COLORADO SPRINGS CHARTER ACADEMY BENEFITS

Higginbotham Public Sector (833) 453-1680

www.mybenefitshub.com/ cscharteracademy

United Health Care (855) 828-7715

www.welcometouhc.com

SAVINGS ACCOUNT (HSA)

Optum (800) 791-9361 customercare@optum.com HOSPITAL CASH

CHUBB

Group #100000250 (888) 499-0425

educatorclaims@chubb.com

MetLife (800) 275-4638

www.metlife.com/dental Network: PDP Plus

MetLife (800) 275-4638

www.metlife.com/vision Network: VSP Choice DISABILITY

Lincoln Financial Group Group #1213109 (800) 423-2756 www.lfg.com

CHUBB Group #100000250 (888) 499-0425 educatorclaims@chubb.com

AND AD&D FLEXIBLE SPENDING ACCOUNT (FSA)

Lincoln Financial Group Group #1213109 (800) 423-2756 custservsupportteam@lfg.com

Don’t Forget!

ILLNESS

CHUBB Group #100000250 (888) 499-0425 educatorclaims@chubb.com

Higginbotham (866) 419-3519

https://flexservices.higginbotham.net/ Flexclaims@higginbotham.net

• Login and complete your benefit enrollment from 08/01/2024 - 08/15/2024

• Enrollment assistance is available by calling Higginbotham Public Sector at (866) 914-5202.

• Update your information: home address, phone numbers, email, and beneficiaries.

• REQUIRED!! Due to the Affordable Care Act (ACA) reporting requirements, you must add your dependent’s CORRECT social security numbers in the online enrollment system. If you have questions, please contact your Benefits Administrator.

1

2

www.mybenefitshub.com/cscharteracademy

3

4

Enter your Information

• Last Name

• Date of Birth

• Last Four (4) of Social Security Number

NOTE: THEbenefitsHUB uses this information to check behind the scenes to confirm your employment status. CLICK LOGIN

Once confirmed, the Additional Security Verification page will list the contact options from your profile. Select either Text, Email, Call, or Ask Admin options to receive a code to complete the final verification step.

5

Enter the code that you receive and click Verify. You can now complete your benefits enrollment!

During your annual enrollment period, you have the opportunity to review, change or continue benefit elections each year. Changes are not permitted during the plan year (outside of annual enrollment) unless a Section 125 qualifying event occurs.

• Changes, additions or drops may be made only during the annual enrollment period without a qualifying event.

• Employees must review their personal information and verify that dependents they wish to provide coverage for are included in the dependent profile. Additionally, you must notify your employer of any discrepancy in personal and/or benefit information.

• Employees must confirm on each benefit screen (medical, dental, vision, etc.) that each dependent to be covered is selected in order to be included in the coverage for that particular benefit.

All new hire enrollment elections must be completed in the online enrollment system within the first 30 days of benefit eligibility employment. Failure to complete elections during this timeframe will result in the forfeiture of coverage.

For supplemental benefit questions, you can contact your Benefits Office or you can call Higginbotham Public Sector at (866) 914-5202 for assistance.

Where can I find forms?

For benefit summaries and claim forms, go to your benefit website: www.mybenefitshub.com/ cscharteracademy. Click the benefit plan you need information on (i.e., Dental) and you can find the forms you need under the Benefits and Forms section.

For benefit summaries and claim forms, go to the Colorado Springs Charter Academy benefit website: www.mybenefitshub.com/cscharteracademy. Click on the benefit plan you need information on (i.e., Dental) and you can find provider search links under the Quick Links section.

If the insurance carrier provides ID cards, you can expect to receive those 3-4 weeks after your effective date. For most dental and vision plans, you can login to the carrier website and print a temporary ID card or simply give your provider the insurance company’s phone number and they can call and verify your coverage if you do not have an ID card at that time. If you do not receive your ID card, you can call the carrier’s customer service number to request another card.

If the insurance carrier provides ID cards, but there are no changes to the plan, you typically will not receive a new ID card each year.

The amount of coverage you can elect without answering any medical questions or taking a health exam. Guaranteed coverage is only available during initial eligibility period. Actively-at-work and/or preexisting condition exclusion provisions do apply, as applicable by carrier.

Applies to any illness, injury or condition for which the participant has been under the care of a health care provider, taken prescriptions drugs or is under a health care provider’s orders to take drugs, or received medical care or services (including diagnostic and/or consultation services).

A Cafeteria plan enables you to save money by using pre-tax dollars to pay for eligible group insurance premiums sponsored and offered by your employer. Enrollment is automatic unless you decline this benefit. Elections made during annual enrollment will become effective on the plan effective date and will remain in effect during the entire plan year.

(CIS):

Marital Status

Change in Number of Tax Dependents

Change in Status of Employment Affecting Coverage Eligibility

Gain/Loss of Dependents’ Eligibility Status

Judgment/ Decree/Order

Eligibility for Government Programs

Changes in benefit elections can occur only if you experience a qualifying event. You must present proof of a qualifying event to your Benefit Office within 30 days of your qualifying event and meet with your Benefits Office to complete and sign the necessary paperwork in order to make a benefit election change. Benefit changes must be consistent with the qualifying event.

A change in marital status includes marriage, death of a spouse, divorce or annulment (legal separation is not recognized in all states).

A change in number of dependents includes the following: birth, adoption and placement for adoption. You can add existing dependents not previously enrolled whenever a dependent gains eligibility as a result of a valid change in status event.

Change in employment status of the employee, or a spouse or dependent of the employee, that affects the individual’s eligibility under an employer’s plan includes commencement or termination of employment.

An event that causes an employee’s dependent to satisfy or cease to satisfy coverage requirements under an employer’s plan may include change in age, student, marital, employment or tax dependent status.

If a judgment, decree, or order from a divorce, annulment or change in legal custody requires that you provide accident or health coverage for your dependent child (including a foster child who is your dependent), you may change your election to provide coverage for the dependent child. If the order requires that another individual (including your spouse and former spouse) covers the dependent child and provides coverage under that individual’s plan, you may change your election to revoke coverage only for that dependent child and only if the other individual actually provides the coverage.

Gain or loss of Medicare/Medicaid coverage may trigger a permitted election change.

Medical and Supplemental Benefits: Eligible employees must work 30 or more regularly scheduled hours each work week.

Eligible employees must be actively at work on the plan effective date for new benefits to be effective, meaning you are physically capable of performing the functions of your job on the first day of work concurrent with the plan effective date. For example, if your 2024 benefits become effective on September 1, 2024, you must be actively-at-work on September 1, 2024 to be eligible for your new benefits.

Dependent Eligibility: You can cover eligible dependent

children under a benefit that offers dependent coverage, provided you participate in the same benefit, through the maximum age listed below. Dependents cannot be double covered by married spouses within the district as both employees and dependents.

You are performing your regular occupation for the employer on a full-time basis, either at one of the employer’s usual places of business or at some location to which the employer’s business requires you to travel. If you will not be actively at work beginning 9/1/2024 please notify your benefits administrator.

Please note, limits and exclusions may apply when obtaining coverage as a married couple or when obtaining coverage for dependents.

Potential Spouse Coverage Limitations: When enrolling in coverage, please keep in mind that some benefits may not allow you to cover your spouse as a dependent if your spouse is enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on spouse eligibility.

FSA/HSA Limitations: Please note, in general, per IRS regulations, married couples may not enroll in both a Flexible Spending Account (FSA) and a Health Savings Account (HSA). If your spouse is covered under an FSA that reimburses for medical expenses then you and your spouse are not HSA eligible, even if you would not use your spouse’s FSA to reimburse your expenses. However, there are some exceptions to the general limitation regarding specific types of FSAs. To obtain more information on whether you can enroll in a specific type of FSA or HSA as a married couple, please reach out to the FSA and/or HSA provider prior to enrolling or reach out to your tax advisor for further guidance.

Potential Dependent Coverage Limitations: When enrolling for dependent coverage, please keep in mind that some benefits may not allow you to cover your eligible dependents if they are enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on dependent eligibility.

