August 2023

fintechmagazine.com

CREDIT UNION OF AMERICA: Upholding values amid a fast and furious tide of innovation

LENDERS BY TOTAL FUNDING

MSUFCU: Innovating the community

HSB CANADA: A history of digital transformation within insurance

August 2023

fintechmagazine.com

CREDIT UNION OF AMERICA: Upholding values amid a fast and furious tide of innovation

LENDERS BY TOTAL FUNDING

MSUFCU: Innovating the community

HSB CANADA: A history of digital transformation within insurance

Jeremy Zung discusses improving employee experience by deploying leading technologies and transforming existing systems

8 - 9 November 2023

QEII Centre, London

SPONSORSHIPS GET YOUR PASS

FinTech magazine is an established and trusted voice with an engaged and highly targeted audience of 2,000,000 global executives

Digital Magazine

Website Newsletters

Industry Data & Demand Generation

Webinars: Creation & Promotion

White Papers & Research Reports

Lists: Top 10s & Top 100s

Events: Virtual & In-Person

WORK WITH US

For people who work inside the financial services industry, it can be easy to forget on a day-today basis what we’re building towards. Hopefully, in most cases, that should be greater financial inclusion and equity

By 2030, it’s estimated that the top 1% of wealthiest people will own two-thirds of the world’s wealth while the bottom 50% will have just 2%. That leaves almost 50 underdeveloped economies facing “serious impediments” to their economic progress, according to the United Nations.

Despite our best intentions, financial inclusion is still a huge issue for the global financial system. In this issue of FinTech Magazine, we take a look at underbanked populations and ask what can be done to improve the fortunes of people in developing countries. We take stock of the progress financial technology has made in bettering their lives, and whether it has empowered traditionally underserved communities.

We also reflect on some of the core innovations that are driving our industry forward, from open banking and blockchain to the emergence of biometrics. We hope you enjoy the content in this month’s issue!

ALEX CLERE

“IN SOME PARTS OF THE WORLD, PEOPLE ARE MORE LIKELY TO HAVE A SMARTPHONE THAN A BANK ACCOUNT”

8 - 9 November 2023

QEII Centre, London

SPONSORSHIPS GET YOUR PASS

An exhibition hall within the Pergamon Museum in Berlin. Germany has become the latest European country to offer a free ‘cultural pass’ to citizens turning 18 in a bid to incentivise spending on culture and the arts. The initiative, which launched in June, provides €200 towards the cost of museum and gallery admission, live events and theatre. Italy was the first country to offer such a scheme seven years ago, followed by France and later Spain. The latter imposed limits for different types of spending, following criticism that vouchers weren’t being used on a diverse enough variety of cultural experiences.

Pieter van der Does is the Co-Founder and Co-CEO of Dutch payments company Adyen. He founded the business in 2006, long before the word ‘fintech’ was common parlance. A graduate of the University of Amsterdam and Harvard Business School, he worked for a couple of banks including ING and RBS before founding the business almost 17 years ago.

Back then, van der Does recognised that payment providers were offering services based on a patchwork of systems that were built on outdated infrastructure, and – together with fellow founder Arnout Schuijff, who stepped away from the business a couple of years – set about trying to change that.

In the intervening years, Adyen has experienced astronomical success. Today, it has over 3,000 employees across 27 different offices worldwide – from Amsterdam to Sydney, and San Francisco to Dubai. Its clients include household names such as Uber, Facebook, H&M and eBay, who all benefit from Adyen’s end-to-end payment capabilities, data enhancements and financial products all packaged into a single solution.

A diverse team comprising over 115 different nationalities helped realise €767.5bn in processed volume last year – and its long-serving chief exec has reaped the rewards of that success over the years. Pieter van der Does is a billionaire, worth US$2.2bn according to

Forbes magazine. This make him the fourth richest person in the Netherlands, Forbes says (and ‘Schuijff’ the third), bettered only by a small handful of entrepreneurs and industrialists – including Charlene de Carvalho-Heineken, heiress to the beer fortune; and Frits Goldschmeding, the founder of temping agency Randstad.

In February this year, it was announced that Adyen was promoting CFO Ingo Uytdehaage to the role of co-CEO –a move that was accompanied by a broader shakeup of Adyen’s executive team. Uytdehaage is a company veteran, having been CFO for 12 years and consequently been present for

TITLE: CO-FOUNDER AND CO-CEO

COMPANY: ADYEN

INDUSTRY: FINANCIAL SERVICES

LOCATION: NETHERLANDS

Adyen is the financial technology platform of choice for leading companies. By providing end-to-end payments capabilities, data-driven insights, and financial products in a single global solution, Adyen helps businesses achieve their ambitions faster.

The co-founder and long-time CEO of Adyen, Pieter van der Does, has carved himself a place among Dutch business nobility

more than two thirds of Adyen’s growth journey. He had previously been a finance director at Dutch telecommunications firm KPM, and is presently a non-executive director at money transfer business Wise.

But Uytdehaage’s appointment doesn’t necessarily spell the end of Pieter van der Does at Adyen. Instead, the two will share roles. It is the formalisation of an arrangement that is already working in practice, van der Does says, one that will give him more time to concentrate on his health if required.

“I had to balance my time between being at our Adyen offices and my health for a month or two in November,” van der Does said when Uytdehaage’s promotion was confirmed to the press. “What I learned is that, should it be needed in the future, it’s important to be able to spend

time on my health. With Ingo as co-CEO, I can do that while Adyen stays its course.” Many onlookers will also point out that, with van der Does at the helm for all of Adyen’s history prior to February, the company was in desperate need of a clear succession plan – one that it now has.

In an interview with The Telegraph way back in 2017, van der Does – who is relatively sparing with his media appearances, particularly in an industry that is quick to rush into the limelight – explained that Adyen avoids email wherever possible because it helps to build corporate culture. In the modern workplace, where people have numerous digital communication tools at their fingertips, employees often omit or overlook the personal touch.

In an interview with Bloomberg in March 2023, van der Does also revealed that Adyen was currently undergoing a recruitment drive. The labour market, particularly for engineers, had become somewhat less competitive, he explained. “So let’s sign them up!” However, this had an inevitable effect on Adyen’s profit margin, which has been dented slightly, but once the company was fully staffed-up then this should return to normal.

Recruitment should slow down again next year, he intimated, meaning that its profit margin would “trend in the other direction”. This would be particularly convenient timing, given the current emphasis within the financial industry on long-term sustainability and profitability over near-sighted acquisition and growth.

“SHOULD IT BE NEEDED IN THE FUTURE, [INGO UYTDEHAAGE’S APPOINTMENT AS CO-CEO] IS IMPORTANT TO BE ABLE TO SPEND TIME ON MY HEALTH”

» Becoming IDVerse CEO has been an incredible journey. For the last 25 years, I’ve built a business that helps other businesses grow. One of the things that I did in the early days of my career is launch a venture-build business alongside our consulting business. It was only small, consisting of 150 people in seven countries. It was designed so that we could invest in founders who had a cultural fit and alignment with us. It meant we could put our arms around them, share our skills and embark on the same adventure with them.

Then, around 13 or 14 years ago, two young men, Matthew Adams and Daniel Aiello (OCR Labs Co-founders), came into my office because they wanted help setting up their business properly. Fast-forward a few years and Matt and Dan were looking to move on from that venture. We sat down and they said to

me ‘we want to build the world’s greatest verification technology, and we want you to build the business around us’, so they could focus on the tech while I ran the operational side of things.

I was flattered. And, even though I couldn’t quite grasp their tech proposition, they used big words in their PowerPoint presentation and made the slides really easy to understand, so that definitely helped! And that was the start of OCR Labs, now IDVerse.

As the business grew and we took hold in Asian-Pacific (APAC) markets, it became clear to me that this wasn’t a fractional or part-time role. I was too engaged in the business to let anyone else be a part of it other than myself. I felt a responsibility as the custodian of these guys’ tech, so I removed myself from my main business, and put different people in charge of the venture-build business while I continued to manage what was then OCR Labs, and I’m still here to this day.

With fraud on the rise across the financial sector, identity verification has become all the more important. For IDVerse’s CEO, John Myers, helping people and businesses feel secure is imperative

» It was actually hard for us to shift away from OCR Labs. It was something we were quite emotionally invested in, but we felt the name didn’t quite reflect the full extent of what we could offer to our customers. What’s more, the identity verification space has changed so much since OCR Labs was launched. Fraudsters are becoming smarter, they’ve got more ammunition in their armoury. So we made the change to IDVerse to reflect the expanding marketplace – it allows us to really state what the product is: a universal identity verification service.

