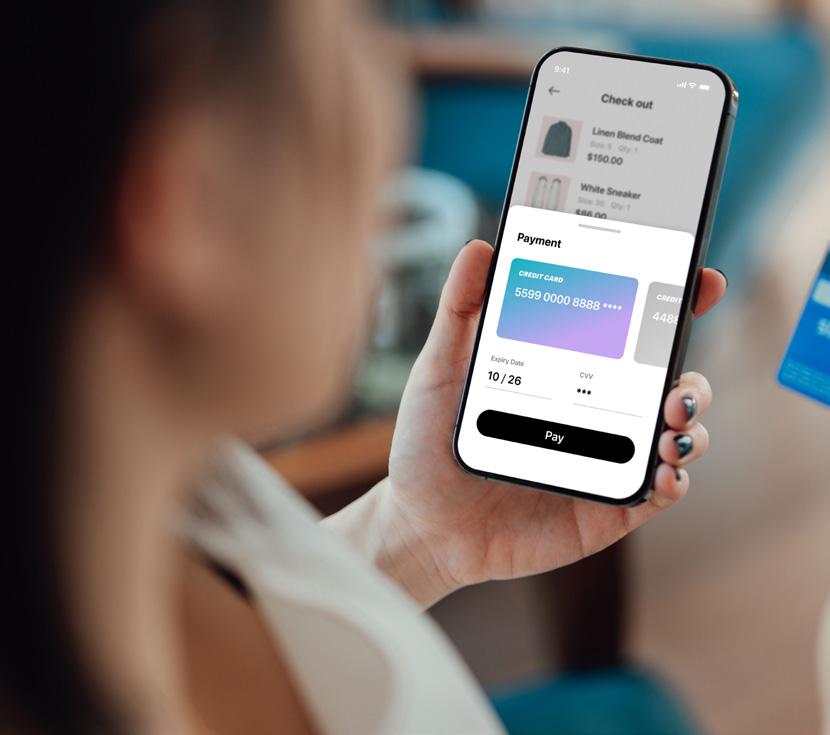

More people are transacting online than ever before, with 92% of consumers expecting a frictionless and secure experience while shopping online1.

More people are transacting online than ever before, with 92% of consumers expecting a frictionless and secure experience while shopping online1.

Ecommerce companies and payment services providers must constantly innovate to create a seamless customer experience while keeping fraudsters at bay. Leading ecommerce platforms leverage Ekata’s real-time identity insights to balance customer experience with the business risk that can erode their bottom line.

Ecommerce companies and payment services providers must constantly innovate to create a seamless customer experience while keeping fraudsters at bay. Leading ecommerce platforms leverage Ekata’s real-time identity insights to balance customer experience with the business risk that can erode their bottom line.

Ekata, a Mastercard company, uses sophisticated data science and machine learning to fuel global payments and ecommerce companies with identity verification data that empowers them to reduce friction, maximise approval rates, and fight payment fraud in every transaction.

Ekata, a Mastercard company, uses sophisticated data science and machine learning to fuel global payments and ecommerce companies with identity verification data that empowers them to reduce friction, maximise approval rates, and fight payment fraud in every transaction.

WWW.EKATA.COM

1According to VansonBourne, 2020, “Infinite want: Consumers demand speed and security in the digital experience.” https://www.vansonbourne.com/work/29081801ep

WWW.EKATA.COM

Use more image captions as often as possible

1According to VansonBourne, 2020, “Infinite want: Consumers demand speed and security in the digital experience.” https://www.vansonbourne.com/work/29081801ep

EDITOR-IN-CHIEF

ALEX CLERE

CHIEF CONTENT OFFICER

SCOTT BIRCH

MANAGING EDITOR

NEIL PERRY

CHIEF DESIGN OFFICER

MATT JOHNSON

HEAD OF DESIGN

ANDY WOOLLACOTT

SENIOR DESIGNER

MIMI GUNN

FEATURE DESIGNERS

REBEKAH BIRLESON

SAM HUBBARD

SOPHIE-ANN PINNELL

HECTOR PENROSE

ADVERT DESIGNERS

JORDAN WOOD

CALLUM HOOD

VIDEO PRODUCTION MANAGER

KIERAN WAITE

PRODUCTION DIRECTORS

GEORGIA ALLEN

DANIELA KIANICKOVÁ

PRODUCTION MANAGERS

JANE ARNETA

MARIA GONZALEZ

CHARLIE KING

YEVHENIIA SUBBOTINA

MARKETING MANAGER

EVELYN HOWAT evelyn.howat@bizclikmedia.com

PROJECT DIRECTORS

JAKE MEGEARY jake.megeary@bizclikmedia.com

JACK MITCHELL jack.mitchell@bizclikmedia.com

MEDIA SALES DIRECTOR

JAMES WHITE james.white@bizclikmedia.com

MANAGING DIRECTOR

LEWIS VAUGHAN lewis.vaughan@bizclikmedia.com

CEO GLEN WHITE

ere at FinTech magazine, we are proud to once again be an official media partner and exhibitor at Money20/20.

This is a great chance for us to catch up clients and make new partnerships, and it’s also an opportunity for you to get to know us better.

This special supplement showcases some of our work that we do – exclusive interviews with some of the biggest names and brands in finance. It’s what we do.

We also have our daily news and views website, weekly newsletters, virtual events, live events – not to mention a whole host of content solutions where we provide a complete end-to-end service.

From webinars to whitepapers, roundtables to company reports – we’ve got all your bases covered.

It’s great to be back in Amsterdam, and we look forward to seeing you at Stand D190 where you can meet with our marketing team or share your insights with our on-site editors and film crews.

And while your focus will rightly be on Money20/20, mark your calendar and save the dates 8-9 November 2023 for FinTech LIVE in London. We will be welcoming thousands of fintech leaders and innovators to our stages to share their views on the future of the industry, in a series of keynotes, roundtables, workshops, and firesides.

Alternatively, if you like what you see inside these pages, check out our digital magazine editions, including bespoke video interviews, by visiting fintechmagazine.com

EDITOR-IN-CHIEF

ALEX CLERE

alex.clere@bizclikmedia.com

@alex-clere

fintechmagazine.com

@fintech-magazine-bizclik

@FinTechMagazine

bizclikmedia.com © 2023 |

@FinTechMagazine

FinTech magazine is an established and trusted voice with an engaged and highly targeted audience of 113,000 global executives

Digital Magazine

Website Newsletters

Industry Data & Demand Generation

Webinars: Creation & Promotion

White Papers & Research Reports

Lists: Top 10s & Top 100s

Events: Virtual & In-Person

WORK WITH US

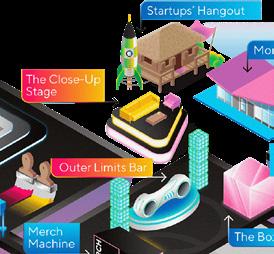

If this is your first time at Money20/20, leave your preconceptions of business events at the door. Industry conferences don’t have to be boring, Money20/20 has flourished into a fintech fiesta.

J.P. Morgan utilises a full arsenal of technology, including on-blockchain data exchange. Christine (Jang) Tan, Head of FIG Sales APAC, talks to us from her office in Singapore about her push in redefining the future of finance.

Rabobank is generating positive social change in the agri-food and energy sectors by doubling down on its commitment to innovation. Bart Leurs, Rabobank’s current Chief Innovation and Technology Officer, talks strategy.

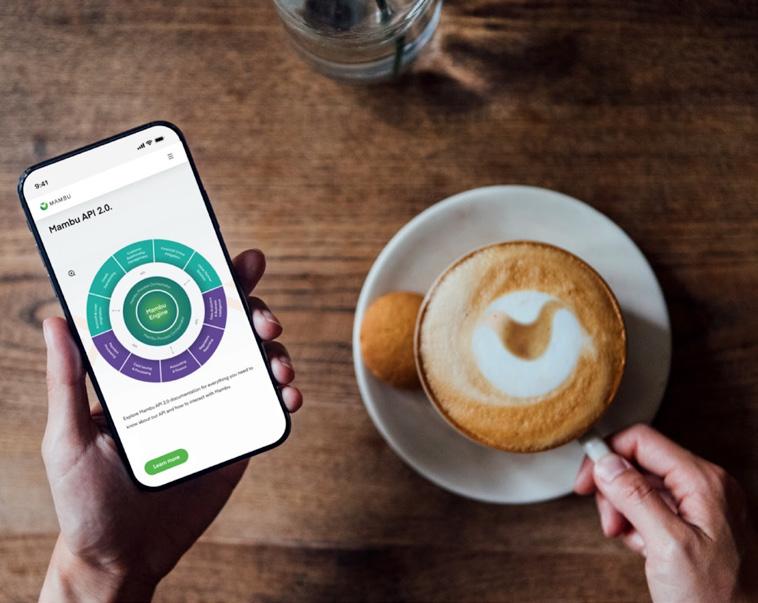

With the current turbulent economic times, Mambu’s SaaS solution is helping financial institutions act quickly, launching and scaling products at speed. Nick Lawler, Mambu’s Market Sales Director for UK&I, explains.

