China Fastener World no.66/2022 003

China Fastener World no.66/2022 004

006 China Fastener World no.66/2022

008 China Fastener World no.66/2022

010 China Fastener World no.66/2022

China Fastener World no.66/2022 011

012 China Fastener World no.66/2022

China Fastener World no.66/2022 013

014 China Fastener World no.66/2022

China Fastener World no.66/2022 015

016 China Fastener World no.66/2022

China Fastener World no.66/2022 017

018 China Fastener World no.66/2022

China Fastener World no.66/2022 021

022 China Fastener World no.66/2022

China Fastener World no.66/2022 023

024 China Fastener World no.66/2022

China Fastener World no.66/2022 025

CMCA Postpones Sep. 2022 Directors and Members Meeting

Influenced by the current pandemic situation in China and in order to prevent the spread of viruses and ensure the health & safety of participants, the management of China General Machine Components Industry Association (CMCA) postponed the 7th term (5th round) directors and members meeting originally scheduled to take place on September 16, 2022 in Qingdao (China) to a new date, which is still yet to be determined. For more update regarding this event, please visit http://www.cmca-view.com/

Ningbo Fastener Industry Association: China’s Fastener Export Data for Jan-Jul 2022 Announced

According to the import and export data of China Customs, in the first seven months of 2022 China exported 2,987,408 tons of fasteners to the world, up 12.4% from the same period of 2021 (or equivalent to 328,423 metric tons). In terms of export value, in the first seven months of 2022 China exported US$ 7.765 billion worth of fasteners to the world, up 30.2% from the same period of 2021 (or equivalent to US$ 1.794 billion).

Chinese Associations News

Mr. Shao-Feng Ji Elected as President of China Wenzhou

Fastener Association

China Wenzhou Fastener Association held its fifth term (first round) annual members meeting on June 18, 2022. During the meeting, President of Wenzhou Junhao Industry Co., Ltd., Mr. Shao-Feng Ji, was elected as the new chairman of China Wenzhou Fastener Association. According to the statistics, currently there are around 1,100 fastener-related companies in Wenzhou City and more than 350 of them demonstrate the scale above the average level of the whole nation.

China Dies & Mould Industry Association Welcomes Nine New Members

Pursuant to the chapters and regulations of China Dies & Mould Industry Association (CDMIA), the applications of nine new companies and organizations for CDMIA membership have been recently accepted and approved. These nine new companies and organizations include: Fujian Fran Optics Co ., Ltd, Xiamen Jinway Mould, Guangdong Sanhexing Mould Materials Technology Co., Ltd., etc.

026 China Fastener World no.66/2022 Association

中國公協會新聞

Compiled by Fastener World

China Fastener World no.66/2022 027

China Fastener World no.66/2022 029

Brazilian News

Compiled by Fastener World

Brazilian Fastener Exports and Imports in Q1 2022 Fasteners

First

First

The only time in which Brazil imported more than US$ 1 billion was in 2013 year: US$ 1.048 billion, 191 thousand of tons fasteners in total. Last year there was expectation to surpass the import value of 2013. However, 2021 was over with just US$ 939.9 million. That result was the better one since 2014 (US$ 962 million/162 thousand tons), establishing a result in volumes with 205 thousand tons.

In the first quarter of 2022, data from the Brazil Economic Ministry has showed US$ 513 million import value, over US$ 457.18 million in 2021 by a little more than 101,556 tons, against the 98,650 tons in 2021.

On the other hand, Brazil is not a big fastener exporter, having 2019 as its better year with US$ 194 million in value, but just 29.6 thousand tons. However, in 2021 Brazil achieved US$ 153 million in value, and a record in volume at 58.6 thousand tons.

From January to June, 2022, the fastener export value was US$ 89.05 million, against US$ 66.31 million in 2021, and 19.929 thousand tons compared with 35.744 thousand tons in 2021.

Source: www.mdic.gov.br

Primat Group Acquires Prosdac

The electroplating company Primat Spa (Lecce, Italy) was founded in 1972, becoming a supplier to the automotive sector in 1982. After acquiring IEB Srl, in 2015, and Zincatura Reggiana Srl, in 2017, from the same segment, it was renamed to Primat Group, responsible for overall coordination.

Primat went across 9.7 thousand kilometres, from Italy to Brazil, to Jundiaí, the host city of Prosdac Revestimentos Técnicos Ltda., 86 kilometres away from the state capital, S. Paulo.

Since March 2022, Primat concluded the acquisition of Prosdac, a surface treatment service company founded in 1995, one of the most traditional brands in the sector. This new Primat subsidiary has a local CEO Ricardo Kiqumoto, the former director of Nipra Surface Treatments, a Prosdac competitor.

“In addition to the 2,600 m² Prosdac plant, Primat purchased a neighbouring property, expanding a total area beyond 5 thousand m², and already with a new machine, produced by Sidasa, about to go into operation, which should raise the actual operating capacity to more than 2,400 tons per month by the end of 2022.”, said the CEO.

Metalac SPS Achieves Nadcap Accreditation

It's a big step to consolidate the brand as a global aerospace fastener provider.

After rigorous technical evaluation of compliance with the requirements from the main customers of the aeronautical industry and of international specifications from this sector, Metalac SPS acquired Nadcap accreditation in March 2022.

To get it, the company underwent audit for its heat treatment operations, in which the conformity of its equipment, procedures, controls and qualification of employees in relation to the program requirements were evaluated and, also, from the customers.

“This achievement represents an important step for us in our consolidation and expansion plans as a fastener manufacturer in aerospace and a provider for the global market”, said Rodrigo Barranqueiro Egêa, the Metalac SPS general manager.

A high strength fastener manufacturer for several critical applications, specially for the automotive industry, Metalac is a Brazilian subsidiary of Precision Castparts Corp., USA.

030 China Fastener World no.66/2022 Brazilian News

Export Import

Quarter 2021 US$ 66.31 million US$ 457.18 million 35,744.99 tons 98,650.51 tons

101,556.3

Quarter 2022 US$ 89.05 million US$ 513.00 million 19,929.54 tons

tons

巴西新聞

▲ Ricardo Kiqumoto (Prosdac CEO)

▲ Rodrigo Egêa

China Fastener World no.66/2022 031

1st Metal Conformation Congress

Grupo Aprenda held the first Metal Conformation Congress (Congresso de Conformação Metálica - CCM), a meeting involving topics on metal technology. The event was held on June 14-15, 2022, at Santo André Foundation University Center, located in Santo André, a city from the metropolitan region of São Paulo, the State Capital, SP.

Despite being a debut in such a cold weather, there were more than 200 people including students and academic members and, mainly, professionals from national and multinational industries.

The event included:

• 9th Forging Technology Seminar: coordinated by Dr. Mauro Moraes de Souza, Faculty of Industrial Engineering (FEI), SBC/SP.

• 4th Stamping Technology Seminar: coordinated by Dr. Gilmar Batalha, University of São Paulo (USP), SP/SP.

• 2nd Seminar on Conformation and Application of High-Performance Steels: coordinated by Dr. Jesualdo Luiz Rossi, Institute for Energy and Nuclear Research (IPEN), SP/SP.

• 2nd Welding Technologies Seminar: coordinated by MSc José Agustin Castillo Lara, Santo André Foundation (FSA), AS/SP.

• 1st Meeting of Fasteners Specialists (Fastening Systems): coordinated by Dr. Roberto Garcia (FSA).

NOF South America Under New Management

The expert global company in surface treatment products has a new commander, since last April 01.

The anti-corrosion division of NOF Corporation, Japan, the NOF Metal Coatings Group has named a new executive to lead the Brazilian unit.

Established in Diadema City, São Paulo State, Brazil, NOF Metal Coatings South America has a local R&D centre plus an industrial plant, producing and serving several customers in Brazil across South America, for decades. Since last April, this subsidiary is under the management of Mr. Kai-Uwe Hirschfelder, the new CEO.

As a German, Kai-Uwe had been living, studying, and working between Brazil and Germany, speaking the Portuguese language so well. Porsche is among his long professional trajectory. At his side, the executive has Mr. Haroldo Chieza as the Commercial and New Business Management. Chieza was working for Norsk Hydro ASA for the last 14 years.

The new directors promise a great improvement and expansion of surface treatment product lines, not just in the automotive industry, a sector that has a solid tradition, but also improvement in a lot of business in several sectors, such as generation and transmission of energy from hydroelectric, solar and wind sources, construction, railroad and many other.

“While Mr. Chieza operates with the focus on relation with market and searching as well as developing new business, we are modernizing all administrative and production structures, to put this unit at the global highest level. It is important that we highlight our action as ecological production, in which we are a global reference using solvent liquid,” said Kay-Uwe.

Brazilian Steel Production Falls

Local production shrunk 1.5% from January to April.

From January to April 2022 the Brazilian crude steel production was 11.6 million tons, representing a drop of 1.5% compared to the same period of 2021. The production of rolled products in the same period was 8.1 million tons, a reduction of 5.9% compared with the same period last year. The production of semi-finished products for sales totalled 2.9 million tons from January to April 2021. 2022 sees an increase of 15.6% on the same comparison basis.

In April, the crude steel production was 2.9 million tons, representing a decrease of 2.2% compared to March 2022.

032 China Fastener World no.66/2022 Brazilian News

▲ NOF SA Industrial Plant

▲ Haroldo Chieza and Kai-Uwe Hirschfelder

AVB's Carbon Neutral Steel

The Brazilian steel mill showcases carbon neutral steel production at an international steelmaking forum.

One of the most important forums in the steel industry, the International Conference on Energy and Material Efficiency and CO2 Reduction in the Steel Industry (EMECR) was held in Brazil for the first time, in June 2022.

The world's first carbon neutral steelmaker, Aço Verde do Brasil (AVB) was present at the meeting to show its green steel production process as well as its ESG sustainability strategies. The AVB director, Ricardo Carvalho was on a mission to talk about the technologies and innovations used in his company.

The company has the best Brazilian indicator of CO2 per ton of crude steel produced in years 2018, 2019, 2020 and 2021.

"While several steel industries are beginning to plan decarbonization, with neutrality forecasts for up to 2060, AVB has already reached this level in 2020", told Ricardo Carvalho.