» Fraud is growing everywhere, so in that sense, the need for an IDVerse is only getting stronger. Our engines are now fired up with generative AI to deal with growing fraud use cases. What that means is that they learn organically how to be stronger and better, to protect people and help the user experience be a little bit more seamless. And I think it’s our use of this AI that’s so important at the moment. Fraudsters have all kinds of abilities to use deep fakes, they’re not scared to try any means necessary. We have a deep fake defender that’s been in production for

JOHN MYERS CEO, IDVERSEfour or five years, and our customers can get that as part of their package.

Bringing customers on board quickly and seamlessly is something the industry needs to pay close attention to. It instils greater trust in the product, and it’s important for clients with data breaches occurring everywhere. Particularly today, biometric verification by means of facial recognition is a crucial piece to help solve some of those issues.

» The first thing that motivates me is making sure there is constant capacity in our tech to keep people safe, helping businesses change the way they operate so they and their customers are both protected. To do this plays into my second motivation, because people always say the security requirements they need can’t be achieved. I love to

“MY CAREER TOOK ME TO A PLACE WHERE I REALISED THAT I LOVED GROWING HUMAN BEINGS”

prove people wrong, which, for the most part, is proving the worth of our technology.

Internally at IDVerse, what motivates me is the ability I have to change people’s lives and be the custodian of this fantastic project. I love growing businesses and growing people. It’s people that drive businesses forward. For me, this is the most soul-nourishing experience anyone could have.

» Given that we’ve tripled in size in a very short amount of time, my biggest challenge now is making sure we keep cultural alignment, especially when we have teams growing at an equal pace across different regions across the globe. It definitely keeps things interesting. Offices in different time

zones mean I find myself in different time zones quite often!

So for me, keeping everyone aligned, spirited and driven in the same direction is probably the biggest challenge I have day-to-day.

» I was told in my early career that I could be more than one thing, which has been sound advice as it’s helped me expand my role and the businesses I’m involved with. But the one thing that has really stuck with me is a phrase spray painted as graffiti in a tunnel near Sydney Harbour: “action is eloquent”.

This really stuck with me. For me, it means just do what you say you’re going to do. Be pragmatic, and get whatever it is you need to do done. And I’ve carried that forward with me ever since.

WRITTEN BY: ALEX CLERE

PRODUCED BY: JAKE MEGEARY

WRITTEN BY: ALEX CLERE

PRODUCED BY: JAKE MEGEARY

Supporting a global professional services firm that enables world class organisations presents many opportunities and challenges for an Information Technology function. Supporting such an organisation requires intense focus and high flexibility. These environments leave little time to be introspective and require a CIO to make instantaneous decisions and constantly evolve their thinking. Working in such a highly dynamic and fluid environment has never been a problem for flexible CIOs such as Jeremy Zung, Chief Information Officer (CIO) for Alvarez & Marsal (A&M).

“When I joined A&M during COVID, there was no playbook or manual to tap into,” he says. “It became very clear, though, that our primary focus needed to be about stabilising the core – this included not just technology, but our staff. We had a lot of technical debt that had built up, similar to many companies.”

As global CIO, Zung is responsible for all internal IT matters including all backoffice technologies and systems. Once the core was stabilised, it allowed the focus to quickly move to improving services to A&M’s growing base of global professionals. Transforming the IT department required a change of mindset to operate IT as a business.

Founded in 1983, A&M provides advisory, business performance improvement, and turnaround management services to a diverse range of clients – from corporates and government agencies to private equity firms and law practices. The business has been expanding rapidly of late and now boasts more than 7,500 people, who provide services across the world.

Based in Florida, Zung joined A&M in July 2021 following a 30-year career at professional services firm PricewaterhouseCoopers (PwC). After college, Zung’s first job was as an actuarial associate with Coopers & Lybrand – where he could never have imagined the diverse jobs he would hold during his career. Those roles included multiple client-facing and internal roles including being the US Advisory IT leader for 12 years, leading 13 acquisitions.

It was a big career move when he made the switch to A&M – but Zung himself is not afraid of change, given that his career has been about continuous improvement and transformation, and his 30 years at PwC had prepared him for this opportunity.

“One of the things that really attracted me to A&M was its history based on relationships and not relying on commercials or TV ads,” he explains. “It’s a people business. That really stuck with me – that its work is through referrals, word-of-mouth, people saying what we’ve done for them.”

Jeremy Zung CIO, Alvarez & Marsal

Jeremy Zung CIO, Alvarez & Marsal

Get an integrated and scalable solution with Enterprise Resource Planning as the core engine of your business landscape.

Arribatec specialises in simplifying the path to the goals for your business by implementing, adapting, maintaining and supporting the entire business landscape with ERP as the core engine.

Learn more about how Arribatec can support your business

Arribatec has provided a full range of services to Alvarez & Marsal (A&M), from integrating software across banking systems to enabling upgrades to HR solutions

Since being founded in 2015, the Arribatec Group has provided digital solutions, services, consultancy and infrastructure for companies looking to simplify and optimise.

Its department dedicated to business services simplifies the path to the goal for clients by implementing, adapting, maintaining and supporting the entire business landscape with ERP as the core engine.

“We can look after our clients’ businesscritical systems, whether it’s ERP, CRM or HCM, plus DBI and analytics,” explains Tom Vandezande, EVP at Arribatec Group and Global Head of Business Services.

“We can also advise clients on the infrastructure side, whether they want to move to our cloud or one of our partner clouds. Finally, we can overlay all of this with our enterprise architect, business process and organisational changement management services, provided by our EA & BPM Business”.

One example of how Arribatec works with partners comes in the form of its work with professional services firm Alvarez & Marsal. As Mark Bloomer, UK MD of Arribatec Business Services describes, Arribatec offered A&M a full range of services, from integrating ERP and banking solutions to consolidating HR systems.

“A&M has quite a large, sophisticated team, but they needed ERP-specific expertise in a number of areas,” Bloomer adds. “Over time, we have built a mutual trusting relationship, and we’re able to blend in seamlessly into their own teams.”

For Vandezande, central to the future for Arribatec is around bringing its solutions to the global market.

“Our tagline is We Simplify Complexity,” he explains. The idea is to take the headache away from the customer and provide an integrated end-to-end solution covering all their angles: looking at everything from the people side of things, the process side of things, the business-critical systems side of things, as well as infrastructure.” Learn

One of the first challenges when he joined A&M was reducing the amount of technical debt that the company faced. “During the last few years prior to my joining, we really fell behind on a lot of things – just like most companies,” Zung says. This technical debt consisted of old laptops, servers, infrastructure components that were reaching their end of life, and slow adoption of cloud services. All of these things were directly impacting A&M staff.

“We focused on eliminating critical points of failure – not just systems – but our talent,” he continues. “We had key areas which were vulnerable when a person went on vacation

“The key benefits for us in automation are reducing manual processes, reducing manual mistakes, and improving our efficiencies”

JEREMY ZUNG CIO, ALVAREZ & MARSAL

or happened to be sick. We really looked at that as part of our stabilisation efforts.

“We also needed to improve performance and reliability across our environment, and institute and improve our governance around our project management portfolio. We had a growing number of project requests backing up. We implemented a governance model including a Portfolio Review Board (PRB) to help decide where to invest firm resources. We can’t do every project that gets requested, so we had to create a structure to evaluate each request including its impacts to the business, costs, and expected value to the firm.”

TITLE: CIO

INDUSTRY: PROFESSIONAL SERVICES

LOCATION: UNITED STATES

Jeremy Zung is the Chief Information Officer (CIO) for global professional services firm Alvarez & Marsal. Leading a team of IT personnel, Jeremy is responsible for the management of firm standard core systems, networking, infrastructure, cloud and data centre services. Jeremy has a 30-year record of success in multiple client-facing and back-office roles including: Actuary, 401(k) Manager, Director of Network Services Architecture and Design, and PwC US Advisory Advisory IT Leader.

Think of SHI as your personal technology concierge connecting your team to IT solutions and services for growth, security, and employee experience. From modern workplaces and defending against cyber threats, to cloud and IT cost optimisation, our 6000-strong team is ready to help you solve what’s next for your organisation

Ian Young, Market VP of Field Sales, explains how SHI is working alongside Cisco to help customers get maximum value out of their investments

With its global team of 6,000 employees, including around 1,000 technical resources, SHI specialises in helping customers take a smarter approach to their technology strategy. The result is more efficient and effective IT operations across the entire technology landscape.

