BENEFIT ADMINISTRATORS

Higginbotham Public Sector (833) 453-1680 www.mybenefitshub.com/calallenisd

Curative Medical Plans (855) 428-7284 www.health@curative.com

SAVINGS

Clever RX Group #1085 partner.cleverrx.com/etxebc

HEALTH SAVINGS ACCOUNT (HSA) FLEXIBLE SPENDING ACCOUNT (FSA) TELEHEALTH

EECU (817) 882-0800 www.eecu.org

National Benefit Services (855) 399-3035 www.nbsbenefits.com

EMERGENCY MEDICAL TRANSPORT DENTAL

MASA MTS

(800) 423-3226

https://www.masamts.com/

Lincoln Financial Group

STD Group #000010266966 LTD Group #000010266963 (800) 423-2765

https://www.lfg.com/

Lincoln Financial Group (800) 423-2765 www.lfg.com

Lincoln Financial Group Group #00001D041379 (800) 423-2765

https://www.lfg.com/

UNUM

Group #448246011 (866) 679-3054 www.unum.com

HOSPITAL INDEMNITY

Lincoln Financial Group (800) 423-2765 www.lfg.com

UNIVERSAL LIFE IDENTITY THEFT

Texas Republic Life (512) 330-0099

www.texasrepubliclife.com

ID Watchdog (800) 970-5182

www.idwatchdog.com

MDLIVE (866) 365-1663 www.mdlive.com/fbsbh

EyeMed Group #VC-146 (844) 225-3107 www.eyemed.com

CHUBB Group #100000195 (888) 499-0425 educatorclaims@chubb.com

AND AD&D

Lincoln Financial Group Basic: Group #000010266962

Voluntary: Group #000400266965 (800) 423-2765

https://www.lfg.com/

1 www.mybenefitshub.com/calallenisd

2

3

4

Enter your Information

• Last Name

• Date of Birth

• Last Four (4) of Social Security Number

NOTE: THEbenefitsHUB uses this information to check behind the scenes to confirm your employment status.

Once confirmed, the Additional Security Verification page will list the contact options from your profile. Select either Text, Email, Call, or Ask Admin options to receive a code to complete the final verification step.

5

Enter the code that you receive and click Verify. You can now complete your benefits enrollment!

During your annual enrollment period, you have the opportunity to review, change or continue benefit elections each year. Changes are not permitted during the plan year (outside of annual enrollment) unless a Section 125 qualifying event occurs.

• Changes, additions or drops may be made only during the annual enrollment period without a qualifying event.

• Employees must review their personal information and verify that dependents they wish to provide coverage for are included in the dependent profile. Additionally, you must notify your employer of any discrepancy in personal and/or benefit information.

• Employees must confirm on each benefit screen (medical, dental, vision, etc.) that each dependent to be covered is selected in order to be included in the coverage for that particular benefit.

All new hire enrollment elections must be completed in the online enrollment system within the first 30 days of benefit eligibility employment. Failure to complete elections during this timeframe will result in the forfeiture of coverage.

Who do I contact with Questions?

For supplemental benefit questions, you can contact your Benefits Office or you can call Higginbotham Public Sector at 866-914-5202 for assistance.

Where can I find forms?

For benefit summaries and claim forms, go to your benefit website: www.mybenefitshub.com/calallenisd Click the benefit plan you need information on (i.e., Dental) and you can find the forms you need under the

Benefits and Forms section.

How can I find a

For benefit summaries and claim forms, go to the Calallen ISD benefit website: www.mybenefitshub.com/calallenisd. Click on the benefit plan you need information on (i.e., Dental) and you can find provider search links under the Quick Links section.

If the insurance carrier provides ID cards, you can expect to receive those 3-4 weeks after your effective date. For most dental and vision plans, you can log in to the carrier website and print a temporary ID card or simply give your provider the insurance company’s phone number, and they can call and verify your coverage if you do not have an ID card at that time. If you do not receive your ID card, you can call the carrier’s customer service number to request another card.

If the insurance carrier provides ID cards, but there are no changes to the plan, you typically will not receive a new ID card each year.

The amount of coverage you can elect without answering any medical questions or taking a health exam. Guaranteed coverage is only available during initial eligibility period. Actively-at-work and/or preexisting condition exclusion provisions do apply, as applicable by carrier.

Applies to any illness, injury or condition for which the participant has been under the care of a health care provider, taken prescription drugs or is under a health care provider’s orders to take drugs, or received medical care or services (including diagnostic and/or consultation services).

A Cafeteria plan enables you to save money by using pre-tax dollars to pay for eligible group insurance premiums sponsored and offered by your employer. Enrollment is automatic unless you decline this benefit. Elections made during annual enrollment will become effective on the plan effective date and will remain in effect during the entire plan year.

Marital Status

Change in Number of Tax Dependents

Change in Status of Employment Affecting Coverage Eligibility

Gain/Loss of Dependents’ Eligibility Status

Judgment/ Decree/Order

Eligibility for Government Programs

Changes in benefit elections can occur only if you experience a qualifying event. You must present proof of a qualifying event to your Benefit Office within 30 days of your qualifying event and meet with your Benefits Office to complete and sign the necessary paperwork in order to make a benefit election change. Benefit changes must be consistent with the qualifying event.

A change in marital status includes marriage, death of a spouse, divorce or annulment (legal separation is not recognized in all states).

A change in number of dependents includes the following: birth, adoption and placement for adoption. You can add existing dependents not previously enrolled whenever a dependent gains eligibility as a result of a valid change in status event.

Change in employment status of the employee, or a spouse or dependent of the employee, that affects the individual’s eligibility under an employer’s plan includes commencement or termination of employment.

An event that causes an employee’s dependent to satisfy or cease to satisfy coverage requirements under an employer’s plan may include change in age, student, marital, employment or tax dependent status.

If a judgment, decree, or order from a divorce, annulment or change in legal custody requires that you provide accident or health coverage for your dependent child (including a foster child who is your dependent), you may change your election to provide coverage for the dependent child. If the order requires that another individual (including your spouse and former spouse) covers the dependent child and provides coverage under that individual’s plan, you may change your election to revoke coverage only for that dependent child and only if the other individual actually provides the coverage.

Gain or loss of Medicare/Medicaid coverage may trigger a permitted election change.

Supplemental Benefits: Eligible employees must work 20 or more regularly scheduled hours each work week.

