Taking Action Toward a Brighter Future

Federal is a recognized leader in the ownership, operation, and redevelopment of high-quality retail-based properties located primarily in major coastal markets from Washington, D.C. to Boston, as well as Silicon Valley and Los Angeles.

Founded in 1962, our mission is to deliver longterm, sustainable growth through investing in communities where retail demand exceeds supply. Our expertise ranges from small neighborhood shopping centers to urban, mixed-use neighborhoods and everything in between.

Our mission is supported by the environmental, social and governance (ESG) principles that we use to manage all aspects of our investments from concept to execution. We believe that ESG not only helps us be a better business but it is our business.

employees (53% women / 47% men)

8.4

319 years average tenure of employees

Federal’s ESG efforts are guided by the United Nations Sustainable Development Goals (UNSDGs). We have focused our efforts on the specific UNSDGs where our business can have the most impact, and our employees advance these goals through the valuable work we do every day.

This report is the primary way in which we convey to our stakeholders our commitment and approach to ESG matters; it also supplements information included in our Annual Report/Form 10-K and our Proxy Statement, both of which are available on our website.

We have aligned this report with the Global Reporting Initiative (GRI) and are providing additional disclosures in alignment with the Sustainability Accounting Standards Board (SASB) and the Taskforce on Climate-Related Financial Disclosures (TCFD).

Received MSCI ESG rating of AAA, upgraded from prior rating of BBB

Approved science-based Scopes 1 and 2 consistent temperature increase

Awarded highest rating of Gender Balanced board from 50/50 Women on Boards for 2nd consecutive year

Named Green Lease by the Institute for Market and U.S. Department

Recognized as Top Workplace by Washington Post for Corporate Headquarters and Northern Virginia regional office

science-based target for consistent with managing increase to 1.5°C

1st in peer group for operating assets Sector Leader in Development for 2nd year

Lease Leader Gold Market Transformation of Energy 2018-2024

Named Best ESG Real Estate Investment Strategy for 2nd consecutive year

Recognized for Gold Level achievement in health and wellness programs for employees

Over the last several years, I have taken the opportunity in this letter to describe how ESG is embedded into everything we do, and how it has been that way for decades. We did not always call our actions ESG, but at the heart, our business practices have always accounted for environmental considerations and resiliency, centered on supporting our teams and communities and rested on strong values and governance principles.

At Federal, we operate with absolute purpose in support of our mission — to create and manage a sustainable business that generates increasing streams of cash flow and creates long-term value using well-located retailbased real estate. As we overlay an ESG lens on this mission, we have identified five key objectives that, when executed well, have the power to drive tremendous positive impact for our business and our many stakeholders.

Throughout this report, you will find detail on each of these objectives, specifically laying out why each is critical to our business goals as well as the actions we have taken and continue to take, and how each manifests in our real estate. This includes updates on our greenhouse gas emissions reduction initiatives, benefits to our community and local economies, and continued enrichment of our corporate culture.

My intent is that within the pages of this report, you better understand the deep integration of ESG within Federal, and the significant role it plays in our continued success. ESG is not a stand-alone endeavor that we do to check boxes — it is a purposeful framework that helps us to identify opportunities, manage risks and deliver superior business results.

A testament of these results is our 55-year history of annual dividend increases paid to our common shareholders, the single longest annual dividend increase record among all REITs.

The progress presented throughout this report would not have been possible without the dedication and hard work of the entire Federal family to deliver on our mission. To each of you, a heartfelt thanks for your countless contributions. And to all of our stakeholders, I thank you for your ongoing support, and look forward to keeping you apprised of our progress as we continue to partner to create sustainable growth for many more years to come.

–DON WOOD Chief Executive Officer

We use the framework established by the Task Force on Climate-Related Financial Disclosures to assist in the identification and management of our climate-related risks and opportunities, and to evaluate potential business impacts. Our governance around that evaluation starts with our Board of Trustees and flows through to every level of our organization.

Our Board of Trustees has overall responsibility for managing company risks and strategy, including risks relating to climate.

The company’s Executive Vice PresidentGeneral Counsel leads all ESG efforts for the company and reports on all climaterelated and other ESG activities, including progress on goals, to the Nominating and Corporate Governance Committee and the full Board of Trustees every quarter.

The company’s Vice President of Sustainability is a professional subject matter expert dedicated to advancing our sustainability efforts. She develops and drives the implementation of initiatives to improve sustainability within the company and develops and measures progress on the company’s sustainability goals.

Our Board has delegated specific responsibility for climate risks and opportunities to its Nominating and Corporate Governance Committee. These responsibilities are specifically set forth in the committee’s charter and include responsibility for monitoring performance against climate-related goals.

The company’s Sustainability Council is a cross-functional team of senior leaders representing all operational and corporate functions within the organization. This group assists with setting ESG strategies and implementing ESG initiatives throughout the company.

Our business involves the ownership and operation of real estate assets, and as a result, our primary climate-related risks and opportunities are driven by the geographic locations of those assets.

We assess current physical risk to our assets based on historical information from our ownership of these assets, supplemented by information provided in the FEMA National Risk Index and WRI Aqueduct tool.

Our exposure to any one type of physical risk is mitigated by our fundamental business strategy of maintaining a portfolio with significant geographic diversity. That geographic diversity ensures that there will be no significant impact to our income stream from any one climate-related event.

To assess future physical risk, we run scenario analyses using both RCP 8.5 and RCP 4.5 to determine the short-term and long-term potential impacts of physical risk. This assessment is updated at least annually for our entire portfolio, when needed to facilitate capital investment decisions and as part of due diligence for new property acquisitions.

In addition to the strategies outlined in the table to the right, potential impact of current and future physical risks is mitigated by:

• Continual reinvestment in our properties to maintain their good physical condition

• Active emergency response plans that are implemented when climate-related events occur

• Asset level operating plans that address physical risks unique to each asset

• Mitigation strategies incorporated into design and construction as we build and renovate our properties

More information on how we manage physical risks associated with our portfolio can be found in the Strengthen Resilience section of this report (pages 38-51).

• Higher water costs

• Limits on water usage

Drought

• Higher water costs

• Monitor/reduce water consumption under tenant and landlord control Water

• Limits on water usage

• Population dislocation

• Increased energy costs

• Increased capital for HVAC units

• Increased likelihood of power outage

• Business interruption

• Loss of property/ property damage

• Implement energy saving technologies

• Monitor/reduce water consumption under tenant and landlord control Heat

• Utilize HVAC systems with greater cooling capacity at exposed assets

• Increase use of solar energy

• Use higher fire-resistant materials

Sea Level Rise Low Low

• Business interruption

• Increased insurance cost

• Higher water costs

• Limits on water usage

• Population dislocation

• Loss of property/ property damage

• Business interruption

• Increased insurance cost

• Reduced property activity and access

• Loss of property/ property damage

• Business interruption

Windstorm Low Low

• Increased insurance cost

• Reduced property activity and access

• Smart location of critical equipment

• Flood insurance, as necessary

• Use air-purifying technologies Flooding

• Smart location of critical equipment

• Flood insurance, as necessary

• Smart location of critical equipment

• Flood insurance as necessary

• Backup power sources for at-risk assets

* Measured as percentage of budgeted 2023 property operating income (“POI”) using RCP 8.5. Low means at least 70% of POI is from properties in areas identified as low risk. Medium means that 30%-70% of POI is from properties in areas identified as medium risk. High means that 70% or more of POI is from properties in areas identified as high risk. Water stress risk for longer-term is as of 2040.

The assessment of risk related to the transition to a low carbon economy is highly dependent on the jurisdictions where we do business. We continually monitor regulatory actions at the federal, state and local levels in each jurisdiction where we own properties. Our assessment has led us to conclude that there is no one single transition risk that would materially impact our business.

More information on how we manage transition risks associated with our portfolio as well as our metrics and targets, can be found in the Advance Decarbonization section of this report (pages 20 – 37) and the GRI Index (pages 106-114).

New/Enhanced Reporting Requirements

Building Performance Standards

Carbon Neutrality Regulatory Mandates

1-10 years

• Increased costs of additional staff, potential fines, etc.

