Discussing the big topics in rural retailing with some of the industry’s top operators

Get ready for the Farm Shop & Deli Show with our full preview

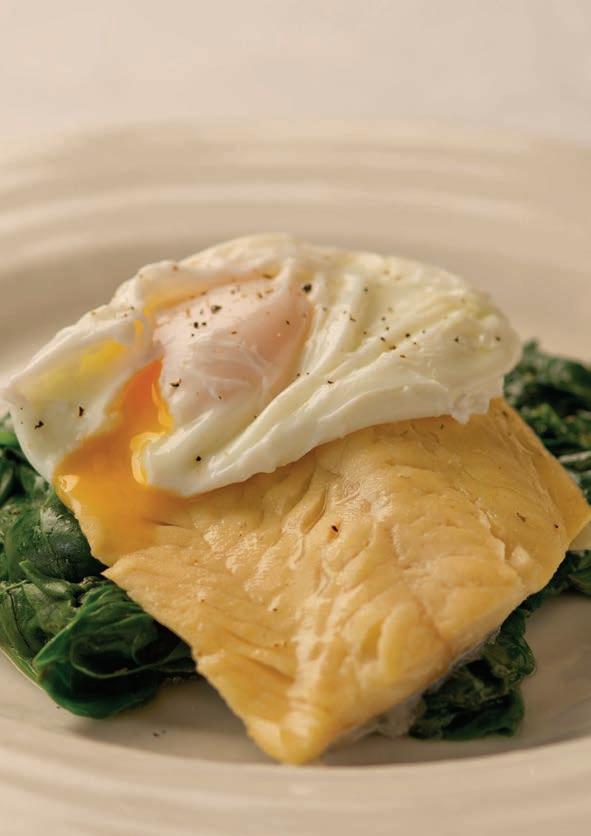

Raise your pastry game with our updated foodservice section

Read about how Kale & Corn grew into a very modern greengrocer

editorial@gff.co.uk

Editor: Michael Lane

Deputy editor: Tanwen Dawn-Hiscox

Art director: Mark Windsor

Contributors: Nick Baines, Richard Faulks, Patrick McGuigan, Greg Pitcher, Lynda Searby, Tom Vaughan

opportunities@gff.co.uk

Sales and publishing director: Sally Coley

Senior sales account manager: Becky Haskett

Sales assistant: Henry Coley

That’s the thing with talking about food & drink. It’s not about right or wrong. It’s about learning and gaining more perspective.

By Michael Lane, editor

Never bring your work home with you, they say. Even in the post-Covid world where we all quite literally do this, the idea of separating work and personal life is something that many people aspire to but ultimately fail at. Me included.

But when you work in the food industry, this is pretty much an impossible task and there is a grey area – usually the kitchen table –where the topics from work become items for family debate.

We had an interesting conversation the other day during dinner about why people assessing food & drink o en say they can taste other things when they describe what’s on their palate. The implication for some people around our table was that detecting a certain type of berry in a red wine, or notes of pineapple in a cheese, seems overly pretentious – even elitist.

Being guilty of this myself sometimes, my clumsy explanation

was that these avour synonyms act as reference points during the appraisal of whatever’s being tasted. My audience wasn’t convinced.

We’ve also had more harmonious conversations about what good value you get when buying proper cheese from a deli counter. To give all you retailers out there even more hope, this was not a topic I initiated.

As fun as preaching to the converted is, my favourite debate recently was sparked by one of the kids when we were talking about a few shops in our area.

“That’s not a farm shop. It can’t be a ‘farm shop’, if they don’t sell stu they grow themselves,” came the battle cry. It’s the kind of thing that internet trolls claim children aren’t capable of saying but I can assure you they did. And we then went down the rabbit hole of retailing nuance and marketing.

That’s the thing with talking about food & drink. It’s not about right or wrong. It’s about learning

and gaining more perspective. It’s about sharing ideas. And ultimately it’s about not feeling like you’re not on your own with your thoughts.

Funnily enough, the chat at home was just a continuation of the previous few days I spent in Birmingham at the Farm Retail Association’s annual conference – a place where I did plenty of talking and listening. This included a roundtable discussion behind closed doors ahead of the conference

I won’t give away too much (there’s a full report on this session starting on page 28) but it was enlightening, concerning, and encouraging in equal measure.

Having this kind of discourse and contact with industry peers is vital. It’s the kind of thing that might just help you keep going during what is an increasingly challenging year.

And, who knows, you might even nd a solution for one of those problems that you keep bringing home with you.

Unfortunate as it is for an employee of the Guild of Fine Food, one of my colleagues here has a nut allergy. However, she described feeling “like she shouldn’t be eating” Sunfly’s seed butters, so convincing are they as nut butter alternatives. As a great lover of peanut butter myself, I can only agree. They don’t feel like a compromise at all, and the Crunchy one makes for a particularly good SB&J.

p.59

Accounts assistant: Julie Coates

Finance director: Ashley Warden support@gff.co.uk

Managing director: John Farrand

Associate managing director: Christabel Cairns

Partner relations director: Tortie Farrand

Chairman: Bob Farrand

Marketing officer: Jenna Morice

Marketing and operations

assistant: Frances Coleman

PR & partnerships officer: Claire Fry

Data strategy & insight manager: Lindsay Farrar

Operations manager: Claire Powell

Operations coordinators: Chris Farrand, Sepi Rowshanaei, Chloë Warren-Wood

Operations & events coordinator: Zara Williams

Operations assistant: Jessica Radley

Published by The Guild of Fine Food Ltd Fine Food Digest is published 11 times a year and is available on subscription for £50 p.a. inc P&P.

© The Guild of Fine Food Ltd 2025. Reproduction of whole or part of this magazine without the publisher’s prior permission is prohibited. The opinions expressed in articles and advertisements are not necessarily those of the editor or publisher. Printed by Blackmore, Dorset

Organic food & drink sales enjoyed a 7.3% boost in 2024, with almost two thirds of UK consumers buying organic products despite cost-of-living pressures, according to a report from the Soil Association. Sales rose by 9% in independent retail.

As part of a £600m investment, Waitrose is set to open two new convenience stores in West Sussex and Bristol, and is planning to refit a further 20 supermarkets throughout 2025.

The Newt in Somerset has hired River Cottage alumnus Gelf Alderson as its new head of food. Alderson, who spent 12 years working with Hugh FearnleyWhittingstall, will oversee all food & drink concepts at the estate.

By Greg Pitcher

Amazon-owned grocer

Whole Foods Market was set to open a new store in London in March a er a decade-long hiatus in the UK.

The retailer, which sells a range of produce including Doughlicious cookies, Butter Bike peanut butter and The Root Co. ginger beer, announced plans for a 21,000 sq premises on the King’s Road in Chelsea.

The store was expected to open on 25th March, becoming Whole Foods Market’s rst new UK store for 10 years and taking its tally to six, all in the capital.

In a publicity drive showcasing the retailer’s renewed interest in this country, the rst 200 customers at the Chelsea outlet were promised tote bags lled with goodies and a voucher.

Whole Foods Market stressed the purity of its products, saying it

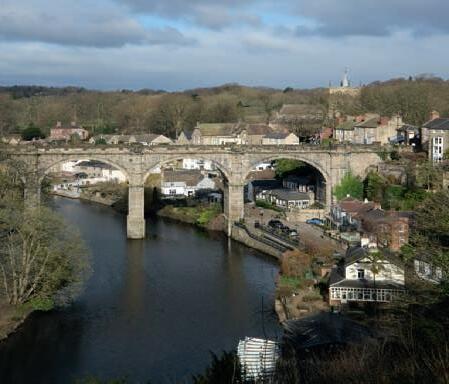

Harrogate institution

Fodder – the Great Yorkshire Food Hall has reopened following refurbishments. The revamp of the site, which was originally launched by the Yorkshire Agricultural Society (YAS) in 2009 to support local farmers and food producers, includes the addition of permanent tasting tables and a redesigned café, now called The Kitchen, which also has an updated menu.

The food hall has been revamped, too, in order to expand the product range and improve the overall layout.

The refit was part of a broader rebrand across YAS businesses – also including The Great Yorkshire Events Centre, Harrogate Caravan Park and the Great Yorkshire Show – which sought to modernise them, and integrate eco-friendly design elements.

had banned more than 300 colours, avours, preservatives and other ingredients from its shelves.

It said the new store would feature a co ee bar, a soup bar, a hot bar, a salad bar, rotisserie chicken and a “full-service deli”.

The retailer pledged to o er a “wide variety” of international and local cheeses as well as more than 350 types of wine.

Its bread is to be baked daily, it added, and it will also stock gluten-free and

vegan produce.