Disclaimer: You acknowledge that you have read the limitations and exclusions that may apply to obtaining spouse and dependent coverage, including limitations and exclusions that may apply to enrollment in Flexible Spending Accounts and Health Savings Accounts as a married couple. You, the enrollee, shall hold harmless, defend, and indemnify Higginbotham Public Sector from any and all claims, actions, suits, charges, and judgments whatsoever that arise out of the enrollee’s enrollment in spouse and/or dependent coverage, including enrollment in Flexible Spending Accounts and Health Savings Accounts.

If your dependent is disabled, coverage may be able to continue past the maximum age under certain plans. If you have a disabled dependent who is reaching an ineligible age, you must provide a physician’s statement confirming your dependent’s disability. Contact your Benefits Office to request a continuation of coverage.

Description

Health Savings Account

(IRC Sec. 223)

Approved by Congress in 2003, HSAs are actual bank accounts in employee’s names that allow employees to save and pay for unreimbursed qualified medical expenses tax-free.

Employer Eligibility A qualified high deductible health plan

Contribution Source Employee and/or employer

Account Owner Individual

Underlying Insurance

Requirement High deductible health plan

Minimum Deductible

Maximum Contribution

Permissible Use Of Funds

Cash-Outs of Unused Amounts (if no medical expenses)

Year-to-year rollover of account balance?

$1,600 single (2024)

Flexible

(IRC Sec. 125)

Allows employees to pay out-of-pocket expenses for copays, deductibles and certain services not covered by medical plan, taxfree. This also allows employees to pay for qualifying dependent care tax- free.

All employers

Employee and/or employer

Employer

None

$3,200 family (2024) N/A

$4,150 single (2024)

$8,300 family (2024) 55+ catch up +$1,000

Employees may use funds any way they wish. If used for non-qualified medical expenses, subject to current tax rate plus 20% penalty.

$3,200 (2024)

Reimbursement for qualified medical expenses (as defined in Sec. 213(d) of IRC).

Permitted, but subject to current tax rate plus 20% penalty (penalty waived after age 65). Not permitted

Yes, will roll over to use for subsequent year’s health coverage. No. CSCA will have a 30 day grace period.

Does the account earn interest? Yes No

Portable?

Yes, portable year-to-year and between jobs. No

website: www.mybenefitshub.com/cscharteracademy

Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered Services Coverage Period: Based on group plan year : Navigate DGIM /K17Y Coverage for: Employee/Family | Plan Type: HMO

The Summary of Benefits and Coverage (SBC) document will help you choose a health plan The SBC shows you how you and the plan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, visit www.welcometouhc.com or by calling 1-855-828-7715. For general definitions of common terms, such as allowed amount , balance billing, coinsurance , copayment , deductible , provider , or other underlined terms, see the Glossary. You can view the Glossary at www.healthcare.gov/sbc-glossary or call 1-866-487-2365 to request a copy.

Important Questions Answers

What is the overall deductible ? Network : $6,100 Individual / $12,200 Family Per calendar year.

Are there services covered before you meet your deductible ?

Are there other deductibles for specific services?

What is the out-of-pocket limit for this plan ?

What is not included in the out-of-pocket limit?

Will you pay less if you use a network provider?

Do you need a referral to see a specialist?

Yes. Preventive care is covered before you meet your deductible

No.

Generally, you must pay all of the costs from providers up to the deductible amount before this plan begins to pay. If you have other family members on the plan, each family member must meet their own individual deductible until the total amount of deductible expenses paid by all family members meets the overall family deductible .

This plan covers some items and services even if you haven’t yet met the deductible amount. But a copayment or coinsurance may apply. For example, this plan covers certain preventive services without cost sharing and before you meet your deductible See a list of covered preventive services at www.healthcare.gov/coverage/preventive-care-benefits/.

You don’t have to meet deductibles for specific services.

Network : $7,750 Individual / $15,500 Family The out-of-pocket limit is the most you could pay in a year for covered services. If you have other family members in this plan, they have to meet their own out-of-pocket limits until the overall family out-of-pocket limit has been met.

Premiums , balance-billing charges (unless balanced billing is prohibited), and health care this plan doesn’t cover.

Yes. See www.welcometouhc.com or call 1-855-828-7715 for a list of network providers

Yes.

Even though you pay these expenses, they don’t count toward the out-of-pocket limit

This plan uses a provider network . You will pay less if you use a provider in the plan’s network You will pay the most if you use an out-of-network provider , and you might receive a bill from a provider for the difference between the provider’s charge and what your plan pays (balance billing). Be aware, your network provider might use an out-of-network provider for some services (such as lab work). Check with your provider before you get services.

This plan will pay some or all of the costs to see a specialist for covered services but only if you have a referral before you see the specialist.

Common Medical Event Services You May Need

If you visit a health care provider’s office or clinic

Primary

visit to treat an injury or illness

Specialist visit

Preventive care/screening /immunization

If you have a test

Provider with referral (You will pay the least)

2 of 8

Virtual visits (Telehealth) - No Charge by a Designated Virtual Network Provider.

Primary Physician must be assigned. Network OB/GYNs - no referral required.

We only accept electronic referrals from the assigned Primary Care Physician

Includes preventive health services specified in the health care reform law. You may have to pay for services that aren’t preventive. Ask your provider if the services needed are preventive. Then check what your plan will pay for.

If you need drugs to treat your illness or condition

More information about prescription drug coverage is available at www. welcometouhc.com

Tier 1Your LowestCost Option

Tier 2Your MidrangeCost Option

Tier 3Your MidrangeCost Option

Tier 4Additional High-Cost Options

Retail: $50 copay

Mail-Order: $125 copay

Specialty Drugs** : $50 copay

Retail: $135 copay

Mail-Order: $337.50 copay

Specialty Drugs** : $135 copay

Retail: $350 copay

Mail-Order: $875 copay

Specialty Drugs** : $500 copay

Retail: $15

Not Covered Provider means pharmacy for purposes of this section.

Retail: $50 copay

Mail-Order: $125 copay

Specialty Drugs** : $50 copay

Retail: $135 copay

Mail-Order: $337.50 copay

Specialty Drugs** : $135 copay

Retail: $350 copay

Mail-Order: $875 copay

Specialty Drugs** : $500 copay

Retail: Up to a 31 day supply. Mail-Order: Up to a 90 day supply or Preferred 90 Day Retail Network Pharmacy. If you use an out-of-Network pharmacy (including a mail order pharmacy), you may be responsible for any amount over the allowed amount **Your cost shown is for a Preferred Specialty Network Pharmacy. Non-Preferred Specialty Network Pharmacy: Copay is 2 times the Preferred Specialty Network Pharmacy Copay or the coinsurance (up to 50% of the Prescription Drug Charge) based on the applicable Tier.

Copay is per prescription order up to the day supply limit listed above.

You may need to obtain certain drugs, including certain specialty drugs, from a pharmacy designated by us. Certain drugs may have a preauthorization requirement or may result in a higher cost. See the website listed for information on drugs covered by your plan Not all drugs are covered.

Prescription drug List (PDL): Essential Network : Standard Select - Walgreens. You may be required to use a lower-cost drug(s) prior to benefits under your policy being available for certain prescribed drugs. Certain preventive medications, zero cost share medications, and Tier 1 contraceptives are covered at No Charge.

If a dispensed drug has a chemically equivalent drug, the cost difference between drugs in addition to any applicable cost share may be applied.

Page 5 of 8

Excluded Services & Other Covered Services:

Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.)

Cosmetic surgery

Weight loss programs

Dental care (Adult) Long-term care

Non-emergency care when traveling outside the U.S.

Routine foot care

Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.)

Acupuncture - 6 treatments/calendar year

Routine eye care (Adult)-1 exam/12 months

Bariatric surgery

Spinal Manipulations-20 visits per calendar year

Hearing aids

Infertility treatment

Private-duty nursingInpatient only

Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agencies is: 1-866-444-3272 or www.dol.gov/ebsa/healthr eform for the U.S. Department of Labor, Employee Benefits Security Administration, you may also contact us at 1-855-828-7715 Other coverage options may be available to you, too, including buying individual insurance coverage through the Health Insurance Marketplace For more information about the Marketplace , visit www.HealthCare.gov or call 1-800-318-2596.

Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim This complaint is called a grievance or appeal For more information about your rights, look at the explanation of benefits you will receive for that medical claim Your plan documents also provide complete information on how to submit a claim, appeal, or a grievance for any reason to your plan For more information about your rights, this notice, or assistance, contact: 1-855-828-7715 ; or the Employee Benefits Security Administration at 1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreform or the Colorado Division of Insurance at 303-894-7490 or www.dora.state.co.us/ insurance.

Does this plan provide Minimum Essential Coverage? Yes.

Minimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid, CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible for the premium tax credit

Does this plan meet Minimum Value Standards? Yes. If your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace

Language Access Services: Spanish (Espa ol): Para obtener asistencia en Espa ol, llame al 1-855-828-7715 Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-855-828-7715 . Chinese 1-855-828-7715

6 of 8

Page 7 of 8 Navajo (Dine): Dinek ehgo shika at ohwol ninisingo, kwiijigo holne 1-855-828-7715

To see examples of how this plan might cover costs for a sample medical situation, see the next section.

This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will be different depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost-sharing amounts (deductibles , copayments and coinsurance ) and excluded services under the plan Use this information to compare the portion of costs you might pay under different health plans. Please note these coverage examples are based on self-only coverage. Peg is Having a Baby

Joeʼs

This EXAMPLE event includes services like:

Specialist office visits (prenatal care)

Childbirth/Delivery Professional Services

Childbirth/Delivery Facility Services

Diagnostic tests (ultrasounds and blood work)

Specialist visit (anesthesia)

This EXAMPLE event includes services like:

Primary

Diagnostic tests (blood work)

Prescription drugs

Durable medical equipment (glucose meter)

This EXAMPLE event includes services like:

Emergency room care (including medical supplies)

Diagnostic test (x-ray)

Durable medical equipment (crutches)

Rehabilitation services (physical therapy)

The plan would be responsible for the other costs of these EXAMPLE covered services.

Page 8 of 8

NAME OF PLAN Navigate DGIM /K17Y

1. Type of Policy Small Employer Group Policy

2. Type of Plan Health maintenance organization (HMO)

3. Areas of Colorado where plan is available Plan is available only in the following areas: Adams, Arapahoe, Archuleta, Broomfield, Boulder, Clear Creek, Crowley, Denver, Delta, Dolores, Douglas, Eagle, El Paso, Garfield, Grand, Gunnison, Hinsdale, Jackson, Jefferson, La Plata, Lake, Larimer, Lincoln, Mesa, Moffat , Montezuma, Montrose, Otero, Ouray, Park, Pitkin, Pueblo, Rio Blanco, Routt, San Juan, San Miguel, Summit, Teller, and Weld.

Important Note: The contents of this form are subject to the provisions of the policy, which contains all terms, covenants and conditions of coverage. It provides additional information meant to supplement the Summary of Benefits of Coverage you have received for this plan. This plan may exclude coverage for certain treatments, diagnoses, or services not specifically noted. Consult the actual policy to determine the exact terms and condit ions of coverage.

4. Annual Deductible Type

5. Out-of-Pocket Maximum

6. What is included in the In-Network Out-of-Pocket Maximum?

INDIVIDUAL - The amount that each member of the family must meet prior to claims being paid. Claims will not be paid for any other individual until their individual deductible or the family deductible has been met.

FAMILY - The maximum amount that the family will pay for the year. The family deductible can be met by 2 or more individuals.

INDIVIDUAL - The amount that each member of the family must meet prior to claims being paid at 100%. Claims will not be paid at 100% for any other individual until their individual out-of-pocket or the family out-of-pocket has been met.

FAMILY - The maximum amount that the family will pay for the year. The family out-of-pocket can be met by 2 or more individuals.

Copayments and Deductibles

7. Is pediatric dental covered by this plan Maximum? Yes, pediatric dental is subject to the medical deductible and out-of-pocket

8. What cancer screenings are covered? Breast Cancer Screening - Cervical Cancer Screening - Colorectal Cancer Screening - Prostate Cancer Screening.

USING THE PLAN

9. If the provider charges more for a covered service than the plan normally pays, does the enrollee have to pay the difference? No

10. Does the plan have a binding arbitration clause? No

Questions: Call 1-800-516-3344 or visit us at www.UnitedHealthcare.com

If you are not satisfied with the resolution of your complaint or grievance, contact:

Colorado Division of Insurance

Consumer Affairs Section

1560 Broadway, Suite 850, Denver, CO 80202

Call: 303-894-7490 (in-state, toll-free: 800-930-3745)

Emal: insurance@dora. state.co.us

Language Access Services:

Spanish (Espa ol): Para obtener asistencia en Espa ol, llame al 1-855-828-7715

Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-855-828-7715

Chinese 1-855-828-7715

Navajo (Dine): Dinek ehgo shika at ohwol ninisingo, kwiijigo holne 1-855-828-7715

SBCCOSUPP17

You have the right to get help and information in your language at no cost. To request an interpreter, call the toll free-member phone number listed on your health plan ID card, press 0. TTY 711

This letter is also available in other formats like large print. To request the document in another format, please call the toll-free member phone number listed on your health plan ID card, TTY 711, Monday through Friday, 8 a.m. to 8 p.m.

The company does not treat members differently because of sex, age, race, color, disability or national origin.

If you think you were treated unfairly because of your sex, age, race, color, disability or national origin, you can send a complaint to the Civil Rights Coordinator.

Online: UHC_Civil_Rights@uhc.com

Mail: Civil Rights Coordinator. UnitedHealthcare Civil Rights Grievance. P.O. Box 30608, Salt Lake City, UT 84130

You must send the complaint within 60 days of when you found out about it. A decision will be sent to you within 30 days. If you disagree with the decision, you have 15 days to ask us to look at it again. If you need help with your complaint, please call the member toll-free phone number listed on your ID card.

You can also file a complaint with the U.S. Dept. of Health and Human Services.

Online: https://ocrportal.hhs.gov/ocr/portal/lobby.jsf

Complaint forms are available at http://www.hhs.gov/ocr/office/file/index.html.

Phone: Toll-free 1-800-368-1019, 1-800-537-7697 (TDD)

Mail: U.S. Dept. of Health and Human Services. 200 Independence Avenue. SW Room 509F, HHH Building, Washington, D.C. 20201

Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered Services Coverage Period: Based on group plan year : Navigate CUO5 /N37Y Coverage for: Employee/Family | Plan Type: HMO

The Summary of Benefits and Coverage (SBC) document will help you choose a health plan The SBC shows you how you and the plan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, visit www.welcometouhc.com or by calling 1-855-828-7715. For general definitions of common terms, such as allowed amount , balance billing, coinsurance , copayment , deductible , provider , or other underlined terms, see the Glossary. You can view the Glossary at www.healthcare.gov/sbc-glossary or call 1-866-487-2365 to request a copy.

Important Questions Answers

What is the overall deductible ?

Network : $3,500 Individual / $7,000 Family Per calendar year.

Are there services covered before you meet your deductible ? Yes. Preventive care and categories with a copay are covered before you meet your deductible

Are there other deductibles for specific services?

What is the out-of-pocket limit for this plan ?

What is not included in the out-of-pocket limit?

Will you pay less if you use a network provider?

Do you need a referral to see a specialist?

No.

Generally, you must pay all of the costs from providers up to the deductible amount before this plan begins to pay. If you have other family members on the plan, each family member must meet their own individual deductible until the total amount of deductible expenses paid by all family members meets the overall family deductible .

This plan covers some items and services even if you haven’t yet met the deductible amount. But a copayment or coinsurance may apply. For example, this plan covers certain preventive services without cost sharing and before you meet your deductible See a list of covered preventive services at www.healthcare.gov/coverage/preventive-care-benefits/.

You don’t have to meet deductibles for specific services.

Network : $8,950 Individual / $17,900 Family The out-of-pocket limit is the most you could pay in a year for covered services. If you have other family members in this plan, they have to meet their own out-of-pocket limits until the overall family out-of-pocket limit has been met.

