Higginbotham Public Sector (800) 583-6908 www.mybenefitshub.com/region19

BCBSTX (866) 355-5999 www.bcbstx.com/trsactivecare

Prudential Group #70168 (844) 455-1002 www.prudential.com DENTAL

Lincoln Financial Group (800) 423-2765

www.lfg.com

Lincoln Financial Group (800) 423-2765

www.lfg.com

EMERGENCY

MASA

Group #B2BESCR19 (800) 423-3226

www.masamts.com

Superior Vision (800) 507-3800

www.superiorvision.com

Unum Group #474633 (800) 635-5597 www.unum.com

New York Life 800-225-5695 www.newyorklife.com

Lincoln Financial Group (800) 423-2765 www.lfg.com

GotZoom (866) 314-8888 www.gotzoom.com

Clever RX (800) 974-3135 Group # 5474

https://cleverrx.com

1 www.mybenefitshub.com/region19

2

3

4

CLICK LOGIN

5

Enter your Information

• Last Name

• Date of Birth

• Last Four (4) of Social Security Number

NOTE: THEbenefitsHUB uses this information to check behind the scenes to confirm your employment status.

Once confirmed, the Additional Security Verification page will list the contact options from your profile. Select either Text, Email, Call, or Ask Admin options to receive a code to complete the final verification step.

Enter the code that you receive and click Verify. You can now complete your benefits enrollment!

• Enrollment assistance is available by calling Higginbotham Public Sector at (866) 915-5202 to speak to a representative. Spanish speaking representatives are also available.

• Annual Open Enrollment Benefit elections will become effective 9/1/2024 (elections requiring evidence of insurability, such as life Insurance, may have a later effective date, if approved). After annual enrollment closes, benefit changes can only be made if you experience a qualifying event (and changes must be made within 30 days of event).

For benefit questions, you can contact your Benefits department or you can call Higginbotham Public Sector at 866-914-5202 for assistance.

For benefit summaries and claim forms, go to your benefit website: www.mybenefitshub.com/region19 Click the benefit plan you need information on (i.e., Dental) and you can find the forms you need under the Benefits and Forms section.

For benefit summaries and claim forms, go to the ESC Region 19 benefit website: www.mybenefitshub. com/region19. Click on the benefit plan you need information on (i.e., Dental) and you can find provider search links under the Quick Links section.

If the insurance carrier provides ID cards, you can expect to receive those 3-4 weeks after your effective date. For most dental and vision plans, you can login to the carrier website and print a temporary ID card or simply give your provider the insurance company’s phone number and they can call and verify your coverage if you do not have an ID card at that time. If you do not receive your ID card, you can call the carrier’s customer service number to request another card. If the insurance carrier provides ID cards, but there are no changes to the plan, you typically will not receive a new ID card each year.

Annual Enrollment: During your annual enrollment period, you have the opportunity to review, change or continue benefit elections each year. Changes are not permitted during the plan year (outside of annual enrollment) unless a Section 125 qualifying event occurs.

• Changes, additions or drops may be made only during the annual enrollment period without a qualifying event.

• Employees must review their personal information and verify that dependents they wish to provide coverage for are included in the dependent profile. Additionally, you must notify your employer of any discrepancy in personal and/or benefit information.

• Employees must confirm on each benefit screen (medical, dental, vision, etc.) that each dependent to be covered is selected in order to be included in the coverage for that particular benefit.

New Hire Enrollment: All new hire enrollment elections must be completed in the online enrollment system within the first 30 days of benefit eligibility employment. Failure to complete elections during this timeframe will result in the forfeiture of coverage.

Actively-at-Work: You are performing your regular occupation for the employer on a full-time basis, either at one of the employer’s usual places of business or at some location to which the employer’s business requires you to travel. If you will not be actively at work beginning 9/1 please notify your benefits administrator.

Annual Deductible: The amount you pay each plan year before the plan begins to pay covered expenses.

Annual Enrollment: The period during which existing employees are given the opportunity to enroll in or change their current elections.

Calendar Year: January 1st through December 31st

Co-insurance: After any applicable deductible, your share of the cost of a covered health care service, calculated as a percentage (for example, 20%) of the allowed amount for the service.

