11 minute read

Grain

Grain and oilseed weekly market r epor t

Global markets

Global grain markets ended last week strong; the USDA plantings and stocks report was bullish for maize, which drove the whole complex higher. The 2021 US maize area was seen at 36.9Mha, 2.2% below trade expectations in a pre-report poll by Refinitiv. US stocks of maize as at 1 March were 195.6Mt, 1.7Mt tighter than trade expectations. The bullish signals for maize were enough to outweigh the bearish wheat news. US farmers intend to plant 18.8Mha to wheat in 2021, 3.1% above trade expectations and 4.5% up year-on-year. Further, US stocks of all wheat were 2.8% above trade estimates at 35.8Mt. As we move through April and into May, weather stories will likely be key drivers of market volatility. We need to watch stories for both the northern and southern Hemispheres. The price risk is heightened by the massive net long position held by managed money funds in Chicago corn futures. Net longs as a percentage of open interest now stand at 22.3%, the most bullish position for funds since February 2011. In Brazil, Safrinha (second crop) maize planting is almost complete, but soil moisture is lacking after la Niña. Longer range weather forecasts suggest only average rainfall in the next month, which may hinder crop prospects. StoneX have trimmed their estimate of Safrinha maize by 3.65Mt, to 77.65Mt. Conab will release their latest forecast on 8 April. North American weather will also be key as maize planting progresses and other crops develop. The first USDA crop report of the year was published yesterday and showed winter wheat conditions to be broadly in line with the five-year average. Finally, Russian analytics firm Sovecon cut its estimate of 2020/21 Russian wheat exports by 200Kt, to 38.9Mt.

UK focus

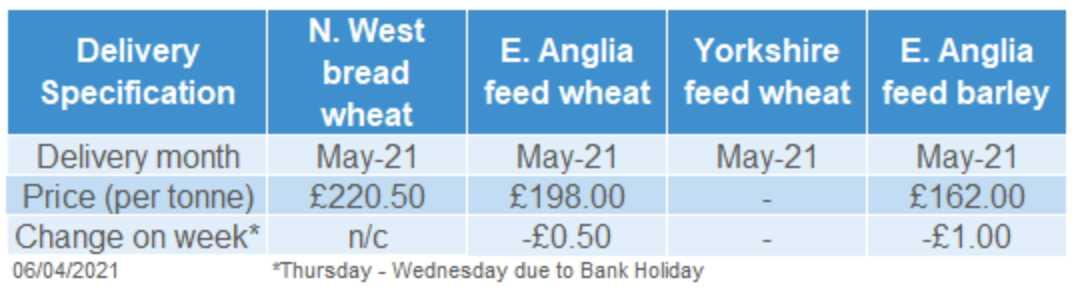

It was a short week of trading for UK markets last week, with Friday a Bank Holiday. In the run up to Wednesday’s USDA reports new crop (Nov-21) feed wheat futures moved lower. The bullish USDA reports saw Nov-21 feed wheat futures move up £3.25/t, on Wednesday. We saw a further downward move on Thursday, with new crop wheat closing at £163.25/t, down £0.75/t ThursdayThursday. UK physical trade remained thin. This, combined with the volatility in futures caused by Wednesday’s reports, made pricing UK grain challenging last week. UK delivered values were largely flat or down, with some reductions to new crop delivered premiums.

Old crop oilseed prices fell or were broadly static last week, while new crop prices rose. All prices moved lower in the in early part of last week due to speculative traders re-positioning ahead of Wednesday night’s USDA report. Prices then rose sharply in response to the report, which showed a smaller than expected US soyabean area. Old crop prices retreated again as speculative traders booked profits, but new crop prices held onto their gains. Nov-21 Chicago soyabean futures closed at $464.30/t on Thursday, up $20.76/t from 26 March. The contract rose a further $1.93/t yesterday to $466.28/t, the contract’s highest price to date. US farmers intend to plant 35.5Mha to soyabeans this year. This is 5% more than last year but far less than the 8% rise the industry expected, according to a poll by Refinitiv. Higher prices could change some farmers’ minds, driving further soyabean acres. If this area is confirmed, the market is worried the US could produce a smaller crop than is needed. The Brazilian soyabean harvest is now 78% complete (AgRural). While this is still behind last year’s pace of 83% complete, the advancing harvest means increasing confidence in production estimates. This could remove some risk premium from old crop prices.