Premiums , balance-billing charges (unless balanced billing is prohibited), and health care this plan doesn’t cover.

Yes. See www.welcometouhc.com or call 1-855-828-7715 for a list of network providers

Yes.

Even though you pay these expenses, they don’t count toward the out-of-pocket limit

This plan uses a provider network . You will pay less if you use a provider in the plan’s network You will pay the most if you use an out-of-network provider , and you might receive a bill from a provider for the difference between the provider’s charge and what your plan pays (balance billing). Be aware, your network provider might use an out-of-network provider for some services (such as lab work). Check with your provider before you get services.

This plan will pay some or all of the costs to see a specialist for covered services but only if you have a referral before you see the specialist.

Page 1 of 8

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.

Common Medical Event Services You May Need

If you visit a health care provider’s office or clinic

Primary care visit to treat an injury or illness

Specialist visit

Network Provider with referral (You will pay the least) Network Provider without referral

$40 copay per visit, deductible does not apply

Provider (You will pay the most)

Covered Not Covered If you receive services in addition to office visit, additional copays , deductibles, or coinsurance may apply e.g. surgery.

Virtual visits (Telehealth) - No Charge by a Designated Virtual Network Provider.

Primary Physician must be assigned. Network OB/GYNs - no referral required.

$80 copay per visit, deductible does not apply

Preventive care/screening /immunization

If you have a test Diagnostic test (x-ray, blood work)

Imaging (CT/PET scans, MRIs)

Free Standing: 20% coinsurance Hospital: 20% coinsurance

Free Standing: 20% coinsurance Hospital: 20% coinsurance

Covered

Covered If you receive services in addition to office visit, additional copays , deductibles, or coinsurance may apply e.g. surgery.

We only accept electronic referrals from the assigned Primary Care Physician.

Covered Includes preventive health services specified in the health care reform law. You may have to pay for services that aren’t preventive. Ask your provider if the services needed are preventive. Then check what your plan will pay for.

Free Standing: 20% coinsurance Hospital: 20% coinsurance Not Covered $250 Hospital-Based per occurrence deductible applies prior to the overall deductible.

Free Standing: 20% coinsurance Hospital: 20% coinsurance Not Covered $500 Hospital-Based per occurrence deductible applies prior to the overall deductible.

Page 2 of 8

If you need drugs to treat your illness or condition

More information about prescription drug coverage is available at www. welcometouhc.com Tier 1Your LowestCost Option

Mail-Order: $37.50 copay

Specialty Drugs** : $15 copay

Tier 2Your MidrangeCost Option

Deductible does not apply. Retail: $55 copay

Mail-Order: $137.50 copay

Specialty Drugs** : $55 copay

Tier 3Your MidrangeCost Option

Deductible does not apply. Retail: $135 copay

Mail-Order: $337.50 copay

Specialty Drugs** : $135 copay

Tier 4Additional High-Cost Options

Deductible does not apply. Retail: $350 copay

Mail-Order: $875 copay

Specialty Drugs** : $500 copay

does not apply. Retail: $15 copay

Specialty Drugs** : $15 copay

Deductible does not apply. Retail: $55 copay

Mail-Order: $137.50 copay

Specialty Drugs** : $55 copay

Deductible does not apply. Retail: $135 copay

Mail-Order: $337.50 copay

Specialty Drugs** : $135 copay

Deductible does not apply. Retail: $350 copay

Mail-Order: $875 copay

Specialty Drugs** : $500 copay

Not Covered

Covered

Provider means pharmacy for purposes of this section. Retail: Up to a 31 day supply. Mail-Order: Up to a 90 day supply or Preferred 90 Day Retail Network Pharmacy. If you use an out-of-Network pharmacy (including a mail order pharmacy), you may be responsible for any amount over the allowed amount **Your cost shown is for a Preferred Specialty Network Pharmacy. Non-Preferred Specialty Network Pharmacy: Copay is 2 times the Preferred Specialty Network Pharmacy Copay or the coinsurance (up to 50% of the Prescription Drug Charge) based on the applicable Tier.

Copay is per prescription order up to the day supply limit listed above.

You may need to obtain certain drugs, including certain specialty drugs, from a pharmacy designated by us. Certain drugs may have a preauthorization requirement or may result in a higher cost. See the website listed for information on drugs covered by your plan Not all drugs are covered.

Prescription drug List (PDL): Essential Network : Standard Select - Walgreens. You may be required to use a lower-cost drug(s) prior to benefits under your policy being available for certain prescribed drugs. Certain preventive medications, zero cost share medications, and Tier 1 contraceptives are covered at No Charge.

If a dispensed drug has a chemically equivalent drug, the cost difference between drugs in addition to any applicable cost share may be applied.

If you need immediate medical attention

Page 4 of 8

of eyeglasses. The benefit does not cover both.

Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Acupuncture - 6 treatments/calendar year

Routine eye care (Adult)-1 exam/12 months Spinal Manipulations-20 visits per calendar year

Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agencies is: 1-866-444-3272 or www.dol.gov/ebsa/healthr eform for the U.S. Department of Labor, Employee Benefits Security Administration, you may also contact us at 1-855-828-7715 Other coverage options may be available to you, too, including buying individual insurance coverage through the Health Insurance Marketplace For more information about the Marketplace , visit www.HealthCare.gov or call 1-800-318-2596.

Page 6 of 8

Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim This complaint is called a grievance or appeal For more information about your rights, look at the explanation of benefits you will receive for that medical claim Your plan documents also provide complete information on how to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, or assistance, contact: 1-855-828-7715 ; or the Employee Benefits Security Administration at 1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreform or the Colorado Division of Insurance at 303-894-7490 or www.dora.state.co.us/ insurance.

Does this plan provide Minimum Essential Coverage? Yes.

Minimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid, CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible for the premium tax credit

Does this plan meet Minimum Value Standards? Yes. If your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.

Language Access Services:

Spanish (Espa ol): Para obtener asistencia en Espa ol, llame al 1-855-828-7715

Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-855-828-7715 . Chinese 1-855-828-7715

Navajo (Dine): Dinek ehgo shika at ohwol ninisingo, kwiijigo holne 1-855-828-7715

To see examples of how this plan might cover costs for a sample medical situation, see the next section.

Page 7 of 8

This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will be different depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost-sharing amounts (deductibles , copayments and coinsurance ) and excluded services under the plan Use this information to compare the portion of costs you might pay under different health plans. Please note these coverage examples are based on self-only coverage.

Joeʼs

This EXAMPLE event includes services like:

Specialist office visits (prenatal care)

Childbirth/Delivery Professional Services

Childbirth/Delivery Facility Services

Diagnostic tests (ultrasounds and blood work)

Specialist visit (anesthesia)

This EXAMPLE event includes services like:

Primary care physician office visits (including disease education)

Diagnostic tests (blood work)

Prescription drugs

Durable medical equipment (glucose meter)

This EXAMPLE event includes services like:

Emergency room care (including medical supplies)

Diagnostic test (x-ray)

Durable medical equipment (crutches)

Rehabilitation services (physical therapy)

The plan would be responsible for the other costs of these EXAMPLE covered services.

Page 8 of 8

NAME OF PLAN Navigate CUO5 /N37Y

1. Type of Policy Small Employer Group Policy

2. Type of Plan Health maintenance organization (HMO)

3. Areas of Colorado where plan is available Plan is available only in the following areas: Adams, Arapahoe, Archuleta, Broomfield, Boulder, Clear Creek, Crowley, Denver, Delta, Dolores, Douglas, Eagle, El Paso, Garfield, Grand, Gunnison, Hinsdale, Jackson, Jefferson, La Plata, Lake, Larimer, Lincoln, Mesa, Moffat , Montezuma, Montrose, Otero, Ouray, Park, Pitkin, Pueblo, Rio Blanco, Routt, San Juan, San Miguel, Summit, Teller, and Weld.

Important Note: The contents of this form are subject to the provisions of the policy, which contains all terms, covenants and conditions of coverage. It provides additional information meant to supplement the Summary of Benefits of Coverage you have received for this plan. This plan may exclude coverage for certain treatments, diagnoses, or services not specifically noted. Consult the actual policy to determine the exact terms and condit ions of coverage.