Guaranteed Coverage: The amount of coverage you can elect without answering any medical questions or taking a health exam. Guaranteed coverage is only available during initial eligibility period. Activelyat-work and/or pre-existing condition exclusion provisions do apply, as applicable by carrier.

In-Network: Doctors, hospitals, optometrists, dentists and other providers who have contracted with the plan as a network provider.

Out-of-Pocket Maximum: The most an eligible or insured person can pay in co-insurance for covered expenses.

Plan Year: September 1st through August 31st

Pre-Existing Conditions: Applies to any illness, injury or condition for which the participant has been under the care of a health care provider, taken prescriptions drugs or is under a health care provider’s orders to take drugs, or received medical care or services (including diagnostic and/or consultation services).

A Cafeteria plan enables you to save money by using pre-tax dollars to pay for eligible group insurance premiums sponsored and offered by your employer. Enrollment is automatic unless you decline this benefit. Elections made during annual enrollment will become effective on the plan effective date and will remain in effect during the entire plan year.

Marital Status

Change in Number of Tax Dependents

Change in Status of Employment Affecting Coverage Eligibility

Gain/Loss of Dependents’ Eligibility Status

Judgment/ Decree/Order

Eligibility for Government Programs

Changes in benefit elections can occur only if you experience a qualifying event. You must present proof of a qualifying event to your Benefit Office within 30 days of your qualifying event and meet with your Benefit Office to complete and sign the necessary paperwork in order to make a benefit election change. Benefit changes must be consistent with the qualifying event.

A change in marital status includes marriage, death of a spouse, divorce or annulment (legal separation is not recognized in all states).

A change in number of dependents includes the following: birth, adoption and placement for adoption. You can add existing dependents not previously enrolled whenever a dependent gains eligibility as a result of a valid change in status event.

Change in employment status of the employee, or a spouse or dependent of the employee, that affects the individual’s eligibility under an employer’s plan includes commencement or termination of employment.

An event that causes an employee’s dependent to satisfy or cease to satisfy coverage requirements under an employer’s plan may include change in age, student, marital, employment or tax dependent status.

If a judgment, decree, or order from a divorce, annulment or change in legal custody requires that you provide accident or health coverage for your dependent child (including a foster child who is your dependent), you may change your election to provide coverage for the dependent child. If the order requires that another individual (including your spouse and former spouse) covers the dependent child and provides coverage under that individual’s plan, you may change your election to revoke coverage only for that dependent child and only if the other individual actually provides the coverage.

Gain or loss of Medicare/Medicaid coverage may trigger a permitted election change.

Supplemental Benefits: Eligible employees must work 20 or more regularly scheduled hours each work week.

Eligible employees must be actively at work on the plan effective date for new benefits to be effective, meaning you are physically capable of performing the functions of your job on the first day of work concurrent with the plan effective date. For example, if your 2024 benefits become effective on September 1, 2024, you must be actively-at-work on September 1, 2024 to be eligible for your new benefits.

Dependent Eligibility: You can cover eligible dependent children under a benefit that offers dependent coverage, provided you participate in the same benefit, through the maximum age listed below. Dependents cannot be double covered by married spouses within the district as both employees and dependents.

Please note, limits and exclusions may apply when obtaining coverage as a married couple or when obtaining coverage for dependents.

Potential Spouse Coverage Limitations: When enrolling in coverage, please keep in mind that some benefits may not allow you to cover your spouse as a dependent if your spouse is enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on spouse eligibility.

FSA/HSA Limitations: Please note, in general, per IRS regulations, married couples may not enroll in both a Flexible Spending Account (FSA) and a Health Savings Account (HSA). If your spouse is covered under an FSA that reimburses for medical expenses then you and your spouse are not HSA eligible, even if you would not use your spouse’s FSA to reimburse your expenses. However, there are some exceptions to the general limitation regarding specific types of FSAs. To obtain more information on whether you can enroll in a specific type of FSA or HSA as a married couple, please reach out to the FSA and/or HSA provider prior to enrolling or reach out to your tax advisor for further guidance.