News provided by: Sergio Milatias, Editor Revista do Parafuso (The Fastener Brazil Magazine) milatias@revistadoparafuso.com.br www.revistadoparafuso.com

033 China Fastener World no.66/2022 Brazilian News

▲ AVB Industrial Plant

▲ Ricardo Carvalho

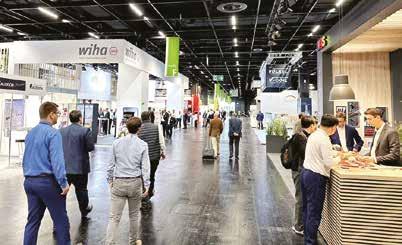

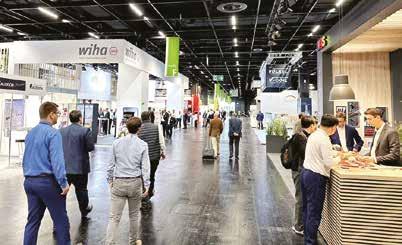

European News

Compiled by Fastener World

Record Sales for Würth Group

Hilti Group Begins Year with Further Growth

In the first four months of 2022 the Hilti Group achieved a 5.6% sales increase to CHF 2.03 billion (€2.03 billion). In local currencies, growth reached 9% compared to the same period last year.

In the Europe business region, the Hilti Group increased sales in local currencies by 8.8% with a particularly positive development in Northern and Southern Europe. In the Americas, the increase amounted to 10.9%, continuously supported by disproportionate growth in Latin America. Influenced by the Covid-19 restrictions in Asian countries, Asia/Pacific achieved only slight growth (+1.1%). The Eastern Europe / Middle East / Africa region recorded double-digit sales growth (+15.4%) as the effects of the war in Ukraine and the associated sanctions against Russia will only become visible in the business results in the coming months.

The challenging market environment and the announced rise in interest rates increases the likelihood of an economic slowdown in the construction industry. Nevertheless, Hilti Group continues to expect double-digit sales growth in local currencies for the full year, driven primarily by price increases.

Christoph Loos, CEO at Hilti, commented: “The global supply bottlenecks, combined with massive price increases for raw materials and for energy and transportation, have been further exacerbated by the war in Ukraine and the current lockdowns in China. Against this background, our continued growth is encouraging. However, the first four months have shown that 2022 will be much more challenging than last year.”

Lesjöfors Expands in the USA

Würth Group has achieved a new record with an operating result of €1.27 billion in the 2021 fiscal year (2020: €775 million). At €17.1 billion, the worldwide operating family business generated the highest sales volume in corporate history (2020: €14.4 billion). This corresponds to growth of 18.4%. Adjusted for currencies, sales grew by 19%.

Robert Friedmann, chairman of the central managing board of the Würth Group, commented: “The Covid-19 pandemic, and the resulting price increases, as well as material shortages on the procurement market, challenged us last year. The distinct increase in sales and operating result furnishes proof that our strategy is worthwhile also in times of crisis. This is the reason why we started 2022 full of optimism. That is, until February when the conflict between Russia and Ukraine escalated. Now, we have to manage this unprecedented situation of uncertainty every single day.”

With a sales share of 40.7%, Germany remains the most important individual market for the Würth Group. In the second year of the pandemic, the German companies proved to be battle-tried and generated a sales plus of 14.3%. The companies outside Germany also succeeded in achieving a sales increase of 21.4%.

Relieving Strain Through Digitalisation

Supply and material bottlenecks that already existed before the Ukraine crisis continue to complicate the day-to-day work of tradespeople. Metals, electronic components or plastics are difficult to obtain. Robert Friedmann emphasised: “There still is lots of sales potential out there once supply security has been restored.”

“The importance of the industry was demonstrated during the pandemic. Being essential businesses, the trades kept going. From the small but essential repair of an electrical installation to the sustainable infrastructure construction project – the trades are and will remain future-proof. We see it as our primary task to support our customers wherever we can.”

Lesjöfors, part of the Beijer Alma group, has signed an agreement to acquire the assets and operations of John Evans’ Sons Inc, a leading US spring manufacturer. With the acquisition, Lesjöfors strengthens its US presence and significantly increases its sales to the medical industry, in line with its ambition to build the leading spring, wire and flat strip component group.

John Evans’ Sons is the oldest spring maker in the USA, founded in 1850, and has a leading position on the US market. The company has a diversified customer base with long customer relationships, attributable to its expertise and ability to support customers early on in their product development projects. Revenue mainly stems from customers within the medical industry but also from customers within the industrial, construction, aerospace and transportation industries. The production facility is located in Lansdale, Pennsylvania, and the company has 72 employees.

Similar to Lesjöfors, John Evans’ Sons has close customer relationships, high technical expertise and strong emphasis on tailored solutions. Through the acquisition, Lesjöfors strengthens its position within the medical segment and builds further scale in the USA. The acquisition also enables other opportunities for profitable growth, such as purchasing coordination, cross-selling, resource/knowledge sharing with Lesjöfors’ other US companies.

034 China Fastener World no.66/2022 European News

歐洲新聞

Voestalpine Records Best Results in Company’s History

Voestalpine posted record results in the business year 2021/22, despite an extremely challenging environment, with revenue rising 36.9% in a year-over-year comparison, to €14.9 billion. The operating result (EBITDA) also developed positively, doubling year over year to €2.3 billion (2020/21: €1.1 billion).

Herbert Eibensteiner, CEO of voestalpine AG, explains: “voestalpine once again demonstrated its great flexibility and adaptability. By maintaining our clear focus on measures to boost efficiency, we were able to exploit the positive economic environment during the business year as best we could. We succeeded in securing our operations through suitably adjusted measures within a very short time following the outbreak of the war in Ukraine.

In the business year 2021/22, demand for the steel and technology Group’s high-quality products developed along extremely robust trajectories in almost all market and product segments. Even the Automotive Components business segment, which was strongly impacted by disruptions to supply chains and related production curtailments, recorded a satisfactory performance. The development of the Railway Systems segment was once again stable. Following the economic recovery, the Aerospace segment, which had been hugely impacted by the pandemic, developed as positively as the energy sector, which was able to profit from the rising oil and natural gas prices. The boom in the Warehouse & Rack Solutions business segment, which is driven especially by the growing trend toward e-commerce, continued unabated in the reporting period.

SFS Achieves Record Results

In a dynamic market environment characterised by high demand, supply chain bottlenecks and the ongoing Covid-19 pandemic, SFS Group seized opportunities that arose in each of its segments to boost its sales by 11.0% to CHF 1.89 billion (€1.88 billion) in 2021. All end markets and regions contributed to this good growth. The result was a high level of production capacity utilisation that strengthened profitability and generated net income of CHF 248 million.

The Covid-19 pandemic continued to be the defining theme for the SFS Group in 2021 again. The market environment had already begun showing signs of recovery in the third quarter of 2020 and this recovery continued unabated during the first half of 2021. The first half of the year saw growth of 23.8% compared to the same period of the previous year, which was dominated by the lockdown. In the second half of the year, production slowdowns – yet another of the consequences of the Covid-19 pandemic –increasingly resulted in global supply chain disruptions as well as shortages of semiconductors and other raw materials, some of which also had an impact on call-offs at SFS.

Fastening Systems

The exceptional demand situation that the Fastening Systems segment had already successfully leveraged in the first half of the year to generate record results continued in the second half, albeit at a slightly lower level. The good market position and robust supply

Böllhoff Acquires Gillis Aerospace

With effect from 1st June 2022 Böllhoff Group has acquired Gillis Aerospace, a French manufacturer of fasteners for the aerospace industry, therefore expanding the product and competence portfolio for customers in the aerospace market segment.

Böllhoff Group already acquired 40% of the shares in Gillis Aerospace in January 2020. Gillis Aerospace specialises in the production of special fasteners and bolts, as well as surface finishing. Due to the high-level of automation, Gillis is especially characterised by high product quality and short lead times. Furthermore, Gillis has its own facilities for surface coating and can therefore offer the complete value chain from a single source with its comprehensive coating know-how. In addition to that, surface coating is also offered as a service to the market.

The acquisition of Gillis adds to Böllhoff’s capabilities within the aerospace sector, after it acquired SNEP in June 2021. “With a comprehensive manufacturing portfolio, material expertise in lightweight materials, and development knowhow, Böllhoff wants to strengthen its position in the aerospace market as a leading supplier of innovative fastening solutions and support the aerospace industry as a competent partner in achieving weight and CO2 targets,” says Michael W Böllhoff, managing partner of the Böllhoff Group.

chains enabled the segment to reliably serve customers and profit from strong demand. The segment succeeded in boosting its sales in this environment by 17.4% year over year to CHF 574.9 million. Consolidation effects and currency translation effects contributed +0.5% and +0.3%, respectively, to sales growth.

Outlook for 2022

Performance will remain characterised by major uncertainties as a result of smouldering geopolitical developments such as the current war in Ukraine, trade conflicts and sustained disruptions in supply chains. Uncertainties in international supply chains, which should gradually subside as the Covid-19 pandemic abates, are expected to persist until early 2023. In this environment, ensuring the highest possible focus on customers takes top priority. Investments in the selective expansion of our production capacity and thus the implementation of ambitious growth projects will continue.

SFS Completes Transaction with Hoffmann

The transaction between the SFS Group and Hoffmann SE that was announced in December 2021 was completed on 11th May 2022 – meaning that Hoffmann has now been officially incorporated into the SFS organisation. SFS Group explains that the joining of forces with Hofmann marks a milestone, with the companies’ complementary positioning opening up attractive development opportunities for both.

In organisational terms, Hoffmann will operate as an independent division within the Distribution & Logistics segment. Hoffmann’s inclusion at various levels of the SFS organisation will create continuity and lay the foundation for the Group’s successful future development.

Hoffmann’s CEO, Martin Reichenecker, will now join the Group executive board of SFS. In addition, Dr. Peter Bauschatz, chairman of the supervisory board of Hoffmann SE, will now join the board of directors of SFS.

036 China Fastener World no.66/2022 European News

China Fastener World no.66/2022 037

New MD at Bossard Germany

Bossard Deutschland GmbH has announced Dr. Daniel Philippe Stier as managing director, succeeding Florian Beer – who is taking a sabbatical at his own request in order to subsequently face new challenges. Dr Frank Hilgers, the second managing director of Bossard Germany – who also works as area manager/ CEO of Bossard North Europe, remains with the company.

