www.financederivative.com Asia | Americas | Africa | Middle East | Europe

Korosh Farazad, Co-CEO,

Investments Invest Like a Pro: A Comprehensive Guide to Smart Investing - Deepak Shukla Intelligence-On-Tap: ChatGPT’s Promise -David Justiniano ISSUE 7 | 2023

Photo Credit to Mr. Kosta Ivanyshyn

Farazad

Finance Derivative Awards Submit your nomination now to awards @financederivative.com

CEO and Publisher

Mehtab Chisti

Editor Mara KI

Head of Distribution

Stefan Stavic

Project Manager

Emma Bakker

Business Consultants

Lena Thomas, Aaron Menon, Blair & Allan Mendez

Business Analyst

Rachel Thomas, Amalia Rubio

Graphic Designer

Sachin MR

Digital Marketing

Mithun Gowda

Web Development and Maintenance

Nesar Kanachur

Advertising Phone: +31208943644

Email: info@financederivative.com

FM. Publishing

Tussen Meer 345 1069DR Amsterdam

Netherlands

Phone: +31208943644

Email: info@financederivative.com

Finance Derivative is the trading name of FM. Publishing Company Registration Number: 71674233

VAT Number: NL002483895B26

ISSN 2666 6715

Image credits: https://www.istockphoto.com/ https://www.rawpixel.com https://pixabay.com

Finance Derivative Awards is established with the aim of honoring excellence in performance and rewarding Companies across different domains of business & financial world.

Our award honors companies and their key players who have performed extraordinarily well and who strive for fineness & provide a platform for recognition.

Check our online publication at www.financederivative.com

FROM THE CEO

Greetings from Finance Derivative and A very warm Welcome to all our readers.

We thank you all the Outstanding and young supporters who keep us inspired to bring this edition to you each time. The engaging content for the year 2023 we bring a lot of exciting topics covering the Quantitative Trading and AI, Chatbots and Embedded finance.

Let’s find out how can we invest Like a Pro: If you want to build wealth and secure your financial future, investing your money can be a wise decision. It can be difficult to know where to begin with so many investment options available.

Nick Corrigan explains us how payments technology will boost businesses future. 2023 is seeing the physical and digital spaces complete their merger into omnichannel, meaning that consumers will cease to view the virtual and physical worlds as separate, but rather two spaces that flow seamlessly between one another. This marks a huge opportunity for many companies to capitalise upon.

Hope you will enjoy reading this issue of Finance Derivative.

Wishing you all great business and success.

Enjoy!

Mehtab Chisti CEO

CONTENTS

TECHNOLOGY:

12. Are you ready to harness ESG data?

16. Using data is key for lenders to make informed decisions and navigate a perfect storm

42. Investing in software - How to use data around open source projects

54. Intelligence-on-Tap: ChatGPT’s Promise

64. Banking on the ChatGPT craze

SPECIAL FEATURES:

28. The Underdog to Top Dog Mentality

48. Finance Derivative || Global Award Winners 2023

FINANCE:

8. Boosting Employee Engagement within Finance Teams in Five Simple Steps

20. Scaling a Business needs Finance Agility and Efficiency

24. Fintech apps are continuing to grow in popularity: here’s how you can benefit

38. A Digital and Automated Approach to Annual Budgeting is a No Brainer

44. Balancing data security and customer service in financial services

76. Why Organisational Alignment Is Key to Achieving Personalisation Maturity in Financial Services

62 70

BUSINESS:

34. How to find an investor that matches your business values

56. Enabling Business: How Payments Technology will Boost Businesses’ Futures

70. Do business plans even matter in turbulent economic times?

74. Hiring and growing in an uncertain market

BANKING:

46. It’s time to transform corporate banking, and the answer is embedded finance

58. How financial services can fortify digital banking with identity security

62. Improving consumers’ financial health through building awareness and trust in open banking

72. A Golden Record and a Personalised Banking Experience

WEALTH MANAGEMENT:

6. Invest Like a Pro: A Comprehensive Guide to Smart Investing

22. Which Cloud architecture model is best for Insurtech?

26. Bringing VCs into the 21st century: with transparency at the top of the agenda, investors need to stay ahead to survive

36. Maximising investments; minimising fees

66. Top 5 AI Use Cases for Quantitative Trading

12 64 42 16 08 38

56 06

46 Cover Story

Invest Like a Pro:

A Comprehensive Guide to Smart Investing

- Deepak Shukla , Founder and CEO of Pearl Lemon

- Deepak Shukla , Founder and CEO of Pearl Lemon

If you want to build wealth and secure your financial future, investing your money can be a wise decision. It can be difficult to know where to begin with so many investment options available. You need to do extensive research and carefully consider your options if you want to make wise investments. Here are some pointers to assist you in making wise investment decisions:

Outline your investment objectives clearly

Determine your goals before you get started. Do you intend to make retirement savings? acquiring a home? Do you encourage your kids to go to school? You can decide how much money you need to invest and what types of investments are best for your needs once you have a clear understanding of your goals.

Conduct research

Before investing in any business or asset, it's crucial to be aware of the risks and potential rewards. To gauge the company's prospects, review the financial statements, read news articles, analyst reports, talk to other investors, and read news articles. This can be used to guide your decision regarding the best investments for you.

Wealth Management 6

Create a diversified investment portfolio

Doing so will help you lower your risk. You can lessen the effect of any one investment on your portfolio as a whole by distributing your funds among various asset classes, such as stocks, bonds, and real estate. This can shield your funds from market turbulence and recessions.

Maintain discipline

Investing can be an emotional rollercoaster because of the volatile nature of the markets and investors' propensity to react to recent news or events. Exercise restraint and adhere to your investment strategy if you want to make wise investments. Instead of reacting emotionally to market changes, focus on your longterm objectives.

Invest for the long term

Investing is a long-term strategy. Even though it might be tempting to try to time the market or focus only on short-term gains, doing so rarely results in long-term gains.

Reduce the cost of fees

Due to investment fees, your returns might gradually decline over time. Before using any investment services or products, make sure you are aware of the associated fees. Then, look for ways to reduce these costs whenever possible. If you want to maintain low fees while still achieving broad diversification, take into account low-cost index funds or exchange-traded funds (ETFs).

Take into account your risk tolerance

Different investment types come with different levels of risk. Bonds typically offer lower returns but are more stable than stocks, which can be erratic and subject to large price swings. When selecting investments, take your risk tolerance into account. Stocks may be a wise investment if you don't mind taking on some risk and have a long time horizon. Bonds or real estate might be a better fit for you if you're more risk-averse.

To sum up, making wise investments requires discipline and effort but can be profitable in the long run. You can build a solid investment portfolio that will assist you in reaching your financial objectives by setting clear goals, diversifying your portfolio, doing research, taking your risk tolerance into account, investing for the long term, reducing fees, and practicing discipline.

Wealth Management 7

Boosting Employee Engagement within Finance Teams in Five Simple Steps

Following the Great Resignation, when a record number of people left their jobs to find more fulfilling roles, businesses still face ongoing challenges with employee engagement. Most notable is ‘quiet quitting’, where employees simply perform their absolute base-line duties with no motivation to go above and beyond – and are still likely to leave in the long term. There is clearly still a pressing need to boost engagement with employees. Happier teams mean greater benefits for the business, with research showing that the most engaged teams create higher profitability, sales and productivity than their less-engaged counterparts.

Finance teams are critical to business success – in particular the accounts receivable (AR) team who keep AR processes operating smoothly and ensure the company receives what it’s owed. Low engagement levels here could mean reduced productivity, meaning invoices take longer to process and follow up; reduced accuracy, meaning records may be inaccurate and finances harder to forecast; and ultimately less care paid to what is often the frontline of customer relations.

By boosting employee engagement, AR functions can help set enterprises up for success. This piece shares five key areas that will help organisations boost employee engagement within their finance team.

