The World’s Fastest Growing Fintech & Crypto Event

8 - 9 November 2023

QEII Centre, London

SPONSORSHIPS GET YOUR PASS

Ways to Work With us

FinTech magazine is an established and trusted voice with an engaged and highly targeted audience of 2,000,000 global executives

Digital Magazine

Website Newsletters

Industry Data & Demand Generation

Webinars: Creation & Promotion

White Papers & Research Reports

Lists: Top 10s & Top 100s

Events: Virtual & In-Person

WORK WITH US

OPEN SEASON FOR INNOVATION IN FINTECH

As summer slowly melds into autumn, it’s time for many of us to start looking ahead. Don’t worry, I’m not talking about getting ready for Christmas – not yet, anyway.

In truth, we have a lot to look forward to as an industry, both literally and figuratively. This month, we’ll be hosting our first InsurTech LIVE virtual event on 18 October. We have already announced some internationally acclaimed speakers, and we have a full schedule of keynote addresses and fireside discussions planned, so be sure to join us for that.

We’ll also be out in force at Money20/20 USA in Las Vegas from 22-25 October, following on from the success of our attendance at the European version of the show in Amsterdam, where we were a media partner and had our own booth. This time, we’ll be roaming the halls of The Venetian looking for the next big things in finance and connecting, hopefully, with as many of you as possible.

We can do some looking ahead in October’s issue of FinTech Magazine, too. This month, we have features on the rise of community banking, which is providing a vital lifeline in trying times; and we look ahead to Crypto 2050, asking what utopia looks like in terms of cryptocurrency adoption. Do enjoy those articles and more in this issue!

“WHAT DOES UTOPIA LOOK LIKE FOR CRYPTO, AND WHERE WILL THE INDUSTRY FIND ITSELF IN 30 YEARS’ TIME?”

CONTENTS

UP FRONT

14 BIG PICTURE US Federal Reserve launches peer-to-peer, real-time payments service FedNow

16 LIFETIME OF ACHIEVEMENT Ahmed Karsli

20 INTERVIEW WITH Alberto Guerra

28 TOP 10 Fintechs in APAC and MEA

The World’s Fastest Growing Fintech & Crypto Event

8 - 9 November 2023

QEII Centre, London

SPONSORSHIPS GET YOUR PASS

AWARDS

The Global FinTech Awards 2024 will be celebrating the very best in Fintech with the following categories:

Digital Banking Award

–PayTech Award

–

Digital Currency Award

–

FinTech Award

–InsurTech Award

–

Sustainable FinTech

–

FinTech Technology Award

–

FinTech Consultancy Award

–

Future Leader Award

–

Executive of the Year Award

–

Project of the Year Award

–

Lifetime Achievement Award

BIG PICTURE

US Federal Reserve launches peer-to-peer, real-time payments service FedNow

US Federal Reserve, Eccles Building, Washington DC

Washington DC’s Eccles Building, home of the US Federal Reserve. The US’ central banking system recently launched FedNow, a peer-to-peer real-time payments (RTP) service designed to foster faster cash flow between individuals and businesses.

Companies such as Zelle and Venmo are private RTP services operating in the US, so FedNow will offer a centralised system for transferring funds in real time. There are some high-profile early FedNow adopters too, US banking giants JPMorgan Chase and Wells Fargo included.

The willingness of established institutions to immediately sign-up for FedNow highlights its significance to the US economy.

Ahmed Karslı

Meet the man spearheading growth at Turkey’s billion-dollar neobank, Papara

Ahmed Karslı is the CEO of Papara, the Turkish neobank that has bootstrapped its way to exponential growth and recently became a fintech unicorn for the first time. The company emerged out of the ashes of Turkey’s antiquated banking sector, and from the outset it had a very clear purpose.

Karslı – who himself is a big fan of fintechs including Cash App, Revolut and Robinhood – wanted to drive financial inclusion. “We began as a small but ambitious venture with a vision of offering Turkey an accessible financial service when we saw many being underbanked and underprovided,” he recalls in conversation with FinTech Magazine.

“I founded Papara with a mission of promoting financial inclusion and freedom for all. This foundation remains ingrained in Papara’s ethos, as we firmly believe that everyone deserves access to financial services that cater to their unique needs and preferences. In 2021, over 30% of Turkey’s population was reported by the World Bank to be underbanked and so Papara wants to drive positive change within the industry to establish a financial system that benefits everyone.

“Traditional banking systems often impose barriers through their terms and fees, leaving many underserviced. We’re proud to be leading change in Turkey, offering customers the ability to enter the financial landscape on their own terms, fostering a more equal and democratic environment.”

Papara’s exponential growth has been ‘incredible’

At a time when many fintechs are reliant on venture capital funding – and some now are understanding the need to rediscover profitability – Papara has done things uniquely. The neobank has bootstrapped its way to where it stands today, with no external investment, having been profitable since 2017.

“I founded Papara with a mission of promoting financial inclusion and freedom for all”

In July, it announced that it was acquiring Madrid-based neobank Rebellion – the first time that Papara has expanded beyond its home market. In so doing, Papara secured the coveted unicorn status for the first time, as the combined group has a valuation in excess of US$1bn.

Explaining the timing of the acquisition, Karslı stated at the time that Papara was “confident that our products, services and vision can compete on a global scale”. It marks the start of a prospective European expansion that he believes will be characterised by acquisitions of this kind, drawing on local market expertise and on-the-ground insight.

“We knew that our first steps for international expansion would be to augment our European position and, during our search for potential opportunities, we explored multiple avenues,” Karslı says. “Rebellion emerged as the ideal foundation on which we could build on our ambitious plan for growth and continue fulfilling our mission of generating financial inclusion for all.

“Rebellion and its team resonated with Papara on multiple fronts. They hold an unparalleled grasp of the local market, which will be an invaluable asset for us as we want to carefully cater to Spanish user’s unique needs. Rebellion’s portfolio of best-in-class products further reinforced our confidence in forging a partnership. However, what truly impressed us was the alignment of our goals with theirs, signifying a shared vision for the future.”

He remains tight-lipped about which markets might be next, but on Papara’s success to date he says: “It has been incredibly exciting to see Papara’s exponential growth since we founded the business in 2015. To see Papara reach over 16m users and become Turkey’s largest

2015 Year Papara founded US$1bn

Most recent valuation

16m

Number of users

fintech company in such a short space of time without external investment has been an exceptionally fulfilling journey. Not only has the growth been a testament to our team’s hard work and success, but it shows that we were right in our founding motivations, and far too many people had been financially excluded for far too long.”

‘Bootstrapping a young startup is exhilarating’

Karslı is a graduate of Istanbul’s Bahcesehir University and Istanbul University, where he studied towards a Masters of Law. Away from

“Bootstrapping a young startup is exhilarating due to the raw creativity that’s required and the sense of building something from the ground up”

the office, he is passionate about history and fascinated by antiques, collecting old items and artefacts that – much like Papara – have their own story to tell.

“These pieces connect me to the people who lived before us and remind me of the journey of humanity,” he says. “It’s like uncovering hidden chapters of our world’s story and feeling a sense of kinship with those who came before.”

So what of the founder experience –and more pointedly, which does he prefer: overseeing a billion-dollar unicorn in modern-day Papara, or leading a plucky

startup like the Papara of yesteryear?

“Both scenarios have their own allure and challenges,” he admits.

“Bootstrapping a young startup is exhilarating due to the raw creativity that’s required and the sense of building something from the ground up. On the other hand, leading a billion-dollar fintech brings a different level of responsibility and impact. It’s about steering a wellestablished ship toward even greater achievements. Ultimately, I find fulfilment in both, as they offer unique opportunities for growth and innovation.”

UniTeller’s CEO, Alberto Guerra, explains the frictions in cross-border payments, the apps that are a source of inspiration in fintech, plus why he doesn’t necessarily believe in luck

Q. COULD YOU DESCRIBE YOUR ROLE AND YOUR BACKGROUND?

» I am Alberto Guerra, CEO of UniTeller Financial Services, a company founded in 1995 and acquired in 2007 by Grupo Financiero Banorte, one of the largest financial groups in Mexico and Latin America.