Eligible employees must be actively at work on the plan effective date for new benefits to be effective, meaning you are physically capable of performing the functions of your job on the first day of work concurrent with the plan effective date. For example, if your 2024 benefits become effective on September 1, 2024, you must be actively-at-work on September 1, 2024 to be eligible for your new benefits.

Dependent Eligibility: You can cover eligible dependent children under a benefit that offers dependent coverage, provided you participate in the same benefit, through the maximum age listed below. Dependents cannot be double covered by married spouses within the district as both employees and dependents.

Spouse Eligibility: Legal spouse or common-law marriage

Child Eligibility: Tax dependent

Please note, limits and exclusions may apply when obtaining coverage as a married couple or when obtaining coverage for dependents.

Potential Spouse Coverage Limitations: When enrolling in coverage, please keep in mind that some benefits may not allow you to cover your spouse as a dependent if your spouse is enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on spouse eligibility.

FSA/HSA Limitations: Please note, in general, per IRS regulations, married couples may not enroll in both a Flexible Spending Account (FSA) and a Health Savings Account (HSA). If your spouse is covered under an FSA that reimburses for medical expenses then you and your spouse are not HSA eligible, even if you would not use your spouse’s FSA to reimburse your expenses. However, there are some exceptions to the general limitation regarding specific types of FSAs. To obtain more information on whether you can enroll in a specific type of FSA or HSA as a married couple, please reach out to the FSA and/or HSA provider prior to enrolling or reach out to your tax advisor for further guidance.

Potential Dependent Coverage Limitations: When enrolling for dependent coverage, please keep in mind that some benefits may not allow you to cover your eligible dependents if they are enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on dependent eligibility.

Disclaimer: You acknowledge that you have read the limitations and exclusions that may apply to obtaining spouse and dependent coverage, including limitations and exclusions that may apply to enrollment in Flexible Spending Accounts and Health Savings Accounts as a married couple. You, the enrollee, shall hold harmless, defend, and indemnify Higginbotham Public Sector from any and all claims, actions, suits, charges, and judgments whatsoever that arise out of the enrollee’s enrollment in spouse and/or dependent coverage, including enrollment in Flexible Spending Accounts and Health Savings Accounts.

If your dependent is disabled, coverage may be able to continue past the maximum age under certain plans. If you have a disabled dependent who is reaching an ineligible age, you must provide a physician’s statement confirming your dependent’s disability. Contact your Benefits Office to request a continuation of coverage.

Description

(IRC Sec. 223)

Approved by Congress in 2003, HSAs are actual bank accounts in employees' names that allow employees to save and pay for unreimbursed qualified medical expenses tax-free.

(IRC Sec. 125)

Allows employees to pay out-of-pocket expenses for copays, deductibles and certain services not covered by medical plan, taxfree. This also allows employees to pay for qualifying dependent care tax- free.

Employer

Minimum Deductible

Maximum Contribution

Permissible Use Of Funds

Cash-Outs of Unused Amounts (if no medical expenses)

$1,600 single (2024)

$3,200 family (2024)

$4,150 single (2024)

$8,300 family (2024)

Employees may use funds any way they wish. If used for non-qualified medical expenses, subject to current tax rate plus 20% penalty.

$3,200 (2024)

Reimbursement for qualified medical expenses (as defined in Sec. 213(d) of IRC).

Permitted, but subject to current tax rate plus 20% penalty (penalty waived after age 65). Not permitted

Year-to-year rollover of account balance? Yes, will roll over to use for subsequent year’s health coverage.

Does the account earn interest?

Portable?

Yes

No. Access to some funds may be extended if your employer’s plan contains a 2 1/2-month grace period.

No

Yes, portable year-to-year and between jobs. No

Download your Clever RX card or Clever RX App to unlock exclusive savings.

Present your Clever RX App or Clever RX card to your pharmacist.

ST EP 1:

Download the FREE Clever RX App. From your App Store search for "Clever RX" and hit download. Make sure you enter in Group ID and in Member ID during the on-boarding process. This will unlock exclusive savings for you and your family!

ST EP 2 :

Find where you can save on your medication. Using your zip code, when you search for your medication Clever RX checks which pharmacies near you offer the lowest price. Savings can be up to 80% compared to what you're currently paying.

FREE to use. Save up to 80% off prescription drugs and beat copay prices.

Accepted at most pharmacies nationwide ST AR T SA VI NG TOD AY W

100% FREE to use

Unlock discounts on thousands of medications

Save up to 80% off prescription drugs – often beats the average copay

Over 7 0% of peopl e c an benefi t fro m a pre sc rip ti on sav ing s c ard due t o high dedu ct ible heal t h plan s, high c opa ys , and being unde r in s ured or u ni ns ur ed

ST EP 3 :

Click the voucher with the lowest price, closest location, and/or at your preferred pharmacy. Click "share" to text yourself the voucher for easy access when you are ready to use it. Show the voucher on your screen to the pharmacist when you pick up your medication.

ST EP 4:

Share the Clever RX App. Click "Share" on the bottom of the Clever RX App to send your friends, family, and anyone else you want to help receive instant discounts on their prescription medication. Over 70% of people can benefit from a prescription savings card.

TH A T IS N O T ONLY CL EVER, I T IS CL EVE R RX .

DID Y OU KNOW?

Ov er 3 0 % of

A Health Savings Account (HSA) is a personal savings account where the money can only be used for eligible medical expenses. Unlike a flexible spending account (FSA), the money rolls over year to year however only those funds that have been deposited in your account can be used. Contributions to a Health Savings Account can only be used if you are also enrolled in a High Deductible Health Care Plan (HDHP). For full plan details, please visit your benefit website: www.mybenefitshub.com/calallenisd

A Health Savings Account (HSA) is more than a way to help you and your family cover health care costs – it is also a tax-exempt tool to supplement your retirement savings and cover health expenses during retirement. An HSA can provide the funds to help pay current health care expenses as well as future health care costs.

A type of personal savings account, an HSA is always yours even if you change health plans or jobs. The money in your HSA (including interest and investment earnings) grows tax-free and spends tax-free if used to pay for qualified medical expenses. There is no “use it or lose it” rule — you do not lose your money if you do not spend it in the calendar year — and there are no vesting requirements or forfeiture provisions. The account automatically rolls over year after year.