1-10 years

• Increased capital costs to comply

• Potential fines for failure to comply

10+ years

• Increased capital costs to comply

• Physical obsolescence

Reputation

1-10 years

• Less availability/higher cost of capital if not meeting investor "green" expectations

• Loss of tenants/revenue if not meeting "green" expectations

• Advance preparation and strong reporting infrastructure

• Ongoing investment in energy efficiency upgrades

• Continual reinvestment in assets

• Ongoing efforts to reduce GHG emissions

• Newer buildings designed/ built more efficiently

• Commitment to achieve net zero emissions for Scope 1 & 2 by 2050

• Ongoing discussions with investors/lenders

• Active management of all aspects of ESG

Competitive advantage of properties located in markets where public and private sectors are collectively investing in infrastructure to improve resilience and manage GHG emissions

• Improved infrastructure enhances resiliency of our individual assets

• Financial incentives available to invest capital needed to make resilience and decarbonization investments

Improved access to capital and employee satisfaction from being a leader in addressing climate change

• Potential new sources of capital from ESG-focused funds and other equity investors with ESG criteria

• Improved ability to recruit and retain talent as a result of commitment to ESG initiatives

Increased demand for our properties based on “green” characteristics

• Property of choice for tenants working to meet their own decarbonization and other ESG goals

• Ability to charge higher rents for “green” assets

• Less downtime from climate-related weather events because of resilience improvements

• Greater demand for assets with green certifications

Decrease in costs for operating our assets and our company as a result of investment in resiliency and decarbonization

• Cost savings from lower energy and water usage

• Lower costs of insurance for properties with mitigated climate risk and lower history of loss frequency and severity

• Lower cost of capital as a result of being able to participate in green financing structures

"Pike & Rose was an ideal choice for our new U.S. headquarters. The combination of LEED Gold Certifications for the neighborhood and the building, an amenity rich, walkable neighborhood to support our employees, and an ability to build out our space to maximize efficiencies and limit waste are all in line with Sodexo's sustainability ambitions.”

Tina Burke, VP HR, Sodexo North America, Future Office Tenant at Pike & Rose

Why

5.1M

We believe that effective management and minimization of our carbon footprint supports the transition to a low carbon economy and furthers our ability to deliver long-term sustainable growth.

Includes energy and emissions data for all assets owned and operated during 2022, but excludes assets sold in 2022. In alignment with the GHG protocol, we have included 12 months of data for the assets acquired during the reporting period. Scope 1 & 2 total emissions data has been assured by LRQA. Please see pages 104-105 for full assurance statement, and GRI Index indicators 305-3 on page 112 for specifics on what is included in Scope 3 and how it was calculated.

Our comprehensive approach to managing our greenhouse gas (GHG) emissions requires that we assess our footprint taking into account whether each asset is fully operational, newly developed, or newly acquired. This allows us to target our actions to address emissions at each stage of ownership and to react meaningfully to year-over-year changes without outlier impact.

We also focus on location and market based emissions. Focusing on location based emissions allows us to measure the results of specific actions we are taking to improve energy efficiency and lower emissions from our assets in support of our long-term net zero goal, while evaluation of market based emissions provides insight into the effectiveness of our energy procurement strategy.

Our Goals

market-based GHG emissions by 46% by 2030 compared to 2019 baseline

Approved by Science Based Target initiative

emissions for Scopes 1 & 2 by 2050

Our target for reducing Scope 1 and 2 GHG emissions aligns with climate science for avoiding a global temperature increase of 1.5 degrees Celsius. Through 2022, we made significant progress toward achieving our interim 2030 science-based target as we work towards our long-term objective of net zero Scope 1 and 2 by 2050.

We have used a number of strategies to achieve our Scope 1 and 2 GHG emissions reductions through 2022, and we expect to continue executing these strategies to achieve our near-term 2030 reduction target and longterm net zero goal.

Our single greatest lever to reduce both location based and market based Scope 1 and 2 GHG emissions is improving energy efficiency at our properties. We established a target to reduce landlord controlled electric consumption by 15%, compared to a 2019 baseline, in our like-for-like portfolio of operating assets by 2025. Through 2022, we have achieved an 8% reduction. Our like-for-like portfolio includes approximately 78% of our total square footage in 2022.

The primary driver of energy efficiency in our operating portfolio is upgrading all landlord controlled lighting to LED. This concerted effort to complete LED upgrades across all of our assets is funded by a dedicated budget established by our CEO. To date, over 90% of our properties are fully upgraded to LED, or are in process of being fully upgraded.

We also identify opportunities for lighting upgrades and other energy efficiency improvements during the due diligence process when we acquire new operating assets. A budget for necessary upgrades is then incorporated into the underwriting and capital planning for that asset once it is acquired.

For our development and redevelopment projects, we incorporate LED lighting and other energy efficiency measures directly into the design and construction of the project.

Andorra Shopping Center | Philadelphia, PA

Andorra Shopping Center | Philadelphia, PA

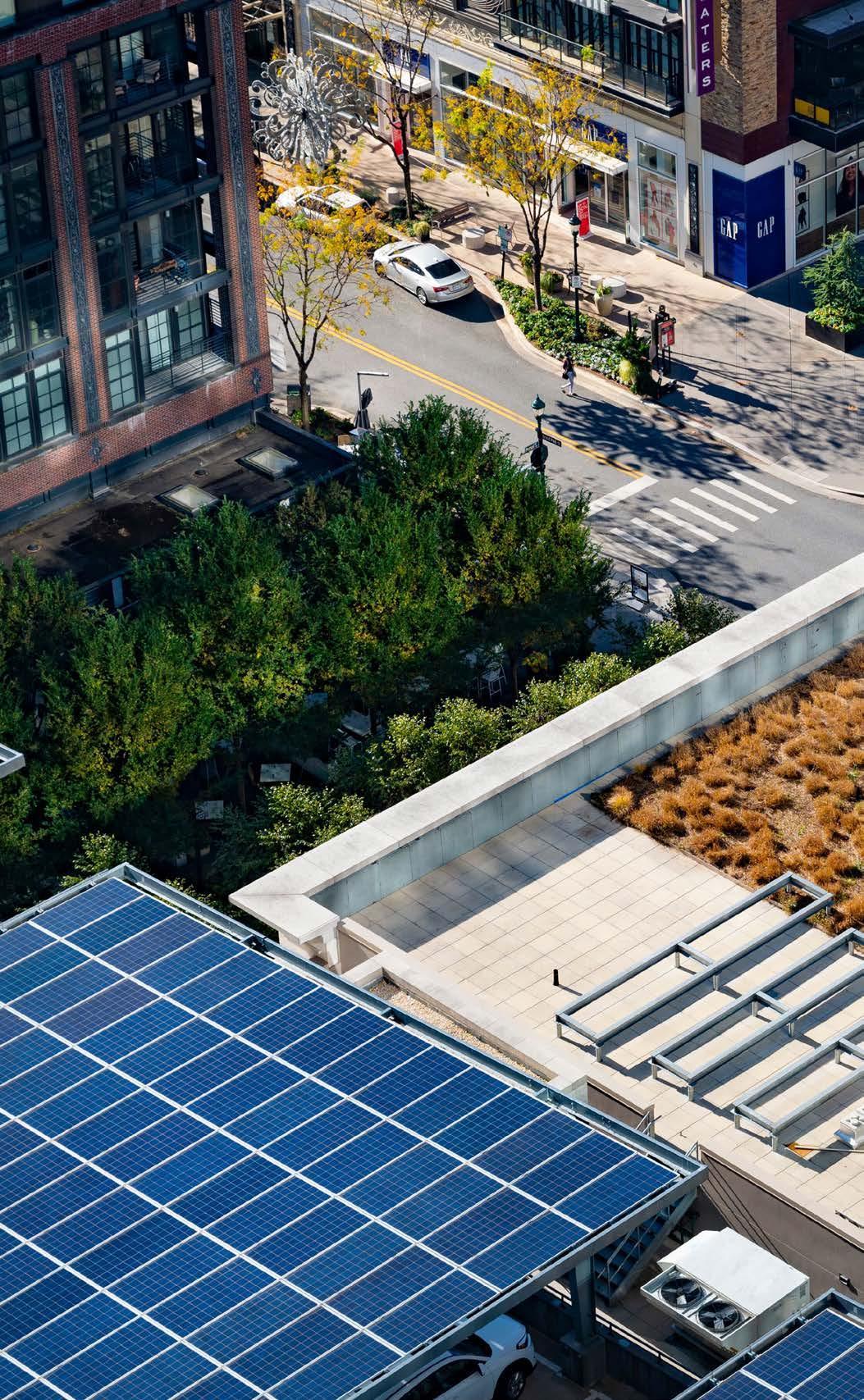

We currently own and operate solar arrays at 25 properties in seven states. All but a small portion of the solar power generated on our properties is used at the property by either us or our tenants, directly contributing to both location based and market based emissions reductions within our own portfolio.

