Higginbotham Public Sector (866) 914-5202 www.mybenefitshub.com/prosperisd

PROSPER ISD BENEFITS

Benefits Department (469) 219-2000 Benefits@prosper-isd.net

BCBSTX (866) 355-5999 www.bcbstx.com/trsactivecare

EECU (817) 882-0800 www.eecu.org

The Hartford Group #872784 (866) 547-4205 thehartford.com/benefits/myclaim

The Hartford Group #872784 866-547-9124 www.thehartford.com

ID Watchdog (800) 774-3772 www.idwatchdog.com

EMPLOYEE ASSISTANCE PROGRAM (EAP)

Deer Oaks EAP Services (866) 827-2400 www.deeroakseap.com

EMPLOYEE ASSISTANCE PROGRAM (EAP)

Recuro Health (844) 979-0313 www.recurohealth.com

Lincoln Financial Group (See Benefit Highlights for Group #’s) DPPO: (800) 423-2765 www.lfg.com

American Public Life Group #24842 (800) 256-8606 www.ampublic.com

Express Scripts (844) 238-8084 https://www.express-scripts.com/trsactivecare

Superior Vision Group #322100 (800) 507-3800 www.superiorvision.com

The Hartford Group #872784 (888) 563-1124 www.thehartford.com

FLEXIBLE SPENDING ACCOUNT (FSA)

Higginbotham (866) 419-3519 https://flexservices.higginbotham.net/

Group #B2BPROISD (800) 643 9023 claims@masaglobal.com www.masamts.com

The Hartford Group #872784 (866) 547-4205 thehartford.com/benefits/myclaim

ILLNESS PRESCRIPTION SAVINGS

The Hartford Group # 872784 (866) 547-4205 thehartford.com/benefits/myclaim

Clever RX (800) 873-1195 partner.cleverrx.com/prosperisd

1 www.mybenefitshub.com/prosperisd

2 Click Login with Microsoft

3

4 Enter your work e-mail address. Click Login

5 Complete the verification steps as outlined by your employer. You can now complete your benefits enrollment!

3 Enter your Information

• Last Name

• Date of Birth

• Last Four (4) of Social Security Number

NOTE: THEbenefitsHUB uses this information to check behind the scenes to confirm your employment status.

4 Once confirmed, the Additional Security Verification page will list the contact options from your profile. Select either Text, Email, Call, or Ask Admin options to receive a code to complete the final verification step.

5 Enter the code that you receive and click Verify You can now complete your benefits enrollment!

During your annual enrollment period, you have the opportunity to review, change or continue benefit elections each year. Changes are not permitted during the plan year (outside of annual enrollment) unless a Section 125 qualifying event occurs.

• Changes, additions or drops may be made only during the annual enrollment period without a qualifying event.

• Employees must review their personal information and verify that dependents they wish to provide coverage for are included in the dependent profile. Additionally, you must notify your employer of any discrepancy in personal and/or benefit information.

• Employees must confirm on each benefit screen (medical, dental, vision, etc.) that each dependent to be covered is selected in order to be included in the coverage for that particular benefit.

All new hire enrollment elections must be completed in the online enrollment system within the first 30 days of benefit eligible employment. Failure to complete elections during this timeframe will result in the forfeiture of coverage.

For supplemental benefit questions, you can call Higginbotham Public Sector at 866-914-5202 for assistance.

For benefit summaries and claim forms, go to your benefit website: www.mybenefitshub.com/prosperisd

Click the benefit plan you need information on (i.e., Dental) and you can find the forms you need under the Benefits and Forms section.

For benefit summaries and claim forms, go to the Prosper ISD benefit website: www.mybenefitshub.com/prosperisd. Click on the benefit plan you need information on (i.e., Dental) and you can find provider search links under the Quick Links section.

If the insurance carrier provides ID cards, you can expect to receive those 3-4 weeks after your effective date. For most dental and vision plans, you can login to the carrier website and print a temporary ID card or simply give your provider the insurance company’s phone number and they can call and verify your coverage if you do not have an ID card at that time. If you do not receive your ID card, you can call the carrier’s customer service number to request another card.

If the insurance carrier provides ID cards, but there are no changes to the plan, you typically will not receive a new ID card each year.

A Cafeteria plan enables you to save money by using pre-tax dollars to pay for eligible group insurance premiums sponsored and offered by your employer. Enrollment is automatic unless you decline this benefit. Elections made during annual enrollment will become effective on the plan effective date and will remain in effect during the entire plan year.

(CIS):

Marital Status

Change in Number of Tax Dependents

Change in Status of Employment Affecting Coverage Eligibility

Gain/Loss of Dependents’ Eligibility Status

Judgment/ Decree/Order

Eligibility for Government Programs

Changes in benefit elections can occur only if you experience a qualifying event. You must present proof of a qualifying event to your Benefit Office within 30 days of your qualifying event and meet with your Benefits Office to complete and sign the necessary paperwork in order to make a benefit election change. Benefit changes must be consistent with the qualifying event.

A change in marital status includes marriage, death of a spouse, divorce or annulment (legal separation is not recognized in all states).

A change in number of dependents includes the following: birth, adoption and placement for adoption. You can add existing dependents not previously enrolled whenever a dependent gains eligibility as a result of a valid change in status event.

Change in employment status of the employee, or a spouse or dependent of the employee, that affects the individual’s eligibility under an employer’s plan includes commencement or termination of employment.

An event that causes an employee’s dependent to satisfy or cease to satisfy coverage requirements under an employer’s plan may include change in age, student, marital, employment or tax dependent status.

If a judgment, decree, or order from a divorce, annulment or change in legal custody requires that you provide accident or health coverage for your dependent child (including a foster child who is your dependent), you may change your election to provide coverage for the dependent child. If the order requires that another individual (including your spouse and former spouse) covers the dependent child and provides coverage under that individual’s plan, you may change your election to revoke coverage only for that dependent child and only if the other individual actually provides the coverage.

Gain or loss of Medicare/Medicaid coverage may trigger a permitted election change.

Supplemental Benefits: Eligible employees must work 20 or more regularly scheduled hours each work week.

Eligible employees must be actively at work on the plan effective date for new benefits to be effective, meaning you are physically capable of performing the functions of your job on the first day of work concurrent with the plan effective date. For example, if your 2024 benefits become effective on January 1, 2024, you must be actively-at-work on January 1, 2024 to be eligible for your new benefits.

Dependent Eligibility: You can cover eligible dependent children under a benefit that offers dependent coverage, provided you participate in the same benefit, through the maximum age listed below. Dependents cannot be double covered by married spouses within the district as both employees and dependents.