My journey with Banorte began many years ago in the International Banking Division. Progressing through various roles, from International Banking to Corporate Banking, M&A and Investment Banking, I became the Head of International Banking at Banorte in 2003. In 2005, Banorte initiated a strategic endeavour to expand into the US and created the Banorte USA Division, with the goal of acquiring a Bank and a Company specialising in cross-border payments and remittances.

As Head of the International Division, I had the privilege of working on the Banorte USA initiative, and successfully overseeing the acquisition of UniTeller in 2006, culminating in the completion of the deal in early 2007. As part of this acquisition, I was presented with the opportunity to relocate to the US and assume the leadership of UniTeller as its CEO. Our vision was to transform UniTeller into a gateway for international crossborder payment transactions to Banorte and financial institutions in Latin America and globally. Being the CEO of UniTeller has been an exciting journey, during which the company evolved from a small, traditional remittance enterprise into what it is today: a major gateway and processor for global cross-border payments.

Guerra

Q. WHO WAS YOUR CHILDHOOD HERO AND WHY?

» I have two. The first is more personal in nature, and the second is a fictional character.

On a personal note, I would undoubtedly choose my father as my hero. I always looked up to him and admired him for his achievements. He was a beacon of inspiration with an exceptionally remarkable professional career. He was not in the finance industry. His domain revolved around the heavy metal industry, particularly in the steel industry. His progress was defined by an extraordinary professional career that was achieved by diligently studying, reading, and through his unwavering and honest dedication to his work.

On a fictional note, I admired Superman as a superhero. His strength, his ability to fly, and to time-travel allowed him to bring positive change to help everyone around him. The notion of bringing change in the world captivated me. While I cannot fly, I do recognise the power within me, “the power of my words, the power of my thoughts, the power of my ideas”. So, I try

to channel my inner superhero to shape my world, the company that I work for, and my family. As Superman, I try to use that power to positively influence those around me.

Q. ARE THERE ANY WORDS OF WISDOM THAT HAVE STUCK WITH YOU THROUGH YOUR CAREER?

» I’ve been very fortunate to have been guided by exceptional mentors throughout my career, and I hold deep admiration and respect for them. One quote that has resonated with me is “the harder you work, the luckier you get”. Sometimes it’s not about being lucky, it’s all about working hard. This phrase, shared by one of my mentors, serves as a constant reminder of the importance of diligence. It’s a philosophy I’ve internalised to the extent that I even have it written on a post-it note at my desk in my office. Reflecting my father’s influence, I’m a firm believer in the value of hard work. When you work hard and follow the right approach, opportunities follow through.

Q. WHAT INSPIRES YOU IN THE WORLD OF FINTECH TODAY?

» There are some people that I hold in high regard that have managed to build very successful companies from nothing, just by having an idea and being committed to that idea and exceling on its implementation. In the remittance space, there are a few leaders that I admire for their accomplishments. Outside of cross-border payments, one prominent figure for me was Steve Jobs. His principles and the frameworks he established can be fully applied to fintech. He excelled in crafting exceptional products with an emphasis on excellence and great customer experience.

There are several companies that have experienced a situation where the mere creation of a product does not automatically generate demand. Steve Jobs wisely said that, at times, people may not realise the need for something until it’s presented to them with the right customer experience and a well-developed ecosystem. This approach cultivates an affinity for products, and occasionally motivates individuals to pay a premium for these products and services. If you translate these concepts into the fintech world, the focal question becomes: how can one build a successful product or service – for individuals or companies? The answer lies in factors such as the quality of the service, the reliability of the service, and the overall customer experience.

Q. ARE THERE FINTECHS OR APPS THAT YOU ENJOY USING YOURSELF?

» I constantly explore fintech apps. I love to download them and understand the customer experience they provide. One of the apps that really piques my interest is SoFi. What I find particularly appealing

about this app is how it consolidates various services, including lending and investing, in a seamless and efficient way. The integrated experience they provide, along with their proactive follow-up is very interesting.

I enjoy using other fintech apps; Acorns and its intriguing micro-investing business model; Crypto.com, with a captivating value proposition for a debit card, wallet with crypto investing. Revolut is another platform that I’ve used that offers a compelling blend of multi-currency accounts, investing and payments; and our own uLink, an app providing an excellent consumer experience with the best rates and fees for international money transfers.

In essence, I’m an avid user of several fintech apps, and some of these companies

really excel in their approach. At UniTeller, we make a deliberate effort to understand and learn from their business models and how they portray their services to their customers.

Q. COULD YOU DESCRIBE UNITELLER IN 25 WORDS OR LESS?

» We are a leading global cross-border payments service provider with state-of-theart technology, advanced digital capabilities, and a robust compliance platform.

Q. WHAT ARE THE BIGGEST FRICTIONS THAT EXIST WHEN CONSUMERS MOVE MONEY ACROSS BORDERS?

» There’s still a lot of work that needs to be done to achieve frictionless global crossborder payments.

Even within the realm of very large corporate payments, it’s astonishing that in certain cases, the process extends beyond two or three days. There’s still a lot of interdependence of banking networks, structural intricacies of different banks, and liquidity issues around making these payments in real-time. This is still a big challenge that has yet to be overcome.

At times, these types of payments lack transparency with regards to fees and payment times. Fortunately, for low-value payments, we’ve witnessed significant improvement. There are several emerging fintechs, including UniTeller, that are actively improving user experience by facilitating more transparent and real-time crossborder payments.

However, there are still challenges that persist since not all payment networks are built to deliver the value of realtime payments. Despite the presence of companies like UniTeller and others that provide access, the ultimate delivery of payments still hinges on the efficiency of the last-mile infrastructure. Regrettably, in some countries, this final leg of the journey isn’t adequately equipped to deliver such payments. We’re engaged in discussions with multiple business partners in different countries to ensure that we can have a seamless experience in a wider range of countries.

Q. DO YOU THINK B2B PAYMENTS STILL LAG BEHIND B2C?

» I believe that the B2B sector is experiencing improvement and catching up. In B2B, especially on the higherticket transactions, liquidity for real-time payments is a problem to solve. For instance, if your company provides these services and needs to make a payment

in a country where you don’t generally make payments, then your counterparty may require advance payment. To execute a real-time payment, you are essentially faced with two options: either have a business partner who is willing to advance the funds to make the payment in real time, or allocate substantial capital within those countries. Both approaches are highly inefficient. There are ongoing initiatives exploring real-time tokens or cryptocurrencies, which aim to enhance settlement efficiencies in some of these

countries. However, for larger-ticket transactions, the complexity intensifies for sure.

Q. UNITELLER RECENTLY ACQUIRED OH MY CARD, WHICH

PROVIDES A PLATFORM FOR GIFT CARD PAYMENTS. WHAT WILL THAT ACQUISITION DO FOR UNITELLER?

» At UniTeller, we see ourselves beyond the scope of being solely a service provider for remittances. While we have expanded into business payments, we firmly believe in the

potential for a broader use case – a scenario where electronic payments can be sent instead of money, with the ability for these payments to eventually be converted to cash or used at retail stores. The underlying technology extends beyond the concept of gift cards; it revolves around establishing a settlement method at retail locations and building a robust settlement network. We do see a lot of synergies within the remittance space in sending gift cards to relatives. Yet, we also envision the prospect of developing wallets capable of leveraging settlement

networks at retail locations, ultimately leading to even more efficient settlements. It’s an interesting and innovative approach. We perceive opportunities and recognise the potential to leverage this technology not only within Latin America but also to expand its reach across other regions.

Q. WHAT’S THE ONE PIECE OF TECHNOLOGY (APART FROM YOUR MOBILE PHONE) THAT YOU ABSOLUTELY COULDN’T LIVE WITHOUT?

» My laptop is indispensable. When I travel, my cell phone and my laptop are absolute must-haves. While I love my phone, there are certain tasks that demand a laptop to be efficient and productive.

Q. DO YOU HAVE ANY INTERESTING HOBBIES OR PASTIMES?

» I have a love for reading, and I read often – novels, biographies, business books. I also love spending time with my family and my kids. Our conversations are a cornerstone of our interactions, and I particularly enjoy talking to my kids about current politics and social issues. Also, my son plays college soccer, and watching him play has always brought me great joy.

Engaging in physical exercise is also particularly important to me. I make it a point to incorporate daily walks and jogs into my routine, often accompanied by my dog, which helps me maintain an active lifestyle.