Women to Watch in 2023

Women are taking an increasingly central role at the helm of established global corporations and dynamic startup companies, propelling change in fintech.

The Event Disrupting FinTech, InsurTech & Crypto

The UK's fastest growing Fintech event comes to you on 8-9 November from the QEII in London.

The Fintech Disruptor Making Smarter Trading Simple The finance industry is catching on to Saphyre’s secret sauce and realising the opportunity to gain competitive advantage with AI-powered trading tools.

Chris Comparato, CEO of Toast

The point-of-sale platform for over 79,000 restaurants world-wide.

Crafting New Digital Experiences Using Open Finance

Fiserv is helping clients, including fintechs and global brands, unlock new revenue streams with solutions that reach virtually every US household.

Path to IPO: Liquidity in Private Capital Markets

Morgan Stanley at Work is helping to create a new roadmap for private and public companies seeking to generate liquidity.

How Fidelity Brings Digital Assets to Institutional Clients

Informed by customer demand, Fidelity International has backed itself to create innovative investment products for institutional clients.

Daumantas Dvilinskas, CEO of TransferGo

With first-hand experience of how difficult crossborder transactions can be, Dvilinskas shares how he's used this to his advantage.

WRITTEN BY: SCOTT BIRCH

WRITTEN BY: SCOTT BIRCH

If this is your first time at Money20/20, leave your preconceptions of business events at the door. Founded in 2012 with a view that serious industry conferences didn’t have to be boring, Money20/20 has flourished into a fintech fiesta.

The annual festival of finance returns to Amsterdam for three memorable days of executive insights, game-changing inspiration, and all-important networking.

So, congratulations for being here.

Money20/20 brings together the great and the good for the financial world, covering everything from banking to payments, and crypto to insurance. As well as attracting a wealth of disruptive startups, Money20/20 this year welcomes senior executives from giants including HSBC, JP Morgan, Visa, Mastercard, Morgan Stanley, UBS, ING, Barclays, ABN Amro, and Citi.

“We are thrilled to welcome such powerhouses to our stages and throughout the show this year. These companies are coming to lead, transform and flip the script on every front of our fintech expectations. And

the speaker line-up is just the tip of the iceberg, the entire show will be one to remember,” said Money20/20 President, Tracey Davies.

“Money20/20 Europe is giving participants new content formats, new stages, and key experiences embedded throughout the show that will connect, inspire and inform them. We have worked hard to make sure we exceed everyone’s expectations with big opportunities, powerful learnings and unparalleled networking.”

Key themes and speakers at Money20/20 Europe 2023 include:

FINTECH GETS REAL Fintech is no longer a niche industry. It is now mainstream, and it is having a major impact on the way we bank, invest, and manage our finances.

SMOOTH INTERACTIONS

Making the customer experience as seamless and frictionless as possible. This is being done through innovative technologies, such as artificial intelligence, chatbots, and biometric authentication.

7,500+ ATTENDEES

2,300+ ATTENDING COMPANIES

350+ SPEAKERS 380+ SPONSORS 90+ COUNTRIES REPRESENTED

11:00

B2B BNPL: Our Survey Says…

The Box, RAI

Anil Stocker, CEO and Co-founder of Kriya, is the speaker at this intimate, 45-minute session taking a deep dive into Buy Now Pay Later data. BNPL is a hot topic when it comes to consumer applications but relatively unsung in the B2B arena.

TUESDAY 6 JUNE

09:30

Introducing: Tuesday Fusion Stage, RAI

This is a great way to get a flavour of the day ahead, with this opening session providing a cheat-sheet for the day’s hottest talks, workshops, and pitches. Expect exclusive chats with some of the key speakers plus some special guests, too. You can also catch the early Introducing session on subsequent days of the show.

10:35

Cloud on Europe’s Terms: Sovereignty and Security in the Banking Sector

Fusion Stage, RAI

As we are all well aware, cyber attacks are on the rise and one of the top priorities for business leaders. This session will explore what sovereignty focus means for Europe’s financial sector, discussing links between sovereignty and cybersecurity, and the expectations of the markets and its regulators.

Speakers include Alexandra Maniati of the European banking Federation and Brent Phillips of Deutsche Bank, while the moderator is Georgina Bulkeley of Google Cloud.

This session allows the audience to get up close and personal with data, giving them the ability to ask questions, discuss and really understand at a high level the current opportunities and concerns. Note: only the first 40 people will be able to attend this session.

13:15

Banking On It: HSBC

UK CEO Ian Stuart Encore, RAI

Hear how HSBC worked to structure the SVB UK deal in record time from CEO Ian Stuart, why HSBC felt it needed to act fast to support the UK’s startups, and how he sees things playing out for European startups and banks as they build a new future together. Should be a fascinating session.

14:00

Gender Diversity in Blockchain and Crypto: Brining Women Onboard

The Box, RAI

Gina Ordonez Pari of Zimpler will explore the benefits of promoting diversity and inclusivity in the industry. She’ll also discuss how engaging more women can contribute to a larger user base and drive the growth and success of the industry.

15:05

Star(ling) Your Engines: A UK Export Success Story

The Close Up Stage, RAI

Rather than expanding into other markets, Starling has its own SaaS arm, Engine. In this intimate fireside chat, Starling CEO Anne Boden and Engine CEO Sam Everington discuss their progress, what the strategy entails and what the industry reaction has been so far.

16:00

FinTech Magazine's Happy Hour

Hall 1, Stand D190

You've had a busy day, so why not come and put your feet up at our stand for a well deserved beverage or two on us!

16:30

Fintech + Travel: An Unexpected Journey

Fusion Stage, RAI Research shows that consumers plan to prioritise spend on travel even as other discretionary spend areas come under pressure.

Consumers are also open to new fintech experiences in travel like BNPL and Foreign Exchange services to travel more flexibly. This panel session will draw on insights from some of digital travel's hottest innovators to explore how fintech and payments innovation are improving the customer experience and driving new growth.

10:42

Welcome to the Age of Centaurs: Hundred-Million Lessons for Startup Success

Money-Bot, RAI

They run a tight schedule at Money20/20, which is why this session is due to start at an irregular time. However, this session is about time, specifically the changing nature of it. It’s been nine years since Aileen Lee coined the term ‘unicorn’. Get ready for the next generation, as Money20/20 Wizard Sanjib Kalita heralds the dawn of a new era, where sustainable success takes precedence over glittering valuations. Welcome to the Age of Centaurs.

13:00

Future of Money 2035

The Box, RAI Hamish Thomas of Deloitte shares four possible scenarios ahead on the journey to 2035 and the future state of Money and Payments.

Alongside the longer range perspectives, understand significant near-term change that Deloitte can foresee. This session is especially relevant to retailers, tech companies, governments and regulators, covering potential responses to anticipated opportunities and challenges.

15:00

Europe's Got Access (Winner announcement)

Encore, RAI

Find out which climate-focused startup will walk away with US$100,000, in this contest backed by Commerce Ventures.

15:37

Generative AI within Fintech & Financial Services

The Summits, RAI

There is no escaping ChatGPT and generative AI, but what does it mean for banking and fintech? Discover from leaders at BBVA, Swift and NVIDIA how banks and fintechs evaluate generative AI, which applications they embed with AI first, and why waiting to invest is not an option.

10:05

Europe’s Formula for Supporting

Female Founders in Fintech Elements, RAI

Fun fact – Europe produces more female fintech founders than anywhere else.

This panel features female founders, co-founders and VCs discussing what needs to be done to level the playing field for women across the globe.

11:00

16:00

If you missed us yesterday, swing past and say hello!

16:20

What's Sharia Got to Do With It? New Banking Solutions for an Evolving Muslim World Money-Bot, RAI Europe is home to more than 40 million Muslims who remain underserved. From halal investment products to sharia-compliant banking solutions, this session explores why it's critical for banks and fintechs to understand the unique needs of Muslims.