We have grown our solar portfolio considerably since our first installation in 2012 and now have over 14 MW of generating capacity, the largest generating capacity of any publicly traded shopping center REIT.* Identifying additional locations to expand our solar energy production capabilities is a routine part of managing our operating portfolio and of evaluating new assets for acquisition and development. We are about to begin construction on new solar installations that will add an additional 1 MW of generating capacity with an additional 4 MW of potential generating capacity under evaluation.

*Based on the Black Bear Energy Solar Leaderboard report published in May 2023.

The vast majority of our assets are located in jurisdictions where utility companies have made or are expected to make significant investments in the ‘greening of the grid', and we are a direct beneficiary of those investments.

As utility grids continue to transition to renewable energy sources, we expect our location and market based emissions associated with electricity use from those grids to decrease and support our progress toward both our interim 2030 emissions reduction target and our 2050 net zero goal.

Already, a 3% reduction in Scope 2 GHG emissions occurred from 2019 to 2022 with our Maryland and New Jersey properties, representing about onethird of our total portfolio, solely as a result of the shift to a ‘greener’ grid.

Plaza del Mercado | Silver Spring, MD

Plaza del Mercado | Silver Spring, MD

To further reduce our market based emissions, we leverage our strategic locations in deregulated energy markets to procure electricity, at little to no incremental cost, from third-party suppliers that generate energy from renewable or zero carbon sources. This green-focused procurement strategy has been part of our energy procurement practices for more than 11 years. New development projects and new acquisitions are incorporated into green supply agreements as soon as we are able to fully maximize the benefits of participation.

Energy Procurement 04 / Resilience

03 / Decarbonization 05 / Communities

% 01 / Introduction 02 / TCFD 06 / Teams 07 / Governance 08 / Appendix

of electricity used by Federal in 2022 was from zero carbon sources

Scope 3 indirect emissions represent the most significant portion of our company’s total carbon footprint. We are focused on measuring and reducing emissions generated by our tenants, emissions from waste at our properties, and emissions generated by employee business travel and commuting.

Tenant Electric 75%

203,787 MTCO2e Tenant Natural Gas 13%

Tenant and waste generated emissions represent emissions during time of property ownership.

at Properties 11%

Employee Travel and Commuting 0.4%

Our tenants comprise the largest share of our Scope 3 emissions, and as such, we actively work with our tenants to help them reduce emissions from their businesses.

Approximately 58% of 2022 Scope 3 tenant emissions is based on actual data from the local utility, from the tenant directly, or from utility accounts where we bill back tenants for their usage. The remainder of usage is estimated using data from the Commercial Building Energy Consumption Survey (CBECS) and is applied to the specific tenant’s use of the space and property location.

We employ a number of strategies that are intended to help our tenants reduce emissions from their operations at our properties.

When designing and constructing the space for our tenants, whether retail, office or residential, we rely on our Green Box™ standards that were first developed in 2008. These standards set out criteria for ways in which the space can be designed and constructed to maximize energy efficiency and otherwise reduce emissions and impact on the environment.

Key criteria in our commercial Green Box™ guidelines that apply to retail and office spaces include LED lighting, high efficiency HVAC units and low-organic volatile paints. These criteria are supplemented by our Green Box™ standards for residential units to include energy efficient appliances and water efficient bathroom and kitchen fixtures. Our design and construction standards and tenant handbook provide additional recommendations for tenants to operate their spaces more efficiently.

Numerous provisions in our leases are designed to ensure alignment between Federal and our tenants on sustainability objectives and investments, including data collection, submetering and costsharing. We have updated our lease language to ensure that both our company and our tenants are prepared for potential impacts of local building energy performance standards that are being adopted by a number of jurisdictions.

2018 - 2024

Tower Shops | Davie, FLWhere possible, we provide tenants with the opportunity to purchase solar power directly from the rooftop at the property where they lease space. This option helps support the financial investment to install the solar array, provides tenants a means to achieve their own emissions goals and reduces overall emissions of the property. We currently have 21 of these agreements in place, covering approximately 40% of the solar power we generate.

We pass on to our tenants wherever possible the benefits of our purchasing zero carbon power. In 2022, 31% of the electricity we supplied to our tenants was from onsite solar arrays and other zero carbon power sources.

Brick Plaza | Brick, NJ

Brick Plaza | Brick, NJ

Scope 3 emissions from our construction-related activities include construction of new buildings as well as renovations of existing assets. We have an intense focus on designing buildings to maximize efficiency and minimize emissions from operational activities over the long life of the asset. We also design our buildings so they will be resilient to both climate and market changes over time.

In recent years, we have focused more intently on emissions generated from the construction process itself and specifically on the embodied carbon from those projects.

On the only two major construction projects started since 2018, we have measured the embodied carbon using a life cycle assessment to help us better understand the impact of design and material choices. Based on those assessments, we have estimated that the choices we made reduced the embodied carbon for those buildings by approximately 19%.

We are not yet reporting emissions from our construction activities in our aggregate Scope 3 emissions data, and do not anticipate reporting that data until we able to more accurately collect, estimate and report on these emissions, particularly for our many smaller construction projects.

Of the approximately 4.6 million square feet of significant new buildings that we have constructed and delivered over the past 10 years, approximately 80% of that square footage earned a LEED certification, demonstrating our commitment to higher levels of energy efficiency and other sustainability measures.

total SF* 5.1M

invested* $2.4B

*buildings that have achieved or are expected to achieve LEED certification

No greenfield development; prioritize urban revitalization

Prioritize energy and water efficiency as part of an integrative design process

Use Green Box™ standards for tenant space design and buildout

Target LEED Gold certification for all new office developments

Targeted Strategies

Energy + Water

Project-wide LED lighting

White or green roofs

On-site renewable energy

EV charging stations

Stormwater management

High-efficiency flush and flow fixtures

Materials

Reuse materials already on site

Measure and reduce embodied carbon in materials

Divert at least 75% of waste from landfill

Target LEED or other certification on all new residential projects

Social Impact

Walkability of property to and within site

Community gathering places

Health and wellness features

Biophilic design

A small portion of our scope 3 emissions profile comes from employee business travel and commuting. Efforts to minimize our footprint in this category include utilizing teleconferencing capabilities in lieu of in person meetings to reduce travel, positioning our largest offices within blocks of major public transit stops and providing team members the ability to work from home – all of which benefit our emission footprint while supporting employee retention.

Waste generated from our assets is a significant contributor to our Scope 3 emissions with 21,575 MTCO2e generated in 2022. Although most of the waste at our assets is generated by the activities of our tenants, we are responsible for removal of the waste, and as a result, include the full impact of waste generation and removal in our reporting. See a more detailed discussion of our waste management activities on pages 46-47.

Throughout our portfolio, we are supporting the transition to a low carbon economy by installing electric vehicle charging stations. We have installed nearly 425 EV charging stations with more in progress at our properties across the country.

750

estimated metric tons avoided emissions in 2022

85K

estimated gallons of gasoline saved in 2022

03 / Decarbonization 05 / Communities

1.2M 01 / Introduction 02 / TCFD 06 / Teams 07 / Governance 08 / Appendix

04 / Resilience

Protect our assets from increasing frequency and severity of weather-related events and other hazards of climate change

Delivering long-term sustainable growth in cash flow and asset value requires that our assets be able to minimize cost, damage and down-time from weather and climate-related events

< $200K

total damage incurred in last 3 years from climate and weather events

92%

waste diversion rate recent LEED buildings

100%

of acquisitions since 2020 included a climate risk analysis during due diligence

45%

properties with real time water usage monitoring

The expected increase in frequency and severity of weather-related events and the potential impact to resource availability due to climate change make it more important than ever that our assets be well-positioned to withstand events and minimize related financial impacts.*

Resilience:

* See our TCFD disclosure on pages 12-19 in this report for more detailed information on our management of climate-related risks.