I also collect model airplanes. I have always been fascinated by planes and I hope to get a pilot’s licence someday. It is one thing that I’ve had on my bucket list and I’m sure that one day, I will!

Q. DESCRIBE YOURSELF IN THREE WORDS.

» Hard-working, blessed, and persistent.

We run through our Top 10 fintechs from the Asia-Pacific (APAC) and Middle East & African (MEA) regions.

Find out who takes our number-one spot here

WRITTEN BY: LOUIS THOMPSETTWhile the eyes of many may focus on the accomplishments and impressive growth rates of fintechs in the Western world, let’s not overlook the successes and significant financial growth of fintechs hailing from both the Asia-Pacific (APAC) and Middle East & African (MEA) regions.

Read on to find out our Top 10 fintechs from both regions, starting with Egypt’s MNT-Halan…

FINTECHS APAC

FINTECHS IN AND MEA

MNT-Halan 10

A burgeoning Egyptian fintech, MNT-Halan is the country’s leading finance ecosystem, and a fastgrowing lender to unbanked and underbanked populations. Founded in 2018, MNT-Halan has grown a digital ecosystem encompassing lending options, buy now pay later finance and ecommerce. MNT-Halan backs its platform with Neuron, its proprietary technology, which sees it serve over 5m customers in Egypt alone. The fintech says it processes over US$100m in transactions on a monthly basis. In February 2023, it secured US$400m in equity and debt funding to fuel its growth on the international stage.

Razorpay 09

With over 300m customers, Razorpay can count itself among the largest fintechs in India. Founded in 2014 by Harshil Mathur and Shashank Kumar, the company’s aim is to leverage developer-friendly APIs to enable frictionless transactions and overhaul money management for online businesses. Razorpay boasts a workforce of roughly 800 employees and is backed by the likes of Sequoia, Ribbit Capital, Tiger Global and Y Combinator, as it continues to offer fast and secure ways for merchants, ecommerce companies and public institutions to accept and disburse payments online – with services ranging from payments and banking to credit and payroll.

Ke Holdings

Ke Holdings is a Chinese holdings company engaged in housing transactions and other related services. Founded in 2001, Ke Holdings operates across three segments: Existing Home Transaction Services, New Home Transaction Services, and Emerging and Other services. Its Existing Home Transaction Services provides sales and leasing of existing housing through the online brokerage Beike; the New Home Transaction Services segment provides new housing agency sales for real estate developers; while the Emerging and Other services segment is engaged in financial services and other newly developed businesses.

Optasia

Dubai-based Optasia is an advanced AI platform enabling access to financial products and solutions for underserved populations. Extending its services to over 30 countries, Optasia’s data engine and algorithms analyse different data from mobile devices to provide instant credit decisions to its partners. Today, the company enables credit decisions for an estimated 88m customers a month, and, as of 2021, had 560m addressable customers. The fintech has partnered with Vodapay in recent times – the financial arm of telecom company Vodacom – expanding its presence in the Democratic Republic of Congo.

The World’s Fastest Growing Fintech & Crypto Event

8 - 9 November 2023

QEII Centre, London

SPONSORSHIPS GET YOUR PASS

MadfooatCom

Real-time bill presentment and payment system provider MadfooatCom is a leading Jordanian fintech, enabling consumers to pay and enquire about their bills. Founded in 2011, MadfooatCom partners with banks in Jordan to help them enhance their customer experiences and shorten collection cycles. In fact, MadfooatCom partners with more than just banks, striking deals with telecom companies, government agencies and nonprofit organisations across Egypt, Saudi Arabia, Oman, Palestine, the UAE and Morocco, as well as its native Jordan.

Grab is a Southeast Asian superapp that describes itself as ‘the everyday everything app’. The app allows users to order food deliveries, pay for daily purchases, invest in the stock market, take out insurance for life’s necessities, and even book a hotel room. Since its founding in 2012, Grab has grown to become an app used by millions of consumers daily across Southeast Asia, with a presence in 13 different markets. Headquartered in Singapore, the fintech is currently led by former Harvard Business School graduate Anthony Tan as Co-Founder and CEO.

Fawry 04

Egyptian fintech Fawry is a leading digital payments platform in the region. Founded in 2008, Fawry provides electronic bill payments, mobile top-ups, cash deposits and withdrawals to the consumers it serves. The fintech also has an extensive range of investments, savings, insurance, rewards, loyalty and e-ticketing products. Fawry also serves SMEs, enabling them to accept payments through a range of terminals, be it online, mobile, or point-of-sale (POS). The fintech went public in 2019 and has since launched Tamweelak Fawry, a lending platform for SMEs and micro businesses.

Lufax Holding 03

Another Chinese company, Lufax Holding is a financial services empowering institution for small and micro businesses operating out of China. Associated with Ping An Group, Lufax’s mission is to foster small business competitiveness, providing SMEs and individuals with inclusive products and services to help institutional partners reach and serve SBOs efficiently. Today, Lufax is partnered with over 550 financial institutions in China, supporting them through its offline-to-online model by leveraging an extensive nationwide direct sales network.

Tencent

Tencent is one of China’s biggest multinational technology and entertainment conglomerates. The operator of WeChat, Tencent’s platform plays host to a range of embedded finance offerings. In 2018, the company surpassed a market value of US$500bn and is today the most valuable publicly

traded company in China. Today, Tencent is involved in many emerging trends shaping the future of financial services, leveraging advanced AI and large industry models to serve its customers and business partners. Among other ventures, Tencent is one of the world’s largest video game vendors.

Tech for Smart Life

The Portfolio

Ant Group

Our top fintech in APAC is Ant Group, the parent company of Alipay, and one of the world’s most-used mobile payment platforms. Alipay helps to connect consumers and merchants, supporting both ecommerce and physical transactions. Today, the fintech supports over 2,000 financial institutions in China to provide inclusive financial services – ranging from consumer finance and wealth

management to insurance. It also collaborates with local governments in over 1,000 counties, more than 500 brands, and 1,000 financial institutions. Formerly part of the Alibaba Group, Ant Group was split out in 2011. Recently, the founder of both Ant Group and Alibaba, Jack Ma, gave up overall control of Ant Group amid a whirlpool of regulatory scrutiny.

ARE YOU READY FOR 2024?

Convera looks at today’s global economy, analysing the impacts of monetary policy, bonds & equity, credit, trade and geopolitics on FX rates, with an eye to how these may change as we enter 2024

WRITTEN BY: LOUIS THOMPSETT PRODUCED BY: JAMES WHITEFacing headwinds and high expectations for global commerce

Today, exchange rates are experiencing volatility, with economic headwinds leading to unpredictable impacts on a growing global trade market post-COVID-19. This volatility is affecting cross-border trade for SMEs and large corporations alike.

Interest rates from 155 central banks between August 2021-2023 have risen over 500 times – constituting the most aggressive period of interest rate hikes ever recorded – a reality that has jolted foreign exchange (FX) rates.

The cause of these unprecedented hikes? The need to swiftly contain inflation. Central banks have had to reverse course from their actions during the COVID-19 pandemic when over 200 interest rate cuts happened throughout 2020.

As the gears of industry and trade began turning again in 2021, a regime shift has been mandated to control inflation. But rapidly imposed, successive interest rate hikes have knocked exchange rates; the euro, US dollar and pound sterling have seen much volatility since.