The Impact of Quantum Computing on Banking, Payments and Financial Services Outer Limits, RAI

The speakers in this session from IBM explore what quantum computing means to the payments industry, and to bank and corporate CIOs and CPOs as they try to stay ahead of security threats and risks.

14:45

Marketing on a Changing Frontier: CMO Strategies to Succeed Elements, RAI

In uncertain times, CMOs need a clear vision, and this panel aims to provide you the insight required to prioritise marketing efforts.

The discussion brings FinTech and Financial Services marketing leaders together, sharing their experiences, best practices, case studies and real-life examples on visionary perspectives.

Fintechs are facing a number of strategic challenges, like how to compete with traditional banks, how to manage risk, and how to scale their businesses. Hear from top execs how they overcome these hurdles.

Showcasing the shift from a centralised to a decentralised model of ownership.

The frontline battle for customer attention is being fought on the front end. In the past, financial institutions focused on building robust back-end systems. However, in today's digital world, the front-end experience is just as important, if not more so.

“We are proud to present an agenda designed to help the industry build bridges from the challenges of right now to the incredible opportunities of what is next. Money20/20 Europe is the place where money does business. We can’t wait to open

the doors to the RAI Amsterdam Convention Centre on June 6th, fueling the industry with inspiration, knowledge sharing, genuine in-person connections and so much more,” said Tracey Davies, President of Money20/20.

Green finance also takes centre stage this year, with the Champions of Change – plus seven influential fintech leaders

As the name suggests, the Money20/20 panel of investors has selected the best startups to showcase their propositions on stage. Don’t miss out on the Next Big Thing. Watch out for a series of 10-minute pitches on The Close Up Stage

presenting or moderating sessions as part of the programme. They include:

• Dr. Ruth Wandhofer, Executive Director and VC partner at Gauss Ventures

• Maria Prados, Head of Vertical Growth at Worldpay

• Mary Agebsanwa, Fintech Growth Lead at investment technology provider Seccl

• Maarten Stolk, Co-founder and CEO of Deeploy

• Gerrit Sindermann, Deputy Executive Director at Green Digital Finance Alliance

• Joanne Dewar, Vice Chair for Global Processing Services

• Aydan Al-Saad, Creator at the startup European Income

“The Champions of Change is a team of influential, passionate thinkers with impact and purpose beyond the norm, leading and disrupting everything from green finance, financial inclusion and explainable AI,” said Davies.

FinTech magazine was a media sponsor at last year’s gathering and has a significantly increased presence in 2023 – that’s inflation for you. But seriously, as FinTech’s global audience and stature has grown over the last 12 months, it seemed a logical move to come back bigger (check out our stand in Hall 1/D190)

FinTech is a fast-moving beast, and many of the CEOs and founders we interviewed in 2022 have already moved on or moved aside due to rampant M&A activity in the sector. If you want to showcase your company to our community, get in touch by contacting james.white@bizclikmedia.com or simply drop by the stand.

As well as this mega Money20/20 Europe event, Money20/20 USA takes place 22-25 October 2023 in Las Vegas.

Even bigger than its European counterpart, Money20/20 USA is the world’s biggest, most influential gathering of the global money ecosystem. It’s Money20/20 Europe, just bigger.

The theme of the USA event sounds like a threat or an opportunity, depending on your perspective – 2023: A Reckoning Is On The Horizon.

The agenda focuses on four distinct chapters addressing what’s happening now and where the industry is going next:

• Trust & Uncertainty

• Creative Destruction & A Technological Renaissance

• Age of Fundamentals

• It’s Time to Build (Utility)

Here’s something to get excited about. After a break of five years (yes, you read that right, five years) Money 20/20 makes a triumphant return to Asia in 2024.

Being held in Bangkok, Thailand, for the first time, your favourite finance event was last held in Singapore in 2019 at the Marina Bay Sands, with the 2020 event cancelled due to COVID-19.

Money20/20 Asia connects the entire Asian money ecosystem from banks, payments, tech, startups, retail, fintech, financial services to policy, and more. From in-depth analysis and inspirational speakers to hours of structured and unstructured networking opportunities, you will walk away with business-critical insights and new connections to help you stay ahead.

And, it’s in Bangkok. What’s not to love?

See you there from 23-25 April 2024.

f you lived on planet Earth during the pandemic – or any time since, for that matter –chances are you ordered in. With restaurants shuttered and social distancing rules in place, many of us took advantage of the speed and convenience of food delivery. It’s a growing trend and a market that’s expected to be worth as much as US$430bn globally by 2030.

Along with the rapid rise of digital payments, it is one of the consumer demands that is driving a technological revolution in the restaurant business. One company that is helping to serve restaurants and meet those needs is Bostonbased Toast, which has been on an

astronomical ascent since it was founded in 2011. The company has raised more than US$900m in funding since the beginning of 2015 – during which time it has been led by one man.

Chris Comparato has an extensive background leading high-growth SaaS companies, which explains why he was such a good fit for the top job at Toast when he was appointed in February 2015. Before Toast, he led all customer success functions at Acquia and Endeca, as well as roles at consulting firms Keane and Cambridge Technology Partners.

When the COVID-19 pandemic hit, Toast was doing well. Revenue had increased by more than 100% year-on-year, and the firm had just raised US$400m in its largest funding round to date led by the likes of Bessemer Venture Partners and Tiger Global Management. It was a stern test – not just for Toast, but for its merchants too, who were already having to adapt rapidly to dining habits in constant flux.

Following a turbulent few years, restaurants are under pressure to move with consumer habits and offer fantastic experiences online and off. Toast is one of the companies helping them do it

“We enable restaurants to deliver fantastic experiences to guests, freeing up their time and energy to do more of what they love”

“If you look at the course of the last two-and-a-half years, the restaurant industry has been incredibly resilient,” Comparato told CNBC earlier this year. “We’re making sure that our merchants and restaurants are ready to adapt and be resilient. Restaurants continue to struggle with staff shortages, food inflation, and how to engage their team. Our platform helps our customers strengthen their position on those three dimensions.”

Despite the challenges of the past few years, restaurants are beginning to bounce back. More consumers are dining out again,

and food delivery is a long-term trend that will prevail because of its overwhelming convenience to customers. Inflation poses a new threat – both in terms of business rates, but also consumer budgets facing greater pressure – though research from restaurant marketing company Popmenu suggests that almost 60% of US consumers were dining out more last year, despite rising menu prices.

Toast continues to add more restaurants

Toast’s system helps restaurateurs to reduce ticket times by up to

40%, connecting the kitchen with the front-of-house to ensure that no tickets are lost and orders are picked up accurately. A bill-splitting feature allows diners to share the cost of a meal with others at their table, while handheld units let waiters put down their pad and pen.

Toast is trusted by nearly 80,000 individual restaurants, having added another 23,000 net new locations last year. It’s not just for big chains; even for small franchises, Toast can help realise productivity savings and empower staff to turn over tables more quickly.

Explaining the value that Toast brings, Comparato recently told the Entrepreneur podcast: “Our platform enables restaurant operators to deliver great guest experiences, whether it’s ordering off-premise through online ordering; whether it’s ordering takeout; whether it’s having a tremendous dining experience within the restaurant. We enable restaurants to deliver these fantastic experiences. We want to make sure that we’re freeing up their time and energy to do more of what they love.”

Today, Toast is a public company, having listed on the New York Stock Exchange in September 2021 as part of a successful IPO that valued the company at US$20bn and made all three of its original founders billionaires.

As for Comparato, he continues to lead the business as it recruits even more restaurants into the Toast ecosystem – or Toasters, as the company calls them. His name gives some clues to his Italian heritage, and subsequently his favourite type of cuisine when he decides to eat out. “Italian of course,” he says.

“Restaurants have been incredibly resilient but they continue to struggle with staff shortages, food inflation, and how to engage their team”

WRITTEN BY: ALEX CLERE

WRITTEN BY: ALEX CLERE

1 Expected estimates on number of institutions, number of accounts and number of corridors on Confirm are calculated based on projections from market research and incoming clients in Confirm’s pipeline and are subject to change. 2 All estimates on number of institutions, number of accounts and number of corridors include data from J.P. Morgan as a Responder and Inquirer on Confirm.

When Christine (Jang) Tan talks to us from her office in Singapore, she has just returned from Sibos – the landmark financial conference held in Amsterdam. It’s a major event for J.P. Morgan. Indeed, several of the company’s executives participated in panel discussions and debates at the conference, held in person for the first time in three years.