Rapeseed focus

Rapeseed prices followed the trends set by soyabeans and old crop prices ended last week down, while new crop prices were up. New crop (Nov-21) rapeseed delivered to Erith was reported at £391.00/t on Thursday, £4.50/t more than on Friday 26 March. This was a similar gain to new crop Paris futures in percentage terms. Something to watch going forward is the recent rise in sterling. On Thursday (01 April) £1 was worth €1.1745, compared to €1.1556 on 01 March (Refinitiv). This strength in sterling is expected to continue in the short term. This means that even if global prices rise, UK prices may not rise as much. The 2021 EU-27 rapeseed crop is forecast at 16.8Mt by Stratégie Grains (Refinitiv). This is down from the 17.1Mt forecast last month. This would keep European OSR supplies tight next season and keep European and UK rapeseed prices high compared to those for other oilseeds.

F oliar Application Boosts the Zinc Content of Wheat Grain by Up to 50%

A team from the Department of Agronomy at the UCO has demonstrated, through field tests carried out during 8 agricultural seasons, that foliar feeding with fertilizer increases the concentration of zinc in wheat more than if it is applied to the soil.

Micronutrient deficiencies pose health problems for a third of the world's population. Worldwide, zinc deficits are more problematic in the rural areas of developing countries, where diets are largely limited to vegetable products grown in soils suffering from low nutrient availability. Biofortification, the process of bolstering the nutritional value of crops by increasing the concentration of vitamins and minerals in them, has arisen as a remedy for this problem. In the search for solutions, the Edaphology Unit of the María de Maeztu Excellence Unit in the Department of Agronomy at the University of Cordoba (DAUCO), headed by the researcher Antonio R. Sánchez Rodríguez, has spent 8 years searching for the best biofortification strategy in terms of applying zinc to wheat grown in calcareous soils in southern Spain. Between 2012 and 2019 this team tested different methods to biofortify wheat in 11 field trials in zinc-deficient soils. The effects of applying different doses of fertilizer to the soil (up to 10 kg per hectare) were evaluated, in addition to the results of applying different doses of zinc by spraying the plant in various phenological stages of the wheat's growth. While application to the soil was not very effective, foliar application, or feeding, was shown to be a very efficient strategy to increase the zinc content in plants, "augmenting the concentration in grains up to 50%," says the researcher. That is, foliar application was shown to be much more effective, as, with just a tenth of the product (1.28 kg per hectare) better results were obtained than when applied to the soil. Taking into account the variety of wheat, this direct application to plants was more effective after the start of growth or during flowering. Nourishing the plant itself, and not the soil, thus, was demonstrated to be an effective way to tackle the problem of zinc deficits in calcareous soils in the short term. In addition, if at some point wheat were purchased based on its nutritional content, growers could see increases in their profits. This solution "is very valuable for places where there is no other source of zinc in diets, although it would entail adding another task to wheat cultivation, or combining it with the application of other phytosanitary treatments" notes Sánchez. Predicting wheat yields after fertilization with zinc On this project the team from the Edaphology Unit also looked for a soil indicator that would help predict the response of durum wheat to zinc fertilization, in terms of its yields. However, they found that conditions in the field make it very difficult to verify this parameter, and that a simple indicator cannot predict this response. While at the laboratory level some indicators could be defined, in the field this task is difficult, since it is highly dependent on factors such as precipitation, and would require many more years of study. Sánchez-Rodríguez, A.R., MarínParedes, M., González-Guzmán, A. et al. Zinc biofortification strategies for wheat grown on calcareous Vertisols in southern Spain: application method and rate. Plant Soil (2021). https://doi.org/ 10.1007/s11104-021-04863-7