Nick Miles, director of retail analysis at consultancy IGD, said: “Since acquiring Whole Foods in 2017, Amazon has focused on improving e ciency rather than opening new stores.

“In the UK, Whole Foods [already] operates ve stores in London, catering to the demand for natural, healthy and organic products. The retailer has signalled plans to open more stores, however it is unclear

whether this will be in the UK or its other markets.

“Given that Whole Foods has not opened stores outside of the UK capital to date, we would expect any new store developments to be focused in London.”

IGD said the retailer’s tally of shops had been relatively at across the UK, the US and Canada over the past eight years.

But it highlighted talk of 90 new outlets being in the rm’s global pipeline.

The consultancy added that Amazon had bolstered its leadership team with grocery experts and started experimenting more with new formats.

Whole Foods Market’s rst smaller-style store opened in New York last year. This 9,101 sq Whole Foods Market Daily Shop was touted as bringing the “freshest, high-quality ingredients” to customers with “convenience that ts their fast-paced urban lifestyles”.

UK food security report calls for updated policies as ‘a matter of national concern’

The UK should reduce its reliance on a small number of “big retailerdominated” food distributors as it seeks to ensure its inhabitants are protected from major crises, a report has urged.

Tim Lang, professor emeritus of food policy at City, University of London, set out a seven-step blueprint for narrowing the resilience gap.

His report to the National Preparedness Commission warned that “absence of an integrated and coherent food policy […] should be a matter of national concern”.

The study listed 26 potential threats to food supply from military

blockades to animal diseases that transfer to humans.

These also included “high food sector concentration”, with Lang warning that “decades of creating big-brand loyalty creates risk anxiety”.

The report called for new food connections and “less reliance upon a few big retailerdominated and overcentralised food distributors”.

Lang said a national food policy was “overdue but urgently needed”.

“This should provide clear goals, guidelines and indicators on many of the issues raised by the report.

“It should also improve cross-UK and multi-level co-ordination between existing ministries, agencies, regions and local authorities.”

Lord Toby Harris, Chair of the National Preparedness Commission, said: “The risks to our food systems are more pronounced than ever before. From floods in key farming regions to disruptions in global trade, we are facing a confluence of threats that could undermine our ability to feed ourselves. The recommendations provide a clear path forward, and it is vital that these are considered urgently.”

STEFANO CUOMO, MACKNADE

“Our sector has been good at looking after its teams, sometimes even people who are not as productive as others. This will put pressure on those roles. The short term might be fairly brutal but longer term, with fewer roles, businesses might be more productive.”

DANIEL WILLIAMS, GODFREY C. WILLIAMS & SON

“Even though we pay more than National Minimum Wage, we need to maintain the headroom above it to attract the right talent. Since Brexit we have noticed a shrinkage in quality and availability of workers. More businesses are competing for [fewer] people for minimum wage roles.”

JOHN FARRAND GUILD OF FINE FOOD

“The changes to minimum wage and NI may mean some tricky decisions, but small business owners have an obligation to ensure continuity and keep the ship afloat. It’s tough, there is no doubt, but spring has sprung and we must all fight to survive and do what we do best – sell great products and engage with customers. The supermarkets don’t do that.”

By Greg Pitcher

Independent food retailers were focusing on processes, prices and productivity in March as they braced for a triple tax thump in April.

Employer national insurance contributions jump from 13.8% to 15% this month, while the earnings threshold at which these kick in is slashed from £9,100 to £5,000 per employee.

All levels of minimum wage rise in April, with anyone aged 21 or older costing employers at least £12.21 an hour, and 18-20 year-olds due £10 an hour.

Meanwhile the retail, hospitality and leisure Business Rates Relief Scheme drops from 75% to 40%, meaning many companies will see their bill more than double.

The British Independent Retailers Association (BIRA) said many owners were shutting up shop rather than face the

nancial triple-whammy.

Chief executive Andrew Goodacre described a “deeply concerning trend of pre-emptive closures”.

“Shop owners are doing the maths and many are concluding that continuing simply isn’t viable,” he warned.

Daniel Williams, project manager at Godfrey C. Williams & Son, said the Cheshire deli had spoken to its local MP about the tax hikes. He said they came as many raw produce costs were also rising.

Ministers have confirmed plans for new retail-crime prevention measures and set out their justification.

The Home Office published a factsheet relating to shopbased clauses in the forthcoming Crime and Policing Bill, reaffirming plans to create a standalone offence for assaulting a retail worker. It added that the act, which defines theft of up to £200 worth of goods as “low-value shoplifting”, would be scrapped. This would leave such criminals open to sentences of up to seven years in jail rather than a 51 week cap. The factsheet said assaulting a retail worker would

have a maximum penalty of six months in prison and an unlimited fine.

“Upon first conviction, there is a presumption on the courts to impose a criminal behaviour order,” it added. This could ban criminals from visiting affected shops.

The government said police had recorded 492,914 shop theft offences for the year ending September 2024, a year-on-year increase of almost a quarter.

It also pointed to a recent British Retail Consortium (BRC) report showing some 737,000 incidents of violence and abuse in 2023-24, up from 475,000 in the previous year.

“We are mitigating through prices on some orders as they come in for April,” said Williams. “I worry about the impact not just on us but on small producers.

“We are looking at taking on new positions requiring quite a bit of responsibility but we will have to be more picky. We are willing to pay the right price for someone but need to make sure they have the experience and know-how.”

Stefano Cuomo, chief executive of Macknade, said

the Kent food hall would look closely at hiring plans in the wake of cost hikes.

“We will take a view on whether to recruit to roles we might have been thinking of,” he said.

“We will put more e ort into hiring correctly, and onboarding. There is an element of being clear about what we are recruiting for and spending time to get the right person.”

Cuomo said productivity would also come into focus across the industry.

“This will sharpen all of us to look at pro t and loss more closely – more training, more engagement. Digitalisation.”

Chancellor Rachel Reeves defended employment cost hikes at last autumn’s Budget. “We are asking business to contribute more,” she conceded. “But in the circumstances that I have inherited, it is the right choice to make.”

Struggling with a costly direct to consumer model and mounting losses, online cheesemonger and wholesaler Cheesegeek has been acquired out of administration by Albex Group. Investors, meanwhile (which include Dragons’ Den’s Steven Bartlett, who bought a 5% stake of the £3m business for £150,000 in 2022) have lost out.

Cheesegeek was founded in 2017 by former investment banker Ed Hancock, in a bid to promote and broaden the audience for British cheese. Hancock invested £720,000 of his own money into starting the business and raised more than £2m from investors, including £421,000

through a Crowdcube campaign in 2023.

The company released a retail range in Sainsbury’s and generated £4.5m in revenue, but the capital intensive direct to consumer business model led to just short of £3m in losses. Efforts to streamline operations by outsourcing fulfilment weren’t effective fast enough, leading the company to seek administrators in Albex.

The Scottish ingredients firm, which owns Tom Walker & Sons – a firm offering cheese cutting, packing, and distribution – is keeping Hancock on as the managing director of the company, and says it is planning long-term investment in Cheesegeek.

By Tanwen Dawn-Hiscox

Devon’s Darts Farm is celebrating a double victory after after winning both Large Farm Shop of the Year and Farm Café/ Restaurant of the Year at last month’s Farm Retail Association (FRA) awards.

The gala was held at the Eastside Rooms on 12th March, with Darts sharing the spotlight with Castle Farm in Kent, awarded the title of Small Farm Shop of the Year. The awards ceremony marked the culmination of the annual FRA conference, bringing together farm retailers from across the UK for a schedule of lectures, workshops, an AGM, and farm shop tours.

Founded by Ronald Dart in 1971 as a pick-yourown business, Darts Farm has since evolved into a destination on the outskirts of Exeter. In 1982, his three sons took over, expanding it into a farm shop, three restaurants, a café, a food-

The trade gap between the UK and the EU is continuing to widen, according to the FDF, which has reported a 34.1% drop in exports in 2024 compared with 2019. Adjusted for inflation, food & drink export values fell by 12.6% last year, while imports rose by 3.3%. The imbalance is partly explained by the strict physical checks on products entering the EU since 2021, only reciprocated by the UK in April last year. The FDF has advised that the Government take a strategic approach to trade relations, including a veterinary agreement and support for Britain’s independent food & drink sector.

to-go shack, and a bar. Its main restaurant, The Farm Table, which won the award, uses seasonal produce either grown onsite or sourced locally and sold in the shop.

Celebrating the news, Darts Farm published a statement on its website, saying: “These awards celebrate the very best in UK farm retail, recognising

those who champion local food, support local economies, and forge meaningful connections with their communities and landscapes. This is a testament to our team’s hard work and dedication. We couldn’t be prouder.”

