8 minute read

Halifax

Low interest rates, domestic and international demand and oceanfront views are creating a ‘perfect storm’ seller’s market.

Market Overview

Halifax’s low inventory, coupled with its position as a destination for entrepreneurial millennials and international buyers has positioned it as an up-and-coming Canadian “market to watch.”

The year began with an active first quarter compared to last year. Fewer days on market, multiple offer situations and price increases were typical conditions in the first and second quarters, even amidst the COVID-19 pandemic. Halifax closed the second quarter holding its position as a strong seller’s market with sustained buyer demand from locals within the province. June reported a significant increase of 10.4 per cent in home sales compared to last year, setting a new sales record for the province. 10

Halifax’s spring season started off strong with active buyers and sellers. However, as COVID-19 restrictions set in, mid-April experienced an abrupt stop in new inventory that sustained for three weeks. Within the

Halifax-Dartmouth region, April showed a 47.2 per cent drop in home sales year-over-year. 11

As COVID-19 stretched into May and consumers became accustomed to changes in market conditions, properties

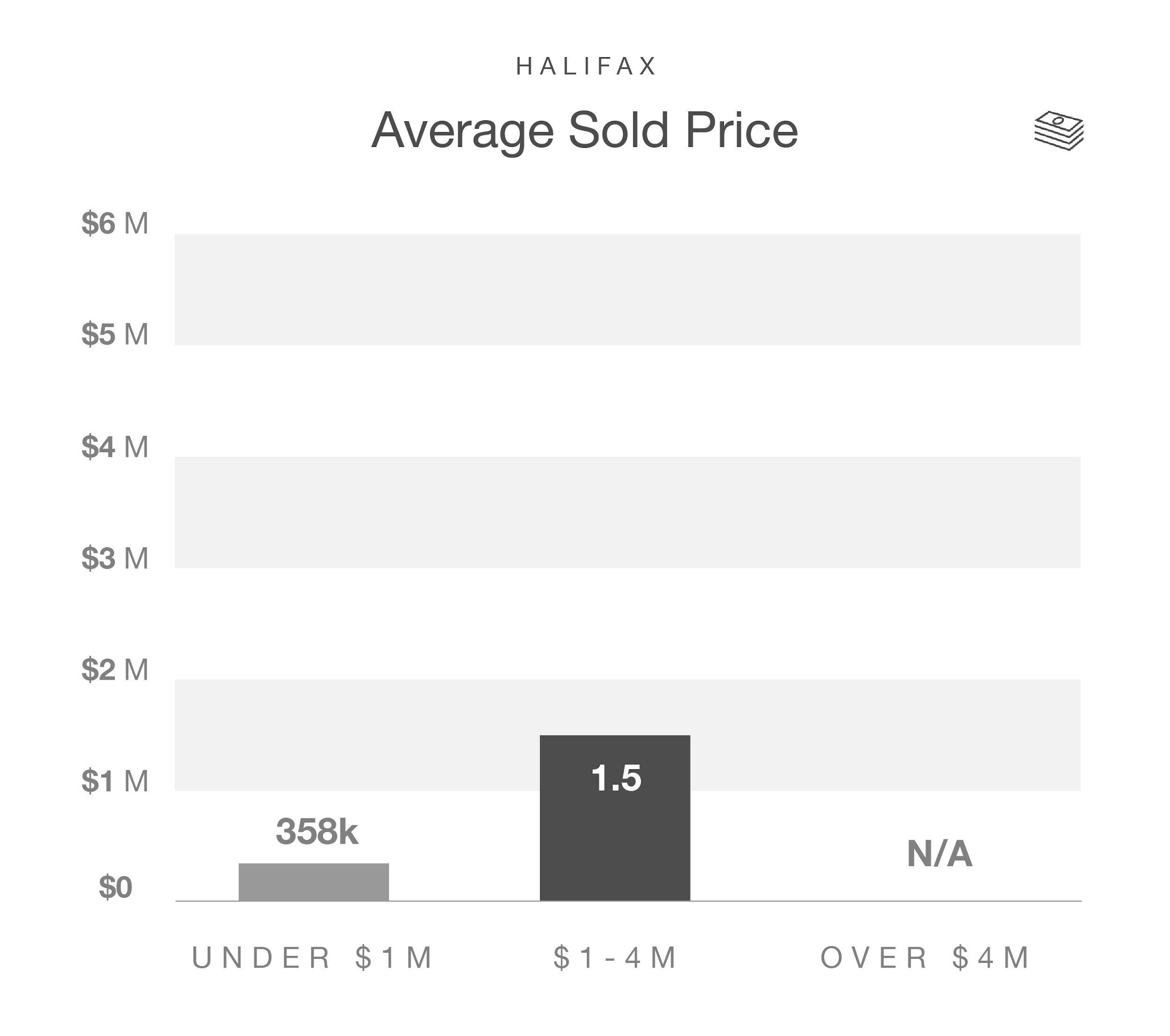

10 Nova Scotia Association of Realtors, June 2020 11 Nova Scotia Association of Realtors, April 2020 12 Nova Scotia Association of Realtors, May 2020 13 Nova Scotia Association of Realtors, May 2020 13 Engel & Völkers Americas Canadian Luxury Real Estate Market Report Mid-Year 2020 were being listed again by mid-month. Despite home sales decreasing by 47.3 per cent year-over-year and residential listings dropping 42.1 per cent year-over-year, prices did not. 12 Short supply combined with buyer demand contributed to a sharp 9.3 per cent price increase in May 2020. The average residential home price reached $359,958. 13 A popular area with homes priced under $1 million dollars is the North End, a bustling, vibrant community with an entrepreneurial spirit attracting locals and newcomers.