Potential Dependent Coverage Limitations: When enrolling for dependent coverage, please keep in mind that some benefits may not allow you to cover your eligible dependents if they are enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Higginbotham Public Sector, or contact the insurance carrier for additional information on dependent eligibility.

Disclaimer: You acknowledge that you have read the limitations and exclusions that may apply to obtaining spouse and dependent coverage, including limitations and exclusions that may apply to enrollment in Flexible Spending Accounts and Health Savings Accounts as a married couple. You, the enrollee, shall hold harmless, defend, and indemnify Higginbotham Public Sector, LLC from any and all claims, actions, suits, charges, and judgments whatsoever that arise out of the enrollee’s enrollment in spouse and/or dependent coverage, including enrollment in Flexible Spending Accounts and Health Savings Accounts.

If your dependent is disabled, coverage may be able to continue past the maximum age under certain plans. If you have a disabled dependent who is reaching an ineligible age, you must provide a physician’s statement confirming your dependent’s disability. Contact your Benefits Administrator to request a continuation of coverage.

For full plan details, please visit your benefit website: www.mybenefitshub.com/region19

Learn the Terms.

• Premium: The monthly amount you pay for health care coverage.

• Deductible: The annual amount for medical expenses you’re responsible to pay before your plan begins to pay.

• Copay: The set amount you pay for a covered service at the time you receive it. The amount can vary based on the service.

• Coinsurance: The portion you’re required to pay for services after you meet your deductible. It’s often a specified percentage of the costs; e.g., you pay 20% while the health care plan pays 80%.

• Out-of-Pocket Maximum: The maximum amount you pay each year for medical costs. After reaching the out-of-pocket maximum, the plan pays 100% of allowable charges for covered services.

This is an affordable supplemental plan that pays you should you be inpatient hospital confined. This plan complements your health insurance by helping you pay for costs left unpaid by your health insurance.

For full plan details, please visit your benefit website: www.mybenefitshub.com/region19

Hospital Indemnity Insurance issued by The Prudential Insurance Company of America (Prudential) pays you regardless of what your medical plan covers. Your benefits are paid directly to you to spend however you like, including out-of-pocket medical costs and everyday living expenses.

Below is a summary of the coverage available to you, your spouse and child(ren). For a complete list of benefits, limitations, and exclusions, please refer to your Certificate of Coverage.

This is a summary of benefits and does not include all plan provisions, exclusions, and limitations. If there is a discrepancy between this document and the group contract issued by The Prudential Insurance Company of America, the terms of the group contract will govern.

Dental insurance is a coverage that helps defray the costs of dental care. It insures against the expense of routine care, dental treatment and disease.

For full plan details, please visit your benefit website: www.mybenefitshub.com/region19

Deductibles are combined for basic and major Contracting Dentists’ services. Deductibles are

and

NonContracting Dentists’ services.

Routine oral exams

Bitewing X-rays

Full-mouth or panoramic X-rays

Other dental X-rays - including periapical films Routine cleanings

Fluoride treatments

Space maintainers for children

Palliative treatment - including emergency relief of dental pain

Sealants

Basic Services

Problem focused exams

Injections of antibiotics and other therapeutic medications

Fillings

Simple extractions

General

Major Services

Consultations

Prefabricated stainless steel and resin crowns

Surgical extractions

Oral surgery

Biopsy and examination of oral tissue - including brush biopsy

Prosthetic repair and cementation services

Endodontics - including root canal treatment

Orthodontics

Orthodontic exams

X-rays Extractions

The Lincoln Dental – PPO HIGH Contracting Dentists Non-Contracting Dentists

Calendar (Annual) Deductible

Individual: $50 Family: $150

Waived for: Preventive

Individual: $50 Family: $150

Waived for: Preventive

Deductibles are combined for basic and major Contracting Dentists’ services. Deductibles are combined for basic and major NonContracting Dentists’ services.