Castle Farm, meanwhile, is a 1,200acre mixed crop farm and the UK’s largest lavender

The former Keelham Farm Shop in Skipton, North Yorkshire, which fell into administration at the beginning of 2024, has been purchased by Robertshaw’s Farm Shop. Robertshaw’s has run a farm shop in Thornton, Bradford for over 50 years and is planning a grand opening for the Skipton site. robertshawsfarmshop. co.uk

farm, whose retail outlet, The Hop Shop, opened in 1985. It sells dried flowers, the farm’s own beef, apples and apple juice, as well as local produce. Reacting to its victory, it said: “We are honoured to have been chosen among so many fantastic farm shops.”

It added: “The Farm Retail Awards are judged by fellow farm retailers, making this recognition even more meaningful.”

The Lifetime Achievement Award went to Jo Mounce, founder of Strawberry Fields, which won Large Farm Shop of the Year in 2023.

Jo and her husband Roger Mounce established the business in Lifton, Devon, in 1991, first as a pick-your-own business before opening Lifton Farm Shop in 2002. Renamed Strawberry Fields in 2023, the shop champions homegrown produce and family recipes. Since Jo has stepped back from the day-to-day operations, these are managed by her son Adam and his wife, Laura.

A bill introduced to Parliament last month could secure fairer prices for UK farmers by strengthening the Groceries Code Adjudicator, enhancing food labelling, and improving public procurement of local food.

Yeo Valley acquired The Collective Dairy last month for an undisclosed sum. Yeo Valley said the companies’ shared missions make it perfect to support The Collective’s ongoing growth.

Olive oil prices are finally starting to drop after bumper harvests were recorded in Spain, Greece and Tunisia last year. The Grocer recorded a drop in prices in 15% of supermarket products, by as much as 33%.

Take a basket with you if you are wandering the towpaths of Cheshire this summer, as you might come across The Floating Farmshop. Naomi Cooper, who lives on a 30-foot narrow boat, is turning it into a farm shop selling home-made preserves, scones and locally-grown fruit and vegetables. The floating shop opens for business in Bollington in May.

Landymore’s Farm Shop in Stowbridge, Norfolk has recently applied to expand by converting an adjoining barn. Plans are to move the existing café into the new barn to free up more space on the premises for the growing business.

Adams Hill Farm in Chapmanslade, Somerset, has submitted an application to convert a barn on site into a farm shop. It would be around 150 sq m and would open between 8am-6pm Monday to Saturday, and 10am-4pm on Sundays.

Partnering and supporting Artisan cheese makers to bring you quality, value, and exclusive local cheeses to your counter.

MEGAN CALEY, co-owner, Kale and Corn, Duffield, Derbyshire

I grew up in Duffield and my family always said that the village needed a greengrocer to accompany the butcher. It was to be a few years before I put this idea into practice.

Following a lockdown redundancy, I was unsure what to do next. After obtaining my Class 2 licence, I helped with the country’s supply chain for six months before turning my passion for baking into a business. My then-fiancé Benn and I started selling my bakes at events around the Midlands which sparked a desire to retail. We set up a gazebo in a church car park and ran a ‘pop-up’ greengrocer every Saturday for several months to see if a traditional greengrocer could survive. We received amazing feedback and could tell that there was demand in the village.

We got married in June 2022 and when we returned from our honeymoon, we heard of a suitable venue. We wasted no time in signing a lease and opened in September. We opted for standalone display units due to time constraints, but with hindsight we should have commissioned a carpenter to install more space-efficient built-in units. After a year of trading, this is exactly what we did, expanding our ‘zero waste station’ from 12 dispensers to 36, offering a variety of rice, pasta, nuts, seeds, etc.

Our ethos has always been to offer fresh produce while avoiding single-use plastic, supporting local farmers where possible. We go to Derby market every morning to ensure our customers get the freshest produce possible.

Choosing what to stock was one of our biggest challenges but over the last two years we’ve listened to our customers. What started as a greengrocer soon turned into a village store where people can buy weekly groceries along with milk and eggs from local farms, homemade cakes and artisan sourdough.

Going into this business, our main concern was the associated waste. We offer a ‘weigh-and-pay’ service so customers can reduce their food waste by only buying what they need. We also turn our leftover produce into soups that are enjoyed by most of the village workers throughout the week. Being a greengrocer in today’s market is tough but consumers are becoming more ethically conscious and are happy to pay a little more than what they would at a supermarket if they’re helping the environment. The margins from fruit and vegetables alone wouldn’t pay our bills, which is why we are constantly expanding our range. We plan to introduce prepared foods, including salads, sandwiches and ready meals, which will provide higher margins and meet customer demand for convenience.

Interview Lynda Searby

Richard Faulks

FFD’s publisher and Guild of Fine Food managing director John Farrand has his say

THE WEATHER CHEERED up last week. I actually felt the warmth of the sun. It was beating down on my back as I stood on court –just before I skidded into the net, grazing my knee. I looked like a seven-year-old boy again.

Spring sun means tennis, picnics, rosé, lamb and increased retail sales. Much needed increased sales. I wonder what will happen to sales of my fave picnic staples a er they were on the receiving end of two very di erent gourmet rulings in recent weeks.

In a line that could come from a Protected Designation of Origin (PDO) chronicle of C S Lewis’ Narnia, Matthew O’Callaghan

Retailers with a cheese counter are invited to take part in one of The Guild of Fine Food’s interactive oneday Retail Cheese courses this year. Instructed by two experts in the field, Patrick McGuigan and Emma Young, attendees will learn how to taste and identify different cheeses, gain confidence in knowing what to stock and improve product knowledge, and more.

Upcoming dates:

The Balmoral Hotel, Edinburgh, Tuesday 13th May

No. 42 Southwark Street, London, Tuesday 10th June, Tuesday 22nd July, Tuesday 21st October

Farmer Copleys, Wakefield, Tuesday 15th July

Guild House, Gillingham, Tuesday 30th September

stated that Melton Mowbray Pork Pie should hail from a protected area de ned as, “the Leicester to Stamford road – the A47, to the south, the Great North Road the A1, to the east, the River Trent in the north, including Nottingham, and then to the west, the River Soar”.

But this can’t happen thanks to a ruling in March in which Defra refused to shrink the geographical region as de ned in its criteria – a criteria that some would argue was arti cially skewed in the rst place to include Saxby’s, a larger processor with a factory outside the traditional Melton Mowbray pie-making manor. Saxby’s ceased production 10 years ago a er General Mills, an American multinational bought and closed it down within a year.

There was more respect for where and how food and drink is made in France, back in February. I’m ending my picnic with a cheeseboard (obviously) and despite the irritating wasps (they do good things breaking down fallen trees, despite the bad press, you know),

I’m tucking into a Camembert de Normandie.

And in contrast to Defra, French legislators are tightening the net as opposed to loosening it. In a ‘landmark’ (read useful and informed) legal ruling, the PDO controlling its production has been reinforced to ensure that largescale makers can no longer state or infer their cheese is ‘Made in Normandy’.

The images of Norman cows, maids hand-ladling curds into

For years consumers have been duped, quite openly by big producers and bigger supermarkets.

moulds or lush northern France pastures must go. It’s quite simple really. Many of the makers of Camembert do not make the cheese with raw milk from the historical breed, and lo and behold, it doesn’t taste as good. That last one is a John Farrand condition, PDO does not control quality or taste. But for years consumers have been duped, quite openly by big producers and bigger supermarkets. Sounds familiar, eh?

When asked about the pork pie decision, Defra stated: “This would directly a ect market access and impose new trade restrictions, which is not permitted under the regulation.”

Read that last sentence again, slowly. “A ect market access”, “impose trade restrictions” – if only that sensible rationale could apply to issues around import, export, sending trade samples and the silent-but-deadly Extended Producer Responsibility hoo-ha. It’s started raining again as I write. Both metaphorically, and on our picnic.

By Edward Woodall Association of Convenience Stores

THIS MONTH the Government has introduced its Crime & Policing Bill 2025 into Parliament. This marks a significant moment for retailers across the country, who have long campaigned for action on the persistent issue of shop theft and rising incidents of violence. This Bill introduces robust measures designed to protect retailers and their staff, ensuring a safer and more secure environment for all.

One of the most notable provisions of the Bill is the repeal of Section 22A of the Magistrates’ Courts Act 1980. This section had previously created a perception that theft of goods valued at £200 or less would not be investigated or prosecuted. By repealing this section, it is hoped the Bill ensures that all shop theft offences are treated with the seriousness they deserve, regardless of the value of

the stolen goods.