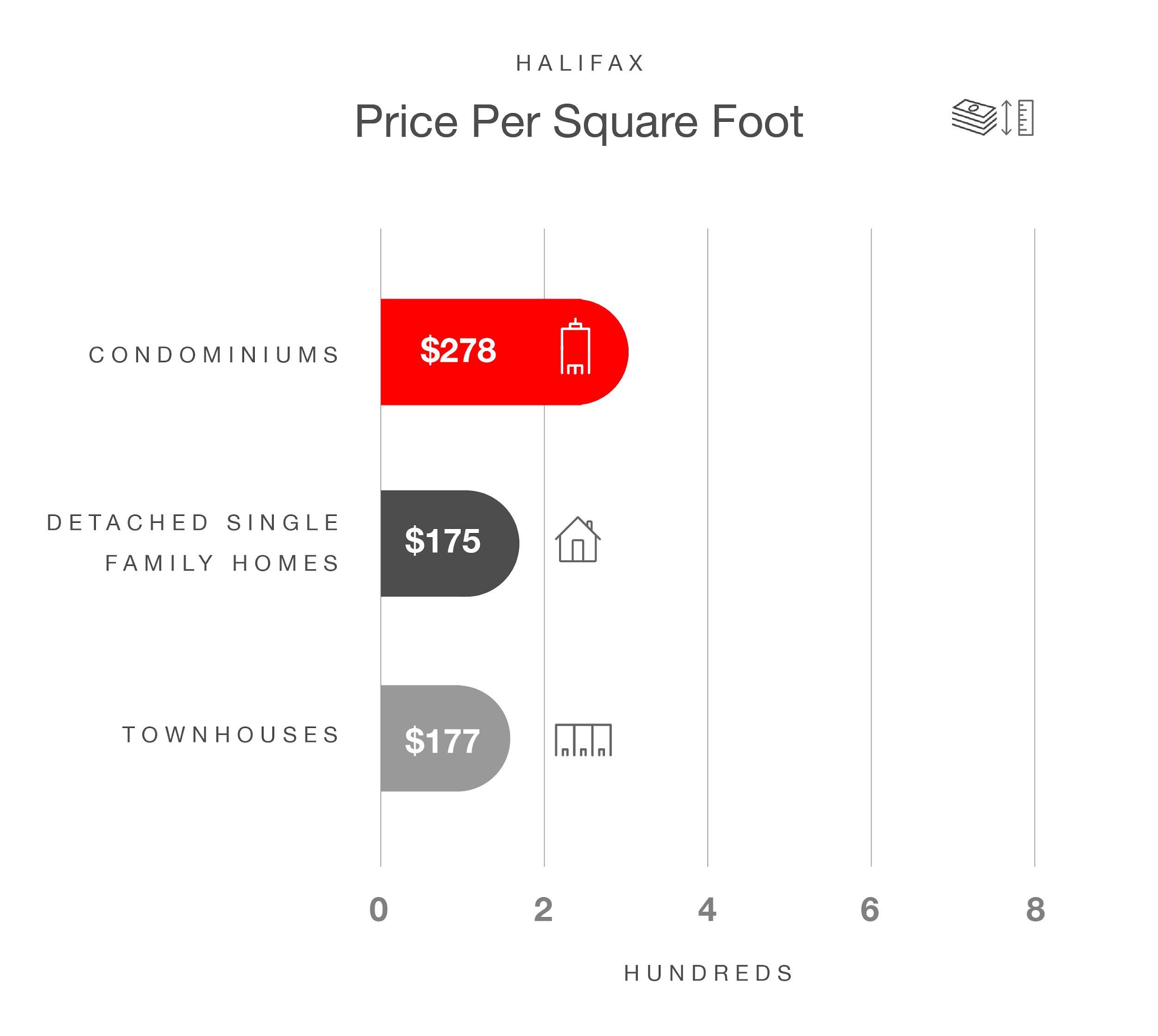

Supply remained consistently low throughout the pandemic, even as lockdown restrictions eased. Engel & Völkers data shows within the price segment $1 million and below, active listings of condominiums increased from 153 in April to 156 in June. For detached single-family houses priced below $1 million, active listings increased from 1,121 in April to 1,304 in June. The market saw an uptick in new listings matched by high absorption rates. Housing inventory remained relatively low compared to last year, especially in the core Halifax peninsula. This trend continued through the end of Q2, seeing the sales to listings ratio get even tighter due to increased demand, from 98.77 per cent in April to 100.57 per cent in June.

115 Gill Cove Road

Engel & Völkers Nova Scotia

An In-Depth Look

The quarter started off strong, with COVID-19 showing little impact on Halifax’s real estate market until the beginning of Q2. In April, active residential listings declined by 32.2 per cent compared to last year, compounding Nova Scotia’s short supply. 14

Although buyers continued to shop and new inventory was successfully sold, the significant decrease in the number of listings in April, compared to last year, led to an overall reduction in sales activity.

June marked the beginning of what is typically the busy spring season that was pushed to the summer due to COVID-19. Home sales experienced a significant rebound compared to early Q2. Inventory continues to sell as quickly as it is being listed. Properties that were previously sitting inside the urban core have now sold as inventory evaporates. Halifax home sales in June increased 9.9 per cent year-over-year and 10.4 per cent across Nova Scotia, setting a new provincial record. 15 Residential

average prices in Halifax increased further in June reaching $366,243 with price gains of 13.3 per cent year-over-year as conditions continued to tighten. 16

People who remained employed accumulated more cash flow due to staying home. This, coupled with low interest rates, saw a trend toward buying properties with more space outside of the city core or recreation properties for summer leisure.