You are eligible to open and contribute to an HSA if you are:

• Enrolled in an HSA-eligible HDHP (High Deductible Health Plan) Not covered by another plan that is not a qualified HDHP, such as your spouse’s health plan

• Not enrolled in a Health Care Flexible Spending Account, nor should your spouse be contributing towards a Health Care Flexible Spending Account

• Not eligible to be claimed as a dependent on someone else’s tax return

• Not enrolled in Medicare or TRICARE

• Not receiving Veterans Administration benefits

You can use the money in your HSA to pay for qualified medical expenses now or in the future. You can also use HSA funds to pay health care expenses for your dependents, even if they are not covered under your HDHP.

Your HSA contributions may not exceed the annual maximum amount established by the Internal Revenue Service. The annual contribution maximum for 2024 is based on the coverage option you elect:

• Individual – $4,150

• Family (filing jointly) – $8,300

You decide whether to use the money in your account to pay for qualified expenses or let it grow for future use. If you are 55 or older, you may make a yearly catch-up contribution of up to $1,000 to your HSA. If you turn 55 at any time during the plan year, you are eligible to make the catch-up contribution for the entire plan year.

If you meet the eligibility requirements, you may open an HSA administered by EECU. You will receive a debit card to manage your HSA account reimbursements. Keep in mind, available funds are limited to the balance in your HSA.

• Always ask your health care provider to file claims with your medical provider so network discounts can be applied. You can pay the provider with your HSA debit card based on the balance due after discount.

• You, not your employer, are responsible for maintaining ALL records and receipts for HSA reimbursements in the event of an IRS audit.

• You may open an HSA at the financial institution of your choice, but only accounts opened through EECU are eligible for automatic payroll deduction and company contributions.

• Online/Mobile: Sign-in for 24/7 account access to check your balance, pay bills and more.

• Call/Text: (817) 882-0800 EECU’s dedicated member service representatives are available to assist you with any questions. Their hours of operation are Monday through Friday from 8:00 a.m. to 7:00 p.m. CT, Saturday 9:00 a.m. to 1:00 p.m. CT and closed on Sunday.

• Lost/Stolen Debit Card: Call the 24/7 debit card hotline at (800)333-9934.

• Stop by a local EECU financial center: www.eecu.org/ locations.

returns); (b) your taxable compensation; (c) your spouse’s actual or deemed earned income.

“Register” in the top right corner, and follow the

Your benefits include reliable 24/7 health care by phone or video. Our national network of board-certified doctors provides personalized care for hundreds of medical and mental health needs. No surprise costs. No hassle. Just create an account to enroll.

On-demand care for illness and injuries.

Talk to a board-certified doctor in just minutes when you need care fast, including prescriptions.

Reliable and affordable alternative to urgent care clinics for more than 80 common, non-emergency conditions like flu, sinus infections, ear pain, and UTIs (Females, 18+).

Talk therapy and psychiatry from the privacy of home.1

Licensed therapists and board-certified psychiatrists.

Schedule your appointment in as little as five days with after-hours and flexible sessions available. Meet Sophie, your personal assistant Text FBSBH to 635483 to create an account

STEP 2: REQUEST AN APPOINTMENT.

Have an urgent care appointment right away, or schedule a time that works for you.

STEP 3: FEEL BETTER FASTER.

Get a diagnosis, treatment plan, and prescriptions, when appropriate, sent right to your preferred pharmacy.1

Comprehensive coverage and care for emergency transport.

Our Emergent Plus membership plan includes:

Emergency Ground Ambulance Coverage1

Your out-of-pocket expenses for your emergency ground transportation to a medical facility are covered with MASA.

Your out-of-pocket expenses for your emergency air transportation to a medical facility are covered with MASA.

When specialized care is required but not available at the initial emergency facility, your out-of-pocket expenses for the ground or air ambulance transfer to the nearest appropriate medical facility are covered with MASA.

Should you need continued care and your care provider has approved moving you to a hospital nearer to your home, MASA coordinates and covers the expense for ambulance transportation to the approved medical facility.

Did you know?

51.3 million emergency responses occur each year

MASA protects families against uncovered costs for emergency transportation and provides connections with care services.

Source: NEMSIS, National EMS Data Report, 2023

MASA is coverage and care you can count on to protect you from the unexpected. With us, there is no “out-of-network” ambulance. Just send us the bill when it arrives and we’ll work to ensure charges are covered. Plus, we’ll be there for you beyond your initial ride, with expert coordination services on call to manage complex transport needs during or after your emergency — such as transferring you and your loved ones home safely.

Protect yourself, your family, and your family’s financial future with MASA.

protects families against out-of-pocket costs for emergency transportation and provides connections with care. Gain peace of mind and shield your finances knowing there’s a MASA plan best suited for your needs.

Dental insurance is a coverage that helps defray the costs of dental care. It insures against the expense of routine care, dental treatment and disease.

For full plan details, please visit your benefit website: www.mybenefitshub.com/calallenisd

The Lincoln DentalConnect® PPO Plans:

• Plans cover many preventive, basic, and major dental care services

• Also cover orthodontic treatment for children

• Feature group rates for Calallen ISD employees

• Let you choose any dentist you wish, though you can lower your out-of-pocket costs by selecting a contracting dentist

• Do not make you and your loved ones wait six months between routine cleanings

You can search by:

• Location

• Dentist name or office name

• Distance you are willing to travel

• Specialty, language and more Your search will automatically provide up to 100 dentists that most closely match your criteria. If your search does not locate the dentist you prefer, you can nominate one—just click the Nominate a Dentist link and complete the online form.

Deductibles are combined for basic and major Contracting Dentists’ services. Deductibles are combined for basic and major Non-Contracting Dentists’ services.

MaxRewards® lets you and your covered family members roll a portion of unused dental benefits from one year into the next. So you have extra benefit dollars available when you need them most.

Eye care is an experience. From the day you enroll to the day you find your favorite frames, we’ll be part of it. Guiding. Advising. Helping you make the most of your vision benefits.

We go out of our way to make your benefits easy to understand and even easier to experience.

You’ve probably already seen your Welcome Kit in the mail. It’ll give you a head start with benefit details, the 10 closest eye doctors and your ID card.

Get guidance from the vision experts at eyesiteonwellness.com. Plus learn how to maximize your benefits and get special offers when you sign up for inSIGHTS.