The Bill also introduces a new standalone offence for assaulting a retail worker. This measure aims to protect shop workers who have faced an alarming increase in threats, abuse, and violence. The new offence carries a maximum penalty of six months in prison and/or an unlimited fine, with a presumption on the courts to impose a criminal behaviour order upon first conviction. This provision also underscores the Government’s commitment to supporting those on the front lines of the retail sector.

Simultaneously with the Bill’s introduction to Parliament, our Crime Report 2025 has been published. The report’s findings underscore the necessity of this legislation, revealing an estimated 6.4 million incidents of shop theft and over 57,000 violent acts against retail workers. While the Bill’s measures aim to address these issues, the report highlights the crucial role of police forces and

retailers in effecting real change.

The report dedicates a section to effective strategies for combating retail crime, emphasising the substantial investments retailers continue to make in staff training and new technologies, such as headsets and body-worn cameras, to detect and deter criminals.

Furthermore, it calls for Police and Crime Commissioners to ensure that police forces nationwide allocate more resources to addressing prolific and violent shop theft. While we advocate for robust legislation and tougher judicial penalties, the importance of local police presence and action remains paramount. Without adequate local enforcement, retailers are left despondent about the safety of their customers, colleagues, and communities.

Edward Woodall is government relations director at the ACS edward.woodall@acs.org.uk

AH, THE GOOD old reference request. That little digital tap on the shoulder from the ghost of employees past.

And who did I get one of these from recently? Let’s just say their name appearing in my inbox didn’t exactly spark joy. More like a mild, existential dread. They weren’t a thief, or a re-breathing dragon of incompetence, just…meh. Perfectly adequate. And in the cutthroat world of ne food, “adequate” is about as welcome as a lukewarm cup of instant co ee.

The form, bless its generic heart, was a breeze. Punctual? Sure. Absences? Nope. Quality of work? “Good.” A word so bland it could be used to describe wallpaper paste. I lled it in, picturing them landing the job, probably thinking, “Hey, I didn’t completely ruin that place!” And I’m le wondering if I’ve just inadvertently in icted mediocrity

on some unsuspecting business.

Over the years, I’ve learned a thing or two about references. Forms are for robots. Give me a phone call any day. The subtle tremor in a voice, the pregnant pause, the sudden urge to discuss the weather – that’s where the gold is. I once asked about a candidate

The subtle tremor in a voice, the pregnant pause, the sudden urge to discuss the weather – that’s where the gold is

and got a silence so profound I could hear the other person’s soul leaving their body. Turns out they’d been shown the door for a spectacular display of a er-hours “team bonding” that involved more booze than business.

Then there are the “culture killers”. The ones who smile while subtly poisoning the well. They work hard, sure, but leave a trail of passive-aggressive notes and whispered complaints. They’re the human equivalent of a damp sponge. And a form won’t capture that. That’s why I always ask their referees “Would you rehire them?” The answer, or the stammering non-answer, tells you everything.

Occasionally when a reference request comes in, I just hit “delete.” Or reply with the simple line: “I decline to leave a reference”. Silence, in this case, is a symphony of disapproval. It’s saying, “I have nothing nice to say, and I’m not going to pretend otherwise.” Sometimes, the truth is a dish best served cold.

So, here’s to the reference game, where “good enough” is the enemy of greatness, and a wellplaced silence can speak volumes. May your inbox be lled with requests from superstars, and may you never again have to describe someone as “adequately punctual”.

There was a 34.1% drop in volume of exports in 2024 compared with 2019 –before the UK left the EU. Importsfrom the EU rose by 3.3% in the past year.

Source: The Food & Drink Federation

RUSSELL OF THE FOOD MARKETING EXPERTS

THE ART OF RETAIL CONVERSATIONS

Conversation is a vital element in any business’s success. People buy from people and we buy more from people we like, so making the connection as a business with your customers is key. I love that when I go into my local deli they greet me and say good morning/a ernoon and take the time, even when they are busy, to o er me a taster of whatever is being sampled that day. It makes me feel valued as a customer and then I feel loyal.

Sampling is a great way to start a conversation, creating a pairing that gets people talking is always going to drive engagement. So, whether it is a tasting of a hot cross bun with bacon or a new combo of Marmite and marmalade on toast (not my suggestion but apparently, it’s really good!) it is the connection and the conversation that is key. Once you have given that sample to the customer, you have started the conversation to understand more about them, what they are looking for, and how you can help them nd more in your shop.

The conversation isn’t just in-store, it is also online across social media. If a customer

has taken the time to take a photo and share it on social media be sure to respond, saying ‘thank you’ and engaging with it by sharing it on your Stories. It all helps spread the word about your business and makes the customer feel connected with you. You can also ask questions on social media so that you can engage with your customers in a more speci c way, e.g. ‘What is your favourite pairing with a sourdough?’

Using Google reviews is another great way for your customers to champion you, but please remember they are also a conversation so they do need a reply and acknowledgement. Reviews help increase your reach and help more people nd you. I am using them as my way of saying ‘thank you’ to businesses and brands this year. I consider it my way of tipping but with a potentially bigger nancial impact. If more people know about them, they’ll get more visitors.

How can you chat with your customer today? The conversation is the start of so many positive things.

thefoodmarketingexperts.co.uk

Sampling is a great way to start a conversation

Whether it’s staff training, business advice, event space, making industry connections or opportunities to meet trade buyers and food lovers, the Guild of Fine Food does far more than publish FFD. The Guild has been championing independent food & drink for over 30 years. Join us today and find out what we can do for your business.

Support & ideas: support@gff.co.uk

Training & venue hire: bookings@gff.co.uk

Exhibition stands: opportunities@gff.co.uk

MyGuild assistance: myguild@gff.co.uk

gff.co.uk/join

This is Food and Drink. This is Wales.

Our producers reflect the rich heritage and culture of Wales. From traditional ingredients to innovative creations, the industry’s growing success underlines the passion and dedication of its people.

Discover a world of possibilities with Welsh food and drink: gov.wales/foodanddrinkwales

Award-winning, handcrafted cheese & accompaniments range using the finest natural and fresh ingredients producing extraordinary depth of flavour.

By Patrick McGuigan

A new sheep and goats’ cheese company has launched on the Holker Estate in Cumbria following the demise of St James Cheese, which was well known for its eponymous washed rind cheese.

St James was set up by Martin Gott and Nicola Robinson in 2006 and made St James, Ingot and Crookwheel using raw milk from its own sheep and goats. But the company is no longer in operation a er Gott and Robinson separated last year and the animals were sold.

Since then, Gott has moved to Oman in the Middle East to work at an organic dairy, while Robinson has started making cheese on her own at the estate, buying in milk from the farms that acquired St James’ livestock last year.

The new company, called Raven Tree Cheese, has launched several cheeses, including a square washed rind sheep’s cheese called St Elizabeth and a similar style made with goats’ milk called Ravensworth.

Others in the pipeline include a brick-shaped lactic goats’ cheese called Huginn, a hard sheep’s cheese called Lakeland Dawn and a hard goats’ cheese called

Ravenscrag. The company will also make the Reblochon-style St Sundays and halloumi-style Lakes A Lomi – cow’s milk cheeses that were previously made by St James – using milk from nearby Strickley Farm near Kendal.

All the cheeses are made with pasteurised milk and vegetarian rennet. St Elizabeth is named a er the patron saint of new beginnings, while Huginn was one of Odin’s ravens. St Elizabeth and Ravensworth, named a er a village near where the goats are farmed, are already being stocked by The Courtyard Dairy and Cartmel Cheeses. Robinson is also in talks with Neal’s Yard, The Fine Cheese Co., and Paxton & Whit eld.

Devon cheesemaker Sharpham launched a crowdfunding scheme last month to raise £65,000 to invest in renewable energy, water recycling and new equipment at its new premises near Totnes. crowdfunder.co.uk/p/sharpham-cheese

Guernsey Dairy has ceased all cheese production to free up space for new milk packing equipment. The company made a range of Cheddar-style cheeses, including smoked and flavoured versions.

Shoppers are opting for stronger Cheddars, according to research from Kantar. Sales of Extra Mature and Vintage cheeses grew by 2% and 5.4%, respectively, last year, while medium Cheddar fell by 5.6% and mild Cheddar was down 2.4%.

Cheeses will be available from this month onwards.

“Cheesemaking is what I know and it’s something I really enjoy doing, so I’m so pleased to be back in the dairy and involved in a new project,” Robinson told FFD. “We’ve made the decision to switch to pasteurised milk because we are now buying in milk, but I continue to make my own starter cultures. In taste trials people have struggled to notice the di erence.”