Thanks to its concierge approach and in-house expertise, SHI has become a trusted partner of countless organisations, including professional services giant Alvarez & Marsal. Ian Young, Market VP of SHI Field Sales, explains: “Working alongside Cisco, we are helping A&M tackle critical business and technological challenges through a strategic approach, driving favourable results.”

As a Cisco Gold Partner, SHI’s longstanding partnership with Cisco ensures exceptional customer support. Cisco has recognised SHI’s performance, naming it US security partner of the year in 2022. Such is the strength of the relationship, close to 100 of SHI’s 1,000 engineers are Cisco-dedicated, including subject matter experts, pre-sales engineers, solution architects and renewal specialists.

“SHI has a unique approach to digital transformation in collaboration with Cisco,” Young adds. “SHI leverages Cisco’s extensive range of cutting-edge products and services, and aligns its engineers and resources to assist customers in achieving their desired outcomes.

“A&M is fully utilising the potential of Cisco’s products and services, while also benefitting from the exceptional customer experience provided by SHI. They know they’re in capable hands with SHI and Cisco.”

SHI’s reputation as a trusted technology partner is the result of its comprehensive portfolio of products and services, complemented by an exceptional team of engineers and subject matter experts who are dedicated to serving their customers.

“We value being involved in strategic planning, technology roadmaps and technology assessments,” continues Young. “We aim to complement these efforts with solution design services so that our customers realise the return on their investments.”

In a growing business, challenges are always popping up. Manual processes that worked fine when the firm was much smaller suddenly became nightmares when you’re talking about roughly 8,000 employees and third-party staff.

“Moving to a two-year laptop refresh cycle is really generous and we knew our end users would love this change,” Zung explains, “but it created a big problem in IT. We had over 85 different laptop makes/models in our environment! Working with resellers Insight and CDW along with our laptop providers Dell, HP and Lenovo, we shrunk that down to under 20 to have a common build process developed by Camwood. When you factor in new hires in addition to our existing staff, that’s about 5,000 machines a year to image and issue. The legacy process for doing that

“While AI gets all the fanfare right now, I still believe most companies who haven’t gone through a transformation can see bigger cost savings by automating all the little things”

JEREMY ZUNG CIO, ALVAREZ & MARSAL

involved taking the computer out of an enduser’s hands for 4-8 business hours – and significant manual tasks for our IT team. “We quickly identified we would need an army of IT staff to meet this need, if we did not completely rethink our tools and processes.”

New processes were devised – and it involved automating “pretty much anything and everything”. The process now starts with an automated survey, which gives each user advance notice that they’re due to receive a new machine soon. In that survey, colleagues choose from approved models to meet their needs. “Some prefer a specific brand, some want a larger screen and some want a lightweight model for example,” Zung says.

The user also selects where they want their new laptops shipped – rather than having to come into the office and schedule

time with an IT staff member. At the heart of the configuration and build process, we leverage cloud services from Microsoft including Autopilot which allow the user, within 30 minutes after powering up, to be up-and running for most of the applications they use. In terms of returning their old machine, they’re given a short grace period to ensure everything is working properly, and then they use a supplied shipping label to return their old laptop to A&M where it is securely cleansed and disposed of.

“We’ve gone from spending 20-40,000 hours of lost hours per year for our users to a fraction of that. When you’re in a consulting firm, that’s a lot of hours to put back into serving our clients.”

Another part of Zung’s focus when he joined A&M was around improving performance and reliability. A lot of this involved the transition to cloud and taking advantage of the capabilities that cloud service providers bring. “For example, if you think about a physical file server or component, where our staff have to manually take care of issues,

moving that to the cloud saves us significant people time and increases our agility,” Zung says.

Cloud usage has improved system uptime and availability. “It’s quite beneficial for us to leverage the big investment budgets that our cloud providers have!”

“The key benefits for us in automation are reducing manual processes, reducing manual mistakes, and improving our efficiencies,” Zung continues. As the business has grown, so has the IT department, but he recognises that successful businesses need to find ways for support functions to grow at much smaller levels than growth happening to the rest of the firm.

A&M is a business built on its relationships –both those it enjoys with clients, obviously, but also those that it has with internal

“A&M’s work is based on relationships. It’s a people business”

JEREMY ZUNG CIO, ALVAREZ & MARSAL

stakeholders. This is reflected in the care and diligence that it puts into internal programmes, like changing out laptops every two years to keep frontline technology fresh.

But that mindset extends to A&M’s technology vendors as well. From his Tampa, Florida office, Zung tells us what he looks for in an external partner. He doesn’t just want ‘yes-people’ that do what’s asked of them. “More times than we want to admit, we’re wrong with our internal thinking or sometimes have hidden biases,” he explains. Instead, he wants vendors that guide A&M towards the right solutions and processes that are fit for growth.

Zung wants to partner with vendors who are upfront and honest about their products and capabilities. He wants them to speak up when A&M is headed in the wrong direction, or when the company is about to make a mistake. This creates long-term relationships built on mutual trust and understanding, rather than short term relationships where the supplier may not raise best practices or focus on long term strategy.

A significant part of his approach has been to establish and grow strategic relationships with key providers such as Arribatec, Camwood, CDW, Cisco, Dell, HP, Insight, Lenovo, Microsoft, NewRocket, ServiceNow, and SHI. The benefits come in many forms but include:

• Implementation of managed services

• Migration to cloud services

• Implementing new technologies and capabilities

• Reduced talent costs

• Increased support capacity

• Reduction of duplicative systems/processes

SHI and Cisco have helped A&M navigate through extended supply chain challenges, manage the accelerating nature of technology, manage a growing firm footprint and end-of-life/end-of-support concerns while also working to decrease administrative tasks by leveraging more cloud products. They are trusted providers that are relied upon to help forecast and roadmap audio/video, voice, network and infrastructure services. The tight collaboration between SHI and Cisco allows A&M to recognise and understand emerging services and technologies much earlier than if they had to go it alone.

Another top priority has been to recommit to A&M’s ServiceNow (SNOW) platform and leverage that investment. Besides SNOW incident and ticketing management, A&M has enabled space reservations, security/operations, and hardware asset management. Zung and team are also in-flight implementing software asset management, migrating multiple back office and client service teams away from legacy email and Excel-based incident ticket management and tracking to SNOW.

“We view SNOW as a key piece of our technology enabling capabilities and not

“You can’t just be the smartest IT guy in the room and be a good CIO anymore”

JEREMY ZUNG CIO, ALVAREZ & MARSAL

just a ticketing system or back-office tool. Our journey would not have been possible without the full support of ServiceNow and NewRocket. They have carefully and patiently listened to our needs and unique challenges and avoided just recommending all of their off-the-shelf offerings.”

Arribatec adds bench strength to A&M’s ERP support and project teams, which have allowed the introduction of new features and enhancements, while increasing support capacity with expanded hours and capabilities. Arribatec’s approach to understanding A&M’s growing global needs and requirements has helped to simplify and implement solutions for a growing pipeline of project requests. “They provide us the ability to handle projects in multiple locations around the world while enabling our current support model and capabilities.”

Our relationship with Microsoft has been especially beneficial, when we think about the SME’s they bring to the table. From presales to post sales activities, Microsoft has always been there for us to help introduce and explain new services and offerings while listening to our unique needs. They have supported our journey to leverage more cloud tools including migrations from Sharepoint on-premise to Sharepoint Online, improved usage of the Power Platform, migration to Autopilot and so much more.

“For most of my career, I never thought of IT as a business”. But now, he believes that the leaders of IT departments need to possess broader skillsets than ever. “The breadth and scope of what we support has grown exponentially, and it’s probably not going to stop.

“We’re not just supporting a finance system or an HR system. We do so much more. We negotiate contracts with vendors for supplies

and materials. We’re taking those supplies and materials and making them into some sort of technology product. We’re managing relationships to our business units and providers. We’re managing finances, we’re managing projects. The amount of things we do, we really are like a business inside a business, and I think that’s an important shift that I don’t think’s going to stop.

“I think future generations of CIOs are going to be required to be more than just an IT guy. You can’t just be the smartest IT guy in the room and be a good CIO anymore. CIOs tend to have a much broader offering. They understand finances, business operations, and how a company works. They’ve probably held multiple different roles previously that allow them to really operate a business.”

