8 minute read

Toronto

June boom: sales of homes and townhomes accelerate while condo slowdown presents a temporary buying opportunity in Toronto’s downtown core.

Market Overview

The first quarter of 2020 showed busy activity until the onset of Ontario’s COVID-19 lockdown mid-March. Despite a mid-Q2 pause, Toronto’s popularity among domestic and international migrants is keeping the market on firm ground. Supply and demand fell in tandem and the market remained balanced. The halted spring season picked up in June, with inventory moving in most segments except the condo market.

Resales were up 49 per cent year-over-year during the first two weeks of March. As lockdown began, the season adjourned. Home sales plummeted 16 per cent in the latter half of the month. 32 Engel & Völkers reports from March to April, total units sold for all homes priced $1-4 million fell from 616 in March to 251 in April.

May brought the first glimmer of market recovery as Toronto saw a pick-up in housing activity. Home sales increased by 55.2 per cent and new listings jumped by 47.5 per cent compared to the previous month. These activities kept the market moving at a well-distributed and In June 2020, YoY residential home benchmark prices were up

11.9%

balanced pace. At the close of the month, prices rose by three per cent year-over-year, indicating the market is regaining traction and moving toward normalcy. 33

June’s arrival ushered in pent-up buyer demand, especially for detached and semi-detached homes. This, coupled with tight housing supply and growing consumer confidence post-COVID, is effectively positioning Toronto as a seller’s market. Residential home benchmark prices were up 11.9 per cent year-over year with the strongest price growth in the detached and semi-detached segments, up 14.3 per cent and 22 per cent respectively. Average sales price was also up substantially by 7.8 per cent month-over-month, signalling a revival in the higher price-point segment in the Greater Toronto Area (GTA). 34

32 Toronto Regional Real Estate Board, March 2020 33 Toronto Regional Real Estate Board, May 2020 34 Toronto Regional Real Estate Board, June 2020

98 Valecrest Drive

Engel & Völkers Toronto Central

An In-Depth Look

Demand for high-end real estate is rising as buyers seek out homes accommodating all daily activities. This move is opening a temporary window to purchase condo property in North America’s fastest growing city.

The most in-demand luxury locations for homes priced over $4 million remain Bridle Path, Forest Hill, and Rosedale year-over-year. Summerhill, Yorkville, and Lawrence Park are favoured neighbourhoods for buyers seeking luxury homes priced $2.5 million and over.

Data from January and February indicated a strong sales outlook for Toronto, however, the effects of the pandemic trickled into the market mid-March and caused a sharp decline in April, mostly affecting downtown Toronto. April’s reduced activity caused a significant 67 per cent drop in home sales year-over-year, a generational low. 35

The condo segment came to a standstill as most buildings prohibited showings throughout the lockdown. Decline in condo activity within the GTA is expected to continue until COVID-19 restrictions ease. April condo sales in the GTA saw a drastic 71.6 per cent decrease compared to last year, the biggest drop amongst all major home types. 36

Nonetheless, the condo market will likely rebound at a brisk pace and return to its status as a luxury purchase for first-time home buyers and investors.