Maximum

Orthodontic Max

Waiting Period

Preventive Services

Routine oral exams

Bitewing X-rays

Full-mouth or panoramic X-rays

Other dental X-rays - including periapical films

Routine cleanings

Fluoride treatments

Space maintainers for children

Palliative treatment - including emergency relief of dental pain

Sealants

Basic Services

Problem focused exams

Injections of antibiotics and other therapeutic medications Fillings

Simple extractions

General anesthesia and I.V. sedation

Major Services

Consultations

Prefabricated stainless steel and resin crowns

Surgical extractions

Oral surgery

Biopsy and examination of oral tissue - including brush biopsy

Prosthetic repair and re-cementation services

Endodontics - including root canal treatment

Orthodontics

Orthodontic exams

There are no benefit waiting periods for any service types

You can request your dental ID card by contacting Lincoln Financial Dental directly at 800-423-2765.

Contracting Dentists/Non-Contracting Dentists: Visit www.LincolnFinancial.com/FindADentist to find a contracting dentist near you. This plan lets you choose any dentist you wish. However, your out-of-pocket costs are likely to be lower when you choose a contracting dentist.

Contracting Dentists: you pay a deductible (if applicable), then 50% of the remaining discounted fee for PPO members. This is known as a PPO contracted fee.

Non-Contracting Dentists: you pay a deductible (if applicable), then 50% of the usual and customary fee, which is the maximum expense covered by the plan. You are responsible for the different between the usual and customary fee and the dentist’s billed charge.

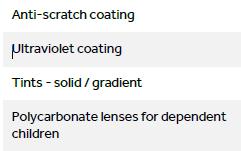

Vision insurance helps cover the cost of care for maintaining healthy vision. Similar to an annual checkup at your family doctor, routine eyecare is necessary to ensure that your eyes are healthy and to check for any signs of eye conditions or diseases . Most plans cover your routine eye exam with a copay and provide an allowance for Frames or Contact Lenses.

www.mybenefitshub.com/region19

For full plan details, please visit your benefit website: www.mybenefitshub.com/escregion19

Superior Vision Customer Service 1-800-507-3800

• In-network benefits available through network eye care professionals.

• Find an in-network eye care professional at superiorvision.com. Call your eye doctor to verify network participation.

• Obtain a vision exam with either an MD or OD.

• Flexibility to use different eye care professionals for exam and for eyewear.

• Access your benefits through our mobile app – Display member ID card – view your member ID card in full screen or save to wallet .

Our network is built to support you.

• We manage one of the largest eye care professional networks in the country .

• The network includes 50 of the top 50 national retailers. Examples include:

• In-network online retail Providers :

Members may also receive additional discounts, including 20% off lens upgrades and 30% off additional pairs of glasses.*

A LASIK discount is available to all covered members. Our Discounted LASIK services are administered by QualSight. Visit lasik.sv.qualsight.com to learn more.

Members save up to 40% on brand name hearing aids and have access to a nationwide network of licensed hearing professionals through Your Hearing Network.

*Discounts are provided by participating locations. Verify if their eye care professional participates in the discount featur e before receiving service.

Disability insurance protects one of your most valuable assets, your paycheck. This insurance will replace a portion of your income in the event that you become physically unable to work due to sickness or injury for an extended period of time.

For full plan details, please visit your benefit website: www.mybenefitshub.com/region19

A disability doesn’t always mean a serious handicap. Any illness or injury can prevent you from earning your salary. Consider what would happen if you couldn’t work or pay your bills. How might this affect your savings and your lifestyle?

Disability insurance from New York Life Group Benefit Solutions (NYL GBS) can help provide the financial security and assurance you’ll need if you experience a covered illness or injury that keeps you out of work.

Why is disability insurance important?

Disability insurance can pay you benefits if you suffer a covered disability. Think of it as insurance for a portion of your paycheck. Payments may come directly to you or someone you designate and can help pay for things like groceries, the mortgage, utilities & even medical bills.