Starting with the basics

A good place to start when addressing employee engagement is ensuring good communication with management. AR staff are faced with a myriad of tasks on a daily basis including maintaining accurate financial data and running the cash application process. Their job is only

made harder if they lack the tools they need to carry out their duties, or the training to complete tasks accurately.

If AR team members feel they can open up to management when needed - for instance when they feel they’re overloaded with work, or need help prioritising their time, they in turn will feel heard and supported. A team that speaks up when it has too much on its plate, and delegates when required, is one that is freeing up its own time. In turn, this frees up the AR department to address more meaningful and satisfying opportunities such as improving customer relationships or providing more strategic value to the organisation. But it all starts with knowing their voices can and will be heard by their superiors.

Performance recognition

Internal praise is powerful within businesses as it shows staff they belong and are appreciated.

Benefits of praise

Finance 8

such as encouraging collaboration, clarifying organisational goals, reinforcing employee purpose, and improving quality are all key to ensuring the success of the company, especially during the current economic climate. A recent report highlights ‘performance coaching’, whereby performance is reviewed weekly, as a strategy to boost employee engagement by assisting development and offering additional training where skills gaps exist.

In AR teams, this can be applied in many ways. One example is CFOs mentioning top performers on company calls, or offering incentives to motivate staff. A recent report highlights that 69% of employees planning to quit their jobs said that receiving recognition and rewards would cause them to stay in their current position. Performance recognition motivates staff to both work hard independently, and pull together to achieve results.

Feedback culture

Employee recognition should form part of a broader focus on creating a feedback culture. This encompasses managers asking themselves whether employees feel their opinions are listened to and valued, as well as if they’re receiving regular input on their progress. This includes asking questions like: do your finance teams speak up when they are struggling with their workload, or feel they have too many invoices to process and not enough time to finish them all? Research has revealed that organisations investing in regular employee feedback have almost 15% lower turnover rates, and teams are five times more likely to report increased productivity. Both these outcomes

have a transformative impact on performance and company success.

Adopting agile practices

Companies who adopt agile practices deliver work in small, but consumable increments without compromising quality. For example, sprint planning in AR teams: using daily meetings to report on progress and share any areas that are limiting staff from achieving their goals. This could include discussing concerns like manual data entry prohibiting teams from doing more engaging and meaningful work. Similarly, sprint reviews can provide the same feedback from the opposite direction: regularly reporting on results within projects and discussing changes that should be implemented in the next sprint.

Achieving team consensus on suggested approaches is an effective way to empower employees. Silos are eliminated and the collective brainpower of the team is far more equipped to solve a challenge than one person struggling silently. In fact, there is a huge impact on organisations that encompass agile working practices, including a 60% growth in both revenue and profit.

Automation and adding value

Even following the steps laid out above, employee engagement can still be limited within AR teams. This is largely because employees are still completing repetitive manual tasks daily such as invoicing customers, tracking invoices, and accounting for aspects such as early payment discounts and late payments. Finance teams need the right tools to eliminate these mundane and

time-consuming tasks, delivering greater job satisfaction, and creating more value for their organisation. Automation is key to this. By centralising account data and providing transparency between departments, less time is spent chasing relevant information. Instead, staff can focus on more value-adding and engaging tasks.

CorneaGen is one organisation that adopted automation within its AR process, making reporting easier and giving employees more time to focus on improving the customer experience. Its adoption also boosted employee morale, helping them gain recognition for exceeding KPIs and freeing up time to focus on tasks that drive greater job satisfaction.

Employee engagement is vital for driving the success of AR and Finance teams. Without engaged employees, organisations are at risk of high turnover rates, decreased productivity and profitability. Given the economic crisis with falling consumer confidence and business output, it is important that businesses prioritise their AR and finance function to set them up for success. By doing so, employees will value the work they do, yielding substantial benefits for both themselves, and the company as a whole.

Finance 11

Anthony Venus, SVP, Global Accounts Receivable Automation at Quadient AR by YayPay

ARE YOU READY TO HARNESS ESG DATA?

ver the last few years, Environmental, Social and Governance (ESG) data collection and reporting has become a much bigger priority for organisations with over 96% of S&P 500 companies publishing sustainability reports in 2021, according to research from the Governance and Accountability Institute.

There are many factors driving this need to examine and publish ESG data, but at the forefront are customer, employee, and governmental influence. Increasingly, consumers and employees are picking companies that they interact with and work for based on their track record with ESG policies and reporting. Additionally, government bodies and regulators are starting to weigh in with regulations.

While just at the start of the journey with regulations, many government bodies and regulators either have, or are considering, mandatory ESG data collection and ESG data reporting requirements for corporations under their jurisdictions. In December, 2022, the European Banking Authority (EBA) published its roadmap for sustainable finance. The roadmap – a collection of standards and rules aimed at better integrating ESG risk considerations into the banking sector – is set to come into effect in stages over the next three years.

Technology 13

In preparation for the regulations that come along with this roadmap, many European banks have already worked on their ESG data platforms to meet the new requirements around green financing. A key part of this is figuring out how to flexibly incorporate all of the new data sources, types and formats that will be ingested and analysed under the EBA’s new roadmap.

Understanding ESG data

ESG data comes in two categories –‘inside-out’ and ‘outside-in’. Data that comes from companies and is used for analysis is ‘inside-out’ and this data normally lags about 6-12 months behind because it is normally from annual ESG-related disclosures. On the other hand, ‘outside-in’ data is more regularly updated, sometimes in real time. It comes from a variety of sources that banks have access to from financial and company data of

their customers and can have more just-in-time impact. Additionally, outside-in data can also encapsulate the collation of multiple diverse data sources, for example satellite images of fields with water level information meshed up with commercial transportation data.

While most financial datasets are numerical, ESG data normally includes both structured and unstructured datasets. It can include not only text and images, but if a company wants to analyse satellite data to understand their own climate dataset, they may even need to analyse videos. And this is only a few examples of the variety of data, so it is vital to work with a data model that can support many different types of data.

The velocity of ESG data collection and analyses also increases exponentially as organisations embrace the idea of integrating this data in

real-time. For example, loan due diligence used to depend on quarterly ESG data, but as customers demand faster loan approvals, financial institutions are increasingly going to have to rely on real-time data.

With both the variety and velocity of ESG data increasing, so too will the volume of data requiring storage and analysis. Additionally, at the moment, there are no universally applicable ESG standards which means organisations are dealing with many different standards, with different data requirements depending on where they operate.

ESG data in real time

With ESG data, it is vital that it accurately reflects what is happening at the time of use which means the use of real-time data in analysis, reporting and scoring is becoming more common. This, however, requires

Technology 14

harnessing technologies such as cloud computing, AI, and machine learning to instantly track breaking news stories for ESG-related data on investments or incorporating up-tothe-minute satellite data into reports on a firm's environmental impact for example.

Using real-time data platforms, asset and fund managers can calculate accurate ESG scores to aid in investment decisions or risk calculations. Commercial operators can also ensure that their diligence covers their supply chain and in-direct production facilities at third parties.

Leveraging ESG data

A key part of the EBA roadmap is the use of ESG data around loans with environmental sustainability features, or green lending. These loans, sometimes called energy efficient or green mortgages, are typically given

to retail or SME clients to make energy efficient improvements to their properties, think solar panels or funding renewable energy work.

This will have an impact on scoring criteria for green loans and banks will now have to take into account these changes in relation to performance indicators, including the acceptance performance of loans and mortgages. This will also impact loans that have already been originated.

The loan origination process and data systems supporting the process will also be impacted. Banks need to think now about how they are going to tackle evolving or unforeseen changes, capture different data attributes for the same product or loan, incorporate new data types and formats, find insights from data explosion and meet the demands of customers and the competition.

While monitoring the upcoming roadmap and shifting world of regulations around ESG, banks and financial institutions should start to evaluate whether their infrastructure can handle the varied types and volume of data that will be required. Also, breaking down siloed data sets to enable easy search and analysis of data will be key to finding value in ESG data.