Spotting how end-users work – and adapting Ultimately, everything that Zung and his team achieve are with a view to productivity. In

isolation, small accomplishments –like enabling key cards for office printers, which activate the machine and prevent the need for long credential strings – may seem relatively insignificant, but those small changes all contribute to a much greater effect.

“If you save somebody 15 minutes a week, assuming they work 45 weeks a year, and

“It’s taken me the majority of my career to realise it, but IT has to operate like a business”

JEREMY ZUNG CIO, ALVAREZ & MARSAL

multiply that by thousands of employees –boom, all of a sudden you’re talking about millions of dollars in time savings. Even something that’s a 5 or 10-minute task for end users can scale up to be over a sevenfigure benefit to the company right away.

“While AI gets all the fanfare right now, I still believe that most companies who haven’t gone through a transformation can see much bigger cost savings and cost avoidances by automating all these little internal things first.”

It’s in this spirit of ‘watching the pennies’ that A&M’s IT function runs an innovation award, which recognises team members who find new ways to eradicate inefficiencies and boost productivity in the workforce. It increases engagement with the company’s technologies, and ensures rank-and-file staff are aware that every little improvement is part of a much bigger picture.

To this end, A&M has begun deploying custom mobile applications to allow staff easier access to information they need. One of the recent innovations is a mobile application called People Directory. It allows colleagues to look up coworkers in different offices or different countries, and filter and sort details including staff level, business unit and more. People Directory replaced manually created PDFs full of pictures and hierarchies that were necessary before.

And the company isn’t going to stop innovating there: later this year, A&M intends to roll out a mobile-based self-service password reset application which will not only reduce the time spent by IT resources but also speed up the reset experience. “It’s a big part of our strategy,” Zung concludes, “of listening to how our people work and helping them out.

The Global FinTech Awards 2024 will be celebrating the very best in Fintech with the following categories:

Digital Banking Award

–PayTech Award

–

Digital Currency Award

–

FinTech Award

–InsurTech Award

–

Sustainable FinTech

–

FinTech Technology Award

–

FinTech Consultancy Award

–

Future Leader Award

–

Executive of the Year Award

–

Project of the Year Award

–

Lifetime Achievement Award

Financial ecosystems are critical to the future of banking, but, at present, many legacy banks are slow to join them. We explore the finer details

WRITTEN BY: LOUIS THOMPSETT

WRITTEN BY: LOUIS THOMPSETT

Five years on from the revised Payment Services Directive (PSD2) – the regulatory framework that started an era of open banking across Europe, and a marketled push proliferating data sharing at banks in the US and Europe, among other jurisdictions – innovation in the sector has started to bear fruit.

Notably, open banking has laid the foundations for banks to create, or join, partnered ecosystems – a network of financial providers offering a one-stop-shop for all customers’ financial services needs including lending, payments, investments and insurance.

It is in this way that financial ecosystems play into the core tenet of open banking, shifting focus from the product to the customer and promoting convenience, choice and efficiency. With each specialised provider contributing its expertise through APIs – be it a bank, fintech or insurer – data can be securely and functionally exchanged to enable a single entity within the ecosystem to offer the services of its partners.

For example, “a customer could access their bank account, apply for a loan from a different provider, and invest in financial markets through another specialised entity –all within a unified ecosystem,” says Seshika Fernando, VP, Head of Banking and Financial Services at WSO2.

Yet, while the revenue-boosting possibilities for ecosystem partners are seemingly obvious, less than a third of the world’s biggest banks are meaningfully investing in banking ecosystems at present, according to a study by Boston Consulting Group’s Henderson Institute. In fact, the same study suggests nearly a quarter of large global banks are not investing in ecosystem models at all.

PayEX offers customizable AR/AP Automation software for B2B businesses looking to optimize their working capital and unearth hidden revenue otherwise written off due to manual processes and slow communication

JAMES ALLUM SVP FOR EUROPE, PAYONEER

JAMES ALLUM SVP FOR EUROPE, PAYONEER

While open banking may have forced the issue for reluctant banks to foster financial ecosystems, particularly those with extensive data pools that may be timeconsuming or costly to integrate into a financial ecosystem, the question remains: why are some banks reluctant to foster or join financial ecosystems?

For Fernando, the slow adoption rate of financial ecosystems at legacy banks comes down to a shift in mindset, one which many

institutions struggle to adopt, having historically built walls around customers’ finances and data.

“Banks have jealously guarded their customer data against any external sources,” says Fernando. “With the introduction of open ecosystems, banks face a new challenge: opening their data to third parties while ensuring customer consent. This concept was counterintuitive and initially intimidating for banks. The idea of sharing customer data with external entities went against the long-standing approach of protecting data within their fortified systems.”

It seems, then, the slow uptake of open ecosystems at legacy institutions is as much a philosophical issue as it is a practical one, with the need to embrace openness and

“THE FUNDAMENTAL CHALLENGE WILL BE WHETHER A BANK’S IN-HOUSE TECHNOLOGY CAN SUPPORT THE DEVELOPMENT OF A DIGITAL PLATFORM”

collaboration a significant hurdle for banks to overcome.

While concerns regarding data security, privacy and maintaining regulatory compliance were once paramount for banks, banking ecosystems have flipped this model on its head, necessitating data sharing with third parties.

As such, security models need updating to guard customers’ data across an entire ecosystem.

Prakash Pattni, Managing Director of Digital Transformation at IBM Cloud for Financial Services, notes: “In order to connect to an ecosystem, a bank needs to give partners access to its system. Open banking is great, but you really need to be able to do this in a secure way. It can take fintechs and startups 18-24 months to onboard with banks because the bank has to complete due diligence and security checks.”

The status of a bank’s legacy technology can, therefore, have a significant bearing on its willingness to join an ecosystem. As noted by Payoneer’s SVP for Europe, James Allum: “The fundamental challenge will be whether a bank’s in-house technology can support the development of a digital platform that allows the onboarding of partners and accounts, while addressing associated security concerns around data sharing and privacy.”

The difficulties legacy banks face, which predominantly need to overhaul their existing tech, is why Allum sees banks with a small geographical focus, featuring products “defined to meet local needs”, as more readily adapted to integrate into broader ecosystems. They typically have smaller tech stacks, less customer data and a greater will to integrate into a wider ecosystem to meet their growth aims.

“WE’RE ALREADY SEEING BANKS MOVING EVERYTHING TO THE CLOUD, IT’S JUST A LONG AND COSTLY PROCESS”

PRAKASH PATTNI MANAGING DIRECTOR OF DIGITAL TRANSFORMATION, IBM CLOUD FOR FINANCIAL SERVICES

However, given the extensive timescale legacy banks face when onboarding the services of fintechs and other relevant partners, it’s a matter of when, not if, most legacy banks will integrate into broader ecosystems. “We’re already seeing banks moving everything to the cloud, it’s just a long and costly process,” says Pattni.

“At IBM, we’re taking a hybrid approach, to help some banking clients accelerate a tech upgrade, moving relevant operations over to the cloud.” Though an expected undertaking from one of the world’s biggest technology providers, IBM’s work with banks firmly

implies a growing willingness from legacy institutions to hasten their open banking capabilities and enter wider ecosystems.

As more banks cotton on to the financial ecosystem ball, it’s small wonder McKinsey has estimated the future of banking represents a US$70tn opportunity for those who break up their services into broader cross-industry platforms. Banks are coming to terms with the importance of financial ecosystems in providing revenue-boosting opportunities.

BRYAN GAYNOR EU CEO AND VP OF PRODUCT, BLUESNAP

BRYAN GAYNOR EU CEO AND VP OF PRODUCT, BLUESNAP

For Pattni, the key to maximising revenue from an ecosystem harks back to open banking’s core tenet: ecosystems are largely driven by customer expectations.

He says: “Big techs are constantly enhancing the richness of their platforms, integrating multiple payment options. People have gotten used to that level of service and are now expecting that from their financial service providers across the board, whether it’s for offering loans or mortgage products.”

The adaptability and rate of evolution at big tech firms can be attained by “the ecosystem play”, according to Allum, “which allows banks to adapt to a changing financial system as the margins from traditional products like payments shrink.”

The slow migration of banks joining ecosystems – despite their willingness – has led to suggestions that big tech firms, which already have a foothold in digital payments (Apple Pay and Google Pay for example), could look to capitalise on this and launch their own banking services.