Robinson rst started making cheese with pioneering goats’ cheesemaker Mary Holbrook in Bath in the 1990s and went on to work at Kirkham’s Lancashire, before setting up St James Cheese with Gott.

Equipment from Britain’s oldest Stilton maker went under the hammer at auctioneers Eddisons last month, as production at Tuxford & Tebbutt in Melton Mowbray came to an end after more than 200 years. Parent company Arla put the business up for sale last year, but no buyer could be found.

Mons is known for ageing and selling French classics, but in 2016 it also started making cheese at its own dairy in the Loire. Le Barriquet (The Barrel) is made there with raw, organic goats’ milk from a local farm, which is transformed into a springy barrel-shaped cheese with the bouncy texture of a young tomme, then washed to create a pungent orange rind. The flavour is sweet, floral and meaty.

Chilli Jam and lactic goats’ cheese is always a good idea. The colourful, spicy condiment turbo charges the delicate dairy notes, but it also works well with the firmer, sweeter Barriquet, tying together the caramel notes in the paste and the savoury rind in a pleasing way. Tracklements’ Fresh Chilli Jam is recommended.

Barriquet’s smoky, meaty rind is reminiscent of charcuterie, so it’s a no-brainer to serve some ham on the side. Something soft and lightly smoked is required, so the sweet floral notes of the interior are not overwhelmed. Alto Adige Speck from the Italian Alps is a good bet, as is Lishman’s of Ilkley’s oak-smoked Speck.

Dessert wine

White wine and lactic goats’ cheeses are an easy match, but the washed rind of Barriquet requires something with a little more heft. Dessert wines, such as Sauternes and Jurançon, work well thanks to fresh acidity, and also an ambrosial sweetness that stands up to the washed rind.

By Patrick McGuigan

Butlers Farmhouse Cheeses has secured planning application to build a state-of-the-art “cheesemaking campus” at its farm in Inglewhite, Lancashire, a er a re destroyed its 65,000sq o ce and packing site.

The new facility, which incorporates maturation, packing and o ce facilities, will be “inspired by the land and a melting pot for innovation and ideas”, said Matthew Hall, fourth-generation owner at Butlers. He added that the re at the site in Longridge in November 2023 had made the past 16 months challenging, but the company had received “incredible” support from customers.

“What [the experience] has done, is ignite our desire to nurture our cheese from beginning to end on the farm. Cheesemaking is at the very heart of our business. We are now in a position to build a leading maturation space that meets the speci c requirements

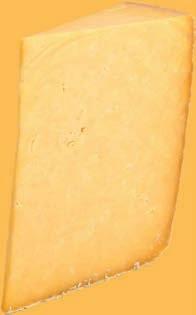

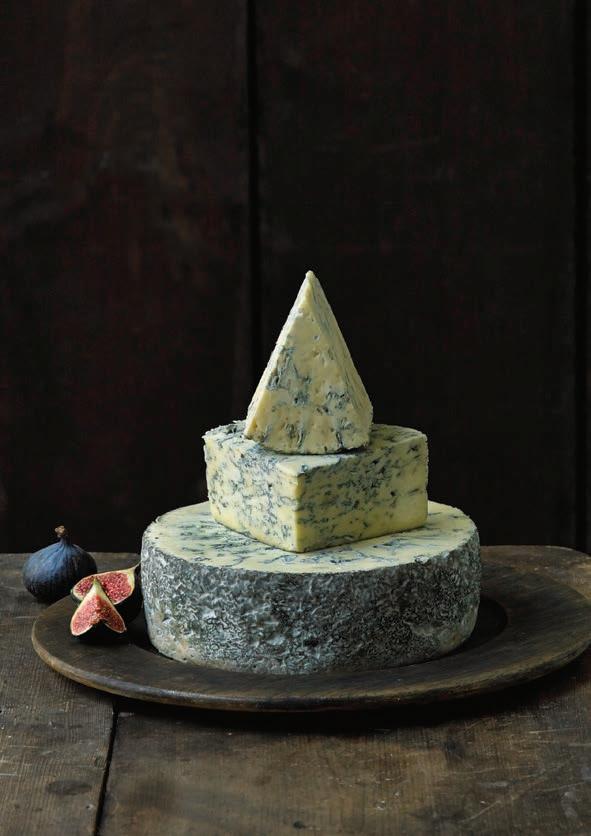

Clothbound Cheshire

What’s the story?

Cheshire cheese is now primarily produced in large-scale factories across the UK, giving it

of our farmhouse cheese and get us back to our pre- re sales, where we are currently operating at 60% due to space limitations.”

In its most recently led accounts, covering the year to 30th September 2023 (before the re), Butlers’ saw turnover rise by 11% to £20.3m, while pre-tax pro ts rose from £900k to £1.2m.

The company acquired Hampshire Cheese Company in March 2024, and has since

a flavour profile like other mass-produced crumbly cheeses such as Wensleydale and Lancashire. However, the original farmhouse variety boasts a rich history dating back to at least the 16th century, with a distinct flavour shaped by the mineral-rich soil of the Cheshire Plain, where it was traditionally made. Once the most valued cheese in the UK, its popularity has declined significantly, and today there are few farmhouse producers continuing the tradition of making clothbound Cheshire cheese with unpasteurised milk.

How is it Made?

transferred

Butlers has enlisted a number of local Lancashire suppliers for the build, which will incorporate stone from Longridge quarry and rubble recycled from the old Longridge site. The company’s food miles will be reduced by 40% by moving all operations to one site with the new facility expected to be nished by the end of the year.

Svetlana Kukharchuk, The Cheese Lady, Haddington & North Berwick, Scotland

There are obvious benefits to opening a second shop, but how to make the most of them is a question that Svetlana Kukharchuk, owner of The Cheese Lady in Haddington, is addressing after opening another shop in North Berwick before Christmas.

“I wish I could split myself in two,” she says. “But I’m finding ways to divide my time. Haddington opens an hour earlier, so I start there and then open North Berwick, where I’m spending most of my time to help build the clientele and brand.”

She is also putting together centralised systems around marketing, training and accounting, although ordering is complicated with some deliveries sent to the larger Haddington shop to meet minimum orders, where they are then divided.

The two shops are only 20 minutes apart by car, but North Berwick has a different customer base with more tourists. “We’re developing an ecosystem. People are discovering our Haddington shop through the North Berwick shop, and vice versa. We’re also encouraging more people to buy online.”

cheese is wrapped in muslin and matured for six to twelve weeks, allowing its texture and flavour to fully develop.

Appearance & texture:

Cheesemonger tip:

Eat at room temperature to appreciate the yoghurt sour-cream flavours.

The curds are scalded at around 32°C, a lower temperature than that used for Cheddar, which helps retain moisture in the

cheese. After the whey is drained, the curds are cut into blocks, turned, stacked and gently broken up by hand. They are then milled, salted, and left to rest overnight before being pressed. Once pressed, the

Clothbound Cheshire has a moist and crumbly texture with zesty, grassy and mineral notes. The interior tends to be ivory white coloured pale orange with the addition of annatto.

Variations: Coloured & Smoked

Clothbound Cheshire pairs particularly well with fruit cake, figs or dates as the acidity complements the sweetness of the fruit. Match with a mediumbodied red wine such as Côtes du Rhône and Rioja. It is also great with a hoppy pale ale.

Chef’s recommendation:

Clothbound Cheshire is a delicious ingredient in Tarte Owt of Lente, an Elizabethan cheese tart that includes double cream, eggs and cheese. This version comes from the Kitchens in Hampton Court.

Lactobacillus helveticus, lactis, bulgaricus harbinensis,casei, plantarum, zeae

Lactococcus lactis, raffinolactis... Leuconostoc mesenteroides, lactis, kimchi...

Propionibacterium freudenreichii, shermanii

Brevibacterium, Brachybacterium, Corynebacterium, Microbacterium

Geotrichum candidum, G. fragrans, Kluyveromyces, Debaryomyces, Saccharomyces

Come to choose your flavour, aspects, personality

Selection of natural food microorganisms of interest...

Provide robust ferments to food processors

Provide organoleptic, dietetic, nutritional and bioprotection qualities

Develop minimally processes foods that keep over time

Our expertise

Control of fermentation and processes

Selection of ferments adapted to your production Analysis and optimization of microbial ecosystems

Research & innovation for “best” cheeses

Laboratoires STANDA +33 (0)2 31 74 54 89

68 rue Robert Kaskoreff 14050 Caen FRANCE www.standa-fr.com | standa@standa-fr.com

Treur Kaas, Woerden, The Netherlands - info@treurkaas.nl - www.treurkaas.com

12-13 May 2025

If you’re a delicatessen, farm shop, retail, hospitality or foodservice buyer, there is no better place to visit.