After graduating with a degree in business mathematics from the University of Ulm, and doctorate from the University of Hohenheim, Dr. Daniel Philippe Stier first worked for a well-known car manufacturer and then for a management holding company for the Saarland steel industry, most recently as head of risk management. He has held various positions at Dillinger Hütte since 2016, including sole managing director of Dillinger Hütte Vertrieb GmbH and chairman of the supervisory and advisory boards of various sales companies worldwide.

Bossard — Continued Dynamic Sales Growth

Bossard Group has reported an excellent start to the year, with first quarter sales increasing by 19.1% to CHF 291.6 million (2021: CHF 244.8 million), equivalent to 20.6% in local currency. The Group also posted double-digit growth rates in all three market regions. Bossard’s favourable business development, which has been ongoing since the fourth quarter of 2020, continued through the first quarter of the current financial year in all three market regions. In the still tense procurement market situation, availability is a key success factor.

“Our consistently high delivery capability is based on the purchasing strategy practiced for years, which is based on multiple procurement sources. The focus on Smart Factory services in times of complex procurement markets and cost increases also paid off,” states Dr Daniel Bossard, CEO of the Bossard Group. "Our focus on product solutions as well as our engineering and logistics services serve to increase the productivity and efficiency of our customers. True to our approach of Proven Productivity we are able to significantly reduce our customers’ total costs in C-parts management and assembly. And this is especially the case today, when permanent wage and price increases are affecting our customers' cost base.

Broad-based Growth

In Europe, Bossard posted sales growth of 15% to CHF 169.9 million (in local currency +18.9%). Above-average sales growth was achieved in particular in the mechanical engineering, electronics and aerospace industries. Adjusted for acquisitions, growth in local currency was 11.9%. Sales in America increased by 24.4% to CHF 68.4 million (in local currency +21.7%). The positive business development was driven by the ongoing diversification of the customer base in this market region, particularly in the electronics, mechanical engineering and electromobility industrial segments.

The Asia market region grew by 26.6% to CHF 53.3 million (in local currency +25.1%). On the one hand, it benefited on the demand side from a recovery effect from the Covid-19 pandemic, while on the other hand the systematic development of the sales pipeline led to steady customer growth in the focus areas automation, electronics and electromobility. This allowed Bossard’s Asia business to post doubledigit growth in local currency for the sixth quarter in a row.

New fischer Insulation Fixing TermoZ CS II

fischer’s new TermoZ CS II screw fixing anchors ETICS insulation panels made of any kind of material, including fire bars, into any conventional construction material to enable simple, time saving screw mounting with minimal thermal bridges.

fischer points out that the latest addition to its range of ETICS fastenings is multitalented, as it is suitable for fastening insulating panels in any conventional material and thickness on all standard solid and hollow construction materials. The ETICS fixing therefore doesn't need to be replaced if the façade is equipped with various insulating materials, such as a fire bar, which saves additional time.

TermoZ CS II’s approval for every building material class (A, B, C, D, E) guarantees its secure application – making it suitable for subsequent insulation on renovated buildings if there is uncertainty about their anchor substrate. Further advantages include the fact that any improper use caused by unsuitable insulation fixings is prevented and users can make do with a single ETICS fixing even if the building has various substrates.

The screw fixing consists of a polypropylene anchor sleeve with a diameter of 8mm, as well as an insulation plate (various diameters) made of glass-fibre reinforced polyamide. The fixing is fastened by inserting the special compound screw made of zinc-plated steel and glass-fibre reinforced polyamide. While the screw is inserted, the anchor sleeve expands to provide a firm anchoring in the substrate. Because the screw is thermally isolated, thermal bridges are minimised so that there is no need for a sealing plug.

038 China Fastener World no.66/2022 European News

China Fastener World no.66/2022 039

NORMA Group Achieves Sales of €1 Billion

NORMA Group has generated sales of €1.091 billion in fiscal year 2021 (2020: €952.2 million), representing a 14.7% increase in organic revenue. At €113.8 million, adjusted earnings before interest and taxes (adjusted EBIT) were well above the figure for the previous year, which was severely impacted by the Covid-19 pandemic (2020: €45.3 million).

The 2021 fiscal year was shaped by varying global developments. One of these was the fact that despite the ongoing Covid-19 pandemic, economic conditions improved significantly. In the first half of the year in particular, NORMA Group recorded increased customer demand in all business segments and regions. At the same time, turmoil in global supply chains created an entirely new set of challenges. The resulting material shortages led to a sharp rise in raw material prices, particularly in the second half of the year. This was reflected, among other things, in highly volatile ordering behavior on the part of customers, particularly from the automotive sector.

Development in the Business Regions

In the EMEA region (Europe, Middle East and Africa), sales increased by 12.9% to €462.4 million in 2021 (2020: €409.5 million). In the wake of the Covid-19 related declines in 2020, recovery effects in the Standardised Joining Technology (SJT) business and in the automotive business contributed to the sales increase.

In the America region, sales showed a significant 18.5% increase to €456.8 million (2020: €385.5 million). The positive development was the result of the general economic recovery on the one hand, and the continued very good performance of the US water business on the other. The US water business generated organic growth of 20.9% in fiscal year 2021 (2020: 6.7%).

In the Asia-Pacific region, sales totaled €172.8 million, an increase of 9.9% compared to the previous year (2020: €157.2 million). Increased demand from the Chinese automotive industry in the first half of the year as well as positive development in the SJT area contributed to the growth in sales.

Berner New High-bay Warehouse Goes in Operation

Berner Group has implemented the next important building block in its European logistics offensive, with a new fully automated high-bay warehouse now operation in Braunau am Inn, Austria.

With an investment of almost €6 million in this major project, as well as in further conversion and expansion measures at its Austrian subsidiary, Berner Group has been able to increase the logistics capacity of the site by around 1,000m2 of floor space and 5,500 additional pallet storage spaces.

"We are proud that we managed a precision landing despite the generally difficult raw material and supply situation on the world market," says Robert Kü hl, who as Chief Supply Chain Officer is responsible for the logistics division at the Berner Group. "The modernisation was implemented completely and without delays within the budget plan."

"Thanks to full automation, including order picking and other targeted improvements – such as a more direct connection to the other sections of the logistics centre, the throughput time of the products has been reduced by about 50%, so that we can now store and retrieve almost twice as many pallets per hour," reports Robert.

Fabory Acquires Fastto Nederland

Fabory Group has signed an agreement to acquire Fastto Nederland B.V from founder and owner Guido Voskamp. Fastto is a recognised fastener specialist with a relevant product portfolio and strong customer advocacy.

The Fabory Fastto combination shows a strong strategic fit between two fastener specialists. “Fabory is impressed by the customer intimacy Fastto is known for,” states Francisco Terol, CEO Fabory. “The team’s enthusiasm and customer focus is inspiring. It is easy to understand how Fastto has managed to build longstanding customer relationships.”

Guido Voskamp, owner and founder of Fastto, commented: “I envisioned a fastener specialist like Fabory when I started Fastto, both companies are strongly rooted in the world of fasteners. This is an exciting next step in Fastto’s development. The combination will benefit from an extensive product range combined with relevant expertise and a differentiated service mentality to support customers in their needs for fastening solutions. We are convinced that joining forces will open up many new opportunities.” Ever since it was founded in 2000, Fastto has been 100% focused on the distribution of fasteners. The company offers a wide and broad assortment of specialised fasteners in combination with strong customer service.

040 China Fastener World no.66/2022 European News

Bufab Acquires TIMCO

Bufab Group has acquired TIMCO (TI Midwood & Co Limited), one of the UK’s leading suppliers of essential construction products. Simon Midwood, managing director at TIMCO, will continue to run the business with the senior team. The purchase price paid upon closing of the transaction amounts to GB£54 million (€64.2 million) on a cash free/debt free basis.

TIMCO has been family-owned since its foundation in 1972 by Tim Midwood, and is currently run by Tim’s son, Simon Midwood. TIMCO reported a turnover of GB£49.7 million (€59.1 million) in 2020 and is expected to report a turnover of approximately GB£60 million for 2021.

Under Simon’s leadership, TIMCO has expanded to become a ‘one-stop shop’ for over 4,500 independent merchants across the UK and Ireland, supplying essential products that trade professionals rely on every day, such as screws, fasteners and fixings, nails, adhesives and chemicals, power tool accessories, hand tools, building hardware and site protection, security and ironmongery and PPE.

Additionally, Bufab’s board of directors has appointed Erik Lundén as the new president and CEO. Currently division manager for parts & services at Sandvik Mining & Rock Solutions in the Netherlands, Erik will assume his role on 15th August 2022.

Ahlsell Acquires Skånebeslag

and Skånesnickeri

Ahlsell has entered into an agreement to purchase all shares in Skånebeslag and Skånesnickeri AB – with the two companies having a combined annual turnover of more than SEK 60 million (€5.7million).

Ahlsell Group has a turnover of approximately SEK 37 billion (€3.56 billion) and has more than 6 000 skilled employees, over 240 stores and three central warehouses. The joint acquisition will enable it to further develop its offering in the field of circular construction and renovation solutions – an important contribution to a more sustainable development of society.

Both Skånebeslag and Skånesnickeri have been active since 1972 and have always had a good relationship with Ahlsell. They are at the forefront when it comes to customised solutions for construction customers, with both constantly developing their range of fittings and fixtures, and have a customer focus that suits Ahlsell’s culture.

As they now become part of the Ahlsell Group, synergies and opportunities are created for both companies to learn and develop even more. The acquisition gives Ahlsell access to Skånebeslag’s entire expertise and product range, and through the acquisition of Skånesnickerier, the opportunity to learn a new product area with cutting-edge expertise in the areas of reuse, renovation and circularity.

News provided by: Fastener + Fixing Magazine (www.fastenerandfixing.com)

041 China Fastener World no.66/2022 European News

American News

Compiled by Fastener World

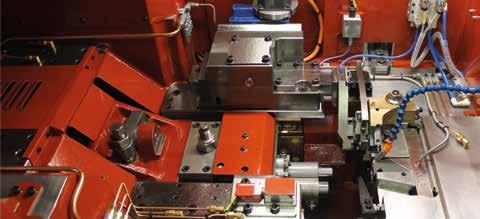

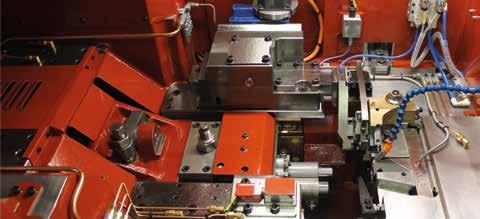

National Machinery Introduces Lean Header/Threader

for Re-Shoring

National Machinery

LLC introduced a new “lean header & threader” to make small screws / fasteners up to M6 sizes. It uses a small footprint and sound enclosure for efficiency, sales & marketing VP Jerry Bupp said. “The machines target industry needs for the re-shoring of small fasteners and replacement of traditional headers,” the company stated.