Please note, limits and exclusions may apply when obtaining coverage as a married couple or when obtaining coverage for dependents.

Medical To age 26

Health Savings Account Tax Dependent

Hospital Indemnity To age 26

Telehealth Unmarried to age 26

Dental To age 26

Vision To age 26

Cancer To age 26

Accident To age 26

Critical Illness To age 26

Voluntary Life Unmarried to age 26

Individual Life Issue age: Children to age 23, Grandchildren to age 18; Keep to age 121

Identity Theft Unmarried to age 26

Medical FSA To age 26

Dependent Care FSA 12 or younger or qualified individual unable to care for themselves and claimed as tax dependent

Employee Assistance Plan To Age 26

Potential Spouse Coverage Limitations: When enrolling in coverage, please keep in mind that some benefits may not allow you to cover your spouse as a dependent if your spouse is enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Financial Benefit Services, or contact the insurance carrier for additional information on spouse eligibility.

FSA/HSA Limitations: Please note, in general, per IRS regulations, married couples may not enroll in both a Flexible Spending Account (FSA) and a Health Savings Account (HSA). If your spouse is covered under an FSA that reimburses for medical expenses then you and your spouse are not HSA eligible, even if you would not use your spouse’s FSA to reimburse your expenses. However, there are some exceptions to the general limitation regarding specific types of FSAs. To obtain more information on whether you can enroll in a specific type of FSA or HSA as a married couple, please reach out to the FSA and/or HSA provider prior to enrolling or reach out to your tax advisor for further guidance.

Potential Dependent Coverage Limitations: When enrolling for dependent coverage, please keep in mind that some benefits may not allow you to cover your eligible dependents if they are enrolled for coverage as an employee under the same employer. Review the applicable plan documents, contact Financial Benefit Services, or contact the insurance carrier for additional information on dependent eligibility.

Disclaimer: You acknowledge that you have read the limitations and exclusions that may apply to obtaining spouse and dependent coverage, including limitations and exclusions that may apply to enrollment in Flexible Spending Accounts and Health Savings Accounts as a married couple. You, the enrollee, shall hold harmless, defend, and indemnify Financial Benefit Services, LLC from any and all claims, actions, suits, charges, and judgments whatsoever that arise out of the enrollee’s enrollment in spouse and/or dependent coverage, including enrollment in Flexible Spending Accounts and Health Savings Accounts.

If your dependent is disabled, coverage may be able to continue past the maximum age under certain plans. If you have a disabled dependent who is reaching an ineligible age, you must provide a physician’s statement confirming your dependent’s disability. Contact your HR/Benefit Administrator to request a continuation of coverage.

Description

Health Savings Account (HSA) (IRC Sec. 223)

Approved by Congress in 2003, HSAs are actual bank accounts in employee’s names that allow employees to save and pay for unreimbursed qualified medical expenses tax-free.

Flexible Spending Account (FSA) (IRC Sec. 125)

Allows employees to pay out-of-pocket expenses for copays, deductibles and certain services not covered by medical plan, taxfree. This also allows employees to pay for qualifying dependent care tax- free.

Employer Eligibility A qualified high deductible health plan All employers

Contribution Source Employee and/or employer

Account Owner Individual

Underlying Insurance Requirement High deductible health plan

Minimum Deductible

Maximum Contribution

Permissible Use Of Funds

Cash-Outs of Unused Amounts (if no medical expenses)

Year-to-year rollover of account balance?

Does the account earn interest?

Portable?

Employee and/or employer

Employer

None

$1,600 single (2024)

$3,200 family (2024) N/A

$4,150 single (2024)

$8,300 family (2024) 55+ catch up +$1,000

Employees may use funds any way they wish. If used for non-qualified medical expenses, subject to current tax rate plus 20% penalty.

$3,200 (2024)

Reimbursement for qualified medical expenses (as defined in Sec. 213(d) of IRC).

Permitted, but subject to current tax rate plus 20% penalty (penalty waived after age 65). Not permitted

Yes, will roll over to use for subsequent year’s health coverage.

Yes

No. Access to some funds may be extended with a $500 rollover provision under the guidelines of the IRS.

No

Yes, portable year-to-year and between jobs. No

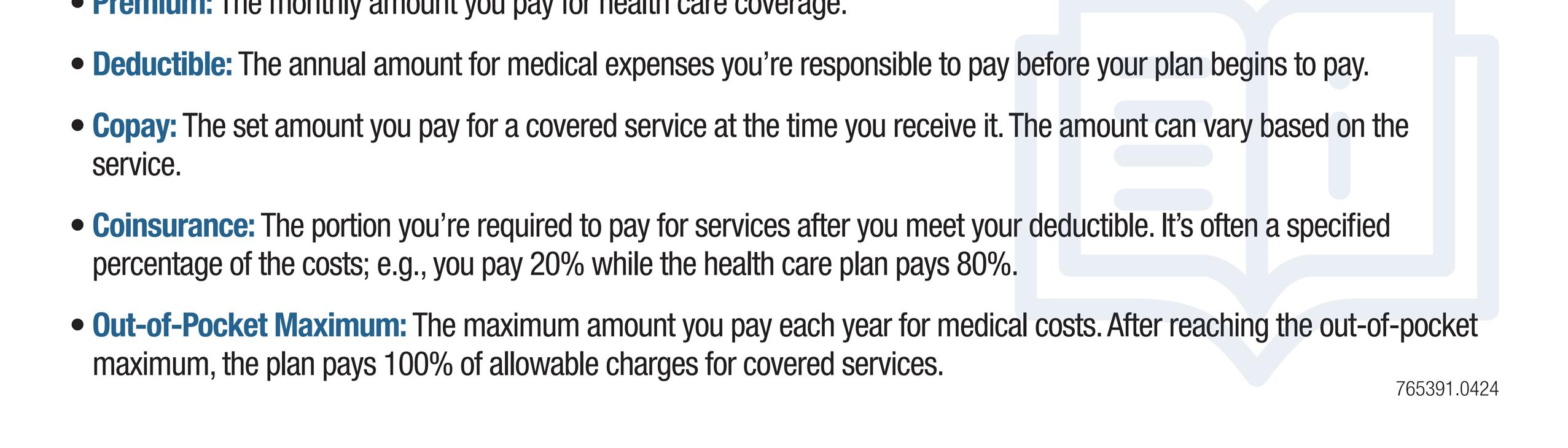

Major medical insurance is a type of health care coverage that provides benefits for a broad range of medical expenses that may be incurred either on an inpatient or outpatient basis.