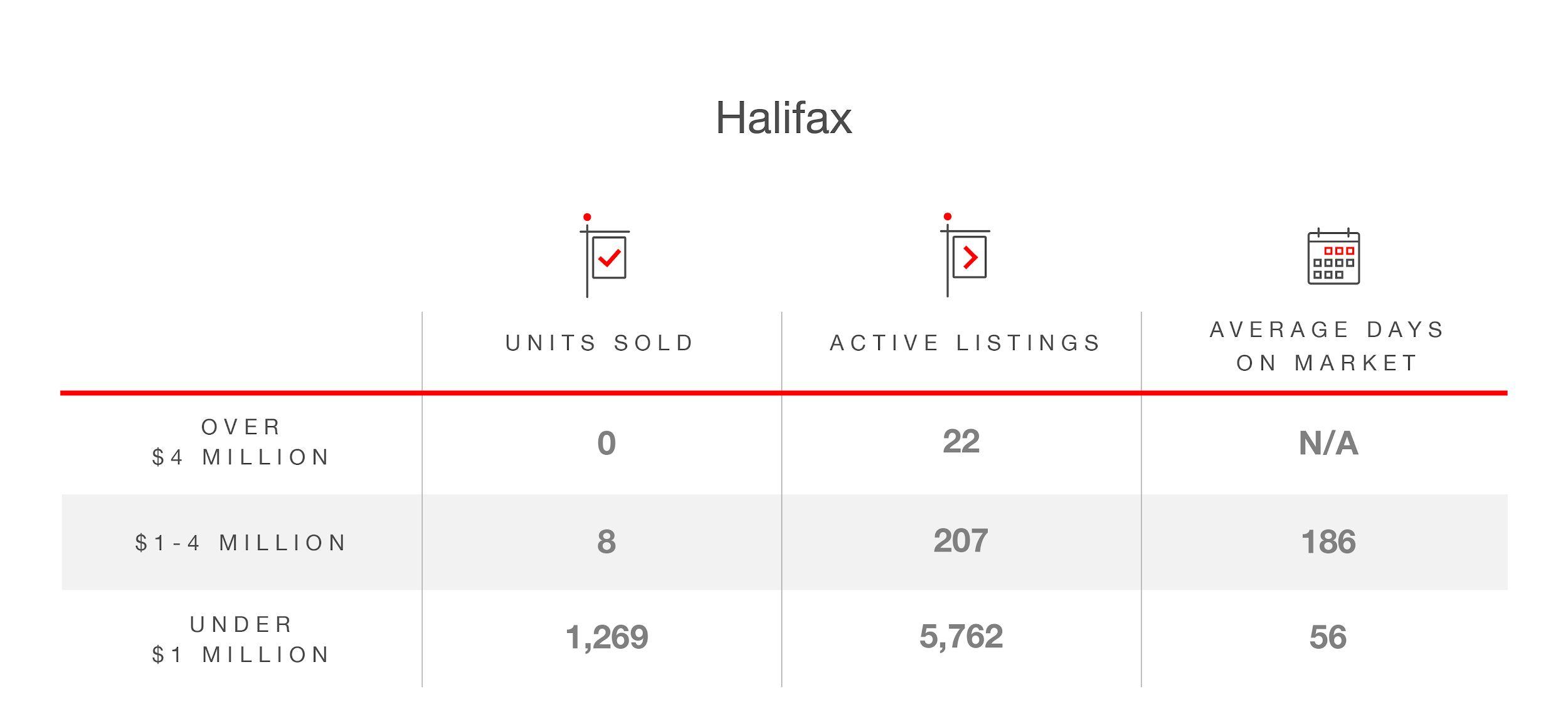

Engel & Völkers reports that in Halifax in May 2020, while five properties sold priced between $1-4 million, 452 properties sold for under $1 million that same month.

This data represents totals and averages from April - June 2020

14 Nova Scotia Association of Realtors, April 2020 15 Nova Scotia Association of Realtors, June 2020 16 Nova Scotia Association of Realtors, June 2020 15 Engel & Völkers Americas Canadian Luxury Real Estate Market Report Mid-Year 2020

In Halifax, homes ranging from $1-2 million make up the majority of the high-end market, and inventory in this segment is quickly being purchased by locals, retirees and young families from within Canada and abroad.