Technology 15

Boris Bialek, MD of industry solutions at MongoDB

Continued inflation, rising interest rates and the ensuing cost-of-living crisis will inevitably lead to increasing numbers of customers falling into arrears. Lenders will face the dual pressures of increasing provisions on the balance sheet and the rising operational expense of supporting their customers through this period.

This tough macro-economic environment, unfortunately, coincides with a challenging period in terms of compliance and regulation. The introduction of Consumer Duty in July 2023 means that lenders of all types and sizes need to examine the way they operate and may need to adapt. This new and enhanced set of standards aims to increase the quality of outcomes for customers. Organisations must act now to protect and support all customers, particularly those who are vulnerable – identifying those at risk of falling into arrears and supporting those already in arrears.

Understanding customers’ attitudes to debt

Our recent research shows that a fifth of UK consumers (19%) aren’t confident they are able to pay all their bills and 30% fear they won’t be able to pay an unexpected bill. These figures show a real lack of confidence in the personal

Technology 17

Using data is key for lenders to make informed decisions and navigate a perfect storm

finances of a significant proportion of the UK’s population.

When asked what they would do if they found themselves unable to pay a bill, nearly 60% say they would seek support from friends or family members, but 15% would do nothing, which is extremely worrying.

The lack of reliable and robust data throughout the consumer lifecycle prevents many organisations from effectively communicating with customers or making informed decisions. They cannot form a 360-degree view of their customers, which hampers their ability to adopt a consumer-centric approach to identify and support ‘at risk’ people. Over a third of consumers (36%) say they never get a personalised service from their main bank.

Leveraging data to offer more personalised services

With the impact of the cost-of-living crisis reaching far and wide, there’s a real need to fully understand customers and their attitudes to debt. In particular, it’s critical to identify consumers who can’t repay the money they owe lenders to effectively manage and protect them.

Lenders must take the time to fully understand the different data sources available. Making good use of behavioural data, showing how a customer interacts with the organisation at different touchpoints, will give lenders insight and knowledge into how they are likely to behave in future and will allow them to offer more personalised services.

Such insight can help lenders provide valuable financial advice and ensure their services suit each

customer. It’s their role to guide customers through difficult times – educating and signposting them to third parties if needed to ensure they receive the appropriate amount of support.

Data analytics is key to making informed decisions

Investing in data analytics is key to ensuring the information is properly used to build different customer personas and segments, allowing for insight-driven decision-making and creating personalised services. For example, predictive modelling of customer behaviour enables a forward-thinking and proactive view of the customer, helping to identify who is likely to default on a debt and when. Using such insight will enable lenders to create successful contact strategies.

Likewise, with a Systems Integrator, companies can use sophisticated technologies such as Big Data, AI and Internet of Things (IoT) to provide real-time insights into consumer behaviour and preferences. Financial services providers can use that insight to prevent bad debt, reduce operational costs, and ensure customers are cared for throughout their financial lifecycles.

Adapting communication strategies to customer preferences

Debt can be a highly sensitive and embarrassing topic for many, and debtors may not admit they are in difficulty and need support. The type of communication people prefer reflects those needs. Our findings show that 18% of consumers prefer the lender to get in touch by post if they are falling behind in their payments for a loan or

mortgage, 15% by telephone, 16% via a text message, 12% by email, and 9% prefer to be contacted via a mobile app.

Banks and other lenders must adapt their communication strategies to reflect the spread of preferences across various channels. There is a real need for omni-channel services within the sector to make successful debt collections a reality. Customer journeys need to be designed with integrated touchpoints, offering customers the opportunity to pay on their terms via the channels they use and are comfortable with.

Closing thoughts

Many people choose to ignore their financial worries rather than reach out for available support. Lenders must be proactive in their approach. By revisiting their existing vulnerability and customer engagement methods, financial services providers can better handle customers’ increasing demand for support.

As the cost-of-living crisis continues and Consumer Duty increases scrutiny and pressure on the sector, creating a solid foundation of customer-centric data and analytics will help teams deliver compliant, personalised and supportive services through the crisis and beyond.

Technology 19

Craig Wilson, Managing Director of Private Sector , Sopra Steria UK

Scaling a Business needs Finance Agility and Efficiency

It's incredible how quickly a business can suddenly grow. From opening a new line of business, acquiring a major new partner or just being in the right place at the right time, going from zero to 1000 is an incredible experience. But without the organisation being set up to capitalise on this growth, opportunities that need a swift response can vanish before action is taken.

Because of this, when a business scales up, the finance function must be a beacon of efficiency. It must be agile, flexible, able to anticipate the next turn in the road and prepare the business for each momentous step. And this agility can only be delivered when the CFO takes a lead in transforming the traditional finance function into the intelligent financial hub of the company.

Through automating routine and mundane processes, and integrating smart technology that orchestrates data, the CFO can streamline reporting, analysing performance at the most granular level that provides

new insights across the business. This new finance function provides more services to the business and plays a far greater role in making strategic decisions that drive the organisation forward.

Finance is the home of real business data

For data to be helpful to the business, it must be accessible on demand, reliable and structured. For the vast majority of finance teams, this is a herculean ask that requires a new mindset and equipping with new tools. But with the right finance system in place, the team can remove the laborious process

of scraping data together and begin to derive meaning from the reports themselves, without delegating this responsibility elsewhere within the company. It allows the team to build rapport across departments and units, and enables purposeful discussions based on evidence and genuine business intelligence.

This new mindset means focusing less on processing transactions and moving more toward producing dynamic data that paints a true picture of the business, from moment to moment, and at fixed points in time, to analyse progress. This 360-view not only improves cashflow and forecasting but can shorten the working

Finance 20

Darren Cran, COO of AccountsIQ

capital cycle and make the company’s assets work harder.

This means that the skills within the finance team can be exploited to their full potential. After all, intelligent and ambitious finance graduates didn’t sign up for data entry. The chances are your finance team already has the skills to deliver insights, they just need the opportunity to do so.

And there is no secret magic required to transform finance and create efficiency, it all comes down to the right choice of automation tools and software.

Freeing up your most valuable currency - time

Efficiency isn’t about removing tasks that are unimportant, far from it. But in order to build a new type of finance function, time spent on manual tasks

needs to be minimised. There is recognition in all teams where manual processes dominate, that there must be a better way of working to impact business growth.

Applying technology allows for inverting the traditional finance pyramid, where transactional processing along with compliance and reporting take up the majority of finance time. By automating the tasks that can be automated, the finance team can devote more time to what it should be doing –providing creative insights across the business that support intelligent, evidence-based business decisions.

Along with cashflow forecasting, consolidated and segmented P&L, the finance team also needs to be on top of sales forecasts and the product sales mix. But when multi-entry consolidation or multi-currency

management can tie up a department for weeks at a time, how can the finance department fulfil its expectations without automating these tasks into one-click operations?

Finance must lead by example

After taming much of the manual processes which has plagued the department for decades, the finance team can begin collaborating with other parts of the business. In doing so, they can move from a data entry department to a fully-fledged consulting arm of the enterprise.

Without taking these steps, finance teams risk being a bottleneck in the development of the business. As revenues and opportunities grow, finance teams need to grow in accordance to provide the acute advice and guidance that every fast-moving business requires.

Finance 21

Which Cloud architecture model is best for Insurtech?

It's no surprise that insurers are quickly adopting Cloud solutions as part of their core technology platforms, modifying legacy systems to make way for digitally advanced software. Global cloud infrastructure service spending increased to $57 billion in Q3 of 2022, bringing the industry total for the previous twelve months to $217 billion. There are numerous ways for insurers to use the Cloud to improve their business operations, particularly when it comes to deploying new applications or services, reducing time to market, and improving data storage and backup resilience.

The insurance industry was one of the first to embrace Cloud computing,

with nearly 60% of companies utilising the technology in some capacity. There are several reasons for this, the most important of which is that it allows for greater agility and can handle large amounts of traffic, making it the ideal platform for insurers to scale their offerings during periods of high activity. The insurance industry is highly competitive and regulated, and companies must be able to respond quickly to changes in the market, making the Cloud the perfect solution. It can, furthermore, be used to connect Insurtech systems to third-party providers via APIs, giving them access to better functionalities and improving customer service with real-time responses.