“While it remains to be seen how much of it is permanent, re-shoring is indeed happening,” Bupp said. Most orders are going to North America, with some headed to Europe. Most of the new header & threader sales are to existing fastener manufacturers, Bupp said. “There have been inquiries from startups, but when they learn the complexity of forming that makes them realize it may not be the right fit,” Bupp finds.

Founded in 1874 by William Anderson, National Machinery has facilities on four continents and is headquartered in Ohio.

FAA Clears Boeing to Resume 787 Dreamliner Deliveries

Boeing could soon resume deliveries of its large 787 airliner, which has been plagued by a series of production issues since late 2020, the Associated Press reports. The Federal Aviation Administration will approve the company’s process for validating fixes to each plane before they are delivered to airline customers. “Approval to resume deliveries would be a boost for Boeing, which collects a big chunk of each plane’s purchase price at delivery,” according to AP. Boeing has accumulated a backlog of about 120 undelivered 787s. The plane, which Boeing calls the Dreamliner, lists at $248 million to $338 million depending on size.

Issues with the 787 started in 2020 when small gaps were found between panels of the fuselage that are made of carbon composite material. Inspections that turned up problems with a pressurization bulkhead at the front of the plane. Boeing also had to replace titanium parts including fasteners after it was discovered that the Italian supplier used alloys that did not meet FAA standards. Fasteners played a prominent role in the nearly three-year delay of the Dreamliner as supply disruptions and improper installation plagued its test aircraft fleet.

Boeing had an issue with overtorqued fasteners in some of the first 787s. The aircraft manufacturer discovered hairline cracks in wings “stemmed from fasteners used to connect aluminum shear ties on the wing ribs to the carbon fibre composite wing panel,” according to the Wall Street Journal. “The fasteners were over-tightened without the use of manufacturing fillers, compressing a gap in the structure and in some cases caused hairline cracks of less than an inch: if left unchecked it can cause unintended stress on the jet’s structure and lead to further damage.”

Likewise, an “unusual production mishap” on the 787 assembly line in Everett, WA, revealed a continued problem with incomplete fuselage sections from Boeing's South Carolina facility, according to the Seattle Times. “During 787 assembly, before the point where all the fuselage sections and wings are joined to make the complete airframe, the fuselage sections are held in place by cradles,” wrote Dominic Gates of the Times. “After the join is made, the cradles are lowered and removed.” However, when mechanics in Everett removed the cradles, “nearly 100 improperly installed fasteners clattered to the factory floor.” “A subsequent inspection found the South Carolina team in Everett had installed hundreds of temporary fasteners near the join between the two aft fuselage sections without the collars needed to hold them in place,” according to the Times.

It is unclear how long it will take Boeing to deliver all 120 backlogged planes, which were built at factories in Washington state and South Carolina. Each one will need to be cleared by the FAA.

042 China Fastener World no.66/2022 American News

美洲新聞

China Fastener World no.66/2022 043

LindFast Acquires Star Stainless Screw Co.

LindFast Solutions Group acquired Star Stainless Screw Company for an undisclosed sum. “We believe the combination of LSG and Star will give our collective customers unparalleled ability to meet all of their fastener needs with one company,” said LindFast CEO Bill Niketas. “With Star’s 14 branches and distribution centers across North America and the 16 locations we have, this collective footprint will allow our customers to access product even more efficiently than in the past.”

Together LSG and Star will distribute fasteners ranging from stainless to inch, to metric and provide value-added services. As with other recent LindFast acquisitions “little change is expected in the near term from a customer perspective,” Niketas said. For the foreseeable future, Star will continue to operate out of its existing facilities, will remain on the same ERP system, and will extend the same policies currently in place.

Lindstrom was founded in 1983 by Virg Lindstrom. Stelfast traces its founding to 1972 when Surinder Sakhuja started Eses Limited as a manufacturer of industrial gears and screw machine products. The company took the Stelfast name in 1976 and became an importer and master distributor of fasteners.

Lindstrom was a master distributor specializing in metric fasteners when it acquired Stelfast – an imperial fasteners master distributor – in 2018. In 1946 Bernard Golden founded Star Stainless Steel Polishing Co. in New Jersey. In 1950 a few bags of screws found in the employee locker room led to the start of Star Stainless Screw Co. Star Stainless survived a fire which destroyed its building in 1954. When Bernard Golden died in 1984, his son Wayne Golden succeeded him. Bruce Wheeler became president in 2003. Tim Roberto is the current president.

ParkOhio Bolsters Its Fastener Business

ParkOhio acquired two companies to bolster its fastener business. ParkOhio acquired Southern Fasteners & Supply, which will be included in ParkOhio’s Supply Technologies segment. Winston-Salem, NC-based Southern Fasteners provides commercial fasteners and industrial supplies to MRO and OEM customers. The company lists operations in Montgomery, AL; Anaheim, CA; Orlando, FL; Pendergrass, GA; D'Iberville, MS; Greenville, SC; New Johnsonville, TN; Houston, TX; Richmond, VA; and Parkersburg, WV.

Southern Fasteners has annual revenue of US$25 million. In addition, ParkOhio finalized the acquisition of Charter Automotive (Changzhou) Co. Ltd., which will also be included in ParkOhio’s Supply Technologies segment. Changzhou, China-based Charter “is strategic to our fastener manufacturing business and will accelerate the global growth of its proprietary products to Electric Vehicle and other autorelated platforms,” ParkOhio noted. Charter has annual revenues of approximately US$15 million.

ParkOhio completed the acquisitions during a strong second quarter performance. Revenue increased 22% to US$429 million, boosted by strong results from its Supply Technologies and Engineered Products segments. Net income improved to $1 million from a US$3.5 million loss in the second quarter of 2021.

Supply Technologies segment sales rose 13% to an all-time quarterly high of US$175.8 million, breaking the previous record of US$168.8 million established last quarter. Sales gains were driven by “strong customer demand in the majority of our end markets, with the biggest increases in heavy-duty truck, semiconductor, industrial and agricultural equipment and civilian aerospace.” Average daily sales increased 18%, with operating income up 24% to US$12.7 million. Q2 operating margins improved to 7.2%, “as profit flow-through from the higher sales levels and the favorable impact of pricing initiatives more than offset higher supply chain costs and general inflation.”

Ohio-based Supply Technologies provides logistics services for 190,000 production components, including fasteners, to OEMs, other manufacturers and distributors. ILS also engineers and manufactures precision cold formed and cold extruded products, including locknuts, SPAC nuts and wheel hardware. The segment employs more than 1,500 at 55 logistics service centers in North America, Scotland, Hungary, Asia and India. Park-Ohio entered the fastener business in 1995 by acquiring RB&W. Subsequent fastener acquisitions included Arden Industrial Products Inc., Arcon Fastener Corp., Delo Screw Products Co., Direct Fasteners, Gateway Industrial Supply and Columbia Nut & Bolt Corp. and Purchased Parts Group Inc.

AFC Industries Acquires TFC Ltd.

AFC Industries acquired UK-based TFC Ltd. Terms of the deal were not disclosed. For over 60 years, TFC has supplied industrial fastening products and services via a network of UK and European locations. TFC offers customized VMI, product solutions, and engineering and design consultation for industrial markets. TFC will continue to be led by Morgan Burgoyne and the current TFC management team as the AFC European business unit.

AFC distributes fasteners and assembly components to OEMs, assembly plants and other users. AFC provides supply chain management, VMI, stock and release programs, right assembly, kitting and private labeling to a range of industries. AFC has facilities in Connecticut, Ohio, Minnesota and Nevada plus Mexico and is headquartered in Fairfield, OH. In 2021, AFC Industries was acquired by Foster City, CA-based Bertram Capital.

044 China Fastener World no.66/2022 American News

China Fastener World no.66/2022 045

NFDA on Cybersecurity: The New Normal

Cyber crime is a legitimate business in other countries, Will Snyder of WTC Business Technology Services told National Fastener Distributors Association members. “Plan for a Cyber incident to happen... It is not IF, but WHEN!” Snyder stated. Snyder advocates a “shotgun” approach to system vulnerabilities/breaches. This includes security measures, staff training and cyber liability and business disruption insurance.

The first order of business is security. Measures such as DNS proxy, next-generation firewalls (with automatic system updates), GEO blocking (blocking traffic from countries where you don’t do business), content filtering and IPS/IDS (intrusion prevention systems and intrusion detection systems) are essential to help keep your business safe from hackers. Such measures help “secure the edge,” Snyder explained.

Fastener distributors also need to “secure the endpoint.” This involves next-gen endpoint protection (antivirus) software with 24/7 monitoring, tightening your password policy (complex requirement that changes every six months) and access control, and device updates and patching (using RMM to automate and schedule Windows updates on workstations and laptops). “Perform an internal vulnerability scan yearly to make sure nothing is missed,” Snyder emphasized. Fastener distributors also need to secure their networks. This involves an improved password policy and access control and remote machine management (RMM) to support and monitor all network devices.

It’s a very big risk to have your email hosted locally, Snyder explained. “My brother-in-law has an email server that has worked for the past 20 years: Why do I need to update?” won’t save your business in a cyber attack. Most importantly, businesses must secure their data. “If everything else fails… having a data backup stored securely” can get your business back up and running quickly,” Snyder explained.

To secure company data, put encryption on everything. Likewise, place “smart” cameras on all key areas, such as IT rooms. Use on-premises encrypted server image backups daily. And create documented disaster recovery/business continuity plans to prepare for the worst. Educating staff on security risks is essential as well. Snyder encouraged “user security awareness training” and having staff take various phishing tests (social media, financial ACH, etc). Training should occur every quarter, he noted.

In addition, it’s vital to test your business response to everything. Disaster recovery and incident response test at least yearly and backups tested monthly, with all processes documented and documentation used each year in testing. These solutions are not expensive but they’re essential in the 21st century, he noted. “ALL companies are now at risk. Having simple antivirus software is no longer enough.”