“The capacity of a community, business, or natural environment to prevent, withstand, respond to, and recover from disruption.”

– U.S. Climate Resilience ToolkitGaithersburg Square | Gaithersburg, MD

As a long-term owner of real estate, we have always had an intense focus on protecting and enhancing the value of our assets. For us, that means aggressive management and continual reinvestment in those assets to ensure that they remain in good physical condition.

It also includes maintaining property-specific plans for preparation in advance of a weather or other climaterelated event, management through that event and recovery after that event. The ability to have our properties fully open and operating as quickly as possible after an event is critical to minimizing losses for our business, our tenants and local communities.

Minimizing loss from a climate event requires that the local community also be resilient and able to recover quickly with restoration of utility service, availability of transit and other critical services and infrastructure. Our properties are largely located in areas that are positioned to recover quickly which will help to minimize the negative financial impacts from such events.

$22M ongoing maintenance

Minimizes damage from storms and other events

$342M new construction and renovation

33%

community resilience

Percentage of 2023 budgeted POI using FEMA National Risk Index Community Resilience scores

03 / Decarbonization 05 / Communities

Average Annual Property Investment 2018-2022 01 / Introduction 02 / TCFD 06 / Teams 07 / Governance 08 / Appendix

04 / Resilience

Improving the resilience of our assets over the long term is a key consideration as we reinvest in our assets.

Prioritize urban revitalization on contaminated sites or land already developed in order to preserve and improve natural habitats

Use high efficiency flush and flow water fixtures for tenant spaces and common areas

Drive aggressive recycling with objective to divert at least 75% of construction waste from landfill

Target LEED Gold certification for all new office and LEED or other certification for all new residential projects

Prioritize energy efficient lighting and HVAC, white or green roofs and onsite renewable or other clean energy sources

Reuse existing building structures and other on-site materials

Incorporate stormwater management techniques that help to preserve fresh water supplies and protect integrity of local watersheds

Incorporate impact of potential future physical climate risk into design and construction

Darien Commons is located at the low point of a 125acre watershed and less than two miles upstream from the Long Island Sound. As the redevelopment of this property was designed and constructed, the team took into account our climate risk assessment that identified the property as being a high risk for flooding in both the short- and long-term.

As a result, we incorporated in the redevelopment the installation of a large stormwater management vault that is expected to significantly mitigate current and future flooding risk for both our property and the surrounding community. In addition, this stormwater vault was designed to treat the stormwater runoff flowing into the Long Island Sound, which is projected to reduce pollutants at a rate four-fold higher than the existing condition.

Not only did this investment make financial sense for us as part of our overall redevelopment of the property and improvement of its long-term resilience, but it has activated redevelopment opportunities for other property owners in the immediate area—a result which in our experience shows will also help increase the value of our property over time.

Reducing our water consumption supports the long-term resilience of our properties and the local communities. Today, 27% of our total square footage and 22% of property operating income (POI) is in areas with high risk of water stress, making our efforts around water efficiency critical.

One of our most effective tools for managing water consumption is real-time data monitoring through use of automatic meter readers. These meters allow us to monitor water consumption every 15 minutes and immediately provide alerts when usage is above normal so that leaks and other issues can be addressed quickly. We have installed automatic meter readers at about 45% of our properties with the intention of increasing that percentage over time.

Other water consumption management techniques we use throughout our portfolio include installation of water-efficient fixtures and smart irrigation controls where possible, planting of drought tolerant and native landscaping, use of proactive maintenance on all water-related systems, and use of grey water for property cleaning.

8%

reduction

in like for like landlord controlled water usage between 2021 and 2022

Chelsea Commons | Chelsea, MA

Our automatic meter reader identified abnormally high water consumption in a tenant space. The immediate alert from the meter allowed us to work with the tenant to identify and repair a leak. We estimate that the tenant’s water usage would have been approximately 6,700 gallons higher for each and every day that the leak had gone undetected.

Spotlight

Santana Row | San Jose, CA

The closed loop chiller system at Santana Row supplies heating and cooling for virtually all of the 1.2 million square feet of commercial space, the 213 room hotel and the 834 residential units at the property, making it the single largest user of water in our portfolio. Through aggressive management and adjustments to the chiller system, the team has reduced the total water consumption of the system by an estimated 20% annually.

Waste management, whether at our operating properties or as part of our design and construction activities, is essential to our resilience as it works to preserve natural resources and minimize the negative effects of pollution and emissions.

At our operating properties, we actively manage our waste streams through methods that include using appropriately-sized equipment, coordinating waste management efforts with our tenants, collaborating with local restaurants to reduce food waste and hosting book and clothing bins for donations of used items to promote recycling and reuse. We estimate that we diverted about 30% of the waste generated on our properties from the landfill in 2022.

In 2022, we initiated a pilot waste management program at our assets in California with an objective to improve accuracy of data, increase diversion rates, reduce cost, and prepare for expected reporting and other regulatory requirements. After 12 months, we are seeing results with better quality data and cost savings estimated to be in the range of $400,000 annually at just our California assets. While we are too early in the project to fully evaluate the impact on our diversion rates, we are confident that we will be better positioned to improve our overall waste management and diversion rates over the long-term.

We have also had in place for more than a decade an active program to collect and recycle fryer oil, waste cooking oil and grease trap materials from restaurant and other tenants. Those waste products are then turned into raw materials that can be used to manufacture new products such as animal feed and biodiesel fuel. This program was active in 2022 at 18 of our Maryland and Virginia properties resulting in nearly 200,000 net pounds of cooking-related waste being reused instead of being sent to a landfill.

The Avenue at White Marsh | Baltimore, MDWaste management is also an important part of our design and construction process, both in tenant spaces and newly constructed buildings. No matter the scale of the construction project, we place a high priority on smart use of building materials and diversion of construction waste and debris from landfills.

Our tenant construction team is aggressively managing the reuse of materials as we turn over spaces to new tenants. Numerous examples abound where materials left in a tenant space –from hardwood flooring to furniture and equipment – are donated to local causes, sold or reused in the space. Even landscaping that is displaced by a tenant during buildout is replanted in other locations at the property.

The results of our efforts to divert construction waste and debris can be seen at our four most recently completed LEED Gold certified buildings comprising over 1.6 million square feet.

19K+

tons waste avoided landfill

92%

waste diversion rate

We believe that real estate investment, development and operations should maintain a deep appreciation for the natural environment and protect local ecosystems. Our commitment to biodiversity can be found throughout our portfolio with much of it learned from our experiences at Pike & Rose where biodiversity features contributed to the property receiving a LEED for Neighborhood Gold certification and being named as the 2019 Best Sustainable Project by NAIOP’s DC/MD chapter.

We develop exclusively on contaminated sites or on land that has already been developed to avoid disturbing natural habitats and to improve them.

Before its transformation, Pike & Rose was a traditional strip shopping center on 23 acres of asphalt.

Efforts at our properties around water conservation help to ensure sufficient fresh water and proper stormwater management preserves the integrity of local watersheds.

Bee colonies help repopulate local bee populations and provide fresh honey to people at the property, while also contributing to research for the long-term health of bees given their key role as pollinators.

A combination of more than 21,000 cubic feet of green roof space and underground silva cells that house more than 43,000 cubic feet of soil were incorporated into the stormwater management system. The silva cells treat nearly all of the stormwater on site to reduce pollutants flowing to the Chesapeake Bay with the soil absorbing the water, which then provides water directly to the trees onsite. It is estimated that the stormwater management system at Pike & Rose prevents over 75% of stormwater from running off into local watersheds.

Pike & Rose houses bee colonies to help pollinate the crops on the rooftop farm at the property, and provide research data about local bee populations.

Use of native and pollinator friendly landscaping at our properties helps local species thrive, and reduces the need for more water intensive irrigation.

The combination of green roofs, native plantings and other sustainable irrigation on site is estimated to reduce potable water consumption at Pike & Rose by 96% versus typical commercial landscaping and irrigation, and help local species flourish.