J.P. Morgan showcased Confirm powered by LIINK, a global account validation service designed to enhance the efficiency of cross-border payments. Confirm runs on the ONYX platform, the firm’s blockchain division. Confirm is the world’s first bank-led, production-grade, peer-to-peer blockchain network that has the ability to verify over 2bn bank accounts from over 3,500 financial institutions1,2

“We are propelling solutions that address the demands of customers globally – that means they need to be agile, nimble and frictionless,” says Jang. “We have that ability, as we can leverage global infrastructure and incorporate local best practices to our solutions, customising them to the specific client and industry segments, including strategic partnerships to enable an end-toend payments ecosystem. We also featured our cross-currency proposition customised for banks, fintechs, corporates, and non-bank FIs.”

J.P. Morgan, led by the ONYX team, also attended the Fintech Festival in Singapore. As a key foreign bank, the team is working closely with various central banks around the world, including the Monetary Authority of Singapore. The aim of this is to support new areas of innovation leveraging blockchain technology, with the goal of enabling the movement of money to be faster, better, more cost effective, and take place in a secured manner.

Jang works in J.P. Morgan’s Payments business, heading up Financial Institutions Group Sales in APAC. Not only is Payments a key part of J.P. Morgan’s push in redefining the future of finance, APAC is also a region that has historically been at the forefront of innovation with real-time payments and continues to be a torchbearer to this day.

Impressive credentials underline J.P. Morgan’s scale “We operate with in-country presence in 16 markets,” Jang says. “We support 18 markets from a client segment standpoint within Asia.”

And then of course they move their flows on a global basis. In APAC alone, the Payments business operates hubs in Manila and Mumbai, which facilitate some of the treasury services and trade processing that J.P. Morgan carries out on behalf of its clients.

J.P. Morgan is regarded as the number one US dollar clearing bank globally, processing almost US$10tn a day in payments.

With such large volumes at stake, the company is keenly aware of its responsibilities around cybersecurity and protecting clients’ money. “That cybersecurity aspect is very critical and in our connections with all the banks, that's one of their key priorities – to have not just a trusted partner who innovates, but the ability to

execute securely,” Jang says. “That's very critical, particularly in Asia where you've got a lot of central banks as well as regulators and a complex landscape.”

Sheer volume means cyber becomes key focus

That duty of care comes with expected levels of best practice: large financial institutions and emerging fintechs alike expect their partners to act impeccably, particularly when it comes to complying with legal and regulatory obligations or safeguarding systems from attack. “While we do share best practices, we also expect the same in terms of the companies [that we partner with] actually adhering to certain standards. It's really to protect the entire community.”

When she looks at how J.P. Morgan is likely to invest its resources in the future, Jang says: “We have to keep developing, and there has to be a cyber component that we continue to invest in. On blockchain, the use

cases will continue and we've leveraged Confirm as one of our applications for banks, non-bank financial institutions, corporates and fintechs to use.

“We also just recently had the announcement with VISA B2B, who will be leveraging Confirm to facilitate their payment flows cross-border as well.”

When you’re working at such an astronomic level, it takes some bright-shining stars to inspire you. Within J.P. Morgan, Jang says she looks up to Takis Georgakopoulos, the Global Head of J.P. Morgan’s Payments division. “He was previously my boss when he ran the MNCs Corporate Banking business, and brings a unique strategic background to his current role. His vision of bringing together four discrete businesses under a single Payments umbrella is what differentiates us today, enabling the bank to provide end-to-end pay-in, pay-out cash management and trade finance capabilities to our clients. Today, we process almost US$10tn in

CHRISTINE (JANG) TAN HEAD OF FIG SALES APAC, J.P. MORGAN PAYMENTS

“THE CYBERSECURITY ASPECT IS VERY CRITICAL AND IN OUR CONNECTIONS WITH ALL THE BANKS, THAT'S ONE OF THEIR KEY PRIORITIES”

TITLE: MANAGING DIRECTOR, HEAD OF ASIA PACIFIC – FINANCIAL INSTITUTIONS GROUP (FIG) SALES, PAYMENTS

Christine (Jang) Tan is Managing Director and Head of Asia Pacific – Financial Institutions Group for J.P. Morgan Payments, based in Singapore. In this role, she has leadership responsibility for banks, broker-dealers and non-bank financial institutions portfolios across the region, providing strategic advice and growing the business with both existing and new clients.

Prior to this position, Christine was Head of Treasury Services, ASEAN responsible for embedding the end-toend Treasury Services model across Indonesia, Malaysia, Pakistan, Philippines, Singapore, Thailand and Vietnam, ensuring resilience and robustness in product offering, service model and control environment. She was also Head of Multinational Corporates (MNCs) for Asia Pacific for five years and has a wealth of MNC experience in the region across multiple key markets.

Christine joined J.P. Morgan from Bank of America Merrill Lynch (BAML), where she was Head of Regional Treasury Sales for South Asia, with responsibility for developing and executing the sales strategy for pan-Asia subsidiary businesses of multinational clients and for large corporates in the region.

Prior to her time at BAML, Christine spent 12 years at Citi in a number of regional roles, including head of the Hong Kong Global Subsidiaries Group.

Christine also worked as an analyst covering Asian airlines and airports earlier in her career, where she also engaged in aircraft financing through structured trade finance, global cash management and fuel hedging for airlines.

Christine holds a Master of Business Administration and a Bachelor of Science in Business Administration from the University of Kansas.

payments daily in more than 120 currencies and over 160+ countries across the world, and we’re only getting started on this journey.”

A Singaporean native, Jang takes inspiration from the country’s late founding father and first prime minister, Lee Kuan Yew, as well. “Mr. Lee put Singapore on the map, and the financial services industry thrived under his leadership,” Jang says. “It's been growing as a key financial hub globally so I’m really inspired by his journey running the country.”

Within its payments business in APAC, J.P. Morgan takes an approach that Jang calls the ‘three Cs’: client, collaborator and competitor.

On a client side, the firm is obsessively focused on

innovating to support its clients with the rollout of new features and functionality. J.P. Morgan is a co-founder – alongside Singaporean bank DBS and sovereign fund Temasek – of an entity called Partior. The vision for Partior is to facilitate multi-bank settlement on the blockchain in multiple currencies. The firm has facilitated live transactions settling Singapore and US Dollars, and is in the process of adding settlement banks to facilitate additional currencies – including Euros, Japanese Yen and Chinese Renminbi.

For J.P. Morgan, collaboration is key to growth in the Payment business. A prime example is the partnership with European car manufacturer Volkswagen to create Mobility Payments Solutions, focused on the future of cars and how payments can drive innovation

through the auto segment. The company continues to look at additional partnerships that it might leverage in Asia – whether that’s with fintechs, aggregators, financial institutions, nonbanks or corporates. The firm also conducted strategic acquisition and alliances with Cleareye.AI, and the latest in-region partnership was with In-Solutions Global (ISG), a leading payment solutions provider.

“Those are collaboration aspects where we would look at whether we want to partner with them, invest in them, and then leverage their technology to support our solutions at the end of the day,” Jang explains.

Finally, on competition, J.P. Morgan does not allow its size or scale to cloud its judgement of rivals in the market. “Clearly we do face competition, with fintechs these days becoming more prevalent,” Jang elaborates. “But I do think having competition is healthy. Ultimately, it’s about benefitting the consumers who have the ability to choose their payment

CHRISTINE (JANG) TAN HEAD OF FIG SALES APAC, J.P. MORGAN PAYMENTS

“WE BELIEVE THAT SEAMLESS AND SECURE PAYMENT SOLUTIONS CAN HELP OUR CLIENTS AND THEIR BUSINESS… TO GROW, DIVERSIFY, AND THRIVE”

options – whether it's through banks, wallets or fintechs. And J.P. Morgan wants to be part of partnerships that deliver for clients.”

Blockchain a key driver behind payments

Jang is a firm believer in the possibilities brought about by blockchain, and expects the decentralised technology to form a key pillar of J.P. Morgan’s strategy as the company prepares for the future of payments. Jang explains: “We are working globally on opportunities to leverage the technology and apply them to various requirements and solutioning – whether it's on the markets front, tokenisation, real-time movement of money and cross-border payments.”

In addition to using SWIFT and ISO as the payment rails for cross-border transactions, J.P. Morgan is seeking to improve the sharing of data in realtime with Liink – the world’s first bank-led, productiongrade, peer-to-peer blockchain network for information sharing

– and Confirm, an application for global account validation. This will reduce timescales for banks, cutting down on laborious tasks that need to be carried out manually while lowering rejection rates at the same time.