Different Archetypes for Different Requirements

There is no doubt that Cloud computing has transformed the insurance industry, but the most important question for IT leaders in this space is: what Cloud architecture model is best for their business? They have three options for Cloud architecture: public, private, and hybrid, each with its own set of challenges and benefits. The best cloud architecture for a company is determined by several factors, including the type of data they are working with, their budget, and the level of control they require over the infrastructure. Companies must consider the advantages and disadvantages of each type of Cloud

Wealth Management 22

architecture to determine which best meets their business requirements.

Public Cloud Architecture

The public Cloud has democratised technology, allowing businesses of all sizes to access the same level of innovation and scale as the largest corporations. A third-party service provider owns and manages this cloud infrastructure, and the resources are made available to the general public via the Internet. It provides lower upfront costs because resources are paid based on usage, elasticity, and scalability, allowing insurers to adjust resource usage as needed. Finally, it lowers IT costs as the service provider handles most of the infrastructure maintenance.

However, the public Cloud is not without its drawbacks. Limited upfront costs also mean limited control over the infrastructure and security. And with that comes the potential for privacy concerns, as data is stored in a third-party data centre. Public Cloud providers implement a variety of security measures to protect their customers' data, but there is always a risk of data breaches, data loss, or unauthorised access. Ultimately, the greatest challenge comes with the possibility of service outages or disruptions due to shared infrastructure and dependence on internet connectivity.

Private Cloud Architecture

This is a Cloud infrastructure owned and managed by a single insurer, and the resources are only used by that organisation. Private Clouds enable faster and more flexible deployment of new applications, resources, and services than traditional IT infrastructure, while also providing greater control and security for sensitive

data and applications. This means it's an excellent Insurtech solution, as the industry has its own set of regulatory compliance. Furthermore, as long as it is well designed and maintained, it provides greater reliability than public networks.

Nevertheless, the advantages of a private solution entail much higher upfront costs as well as ongoing costs for infrastructure maintenance. Furthermore, the complexities of implementing this type of solution result in companies having limited scalability compared to a public Cloud. Finally, a private Cloud requires a team to manage, maintain, and adjust it as needed, which means insurers will need an in-house IT team with infrastructure expertise.

Hybrid Cloud Architecture

This Cloud infrastructure combines both public and private Cloud architectures, allowing insurers the flexibility to utilise both benefits. Beyond the obvious advantages of elasticity in a hybrid architecture, it also proved unprecedented scalability, depending on usage and workload requirements. What’s more, the hybrid Cloud delivers all the security and compliance needed to manage sensitive data in the insurance industry, while still providing flexibility.

However, with the integration of different solutions comes complexities. Integrating data between public and private Clouds can be challenging, as data may need to be migrated between different systems and formats, and data consistency and synchronisation must be ensured. Moreover, ensuring connectivity between public and private Clouds can be challenging, as different network architectures and protocols may be involved, and security and

performance requirements must be addressed, especially in the insurance industry where most data is highly sensitive. Furthermore, as with any IT solution, there is a potential for security and data privacy issues if not properly managed.

Choosing The Right Tech

Cloud computing can provide greater agility and scalability while also handling high volumes of traffic, making it an ideal platform for insurers. But choosing a solution necessitates a thorough understanding of an organisation's goals, processes, and challenges and an in-depth understanding of the capabilities and limitations of available technologies. The key to selecting the right Cloud type for insurers is to concentrate on solving specific business problems and identifying the technology that best addresses those problems.

Each of the three Cloud architectures has its own set of challenges and benefits, and insurers must weigh the pros and cons of each to determine which one best meets their needs. Choosing the right Cloud architecture model is critical to success in the insurance industry, whether a company is looking for lower upfront costs, greater control over infrastructure and security, or the flexibility to leverage the benefits of both public and private Clouds.

Wealth Management 23

Adam Gaca, Head of Managed Services & CloudOps at Future Processing

Over the past few years, fintech apps have grown rapidly in popularity as consumers have adapted to managing their finances digitally, spurred by the global pandemic. At present, as the cost of living crisis and a looming recession remain a worry for many in the UK, we’re seeing some interesting trends in fintech app usage that prove just how resilient these apps really are, and highlight the opportunities that lie ahead for marketers.

Finance 24

Fintech apps are continuing to grow in popularity: here’s how you can benefit

Lessons learned from 2022

Last year, the fintech industry faced a number of significant knockbacks, from the crypto crash and subsequent ‘winter’ to the downturn in the stock market. Not to mention the wider economic uncertainty and fear of a potential recession.

Despite this, Adjust’s most recent 2023 Mobile App Trends report revealed some positive trends, similar to what we saw in 2022, which demonstrates the resilience of mobile financial services. According to the research, global installs for fintech apps grew 2% in 2022 with EMEA (10%) and LATAM (8%) experiencing the most growth. In fact, this growth is continuing into 2023 – with January up 6% YoY and 13% compared to the 2022 average.

In addition, we saw that consumers are using the apps more, as global sessions grew 19% YoY in 2022 — up most notably in LATAM (54%) and EMEA (40%). Evidently, even with understandable economic uncertainty, people are turning to their fintech apps to manage their funds. Sessions are also up so far in 2023, with January seeing 7% growth compared to the 2022 average and 15% compared to January 2022.

Importantly, users also spent more money YoY in 2022 compared to 2021. Fintech in-app revenue skyrocketed 44% YoY. November and December were the main months driving this impressive upward tick, increasing 83% and 112%, respectively, compared to the year’s

average. In fact, December 2022 was the highest ever month for fintech inapp revenue tracked by Adjust.

With installs, sessions and spending in fintech apps increasing across all regions and sub-verticals, it is clear that the global fintech app ecosystem is thriving. Across the board, fintech apps have been able to retain the stream of customers gained throughout 2020 and 2021.

What we can expect to see in 2023

Continued growth can be expected from this space in the next year, even more so as the increasing cost of living drives consumer interest in easy money management. Consumers will continue to realise and take advantage of the benefits of fintech apps - simple payment processes, quick access to funds and effective money management tools, to name a few. It’s a great time to lean into this growth to look for app growth opportunities to retain valuable customers as we take on 2023.

Having said that, there will be users who are wary of the recession and are therefore not spending as much. To counter this challenge to revenue, fintech apps must focus on attracting and retaining customers by providing the best possible experience for their users. Developers must create features that complement the app’s core functionality to encourage continued engagement even when users are not actively spending.

Gathering feedback from app reviews, in-app prompts and email surveys will be crucial. App teams can then capitalise on what’s working well and work on fixes for what isn’t as effective. Identify points in the user journey when disengagement is highest and alleviate these pain points or insert prompts at these moments to get clear insights directly from the users themselves.

And more critical than ever in a time of needing to do more with less, fintech app developers must take full advantage of app analytics to optimise apps and marketing campaigns. The analysis of performance data is used to understand the user journey better and make informed decisions. Without app analytics, developers cannot clearly identify potential problems with their app and/ or campaigns, nor can they identify corresponding solutions.

In a competitive market with over 2.2 million mobile applications available on the Apple App Store and 3.5 million apps on the Google Play Store, the insights gained through app analytics are critical components to success in converting, engaging and retaining users with high lifetime value.

Alexandre Pham, VP EMEA, Adjust

Finance 25

Bringing VCs into the 21st century:

with transparency at the top of the agenda, investors need to stay ahead to survive

The venture capital industry is a crucial element in the startup ecosystem, providing funding and support to early-stage companies with high growth potential. However, the industry is currently experiencing its greatest reckoning since the dotcom bubble bursting. We’re witnessing down rounds and slashed valuations in real time, as tech layoffs rage on, funding slows and returns decline. The economic downturn sparked a recalibration for investors worldwide, with grave consequences for overhyped, overfunded, overvalued tech giants and their backers.