We support local efforts to protect biodiversity through the roof-top farms at some of our properties.

The 17,000 square foot farm at Pike & Rose is the largest roof-top farm in the Mid-Atlantic and generates over 10,000 pounds of produce annually that is donated to local food charities.

Objective

Use our real estate to contribute to social and economic prosperity of the community and advance social equity

Why Properties that serve the local community improve the economic wellbeing of the community which in turn, improves the cash flow and value of our properties over the long-term

When real estate truly meets the needs of the community, the local economy is more prosperous and the real estate is more valuable. This perpetual cycle allows the property and the community to continually lift each other and create sustainable, positive impact over time.

Investment

Invest and reinvest in the real estate

Value

Increase in property value supporting additional investment

Integration

Integrate with community through art, tenants, philanthropy and experiences

Acceleration of growth in the surounding area through new investments

Increase in economic activity and opportunities in the community

The view outside of Federal’s corporate headquarters in 1993 included underused shops, low-rise office buildings and surface parking. Inspired by the possibility of converting this neglected area of downtown into a vibrant shopping and entertainment district, we began acquiring and redeveloping the 17 acres now known as Bethesda Row.

With input from local residents and a public-private partnership sharing a vision for the future, Bethesda Row has become one of the most significant economic contributors to the county, continuing to increase in value and to spur tremendous economic growth for the surrounding area since first redeveloped in 1997.

Shows absolute percentage change between 2000 and 2022 based on ESRI demographic information for a 5-mile radius around Bethesda Row and sales information from Urban Land Institute and Federal for 2000 and 2022, respectively.

Shows absolute percentage change between 2000 and 2022 based on ESRI demographic information for a 5-mile radius around Bethesda Row and sales information from Urban Land Institute and Federal for 2000 and 2022, respectively.

“I grew up in this area and am amazed by the transformation of this district that started with Bethesda Row. The combined vision of Federal Realty and the community has created what I believe is one of the finest, most vibrant, walkable neighborhoods. Bethesda Row defines this community and led a broader revitalization of the area, allowing us to achieve our county-wide priorities.”

Andrew Friedson Council Vice President, Montgomery County MD Council

Actual new commercial square footage

+930K

new residential units +1,000

+375K

approved new commercial square footage

approved new residential units +1,300

*As of December 31, 2022. Covers approximately 16 blocks that are adjacent to and part of the Bethesda Row District

For 25 years, the Bethesda Row Arts Festival has turned the district into a premier outdoor art gallery, featuring juried fine arts and crafts. This two-day event now attracts more than 25,000 patrons and is recognized as one of the top 30 fine arts shows in the United States.

Source: Fair Sourcebook

With a walk score of 98, Bethesda Row has been recognized by the EPA as a case study for creating a walkable neighborhood. The property is served by both subway and light rail transit within 2 blocks and has an 11 mile hiking/biking trail through it for recreational and commuting use by local residents.

Bethesda Row was a suburban retrofit of existing buildings that has earned designation as an IREM Certified Sustainable Property. It includes a 6,400 square foot rooftop farm located atop a 48,000 square foot LEED certified building that supplies herbs to the restaurants at the property.

“We opened our first location in 1982 before the redevelopment, and we’re happy to say that we are still here – the longest, original tenant of Bethesda Row. Our family and business has grown alongside this community, and we are still as in love with the area now as we were the first time that we visited.”

Federal’s redevelopment of Bethesda Row epitomizes the creation of a sustainable community that began nearly three decades ago, long before concepts of ‘sustainability’ were fully mainstream. It established the foundation for growing a strong and prosperous surrounding economy and that strong economy has enhanced the value of the real estate. Today, this socially, culturally and environmentally minded redevelopment continues to propel the community.

Bethesda Downtown Plan

Adopted May 2017

The Fleishmans, Owners of Bethesda Bagels Bethesda Bagels website

The Fleishmans, Owners of Bethesda Bagels Bethesda Bagels website

“This district serves as the heart of Downtown Bethesda and is a regional destination and model for placemaking with thriving retail, human-scaled design and an active streetscape environment. Bethesda…is the economic heart of Montgomery County”

Primestor shares our belief that real estate that is tailored to serve the needs and desires of the local community will provide lasting benefits and opportunities for that community. As the fortunes of the community improve, so too does the value of the real estate.

In partnership with Primestor Development, a certified Minority Business Enterprise, Federal has invested nearly $450 million in nine properties located in communities that have historically been underserved and marginalized with additional investment in process. On average, more than 88% of the population within a 3-mile radius of these properties identify as members of a racial or ethnic minority.

Los Angeles, CA

This shopping center was developed on land owned by the Los Angeles County housing authority using a combination of public and private funds to invest in an area that lagged behind neighbors for investment in economic development and where residents often had difficulty accessing fresh food and wellness services necessary to contribute to quality of life.

More than half of the square footage at Freedom Plaza is devoted to tenants who provide products and services to improve health and wellness of the community. With property sponsored scholarships for local residents to attend art school and college, cultural events and programs and a property based workforce comprised of 65% area residents as of 2021, Freedom Plaza provides a foundation for further economic improvement in the surrounding community.

Spotlight

Azalea

South Gate, CA

This public-private partnership resulted in the redevelopment of a formerly blighted industrial site into a shopping center that houses retailers that the community identified and offers a central gathering place and local jobs. The success of the project resulted in an economic success payment to the city that was used by the city to develop a resource center

that provides residents with training and workforce development, and to fund a loan program to spur future economic growth in the area. The project was recognized by the Los Angeles Business Journal with a Commercial Real Estate Award (Silver) for the most impactful project completed in 2014.

Our commitment to social responsibility is reflected in how, where and why we invest in our real estate. We continually reinvest in our assets to ensure that they evolve along with the expectations and needs of the communities that rely on them. That reinvestment enhances the value of our assets as well as the investment in the communities through job creation and sales and real estate taxes.

Each year, we offer more than 300 events, activations and popups at our properties that are designed to surprise and delight community members of all ages.

Santana Row | San Jose, CA | 20th Anniversary Celebration

Santana Row | San Jose, CA | 20th Anniversary Celebration

By incorporating local art, including sculptures, murals, architectural and other features, we seek to speak to the history and culture of each community.