BDC Systems to r epr esent Gibbons Agricultural in Scotland

Extension of par tnership now covers Scotland in addition to souther n England

BDC Systems Ltd and Gibbons Agricultural have extended their longstanding partnership. BDC will now act as Gibbons' Scottish agent as well as continuing to represent the company across the south of England. "BDC, a complete grain handling solutions provider, has been successfully selling our highperformance grain cooling fans across the south of England for over 20 years," said Matthew Gibbons, MD of Gibbons Agricultural, a division of Gibbons Engineering Group and a specialist grain storage equipment manufacturer. "Under the able stewardship of its Scottish Sales Manager, John Wilson, BDC already has a strong and established presence across Scotland, so it made absolute sense to ask BDC to represent us across this region," continued Matthew. Gibbons' simple plug and play products have been designed to make grain conditioning easier for farmers. Its Airspear works alongside the Plug&Cool Pedestal to help cool hotspots in grain piles. The Plug&Cool wireless differential temperature control panel range supports grain store fans. "Gibbons has always provided a wide range of high quality, robust and reliable low volume ventilation fans but the Plug&Cool solution which includes pedestals, ventilation towers and automatic fan controls now delivers a complete grain cooling package for farmers," explained John Wilson. A valued BDC partner, Gibbons is one of the market leading manufacturers the company represents. The Gibbons' Plug&Cool system is another grain handling solution which BDC is able to deliver for its customers. Not being limited to offering products from a single manufacturer means that BDC is able to give farmers the grain handling solutions that exactly meet their requirements. "Farmers across the south of England are already benefiting and will continue to benefit from deploying Gibbons' Plug&Cool system. BDC is confident that Scottish farmers will quickly understand just how Plug&Cool can cool their grain the easy way, saving them time, energy and most important of all, money!" concluded Andrew Head, BDC's MD.

P O W E R I N G T H E E D E N P R O J E C T

Makita UK has been appointed as the dedicated outdoor equipment supplier to the Eden Project. The leading power tool manufacturer has been awarded the prestigious contract to exclusively supply its cordless garden machinery and power tools to assist with maintenance and redevelopment work at the home of the famous Biomes near St Austell in Cornwall. With its wide range of cordless machinery offering a reliable and powerful alternative to petrol powered equipment and a one battery fits all solution for cordless construction and grounds maintenance tools, Makita was the ideal choice to help Eden meet its sustainable vision and ecological ethos. The partnership will see the Eden Project team replace its existing petrol and corded machines with Makita’s battery-powered products. Si Bellamy, Interim Chief Operating Officer at the Eden Project, said: “Eden is dedicated to using sustainable methods and we wanted to update our grounds equipment with more environmentally friendly kit without compromising on power or performance. “With Makita’s extensive range of cordless power tools and garden machinery, we can make the transition over to cordless incredibly easily. Makita’s cordless range will enable us to complete day-to-day maintenance tasks and larger projects in a safer, quieter, more efficient way. “The use of battery power as fuel completely eliminates the need for our team to transport and handle petrol and as no fumes are omitted during operation there are zero gas emissions – which is fantastic for reducing our carbon footprint further. What’s more, there is no need to consider the safe placement of cables as with corded machines. As a result, we will be able to safely carry out work when visitors are on site.” Makita’s innovative cordless technology also means that the machines work for long periods of time without needing to be charged. As a result, Eden team can work on large areas and tasks without needing to stop to replace or recharge the batteries, improving productivity further. Mark Earles, Business Development Manager for garden machinery at Makita said: “The Eden Project is an educational charity and visitor attraction focused on showcasing the power of nature and inspiring visitors to think more sustainably. We are thrilled to be working with the team, as part of its efforts to improve environmental efficiency, by delivering cordless solutions to help the team work more efficiently on site. “With over 270 cordless products in our LXT portfolio, we can ensure that the Eden Project have access to the machines they need, no matter the task. Our battery platforms also mean that the team can switch between tools and tasks effortlessly, reducing downtime and improving productivity.” Makita’s product range is designed to work in tough outdoor environments, making the partnership an ideal backdrop for the Eden Project team to put the kit through its paces in unique settings, such as the heat of the Eden Project’s Rainforest Biome. Makita will be using this as a long-term opportunity to gain user feedback on the performance of the machines, to assist with research and development into new models and tool technologies. Si Bellamy added: “We are really excited to kick off our partnership with Makita and see what we can achieve together over the next five years and beyond. It is really important for us to develop a strong partnership with Makita and work collaboratively with them to further our capabilities here at the Eden Project.” To find out more about Makita and its range of cordless machines visit: www.makitauk.com For more information about the Eden Project visit: www.edenproject.com