For full plan details, please visit your benefit website: www.mybenefitshub.com/prosperisd

NOW TH A T’S CL EVE R.

Download your Clever RX card or Clever RX App to unlock exclusive savings.

ST EP 1:

Download the FREE Clever RX App From your App Store search for "Clever RX" and hit download. Make sure you enter in Group ID and in Member ID during the on-boarding process. This will unlock exclusive savings for you and your family!

ST EP 2 :

Find where you can save on your medication. Using your zip code, when you search for your medication Clever RX checks which pharmacies near you offer the lowest price. Savings can be up to 80% compared to what you're currently paying.

Present your Clever RX App or Clever RX card to your pharmacist. DID Y OU KNOW?

FREE to use. Save up to 80% off prescription drugs and beat copay prices.

ST AR T SA VI NG TOD AY W

100% FREE to use

Unlock discounts on thousands of medications

Save up to 80% off prescription drugs – often beats the average copay

Accepted at most pharmacies nationwide

ST EP 3 :

Click the voucher with the lowest price, closest location, and/or at your preferred pharmacy. Click "share" to text yourself the voucher for easy access when you are ready to use it. Show the voucher on your screen to the pharmacist when you pick up your medication.

ST EP 4:

Share the Clever RX App. Click "Share" on the bottom of the Clever RX App to send your friends, family, and anyone else you want to help receive instant discounts on their prescription medication. Over 70% of people can benefit from a prescription savings card.

NOW TH A T IS N O T ONLY CL EVER, I T IS CL EVE R RX 70%

Over 7 0% of peopl e c an benefi t fro m a pre sc rip ti on sav ing s c ard due t o high dedu ct ible heal t h plan s, high c opa ys , and being unde r in s ured or u ni ns ur ed

Ov er 3 0 % of pre sc rip t ion s ne ver ge t filled due t o high co sts 30%

4 0% of t he t op t en most prescribed d rugs ha v e in cr ea s ed in cost b y o v e r 1 00 %

An Employee Assistance Program (EAP) is a program that assists you in resolving problems such as finding child or elder care, relationship challenges, financial or legal problems, etc. This program is provided by your employer at no cost to you.

For full plan details, please visit your benefit website: www.mybenefitshub.com/prosperisd

The Deer Oaks Employee Assistance Program (EAP) is a free service provided for you, your dependents, and household members by your employer. This program offers a wide variety of counseling, referral, and consultation services, which are all designed to assist you and your family in resolving work and life issues to live happier, healthier, more balanced lives. From stress, addiction, and change management, to locating childcare facilities, legal assistance, and financial challenges, our qualified professionals are here to help. These services are completely confidential and can be easily accessed 24/7, offering you aroundthe-clock assistance for all of life’s challenges.

Program Access: You may access the EAP by calling the tollfree Helpline number, using our iConnectYou App, or instant messaging with a work-life consultant through our online instant messaging system.

Telephonic Assessments & Support: In-the-moment telephonic support and crisis intervention are available 24/7 along with intake and clinical assessments.

Short-term Counseling: Counseling sessions with a qualified counselor to assist with issues such as stress, anxiety, grief, marital/family challenges, relationship issues, addiction, etc. Counseling is available via structured telephonic sessions, video, and in-person at local provider offices.

Referrals & Community Resources: Our team provides referrals to local community resources, member health plans, support groups, legal resources, and child/elder care/daily living resources.

Advantage Legal Assist: Free 30 minute telephonic or in-person consultation with a plan attorney; 25% discount on hourly attorney fees if representation is required; unlimited online access to a wealth of educational legal resources, links, tools and forms; and interactive online Simple Will preparation.

Advantage Financial Assist: Unlimited telephonic consultation with an Accredited Financial Counselor qualified to advise on a range of financial issues such as bankruptcy prevention, debt reduction, financial planning, and identity theft; supporting educational materials available; unlimited online access to a wealth of educational financial resources, links, tools and forms (i.e. tax guides, financial calculators, etc.).

Alternate Modes of Support: Your EAP offers support alternatives in addition to traditional short-term counseling including telephonic life coaching, AWARE stress reduction sessions, and virtual group counseling. During your call with one of our counselors, ask if these programs would be right for you.

Work-life Services: Our work-life consultants are available to assist you with a wide range of daily living resources such as locating pet sitters, event planners, home repair, tutors, travel planning, and moving services. Simply call the Helpline for resource and referral information.

Child & Elder Care Referrals: Our child and elder care specialists can help you with your search for licensed child and elder care facilities in your area. They will discuss your needs, provide guidance, resources, and qualified referral packets. Searchable databases and other resources are also available on the Deer Oaks member website.

Take the High Road Ride Reimbursement Program: Deer Oaks reimburses members for their cab, Lyft and Uber fares in the event that they are incapacitated due to impairment by a substance or extreme emotional condition. This service is available once per year per participant, with a maximum reimbursement of $45.00 (excludes tips).

Contact Us:

Toll-Free: (888) 993-7650

Website: www.deeroakseap.com

Email: eap@deeroaks.com

A Health Savings Account (HSA) is a personal savings account where the money can only be used for eligible medical expenses. Unlike a flexible spending account (FSA), the money rolls over year to year however only those funds that have been deposited in your account can be used. Contributions to a Health Savings Account can only be used if you are also enrolled in a High Deductible Health Care Plan (HDHP).

www.mybenefitshub.com/prosperisd

For full plan details, please visit your benefit website: www.mybeneitshub.com/sampleisd

A Health Savings Account (HSA) is more than a way to help you and your family cover health care costs – it is also a tax-exempt tool to supplement your retirement savings and cover health expenses during retirement. An HSA can provide the funds to help pay current health care expenses as well as future health care costs.

A type of personal savings account, an HSA is always yours even if you change health plans or jobs. The money in your HSA (including interest and investment earnings) grows tax-free and spends tax-free if used to pay for qualified medical expenses. There is no “use it or lose it” rule — you do not lose your money if you do not spend it in the calendar year — and there are no vesting requirements or forfeiture provisions. The account automatically rolls over year after year.

You are eligible to open and contribute to an HSA if you are:

• Enrolled in an HSA-eligible HDHP (High Deductible Health Plan) Not covered by another plan that is not a qualified HDHP, such as your spouse’s health plan

• Not enrolled in a Health Care Flexible Spending Account, nor should your spouse be contributing towards a Health Care Flexible Spending Account

• Not eligible to be claimed as a dependent on someone else’s tax return

• Not enrolled in Medicare or TRICARE

• Not receiving Veterans Administration benefits

You can use the money in your HSA to pay for qualified medical expenses now or in the future. You can also use HSA funds to pay health care expenses for your dependents, even if they are not covered under your HDHP.