Despite these claims, banking is not something Fernando thinks will interest big tech firms. She says: “It is important to consider that big tech makes more revenue from banks through its advertising, media and cloud services. In many cases, big tech firms generate more significant revenues by partnering with or providing services to big banks rather than directly becoming banks themselves.”

This view is shared by BlueSnap’s EU CEO and VP of Product, Bryan Gaynor, who believes tech firms will be put off by the amount of “glue needed to manage regulations and cash-in accounts”, something which banking infrastructures are traditionally built to accommodate. Tech companies are used to “moving significantly faster with their agile infrastructures”, Gaynor adds.

Banking ecosystems are being formed as a by-product of open banking, or third-party data sharing between banks and other financial providers worldwide. Below, we look at the two approaches to open banking in different markets across the globe.

Open banking is enforced by regulations in both the UK and EU. After the revised Payment Services Directive (PSD2) was passed in 2018, it became mandatory for large banking institutions to share data with third-party financial services providers. The passing of this regulation paved a path for challenger banks, notably Revolut, Monzo and Starling in the UK, to streamline open banking and foster digital ecosystems in financial services.

Outside of the EU, though, Hong Kong and Australia have both adopted a regulatory-driven approach to open banking too. In 2018, The Hong Kong Monetary Authority issued an Open API Framework, with a four-stage approach for banks to integrate open APIs. Unlike the EU, banks in Hong Kong must restrict access to third-party providers they partner with.

Meanwhile, Australia’s Consumer Data Right Act allows consumers to share their data with third parties of their choice. Unlike the EU, this is a data policy as opposed to a financial one, with a focus on customer-centricity.

In markets including the US, India, South Korea and Japan, open banking is driven by the markets. After regulation in the EU and other markets, many banks in other jurisdictions have opted to share third-party data in order to generate revenues as they look to stay ahead in the digitisation of the global banking industry.

Major US banks are already developing API-based offerings, entering into third-party contracts to attract new customers and gain a competitive edge.

JAMES ALLUM SVP FOR EUROPE AT PAYONEER

PRAKASH PATTNI MANAGING DIRECTOR OF DIGITAL TRANSFORMATION AT IBM CLOUD FOR FINANCIAL SERVICES

SESHIKA FERNANDO VP, HEAD OF BANKING AND FINANCIAL SERVICES, WSO2

SESHIKA FERNANDO VP, HEAD OF BANKING AND FINANCIAL SERVICES, WSO2

JAMES ALLUM SVP FOR EUROPE AT PAYONEER

PRAKASH PATTNI MANAGING DIRECTOR OF DIGITAL TRANSFORMATION AT IBM CLOUD FOR FINANCIAL SERVICES

SESHIKA FERNANDO VP, HEAD OF BANKING AND FINANCIAL SERVICES, WSO2

SESHIKA FERNANDO VP, HEAD OF BANKING AND FINANCIAL SERVICES, WSO2

There is no appetite for tech firms to become mired in a pool of regulations; they are able to remain agile “by walking the tightrope” of compliance, avoiding an incurrence of full-blooded regulatory requirements according to Pattni.

He notes: “If big tech goes too far, these firms are going to become fully regulated, and then they’re going to have to spend all this time and money on all the things banks do. But they’re trying not to cross that threshold, their margins stay higher that way.”

So, while the threat of big tech swooping down to eat the lunch of legacy banks may not be in the interests of technology firms, it is still imperative that big banks reposition their systems to operate across ecosystems, lest they be outmuscled by challenger banks.

Most banks know it too, it’s just a case of updating legacy systems as quickly as possible to keep pace with technology and customer expectations. Once they do, though, the future of banking as part of a financial ecosystem looks bright.

In fact, once banks reposition themselves to a secure data-sharing model, they don’t

even necessarily have to build ecosystem models from scratch.

As Fernando notes: “Ecosystems have already been formed, driven by the emergence of fintech startups, big tech firms, and other players within the financial services industry. Instead, banks can participate in these ecosystems by leveraging APIs and connecting their systems and services with external partners.”

There is a warning, though, for those that don’t integrate their services into a broader digital ecosystem – they may get left behind in this era of digital revolution.

Raphael Bianchi, Senior Partner at Synpulse and President of the Openwealth Association, says: “To be part of the digital revolution, companies must stick to what they do best and focus on joining existing ecosystems to help them integrate seamlessly with providers and help provide clients with the digital experience they expect.”

Despite the ever-hastening need for banks to join ecosystems, for Pattni, it’s just “a matter of time”. He concludes: “As banks get all the pieces of the jigsaw into place, we’ll definitely start to see more adoption of ecosystem models in the coming years.”

“WITH THE INTRODUCTION OF OPEN ECOSYSTEMS, BANKS FACE A NEW CHALLENGE: OPENING THEIR DATA TO THIRD PARTIES WHILE ENSURING CUSTOMER CONSENT”

18 - 19 October 2023

1,000+ Virtual Attendees

2 Day Learning and Networking Event

30+ Acclaimed Speakers

5 Interactive Panel Discussions

SPONSORSHIPS GET YOUR PASS

WRITTEN BY: LOUIS THOMPSETT

PRODUCED BY: GLEN WHITE

WRITTEN BY: LOUIS THOMPSETT

PRODUCED BY: GLEN WHITE

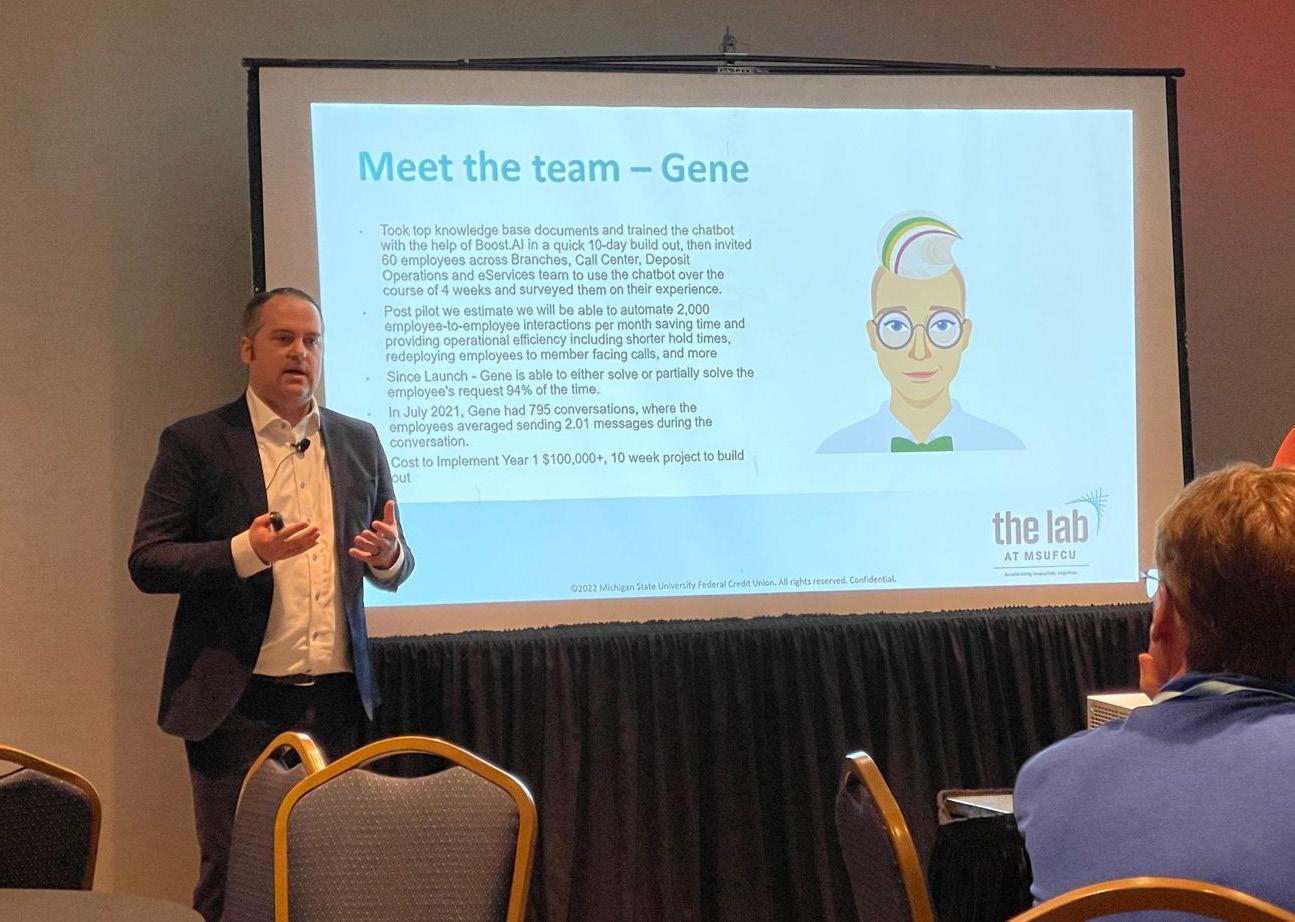

It’s not often you find someone who has worked at one company for over a decade, but Benjamin Maxim, Michigan State University Federal Credit Union’s (MSUFCU) Chief Digital Strategy & Innovation Officer, is one of them.