NFDA Panelists: Supply Chain Faces ‘Bumps’

Industry panelists at the National Fastener Distributors Association 2022 spring meeting reported supply chain problems are easing, but are not back to normal. Joe Kochan, COO of the Elgin Fastener Group, said “inbound raw material was stabilizing” before Russia invaded Ukraine. Raw material “continues to be a challenge” for Elgin. The Ohio-based manufacturer is ordering and forecasting further out, Kochan said. There also are delays in outside processing for manufacturers, Kochan added.

Shipping has improved, but Tim Roberto, president of Star Stainless Screw, said “ports can’t handle” the shipping as is and “any little bump down the road” creates larger problems. “Your customers are going through the same problems,” Roberto pointed out. Angela Philipport of AFC Industries, who has 25 years in various purchasing roles, said a key will be “keeping lines of communication open in the supply chain. AFC has relied on “communication and collaboration.” Roberto agreed there is a need to share information. Star Stainless is relying on supply chain relationships, he said. “We are all swimming in the same ocean” panel moderator Eric Dudas summarized.

Recession ahead? “I’m usually the optimist,” Roberto said. But he finds fear of a recession “is driving the narrative.” Kochan pointed out that even if a recession develops that “we serve different markets” and some markets will have a soft landing.” “There is still business during a recession,” Roberto pointed out.

Roberto started in the fastener industry with a summer job 31 years ago. He became a branch manager at age 25. All along he has been “building relationships” with Star Stainless people by “sitting down and having a conversation.” When you get to know them you “recognize where their strengths are.” Also be aware that “people evolve,” Roberto added. “Give tools to people who are motivated.”

Philipports said AFC is ordering further in advance and working with domestic partners for “greater control over the order board.” In buying domestic, AFC is looking “at the total cost of imported product.” Roberto said the import / domestic ratio “comes back to cost.” Roberto asked and answered reshoring questions: “Can we? Yes. Should we? Yes.” Kochan agreed that domestic vs. imported “comes down to cost.” But he noted that “people are talking about it (reshoring) more” and EFG is having “conversations with customers.” He predicts there will be more domestic production. “Price is not the total cost of ownership,” Kochan noted.

Philipports said remote employees have opened a greater talent pool. She cited a recent search drew 12 applicants to work in the office, but “a thousand-plus to work remotely.” Kochan touted EFG’s internship program and noted he just hired an engineer who had been an intern. He had once been “third shift on the shop floor in Alabama who others had helped along.” Kochan urged management to be engaged with employees. “People need to know they are important” and they “have a future” with the company. Roberto suggested to improve efficiency “go to the person who is doing that job” for suggestions. Philipports emphasized that managers “need to be leaders. I have to be the leader” and “set the example.”

EFG developed a program of games to get people to look forward to being at work. Referring to the pandemic of 2020, Philipport norms “there was no playbook” and AFC had to “look at alternatives.”

046 China Fastener World no.66/2022 American News

China Fastener World no.66/2022 047

CELO’s USA Team Gets Ready for New Carlo Salvi Machines

To cope with the growing business in the USA, members of the CELO USA production team had a training session at CELO’s Spanish manufacturing plant, where they learned all about Carlo Salvi machines. CELO reports, “It was great that the teams were able to meet in person and thank you to our Spanish team for being such good teachers!” CELO is a brand dedicated to the design and manufacture of highprecision fixing and fastening solutions for the fields of industry and construction. It has an international presence on three continents: Europe, Asia and America, while staying true to its roots as a family business.

Industrial Fasteners Institute (IFI) Announces New IFI Standard: IFI-171

Industrial Fasteners Institute (IFI) has announced the publication of a new IFI standard, IFI-171, thread dimensions for sizes 1-5/8 – 5-1/2 and 1-7/8 UNS for Assembly of Bolts, Studs and Nuts in the Steel Construction Industry. The new standard specifies thread dimensions and tolerances for two sizes of coarse threads, 1-5/8 – 5-1/2 and 1-7/8—5, that are commonly used in the steel construction industry. The standard resolves slight differences that commonly resulted from varied interpretations of ASME B1.1 (2019), which does not explicitly list sizes. IFI standards are developed by industry experts that volunteer at the request of IFI members and industry stakeholders. Many of these experts are also engaged in the production of the IFI Book of Fastener Standards, a compilation of nearly 100 standards from ASTM, ASME, SAE and the IFI. “I am very appreciative for the contribution of the task group members, beginning with Mike Friel from Haydon Bolts who identified the gap and pushed for a standard to be published,” said Salim Brahimi, Director of Engineering and Technology for IFI. “I am also grateful for the expertise and guidance of Al Barrows, chair of ASME Committee B1 on Threads. His support was essential to validate the accuracy of the dimensions and to ensure we did the work correctly and in concert with ASME B1.1. This standard will be added the Online Book of Fastener Standards and to future publications of the hardcover Book of Fastener Standards.”

MSC Acquires Tower Fasteners via AIS Subsidiary

MSC industrial Supply Co. has acquired Tower Fasteners, a valued-added distributor of Original Equipment Manufacturer (OEM) fasteners and components. Under the equity purchase agreement, Tower will continue to operate under its current name after becoming an MSC company. Mark Shannon, President of Tower, will continue to lead the business, which has approximately 100 associates. Tower's revenue in calendar 2021 was approximately $35 million. MSC's acquisition of Tower, made through its All Integrated Solutions (AIS) subsidiary, expands the company’s presence in the OEM fastener market, which it entered in 2018 with the acquisition of AIS, a leading value-added distributor of industrial fasteners and components, MRO supplies and assembly tools based in Wisconsin. Tower's growing footprint complements AIS's existing locations concentrated in the Midwest. The company operates eight distribution centers along the East Coast and in the Southwestern regions of the United States, Mexico and Europe. Tower serves manufacturers in the industrial, electronics, medical equipment, aerospace, military, and security, fire and safety sectors. MSC plans to maintain Tower’s operations, providing the company’s customer base access to MSC's 2 million-plus product portfolio to support their full metalworking and MRO needs. Similarly, MSC will extend Tower’s production fastener solutions to its manufacturing customers.

Lawson Products Changes Name to Distribution Solutions Group

The specialty distribution company includes MRO c-parts distributor Lawson Products, OEM supply chain services provider Gexpro Services, and TestEquity, an electronic test & measurement solutions provider. “We are excited to reach this next step in the evolution and transformation of these businesses, and believe that Distribution Solutions Group, tagline Powerful Solutions. Proven Results., exemplifies our strong leadership position,” stated chairman and CEO J. Bryan King.

Founded in 1952, Chicago-based Lawson Products distributes MRO products and services from facilities in all 50 states, as well as Puerto Rico, Canada, Mexico and the Caribbean. Lawson’s Bolt Supply House serves customers in Western Canada and the Kent Automotive brand supplies collision and mechanical repair products to the automotive aftermarket.

In the first quarter of 2022, Lawson Products reported sales, including fasteners, rose 13.8% to US$117.9 million. Average daily sales grew 12% to US$1.84 million. The integrated Lawson/Partsmaster sales grew 12.1% through price, volume and sales rep productivity. Realization of price increases instituted during 2021 and the first quarter of 2022 led to higher sales on a sequential basis and compared to the prior year quarter. The Bolt Supply House sales improved 26.9% from continued strength in branch location sales and a recovery of direct sales to oil and gas customers. Q1 gross profit increased US$5.9 million to US$60.5 million, driven by higher sales. As a percentage of sales, reported gross margin decreased to 51.3%. Net income nearly tripled to US$9 million.

DSG serves 120,000 customers supported by more than 3,000 employees. DSG ships from distribution and service centers to customers in North America, Europe, Asia, South America and the Middle East.

048 China Fastener World no.66/2022 American News

Henkel Decarbonizing Supply Chain

Adhesives manufacturer Henkel has set a corporate goal to be climate-positive by 2030. The company has partnered with energy and sustainability firm Schneider Electric to halve their operation’s CO2 emissions by 2025.

“Decarbonization is a fundamental part of meeting our ambitious sustainability targets,” said Ulla Hüppe, director of sustainability for Henkel’s Adhesive Technologies business unit. “We are fully committed to the Schneider Electric program, and we’re honored to have been asked to share our expertise to help other suppliers get started. Together, we can advance our positive environmental impact.”

As of 2021, Henkel’s CO2 emissions per ton of product have been reduced by 50% (vs. base year 2010), offering a model of success in sustainability.

“The catastrophic challenge that climate change presents cannot be overcome by a company’s actions alone,” said Christophe Quiquempoix, VP, Sustainable Procurement & External Manufacturing for Schneider Electric. “A company’s supply chain accounts for a much larger proportion of emissions, so engaging supplier partners is a critical step towards climate action. Energy is a major source of greenhouse gas emissions, and while we recognize that decarbonization is not easy, it’s necessary.”

Hilti Group Sales Rise in 2021

In the first four months of 2022, the Hilti Group achieved a 5.6% sales increase to CHF 2.03 billion (US$2.04 billion). In local currencies, growth reached 9%. “The global supply bottlenecks, combined with massive price increases for raw materials and for energy and transportation, have been further exacerbated by the war in Ukraine and the current lockdowns in China,” stated CEO Christoph Loos.

In Europe, Hilti increased sales in local currencies by 8.8% with a positive development in Northern and Southern Europe. In the Americas, the increase amounted to 10.9%, supported by strong growth in Latin America. Influenced by the COVID-19 restrictions, sales in Asia achieved only slight growth of 1.1%. The Eastern Europe / Middle East / Africa region recorded double-digit sales growth (+15.4%) “as the effects of the war in Ukraine and the associated sanctions against Russia will only become visible in the business results in the coming months.”

The challenging market environment and rising interest rates increase the likelihood of an economic slowdown in the construction industry. “Nevertheless, the Hilti Group continues to expect doubledigit sales growth in local currencies for the full year, driven primarily by price increases.”

The Hilti Group supplies the global construction and energy industries with products, systems, software and services. With about 31,000 team members in over 120 countries, the company generated sales of nearly CHF 6 billion in 2021. Headquartered in Schaan, Liechtenstein, since its founding in 1941, Hilti is privately owned by the Martin Hilti Family Trust.