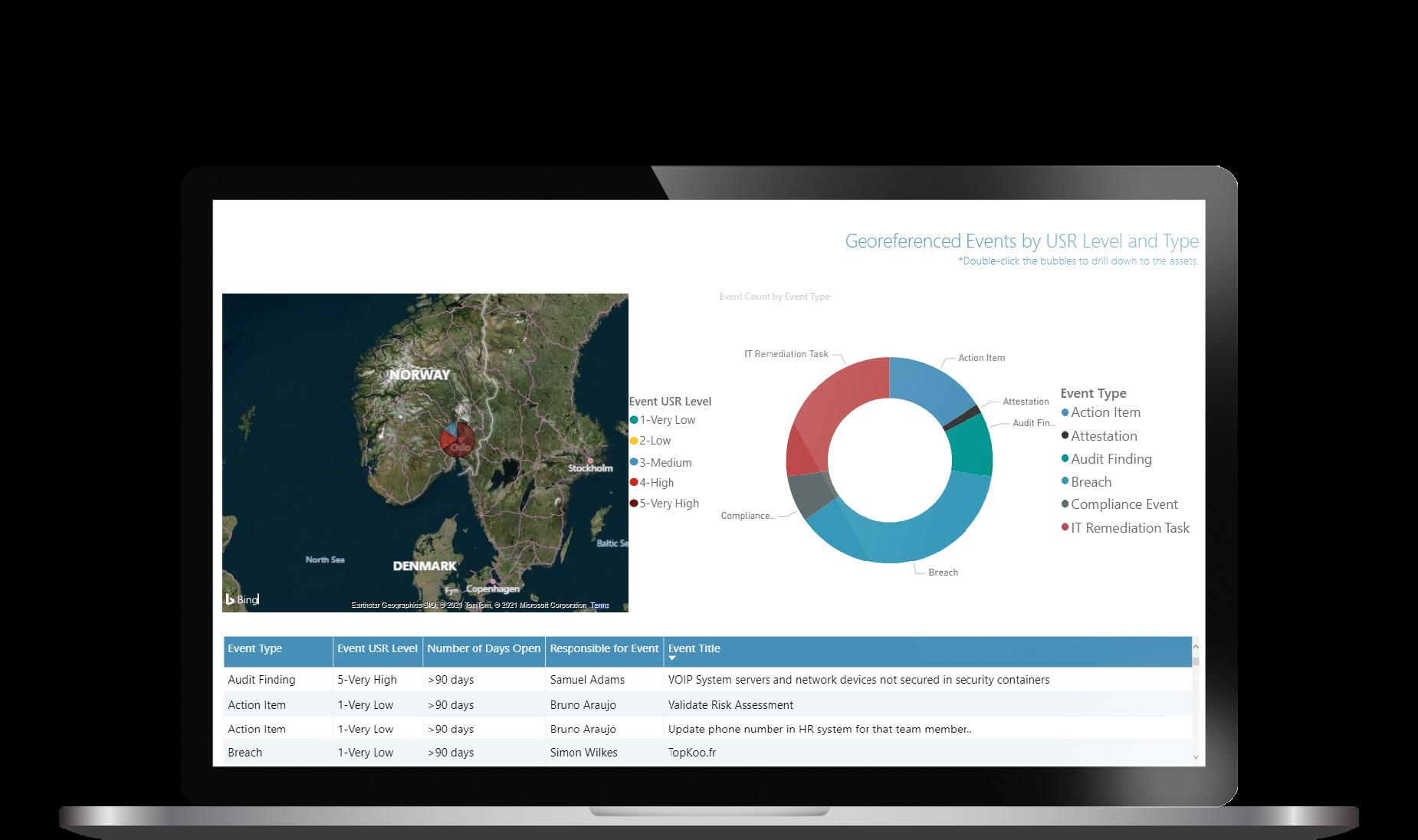

Top five macro concerns businesses expect 6-12 months ahead

Note: percentages will not add up to 100% due to multiple response options. Only displaying top 5 concerns.

Source: Convera – July 6-7 2023. Displaying responses from 95 businesses across Europe, APAC and NAM. Respondents included industries such as financial services, manufacturing, and respondent job titles included FDs, CFOs, and MDs. Question: “Thinking about the next 6-12 months, what issue(s) concerns you most today?”. ‘Other’ concerns not displayed included Digital transformation/automation.

In fact, Kybira’s 2023 Currency Impact Report examining 1,200 companies found that rising exchange rate risk cost them US$64.2bn in Q3 2022 alone. These FX headwinds were more than three times the fiscal amount of any tailwinds experienced by any of the sampled companies.

Moreover, a Convera survey found that 71% of such businesses counted high inflation and rising interest rates as the most pressing macroeconomic issues they face, with another 49% citing a lack of cash flow and 44% geopolitical trade risks as the most immediate issues. These figures are best highlighted in the graph below.

With these figures in mind, it’s clear that exchange rate risk constitutes a significant point of friction in cross-border trade for SMEs and corporates alike. These headwinds are affecting payments and organisations’ bottom lines.

2024 may mark a turning point, with volatility easing at the back end of the year to keep cross-border trade on a path to growth. Convera forecasts that crossborder business will accelerate some 33% between 2023-2028, reaching US$39.8tn from US$30.3tn in 2022.

Today’s higher for longer interest rate narrative will be challenged if inflation falls to the much-coveted 2% mark, meaning central banks could be compelled to lower interest rates.

In the US, inflation is falling, but economic resilience has resulted in volatile US rate expectations, reducing the US dollar’s 13% fall from its October 2022 high, to around 7% at present.

While falling inflation could constitute a shift in monetary policy from central banks – which in turn could impact FX rates – other factors could contribute to

the broader macroeconomic outlook and the potential for further FX rate volatility: bond and equity price divergence, credit conditions, trade circumstances, and the geopolitical landscape.

This report considers each of these coalescing factors, forecasting their compounding effects on FX rates.

From Convera’s perspective, the key to success for cross-border trading businesses in 2024 will be determined by their ability to mitigate cross-border frictions and volatility, negate losses and maximise growth. Those who succeed will execute sophisticated hedging processes, effectively automating these processes at speed.

Having the right solutions in place will enable global organisations to address cross-border frictions, ensuring they remain beneficiaries of a growing trade industry, amid widening macroeconomic uncertainty.

Today’s macroeconomic landscape: A picture of economic uncertainty

Exchange rates are experiencing volatility today. This is a legacy of recent crises –from the US-China trade war, the aftermath of fiscal COVID-19 measures and Russia’s war with Ukraine – all leading to the current cost-of-living crisis stretching from 2021 into 2023.

Many economists predicted the global economy would fall under its weight, with high interest rates and high energy prices – the latter a partial symptom of severed trade with Russia following its invasion of Ukraine – seeing consumers’ wallets pinched and the economy heading to a potential recession.

Despite fears, inflation – particularly in the US (as aforementioned) – has started to

fall. With incoming economic data showing resilience, these stagflation risks have subsequently eased.

But where does this economic resilience come from? The pandemic may have had a part to play. Fiscal stimulus measures sparked a global consumption boom that is still influencing the global economy in 2023.

Consumers have accrued excess savings post-pandemic and a shift in consumer preferences may have contributed to the disconnect between lagging and leading economic indicators currently seen.

But this is not the only disparity contributing to an uncertain economy. The potential for further divergence between bond and equity markets could further alter the outlook for FX rates.

Quantitative tightening is gaining more and more attention and could have significant side effects for the economy and, subsequently, FX rates. Bond yields have continued to surge as central banks raise interest rates across the board and actively sell government bonds. The graph below shows how, historically, bond prices fall

Equities and bonds to surge – dollar to weaken in 2024?

Median cross-asset performance after interest rates peak, 7-day moving average

Sources: Refinitiv,

Note: Historical data since 1971. G7 bond price series is an average of individual bond prices for G7 nations, weighed by their respective GDP values. G7 equity index is an average of individual equity indices, weighed by their respective trading volumes. Yahoo Finance, Oxford Economics, Macrobond, Convera – August 2023when the Federal Reserve raises rates but rise once rates eventually reach their peak.

Additionally, equities have surprinsgly outperformed this year and the VIX Index – a measure of equity market volatility commonly known as the “fear index” –has stayed below its long-term index average of 20 for over three quarters of this year. In comparison, we saw the VIX Index above 20 for over 90% of the time in 2022.

This only adds to the picture of an uncertain economy, and the divergence between bond and equity markets could lead to further jolts in FX volatility as we head into 2024.

Quantitative tightening to reduce the economy’s money supply, as imposed by central banks, has been mirrored in the credit space. In fact, one of the most aggressive credit tightening cycles is potentially coming to an end, although the impact of higher credit rates is still feeding through.

The result of this tightening is that 40% of consumers across 28 markets expect their disposable income to fall in the next year, potentially driving down consumer spending.

For years, consumers have relied upon cheap credit. In December 2020, at the height of the pandemic, the world’s negative-yielding debt pile hit a record high of US$18tn and home prices in the US, UK and Germany rose by an average of 30% from the start of 2020 to mid-2022.