Your HSA contributions may not exceed the annual maximum amount established by the Internal Revenue Service. The annual contribution maximum for 2024 is based on the coverage option you elect:

• Individual – $4,150

• Family (filing jointly) – $8,300

You decide whether to use the money in your account to pay for qualified expenses or let it grow for future use. If you are 55 or older, you may make a yearly catch-up contribution of up to $1,000 to your HSA. If you turn 55 at any time during the plan year, you are eligible to make the catch-up contribution for the entire plan year.

If you meet the eligibility requirements, you may open an HSA administered by EECU. You will receive a debit card to manage your HSA account reimbursements. Keep in mind, available funds are limited to the balance in your HSA.

• Always ask your health care provider to file claims with your medical provider so network discounts can be applied. You can pay the provider with your HSA debit card based on the balance due after discount.

• You, not your employer, are responsible for maintaining ALL records and receipts for HSA reimbursements in the event of an IRS audit.

• You may open an HSA at the financial institution of your choice, but only accounts opened through EECU are eligible for automatic payroll deduction and company contributions.

• Online/Mobile: Sign-in for 24/7 account access to check your balance, pay bills and more.

• Call/Text: (817) 882-0800 EECU’s dedicated member service representatives are available to assist you with any questions. Their hours of operation are Monday through Friday from 8:00 a.m. to 7:00 p.m. CT, Saturday 9:00 a.m. to 1:00 p.m. CT and closed on Sunday.

• Lost/Stolen Debit Card: Call the 24/7 debit card hotline at (800)333-9934.

• Stop by a local EECU financial center: www.eecu.org/ locations.

Do you have kids playing sports, are you a weekend warrior, or maybe accident prone? Accident plans are designed to help pay for medical costs associated with accidents and benefits are paid directly to you.

For full plan details, please visit your benefit website: www.mybenefitshub.com/prosperisd

You have a choice of two accident plans, which allows you the flexibility to enroll for the coverage that best meets your needs. This insurance provides benefits when injuries, medical treatment and/or services occur as the result of a covered accident. Unless otherwise noted, the benefit amounts payable under each plan are the same for you and your dependent(s).

FEATURES

Ability Assist® EAP2 – 24/7/365 access to help for financial, legal or emotional issues

HealthChampionSM3 – Administrative & clinical support following serious illness or injury

Claims

The claim form is online at thehartford.com/benefits/myclaim. If you need assistance completing this form, contact 1-866-547-4205. In addition, they can help you understand how to submit the claim successfully and provide guidance on supporting documents that may be required.

This is an affordable supplemental plan that pays you should you be inpatient hospital confined. This plan complements your health insurance by helping you pay for costs left unpaid by your health insurance.

For full plan details, please visit your benefit website: www.mybenefitshub.com/prosperisd

Hospital indemnity (HI) insurance pays a cash benefit if you or an insured dependent (spouse or child) are confined in a hospital for a covered illness or injury. It also provides additional daily benefits for related services. The benefits are paid in lump sum amounts to you, and can help offset expenses that primary health insurance doesn’t cover (like deductibles, co-insurance amounts or co- pays), or benefits can be used for any nonmedical expenses (like housing costs, groceries, car expenses, etc.).

You have a choice of two hospital indemnity plans, which allows you the flexibility to enroll for the coverage that best meets your current financial protection needs. Benefit amounts are based on the plan in effect for you or an insured dependent at the time the covered event occurs. Unless otherwise noted, the benefit amounts payable under each plan are the same for you and your dependent(s). There is no limitation for pre-existing conditions. You and your dependents must be citizens or legal residents of the United States.

Ability Assist® Counseling Services provides access to Master’s- and PhD-degreed clinicians for 24/7 assistance if you’re enrolled in coverage. This includes 3 face-to-face visits per occurrence per year for emotional concerns and unlimited phone consultations for financial, legal, and work-life concerns.

For more information on Ability Assist® Counseling Services: Call 1-800-964-3577

Visit www.guidanceresources.com

Company name: Abili Company ID: HLF90

HealthChampionSM offers unlimited access to benefit specialists and nurses for administrative and clinical support to address medical care and health insurance claims concerns if you’re enrolled in coverage. Service includes: guidance on health insurance claims and billing support, explanation of benefits, cost estimates and fee negotiation, information related to conditions and available treatments, and support to help prepare for medical visits.

For more information on HealthChampionSM Services

Call 1-800-964-3577

Visit www.guidanceresources.com

Company name: Abili Company ID: HLF902

LIMITATIONS & EXCLUSIONS

Exclusions. This insurance does not provide benefits for any loss that results from or is caused by:

• Suicide or attempted suicide, whether sane or insane, or intentional self-infliction

• Voluntary intoxication (as defined by the law of the jurisdiction in which the illness or injury occurred) or while under the influence of any narcotic, drug or controlled substance, unless administered by or taken according to the instruction of a physician or medical professional

• Voluntary intoxication through use of poison, gas or fumes, whether by ingestion, injection, inhalation or absorption

• Voluntary commission of or attempt to commit a felony, voluntary participation in illegal activities (except for misdemeanor violations), voluntary participation in a riot, or voluntary engagement in an illegal occupation

• Incarceration or imprisonment following conviction for a crime

• Travel in or descent from any vehicle or device for aviation or aerial navigation, except as a fare-paying passenger in a commercial aircraft (other than a charter airline) on a regularly scheduled passenger flight or while traveling on business of the policyholder

• Ride in or on any motor vehicle or aircraft engaged in acrobatic tricks/stunts (for motor vehicles), acrobatic/stunt flying (for aircraft), endurance tests, off- road activities (for motor vehicles), or racing

• Participation in any organized sport in a professional or semi-professional capacity

• Participation in abseiling, base jumping, Bossaball, bouldering, bungee jumping, cave diving, cliff jumping, free climbing, freediving, freerunning, hang gliding, ice climbing, Jai Alai, jet powered flight, kite surfing, kiteboarding, luging, missed climbing, mountain biking, mountain boarding, mountain climbing, mountaineering, parachuting, paragliding, parakiting, paramotoring, parasailing, Parkour, proximity flying, rock climbing, sail gliding, sandboarding, scuba diving, sepak takraw, slacklining, ski jumping, skydiving, sky surfing, speed flying, speed riding, train surfing, tricking, wingsuit flying, or other similar extreme sports or high risk activities

• Travel or activity outside the United States or Canada

• Active duty service or training in the military (naval force, air force or National Guard/Reserves or equivalent) for service/training extending beyond 31 days of any state, country or international organization, unless specifically allowed by a provision of the certificate

• Involvement in any declared or undeclared war or act of war (not including acts of terrorism), while serving in the military or an auxiliary unit attached to the military, or working in an area of war whether voluntarily or as required by an employer

Critical illness insurance can be used towards medical or other expenses. It provides a lump sum benefit payable directly to the insured upon diagnosis of a covered condition or event, like a heart attack or stroke. The money can also be used for non-medical costs related to the illness, including transportation, child care, etc.