Soft Sales Slow FDI Growth

The seasonally adjusted April Fastener Distributor Index declined to 52.6 from 57.2 in March, driven by a decline in the sales index from a general market slowdown, limited material availability for specialty fasteners, lower “panic buying” and Spring Break-related softness. “Pricing continues to march higher – particularly on stainless steel – as evidenced by further improvement in the year-to-year pricing index,” according to R.W. Baird analyst David Manthey. “Overall, growth/market conditions remain nicely positive but slowing relative to recent months.”

The seasonally adjusted Forward Looking Index dropped to 55.1 from 65.4 the previous month, hurt by a weaker employment reading and lower six-month outlook. “Overall, with demand still in a healthy place and supply chain challenges leading to very extended backlogs, we believe the FDI should remain in growth mode ahead,” Manthey writes.

The most common theme in April was slowing growth. One respondent said they were “seeing some market slowing, however other parts of our business are still growing.” “Business is starting to taper, panic buying is over and product is [slowly] arriving,” another respondent noted. Availability of products and extended lead times continue to plague respondents.

“Incoming orders continue to be very strong,” Manthey explained. “Material pricing still on the rise, especially stainless steel but at least we are getting regular deliveries again. Lead times on new orders are stretching out to 4-6 months depending on material.” Despite supply chain challenges, many participants’ sales are still exceeding expectations.

Fastenal’s 20.3% overall April daily sales growth was a touch below our 22.2% estimate. Fastener sales were very strong at 25.5% y/y (essentially consistent with last month’s 25.2% growth).

Rotor Clip & LISI Automotive Partnership

Rotor Clip and LISI Automotive NOMEL have partnered to serve the industrial market. With over 200 years of combined manufacturing excellence serving industries like automotive, aerospace, medical and more, Rotor Clip and LISI are the global leaders in Application Driven Solutions™.

As the global leader in the manufacture and design of circlips, retaining rings and wave springs, Rotor Clip now expands its reach of products, engineering and service to the market though LISI Automotive, and the two companies have synergy with their established manufacturing and distribution facilities in the EU marketplace. “The two brands, both well known and well established in Europe, will offer advice and technical expertise to their customers as well as a wide range of locally manufactured products,” says Christophe Martin, General Manager of Business Development at LISI Automotive. “This collaboration will guarantee increased stability of the supply chain to a European market undergoing a profound change.”

050 China Fastener World no.66/2022 American News

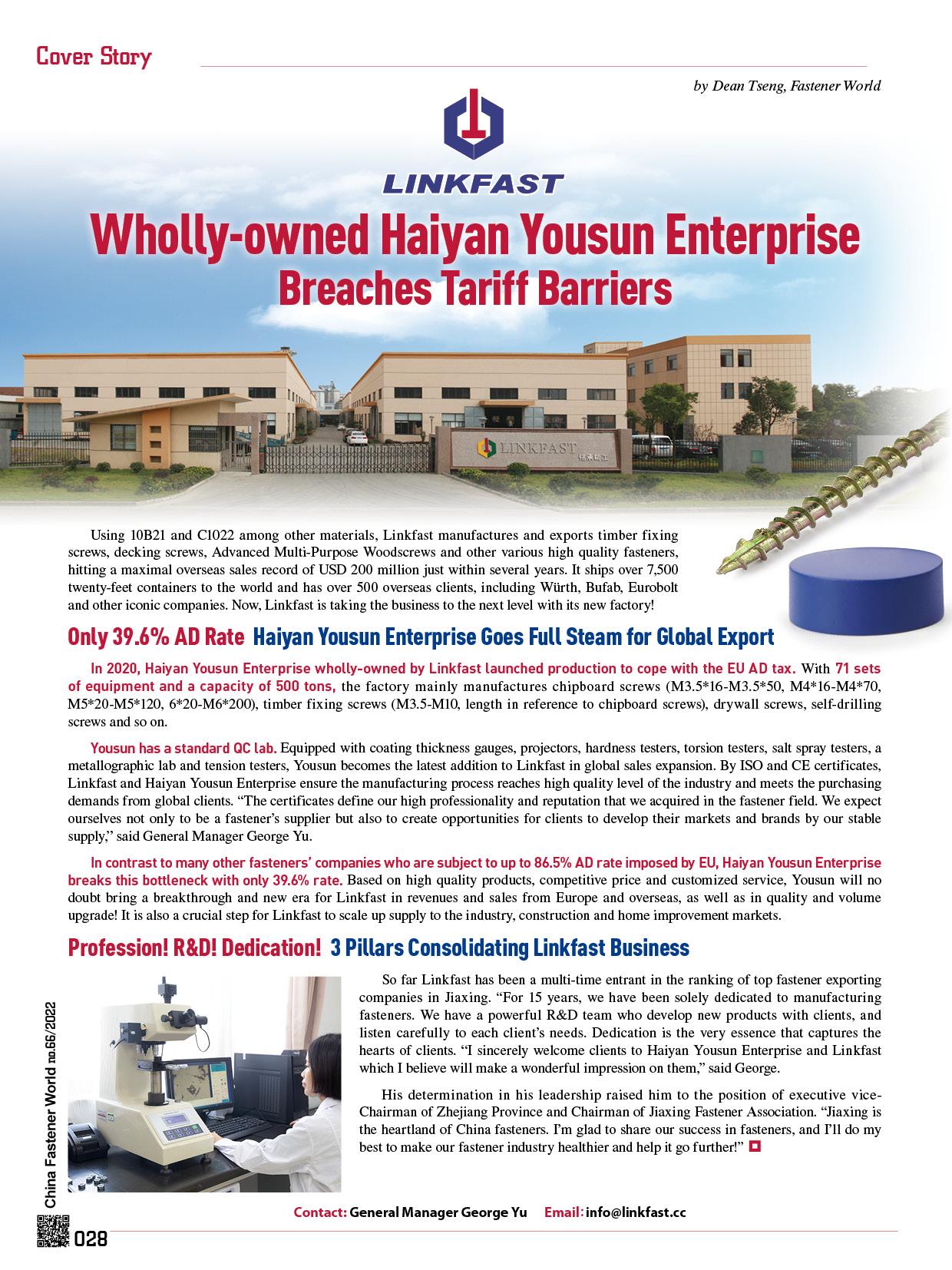

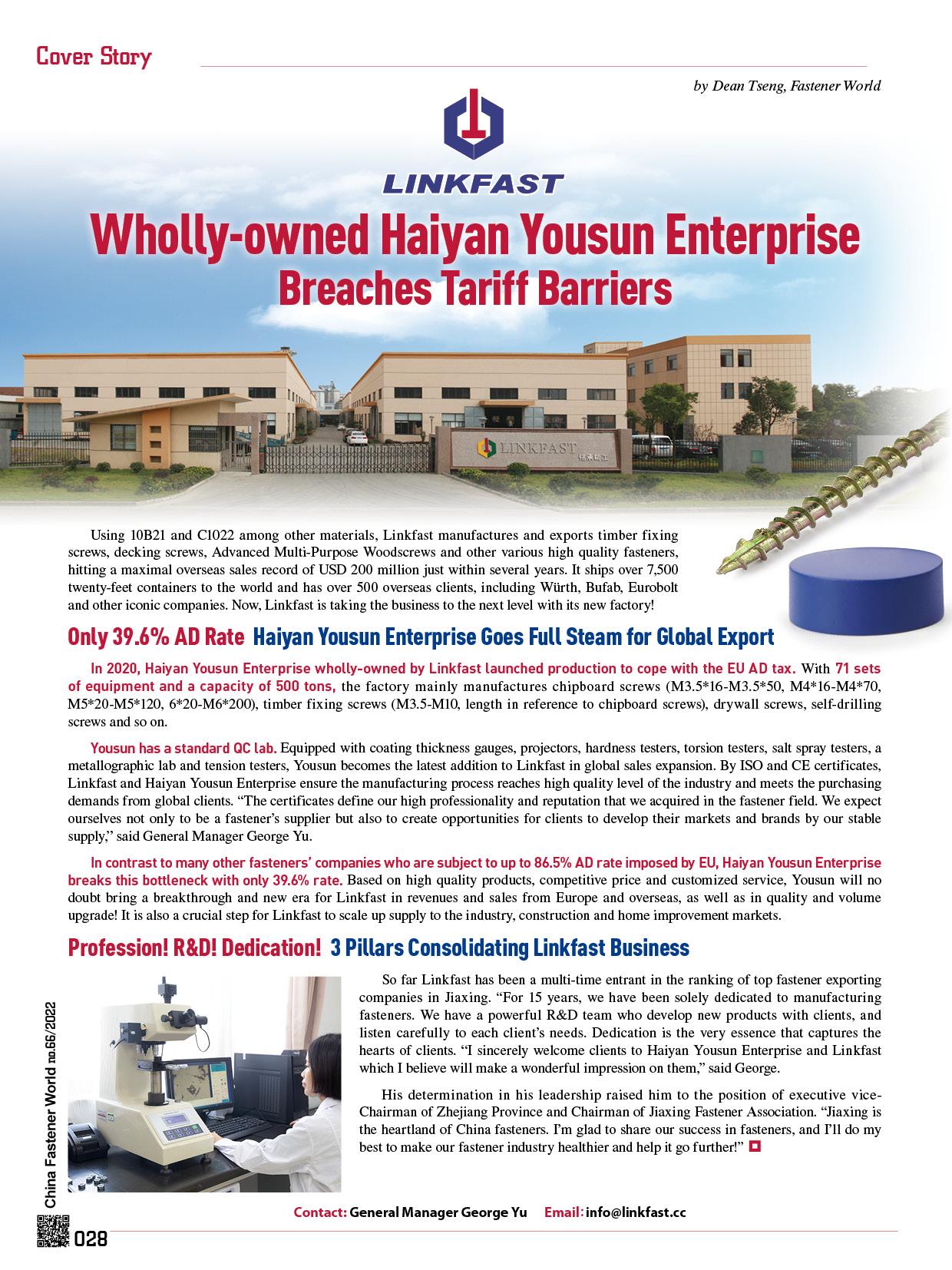

Zhongda United Holding Group Co., Ltd. was established in 1964. It is an IS09001, IS014001 and OHSAS18001 qualified enterprise with more than 3,000 employees and a total area of 478,000 square meters. In 2021, the company's total sales amount was $1.02 billion. Due to the company's business segmentation, our fastener business has been operating under the name ZDI SUPPLIES (HAIYAN) CO., LTD. since Sep. 2020.