But since then, the battle against rising inflation has shifted the landscape of credit in the private sector. Today, shortterm interest rates and mortgage rates in G10 countries have hit a 14-year high, and

“As we near the peak of high interest rates and ponder the timing of future rate cuts, volatility in, and divergence between bond and equity markets could materially alter the outlook for FX rates”

GEORGE VESSEY LEAD FX & MACRO STRATEGIST, EUROPE

we see companies and households having to adjust to a new rate environment.

While we don’t expect credit conditions to tighten much more, the lagged negative effect of tighter conditions is yet to be experienced by businesses and households.

This could be particularly true for mortgage holders. In the UK, mortgage debt has shifted from being responsive to changing interest rates to stagnant over longer periods as many consumers have elected for fixed mortgage rates in blocks of two or five years.

With this lagged impact on consumers in mind, financial conditions – particularly consumer spending – could tighten further in 2024 when both sovereign credit and mortgages come due for refinancing.

We are already seeing tighter bank lending standards due to rising interest rates, which may start to crimp down on credit flowing to businesses and households, particularly those households with mortgages due for refinancing.

In the Eurozone, the Bank Lending Survey (BLS) reported demand from firms for loans or drawing of credit lines in

Global credit cycle remains negative, but is improving

Change in G5 central bank’s balance sheets as a share of global GDP, in % terms Note: Global GDP forecast taken from the IMF for

of Convera Analyse Global Economy & FX Rate Influences for 2024

the second quarter of 2023 dropped to a record low.

Meanwhile, the share of small US firms reporting it is difficult to access loans rose to a 10-year high in May 2023, and the Senior Loan Officer Opinion Survey (SLOOS) showed that US banks’ tighter lending standards have breached the threshold that in the past was consistent with a recession. This may come into sharper focus once lag effects have run their course.

And yet – to add further fuel to economic uncertainty – while credit may be tightening and bond prices surging, global stocks have bucked the trend seen from other economic indicators that point toward recession – appreciating over 15% year-to-date. US Nasdaq stocks are

particularly noteworthy in their defiance of expectations, surging 40% in large part thanks to the emergence of AI products on the market.

With global stocks healthy, one may assume this lays the foundation for stability in global trade. But is this the case? Yes and no. The value of cross-border global trade, much like stock markets, defied expectations of a downturn. Although global cross-border collapses were feared amid the onset of the COVID-19 pandemic, trade grew 24% between 2019 and 2022 and compared favourably with the longrun average of around 6% per annum since 1995. Nevertheless, a thriving global crossborder trade market does not necessarily rule out volatility, particularly regarding FX rates.

New politically charged trading policies have had a big impact on trade in recent years, as leading Western nations look to diversify from an over-reliance on China. Near-shoring trading has seen India, Vietnam, Mexico and Thailand become key beneficiaries of new trade opportunities as global firms move production away from China.

The US Inflation Reduction Act and the CHIPS and Science Act have both impacted the ability of China to undertake trade with the US and accept foreign direct investment. Chipmaker Intel is one major producer that is considering moving

production out of China to comply with new US regulations.

Today, the difference between Chinese imports into the US compared to five years ago is stark. In the first six months of 2018, Chinese imports into the US sat at US$249bn, but in the same period in 2023, Chinese imports accounted for only US$203bn – a drop of 18.5%.

Decoupling from China, the US has turned to Mexico as its number one importer. Its imports have grown from US$168bn in the first six months of 2018 to US$236bn in the first six months of 2023 –an increase of more than 40%, underpinning

Mexico overtakes China as US’ #1 source market for goods

Monthly US imports, USD mln, 6-month rolling total Sources: US Census Bureau,

the geopolitically-fuelled shifts emerging in trade patterns post-pandemic as part of the US-China trade war.

The process of decoupling from China is hastening amid growing geopolitical tensions, something that is bound to have implications for USD/CNY exchange rates.

This could be further complicated, as Xi Jinping looks to diversify his country’s economy, a process that is expected to result in China generating more than onequarter of all global consumption growth – more than any other country.

How the Chinese Yuan will subsequently look against the US Dollar seems all the more uncertain.

Shifting trade conditions are not endemic to just China and the US, Europe has introduced the EU Carbon Border Adjustment Mechanism (coming into force in 2026) to penalise high-carbon imports which, according to Energy Monitor, is likely to have the biggest impact on Russia. Over US$10bn of its largely iron and steel exports between 2015 and 2019 would have fallen under this new CBAM legislation.

Of course, the key driver in these shifting trade conditions is the result of geopolitical decisions and the key role politics plays in economic issues that affect FX rates. And in 2024, some big political events could alter economic outlooks, thus fuelling exchange rate volatility.

No upcoming political event is perhaps as large as the impending 2024 US election, where it is expected that incumbent President Joe Biden will again face off with Donald Trump, the likely Republican candidate.

The outcome of this election could have vastly different geopolitical implications.

“In the first six months of 2023, Mexico overtook China as the largest overseas source market for US imports of goods. Trade disputes or diversification is having consequences for longer-term balance of trade and payments”

STEVEN DOOLEY LEAD FX & MACRO STRATEGIST, APAC

For instance, would another Trump administration roll back any of the severe economic sanctions on Moscow that ensued after Russia invaded Ukraine in 2022?

Such is the polarity in today’s political sphere that the impact of elections on the economy is arguably more unpredictable than ever.

History backs this up. Since 1980, only six of the US’s Congressional 21 sessions (29%) have been led by a unified government, leading to higher policy uncertainty.

Add to that Donald Trump’s 2016 election win, the US-China trade war and pandemic-led economic policy responses, and the polarity only grows. The Global Economic Policy Uncertainty Index has already reached record levels near 435 in 2020 (versus 196 in 2010) and it has never really normalised to pre-pandemic levels.

Such political conditions are not constrained to the US alone either – they are global.

Take the UK, where the British pound collapsed in 2022 because of thenPrime Minister Liz Truss’ poorly received economic recovery plan. And the UK could see further economic shifts in 2025 at the time of its next general election.

That is if it does happen in 2025. There are suggestions current Prime Minister Rishi Sunak could pull this timeline forward should the UK economy remain on a resilient path. And should the British public vote in the Labour Party after more than a decade out, there is a chance this could alter UK-EU trade and business relations.

The scope for election-driven economic uncertainty is everywhere in 2024, with key elections happening in Mexico, South Africa and the EU. There is

“Most forward-looking indicators – like the Purchasing Managers Index, the Conference Board’s Economic Index, and yield curves across government bonds –point to high recession probabilities in 2024, while backward-looking indicators continue to perform well”

BORIS KOVACEVIC GLOBAL MACRO STRATEGIST

uncertainty around the election of a new European Parliament in 2024, with far-right candidates gaining traction in recent months.

Could far-right candidates, if successful, reshape the European landscape for climate policy and lead to a more conservative Brussels?

This adds to today’s economic picture of disparity and uncertainty. The changeability of political policy and shifting trade allegiances, alongside a lag in the pinch on credit, and a divergence between bonds and equities points to an uncertain economic outlook, one which could unpredictably affect FX rates globally.

Most forward-looking indicators –like the Purchasing Managers Index, the Conference Board’s Economic Index, and yield curves across government bonds – point to high recession probabilities in

Get a copy of our full report:

Are you ready for 2024?

2024, while backward-looking indicators continue to perform well.

The last four recessions have been preceded by circumstances that are currently in place, such as tighter US Federal Reserve monetary policy, the New York Federal Reserve’s recession probability indicator rising above 30%, the Conference Board’s US Leading Economic Index falling below -5, over 50% of US bond yield curves inverting, and the US’ CEO Confidence Index falling below the key 40 threshold. Nevertheless, consumer spending has remained resilient and global stocks have appreciated, with the Nasdaq surging.

So, amid the divergence and uncertainty today, what outcomes should we expect in 2024, and how could these potential outcomes affect FX rates?

In our full report, we’ll provide an even more comprehensive outlook for 2024, looking at how key markets will be affected in our FX rates analysis and forecast scenarios and recommendations for crossborder businesses looking to successfully navigate international trade as we enter 2024. Register here to receive a copy of our full report, launching at Money2020 US on October 23rd.

Community banking: A growing alternative

Community banks have long been an alternative to larger institutions, but as big bank branch closures rise, is there an opportunity for community banks?

WRITTEN BY: LOUIS THOMPSETTommunity banks have long been among the great alternatives to large banking institutions – depository institutions serving the needs of a local community’s individuals and businesses.