Perring Plaza | Baltimore, MD

Perring Plaza | Baltimore, MD

Lawrence Park | Broomall, PA

Lawrence Park | Broomall, PA

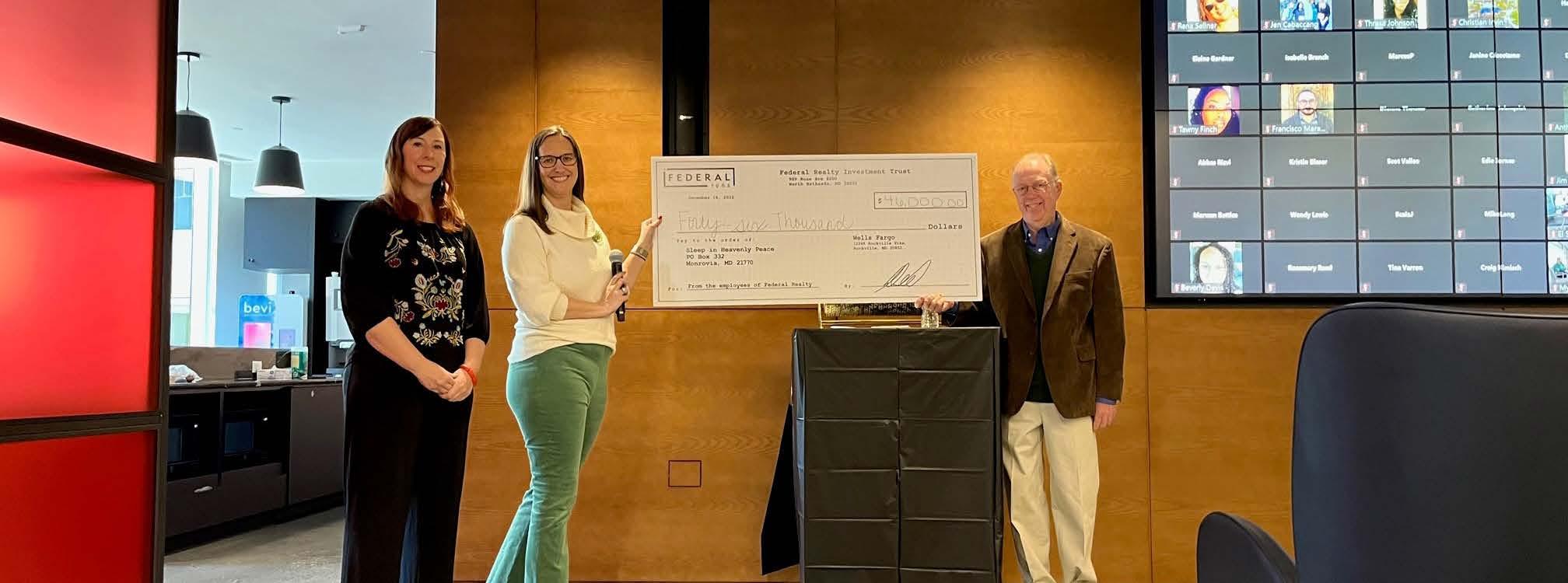

Sleep in Heavenly Peace received a $46,000 donation as the recipient of our 2022 annual giving campaign. This worthy cause provides beds, bedding and pillows to children in the county who do not have their own bed to sleep on and was nominated and selected by a vote of our employees.

“I am a frequent volunteer with Sleep in Heavenly Peace and see first-hand the positive impact a bed can have on a child’s happiness and health. This donation from the company and my co-workers will have a profoundly positive impact on the lives of so many needy children in the county.”

Jenny Higgins Lease Administrator, Corporate Headquarters

Wynnewood, PA

Philadelphia area employees volunteering at Philabundance, a local nonprofit aimed at eliminating hunger in the community.

North Bethesda, MD

North Bethesda, MD employees at AfriThrive, a group dedicated to providing African immigrant and minority families with access to food, youth skills and economic opportunity.

Santana Row | San Jose, CA

One of the many events celebrating the 20th Anniversary of Santana Row, San Jose, CA raised over $12,000 for the Second Harvest Food Bank

The Shops at Pembroke Gardens | Pembroke Pines, FL

Having not suffered damage from Hurricane Ian, The Shops at Pembroke Gardens served as a host location in partnership with local, state and federal law enforcement to collect and deliver supplies to the surrounding community after that hurricane.

Assembly Row | Somerville, MA

Our two apartment buildings at Assembly Row lead a resident-driven philanthropic effort to help local organizations, non-profits, and charities throughout Somerville and the metro Boston area with much needed donations.

We create growth in our properties and their communities by placing the right tenants in the right properties and partnering with them for success.

Pike & Rose | North Bethesda, MD

CocoWalk | Coconut Grove, FL

Wildwood Shopping Center | Bethesda, MD

Pike & Rose | North Bethesda, MD

CocoWalk | Coconut Grove, FL

Wildwood Shopping Center | Bethesda, MD

Sylmar Towne Center | Sylmar, CA

Tia Chucha’s mission is to transform the local community through arts, literacy, creative engagement and ancestral knowledge. This tenant is a pillar of the local community that provides year-round arts and literacy bilingual intergenerational programming. This includes mural painting, dance, writing and visual arts with workshops and activities in Mexican dance, and indigenous cosmology/philosophy. Tia Chucha also hosts open mic nights in Spanish and English as well as author readings, film screenings and art exhibits.

“Once I understood the importance of Tia Chucha’s to the local community, I knew they’d be perfect for our property. Not only can we support this tenant in its mission but it will bring more and more community members to our property which will further drive the success of the asset and make it the property of choice for the community."

Jeff Kreshek, Senior Vice President-Western Region President Federal Realty

4,500+

training hours completed by employees in 2022

by Washington Post in 2022

71%

of promotions and advancements in 2022 were women

47%

of new hires in 2022 were ethnic or racial minorities

No pay anomalies based on race or gender

Our success is driven by our team of more than 300 professionals who bring passion, dedication and know-how to their jobs each and every day. Through competitive compensation and benefits, development opportunities, inclusivity, and personal recognition, we continue to create an environment where our team members thrive.

Information on the Board and Leadership is as of March 31, 2023. Information on the company is as of December 31, 2022. Leadership includes all positions of Vice President and above.

The results of this company are driven by our talented team members which makes employee engagement critical to our success. Engaged employees are invested in the company, care about company success, and approach their work with enthusiasm. This leads to higher productivity, lower turnover, and better, more consistent results.

An employee engagement survey is conducted each year to provide insight into the overall satisfaction level of our employees.

2023 Engagement Survey Results:

95%

85%

survey participation rate

6%

improvement versus 2022 in number of actively engaged employees

“I feel proud to work for this organization”

Diversity of thoughts, perspectives, and life experiences have long been embedded within the Federal culture and are an important part of employee engagement. Empowering our team members to share differing points of view and perspectives challenges our thinking and drives better results for the company, while also giving our employees the satisfaction of knowing they make a difference.

A Legacy of Diverse Leadership

1988

One or more female senior executives

1995

One or more female trustees

2003

At least 1/3 female non-management trustees

2007

At least one minority trustee

Corporate Headquarters | North Bethesda, MD

Even today, the construction industry lacks gender diversity. Not at Federal. Within our tenant construction department, 67% of the director level positions are held by women. These talented women are responsible for building out tenant spaces and ensuring that lease requirements that trigger the tenant’s obligation to start paying rent are met. Nearly 80% of our commercial square footage is under the direct supervision of these extremely talented, barrier-breaking women.

”“I’ve been leasing retail space for more than 35 years and my construction partners for most of those 35 years have been men. I love the fact that I have the opportunity today to partner with these talented women who lead a team that is second to none in the business.”

Wendy Seher, Executive Vice President, Eastern Region President, Federal Realty

Amy Whitacre Corporate Headquarters North Bethesda, MD

Shiella Kitagawa West Coast Headquarters San Jose, CA

Laura Polin Boston Office Somerville, MA

Amy Whitacre Corporate Headquarters North Bethesda, MD

Shiella Kitagawa West Coast Headquarters San Jose, CA

Laura Polin Boston Office Somerville, MA

Equal pay for equal work is a fundamental tenet of our core integrity value. Findings from our thirdparty study once again found no disparities among team members performing the same or similar jobs. This means all employees are paid fairly regardless of gender, race, sexual orientation, or other demographic characteristics.

We also compare absolute pay differentials between males and females, and white and minority team members irrespective of role using average base pay plus annual bonus, and made significant progress on narrowing that absolute pay differential across both groups in 2022.

Absolute Gender Pay Gap*

Our success in narrowing the absolute pay gap is a direct result of our focus on hiring, developing, and promoting women and minorities into higher-level positions as we work to foster the next generation of talent.

women

decrease from 2021

Absolute Racial/Ethnic Minority Pay Gap*

10%

8% decrease from 2021

*Calculation excludes CEO

37%

42% racial/ethnic minority

*Senior positions include Executive/Senior Level Officials, First/Mid-Level Officials and Professionals categories used for EEO-1 reporting.

Spotlight

Dawn Jasper Property Manager, Wynnewood Office | Wynnewood, PA

95

% Employees are treated fairly regardless of their race, gender, age, sexual orientation, etc.

positive response overall

positive response overall

94%

positive response from women

91%

positive response ethnic/racial minorities

90%+

” ” 85 01 / Introduction 02 / TCFD 06 / Teams 07 / Governance 08 / Appendix 04 / Resilience 03 / Decarbonization 05 / Communities

We provide opportunities for our team members to learn and advance both personally and professionally; this was identified by 90% of our employees as an important part of their overall job satisfaction. Providing these opportunities motivates our team, drives engagement, and arms them with skills and knowledge that help deliver superior results.

Frequent exposure to senior leadership and participation in key decisions provides employees with practical experience throughout their careers that is critical to professional development.

Over 21,000 training materials offer employees the opportunity to learn everything from how to improve skills required in their current role to acquiring knowledge and skills necessary to earn a professional certification, to information about the company and the industry.

Our team members are encouraged to be panelists and to attend conferences and webinars to further their learning around topics of interest to them and important to their jobs.