Our member app is like a personal assistant. Login with 1 touch. Find an eye doctor. Pull up your prescription or ID card anytime (or store it in your Wallet).*

Get live help from one of America’s highest-rated call centers. Our call center resolves 99.4% of issues during the first call.

Get updates and reminders,tips to maximize your benefits and extra ways to save money right to your mobile device. Call 844.873.7853 to opt in. Be sure to have your 9-digit Member ID handy.

Manage your vision benefits, find an eye doctor, print ID cards, get special offers and more on eyemed.com.

Register on eyemed.com or grab the member app (App Store or Google Play) now

*Touch ID, Face ID and Apple Wallet features available only on iPhones This information is available broadly and is not plan or state specific. Offers are not valid in the state of Texas.

20%OFF non-covered items, including nonprescription sunglasses Find an eye doctor (Insight Network)

• eyemed.com

• EyeMed Members App

• For LASIK, call 1.800.988.4221

Heads up

You may have additional benefits. Log into eyemed com/member to see all plans included with your benefits.

CONTACT LENS FIT AND FOLLOW-UP Fit & Follow-up -

F FRAME

S STANDARD PLASTIC LENSES

L LENS OPTIONS

O

(Plan allows member to receive either contacts and frame, or frame and lens services)

QL-0000043115

EyeMed reserves the right to make changes to the products available on each tier. All providers are not required to carry all brands on all tiers. For current listing of brands by tier, call 866-939-3633. No benefits will be paid for services or materials connected with or charges arising from: medical or surgical treatment, services or supplies for the treatment of the eye, eyes or supporting structures; Refraction, when not provided as part of a Comprehensive Eye Examination; services provided as a result of any Workers’ Compensation law, or similar legislation, or required by any governmental agency or program whether federal, state or subdivisions thereof; orthoptic or vision training, subnormal vision aids and any associated supplemental testing; Aniseikonic lenses; any Vision Examination or any corrective Vision Materials required by a Policyholder as a condition of employment; safety eyewear; solutions, cleaning products or frame cases; non-prescription sunglasses; plano (non-prescription) lenses; plano (nonprescription) contact lenses; two pair of glasses in lieu of bifocals; electronic vision devices; services rendered after the date an Insured Person ceases to be covered under the Policy, except when Vision Materials ordered before coverage ended are delivered, and the services rendered to the Insured Person are within 31 days from the date of such order; or lost or broken lenses, frames, glasses, or contact lenses that are replaced before the next Benefit Frequency when Vision Materials would next become available. Fees charged by a Provider for services other than a covered benefit and any local, state or Federal taxes must be paid in full by the Insured Person to the Provider. Such fees, taxes or materials are not covered under the Policy. Allowances provide no remaining balance for future use within the same Benefit Frequency. Some provisions, benefits, exclusions or limitations listed herein may vary by state. Plan discounts cannot be combined with any other discounts or promotional offers. In certain states members may be required to pay the full retail rate and not the negotiated discount rate with certain participating providers. Please see online provider locator to determine which participating providers have agreed to the discounted rate.

Disability insurance protects one of your most valuable assets, your paycheck. This insurance will replace a portion of your income in the event that you become physically unable to work due to sickness or injury for an extended period of time.

For full plan details, please visit your benefit website: www.mybenefitshub.com/calallenisd

• Provides a cash benefit when you are out of work for up to 11 weeks due to injury, illness, surgery, or recovery from childbirth

• Provides a partial cash benefit if you can only do part of your job or work part time

• Features group rates for Calallen ISD employees

• Offers a fast, no-hassle claims process

Weekly benefit amount

Sickness elimination period

Accident elimination period

60% of your weekly salary, limited to $1,000 per week

You must be out of work for 14 days due to an illness before you can collect disability benefits. You can begin collecting benefits on day 15.

You must be out of work for 14 days due to an accidental injury before you can collect disability benefits. You can begin collecting benefits on day 15.

60% of your weekly salary, limited to $1,000 per week

You must be out of work for 30 days due to an illness before you can collect disability benefits. You can begin collecting benefits on day 31.

You must be out of work for 30 days due to an accidental injury before you can collect disability benefits. You can begin collecting benefits on day 31.

The elimination period is reduced if you are hospitalized due to an illness or accidental injury. You can begin collecting benefits on the first day of hospitalization.

If you have a medical condition that begins before your coverage takes effect, and you receive treatment for this condition within the 3 months leading up to your coverage start date, you may not be eligible for benefits for that condition until you have been covered by the plan for 12 months, unless you received no treatment of the condition for 12 consecutive months after your effective date.

• Your short-term disability benefits can coordinate with income from other sources, such as continued income or sick pay from your employer, during your disability.

• This allows you to receive up to 100% of your pre-disability income.

When you are first offered this coverage (and during approved open enrollment periods), you can take advantage of this important coverage with no health examination.

• Provides a cash benefit after you are out of work for 90 days or more due to injury, illness, or surgery

• Features group rates for Calallen ISD employees

• Includes Employee Connect services, which give you and your family confidential access to counselors as well as personal, legal, and financial assistance

to age 65 or Social Security Normal Retirement Age (SSNRA), whichever is later Additional

Elimination Period

• This is the number of days you must be disabled before you can collect disability benefits.

• The 90-day elimination period can be met through either total disability (out of work entirely) or partial disability working with a reduced schedule or performing different types of duties).

Coverage Period for Your Occupation

• This is the coverage period for the trade or profession in which you were employed at the time of your disability (also known as your own occupation).

• You may be eligible to continue receiving benefits if your disability prohibits you from any employment for which you are reasonably suited through your training, education, and experience. In this case, your benefits are extended through the end of your maximum coverage period (benefit duration).

Maximum Coverage Period

• This is the total amount of time you can collect disability benefits (also known as the benefit duration).

• Benefits are limited to 24 months for mental illness; 24 months for substance abuse.

Pre-existing Condition

If you have a medical condition that begins before your coverage takes effect, and you receive treatment for this condition within the 3 months leading up to your coverage start date, you may not be eligible for benefits for that condition until you have been covered by the plan for 12 months.

When you are first offered this coverage (and during approved open enrollment periods), you can take advantage of this important coverage with no health examination.