VC investors have been scarred by the legacy of the scammer CEO. Just last year, FTX’s Founder and ex-CEO Sam Bankman-Fried joined a growing list of now infamous fraudster founders. Theranos’s Elizabeth Holmes, WeWork’s Adam Neumann and ‘Pharma Bro’ Martin Shkreli have all demonstrated the dangers of buying into a ‘visionary’ as opposed to a viable opportunity. But post-Theranos, post-WeWork, post-FTX, the only way for the venture industry to show it has really learned its lesson, is to demand radical transparency.

These scandals have acted as a catalyst for a long-needed change. For years, the VC industry has not kept up with others; staying stuck in the stone age with models which do not encourage transparency and thorough due diligence which are the cornerstones of fostering innovation, increasing social responsibility and entrepreneurial drive.

Professional investors are facing this increasing scrutiny to stay ahead, with LPs demanding immediate clarity and expecting their investment returns to be presented alongside human social impact. As we enter into this new era of VC investing, transparency will become paramount. But that can only be achieved when information is ultra-accessible and readily available. In doing so, due diligence can evolve from a burdensome chore into an easy and ongoing process.

So, how can VCs navigate the choppy waters ahead?

1. Beware of misleading KPIs: Both ride-hailing/sharing apps and grocery delivery services have fallen victim to this phenomenon. “Fear of missing out” clouded investors’ judgment, who got overly excited by growth metrics and soaring valuations.

Of course, that user growth was often driven by generous discounts, subsidised by venture capital itself. A loyal customer base could not be sustained after these tempting discounts ceased. Consumers were in no way sticky and loyal to a brand, switching to competitors when lower prices were offered. User growth is not the only defining metric to pay attention to when seeking out venture opportunities.

Investors need to look under the bonnet to get a more complete understanding of the financials of the business, paying attention to what really is going to drive long-term, sustainable growth. Early stages of growth are very linked to social, political and economic contexts which can lead to quick – but ultimately unsustainable – customer growth. What really matters, and what VCs should be inspecting, is how these companies acquire news customers. A stable business must have three predictable means of acquiring new customers - for example, through social media, digital advertising and SEO strategies.

Wealth Management 26

2. Interrogate the product: VCs should be requesting – and demanding – product demonstrations. They don’t just need to inspect the business’s finances. They should scrutinise the offering, how it will work, how it will scale, and whether there is in fact a true market demand. In fact, if a VC does not request a detailed product demonstration, it should act as a red flag to portfolio companies - a sign that the investors have nothing to offer but capital, and potentially lack the invaluable expertise and guidance truly inquisitive investors can offer.

3. Always be driven by data: Taking a data-driven approach can reduce bias and the inequality gap in startup funding. According to Andre Retterath, only 10% of VC decision makers in the industry are women, and opportunities for female-owned companies account for only 2.2% of global VC funding. It is clear that gender bias is a pressing issue for the industry, and part of this problem

stems from outdated data processes at sourcing and screening stages. Data-driven VCs who take advantage of tools which reduce manual workflows will be able to make more investments which fight this inequality gap, ensuring that funds are used for social good.

4. Walk the walk: Transparency should go both ways. If VCs are demanding it of their portfolio companies, they too should practice transparency. VCs need to be willing and able to clearly communicate how and where their values align with their portfolio companies’. Taking it one step further, they should also offer an insight into how the fund is being operated, how it is performing, and what its longer-term plans are. Transparency can be a reputational advantage for both VCs and start-ups.

The venture capital landscape is changing rapidly, and the outcome is that LPs are (quite rightly)

increasingly wary and are questioning more how their funds are being invested. Transparency should at the top of VCs agenda throughout the entire investment journey, from the initial KPIs right through to presenting results to LPs. The traditional model of management – namely, spreadsheets – is outdated and not fit for this purpose, presenting a real danger to professional investors. The industry must be brought into the 21st century; ultimately, a digital revolution will drive innovation, foster entrepreneurship and increase financial growth.

Wealth Management 27

Clément Aglietta, Co-Founder and CEO, Edda

THE UNDERDOG TO TOP DOG MENTALITY

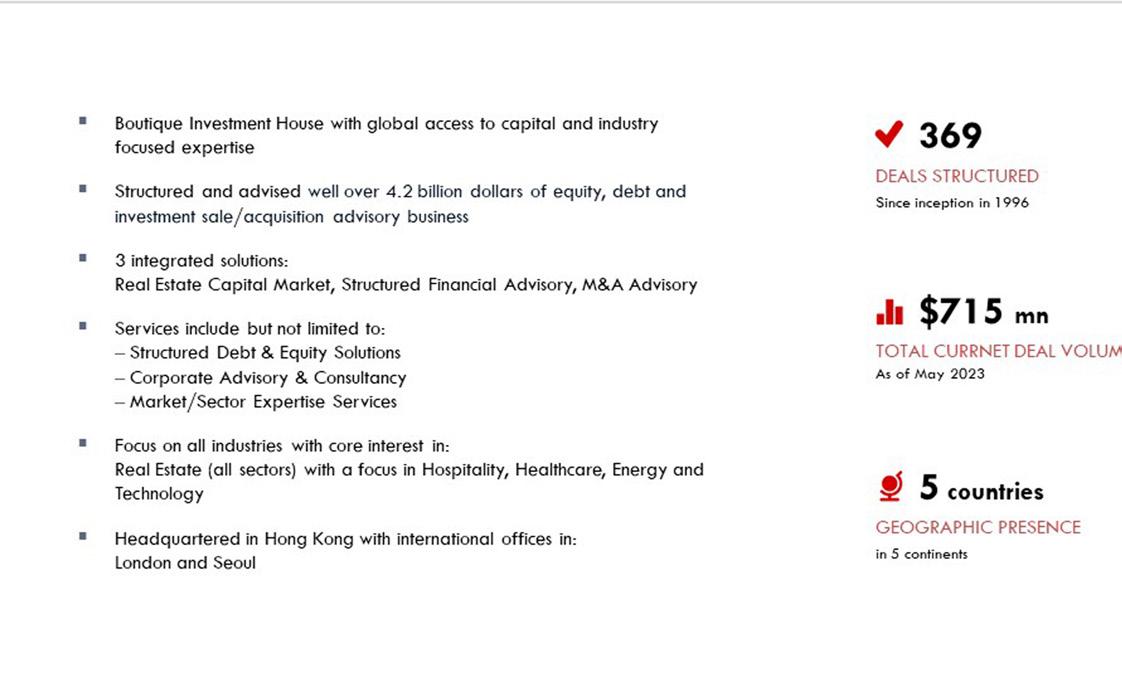

Korosh Farazad, a distinguished veteran in the world of investment banking and private equity. With over 20 years of invaluable experience, Korosh has consistently demonstrated an exceptional level of expertise and professionalism in his field. Throughout his illustrious career, Korosh has been instrumental in structuring complex financial transactions with some of the largest Private Equity groups on a global scale. Their extensive portfolio spans across continents, successfully managing and advising elite clients ranging from Asia to North America. Korosh has honed his skills and insights by working closely with renowned industry leaders, cultivating an in-depth understanding of the ever-evolving dynamics of the financial landscape. His commitment to excellence and strategic

acumen has positioned him as a trusted partner to esteemed clients, assisting them in achieving their investment goals and realizing substantial returns.

It is a privilege to have Korosh here today, and we look forward to benefiting from his unparalleled expertise as we navigate the intricate world of investment banking and private equity.

1.