We provide our employees with up to $5,250 per year to reimburse them for costs of continuing education of any type whether or not it directly relates to their job responsibilities.

Our commitment to our employees is underpinned by industry-leading compensation and benefits reflecting the importance of our employees to the overall success of the company.

Medical Plans

Industry-leading affordable medical plans with no cost increase to employees for the last 3 years

Dental & Vision Plans

Excellent plans at low employee cost

401(k)

Tax-deferred and Roth 401(k) plan options with company match

Employee Assistance Program

Confidential support for work, personal or family issues at no cost

Life Insurance Company paid life insurance for employees and family

Flexible Spending Account

Flexible spending accounts for medical, dependent care, and commuter expenses.

Health Spending Account

Health savings account for medical expenses with employer contribution

Disability

Short- and long-term disability insurance at no cost to employees

Paid Time Off

Generous and flexible paid time off including ability to carry over up to 8 weeks of both sick time and vacation

Employee Stock Purchase Plan

Opportunity for employees to purchase company stock without commissions

Family Leave

Up to 4 weeks of paid family and medical leave to eligible employees that qualify for FMLA

Employee Discount Program

Access to discounts on wide variety of items and services, including rent at Company properties

Tuition Reimbursement

Financial support for pursuing continuing education

Financial Planning

Meetings with financial planners at no cost to employees

Training & Development

Programs to enhance professional and personal development

Fitness Reimbursements

Monthly reimbursement of employee expense incurred for fitness activity or membership

Our longstanding award programs celebrate our team members’ accomplishments and contributions and ensure that they feel seen, heard, and valued. From spot awards in the form of gift cards acknowledging a job well done to our years of service awards recognizing milestone anniversaries to our “Find A Better Way” award encouraging innovation, our team members are respected for the time and talents they bring to the company.

The health, safety and well-being of our team members is essential to building an effective and engaged workforce. We prioritize their physical, mental, and financial health, at home and in the workplace. Under our Be Well at Federal brand, we provide award-winning, comprehensive health and wellness programs that supply year-long information campaigns as well as signature team events.

One week each year is set aside for a comprehensive program dedicated to employee health and wellness with a series of in-person activities, webinars and materials posted on our intranet. About one third of our employees participated in our 2022 Wellness Week which was capped off with a raffle to win a Peloton with a full year prepaid membership.

Our Step Up with Federal challenge combines health, comradery, and philanthropy as team members literally take steps to raise money for causes selected by our employees. Teams are assembled with representatives from various departments and offices to promote connection, collaboration, and spirited competition. The winning team members are awarded a prize and the internal bragging rights that are highly valued by our inherently competitive employees who always push one another to improve and succeed.

Each week has a specific focus on some aspect of mental health including reducing the stigma of mental health, setting boundaries at work and home, where to start with self-care, and prioritizing when you are overwhelmed. Federal created a dedicated employee support page to share useful resources with employees including our employee assistance program and behavioral health services offered 24/7 through Teladoc.

Providing a healthy working environment for our employees is important to the overall health and wellbeing of our team. Nearly 90% of our office-based employees work at one of our mixed-use, walkable properties with nearly 80% of those employees being officed in LEED Gold-certified buildings with all the related health and wellness benefits. In addition, 82% of our office-based employees are equipped with adjustable height desks to promote healthier, more productive workspaces.

Each of our offices has emergency preparedness plans that include employee volunteers with regular CPR certification that are part of our office Emergency Action Committees.

For our property-based employees, we adhere to all Occupational Health and Safety Act guidelines, supplemented by site-specific safety and maintenance policies. As a result, we maintain a strong safety record for our property-based employees. Only two workers compensation claims have been filed in the past two years, neither resulting in any lost time.

Establish foundation to run the company ethically with appropriate fiscal and decision-making controls to manage risk

No company can have sustained longterm success without appropriate oversight and smart, balanced controls that allow the company to thrive without undue exposure to risk

Our corporate governance framework is built on the principles of integrity, transparency and accountability, and designed to ensure that our company’s processes and policies align with our values and support our business.

At Federal, corporate governance starts with our Board of Trustees, which has primary responsibility for overseeing the business of our company on behalf of our shareholders and other stakeholders. Under the direction of the Board, our Executive Leadership Team is responsible for developing and executing our strategy and managing the day-to-day operations of our business.

More information about our Board, our Trustees and our Executive Leadership Team is available on our website, as are our key governance policies and documents.

Tom McEachin Trustee

Gail P. Steinel Audit Committee Chair

David W. Faeder Non-Executive Chairman of the

Elizabeth I. Holland Compensation Management Committee

Nicole Y. Lamb-Hale Trustee

Tom McEachin Trustee

Gail P. Steinel Audit Committee Chair

David W. Faeder Non-Executive Chairman of the

Elizabeth I. Holland Compensation Management Committee

Nicole Y. Lamb-Hale Trustee

years average tenure of non-management trustees

Annual election of all Trustees

Independent Audit, Compensation, and Nominating Committees

Independent non-executive chairman of the Board since 2003

Direct Board oversight of all environmental, social and governance matters

Direct Board oversight of cyber security and data protection matters

Direct Board oversight of human resources policies and strategies

Annual Board and individual Trustee evaluations

Shareholder approval required to classify the Board

Majority voting in uncontested elections

Proxy access for shareholders

Pay-for-performance compensation philosophy

Prohibition on hedging and pledging our stock

Robust stock ownership requirements for Trustees and senior management

No poison pill

Clawback policy in place

Don Wood Chief Executive Officer

Dan Guglielmone

Executive Vice President, Chief Financial Officer and Treasurer

Dawn Becker Executive Vice President, General Counsel and Secretary

Wendy Seher Executive Vice President, Eastern Region President

Jeff Berkes

President and Chief Operating Officer

Jan Sweetnam

Executive Vice President, Chief Investment Officer

Don Wood Chief Executive Officer

Dan Guglielmone

Executive Vice President, Chief Financial Officer and Treasurer

Dawn Becker Executive Vice President, General Counsel and Secretary

Wendy Seher Executive Vice President, Eastern Region President

Jeff Berkes

President and Chief Operating Officer

Jan Sweetnam

Executive Vice President, Chief Investment Officer

We are deeply committed to ensuring that our investments are made in the best interests of the business, our shareholders and other stakeholders.

All proposed capital investments in excess of $1 million, as well as all dispositions, are presented to management's Investment Committee for review and approval.

Our eight-person Investment Committee is comprised of our CEO, President and COO, CFO, General Counsel, Chief Investment Officer, Eastern Region President, SVP of Acquisitions, and Arturo Sneider, president of Primestor, with each person having one equal vote.

The diversity of our Investment Committee members and their respective experiences and disciplines provides a full range of relevant considerations for each investment decision. Investments approved by the Investment Committee that exceed certain size thresholds must be submitted to the full Board for approval. The supporting package that is prepared for review and consideration by the Investment Committee and/or the Board includes a description of the request, detailed financial analysis, the ESG considerations related to the request, and an evaluation of major risks and potential opportunities.

Integrity is one of Federal’s four core values, reflecting an expectation of the highest ethical behavior from our company, including our trustees, employees and other representatives in all aspects of our business.

Our Board has adopted a Code of Conduct that applies to every trustee and employee and addresses topics such as conflicts of interest, prohibition on bribery, fair dealing with third parties, and protection of Federal’s assets. All of our employees have confirmed their commitment to the principles of the Code of Conduct.

An additional Code of Ethics governs our most senior officers in relation to professional integrity and appropriate controls with respect to all of our financial reporting. Each year, our senior officers acknowledge their agreement to be bound by that Code of Ethics.

Employees and other parties with whom we do business can use our whistleblower hotline to anonymously report any violations of the Code of Conduct, Code of Ethics or any other behavior that may not be appropriate. Our General Counsel has direct oversight responsibility for ensuring compliance with the Code of Conduct and Code of Ethics and reports directly to the chair of the Board’s Audit Committee on any violations.

Zero Violations in 2022 Code of Conduct Violations

0 Code of Ethics Violations

0 calls to Whistleblower Hotline

0

We have implemented strong information and cyber security measures to protect our systems and data.