4. Annual Deductible Type

5. Out-of-Pocket Maximum

6. What is included in the In-Network Out-of-Pocket Maximum?

INDIVIDUAL - The amount that each member of the family must meet prior to claims being paid. Claims will not be paid for any other individual until their individual deductible or the family deductible has been met.

FAMILY - The maximum amount that the family will pay for the year. The family deductible can be met by 2 or more individuals.

INDIVIDUAL - The amount that each member of the family must meet prior to claims being paid at 100%. Claims will not be paid at 100% for any other individual until their individual out-of-pocket or the family out-of-pocket has been met.

FAMILY - The maximum amount that the family will pay for the year. The family out-of-pocket can be met by 2 or more individuals.

Copayments and Deductibles

7. Is pediatric dental covered by this plan Maximum? Yes, pediatric dental is subject to the medical deductible and out-of-pocket

8. What cancer screenings are covered? Breast Cancer Screening - Cervical Cancer Screening - Colorectal Cancer Screening - Prostate Cancer Screening.

USING THE PLAN

9. If the provider charges more for a covered service than the plan normally pays, does the enrollee have to pay the difference? No

10. Does the plan have a binding arbitration clause? No

Questions: Call 1-800-516-3344 or visit us at www.UnitedHealthcare.com

If you are not satisfied with the resolution of your complaint or grievance, contact:

Colorado Division of Insurance

Consumer Affairs Section

1560 Broadway, Suite 850, Denver, CO 80202

Call: 303-894-7490 (in-state, toll-free: 800-930-3745)

Emal: insurance@dora. state.co.us

Language Access Services:

Spanish (Espa ol): Para obtener asistencia en Espa ol, llame al 1-855-828-7715

Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-855-828-7715

Chinese 1-855-828-7715

Navajo (Dine): Dinek ehgo shika at ohwol ninisingo, kwiijigo holne 1-855-828-7715

SBCCOSUPP17

You have the right to get help and information in your language at no cost. To request an interpreter, call the toll free-member phone number listed on your health plan ID card, press 0. TTY 711

This letter is also available in other formats like large print. To request the document in another format, please call the toll-free member phone number listed on your health plan ID card, TTY 711, Monday through Friday, 8 a.m. to 8 p.m.

The company does not treat members differently because of sex, age, race, color, disability or national origin.

If you think you were treated unfairly because of your sex, age, race, color, disability or national origin, you can send a complaint to the Civil Rights Coordinator.

Online: UHC_Civil_Rights@uhc.com

Mail: Civil Rights Coordinator. UnitedHealthcare Civil Rights Grievance. P.O. Box 30608, Salt Lake City, UT 84130

You must send the complaint within 60 days of when you found out about it. A decision will be sent to you within 30 days. If you disagree with the decision, you have 15 days to ask us to look at it again. If you need help with your complaint, please call the member toll-free phone number listed on your ID card.

You can also file a complaint with the U.S. Dept. of Health and Human Services.

Online: https://ocrportal.hhs.gov/ocr/portal/lobby.jsf

Complaint forms are available at http://www.hhs.gov/ocr/office/file/index.html.

Phone: Toll-free 1-800-368-1019, 1-800-537-7697 (TDD)

Mail: U.S. Dept. of Health and Human Services. 200 Independence Avenue. SW Room 509F, HHH Building, Washington, D.C. 20201

Summary of Benefits and Coverage: What this Plan Covers & What You Pay for Covered Services Coverage Period: Based on group plan year : Choice Plus CUNJ /N37Y Coverage for: Employee/Family | Plan Type: POS

The Summary of Benefits and Coverage (SBC) document will help you choose a health plan The SBC shows you how you and the plan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will be provided separately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, visit www.welcometouhc.com or by calling 1-800-782-3740. For general definitions of common terms, such as allowed amount , balance billing, coinsurance , copayment , deductible , provider , or other underlined terms, see the Glossary. You can view the Glossary at www.healthcare.gov/sbc-glossary or call 1-866-487-2365 to request a copy.

Important Questions Answers

What is the overall deductible ?

Are there services covered before you meet your deductible ?

Network : $1,000 Individual / $2,000 Family out-of-Network : $7,500 Individual / $15,000 Family Per calendar year.

Yes. Preventive care and categories with a copay are covered before you meet your deductible

Are there other deductibles for specific services? No.

What is the out-of-pocket limit for this plan ?

What is not included in the out-of-pocket limit?

Will you pay less if you use a network provider?

Do you need a referral to see a specialist?

Network : $6,950 Individual / $13,900 Family out-of-Network : $15,000 Individual / $30,000 Family

Premiums , balance-billing charges (unless balanced billing is prohibited), health care this plan doesn’t cover and penalties for failure to obtain preauthorization for services.

Yes. See www.welcometouhc.com or call 1-800-782-3740 for a list of network providers

Generally, you must pay all of the costs from providers up to the deductible amount before this plan begins to pay. If you have other family members on the plan, each family member must meet their own individual deductible until the total amount of deductible expenses paid by all family members meets the overall family deductible .

This plan covers some items and services even if you haven’t yet met the deductible amount. But a copayment or coinsurance may apply. For example, this plan covers certain preventive services without cost sharing and before you meet your deductible See a list of covered preventive services at www.healthcare.gov/coverage/preventive-care-benefits/.

You don’t have to meet deductibles for specific services.

The out-of-pocket limit is the most you could pay in a year for covered services. If you have other family members in this plan, they have to meet their own out-of-pocket limits until the overall family out-of-pocket limit has been met.

Even though you pay these expenses, they don’t count toward the out-of-pocket limit

This plan uses a provider network You will pay less if you use a provider in the plan’s network You will pay the most if you use an out-of-network provider , and you might receive a bill from a provider for the difference between the provider’s charge and what your plan pays (balance billing). Be aware, your network provider might use an out-of-network provider for some services (such as lab work). Check with your provider before you get services.

No.

You can see the specialist you choose without a referral

Page 1 of 8

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.

Common Medical Event Services You May Need What You Will Pay

Provider (You will pay the least)

If you visit a health care provider’s office or clinic

Primary care visit to treat an injury or illness $35 copay per visit, deductible does not apply

Specialist visit $70 copay per visit, deductible does not apply

Preventive care/screening /immunization

If you have a test Diagnostic test (x-ray, blood work)

Provider (You will pay the most) Limitations, Exceptions, & Other Important Information

Virtual visits (Telehealth) - No Charge by a Designated Virtual Network Provider No virtual coverage for out-of-Network

If you receive services in addition to office visit, additional copays , deductibles, or coinsurance may apply e.g. surgery.

If you receive services in addition to office visit, additional copays , deductibles, or coinsurance may apply e.g. surgery.

*Certain services are covered when using an out-of-Network . Includes preventive health services specified in the health care reform law. You may have to pay for services that aren’t preventive. Ask your provider if the services needed are preventive. Then check what your plan will pay for.

Preauthorization required for out-of-Network for certain services or benefit reduces to 50% of allowed. Out-of-Network lab is not covered. Imaging (CT/PET scans, MRIs)

Page 2 of 8

Preauthorization required for out-of-Network or benefit reduces to 50% of allowed.