Like any insurance, this long-term disability insurance policy does have some exclusions. You will not receive benefits if:

• Your disability is the result of a self-inflicted injury or act of war

• You are not under the regular care of a doctor when you request disability benefits

• Your disability occurs while you are committing a felony or participating in a riot

• Your disability occurs while you are imprisoned for committing a felony

• Your disability occurs while you are residing outside of the United States or Canada for more than 12 consecutive months for a purpose other than work

Your benefits may be reduced if you are eligible to receive benefits from:

• A state disability plan or similar compulsory benefit act or law

• A retirement plan

• Social Security

• Any form of employment

• Workers’ Compensation

• Salary continuance

• Sick leave

A complete list of benefit exclusions and reductions is included in the policy. State restrictions may apply to this plan.

Do you have kids playing sports, are you a weekend warrior, or maybe you're accident-prone? Accident plans are designed to help pay for medical costs associated with accidents, and benefits are paid directly to you.

For full plan details, please visit your benefit website: www.mybenefitshub.com/calallenisd

How does it work?

Can pay a set benefit amount based on the type of injury you have and the type of treatment you need. It covers accidents that occur on and off the job. And it includes a range of incidents, from common injuries to more serious events.

Why is this coverage so valuable?

• It can help you with out-of-pocket costs that your medical plan doesn’t cover, like co-pays and deductibles.

• You’re guaranteed base coverage, without answering health questions.

• The cost is conveniently deducted from your paycheck.

• You can keep your coverage if you change jobs or retire. You’ll be billed directly.

Who can get coverage?

• You - If you’re actively at work.*

• Your spouse - Can get coverage as long as you have purchased coverage for yourself.

• Your children - Dependent children from birth until their 26th birthday, regardless of marital or student status.

How to file a Claim: www.unum.com/employees/file-a-claim

AVAILABLE 24/7/365

• On the web: First time filing a claim? Go to our secure website, unum.com/claims, and register for an account. You can file and manage all your claims on this site, or on your mobile device.

• Using your mobile device: After you’ve registered online, you can download the Unum Customer App for Apple or Android devices (available wherever you get your apps). You can use the app to manage your claim or file new claims.

DIGITALLY FILE ALL TYPES OF CLAIMS

• Disability Insurance

• Leaves of absence (disability, maternity, FMLA)

• Life Insurance

• Accident, Critical Illness, Hospital, Dental and Vision Insurance

• Wellness benefits for screening tests

Not sure which type of claim to file? No problem. Just answer a few questions on the website or app, and we’ll help you figure everything out.

• Disability Insurance: Check with your HR department at work to find out whether you can file a disability claim over the phone.

• All other benefits: Call 1-800-635-5597.

• Get a claim form at unum.com/claims, or contact your HR department at work.

• Follow the instructions on the form to mail or fax your completed form.

Cancer insurance offers you and your family supplemental insurance protection in the event you or a covered family member is diagnosed with cancer. It pays a benefit directly to you to help with expenses associated with cancer treatment.

For full plan details, please visit your benefit website: www.mybenefitshub.com/calallenisd

A cancer diagnosis and treatment can be an emotionally and physically difficult time. Chubb is here to help support you by providing cash benefits paid directly to you. Benefits are paid if you are diagnosed with cancer, but also help cover many other cancer-related services such as doctor’s visits, treatments, specialty care, and recovery. However, there are no restrictions on how to use these cash benefits—so you can use them as you see fit.

Choose the right level of coverage during the enrollment period to better protect your family.

First cancer benefit

Diagnosis of cancer

Hospital confinement

Hospital confinement ICU

Radiation therapy, chemotherapy, immunotherapy

Alternative care

Medical imaging

Skin cancer initial diagnosis

Attending physician

Hospital confinement sub-acute ICU

$100 paid upon receipt of first covered claim for cancer; only one payment per covered person per certificate per calendar year

$5,000 employee or spouse

$7,500 child(ren)

Waiting period: 0 days

Benefit reduction: none

$100 per day – days 1 through 30

Additional days: $100

Maximum days per confinement: 31

$200 per day – days 1 through 30

Additional days: $200

Maximum days per confinement: 31

Maximum per covered person per calendar year

12-month period: $10,000

$75 per visit

Maximum visits per calendar year: 4

$500 per imaging study

Maximum studies per calendar year: 2

$100 per diagnosis

Lifetime maximum: 1

$30 per visit

Maximum visits per confinement: 2

Maximum visits per calendar year: 4

$100 per day – days 1 through 30

Additional days: $200

Maximum days per confinement: 31

$100 paid upon receipt of first covered claim for cancer; only one payment per covered person per certificate per calendar year

$10,000 employee or spouse

$15,000 child(ren)

Waiting period: 0 days

Benefit reduction: none

$200 per day – days 1 through 30

Additional days: $200

Maximum days per confinement: 31

$400 per day – days 1 through 30

Additional days: $400

Maximum days per confinement: 31

Maximum per covered person per calendar year

12-month period: $20,000

$75 per visit

Maximum visits per calendar year: 4

$500 per imaging study

Maximum studies per calendar year: 2

$100 per diagnosis

Lifetime maximum: 1

$50 per visit

Maximum visits per confinement: 2

Maximum visits per calendar year: 4

$100 per day – days 1 through 30

Additional days: $200

Maximum days per confinement: 31

Family care

Prescription drug in-patient

Private full-time nursing services

U.S. government or charity hospital

Family member transportation and lodging

Home health care

Hospice care

Skilled nursing care facility

Childcare: $100 per day per child

Maximum days per calendar year: 30

Adult day care or home healthcare: $100 per day

Maximum days per calendar year: 30

Per confinement: $150

Maximum confinements per calendar year: 6

$150 per day

Maximum days per confinement: 5

Days 1 through 30: $100

Additional days: $100

Maximum days per confinement: 15

Childcare: $100 per day per child

Maximum days per calendar year: 30

Adult day care or home healthcare: $100 per day

Maximum days per calendar year: 30

Per confinement: $150

Maximum confinements per calendar year: 6

$150 per day

Maximum days per confinement: 5

Days 1 through 30: $300

Additional days: $600

Maximum days per confinement: 15

Family transportation: $100 per trip

Maximum trips per calendar year: 12

Family lodging: $100 per day

Maximum days per calendar year: 100

$100 per day not to exceed the number of days confined

Maximum days per calendar year: 30

$100 per day

$100 per day

Maximum days per calendar year: 30

Renewability

Family transportation: $100 per trip

Maximum trips per calendar year: 12

Family lodging: $200 per day

Maximum days per calendar year: 100

$300 per day not to exceed the number of days confined

Maximum days per calendar year: 30

$300 per day

$300 per day

Maximum days per calendar year: 30

Conditionally Renewable Coverage is automatically renewed as long as the insured is an eligible employee, premiums are paid as due, and the Policy is in force.