The Audit Committee of our Board oversees the risk management process relating to cyber security with management responsibility falling under our Executive Vice President-General Counsel and our Chief Information Officer. We supplement our internal oversight with a third party consulting firm that serves as our chief information security officer. Management discusses with the Audit Committee each quarter all aspects of our overall cyber strategy including an identification of the company’s cyber risks, actions being taken to mitigate those risks, whether we experienced any breaches or other intrusions into our systems in the last quarter and trends we are seeing develop around cyber security matters.

Our information systems are designed to support our overall business strategy and to allow our employees to work seamlessly and securely whether within our offices or elsewhere. We focus on maintaining the security and integrity of these systems in order to mitigate the risk of them being breached or compromised in any way.

We continually evaluate risks to our systems and ways to mitigate those risks through things such as ongoing employee training, intrusion detection and prevention, response protocols for identified intrusions and business continuity and recovery plans in the event of a breach. We maintain cyber security insurance to provide further protection for our company and our assets.

System breaches are immediately reported to our senior management and the chair of the Board’s Audit Committee if it is material. Actions are immediately taken to stop the breach, evaluate the source of the breach and remediate identified vulnerabilities. Public disclosure of any breach and its impact would be made if required.

We expect our vendors, suppliers, contractors, and consultants to act with the highest degree of integrity in their own businesses as they work to support the growth of ours.

We have implemented a separate code of conduct for these groups that specifically lays out our expectations for their general business practices, their policies towards working conditions, human rights and environmental impact. The policies provide information for how to report violations, including the ability to report anonymously using our whistleblower hotline.

We do not make contributions of any kind to any federal candidates or campaigns. We do authorize contributions to state and local candidates and to promote ballot initiatives when it is needed to support our business objectives in a particular locality, subject to obtaining necessary internal approvals.

In addition, Federal belongs to various trade associations that may engage in federal and local lobbying activities. We do not control those activities in any way; they are generally undertaken for the benefit of the industry and all members as a whole. We may, from time to time, lease space in our properties to candidates or campaigns solely

for office use with an express prohibition against holding any political activities at the property.

Our employees are encouraged to engage in the political and governmental process; however, with the exception of paid time off to vote, those activities are considered personal, must be undertaken on the employee’s own time, may not involve the use of company resources, and may not interfere with or disrupt our business. More detail on this topic can be found in our Policy on Political Activities and Contributions available on our website.

This Assurance Statement has been prepared for Federal Realty Investment Trust in accordance with our contract.

LRQA was commissioned by Federal Realty Investment Trust (FRIT) to provide independent assurance of its greenhouse gas (GHG) emissions inventory (“the Inventory”) for the calendar year 2022 against the assurance criteria below to a limited level of assurance and materiality of the professional judgement of the verifier. The assurance was performed using LRQA’s verification procedure based on ISO 14064 - Part 3 for greenhouse gas emissions and in accordance with ISAE 3000.

Our assurance engagement covered FRIT’s owned, occupied and operated properties in the United States and specifically the following requirements:

• Verifying conformance with:

• FRIT’s Inventory management procedures and reporting methodologies for the selected datasets; and

• World Resources Institute / World Business Council for Sustainable Development Greenhouse Gas Protocol: A corporate accounting and Inventorying standard, revised edition (otherwise referred to as the WRI/WBCSD GHG Protocol) for the GHG data1 .

• Evaluating the accuracy and reliability of data and information for only the selected indicators listed below:

• Direct (Scope 1) and Energy Indirect (Scope 2) GHG emissions.

▪ The inventory only includes carbon dio xide (CO2), methane (CH4) and nitrous oxide (N2O)

• Energy-use data

The Inventory was reported using the Operational Control consolidation approach and covered a complete twelve months of data from properties purchased during, or owned throughout, the CY2022 reporting year. Data from properties sold during 2022 were excluded. Data related to refrigerants were excluded on the basis of their being de minimis.

LRQA’s responsibility is only to FRIT. LRQA disclaims any liability or responsibility to others as explained in the end footnote. FRIT’s responsibility is for collecting, aggregating, analysing and presenting all the data and information within the Inventory and for maintaining effective internal controls over the systems from which the Inventory is derived. Ultimately, the Inventory has been approved by, and remains the responsibility of FRIT

Based on LRQA’s approach, nothing has come to our attention that would cause us to believe that FRIT has not, in all material respects:

• Met the requirements of the criteria listed above; and

• Disclosed accurate and reliable performance data and information as summarized in Table 1 below.

The opinion expressed is formed on the basis of a limited level of assurance2 and at the materiality of the professional judgement of the verifier.

1 http://www.ghgprotocol.org/

2 The extent of evidence-gathering for a limited assurance engagement is less than for a reasonable assurance engagement. Limited assurance engagements focus on aggregated data rather than physically checking source data at sites. Consequently, the level of assurance obtained in a limited assurance engagement is lower than the assurance that would have been obtained had a reasonable assurance engagement been performed.

Note 1: Scope 2, Location-based and Scope 2, Market-based are defined in the WRI/WBCSD GHG

Protocol Scope 2 Guidance, 2015

LRQA’s assurance engagements are carried out in accordance with our verification procedure. Th e following tasks were undertaken as part of the evidence gathering process for this assurance engagement:

• interviewing relevant personnel responsible for managing GHG emissions and energy-use data and records;

• assessing FRIT’s data management systems to confirm they are designed to prevent significant errors, omissions or mis-statements in the Inventory. We did this by reviewing the effectiveness of data handling procedures, instructions and systems, including those for internal quality control; and

• verifying historical GHG emissions and energy-use data and records at an aggregated level for calendar year 2022

LRQA implements and maintains a comprehensive management system that meets accreditation requirements for ISO 14065 Greenhouse gases – Requirements for greenhouse gas validation and verification bodies for use in accreditation or other forms of recognition and ISO/IEC 17021 Conformity assessment – Requirements for bodies providing audit and certification of management systems that are at least as demanding as the requirements of the International Standard on Quality Control 1 and comply with the Code of Ethics for Professional Accountants issued by the International Ethics Standards Board for Accountants.

LRQA ensures the selection of appropriately qualified individuals based on their qualifications, training and experience. The outcome of all verification and certification assessments is then internally reviewed by senior management to ensure that the approach applied is rigorous and transparent.

Signed

David

Signed

David

LRQA

On behalf of LRQA, Inc.

2101 CityWest Blvd, Houston, TX 77042

LRQA reference: UQA00002230/5664804

LRQA

The

Copyright

Dated: 26 May, 2023

Hadlet

Lead Verifier

Group Limited, its affiliates and subsidiaries, and their respective officers, employees or agents are, individually and collectively, ref erred to in this clause as 'LRQA'. LRQA assumes no responsibility and shall not be liable to any person for any loss, damage or expense caused by reliance on the information or advice in this document or howsoever provided, unless that person has signed a contract with the relevant LRQA entity for the provision of this information or advice and in that case any responsibility or liability is exclusively on the terms and conditions set out in that contract.

English version of this Assurance Statement is the only valid version. LRQA assumes no responsibility for versions translated into other languages.

This Assurance Statement is only valid when published with the Inventory to which it refers. It may only be reproduced in its entirety.

© LRQA, 2023

Legal name

Nature of ownership and legal form

Headquarters location

Countries of operation

Entities included in sustainability reporting

Differences between entities in financial reporting and sustainability reporting

Approach used to consolidate information

Publicly traded real estate investment trust (NYSE:FRT); 2022 Form 10-K pages 3-4 and 29

909 Rose Avenue, Suite 200, North Bethesda, MD

Report page 4; 2022 Form 10-K pages 3-4, 19 and 22-27

2022 Form 10-K page 1

None

Our properties and subsidiaries are operated as one consolidated business segment with consolidation for financial reporting being determined in accordance with Generally Accepted Accounting Principles (GAAP)

Reporting period and frequency of sustainability reporting

Reporting period for financial reporting

Publication date of report

Contact person for questions

Restatements from previous periods

Process for external assurance

Report sectors in which we are active

Value chain including products, markets, supply chain and downstream entities

January 1, 2022 through December 31, 2022; annually

January 1, 2022 through December 31, 2022; annually

June 1, 2023

Emily McLachlan, Vice President-Sustainability; 301-998-8100

None

See page 104 for assurance statement