The company is working with a lot of different companies to facilitate crossborder exchange of that data into different corridors, particularly when it comes to demand for remittances associated with overseas

workers, who want to send money back home to markets like Indonesia, India, Bangladesh and Sri Lanka to support their family and communities. J.P. Morgan is expanding the service into the Philippines, Vietnam and Thailand.

As she looks ahead to a promising future – one in which J.P. Morgan will play an undoubtedly pivotal role – Jang neatly summarises the pinsharp focus of its Asia Pacific payments team: “We believe that seamless and secure payment solutions can help our clients and their business to grow, diversify, and thrive by enabling rails for companies, financial institutions, and consumers to pay anyone by any method or channel from anywhere, anytime.” It’s not a straightforward brief – endusers want everything, and they want it now – but if any company has the track record behind it to make it happen, it’s J.P. Morgan. jpmorgan.com/payments

Banking Circle’s proprietary technology enables Payments businesses, Banks and Marketplaces of any scale to seize opportunities, compete and grow.

From multi-currency accounts to real-time FX, international payments to local clearing, we’re quick, low-cost, and secure.

Bypass old, bureaucratic and expensive systems and enable global banking services for your clients.

WRITTEN BY: ALEX CLERE

WRITTEN BY: ALEX CLERE

To anyone well-versed in marketing speak, descriptions of a superlative nature are usually best avoided.

Anything that is the ‘biggest’, the ‘most’, or the ‘best’ is usually nothing more than corporate bluster and hype. But no matter which way you slice it, Fiserv is one of the largest and most significant players in financial technology.

First, take its reach: Fiserv does business in more than 100 countries, and, in the US, its products or services reach nearly 100% of households, either directly or indirectly through a financial institution, fintech, merchant, or biller. Then there’s the size of the business: Fiserv has 40,000 associates globally and serves thousands of financial institutions and millions of merchants and consumers. Finally, its impact is reflected in the range of financial solutions and services offered, spanning the full spectrum of banking and commerce.

When Head of Fintech and Growth Sunil Sachdev and President of Digital Payments Matt Wilcox join me to discuss the company’s growing focus on open finance, the two are united by a clear common cause. Simply put: leverage the expertise and innovation Fiserv has to help clients continue bringing new financial innovations to market, deepening relationships by adding more value for the consumers and businesses they serve.

“We have thousands of clients in the financial institution space, and millions of clients in the merchant and small business space. When we think about how we serve those clients every day, it’s all about earning their trust and ensuring that the products and services they have from us are performing. That’s paramount.”

The company’s success is testament to the transformational impact it has managed to achieve on behalf of its clients. Fiserv has a wide spectrum of clients including financial institutions, fintechs, enterprise merchants, and main-street merchants, as well as corporate entities all looking to increase engagement with their customers. The Fiserv approach to open finance helps define and accelerate its clients’ ability to innovate with new financial products and experiences, embedded directly at the point of need.

The talented people within the business help tailor approaches to individual clients, working with them

to understand their needs and lend a guiding hand – something that becomes increasingly valuable given the recent turmoil in the markets and general economic volatility.

“Based on the broad set of ledger, processing, acquiring, payments and data services we have at Fiserv, we continually advise clients on how they need to evolve their best-ofbreed offerings to stay competitive in a fast-moving regulatory and financial services landscape,” Sachdev explains. “We believe that makes Fiserv very unique. It would be harder and less cost effective for them to engage with multiple parties who may only be familiar with one specific area and not the bigger financial services picture.”

When asked who he admires or looks up to in life, Sachdev gives a wry smile. There is the touching deferential nod to inspirational

Fiserv is helping clients, including fintechs and global brands, unlock new revenue streams with solutions that reach virtually every US household

colleagues and bosses-gone-by –one of them being Ken Chenault, long-time CEO of American Express, where Sachdev worked for more than a decade. But then he admits to being a long-suffering New York Knicks supporter and a fan of the Rocky movie franchise.

“I guess I enjoy the underdog story,” he says. “There’s something about those types of stories that really highlights the excellence of people, whether they’re athletes or in other walks of life.”

This sentiment is pertinent to the role Fiserv plays in facilitating financial inclusion and increasing access to financial services through its products. Sachdev has an extensive background in banking and payments, working for fintechs both in the US and overseas. His travels have seen him put down roots in the UK, South Asia and India before returning to New York five years ago. This experience has given him a much richer insight into the challenges and obstacles that face consumers in other parts of the world.

“Living overseas and working in emerging markets really makes it personal for me to develop services

and capabilities that can lift people,” Sachdev states. “I feel like I draw on that quite a bit to help deliver some of the services that we’re thinking about delivering today.”

According to the World Bank, more than 1.4bn people worldwide remain unbanked, while the Federal Reserve reports that 22% of American adults (63mn) are either unbanked or underbanked – cut off from vital

financial services. Financial technology has a real power to elevate people, particularly underserved communities, and this is one of the reasons that Sachdev calls it a ‘privilege’ to show up for work each day.

“Fiserv is all about taking something from the whiteboard and bringing it to life,” he explains. “For me, that’s the best part of it – it’s about having an idea or identifying a problem, having a conversation with our clients and other market participants, being able to bring different subject matter experts together. Then we combine the technical pieces, commercial pieces and the go-to-market pieces to build a successful product or service to address that opportunity. That’s why I enjoy it. I don’t really think of it as work at all.”

Whether it’s a community bank leveraging fintech tools to better support the financial wellness of its customers, or a fintech leveraging Fiserv technology to bring these capabilities directly to market, Fiserv is bridging the gap to bring these scenariosto life at scale.

The business unit that Sachdev heads up – the fintech-focused team – was founded little more than a year ago. Before that, Fiserv was servicing fintechs in a siloed way, more often at a product level rather than a strategic one. Now, clients across a range of sectors that want to tailor financial services products for their various customer segments have a single entry point and are guided through their journey.

In turn, as the business unit matures, it is transforming to meet the needs of those clients. On any given day, Sachdev finds himself working closely with the varied talent that Fiserv boasts within its vast workforce. The goal is to integrate Fiserv services and capabilities and bring them to market in a more cohesive way, while modernising the tech stack to increase agility and accelerate time to market.

SUNIL SACHDEV HEAD OF FINTECH & GROWTH, FISERV

“FISERV IS ALL ABOUT TAKING SOMETHING FROM THE WHITEBOARD AND BRINGING IT TO LIFE. FOR ME, THAT’S THE BEST PART OF IT”

Fiserv’s Matt Wilcox, President of Digital Payments (left) with Sunil Sachdev, Head of Fintech & Growth (right)

Fiserv’s Matt Wilcox, President of Digital Payments (left) with Sunil Sachdev, Head of Fintech & Growth (right)

One thing that has aided in that pursuit is the Fiserv acquisition of Finxact, which was completed in April 2022. Leveraging the latest technologies, Finxact has developed a cloud-native, next-generation core banking platform designed to meet the scale and performance requirements of organisations of nearly any size. At the time of the acquisition, Fiserv President and Chief Executive Officer Frank Bisignano said the deal would “accelerate the ability of fintechs and financial institutions to deliver differentiated digital banking experiences to their customers” – something that Sachdev and his team spend a large part of their waking hours focused on.

Many financial institutions are choosing to run Finxact alongside their current banking core as a flexible platform to deliver new innovations and initiatives. A great deal of postacquisition investment has focused

on orchestrating a seamless backend experience to accommodate implementations that involve multiple systems of record.

For fintechs and other businesses leveraging Finxact as the banking-andpayments backbone for all types of creative use cases, the vast network of financial institutions served by Fiserv provides a ready source of sponsor banks to support these endeavours.

Fintechs can also tap into the power of the Fiserv network by offering their solutions to financial institutions through AppMarket, a digital marketplace where thousands of banks and credit unions using Fiserv core solutions go to access pre-integrated fintech innovations to expand their capabilities. With the high customer acquisition cost of direct-to-consumer models, many fintechs find that distributing their solutions through financial institutions can speed up time to revenue.

Part of the revolution behind open finance has been around data. Indeed, it would be almost inconceivable for the fintech use cases that are popular now to have ever existed were it not for consumers being able, and willing, to share their data through APIs. For Fiserv, open finance has been a way to accelerate innovation and increase industry collaboration.