For full plan details, please visit your benefit website: www.mybenefitshub.com/prosperisd

To be insured under the Policy an Employee must elect coverage for themself and any Dependent(s). The Employee is required to pay a premium for the coverage selected. Payment of premium does not guarantee eligibility for coverage.

Any amount of insurance for a Spouse/Partner or Dependent Child(ren) will be rounded to the next higher multiple of $1,000, if not already an even multiple of $1,000. All Coverage Amount(s) are Guaranteed Issue.

Employee Coverage Amount Choice of $10,000 to $40,000 in increments of $10,000

Spouse Coverage Amount

Child(ren) Coverage Amount

50% of your coverage amount

50% of your coverage amount at no cost. Must be under age 26 and elected as a covered member during enrollment.

• ST-Segment Elevation Myocardial Infarction (STEMI)

•

• Stroke Without Impairment (including Transient Ischemic Attack (TIA))

• Mild Stroke

• Moderate Stroke

• Severe Stroke

Critical Illnesses included in the Child Conditions Category must be Diagnosed during Childhood, with the exception of Type 1 Diabetes which may be Diagnosed during Childhood or Adolescence.

Continuation of Coverage

Extended Continuation

Ability Assist® EAP1

HealthChampionSM1

You may be able to continue insurance for You and Your Dependent(s) in certain circumstances when You are no longer Actively at Work, with payment of premium and subject to certain conditions. The available continuation option(s) are described in the Certificate.

You or an insured Spouse/Partner, in certain circumstances, may continue coverage under the Policy when insurance would otherwise end under the Termination of Coverage provision, with payment of premium and subject to certain conditions. This provision is fully described in the Certificate.

24/7/365 access to help for financial, legal, or emotional issues

Administrative and clinical support following serious illness or injury

1. ONLINE CLAIMS

• Visit the Supplemental Insurance Claims Portal at TheHartford.com/benefits/myclaim.

• Register for access if you have not done so already. (Please note: We must have current eligibility from your benefits administrator for you and any dependents to be eligible to register on the portal.)

• Log in to the portal.

• Click on “Complete Your Claim Form Online” under the Quick Links section.

• Follow the prompts to complete and submit a claim.

2. FILE A CLAIM OVER THE PHONE

(Applicable to Health Screening Benefit/Accident Protection Benefit Only)

• File your claim by calling 866-547-4205.

• Available Monday through Friday, 8:00 a.m. - 6:00 p.m.

• SUBMIT A CLAIM VIA MAIL OR

• Download a claim form at TheHartford.com/benefits/myclaim.

• Complete the form and mail or fax it to: The Hartford Supplemental Insurance Benefit Department P.O. Box 99906 Grapevine, TX 76099

Fax Number: 469-417-1952

For assistance filing your claim, call 866-547-4205.

NOTE: Go to www.mybenefitshub.com/prosperisd under the Criical Illness Section for a full

Dental insurance is a coverage that helps defray the costs of dental care. It insures against the expense of routine care, dental treatment and disease.

For full plan details, please visit your benefit website: www.mybenefitshub.com/prosperisd

The Lincoln DentalConnect® PPO Plans:

• Cover many preventive, basic, and major dental care services

• Also cover orthodontic treatment for children

• Let you choose any dentist you wish, though you can lower your out-of-pocket costs by selecting a contracting dentist

• Do not make you and your loved ones wait six months between routine cleanings

Calendar (Annual) Deductible

Waiting Period

Individual: $50 Family: $150 Waived for Preventive

Individual: $50 Family: $150 Waived for Preventive

Individual: $50 Family: $150 Waived for Preventive

Deductibles are combined for basic and major Contracting Dentists’ services. Deductibles are combined for basic and major Non-Contracting Dentists’ services.

Visit LincolnFinancial.com/FindADentist

You can search by:

• Location

• Dentist name or office name

• Distance you are willing to travel

• Specialty, language and more

*Orthodontic Coverage is available for dependent children.

There are no benefit waiting periods for any service types

Your search will automatically provide up to 100 dentists that most closely match your criteria. If your search does not locate the dentist you prefer, you can nominate one—just click the Nominate a Dentist link and complete the online form.

*Services included in each category vary by plan. Refer to your benefit website for a full list of details for each plan.

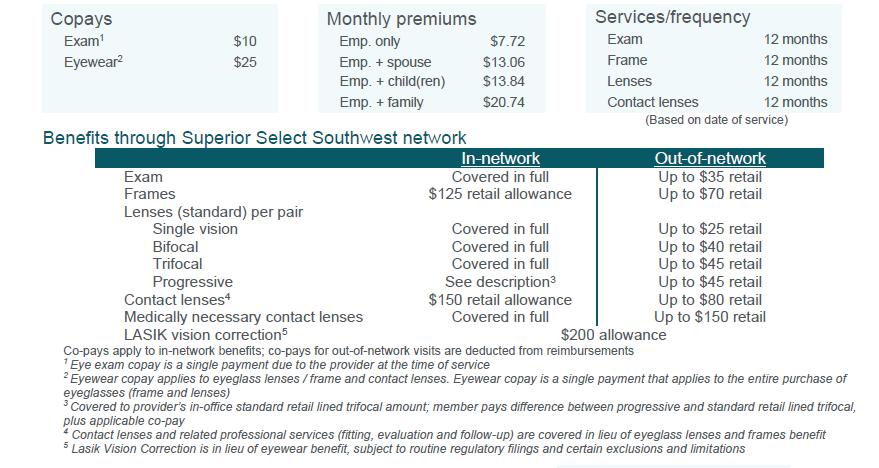

Vision insurance helps cover the cost of care for maintaining healthy vision. Similar to an annual checkup at your family doctor, routine eyecare is necessary to ensure that your eyes are healthy and to check for any signs of eye conditions or diseases . Most plans cover your routine eye exam with a copay and provide an allowance for Frames or Contact Lenses.