Contrary to the national and/or global ambitions of larger banking institutions, community banks, alongside credit unions or building societies, are tailored to support the specific needs of the communities they serve.

Kin + Carta’s Financial Services Director Europe, Phillip O’Neill, sees community banks as being important for supporting those in underserved communities.

He says: “Because community banks are set up in local communities, they have a deeper, more intricate understanding of the people they serve and can use this specialist understanding to offer people and small businesses access to financing in cases where they would have been rejected by high street banks.”

Head of Payments Infrastructure at OpenPayd, Barry O’Sullivan, adds that while community banks have “fewer business lines than a large bank, focusing mostly on day-today banking, mortgages, and small business loans”, these companies have a deeper understanding of their local communities.

He continues: “Most consumers will be familiar with building societies and credit unions that focus on a specific region.

“These companies rely on knowing their local market better than a high-street bank and reinvest the deposits held with them back into the community. Many will also have some element of community ownership.”

Despite the perks of community banks, the tag of ‘alternative’ has always loomed

PayEX offers customizable AR/AP Automation software for B2B businesses looking to optimize their working capital and unearth hidden revenue otherwise written off due to manual processes and slow communication

large, and as community-owned ventures, they are only as large as the funds their members put in.

Though community banks may play second-fiddle to national and international banking institutions, recently, community banks have seen an uptick in growth.

This is according to a Wipfli survey, which found that 77% of community banking leaders expect to see 5% growth in 2023, despite a report from S&P Global anticipating a fall in community bank earnings in 2023 of 22.6%.

Amid economic uncertainty, with the aftermath of COVID-19 and the war in Ukraine leading to the collapse of significant world banks – Silicon Valley Bank (SVB) and Credit Suisse included – why do things look seemingly on the up for community banks?

“By partnering with the right fintech infrastructure providers, community banks are now upgrading their core systems and building new digital propositions”

PHILLIP O’NEILL FINANCIAL SERVICES DIRECTOR, EUROPE, KIN + CARTA

Community banks: Growth in turbulent times

One of the key contributors to anticipated growth at community banks is new M&A opportunities; fintechs continue to proliferate the market and many community banks are looking to streamline the experience offered to members by leveraging tech.

Acquiring and integrating fintechs into community banking systems has the potential to boost profitability too by attracting new members, and could make up lost earnings of today in later years.

Perhaps, though, the greatest opportunity for growth at community banks – as the financial world continues to tread the path of

greater digitalisation – isn’t even an initiative led by community banks themselves.

As explained by O’Neill: “The closure of bank branches could see community banks’ importance in local communities grow.

“More than 250 high street bank and building society branches in the UK alone will close this year – spurred by the transition to digital banking, which has lowered overall demand for branch services, as well as to cut costs amid economic uncertainty.

“This is going to impact local communities, people who rely on cash, and small businesses massively, which could see more people use community banks as a replacement.”

So, as national and global banks shift away from in-person to digital customer

engagement, the opportunity opens for community banks to be the local service for community members that need it.

The role of tech at community banks

Given the opportunity offered to community banks with the presence of in-person banks receding, the strategies they employ to best use technology are of vital importance.

For community banks, it’s about finding the balance between technological innovation and ensuring customer experiences retain a human touch.

Kin + Carta’s O’Neill notes that while community banks “have been playing catch up to high-street banks in terms of

COMMUNITY BANKS: FINTECH FUNDING

As more community banks have come to see the value in digitalisation as a means to augment and enhance the customer experience they can offer, so too has their funding in fintech startups.

Data from CB Insights reveals that while fintech funding from VC firms is on the decline, the funding void is being filled by community banks – with an eye to eventual acquisition or partnership with burgeoning fintechs.

In fact, a study from Cornerstone Advisors revealed that, as of 2023, over 500 community banks and credit unions make direct investments in fintech startups.

The data backs this up, detailing the average fintech investment of a community bank in 2022 stood at US$3m, a figure that is expected to rise to US$4m by the end of 2023.

In total, Cornerstone predicts community banks and credit unions will invest US$1.5bn in fintechs by the end of Q4 2023. This would represent one of the biggest-ever years of investment in fintech from credit unions and community banks.

“The closure of bank branches could see community banks’ importance in local communities grow”

PHILLIP O’NEILL FINANCIAL SERVICES DIRECTOR, EUROPE, KIN + CARTA

DO COMMUNITY BANKS NOW HAVE AN ADVANTAGE OVER LARGER BANKS?

It would seem many community banks, credit unions, and building societies share a working model, to implement the latest fintech capabilities while maintaining an in-person, human element to front-end operations.

As international institutions move away from an in-person banking experience, are community banks now at an advantage?

For O’Neill, the advantage is absolute. He says: “Customer service is a core selling point for a community bank; however, historically they may have lost out by not being able to offer the full suite of financial services that people or companies need and can get from enterprise banks.

“By partnering with fintechs to build those offerings, bringing them to their communities and local businesses through their strong customer-centric channels, this would provide a compelling proposition.”

OpenPayd’s O’Sullivan agrees: “Historically, community banks’ biggest strengths – their local focus and relatively small size – has made it difficult for them to invest in technology and infrastructure as the high-street banks have done.

“The growth of fintech companies has completely reversed that dynamic. By partnering with the right fintech infrastructure providers, community banks are now upgrading their core systems and building new digital propositions.

“For the first time, community banks can have the best of both worlds: local knowledge and expertise, backed up by world-class underlying infrastructure.”

So, can we expect a greater migration to community banks in the near future? Indeed, the signs look promising for your local high-street banking institution.

“Community banks rely on knowing their local market better than a high-street bank and reinvest the deposits held with them back into the community”

BARRY O’SULLIVAN HEAD OF PAYMENTS INFRASTRUCTURE, OPENPAYD

technology… partnerships between credit unions and fintechs like Engage, Solaris’ community banking division, are evidence that this could change”.

This change may be further along than many think, particularly at credit unions. In the US, MSU Federal Credit Union (MSUFCU) recently launched an AI-driven chatbot, Fran, but rather than replace face-to-face customer service, MSUFCU’s Chief Digital Strategy & Innovation Officer, Benjamin Maxim, says technological initiatives are being employed to augment – not replace –the customer experience.

“Our approach now is combining digital and human service, to create an experience that is both digital and human. Look at the pandemic. We all learned how to use video technology because it was the only choice,” adds Maxim.

“Well, we now have a video banking solution, to more easily connect our members to our employees. This is how we combine technology to better serve and connect with our members, not distance ourselves.”

A similar approach is being taken at Credit Union of America, which is trying to instil an omnichannel approach to customer services.

Its Chief Information Officer, Jon Douglas, says: “We’re trying to bring in technology, utilise and build that technology so that the member that comes into the branch and the member that does things online have the same experience with us, regardless of how they interact with us.”

And, at Virginia-based Farmers & Merchants Bank, the mission is to leverage technology to upgrade back-end systems as well as on the customer-facing side.

The bank’s Chief Experience Officer, Charles Driest, notes: “The future is technology and people, that’s what is going to win the day, not one or the other.

“This is where community banks have a huge advantage, particularly when we are so close to these communities, we provide the human element that AI misses. AI cannot, or has not yet at least, been taught human empathy.”

Apiture is driving digital banking innovation in the US

AD FEATURE

WRITTEN BY: SCOTT BIRCH PRODUCED BY: JAKEMEGEARY

Apiture’s Chris Cox and Daniel Haisley share how the innovative fintech is transforming how US financial institutions engage with consumers and businesses

Financial Institutions in the US have always prided themselves on delivering personal customer service. With the decline in use of brick and mortar branches and face-to-face interaction, many of these institutions may feel like there is a growing gap between them and their valued customers – but it does not have to be that way. In fact, these financial institutions could provide even better, more individual experiences thanks to advances in online and mobile banking technology.

Apiture is a digital banking company headquartered in Wilmington, North Carolina, that serves community and regional banks and credit unions in the US market. The company’s mission is to empower financial institutions to know and serve their clients with the care of a traditional community institution at the scale, speed, and efficiency required in today’s digital world.

Apiture does exactly that for more than 300 clients throughout the US, delivering comprehensive online and mobile banking solutions that help community and regional institutions level the playing field with larger institutions.