We consider ourselves as a solution provider of fasteners, especially when it comes to project supply We can supply Chipboard Screws & Construction Screws (capacity: 1000 tons per month), Drywall Screws (capacity: 1000 tons per month), as well as other screws, bolts, nuts, threaded rods and stamped parts.

We can also provide a full range of DIY assortment and professional packaging design solutions for retailer display purpose. We have good experiences in cooperating with European and America retailers (TCHIBO, LIDI, ALDI, HORNBACH, LOWE'S, HOMEDEPOT, etc.)

We have our own lab, which is CNAS approved, as we treat product quality as top priority We can carry out tensile and impact test, corrosion resistance test, metallographic test and more according to customers' requirements. With our passion for fasteners, you will find our team a trustworthy partner and we are eager to hear from you.

RUSSIA

STAFDA: Employee Retention About More Than Money

A company’s culture is what can keep standout employees from quitting to go down the street for 50 cents more an hour, a “chief appreciation strategist” told participants of a Specialty Tools & Fasteners Distributors Association webinar. Lisa Ryan recalled intrigue with the welding consumables industry drawing her into a job with Lawson Products where she was the only woman in the orientation class. She “fell in” by learning about metal preparation, joining assemblies and the “smell of welding.” But it was the culture of the company led by the boss that “kept me there” for seven years, Ryan recalled.

At a Premier Automotive Supply Co. picnic, new employee Ryan approached CEO Mort Mandel. He took interest in meeting her and in doing so created a fan. Traditionally it could be layers of management asking “if it is ‘okay’ if Lisa says ‘hello’ to Mr. Mandel,” she said. Such personal contact can be lost in remote jobs. Particularly with working remotely during the pandemic the personal connection of “hallway conversations” are missed, Ryan found. To retain “human connections” with remote employees, Ryan suggested “keep the camera on” during remote meetings.

Often an employee departing is “not about the money. They are leaving you, they are leaving your culture,” Ryan said. A positive company culture means the chance of employees leaving “goes down substantially.” Ryan said she has known employees who have taken wage decreases – even 20% less money – for a better work culture.

Ryan recommends a seven-point program for employee relations:

1. Acknowledge excellence.

2. Be accessible. Employees want access to company leadership –particularly younger ones, Ryan said.

3. Express empathy. Your other employees will see and realize “they will have my back” in time of need. If you show empathy, a certain number of employees will take advantage of you, but 97% will appreciate that you will assist them.

4. Flexibility. Does every job have to be 8-to-5 or can working hours be adjusted for an employee due to babysitter availability or other situation?

5. Conduct ‘Stay’ interviews. Employers traditionally conduct “Exit” interviews, but should add “Stay” interviews, too. Start by asking for three things the employees like. Then instead of asking the negative of what they “don’t like,” ask the positive of “If you were me, what changes would you make?” Ryan said in the first round of “Stay” interviews, employees tend to “tell exactly what they think you want to hear,” but in subsequent sessions many tell more.

6. Invest in training. Many are reluctant to pay for training because the employee leaves. But Ryan asks: “What if you don’t train them and they stay?” She suggested offering US$1,500 to employees for a variety of training programs. That can be lunch and learn, sending an employee to a trade show or even participating in a group such as Toastmasters. The 3% to 5% who take advantage of the training “are your future leaders,” Ryan predicted.

7. Thank your people. Ryan recalled that while a salesperson in the welding division of Lawson Products, the boss hand wrote a compliment on her commission statement.

Field Announces Leadership Succession

Rockford, IL, USA-based Field Fastener, a family owned, global supplier of inventory management, technical support services and complete supply chain solutions for fasteners and other “C” class items, has announced the company’s leadership succession plan. Jim Derry, President/CEO of Field, has announced that Adam Derry will be promoted to succeed him as President. In addition, Chris Pauli will be promoted to Executive VicePresident and Chief Financial Officer (CFO). Jim Derry will remain the company’s CEO.

In 1990, Jim and Bill Derry acquired Field from Dick Field. Since that time, Field has seen aggressive growth, achieving an 18% average growth rate per year due to its worldclass culture and staying customer centric. Field currently has operations in Rockford, IL, USA; Tyler, TX, USA; Florence, SC, USA; Troy, IL, USA; Monterrey and Monclova, Mexico; and Kaohsiung, Taiwan. As Field CEO, Jim Derry will focus on key customer relationships, acquisitions and strategic planning. As Field President, Adam Derry will provide strategic direction for the entire organization, ensuring Field achieves its financial and organizational objectives. Adam will have overall accountability towards Field’s operating plan, and ten-year strategic plan, as well as protecting and enhancing the Field culture as it continues to grow.

Copper State Bolt & Nut Celebrates 50 Years

Copper State Bolt & Nut is celebrating 50 years as a distributor/manufacturer providing quality products, great service and strong relationships with customers in construction, mining, manufacturing and renewable energy. Martin Calfee began the business in 1972 in Phoenix, AZ, USA, with six employees and a 6000 ft2 warehouse, and he knew building a foundation of quality customer service was key.

“My goal from the start has been to be the best distributor in the USA,” said Calfee. “I wanted to provide the best customer service around town, and I wanted my suppliers to think of me as their best customer.” To achieve this, Copper State focuses on ensuring all employees, customers and vendors know they are part of the family. This emphasis on putting relationships first is why the company has been able to expand to 500 employees in 30 sites across 10 western states serving more than 20,000 customers.

News provided by:

John

Mike

Wolz,

Editor of

McNulty,

FIN (globalfastenernews.com)

FTI VP & Editor (www.fastenertech.com)