International interest is also increasing and an influx of immigrants is contributing to growth in Halifax. The majority of international buyers are coming from the United States, Germany, Belgium, Britain and Switzerland.

Homes over $4 million are located inside and outside Halifax Regional Municipality (HRM) at locations like North West Arm, Portuguese Cove, and in places like Fox Harbour and Cabot Links, two of Nova Scotia’s top golf resorts. The South Shore is also a historically affluent area and year-round destination that includes the UNESCO World Heritage Site of Old Town Lunenburg, Chester, Peggy’s Cove, and St. Margarets Bay. Properties in the $1 million plus segment are located at the South End and Northwest Arm in the HRM, and oceanfront areas between Halifax and the South Shore. The five Engel & Völkers shops in Nova Scotia as of June 30, 2020 make up 12 per cent market share of the total sold and active listings within the province. During COVID-19, the brokerage closed 61 per cent of its 2020 transactions from March to June resulting in 103 closed deals.

Multiple offer situations are common within the HRM, with the average property receiving as many as six offers. In high demand areas like downtown Halifax, an average of three to eight offers per listing are presented before a contract is signed. The uptick in multiple offers is attributed to lower interest rates, increased domestic demand and a supply shortage due to historically low inventory. Currently, buying on the Halifax peninsula is becoming more challenging as demand continues to grow and inventory levels shrink.

“ The lowered Interest rates from COVID-19 have boosted purchasing power among buyers. This, combined with historically low inventory in both the new construction and resale markets, is contributing to the uptick in the multiple offers situations our shop is seeing. In regards to sellers, I believe our province’s response to the pandemic and our group effort in moving past the curve ultimately led to more people listing their properties — and many are selling fast with multiple offers. ”

Donna Harding, License Partner, Engel & Völkers Nova Scotia

Nova Scotia has a unique geography, where its suburban and rural areas can be as little as a 30 - 60 minute drive

from downtown Halifax. Buyers looking to purchase in the HRM have more flexibility in choosing locations, and there is rising demand in areas bordering Halifax.

There has been an influx of millennials buying real estate and settling in Halifax in recent years. The city has invested in redevelopment and focused on creating employment and educational opportunities specifically targeting jobs for young people. Additionally, industry and government incentives are attracting a large number of tech workers and startups. This entrepreneurial influx is spilling into other areas of the marketplace.

Local breweries now number 20 times the amount

compared to a decade ago, and cannabis growers are purchasing farmland and setting up shop. The province’s low unemployment rate and high immigration rate are making it a destination for those seeking opportunities. HRM includes Dartmouth, known as the City of Lakes, and Halifax/Dartmouth. All of HRM is now known as a

four season destination, gaining traction as the next best place to live in Canada.

Q3 Outlook

Although Halifax’s growth at the beginning of Q2 softened in response to the COVID-19 lockdown, gains continued through end of Q2 setting records for both new sales units and total dollar volume in June 2020.

This data represents totals and averages from April - June 2020

By June, Halifax’s YoY home prices had increased

13.3%

Engel & Völkers Nova Scotia is forecasting this trend will continue into Q3 as the expected pent-up buyer demand and low interest rates reinforce Halifax’s position as a seller’s market. It predicts its usually robust spring market will move into summer and then continue into the fall.

With the

15-year low inventory levels expected to continue, current pressure on prices are not forecasted to ease. Even as prices increase, Halifax is a relatively affordable market when compared to other Canadian metro areas, and it expects to see an influx of interest, both nationally and internationally once borders reopen.

This data represents totals and averages from April - June 2020

For investors, Halifax’s vacancy rate is one per cent, making it a prime location for growth and viability. The ROY and The Residences at Queen’s Marque are two new luxury developments coming soon which are expected to be hot commodities in the high-end segment.

Prices are likely to grow at a steady pace year-over-year as more people make a permanent move to the province. As multiple offers remain common and buyer demand stays high, the outlook is extremely positive for Halifax.