As Fiserv has opened its ecosystem to support this revolution, financial institutions, fintechs and other businesses now have multiple ways to consume and connect with data. Developer Studio provides access to Fiserv restful APIs, including a workspace that gives developers instant access to begin working with core banking APIs. Financial data can be streamed from banking core platforms in real time, and cloudbased data storage provides a way to tap into deep and wide datasets on demand.

Fiserv also has built a data aggregation platform that brings together data from 18,000 sources, including financial institutions, a full biller network, brokerage and wealth

SUNIL SACHDEV HEAD OF FINTECH & GROWTH, FISERV“LIVING OVERSEAS AND WORKING IN EMERGING MARKETS REALLY MAKES IT PERSONAL FOR ME TO DEVELOP SERVICES AND CAPABILITIES THAT CAN LIFT PEOPLE”

TITLE: HEAD OF FINTECH & GROWTH

INDUSTRY: IT CONSULTING

LOCATION: UNITED STATES

Sunil Sachdev is a global fintech executive with a significant breadth of experience in banking and payments at companies such as American Express, Meed and Pershing. He has worked for Fiserv for nearly a decade in various roles and geographies. In recent years, he led the community bank segment, with a focus on enabling financial institutions to leverage modern technology to deliver differentiating experiences and improve time to market. Since 2021, Sunil has headed up the fintech segment, leading a team that has greatly accelerated the planning, execution and delivery of open finance and digital transformation capabilities across the enterprise.

@sunil-sachdev-5128463

management houses. Providing consumer-permissioned access to this data creates the foundation for a growing number of open finance use cases.

“We’re starting to see the area of open finance really open up,” explains Matt Wilcox. Wilcox is President of Digital Payments at Fiserv and, as such, sits at the beating heart of fintech innovation – all of which begins with data. “We’ve seen a faster clip of innovation. And that’s starting to open the doors for industry collaboration. We’re working with countless companies where that opportunity exists now and there’s a faster path towards more open finance.”

Until now, innovation around open finance has largely been concentrated in other regions like Europe – but North America is slowly beginning to catch up, Wilcox posits. For the customer, he explains, this brings innumerable benefits. And, where once open finance was mostly about personal financial management

(PFM), it is now spreading into other exciting use cases including real-time account verification, real-time money movement, and new ways to pay at a merchant such as pay by bank.

“The consumer will benefit because there’s going to be a better mitigation of fraud and risk,” Wilcox says. “Financial institutions will benefit because they’ll be able to provide more financial wellnesstype solutions, and I think everyone else is going to benefit from a more personalised experience and new

Fiserv: crafting new digital experiences using open finance

options for faster, more secure money movement. Having access to the data within an open finance environment is going to make things unique for you or for me in ways that we haven’t even thought of yet.”

Even in a very simple sense, onboarding and ID verification are changing. The option for consumers to share their personal transactional data through an open API rather than having to manually upload documents is powerfully transformational. And in these times, it is imperative that businesses have a thorough handle on who their clients are. Wilcox believes we’re witnessing a tilt towards open finance being primarily driven by compliance and AML use cases.

“We’ve been building and nurturing our data aggregation platform, called AllData, for about 15 years now,” Wilcox continues. “The original use case was PFM; now, we’re seeing the use cases of that data aggregation platform explode, especially with open finance. A couple of things have happened. First, we’ve moved away from the old model of screen scraping to direct access agreements, and we can now pull data in real time, which means real-time data can be used in open finance ecosystems.

“Data aggregation has moved beyond a PFM use case where we’re now using it for fraud and risk management. We’re using it for verification that a user is who they say they are. That a given user owns the account they say they own. If they

then want to connect another bank account at a different bank, we can verify their ownership in real time.”

This has taken on renewed significance in the past year. Multiple disparate sanctions lists mean that companies need to know who their customers are more than ever; coupled with a crackdown in the US on money laundering, compliance is a key consideration for fintechs and banks alike.

Putting consumer power back in consumer hands

Despite the optimism around open finance, it’s clear there still need to be checks and balances on what can be done with consumer data. It is their data after all, so informed consent is important.

MATT WILCOXTITLE: PRESIDENT OF DIGITAL PAYMENTS

INDUSTRY: IT CONSULTING

LOCATION: UNITED STATES

As President of Digital Payments at Fiserv, Matt Wilcox is responsible for turnkey services for a multitude of Fiserv product lines while also focusing on creating high-growth digital experiences in the real-time payment solutions marketplace. Wilcox oversees collaboration opportunities within the financial services industry, helping to build digital and payment strategies and product innovations that drive revenue, client retention and new client acquisition. During his career, Matt has directed work in emerging technologies, mobile and online banking, payments, social media and marketing strategies.

@matthewwilcox

MATT WILCOX PRESIDENT OF DIGITAL PAYMENTS, FISERV

“WE’VE BEEN BUILDING AND NURTURING OUR DATA AGGREGATION PLATFORM, CALLED ALLDATA, FOR ABOUT 15 YEARS”

According to the Pew Research Center, nearly 80% of Americans are concerned by how their personal data is being used online – and a similar percentage report having little to no confidence that companies will admit to mistakes and accept responsibility if a data breach occurs. That level of distrust is not exactly conducive to broader adoption of new services among consumers, so taking the right precautions is more vital than ever.

One of the things that Fiserv has built into its AllData platform is an extension called AllData Connect, which allows banks and financial institutions to determine who is able to pull data into, and out of, their ecosystem. Consumers can also decide whether they’re willing to share personal data with a certain fintech or a specific integrator. “That puts the permissioning rights over consumer data in the consumer’s hands,” Wilcox says.

Fiserv will guide that process to ensure the proper checks are done

on the data being loaded into an ecosystem, but its main focus is very much on putting the right technology tools – and subsequently, the power – into consumer’s hands. This entire approach replaces the screen scraping model, which can be challenging to maintain.

Sunil Sachdev believes that we can look forward to a bright future in fintech, thanks in part to the power of open finance. Perhaps surprisingly, he likens it to the galactic empire: “If I were to hypothesise on the future of open finance, I’d point to Star Wars and other futuristic movies, where payments and exchanges of value leverage some form of universal currency. I think that’s what’s promising about embedded finance and modern finance more holistically: we’re able to embed payments and other digital assets into user experiences so transactions become much more

seamless, and the fungibility of the underlying assets neededto enable a universal currency increases.

“Ultimately, it represents the ability for all of us to be on the same tender type, so to speak. Given the current direction of digital identity and real-time payments around the world, it’s hard not to see that we are moving quickly towards a universal payment vehicle that accounts for identity and value exchanged at the time of the transaction. It’s a future where you don’t have to worry about geographical or regulatory limitations for whatever product or service you’relooking to access.”

In terms of data ownership specifically, Matt Wilcox continues: “We’re headed towards an environment where data is going to move more freely, but in a really sound and safe way. There will be more of a governing body around the movement of data – similar to what we’ve seen in other regions.

“Direct connections and direct access to data will open up innovation, because, despite the progress we have made in open finance around pulling in all of the financial data on behalf of a consumer or a business, we still have a way to go.

“I still think that the pace of innovation can increase exponentially, and I still think that there are too many entry points for access to the consumer’s data. On behalf of the consumer, I’d like to see open finance really streamline that so we can put the consumer in a decision-making role on how their data can be used and shared. We’ve seen that, when we give them that ability, they’re not necessarily restricted but they’re exposed to the benefits of that personalised experience.” fiserv.com

As the fintech industry continues to thrive globally, breaking new boundaries and introducing more innovations to the marketplace, women are taking an increasingly central role at the helm of disruptive fintech companies. Whether they are C-level decision makers in established global corporations or dynamic startup founders, their contributions to the changes in fintech – and the way in which products and services now better serve 50% of the world’s population – are undeniable.

We list the top 10 women to watch in 2023 and the companies they steer that are propelling change.

Vrinda Gupta is the innovative Founder and CEO of Sequin Financial – a fintech company aimed specifically at boosting credit ratings for women. She launched the company after developing a card for Visa and then being turned down for the product.

Gupta was recently named one of NYC’s 55 Most Inspiring Women in Fintech, which was celebrated at the New York Stock exchange. Of the moment, she said: “This is an especially meaningful honour, as the New York Stock Exchange took 175 years to seat its first woman – Muriel Siebert. I’m inspired by women’s progress and accomplishments, as inspirational leaders and innovators in an industry that was designed to leave women out of the narrative.”

Manuela Seve is the Co-founder and CEO of the US-based startup Alphaa.io and was recently named one of the top 100 influential Latinos/Latinas by Bloomberg.