For full plan details, please visit your benefit website: www.mybenefitshub.com/ prosperisd

Superior Vision Customer Service 1-800-507-3800

• In-network benefits available through network eye care professionals.

• Find an in-network eye care professional at superiorvision.com. Call your eye doctor to verify network participation.

• Obtain a vision exam with either an MD or OD.

• Flexibility to use different eye care professionals for exam and for eyewear.

• Access your benefits through our mobile app – Display member ID card – view your member ID card in full screen or save to wallet .

Our network is built to support you.

• We manage one of the largest eye care professional networks in the country .

• The network includes 50 of the top 50 national retailers. Examples include:

• In-network online retail Providers :

Members may also receive additional discounts, including 20% off lens upgrades and 30% off additional pairs of glasses.*

A LASIK discount is available to all covered members. Our Discounted LASIK services are administered by QualSight. Visit lasik.sv.qualsight.com to learn more.

Members save up to 40% on brand name hearing aids and have access to a nationwide network of licensed hearing professionals through Your Hearing Network.

*Discounts are provided by participating locations. Verify if their eye care professional participates in the discount featur e before receiving service.

Not all providers participate in Superior Vision Discounts, including the member out-of-pocket features. Call your provider prior to scheduling an appointment to confirm if he/she offers the discount and member out-of-pocket features. The discount and member outof-pocket features are not insurance. Discounts and member out -ofpocket are subject to change without notice and do not apply if prohibited by the manufacturer. Lens options may not be availa ble from all Superior Vision providers/all locations.

Disability insurance protects one of your most valuable assets, your paycheck. This insurance will replace a portion of your income in the event that you become physically unable to work due to sickness or injury for an extended period of time.

For full plan details, please visit your benefit website: www.mybenefitshub.com/prosperisd

Disability Insurance pays you a portion of your earnings if you cannot work because of a disabling illness or injury. You can purchase Disability Insurance through your employer. This highlight sheet is an overview of your Disability Insurance. Once a group policy is issued to your employer; a certificate of insurance will be available to explain your coverage in detail. Actively at Work: You must be at work with your Employer on your regularly scheduled workday. On that day, you must be performing for wage or profit all of your regular duties in the usual way and for your usual number of hours. If school is not in session due to normal vacation or school break(s), Actively at Work shall mean you are able to report for work with your Employer, performing all the regular duties of Your Occupation in the usual way for your usual number of hours as if school was in session.

Coverage Amount: You may purchase coverage that will pay you a monthly flat dollar benefit in $100 increments between $200 and $7,500 that cannot exceed 66 2/3% of your current monthly earnings.

Elimination Period: You must be disabled for at least the number of days indicated by the elimination period that you select before you can receive a disability benefit payment. The elimination period that you select consists of two numbers. The first number shows the number of days you must be disabled by an accident before your benefits can begin. The second number indicates the number of days you must be disabled by a sickness before your benefits can begin. For those employees electing an elimination period of 30 days or less, if you are confined to a hospital for 24 hours or more due to a disability, the elimination period will be waived, and benefits will be payable from the first day of hospitalization.

Definition of Disability: Disability is defined as The Hartford’s contract with your employer. Typically, disability means that you cannot perform one or more of the essential duties of your occupation due to injury, sickness, pregnancy or other medical conditions covered by the insurance, and as a result, your current

monthly earnings are 80% or less of your pre-disability earnings. Once you have been disabled for 24 months, you must be prevented from performing one or more essential duties of any occupation, and as a result, your monthly earnings are 66 2/3% or less of your pre-disability earnings.

Pre-Existing Condition Limitation: Your policy limits the benefits you can receive for a disability caused by a pre-existing condition. In general, if you were diagnosed or received care for a disabling condition within the 3 consecutive months just prior to the effective date of this policy, your benefit payment will be limited, unless: You have not received treatment for the disabling condition within 3 months, while insured under this policy, before the disability begins, or You have been insured under this policy for 12 months before your disability begins.

If your disability is a result of a pre-existing condition, we will pay benefits for a maximum of 6 weeks.

Maximum Benefit Duration: Benefit Duration is the maximum time for which we pay benefits for disability resulting from sickness or injury. Depending on the age at which disability occurs, the maximum duration may vary. Please see the applicable schedule below based on the Premium benefit option. Premium Option: For the Premium benefit option – the table below applies to disabilities resulting from sickness or injury.

Prior to 60 To Age 65

Age 60 -64 60 Months

Age 65 -67 To age 70

Age 68 and over 24 months

Benefit Integration: For the first 6 months your benefit may be reduced by other income due to your disability such as a leave of absence, less the cost of paying a substitute teacher if required to do so, or income received from your Employer’s assault leave plan or similar leave of absence plan resulting from you being physically assaulted while acting in your official capacity.

After 6 months, your benefit may be reduced by other income you receive or are eligible to receive due to your disability, such as:

• Social Security Disability Insurance

• State Teacher Retirement Disability Plans

• Other employer-based disability insurance coverage you may have

• Unemployment benefits

• Retirement benefits that your employer fully or partially pays for (such as a pension plan)

Your plan includes a minimum benefit of 25% of your elected benefit.

Added value services include Ability Assist Counseling Services with three face-to-face counseling sessions per occurrence per year. Call 800-964-3577 or register at: www.guidanceresource.com Company code HLF902 Company Name ABILI. Other services include Funeral Concierge Services, Estate Guidance Will Services and Beneficiary Counseling Services.

How to file a claim: Claims are now processed telephonically by calling 866-547-9124. Just refer to policy number 872784 and follow these easy steps:

1. If your absence is scheduled, call 30 days prior and if unscheduled, please call as soon as possible.

2. Have your information ready

• Name address other key information

• Name of department and last day full day of active work

• The nature of your claim or leave request.

• Your treating physicians name, address, and fax numbers

With your information handy, you will be assisted by a member who will take your information, answer your questions, and file your claim.

What is disability insurance? Disability insurance protects one of your most valuable assets, your paycheck. This insurance will replace a portion of your income in the event that you become physically unable to work due to sickness or injury for an extended period of time. This type of disability plan is called an educator disability plan and includes both long and short term coverage into one convenient plan.

Pre-Existing Condition Limitations - Please note that all plans will include pre-existing condition limitations that could impact you if you are a first-time enrollee in your employer’s disability plan. This includes during your initial new hire enrollment. Please review your plan details to find more information about preexisting condition limitations.