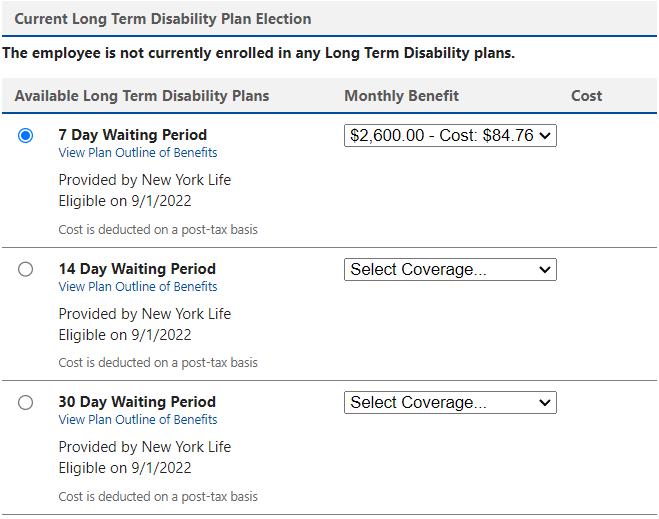

Who’s eligible for disability insurance, and what are the plan options?

All active, Full-time Employees of the Employer regularly working a minimum of 20 hours per week in the United States, who are citizens or permanent resident aliens of the United States. Coverage is available for Long-term disability (LTD).

Your Disability insurance includes access to a suite of programs and services, available from day one. They’re included in your plan, so you’re automatically enrolled, and it’s our way of saying thanks for being a valued customer.

Employee Assistance & Wellness Support2

Emotional support for you and/or family members at no additional cost. Access is available 24 hours a day, seven days a week. Includes work/life assistance, coaching, online articles, resources, and videos for work/life issues.

Financial, Legal & Estate Support2

Professional support for all types of financial, legal or estate issues including tax consultations, credit questions, and much more. Assistance also includes identity theft and fraud resolution services and online tools for state-specific wills and other important legal documents.

Accident/Sickness

7 Days/7 Days

the later of your social security normal retirement age of the maximum benefit period provided in your summary of benefits. Option 2

14 Days/14 Days

30 Days/30 Days

90 Days/90 Days

180/ Days/180/ Days

Accident/Sickness

7 Days/7 Days

14 Days/14 Days

30 Days/30 Days

90 Days/90 Days

180/ Days/180/ Days

Accident/Sickness

7 Days/7 Days

14 Days/14 Days

30 Days/30 Days

90 Days/90 Days

180/ Days/180/ Days

the later of your social security normal retirement age of the maximum benefit period provided in your summary of benefits.

the later of your social security normal retirement age of the maximum benefit period provided in your summary of benefits.

What is disability insurance? Disability insurance protects one of your most valuable assets, your paycheck. This insurance will replace a portion of your income in the event that you become physically unable to work due to sickness or injury for an extended period of time. This type of disability plan is called an educator disability plan and includes both long and short term coverage into one convenient plan.

Pre-Existing Condition Limitations - Please note that all plans will include pre-existing condition limitations that could impact you if you are a first-time enrollee in your employer’s disability plan. This includes during your initial new hire enrollment. Please review your plan details to find more information about preexisting condition limitations.

How do I choose which plan to enroll in during my open enrollment?

1. First choose your elimination period. The elimination period, sometimes referred to as the waiting period, is how long you are disabled and unable to work before your benefit will begin. This will be displayed as 2 numbers such as 0/7, 14/14, 30/30, 60/60, 90/90, etc.

The first number indicates the number of days you must be disabled due to Injury and the second number indicates the number of days you must be disabled due to Sickness

When choosing your elimination period, ask yourself, “How long can I go without a paycheck?” Based on the answer to this question, choose your elimination period accordingly.

Important Note- some plans will waive the elimination period if you choose 30/30 or less and you are confined as an inpatient to the hospital for a specific time period. Please review your plan details to see if this feature is available to you.

2. Next choose your benefit amount. This is the maximum amount of money you would receive from the carrier on a monthly basis once your disability claim is approved by the carrier.

When choosing your monthly benefit, ask yourself, “How much money do I need to be able to pay my monthly expenses?” Based on the answer to this question, choose your monthly benefit accordingly.

Choose your desired elimination period.

Choose your Benefit Amount from the drop down box.

Do you have kids playing sports, are you a weekend warrior, or maybe accident prone? Accident plans are designed to help pay for medical costs associated with accidents and benefits are paid directly to you.