If you need drugs to treat your illness or condition

More information about prescription drug coverage is available at www. welcometouhc.com

Tier 1 - Your Lowest-Cost Option

Tier 2 - Your Midrange-Cost Option

Tier 3 - Your Midrange-Cost Option

Deductible does not apply. Retail: $15 copay

Mail-Order: $37.50 copay

Specialty Drugs** : $15 copay

Deductible does not apply. Retail: $55 copay

Mail-Order: $137.50 copay

Specialty Drugs** : $55 copay

Deductible does not apply. Retail: $135 copay

Mail-Order: $337.50 copay

Specialty Drugs** : $135 copay

Tier 4 - Additional High-Cost Options

Deductible does not apply. Retail: $350 copay

Mail-Order: $875 copay

Specialty Drugs** : $500 copay

Deductible does not apply. Retail: $15 copay

Specialty Drugs: $15 copay

Deductible does not apply. Retail: $55 copay

Specialty Drugs: $55 copay

Deductible does not apply. Retail: $135 copay

Specialty Drugs: $135 copay

Deductible does not apply. Retail: $350 copay

Specialty Drugs: $500 copay

If you have outpatient surgery Facility fee (e.g., ambulatory surgery center) 20% coinsurance 50% coinsurance

Provider means pharmacy for purposes of this section. Retail: Up to a 31 day supply. Mail-Order: Up to a 90 day supply or Preferred 90 Day Retail Network pharmacy. If you use an out-of-Network pharmacy (including a mail order pharmacy), you may be responsible for any amount over the allowed amount

**Your cost shown is for a Preferred Specialty Network Pharmacy. Non-Preferred Specialty Network Pharmacy: Copay is 2 times the Preferred Specialty Network Pharmacy Copay or the coinsurance (up to 50% of the Prescription Drugs Charge) based on the applicable Tier.

Copay is per prescription order up to the day supply limit listed above.

You may need to obtain certain drugs, including certain specialty drugs, from a pharmacy designated by us.

Certain drugs may have a preauthorization requirement or may result in a higher cost. You may be required to use a lower-cost drug(s) prior to benefits under your policy being available for certain prescribed drugs.

See the website listed for information on drugs covered by your plan Not all drugs are covered.

Prescription drug List (PDL): Essential Network : Standard Select - Walgreens.

If a dispensed drug has a chemically equivalent drug, the cost difference between drugs in addition to any applicable copay and/or coinsurance may be applied. Certain preventive medications, zero cost share medications, and Tier 1 contraceptives are covered at No Charge.

Preauthorization required for certain services for out-of-Network or benefit reduces to 50% of allowed.

3 of 8

If you receive services in addition to urgent care visit, additional copays , deductibles, or coinsurance may apply e.g. surgery.

you have a hospital stay

If you need mental health, behavioral health, or substance abuse services

you are pregnant

If you need help recovering or have other special health needs

Page 4 of 8

Preauthorization required for certain services for out-of-Network or benefit reduces to 50% of allowed.

required for out-of-Network or

reduces to 50% of allowed.

Cost sharing does not apply for preventive services Depending on the type of services, a copayment, deductibles, or coinsurance may apply.

Maternity care may include tests and services described elsewhere in the SBC (i.e., ultrasound.)

Inpatient preauthorization apply for out-of-Network if stay exceeds 48 hours (C-Section: 96 hours) or benefit reduces to 50% of allowed.

Limited to 364 visits per calendar year.

Preauthorization required for out-of-Network or benefit reduces to 50% of allowed.

Rehabilitation services $35 copay per outpatient visit, deductible does not apply

Habilitation services $35 copay per outpatient visit, deductible does not apply

Limits per calendar year: Physical, Speech, Occupational: 20 visits each. Cardiac & Pulmonary: Unlimited.

Limits per

year: Physical, Speech, Occupational: 20 visits each.

Cost share applies for outpatient services only.

Preauthorization required for out-of-Network inpatient services or benefit reduces to 50% of allowed.

Skilled Nursing Facility is limited to 100 days per calendar year . Preauthorization required for out-of-Network or benefit reduces to 50% of allowed.

Hospice

One pair every 12 months.

Costs may increase depending on the frames selected. You may choose contact lenses instead of eyeglasses. The benefit does not cover both. Children’s

Cleanings covered 2 times per 12 months.

Page 5 of 8

Excluded Services & Other Covered Services:

Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.)

Cosmetic surgery Dental care (Adult) Long-term care

Weight loss programs

Non-emergency care when traveling outside the U.S.

Routine foot care

Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.)

Acupuncture - 6 treatments/calendar year

Routine eye care (Adult)-1 exam/12 months

Bariatric surgery

Spinal Manipulations-20 visits per calendar year

Hearing aids

Infertility treatment

Private-duty nursingInpatient only

Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those agencies is: 1-866-444-3272 or www.dol.gov/ebsa/healthr eform for the U.S. Department of Labor, Employee Benefits Security Administration, you may also contact us at 1-800-782-3740 Other coverage options may be available to you, too, including buying individual insurance coverage through the Health Insurance Marketplace For more information about the Marketplace , visit www.HealthCare.gov or call 1-800-318-2596.

Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim This complaint is called a grievance or appeal For more information about your rights, look at the explanation of benefits you will receive for that medical claim Your plan documents also provide complete information on how to submit a claim, appeal, or a grievance for any reason to your plan For more information about your rights, this notice, or assistance, contact: 1-800-782-3740 ; or the Employee Benefits Security Administration at 1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreform or the Colorado Division of Insurance at 303-894-7490 or www.dora.state.co.us/ insurance.

Does this plan provide Minimum Essential Coverage? Yes.

Minimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid, CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible for the premium tax credit

Does this plan meet Minimum Value Standards? Yes. If your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace

Language Access Services: Spanish (Espa ol): Para obtener asistencia en Espa ol, llame al 1-800-782-3740 Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-800-782-3740 . Chinese 1-800-782-3740

6 of 8

Page 7 of 8 Navajo (Dine): Dinek ehgo shika at ohwol ninisingo, kwiijigo holne 1-800-782-3740

To see examples of how this plan might cover costs for a sample medical situation, see the next section.

This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will be different depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost-sharing amounts (deductibles , copayments and coinsurance ) and excluded services under the plan Use this information to compare the portion of costs you might pay under different health plans. Please note these coverage examples are based on self-only coverage.

This EXAMPLE event includes services like:

Specialist office visits (prenatal care)

Childbirth/Delivery Professional Services

Childbirth/Delivery Facility Services

Diagnostic tests (ultrasounds and blood work)

Specialist visit (anesthesia)

This EXAMPLE event includes services like:

Primary care physician office visits (including disease education)

Diagnostic tests (blood work)

Prescription drugs

Durable medical equipment (glucose meter)

This EXAMPLE event includes services like:

Emergency room care (including medical supplies)

Diagnostic test (x-ray)

Durable medical equipment (crutches)

Rehabilitation services (physical therapy)

this example, Mia would pay:

The plan would be responsible for the other costs of these EXAMPLE covered services.

Page 8 of 8

Colorado Supplement to the Summary of Benefits and Coverage Form

NAME OF PLAN Choice Plus CUNJ /N37Y

1. Type of Policy Small Employer Group Policy

2. Type of Plan Point of service (POS)

3. Areas of Colorado where plan is available Plan is available only in the following areas: Adams, Alamosa Arapahoe, Archuleta, Bent, Boulder, Broomfield, Chafee, Clear Creek, Conejos, Costilla, Crowley, Custer, Delta, Denver, Dolores, Douglas, Eagle, El Paso, Elbert, Fremont, Garfield, Gilpin, Grand, Gunnison, Huerfan o, Jefferson, Kiowa, Kit Carson, La Plata, Lake, Larimer, Las Animas, Lincoln, Logan, Mesa, Moffat, Montezuma, Montrose, Morgan, Otero, Ouray, Park, Phillips, Pitkin, Prowers, Pueblo, Rio Blanco, Rio Grande, Routt, Saguache, San Miguel, Sedgwick, Summit, Teller, Washington, Weld & Yuma.

SUPPLEMENTAL INFORMATION REGARDING BENEFITS

Important Note: The contents of this form are subject to the provisions of the policy, which contains all terms, covenants and conditions of coverage. It provides additional information meant to supplement the Summary of Benefits of Coverage you have received for this plan. This plan may exclude coverage for certain treatments, diagnoses, or services not specifically noted. Consult the actual policy to determine the exact terms and condit ions of coverage.

4. Annual Deductible Type

5. Out-of-Pocket Maximum

6. What is included in the In-Network Out-of-Pocket Maximum?

INDIVIDUAL - The amount that each member of the family must meet prior to claims being paid. Claims will not be paid for any other individual until their individual deductible or the family deductible has been met.

FAMILY - The maximum amount that the family will pay for the year. The family deductible can be met by 2 or more individuals.