Now in his 16th year at MSUFCU, Maxim’s first role there was as a web developer. Joining at the height of the recession after the collapse of global housing markets in 2007, Maxim says he was “just happy to have a job” at the time.

Initially “planning to stick it out until finding something else” he wanted to do, little did Maxim know he had already landed at the organisation that would define the rest of his career.

“I immediately fell in love with the credit union mission of people helping people and felt it gave meaning to a career in technology that might be absent at other bigger tech firms. I had only ever had an account with a credit union, never a bank, so it was probably meant to be.”

From web developer to Chief Digital Strategy & Innovation Officer, Maxim has been able to keep his drive by being challenged with new experiences during his time at MSUFCU.

“I have a leader who I’ve reported to for most of my career, who has been so

supportive and allowed me to follow a path of technology and innovation in a series of mini careers along the way. I haven’t just done the same thing for 16 years,” explains Maxim.

From web development to iOS development and then development management, Maxim has been involved with almost all MSUFCU has to offer. Helping build the credit union’s internal web operations, Maxim then found himself building MSUFCU’s new digital banking solution, a transaction solution “similar to Venmo or PayPal”, and mobile remote deposit capture software.

Working across the credit union’s broad technological infrastructure, Maxim was

“WHAT’S UNIQUE ABOUT THE CREDIT UNION INDUSTRY IS THAT WE LIKE TO SHARE AND COLLABORATE, WHICH FOR ME IS REALLY EXCITING”

BENJAMIN MAXIM CHIEF DIGITAL STRATEGY & INNOVATION OFFICER, MSUFCU

then asked to lead MSUFCU’s innovation programme, after building UX, QA, and development teams, the latter of which is now 25-person strong. Now three years into the role, Maxim has already helped develop an innovation lab and an MSUFCU investment arm – Reseda Group – where Maxim serves as Chief Technology Officer.

Growing alongside the credit union, Maxim is grateful he gets “to be involved in everything from start to finish”. And, although admitting his dream job would have seen him at a major tech company like Apple or Google, he “would’ve been a little fish in a massive pond”. At MSUFCU, Maxim gets to be a big fish, and as he grows, so does the pond.

TITLE: CHIEF DIGITAL STRATEGY & INNOVATION OFFICER

INDUSTRY: BANKING

LOCATION: UNITED STATES

Ben Maxim joined MSU Federal Credit Union in 2007 and currently serves in a dual role as Chief Digital Strategy and Innovation Officer for MSUFCU and as Chief Technology Officer for MSUFCU’s wholly-owned CUSO Reseda Group. He is responsible for assessing emerging business trends and technologies, providing strategic direction for existing and future digital channels, and facilitating innovation throughout the Credit Union including leading their innovation center The Lab at MSUFCU. He is also responsible for the technology and product pillars of Reseda Group and its subsidiaries. Maxim began work initially as a Web Developer and in 2014, he became E-Commerce Manager before moving into roles including Assistant Vice President of Software Development. He earned a bachelor’s degree from Michigan State University and a professional certificate in Innovation & Entrepreneurship from Stanford University. Maxim was honored as Finopotamus’s 2022 Tekkie Awards Technologist of the Year.

Like all credit unions, MSUFCU faces the challenge of nurturing meaningful relationships with members in an era when in-branch visits have declined, made more difficult as a significant portion of its members are students and many of them relocate each year after graduation.

“We have made great strides using technology to make it faster and easier for our members to transact business with us digitally, but those faster interactions came at the cost of engagement and enduring humanized connections in-branch experiences have created for decades.”

Those challenges led MSUFCU’s Ben Maxim to exagens’ behavioral banking solutions with its focus on building and maintaining relationships and a bond of community, digitally.

The decision to implement Behavioral Banking proved to be a winner, with its launch characterized as one of the most successful MSUFCU has experienced, with the quickest adoption rate and most enthusiastic initial feedback including:

36% average engagement across all insights with some as high as 46%

In the very first month, a member responded to enthuse that the insight regarding their Amazon Prime membership resulted in them canceling it and saving money

Providing new benefits to members and growing the credit union often gets stymied by the realities of legacy technology, messy data, security, and privacy protection.

Those concerns were another factor in Maxim’s and MSUFCU’s selection of exagens - its ease of implementation and no requirement for personally identifiable information (PII).

29% engagement with tips reminding members of their credit card benefits and 17% on auto-related opportunities.

Commenting on the success, Maxim noted: “This is just the beginning of the potential that behavioral banking unlocks, and already it has become the key pillar of our digital experience strategy for the future.”

“Exagens has been a true partner and had thoughtfully built not just a great product, but also invested a lot in their process, with a tiered implementation to get up and running quickly. It has all been built to work with the realities we deal with on the ground, delivering results without excessive time and effort on the part of the credit union.’’

“I was immediately interested because exagens approach is grounded in a deep understanding of how people think and make decisions, and how to keep them connected, and energize them to make better financial decisions.’’

BENJAMIN MAXIM

BENJAMIN MAXIM

Customers enjoy better, individualized assistance and guidance, tailored to their specific circumstances.

The credit union reaps long lasting financial growth that can only come from customer satisfaction, loyalty, and trust: a greater share of wallet, more product adoption and usage, and reducing churn.

Behavioral Banking codifies the aspects of psychology, neuroscience and behavioral economics, (Behavioral Science) which characterize the dominant role emotions have in how we think about and make decisions regarding money. It understands why most people would rather go to the dentist than deal with their finances and how best to engage them. Then, using advanced analytics and AI, it creates situationally relevant and emotionally activating money-related scenarios (Sparxs), individualized and curated to each persons’ unique situation and concerns.

To learn more about the benefits that credit unions like MSUFCU have achieved through behavioral banking with Exagens’ MoneySparxs, click here.

It is in this way that Maxim and MSUFCU have become one and the same after 16 years, with a joint path for progression. As Maxim puts it: “Our mission and focus now is to increase financial access, increase financial literacy, and among many of the other things we are trying to do, build up our communities, making them a place people want to live, work, and enjoy.

“This gives me an aim to build innovations around these values, putting our technological focus into ways of serving our communities and ultimately our members.”

With the spread of fintech innovation on an ever-upward trend, industry-wide conditions are perfect for Maxim and MSUFCU to achieve their goals. Many

“THE GOAL IS TO CREATE NEW PRODUCTS THAT TAKE ADVANTAGE OF ALL THESE NEW INNOVATIONS THAT HELP YOUNGER MEMBERS GET THE PRODUCTS THAT ARE THE RIGHT FIT”

BENJAMIN MAXIM CHIEF DIGITAL STRATEGY & INNOVATION OFFICER, MSUFCU

fintechs are designed to offer ways of improving financial access, which Maxim leverages to support underserved areas of the credit union’s different communities.

“At MSUFCU we have a lot of student accounts. The question is how do we keep them interested and engaged including after they graduate? How do we get them excited about credit unions when they think all they need is a Venmo instead of a bank account?

“For me, the goal is to create new products and digital member experiences that take advantage of AI, machine learning, blockchain, and other emerging technologies that help personalising the experience for younger members (and really all members) to get them products that are the right fit and are the most convenient for them.”

Not content on providing ways to just take MSUFCU above the competition, for Maxim, it’s important to share new innovations and tech products with the wider credit union ecosystem.

“What’s unique about the credit union industry is that we like to share and collaborate, which for me is really exciting. It’s great to have a community, rather than having a singular focus, to talk about innovations, share ideas, and work together to move the whole credit union industry forward.”

Although sharing innovations between banks and other financial institutions is typically considered counterintuitive, for Maxim, this is only natural for credit unions.