You’ll find a huge a range of exciting new food & drink product launches to get your tastebuds tingling.

Attending NOPEX is how we understand what’s out there. There are loads of products and brands here so there’s something for everyone. It is the place for innovation!”

WAITROSE

REGISTER FOR YOUR FREE TRADE TICKET

Economic headwinds and pressure from big beer have le independent breweries in a spot of trouble. Has the golden era of cra beer come and gone, or is this consolidation a sign of it adapting to a new world?

By Tanwen Dawn-Hiscox

Earlier this year, the Society of Independent Brewers and Associates (SIBA) reported a record number of brewery closures in the UK – over 100 in the 12 months leading up to January 2024 – bringing the total to 1,715, down from 1,815 the year before. While many food & drink businesses are struggling, independent beer has been particularly hard hit, begging the question

There was de nitely an issue of over proliferation, and possibly a watering down of quality. Sam Kemmer, Against the Grain

of what’s behind these closures.

Without a doubt, Brexit dealt the industry an early blow. “It’s obviously still playing a part,” says Jen Ferguson, co-owner of two independent shops called Hop, Burns & Black in South London. “And I still don’t think we’ve fully seen the impact of it.” Then came Covid, which forced many breweries into debt. “A lot of smaller breweries built up debt with the tax man and their landlords,” she adds.

Rising costs have only made matters worse, says Sam Kemmer, owner of Edinburgh bottle shop Against the Grain. “Energy costs are colossal when you consider how much money goes into heating things up and cooling them down in a brewery. I’ve talked to people working in medium-sized breweries with hundreds of thousands going on energy bills every year.”

Meanwhile, the cost-of-living crisis has seen a drop in consumer spending. “We all expected there would be some roaring 20s a er Covid,” says Ferguson. “But we haven’t had that big bounce back.”

That’s not all, according to SIBA. The way the organisation sees it, big beer has co-opted the cra beer aesthetic, making it harder for consumers to distinguish truly independent breweries from multinational-owned brands.

“Polling is showing that people don’t necessarily realise who owns and produces beer,” says SIBA’s head of policy and public a airs, Barry Watts. “Sometimes they associate some of the beers that are actually produced by big breweries with local cra breweries.”

The group also argues that brewers face

major market access challenges, and that large beer companies dominate the pub trade through tied lines – contracts that lock publicans into speci c suppliers. “The tied market only covers a h of all pubs,” says Watts, “but 78% of all dra beer sold in UK pubs is from just ve global companies.” He estimates that 60% of independent breweries can’t access 60% of their local pubs.

Supermarkets, once a lifeline, have also become a dead end for some breweries. “I think supermarkets are behind some of the failures we’ve seen,” says Jack Hobday, co-founder of

Definitions of craft beer and independent beer vary, but typically, craft beer is made using traditional methods, often with innovative styles and flavours – but it can still come from a large brewery. Independent beer, however, is brewed by a company that isn’t owned by a multinational, giving it more creative and financial independence.

London brewery Anspach & Hobday. Having supplied M&S themselves, when in ation hit, the supermarket didn’t respond to a price rise request from the brewery. “It was already the slimmest of margins,” Hobday says. “It was a really good lesson for us to learn that actually we were better o supplying to independents.”

Shi ing trends have played a role in the decline of independent breweries, too. Cra beer enjoyed a golden era in the 2010s, but culture has evolved. “The demographic is not particularly surprising,” says Kemmer. “It’s safe to say you’re talking about mainly 45-year-old males.”

This means breweries must now recalibrate – for example, by appealing to a broader demographic, particularly Gen Z, who are drinking less alcohol. “There’s been a huge increase in low and no-alcohol beer,” says Ferguson. “It’s been a bit of a lifeline for retailers.”

At the same time, cra beer may have grown too fast. “There was de nitely an issue of over proliferation, and possibly a watering down of quality,” says Kemmer. “A new brewery was opening every week, and the culture that ran through beer for a while was that there had to be new releases every week.” He argues that breweries would do better to focus on consistency. “It’s more important to make the

The Indie Beer mark helps people realise which is an authentic, local, independent beer and which is not.

Barry Watts, SIBA

same beer well over and over again and build a loyal customer base.”

While some consolidation was inevitable, Kemmer says this isn’t just a case of survival of the ttest. “What I don’t want that to sound like is that it’s the good breweries that are surviving and the bad ones that aren’t. That’s very de nitely not the case. It all depends on individual circumstances.”

And indeed, some breweries are managing to succeed despite the tough market conditions. Anspach & Hobday’s sales, for example, are up 50% year-on-year, and its exports have doubled in the past year. This success is partly down to strong branding and a diversi ed business model spanning taprooms, on-trade, and international markets, says Hobday, but “no matter which way you look at it, we’re bucking the trend because our lead beer, [London Black], is a dark beer, and the country is in the midst of a stout boom.”

While the majority of sales are on dra –with the Nitro cans of London Black (unique in that only Guinness o ered one before they created it) accounting for just 10-15% of sales, he adds, “It’s our hero beer. It’s around 70% of our

The breweries that do best have got a personality, they’ve got a fan base, they’re known for standing for something.

Jen Ferguson, Hop, Burns & Black

production, and we’re struggling to keep up.”

Ferguson points to Beak, Verdant, and DEYA as other breweries succeeding by championing independence and quality. “The breweries that do best for us seem to have established a brand for themselves,” she says. “They don’t necessarily have a big marketing budget, but they’ve got a personality, they’ve got a fan base and they’re known for standing for something. Drinkers have become fans of them in the good times, and they’ve stuck with them in the harder times.”

Thankfully, industry bodies like SIBA are also working to level the playing eld for independent breweries. It successfully fought the case for a new guest beer agreement in Scotland, which allows tied pubs to stock an independent beer. Watts says that if a similar scheme were introduced in England and Wales, “it would be worth £28 million for small breweries.”

The group has also launched the ‘Indie Beer’ trademark, which will appear on bottles, cans, and pub pump clips to help consumers identify truly independent breweries. “It’s about transparency,” Watts explains. “So people can realise which is an authentic, local, independent beer and which is not.” The new mark sits

We’re bucking the trend because our lead beer is a dark beer, and the country is in the midst of a stout boom.

Jack Hobday, Anspach & Hobday

alongside SIBA’s database of independent breweries, which it has recently updated. “You can just type in a beer and it tells you if it’s independent or not,” he adds.

Retailers can also make a di erence. Ferguson says she and her partner Glenn Williams were hit hard by the acquisitions of breweries like Brick, Beavertown, and Camden, forcing them to take a stand and stay true to their independent ethos, even when it meant dropping once-beloved brands.

“We have always had one of the most strident, outspoken businesses on the whole issue of independence. We’ve always been very passionate about it and put our money where our mouth is with it.”

It has succeeded by building relationships with local breweries, selecting a few and working closely with them. “The smaller breweries that are doing well are the ones that create that local community,” she adds.

Finding quality breweries can be an issue, but not irresolvable. Kemmer notes that ten years ago, Twitter was a hub for beer conversation, helping spread the word about new breweries. “That’s mostly gone now,” he says. “That makes direct relationships even more important. Customers o en introduce me to new things –many of them travel more than I do and come back from places like Manchester or London having visited bars I can’t get to.”

And while X, formerly known as Twitter, may no longer be a reliable source, Ferguson says, “if people don’t really have an idea of where to start to nd those beer in uencers online,” there’s always Instagram, TikTok, or Bluesky – as well as more specialised publications than FFD, like Pellicle.

Importantly, Ferguson warns retailers not to try and compete on price with supermarkets. “Cra beer is a premium product, and taking that approach has served us well. Once we realised we could charge what we needed, that was a big moment for us.”

Despite the challenges, there is cause for optimism. “A er the hard times we’ve all had, we’re nally enjoying some good times,” says Hobday. “Growing the business and seeing success has been exhilarating for the whole team.”

There is hope for independent beer – and as always, retailers can be champions of it.

Natasha and Barnes

Garlic

discuss the bene ts and challenges of certi cation in the ne food sector, and how food producers can be part of values-led transformational change.

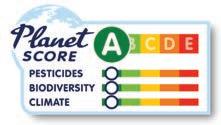

THE RISE OF corporate greenwashing poses a signi cant challenge to the trusted link between those who produce food and those who consume it. Could this present an opportunity for independent food retailers to provide credible assurance to buyers and consumers about the impact of their food choices? Can certi cation step in to play a crucial role in distinguishing genuine commitments from empty promises?