Portability Employees can keep their coverage if they change jobs or retire while the Policy is in-force.

Continuity of coverage Included

Pre-existing conditions limitation A condition for which a covered person received medical advice or treatment within the 12 months preceding the certificate effective date.

Waiver of premium Included

No benefits will be paid for a date of diagnosis or treatment of cancer prior to the coverage effective date, except where continuity of coverage applies.

No benefits will be paid for services rendered by a member of the immediate family of a covered person.

We will not pay benefits for other conditions or diseases, except losses due directly from cancer or skin cancer.

We will not pay benefits for cancer or skin cancer if the diagnosis or treatment of cancer is received outside of the territorial limits of the United States and its possessions. Benefits will be payable if the covered person returns to the territorial limits of the United States and its possessions, and a physician confirms the diagnosis or receives treatment.

Critical illness insurance can be used towards medical or other expenses. It provides a lump sum benefit payable directly to the insured upon diagnosis of a covered condition or event, like a heart attack or stroke. The money can also be used for non-medical costs related to the illness, including transportation, child care, etc.

For full plan details, please visit your benefit website: www.mybenefitshub.com/calallenisd

Employees of Calallen Independent School District

* You can elect Critical Illness Insurance for your dependent children when you choose coverage for yourself.

This is an affordable supplemental plan that pays you should you be inpatient hospital confined. This plan complements your health insurance by helping you pay for costs left unpaid by your health insurance.

For full plan details, please visit your benefit website: www.mybenefitshub.com/calallenisd

Employees of Calallen Independent School District

If you or a covered family member have to go to the hospital for an accident or injury, hospital indemnity insurance provides a lumpsum cash benefit to help you take care of unexpected expenses — anything from deductibles to child care to everyday bills. Because you’re selecting this coverage through your company, you can take advantage of group rates. You don’t have to answer medical questions to receive coverage; this is guarantee issue coverage. Core hospital benefits

Hospital admission

For the initial day of admission to a hospital for treatment of a sickness/an injury

Hospital confinement

For each day of confinement in a hospital as a result of a sickness/an injury

Hospital intensive care unit (ICU) admission

For the initial day of admission to an ICU for treatment as the result of a sickness/ an injury

Hospital ICU confinement

For each full or partial day of confinement in an ICU as a result of a sickness/an injury

$1,500 per day up to 1 day per calendar year

$200 per day up to 30 days per calendar year starting on 2nd day of confinement

$1,500 per day up to 1 day per calendar year

$400 per day up to 30 days per calendar year starting the 2nd day of confinement

$2,000 per day up to 1 day per calendar year

$200 per day up to 30 days per calendar year starting the 2nd day of confinement

$2,000 per day up to 1 day per calendar year

$400 per day up to 30 days per calendar year starting the 2nd day of confinement

$3,000 per day up to 1 day per calendar year

$200 per day up to 30 days per calendar year starting the 2nd day of confinement

$3,000 per day up to 1 day per calendar year

$400 per day up to 30 days per calendar year starting the 2nd day of confinement

Complications of pregnancy Included Included Included

• Admission or Admitted means accepted for inpatient services in a hospital or intensive care unit for a period of more than 20 hours.

• If admitted to a hospital or ICU within 90 days after being discharged from a preceding stay for the same or related cause, the subsequent admission will be considered part of the first admission.

• If both hospital and ICU admission or hospital and ICU confinement become payable for the same day, only the Hospital ICU Admission benefit will be paid.

Additional confinement benefits

Rehabilitation facility

For each day of inpatient confinement to a rehabilitation facility as a result of a sickness/an injury

Newborn care

For each day of confinement to a hospital for routine post-natal care following birth

$200 per day up to 30 days per calendar year

$200 per day up to 2 days per calendar year

$200 per day up to 30 days per calendar year

$200 per day up to 2 days per calendar year

$200 per day up to 30 days per calendar year

$200 per day up to 2 days per calendar year

Portability if you leave your employer Included

Note: See the policy for details and specific requirements for each of these benefits.

The policy covers only sicknesses and injuries that occur while insurance is in force. No indemnities will be paid for a sickness or injury that occurs before the effective date of the insurance. Benefits are not payable for any loss caused or contributed to by:

1. Suicide, attempted suicide, or any intentionally self-inflicted injury while sane or insane*

2. Voluntary intake or use by any means of any drugs, poison, gas, or fumes, except when:

a. Prescribed or administered by a physician

b. Taken in accordance with the physician’s instructions

3. Committing or attempting to commit a felony

4. War or any act of war, declared or undeclared

5. Participation in a riot, insurrection, or rebellion of any kind

6. Participation in an act of terrorism

7. Military duty, including the Reserves or National Guard

8. Travel or flight in or on any aircraft, except as a fare-paying passenger on a regularly scheduled commercial flight, or as a passenger, pilot, or crew member in the group policyholder's aircraft while flying for group policyholder business, provided:

a. The aircraft has a valid U.S. airworthiness certificate (or foreign equivalent)

b. The pilot has a valid pilot's certificate with a non-student rating authorizing them to fly the aircraft

9. Driving a vehicle while intoxicated, as defined by the jurisdiction where the accident occurred

10. Cosmetic or elective surgery, unless the treatment is the result of a covered event

Call 800-423-2765 and mention ID: 1001048

Affordable group rates – Monthly premiums

11. Treatment for dental care or dental procedures, unless the treatment is the result of a covered event

12. Treatment of a mental illness*

13. Treatment of alcoholism, drug addiction, chemical dependency, or complications thereof*

14. Treatment through experimental procedures

15. Travel outside the United States and its possessions for the sole purpose of receiving medical care or treatment

16. Participating in, practicing for, or officiating any semi-professional or professional sport

17. Riding in or driving in any motor driven vehicle for race, stunt show, or speed test

18. Being incarcerated in any type of penal or detention facility

19. Scuba diving

20. Mountaineering or spelunking

21. Bungee cord jumping, hang gliding, sail gliding, parasailing, parakiting, kitesurfing, base jumping, or any similar activities

22. Skydiving, parachuting, jumping, or falling from any aircraft for recreational purposes

23. Residing outside the United States, U.S. Territories, Canada, or Mexico for more than 12 months

24. Injury arising out of or during employment for wage or profit

*This is a partial list of benefit exclusions. A complete list is included in the policy. State variations apply.