An Economics graduate from IBMEC, Seve spent five years working with the former President of the Central Bank of Brazil, Armínio Fraga, at Gávea Investimentos.

In 2015, she began examining the use of blockchain for authenticating art collectibles and, in 2017, developed the Alphaa.io API – a blockchain platform that addresses three problems in the space, namely authenticity, resale, and community-building in various sectors.

Ghinwa Baradhi is considered one of the top CIO banking leaders globally. An innovative and dynamic executive who excels in leading multidisciplined international virtual resource teams across both business and IT, she is HSBC’s nominated member of the UAE Banks Federation (UBF) IT Committee.

Baradhi is also HSBC’s nominated Sponsor for Diversity & Inclusion for Technology, globally. She is on the Technical Advisory Board of Nodes Agency, a leading digital product development enterprise, and is also an Advisory Board Member for the Money 20/20 Asia RiseUp Program, a global accelerator programme focusing on gender diversity and supporting women across financial services.

With over 25 years of experience in financial services, bank operations, and management consulting at Visa, Charlotte Hogg is a respected figure in the financial industry.

She served as a Chief Operating Officer for the Bank of England from 2013 to 2017 and, before that, led retail distribution for Santander in the UK. Prior to these, Hogg was the Managing Director of Experian’s UK and Ireland operations.

Earlier in her career, Hogg was also the CEO of Goldfish Bank at Discover Financial Services, a Managing Director for strategy and planning at Morgan Stanley, and a Management Consultant at McKinsey & Company, based in the US.

Mariquit Corcoran has 20 years of experience in leading business teams in areas spanning fixed income, operations, risk management, finance, and banking.

Before Barclays, she led the team responsible for sourcing and closing deals for all strategic engagements of a newly launched fintech, Marcus by Goldman Sachs. Now, Mariquit serves on the Strategic Advisory Board for FTV Capital.

Corcoran was recognised in the HERoes Top 100 Women Executives in 2021, 2020, and 2019 by INvolve and Yahoo Finance; NYC FinTech Women’s Inspiring Females of 2019; and, most recently, named in the 2021 FinTech Magazine/IBM’s Top 100 Women in FinTech.

In her spare time, Corcoran is a keen runner, dancer, tennis player, and endurance racer.

JoAnn Stonier – formerly Head of Business Intelligence at Emirates Bank in the UAE – has spent two decades climbing through the ranks at HSBC.

A global data expert with substantial experience creating data strategy and management programs, Stonier ensures data innovation while navigating data risks. She’s a leading expert in data ethics and responsible data practices, with a focus on machine learning and AI. Her skills include expertise in anonymisation and analytics, and she is Adjunct Professor at both Graduate and Undergraduate level.

Mariquit Corcoran Group Chief Innovation Officer Barclays Charlotte Hogg Chief Executive Officer, EU Visa JoAnn Stonier Chief Data Officer MastercardWelsh entrepreneur Anne Boden MBE is a veteran of the financial industry. Prior to launching Starling Bank in 2014, Boden enjoyed a 30-year career holding leading positions at Allied Irish Banks, Royal Bank of Scotland, and ABN AMRO.

A qualified computer scientist, she was an early advocate for the use of technology in the financial industry and launched Starling Bank in 2014. Her strategy from the outset involved making the bank a global brand.

As the CEO, she oversees the Executive Leadership Team and is a member of Starling’s Board of Directors. Boden was awarded an MBE for her services to the financial and technology industry in 2018.

The climb to success hasn’t always been easy for Samantha Ku. After graduating from the University of Miami as a 21-year-old in the middle of an economic recession, she was deeply in debt and found the employment market unforgiving. She recalls that it was “a perfect storm of emotion to end the greatest college experience anyone could have”.

But, despite a period of turmoil that came after attending 50 job interviews seemingly without any success, Citibank offered Ku her first position in the financial industry in 2010.

She later joined Square in 2015 as Head of Operations, rising through the ranks to her current position of COO. Ku then built and led several teams foundational to the Square Capital program product suite, expanding the team to 100+ employees across San Francisco, New York, Las Vegas, and Melbourne in Australia.

Anne Boden

Samantha Ku COO

Anne Boden

Samantha Ku COO

Emilie Choi joined Coinbase in early 2018 as the vice president of business and data before moving up the ranks to become President and Chief Operating Officer. She helped build the exchange alongside founder and CEO, Brian Armstrong.

Choi is also a keen angel investor and has taken part in several seed, Series A, and Series B funding rounds for a number of successful fintechs.

Prior to joining Coinbase, Choi held senior executive roles at Warner Bros, Yahoo and Naspers. While serving as LinkedIn’s Vice President of Corporate Development, Choi oversaw more than 40 transactions – including the acquisitions of Lynda, Bright, Newsle, Connectifier, Slideshare, and Fliptop, as well as LinkedIn’s JV in China and strategic investments in Cornerstone On Demand and G2 Crowd.

The dynamic leader has helped steer the company through four crypto winters and Coinbase’s recent round of redundancies. In relation to the fluctuations in cryptocurrency, though, the leadership team is looking beyond the current economic cycle and says that, despite the recent downturn, the company continues to be strong.

Speaking at Coinbase’s public listing in 2021, when the company was valued at US$86bn, Choi told reporters: “I want everybody to be in this for the long term. Crypto, as you know, has cycles. I want us to think about things much in the way Amazon did. Nothing matters right now day to day.”

Coinbase’s latest valuation is US$14bn.

In August 2022, she was appointed to the board of directors for independent identity provider Okta.

Choi holds a BA in Economics from the Johns Hopkins University and an M.B.A from the Wharton School at the University of Pennsylvania.

“I WANT EVERYBODY TO BE IN THIS FOR THE LONG TERM. CRYPTO, AS YOU KNOW, HAS CYCLES. I WANT US TO THINK ABOUT THINGS MUCH IN THE WAY AMAZON DID. NOTHING MATTERS RIGHT NOW DAY TO DAY”

Financial innovator and fintech founder Cristina Junqueira has smashed the glass ceiling in the fiercely male-orientated environment of the Brazilian financial industry, with her contributions having helped launch a new wave of digital banking and finance in the region.

Prior to the launch of Nubank – a collaborative effort between Junqueira and her two co-founders, David Vélez and Edward Wible – bank customers in Brazil had little choice but to fall in with the demands of the incumbent banks, all of which charged high fees for every service. Such exorbitant expenses drained precious resources from hardworking families, thus maintaining, rather than aiding, the financial inclusion gap.

A mother of two and qualified engineer, Junqueira helped launch Nubank in 2013. Her passion to drive change in the Brazilian banking world has, in turn, been realised, serving an estimated 75 million customers.

Success has seen Junqueira become only the second self-made female billionaire from Brazil – her 2.9% stake in Nubank gives her a personal fortune of around US$1.3 billion.

According to its IPO prospectus, Nubank’s total market potential was valued at US$99bn in 2020, and it has been predicted to grow to US$126bn by 2025.

Still under 40 years of age, Junqueira is not averse to referencing Star Wars, even though she was born 7 years after its 1977 release.

“If banks are Darth Vader, credit cards are the Death Star. They’re the horrible weapon the banks used,” she said.

“IF BANKS ARE DARTH VADER, CREDIT CARDS ARE THE DEATH STAR. THEY’RE THE HORRIBLE WEAPON THE BANKS USED”

Swan, who studied as an engineer specialising in mechatronics – a multidisciplinary field that exists at the intersection of mechanical, electrical and computer engineering – got swept into the financial world through his early career experiences in startup companies. The path led him into venture capital and later to a company called Solium Capital, which was then acquired by Morgan Stanley in 2019.

The route to IPO is a complicated one – especially given the current climate, as the economy slows and companies are under increasing pressure to scale while maintaining more modest financial constraints than they were previously afforded.

When a private company seeks to go public, it usually means one of three things: firstly, a company is seeking to raise capital; secondly, its board is planning to provide liquidity for investors and employees; and, finally, there’s a desire to raise brand awareness and strengthen market position in the eyes of potential customers. The route to an IPO has often been seen as a key milestone in a company’s development in the global marketplace.

But in recent years – helped along by some regulatory changes and market factors – many companies are choosing to delay their route to the public markets and instead work on accessing capital through venture capital and growth equity investors to maintain their private company status.

According to Kevin Swan, Co-Head of Global Private Markets for Morgan Stanley at Work, these days the average time for a startup company, from launch to making the move to go public, is now over 12 years.