“Innovation is the core of what credit unions are. When credit unions first popped up as a result of anti-bank sentiment following the Great Depression, they were considered an innovative way to deliver financial services to people –members had control.”

“At MSUFCU, we were an early adopter of ATMs, and in the 1950s-1960s, we had one of the first female CEOs in the financial industry at the time. Today, our chatbot, Fran, is named after her.”

Serving students, faculty and staff, and alumni, MSUFCU sticks to its roots, having been founded by a selection of Michigan State University (MSU) faculty and staff

Finding financial solutions for all university campus goers is part of the ethos and not just MSU. MSUFCU has a partnership with Oakland University, too as Oakland University Credit Union, and has recently launched two digital-only brands to further support students in their life’s financial journey in AlumniFI and Collegiate Credit Union.

Now serving a range of community sectors, including government, hospitals and local SMBs, and a wide range of ages from birth to over 100, the aim for Maxim and MSUFCU is to personalise services for each individual and business.

Of course, finding the right mix of products for a potential member is doable following consultation, but in an era of speed and technological innovation, Maxim says it’s important to know the right product for the right person soon after they walk through the door – data and technology help us do just that.

Partnering with over 30 fintech vendors and integrating their services has improved both the speed and efficiency of MSUFCU’s digital member experience.

Maxim says: “As financial institutions are a key enabler of people’s lives, we end up having a lot of data that we struggle to leverage on our own. One of the most innovative fintechs we’re working with is called Exagens, which specialises in the behavioural banking space. Their solution helps us unlock this bank-owned data and addresses a challenge common to all credit unions – engaging members beyond just transactions, to help grow their finances and the communities we serve.”

“They’ve become a core part of our experience strategy and together we’ve unlocked new value from our bank-owned

Reseda Group is a catalyst for cutting-edge products and financial technologies to help credit unions build better for members and communities.

data, and provide some 90 different highly individualised money-related engagement scenarios to our members, to know and serve them better”

Just one of MSFUCU’s many partners, marrying fintech innovation with its own proprietary data has supported the credit union in growing its member base.

But, while leveraging tech will help find the right financial product mix for a member, another intuitive means of achieving this is improving the financial wellness of communities by providing access to financial education and promoting financial literacy of individuals and businesses.

A credit union made in the education system, MSUFCU provides the community with a large team of financial educators.

“We send them to schools and colleges, to be the education focus for students at all levels of understanding money management. We even lead a preretirement financial education service, education for buying a house, car, and various other budgeting tools.”

“OUR MISSION AND FOCUS NOW IS TO INCREASE FINANCIAL ACCESS, INCREASE FINANCIAL LITERACY, AND BUILD UP OUR COMMUNITIES”

BENJAMIN MAXIM CHIEF DIGITAL STRATEGY & INNOVATION OFFICER, MSUFCU

While implementing AI alongside machine learning and other tech innovations can boost customer satisfaction and backend processes, an important part of integrating fintech partners is to ensure technology is streamlined to the specific regulatory requirements partnering with a credit union entails.

Maxim notes: “When fintechs want to work with us, MSUFCU may be the only credit union they’re partnered with. So, along the way we are teaching them what it means to work with a credit union; what our regulations are, what our examiners care about; and what our compliance needs are.”

For Maxim, it is therefore important to make sure the onboarding process is robust and thorough. “We’ve built extensive compliance, risk and legal teams here at MSUFCU. So, for us, it’s imperative we thoroughly analyse any new partnership to make sure there are no data privacy concerns, no reputation risk, and if we’re using data, it’s important we’re permissioned properly.”

Establishing partnerships with fintech vendors is one thing, but nurturing an ecosystem, where each vendor plays into MSUFCU’s wider orchestral tune is another. While some vendors are commoditised, the “key differentiators”, as Maxim calls them (businesses tied to MSUFCU’s core banking solutions), are imperative to the credit union’s functionality.

“With a payment provider for example, like Visa, if they don’t do well or integrate into the broader scope of the credit union

then that stops us running our business. As a result, we focus heavily on getting the right balance between our different vendor partners. But, we want these integrations as it makes us a stronger company and helps make them a stronger partner.

“We really want to nurture these bonds and share them with the greater credit union industry. That’s why we formed our wholly-owned Credit Union Service Organization (CUSO), Reseda Group, to start making investments in fintechs, to make sure we have the right partners on board and be a strategic advisor for them too.”

With a new branch recently opened in Detroit, MSUFCU is keeping its commitment to an in-person credit union experience, alongside the implementation of tech to create an omnichannel customer experience.

Maxim hopes the credit union’s growth will only continue. He concludes: “One of our major focuses is on branching, opening up in new markets while improving the offering in the places we’re already in.”

“So, we’re all about scale at this stage and we plan to overhaul all our digital channels to better support the fintech partnerships we have. This will make it easier for us to play, test new technologies in our ecosystem and pull it back if it isn’t working.”

“As we rework our website, online banking, our iOS and Android apps, we believe at MSUFCU that this will enable us to move forward significantly with our technology offering.”

Furthermore, Maxim is all too aware of the dangers that trudging too far down the tech path leads to — community disconnect. This is why when launching the likes of chatbot

Fran, Maxim is always careful to make sure “it’s an augmentation of customer service, not a replacement for it”.

He adds: “Our approach now is combining digital and human service together, to create an experience that is both digital and human. Look at the pandemic. We all learned how to use video technology because it was the only choice.

“Well, we now have a video banking solution, to more easily connect to our members to our employees. This is how we combine technology to better serve and connect with our members, not distance ourselves.”

“But you always have to measure this with the members’ needs and understand what their feelings are. Are they going to use it? Are they going to be receptive to it?”

One thing Maxim feels will further enhance the effectiveness of MSFCU’s customer experience is a further augmentation of the credit union’s chatbot with generative AI.

“Leveraging AI, we are able to improve our member service with our chatbot to answer simple questions. It’s just about framing what the right use case is for the technology. With Fran, you can even just type “agent” and it will instantly redirect you if that’s what you want to do, so it’s just about providing choice.”

The advent of new technologies – including mobile wallets and smartwatches – as well as the residual effects of the COVID19 pandemic mean that digital payment methods are on the increase. But will that mean the end of cash or even plastic cards?

“When people discuss the future of payments they tend to predict the end of cash,” say Marion Laboure and Jim Reid, authors of Deutsche Bank research into the future of payments published in 2020. This is not a vision they agree with, but they do accept that, while cash will remain in circulation, “the coming decade will see digital payments grow at lightning speed”.

Indeed, Deutsche Bank’s research shows that consumers in six major markets intend to rely less on cash and cards in favour of contactless and mobile payments. Paying for goods using a cheque is expected to become less commonplace in five out of the six markets – only China sees a future for cheques as a payment method, the only country witnessing a net positive increase in all payment methods that Deutsche Bank asked about, perhaps reflecting the country’s emerging middle class and rising levels of disposable income.

Cash is expected to decline as a payment method in three of the six countries – the UK, France and Italy – but not in the US, China or Germany. The latter is among the

The way we pay for goods and services is changing rapidly. So will the rise of smartphones and smartwatch payments make physical cards obsolete?FRAZER HARPER VP OF PAYMENTS PRODUCTS, DOJO CATHARINA EKLOF CHIEF COMMERCIAL OFFICER, IDEX BIOMETRICS PAT PHELAN MANAGING DIRECTOR UK&I, GOCARDLESS

Experience composable banking with Mambu's SaaS cloud banking platform.

Learn more

most cash-loyal nations in the world, with consumers preferring to pay using physical currency in over half of transactions.

Contactless payments are expected to become more popular, driven by the highest rates of growth in the UK, France and Italy. Smartphone payments and smartwatch payments will also rise in popularity; in both cases China is expected to see the highest rate of growth. Of course, this research does not take into account the boom effect experienced during the pandemic, when contactless payment methods were considered favourable due to hygiene and public safety considerations – so it’s possible that Deutsche Bank’s initial findings will actually be accelerated because of the pandemic.

“IT’S IMPORTANT WE DON’T EXCLUDE PEOPLE AS A CONSEQUENCE OF TECH INNOVATION”

Will digital wallets and payment cards replace plastic? The obvious question, then, is whether emerging payment methods will replace the old-fashioned way of paying for goods. “Technologies such as digital wallets, virtual cards and embedded finance are already replacing cards,” proclaims Pat Phelan, Managing Director UK&I at GoCardless.