As an employee, you can take advantage of this accident insurance plan. Plus, you can add loved ones to the plan for just a little more.

Group term life is the most inexpensive way to purchase life insurance. You have the freedom to select an amount of life insurance coverage you need to help protect the well-being of your family.

Accidental Death & Dismemberment is life insurance coverage that pays a death benefit to the beneficiary, should death occur due to a covered accident. Dismemberment benefits are paid to you, according to the benefit level you select, if accidentally dismembered.

For full plan details, please visit your benefit website: www.mybenefitshub.com/calallenisd

Employer-paid insurance that safeguards the most important people in your life. Term life insurance can help your loved ones in so many ways, like covering everyday expenses, paying off debt, and protecting savings. AD&D provides even more coverage if you die or suffer a covered loss in an accident.

• A cash benefit of $25,000 to your loved ones in the event of your death, plus a matching cash benefit if you die in an accident

• A cash benefit to you if you suffer a covered loss in an accident, such as losing a limb or your eyesight

• Life Keys® services, which provide access to counseling, financial, and legal support

• Travel Connect® services, which give you and your family access to emergency medical assistance when you're on a trip 100+ miles from home

• Employee Connect services, which give you and your family confidential access to counselors as well as personal, legal, and financial assistance

Conversion: You can convert your group term life coverage to an individual life insurance policy without providing evidence of insurability if you lose coverage due to leaving your job or for another reason outlined in the plan contract. AD&D benefits cannot be converted.

Benefit Reduction: Coverage amounts begin to reduce at age 70 and benefits terminate at retirement. See the plan certificate for details.

Call Customer Service Center: 800-423-2765

Step 1: Press “1” to indicate that you’re an insured member

Step 2: Enter your Social Security number (SSN) or the policyholder’s SSN (if different). If your SSN cannot be located or is not yet in the system, you can select from the following options:

• Claims and verification of benefits

• Member service (enrollment status, evidence of insurability and continuation of options)

Step 3: Select the type of coverage you are calling about:

• Press “1” for Absence Management, Disability, Accident, or Critical Illness

• Press “2” for Dental

• Press “3” for Life

• Press “4” for Vision

Group term life is the most inexpensive way to purchase life insurance. You have the freedom to select an amount of life insurance coverage you need to help protect the well-being of your family.

Accidental Death & Dismemberment is life insurance coverage that pays a death benefit to the beneficiary, should death occur due to a covered accident. Dismemberment benefits are paid to you, according to the benefit level you select, if accidentally dismembered.

For full plan details, please visit your benefit website: www.mybenefitshub.com/calallenisd

• Provides a cash benefit to your loved ones in the event of your death

• A cash benefit to you if you suffer a covered loss in an accident, such as losing a limb or your eyesight

• LifeKeys® services, which provide access to counseling, financial, and legal support services

• Also includes TravelConnect® services, which give you and your family access to emergency medical assistance when you’re on a trip 100+ miles from home

• To file a claim contact Lincoln Financial at (800) 423-2765

Like any insurance, this term life insurance policy does have exclusions. A suicide exclusion may apply. In addition, the AD&D insurance policy does not cover sickness or disease, including the medical and surgical treatment of a disease. A complete list of benefit exclusions is included in the policy. State variations apply.

Note: You must be an active Calallen Independent School District employee to select coverage for a spouse and/or dependent children. To be eligible for coverage, a spouse or dependent child cannot be confined to a health care facility or unable to perform the typical activities of a healthy person of the same age and gender.

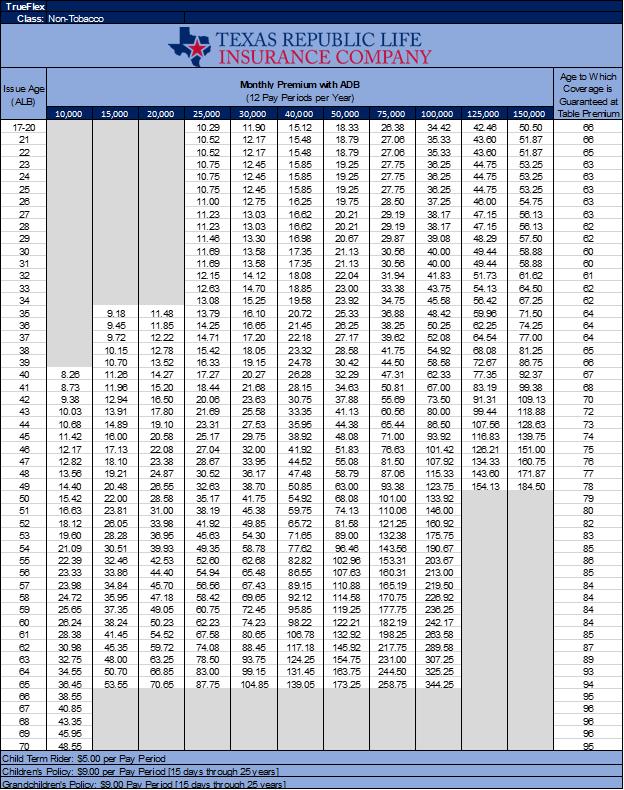

The TrueFlex UL with L Living Benefits offers you protection if you encounter some hardship along life's journey, or simply would like to leave some resources to those close to you when your journey ends.

Employee, spouse, children and grandchildren are eligible. For less than a cup of coffee, a premium of $3.45 a week, a 35-year-old employee can purchase $25,000 of life insurance coverage, through Texas Republic Life’s, TrueFlex Universal life product.

For more details, please visit our website: www.texasrepubliclife.com

TrueFlex is guaranteed issue up to $100,000 in coverage and for more coverage only answer 3 questions (at right) covering the last six months: NO MEDICAL EXAM!

TrueFlex is easy to enroll in, right at your place of employment. No one coming to your home.

TrueFlex is easy to fund by payroll deduction.

TrueFlex policies are easy to port, you keep the Tr same premium, your payment simply changes from a payroll deduction to a bank draft. No re-qualifying, no conversions and no decreasing face amounts.

TrueFlex is easy to keep, (See form: TRLIC-WFUL1) you have permanent life insurance coverage to age 121 as long as you pay the required premiums. Texas Republic Life has a service desk to address any questions you may have, or policy services that you may need.