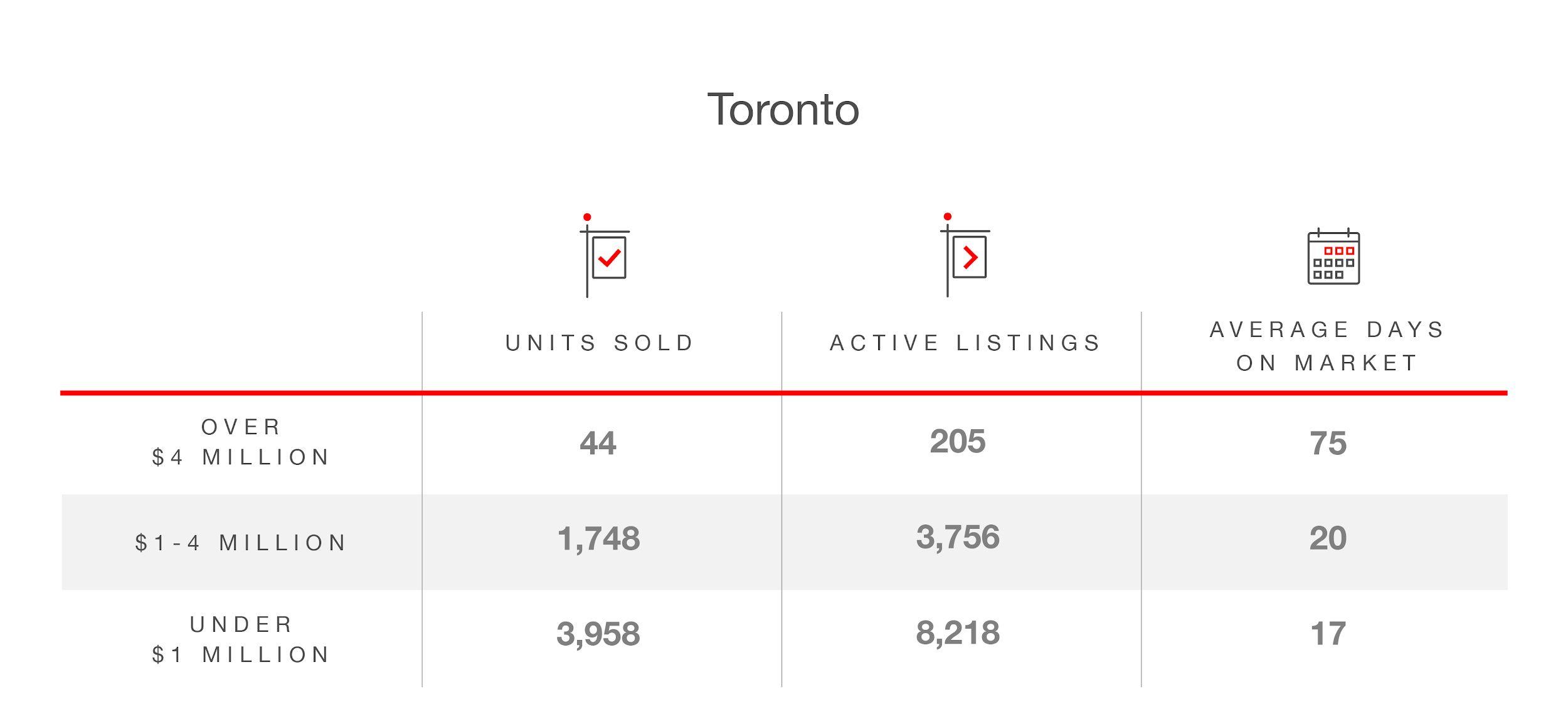

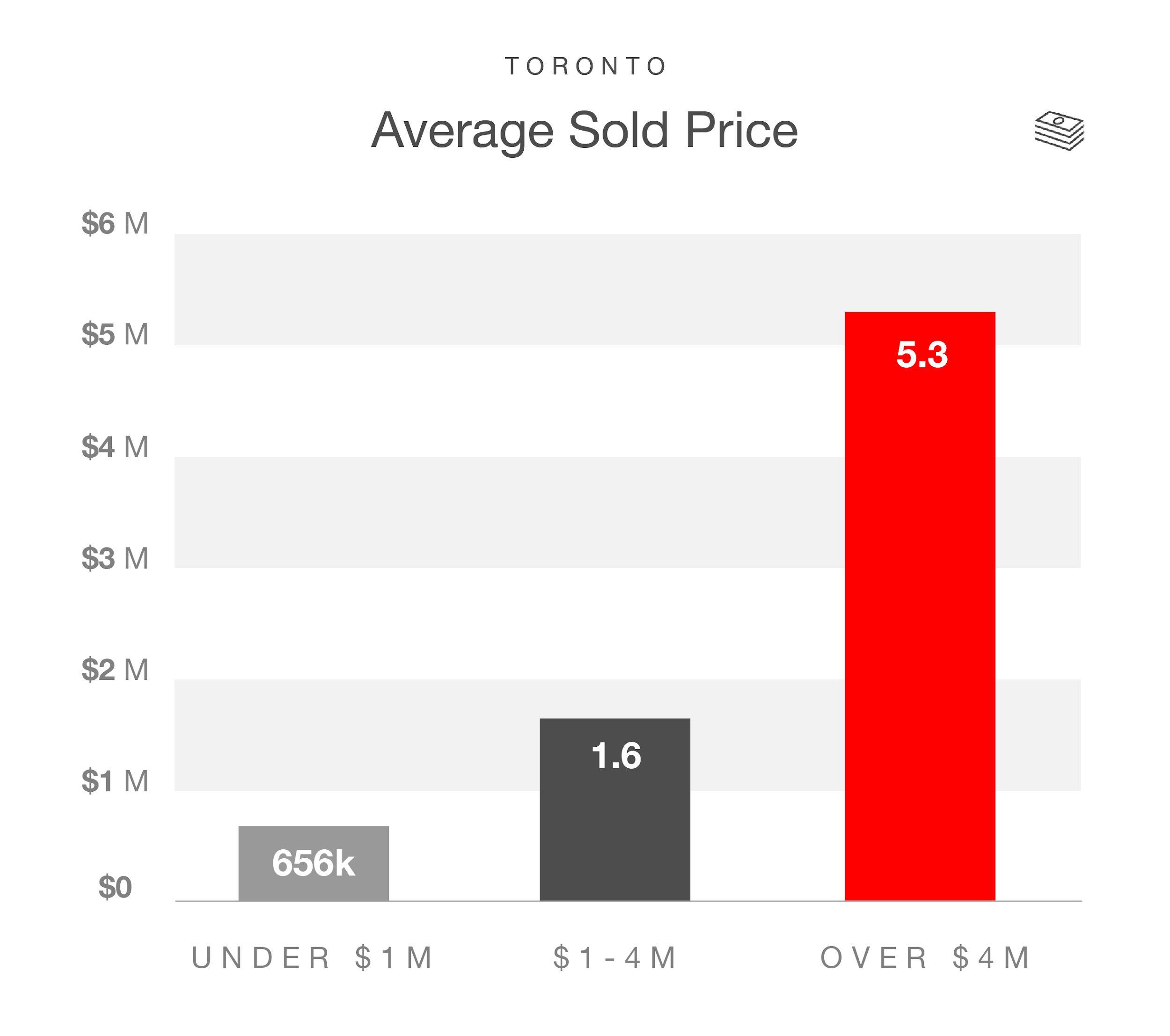

This data represents totals and averages from April - June 2020

35 Toronto Regional Real Estate Board, April 2020 36 Toronto Regional Real Estate Board, April 2020 37 Toronto Regional Real Estate Board, May 2020

Backed up by domestic buyers, Toronto proved resilient in June with consistent increases in market activities as the

city entered more reopening phases. Home sales rose drastically from May by a sharp 89 per cent (on an actual basis) and benchmark prices for a residential home increased by 8.2 per cent year-over-year. 38 Pent-up demand persisted with homes selling quickly once on the market. This, coupled with low interest rates and an inventory shortage, drove up prices.

Engel & Völkers Toronto Central is reporting a rising trend of property searches in the suburbs and cottage country. In the Greater Toronto Area, demand for properties under $1 million remained high, especially in places like Hamilton, Burlington, Ajax, and Oshawa.

Demand in cottage country sustained through the pandemic. For example, The Lakelands region, including Muskoka, is only reporting a 46.3 per cent decline in residential non-waterfront sales, and a 37.3 per cent decline in waterfront sales in April compared to last year. 39

The drops in activity were milder in comparison to Toronto, where the market saw a 67 per cent drop in home sales that same month. As lockdowns eased, activity spiked. In the Grey Highlands, a popular recreational market, the average sold price increased by 39.2 per cent year-over-year in June. Prices in the Georgian Bluffs increased by 64 per cent year-over-year in June.