Apiture’s flexible, highly configurable solutions include innovative data intelligence and embedded banking strategies to empower banks and credit unions to attract and retain consumer and business customers.

COO Chris Cox explains that the US banking market is very large and competitive, with up to 9,000 banks and credit unions all competing for the same customers, the same deposits, and the same loans.

“Research clearly shows that for all businesses, including financial institutions, digital engagement is paramount,” says Cox.

“Consumers are willing to change financial institutions for a better digital experience. That means innovation is necessary to allow our clients to compete in the market by creating new and better user experiences and digital engagement. It’s our job to bring that technology to financial institutions in the US in a meaningful way.”

One of the main challenges any fintech faces – especially in a vast market like the US – is having a point of difference, a unique

selling proposition. Digital banking is an increasingly crowded industry, and standing out from the competition is essential to survive and thrive. So what makes Apiture different from the rest?

“One of our key advantages is our ability to help our clients innovate quickly by integrating our solutions with best-ofbreed fintechs,” says Daniel Haisley, EVP of Innovation.

“We can bring those fintechs to the table, while we also continue to enhance our solutions through in-house development based on what we are hearing directly from the market and from our clients.”

The way that community and regional financial institutions serve their customers has evolved dramatically in the last decade. For more than 100 years, relationships were driven through face-to-face interactions,

CHRIS COX

TITLE: COO

COMPANY: APITURE

LOCATION: UNITED STATES

Chris Cox serves as the Chief Operating Officer of Apiture, overseeing all aspects of business operations. Previously, Chris was the General Manager of First Data’s digital banking business. He also led mobile payment product development efforts at First Data. Prior to joining First Data, Chris was a Principal Consultant at Diamond Management & Technology Consultants and a Staff Consultant at CSC Consulting. Chris has more than 20 years of experience in banking, payments, mobile commerce, product innovation, and technology strategy. He holds a bachelor’s degree in mathematics from Miami University and an MBA from Duke University.

DANIEL HAISLEY

TITLE: EVP OF INNOVATION

COMPANY: APITURE

LOCATION: UNITED STATES

Daniel Haisley serves as EVP of Innovation at Apiture, leading development of Apiture’s Data Intelligence and API Banking solutions as well as other innovation initiatives. Daniel has an extensive background in product and design management. He brings 10+ years of experience driving innovation in technology for financial institutions, previously holding product leadership roles at Live Oak Bank and 1st Source Bank. Daniel is a graduate of Purdue University in West Lafayette, IN, where he earned a B.S. in Financial Counseling & Planning, and the Graduate School of Banking at the University of Wisconsin in Madison, WI.

and conversations with people walking into a branch off the street.

Those physical meetings and interactions have dwindled, so how can bankers go about serving the unique needs of individual customers and members? That’s where Apiture comes in.

“With our data intelligence solution, that’s exactly what we seek to do,” explains Haisley. “We give the bank the insights to understand each customer, to understand their needs, and then execute on those needs through relevant interaction with that customer within digital channels.”

Cox says financial institutions have the potential to know more about their customers than any other business. That’s because financial activity touches every aspect of a person’s life throughout their entire life.

“Financial institutions want to be able to use their data to know their customers better – but mostly they can’t,” says Cox.

“That’s because they don’t have access to relevant data. They don’t necessarily have the ability to turn that data into meaningful

insights, and they can’t always trigger actions from those insights. So that’s what Apiture is doing with its Data Intelligence solution.”

Haisley leads the Innovation Team behind Data Intelligence – a suite of options that helps financial institutions better use their vast amount of customer data. There are a range of options under the Data Intelligence umbrella, such as Data Engage – a no-code toolkit that helps financial institutions see how users are engaging with digital banking and lets them create on-screen tips and guides to encourage engagement with their digital banking solution.

Data Intelligence also allows banks and credit unions to better understand user behaviour and create relevant targeted marketing.

“Innovation is important in the digital banking space, because in the US market, there’s just so much room for improvement when it comes to helping financial institutions to maximise their potential,” says Haisley.

“Every day, the Innovation Team wakes up thinking about how we can do that. How can we bring solutions to bear that will better help the consumers and small business owners understand their finances better, know what decisions need to be made, and execute on those decisions. Innovation drives that.”

Apiture is also exploring the use of AI to deliver tools that will provide a real-time assessment of a customer’s financial standing along with proactive recommendations to improve that standing.

By analysing data such as transaction history, account balances, and engagement metrics, this technology will enable financial institutions to establish a highly personalised, consultative relationship with their customers.

DANIEL HAISLEY EVP OF INNOVATION, APITURE

“In the US market, there’s just so much room for improvement when it comes to helping financial institutions to maximise their potential”

The use of artificial intelligence is not new in the financial sector, but Haisley believes there is huge potential to be unlocked.

“There’s a tremendous amount of data that banks and credit unions have available today, to do things like provide and manage budgets for their customers or members,” says Haisley.

However, historically banks have used that data to look back at customer history rather than use the data to predict what will happen in the future.

“In so doing, you empower your customers and your members to learn the easy way versus learning the hard way,” says Haisley. “And that’s where artificial intelligence and machine learning really unlock an inflection point for digital banking.”

Right now, the Innovation Team is laser focused on helping banks and credit unions to better utilise the data that they already have while also using APIs to empower those financial institutions to create unique experiences.

“By using APIs, we can bring system and people together that otherwise may not have been connected,” says Haisley.

“For example, using APIs to embed banking capabilities in non-financial partners’ software – like a university’s student portal or medical practice management software – is a powerful new way for financial institutions to connect with more customers digitally.”

Apiture has grown since its formation in 2017 as a joint venture between First Data Corporation and Live Oak Bank.

CHRIS COX COO, APITURE

“We built this company specifically so that we could be a great partner to financial institutions in the US market”

The company prides itself on having a team with hundreds of years of collective experience working at leading US banks and credit unions.

Despite its tender years, Apiture provides the operational efficiency of a mature company, coupled with the agility of a startup – something vital in the fast-moving world of fintech.

Company culture is also essential for success. “We built this company specifically so that we could be a great partner to financial institutions in the US market,” explains Cox. “We created a team, processes and tools all geared specifically toward being real partners to our clients. This is a relationship business that we’re in. And we take that very seriously.

“We’ve also focused a lot on our company culture. When we built the company, the idea was if we create a great place to work where people get excited to come to work every day, that directly translates into happy and satisfied clients.

“Our job is to create a seamless digital experience that allows financial institutions to engage with their customers. We do that by building a great solution. We do that by integrating partners and solutions. And we do that well.”

That is clearly the case, with more financial institutions choosing to leverage Apiture’s tech solutions and deliver the feature-rich online and mobile banking experience that today’s consumers and businesses expect in an increasingly digital-first world.

Payments in telecoms: Deepening customer relationships

telecoms: customer

FinTech Magazine explores how telecom companies are leveraging digitalisation in payments to expand their financial offerings in emerging markets

WRITTEN BY: LOUIS THOMPSETTMany Western markets may not be too familiar with the likes of VodaPay or T-Mobile MONEY, but these newly launched telecoms payments options play a significant role in emerging regions.

In fact, when Vodacom – the South African telecoms company half-owned by Vodafone – debuted VodaPay in 2022, this led to a 12.5% revenue jump at Vodacom by Q4 of the same year.

It is, therefore, no wonder OpenPayd’s Head of Product Strategy, Daniel Belda, says digital payment technologies are enabling telecom companies “to take this one step further and improve the engagement with and retention of their expansive customer bases”.

The success of VodaPay and T-Mobile MONEY, as just two examples, proves that providing embedded payment options for telecom companies has led to “increased customer engagement and loyalty compared to other companies looking to deploy a digital wallet or super-app,” adds Belda.

Ericsson’s Head of Mobile Financial Services, Ola Persson, goes one step further, saying the advent of digital payments has “revolutionised the way that customers engage with telecom companies”.

Experience composable banking with Mambu's SaaS cloud banking platform.

Learn more

He notes: “Digital payments help telecom companies meet customers where they are – through their mobile phones – giving them the power to make payments, local transfers, international transfers, give gifts, and more – all while removing the need for a physical card that can be easily lost, or involve a tedious in-person trip.”

