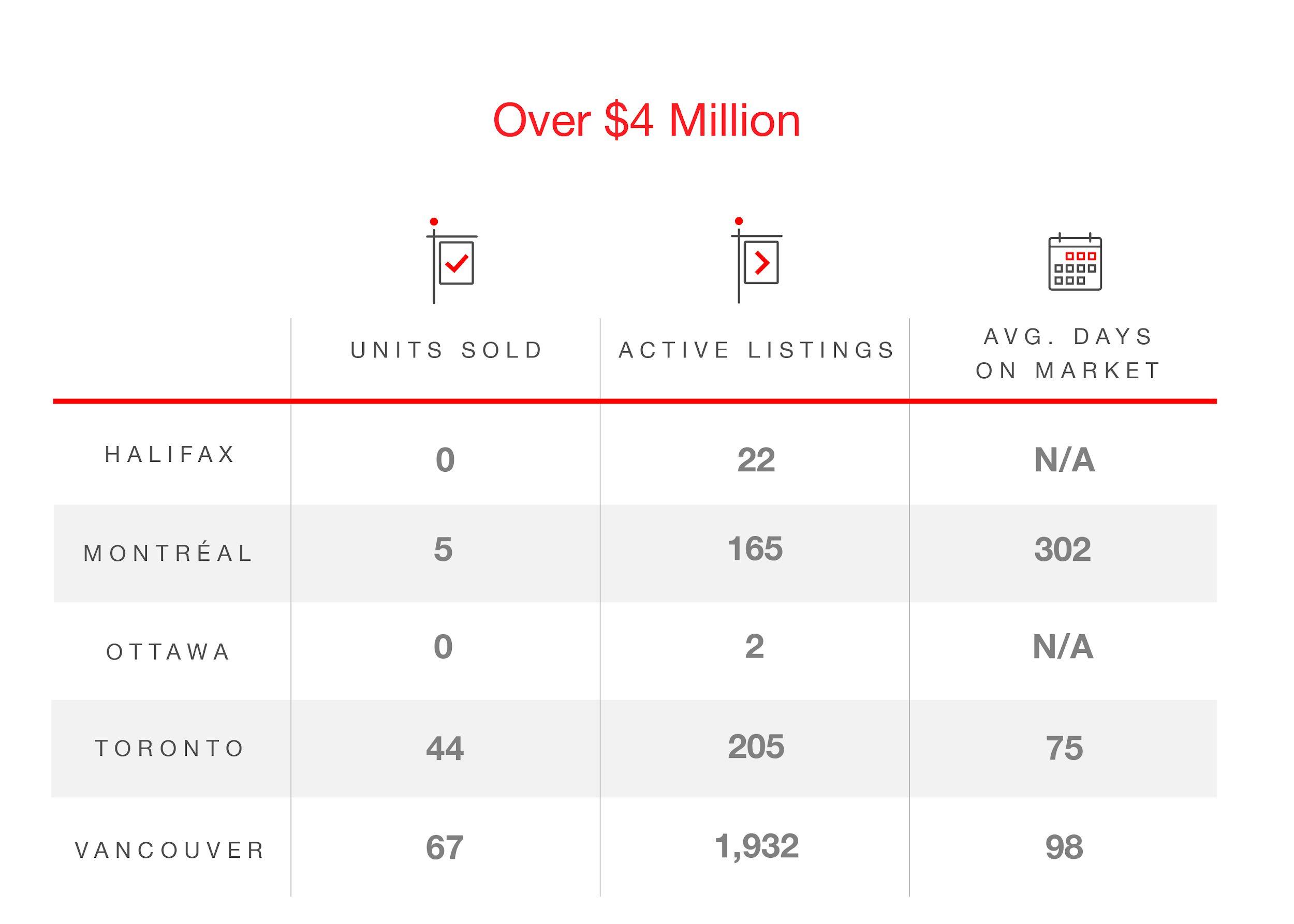

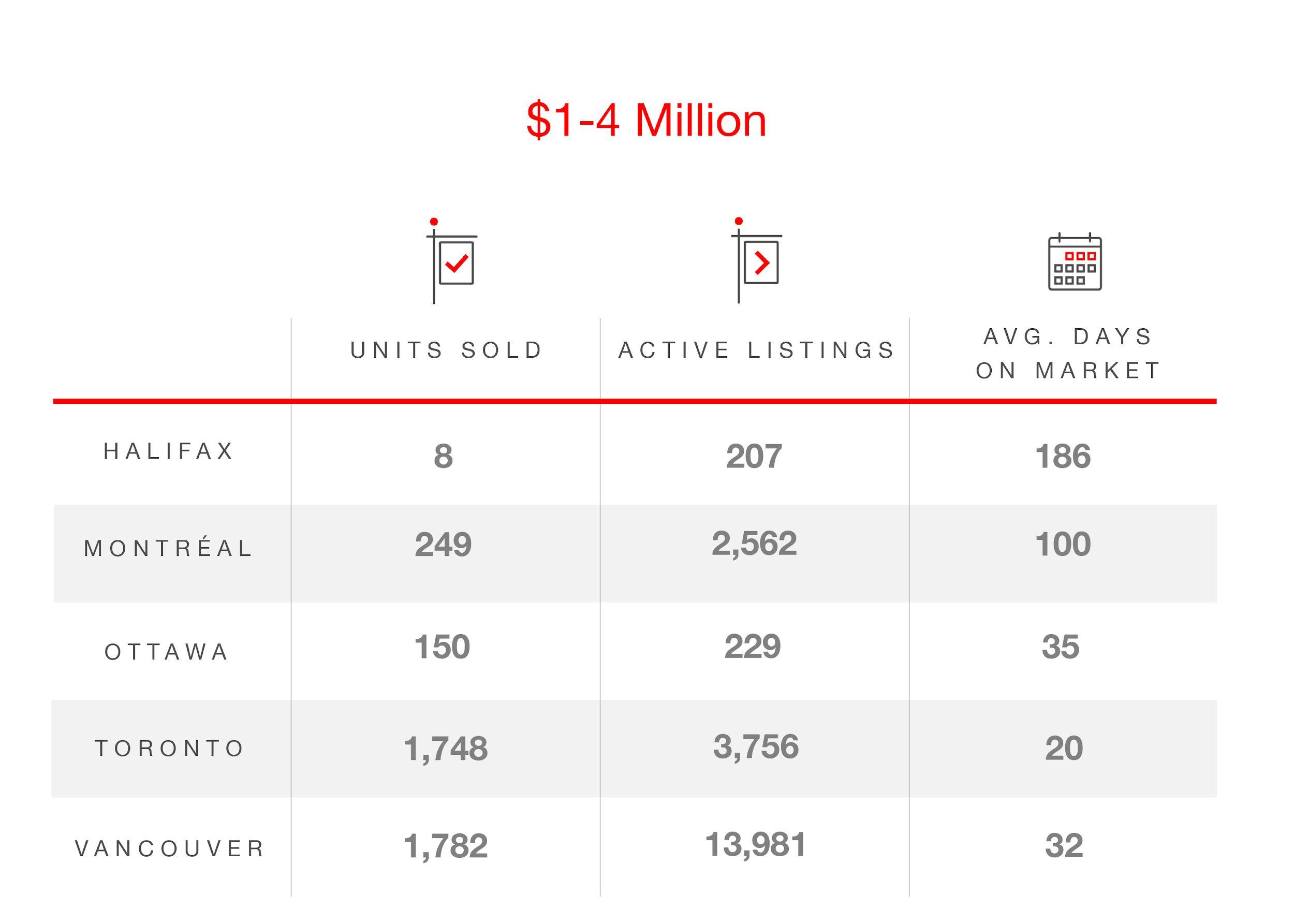

This data represents totals and averages from April - June 2020

prime working and spending years. While many have yet to purchase their first home or start a family, others are established and are now upsizing after benefiting from strong growth in the condo market during recent years.

Over the past four years, the population growth rate of millennials accelerated from 0.4 per cent to a record 2.5 per cent in 2018/2019. The Canadian cities experiencing above average growth in the millennial segment include Abbotsford-Mission, British Columbia (+4.0 per cent), London, Ontario (+3.7 per cent), Toronto, Ontario (+3.7 per cent) and Halifax, Nova Scotia (+3.6 per cent). 9

This data matches what Engel & Völkers Nova Scotia is reporting anecdotally. Halifax is seeing ‘peak millennials’ (those at the top end of the age cohort) migrate to its market from other big cities in Canada. In recent years, Halifax Mayor Mike Savage has been scouting for tech and creative talent in other Canadian metropolitan areas in an effort to drive economic growth. As a result, there has been a dramatic increase in 25-39 year olds who have made Halifax their home due to its value proposition, including affordable housing, a relaxed lifestyle, a vibrant arts community and a growing startup ecosystem.

9 Statistics Canada, February 2020