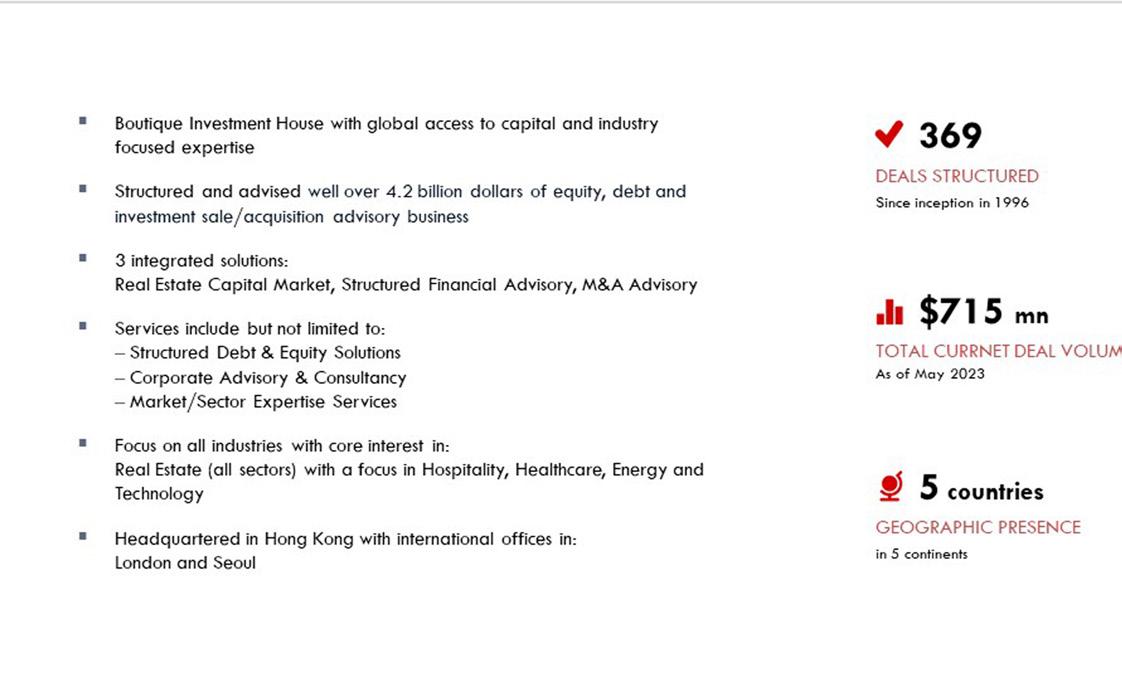

Pleasure to have you here. Please tell us about your presence being a global Boutique Investment House.

Thank you for having me. Farazad Investments is a subsidiary of Farazad Group, and it compliments rather than competing with

A talk with Korosh Farazad,Co-CEO, Farazad Investments

28 INTERVIEW

Photo Credits to Mr. Kosta Ivanyshyn

the other subsidiaries of the group of companies. Mostly, 80% of the business model specialises in the Real Estate Capital Markets with a strong emphasis on the hospitality investments. We focus on an A-Z structure, where we assist our clients with all elements of the capital stack (combination of different types of financing constitutes a mix of debt and equity instruments, each with varying levels of risk and return.), identifying hotel operators whether they are franchise operators or Hotel Management Agreements (HMA), different F&B concepts to compliment the region, theme of the operator, providing ideas and concepts for other revenue streams for the asset and not simply focused on the revenues from the room and occupancy rates. Having the ability to operate worldwide, it allows us to cater to clients in different countries and regions. We provide a personalized and tailored services to meet the unique needs of our clients in the real estate and hospitality sectors alongside other sectors that are not strictly hospitality driven (multi-residential, industrial, student-housing, etc.). We have a developed expertise and deep knowledge in these areas, allowing it to offer specialized advice, strategies, and solutions. Everything is done in-house, from the initial assessment to deal structuring and execution, which allows us to take full responsibility for the work we do and always have a direct dialogue with our clients and investment partners.

The other 20% of our business model is Corporate Finance, M&A’s, and introducing qualified companies with a healthy EBIDTA and business plan, to become a public company (IPO) within their jurisdiction.

We have a very talented team of people working for the company in Hong Kong, Seoul, and London, which allows us to have a wide reach of different equity investors, lenders at our fingertips to introduce potential opportunities subject to pre-underwriting the deal to understand the validity of the transaction and its success ratio. We currently have two companies that are going IPO in S. Korea and the other in Melbourne, Australia. The Korean opportunity is absolutely going to revolutionise hearing aid and I think by

the time this interview published, the company will be officially a public company.

2.As of date, Farazad Investments continues its global business expansion. What are the upcoming strategies?

Let me start by saying, I never thought that the company would be in the position that it is today with roughly US$ 1 Billion in deal flow and mandates in its books, and more importantly, the expansion of the other subsidiaries, which are Farazad Advisory, Farazad Ventures, Farazad Facility Services and HYDE Recruitment (outsourcing temporary workers to Hotels across UK to fill in the labour gap post BREXIT).

Sector Diversification: To focus on diversifying client base across various sectors. By expanding the expertise beyond a single industry, this way, we can can reduce risk and capture opportunities in different market segments.

Geographical Expansion: We are aggressively considering expanding presence into new geographical regions or markets. This would constitute establishing offices or partnerships in key global financial centres to attract a wider range of clients and access different sources of capital.

Enhanced Deal Sourcing: We have planned and now in action to develop robust deal sourcing capabilities to identify attractive investment opportunities. This may involve leveraging technology, data analytics, and networks to discover untapped markets and high-potential projects.

Specialized Advisory Services: This goes back to the subsidiary companies complimenting and not competing, our specialized advisory services that provide unique insights and value-add to clients. This includes in-depth sector expertise, customized financial solutions, and strategic guidance throughout the investment lifecycle.

Innovation and Technology: Embracing technological advancements and innovation can significantly enhance efficiency and client experience.

29 INTERVIEW

We have monitored this sector and have considered investing in advanced data analytics, artificial intelligence, and automation tools to streamline processes, improve decision-making, and provide real-time insights to clients.

Sustainable and Impact Investing: There is a growing trend towards sustainable and impact investing. With 90% of our transaction, we have incorporated environmental, social, and governance (ESG) into our client’s investment strategy, only if one was not implemented prior to them introducing the transaction to us. Further, we offer clients opportunities to align their investments with their values with ESG would is an imminent win for all parties.

Capital Markets Expertise: Given the mandate to raise both equity and debt financing, this requires for us to always be tuned and up to date on market trends, maintaining relationships with investors and lenders, and offering innovative financing structures tailored to clients' needs.

Client Relationship Management: One of the

core and fundamental focuses for us is building strong, long-term relationships with clients. By providing exceptional client service, maintaining open lines of communication, and understanding their clients' evolving needs, they can foster loyalty and attract new business.

3.As a CEO of a boutique investment house, what are the leadership and management skills you have implemented to have the team benefit from?

Clear communication: One of the most essential skills for any leader is the ability to communicate effectively with the team. Despite the challenges this may have, I have developed a clear communication plan and ensure that everyone is aware of their roles and responsibilities.

Empathy: Being an empathetic leader means understanding and acknowledging the team's perspectives and needs while leading them towards achieving company goals. Encourage and motivating the team to speak up, listen

Page No 30 INTERVIEW

actively to their concerns, provide solutions, and foster a safe and respectful work culture.

Focus on Goals: Focus on setting clear and measurable goals for my team so that they can strive to achieve them. These goals can further motivate them and allow them to showcase their individual strengths and work collaboratively to achieve the shared goals.

Lead by example: Leading by example is a crucial aspect of a good leader. It means that I must always demonstrate the qualities that I want my team to embrace. Show initiative, be proactive, prompt, organized, and disciplined.

Continuously learn and develop: As a leader, it is super important to continuously teach/ guide and develop their skills to become better. Encourage them to learn and grow by providing ongoing training and development opportunities to enhance their skills and knowledge where and if needed.

4.

Do you have a hobby outside of work that helps you be a better leader?

As a CEO and running several companies literally simultaneously on a day-by-day basis and making precise and calculated decisions is part of the process and therefore, engaging in hobbies or as I call it “different value-add activities” outside of work can be instrumental in enhancing leadership skills and adapting to a constantly changing world.