Swan’s background has been instrumental in his understanding of the various reasons underscoring certain companies’ decision to choose an IPO route or remain as private entities. The delay in going public, he explains, is mainly due to changes in the regulatory environment in addition to the flow of capital from public to private markets. This has resulted in private companies being able to raise significant capital without having to go public.

“Over the past decade, we’ve seen increasing amounts of capital flow into the private markets, and we’ve encountered several other factors that have led to this dynamic situation, where companies are now staying private for much, much longer. Now, the average time to enter the public market for a venturebacked tech startup is much longer and these companies are valued in the billions, many in the tens of billions. Furthermore, some are able to raise enough private capital to not even necessarily need to pursue an IPO and rather enter the public markets through a direct listing.”

Even though it may take a company several years to reach the point where pursuing the public markets is a possibility, preparing for that process requires careful planning. Alternatively, while a company may wish to remain private, it may need to address its equity structure and liquidity strategy to ensure it remains an attractive option for its investors and employees as well as navigate the current economic climate.

Morgan Stanley at Work is helping to create a new roadmap for private and public companies seeking to generate liquidity

Although IPOs are generally considered the ultimate liquidity event, private capital markets are continuing to gain momentum in terms of investment interest. As a result, many companies are able to generate the funds required to provide employees with some liquidity on their equity packages, without going public.

These types of events, however – and the management of successful equity programmes –require considerable groundwork to be viable.

And that’s where Morgan Stanley at Work comes in: a division of Morgan Stanley that is focused entirely on private and public company share plan administration solutions that empower companies in providing employees workplace financial benefits. Their offering covers equity management, retirement solutions and financial wellness. For private companies wanting to maximise the benefit of their equity programmes, Morgan Stanley at Work offers a number of liquidity solutions.

Morgan Stanley’s day-to-day operations primarily consist of investment banking and financial services, so offering solutions that aid in the path to the public markets beyond raising capital has been a natural progression. As a global corporation, it is uniquely positioned to provide an equity management system for the private market that can facilitate recordkeeping, transactions, and money movement.

“If you’re a public company, that infrastructure already exists in the form of transfer agents and

clearing brokers, where you can easily buy and sell stocks in a public company online or through your financial advisor,” Swan says.

However, in the private marketplace, this can be more of a challenge, as historically speaking, there’s never been a highly sophisticated infrastructure to provide easy liquidity solutions. Morgan Stanley at Work is taking a progressive approach to solving that challenge by building a trading infrastructure and transaction execution framework that caters to private markets and is designed with an issuer perspective.

Unsurprisingly, the private markets don’t operate in the same way as public markets. Regulation is quite different, and the private investor community often has different objectives and time horizons than public investors. Morgan Stanley at Work offers Shareworks – an equity management platform utilised by private companies to manage their cap tables, employee stock plan and liquidity programmes. They have also launched a private market transaction desk that can help execute block sales and other forms of secondary transactions, giving shareholders access to liquidity and clients access to investment opportunities.

KEVIN SWAN CO-HEAD OF GLOBAL PRIVATE MARKETS, MORGAN STANLEY AT WORK

“Historically speaking, there’s never been a highly sophisticated infrastructure to provide easy liquidity solutions in the private marketplace and Morgan Stanley at Work is taking a progressive approach to solving that challenge”

“We have the equity management platform and transactional capabilities to be able to support companies and shareholders,” Swan explains. “We also have an attractive investor client base for participation in liquidity events and secondary transactions.”

According to Swan, high-growth venture-backed companies control their cap tables, as ownership structures and the different legalities provide them the authority to decide who can be an investor –and who can’t.

“The big takeaway is that these companies have a definitive say in terms of who can actually own their shares. So they want high-quality, reputable, long term investors on their cap table.”

Morgan Stanley at Work is fortunate to work with some of the best companies in the world, due to the full suite of wealth management and financial wellness offerings. These services empower companies to extend benefits to their employees, at the same time as engaging directly with both employees and investors.

“A lot of times, for employees in these startups, it’s the first time that they’ve obtained any wealth. And whether that’s a modest amount or generational wealth– which isn’t uncommon at some of these

INDUSTRY: FINANCIAL SERVICES

LOCATION: ALBERTA, CANADA

Kevin Swan is a Managing Director of Morgan Stanley in Wealth Management. He is Co-Head of Global Private Markets for Morgan Stanley At Work, which delivers equity management, liquidity, and workplace solutions to private companies. He joined Morgan Stanley through the acquisition of Solium Capital where he served as the VP of Corporate Development. Prior to joining Morgan Stanley, Kevin held roles in product management and corporate development, was a Partner at venture capital firm Inovia Capital, and served as a board member at several venture backed technology startups. Kevin has a B.Sc. from the University of Alberta and an M.S. from Stanford University where he studied mechatronics and control systems.

startup companies – we have solutions and a large population of top financial advisors to support these employees on their financial journey.”

Sam Adams is the Executive Director of Private to Public Strategy for Morgan Stanley at Work. A veteran of the ‘route to IPO’ journey prior to joining Morgan Stanley, she managed a number of prominent IPO projects, which helped her to decide that managing share plan administration programmes and supporting companies through the process was the perfect use of her acquired skills.

“We have several private clients who have no intentions of ever going public and we’re starting to see a larger trend in new clients who want to establish stock plans with regular liquidity activity already preprogrammed in,” explains Adams.

“This is because it gives them the flexibility to allow people to take some of the value that they’ve helped create in the company off the table through the shares they’ve earned as an employee, while not putting so much pressure on the overall company to have to make a decision of whether or not to go public within a certain time period.”

As someone who has witnessed first-hand the complicated process of the path to IPO, Adams is passionate about her role and says companies that manage their equity programmes well not only benefit themselves but in turn, also change the lives of their loyal employees.

“One of my personal missions in life is to make sure that capturing that opportunity doesn’t get lost on other people. It really can be a life-changing thing, and Morgan Stanley at Work can not only help the company have the underlying infrastructure to make those transactions happen, but on the participant side, ensure that people have the right resources to take advantage of what that opportunity brings to the table.”

A good equity programme not only rewards employees but also creates a deeper investment culture within the organisation. If an employee can see the value of their shares rising as the company grows, it can incentivise them to work towards the company’s common goals. Equally, companies today may have to take into account lifestyle choices. Employees might have certain expectations in mind when they consider equity programmes at the joboffer level.

Today, as companies take longer to reach the IPO stage, they also have simultaneous opportunity to scale and grow. This means they have to offer competitive equity stake value or risk losing out to the

competition. The war for talent as we’ve known it for the last 10 years is beginning to slow, evidenced by the volume of layoffs, particularly in the technology sector. However, down markets may breed innovation because with mass layoffs comes a surplus of talented people that find themselves without work, have potentially realised some significant value from previous roles and are ready to solve new problems. Similar to companies that emerged in the aftermath of the 2008 financial crisis, Morgan Stanley at Work believes there will be a new period of innovation out of the current downturn as well.

Swan says: “One of the big drivers in the evolving approach private companies take towards liquidity over the last decade was the war for talent. Private companies have become much larger, but the draw for startups to attract employees was always in the equity. You knew that you were taking a job where you were going to be fairly underpaid from a market perspective in your base salary. However, you’re going to have the upside of equity, which could create an asymmetrical outcome, financially, for yourself.”

But what happens if these companies stay private for longer? “Now, we have companies that are worth billions – even tens of billions of dollars and they’re financially sound – and they’ve raised a tonne of capital. But as valuations increase, you obviously don’t have quite the same upside in any new equity you receive as you did when you were a small startup worth a few million dollars,” Swan says.

He goes on to explain that a shift has occurred, where these companies have to start paying more competitively on base salaries. But they may also have to be competitive on the equity front. And very often in these cases, private companies are competing with large public companies.

“So, if I’m a senior engineer looking at joining one of these late-stage private companies and I’ve got an offer from them and I’ve got an offer from one of the world’s leading public tech companies – they may be very similar in terms of the base salary, and even the value of the equity I’m getting.”

“But one big difference is that in a public company, when your equity vests, you can immediately sell it on the public markets. You have access to a liquid market.”

At a private company, the options are more limited. Swan establishes that this is where Morgan Stanley at Work comes in, following a growing number of private companies that have started becoming more proactive in providing liquidity to compete with public companies. Just over the past three years, it’s a much more commonplace approach for large companies to take.

Current financial instability is another reason for employees to demand greater value and security from their companies, says Adams, highlighting that the need for better equity packages has probably never been greater.