INDIVIDUAL - The amount that each member of the family must meet prior to claims being paid at 100%. Claims will not be paid at 100% for any other individual until their individual out-of-pocket or the family out-of-pocket has been met.

FAMILY - The maximum amount that the family will pay for the year. The family out-of-pocket can be met by 2 or more individuals.

Copayments and Deductibles

7. Is pediatric dental covered by this plan Maximum? Yes, pediatric dental is subject to the medical deductible and out-of-pocket

8. What cancer screenings are covered? Breast Cancer Screening - Cervical Cancer Screening - Colorectal Cancer Screening - Prostate Cancer Screening.

USING THE PLAN

IN-NETWORK OUT-OF-NETWORK

9. If the provider charges more for a covered service than the plan normally pays, does the enrollee have to pay the difference? No Yes

10. Does the plan have a binding arbitration clause? No

Questions: Call 1-800-516-3344 or visit us at www.UnitedHealthcare.com

If you are not satisfied with the resolution of your complaint or grievance, contact:

Colorado Division of Insurance

Consumer Affairs Section

1560 Broadway, Suite 850, Denver, CO 80202

Call: 303-894-7490 (in-state, toll-free: 800-930-3745)

Emal: insurance@dora. state.co.us

Language Access Services:

Spanish (Espa ol): Para obtener asistencia en Espa ol, llame al 1-800-782-3740

Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-800-782-3740

Chinese 1-800-782-3740

Navajo (Dine): Dinek ehgo shika at ohwol ninisingo, kwiijigo holne 1-800-782-3740

SBCCOSUPP17

You have the right to get help and information in your language at no cost. To request an interpreter, call the toll free-member phone number listed on your health plan ID card, press 0. TTY 711

This letter is also available in other formats like large print. To request the document in another format, please call the toll-free member phone number listed on your health plan ID card, TTY 711, Monday through Friday, 8 a.m. to 8 p.m.

The company does not treat members differently because of sex, age, race, color, disability or national origin.

If you think you were treated unfairly because of your sex, age, race, color, disability or national origin, you can send a complaint to the Civil Rights Coordinator.

Online: UHC_Civil_Rights@uhc.com

Mail: Civil Rights Coordinator. UnitedHealthcare Civil Rights Grievance. P.O. Box 30608, Salt Lake City, UT 84130

You must send the complaint within 60 days of when you found out about it. A decision will be sent to you within 30 days. If you disagree with the decision, you have 15 days to ask us to look at it again. If you need help with your complaint, please call the member toll-free phone number listed on your ID card.

You can also file a complaint with the U.S. Dept. of Health and Human Services.

Online: https://ocrportal.hhs.gov/ocr/portal/lobby.jsf

Complaint forms are available at http://www.hhs.gov/ocr/office/file/index.html.

Phone: Toll-free 1-800-368-1019, 1-800-537-7697 (TDD)

Mail: U.S. Dept. of Health and Human Services. 200 Independence Avenue. SW Room 509F, HHH Building, Washington, D.C. 20201

A Health Savings Account (HSA) is a personal savings account where the money can only be used for eligible medical expenses. Unlike a flexible spending account (FSA), the money rolls over year to year however only those funds that have been deposited in your account can be used. Contributions to a Health Savings Account can only be used if you are also enrolled in a High Deductible Health Care Plan (HDHP).

For full plan details, please visit your benefit website: www.mybenefitshub.com/cscharteracademy

A Health Savings Account (HSA) is more than a way to help you and your family cover health care costs – it is also a tax-exempt tool to supplement your retirement savings and cover health expenses during retirement. An HSA can provide the funds to help pay current health care expenses as well as future health care costs.

A type of personal savings account, an HSA is always yours even if you change health plans or jobs. The money in your HSA (including interest and investment earnings) grows taxfree and spends tax-free if used to pay for qualified medical expenses. There is no “use it or lose it” rule — you do not lose your money if you do not spend it in the calendar year — and there are no vesting requirements or forfeiture provisions. The account automatically rolls over year after year.

You are eligible to open and contribute to an HSA if you are:

• Enrolled in an HSA-eligible HDHP (High Deductible Health Plan) Not covered by another plan that is not a qualified HDHP, such as your spouse’s health plan

• Not enrolled in a Health Care Flexible Spending Account, nor should your spouse be contributing towards a Health Care Flexible Spending Account

• Not eligible to be claimed as a dependent on someone else’s tax return

• Not enrolled in Medicare or TRICARE

• Not receiving Veterans Administration benefits

You can use the money in your HSA to pay for qualified medical expenses now or in the future. You can also use HSA funds to pay health care expenses for your dependents, even if they are not covered under your HDHP.

Your HSA contributions may not exceed the annual maximum amount established by the Internal Revenue Service. The annual contribution maximum for 2024 is based on the coverage option you elect:

• Individual – $4,150

• Family (filing jointly) – $8,300

You decide whether to use the money in your account to pay for qualified expenses or let it grow for future use. If you are 55 or older, you may make a yearly catch-up contribution of up to $1,000 to your HSA. If you turn 55 at any time during the plan year, you are eligible to make the catch-up contribution for the entire plan year.

• Always ask your health care provider to file claims with your medical provider so network discounts can be applied. You can pay the provider with your HSA debit card based on the balance due after discount.

• You, not your employer, are responsible for maintaining ALL records and receipts for HSA reimbursements in the event of an IRS audit.

It’s not easy to pay hospital bills, especially if you have a high-deductible medical plan. Chubb Hospital Cash pays money directly to you if you are hospitalized so you can focus on your recovery. And since the cash goes directly to you, there are no restrictions on how you use your money.

First Hospitalization Benefit

This benefit is payable for the first covered hospital confinement per certificate.

Hospital Admission Benefit

This benefit is for admission to a hospital or hospital sub-acute intensive care unit.

Hospital Admission ICU Benefit

This benefit is for admission to a hospital intensive care unit.

Hospital Confinement Benefit

This benefit is for confinement in hospital or hospital sub-acute intensive care unit.

Hospital Confinement ICU Benefit

This benefit is for confinement in a hospital intensive care unit.

Newborn Nursery Benefit

This benefit is payable for an insured newborn baby receiving newborn nursery care and who is not confined for treatment of a physical illness, infirmity, disease, or injury.

Observation Unit Benefit

This benefit is for treatment in a hospital observation unit for a period of less than 20 hours.

average three-day hospitalization cost.¹ average hospital stay.²

5.4 days $30,000 ¹

• $500

• Maximum benefit per certificate: 1

• $1,500

• Maximum benefit per calendar year: 5

• $3,000

• Maximum benefit per calendar year: 3

• $100 per day

• Maximum days per calendar year: 30

• $200 per day

• Maximum days per calendar year: 30

• $500 per day

• Maximum days per confinementnormal delivery: 2

• Maximum days per confinementcaesarean section: 2

• $500

• Maximum benefit per calendar year: 2

• $500

• Maximum benefit per certificate: 1

• $3,000

• Maximum benefit per calendar year: 5

• $6,000

• Maximum benefit per calendar year: 3

• $200 per day

• Maximum days per calendar year: 30

• $400 per day

• Maximum days per calendar year: 30

• $500 per day

• Maximum days per confinementnormal delivery: 2

• Maximum days per confinementcaesarean section: 2

• $500

• Maximum benefit per calendar year: 2

Waiver of Premium for Hospital Confinement

This benefit waives premium when the employee or spouse is confined for more than 30 continuous days.

Included

We will not pay for any Covered Accident or Covered Sickness that is caused by, or occurs as a result of 1) committing or attempting to commit suicide or intentionally injuring oneself; 2) war or serving in any of the armed forces or its auxiliary units; 3) participating in an illegal occupation or attempting to commit or actually committing a felony; 4) sky diving, hang gliding, parachuting, bungee jumping, parasailing, or scuba diving; 5) being intoxicated or being under the influence or any narcotic or other prescription drug unless taken in accordance with Physician’s instructions 6) alcoholism; 7) cosmetic surgery, except for reconstructive surgery needed as the result of an Injury or Sickness or is related to or results from a congenital disease or anomaly of a covered Dependent Child; 8) services related to sterilization, reversal of a vasectomy or tubal ligation, in vitro fertilization, and diagnostic treatment of infertility or other related problems.