Reading: Cultivating a habit of reading helps broadens my knowledge and understanding of various subjects, including business, leadership, economics, technology, and global affairs. It enables me to stay informed, think critically, and make well-informed decisions in a rapidly evolving business landscape.

Physical Fitness: I maintain and try to maintain an active lifestyle through exercise or walking to my meetings and getting in my 10k steps on a daily basis, which not only promotes my well-being but also fosters discipline, resilience, and determination.

Traveling: One of the values and perks my job offers is the travelling. I travel on average once per week outside of UK; this is either day trips or overnight stays. This most certainly allows me to experience different cultures, meeting diverse individuals, and experiencing new environments that most certainly expands my perspective and develops my adaptability. I am proud to say, I have lived in several different countries and for me, adapting is no longer a challenge, and it is considered art!

5.

What do you expect 2024 to bring?

To be perfectly candid, we had no idea how 2023 was going to turn out and we managed to overcome some very challenging times in terms of cost of financing, identifying different equity partners with the same vision and alignment with ours and our clients.

Page No 31 INTERVIEW

Of course, the specific outcomes can be influenced by various factors and are subject to market conditions and economic trends. To continue with the positive streak and not get side tracked with the volatility of the markets and pessimism, we focus purely on

Market Conditions: The performance of the financial markets can greatly impact the activities of our group. If the global economy continues to grow steadily, it will create a favorable environment for investment and capital raising activities. However, market conditions can be volatile and subject to various risks, including geopolitical events, regulatory changes, and economic downturns. It's crucial to stay vigilant and adapt to changing market conditions.

Deal Flow: As of 30 May 2023, we have roughly US$ 750 million of mandates within our active pipeline. The deal flow can be influenced by market sentiment, investor appetite, and industry-specific trends. If the economic environment remains favorable, we can easily see increased activity in mergers and acquisitions, capital raising, and advisory services.

Technology and Innovation: The financial industry is undergoing rapid technological advancements, including digital transformation, automation, and artificial intelligence. Embracing these innovations can enhance operational efficiency, streamline processes, and improve client experiences, which has had integrated this year but 2024, this process will be ramped up significantly.

With the foundation that I have created just within the last 5-years has allowed the company to work seamlessly and continuously grow by 20% on average. This is simply with the structure, which I have explained above.

Talent and Team Development: As the CEO, last year, I started preparing and nurturing a talented and diverse team for the long-term success of the brand. Therefore, for 2024 and beyond, investing in employee development, attracting top talent, and fostering a culture of innovation and collaboration will be vital.

- Korosh Farazad, Co-CEO, Farazad Investments

- Korosh Farazad, Co-CEO, Farazad Investments

Page No 32 INTERVIEW

Page No 33 INTERVIEW

How to find an investor that matches your business values

In the past few years, I have seen businesses partner with investors that do not align well with the companies’ values and the consequences can be devastating to long-term growth and profitability and overall performance of the companies.

Finding an investor who aligns with your business values is a critical step in building a successful partnership that can only benefit your business in the long run, but for many businesses, too often there’s a temptation to take investor money without thinking about whether the investor is someone who shares your vision, or you want to work with long-term

Here are five steps to first consider before partnering with an investor:

Step 1 - Outline your business values

Start by clearly defining your company's values. What is your mission and vision? What are your core beliefs and principles? Write them down and make sure they are clear and concise, the more detail the better. The key aspect is to define boundaries and what you would do or not do. For example, if you are a consulting business, will you share findings from an assignment with a competitor of a client?

Business Page No 34

- Rafael S. Laujenesse, CEO of ReachX

Step 2 - Research

Look for investors who share your values by researching their investment philosophy, portfolio companies, and previous investments. You can also use online resources such as Crunchbase, AngelList, or LinkedIn to search for investors, there are many resources online for you to do your due diligence in the first instance. Once an investor is interested in investing, there is a bit of a reverse process, where they lay out all the value they can add to your business. This is an important moment to investigate the softer side of investing, and see if trust can be established. The investors you will invite in your business will make decisions with you over capex, acquisitions, and potentially taking other investors or even selling the business. You want to create a partnership with this investor.

Step 3- Network

Online resources are great but there is also tremendous value in attending networking events and conferences related to your industry or niche to meet potential investors. This enables you to make important connections, ask questions, and get a better sense of who shares your values.

Step 4 - Word of Mouth

Word of mouth referrals are a great tool to scope if an investor is right for you. Ask entrepreneurs, advisors or mentors for referrals of investors who may align with your company values. This can be a great way to find investors who are a good fit and has the added bonus of a referral from someone you already trust

Step 5 -Interview potential matches

When you have identified potential investors, a good way forward is to set up interviews to truly learn more about their investment philosophy, values, and goals. This will help you to determine if they are a good fit for your business and gives you the chance to get to know them.

So you’ve taken the first step, done your due diligence, but the question is why is it so important to partner with an investor that shares the same values as your business?

Reasons why alignment in values with an investor will benefit your business

Goals alignment

When an investor shares your company's values, they are inclined to understand and support your company's goals. This can lead to a more harmonious working relationship because both parties are pursuing the same goals.

Cultural compatibility

Investors who share your values are more likely to fit in with your company culture. A good cultural fit can lead to improved communication and collaboration between the investor and the company, which is critical for long-term success.

Growth that is sustainable

When it comes to achieving sustainable growth, an investor who shares your company's values is more likely to be patient and understanding. This means they are more inclined to support long-term objectives rather than short-term gains, which can lead to more sustainable and stable growth for your company.

Brand image and reputation

Partnering with investors who share your values can help to strengthen your reputation and brand image which is vital for successful business growth. It can convey to customers and other stakeholders that your company is dedicated to certain principles and values, which is very important in today's socially conscious environment.

As a founder, you are responsible for your company's values. Although you may not own all of the company's shares, the ethics and standards that guide your business will always be yours to manage. Because of this, you need to protect what you've created, so do everything you can to maintain your control. Overall, finding an investor who shares your values can help your scale-up business achieve long-term success while maintaining its principles and values. A win-win for everyone. It is important for your Board, your employees, and your partners to get this right.

About Rafael S. Lajeunesse

Rafael is CEO of ReachX and responsible for driving the company's vision to be the trusted platform for institutional investors and corporates, offering bespoke Investment banking services and access to investment opportunities and capital. Prior to ReachX, Rafael worked with JPMorgan & Co. in London where he was a Portfolio Manager. He was also a consultant with McKinsey & Co. in New York working with clients across media and financial services. He earned an MSc. from the EMLyon Business school and received his MBA from The Wharton School.

Business Page No 35

Alister Sneddon, Head of Product, CMC Invest

maximising investments; minimising Fees

Without planning and research investing can come with more ‘investment’ than you bargained for. Namely, incurred fees. As we face the ongoing economic crisis, more people are turning to investments to protect their money from rising inflation rates. So now, more than ever, it’s important for all investors, new and experienced, to consider potential fees when choosing investments.

There is a range of potential costs, from management charges to transaction costs. Calculated incorrectly, they can affect your investment’s performance, compound losses, and restrict returns. Shockingly, finder.com research shows that the average UK investor could lose up to £1,200 a year on broker fees. No investor wants to lose money, let alone unnecessarily on fees, and especially, in the current economic climate.

What fees should you look out for?

Well, there are a fair few. Most can’t be avoided, but fees can be minimised. Let’s break them down:

Fund management fees: if you have investments in a fund, you need to consider the annual management fees. These cover the cost of your fund manager and are set by the fund management group. Occasionally, larger platforms will receive a discount from the funds, which means you might be charged a higher platform fee and a lower fund fee. Don’t be fooled by the trope of ‘higher price, higher quality’; a high fee does not guarantee high performance. Compare how funds have performed in the past, and from there you can judge whether the price is fair versus competitor rates. Past success is never a certain measure of future performance, but it’s a great place to start.