“You don’t need to look far to see it happening – walk onto public transport and see people tap and go with their phones at the barriers, or use their device to pay for dinner at a restaurant. It’s only a matter of time before plastic cards are redundant. However, current payment options are mostly still linked to a physical payment card, even if that card never leaves the wallet. It’s likely this will change too, particularly if and when these digital wallets become linked directly to a user’s bank account or other payment methods, leaving the payment card fully behind.”

However, not everybody is so convinced. Some observers believe there is room for plastic in a digital economy, even if in small quantities. “Digital technologies may one day replace physical cards, but this isn’t likely to be anytime soon,” says Frazer Harper, VP of Payments Products at Dojo.

Although there is unquestionably appetite for digital payments, there are still drawbacks to the technology that could prove to be deal-breakers. “Not only is it a payment method reliant entirely on device battery life, it’s also one that could leave people behind,” Harper continues. “It’s important we don’t exclude people as a consequence of tech innovation – and with traditional card usage still high, we see these physical cards playing a key role for the mid-to long-term.”

“IN 10 YEARS, CARD PAYMENTS WILL BE FASTER, SAFER AND MORE DIGITAL”

DR STEPHEN WHITEHOUSE PARTNER, OLIVER WYMAN’S RETAIL AND BUSINESS BANKING PRACTICE

This is something that Dr Stephen Whitehouse, a partner in Oliver Wyman’s Retail and Business Banking practice, concurs with. “While digital finance is on the rise, plastic cards will likely stick around for a while, especially in areas where digital solutions are less accessible or accepted,” Whitehouse says.

Despite their enduring popularity, there are still areas where the physical payment card could evolve. One of the most exciting,

particularly from a fraud perspective, is biometrics. This is a catch-all term used to refer to several different technologies – including fingerprint recognition, which is already popular but expected to grow in the coming years; facial recognition, which is benefitting from the improved reliability of AI; voice recognition and voice authentication, which, inspired by the popularity of virtual assistants, are also on the rise; and iris scanning, an emerging technology that takes advantage of the uniqueness of the iris, the colourful part of the eye surrounding the pupil.

Biometrics provide a fine balance between convenience and security. Recent research from GoCardless shows that nearly 70% of consumers would abandon a checkout process if it was overly complicated, while 80% would abandon the process if the security arrangements didn’t feel safe enough. This means biometrics can tick off two important boxes for consumers.

“Businesses can enter this ‘goldilocks zone’ by providing consumers with the ability to make a payment using simple biometrics, such as fingerprint or facial recognition,” GoCardless’ Pat Phelan says. “Most of the time this can be easily done, and on a device that payers use all the time such as a smartphone.

“Looking ahead, we believe consumers will become even more interested in noncard payments that have extra security built in. One example is open banking payments, which have seen volumes nearly triple in just one year. These payments use bankgrade security, requiring consumers to log into their online banking platform – often with biometrics – before they can make a payment. This hurdle is much harder for fraudsters to overcome compared to entering stolen card details into a checkout. It makes open banking payments more appealing for fraud-conscious consumers.”

Biometrics is the future of card security, believes Dojo’s Frazer Harper: “In a decade’s time, I see a world where biometrics such as a person’s face or their fingerprint becomes the

primary method of authentication, providing access to funds without the need for knowledge-based card numbers and PINs.”

And finally, Catharina Eklof, Chief Commercial Officer at IDEX Biometrics, tells FinTech Magazine: “Following an increase in demand for card payments, and more specifically contactless payments, biometrics have become an unparalleled means of authentication. As user behaviour changes, so do the standards for user protection. Fingerprint biometrics can provide near-instant authentication of payments and identity, making consumers’ lives more convenient and providing them with more choices for confirming their identity. With definitive advantages to both users and issuers, biometric payment cards

have the potential for exponential growth well-beyond 2023.”

Our evolving payment habits, coupled with the scope for greater use of biometrics, mean that the card payments industry could be completely reshaped in the course of the next decade. But there are still things holding us back from greater adoption.

These can be categorised into three buckets, Frazer Harper believes: “Regulation, while acting as a key guardrail, will always slow advances in technology while the industry ensures it’s being deployed in the right way. Consumer adoption always takes time, as there’s a requirement to educate

“I SEE A WORLD WHERE BIOMETRICS SUCH AS A PERSON’S FACE OR THEIR FINGERPRINT BECOMES THE PRIMARY METHOD OF AUTHENTICATION

FRAZER HARPER VP OF PAYMENTS PRODUCTS, DOJO

By Todd Clyde, CEO of Token.io

By Todd Clyde, CEO of Token.io

Open banking-enabled account-to-account (A2A) payments might not kill cards entirely – but the threat they pose is indisputable. A2A payments has emerged as a powerful contender and is claiming volume from cards. In Europe, credit and debit cards’ combined share of ecommerce transaction value is forecast to decline from 40% in 2022 to 35% in 2026, as analysts predict a bold future for A2A payments (often called ‘pay-by-bank’).

A2A payments move money over national clearing systems. 74 countries already have, or are, in the process of upgrading these systems to instant or realtime. This trend, combined with the easier access to these systems that open banking enables, is a catalyst for the emergence of a next-generation and lower-cost network for processing payments.

For some time, merchants have been sounding the alarm over rising card fees. Pay-by-bank presents an attractive, lowercost alternative. A2A payments also outperform cards when it comes to UX. Consumers approve payments directly in their banking app, benefiting from bankgrade security with a smoother payments experience.

Merchants also benefit from instant settlement and an unparalleled ability to maximise acceptance. A2A payments can be used by anyone with a bank account, and now also deliver better success rates than cards in many markets.

users around new technologies and facilitate change around existing habits.

“Finally, there’s always work to do to build trust when we’re discussing new technologies around payments. How can we demonstrate the new tech is safe and secure to build that trust? The combination of all three of these factors always takes time on a populationwide scale.”

Despite these immediate obstacles, our experts still believe the future looks promising for the card payments sector. “In 10 years, card payments will be faster, safer and more digital,” predicts Dr Stephen Whitehouse. “Picture biometrics replacing PINs, digital wallets becoming the norm, and plastic cards dwindling – but persisting in tech-limited regions. Expect a digital-first, security-focused and highly convenient payment world.”

Pat Phelan continues: “We expect to see card payments decline relative to bank-based payments. As consumers and businesses, we hold most of our money in our bank account, and as technology continues to make it easier to move money directly from one account to another, we’ll all realise the benefits – namely, cheaper, faster and more secure payments.

“We’re not the only ones who believe this. Just look at the number of card players that are wading into this space; Visa and Mastercard are both, for example, exploring opportunities in bank payments. Over time, it’s likely that others in the card ecosystem will develop some kind of bank payment proposition.

“From a consumer perspective, the built-in security and convenience of bank payments will drive further adoption. We’re already seeing a move away from physical cards, and this will continue.”

PRODUCED BY: JAKE MEGEARY WRITTEN BY: ALEX CLERE

PRODUCED BY: JAKE MEGEARY WRITTEN BY: ALEX CLERE

When a company has been in business for almost 150 years, you would expect to encounter some change along the way. Founded in 1875, HSB Canada started life at a time when pressure boilers were the primary engine powering equipment and machinery in industry across Canada.

The technology was relatively new and explosions were quite common, until companies like HSB Canada started deploying engineers to routinely inspect this prone equipment. At the time, this was an extremely novel approach, but the insurance industry has come a long way since 1875 –and HSB Canada with it.

Today, the Toronto-headquartered business provides inspection, risk management and IoT technology services, as well as insuring a number of specialty lines, including equipment breakdown cover – a nod to the company’s heritage, which is still reflected in its logo – as well as cyber insurance cover, a huge area of need in an increasingly volatile world. Since 2009, HSB has been a part of the Munich Re Group, giving it access to a wider pool of expertise –and the company acknowledges that talent is one of the things that sets it apart.

“The people here are one of our biggest differentiators,” proclaims Mike Scarbeau, Vice President Information Technology at

HSB Canada. “We have a lot of fantastic subject matter experts who are, I would say, the de facto experts in Canada, particularly on the inspection and engineering side. There’s a lot of great talent that has been brought into the business, so it’s a really exciting time to be here.”

Becoming part of Munich Re 15 years ago – the latest chapter in a long and storied history for the business – has only helped to accentuate that. “You certainly feel you’re part of a bigger group that has some amazing talent across the globe,” Scarbeau adds.