How do I choose which plan to enroll in during my open enrollment?

1. First choose your elimination period. The elimination period, sometimes referred to as the waiting period, is how long you are disabled and unable to work before your benefit will begin. This will be displayed as 2 numbers such as 0/7, 14/14, 30/30, 60/60, 90/90, etc.

The first number indicates the number of days you must be disabled due to Injury and the second number indicates the number of days you must be disabled due to Sickness

When choosing your elimination period, ask yourself, “How long can I go without a paycheck?” Based on the answer to this question, choose your elimination period accordingly.

Important Note- some plans will waive the elimination period if you choose 30/30 or less and you are confined as an inpatient to the hospital for a specific time period. Please review your plan details to see if this feature is available to you.

2. Next choose your benefit amount. This is the maximum amount of money you would receive from the carrier on a monthly basis once your disability claim is approved by the carrier.

When choosing your monthly benefit, ask yourself, “How much money do I need to be able to pay my monthly expenses?” Based on the answer to this question, choose your monthly benefit accordingly.

Choose your desired elimination period.

Choose your Benefit Amount from the drop down box.

Cancer insurance offers you and your family supplemental insurance protection in the event you or a covered family member is diagnosed with cancer. It pays a benefit directly to you to help with expenses associated with cancer treatment.

For full plan details, please visit your benefit website: www.mybenefitshub.com/prosperisd

THIS IS ONLY A SUMMARY OF BENEFITS. PLEASE REFER TO THE CERTIFICATE OF COVERAGE FOR LIMITATIONS AND EXCLUSIONS TO DETERMINE ACTUAL COVERAGES. GO TO WWW.MYBENEFITSHUB.COM/PROSPERISD UNDER THE CANCER SECTION FOR COMPLETE DETAILS.

Group term life is the most inexpensive way to purchase life insurance. You have the freedom to select an amount of life insurance coverage you need to help protect the well-being of your family.

Accidental Death & Dismemberment is life insurance coverage that pays a death benefit to the beneficiary, should death occur due to a covered accident. Dismemberment benefits are paid to you, according to the benefit level you select, if accidentally dismembered.

For full plan details, please visit your benefit website: www.mybenefitshub.com/prosperisd

The Group Term Life and Accidental Death and Dismemberment (AD&D) insurance available through your employer gives extra protection that you and your family may need. Life and AD&D insurance offers financial protection by providing you coverage in case of an untimely death or an accident that destroys your income- earning ability. Life benefits are disbursed to your beneficiaries in a lump sum in the event of your death.

Life Insurance Coverage Information

Employee

Reductions at age 65 and 70

Benefit: $10,000

AD&D: Included

Spouse Not Included

Child(ren) Not Included

Note: Basic Life is Employer Paid

Benefit: Increments of $10,000

Maximum: the lesser of 5x earnings or $500,000

Benefit: Increments of $10,000

Maximum: the lesser of 100% of your supplemental coverage or $250,000

Benefit: Increments of $5,000 Maximum: $10,000

Group Voluntary Accidental Death & Dismemberment (AD&D) insurance pays your beneficiary a death benefit if you die due to a covered accident or pays you if you are unexpectedly injured in a covered accident. The benefits are paid in lump sum amounts to you (or your beneficiary) and can be used to pay for health care expenses not covered by your major medical insurance, help replace income lost while not working, funeral expenses, or however you choose. Acci-dental death benefits are paid in addition to any life insurance.

Increments of $10,000

the lesser of 5x earnings or $500,000

365

LOSS FROM ACCIDENT (cont’d)

(Paraplegia)

Movement of the Upper and Lower Limbs of One Side of the Body (Hemiplegia)

Hand or Foot

and Index Finger of Either Hand

Your benefit will be reduced by 35% at age 65 and 50% at age 70. Reductions will be applied to the original amount.

If you are enrolled in insurance coverage with The Hartford, you may also be eligible to receive additional services at no cost to you. These services help with challenges that come before and after a claim. Be sure to read the information provided below; The Hartford wants to be there when you need us.

COVERAGE ENROLLED IN

Life & Accidental Death and Dismemberment

ADDITIONAL SERVICES AVAILABLE

• Beneficiary Assist® Counseling Services

• EstateGuidance® Will Services

• Funeral Planning and Concierge Services

• Travel Assistance Services with ID Theft Protection and Assistance

Refer to your benefit website for details on these additional services.

This insurance coverage includes certain limitations and exclusions. The certificate details all provisions, limitations, and exclusions for this insurance coverage. A copy of the certificate can be obtained at www.mybenefitshub.com/prosperisd com under the Basic Life and Voluntary Life Sections.

Identity theft protection monitors and alerts you to identity threats. Resolution services are included should your identity ever be compromised while you are covered.

For full plan details, please visit your benefit website: www.mybenefitshub.com/prosperisd

ID Watchdog is everywhere you can’t be — monitoring credit reports, social media, transaction records, public records and more — to help you better protect your identity. And don’t worry, we’re always here for you. In fact, our U.S.-based customer care team is available 24/7/365 at 866.513.1518.

Monitor & Detect

• Dark Web Monitoring*

• High-Risk Transactions Monitoring*

• Subprime Loan Monitoring*

• Public Records Monitorin*

• USPS Change of Address Monitoring

• Identity Profile Report

Manage & Alert

• Child Credit Lock | 1 Bureau*

• Financial Accounts Monitoring

• Social Network Alerts*

• Registered Sex Offender Reporting*

• Customizable Alert Options

• Breach Alert Emails

• Mobile App

Support & Restore

• Identity Theft Resolution Specialists (Resolution for Pre-existing Conditions)*

• 24/7/365 U.S.-based Customer Care Center

• Lost Wallet Vault & Assistance

• Deceased Family Member Fraud Remediation

• Fraud Alert & Credit Freeze Assistance

*Helps better protect children

1 Bureau = Equifax® | Applies to the 1B plan and includes monthly monitoring Multi-Bureau = Equifax, TransUnion® | Applies to the Platinum Plan to lock your credit report to avoid fraud

3 Bureau = Equifax, Experian®, TransUnion | Applies to the Platinum Plan and allows monitoring for all 3 credit bureaus listed

Please refer to the website, www.mybenefitshub.com/prosperisd for more details.

24/7 access to board-certified doctors for treatment of common medical concerns with ongoing communication with your doctor. Accessible virtually through phone, web, and desktop computer.