FX fees: if you have investments in stocks outside the UK, once you transfer them back into sterling there may be a hidden cost. Depending on the spread of your investments, this could be fairly large and will be impacted by the size of each transaction - and how many you make. This fee can’t be avoided, but being consciously aware of the hidden costs will help you make strategic decisions to minimise the total fees each year.

Commission: every time shares are bought or sold on a platform you will be charged a fee for the transaction. It will depend on each platform how it’s calculated; for instance, it could be a set fee or based on the size of the transaction. So, always make

Wealth Management Page No 36

sure to research and compare ahead of choosing a platform.

Platform fees: as the name suggests, rather than linking to a transaction, these fees cover the general costs of using a platform for holding investments (custody charges) or administration fees - this includes both SIPP and ISA charges. How and what you are charged will vary, so research is important here. It may be a monthly flat fee, or it could be a percentage fee based on the total value of your investments. Typically, they will all be wrapped up together as platform fees.

It doesn’t stop there. Other hidden fees include; account opening fees,

withdrawal fees, dividend reinvestment charges, and exit fees. Being mindful of every potential expense will help you make informed and measured decisions.

Managing and minimising platform fees

Over time, fees will add up, so something you considered okay to begin with may start to impact your total take home. Assessing your situation will drive which fee option suits you. For example, if you invest large amounts each month, a flat fee will most likely give you higher total returns than a percentage.

Likewise, if you know you will

rebalance or buy and sell holdings regularly, this will increase your trading fees. Focusing on a long-term strategy will help to minimise hidden fees associated with a change of tack and make extra costs more ‘predictable’.

No more hidden costs

Though you can’t eradicate associated costs, being aware of them will ultimately put you in the strongest position going forward. With every decision you make, assess how it will contribute to your end goal and the cost of doing so - accounting for every fee, even if it's only a potential. By taking back control, you will maximise your chances of success.

Wealth Management Page No 37

A DIGITAL AND AUTOMATED APPROACH TO ANNUAL BUDGETING IS A NO BRAINER

Simon Bittlestone, CEO, Metapraxis

Simon Bittlestone, CEO, Metapraxis

Speak to any CFO, especially in large multi-national organisations, and they’ll tell you about the relentless challenges they face with regard to creating annual budgets and business forecasts. Why? Budgets and forecasts are still often created and delivered manually in Microsoft Excel – which is undoubtedly an excellent tool and offers numerous benefits to FP&A teams – but it isn’t designed for this activity.

Finance Page No 38

Finance Page No 39

The challenge of Excelbased budgeting

Typically, organisations tend to follow a similar annual budgeting process. The central finance team creates a starting point for the new year’s budget, often rolled over from the previous year, with a targets incorporated. Depending on the size of the enterprise, anywhere between 10 and 200 people will then typically input into the budget, starting with the revenue plan through to build up of costs, and the impact on cash flow and the balance sheet. The central finance team then has the unenviable task of consolidating all those inputs manually into a single Excel budget spreadsheet. This in itself is no mean feat, when you consider how

complex, time-consuming and error-prone this process is.

The finance team summarises the context to reflect the assumptions such as the marketing expenditure required to achieve new product sales and so on. Following the presentation of this mammoth budget spreadsheet to the CFO and senior management, changes are inevitably needed, which in turn means that further input from many of the 200 people who originally contributed is required. This process continues until the CFO, management and the business units at large are on board with the business goals and targets for the year. The timeframe to reach this point could range from anywhere between three and six months, with numerous team members having

time and headspace for little else.

The difficulty of this exercise is easy to grasp. A single misstype could break a formula or even multiply an error, the repercussions of which could potentially be catastrophic for the enterprise. Most finance teams have their war stories. A fortnight away from budget presentation D-day, whilst conducting the final checks of the annual budget, the central finance team in a US based multi-billion dollar business spotted an error, resulting in the department having to completely re-do the entire budget to ensure accurate representation when submitted to the Board. One small mistake led to the team working long into the night and weekends to meet the deadline.

Finance 40

Digitisation for strategic insight

In today’s predominantly digital business environment, fighting with Excel spreadsheets is a futile and wasteful exercise. A digital approach delivers the same results in a fraction of the time, saving the enterprise a significant amount of money. To illustrate a hypothetical scenario, an organisation comprising five business units, each with 10 cost centre owners, running an Excel-based manual budgeting process across revenue, cost, capex and cash flows, before a group-wide consolidation process, incurs c.370 days of effort versus under 130 days if a digital and automated methodology were used. The total cost saving in such a scenario would be c.$200,000 per year, before any of the benefits of improved accuracy and better use of time are quantified. This estimation is based on a budgeting calculator that leverages industry standards and best-practice to arrive at a cost saving calculation.

Furthermore, budgeting isn’t only about revenue and cost numbers, it’s also critically about understanding business trends in the organisation, identifying the opportunities and risks, and based on data insight, taking better decisions to achieve commercial goals.

In a digitised finance operation, adoption of automation can help exponentially shorten the time to produce the budget, freeing up FP&A teams to provide strategic insight into the business, and in doing so add value and expertise.

A large corporate’s central finance team confessed that prior to adopting an automated approach to annual budgeting, the department was spending nearly 80 percent of its budget process time inputting and sanitising the data, until they moved to a digital process which instantly brought the time down to under 20 percent.

Digitisation a foundation for analytics and AI

With the digital fundamentals in place, FP&A teams can leverage their datasets for analytics to better understand business performance, areas for growth and even the broader environment within which the organisation operates. In which business units are staff costs out of line with revenue growth? Which divisions are underperforming against their annual targets? Are there signs of customer churn brewing? Can we better predict customer demand over the next three years? Is there an opportunity to launch a new product or service? Is there the right correlation between marketing costs and revenue?, and the list goes on.

The days of Excel-based budgeting are numbered. In the next decade, large swathes of finance and accounting work is going to be automated through AI, and anyone who doesn’t believe, I dare say, is burying their head in the sand. These technologies require a robust foundation of digitised processes, and now’s the time to do it.

Finance 41

How to use data around open source projects

Open source has become one of the most recognised movements in technology in the last decade. According to Red Hat, 90% of IT leaders use enterprise open source software, and by 2026, the open source services market will be worth $50 billion. The number of open source projects and businesses based around open source has skyrocketed over the past decade.

Technology Page No 42

These projects need people to support them. This takes money. Traditionally, this would come from venture capital firms that would provide funding that would go into recruiting staff, developing the community and growing a business. In today’s climate, securing funding for these kinds of businesses has dropped massively - during 2022, investment in startups dropped by 43 percent compared to the previous year according to Crunchbase. Today, venture capital firms are focusing on companies that have a clearer path to sustainable revenue operations. So how do you quantify these opportunities for them, and help them understand growth?

Cowboy Ventures shared that ‘usage’ is the number one metric investors look for when deciding on which companies to fund. The Cowboy Ventures team found that “running a project in production signals trust as it can impact end-user experiences.” Similarly, Redpoint Ventures recently published their top 25 open source infrastructure companies, which compounded the need for the rate of growth to be tied to external contributors, not stars on GitHub.

The team at Redpoint commented: “We anchor too much on total GitHub stars. In our opinion, usage is the most important metric.” For firms looking at investing in open source, this real world data is an essential guide for who to back at the beginning.

Building a business, not just software

The film Field of Dreams is best remembered for the line, “If you build it, they will come.” But wildfire open source adoption does not just

happen, and it does not guarantee commercial success even if it does. Garnering millions of downloads or recruiting thousands of contributors does not equate to a capacity to monetise.

Cultivating a viable business around an open source project hinges on the company’s ability to turn anonymous usage of that software into a set of known users, and then to turn some of those known users into paying customers for a product or service around that software. To invest in such a business is to take a bet on the effectiveness of that funnel, so it’s critical for investors to understand the real number of active users and their propensity to become customers.

Contributors offer a starting point to understanding who is using the project, but typically this is an extremely limited subset of the user base. Any company that strives to commercialise its product and grow to the next level will inevitably need a more complete picture of their adoption metrics.