A Physician cannot be You or a member of Your Immediate Family, Your business or professional partner, or any person who has a financial affiliation or business interest with You.

*If the employee waives medical coverage, the district will pay the $23.66 employee cost for Plan 2, and if the employee elects any other tier on Plan 2, the $23.66 will be credited toward the employee’s coverage.

Contact the FBS Benefits CareLine via the QR code or (833) 453-1680.

*Please refer to your Certificate of Insurance at www.mybenefitshub.com/cscharteracademy for a complete listing of available benefits, limitations and exclusions. Underwritten by ACE Property & Casualty Company, a Chubb company. This information is a brief description of the important benefits and features of the insurance plan. It is not an insurance contract. This is a supplement to health insurance and is not a substitute for Major Medical or other minimal essential coverage. Hospital indemnity coverage provides a benefit for covered loss; neither the product name nor benefits payable are intended to provide reimbursement for medical expenses incurred by a covered person or to result in any payment in excess of loss.

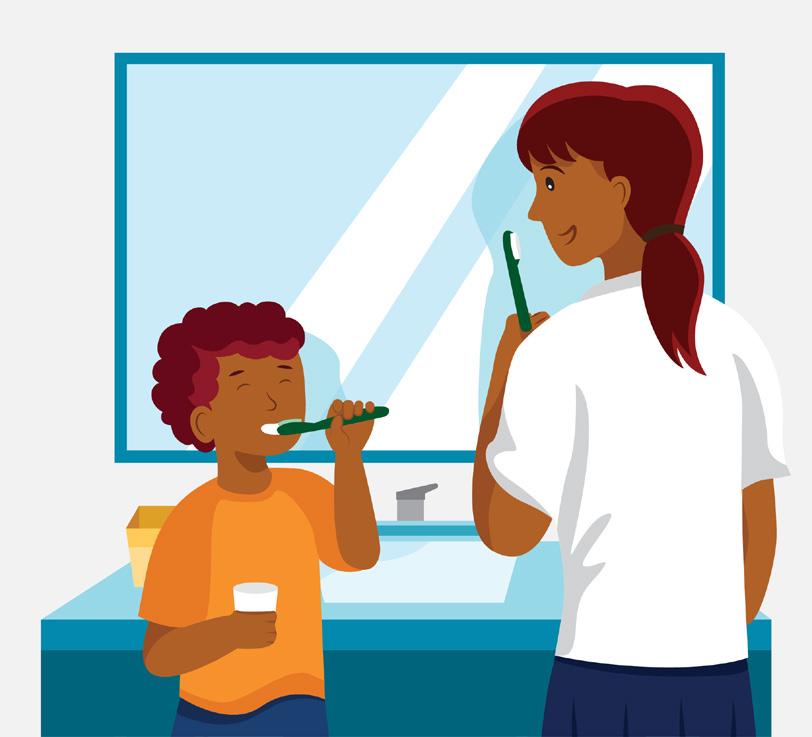

Dental insurance is a coverage that helps defray the costs of dental care. It insures against the expense of routine care, dental treatment and disease.

For full plan details, please visit your benefit website: www.mybenefitshub.com/cscharteracademy

The Preferred Dentist Program was designed to help you get the dental care you need and help lower your costs. You get benefits for a wide range of covered services — both in and out of the network. The goal is to deliver cost-effective protection for a healthier smile and a healthier you.

You have two plans to chose from. Following are highlights of these plans, please see plan documents for details, definitions and limitations.

Network: PDP Plus

Type A - Preventive How Many/How Often:

Oral Examinations

Full Mouth X-rays

Bitewing X-rays (Adult/Child)

Prophylaxis - Cleanings

Topical Fluoride Applications

Sealants

- Children to age 16

Type B - Basic Restorative How Many/How Often: Space Maintainers

Endodontics

Periodontal

Periodontal

Periodontal

Oral

General Anesthesia

Consultations

Type C - Major Restorative How Many/How Often:

Crowns/Inlays/Onlays

Prefabricated Crowns Repairs

Oral Surgery (Surgical Extractions)

Other Oral Surgery

Bridges Dentures

Implant

How do I find a participating dentist?

There are thousands of general dentists and specialists to choose from nationwide --so you are sure to find one that meets your needs. You can receive a list of these participating dentists online at www.metlife.com/dental or call 1-800-275-4638 to have a list faxed or mailed to you.

Do I need an ID card?

No, You do not need to present an ID card to confirm that you are eligible. You should notify your dentist that you are enrolled in a MetLife Dental Plan. Your dentist can easily verify information about your coverage through a toll-free automated Computer Voice Response system.

Vision insurance provides coverage for routine eye examinations and can help with covering some of the costs for eyeglass frames, lenses or contact lenses.

For full plan details, please visit your benefit website: www.mybenefitshub.com/cscharteracademy

• Eye health exam, dilation, prescription and refraction for glasses: At no additional cost after a $10 copay.

• Retinal imaging: At no additional cost Up to a $39 copay on routine retinal screening when performed by a private practice provider. Frame

• Allowance: $180 after $10 eyewear copay.

• Costco, Walmart and Sam’s Club: $100 allowance after $10 eyewear copay. You will receive an additional 20% savings on the amount that you pay over your allowance. This offer is available from all participating locations except Costco, Walmart and Sam’s Club.

Standard corrective lenses

• Single vision, lined bifocal, lined trifocal, lenticular: At no additional cost after $10 eyewear copay.

Standard lens enhancements1

• Polycarbonate (child up to age 18) and Ultraviolet (UV) coating: At no additional cost after $10 eyewear copay.

• Progressive Standard, Progressive Premium/Custom, Polycarbonate (adult), Photochromic, Anti-reflective, Scratch-resistant coatings and Tints: Your cost will be limited to a copay that MetLife has negotiated for you. These copays can be viewed after enrollment at www.metlife.com/mybenefits

Contact lenses instead of eye glasses Once

• Contact fitting and evaluation: At no additional cost with a maximum copay of $60.

• Elective lenses: $180 allowance.

• Necessary lenses: At no additional cost after eyewear copay.

Out-of-network reimbursement*

You pay for services and then submit a claim for reimbursement. The same benefit frequencies for In-network benefits apply.

• Eye exam: up to $45

• Frames: up to $70

• Contact lenses:

• Elective up to $105

• Necessary up to $210

• Single vision lenses: up to $30

• Lined bifocal lenses: up to $50

• Lined trifocal lenses: up to $65

• Lenticular lenses: up to $100

• Progressive lenses: up to $50

*If you choose an out-of-network provider, you will have increased outof-pocket expenses, pay in full at time of service, and file a claim for reimbursement.

Disability insurance protects one of your most valuable assets, your paycheck. This insurance will replace a portion of your income in the event that you become physically unable to work due to sickness or injury for an extended period of time.

For full plan details, please visit your benefit website: www.mybenefitshub.com/cscharteracademy

Short Term Disability Insurance can pay you a weekly benefit if you have a covered disability that keeps you from working. Short-Term Disability Benefit Overview-Please see plan documents for details.

Long Term Disability Insurance can replace part of your income if a disability keeps you out of work for a long period of time.

Long-Term Disability Benefit Overview- please see plan documents for details.

Long-Term Disability Benefits

Elimination Period

Maximum Benefit Period

of $100 or 10% of Benefit

of Age 65 or SSNRA

Pre-Existing Conditions* Subject to a 3/12 pre-existing limitation

Definition of Earnings

Return to Work Incentive

Annual Earnings Excluding Overtime, Bonuses, & Commission

of Age 65 or SSNRA

Maximum Benefit Period Benefits for a disabled employee are payable to the employee’s Social Security Normal Retirement Age or the Maximum Benefit Period listed on plan documents. All employees must be actively at work on policy’s effective date. Please see plan documents for plan details, definitions and limitations.

What is disability insurance? Disability insurance protects one of your most valuable assets, your paycheck. This insurance will replace a portion of your income in the event that you become physically unable to work due to sickness or injury for an extended period of time.