Coordinated

If needed, urgent care can seamlessly transition to Recuro’s ongoing virtual primary care to improve patient health and preempt future issues.

Patients can see a board-certified physician wherever they are, whenever they need it.

Patients receive treatment plans based on their unique needs and can ask follow-up questions to their doctors after the visit, free of charge.

Comprehensive behavioral health care from therapy and counseling to psychiatry and medication management, all delivered virtually.

Primary care and behavioral health doctors collaborate closely to ensure coordinated treatment plans that care for the whole patient. Holistic

Pharmacogenetic (PGx) testing ensures the right behavioral health medication is prescribed, the first time. Targeted

While today behavioral healthcare is difficult to access for so many, at Recuro it is available and affordable. Accessible

A Flexible Spending Account allows you to pay for eligible healthcare expenses with a pre-loaded debit card. You choose the amount to set aside from your paycheck every plan year, based on your employer’s annual plan limit. This money is use it or lose it within the plan year.

For full plan details, please visit your benefit website: www.mybenefitshub.com/sampleisd

www.mybenefitshub.com/prosperisd

The Health Care FSA covers qualified medical, dental and vision expenses for you or your eligible dependents. You may contribute up to $3,200 annually to a Health Care FSA and you are entitled to the full election from day one of your plan year. Eligible expenses include:

• Dental and vision expenses

• Medical deductibles and coinsurance

• Prescription copays

• Hearing aids and batteries

You may not contribute to a Health Care FSA if you contribute to a Health Savings Account (HSA)

The Higginbotham Benefits Debit Card gives you immediate access to funds in your Health Care FSA when you make a purchase without needing to file a claim for reimbursement. If you use the debit card to pay anything other than a copay amount, you will need to submit an itemized receipt or an Explanation of Benefits (EOB).

The Dependent Care FSA helps pay for expenses associated with caring for elder or child dependents so you or your spouse can work or attend school full time. You can use the account to pay for day care or baby sitter expenses for your children under age 13 and qualifying older dependents, such as dependent parents. Reimbursement from your Depend ent Care FSA is limited to the total amount deposited in your account at that time. To be eligible, you must be a single parent or you and your spouse must be employed outside the home, disabled or a full-time student.

• Overnight camps are not eligible for reimbursement (only day camps can be considered).

• If your child turns 13 midyear, you may only request reimbursement for the part of the year when the child is under age 13.

• You may request reimbursement for care of a spouse or dependent of any age who spends at least eight hours a day in your home and is mentally or physically incapable of self-care.

• The dependent care provider cannot be your child under age 19 or anyone claimed as a dependent on your income taxes.

• The maximum per plan year you can contribute to a Health Care FSA is $3,200. The maximum per plan year you can contribute to a Dependent Care FSA is $5,000 when filing jointly or head of household and $2,500 when married filing separately.

• You cannot change your election during the year unless you experience a Qualifying Life Event.

• In most cases, you can continue to file claims incurred during the plan year for another 90 days after the plan year ends.

• Your Health Care FSA debit card can be used for health care expenses only. It cannot be used to pay for dependent care expenses.

• Review your employer's Summary Plan Document for full details. FSA rules vary by employer.

Health care reform legislation requires that certain over-the-counter (OTC) items require a prescription to qualify as an eligible Health Care FSA expense. You will only need to obtain a one-time prescription for the current plan year. You can continue to purchase your regular prescription medications with your FSA debit card. However, the FSA debit card may not be used as payment for an OTC item, even when accompanied by a prescription.

Higginbotham Portal

The Higginbotham Portal provides information and resources to help you manage your FSAs.

• Access plan documents, letters and notices, forms, account balances, contributions and other plan information

• Update your personal information

• Utilize Section 125 tax calculators

• Look up qualified expenses

• Submit claims

• Request a new or replacement Benefits Debit Card

Register on the Higginbotham Portal

Visit https://flexservices.higginbotham.net and click Register. Follow the instructions and scroll down to enter your information.

• Enter your Employee ID, which is your Social Security number with no dashes or spaces.

• Follow the prompts to navigate the site.

• If you have any questions or concerns, contact Higginbotham:

∗ Phone – 866-419-3519

∗ Questions – flexsupport@higginbotham.net

∗ Fax – 866-419-3516

∗ Claims- flexclaims@higginbotham.net

$14/month $14/month

Comprehensive coverage and care for emergency transport.

Our Emergent Plus membership plan includes:

Emergency Ground Ambulance Coverage1

Your out-of-pocket expenses for your emergency ground transportation to a medical facility are covered with MASA.

Emergency Air Ambulance Coverage1

Your out-of-pocket expenses for your emergency air transportation to a medical facility are covered with MASA.

When specialized care is required but not available at the initial emergency facility, your out-of-pocket expenses for the ground or air ambulance transfer to the nearest appropriate medical facility are covered with MASA.

Should you need continued care and your care provider has approved moving you to a hospital nearer to your home, MASA coordinates and covers the expense for ambulance transportation to the approved medical facility.

Did you know?

51.3 million emergency responses occur each year

MASA protects families against uncovered costs for emergency transportation and provides connections with care services.

Source: NEMSIS, National EMS Data Report, 2023

MASA is coverage and care you can count on to protect you from the unexpected. With us, there is no “out-of-network” ambulance. Just send us the bill when it arrives and we’ll work to ensure charges are covered. Plus, we’ll be there for you beyond your initial ride, with expert coordination services on call to manage complex transport needs during or after your emergency — such as transferring you and your loved ones home safely.

Protect yourself, your family, and your family’s financial future with MASA.

Enrollment Guide General Disclaimer: This summary of benefits for employees is meant only as a brief description of some of the programs for which employees may be eligible. This summary does not include specific plan details. You must refer to the specific plan documentation for specific plan details such as coverage expenses, limitations, exclusions, and other plan terms, which can be found at the Prosper ISD Benefits Website. This summary does not replace or amend the underlying plan documentation. In the event of a discrepancy between this summary and the plan documentation the plan documentation governs. All plans and benefits described in this summary may be discontinued, increased, decreased, or altered at any time with or without notice.

Rate Sheet General Disclaimer: The rate information provided in this guide is subject to change at any time by your employer and/or the plan provider. The rate information included herein, does not guarantee coverage or change or otherwise interpret the terms of the specific plan documentation, available at the Prosper ISD Benefits Website, which may include additional exclusions and limitations and may require an application for coverage to determine eligibility for the health benefit plan. To the extent the information provided in this summary is inconsistent with the specific plan documentation, the provisions of the specific plan documentation will govern in all cases.