38 Toronto Regional Real Estate Board, June 2020 39 The Lakelands Association of Realtors, April 2020 40 McKnight, Nicole, et al. “Generation Rent: How Many Canadians Think They'll Be Able to Buy a Home?” Finder CA, 11 May 2020, www.finder.com/ca/generation-rent. Millennials, the once dominant group of first-time home buyers, are now leveling-up, purchasing houses in the $2-3 million range. Properties under $1 million are a hot commodity for first-time buyers and for those looking to move from a condo to a single family house.

Toronto is seeing Gen Z buyers entering the market as they begin to use savings for their first real estate purchase. A surprising 81 per cent of Canada’s Gen Z cohort are optimistic about home ownership and expressed interest in owning a home in the next 20 years. Only four per cent said they would never be interested, and 29 per cent reported a plan to purchase in the next one to five years. 40 Engel & Völkers Toronto Central observes Gen Z buyers are prudent, with greater saving habits in comparison to the previous generation. They care less about amenities and are willing to buy fixer-uppers, giving them an edge as viable first-time home buyers with purchasing power.

Toronto is holding its position as the fastest growing metropolitan area in Canada and the United States. Last year, the City of Toronto’s population increased by 45,742 persons, exceeding the combined gains of the two fastest growing central cities in the United States (Phoenix, Arizona and San Antonio, Texas).

In contrast to New York City, Toronto had almost three times as much population growth from immigration. This spark in growth, global interest in immigration, and steadily increasing population is expected to boost home prices and drive new market activity in the GTA moving forward. 41

Q3 Outlook

Engel & Völkers Toronto Central expects to see robust market activity through the summer. May’s pick-up and June’s boom saw Toronto close the quarter with an alltime high average sale price of $930,869.

There is movement across all price points with no signs of slowing down. The outlook going forward is optimistic, as government restrictions ease and buyers regain buying opportunity for people interested in securing

confidence and comfortability with the current market.

In the post-COVID era, Engel & Völkers Toronto Central property inside North America’s fastest growing city.

predicts sellers will gradually return to the market. A sudden surge in inventory is not expected and buyers will continue competing for a limited number of properties. Engel & Völkers is forecasting a group of buyers with savings, due to low spending during the pandemic, could upsize their current homes, move to cottage country or Engel & Völkers Toronto Central and Engel & Völkers Toronto Uptown closed 20 deals over $1 million with an average sales price of $2.1 million in June 2020 combined.

The stagnant condo market is presenting a temporary purchase recreational property.

Moving forward, housing in Toronto remains a hot commodity with consistent movement in the under $1 million segment. This has not changed since the start of COVID-19 and is expected to hold throughout 2020.

“ Unsurprisingly, homes under $1 million continue their momentum as a hot market and remain in high demand with short days on market. That is where the sweet spot is. In terms of inventory, homes between $1-2 million have more movement compared to those between $2-4 million, but interest in both segments is strong as demand for space and living amenities increases through the summer. People are spending their vacation budgets on buying bigger spaces or purchasing recreational homes.”

Anita Springate-Renaud, License Partner, Engel & Völkers Toronto Central

41 Ryerson University’s Centre for Urban Research and Land Development. Ryerson University, 2020, Toronto Now Fastest Growing Metropolitan Area in the United States and Canada, City of Toronto Still Fastest Growing Central City, www.ryerson.ca/content/dam/cur/BLOG/Blog48/Population_Growth_US_Canada_2019_Print_Friendly.pdf. Accessed 16 June 2020.

A

highly anticipated mixed-use development to watch, located at the corner of Bay Street and Bloor Street, is being spearheaded by acclaimed architecture firm Herzog & de Meuron. This is the firm’s first project in Toronto and it is teaming up with Quadrangle Architects to bring an urban 87-storey high-rise landmark to the heart of the affluent Yorkville neighbourhood. In terms of investment opportunities, buyers can look to Leslieville and King Street East near the Distillery District for potential new developments. For buyers seeking properties under $1 million in Toronto, the top three up-and-coming neighbourhoods to watch are The Junction, East York and Mimico West.

This data represents totals and averages from April - June 2020

This data represents totals and averages from April - June 2020