For full plan details, please visit your benefit website: www.mybenefitshub.com/region19

Accident Insurance pays you benefits for specific injuries and events resulting from a covered accident that occurs, on or after your coverage effective date. The benefit amount depends on the type of injury and care received. Accident Insurance is a limited benefit policy. It is not health insurance and does not satisfy the requirement of minimum essential coverage under the Affordable Care Act.

• Emergency Treatment

• Fractures:

* Fracture benefits listed are nonsurgical. Treatment for the fracture must occur within 90 days of the accident. The combined maximum of all fractures is two times the highest fracture payable.

• Dislocations:

* Dislocation benefits listed are nonsurgical. Treatment for the dislocation must occur within 90 days of the accident. The combined maximum of all dislocations is two times the highest dislocation payable.

• Specific Injuries:

* A full breakdown of injuries can be access on the employee portal.

* Benefits will be paid up to two times the highest surgical benefit payable for all surgeries

• Hospitalization an Ongoing Care

• Recovery Assistance

• Accident Death & Dismemberment Benefit

You receive a cash benefit every year you and any of your covered family members complete a single covered assessment test $50

Additional Plan Benefits

• Portability

• Child Sports Injury Benefit

Please note that with any insurance policy exclusions do apply. Be sure to access plan summary on employee benefits portal or if you have Questions? Call 800-423-2765 and mention ID: EDUSERV19.

If you’re diagnosed with an illness that is covered by this insurance, you can receive a lump sum benefit payment. You can use the money however you want.

Why is this coverage so valuable?

• The money can help you pay out-of-pocket medical expenses, like deductibles.

• You can use this coverage more than once. Even after you receive a payout for one illness, you’re still covered for the remaining conditions and for the reoccurrence of any critical illness with the exception of skin cancer. The reoccurrence benefit can pay 100% of your coverage amount. Diagnoses must be at least 180 days apart or the conditions can’t be related to each other.

What’s covered?

• Heart attack

• Stroke

• Major organ failure

• End-stage kidney failure

• Amyotrophic Lateral Sclerosis (ALS)

• Dementia, including Alzheimer’s disease

• Multiple Sclerosis (MS)

• Parkinson’s disease

• Functional loss

• Coronary artery disease

• Major (50%):

• Coronary artery bypass graft

• or valve replacement

• Minor (10%):

• Balloon angioplasty or

• stent placement

• Loss of sight, hearing or speech

• Benign brain tumor

• Coma

• Permanent Paralysis

• Occupational HIV, Hepatitis B, C or D

Paid at 25%

• Infectious Diseases

Please refer to the certificate for complete definitions of these covered conditions. Coverage may vary by state. See exclusions and limitations.

• It’s more accessible when you buy it through your employer and the premiums are conveniently deducted from your paycheck.

• Coverage is portable. You may take the coverage with you if you leave the company or retire. You’ll be billed at home.

Every year, each family member who has Critical Illness coverage can also receive $50 for getting a covered Be Well Benefit screening test, such as:

• Annual exams by a physician include sports physicals, wellchild visits, dental and vision exams

• Screenings for cancer, including pap smear, colonoscopy

• Cardiovascular function screenings

You:

• Screenings for cholesterol and diabetes

• Imaging studies, including chest X-ray, mammography

• Immunizations including HPV, MMR, tetanus, influenza

Choose $10,000, $20,000 or $30,000 of coverage with no medical underwriting to qualify if you apply during this enrollment.

Your spouse: Spouses can only get 100% of the employee coverage amount as long as you have purchased coverage for yourself.

Your children:

Children from live birth to age 26 are automatically covered at no extra cost. Their coverage amount is 100% of yours. They are covered for all the same illnesses plus these specific childhood conditions: cerebral palsy, cleft lip or palate, cystic fibrosis, Down syndrome and spina bifida. The diagnosis must occur after the child’s coverage effective date.

Benefits may be subject to a pre-existing condition provision

Group term life is the most inexpensive way to purchase life insurance. You have the freedom to select an amount of life insurance coverage you need to help protect the well-being of your family.

Accidental Death & Dismemberment is life insurance coverage that pays a death benefit to the beneficiary, should death occur due to a covered accident. Dismemberment benefits are paid to you, according to the benefit level you select, if accidentally dismembered.