GUARANTEED ISSUE UP TO $100,000

QUALIFICATION QUESTIONS FROM $100,001 - $150,000

During the last six months, has the proposed insured:

1.

2. Been actively at work on a full-time basis, performing usual duties? Been absent from work due to illness or medical treatment for a period of more than five consecutive working days?

3. Been disabled or received tests, treatment or care of any kind in a hospital or nursing home or received chemotherapy, hormonal therapy for cancer, radiation therapy, dialysis treatment, or treatment for alcohol or drug abuse?

Identity theft can affect anyone—from infants to seniors. Each generation has habits that savvy criminals know how to exploit—resulting in over $43 billion lost to identity fraud in the U.S. in 2022. Take action with award-winning ID Watchdog identity theft protection.

Greater Peace of Mind

With ID Watchdog as an employee benefit, you have a more convenient and affordable way to help better protect and monitor your identity. You’ll be alerted to potentially suspicious activity and enjoy greater peace of mind knowing you don't have to face identity theft alone.

We scour billions of data points— public records, transaction records, social media and more—to search for signs of potential identity theft.

We've got you covered with lock features for added control over your credit report(s) to help keep identity thieves from opening new accounts in your name.

Awarded Best in

If you become a victim, you don’t have to face it alone. One of our certified resolution specialists will personally manage the case for you until your identity is restored.

Our family plan helps you better protect your loved ones with personalized accounts for adult family members, family alert sharing, and exclusive features for children.

Financial Accounts Monitoring

Social Accounts Monitoring

Registered Sex Offender Reporting

Blocked Inquiry Alerts | 1 Bureau

Customizable Alert Options

National Provider ID Alerts

Integrated Fraud Alerts

With a fraud alert, potential lenders are encouraged to take extra steps to verify your identity before extending credit.

Dark Web Monitoring

Data Breach Notifications

High-Risk Transactions Monitoring

Subprime Loan Monitoring

Public Records Monitoring

USPS Change of Address Monitoring

Telecom & Utility Alerts | 1 Bureau

Credit Score Tracker | 1 Bureau

Personalized Identity Restoration

including Pre-Existing Conditions

Online Resolution Tracker

Lost Wallet Vault & Assistance

Deceased Family Member Fraud

Remediation (Family Plan only)

Credit Freeze Assistance

Solicitation Reduction

Help better protect children with Equifax Child Credit Lock & Equifax Child Credit Monitoring PLUS features marked with this icon

Credit Report Monitoring

Credit Report(s) & VantageScore Credit Score(s)

Credit Report Lock

Subprime Loan Block

within the monitored lending network

Personal VPN and Password Manager

Device Security & Online Privacy

Personal Data Scans & Removal

Essentials

to $1 Million Up to $1M Stolen Funds Reimbursement - Checking and savings accounts

to $1 Million Up to $1M Stolen Funds Reimbursement - Checking and savings accounts

Platinum, Platinum Plus

Plus only

Plus only

Essentials Up to $2 Million Up to $2M Stolen Funds Reimbursement - Checking and savings accounts -401k/HSA/ESOP accounts

Home Title Fraud NEW

Cyber Extortion

Professional Identity Fraud

Deceased Family Member Fraud

Bureau = Equifax | Multi-Bureau = Equifax, TransUnion | 3 Bureau = Equifax, Experian , TransUnion ® ® ®

The credit scores provided are based on the VantageScore 3.0 model. For three-bureau VantageScore credit scores, data from Equifax, Experian, and TransUnion are used respectively. Any one-bureau VantageScore uses Equifax data. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness.

(1)The Integrated Fraud Alert feature is made available to consumers by Equifax Information Services LLC and fulfilled on its behalf by Identity Rehab Corporation. (2)There is no guarantee that ID Watchdog is able to locate and scan all deep and dark websites where consumers' personal information is at risk of being traded. (3)The monitored network does not cover all businesses or transactions. (4)For low Family Plans, applicable for enrolled family members only. (5)Monitoring from Equifax will begin on your plan start date. TransUnion and Experian will take several days to begin after you create an online account. (6)Locking your Equifax or TransUnion credit report will prevent access to it by certain third parties. Locking your Equifax or TransUnion credit report will not prevent access to your credit report at any other credit reporting agency. Entities that may still have access to your Equifax or TransUnion credit report include: companies like ID Watchdog and TransUnion Interactive, Inc. which provide you with access to your credit report or credit score, or monitor your credit report as part of a subscription or similar service; companies that provide you with a copy of your credit report or credit score, upon your request; federal, state, and local government agencies and courts in certain circumstances; companies using the information in connection with the underwriting of insurance, or for employment, tenant or background screening purposes; companies that have a current account or relationship with you, and collection agencies acting on behalf of those whom you owe; companies that authenticate a consumer’s identity for purposes other than granting credit, or for investigating or preventing actual or potential fraud; and companies that wish to make pre approved offers of credit or insurance to you. To opt out of preapproved offers, visit www.optoutprescreen.com.

(7)Available for simultaneous use on up to 6 devices. (8)Equip up to 5 devices; 10 with a Family Plan. (10)May be subject to delay or change. To review ID Watchdog Terms & Conditions, go to idwatchdog.com/terms. (9)The Identity Theft Insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits (www.idwatchdog.com/terms/insurance).

Enrollment Guide General Disclaimer: This summary of benefits for employees is meant only as a brief description of some of the programs for which employees may be eligible. This summary does not include specific plan details. You must refer to the specific plan documentation for specific plan details such as coverage expenses, limitations, exclusions, and other plan terms, which can be found at the Calallen ISD Benefits Website. This summary does not replace or amend the underlying plan documentation. In the event of a discrepancy between this summary and the plan documentation the plan documentation governs. All plans and benefits described in this summary may be discontinued, increased, decreased, or altered at any time with or without notice.

Rate Sheet General Disclaimer: The rate information provided in this guide is subject to change at any time by your employer and/or the plan provider. The rate information included herein, does not guarantee coverage or change or otherwise interpret the terms of the specific plan documentation, available at the Calallen ISD Benefits Website, which may include additional exclusions and limitations and may require an application for coverage to determine eligibility for the health benefit plan. To the extent the information provided in this summary is inconsistent with the specific plan documentation, the provisions of the specific plan documentation will govern in all cases.