052 China Fastener World no.66/2022 American News

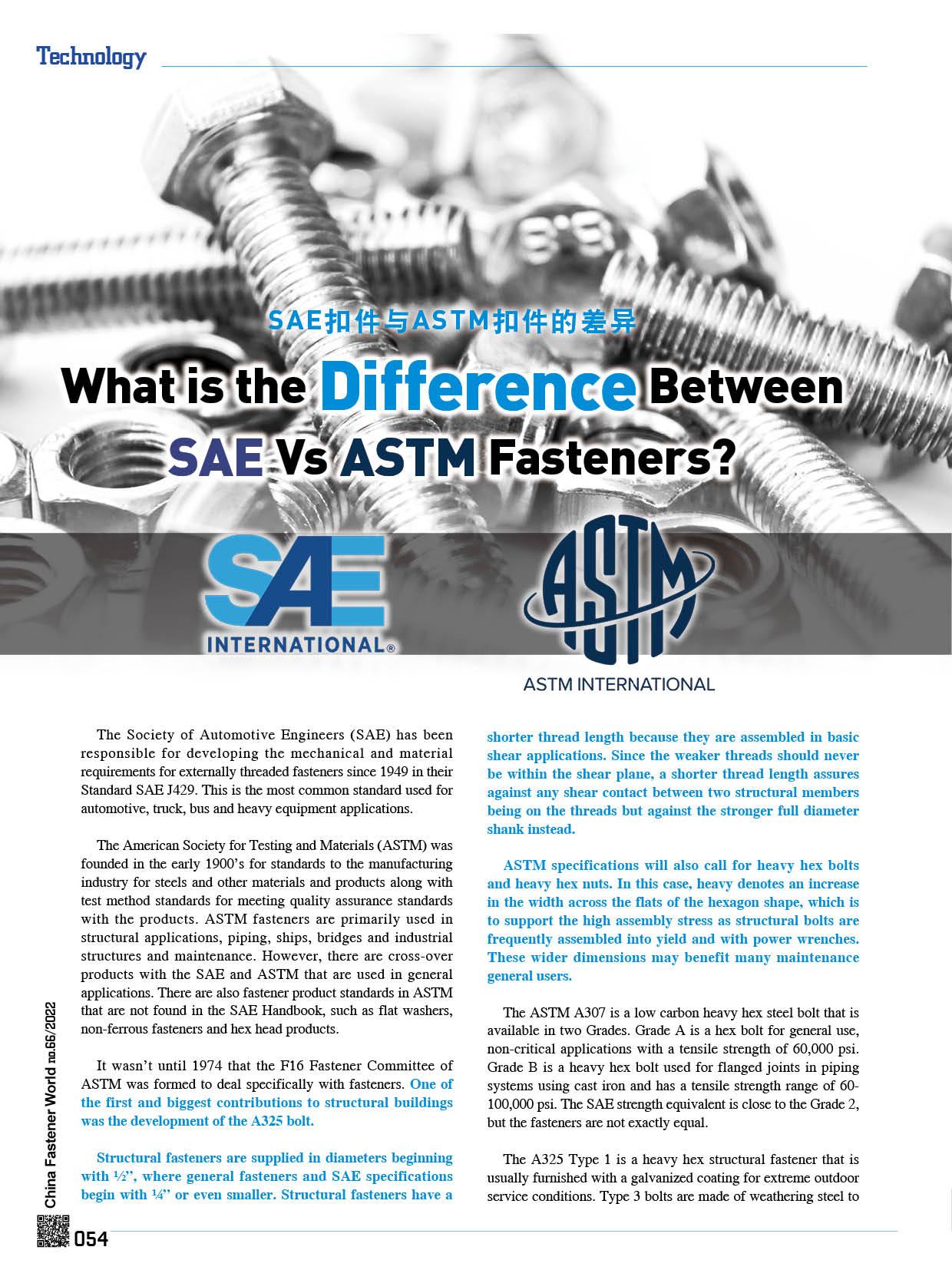

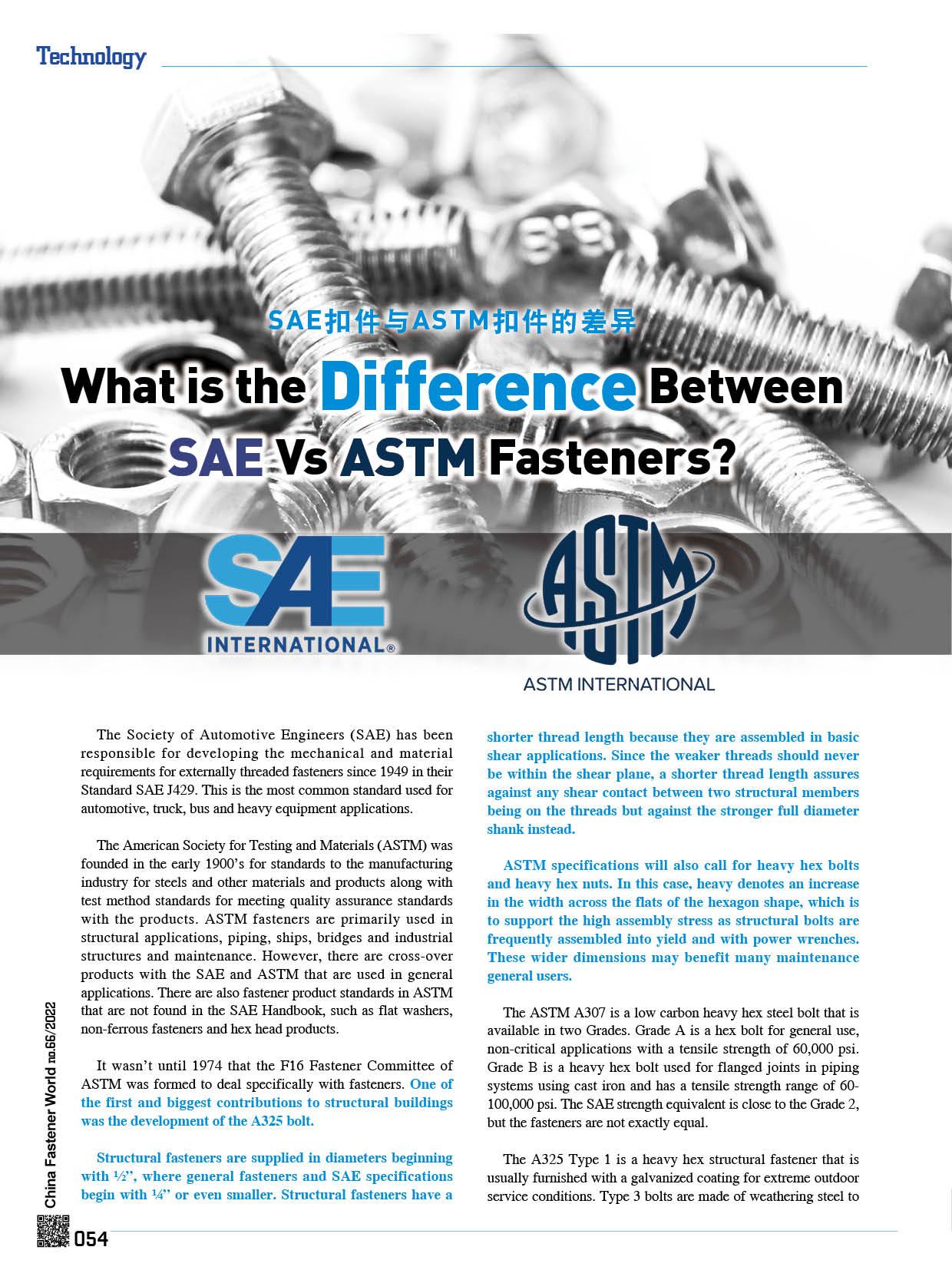

provide atmospheric corrosion resistance. Type 1 fasteners are marked with ‘A325’ but may also have 3 radial lines 120° apart. This is the same strength equivalent and has the same 3 radial line head marking as the SAE Grade 5.

H owever, the ASTM A449 is the exact equivalent of the SAE Grade 5; it specifies the same chemical and material requirements, including the 3 radial grade lines on the head. The dimensions are standard hex cap screw, the same as the SAE product.

T he ASTM A354 Grade BD fasteners are the strength equivalent to the SAE Grade 8, at 150,000 psi and 120,000 psi yield strength, but with a few exceptions. Of greatest importance, all BD fastener sizes are required to be made from alloy steel. SAE has provisions for the use of non-alloy steels in certain sizes. Secondly, the Grade BD requires proof load testing, which the results are to be included in the material test report, in addition to wedge tensile testing and hardness readings. SAE does not require the proof load testing.

The A490 is the structural version of the SAE Grade 8 and the A354, BD. However, by US standards and due to their high strength and high hardness, and that these fasteners are assembled into yield for consistency, the A490 fasteners and matching nuts are never hot dip galvanized nor electroplated to avoid hydrogen embrittlement.

The A325/A449 bolts may be quenched in water after heat treatment. However, it is required that all A490/A354BD bolts are oil quenched. This produces a refined martensitic grain structure that is very ductile at 14%, the same as the A325.

S AE does not have a specific grade for flat washers; they are either plain (fully annealed and soft) or heat treated and hardened. Hardened flat washers are available in commerce but they are also not marked to differentiate between the two types; however, the through hardened flat washers are used in all critical automotive and heavy equipment applications. The ASTM has the specification F436 which does specify the material and heat treatment hardnesses. These hardened flat washers are designed to support high yield loads without dishing or causing significant load relaxation. The flat washers are marked with ‘F436’ on one side.

Therefore, in non-structural and non-shear applications, an SAE Grade 5 can be substituted for an ASTM A449 or an A325 fastener. Likewise, an A354-BD may be substituted for an A490 for non-shear and non-structural applications. However, an A354-BD may be substituted for an SAE Grade 8 bolt for any application but the Grade 8 should never be used in place of the A354-BD without confirmation from the purchaser.

When a specification calls for an ASTM A193 fastener, it may never be substituted with any SAE fastener. The A193 covers high temperature alloy steel fasteners as well as stainless steels. The A193-B7, or B7 for short, is supplied in either threaded rod or heavy hex fasteners. This material is commonly used for high temperature (up to 1100°F, 593°C) and high pressure vessel applications, such as ASME SA193. The B7 threaded rods and bolts can be substituted for SAE Grade 5 but never the other way around, because the B7 is slightly stronger at 125,000 psi than the 120,000 psi tensile strength of the Grade 5. The B7 has better yield properties than the Grade 5 and is made from a 4140 series alloy steel, rather than a medium carbon steel.

N uts are a different matter. The ASTM specifies several dimensions for structural or regular use nuts. Typical nuts are; heavy hex, hex and thick hex. These nuts are listed in the A194 standard.

A heavy hex nut has more mass; i.e., it has a larger width across the flats to provide greater support when a structural fastener is taken into yield. The ASTM A563 grade D has proof load strength of 150 ksi; DH and DH3 are 175 ksi. Compared with the regular hex dimension nuts; grade B is 120 ksi, D is 135 ksi, DH and DH3 are 150 ksi. The DH3 is made of weathering steel to mate with a Type 3 steel bolt. Therefore, a DH nut of either heavy hex or regular hex dimension may be used with a Grade 8 fastener.

All SAE nuts are the same size for different grades. For example, a 1/2" Grade 2 nut has the same dimensions as a 1/2" Grade 5 nut and the same as a 1/2" Grade 8 nut. The differences are in the heat treatments and steel chemistries. Technically, a Grade 2 nut could be used onto a Grade 8 fastener if the nut was thick enough; by at least 2 1/2 times the diameter of the fastener.

T his relationship between thickness and hardness is similar to the depth and strength of a tapped hole. The old rule of thumb was that the hole only had to be as deep as the diameter of the fastener. This was derived from socket head products going into very hard tool steels. If a socket head product went into softer cold rolled steel, the hole would have to be deeper to offer more threads to carry the loads of the fastener. The softer the base materials, in relation to the hardness of the fastener, the deeper the hole must be in order to support the loads required of the fastener.

Whichever specification is used, SAE or ASTM, you can be assured of a fastener whose materials and processing treatments have been specified to provide optimum performance.

Article by Guy Avellon / Copyright owned by Fastener World 055 China Fastener World no.66/2022 Technology

Survival Between a Rock and a Hard Place

by Dean Tseng, Fastener World

Since the beginning of 2022, the global market took the brunt of two shock waves—the war and the face-off between two of the world’s largest political economic entities—triggering a sea change that virtually flips the global supply chain structure. Meanwhile, on September 2 the Office of the United States Trade Representative decided to launch 301 investigation and continue the imposition of tariff on China followed by reviews of these actions. The anti-dumping tax on China imposed by EU remains effective. These factors are inextricably entwined, creating a large pressure against the Chinese fastener market, and therefore it calls for examining China’s fastener trade of the first half of 2022.

F irst of all, China and Taiwan are respectively the largest and second largest fastener suppliers in the world. To better objectively understand China’s fastener trade, this article compares fastener trade of China to that of Taiwan and analyze respective situations and challenges. Next, the article will attempt to suggest several potential countermeasures against the current crisis. Lastly, the article will point out a potential competitor that both China and Taiwan have to be prepared for immediately.

Highlight 1: Comparison of China’s and Taiwan’s Fastener Trade

China’s Fastener Trade in 2021 (USD)

Taiwan’s Fastener Trade in 2021 (USD)

In the first half of 2022, China exported USD 5.14 billion worth of fasteners to the world, which is 1.6 times more than Taiwan’s global export value of USD 3.18 billion in the same period. In the value of fastener import from the world, China was USD 1.47 billion and Taiwan was USD 108 million. Taiwan demanded far less fastener import from the world than China did. China’s top

056 China Fastener World no.66/2022

China’s Fastener Trade in First-half 2022 (USD) Taiwan’s Fastener Trade in First-half 2022 (USD) Ranking Import Source First Half of 2022 Export Destinations First Half of 2022 Import Source First Half of 2022 Export Destinations First Half of 2022 0 World 1,475,295,976 World 5,148,551,761 World 108,226,355 World 3,183,209,705 1 Japan 439,819,788 U.S.A. 858,125,493 Japan 36,177,839 U.S.A. 1,427,203,915 2 Germany 271,571,176 Germany 308,014,680 U.S.A. 21,424,773 Germany 260,847,004 3 U.S.A. 200,127,590 Vietnam 223,559,285 China 12,563,243 Netherlands 169,348,088 4 Taiwan 147,377,359 S. Korea 221,971,974 Germany 7,266,443 Japan 149,510,874 5 Italy 69,391,472 Russia 220,191,744 S. Korea 5,541,891 UK 109,955,298 6 S. Korea 61,354,528 Japan 201,985,763 Vietnam 3,009,690 Canada 107,050,441 7 France 32,780,607 India 172,586,224 Netherlands 2,694,695 China 88,074,895 8 UK 24,980,984 UK 154,190,272 Philippines 2,570,308 Italy 71,511,493 9 Turkey 18,765,358 Italy 146,440,438 Switzerland 2,110,473 Sweden 71,109,514 10 Switzerland 15,773,304 Australia 145,622,009 Sweden 1,740,430 Mexico 70,972,853