For full plan details, please visit your benefit website: www.mybenefitshub.com/region19

Safeguard the most important people in your life.

Consider what your loved ones may face after you’re gone. Term life insurance can help them in so many ways, like helping to cover everyday expenses, pay off debt, and protect savings. Accidental death and dismemberment (AD&D) insurance provides additional benefits if you die or suffer a covered loss in an accident, such as losing a limb or your eyesight.

• A cash benefit of $25,000 to your loved ones in the event of your death, plus an additional cash benefit if you die in an accident

• AD&D Plus: if you suffer an AD&D-covered loss in an accident, you may also receive benefits for the following in addition to your core AD&D benefits: coma, plegia, education, childcare, spouse training. Additional conditions are outlined in your policy.

• Includes LifeKeys® services, which provide access to counseling, financial, and legal support services.

• TravelConnect® services, which give you and your family access to emergency medical assistance when you’re on a trip 100+ miles from home.

Continuation of coverage for ceasing active work: You may be able to continue your coverage if you leave your job for reasons including and not limited to Family and Medical Leave, lay-off, leave of absence, leave of absence due to disability.

Waiver of premium: This provision relieves you from paying premiums during a period of disability that has lasted for a specified length of time.

Accelerated death benefit: Enables you to receive a portion of your policy death benefit while you are living. To qualify, a medical professional must diagnose you with a terminal illness with a life expectancy of fewer than 12 months.

Conversion: You may be able to convert your group term life coverage to an individual life insurance policy if your coverage decreases or you lose coverage due to leaving your job or for other reasons outlined in the plan contract.

Benefit reduction: Your employee Life/AD&D coverage amount will reduce by 50% when you reach age 75. Benefits end when you retire.

Life Coverage Amount: Initial Open Enrollment: When you are first offered this coverage, you can choose a coverage amount up to $250,000 without providing evidence of insurability. Annual Limited Enrollment: If you are a continuing employee, you can increase your coverage amount by $10,000 without providing evidence of insurability. If you submitted evidence of insurability in the past and were declined for medical reasons, you may be required to submit evidence of insurability. If you decline this coverage now and wish to enroll later, evidence of insurability may be required and may be at your own expense. You can increase this amount by up to $20,000 during the next limited open enrollment period.

• Provides a cash benefit to your loved ones if you die in an accident

• Provides a cash benefit to you if you suffer a covered loss in an accident, such as losing a limb or your eyesight

• Features group rates for employees

• Includes LifeKeys® services, which provide access to counseling, financial, and legal support

• Includes TravelConnect® services, which give you and your family access to emergency medical assistance when you’re on a trip 100+ miles from home

Maximum coverage amount

This amount may not exceed the lesser of seven times annual earnings or $500,000 Your employee AD&D coverage amount will reduce by 50% when you reach age 75. Benefits end when you retire. Dependent

You can secure AD&D insurance for your spouse if you select coverage for yourself. Your spouse AD&D coverage amount will reduce by 50% when you reach age 75. Benefits end when you retire.

$10,000

You can secure AD&D insurance for your dependent children if you select coverage for yourself.

Comprehensive coverage and care for emergency transport.

Our Emergent Plus membership plan includes:

Emergency Ground Ambulance Coverage1

Your out-of-pocket expenses for your emergency ground transportation to a medical facility are covered with MASA.

Emergency Air Ambulance Coverage1

Your out-of-pocket expenses for your emergency air transportation to a medical facility are covered with MASA.

When specialized care is required but not available at the initial emergency facility, your out-of-pocket expenses for the ground or air ambulance transfer to the nearest appropriate medical facility are covered with MASA.

Should you need continued care and your care provider has approved moving you to a hospital nearer to your home, MASA coordinates and covers the expense for ambulance transportation to the approved medical facility.

Did you know?

51.3 million emergency responses occur each year

MASA protects families against uncovered costs for emergency transportation and provides connections with care services.