It is not just convenience, either, helping telecom companies expand their customer bases through payments. “Financial inclusion is another critical element of digital payments that keeps customers sticky,” adds Persson.

“Approximately 1.4bn people worldwide are unbanked, many of which live in developing countries. However, many of these people do have access to a mobile phone, which is all they need to harness digital payments and gain access to critical, everyday financial services.

“These elements – convenience and inclusion – are what have made the difference for mobile financial services and allowed their popularity to grow so meteorically across the globe.

“And as telecom companies continue to invest in more layers to the mobile money service mix, like personalisation, it’s clear that customer engagement will continue to increase as well.”

What is also true is that customer engagement is heightened by a stronger customer journey, and digital payments provide this type of journey for telecom companies.

In fact, even in EMEs, “consumers have come to expect end-to-end experiences, which is drawing telecom companies towards offering embedded financial services like digital wallets”, says Belda.

“Digital is the next frontier. That is unquestionable and inevitable”

OLA PERSSON HEAD OF MOBILE FINANCIAL SERVICES, ERICSSON

Persson gives e-shopping as an example, where customers “can easily check out using a variety of payment options from credit cards to digital wallets.

“They can even opt for buy now, pay later services, apply coupons and discounts, and receive cashback or loyalty points all in a single transaction journey.”

Digital payments: Reducing costs

It is not just greater customer journeys, engagement and retention that digitalisation offers the payments divisions of telecom companies – it can also help to significantly reduce costs.

By helping telecom companies reach higher operational efficiencies, the cost of payments infrastructure can be significantly reduced.

For Persson, there are two key areas where digitalisation has helped telecom companies reduce their expenditure: voucher generation and distribution costs.

He notes: “In the ‘old days’, and particularly in developing countries, any customer who needed to top up their phone prepaid subscription had to run to the local store and grab, for example, a US$20 paper voucher.

“Digital payments allow customers to self-top-up through their digital wallets, circumventing the need for these paper vouchers and thus removing the untold costs associated with first printing and then distributing millions upon millions of vouchers.

“For example, MTN, a leading telecom operator in Africa, has more than 24% of its airtime sales processed by MTN Mobile Money.

“Digital payment offerings also enable telecom companies to streamline their payment processes, reduce cash handling expenses, minimise late payments and bad debts, enhance customer service, and gain valuable data insights.

“Consumers have come to expect endto-end experiences, which is drawing telecom companies towards offering embedded financial services like digital wallets”

DANIEL BELDA HEAD OF PRODUCT STRATEGY, OPENPAYD

Payments in telecoms: Enhancing customer journeys with digital payments

Ericsson’s Ola Persson looks at how digital money is helping to streamline customer payment journeys and, subsequently, customer experiences.

“Digital money has quickly become a strong challenger to cash in no doubt due to its convenience, simplicity, and speed. Digital payments have the inbuilt advantage of delivering a seamless experience from end to end.

“Open APIs also play a large role in enabling a seamless journey. New-age payment platforms with open APIs like Ericsson Wallet Platform enable third parties like merchants and enterprises to integrate with mobile financial services to offer seamless transactions and payments.

“Digital payments platforms are typically much more ‘open’ than conventional services,

meaning they offer increased connectivity and opportunities to create new and novel customer journeys.

“Looking towards the next decade, we expect to see personal finance management (PFM) and robo-advisory tools leveraging AI and ML algorithms with holistic data analytics to forecast future money inflows and outflows and also to provide personalised recommendations for savings and investments.

“Chatbots and voicebots powered by AI and natural language processing will be available to customers through apps and websites 24/7, further improving their journey from start to finish.

“Customer care will become automated and able to provide human-like responses that can meaningfully resolve customer queries and issues.”

“Naturally, these benefits contribute to significant cost savings and operational efficiencies for telecom companies, enabling them to focus resources on improving their core services and driving business growth.”

Telecom payments: What are telecom companies missing?

It is clear modern digitisation of financial services paints a rosy picture for telecom operators offering payments. But what are the downsides? What can a payments or financial services provider offer consumers that a telecom company cannot?

For Belda, while telecom companies are becoming increasingly capable, offering more services in different sectors like payments, smart agriculture, and health tech, “to continue to do so efficiently and effectively [they] need to have the right partners on board”.

He adds: “Most telecom companies don’t yet have a clearly defined financial services proposition.

“By partnering with a payments service provider, telecom companies can focus on their core operations and business growth, diversify offerings and increase customer engagement, all while maintaining a competitive edge in the market.”

Meanwhile, as far as Persson is concerned, the main struggle for telecom companies is keeping up with different regulations. “Adhering to various countries’ sanctions, anti-money laundry rules, and regulations can be a very complex undertaking,” says Persson.

“Ideal digital payments providers will be able to help telecom companies navigate an increasingly complex digital age.

“As digital payments increase, so does the potential for fraud. Most enterprises currently rely on ageing IT infrastructure, but advanced security and fraud management systems are needed.

“By partnering with a payments service provider, telecom companies can focus on their core operations and business growth”

DANIEL BELDA HEAD OF PRODUCT STRATEGY, OPENPAYD

“Such systems should be able to utilise AI, data analytics, and sophisticated rule engines to identify anomalies in transaction trends and curb fraud attempts in real-time.

“They should also be able to perform transaction velocity checks and map, analyse, and block the connections of fraudulent users. To succeed, this level of security and trust is paramount.

“Finally, companies are currently late on the potential of cloud to improve scalability. Through the next decade, expect to see telecom companies seek out a partner that can integrate their digital

financial systems onto cloud, unlocking a new realm of increased scale, efficiency, and seamlessness.”

The future of payments and telecoms

But is scaling cloud capabilities the only thing in the future relationship between payments and telecom companies?

While cloud migration is an important step, this is just one area where Belda feels telecom companies will move from solely being a telco to a ‘techco’ (a telecoms operator to a technology company).

He adds: “This has been widely discussed across the telecoms industry over the last few years, with the aim of enabling telecom companies to win new business in wider technology sectors including AI, IoT and cloud.

“We’ll likely see something similar happen with telecom and payments companies. Many operators already offer some form of financial service, like paying for a phone in 12 instalments alongside a new subscription –the precursor of BNPL in Europe.

“In the future, we’ll see increased partnerships and collaboration to offer a breadth of services to customers.”

This is echoed by Persson, who calls digital the next frontier.

“More than 160 telecom operators offer mobile financial services today across geographies including the Middle East, Asia Pacific, the Americas, and Africa,” he adds.

“Telecom operator MTN Uganda, for example, sees approximately 29% of its revenue come from fintech services. That is incredibly significant.

“With existing services like data and voice stagnating, there’s no doubt more operators will continue to jump on board as digital payments become a key avenue for companies to diversify their revenue.”

EY CANADA: FOSTERING INNOVATION REAL-TIME PAYMENTS

WRITTEN BY: ALEX CLERE

PRODUCED BY: JACK MITCHELL

WRITTEN BY: ALEX CLERE

PRODUCED BY: JACK MITCHELL

INNOVATION IN PAYMENTS TECH

EY Canada’s Payments

Practice Leader, Diana Halder, explains how the company is acting as a catalyst for real-time payments

Diana

Halder

innovation

is Payments

Practice Leader at EY Canada, a role she has held since September 2019, becoming a full Partner in the firm three months ago. A vastly experienced payments industry executive, she previously spent six years at Accenture, as well as working in payments and global banking at Scotiabank.

When she catches up with us from her office in Toronto, Canada, it’s clear that this experience has set her in good stead. But she acknowledges that, even though she’s been in the industry for over 18 years, she’s always learning new ways to become a better leader.

“Putting people first definitely matters,” she tells us. “It’s important to understand their interests and ambitions to keep them motivated and engaged.” She characterises the tenets of strong leadership as ‘four Ps’ – people, patience, persistence, and being provocative when it comes to innovation.

“You tend to get a lot of noes as a female and as a minority in a male-dominated industry. There can be a lot of ‘no you

shouldn’t do that’ or ‘no you need to wait’.” Her message is all about being persistent and confident in your vision.

Indeed, gender equality and breaking down barriers for women are common threads woven through many areas of financial services worldwide. According to a report published last year 1, women land just 21% of board seats and only 19% of C-suite roles within the sector globally. That figure falls to an astonishingly low 5% when it comes to the CEO position.