Barnes Edwards, director at The Garlic Farm, says: “Certi cation can be a really powerful tool for buyers in the ne food sector; they give formal credibility to the environment and welfare standards of their suppliers.”

For artisan food producers, standing out in a competitive market is a challenge. Trusted certi cations not only di erentiate products but also provide veri able claims that cannot be manipulated by marketing jargon. When buyers see a certi cation, they can be assured that the product has met stringent, independently audited criteria such as ethical sourcing or natureenhancing farming methods.

The Garlic Farm’s certi cations of B Corp, Soil Association Organic and Pasture for Life have been part of a journey towards articulating their values-led approach which has transformed their farming and business practices.

In line with this approach, managing director Natasha Edwards has been awarded a Nu eld Farming Scholarship 2025 – to travel to New Zealand, the USA, and Europe to investigate how certi cations can support a transition to nature-friendly farming. Her research aims to explore how robust certi cation systems can drive meaningful ecological and economic shi s in agricultural practices. By understanding

di erent international models, Natasha hopes to nd inspirational stories from farms where real change is happening.

Certi cations can do more than establish standards. They connect food businesses to larger movements advocating for systemic change in agriculture and food production.

“On the farm, we learn from and are supported by the movements that surround our certi cations of Organic and Pasture For Life,” says Barnes. “The communities within both are inspiring us to experiment with the most innovative techniques to produce healthy food in ways that actively support nature. Certi cations are the standards, but it’s the movements that are delivering change on the ground.”

While rigor must be maintained to retain trust, it is important that certi cations are not seen as an elitist barrier. Certi cation bodies must strike a balance between accessibility and credibility, ensuring that those joining are genuinely committing to better practices rather than seeking a marketing advantage.

There are great examples of certi cations doing exactly this. B Corp engage its community of certi ed businesses to ensure that transitioning producers can engage without compromising the certi cation’s credibility. Strong mentorship programs and knowledgesharing groups provide education and guidance, allowing food businesses to scale their e orts over time while working towards benchmarks.

The ne food industry has a lot to gain through embracing values-led business practices. Claiming to be ‘eco-friendly’ or ‘regenerative’ without transparent evidence is no longer acceptable; certi ed producers must demonstrate

their commitment through regular audits.

For example, at The Garlic Farm, organic and agroecological farming practices are at the core of their operations. These include livestock integration into crop rotation to enhance soil fertility, planting diverse cover crops, implementing wetland waste-water management systems, and adopting agroforestry techniques.

Beyond environmental bene ts, certi cations can open doors to premium markets, allowing producers to command higher prices and access ethically minded retailers. When buyers in the ne food sector work with certi ed suppliers, they know that the products they are sourcing align with consumer appetite for improved environmental and social impacts.

As consumer awareness grows, certi cations will continue to play a pivotal role in shaping the future of food, connecting consumers more closely to the food they eat and bringing like-minded groups together to encourage transformational change in our food system. While never fully replacing the value of a good chat over the farm gate, by supporting certi ed producers, buyers and consumers alike can contribute to a more transparent, responsible, and environmentally conscious food industry.

www.thegarlicfarm.co.uk

01983 865 378

wholesale@thegarlicfarm.co.uk

Our full range is also available with Cotswold Fayre and Cress Co

Informing, inspiring and connecting the industry

Farm Shop & Deli Show will return to the NEC, Birmingham from the 7 - 9 April, as part of the award-winning UK Food & Drink Shows.

This must-attend event brings together Farm Shop & Deli Show, Food & Drink Expo, National Convenience Show and Foodex Manufacturing Solutions, all under one roof. Discover the latest innovative food and drink products and key insights that will help you grow your specialist retail business.

FFD teamed up the with the Farm Retail Association to host a panel discussion, assembling a team of top retailers to debate some of the biggest issues facing this area of independent retail. Here are the edited highlights from a very broad conversation.

Report by Michael Lane

by Richard Faulks

The session opens with a very broad topic. While farm shops themselves are a diversi cation, the group discusses how much further – beyond pure retail – operators are venturing.

Tom Newey of Cobbs, which has multiple sites in the south of England and the Midlands, says the level of what is on o er at a farm shop depends on location.

“There are certain sites within our group that bene t from a wider diversi cation in terms of events, like pumpkin picking and that sort of stu , because we need a bigger hook to pull customers out when it’s more rural,” he says.

“Whereas a couple of our shops are rural but closer to more chimney pots, therefore the requirement for us to get customers out there onto seats is less.”

“We primarily want to be grocers, that’s our absolute focus. We want to sell food. And actually I have found in the past that sometimes, events can become a distraction sometimes away from the core.”

Will Simkin, who’s worked at his family’s business Essington Farm near Wolverhampton for the best part of two decades, agrees with Newey that the level of diversi cation at retailers may go too far sometimes.

“To me it’s about identity. You can’t be doing everything. Especially in the farm retail industry. I think the history of your farm and where you come from is very important.

“When I came back into the business, we were doing lots of di erent things, but nothing really well. And then it’s like, ‘well, what are we?’

“A farm shop? A destination? Are we a pick-your-own? Are we a restaurant? Are we a maize maze? And you can’t do everything to a decent standard,” he says adding that there’s a ne line between attracting crowds and confusing them.

Guild of Fine Food MD John Farrand says there’s a danger that farm retail businesses doing too much can become “theme parks”.

“You shi away from the food & drink

We got so much advice about doing a tearoom, because it would be easier. But we didn’t want to do that.

Emma Mosey, Yolk Farm / FRA

aspect of it, and you become a bit of an entertainment business. And therefore, the food & drink people are not taking you so seriously, let alone the fact the car park’s full.”

For Emma Mosey, Farm Retail Association chair and co-owner of Minskip Farm Shop in North Yorkshire, how and why a farm shop diversi es beyond retail is all about the target audience.

“We have moved in the opposite direction to what you guys are talking about,” she tells the group. “We bought a small farm shop, which very much had quite an elderly customer base. Our customer demographic was depleting. And we thought to ourselves, ‘We need to look at this in terms of the future of the business’.”

As a result, Mosey and husband Ben focussed on their main farming output, eggs, and created a restaurant called Yolk Farm on

You shi away from the food & drink bit of it, and you become a bit of an entertainment business.

John Farrand, Guild of Fine Food

their site, looking to attract a younger family audience while still catering to the needs of older customers who come to shop.

“We got so much advice about doing a tearoom, because it would be easier, and doing the National Trust model where there’s a counter and you get a tray and all of that. But we didn’t want to do that.”

Mosey’s Yolk Farm brand is as much about educating visitors as it is a foodservice income stream. And the whole panel agrees that an educational focus and smaller ticketed events are generally more bene cial exercises for farm shops.

At The Lambing Shed in Cheshire, Kathryn Mitchell says that one of their key added attractions has evolved over years in a similar fashion.

“It used to be very much ‘Come in, see the lambs, have a cuddle’. That was that. And now we’ve changed it a lot.

“It’s more expensive [for customers]. We have smaller numbers. And my brother’s partner does a whole presentation on how we do lambing – in our actual lambing barn.

“So, you can see what’s going on. And I was a bit afraid of that to begin with. They’re going to see the real lambing.

“But people love it. Tickets sell out straight away. They actually learn something. And it’s better for the business. Because it’s much easier to run an event like that with one sta member.”

With public interest in British farming booming, thanks to TV shows like Countryfile and (more recently) Clarkson’s Farm, the panel concurs that any diversi cation retailers

choose now should be aligned with what a business does agriculturally.

John Farrand summarises: “I think if you become that leisure operator, being really blunt about it, what are you doing for the food and farming industry to support it other than just a pure commercial operation that is there to simply make money?

“Nothing wrong with that. But it’s not what excites me about the industry.”

A number of the retailers in the room suggest that – however a farm shop decides to expand – investing in and increasing your o er could be a solution to the pressures of rising costs and shrinking margins.

Speaking of cost savings and pro t boosting, the concept of entirely unmanned retailing is raised.

“The FRA team get a lot of inquiries at trade shows about vending machines for farmers. To a farmer that feels like an easy way to diversify.”

Will Simkin has practical experience of these kind of machines and tells the group he isn’t entirely convinced.

“Our neighbours are small dairy farmers, and they’ve got a vending machine on their farm, and they’ve got one outside our shop. You’ve got to sell a lot of milk at £1.20 a litre to make it worthwhile.”

“I know it’s an experience, pushing the buttons, and it’s really popular. But ultimately, you’ve got to be selling high-value products. And vending machines just aren’t going to do it, are they?”

Simkin has even researched the possibility of a meat-led vending machine set up.