Source: NEMSIS, National EMS Data Report, 2023

MASA is coverage and care you can count on to protect you from the unexpected. With us, there is no “out-of-network” ambulance. Just send us the bill when it arrives and we’ll work to ensure charges are covered. Plus, we’ll be there for you beyond your initial ride, with expert coordination services on call to manage complex transport needs during or after your emergency — such as transferring you and your loved ones home safely.

Protect yourself, your family, and your family’s financial future with MASA.

protects families against out-of-pocket costs for emergency transportation and provides connections with care. Gain peace of mind and shield your finances knowing there’s a MASA plan best suited for your needs.

GotZoom

Student Loan debt in the United States currently exceeds $1.4 trillion dollars. If you are one of the millions of Americans that are stressed and struggling with high levels of student loan debt, this is a program that may provide student loan relief to those who qualify.

For full plan details, please visit your benefit website: www.mybenefitshub.com/region19

Your Path to Student Loan Relief Reduce your Student Loan Debt by 65%

What’s GotZoom?

Where to Start

Employee Benefits

Service Fee

An established company with a seven-year track record of performance and customer satisfaction. The leader in student debt reduction services.

Go to the enrollment page: https://mystudentloan2.net/ Click on Enroll Now

GotZoom monitors DOE programs and reviews the employee’s status annually to find any additional debt reduction options.

Employee’s loan analysis and Benefits Summary are free (no obligation)

Service fees apply only after the employee has reviewed and approved repayment/ forgiveness programs

Application Fee: $307.

Annual Fee: $359.40 (Monthly Option: $32.95)

Download your Clever RX card or Clever RX App to unlock exclusive savings.

Present your Clever RX App or Clever RX card to your pharmacist.

FREE to use. Save up to 80% off prescription drugs and beat copay prices.

100% FREE to use

Unlock discounts on thousands of medications Accepted at most pharmacies nationwide ST AR T SA VI NG TOD AY

Save up to 80% off prescription drugs – often beats the average copay

ST EP 1:

Download the FREE Clever RX App. From your App Store search for "Clever RX" and hit download. Make sure you enter in Group ID and in Member ID during the on-boarding process. This will unlock exclusive savings for you and your family!

ST EP 2 :

Find where you can save on your medication. Using your zip code, when you search for your medication Clever RX checks which pharmacies near you offer the lowest price. Savings can be up to 80% compared to what you're currently paying.

ST EP 3 :

Click the voucher with the lowest price, closest location, and/or at your preferred pharmacy. Click "share" to text yourself the voucher for easy access when you are ready to use it. Show the voucher on your screen to the pharmacist when you pick up your medication.

ST EP 4:

Share the Clever RX App. Click "Share" on the bottom of the Clever RX App to send your friends, family, and anyone else you want to help receive instant discounts on their prescription medication. Over 70% of people can benefit from a prescription savings card.

Over 7 0% of peopl e c an benefi t fro m a pre sc rip ti on sav ing s c ard due t o high dedu ct ible heal t h plan s, high c opa ys , and being unde r in s ured or u ni ns ur ed

Ov er 3 0 % of pre sc rip t ion s ne ver ge t filled due t o high co sts .

4 0% of t he t op t en most prescribed d rugs ha v e in cr ea s ed in cost b y o v e r 1 00 %

Enrollment Guide General Disclaimer: This summary of benefits for employees is meant only as a brief description of some of the programs for which employees may be eligible. This summary does not include specific plan details. You must refer to the specific plan documentation for specific plan details such as coverage expenses, limitations, exclusions, and other plan terms, which can be found at the ESC Region 19 Benefits Website. This summary does not replace or amend the underlying plan documentation. In the event of a discrepancy between this summary and the plan documentation the plan documentation governs. All plans and benefits described in this summary may be discontinued, increased, decreased, or altered at any time with or without notice.

Rate Sheet General Disclaimer: The rate information provided in this guide is subject to change at any time by your employer and/or the plan provider. The rate information included herein, does not guarantee coverage or change or otherwise interpret the terms of the specific plan documentation, available at the ESC Region 19 Benefits Website, which may include additional exclusions and limitations and may require an application for coverage to determine eligibility for the health benefit plan. To the extent the information provided in this summary is inconsistent with the specific plan documentation, the provisions of the specific plan documentation will govern in all cases.