“I came to the conclusion that if you want to be turning over X amount, you’re going to have to be employing two people, cutting and packing meat, to go into the vending machines. So why not just serve the customer with the meat at the counter?”

Tom Newey highlights the manpower required to keep vending machines going – especially when it comes to cleaning and hygiene – and draws a similar conclusion about o ering the experience in the actual shop.

While diversi cation is primarily a means to get customers spending in the retail areas, there also needs to be a conscious e ort on the part of the retail to protect the shop area from the di erent crowds that come for events or non-food attractions.

“It’s a very di erent shopper that’s coming to the events,” says Kathryn Mitchell. “They might pick up a co ee and a bag of sweets –they’re not coming to do that in a proper shop.

“So, if we’ve got a big event on, we’ll set something up outside where we can get that opportunity for them to buy. And it’s di erent, quicker and more convenient than in the shop.”

Emma Mosey agrees that the regular shop tra c has to be protected but is torn with segregating too much.

“We sell our pig food [for feeding the onsite pigs], which is just waste veg, in the shop. But we’ve talked about moving that to the play barn because it’s the same customer that comes to the play barn as the one that wants

Ultimately, you’ve got to be selling high-value products. And vending machines just aren’t going to do it, are they?

Will Simkin, Essington Farm

the pig food.

“But then we lose them coming into the shop, even though it sometimes upsets the other customers because there’s a lot of children in the shop. I think the payo of having them in the shop is they might pick up a bar of chocolate and a biscuit as well.”

While everyone in the room agrees it might be too early to tell, the incoming inheritance tax measures for farmers will certainly have an impact on how much they diversify. Whether that means more or less development remains to be seen.

Slightly surprisingly, the dissection of this topic didn’t begin with the recent headlinegrabbing issues around inheritance tax.

Instead, both Tom Newey and Will Simkin highlighted the di culty with the shrinking availability of meat and produce and the rising prices that come with that.

Abattoirs are one of our biggest concerns at the moment.

Tom Newey, Cobbs Farm Shops

“Abattoirs are one of our biggest concerns at the moment,” says Newey, continuing on the butchery theme. “They’re disappearing at a fast rate, and if there aren’t any abattoirs then we are all stu ed.”

Will Simkin, who sits on the Abattoir Sector Group, is also passionate about what seems to be a genuine ticking time bomb for farm shops up and down the country.

“A small abattoir is under what they call a discount scheme, so they don’t have to stump up the full costs for running an abattoir – like a vet and things like that,” he says.

“Apparently the Government is all about removing these discounts, and if that goes ahead, then the National Cra Butchers group is predicting that 50% of these abattoirs will just go out of business, because the cost to plan for the legislation is just not worth it.”

Newey says that some abattoirs, that used to take on the slaughter of both a farm shop’s own livestock and smaller local orders, are turning towards bigger lower quality orders. Simkin agrees and adds that there are also

Chocolate Oaties

Part of the Hebridean Baker biscuit range www.stagbakeries.co.uk

flour is ancient which from the finest

Our award-winning flour is produced from the finest ancient grains which are sustainably grown in the beautiful British countryside. Our entire range carry the highly sought after Great Taste 2 and 3 star awards, in recognition of outstanding quality and flavour. Available in 1kg and 20kg bags. Minimum order 2 boxes of 10 × 1 kg bags. No delivery charges. Call or email today for a trade price list

fewer abattoirs out there now that will handle rare breeds (i.e. cattle with horns) or deal with multiple animal species.

If farm shops are having to take their animals further away from their sites to get them slaughtered, Kathryn Mitchell says it detracts from her business’s USP.

“It is a problem because a lot of people are meat-eaters and they actually do care that it’s been travelling,” she says. “It’s alright us saying our beef and lamb is reared here on the farm, but actually if we’ve had to send it miles down the road to be killed, that’s not good.”

Mitchell goes on to point out that the reason this issue about slaughter isn’t in the public eye is because it’s a subject that makes many people “uncomfortable” – and it also doesn’t tap into sentiment that same way that other issues do.

“I think that emotional side is why the inheritance tax has been talked about so much more, because that really hits on an emotional level to farmers – being able to pass on your land.”

Will Simkin’s take, on the changes to inheritance tax for farmers, is that it is “fundamentally wrong”.

“Keir Starmer’s basically saying, why should farmers not pay the same amount of inheritance tax as the general public? It’s a misunderstanding. They do.

“If a farmer has got a million pounds in their private bank account, then they pay 40% of that to the Government when they die –like the public does.

“All they’ve done is change it from private wealth to a tax on business and agricultural land.”

There is a general feeling in the room that

the current Government isn’t demonstrating much understanding about farming or food security with its current policies.

Via her role as FRA chair Emma Mosey has recently met Defra o cials and been le slightly perplexed that they still seem to be learning the lay of the land.

“I think Government either don’t understand what they’re doing, which is worrying, or they know what they’re doing and there’s a bigger plan for UK food.

“If there is a bigger plan though, I don’t think it’s going in the favour of small producers and small businesses – it’s going the opposite way.”

Although everyone in the room concurs there are a lot of challenges vying for Government’s attention (including foreign diplomacy and the wider economy), Kathryn Mitchell suggests that some of the onus is on the industry itself to speak up more about its problems.

“It comes down to education, and supermarkets are so good at making it appear a certain way, and maybe we need to be better at saying ‘actually, no, this is how it is, and this is what we’re doing’.”

She adds that the abattoir situation is a prime example of needing a proper PR campaign.

One thing that the panel is unanimous on is the much-discussed di culties posed by increases in National Insurance payments –even though everyone agrees that paying sta a decent wage is crucial to success.

With that acknowledged, the conversation turns to other Government measures that concern them.

“The scariest thing coming, for me, is the Workers’ Rights Bill,” says Tom Newey. “We

I think Government either don’t understand what they’re doing, which is worrying, or they know what they’re doing and there’s a bigger plan for UK food

Emma Mosey, FRA

don’t know exactly yet, but 80% sick pay from Day One [of absence]. And then guaranteeing sta the hours they’ve had for the previous three months for the coming three months.

“This is where we really do need the supermarkets to get o their backsides and put pressure, because we can’t do it, sadly.”

The Guild’s John Farrand notes just how damaging to independent retail that could end up being following busier times of the year.

“That is so incredibly naive, isn’t it? You think of sta rotas in October, November and December, and then you’re going to have to pay them that in January?”

Newey concludes this topic with several nods from the panel: “I always think it’s a bit unfair of Government to bring in all these amazing things for workers, which costs them nothing. The only person it costs is us.”

Most farm shops wouldn’t deny that their core customer bases are older generations, with the requisite disposable income. And, while the panel all di er slightly on the demographics they most want to court, it’s pretty clear that the key age group still needs a good deal of prioritising.

Tom Newey says that Cobbs expects to get at least another decade of trade from its current customer base.

“We de nitely don’t want to ignore the next generation but they simply are not

going to be putting the money in our tills in enough volume at the moment.

“So we want to embrace them but we have to still focus on that older audience probably over 60 who are generating bigger baskets and weekly shops.

“But of course, it’s through the week you see a change. Monday to Thursday is very much an older market and then, as the weekend comes, it’s younger families with kids.”

At The Lambing Shed, Kathryn Mitchell says the sales split is 50:50 between retail and hospitality – and the younger generations are contributing more to that side of the busisness.

“We can sell expensive co ees all day to that demographic. During weekends and school holidays, that’s when you get that younger audience,” she says.

But while this audience is important to attract, Mitchell says that she has scaled back on social media quite signi cantly.

“I feel like there’s so much out there now that it’s a bit overwhelming for everybody. And the algorithm changes all of the time. You can just get lost in that noise. And we pulled a little bit away,” she tells the group, adding that big numbers of followers and likes doesn’t necessarily translate to footfall. Tom Newey immediately agrees, citing his experience with Cobbs’ Stratford site, which had more than 24,000 followers on Instagram.

“The point I always make to my team is that it’s really exciting that you’ve got all these followers but it means absolutely nothing if they’re not actually coming in and buying stu ,” he says.

Around the table, the feeling is that social media, including platforms like Tripadvisor and Google reviews, is something to be wary of – even when it does drive tra c – because it creates a level of false expectations.

“When we’re away somewhere we’ll avoid places with massive Instagram followers because there’s always a queue,” says Emma Mosey. “And it is worth it when you get in?”

Will Simkins’ strategies at Essington Farm tend to revolve around getting younger generations to interact more with food. These include a PYO dessert scheme where children can dress up their freshly picked berries and working with a TikTok chef to show people how to cook with ingredients from the shop at home.

He adds that there is a big opportunity to leverage all of the things that farm shops do so well with younger generations, which is widely agreed with in the room.